Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STATE STREET CORP | a8-kcreditsuisseconfer.htm |

February 27, 2020 Credit Suisse 21st Annual Financial Services Forum Lou Maiuri Chief Operating Officer 1

Preface and forward-looking statements This presentation contains forward-looking statements as defined by United States securities laws. These statements are not guarantees of future performance, are inherently uncertain, are based on assumptions that are difficult to predict and have a number of risks and uncertainties. The forward-looking statements in this presentation speak only as of the time this presentation is first furnished to the SEC on a Current Report on Form 8-K, and State Street does not undertake efforts to revise forward-looking statements. See “Forward-looking statements” in the Appendix for more information, including a description of certain factors that could affect future results and outcomes. 2

State Street Operations & Technology Driving productivity gains and enhanced client service via technology automation and operational efficiency Operations & Technology (O&T) highlights Operations: Delivering client solutions across 26 countries and more than 100 markets worldwide with a focus on service quality and continued simplification Technology: Enabling scale and efficiencies through innovative technology Expenses: Planned ~(1)% reduction in expected total expenses in 2020, ex-notable itemsA Employees: Represents 2/3 of State Street’s total employee base with three global hubs to serve clients Operations 2020 focus areas Technology 2020 focus areas Increase service quality Infrastructure optimization Enhance productivity Resource optimization A Reduction is relative to 2019 total expenses ex-notable items. Expenses ex-notable items, as presented, are a non-GAAP presentation; refer to the Appendix for a reconciliation of expenses ex-notable items to 3 GAAP expenses and further explanations of non-GAAP measures.

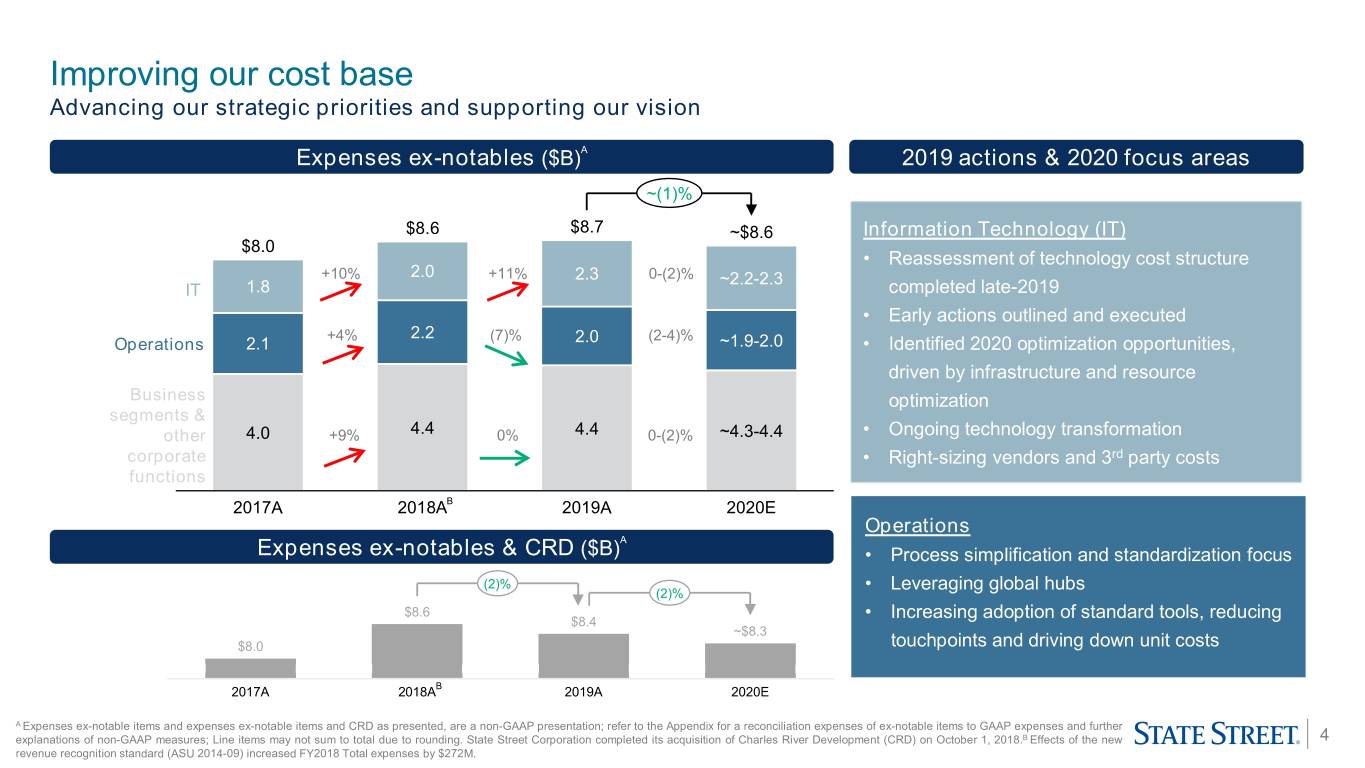

Improving our cost base Advancing our strategic priorities and supporting our vision Expenses ex-notables ($B)A 2019 actions & 2020 focus areas ~(1)% $8.6 $8.7 ~$8.6 Information Technology (IT) $8.0 • Reassessment of technology cost structure +10% 2.0 +11% 2.3 0-(2)% ~2.2-2.3 IT 1.8 completed late-2019 • Early actions outlined and executed +4% 2.2 (7)% 2.0 (2-4)% Operations 2.1 ~1.9-2.0 • Identified 2020 optimization opportunities, driven by infrastructure and resource Business optimization segments & other 4.0 +9% 4.4 0% 4.4 0-(2)% ~4.3-4.4 • Ongoing technology transformation corporate • Right-sizing vendors and 3rd party costs functions B 2017A 2018A 2019A 2020E Operations A Expenses ex-notables & CRD ($B) • Process simplification and standardization focus (2)% • Leveraging global hubs (2)% $8.6 $8.4 • Increasing adoption of standard tools, reducing ~$8.3 $8.0 touchpoints and driving down unit costs B 2017A 2018A 2019A 2020E A Expenses ex-notable items and expenses ex-notable items and CRD as presented, are a non-GAAP presentation; refer to the Appendix for a reconciliation expenses of ex-notable items to GAAP expenses and further explanations of non-GAAP measures; Line items may not sum to total due to rounding. State Street Corporation completed its acquisition of Charles River Development (CRD) on October 1, 2018.B Effects of the new 4 revenue recognition standard (ASU 2014-09) increased FY2018 Total expenses by $272M.

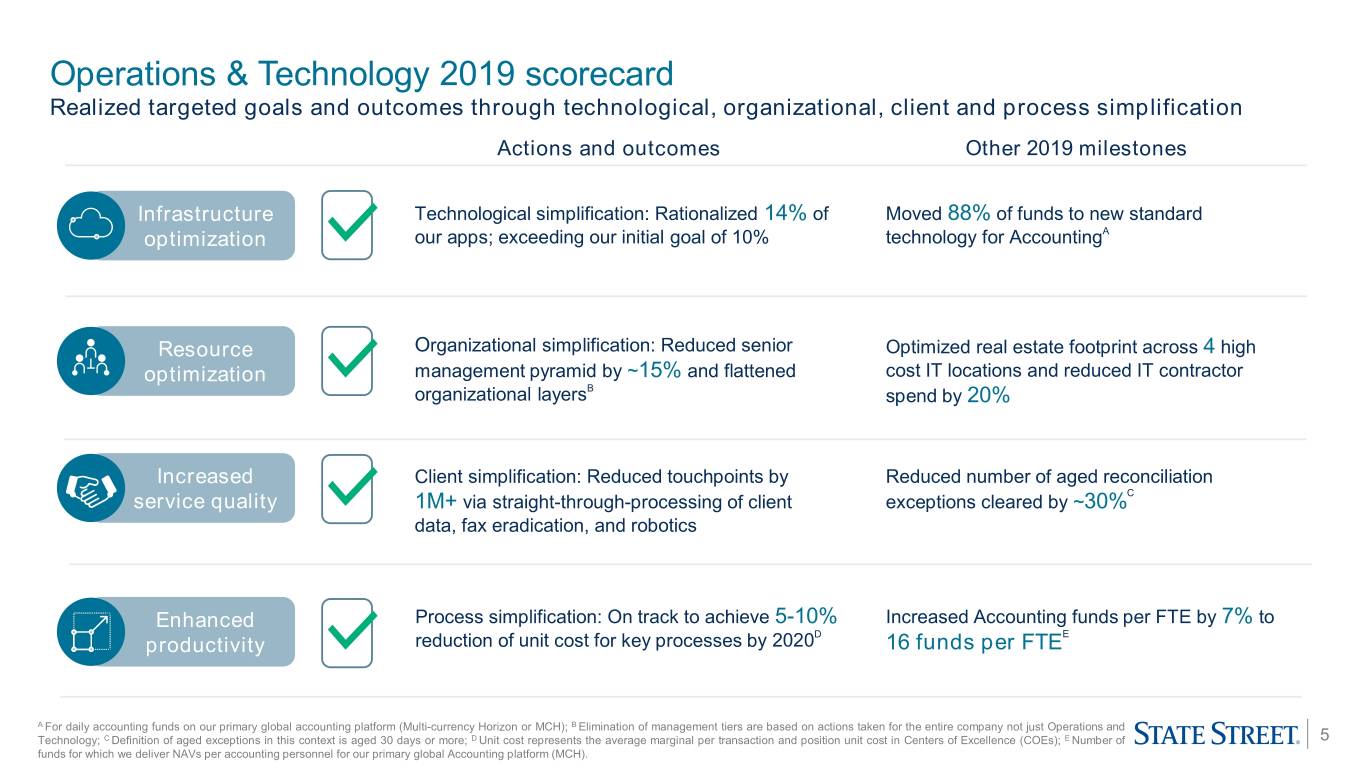

Operations & Technology 2019 scorecard Realized targeted goals and outcomes through technological, organizational, client and process simplification Actions and outcomes Other 2019 milestones Infrastructure Technological simplification: Rationalized 14% of Moved 88% of funds to new standard A optimization our apps; exceeding our initial goal of 10% technology for Accounting Resource Organizational simplification: Reduced senior Optimized real estate footprint across 4 high optimization management pyramid by ~15% and flattened cost IT locations and reduced IT contractor organizational layersB spend by 20% Increased Client simplification: Reduced touchpoints by Reduced number of aged reconciliation C service quality 1M+ via straight-through-processing of client exceptions cleared by ~30% data, fax eradication, and robotics Enhanced Process simplification: On track to achieve 5-10% Increased Accounting funds per FTE by 7% to D E productivity reduction of unit cost for key processes by 2020 16 funds per FTE A For daily accounting funds on our primary global accounting platform (Multi-currency Horizon or MCH); B Elimination of management tiers are based on actions taken for the entire company not just Operations and Technology; C Definition of aged exceptions in this context is aged 30 days or more; D Unit cost represents the average marginal per transaction and position unit cost in Centers of Excellence (COEs); E Number of 5 funds for which we deliver NAVs per accounting personnel for our primary global Accounting platform (MCH).

Technology Technology 2020 focus areas Operations Simplification plan for expected gross savings of $150–200M A 2020 KPIs Infrastructure optimization Implement cloud strategy to deliver enhanced security and enable faster Continue to migrate and have 30-35% of total B time-to-market for client solutions applications on the cloud Lower cost of mainframe computing and transition to cloud Reduce mainframe usage by 15% Consolidate infrastructure services while delivering greater operational Reduce infrastructure external spend by 10-15% efficiencies Rationalize applications and leverage AI and robotics to increase Rationalize 5-10% of applications automation and create new technology capabilities Resource optimization Optimize IT workforce and location strategy to improve operating Increase hub offshore workforce ratio by 10-15%C efficiency and client services Prioritize workforce to strategic initiatives, reducing non-core activities Reduce real estate footprint across an additional and spend 1-2 high cost locationsD Consolidate IT vendors to deliver greater operational efficiencies Reduce # of IT offshore vendors by 33% A Listed KPI metrics are expected to be achieved by end of 2020; B Migration of applications on the cloud includes both private and public cloud. Total applications are inclusive of infrastructure applications and externally hosted vendor applications; C Includes actions taken at the end of 2019 (run rate savings to be achieved in 2020); ratio defined as technology services staff in offshore hub locations divided by total 6 technology services staff, globally; D Actions are incremental to the early reduction of real estate footprint across 4 high cost locations achieved at the end of 2019 (run rate savings to be achieved in 2020).

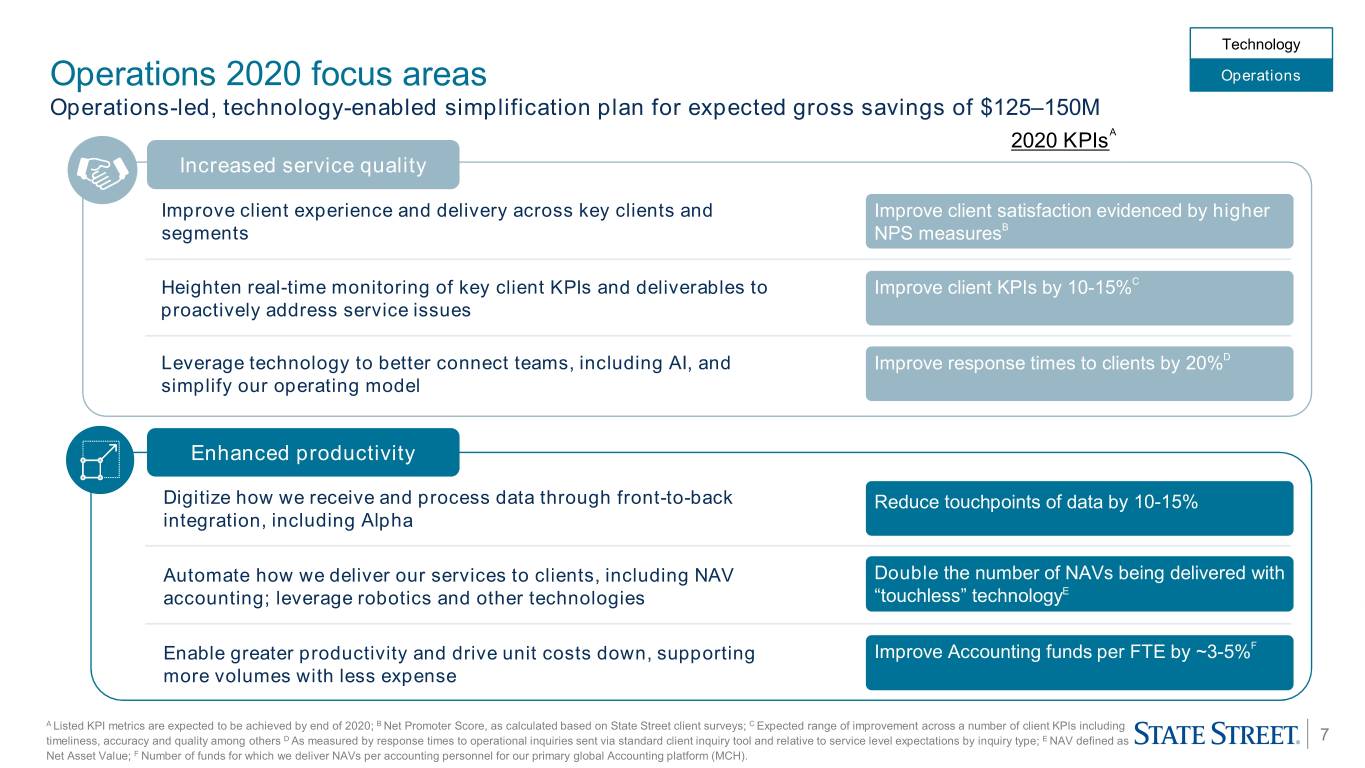

Technology Operations 2020 focus areas Operations Operations-led, technology-enabled simplification plan for expected gross savings of $125–150M A 2020 KPIs Increased service quality Improve client experience and delivery across key clients and Improve client satisfaction evidenced by higher segments NPS measuresB Heighten real-time monitoring of key client KPIs and deliverables to Improve client KPIs by 10-15%C proactively address service issues Leverage technology to better connect teams, including AI, and Improve response times to clients by 20%D simplify our operating model Enhanced productivity Digitize how we receive and process data through front-to-back Reduce touchpoints of data by 10-15% integration, including Alpha Automate how we deliver our services to clients, including NAV Double the number of NAVs being delivered with accounting; leverage robotics and other technologies “touchless” technologyE F Enable greater productivity and drive unit costs down, supporting Improve Accounting funds per FTE by ~3-5% more volumes with less expense A Listed KPI metrics are expected to be achieved by end of 2020; B Net Promoter Score, as calculated based on State Street client surveys; C Expected range of improvement across a number of client KPIs including timeliness, accuracy and quality among others D As measured by response times to operational inquiries sent via standard client inquiry tool and relative to service level expectations by inquiry type; E NAV defined as 7 Net Asset Value; F Number of funds for which we deliver NAVs per accounting personnel for our primary global Accounting platform (MCH).

Fireside Chat Q&A Lou Maiuri Eric Aboaf Susan Katzke 8

Appendix 9

Technology Technology 2020E costs walk-forward Operations Bending the cost curve from +10% to a flat-to-down 2% net reduction Estimated total Technology spend A (Non-GAAP, $B) Flat to (2)% +10% ~$150M ~$250M $2.3 ~$2.2-2.3 ~$(30)M $2.0 ~$(150-200)M 2018A Incremental Technology 2019A Incremental Technology 2020E Technology Savings Technology Optimization Investments Investments A Total IT spend reflects GAAP IT-related expenses less notable items, which are non-GAAP measures; Estimated IT spend components may not sum to total due to rounding; inclusive of CRD. 10

Technology Operations 2020E costs walk-forward Operations Continuing to invest in speed and quality of our delivery while improving productivity Estimated total Operations spend A (Non-GAAP, $B) (7)% ~$100M $2.2 (2-4)% ~$75M $2.0 ~$1.9-2.0 ~$(250)M ~$(125-150)M 2018A Incremental Optimization 2019A Incremental Optimization 2020E Investment and Savings Investment and Savings Variable Cost Variable Cost A Total Operations spend reflects GAAP operations-related expenses less notable items, which are non-GAAP measures; Estimated operations spend components may not sum to total due to rounding; inclusive of CRD. 11

Non-GAAP measures In addition to presenting State Street's financial results in conformity with U.S. generally accepted accounting principles, or GAAP, management also presents certain financial information on a basis that excludes or adjusts one or more items from GAAP. This latter basis is a non-GAAP presentation. In general, our non- GAAP financial results adjust selected GAAP-basis financial results to exclude the impact of revenue and expenses outside of State Street’s normal course of business or other notable items, such as acquisition and restructuring charges, repositioning charges, gains/losses on sales, as well as, for selected comparisons, seasonal items. For example, we sometimes present expenses on a basis we may refer to as “expenses ex-notable items", which exclude notable items and, to provide additional perspective on both prior year quarter and sequential quarter comparisons, also exclude seasonal items and expenses related to our Charles River Development acquisition (completed in October 2018). Management believes that this presentation of financial information facilitates an investor's further understanding and analysis of State Street's financial performance and trends with respect to State Street’s business operations from period-to-period, including providing additional insight into our underlying margin and profitability. In addition, Management may also provide additional non-GAAP measures. For example, we present capital ratios, calculated under regulatory standards scheduled to be effective in the future or other standards, that management uses in evaluating State Street’s business and activities and believes may similarly be useful to investors. Additionally, we may present revenue and expense measures on a constant currency basis to identify the significance of changes in foreign currency exchange rates (which often are variable) in period-to-period comparisons. This presentation represents the effects of applying prior period weighted average foreign currency exchange rates to current period results. Non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, financial measures determined in conformity with GAAP. 12

Reconciliation of expenses ex-notable items and CRD Quarterly reconciliation6 (Dollars in millions) 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 Total expenses, GAAP basis 2,268 2,170 2,091 2,486 2,293 2,154 2,180 2,407 Less: Notable expense items: Repositioning charges: Compensation and employee benefits (61) (198) (98) Occupancy (16) (25) (12) Repositioning charges (77) (223) (110) Acquisition and restructuring costs (24) (9) (12) (27) (29) Legal and related (42) (14) (18) (140) Business exit (24) Total expenses, excluding notable items 2,268 2,093 2,091 2,173 2,270 2,142 2,135 2,128 CRD expenses (39) (41) (46) (56) (58) State Street expenses related to CRD: intangible asset amortization costs (18) (15) (17) (17) (16) Total expenses, excluding notable items and CRD and CRD-related expenses 2,268 2,093 2,091 2,116 2,214 2,079 2,062 2,054 Seasonal expenses (148) (137) Total expenses, excluding notable items, CRD and CRD-related expenses and seasonal expense items 2,120 2,093 2,091 2,116 2,077 2,079 2,062 2,054 Year-end reconciliation6 (Dollars in millions) 2018 2019 Total expenses, GAAP basis 9,015 9,034 Less: Notable expense items: Repositioning charges: Compensation and employee benefits (259) (98) Occupancy (41) (12) Repositioning charges (300) (110) Acquisition and restructuring costs (24) (77) Legal and related (42) (172) Business exit (24) Total expenses, excluding notable items 8,625 8,675 CRD expenses (39) (201) CRD related expenses: intangible asset amortization costs (18) (65) Total expenses, excluding notable items and CRD and CRD-related expenses 8,568 8,409 13

Forward-looking statements This presentation (and the presentation to which it relates) contains forward-looking statements within the meaning of United States securities laws, including statements about our goals and expectations regarding our business, financial and capital condition, results of operations, strategies, the financial and market outlook, dividend and stock purchase programs, governmental and regulatory initiatives and developments, expense reduction programs, new client business, and the business environment. Forward-looking statements are often, but not always, identified by such forward-looking terminology as “outlook,” “guidance,” “expect,” “priority,” “objective,” “intend,” “plan,” “forecast,” “believe,” “anticipate,” “estimate,” “seek,” “may,” “will,” “trend,” “target,” “strategy” and “goal,” or similar statements or variations of such terms. These statements are not guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties. Therefore, actual outcomes and results may differ materially from what is expressed in those statements, and those statements should not be relied upon as representing our expectations or beliefs as of any time subsequent to the time this presentation is first issued. Important factors that may affect future results and outcomes include, but are not limited to: the financial strength of the counterparties with which we or our clients do business and to which we have investment, credit or financial exposures or to which our clients have such exposures as a result of our acting as agent, including as an asset manager or securities lending agent; increases in the volatility of, or declines in the level of, our NII; changes in the composition or valuation of the assets recorded in our consolidated statement of condition (and our ability to measure the fair value of investment securities); and changes in the manner in which we fund those assets; the volatility of servicing fee, management fee, trading fee and securities finance revenues due to, among other factors, the value of equity and fixed-income markets, market interest and FX rates, the volume of client transaction activity, competitive pressures in the investment servicing and asset management industries, and the timing of revenue recognition with respect to software and processing fees revenues; the liquidity of the U.S. and international securities markets, particularly the markets for fixed-income securities and inter-bank credits; the liquidity of the assets on our balance sheet and changes or volatility in the sources of such funding, particularly the deposits of our clients; and demands upon our liquidity, including the liquidity demands and requirements of our clients; the level, volatility and uncertainty of interest rates; the expected discontinuation of Interbank Offered Rates including London Interbank Offered Rate (LIBOR); the valuation of the U.S. dollar relative to other currencies in which we record revenue or accrue expenses; the performance and volatility of securities, credit, currency and other markets in the U.S. and internationally; and the impact of monetary and fiscal policy in the U.S. and internationally on prevailing rates of interest and currency exchange rates in the markets in which we provide services to our clients; the credit quality, credit-agency ratings and fair values of the securities in our investment securities portfolio, a deterioration or downgrade of which could lead to OTTI of such securities and the recognition of an impairment loss in our consolidated statement of income; our ability to attract and retain deposits and other low-cost, short-term funding; our ability to manage the level and pricing of such deposits and the relative portion of our deposits that are determined to be operational under regulatory guidelines; our ability to deploy deposits in a profitable manner consistent with our liquidity needs, regulatory requirements and risk profile; and the risks associated with the potential liquidity mismatch between short-term deposit funding and longer term investments; the manner and timing with which the Federal Reserve and other U.S. and non-U.S. regulators implement or reevaluate the regulatory framework applicable to our operations (as well as changes to that framework), including implementation or modification of the Dodd-Frank Act and related stress testing and resolution planning requirements and implementation of international standards applicable to financial institutions, such as those proposed by the Basel Committee and European legislation (such as Undertakings for Collective Investments in Transferable Securities (UCITS) V, the Money Market Fund Regulation and the Markets in Financial Instruments Directive (MiFID II)/Markets in Financial Instruments Regulation (MiFIR)); among other consequences, these regulatory changes impact the levels of regulatory capital, long-term debt and liquidity we must maintain, acceptable levels of credit exposure to third parties, margin requirements applicable to derivatives, restrictions on banking and financial activities and the manner in which we structure and implement our global operations and servicing relationships. In addition, our regulatory posture and related expenses have been and will continue to be affected by heightened standards and changes in regulatory expectations for global systemically important financial institutions applicable to, among other things, risk management, liquidity and capital planning, cyber-security, resiliency, resolution planning and compliance programs, as well as changes in governmental enforcement approaches to perceived failures to comply with regulatory or legal obligations; adverse changes in the regulatory ratios that we are, or will be, required to meet, whether arising under the Dodd-Frank Act or implementation of international standards applicable to financial institutions, such as those proposed by the Basel Committee, or due to changes in regulatory positions, practices or regulations in jurisdictions in which we engage in banking activities, including changes in internal or external data, formulae, models, assumptions or other advanced systems used in the calculation of our capital or liquidity ratios that cause changes in those ratios as they are measured from period to period; requirements to obtain the prior approval or non-objection of the Federal Reserve or other U.S. and non-U.S. regulators for the use, allocation or distribution of our capital or other specific capital actions or corporate activities, including, without limitation, acquisitions, investments in subsidiaries, dividends and stock repurchases, without which our growth plans, distributions to shareholders, share repurchase programs or other capital or corporate initiatives may be restricted; changes in law or regulation, or the enforcement of law or regulation, that may adversely affect our business activities or those of our clients or our counterparties, and the products or services that we sell, including, without limitation, additional or increased taxes or assessments thereon, capital adequacy requirements, margin requirements and changes that expose us to risks related to our operating model and the adequacy and resiliency of our controls or compliance programs; a cyber-security incident, or a failure to protect our systems and our, our clients' and others' information against cyber-attacks, could result in the theft, loss, unauthorized access to, disclosure, use or alteration of information, system failures, or loss of access to information; any such incident or failure could adversely impact our ability to conduct our businesses, damage our reputation and cause losses, potentially materially; our ability to expand our use of technology to enhance the efficiency, accuracy and reliability of our operations and our dependencies on information technology; to replace and consolidate systems, particularly those relying upon older technology, and to adequately incorporate cyber-security, resiliency and business continuity into our operations, information technology infrastructure and systems management; to implement robust management processes into our technology development and maintenance programs; and to control risks related to use of technology, including cyber-crime and inadvertent data disclosures; our ability to identify and address threats to our information technology infrastructure and systems (including those of our third-party service providers); the effectiveness of our and our third party service providers' efforts to manage the resiliency of the systems on which we rely; controls regarding the access to, and integrity of, our and our clients' data; and complexities and costs of protecting the security of such systems and data; our ability to control operational and resiliency risks, data security breach risks and outsourcing risks; our ability to protect our intellectual property rights; the possibility of errors in the quantitative models we use to manage our business; and the possibility that our controls will prove insufficient, fail or be circumvented; economic or financial market disruptions in the U.S. or internationally, including those which may result from recessions or political instability; for example, the U.K.'s exit from the European Union or actual or potential changes in trade policy, such as tariffs or bilateral and multilateral trade agreements; our ability to create cost efficiencies through changes in our operational processes and to further digitize our processes and interfaces with our clients, any failure of which, in whole or in part, may among other things, reduce our competitive position, diminish the cost-effectiveness of our systems and processes or provide an insufficient return on our associated investment; our ability to promote a strong culture of risk management, operating controls, compliance oversight, ethical behavior and governance that meets our expectations and those of our clients and our regulators, and the financial, regulatory, reputational and other consequences of our failure to meet such expectations; the impact on our compliance and controls enhancement programs associated with the appointment of a monitor under the deferred prosecution agreement with the DOJ and compliance consultant appointed under a settlement with the SEC, including the potential for such monitor and compliance consultant to require changes to our programs or to identify other issues that require substantial expenditures, changes in our operations, payments to clients or reporting to U.S. authorities; the results of our review of our billing practices, including additional findings or amounts we may be required to reimburse clients, as well as potential consequences of such review, including damage to our client relationships or our reputation, adverse actions or penalties imposed by governmental authorities and costs associated with remediation of identified deficiencies; the results of, and costs associated with, governmental or regulatory inquiries and investigations, litigation and similar claims, disputes, or civil or criminal proceedings; changes or potential changes in the amount of compensation we receive from clients for our services, and the mix of services provided by us that clients choose; the large institutional clients on which we focus are often able to exert considerable market influence and have diverse investment activities, and this, combined with strong competitive market forces, subjects us to significant pressure to reduce the fees we charge, to potentially significant changes in our AUC/A or our AUM in the event of the acquisition or loss of a client, in whole or in part, and to potentially significant changes in our revenue in the event a client re-balances or changes its investment approach, re-directs assets to lower- or higher-fee asset classes or changes the mix of products or services that it receives from us; the potential for losses arising from our investments in sponsored investment funds; the possibility that our clients will incur substantial losses in investment pools for which we act as agent; the possibility of significant reductions in the liquidity or valuation of assets underlying those pools and the potential that clients will seek to hold us liable for such losses; and the possibility that our clients or regulators will assert claims that our fees, with respect to such investment products, are not appropriate; our ability to anticipate and manage the level and timing of redemptions and withdrawals from our collateral pools and other collective investment products; the credit agency ratings of our debt and depositary obligations and investor and client perceptions of our financial strength; adverse publicity, whether specific to us or regarding other industry participants or industry-wide factors, or other reputational harm; changes or potential changes to the competitive environment, due to, among other things, regulatory and technological changes, the effects of industry consolidation and perceptions of us, as a suitable service provider or counterparty; our ability to complete acquisitions, joint ventures and divestitures, including, without limitation, our ability to obtain regulatory approvals, the ability to arrange financing as required and the ability to satisfy closing conditions; the risks that our acquired businesses, including, without limitation, our acquisition of CRD, and joint ventures will not achieve their anticipated financial, operational and product innovation benefits or will not be integrated successfully, or that the integration will take longer than anticipated; that expected synergies will not be achieved or unexpected negative synergies or liabilities will be experienced; that client and deposit retention goals will not be met; that other regulatory or operational challenges will be experienced; and that disruptions from the transaction will harm our relationships with our clients, our employees or regulators; our ability to integrate CRD's front office software solutions with our middle and back office capabilities to develop our front-to-middle-to-back office State Street Alpha that is competitive, generates revenues in line with our expectations and meets our clients' requirements; the dependency of State Street Alpha on enhancements to our data management and the risks to our servicing model associated with increased exposure to client data; our ability to recognize evolving needs of our clients and to develop products that are responsive to such trends and profitable to us; the performance of and demand for the products and services we offer; and the potential for new products and services to impose additional costs on us and expose us to increased operational risk; our ability to grow revenue, manage expenses, attract and retain highly skilled people and raise the capital necessary to achieve our business goals and comply with regulatory requirements and expectations; changes in accounting standards and practices; and the impact of the U.S. tax legislation enacted in 2017, and changes in tax legislation and in the interpretation of existing tax laws by U.S. and non-U.S. tax authorities that affect the amount of taxes due. Other important factors that could cause actual results to differ materially from those indicated by any forward-looking statements are set forth in our 2019 Annual Report on Form 10-K and our subsequent SEC filings. We encourage investors to read these filings, particularly the sections on risk factors, for additional information with respect to any forward-looking statements and prior to making any investment decision. The forward-looking statements contained in this presentation should not by relied on as representing our expectations or beliefs as of any time subsequent to the time this presentation is first issued, and we do not undertake efforts to revise those forward-looking statements to reflect events after that time. 14