Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SOUTH JERSEY INDUSTRIES INC | sji-20200226.htm |

Earnings Presentation 2019 Financial Results & 2020 Financial Outlook February 27, 2020

Forward-Looking Statements and Use of Non-GAAP Measures Certain statements contained in this presentation may qualify as “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact should be considered forward-looking statements made in good faith and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Words such as “anticipate”, “believe”, “expect”, “estimate”, “forecast”, “goal”, “intend”, “objective”, “plan”, “project”, “seek”, “strategy”, “target”, “will” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the statements. These risks and uncertainties include, but are not limited to, the following: general economic conditions on an international, national, state and local level; weather conditions in our marketing areas; changes in commodity costs; changes in the availability of natural gas; “non-routine” or “extraordinary” disruptions in our distribution system; regulatory, legislative and court decisions; competition; the availability and cost of capital; costs and effects of legal proceedings and environmental liabilities; the failure of customers or suppliers to fulfill their contractual obligations; and changes in business strategies. These cautionary statements should not be construed by you to be exhaustive. While SJI believes these forward-looking statements to be reasonable, there can be no assurance that they will approximate actual experience. Further, SJI undertakes no obligation to update or revise any of its forward-looking statements, whether as a result of new information, future events or otherwise. This presentation includes certain non-GAAP financial measures, which the Company believes are useful in evaluating its performance. You should not consider the presentation of this additional information in isolation or as a substitute for results prepared in accordance with GAAP. The Company has provided reconciliations of comparable GAAP to non-GAAP measures in tables found later in this presentation. Investor Contact: Daniel Fidell 609-561-9000 x7027 dfidell@sjindustries.com 2

Overview 3

Overview | Shareholder Value & Customer Satisfaction ❖ Our vision is to drive shareholder value and customer satisfaction through investment in expanding and modernizing our utility infrastructure and through regulatory innovation that provides safety, reliability, value and certainty to our customers. ❖ Knowing the criticality of reliable, cost effective supply to our region, we also seek investment in long-term contracted energy infrastructure that will support a more sustainable environment while making the mid-Atlantic region more affordable for families and competitive for businesses. ❖ Finally, we look to leverage our deep industry expertise and relationships, to provide essential services to utilities, power generators and industrial customers through our wholesale marketing, fuel management and consulting services. 4

Overview | Environmental, Social and Corporate Governance (ESG) SJI has formed an internal ESG Committee to evaluate and monitor our stewardship The ESG Committee reports to the Corporate Responsibility Committee of SJI’s Board of Directors, ensuring the highest level of oversight Environmental Social Governance ✓ Collaborate with DEP and our state ✓ Unwavering commitment to safety as the organization’s ✓ 30% of SJI’s board regulators to support effective non-negotiable top priority members are female environmental, health and safety standards ✓ Commitment to supplier diversity ✓ 90% of board members and regulations ✓ 52% workforce diversity across 1,100+ employees are considered ✓ Design/construct/operate/maintain independent ✓ 60% of CEO’s direct reports are female infrastructure for efficiency to minimize leaks ✓ 70% of board members ✓ Significant capital investment in ongoing ✓ Significant investment in technology, people and customer have tenure of 10 years remediation efforts as well as infrastructure communications to drive the Customer Experience or less replacement ✓ Significant monetary and employee volunteer time ✓ Mandatory retirement ✓ 117+ CNG vehicles installed across our fleet contributions support community investment and over 30 age at 75 local non-profit organizations reduce the use of diesel and carbon ✓ Annual independent emissions ✓ Robust intern program, with 28 interns participating from third-party board ✓ Anticipate over 500 tons of carbon emissions 14 universities evaluation and will be reduced at the current pipe ✓ Health and financial wellness programs to support compensation replacement rate employee engagement evaluation 5

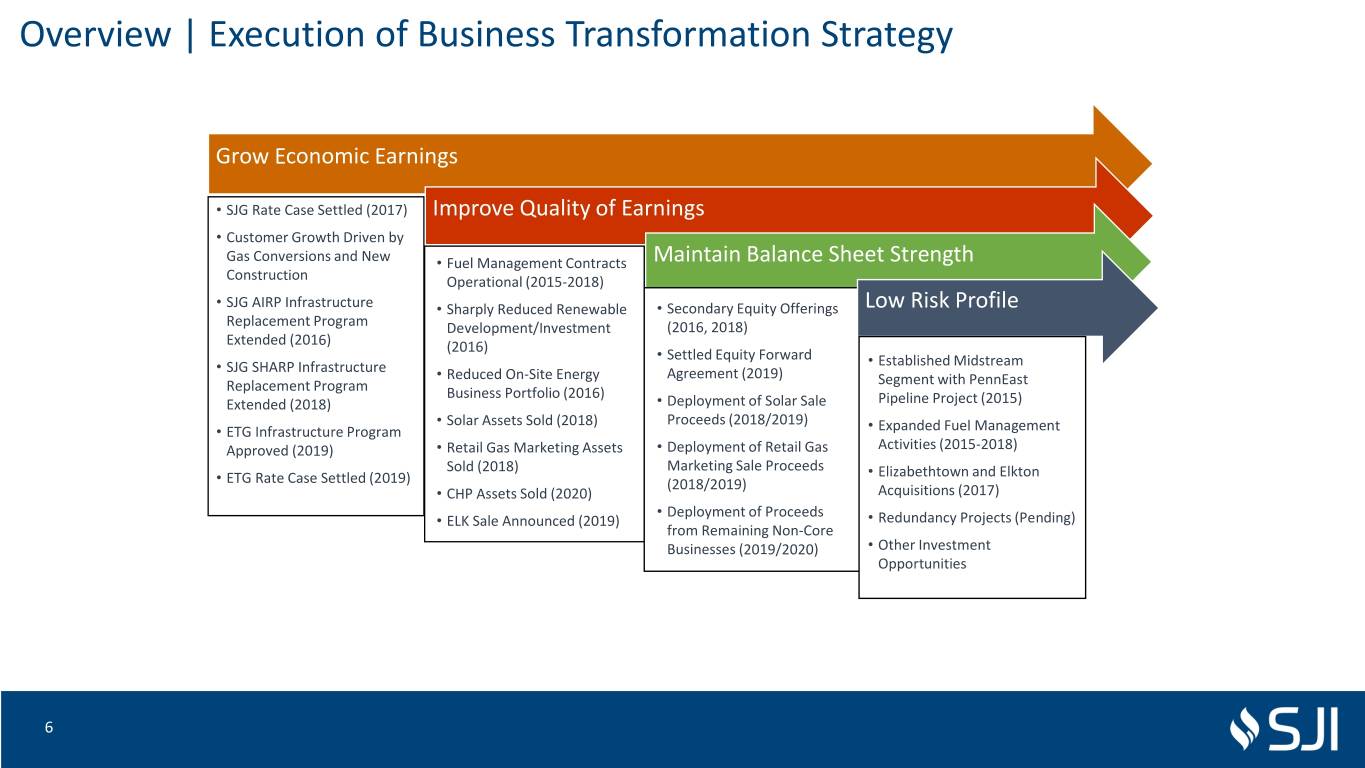

Overview | Execution of Business Transformation Strategy Grow Economic Earnings • SJG Rate Case Settled (2017) Improve Quality of Earnings • Customer Growth Driven by Gas Conversions and New • Fuel Management Contracts Maintain Balance Sheet Strength Construction Operational (2015-2018) • SJG AIRP Infrastructure • Sharply Reduced Renewable • Secondary Equity Offerings Low Risk Profile Replacement Program Development/Investment (2016, 2018) Extended (2016) (2016) • Settled Equity Forward • SJG SHARP Infrastructure • Established Midstream • Reduced On-Site Energy Agreement (2019) Segment with PennEast Replacement Program Business Portfolio (2016) Extended (2018) • Deployment of Solar Sale Pipeline Project (2015) • Solar Assets Sold (2018) Proceeds (2018/2019) • ETG Infrastructure Program • Expanded Fuel Management Approved (2019) • Retail Gas Marketing Assets • Deployment of Retail Gas Activities (2015-2018) Sold (2018) Marketing Sale Proceeds • Elizabethtown and Elkton • ETG Rate Case Settled (2019) (2018/2019) • CHP Assets Sold (2020) Acquisitions (2017) • Deployment of Proceeds • ELK Sale Announced (2019) • Redundancy Projects (Pending) from Remaining Non-Core Businesses (2019/2020) • Other Investment Opportunities 6

New Jersey Energy Master Plan 7

New Jersey Energy Master Plan | New Focus For New Jersey In January, New Jersey Governor Phil Murphy unveiled the state’s updated Energy Master Plan (EMP) • The EMP is intended to set forth a strategic vision for the production, distribution, consumption, and conservation of energy in the State of New Jersey • The EMP is updated and revised periodically -- allows for improvements to reflect changes with technology, energy, and environmental developments and demands • Updated EMP outlines Murphy administration’s goal of 100% clean energy by 2050 • Updated EMP varies dramatically from the prior EMP in 2015 which was heavily supportive of natural gas as an abundant, clean and affordable commodity meriting aggressive expansion to homes and businesses in the state 8

New Jersey Energy Master Plan | New Opportunities for SJI SJI Supports the Clean Energy Goals of the EMP PAST ACTIONS AND INVESTMENTS ❖ REDUCING ENERGY CONSUMPTION/EMISSIONS ✓ Replacement of aging infrastructure, improving safety and reliability for customers and reducing greenhouse gas emissions (GHG) from fugitive emissions; On track for expected reduction of 500 tons of carbon emissions at current replacement rate ✓ Conservation incentive program (CIP) severed the tie between volumes and margins, encouraging reductions in consumption ❖ DEPLOYMENT OF RENEWABLE ENERGY ✓ Sizable investments in solar, combined heat-and-power (CHP), and landfill-to-electric generation ❖ MAXIMIZING ENERGY EFFICIENCY ✓ Energy Efficiency program (EE) designed to reduce consumption ❖ MODERNIZING VIA TECHNOLOGY ✓ Developed enterprise level environmental policy and management system FUTURE INVESTMENT OPPORTUNITIES ❖ REDUCING ENERGY CONSUMPTION/EMISSIONS • Acceleration/extension of NJBPU-approved infrastructure modernization programs ❖ DEPLOYMENT OF RENEWABLE ENERGY • Solar Installations: SJI corporate facilities, landfill properties, community solar and other development projects • Renewable Natural Gas (RNG): Investment opportunities including repurposing existing landfills ❖ MAXIMIZING ENERGY EFFICIENCY • Expansion of existing NJBPU-approved energy efficiency programs to reduce consumption ❖ MODERNIZING VIA TECHNOLOGY • Smart Meter pilot program for 700,000 utility customers to reduce consumption 9

2019 Financial Results 10

2019 Financial Results | Highlights FINANCIAL PERFORMANCE ✓ GAAP earnings of $0.84 per diluted share compared to $0.21 per diluted share in 2018 ✓ Economic Earnings of $1.12 per diluted share compared to $1.38 per diluted share in 2018 ✓ Capital spending of $500+ million; 96% allocated to growth, safety and reliability for SJG and ETG customers RATE CASES ✓ ETG authorized $34 million increase in base rates effective November 15, 2019 ✓ SJG rate case on track for 1Q 2020 filing CUSTOMER GROWTH ✓ 9,500+ new customers added, reflecting 1.4% annualized growth rate; 70%+ converted from heating oil or propane INFRASTRUCTURE MODERNIZATION ✓ SJG infrastructure modernization programs executed on schedule, with rate true-ups on October 1 ✓ ETG authorized $300 million, five-year infrastructure modernization program, with rate true-ups on October 1 SUPPLY/SYSTEM REDUNDANCY ✓ Submitted engineering/route filing to NJBPU to advance critical non-pipeline supply solution for SJG ✓ Accelerated review of critical supply/system reliability solutions for ETG and SJG customers BALANCE SHEET ✓ $300+ million deployed toward debt repayment, using proceeds from equity forward, and solar and retail marketing asset sales ✓ Refinanced debt via $200 million issuance of junior subordinated notes with 60-year duration, with 50% equity credit from S&P 11

2019 Financial Results | Highlights GOVERNANCE ✓ Formation of ESG Committee that reports directly to Corporate Responsibility Committee of Board ✓ Extensive shareholder engagement in support of optimal alignment of benefits and TSR ✓ Annual independent third-party board evaluation and compensation evaluation ENVIRONMENT ✓ Developed enterprise level environmental policy and management system ✓ Replacement of 238 miles of cast iron, bare steel and other aging distribution pipe; 39% reduction in fugitive emissions since 2011 ✓ On track for expected reduction of 500 tons of carbon emissions at the current pipe replacement rate SOCIAL ✓ Unwavering commitment to safety as non-negotiable top priority ✓ 43% female workforce; 39% female leadership; and 50% female Senior Officers ✓ JD Power customer satisfaction scores – ETG #1 in peer group for 5th consecutive year; SJG #3 in same peer group ✓ Monetary and employee volunteer support to more than 30 local non-profit organizations INTEGRATION ✓ Advanced integration of ETG, embedding best practices for people, processes and technology ✓ On track for wind down of transition-services agreement (TSA) with Southern in early 2020 ASSET SALES ✓ Announced sale of Marina Thermal Facility and Elkton Gas, with $100+ million total proceeds targeted for debt repayment DIVIDENDS ✓ 2.6% increase in indicated annual dividend to $1.18 per diluted share; 21 consecutive years of rising dividends 12

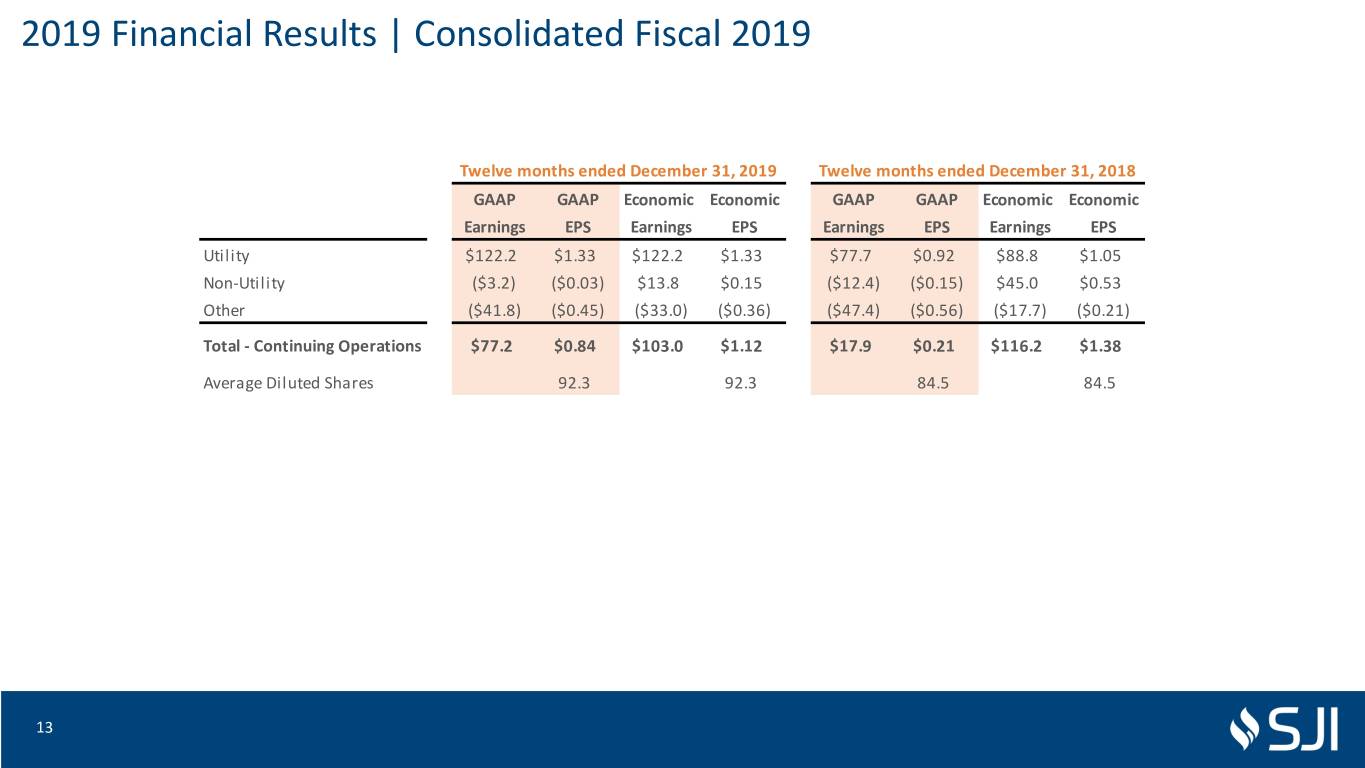

2019 Financial Results | Consolidated Fiscal 2019 Twelve months ended December 31, 2019 Twelve months ended December 31, 2018 GAAP GAAP Economic Economic GAAP GAAP Economic Economic Earnings EPS Earnings EPS Earnings EPS Earnings EPS Utility $122.2 $1.33 $122.2 $1.33 $77.7 $0.92 $88.8 $1.05 Non-Utility ($3.2) ($0.03) $13.8 $0.15 ($12.4) ($0.15) $45.0 $0.53 Other ($41.8) ($0.45) ($33.0) ($0.36) ($47.4) ($0.56) ($17.7) ($0.21) Total - Continuing Operations $77.2 $0.84 $103.0 $1.12 $17.9 $0.21 $116.2 $1.38 Average Diluted Shares 92.3 92.3 84.5 84.5 13

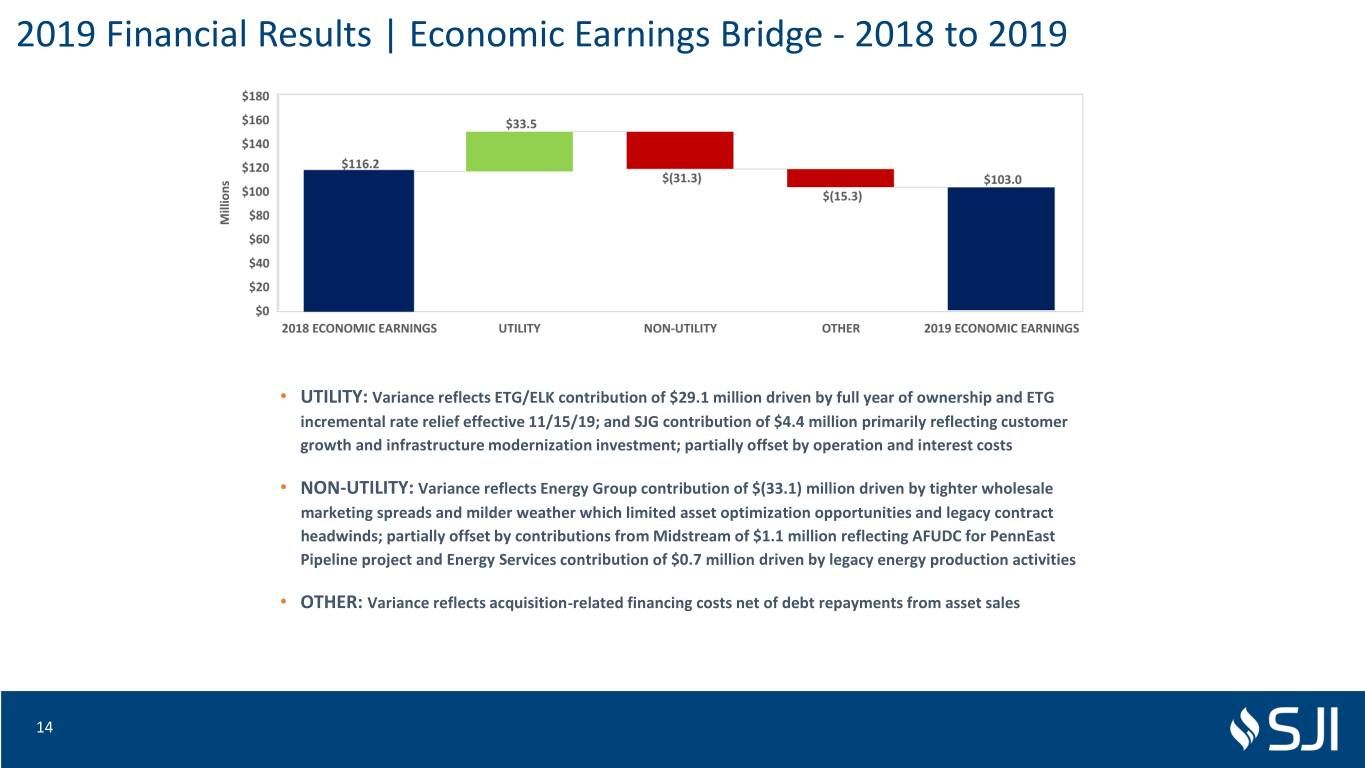

2019 Financial Results | Economic Earnings Bridge - 2018 to 2019 • UTILITY: Variance reflects ETG/ELK contribution of $29.1 million driven by full year of ownership and ETG incremental rate relief effective 11/15/19; and SJG contribution of $4.4 million primarily reflecting customer growth and infrastructure modernization investment; partially offset by operation and interest costs • NON-UTILITY: Variance reflects Energy Group contribution of $(33.1) million driven by tighter wholesale marketing spreads and milder weather which limited asset optimization opportunities and legacy contract headwinds; partially offset by contributions from Midstream of $1.1 million reflecting AFUDC for PennEast Pipeline project and Energy Services contribution of $0.7 million driven by legacy energy production activities • OTHER: Variance reflects acquisition-related financing costs net of debt repayments from asset sales 14

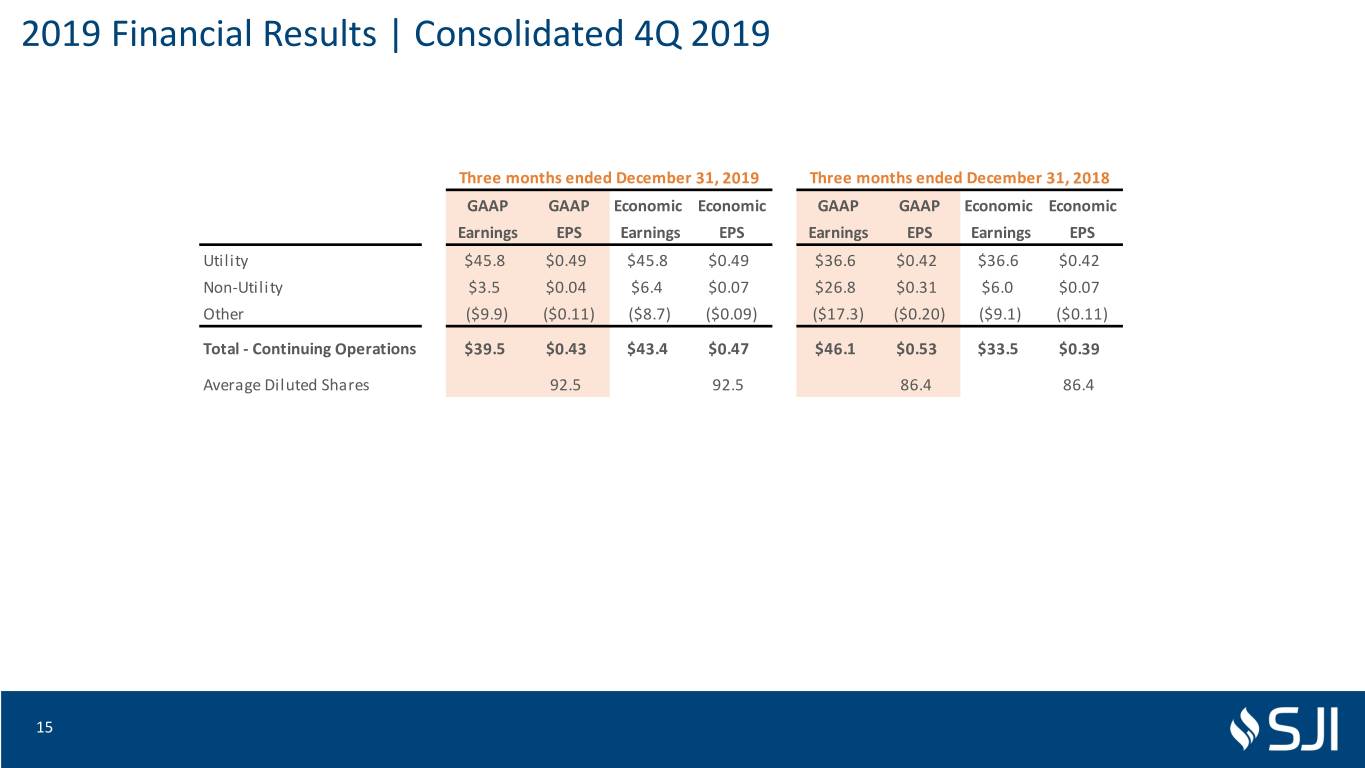

2019 Financial Results | Consolidated 4Q 2019 Three months ended December 31, 2019 Three months ended December 31, 2018 GAAP GAAP Economic Economic GAAP GAAP Economic Economic Earnings EPS Earnings EPS Earnings EPS Earnings EPS Utility $45.8 $0.49 $45.8 $0.49 $36.6 $0.42 $36.6 $0.42 Non-Utility $3.5 $0.04 $6.4 $0.07 $26.8 $0.31 $6.0 $0.07 Other ($9.9) ($0.11) ($8.7) ($0.09) ($17.3) ($0.20) ($9.1) ($0.11) Total - Continuing Operations $39.5 $0.43 $43.4 $0.47 $46.1 $0.53 $33.5 $0.39 Average Diluted Shares 92.5 92.5 86.4 86.4 15

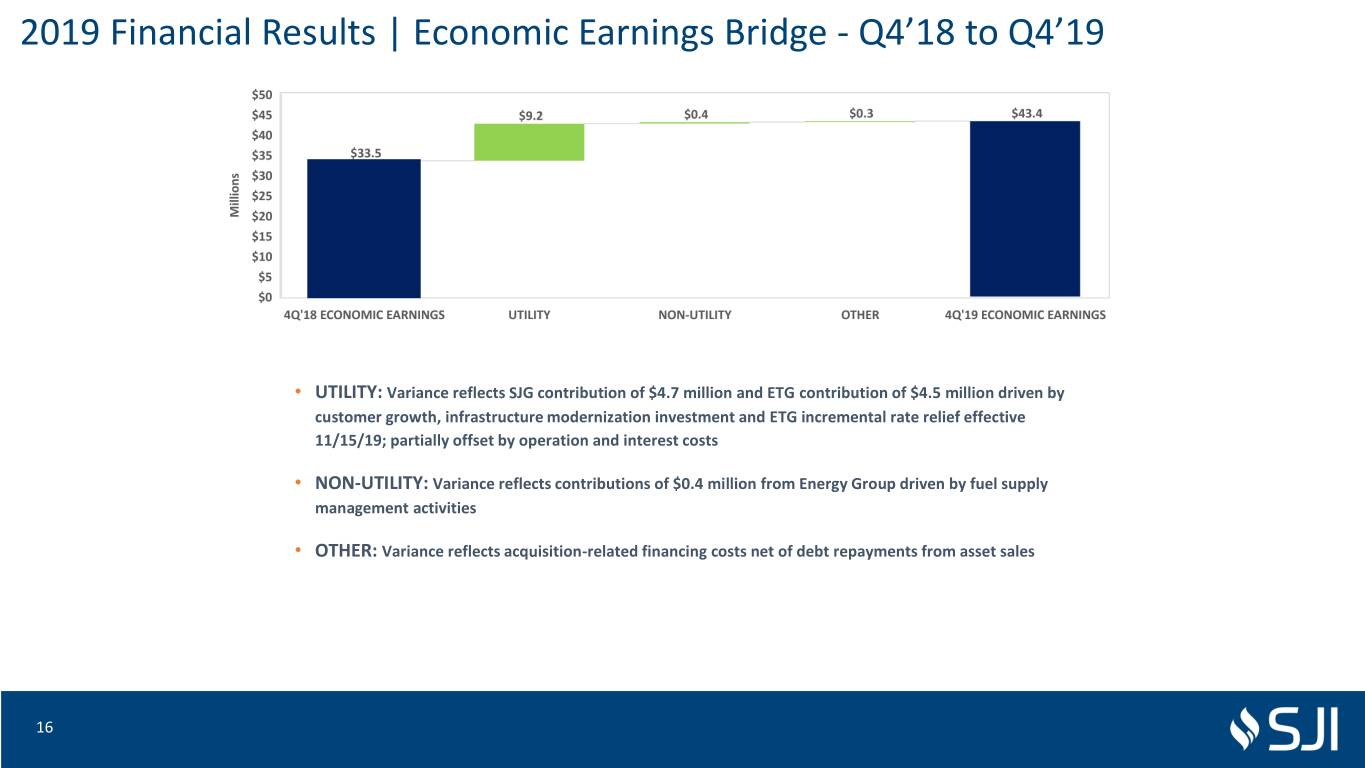

2019 Financial Results | Economic Earnings Bridge - Q4’18 to Q4’19 • UTILITY: Variance reflects SJG contribution of $4.7 million and ETG contribution of $4.5 million driven by customer growth, infrastructure modernization investment and ETG incremental rate relief effective 11/15/19; partially offset by operation and interest costs • NON-UTILITY: Variance reflects contributions of $0.4 million from Energy Group driven by fuel supply management activities • OTHER: Variance reflects acquisition-related financing costs net of debt repayments from asset sales 16

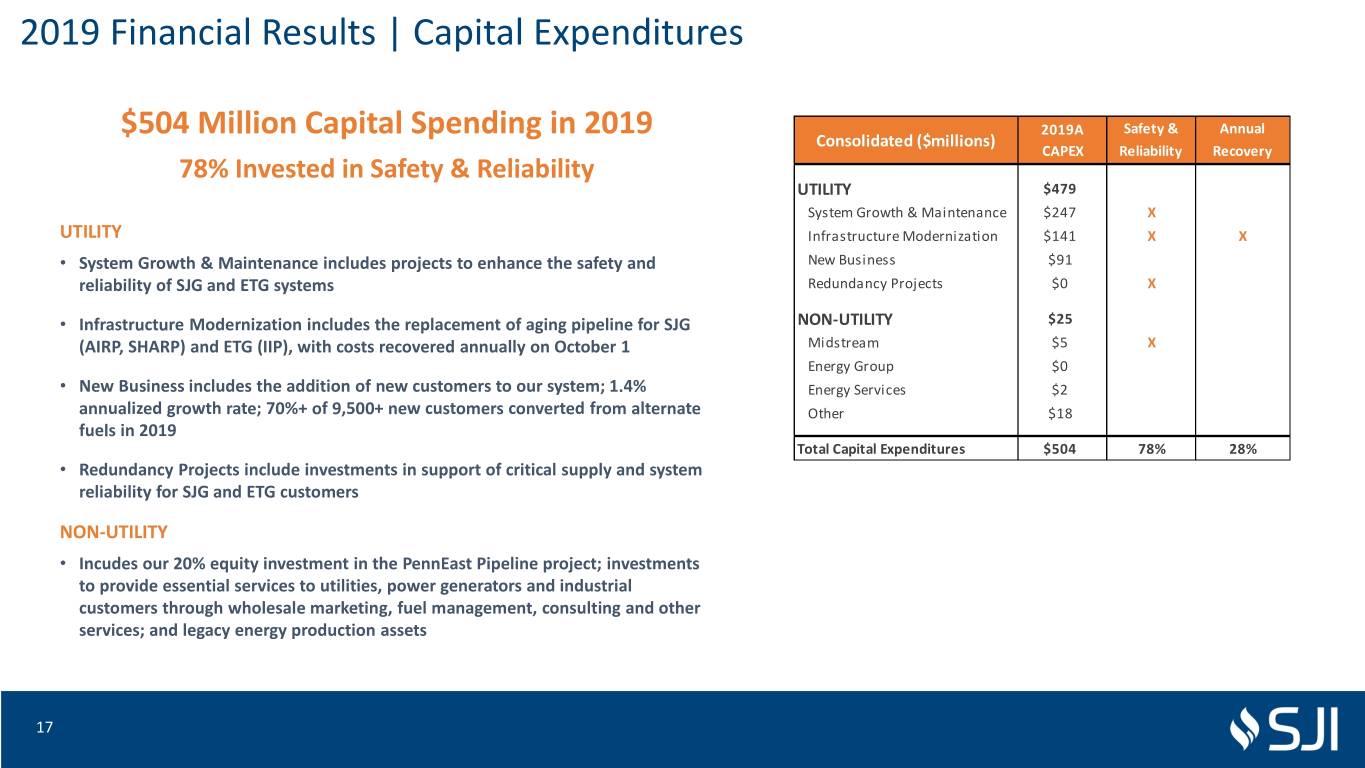

2019 Financial Results | Capital Expenditures $504 Million Capital Spending in 2019 2019A Safety & Annual Consolidated ($millions) CAPEX Reliability Recovery 78% Invested in Safety & Reliability UTILITY $479 System Growth & Maintenance $247 X UTILITY Infrastructure Modernization $141 X X • System Growth & Maintenance includes projects to enhance the safety and New Business $91 reliability of SJG and ETG systems Redundancy Projects $0 X • Infrastructure Modernization includes the replacement of aging pipeline for SJG NON-UTILITY $25 (AIRP, SHARP) and ETG (IIP), with costs recovered annually on October 1 Midstream $5 X Energy Group $0 • New Business includes the addition of new customers to our system; 1.4% Energy Services $2 annualized growth rate; 70%+ of 9,500+ new customers converted from alternate Other $18 fuels in 2019 Total Capital Expenditures $504 78% 28% • Redundancy Projects include investments in support of critical supply and system reliability for SJG and ETG customers NON-UTILITY • Incudes our 20% equity investment in the PennEast Pipeline project; investments to provide essential services to utilities, power generators and industrial customers through wholesale marketing, fuel management, consulting and other services; and legacy energy production assets 17

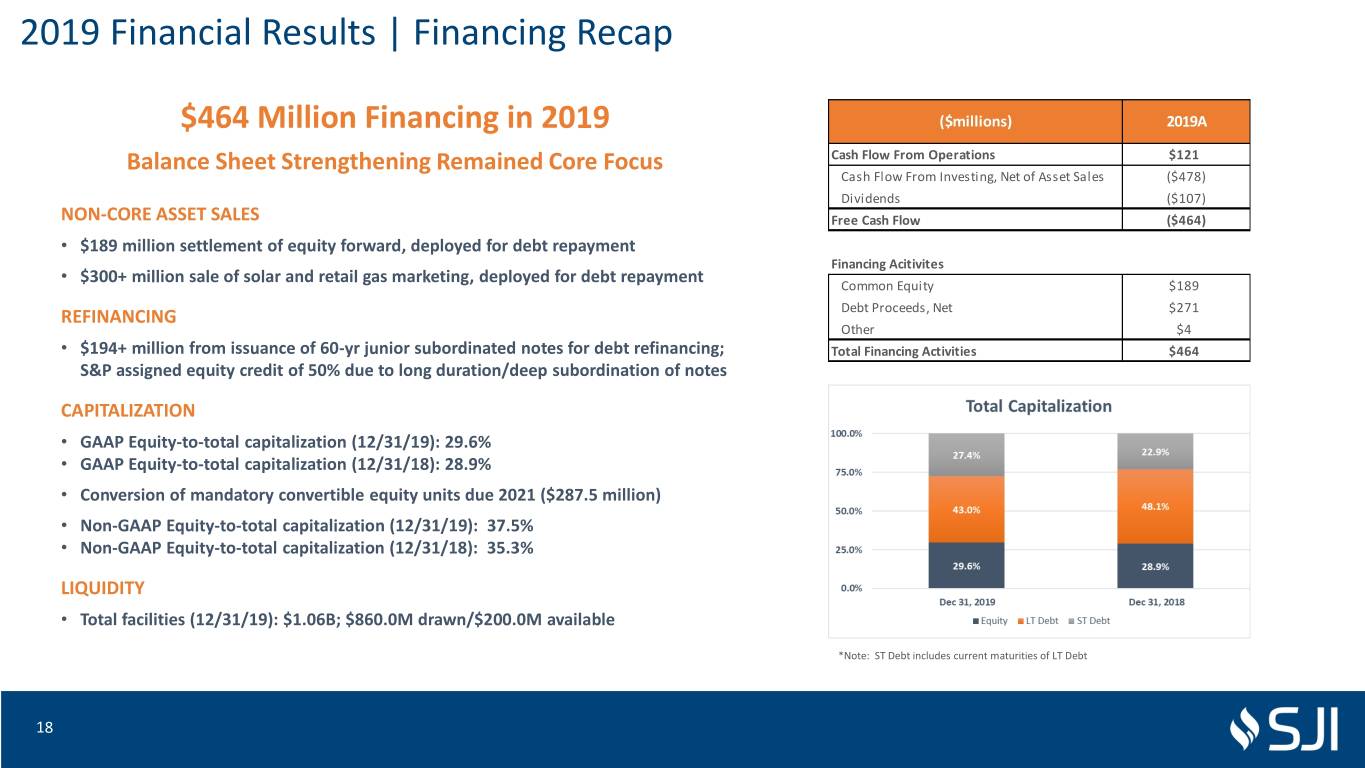

2019 Financial Results | Financing Recap $464 Million Financing in 2019 ($millions) 2019A Balance Sheet Strengthening Remained Core Focus Cash Flow From Operations $121 Cash Flow From Investing, Net of Asset Sales ($478) Dividends ($107) NON-CORE ASSET SALES Free Cash Flow ($464) • $189 million settlement of equity forward, deployed for debt repayment Financing Acitivites • $300+ million sale of solar and retail gas marketing, deployed for debt repayment Common Equity $189 REFINANCING Debt Proceeds, Net $271 Other $4 • $194+ million from issuance of 60-yr junior subordinated notes for debt refinancing; Total Financing Activities $464 S&P assigned equity credit of 50% due to long duration/deep subordination of notes CAPITALIZATION • GAAP Equity-to-total capitalization (12/31/19): 29.6% • GAAP Equity-to-total capitalization (12/31/18): 28.9% • Conversion of mandatory convertible equity units due 2021 ($287.5 million) • Non-GAAP Equity-to-total capitalization (12/31/19): 37.5% • Non-GAAP Equity-to-total capitalization (12/31/18): 35.3% LIQUIDITY • Total facilities (12/31/19): $1.06B; $860.0M drawn/$200.0M available *Note: ST Debt includes current maturities of LT Debt 18

2020 Financial Outlook 19

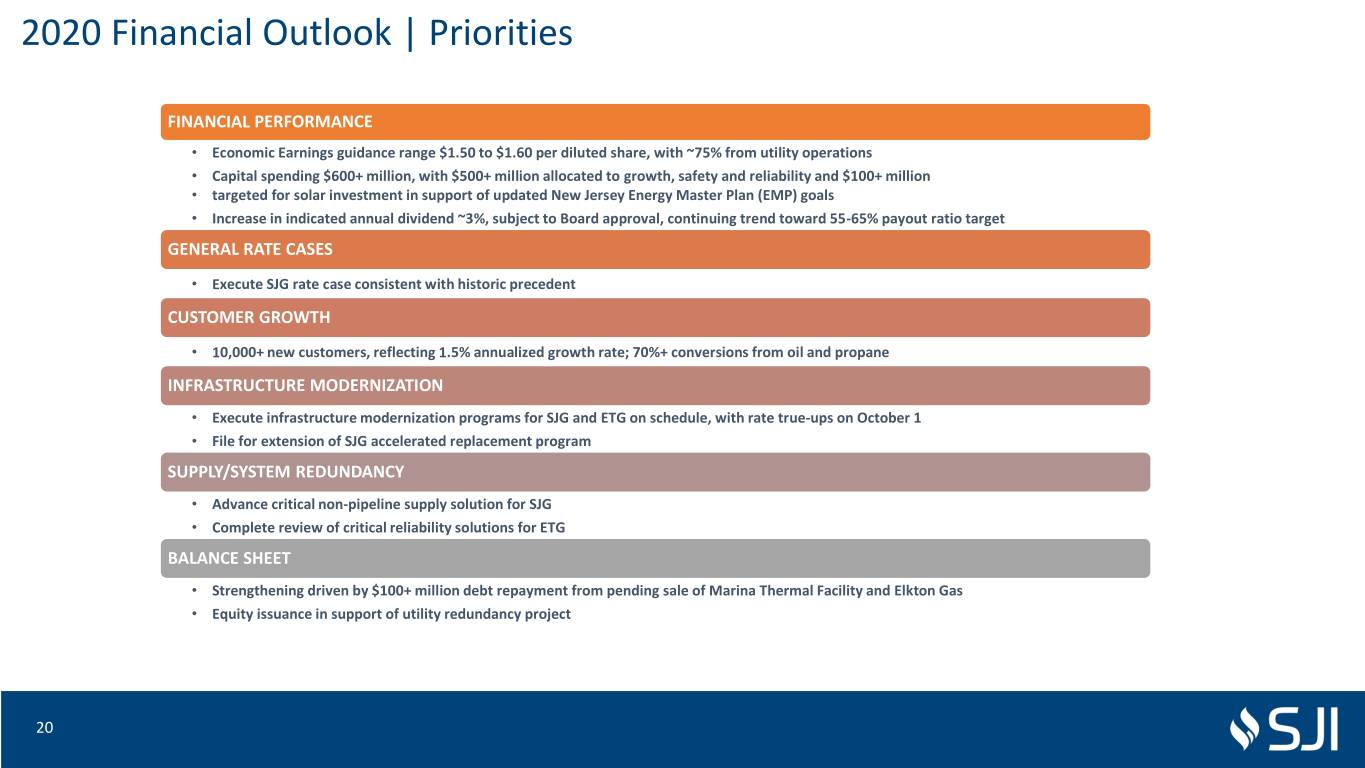

2020 Financial Outlook | Priorities FINANCIAL PERFORMANCE • Economic Earnings guidance range $1.50 to $1.60 per diluted share, with ~75% from utility operations • Capital spending $600+ million, with $500+ million allocated to growth, safety and reliability and $100+ million • targeted for solar investment in support of updated New Jersey Energy Master Plan (EMP) goals • Increase in indicated annual dividend ~3%, subject to Board approval, continuing trend toward 55-65% payout ratio target GENERAL RATE CASES • Execute SJG rate case consistent with historic precedent CUSTOMER GROWTH • 10,000+ new customers, reflecting 1.5% annualized growth rate; 70%+ conversions from oil and propane INFRASTRUCTURE MODERNIZATION • Execute infrastructure modernization programs for SJG and ETG on schedule, with rate true-ups on October 1 • File for extension of SJG accelerated replacement program SUPPLY/SYSTEM REDUNDANCY • Advance critical non-pipeline supply solution for SJG • Complete review of critical reliability solutions for ETG BALANCE SHEET • Strengthening driven by $100+ million debt repayment from pending sale of Marina Thermal Facility and Elkton Gas • Equity issuance in support of utility redundancy project 20

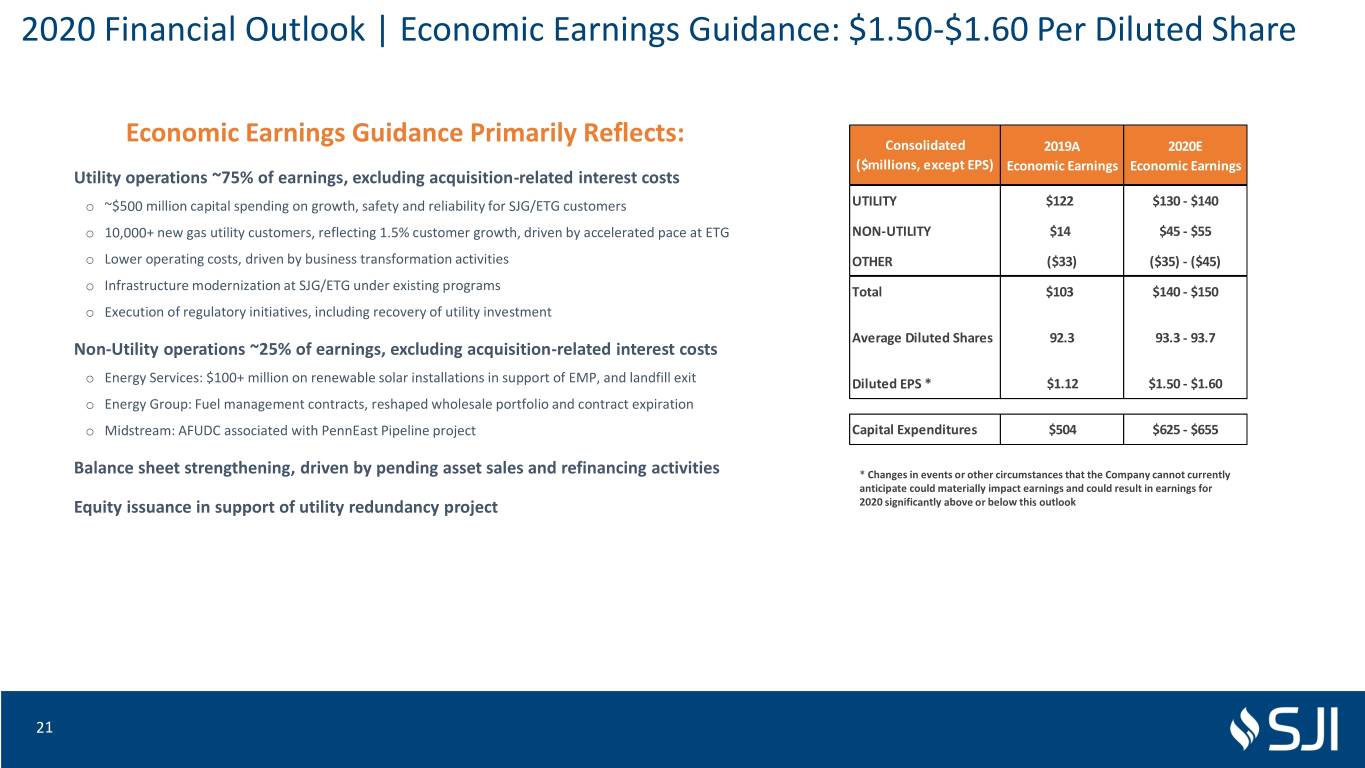

2020 Financial Outlook | Economic Earnings Guidance: $1.50-$1.60 Per Diluted Share Economic Earnings Guidance Primarily Reflects: Consolidated 2019A 2020E ($millions, except EPS) Economic Earnings Economic Earnings Utility operations ~75% of earnings, excluding acquisition-related interest costs o ~$500 million capital spending on growth, safety and reliability for SJG/ETG customers UTILITY $122 $130 - $140 o 10,000+ new gas utility customers, reflecting 1.5% customer growth, driven by accelerated pace at ETG NON-UTILITY $14 $45 - $55 o Lower operating costs, driven by business transformation activities OTHER ($33) ($35) - ($45) o Infrastructure modernization at SJG/ETG under existing programs Total $103 $140 - $150 o Execution of regulatory initiatives, including recovery of utility investment Average Diluted Shares 92.3 93.3 - 93.7 Non-Utility operations ~25% of earnings, excluding acquisition-related interest costs o Energy Services: $100+ million on renewable solar installations in support of EMP, and landfill exit Diluted EPS * $1.12 $1.50 - $1.60 o Energy Group: Fuel management contracts, reshaped wholesale portfolio and contract expiration o Midstream: AFUDC associated with PennEast Pipeline project Capital Expenditures $504 $625 - $655 Balance sheet strengthening, driven by pending asset sales and refinancing activities * Changes in events or other circumstances that the Company cannot currently anticipate could materially impact earnings and could result in earnings for Equity issuance in support of utility redundancy project 2020 significantly above or below this outlook 21

2020 Financial Outlook | Economic Earnings Bridge - 2019 to 2020 Midpoints • UTILITY: Midpoint variance reflects ETG rate relief; 10,000+ new customers; infrastructure investment under modernization programs; benefits from business transformation activities and execution of SJG regulatory initiatives (rate case & redundancy project) • NON-UTILITY: Midpoint variance reflects Energy Group contribution of $10-15 million driven by fuel management, reshaped wholesale portfolio and expiration of legacy contracts; Energy Services contribution of $20-$25 million driven by solar investment in support of NJ Energy Master Plan (EMP) and legacy energy production activities; and Midstream contribution of $1.0 million driven by AFUDC for PennEast Pipeline project • OTHER: Midpoint variance reflects acquisition-related financing costs, net of debt repayments from asset sales 22

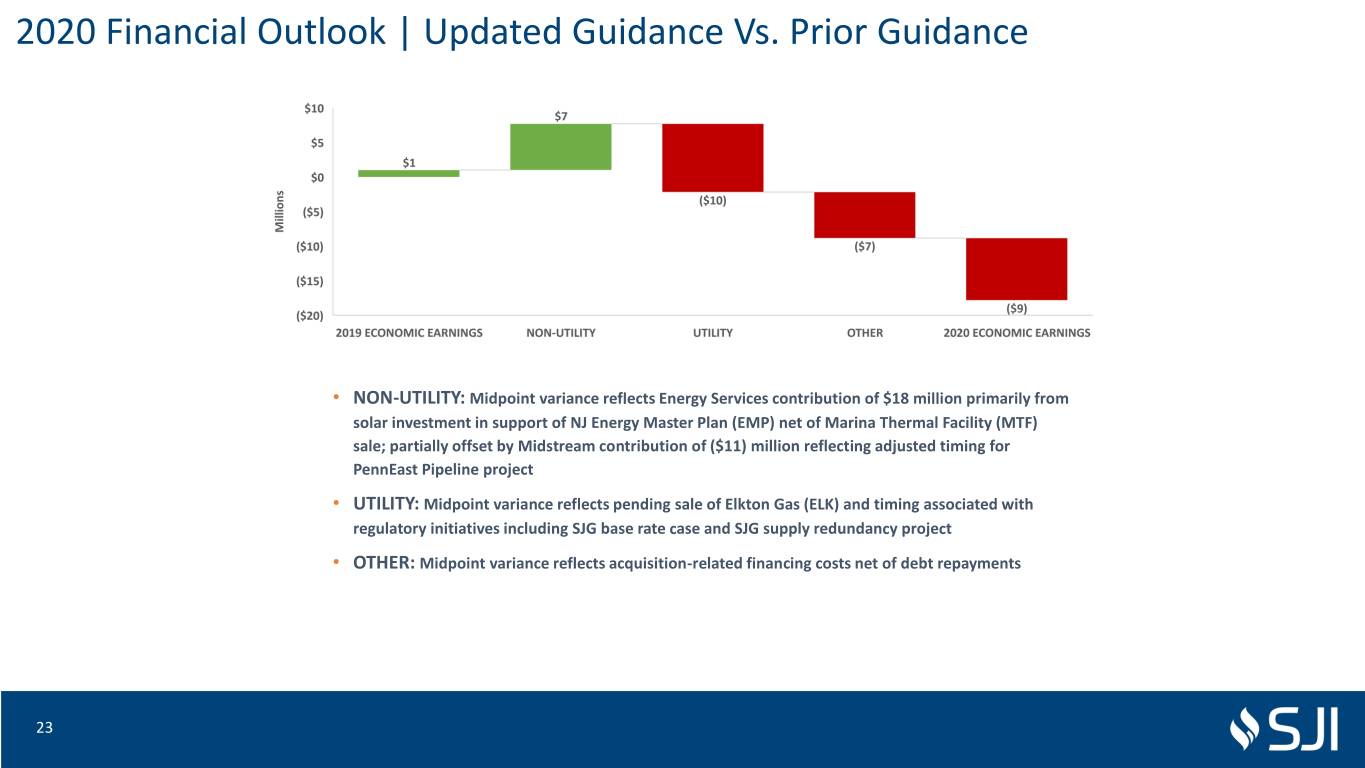

2020 Financial Outlook | Updated Guidance Vs. Prior Guidance • NON-UTILITY: Midpoint variance reflects Energy Services contribution of $18 million primarily from solar investment in support of NJ Energy Master Plan (EMP) net of Marina Thermal Facility (MTF) sale; partially offset by Midstream contribution of ($11) million reflecting adjusted timing for PennEast Pipeline project • UTILITY: Midpoint variance reflects pending sale of Elkton Gas (ELK) and timing associated with regulatory initiatives including SJG base rate case and SJG supply redundancy project • OTHER: Midpoint variance reflects acquisition-related financing costs net of debt repayments 23

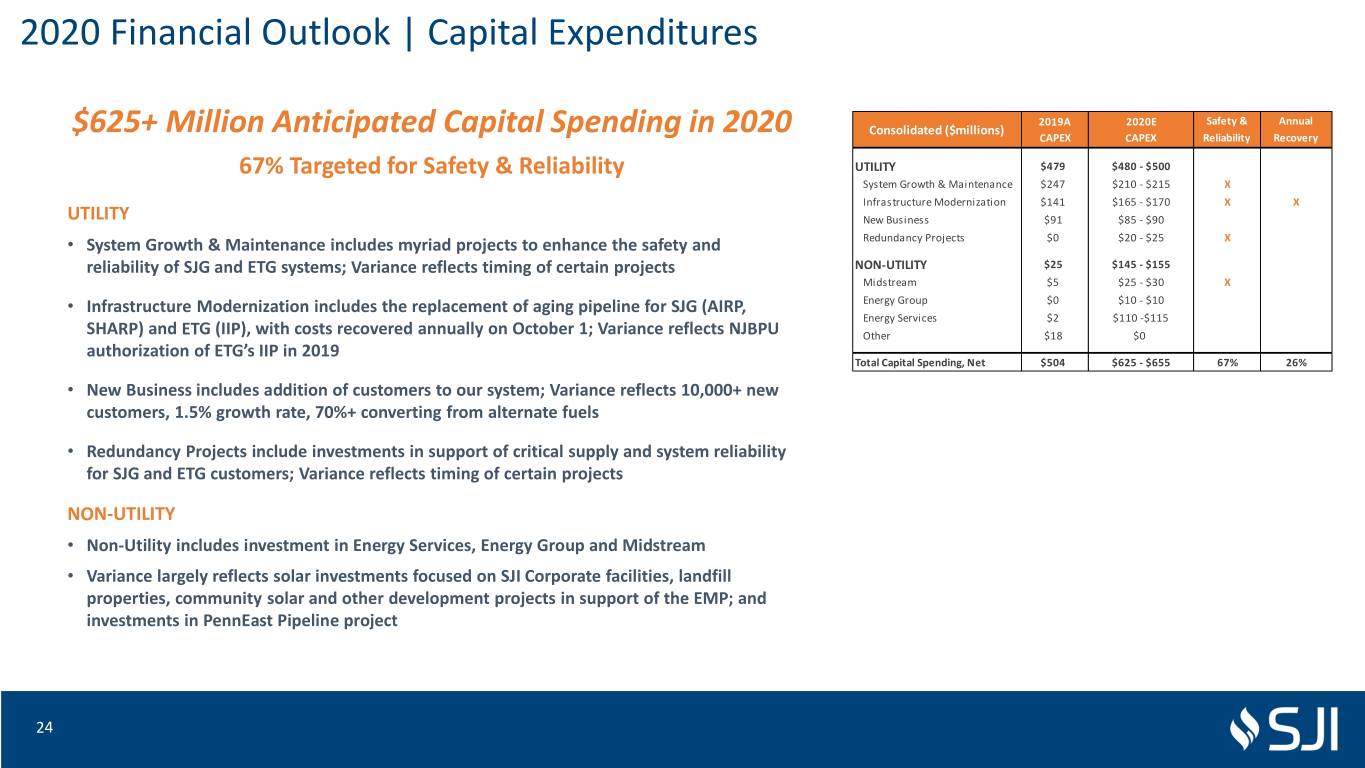

2020 Financial Outlook | Capital Expenditures 2019A 2020E Safety & Annual Consolidated ($millions) $625+ Million Anticipated Capital Spending in 2020 CAPEX CAPEX Reliability Recovery 67% Targeted for Safety & Reliability UTILITY $479 $480 - $500 System Growth & Maintenance $247 $210 - $215 X Infrastructure Modernization $141 $165 - $170 X X UTILITY New Business $91 $85 - $90 • System Growth & Maintenance includes myriad projects to enhance the safety and Redundancy Projects $0 $20 - $25 X reliability of SJG and ETG systems; Variance reflects timing of certain projects NON-UTILITY $25 $145 - $155 Midstream $5 $25 - $30 X • Infrastructure Modernization includes the replacement of aging pipeline for SJG (AIRP, Energy Group $0 $10 - $10 Energy Services $2 $110 -$115 SHARP) and ETG (IIP), with costs recovered annually on October 1; Variance reflects NJBPU Other $18 $0 authorization of ETG’s IIP in 2019 Total Capital Spending, Net $504 $625 - $655 67% 26% • New Business includes addition of customers to our system; Variance reflects 10,000+ new customers, 1.5% growth rate, 70%+ converting from alternate fuels • Redundancy Projects include investments in support of critical supply and system reliability for SJG and ETG customers; Variance reflects timing of certain projects NON-UTILITY • Non-Utility includes investment in Energy Services, Energy Group and Midstream • Variance largely reflects solar investments focused on SJI Corporate facilities, landfill properties, community solar and other development projects in support of the EMP; and investments in PennEast Pipeline project 24

2020 Financial Outlook | Redundancy Projects $20+ Million Anticipated Spending in 2020 on Critical Redundancy Projects • In response to the NJBPU's call for utilities to evaluate preparedness for supply interruptions, we have evaluated potential redundancy solutions for SJG and ETG • These projects are important to ensure service is not interrupted to customers in the event of a significant outage, either behind our city gate, or on one of the two interstate pipelines that serve the SJG system • We have evaluated multiple options including redundant supply feeds and large- scale storage and liquefaction • In December 2019, SJG submitted an engineering/route filing to the NJBPU for approval to construct needed system upgrades in support of a planned 2.0+ Bcf liquefied natural gas (LNG) facility that would provide 15 days of critical supply for SJG customers • Anticipated cost $300+ million; In-service 2023 A resolution from the NJBPU is expected in 2020 25

2020 Financial Outlook | EMP Projects $100+ Million Anticipated Spending in 2020 on EMP-Supportive Projects Solar Investment focused on SJI corporate facilities, landfill properties, community solar and other development projects Targeting Additional Utility & Non-Utility Investment Opportunities: • REDUCING ENERGY CONSUMPTION/EMISSIONS (UTILITY SOLUTION) o Acceleration/extension of NJBPU-approved infrastructure modernization programs • ACCELERATING DEPLOYMENT OF RENEWABLE ENERGY (UTILITY/NON-UTILITY SOLUTIONS) o Renewable Natural Gas (RNG): Investment opportunities including repurposing existing landfills o Solar: SJI corporate facilities, landfill properties, community solar and other development projects • MAXIMIZING ENERGY EFFICIENCY (UTILITY SOLUTION) o Expansion of existing NJBPU-approved energy efficiency programs to reduce consumption • MODERNIZING VIA TECHNOLOGY (UTILITY SOLUTION) o Smart Meter pilot program for 700,000 utility customers to reduce consumption 26

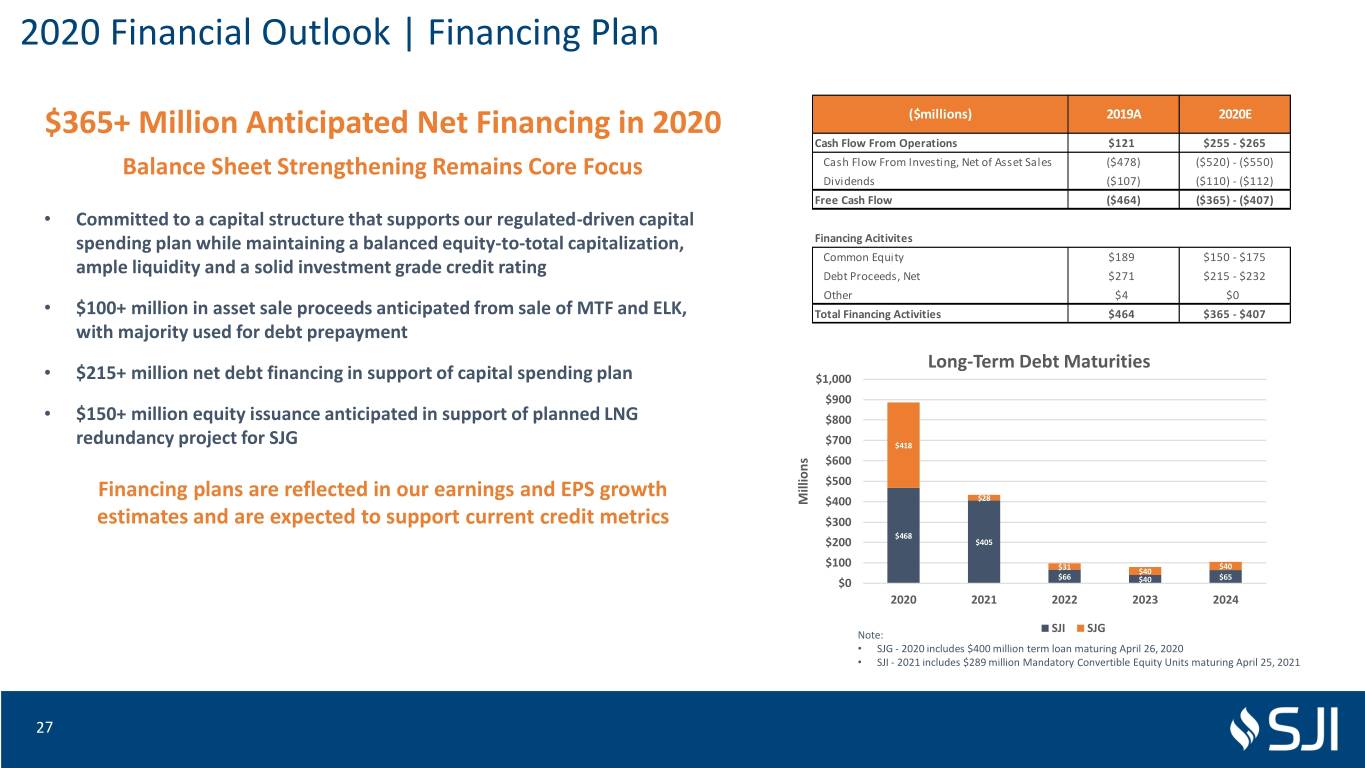

2020 Financial Outlook | Financing Plan $365+ Million Anticipated Net Financing in 2020 ($millions) 2019A 2020E Cash Flow From Operations $121 $255 - $265 Balance Sheet Strengthening Remains Core Focus Cash Flow From Investing, Net of Asset Sales ($478) ($520) - ($550) Dividends ($107) ($110) - ($112) Free Cash Flow ($464) ($365) - ($407) • Committed to a capital structure that supports our regulated-driven capital spending plan while maintaining a balanced equity-to-total capitalization, Financing Acitivites Common Equity $189 $150 - $175 ample liquidity and a solid investment grade credit rating Debt Proceeds, Net $271 $215 - $232 Other $4 $0 • $100+ million in asset sale proceeds anticipated from sale of MTF and ELK, Total Financing Activities $464 $365 - $407 with majority used for debt prepayment Long-Term Debt Maturities • $215+ million net debt financing in support of capital spending plan $1,000 $900 • $150+ million equity issuance anticipated in support of planned LNG $800 redundancy project for SJG $700 $418 $600 $500 Financing plans are reflected in our earnings and EPS growth $28 Millions $400 estimates and are expected to support current credit metrics $300 $468 $200 $405 $100 $31 $40 $40 $0 $66 $40 $65 2020 2021 2022 2023 2024 SJI SJG Note: • SJG - 2020 includes $400 million term loan maturing April 26, 2020 • SJI - 2021 includes $289 million Mandatory Convertible Equity Units maturing April 25, 2021 27

Appendix 28

Appendix | 2019 Financial Performance - Segment Information Fourth Quarter Ended December 31 Year-to-Date Period Ended December 31 Millions Per Diluted Share Millions Per Diluted Share GAAP Earnings 2019 2018 +/- 2019 2018 +/- GAAP Earnings 2019 2018 +/- 2019 2018 +/- UTILITY $45.8 $36.6 $9.2 $0.49 $0.42 $0.07 UTILITY $122.2 $77.7 $44.5 $1.33 $0.92 $0.41 SOUTH JERSEY GAS (SJG) $28.3 $23.6 $4.7 $0.31 $0.27 $0.04 SOUTH JERSEY GAS (SJG) $87.4 $82.9 $4.4 $0.95 $0.98 ($0.03) ELIZABETHTOWN GAS (ETG) $17.2 $12.8 $4.4 $0.19 $0.15 $0.04 ELIZABETHTOWN GAS (ETG) $34.2 ($5.0) $39.2 $0.37 ($0.06) $0.43 ELKTON GAS (ELK) $0.3 $0.2 $0.1 $0.00 $0.00 $0.00 ELKTON GAS (ELK) $0.6 ($0.2) $0.8 $0.01 ($0.00) $0.01 NON-UTILITY $3.5 $26.8 ($23.3) $0.04 $0.31 ($0.27) NON-UTILITY ($3.2) ($12.4) $9.2 ($0.03) ($0.14) $0.11 MIDSTREAM $1.0 $1.1 ($0.1) $0.01 $0.01 ($0.00) MIDSTREAM $4.2 $3.1 $1.1 $0.05 $0.04 $0.01 ENERGY GROUP $9.9 $21.4 ($11.5) $0.11 $0.25 ($0.14) ENERGY GROUP ($0.7) $60.4 ($61.1) ($0.01) $0.72 ($0.73) ENERGY SERVICES ($7.4) $4.3 ($11.7) ($0.08) $0.05 ($0.13) ENERGY SERVICES ($6.7) ($75.9) $69.2 ($0.07) ($0.90) $0.83 OTHER ($9.9) ($17.3) $7.4 ($0.11) ($0.20) $0.09 OTHER ($41.8) ($47.4) $5.6 ($0.45) ($0.56) $0.11 $39.4 $46.1 ($6.7) $0.43 $0.53 ($0.10) $77.2 $17.9 $59.3 $0.84 $0.21 $0.63 Fourth Quarter Ended December 31 Year-to-Date Period Ended December 31 Millions Per Diluted Share Millions Per Diluted Share Economic Earnings 2019 2018 +/- 2019 2018 +/- Economic Earnings 2019 2018 +/- 2019 2018 +/- UTILITY $45.8 $36.6 $9.2 $0.49 $0.42 $0.07 UTILITY $122.2 $88.8 $33.4 $1.33 $1.05 $0.28 SOUTH JERSEY GAS (SJG) $28.3 $23.6 $4.7 $0.31 ($0.11) $0.42 SOUTH JERSEY GAS (SJG) $87.4 $82.9 $4.5 $0.95 $0.98 ($0.03) ELIZABETHTOWN GAS (ETG) $17.2 $12.8 $4.4 $0.19 $0.15 $0.04 ELIZABETHTOWN GAS (ETG) $34.2 $5.8 $28.4 $0.37 $0.07 $0.30 ELKTON GAS (ELK) $0.3 $0.2 $0.1 $0.00 $0.00 $0.00 ELKTON GAS (ELK) $0.6 $0.1 $0.5 $0.01 $0.00 $0.01 NON-UTILITY $6.4 $6.0 $0.4 $0.07 $0.07 ($0.00) NON-UTILITY $13.8 $45.0 ($31.3) $0.15 $0.53 ($0.38) MIDSTREAM $1.0 $1.1 ($0.1) $0.01 $0.01 ($0.00) MIDSTREAM $4.2 $3.1 $1.1 $0.05 $0.04 $0.01 ENERGY GROUP $5.0 $4.5 $0.5 $0.05 $0.05 $0.00 ENERGY GROUP $9.5 $42.6 ($33.1) $0.10 $0.50 ($0.40) Fuel Supply Management $3.2 $2.3 $0.9 $0.04 $0.03 $0.01 Fuel Supply Management $10.9 $8.6 $2.3 $0.12 $0.10 $0.02 Wholesale Marketing $1.3 $2.1 ($0.8) $0.01 $0.02 ($0.01) Wholesale Marketing ($2.2) $35.0 ($37.2) ($0.02) $0.41 ($0.43) Retail Marketing $0.2 $0.1 $0.1 $0.00 $0.00 $0.00 Retail Marketing $0.4 ($1.2) $1.6 $0.00 ($0.01) $0.01 Other $0.2 $0.0 $0.2 $0.00 $0.00 $0.00 Other $0.3 $0.2 $0.1 $0.00 $0.00 $0.00 ENERGY SERVICES $0.4 $0.4 $0.0 $0.00 $0.00 ($0.00) ENERGY SERVICES $0.1 ($0.6) $0.7 $0.00 ($0.01) $0.01 Non-GAAP, see "Explanation and CHP $0.8 ($1.9) $2.7 $0.01 ($0.02) $0.03 CHP $2.0 ($2.4) $4.4 $0.02 ($0.03) $0.05 Reconciliation of Non-GAAP Solar ($0.2) $3.0 ($3.2) ($0.00) $0.03 ($0.04) Solar ($0.3) $3.3 ($3.6) ($0.00) $0.04 ($0.04) Financial Measures." Landfill ($1.1) ($1.2) $0.1 ($0.01) ($0.01) $0.00 Landfill ($4.1) ($3.7) ($0.4) ($0.04) ($0.04) ($0.00) Note: Earnings are in millions. Account Services $0.8 $0.5 $0.3 $0.01 $0.01 $0.00 Account Services $2.5 $2.1 $0.4 $0.03 $0.03 $0.00 Amounts and/or EPS may not add due to rounding. OTHER ($8.7) ($9.1) $0.4 ($0.09) ($0.11) $0.02 OTHER ($33.0) ($17.7) ($15.3) ($0.36) ($0.21) ($0.15) $43.4 $33.5 $9.9 $0.47 $0.39 $0.08 $103.0 $116.2 ($13.2) $1.12 $1.38 ($0.26) 29

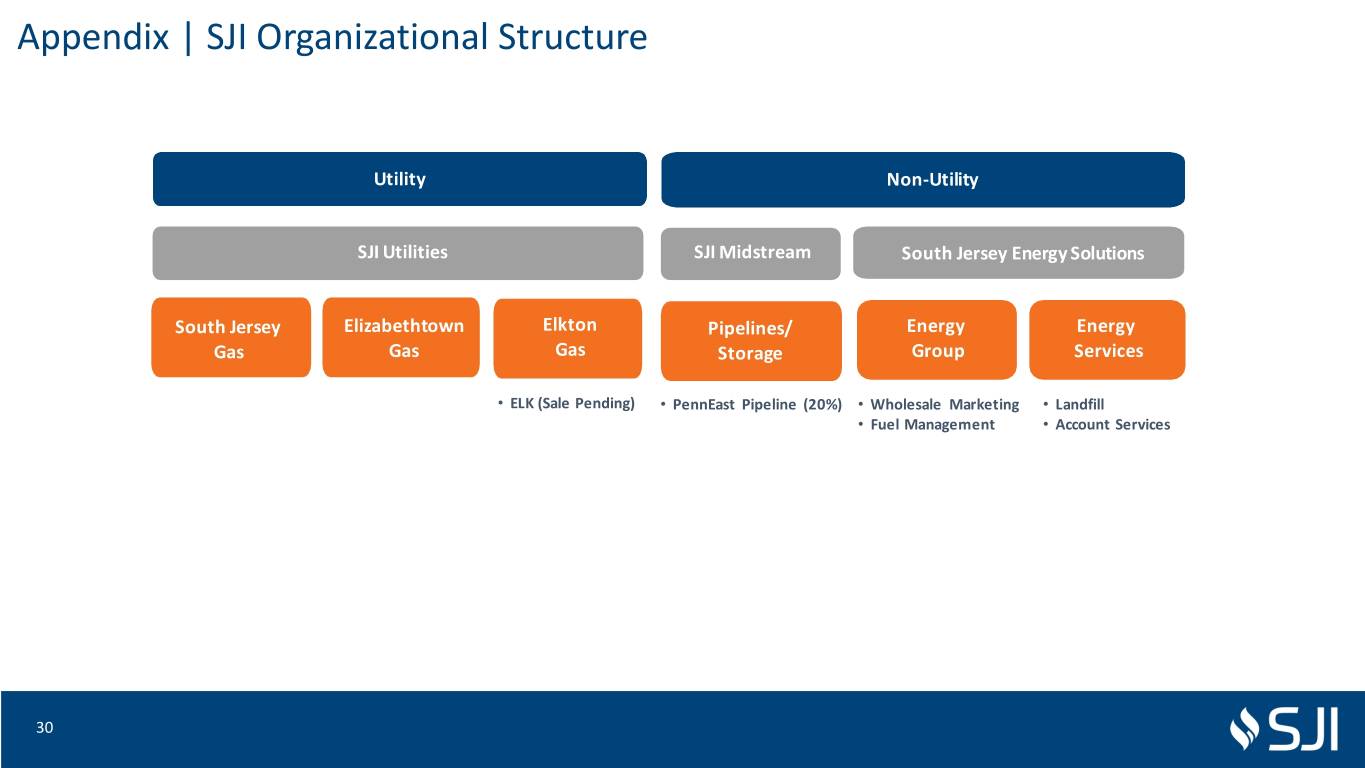

Appendix | SJI Organizational Structure Utility Non-Utility SJI Utilities SJI Midstream South Jersey Energy Solutions South Jersey Elizabethtown Elkton Pipelines/ Energy Energy Gas Gas Gas Storage Group Services • ELK (Sale Pending) • PennEast Pipeline (20%) • Wholesale Marketing • Landfill • Fuel Management • Account Services 30

NYNY Appendix | SJI Utilities Utility SJI Utilities PAPA South Jersey Elizabethtown Elkton Gas Gas Gas • ELK (Sale Pending) NJNJ Largest Stand-Alone Natural Gas Utility in New Jersey ➢ Three gas distribution utilities – South Jersey Gas (SJG) and Elizabethtown Gas (ETG) in NJ; and Elkton Gas (ELK) in MD ➢ ~10,000 miles of distribution and transmission pipeline ➢ ~700,000 total customers ➢ ~$3B combined Rate Base MDMD ➢ Growing customer base MDMD ➢ Mix of new construction and conversions DEDE ➢ Collaborative relationship with NJ regulators ➢ NJ ranks #4 in the nation in per capita income and #8 for GDP 980388_1.wor - NY008P5T 31 VAVA

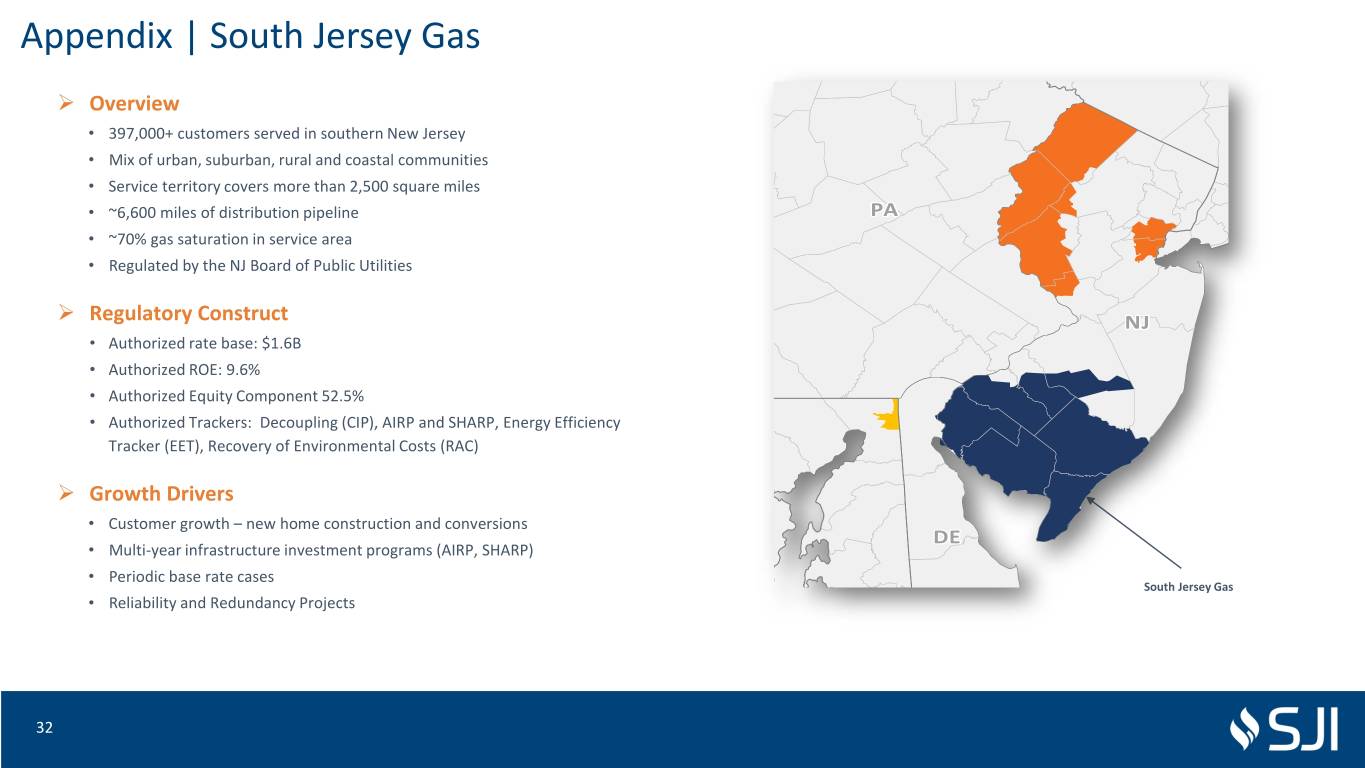

NYNY Appendix | South Jersey Gas ➢ Overview • 397,000+ customers served in southern New Jersey • Mix of urban, suburban, rural and coastal communities • Service territory covers more than 2,500 square miles • ~6,600 miles of distribution pipeline PAPA • ~70% gas saturation in service area • Regulated by the NJ Board of Public Utilities ➢ Regulatory Construct NJNJ • Authorized rate base: $1.6B • Authorized ROE: 9.6% • Authorized Equity Component 52.5% • Authorized Trackers: Decoupling (CIP), AIRP and SHARP, Energy Efficiency Tracker (EET), Recovery of Environmental Costs (RAC) ➢ Growth Drivers MDMD • Customer growth – new home construction and conversions DEDE • Multi-year infrastructure investment programs (AIRP, SHARP) • Periodic base rate cases South Jersey Gas • Reliability and Redundancy Projects 980388_1.wor - NY008P5T VAVA 32

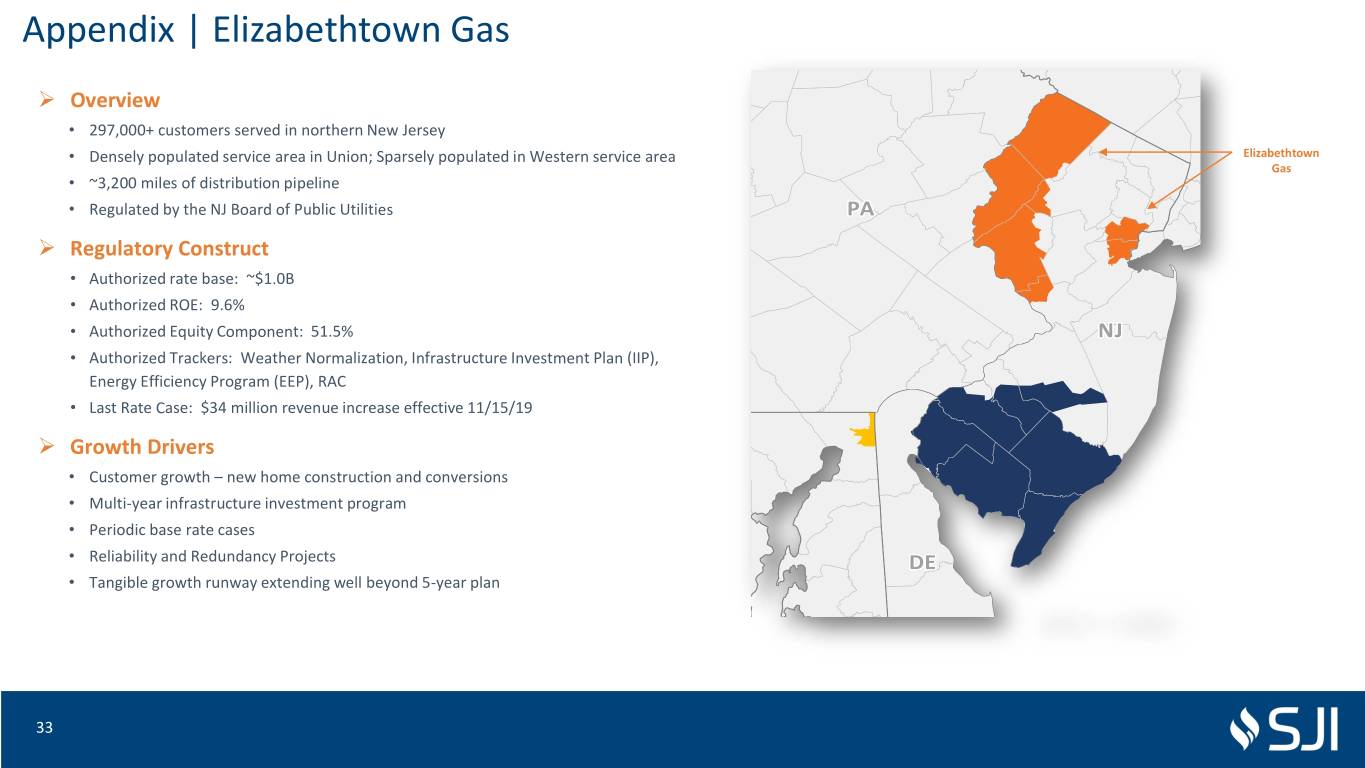

NYNY Appendix | Elizabethtown Gas ➢ Overview • 297,000+ customers served in northern New Jersey • Densely populated service area in Union; Sparsely populated in Western service area Elizabethtown Gas • ~3,200 miles of distribution pipeline • Regulated by the NJ Board of Public Utilities PAPA ➢ Regulatory Construct • Authorized rate base: ~$1.0B • Authorized ROE: 9.6% • Authorized Equity Component: 51.5% NJNJ • Authorized Trackers: Weather Normalization, Infrastructure Investment Plan (IIP), Energy Efficiency Program (EEP), RAC • Last Rate Case: $34 million revenue increase effective 11/15/19 ➢ Growth Drivers • Customer growth – new home construction and conversions • Multi-year infrastructure investment program MDMD • Periodic base rate cases • Reliability and Redundancy Projects DEDE • Tangible growth runway extending well beyond 5-year plan 980388_1.wor - NY008P5T 33 VAVA

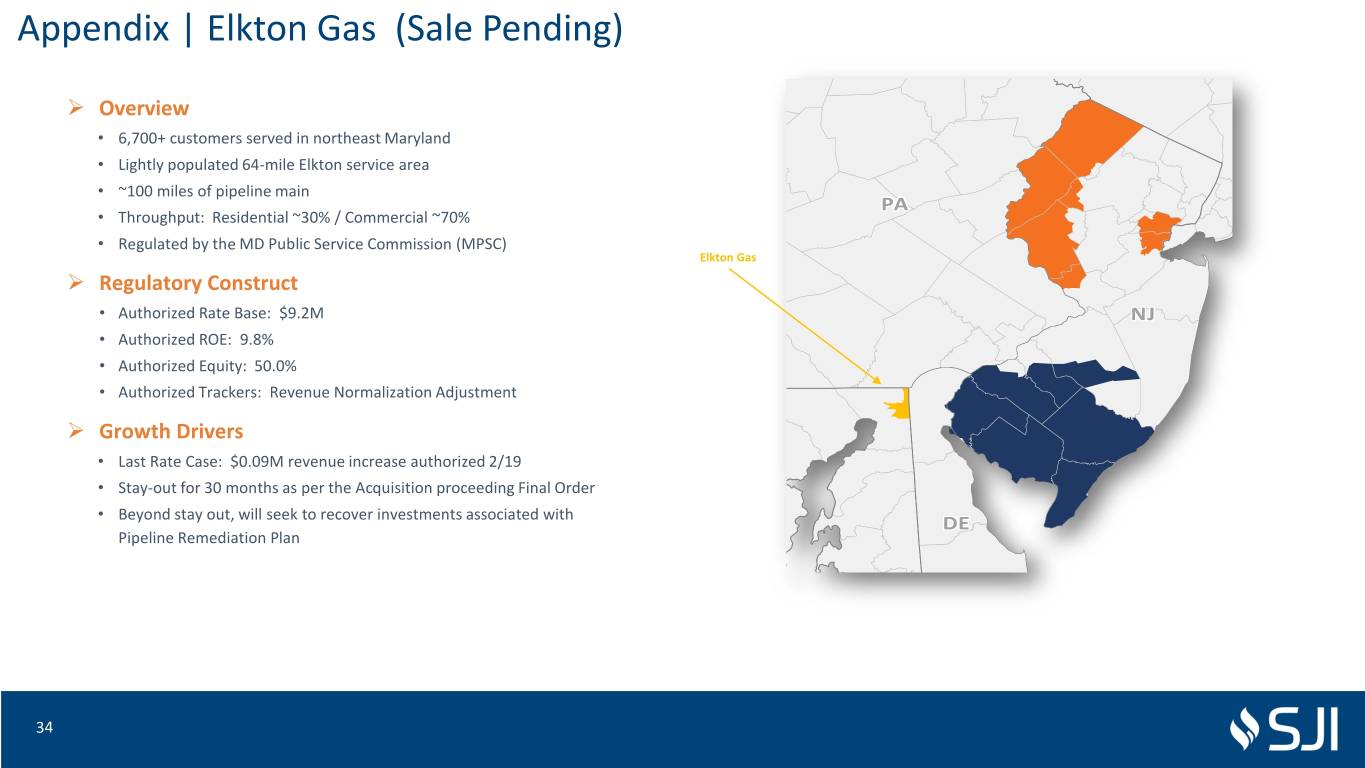

NYNY Appendix | Elkton Gas (Sale Pending) ➢ Overview • 6,700+ customers served in northeast Maryland • Lightly populated 64-mile Elkton service area • ~100 miles of pipeline main PAPA • Throughput: Residential ~30% / Commercial ~70% • Regulated by the MD Public Service Commission (MPSC) Elkton Gas ➢ Regulatory Construct • Authorized Rate Base: $9.2M NJNJ • Authorized ROE: 9.8% • Authorized Equity: 50.0% • Authorized Trackers: Revenue Normalization Adjustment ➢ Growth Drivers • Last Rate Case: $0.09M revenue increase authorized 2/19 • Stay-out for 30 months as per the Acquisition proceeding Final Order MDMD • Beyond stay out, will seek to recover investments associated with DEDE Pipeline Remediation Plan 980388_1.wor - NY008P5T VAVA 34

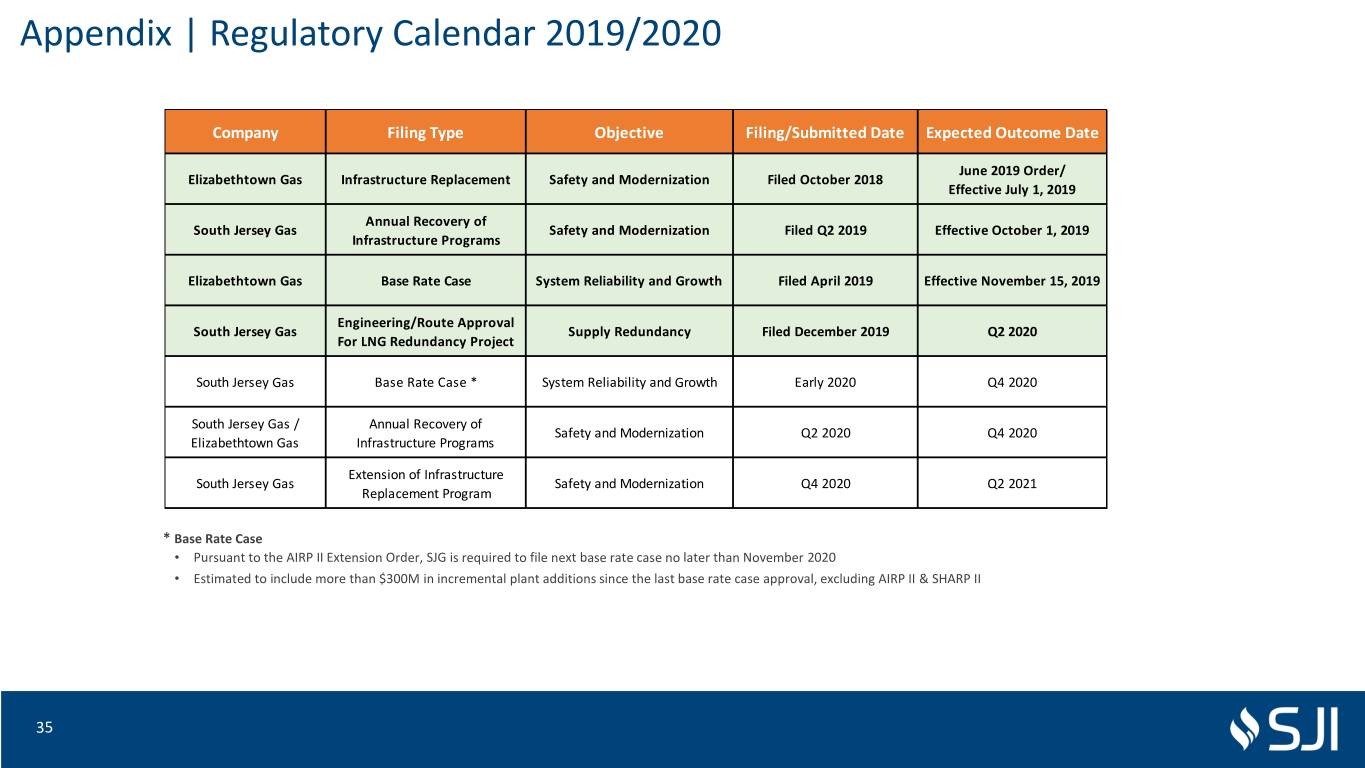

Appendix | Regulatory Calendar 2019/2020 Company Filing Type Objective Filing/Submitted Date Expected Outcome Date June 2019 Order/ Elizabethtown Gas Infrastructure Replacement Safety and Modernization Filed October 2018 Effective July 1, 2019 Annual Recovery of South Jersey Gas Safety and Modernization Filed Q2 2019 Effective October 1, 2019 Infrastructure Programs Elizabethtown Gas Base Rate Case System Reliability and Growth Filed April 2019 Effective November 15, 2019 Engineering/Route Approval South Jersey Gas Supply Redundancy Filed December 2019 Q2 2020 For LNG Redundancy Project South Jersey Gas Base Rate Case * System Reliability and Growth Early 2020 Q4 2020 South Jersey Gas / Annual Recovery of Safety and Modernization Q2 2020 Q4 2020 Elizabethtown Gas Infrastructure Programs Extension of Infrastructure South Jersey Gas Safety and Modernization Q4 2020 Q2 2021 Replacement Program * Base Rate Case • Pursuant to the AIRP II Extension Order, SJG is required to file next base rate case no later than November 2020 • Estimated to include more than $300M in incremental plant additions since the last base rate case approval, excluding AIRP II & SHARP II 35

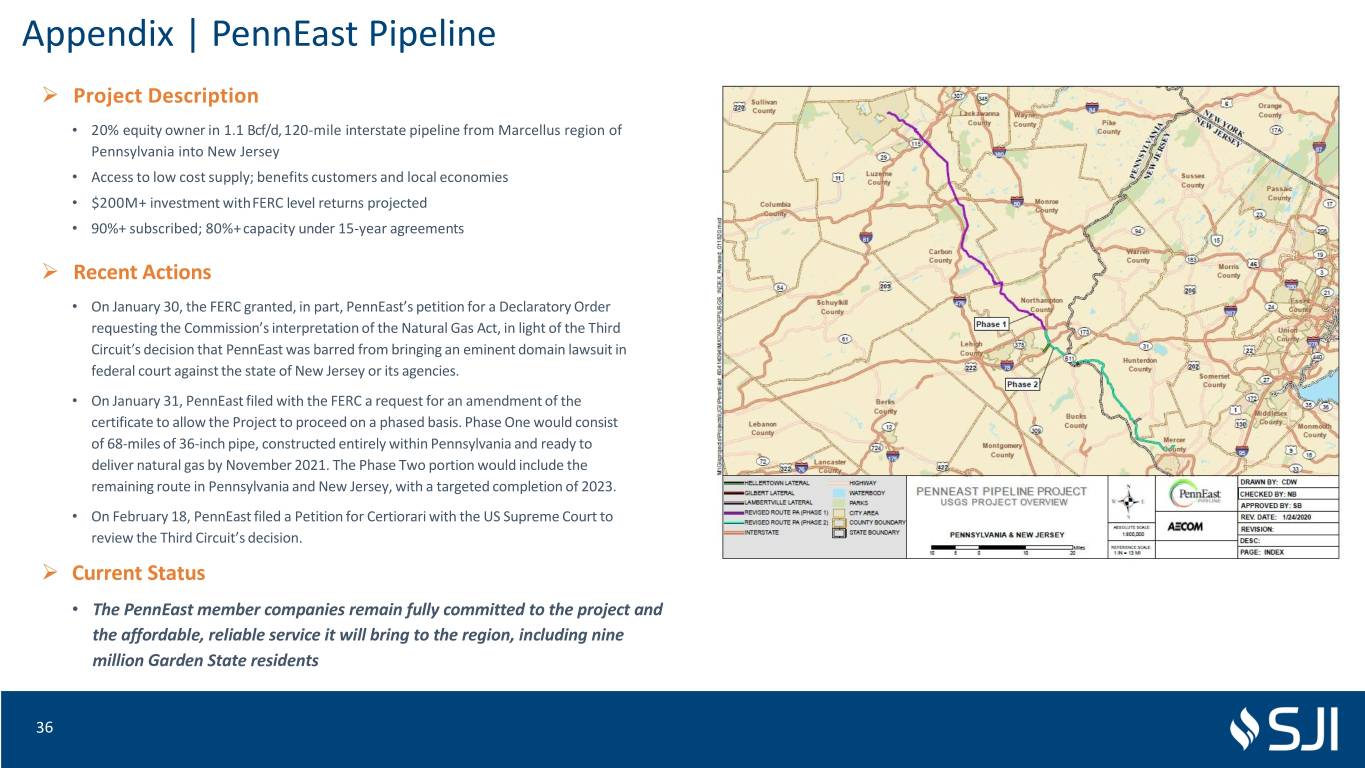

Appendix | PennEast Pipeline ➢ Project Description • 20% equity owner in 1.1 Bcf/d, 120-mile interstate pipeline from Marcellus region of Pennsylvania into New Jersey • Access to low cost supply; benefits customers and local economies • $200M+ investment withFERC level returns projected • 90%+ subscribed; 80%+capacity under 15-year agreements ➢ Recent Actions • On January 30, the FERC granted, in part, PennEast’s petition for a Declaratory Order requesting the Commission’s interpretation of the Natural Gas Act, in light of the Third Circuit’s decision that PennEast was barred from bringing an eminent domain lawsuit in federal court against the state of New Jersey or its agencies. • On January 31, PennEast filed with the FERC a request for an amendment of the certificate to allow the Project to proceed on a phased basis. Phase One would consist of 68-miles of 36-inch pipe, constructed entirely within Pennsylvania and ready to deliver natural gas by November 2021. The Phase Two portion would include the remaining route in Pennsylvania and New Jersey, with a targeted completion of 2023. • On February 18, PennEast filed a Petition for Certiorari with the US Supreme Court to review the Third Circuit’s decision. ➢ Current Status • The PennEast member companies remain fully committed to the project and the affordable, reliable service it will bring to the region, including nine million Garden State residents 36

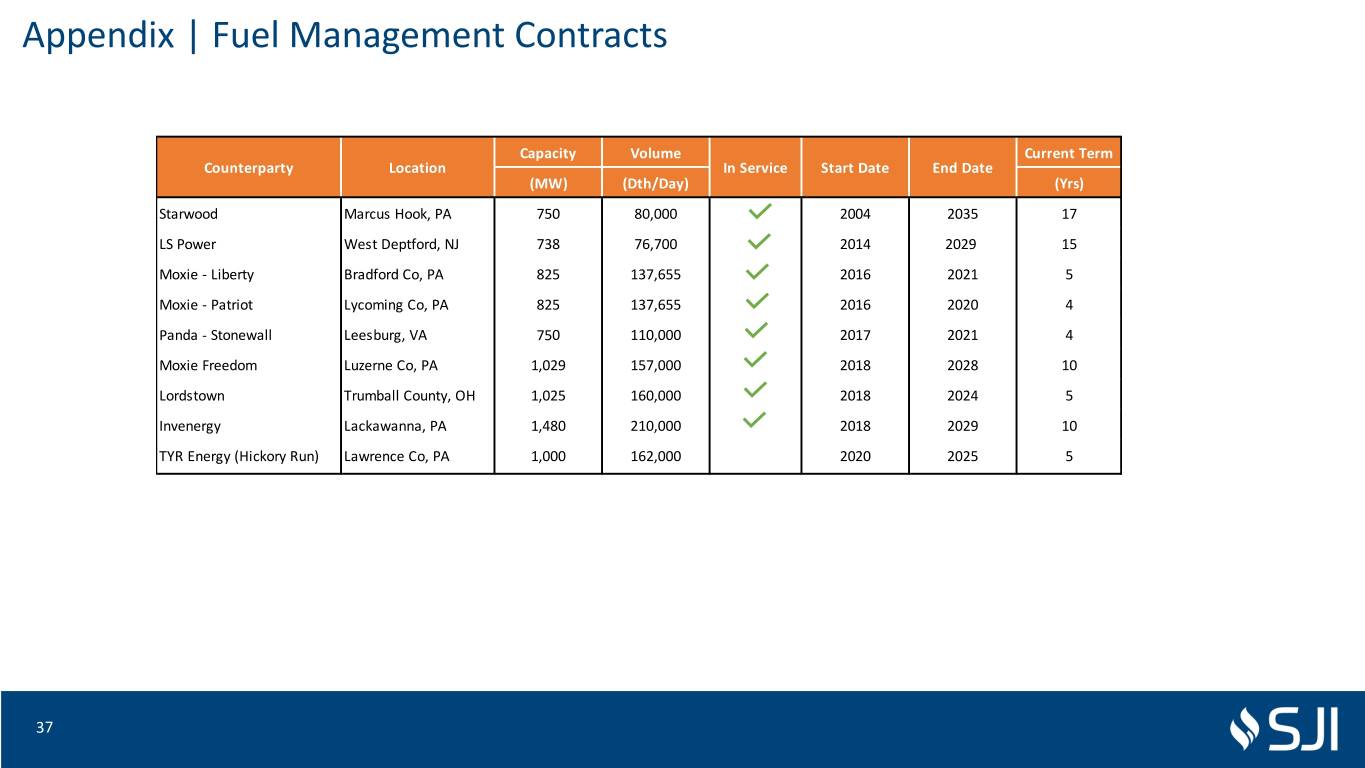

Appendix | Fuel Management Contracts Capacity Volume Current Term Counterparty Location In Service Start Date End Date (MW) (Dth/Day) (Yrs) Starwood Marcus Hook, PA 750 80,000 2004 2035 17 LS Power West Deptford, NJ 738 76,700 2014 2029 15 Moxie - Liberty Bradford Co, PA 825 137,655 2016 2021 5 Moxie - Patriot Lycoming Co, PA 825 137,655 2016 2020 4 Panda - Stonewall Leesburg, VA 750 110,000 2017 2021 4 Moxie Freedom Luzerne Co, PA 1,029 157,000 2018 2028 10 Lordstown Trumball County, OH 1,025 160,000 2018 2024 5 Invenergy Lackawanna, PA 1,480 210,000 2018 2029 10 TYR Energy (Hickory Run) Lawrence Co, PA 1,000 162,000 2020 2025 5 37

Non-GAAP Financial Measures Management uses the non-generally accepted accounting principles (non-GAAP) financial measures of Economic Earnings and Economic Earnings per share when evaluating its results of operations. These non-GAAP financial measures should not be considered as an alternative to GAAP measures, such as net income, operating income, earnings per share from continuing operations or any other GAAP measure of liquidity or financial performance. Economic Earnings is a significant performance metric used by our management to indicate the amount and timing of income from continuing operations that we expect to earn after taking into account the impact of derivative instruments on the related transactions, those transactions or contractual arrangements where the true economic impact will be realized primarily in a future period or was realized in a previous period, and other events that management believes make period to period comparisons of SJI's operations difficult or potentially confusing. Specifically regarding derivatives, we believe that this financial measure indicates to investors the profitability of the entire derivative-related transaction and not just the portion that is subject to mark-to-market valuation under GAAP. We believe that considering only the change in market value on the derivative side of the transaction can produce a false sense as to the ultimate profitability of the total transaction as no change in value is reflected for the non-derivative portion of the transaction. We define Economic Earnings as: Income from continuing operations, (i) less the change in unrealized gains and plus the change in unrealized losses on all derivative transactions; (ii) less realized gains and plus realized losses on all commodity derivative transactions attributed to expected purchases of gas in storage to match the recognition of these gains and losses with the recognition of the related cost of the gas in storage in the period of withdrawal; (iii) less the impact of transactions or contractual arrangements where the true economic impact will be realized in a future period, along with other events that management believes make period to period comparisons of SJI's operations difficult or potentially confusing. Please refer to our annual report on form 10-k and other SEC filings where the reconciliations to GAAP earnings can be found. 38