Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VMWARE, INC. | fy20q4earnings8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - VMWARE, INC. | pressreleasefinancials.htm |

VMW Q4 & FY20 Earnings Conference Call Slide Deck without FY21 Guidance February 27, 2020 ©2020 VMware, Inc.

VMware Delivers the Digital Foundation Build, Run, Manage, Connect and Protect Any App on Any Cloud on Any Device Any Device Intrinsic Intrinsic Security Any Application Traditional Cloud Native SaaS Edge Private Public Any Cloud Hybrid Hybrid Telco ©2020 VMware, Inc. 2

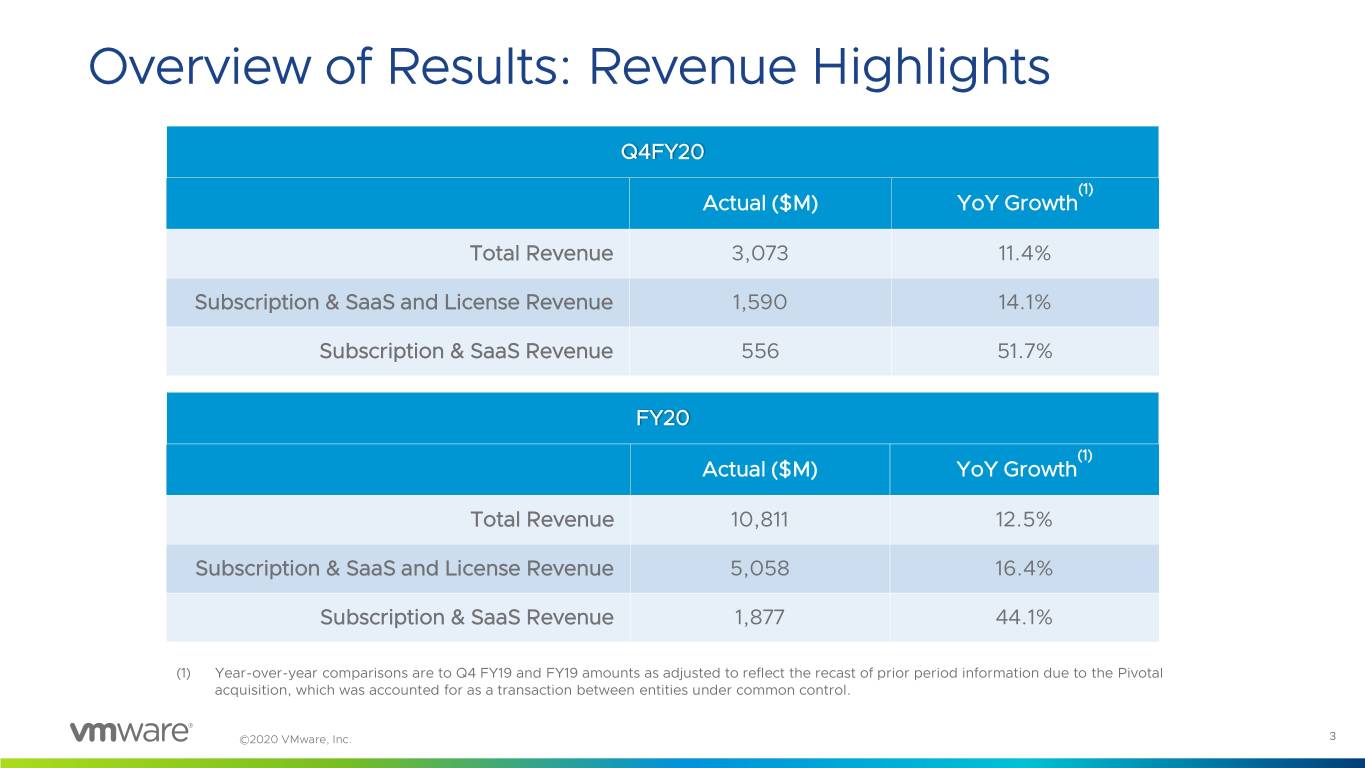

Overview of Results: Revenue Highlights Q4FY20 (1) Actual ($M) YoY Growth Total Revenue 3,073 11.4% Subscription & SaaS and License Revenue 1,590 14.1% Subscription & SaaS Revenue 556 51.7% FY20 (1) Actual ($M) YoY Growth Total Revenue 10,811 12.5% Subscription & SaaS and License Revenue 5,058 16.4% Subscription & SaaS Revenue 1,877 44.1% (1) Year-over-year comparisons are to Q4 FY19 and FY19 amounts as adjusted to reflect the recast of prior period information due to the Pivotal acquisition, which was accounted for as a transaction between entities under common control. ©2020 VMware, Inc. 3

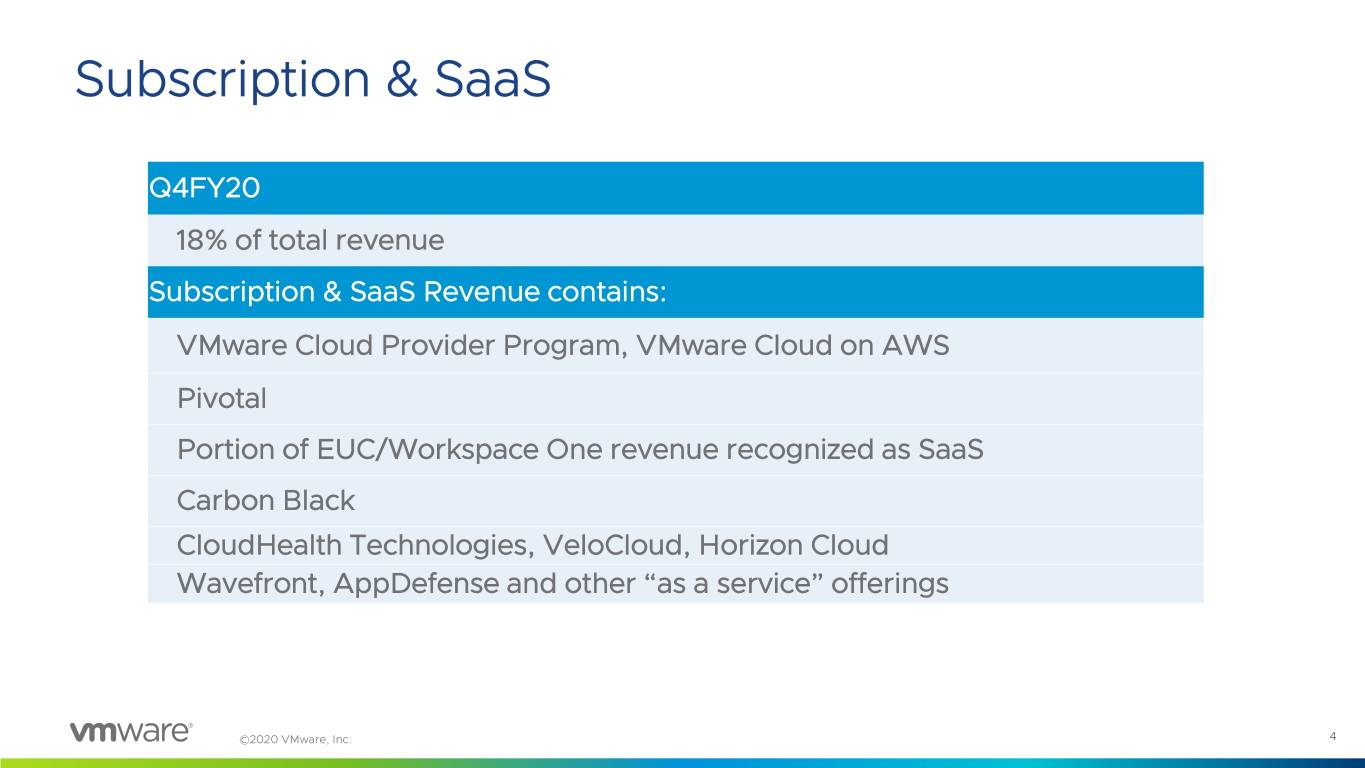

Subscription & SaaS Q4FY20 18% of total revenue Subscription & SaaS Revenue contains: VMware Cloud Provider Program, VMware Cloud on AWS Pivotal Portion of EUC/Workspace One revenue recognized as SaaS Carbon Black CloudHealth Technologies, VeloCloud, Horizon Cloud Wavefront, AppDefense and other “as a service” offerings ©2020 VMware, Inc. 4

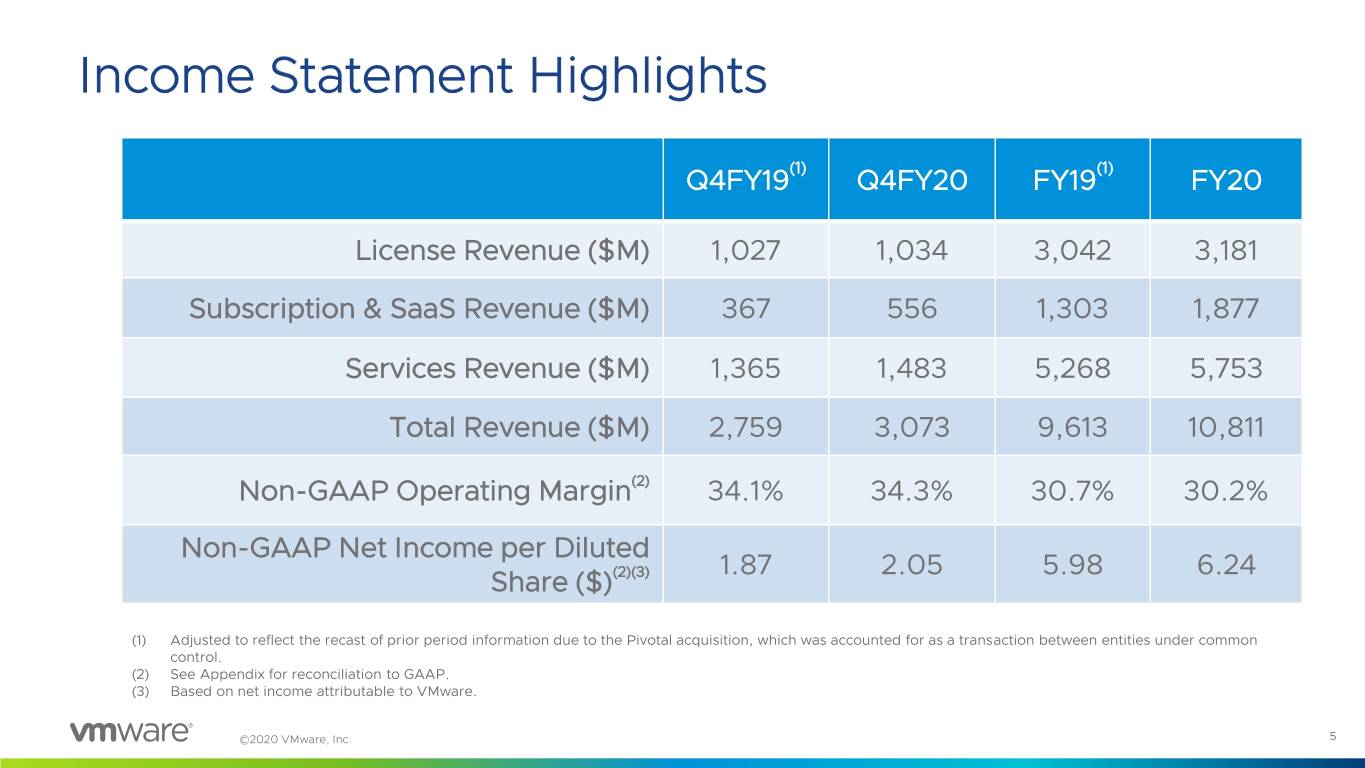

Income Statement Highlights Q4FY19(1) Q4FY20 FY19(1) FY20 License Revenue ($M) 1,027 1,034 3,042 3,181 Subscription & SaaS Revenue ($M) 367 556 1,303 1,877 Services Revenue ($M) 1,365 1,483 5,268 5,753 Total Revenue ($M) 2,759 3,073 9,613 10,811 Non-GAAP Operating Margin(2) 34.1% 34.3% 30.7% 30.2% Non-GAAP Net Income per Diluted (2)(3) 1.87 2.05 5.98 6.24 Share ($) (1) Adjusted to reflect the recast of prior period information due to the Pivotal acquisition, which was accounted for as a transaction between entities under common control. (2) See Appendix for reconciliation to GAAP. (3) Based on net income attributable to VMware. ©2020 VMware, Inc. 5

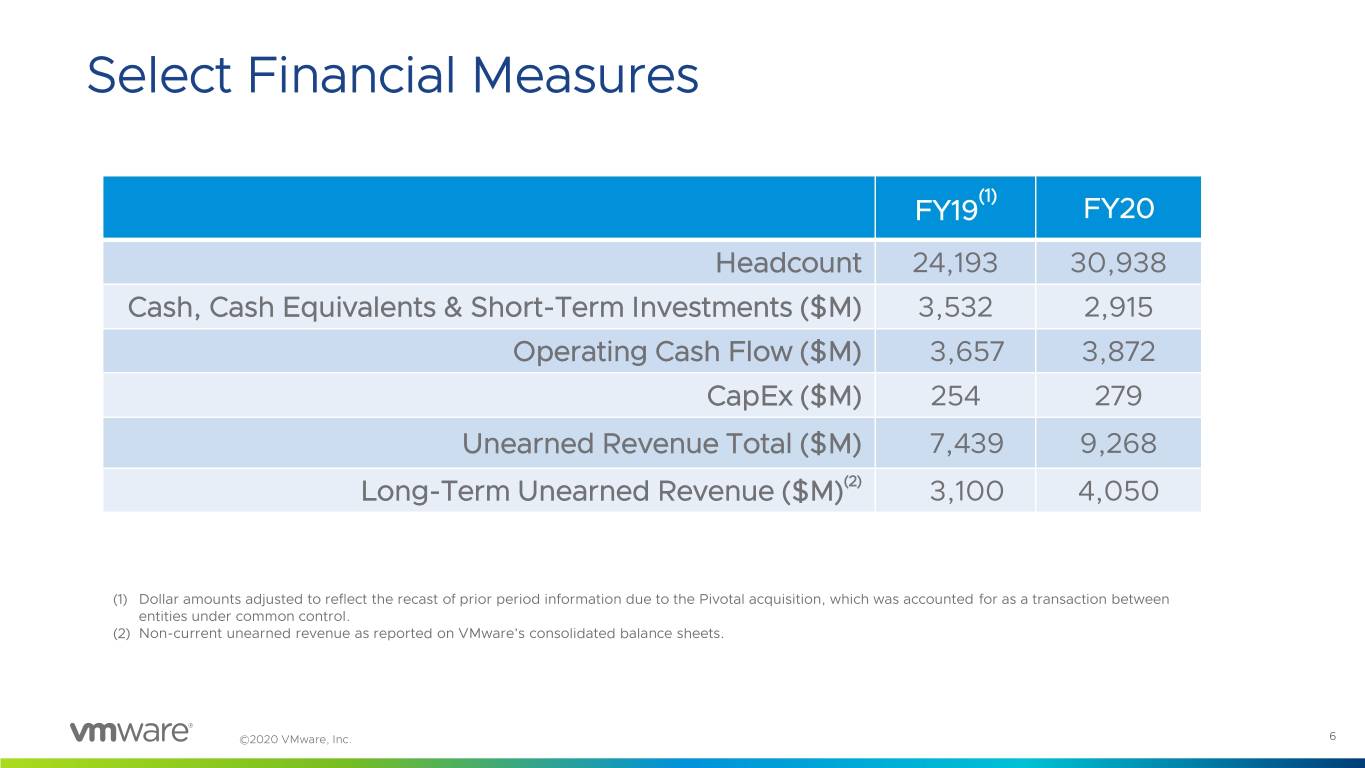

Select Financial Measures (1) FY19 FY20 Headcount 24,193 30,938 Cash, Cash Equivalents & Short-Term Investments ($M) 3,532 2,915 Operating Cash Flow ($M) 3,657 3,872 CapEx ($M) 254 279 Unearned Revenue Total ($M) 7,439 9,268 Long-Term Unearned Revenue ($M)(2) 3,100 4,050 (1) Dollar amounts adjusted to reflect the recast of prior period information due to the Pivotal acquisition, which was accounted for as a transaction between entities under common control. (2) Non-current unearned revenue as reported on VMware’s consolidated balance sheets. ©2020 VMware, Inc. 6

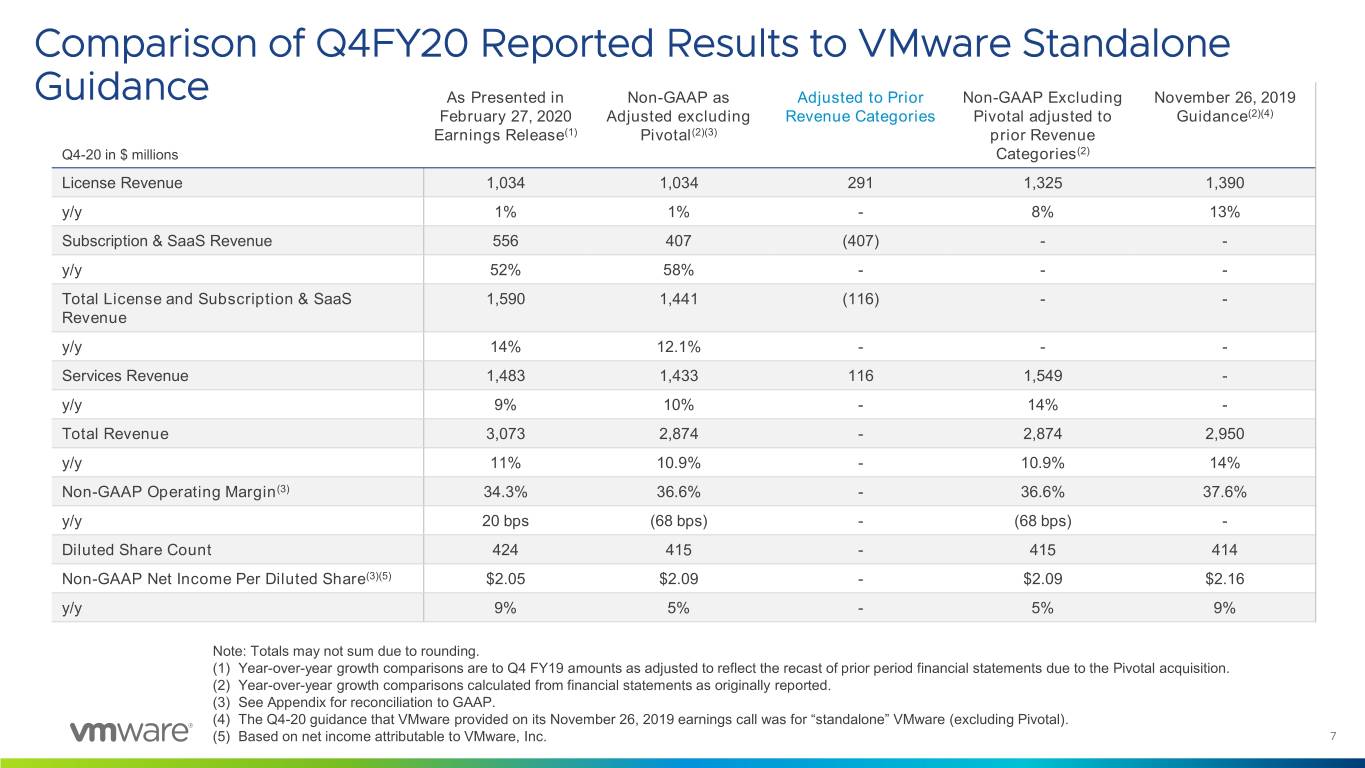

Comparison of Q4FY20 Reported Results to VMware Standalone Guidance As Presented in Non-GAAP as Adjusted to Prior Non-GAAP Excluding November 26, 2019 February 27, 2020 Adjusted excluding Revenue Categories Pivotal adjusted to Guidance(2)(4) Earnings Release(1) Pivotal(2)(3) prior Revenue Q4-20 in $ millions Categories(2) License Revenue 1,034 1,034 291 1,325 1,390 y/y 1% 1% - 8% 13% Subscription & SaaS Revenue 556 407 (407) - - y/y 52% 58% - - - Total License and Subscription & SaaS 1,590 1,441 (116) - - Revenue y/y 14% 12.1% - - - Services Revenue 1,483 1,433 116 1,549 - y/y 9% 10% - 14% - Total Revenue 3,073 2,874 - 2,874 2,950 y/y 11% 10.9% - 10.9% 14% Non-GAAP Operating Margin(3) 34.3% 36.6% - 36.6% 37.6% y/y 20 bps (68 bps) - (68 bps) - Diluted Share Count 424 415 - 415 414 Non-GAAP Net Income Per Diluted Share(3)(5) $2.05 $2.09 - $2.09 $2.16 y/y 9% 5% - 5% 9% Note: Totals may not sum due to rounding. (1) Year-over-year growth comparisons are to Q4 FY19 amounts as adjusted to reflect the recast of prior period financial statements due to the Pivotal acquisition. (2) Year-over-year growth comparisons calculated from financial statements as originally reported. (3) See Appendix for reconciliation to GAAP. (4) The Q4-20 guidance that VMware provided on its November 26, 2019 earnings call was for “standalone” VMware (excluding Pivotal). (5) Based©2020 VMware,on net income Inc. attributable to VMware, Inc. 7

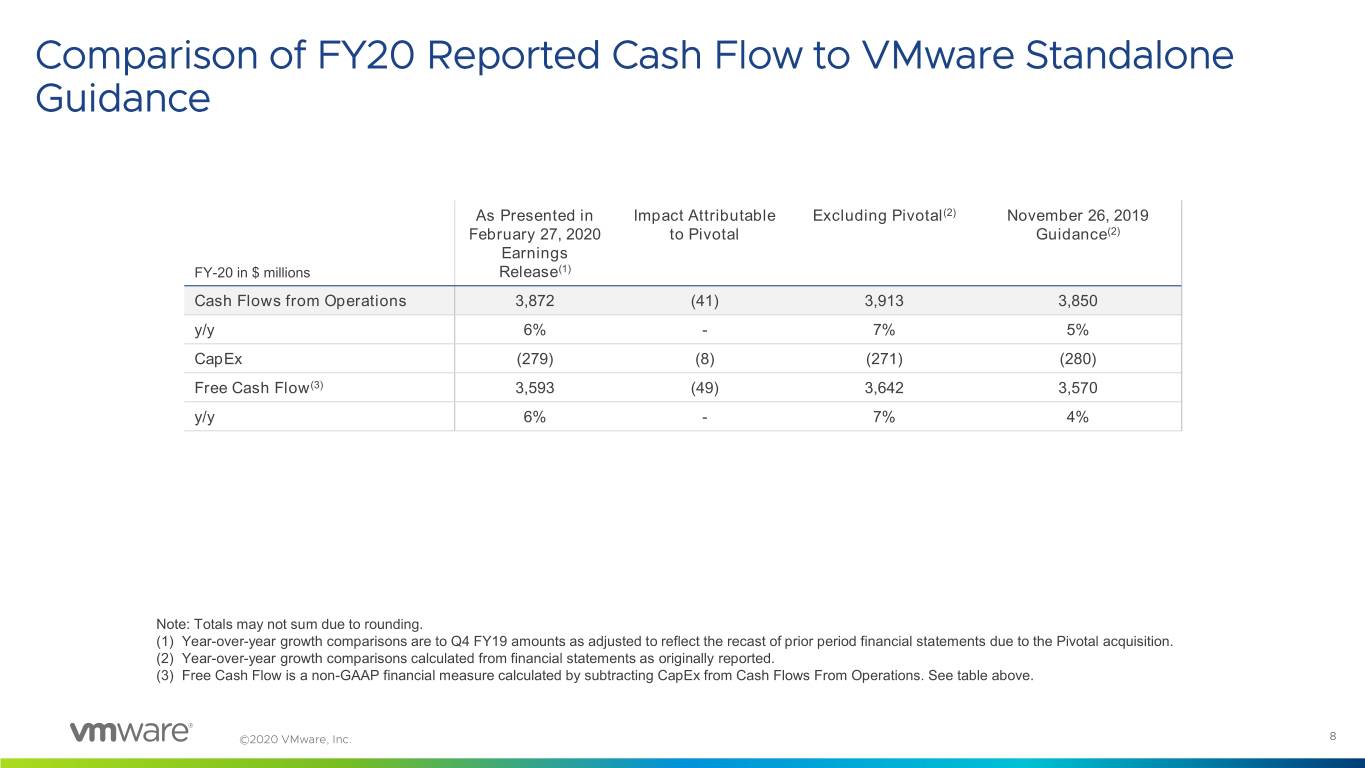

Comparison of FY20 Reported Cash Flow to VMware Standalone Guidance As Presented in Impact Attributable Excluding Pivotal(2) November 26, 2019 February 27, 2020 to Pivotal Guidance(2) Earnings FY-20 in $ millions Release(1) Cash Flows from Operations 3,872 (41) 3,913 3,850 y/y 6% - 7% 5% CapEx (279) (8) (271) (280) Free Cash Flow(3) 3,593 (49) 3,642 3,570 y/y 6% - 7% 4% Note: Totals may not sum due to rounding. (1) Year-over-year growth comparisons are to Q4 FY19 amounts as adjusted to reflect the recast of prior period financial statements due to the Pivotal acquisition. (2) Year-over-year growth comparisons calculated from financial statements as originally reported. (3) Free Cash Flow is a non-GAAP financial measure calculated by subtracting CapEx from Cash Flows From Operations. See table above. ©2020 VMware, Inc. 8

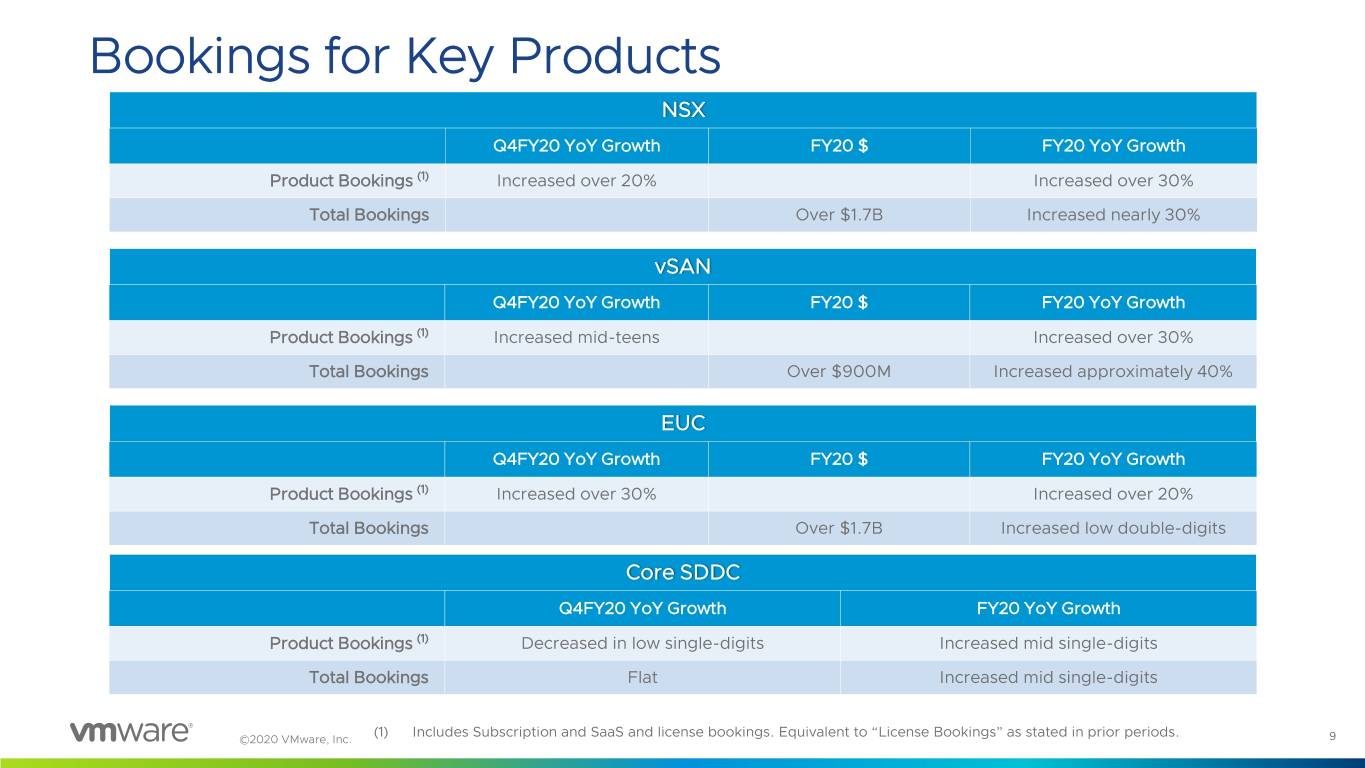

Bookings for Key Products NSX Q4FY20 YoY Growth FY20 $ FY20 YoY Growth Product Bookings (1) Increased over 20% Increased over 30% Total Bookings Over $1.7B Increased nearly 30% vSAN Q4FY20 YoY Growth FY20 $ FY20 YoY Growth Product Bookings (1) Increased mid-teens Increased over 30% Total Bookings Over $900M Increased approximately 40% EUC Q4FY20 YoY Growth FY20 $ FY20 YoY Growth Product Bookings (1) Increased over 30% Increased over 20% Total Bookings Over $1.7B Increased low double-digits Core SDDC Q4FY20 YoY Growth FY20 YoY Growth Product Bookings (1) Decreased in low single-digits Increased mid single-digits Total Bookings Flat Increased mid single-digits (1) Includes Subscription and SaaS and license bookings. Equivalent to “License Bookings” as stated in prior periods. ©2020 VMware, Inc. 9

Q&A ©2019 VMware, Inc. 10

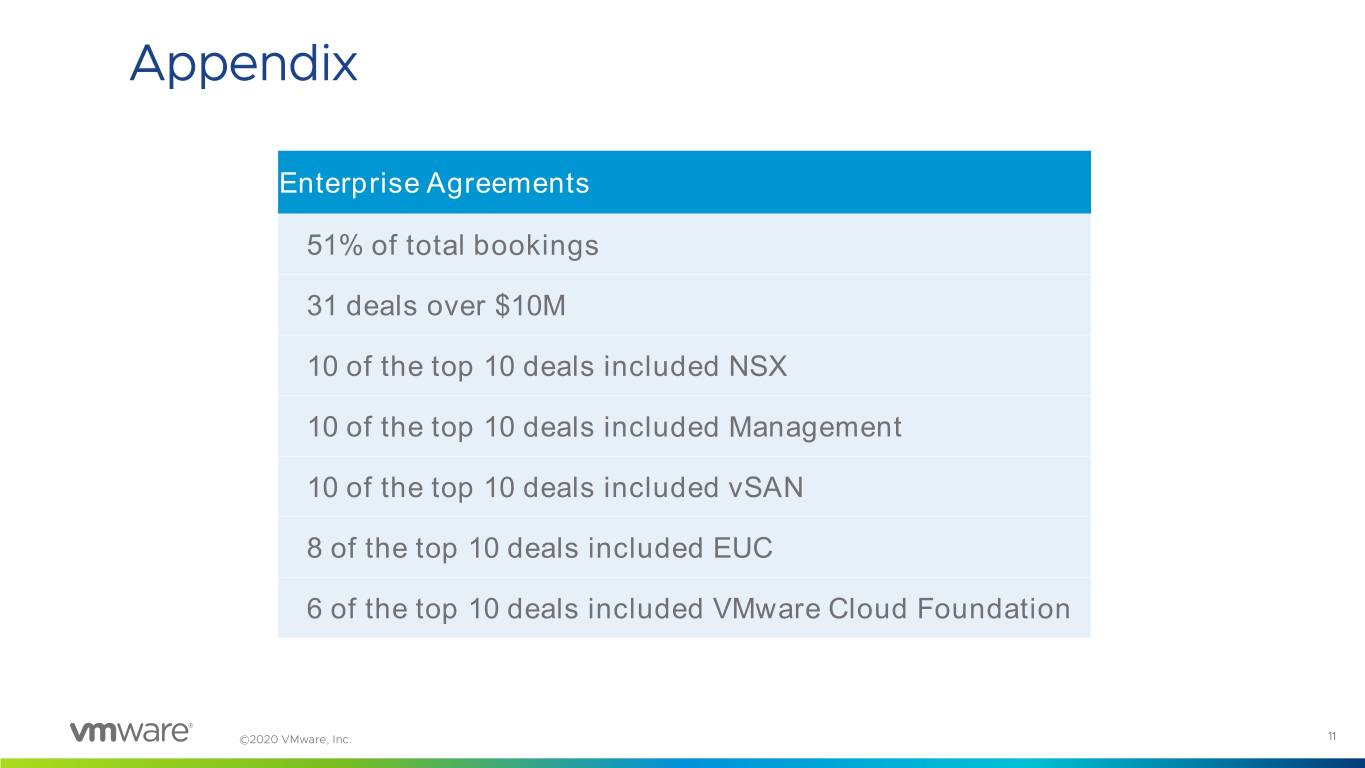

Appendix Enterprise Agreements 51% of total bookings 31 deals over $10M 10 of the top 10 deals included NSX 10 of the top 10 deals included Management 10 of the top 10 deals included vSAN 8 of the top 10 deals included EUC 6 of the top 10 deals included VMware Cloud Foundation ©2020 VMware, Inc. 11

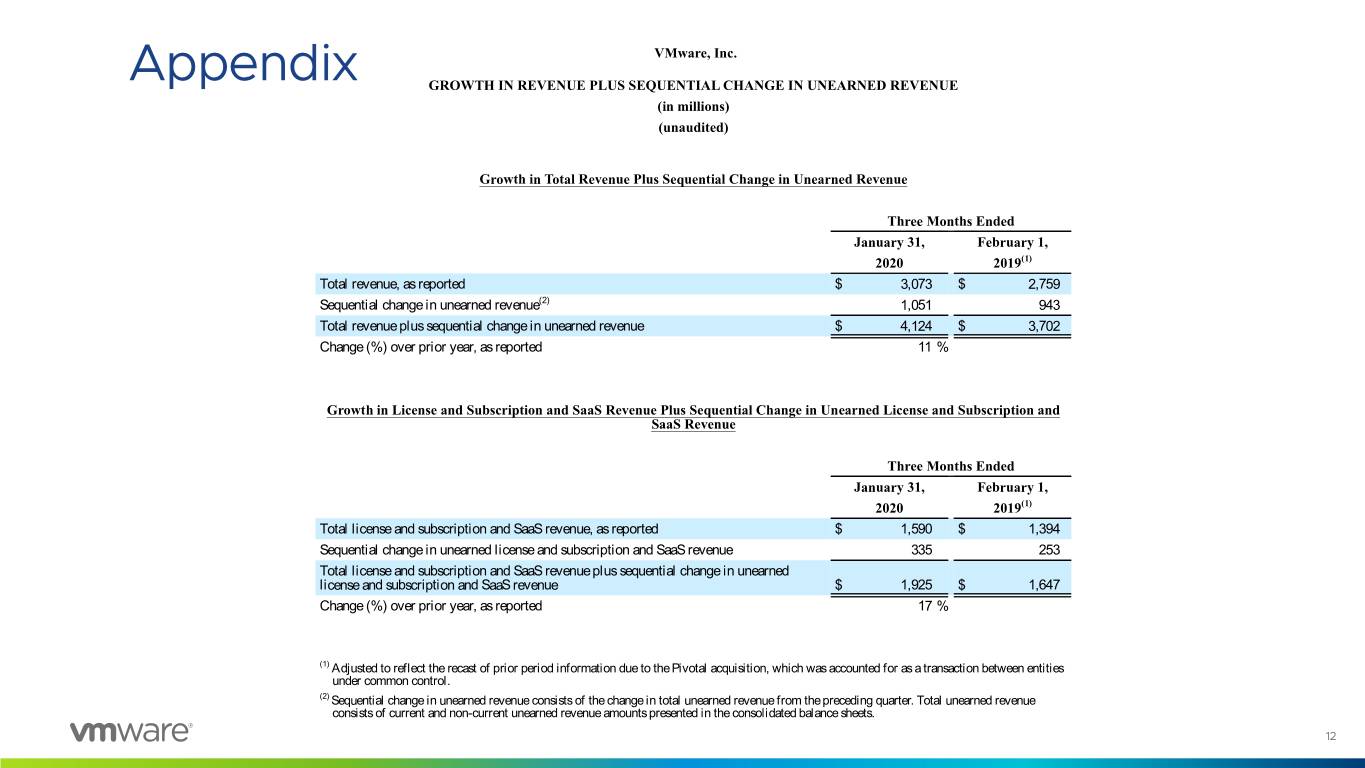

Appendix VMware, Inc. GROWTH IN REVENUE PLUS SEQUENTIAL CHANGE IN UNEARNED REVENUE (in millions) (unaudited) Growth in Total Revenue Plus Sequential Change in Unearned Revenue Three Months Ended January 31, February 1, 2020 2019(1) Total revenue, as reported $ 3,073 $ 2,759 Sequential change in unearned revenue(2) 1,051 943 Total revenue plus sequential change in unearned revenue $ 4,124 $ 3,702 Change (%) over prior year, as reported 11 % Growth in License and Subscription and SaaS Revenue Plus Sequential Change in Unearned License and Subscription and SaaS Revenue Three Months Ended January 31, February 1, 2020 2019(1) Total license and subscription and SaaS revenue, as reported $ 1,590 $ 1,394 Sequential change in unearned license and subscription and SaaS revenue 335 253 Total license and subscription and SaaS revenue plus sequential change in unearned license and subscription and SaaS revenue $ 1,925 $ 1,647 Change (%) over prior year, as reported 17 % (1) Adjusted to reflect the recast of prior period information due to the Pivotal acquisition, which was accounted for as a transaction between entities under common control. (2) Sequential change in unearned revenue consists of the change in total unearned revenue from the preceding quarter. Total unearned revenue consists of current and non-current unearned revenue amounts presented in the consolidated balance sheets. ©2020 VMware, Inc. 12

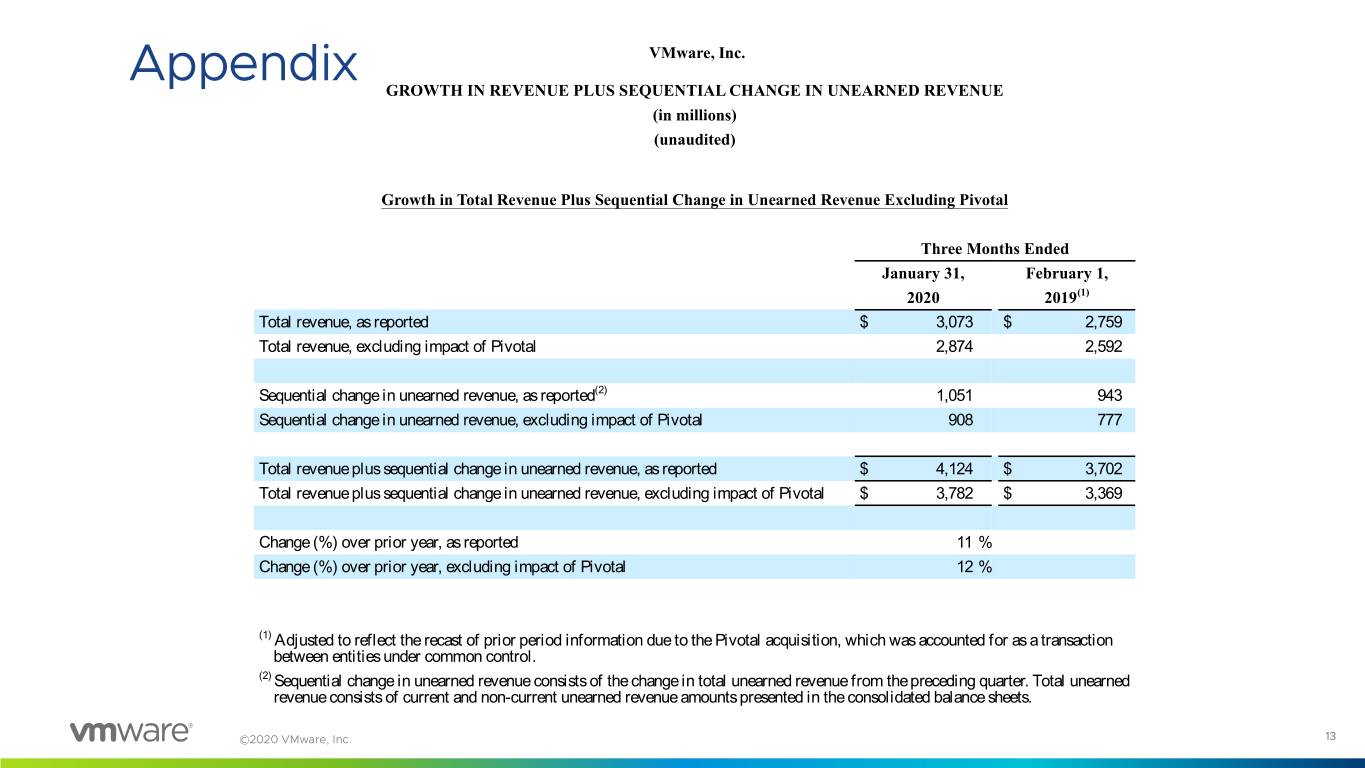

Appendix VMware, Inc. GROWTH IN REVENUE PLUS SEQUENTIAL CHANGE IN UNEARNED REVENUE (in millions) (unaudited) Growth in Total Revenue Plus Sequential Change in Unearned Revenue Excluding Pivotal Three Months Ended January 31, February 1, 2020 2019(1) Total revenue, as reported $ 3,073 $ 2,759 Total revenue, excluding impact of Pivotal 2,874 2,592 Sequential change in unearned revenue, as reported(2) 1,051 943 Sequential change in unearned revenue, excluding impact of Pivotal 908 777 Total revenue plus sequential change in unearned revenue, as reported $ 4,124 $ 3,702 Total revenue plus sequential change in unearned revenue, excluding impact of Pivotal $ 3,782 $ 3,369 Change (%) over prior year, as reported 11 % Change (%) over prior year, excluding impact of Pivotal 12 % (1) Adjusted to reflect the recast of prior period information due to the Pivotal acquisition, which was accounted for as a transaction between entities under common control. (2) Sequential change in unearned revenue consists of the change in total unearned revenue from the preceding quarter. Total unearned revenue consists of current and non-current unearned revenue amounts presented in the consolidated balance sheets. ©2020 VMware, Inc. 13

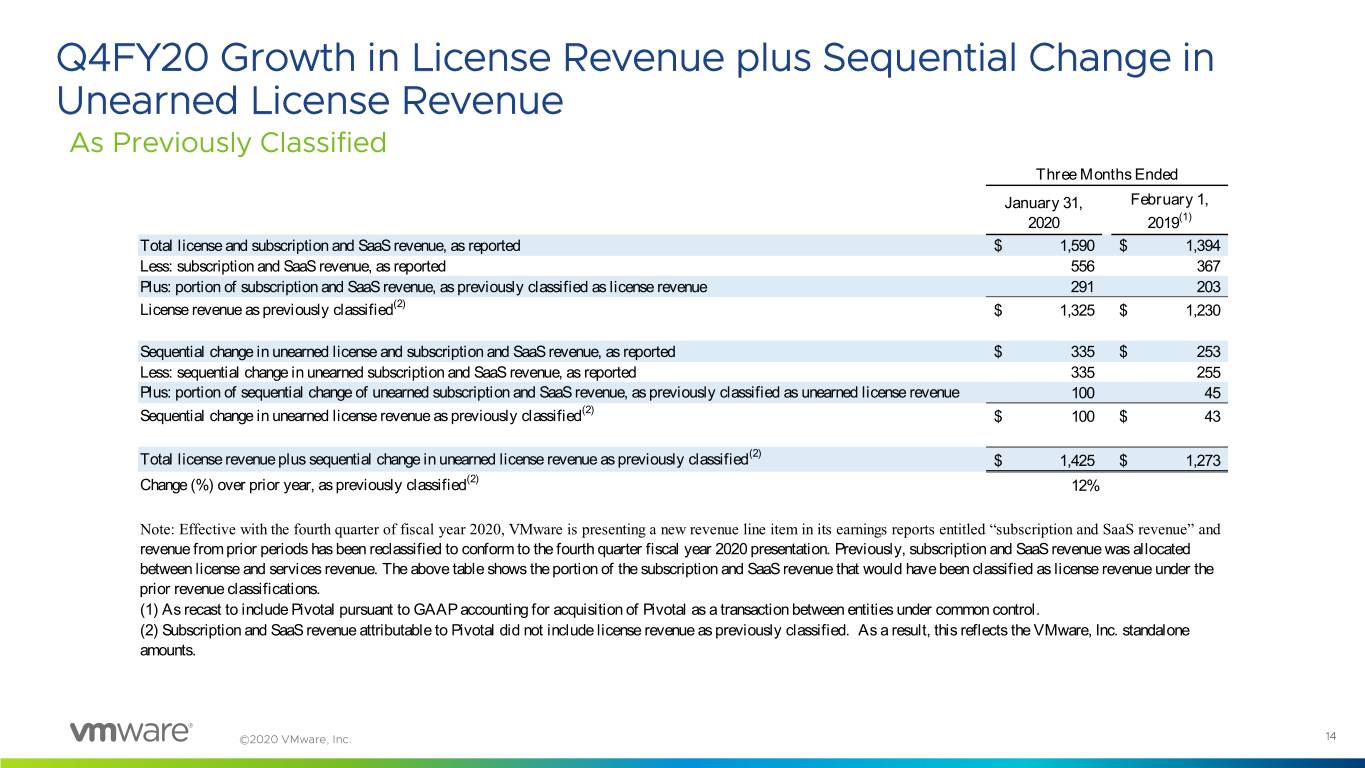

Q4FY20 Growth in License Revenue plus Sequential Change in Unearned License Revenue As Previously Classified Three Months Ended January 31, February 1, 2020 2019(1) Total license and subscription and SaaS revenue, as reported $ 1,590 $ 1,394 Less: subscription and SaaS revenue, as reported 556 367 Plus: portion of subscription and SaaS revenue, as previously classified as license revenue 291 203 License revenue as previously classified(2) $ 1,325 $ 1,230 Sequential change in unearned license and subscription and SaaS revenue, as reported $ 335 $ 253 Less: sequential change in unearned subscription and SaaS revenue, as reported 335 255 Plus: portion of sequential change of unearned subscription and SaaS revenue, as previously classified as unearned license revenue 100 45 Sequential change in unearned license revenue as previously classified(2) $ 100 $ 43 Total license revenue plus sequential change in unearned license revenue as previously classified(2) $ 1,425 $ 1,273 Change (%) over prior year, as previously classified(2) 12% Note: Effective with the fourth quarter of fiscal year 2020, VMware is presenting a new revenue line item in its earnings reports entitled “subscription and SaaS revenue” and revenue from prior periods has been reclassified to conform to the fourth quarter fiscal year 2020 presentation. Previously, subscription and SaaS revenue was allocated between license and services revenue. The above table shows the portion of the subscription and SaaS revenue that would have been classified as license revenue under the prior revenue classifications. (1) As recast to include Pivotal pursuant to GAAP accounting for acquisition of Pivotal as a transaction between entities under common control. (2) Subscription and SaaS revenue attributable to Pivotal did not include license revenue as previously classified. As a result, this reflects the VMware, Inc. standalone amounts. ©2020 VMware, Inc. 14

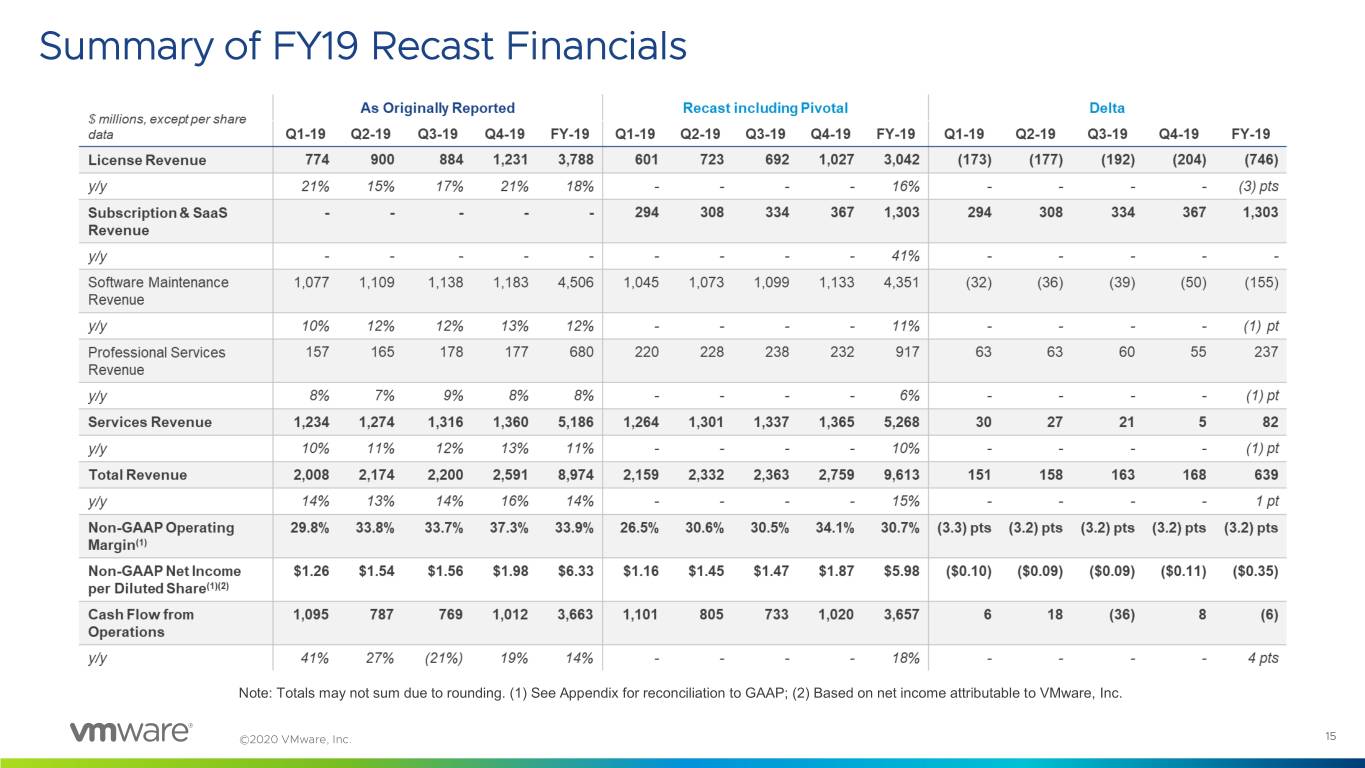

Summary of FY19 Recast Financials Note: Totals may not sum due to rounding. (1) See Appendix for reconciliation to GAAP; (2) Based on net income attributable to VMware, Inc. ©2020 VMware, Inc. 15

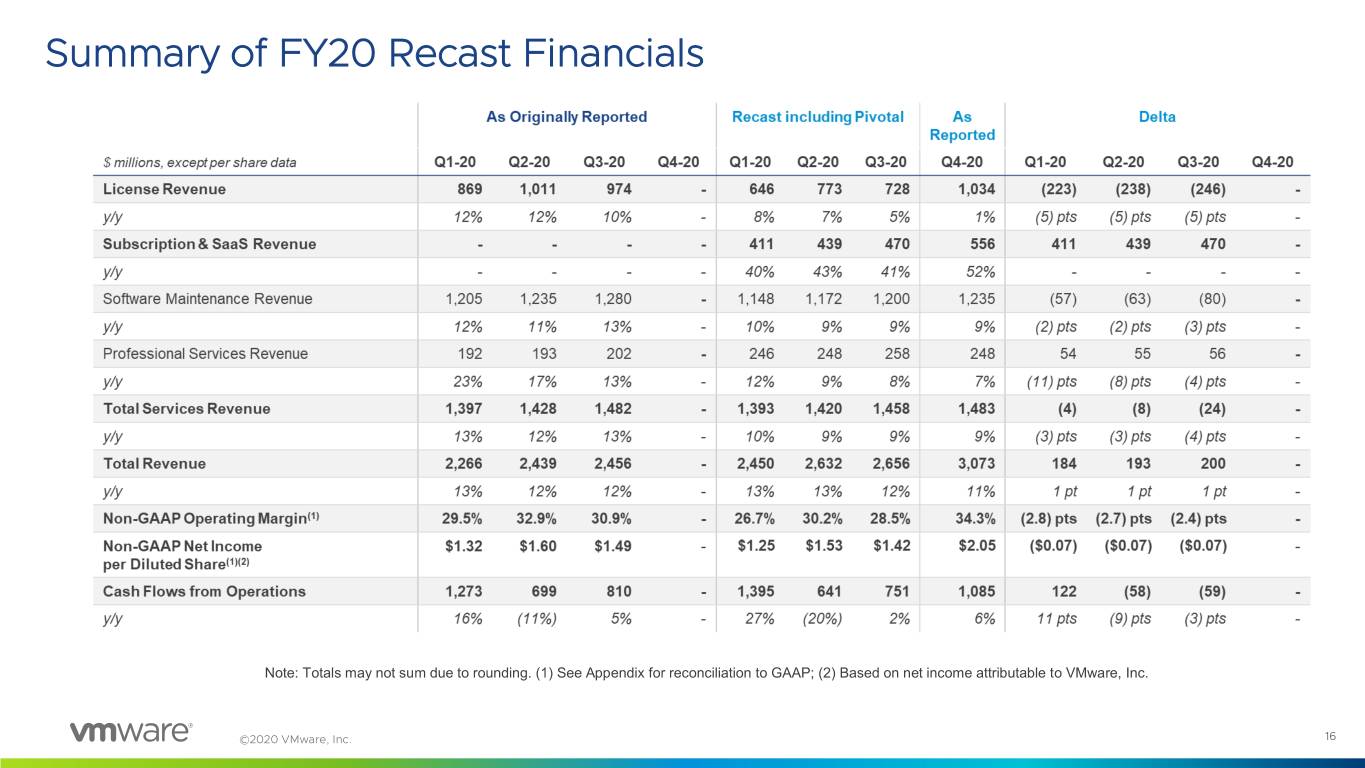

Summary of FY20 Recast Financials Note: Totals may not sum due to rounding. (1) See Appendix for reconciliation to GAAP; (2) Based on net income attributable to VMware, Inc. ©2020 VMware, Inc. 16

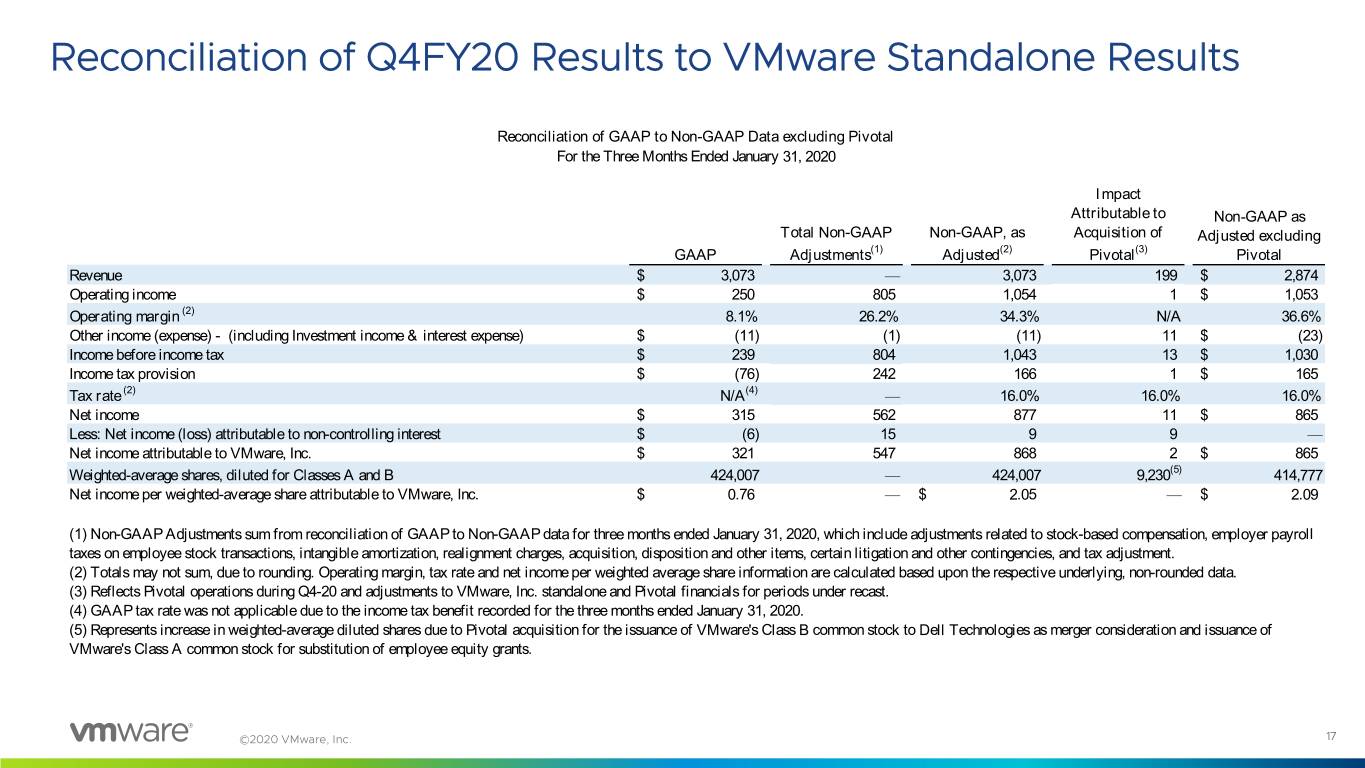

Reconciliation of Q4FY20 Results to VMware Standalone Results Reconciliation of GAAP to Non-GAAP Data excluding Pivotal For the Three Months Ended January 31, 2020 Impact Attributable to Non-GAAP as Total Non-GAAP Non-GAAP, as Acquisition of Adjusted excluding GAAP Adjustments(1) Adjusted(2) Pivotal(3) Pivotal Revenue $ 3,073 — 3,073 199 $ 2,874 Operating income $ 250 805 1,054 1 $ 1,053 Operating margin (2) 8.1% 26.2% 34.3% N/A 36.6% Other income (expense) - (including Investment income & interest expense) $ (11) (1) (11) 11 $ (23) Income before income tax $ 239 804 1,043 13 $ 1,030 Income tax provision $ (76) 242 166 1 $ 165 Tax rate (2) N/A (4) — 16.0% 16.0% 16.0% Net income $ 315 562 877 11 $ 865 Less: Net income (loss) attributable to non-controlling interest $ (6) 15 9 9 — Net income attributable to VMware, Inc. $ 321 547 868 2 $ 865 Weighted-average shares, diluted for Classes A and B 424,007 — 424,007 9,230(5) 414,777 Net income per weighted-average share attributable to VMware, Inc. $ 0.76 — $ 2.05 — $ 2.09 (1) Non-GAAP Adjustments sum from reconciliation of GAAP to Non-GAAP data for three months ended January 31, 2020, which include adjustments related to stock-based compensation, employer payroll taxes on employee stock transactions, intangible amortization, realignment charges, acquisition, disposition and other items, certain litigation and other contingencies, and tax adjustment. (2) Totals may not sum, due to rounding. Operating margin, tax rate and net income per weighted average share information are calculated based upon the respective underlying, non-rounded data. (3) Reflects Pivotal operations during Q4-20 and adjustments to VMware, Inc. standalone and Pivotal financials for periods under recast. (4) GAAP tax rate was not applicable due to the income tax benefit recorded for the three months ended January 31, 2020. (5) Represents increase in weighted-average diluted shares due to Pivotal acquisition for the issuance of VMware's Class B common stock to Dell Technologies as merger consideration and issuance of VMware's Class A common stock for substitution of employee equity grants. ©2020 VMware, Inc. 17

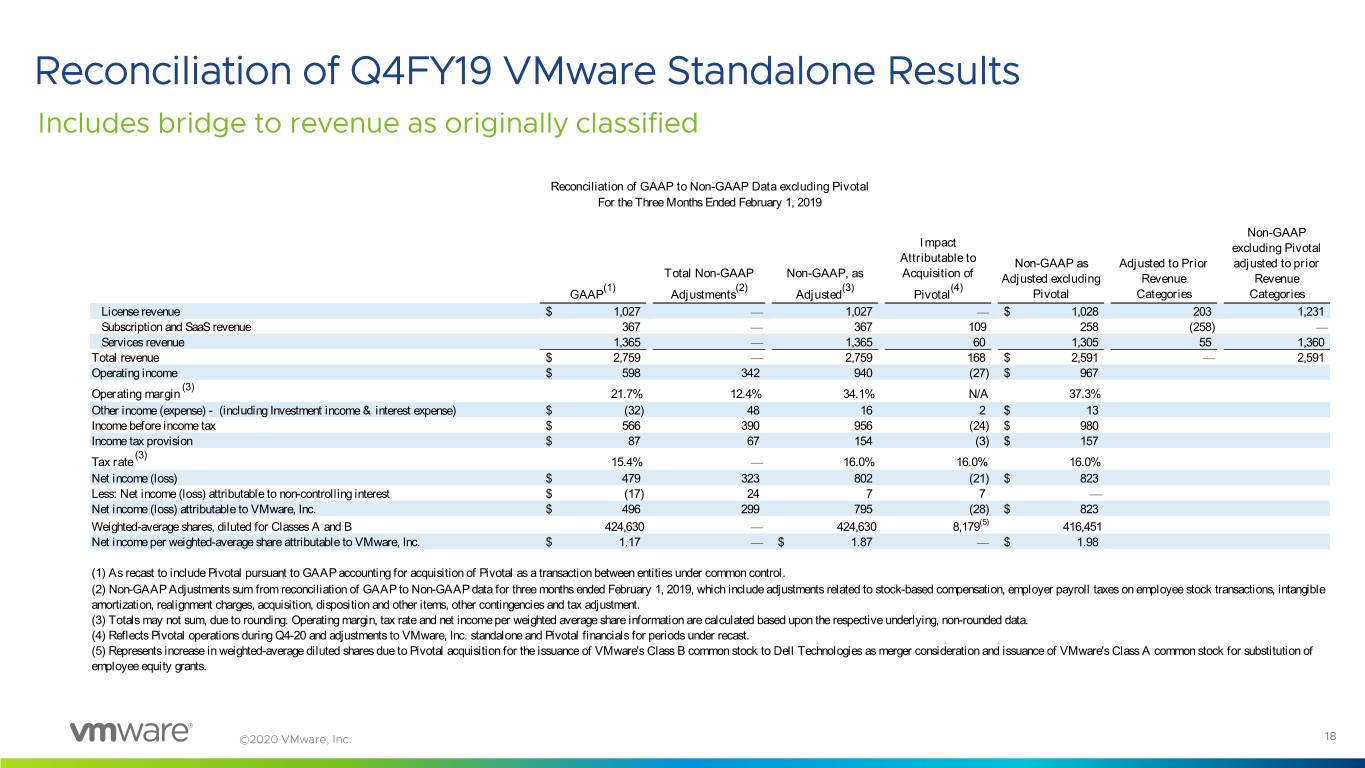

Reconciliation of Q4FY19 VMware Standalone Results Includes bridge to revenue as originally classified Reconciliation of GAAP to Non-GAAP Data excluding Pivotal For the Three Months Ended February 1, 2019 Non-GAAP Impact excluding Pivotal Attributable to Non-GAAP as Adjusted to Prior adjusted to prior Total Non-GAAP Non-GAAP, as Acquisition of Adjusted excluding Revenue Revenue (1) (2) (3) (4) GAAP Adjustments Adjusted Pivotal Pivotal Categories Categories License revenue $ 1,027 — 1,027 — $ 1,028 203 1,231 Subscription and SaaS revenue 367 — 367 109 258 (258) — Services revenue 1,365 — 1,365 60 1,305 55 1,360 Total revenue $ 2,759 — 2,759 168 $ 2,591 — 2,591 Operating income $ 598 342 940 (27) $ 967 (3) Operating margin 21.7% 12.4% 34.1% N/A 37.3% Other income (expense) - (including Investment income & interest expense) $ (32) 48 16 2 $ 13 Income before income tax $ 566 390 956 (24) $ 980 Income tax provision $ 87 67 154 (3) $ 157 (3) Tax rate 15.4% — 16.0% 16.0% 16.0% Net income (loss) $ 479 323 802 (21) $ 823 Less: Net income (loss) attributable to non-controlling interest $ (17) 24 7 7 — Net income (loss) attributable to VMware, Inc. $ 496 299 795 (28) $ 823 Weighted-average shares, diluted for Classes A and B 424,630 — 424,630 8,179(5) 416,451 Net income per weighted-average share attributable to VMware, Inc. $ 1.17 — $ 1.87 — $ 1.98 (1) As recast to include Pivotal pursuant to GAAP accounting for acquisition of Pivotal as a transaction between entities under common control. (2) Non-GAAP Adjustments sum from reconciliation of GAAP to Non-GAAP data for three months ended February 1, 2019, which include adjustments related to stock-based compensation, employer payroll taxes on employee stock transactions, intangible amortization, realignment charges, acquisition, disposition and other items, other contingencies and tax adjustment. (3) Totals may not sum, due to rounding. Operating margin, tax rate and net income per weighted average share information are calculated based upon the respective underlying, non-rounded data. (4) Reflects Pivotal operations during Q4-20 and adjustments to VMware, Inc. standalone and Pivotal financials for periods under recast. (5) Represents increase in weighted-average diluted shares due to Pivotal acquisition for the issuance of VMware's Class B common stock to Dell Technologies as merger consideration and issuance of VMware's Class A common stock for substitution of employee equity grants. ©2020 VMware, Inc. 18

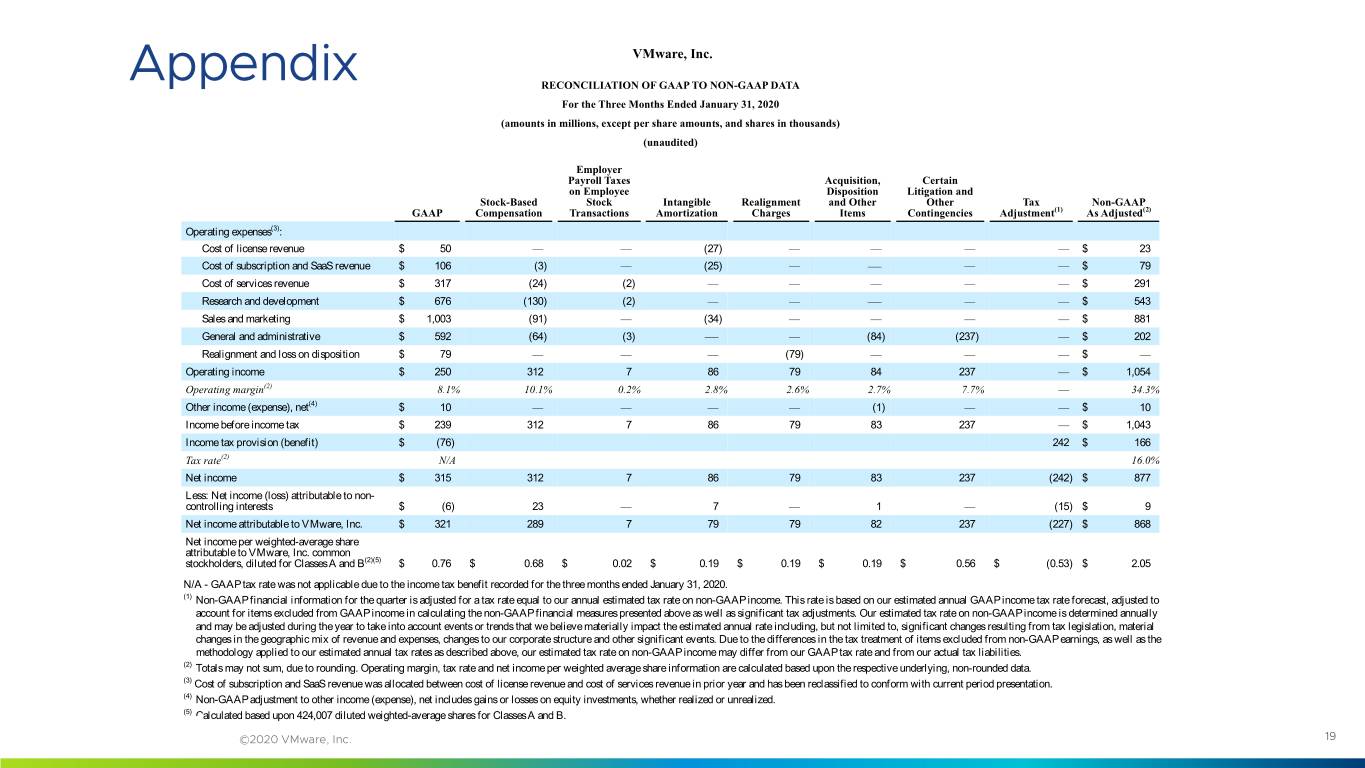

Appendix VMware, Inc. RECONCILIATION OF GAAP TO NON-GAAP DATA For the Three Months Ended January 31, 2020 (amounts in millions, except per share amounts, and shares in thousands) (unaudited) Employer Payroll Taxes Acquisition, Certain on Employee Disposition Litigation and Stock-Based Stock Intangible Realignment and Other Other Tax Non-GAAP GAAP Compensation Transactions Amortization Charges Items Contingencies Adjustment(1) As Adjusted(2) Operating expenses(3): Cost of license revenue $ 50 — — (27) — — — — $ 23 Cost of subscription and SaaS revenue $ 106 (3) — (25) — — — — $ 79 Cost of services revenue $ 317 (24) (2) — — — — — $ 291 Research and development $ 676 (130) (2) — — — — — $ 543 Sales and marketing $ 1,003 (91) — (34) — — — — $ 881 General and administrative $ 592 (64) (3) — — (84) (237) — $ 202 Realignment and loss on disposition $ 79 — — — (79) — — — $ — Operating income $ 250 312 7 86 79 84 237 — $ 1,054 Operating margin(2) 8.1% 10.1% 0.2% 2.8% 2.6% 2.7% 7.7% — 34.3% Other income (expense), net(4) $ 10 — — — — (1) — — $ 10 Income before income tax $ 239 312 7 86 79 83 237 — $ 1,043 Income tax provision (benefit) $ (76) 242 $ 166 Tax rate(2) N/A 16.0% Net income $ 315 312 7 86 79 83 237 (242) $ 877 Less: Net income (loss) attributable to non- controlling interests $ (6) 23 — 7 — 1 — (15) $ 9 Net income attributable to VMware, Inc. $ 321 289 7 79 79 82 237 (227) $ 868 Net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted for Classes A and B(2)(5) $ 0.76 $ 0.68 $ 0.02 $ 0.19 $ 0.19 $ 0.19 $ 0.56 $ (0.53) $ 2.05 N/A - GAAP tax rate was not applicable due to the income tax benefit recorded for the three months ended January 31, 2020. (1) Non-GAAP financial information for the quarter is adjusted for a tax rate equal to our annual estimated tax rate on non-GAAP income. This rate is based on our estimated annual GAAP income tax rate forecast, adjusted to account for items excluded from GAAP income in calculating the non-GAAP financial measures presented above as well as significant tax adjustments. Our estimated tax rate on non-GAAP income is determined annually and may be adjusted during the year to take into account events or trends that we believe materially impact the estimated annual rate including, but not limited to, significant changes resulting from tax legislation, material changes in the geographic mix of revenue and expenses, changes to our corporate structure and other significant events. Due to the differences in the tax treatment of items excluded from non-GAAP earnings, as well as the methodology applied to our estimated annual tax rates as described above, our estimated tax rate on non-GAAP income may differ from our GAAP tax rate and from our actual tax liabilities. (2) Totals may not sum, due to rounding. Operating margin, tax rate and net income per weighted average share information are calculated based upon the respective underlying, non-rounded data. (3) Cost of subscription and SaaS revenue was allocated between cost of license revenue and cost of services revenue in prior year and has been reclassified to conform with current period presentation. (4) Non-GAAP adjustment to other income (expense), net includes gains or losses on equity investments, whether realized or unrealized. (5) Calculated based upon 424,007 diluted weighted-average shares for Classes A and B. ©2020 VMware, Inc. 19

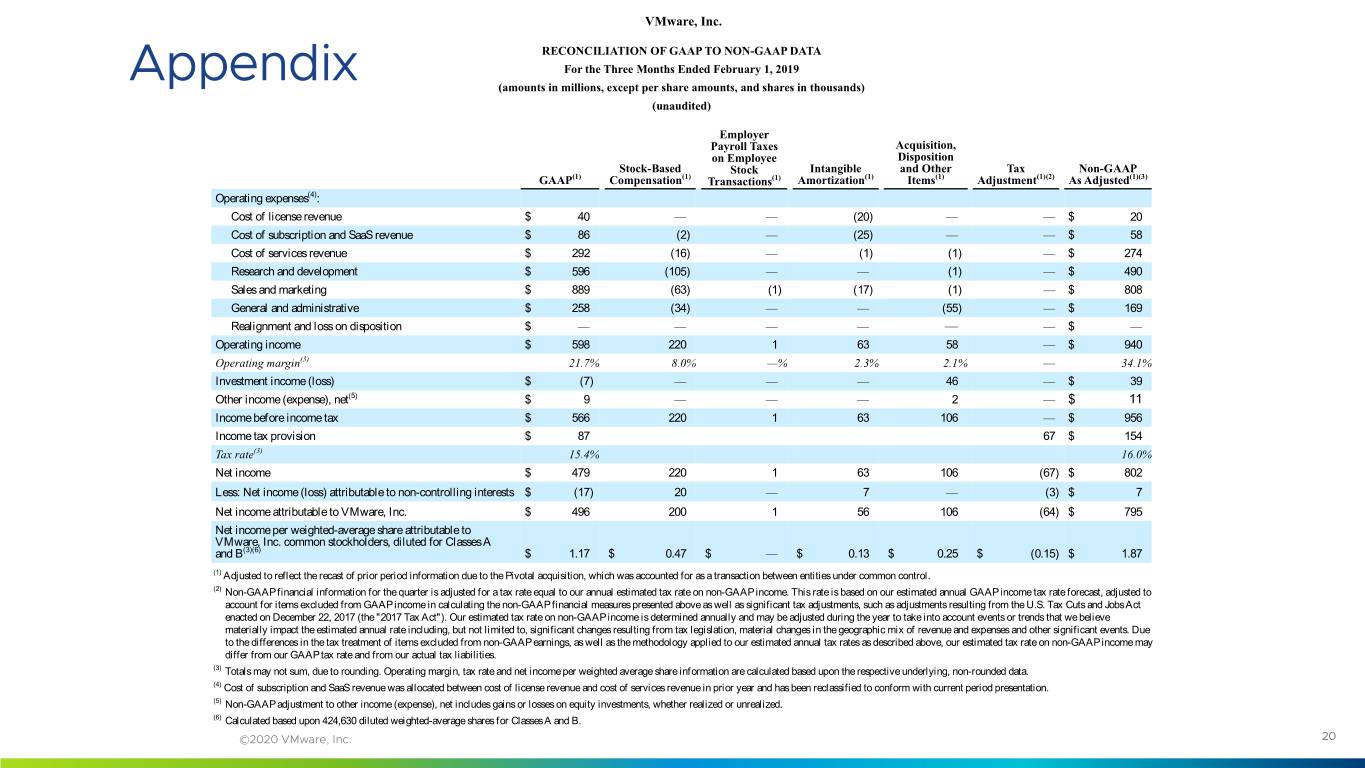

VMware, Inc. RECONCILIATION OF GAAP TO NON-GAAP DATA Appendix For the Three Months Ended February 1, 2019 (amounts in millions, except per share amounts, and shares in thousands) (unaudited) Employer Payroll Taxes Acquisition, on Employee Disposition Stock-Based Stock Intangible and Other Tax Non-GAAP GAAP(1) Compensation(1) Transactions(1) Amortization(1) Items(1) Adjustment(1)(2) As Adjusted(1)(3) Operating expenses(4): Cost of license revenue $ 40 — — (20) — — $ 20 Cost of subscription and SaaS revenue $ 86 (2) — (25) — — $ 58 Cost of services revenue $ 292 (16) — (1) (1) — $ 274 Research and development $ 596 (105) — — (1) — $ 490 Sales and marketing $ 889 (63) (1) (17) (1) — $ 808 General and administrative $ 258 (34) — — (55) — $ 169 Realignment and loss on disposition $ — — — — — — $ — Operating income $ 598 220 1 63 58 — $ 940 Operating margin(3) 21.7% 8.0% —% 2.3% 2.1% — 34.1% Investment income (loss) $ (7) — — — 46 — $ 39 Other income (expense), net(5) $ 9 — — — 2 — $ 11 Income before income tax $ 566 220 1 63 106 — $ 956 Income tax provision $ 87 67 $ 154 Tax rate(3) 15.4% 16.0% Net income $ 479 220 1 63 106 (67) $ 802 Less: Net income (loss) attributable to non-controlling interests $ (17) 20 — 7 — (3) $ 7 Net income attributable to VMware, Inc. $ 496 200 1 56 106 (64) $ 795 Net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted for Classes A and B(3)(6) $ 1.17 $ 0.47 $ — $ 0.13 $ 0.25 $ (0.15) $ 1.87 (1) Adjusted to reflect the recast of prior period information due to the Pivotal acquisition, which was accounted for as a transaction between entities under common control. (2) Non-GAAP financial information for the quarter is adjusted for a tax rate equal to our annual estimated tax rate on non-GAAP income. This rate is based on our estimated annual GAAP income tax rate forecast, adjusted to account for items excluded from GAAP income in calculating the non-GAAP financial measures presented above as well as significant tax adjustments, such as adjustments resulting from the U.S. Tax Cuts and Jobs Act enacted on December 22, 2017 (the "2017 Tax Act"). Our estimated tax rate on non-GAAP income is determined annually and may be adjusted during the year to take into account events or trends that we believe materially impact the estimated annual rate including, but not limited to, significant changes resulting from tax legislation, material changes in the geographic mix of revenue and expenses and other significant events. Due to the differences in the tax treatment of items excluded from non-GAAP earnings, as well as the methodology applied to our estimated annual tax rates as described above, our estimated tax rate on non-GAAP income may differ from our GAAP tax rate and from our actual tax liabilities. (3) Totals may not sum, due to rounding. Operating margin, tax rate and net income per weighted average share information are calculated based upon the respective underlying, non-rounded data. (4) Cost of subscription and SaaS revenue was allocated between cost of license revenue and cost of services revenue in prior year and has been reclassified to conform with current period presentation. (5) Non-GAAP adjustment to other income (expense), net includes gains or losses on equity investments, whether realized or unrealized. (6) Calculated based upon 424,630 diluted weighted-average shares for Classes A and B. ©2020 VMware, Inc. 20

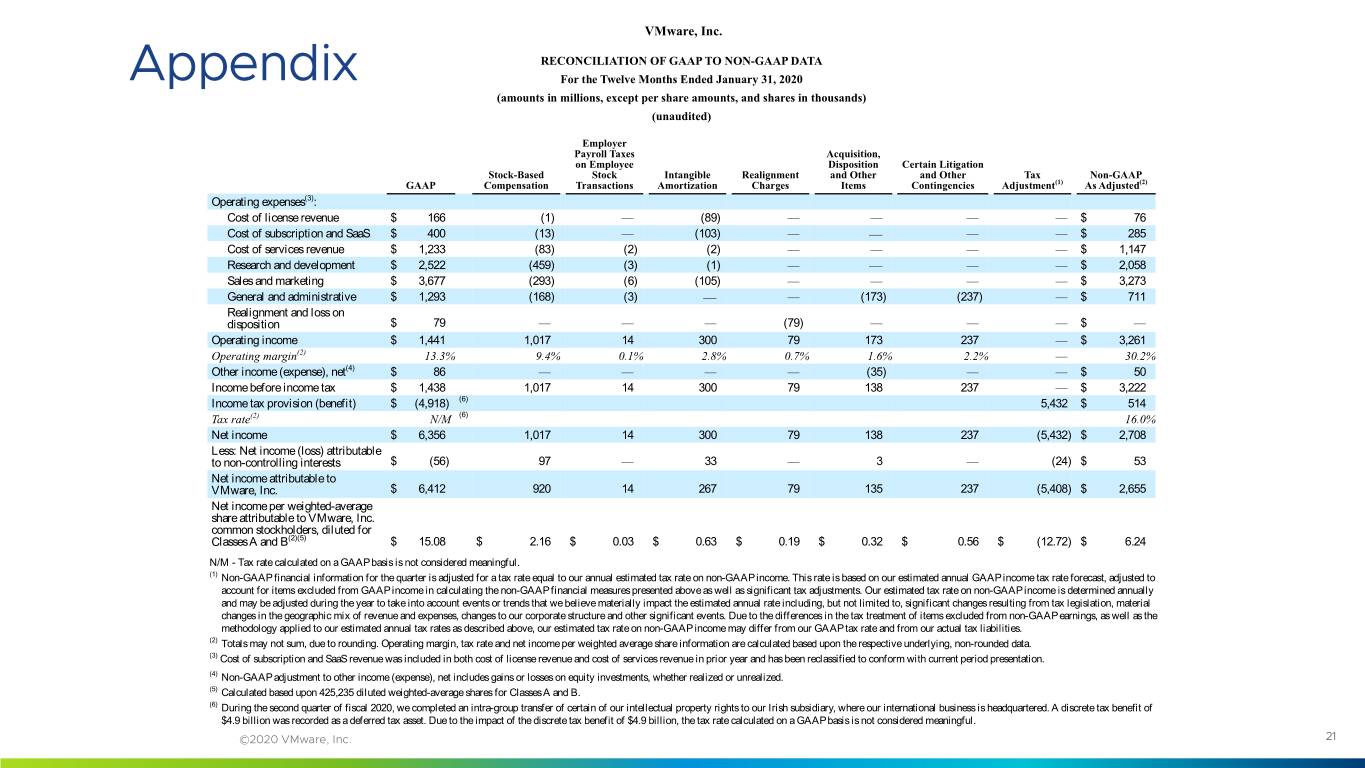

VMware, Inc. RECONCILIATION OF GAAP TO NON-GAAP DATA Appendix For the Twelve Months Ended January 31, 2020 (amounts in millions, except per share amounts, and shares in thousands) (unaudited) Employer Payroll Taxes Acquisition, on Employee Disposition Certain Litigation Stock-Based Stock Intangible Realignment and Other and Other Tax Non-GAAP GAAP Compensation Transactions Amortization Charges Items Contingencies Adjustment(1) As Adjusted(2) Operating expenses(3): Cost of license revenue $ 166 (1) — (89) — — — — $ 76 Cost of subscription and SaaS $ 400 (13) — (103) — — — — $ 285 Cost of services revenue $ 1,233 (83) (2) (2) — — — — $ 1,147 Research and development $ 2,522 (459) (3) (1) — — — — $ 2,058 Sales and marketing $ 3,677 (293) (6) (105) — — — — $ 3,273 General and administrative $ 1,293 (168) (3) — — (173) (237) — $ 711 Realignment and loss on disposition $ 79 — — — (79) — — — $ — Operating income $ 1,441 1,017 14 300 79 173 237 — $ 3,261 Operating margin(2) 13.3% 9.4% 0.1% 2.8% 0.7% 1.6% 2.2% — 30.2% Other income (expense), net(4) $ 86 — — — — (35) — — $ 50 Income before income tax $ 1,438 1,017 14 300 79 138 237 — $ 3,222 Income tax provision (benefit) $ (4,918) (6) 5,432 $ 514 Tax rate(2) N/M (6) 16.0% Net income $ 6,356 1,017 14 300 79 138 237 (5,432) $ 2,708 Less: Net income (loss) attributable to non-controlling interests $ (56) 97 — 33 — 3 — (24) $ 53 Net income attributable to VMware, Inc. $ 6,412 920 14 267 79 135 237 (5,408) $ 2,655 Net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted for Classes A and B(2)(5) $ 15.08 $ 2.16 $ 0.03 $ 0.63 $ 0.19 $ 0.32 $ 0.56 $ (12.72) $ 6.24 N/M - Tax rate calculated on a GAAP basis is not considered meaningful. (1) Non-GAAP financial information for the quarter is adjusted for a tax rate equal to our annual estimated tax rate on non-GAAP income. This rate is based on our estimated annual GAAP income tax rate forecast, adjusted to account for items excluded from GAAP income in calculating the non-GAAP financial measures presented above as well as significant tax adjustments. Our estimated tax rate on non-GAAP income is determined annually and may be adjusted during the year to take into account events or trends that we believe materially impact the estimated annual rate including, but not limited to, significant changes resulting from tax legislation, material changes in the geographic mix of revenue and expenses, changes to our corporate structure and other significant events. Due to the differences in the tax treatment of items excluded from non-GAAP earnings, as well as the methodology applied to our estimated annual tax rates as described above, our estimated tax rate on non-GAAP income may differ from our GAAP tax rate and from our actual tax liabilities. (2) Totals may not sum, due to rounding. Operating margin, tax rate and net income per weighted average share information are calculated based upon the respective underlying, non-rounded data. (3) Cost of subscription and SaaS revenue was included in both cost of license revenue and cost of services revenue in prior year and has been reclassified to conform with current period presentation. (4) Non-GAAP adjustment to other income (expense), net includes gains or losses on equity investments, whether realized or unrealized. (5) Calculated based upon 425,235 diluted weighted-average shares for Classes A and B. (6) During the second quarter of fiscal 2020, we completed an intra-group transfer of certain of our intellectual property rights to our Irish subsidiary, where our international business is headquartered. A discrete tax benefit of $4.9 billion was recorded as a deferred tax asset. Due to the impact of the discrete tax benefit of $4.9 billion, the tax rate calculated on a GAAP basis is not considered meaningful. ©2020 VMware, Inc. 21

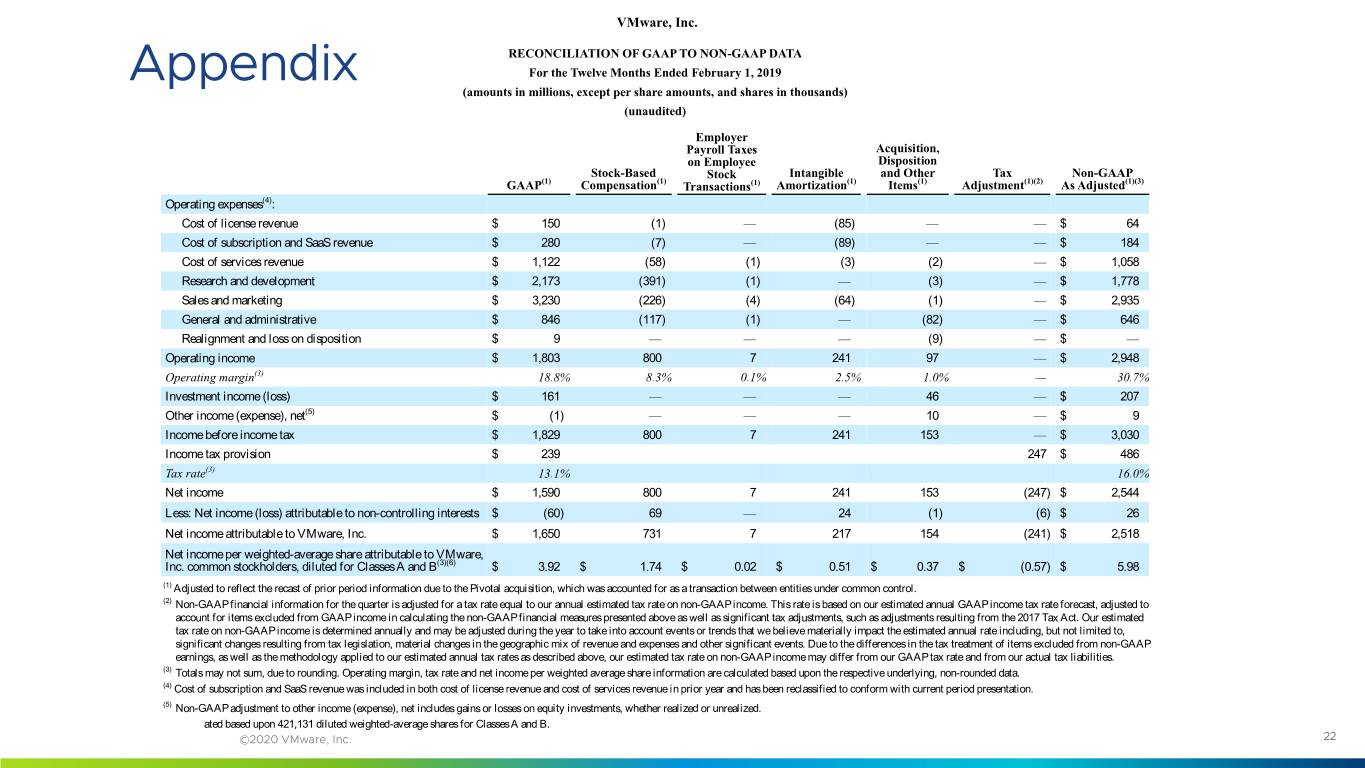

VMware, Inc. RECONCILIATION OF GAAP TO NON-GAAP DATA Appendix For the Twelve Months Ended February 1, 2019 (amounts in millions, except per share amounts, and shares in thousands) (unaudited) Employer Payroll Taxes Acquisition, on Employee Disposition Stock-Based Stock Intangible and Other Tax Non-GAAP GAAP(1) Compensation(1) Transactions(1) Amortization(1) Items(1) Adjustment(1)(2) As Adjusted(1)(3) Operating expenses(4): Cost of license revenue $ 150 (1) — (85) — — $ 64 Cost of subscription and SaaS revenue $ 280 (7) — (89) — — $ 184 Cost of services revenue $ 1,122 (58) (1) (3) (2) — $ 1,058 Research and development $ 2,173 (391) (1) — (3) — $ 1,778 Sales and marketing $ 3,230 (226) (4) (64) (1) — $ 2,935 General and administrative $ 846 (117) (1) — (82) — $ 646 Realignment and loss on disposition $ 9 — — — (9) — $ — Operating income $ 1,803 800 7 241 97 — $ 2,948 Operating margin(3) 18.8% 8.3% 0.1% 2.5% 1.0% — 30.7% Investment income (loss) $ 161 — — — 46 — $ 207 Other income (expense), net(5) $ (1) — — — 10 — $ 9 Income before income tax $ 1,829 800 7 241 153 — $ 3,030 Income tax provision $ 239 247 $ 486 Tax rate(3) 13.1% 16.0% Net income $ 1,590 800 7 241 153 (247) $ 2,544 Less: Net income (loss) attributable to non-controlling interests $ (60) 69 — 24 (1) (6) $ 26 Net income attributable to VMware, Inc. $ 1,650 731 7 217 154 (241) $ 2,518 Net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted for Classes A and B(3)(6) $ 3.92 $ 1.74 $ 0.02 $ 0.51 $ 0.37 $ (0.57) $ 5.98 (1) Adjusted to reflect the recast of prior period information due to the Pivotal acquisition, which was accounted for as a transaction between entities under common control. (2) Non-GAAP financial information for the quarter is adjusted for a tax rate equal to our annual estimated tax rate on non-GAAP income. This rate is based on our estimated annual GAAP income tax rate forecast, adjusted to account for items excluded from GAAP income in calculating the non-GAAP financial measures presented above as well as significant tax adjustments, such as adjustments resulting from the 2017 Tax Act. Our estimated tax rate on non-GAAP income is determined annually and may be adjusted during the year to take into account events or trends that we believe materially impact the estimated annual rate including, but not limited to, significant changes resulting from tax legislation, material changes in the geographic mix of revenue and expenses and other significant events. Due to the differences in the tax treatment of items excluded from non-GAAP earnings, as well as the methodology applied to our estimated annual tax rates as described above, our estimated tax rate on non-GAAP income may differ from our GAAP tax rate and from our actual tax liabilities. (3) Totals may not sum, due to rounding. Operating margin, tax rate and net income per weighted average share information are calculated based upon the respective underlying, non-rounded data. (4) Cost of subscription and SaaS revenue was included in both cost of license revenue and cost of services revenue in prior year and has been reclassified to conform with current period presentation. (5) Non-GAAP adjustment to other income (expense), net includes gains or losses on equity investments, whether realized or unrealized. (6) Calculated based upon 421,131 diluted weighted-average shares for Classes A and B. ©2020 VMware, Inc. 22

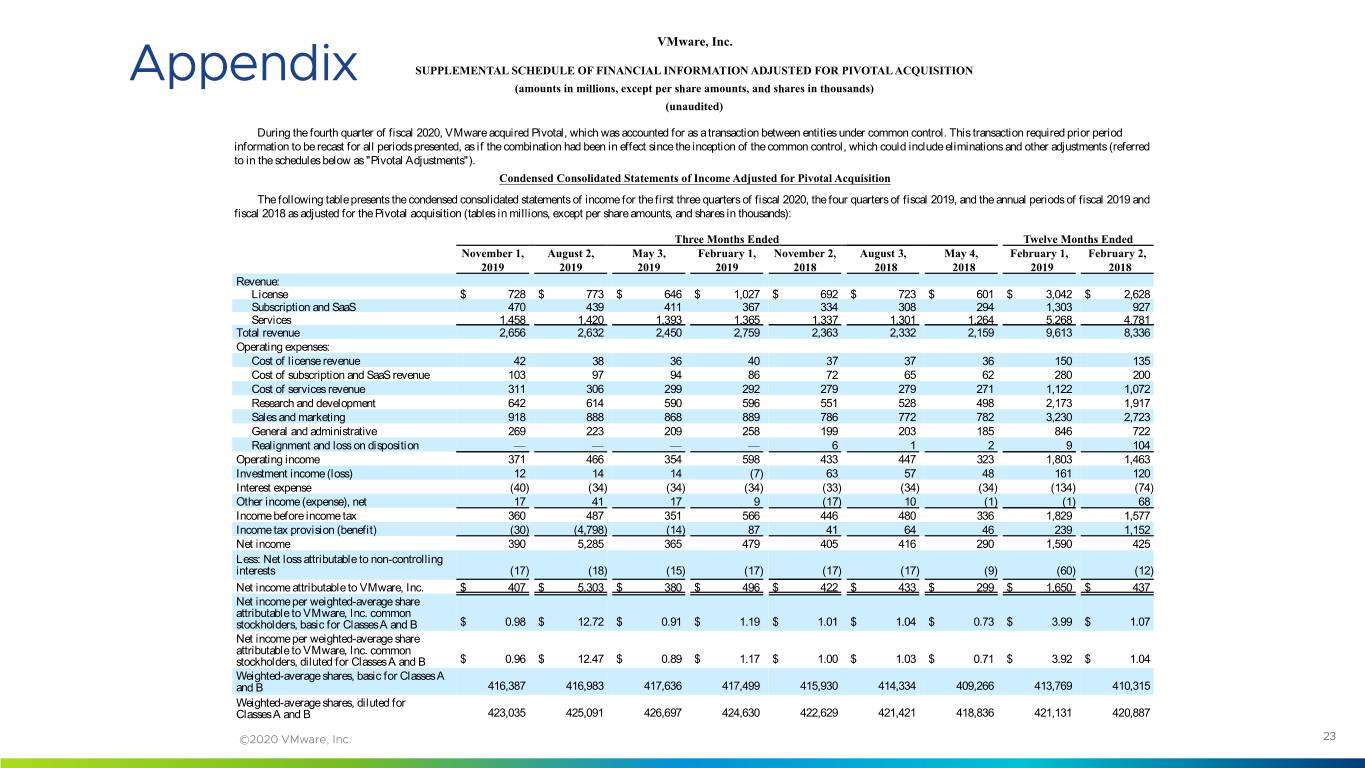

VMware, Inc. Appendix SUPPLEMENTAL SCHEDULE OF FINANCIAL INFORMATION ADJUSTED FOR PIVOTAL ACQUISITION (amounts in millions, except per share amounts, and shares in thousands) (unaudited) During the fourth quarter of fiscal 2020, VMware acquired Pivotal, which was accounted for as a transaction between entities under common control. This transaction required prior period information to be recast for all periods presented, as if the combination had been in effect since the inception of the common control, which could include eliminations and other adjustments (referred to in the schedules below as "Pivotal Adjustments"). Condensed Consolidated Statements of Income Adjusted for Pivotal Acquisition The following table presents the condensed consolidated statements of income for the first three quarters of fiscal 2020, the four quarters of fiscal 2019, and the annual periods of fiscal 2019 and fiscal 2018 as adjusted for the Pivotal acquisition (tables in millions, except per share amounts, and shares in thousands): Three Months Ended Twelve Months Ended November 1, August 2, May 3, February 1, November 2, August 3, May 4, February 1, February 2, 2019 2019 2019 2019 2018 2018 2018 2019 2018 Revenue: License $ 728 $ 773 $ 646 $ 1,027 $ 692 $ 723 $ 601 $ 3,042 $ 2,628 Subscription and SaaS 470 439 411 367 334 308 294 1,303 927 Services 1,458 1,420 1,393 1,365 1,337 1,301 1,264 5,268 4,781 Total revenue 2,656 2,632 2,450 2,759 2,363 2,332 2,159 9,613 8,336 Operating expenses: Cost of license revenue 42 38 36 40 37 37 36 150 135 Cost of subscription and SaaS revenue 103 97 94 86 72 65 62 280 200 Cost of services revenue 311 306 299 292 279 279 271 1,122 1,072 Research and development 642 614 590 596 551 528 498 2,173 1,917 Sales and marketing 918 888 868 889 786 772 782 3,230 2,723 General and administrative 269 223 209 258 199 203 185 846 722 Realignment and loss on disposition — — — — 6 1 2 9 104 Operating income 371 466 354 598 433 447 323 1,803 1,463 Investment income (loss) 12 14 14 (7) 63 57 48 161 120 Interest expense (40) (34) (34) (34) (33) (34) (34) (134) (74) Other income (expense), net 17 41 17 9 (17) 10 (1) (1) 68 Income before income tax 360 487 351 566 446 480 336 1,829 1,577 Income tax provision (benefit) (30) (4,798) (14) 87 41 64 46 239 1,152 Net income 390 5,285 365 479 405 416 290 1,590 425 Less: Net loss attributable to non-controlling interests (17) (18) (15) (17) (17) (17) (9) (60) (12) Net income attributable to VMware, Inc. $ 407 $ 5,303 $ 380 $ 496 $ 422 $ 433 $ 299 $ 1,650 $ 437 Net income per weighted-average share attributable to VMware, Inc. common stockholders, basic for Classes A and B $ 0.98 $ 12.72 $ 0.91 $ 1.19 $ 1.01 $ 1.04 $ 0.73 $ 3.99 $ 1.07 Net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted for Classes A and B $ 0.96 $ 12.47 $ 0.89 $ 1.17 $ 1.00 $ 1.03 $ 0.71 $ 3.92 $ 1.04 Weighted-average shares, basic for Classes A and B 416,387 416,983 417,636 417,499 415,930 414,334 409,266 413,769 410,315 Weighted-average shares, diluted for Classes A and B 423,035 425,091 426,697 424,630 422,629 421,421 418,836 421,131 420,887 ©2020 VMware, Inc. 23

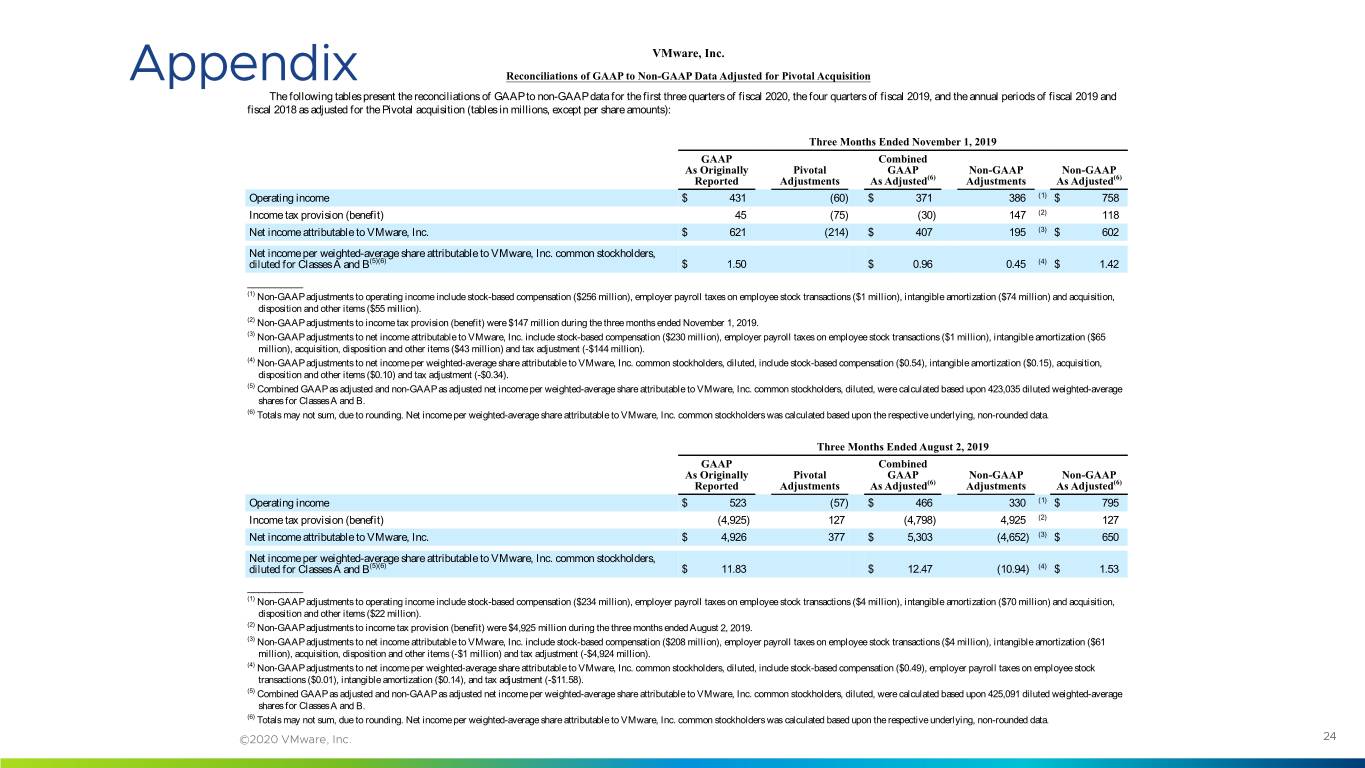

VMware, Inc. Appendix Reconciliations of GAAP to Non-GAAP Data Adjusted for Pivotal Acquisition The following tables present the reconciliations of GAAP to non-GAAP data for the first three quarters of fiscal 2020, the four quarters of fiscal 2019, and the annual periods of fiscal 2019 and fiscal 2018 as adjusted for the Pivotal acquisition (tables in millions, except per share amounts): Three Months Ended November 1, 2019 GAAP Combined As Originally Pivotal GAAP Non-GAAP Non-GAAP Reported Adjustments As Adjusted(6) Adjustments As Adjusted(6) Operating income $ 431 (60) $ 371 386 (1) $ 758 Income tax provision (benefit) 45 (75) (30) 147 (2) 118 Net income attributable to VMware, Inc. $ 621 (214) $ 407 195 (3) $ 602 Net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted for Classes A and B(5)(6) $ 1.50 $ 0.96 0.45 (4) $ 1.42 __________ (1) Non-GAAP adjustments to operating income include stock-based compensation ($256 million), employer payroll taxes on employee stock transactions ($1 million), intangible amortization ($74 million) and acquisition, disposition and other items ($55 million). (2) Non-GAAP adjustments to income tax provision (benefit) were $147 million during the three months ended November 1, 2019. (3) Non-GAAP adjustments to net income attributable to VMware, Inc. include stock-based compensation ($230 million), employer payroll taxes on employee stock transactions ($1 million), intangible amortization ($65 million), acquisition, disposition and other items ($43 million) and tax adjustment (-$144 million). (4) Non-GAAP adjustments to net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, include stock-based compensation ($0.54), intangible amortization ($0.15), acquisition, disposition and other items ($0.10) and tax adjustment (-$0.34). (5) Combined GAAP as adjusted and non-GAAP as adjusted net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, were calculated based upon 423,035 diluted weighted-average shares for Classes A and B. (6) Totals may not sum, due to rounding. Net income per weighted-average share attributable to VMware, Inc. common stockholders was calculated based upon the respective underlying, non-rounded data. Three Months Ended August 2, 2019 GAAP Combined As Originally Pivotal GAAP Non-GAAP Non-GAAP Reported Adjustments As Adjusted(6) Adjustments As Adjusted(6) Operating income $ 523 (57) $ 466 330 (1) $ 795 Income tax provision (benefit) (4,925) 127 (4,798) 4,925 (2) 127 Net income attributable to VMware, Inc. $ 4,926 377 $ 5,303 (4,652) (3) $ 650 Net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted for Classes A and B(5)(6) $ 11.83 $ 12.47 (10.94) (4) $ 1.53 __________ (1) Non-GAAP adjustments to operating income include stock-based compensation ($234 million), employer payroll taxes on employee stock transactions ($4 million), intangible amortization ($70 million) and acquisition, disposition and other items ($22 million). (2) Non-GAAP adjustments to income tax provision (benefit) were $4,925 million during the three months ended August 2, 2019. (3) Non-GAAP adjustments to net income attributable to VMware, Inc. include stock-based compensation ($208 million), employer payroll taxes on employee stock transactions ($4 million), intangible amortization ($61 million), acquisition, disposition and other items (-$1 million) and tax adjustment (-$4,924 million). (4) Non-GAAP adjustments to net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, include stock-based compensation ($0.49), employer payroll taxes on employee stock transactions ($0.01), intangible amortization ($0.14), and tax adjustment (-$11.58). (5) Combined GAAP as adjusted and non-GAAP as adjusted net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, were calculated based upon 425,091 diluted weighted-average shares for Classes A and B. (6) Totals may not sum, due to rounding. Net income per weighted-average share attributable to VMware, Inc. common stockholders was calculated based upon the respective underlying, non-rounded data. ©2020 VMware, Inc. 24

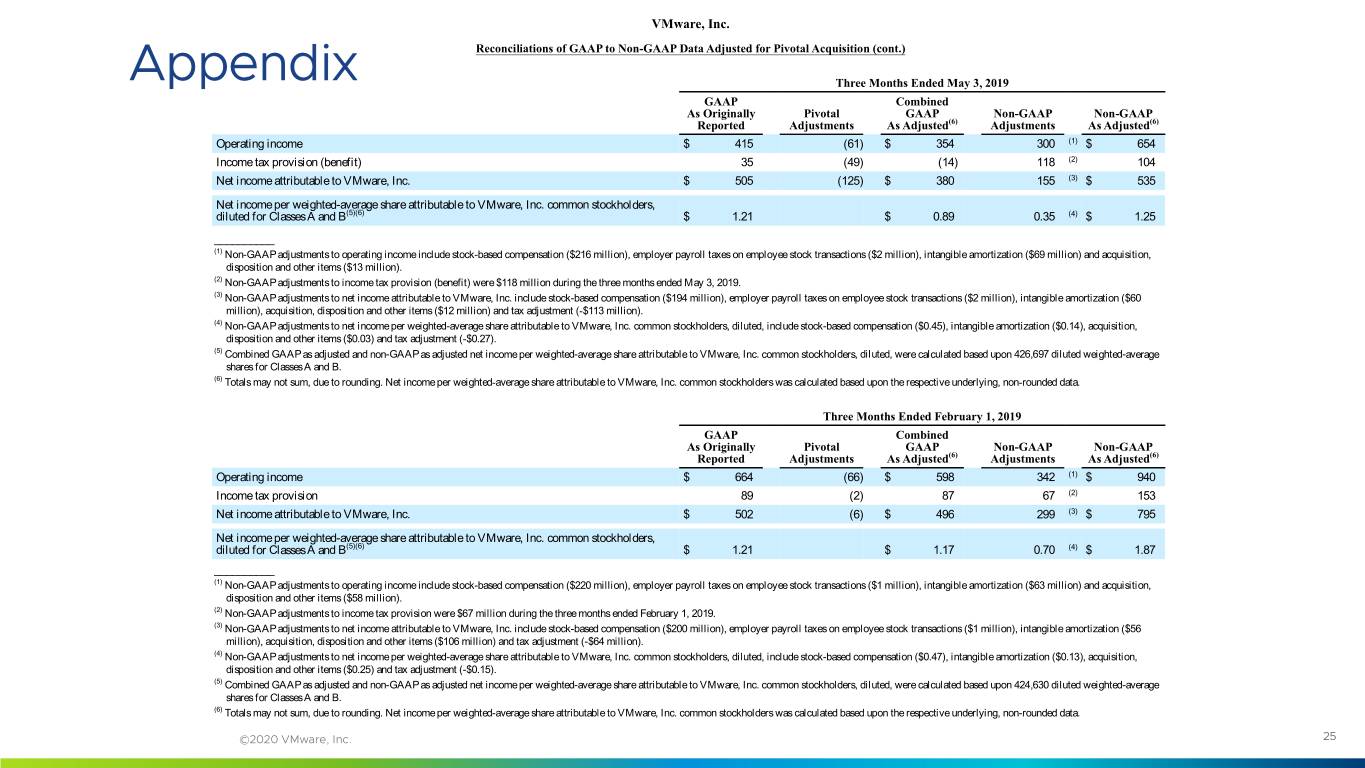

VMware, Inc. Reconciliations of GAAP to Non-GAAP Data Adjusted for Pivotal Acquisition (cont.) Appendix Three Months Ended May 3, 2019 GAAP Combined As Originally Pivotal GAAP Non-GAAP Non-GAAP Reported Adjustments As Adjusted(6) Adjustments As Adjusted(6) Operating income $ 415 (61) $ 354 300 (1) $ 654 Income tax provision (benefit) 35 (49) (14) 118 (2) 104 Net income attributable to VMware, Inc. $ 505 (125) $ 380 155 (3) $ 535 Net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted for Classes A and B(5)(6) $ 1.21 $ 0.89 0.35 (4) $ 1.25 __________ (1) Non-GAAP adjustments to operating income include stock-based compensation ($216 million), employer payroll taxes on employee stock transactions ($2 million), intangible amortization ($69 million) and acquisition, disposition and other items ($13 million). (2) Non-GAAP adjustments to income tax provision (benefit) were $118 million during the three months ended May 3, 2019. (3) Non-GAAP adjustments to net income attributable to VMware, Inc. include stock-based compensation ($194 million), employer payroll taxes on employee stock transactions ($2 million), intangible amortization ($60 million), acquisition, disposition and other items ($12 million) and tax adjustment (-$113 million). (4) Non-GAAP adjustments to net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, include stock-based compensation ($0.45), intangible amortization ($0.14), acquisition, disposition and other items ($0.03) and tax adjustment (-$0.27). (5) Combined GAAP as adjusted and non-GAAP as adjusted net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, were calculated based upon 426,697 diluted weighted-average shares for Classes A and B. (6) Totals may not sum, due to rounding. Net income per weighted-average share attributable to VMware, Inc. common stockholders was calculated based upon the respective underlying, non-rounded data. Three Months Ended February 1, 2019 GAAP Combined As Originally Pivotal GAAP Non-GAAP Non-GAAP Reported Adjustments As Adjusted(6) Adjustments As Adjusted(6) Operating income $ 664 (66) $ 598 342 (1) $ 940 Income tax provision 89 (2) 87 67 (2) 153 Net income attributable to VMware, Inc. $ 502 (6) $ 496 299 (3) $ 795 Net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted for Classes A and B(5)(6) $ 1.21 $ 1.17 0.70 (4) $ 1.87 __________ (1) Non-GAAP adjustments to operating income include stock-based compensation ($220 million), employer payroll taxes on employee stock transactions ($1 million), intangible amortization ($63 million) and acquisition, disposition and other items ($58 million). (2) Non-GAAP adjustments to income tax provision were $67 million during the three months ended February 1, 2019. (3) Non-GAAP adjustments to net income attributable to VMware, Inc. include stock-based compensation ($200 million), employer payroll taxes on employee stock transactions ($1 million), intangible amortization ($56 million), acquisition, disposition and other items ($106 million) and tax adjustment (-$64 million). (4) Non-GAAP adjustments to net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, include stock-based compensation ($0.47), intangible amortization ($0.13), acquisition, disposition and other items ($0.25) and tax adjustment (-$0.15). (5) Combined GAAP as adjusted and non-GAAP as adjusted net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, were calculated based upon 424,630 diluted weighted-average shares for Classes A and B. (6) Totals may not sum, due to rounding. Net income per weighted-average share attributable to VMware, Inc. common stockholders was calculated based upon the respective underlying, non-rounded data. ©2020 VMware, Inc. 25

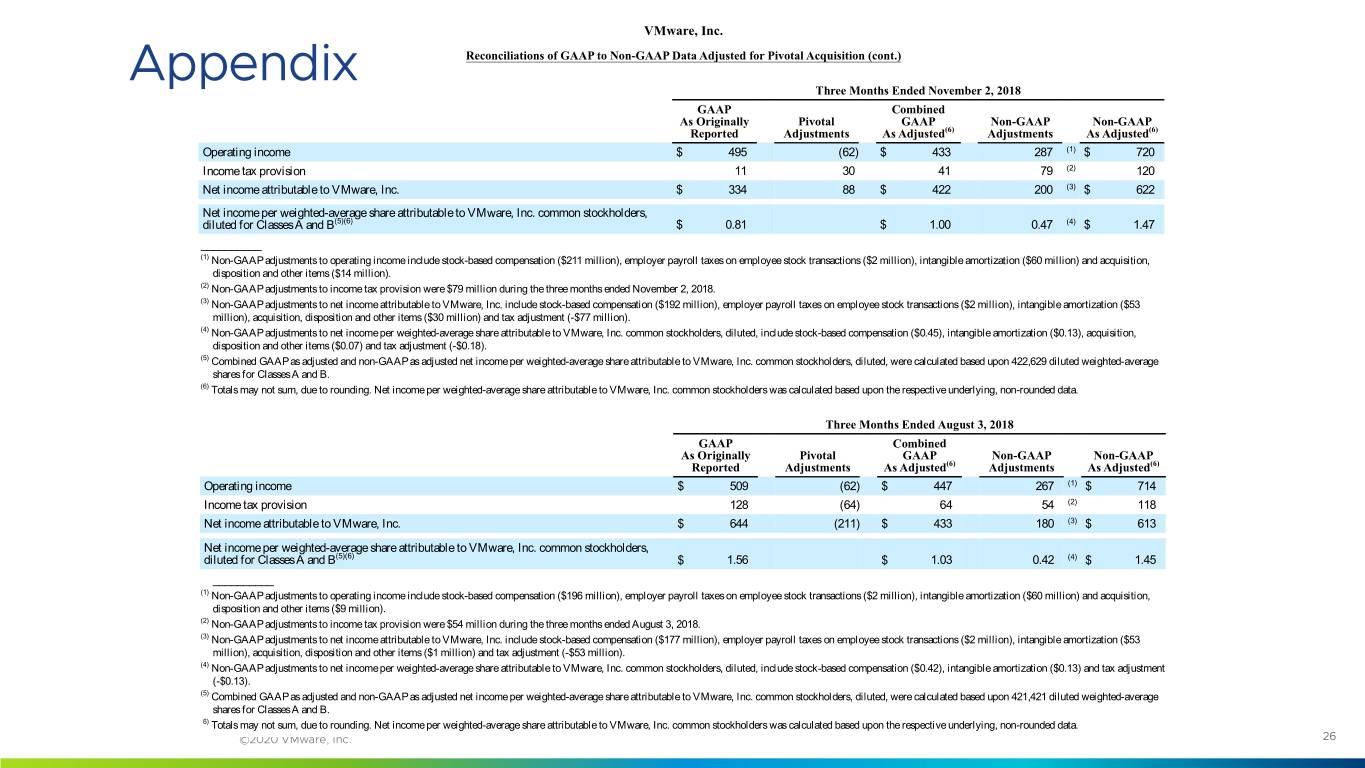

VMware, Inc. Reconciliations of GAAP to Non-GAAP Data Adjusted for Pivotal Acquisition (cont.) Appendix Three Months Ended November 2, 2018 GAAP Combined As Originally Pivotal GAAP Non-GAAP Non-GAAP Reported Adjustments As Adjusted(6) Adjustments As Adjusted(6) Operating income $ 495 (62) $ 433 287 (1) $ 720 Income tax provision 11 30 41 79 (2) 120 Net income attributable to VMware, Inc. $ 334 88 $ 422 200 (3) $ 622 Net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted for Classes A and B(5)(6) $ 0.81 $ 1.00 0.47 (4) $ 1.47 __________ (1) Non-GAAP adjustments to operating income include stock-based compensation ($211 million), employer payroll taxes on employee stock transactions ($2 million), intangible amortization ($60 million) and acquisition, disposition and other items ($14 million). (2) Non-GAAP adjustments to income tax provision were $79 million during the three months ended November 2, 2018. (3) Non-GAAP adjustments to net income attributable to VMware, Inc. include stock-based compensation ($192 million), employer payroll taxes on employee stock transactions ($2 million), intangible amortization ($53 million), acquisition, disposition and other items ($30 million) and tax adjustment (-$77 million). (4) Non-GAAP adjustments to net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, include stock-based compensation ($0.45), intangible amortization ($0.13), acquisition, disposition and other items ($0.07) and tax adjustment (-$0.18). (5) Combined GAAP as adjusted and non-GAAP as adjusted net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, were calculated based upon 422,629 diluted weighted-average shares for Classes A and B. (6) Totals may not sum, due to rounding. Net income per weighted-average share attributable to VMware, Inc. common stockholders was calculated based upon the respective underlying, non-rounded data. Three Months Ended August 3, 2018 GAAP Combined As Originally Pivotal GAAP Non-GAAP Non-GAAP Reported Adjustments As Adjusted(6) Adjustments As Adjusted(6) Operating income $ 509 (62) $ 447 267 (1) $ 714 Income tax provision 128 (64) 64 54 (2) 118 Net income attributable to VMware, Inc. $ 644 (211) $ 433 180 (3) $ 613 Net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted for Classes A and B(5)(6) $ 1.56 $ 1.03 0.42 (4) $ 1.45 __________ (1) Non-GAAP adjustments to operating income include stock-based compensation ($196 million), employer payroll taxes on employee stock transactions ($2 million), intangible amortization ($60 million) and acquisition, disposition and other items ($9 million). (2) Non-GAAP adjustments to income tax provision were $54 million during the three months ended August 3, 2018. (3) Non-GAAP adjustments to net income attributable to VMware, Inc. include stock-based compensation ($177 million), employer payroll taxes on employee stock transactions ($2 million), intangible amortization ($53 million), acquisition, disposition and other items ($1 million) and tax adjustment (-$53 million). (4) Non-GAAP adjustments to net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, include stock-based compensation ($0.42), intangible amortization ($0.13) and tax adjustment (-$0.13). (5) Combined GAAP as adjusted and non-GAAP as adjusted net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, were calculated based upon 421,421 diluted weighted-average shares for Classes A and B. (6) Totals may not sum, due to rounding. Net income per weighted-average share attributable to VMware, Inc. common stockholders was calculated based upon the respective underlying, non-rounded data. ©2020 VMware, Inc. 26

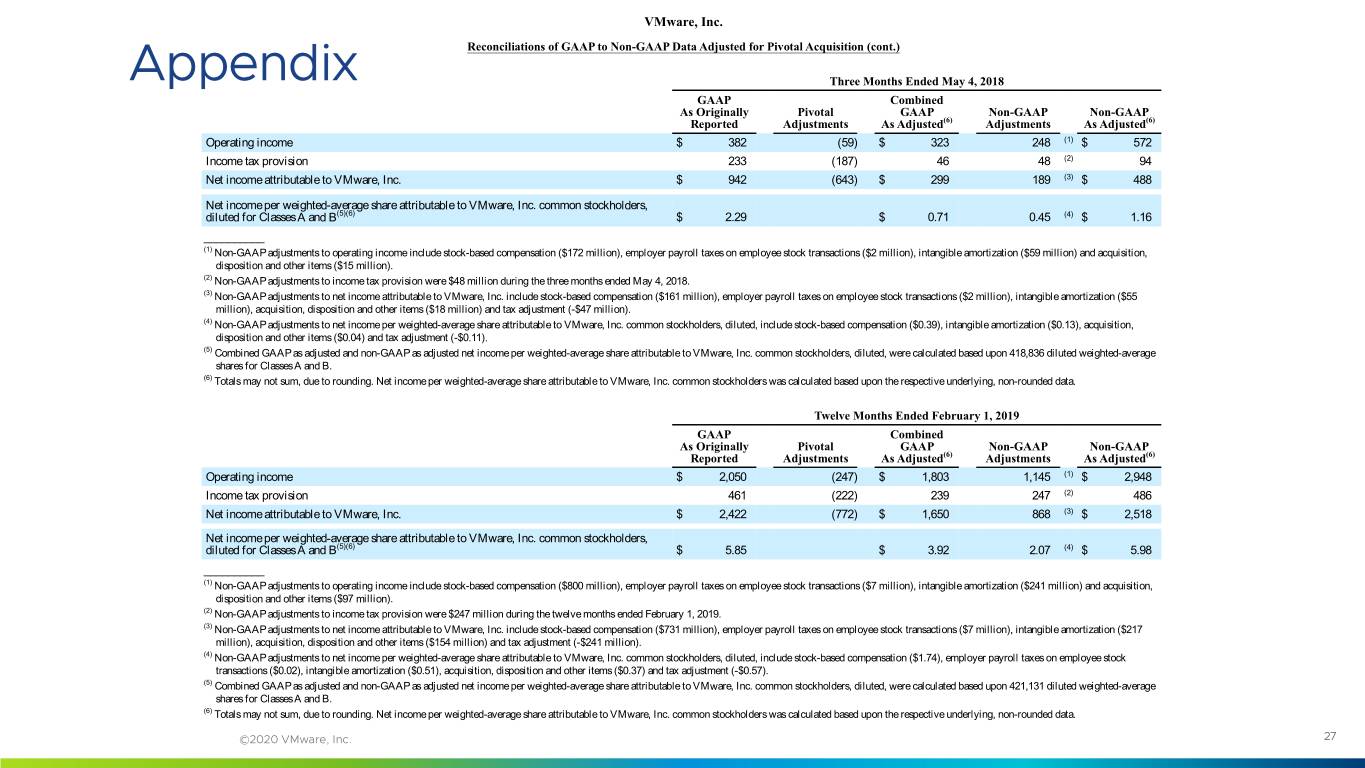

VMware, Inc. Reconciliations of GAAP to Non-GAAP Data Adjusted for Pivotal Acquisition (cont.) Appendix Three Months Ended May 4, 2018 GAAP Combined As Originally Pivotal GAAP Non-GAAP Non-GAAP Reported Adjustments As Adjusted(6) Adjustments As Adjusted(6) Operating income $ 382 (59) $ 323 248 (1) $ 572 Income tax provision 233 (187) 46 48 (2) 94 Net income attributable to VMware, Inc. $ 942 (643) $ 299 189 (3) $ 488 Net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted for Classes A and B(5)(6) $ 2.29 $ 0.71 0.45 (4) $ 1.16 __________ (1) Non-GAAP adjustments to operating income include stock-based compensation ($172 million), employer payroll taxes on employee stock transactions ($2 million), intangible amortization ($59 million) and acquisition, disposition and other items ($15 million). (2) Non-GAAP adjustments to income tax provision were $48 million during the three months ended May 4, 2018. (3) Non-GAAP adjustments to net income attributable to VMware, Inc. include stock-based compensation ($161 million), employer payroll taxes on employee stock transactions ($2 million), intangible amortization ($55 million), acquisition, disposition and other items ($18 million) and tax adjustment (-$47 million). (4) Non-GAAP adjustments to net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, include stock-based compensation ($0.39), intangible amortization ($0.13), acquisition, disposition and other items ($0.04) and tax adjustment (-$0.11). (5) Combined GAAP as adjusted and non-GAAP as adjusted net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, were calculated based upon 418,836 diluted weighted-average shares for Classes A and B. (6) Totals may not sum, due to rounding. Net income per weighted-average share attributable to VMware, Inc. common stockholders was calculated based upon the respective underlying, non-rounded data. Twelve Months Ended February 1, 2019 GAAP Combined As Originally Pivotal GAAP Non-GAAP Non-GAAP Reported Adjustments As Adjusted(6) Adjustments As Adjusted(6) Operating income $ 2,050 (247) $ 1,803 1,145 (1) $ 2,948 Income tax provision 461 (222) 239 247 (2) 486 Net income attributable to VMware, Inc. $ 2,422 (772) $ 1,650 868 (3) $ 2,518 Net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted for Classes A and B(5)(6) $ 5.85 $ 3.92 2.07 (4) $ 5.98 __________ (1) Non-GAAP adjustments to operating income include stock-based compensation ($800 million), employer payroll taxes on employee stock transactions ($7 million), intangible amortization ($241 million) and acquisition, disposition and other items ($97 million). (2) Non-GAAP adjustments to income tax provision were $247 million during the twelve months ended February 1, 2019. (3) Non-GAAP adjustments to net income attributable to VMware, Inc. include stock-based compensation ($731 million), employer payroll taxes on employee stock transactions ($7 million), intangible amortization ($217 million), acquisition, disposition and other items ($154 million) and tax adjustment (-$241 million). (4) Non-GAAP adjustments to net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, include stock-based compensation ($1.74), employer payroll taxes on employee stock transactions ($0.02), intangible amortization ($0.51), acquisition, disposition and other items ($0.37) and tax adjustment (-$0.57). (5) Combined GAAP as adjusted and non-GAAP as adjusted net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, were calculated based upon 421,131 diluted weighted-average shares for Classes A and B. (6) Totals may not sum, due to rounding. Net income per weighted-average share attributable to VMware, Inc. common stockholders was calculated based upon the respective underlying, non-rounded data. ©2020 VMware, Inc. 27

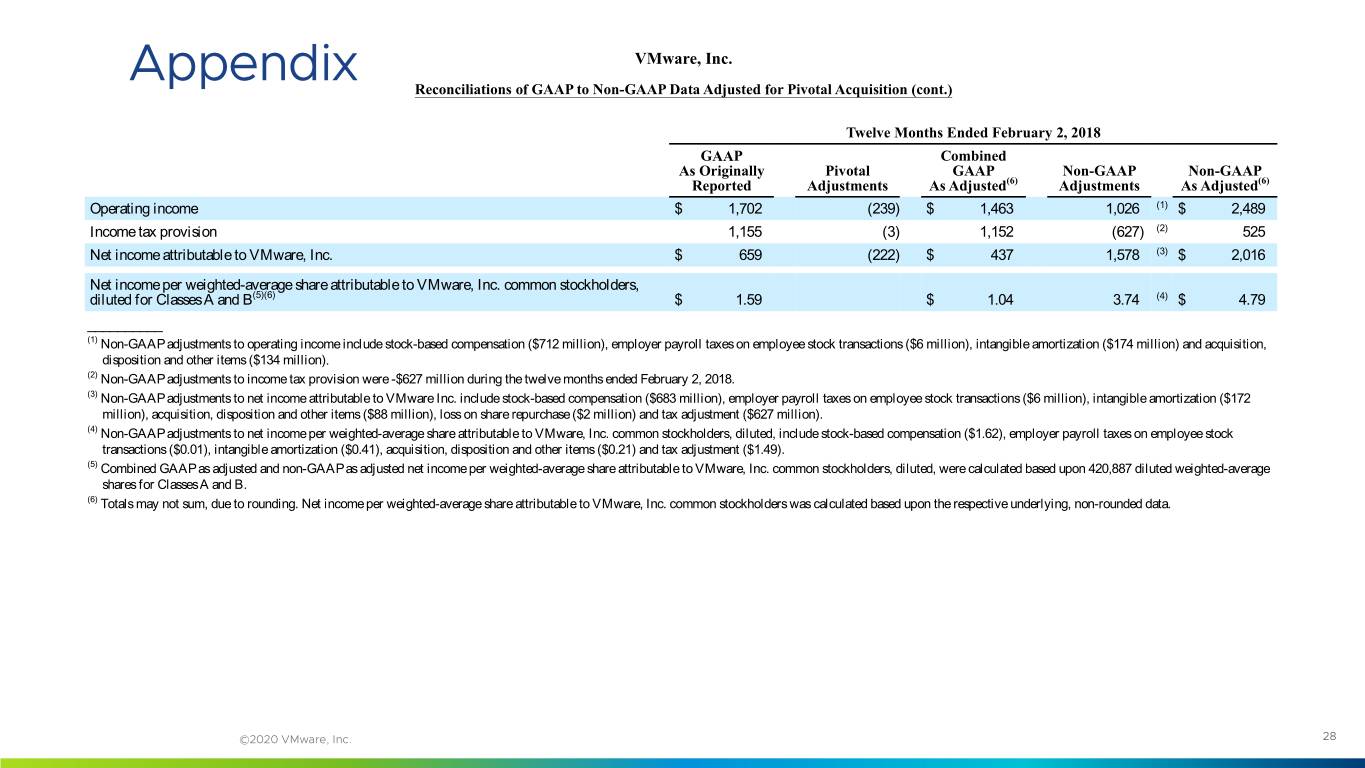

Appendix VMware, Inc. Reconciliations of GAAP to Non-GAAP Data Adjusted for Pivotal Acquisition (cont.) Twelve Months Ended February 2, 2018 GAAP Combined As Originally Pivotal GAAP Non-GAAP Non-GAAP Reported Adjustments As Adjusted(6) Adjustments As Adjusted(6) Operating income $ 1,702 (239) $ 1,463 1,026 (1) $ 2,489 Income tax provision 1,155 (3) 1,152 (627) (2) 525 Net income attributable to VMware, Inc. $ 659 (222) $ 437 1,578 (3) $ 2,016 Net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted for Classes A and B(5)(6) $ 1.59 $ 1.04 3.74 (4) $ 4.79 __________ (1) Non-GAAP adjustments to operating income include stock-based compensation ($712 million), employer payroll taxes on employee stock transactions ($6 million), intangible amortization ($174 million) and acquisition, disposition and other items ($134 million). (2) Non-GAAP adjustments to income tax provision were -$627 million during the twelve months ended February 2, 2018. (3) Non-GAAP adjustments to net income attributable to VMware Inc. include stock-based compensation ($683 million), employer payroll taxes on employee stock transactions ($6 million), intangible amortization ($172 million), acquisition, disposition and other items ($88 million), loss on share repurchase ($2 million) and tax adjustment ($627 million). (4) Non-GAAP adjustments to net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, include stock-based compensation ($1.62), employer payroll taxes on employee stock transactions ($0.01), intangible amortization ($0.41), acquisition, disposition and other items ($0.21) and tax adjustment ($1.49). (5) Combined GAAP as adjusted and non-GAAP as adjusted net income per weighted-average share attributable to VMware, Inc. common stockholders, diluted, were calculated based upon 420,887 diluted weighted-average shares for Classes A and B. (6) Totals may not sum, due to rounding. Net income per weighted-average share attributable to VMware, Inc. common stockholders was calculated based upon the respective underlying, non-rounded data. ©2020 VMware, Inc. 28

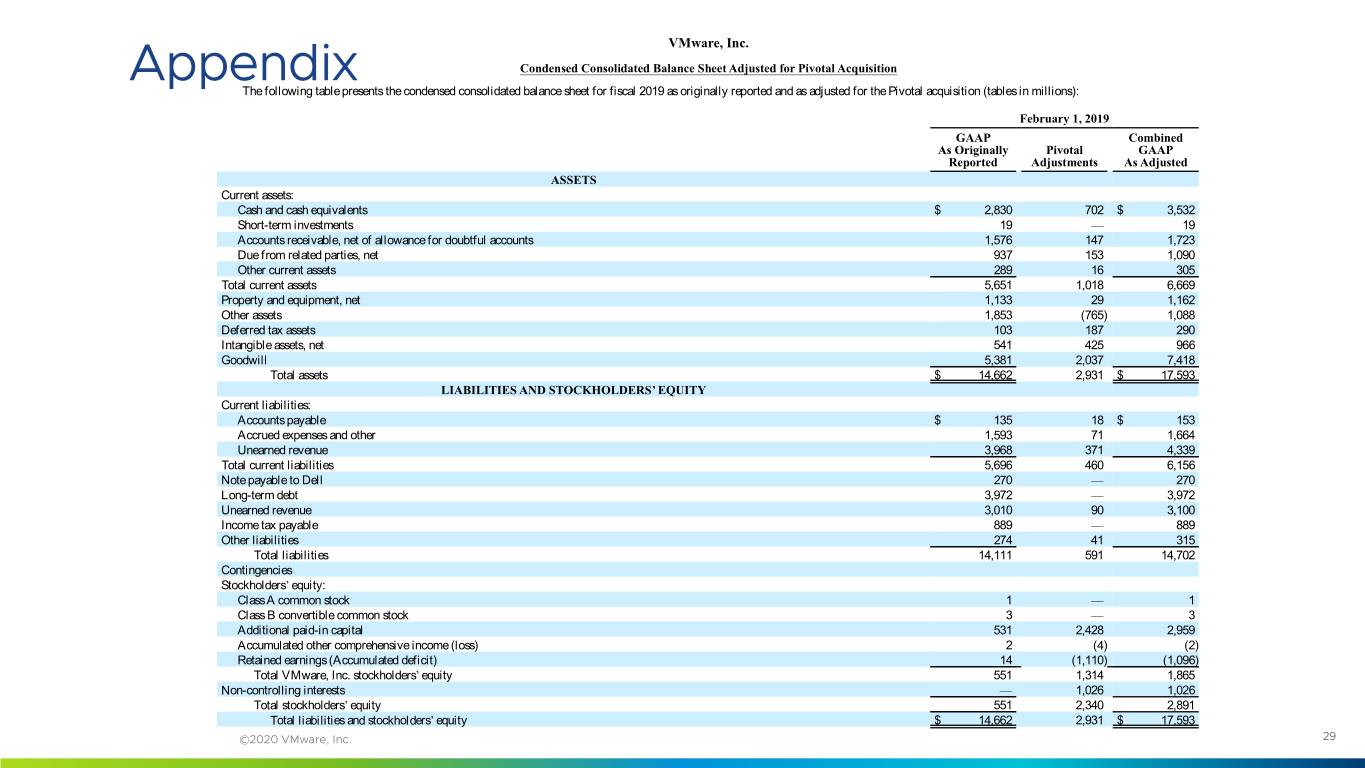

VMware, Inc. Appendix Condensed Consolidated Balance Sheet Adjusted for Pivotal Acquisition The following table presents the condensed consolidated balance sheet for fiscal 2019 as originally reported and as adjusted for the Pivotal acquisition (tables in millions): February 1, 2019 GAAP Combined As Originally Pivotal GAAP Reported Adjustments As Adjusted ASSETS Current assets: Cash and cash equivalents $ 2,830 702 $ 3,532 Short-term investments 19 — 19 Accounts receivable, net of allowance for doubtful accounts 1,576 147 1,723 Due from related parties, net 937 153 1,090 Other current assets 289 16 305 Total current assets 5,651 1,018 6,669 Property and equipment, net 1,133 29 1,162 Other assets 1,853 (765) 1,088 Deferred tax assets 103 187 290 Intangible assets, net 541 425 966 Goodwill 5,381 2,037 7,418 Total assets $ 14,662 2,931 $ 17,593 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $ 135 18 $ 153 Accrued expenses and other 1,593 71 1,664 Unearned revenue 3,968 371 4,339 Total current liabilities 5,696 460 6,156 Note payable to Dell 270 — 270 Long-term debt 3,972 — 3,972 Unearned revenue 3,010 90 3,100 Income tax payable 889 — 889 Other liabilities 274 41 315 Total liabilities 14,111 591 14,702 Contingencies Stockholders’ equity: Class A common stock 1 — 1 Class B convertible common stock 3 — 3 Additional paid-in capital 531 2,428 2,959 Accumulated other comprehensive income (loss) 2 (4) (2) Retained earnings (Accumulated deficit) 14 (1,110) (1,096) Total VMware, Inc. stockholders’ equity 551 1,314 1,865 Non-controlling interests — 1,026 1,026 Total stockholders’ equity 551 2,340 2,891 Total liabilities and stockholders’ equity $ 14,662 2,931 $ 17,593 ©2020 VMware, Inc. 29

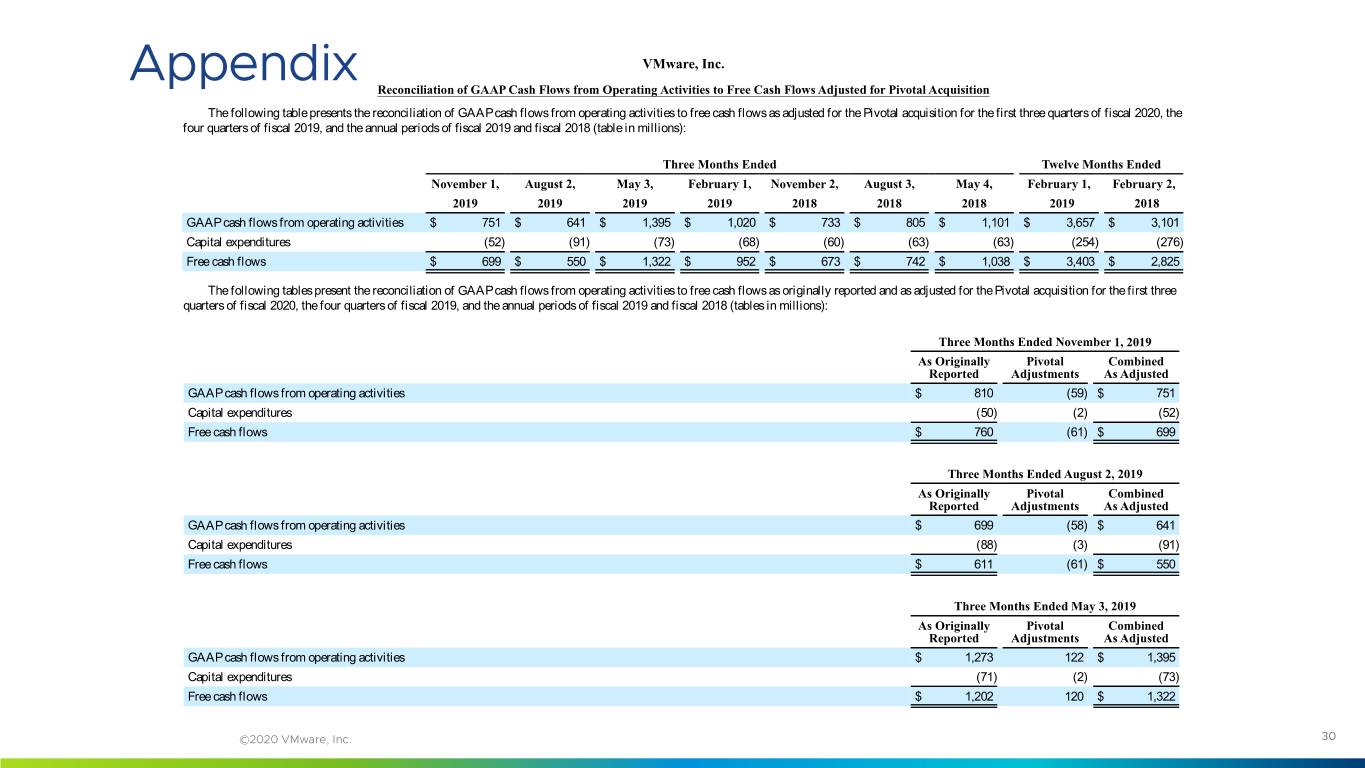

Appendix VMware, Inc. Reconciliation of GAAP Cash Flows from Operating Activities to Free Cash Flows Adjusted for Pivotal Acquisition The following table presents the reconciliation of GAAP cash flows from operating activities to free cash flows as adjusted for the Pivotal acquisition for the first three quarters of fiscal 2020, the four quarters of fiscal 2019, and the annual periods of fiscal 2019 and fiscal 2018 (table in millions): Three Months Ended Twelve Months Ended November 1, August 2, May 3, February 1, November 2, August 3, May 4, February 1, February 2, 2019 2019 2019 2019 2018 2018 2018 2019 2018 GAAP cash flows from operating activities $ 751 $ 641 $ 1,395 $ 1,020 $ 733 $ 805 $ 1,101 $ 3,657 $ 3,101 Capital expenditures (52) (91) (73) (68) (60) (63) (63) (254) (276) Free cash flows $ 699 $ 550 $ 1,322 $ 952 $ 673 $ 742 $ 1,038 $ 3,403 $ 2,825 The following tables present the reconciliation of GAAP cash flows from operating activities to free cash flows as originally reported and as adjusted for the Pivotal acquisition for the first three quarters of fiscal 2020, the four quarters of fiscal 2019, and the annual periods of fiscal 2019 and fiscal 2018 (tables in millions): Three Months Ended November 1, 2019 As Originally Pivotal Combined Reported Adjustments As Adjusted GAAP cash flows from operating activities $ 810 (59) $ 751 Capital expenditures (50) (2) (52) Free cash flows $ 760 (61) $ 699 Three Months Ended August 2, 2019 As Originally Pivotal Combined Reported Adjustments As Adjusted GAAP cash flows from operating activities $ 699 (58) $ 641 Capital expenditures (88) (3) (91) Free cash flows $ 611 (61) $ 550 Three Months Ended May 3, 2019 As Originally Pivotal Combined Reported Adjustments As Adjusted GAAP cash flows from operating activities $ 1,273 122 $ 1,395 Capital expenditures (71) (2) (73) Free cash flows $ 1,202 120 $ 1,322 ©2020 VMware, Inc. 30

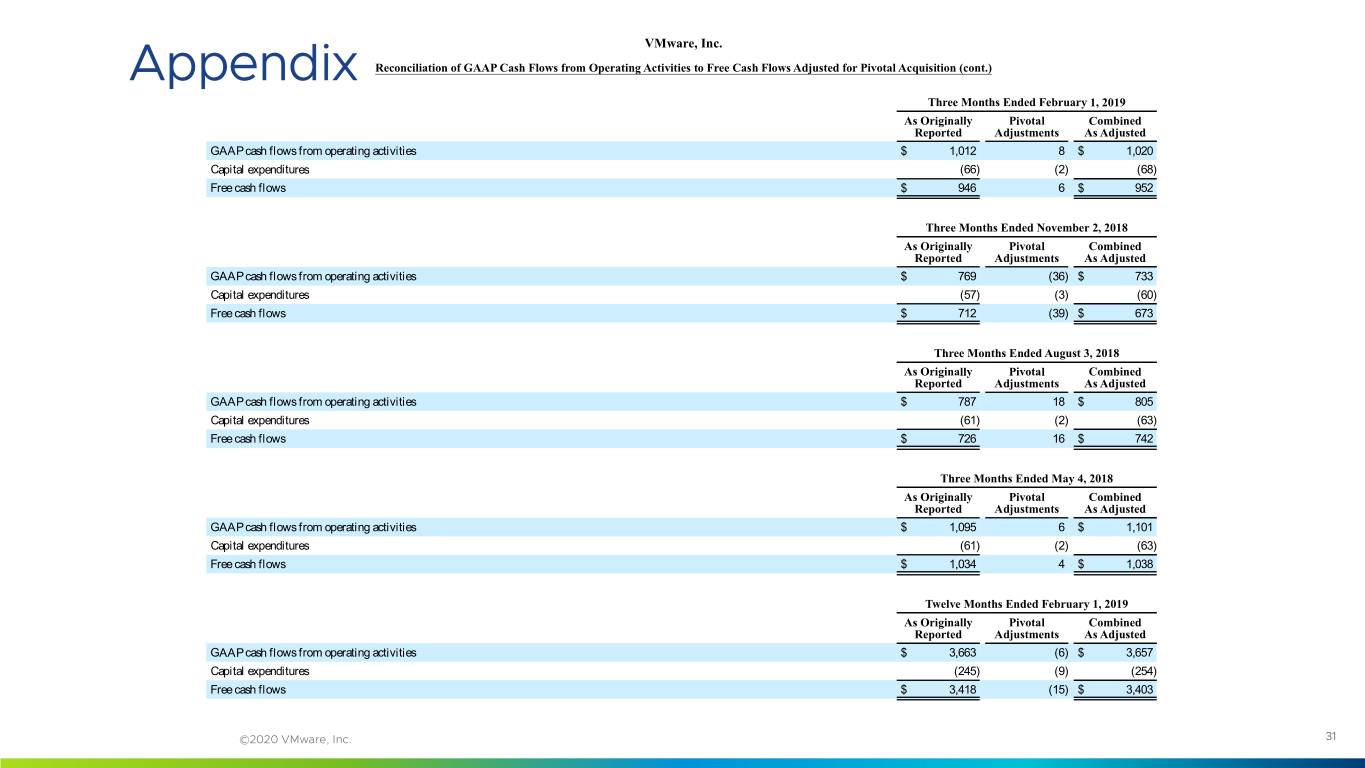

VMware, Inc. Appendix Reconciliation of GAAP Cash Flows from Operating Activities to Free Cash Flows Adjusted for Pivotal Acquisition (cont.) Three Months Ended February 1, 2019 As Originally Pivotal Combined Reported Adjustments As Adjusted GAAP cash flows from operating activities $ 1,012 8 $ 1,020 Capital expenditures (66) (2) (68) Free cash flows $ 946 6 $ 952 Three Months Ended November 2, 2018 As Originally Pivotal Combined Reported Adjustments As Adjusted GAAP cash flows from operating activities $ 769 (36) $ 733 Capital expenditures (57) (3) (60) Free cash flows $ 712 (39) $ 673 Three Months Ended August 3, 2018 As Originally Pivotal Combined Reported Adjustments As Adjusted GAAP cash flows from operating activities $ 787 18 $ 805 Capital expenditures (61) (2) (63) Free cash flows $ 726 16 $ 742 Three Months Ended May 4, 2018 As Originally Pivotal Combined Reported Adjustments As Adjusted GAAP cash flows from operating activities $ 1,095 6 $ 1,101 Capital expenditures (61) (2) (63) Free cash flows $ 1,034 4 $ 1,038 Twelve Months Ended February 1, 2019 As Originally Pivotal Combined Reported Adjustments As Adjusted GAAP cash flows from operating activities $ 3,663 (6) $ 3,657 Capital expenditures (245) (9) (254) Free cash flows $ 3,418 (15) $ 3,403 ©2020 VMware, Inc. 31

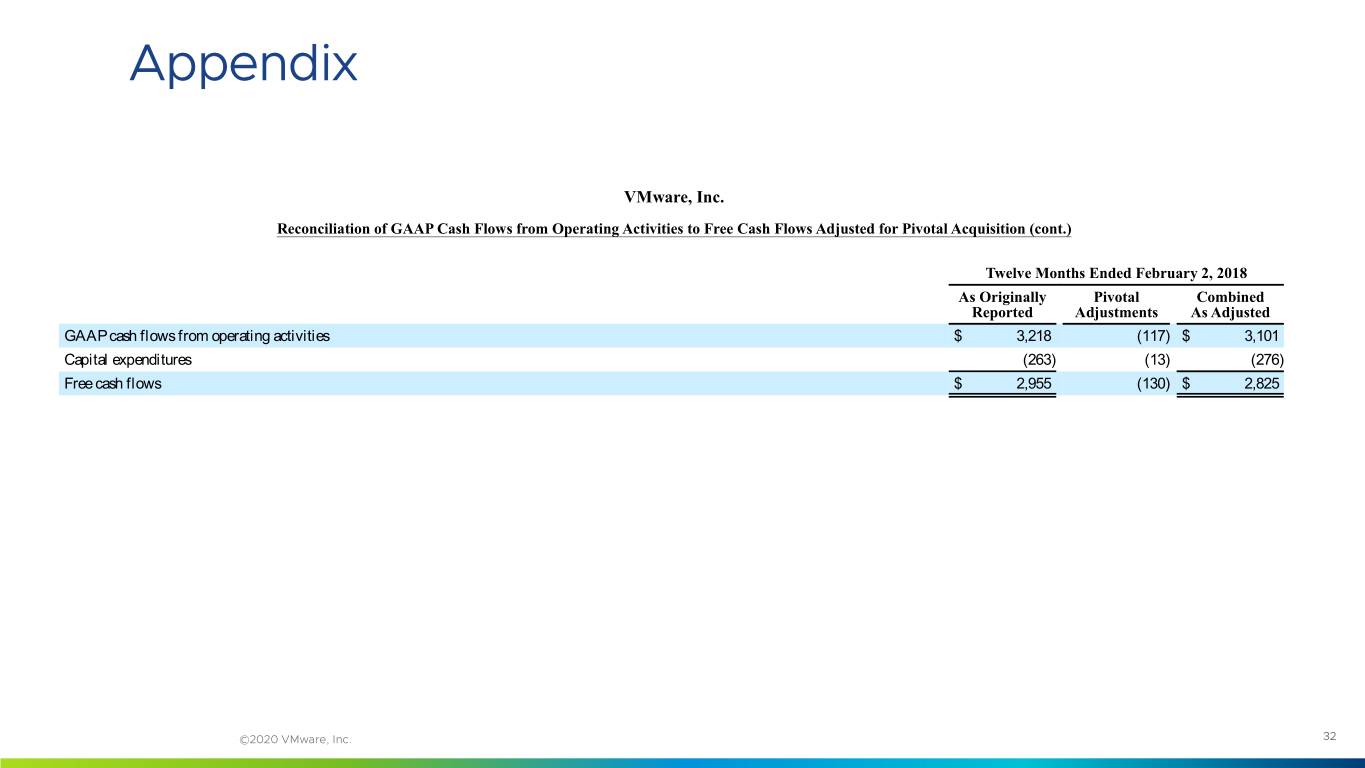

Appendix VMware, Inc. Reconciliation of GAAP Cash Flows from Operating Activities to Free Cash Flows Adjusted for Pivotal Acquisition (cont.) Twelve Months Ended February 2, 2018 As Originally Pivotal Combined Reported Adjustments As Adjusted GAAP cash flows from operating activities $ 3,218 (117) $ 3,101 Capital expenditures (263) (13) (276) Free cash flows $ 2,955 (130) $ 2,825 ©2020 VMware, Inc. 32