Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - REDWOOD TRUST INC | q12020dividendpr.htm |

| EX-99.1 - EXHIBIT 99.1 - REDWOOD TRUST INC | q42019earningsrelease.htm |

| 8-K - 8-K - REDWOOD TRUST INC | q42019form8-kpr.htm |

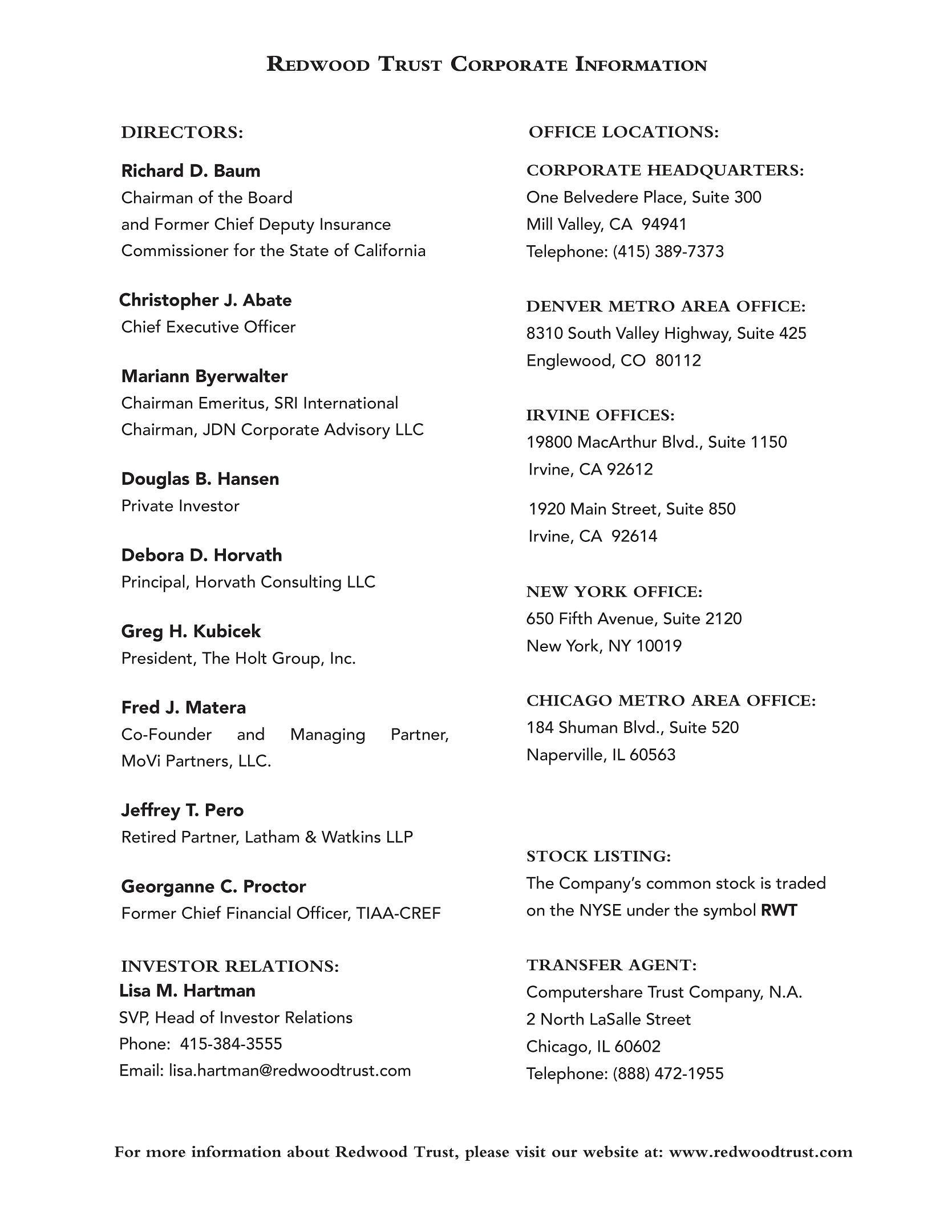

Exhibit 99.2

T A B L E O F C O N T E N T S |

Introduction | |

Shareholder Letter | |

Quarterly Results | |

Ñ Fourth Quarter Highlights | |

Ñ New Segment Overview | |

Ñ Quarterly Earnings and Analysis | |

Ñ Book Value and Economic Return | |

Ñ Return Contribution Analysis | |

Ñ Segment Results | |

Quarterly Positions | |

Ñ Capital Allocations | |

Ñ Leverage | |

Ñ Credit | |

Financial Tables | |

Appendix | |

Ñ CoreVest Acquisition | |

Ñ Dividends and Taxable Income | |

Ñ Non-GAAP Measurements | |

Ñ Forward-Looking Statements | |

Endnotes | |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

1 |

I N T R O D U C T I O N |

Note to Readers:

We file annual reports (on Form 10-K) and quarterly reports (on Form 10-Q) with the Securities and Exchange Commission. These filings and our earnings press releases provide information about Redwood and our financial results in accordance with generally accepted accounting principles (GAAP). These documents, as well as information about our business and a glossary of terms we use in this and other publications, are available through our website, www.redwoodtrust.com. We encourage you to review these documents.

Throughout this document, in addition to our GAAP results, we also present certain non-GAAP measures, including "core earnings" and other measures calculated in a manner consistent with core earnings. The Appendix to this document includes a detailed description of our non-GAAP measures and reconciliations to their equivalent GAAP measures.

References herein to “Redwood,” the “company,” “we,” “us,” and “our” include Redwood Trust, Inc. and its consolidated subsidiaries. Note that because we round numbers in the tables to millions, except per share amounts, some numbers may not foot due to rounding. References to the “fourth quarter” refer to the quarter ended December 31, 2019, and references to the “third quarter” refer to the quarter ended September 30, 2019, unless otherwise specified.

Forward-looking statements:

This Redwood Review contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan,” and similar expressions or their negative forms, or by references to strategy, plans, goals, or intentions. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K under the caption “Risk Factors.” Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected are described below and may be described from time to time in reports we file with the Securities and Exchange Commission, including reports on Forms 10-K, 10-Q, and 8-K. We undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Statements regarding the following subjects, among others, are forward-looking by their nature: statements we make regarding Redwood’s business strategy and strategic focus, statements related to our financial outlook and expectations for 2020 and future years, statements regarding our available capital and sourcing additional capital both internally and from the capital markets, and other statements regarding pending business activities and expectations and estimates relating to our business and financial results. Additional detail regarding the forward-looking statements in this Redwood Review and the important factors that may affect our actual results in 2020 are described in the Appendix of this Redwood Review under the heading “Forward-Looking Statements.”

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

2 |

S H A R E H O L D E R L E T T E R |

Dear Fellow Shareholders:

Redwood ended 2019 on a strong note, with solid earnings and sustained momentum across our business lines. Our GAAP and non-GAAP core earnings were $0.38 and $0.45 per share, respectively, for the fourth quarter. We ended the full year with GAAP earnings of $1.46 per share and core earnings of $1.58 per share, resulting in a core ROE for 2019 of 11.6%. Our earnings for the full year were comprised of a healthy balance of investment returns and income from mortgage banking operations, and we made $1.1 billion of investments through a combination of organic and acquisition activity that we believe will help us deliver increased returns to our shareholders in the coming quarters and years.

In total, we were pleased with our financial results and today we announced a 6.7% increase to our regular quarterly dividend to shareholders to $0.32 per share for the first quarter of 2020. Our ability to raise our dividend despite the market volatility we experienced over the past year is significant in that it demonstrates the stability of our business model driven by diverse revenue streams.

What really set 2019 apart for Redwood was our strategic progress. Fueled in part by two acquisitions, it was a historic year for our business that set a new foundation for profitable growth. We are now a leading participant in several distinct areas of housing credit, and our consolidated portfolio has evolved to incorporate a diverse mix of residential, business purpose, and multifamily investments. We now operate out of four principal locations, and our earnings power is squarely driven by organically created investments and the associated platforms that produce them. Our risk-minded culture and our values, which emphasize passion, integrity, change, relationships, and results, underlie our methodical pursuit to become one of the nation’s most innovative investors in housing credit.

And it would not be Redwood if we didn't continue to move with a quick step, pushing our platform ahead towards the next phase of growth. Our strategic priorities for 2020 are focused on channeling regulatory changes and technological innovations to significantly advance our overall relevance to the housing market. We plan to confront key issues facing housing finance and drive the industry forward with actionable initiatives, which we expand on below.

Put simply, our corporate mission is to help make quality housing accessible to all Americans, whether it's rented or owned. We recognize that the needs of consumers have changed, and that for many the allure of a home has as much to do with comfort, proximity to work, and lifestyle as it does with pride of homeownership.

As we continue with this important work, we recently reorganized our business to create a more scalable infrastructure going forward. This will allow us to better manage the ever-evolving opportunities and risks facing our business and to create better visibility into the earnings power of our operating platforms and the investments they create.

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

3 |

S H A R E H O L D E R L E T T E R |

We now manage our business through four distinct segments or "verticals." Our new structure provides for centralized strategic decision-making that drives the activities of these verticals. In turn, our businesses can operate end-to-end in their respective sectors while benefiting from corporate risk oversight and traditional shared services. Each of our verticals currently operates at a slightly different stage of maturity, creating what we view as a compelling mix of stable earnings generation and future upside. In sum, we believe this profile offers differentiated cash flows and return profiles that will contribute toward a robust earnings stream for our shareholders. As you might expect, accompanying these changes are refocused financial disclosures and analyses throughout this Redwood Review - we look forward to your feedback.

Reflecting on the macro environment in 2019, few expected it to be a record year for residential mortgage refinance activity, but that’s what we got. The Federal Reserve kept rates low after cutting three times in 2019 amid global trade tensions and signs of economic weakness. Inflation, meanwhile, remained low and the U.S. consumer balance sheet remained strong, in part driven by an increased propensity to save that is in turn putting downward pressure on benchmarks. As we head deeper into 2020, the 30-year conforming mortgage rate has fallen once again to three-year lows and is within striking distance of all-time lows. This continues to provide ample fuel for refinance activity, which has boosted volumes year-to-date in 2020. Low rates have also contributed to increased borrower spending power, something that should in theory buoy home purchase demand amongst millennials who are now entering their prime home buying years.

But buying power is a moot point when there is such limited housing stock. While the interest rate environment has contributed to what is now a decade-long run in housing, it also masks some worrisome trends that continue to garner our close attention. Most notably, the supply of quality, affordable homes in the United States badly lags new household formation. While this imbalance has greatly supported rising home prices, it’s made access to desirable housing more challenging for many - especially low to moderate income families, many of whom are would-be first-time home buyers. An expedient solution making the rounds in Washington is to relax underwriting standards and make it easier to offer loans with lower down payments to borrowers with higher debt-to-income ratios. While we support expanding homeownership opportunities for all Americans who desire to own their own homes, lowering underwriting standards had disastrous consequences leading up to the 2008 financial crisis and beyond. Additionally, these solutions ignore the fundamental problem - not enough homes.

At Redwood, our approach to residential underwriting remains unchanged. We emphasize safe, well-structured loans that borrowers can reliably afford. But more importantly, we are championing solutions in our business lines that offer more high quality and accessible housing for consumers. For instance, our business purpose lending initiatives focus not only on stabilized rentals, but also bridge lending - where homes are renovated, upgraded, and brought up to current building codes before getting resold or rented to consumers. We are actively expanding the bridge business to include more robust construction/redevelopment opportunities, including market-leading financing programs for build-to-rent communities, urban infill development, and modular home development, to name a few. These strategies all complement our consumer residential lending business and expand upon our mission.

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

4 |

S H A R E H O L D E R L E T T E R |

As we look ahead into 2020, all eyes are on the U.S. housing regulator (FHFA), where its new director is focused on taking the GSEs out of conservatorship, reducing their footprint across the housing sector, and leveling the playing field for private capital to participate in a larger part of the market. We see this regulatory shift as a major opportunity for our residential lending business, and the catalyst for us to invest in our platform to support higher levels of growth and profitability. We’re now applying recent technological innovations to reimagine the entire non-agency loan production and distribution workstream. We plan to transform our correspondent loan acquisition platform to be more component-based, allowing us to implement the best technologies as they become available rather than through “all-or-none” systems that remain the standard in the industry. We are also working to automate the revalidation of underwriting data to significantly reduce the time it takes us to purchase non-agency loans from originators, allowing them to recycle capital faster and make more loans. At the moment, technology to assist loan sellers in originating conventional loans that can be seamlessly sold exists only in the Agency origination space. We want to make it a reality in the private sector.

An equally compelling runway exists in our business-purpose lending segment. We are now one of the largest originators of business-purpose residential loans, with a platform capable of building on the momentum from a combined platform that originated a cumulative $2.4 billion of loans in 2019. We also have the largest and most highly-regarded SFR securitization platform in the housing market, which will help accelerate our strategy to grow profitably and organically generate assets with attractive risk adjusted returns. We have begun the process of combining the 5 Arches and CoreVest-platforms under a unified leadership structure, taking “best of breed” from both businesses to position for profitable future growth. Once fully integrated, we believe no competing platform will possess the same breadth of financing products and depth of expertise to deliver all-inclusive and customized solutions to residential real estate investors. A unified platform will also allow us to apply our technology advantage to a full suite of products and in the process remove redundant external costs in the day-to-day operation of the business. Importantly, we are still just scratching the surface of how business-purpose lending can leverage the broader Redwood platform. To wit: we have begun the process of offering single-family rental loan programs to our 180 residential loan sellers, secured the ability to pledge single-family rental loans on our FHLB borrowing facility, and lowered our cost of funds through both warehouse lines and securitization. All told, business purpose lending now represents almost 30% of our equity allocation.

Our multifamily initiative continues to grow and expand and is quickly emerging as a strategic and complementary facet of our housing finance strategy. Befittingly, we now designate multifamily investing as a core business at Redwood, with over $475 million of capital invested since 2017. We originate small-balance multifamily loans (both term and bridge) in our business-purpose lending segment - an area of desired growth - however, our capital deployment in traditional multifamily has been almost exclusively in programs offered by Freddie Mac. To date, we remain one of the few investors in newly issued Freddie Mac multifamily B-pieces (first loss credit risk) that is not also a multifamily operator. Given recent changes implemented by the FHFA, we are now exploring ways to expand how we provide liquidity to this rapidly growing market.

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

5 |

S H A R E H O L D E R L E T T E R |

While we anticipate most of our investing activities to be driven from within our residential, business-purpose, and multifamily verticals, we continue to dedicate meaningful resources to other third-party investment activities. For over a quarter century, our role as an active investor and liquidity provider has been, and will remain, highly relevant to the mortgage capital markets. This effort will operate in coordination with our other businesses and actively focus on third-party opportunities that we find attractive, including non-agency RMBS, agency CRT bonds, securities backed by re-performing loans (RPLs), and other investments. Importantly, this vertical also allows us to continue tracking the pertinent markets and manage our capital both opportunistically and for liquidity management purposes.

Over the past two years we’ve made meaningful progress in diversifying revenues, integrating resources, and positioning Redwood to grow profitably in the years ahead. Our business segments now speak for production and earnings generation across a compelling suite of sectors and collaborate toward a unifying vision of being one of the market’s most innovative mortgage investors. As we move forward, we’re committed to serving our mission while generating solid risk-adjusted returns that can sustainably grow our dividends over time for our shareholders.

We appreciate the trust and commitment exhibited by our long-term shareholders who have steadfastly supported Redwood’s evolution. We look forward to sharing a comprehensive overview of our business segments, a deep dive into recent government actions concerning housing finance reform and the role Redwood expects to play at our third annual Investor Day, to be held March 24th in New York City.

Thank you for your continued support.

|  | |

Christopher J. Abate | Dashiell I. Robinson | |

Chief Executive Officer | President | |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

6 |

Q U A R T E R L Y R E S U L T S |

Fourth Quarter Highlights

Key Financial Results and Metrics | ||||||||

Three Months Ended | ||||||||

12/31/2019 | 9/30/2019 | |||||||

Earnings per Share | $ | 0.38 | $ | 0.31 | ||||

Core Earnings per Share (non-GAAP) | $ | 0.45 | $ | 0.37 | ||||

Return on Equity | 10.9 | % | 8.6 | % | ||||

Core Return on Equity (non-GAAP) | 13.6 | % | 10.9 | % | ||||

Book Value per Share | $ | 15.98 | $ | 15.92 | ||||

Dividend per Share | $ | 0.30 | $ | 0.30 | ||||

Economic Return on Book Value (1) | 2.3 | % | 1.3 | % | ||||

Recourse Leverage Ratio (2) | 3.1x | 2.7x | ||||||

Ñ | The acquisition of CoreVest in October 2019 contributed to strong overall results for the quarter, as its origination platform helped drive strong mortgage banking income, and capital deployed into business purpose loan ("BPL") investments drove higher net interest income. Our results were also bolstered by strong performance from our residential mortgage banking platform, which saw increased volume and margins during the quarter, as well as improved returns on our investments from portfolio optimization. |

Ñ | Our fourth quarter results contributed to an increase in book value of $0.06 per share and an economic return on book value of 2.3% for the quarter. Excluding acquisition-related items(3), which negatively impacted book value by $0.11 per share, our economic return on book value was 3.0%. |

Ñ | On February 27, 2020, we announced a 6.7% increase to our regular quarterly dividend to shareholders to $0.32 per share for the first quarter of 2020. |

Ñ | We deployed $634 million of capital during the fourth quarter, inclusive of the acquisition of CoreVest's operating platform and related financial assets. Total transaction consideration for CoreVest was $492 million, net of in-place financing (see the Appendix for additional details). |

Ñ | We purchased $1.8 billion and sold $2.2 billion of residential jumbo loans during the fourth quarter, both through whole loans sales and two securitizations. At December 31, 2019, our pipeline of jumbo residential loans identified for purchase was $1.8 billion. |

Ñ | We originated $750 million of business purpose loans across the CoreVest and 5 Arches platforms, including $435 million of single-family rental ("SFR") loans and $315 million of bridge loans. We sold $395 million of SFR loans through one securitization, Redwood's first SFR securitization since the acquisition of CoreVest, and CoreVest's 10th overall. |

Ñ | Leverage increased modestly during the fourth quarter, as we deployed capital into the CoreVest acquisition that we had accumulated through the prior quarter-end. |

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

7 |

Q U A R T E R L Y R E S U L T S |

New Segment Overview

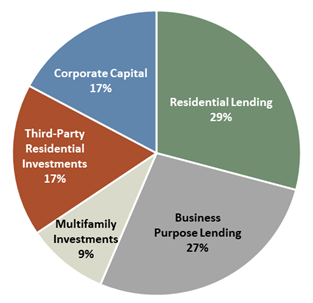

In advancing our strategic priorities, over the past two years we have increased our capital deployment across the broader housing credit market, including business purpose lending, through the acquisitions of 5 Arches and CoreVest and through increased investment activity in the multifamily sector. With these new asset classes growing to comprise more significant portions of our capital allocation, in the fourth quarter of 2019 we reorganized our operations into four business segments. These segments represent areas of the housing market we operate in through vertically integrated platforms.

Each new segment includes all revenue and direct expense associated with the origination, acquisition and management of its associated financial assets. Additionally, we allocate corporate long-term debt (previously included in our corporate segment) to each segment, allowing us to evaluate each segment's contribution to our overall return on equity. Our four new segments include:

Residential Lending – Comprised of our residential mortgage banking operations and investments created from these activities, including: residential loans financed with the FHLB and investments retained from our residential loan securitization activities.

Business Purpose Lending – Comprised of our business purpose mortgage banking operations (both 5 Arches and CoreVest), and investments created from these activities, including: SFR securities retained from CoreVest-sponsored securitizations, SFR loans financed with the FHLB, and investments in residential and small-balance multifamily bridge loans.

Multifamily Investments – Comprised of multifamily securities and loans we have acquired, as well as other multifamily investments.

Third-Party Residential Investments – Comprised of other residential investments not sourced through our residential mortgage banking activities, including: re-performing loan securities, third-party RMBS (including CRT securities and legacy securities), and other investments.

Prior Segments | New Segments | |

Mortgage Banking | Residential Lending | |

Residential Mortgage Banking | Residential Mortgage Banking | |

Business Purpose Mortgage Banking | Residential Lending Investments | |

Investment Portfolio | Business Purpose Lending | |

Residential Lending Investments (Redwood Created) | Business Purpose Mortgage Banking | |

Business Purpose Lending Investments | Business Purpose Lending Investments | |

Multifamily Investments | ||

Third-Party Residential Investments | Multifamily Investments | |

Third-Party Residential Investments | ||

Ñ | Refer to the Capital Allocations section later in this document for additional details on the capital allocations and investments within each of our segments. |

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

8 |

Q U A R T E R L Y R E S U L T S |

Quarterly Earnings and Analysis

Below we present GAAP net income and non-GAAP core earnings for the fourth and third quarters of 2019.

GAAP Net Income and Non-GAAP Core Earnings | ||||||||||||||||

($ in millions, except per share data) | ||||||||||||||||

Three Months Ended | ||||||||||||||||

12/31/2019 | 9/30/2019 | 12/31/2019 | 9/30/2019 | |||||||||||||

GAAP | GAAP | Core | Core | |||||||||||||

Net interest income | ||||||||||||||||

From investments | $ | 38 | $ | 28 | $ | 28 | $ | 25 | ||||||||

From mortgage banking activities | 7 | 6 | 7 | 6 | ||||||||||||

Total net interest income | 45 | 34 | 35 | 31 | ||||||||||||

Non-interest income | ||||||||||||||||

Residential mortgage banking, net | 17 | 5 | 17 | 5 | ||||||||||||

Business purpose mortgage banking, net | 30 | 4 | 30 | 4 | ||||||||||||

Investment fair value changes, net | 1 | 11 | — | — | ||||||||||||

Other income, net | 5 | 4 | 5 | 4 | ||||||||||||

Realized gains, net | 6 | 5 | 23 | 25 | ||||||||||||

Total non-interest income, net | 58 | 30 | 74 | 38 | ||||||||||||

General and administrative expenses | (42 | ) | (27 | ) | (41 | ) | (25 | ) | ||||||||

Other expenses | (7 | ) | (3 | ) | — | — | ||||||||||

Provision for income taxes | (4 | ) | — | (7 | ) | — | ||||||||||

Earnings | $ | 49 | $ | 34 | $ | 61 | $ | 43 | ||||||||

Earnings per diluted common share | $ | 0.38 | $ | 0.31 | $ | 0.45 | $ | 0.37 | ||||||||

GAAP Net Income and Non-GAAP Core Earnings by Segment | ||||||||||||||||

($ in millions) | ||||||||||||||||

Three Months Ended | ||||||||||||||||

12/31/2019 | 9/30/2019 | 12/31/2019 | 9/30/2019 | |||||||||||||

GAAP | GAAP | Core | Core | |||||||||||||

Residential Lending | $ | 16 | $ | 9 | $ | 20 | $ | 14 | ||||||||

Business Purpose Lending | 19 | (1 | ) | 24 | 2 | |||||||||||

Multifamily Investments | 11 | 10 | 7 | 16 | ||||||||||||

Third-Party Residential Investments | 21 | 29 | 24 | 23 | ||||||||||||

Corporate | (18 | ) | (13 | ) | (15 | ) | (11 | ) | ||||||||

Earnings | $ | 49 | $ | 34 | $ | 61 | $ | 43 | ||||||||

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

9 |

Q U A R T E R L Y R E S U L T S |

Analysis of Earnings

Ñ | Business purpose mortgage banking activities improved in the fourth quarter, as new originations from CoreVest increased volume meaningfully in addition to increased volume from 5 Arches. In addition, improvements in single-family rental securitization execution during the fourth quarter helped drive incremental profitability on the inventory of SFR loans we acquired from CoreVest, as well as our subsequent fourth quarter production. |

Ñ | Net interest income improved in the fourth quarter as we redeployed capital out of lower-yielding assets in our residential lending and other portfolios and deployed capital into additional business purpose lending investments, primarily through our CoreVest acquisition. |

Ñ | Residential mortgage banking activities also improved, as loan purchase commitments increased 42% from the third quarter, partly driven by elevated bulk deal activity in the fourth quarter. Gross margins were towards the higher end of our long-term expectations of 75-100 basis points, partly driven by improved securitization execution during the fourth quarter. |

Ñ | Realized gains remained elevated, as continued spread tightening created opportunities for us to sell $225 million of lower-yielding securities, freeing up $150 million of capital for redeployment. |

Ñ | General and administrative expenses increased in the fourth quarter due to the addition of $8 million of GAAP expenses from CoreVest, as well as higher overall variable compensation expense, which rose due to improved GAAP earnings in the fourth quarter. |

Ñ | Other expenses, primarily comprised of acquisition-related intangible amortization expense and contingent consideration expense, increased due to the addition of intangible assets from the acquisition of CoreVest. |

Ñ | Provision for income taxes increased in the fourth quarter due to higher mortgage banking income at our taxable subsidiary, as compared to the third quarter. |

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

10 |

Q U A R T E R L Y R E S U L T S |

Book Value and Economic Return

Changes in Book Value per Share | ||||||||

($ in per share) | ||||||||

Three Months Ended | ||||||||

12/31/19 | 9/30/2019 | |||||||

Beginning GAAP book value per share | $ | 15.92 | $ | 16.01 | ||||

GAAP earnings (per basic share) | 0.42 | 0.33 | ||||||

Add back intangible amortization expense (non-GAAP) | 0.03 | 0.01 | ||||||

Dividends | (0.30 | ) | (0.30 | ) | ||||

Non-cash equity award compensation | (0.04 | ) | 0.02 | |||||

Changes in unrealized gains on securities, net | (0.05 | ) | 0.02 | |||||

Change in long-term debt hedge | 0.09 | (0.11 | ) | |||||

Other, net | 0.02 | (0.05 | ) | |||||

Ending book value before acquisition-related items (non-GAAP) | 16.09 | 15.93 | ||||||

Intangible amortization expense | (0.03 | ) | (0.01 | ) | ||||

CoreVest acquisition equity consideration | (0.08 | ) | — | |||||

Ending GAAP book value per share | $ | 15.98 | $ | 15.92 | ||||

Ñ | Our GAAP book value increased $0.06 per share during the fourth quarter of 2019, largely due to GAAP earnings exceeding our dividend. |

Ñ | Included in our change in GAAP book value was $(0.11) per share associated with acquisition related items. These included $(0.08) per share from the one-time impact of equity-based purchase consideration for CoreVest (treated as compensation for GAAP), and $(0.03) per share of expense related to intangible amortization associated with both the CoreVest and 5 Arches acquisitions. |

Ñ | Excluding these acquisition-related items(1), our non-GAAP book value increased $0.17 per share, and our economic return on book value was 3.0% during the fourth quarter. |

Ñ | Our intangible assets related to both acquisitions will be amortized through 2026, and we expect to incur $(0.03) per share of intangible amortization expense per quarter for the next several quarters. |

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

11 |

Q U A R T E R L Y R E S U L T S |

Return Contribution Analysis

Below we present non-GAAP core returns for the fourth and third quarters of 2019, by segment.

Non-GAAP Core Return Contribution Summary | |||||||||||||||||||||||

($ in millions) | |||||||||||||||||||||||

Three Months Ended | |||||||||||||||||||||||

12/31/2019 | 9/30/2019 | ||||||||||||||||||||||

Average Allocated Equity | Core Earnings | Core ROE | Average Allocated Equity | Core Earnings | Core ROE | ||||||||||||||||||

Residential Lending | |||||||||||||||||||||||

Mortgage Banking | $ | 130 | $ | 11 | 33.5 | % | $ | 130 | $ | 5 | 15.5 | % | |||||||||||

Investments | 336 | 9 | 11.0 | % | 426 | 9 | 8.1 | % | |||||||||||||||

Total | 466 | 20 | 17.3 | % | 556 | 14 | 9.9 | % | |||||||||||||||

Business Purpose Lending | |||||||||||||||||||||||

Mortgage Banking | 255 | 17 | 27.4 | % | 55 | — | (1.0 | )% | |||||||||||||||

Investments | 172 | 7 | 16.1 | % | 32 | 2 | 23.6 | % | |||||||||||||||

Total | 427 | 24 | 22.9 | % | 87 | 2 | 8.1 | % | |||||||||||||||

Multifamily Investments | 146 | 7 | 20.4 | % | 159 | 16 | 39.4 | % | |||||||||||||||

Third-Party Residential Investments | 294 | 24 | 32.8 | % | 308 | 23 | 29.7 | % | |||||||||||||||

Corporate | 468 | (15 | ) | N/A | 482 | (11 | ) | N/A | |||||||||||||||

Total | $ | 1,800 | $ | 61 | 13.6 | % | $ | 1,592 | $ | 43 | 10.9 | % | |||||||||||

Ñ | Residential Lending — Returns from mortgage banking increased during the fourth quarter, as both volume and margins improved from the third quarter. Returns from investments improved during the fourth quarter, as we sold lower-yielding assets, which resulted in gains and positioned the remaining portfolio with a higher average yield. |

Ñ | Business Purpose Lending — Overall returns improved in the fourth quarter, as we benefited from higher loan originations and higher income from investments resulting from our CoreVest acquisition, as well as increased originations from 5 Arches. |

Ñ | Multifamily Investments — Returns declined during the fourth quarter, as the pace of portfolio optimization in the portfolio slowed relative to the third quarter, resulting in fewer realized gains. |

Ñ | Third-Party Residential Investments — Returns on third-party investments remained elevated, as we recognized gains from sales of primarily CRT and mezzanine securities during the third and fourth quarters of 2019. |

Ñ | Corporate — Average allocated equity for corporate included $350 million of average capital available for investment during the fourth quarter, driven in part by the issuance in September 2019 of $201 million of convertible bonds, and subsequent repayment of $201 million of exchangeable bonds in mid-November. Corporate overhead expenses increased in the fourth quarter, as variable compensation was adjusted to reflect improved full-year financial results. |

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

12 |

Q U A R T E R L Y R E S U L T S |

Below we present non-GAAP core returns for our investments organized by segment for the fourth quarter of 2019.

Non-GAAP Core Returns on Investments by Business Segment | ||||||||||||||||||||

($ in millions) | ||||||||||||||||||||

Three Months Ended December 31, 2019 | ||||||||||||||||||||

Residential Lending | Business Purpose Lending | Multifamily Investments | Third-Party Residential Investments | Total | ||||||||||||||||

Net interest income | $ | 5 | $ | 7 | $ | 4 | $ | 10 | $ | 27 | ||||||||||

Other income | 3 | — | 1 | — | 4 | |||||||||||||||

Investment income | 8 | 8 | 5 | 10 | 31 | |||||||||||||||

Realized gains | 3 | — | 3 | 17 | 23 | |||||||||||||||

General and administrative expenses | (2 | ) | (1 | ) | (1 | ) | (1 | ) | (4 | ) | ||||||||||

Provision for income taxes | — | — | — | (2 | ) | (2 | ) | |||||||||||||

Core earnings | $ | 9 | $ | 7 | $ | 7 | $ | 24 | $ | 48 | ||||||||||

Average equity | 336 | 172 | 146 | 294 | 948 | |||||||||||||||

Core investment income yield | 9.5 | % | 18.6 | % | 13.7 | % | 13.6 | % | 13.1 | % | ||||||||||

Core return on equity | 11.0 | % | 16.1 | % | 20.4 | % | 32.8 | % | 20.1 | % | ||||||||||

Ñ | As we deploy our capital available for investment and our pace of portfolio optimization slows, we expect an increasing portion of future quarterly earnings to come from investment income, and less from realized gains. |

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

13 |

Q U A R T E R L Y R E S U L T S |

Segment Results

Residential Lending

The following table presents non-GAAP core results from our residential lending segment for the fourth and third quarters of 2019.

Residential Lending: Non-GAAP Core Earnings | |||||||||||||||||||||||||

($ in millions) | |||||||||||||||||||||||||

Three Months Ended | |||||||||||||||||||||||||

12/31/2019 | 9/30/2019 | ||||||||||||||||||||||||

Investments | Mortgage Banking | Total Residential Lending | Investments | Mortgage Banking | Total Residential Lending | ||||||||||||||||||||

Net interest income | $ | 5 | $ | 5 | $ | 10 | $ | 7 | $ | 5 | $ | 12 | |||||||||||||

Non-interest income | |||||||||||||||||||||||||

Mortgage banking activities, net | — | 17 | 17 | — | 5 | 5 | |||||||||||||||||||

Other income, net | 3 | — | 3 | 2 | — | 2 | |||||||||||||||||||

Realized gains, net | 3 | — | 3 | 1 | — | 1 | |||||||||||||||||||

Total non-interest income, net | 6 | 17 | 23 | 3 | 5 | 8 | |||||||||||||||||||

General and administrative expenses | (1 | ) | (9 | ) | (10 | ) | (1 | ) | (5 | ) | (6 | ) | |||||||||||||

Provision for income taxes | — | (2 | ) | (2 | ) | — | — | — | |||||||||||||||||

Core earnings | $ | 9 | $ | 11 | $ | 20 | $ | 9 | $ | 5 | $ | 14 | |||||||||||||

Key performance indicators | |||||||||||||||||||||||||

Average equity | $ | 336 | $ | 130 | $ | 466 | $ | 426 | $ | 130 | $ | 556 | |||||||||||||

Core return on equity | 11.0 | % | 33.5 | % | 17.3 | % | 8.1 | % | 15.5 | % | 9.9 | % | |||||||||||||

Core pre-tax margin (1) | 60 | % | 48 | % | |||||||||||||||||||||

Loan purchase commitments | $ | 2,419 | $ | 1,700 | |||||||||||||||||||||

Ñ | Core net interest income from investments decreased in the fourth quarter, as average equity invested in this segment declined due to proceeds from portfolio optimization activities being redeployed into other asset classes. |

Ñ | Core mortgage banking results for our residential lending segment improved in the fourth quarter, as loan purchase commitments increased to $2.4 billion from $1.7 billion in the third quarter, and gross margins on securitization and whole loan sales improved from the third quarter. We define gross margins for this segment as the sum of mortgage banking net interest income and mortgage banking activities divided by loan purchase commitments. |

Ñ | Core general and administrative expenses increased in the fourth quarter, as variable compensation was adjusted to reflect improved full-year financial performance of this segment. |

Ñ | Core pre-tax margin improved in the fourth quarter, as revenue growth from higher volume and margins outpaced the increase in general and administrative expenses during the quarter. |

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

14 |

Q U A R T E R L Y R E S U L T S |

Residential Investments

Ñ | We deployed $6 million of capital into Sequoia RMBS retained from securitizations completed in the fourth quarter. |

Ñ | During the fourth quarter, we sold $26 million of lower-yielding securities in this segment, which freed up approximately $5 million of capital for redeployment. |

Ñ | The decline in average capital in this segment during the fourth quarter was primarily attributable to a reduction in the capital associated with our residential whole loans that are held for investment and financed with the FHLB, as paydowns of residential whole loans were replaced with single-family rental loans originated in our business purpose lending segment. |

Residential Mortgage Banking

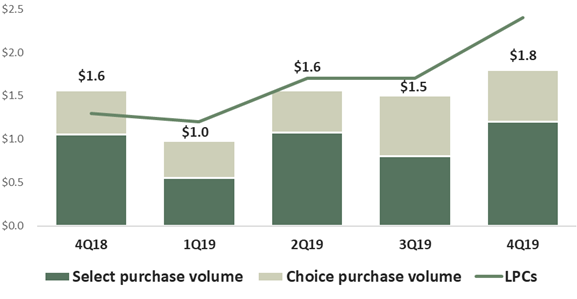

Quarterly Jumbo Loan Purchase Volume

($ in billions)

Ñ | The continued lower interest rate environment, as well as an increase in bulk pool acquisitions, helped elevate loan purchase commitments and purchase volumes in the fourth quarter. |

Ñ | At December 31, 2019, our pipeline of jumbo residential loans identified for purchase was $1.8 billion. |

Ñ | During the fourth quarter, we sold $843 million of Select whole loans to third parties, completed two Select securitizations totaling $776 million, and sold $581 million of Choice whole loans to third parties. |

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

15 |

Q U A R T E R L Y R E S U L T S |

Business Purpose Lending

The following table presents non-GAAP core results from our business purpose lending segment for the fourth and third quarters of 2019.

Business Purpose Lending: Non-GAAP Core Earnings | |||||||||||||||||||||||||

($ in millions) | |||||||||||||||||||||||||

Three Months Ended | |||||||||||||||||||||||||

12/31/2019 | 9/30/2019 | ||||||||||||||||||||||||

Investments | Mortgage Banking | Total Business Purpose Lending | Investments | Mortgage Banking | Total Business Purpose Lending | ||||||||||||||||||||

Net interest income | $ | 7 | $ | 2 | $ | 9 | $ | 2 | $ | 1 | $ | 3 | |||||||||||||

Non-interest income | |||||||||||||||||||||||||

Mortgage banking activities, net | — | 30 | 30 | — | 4 | 4 | |||||||||||||||||||

Other income, net | — | 1 | 2 | — | 2 | 2 | |||||||||||||||||||

Realized gains, net | — | — | — | — | — | — | |||||||||||||||||||

Total non-interest income, net | — | 31 | 31 | — | 6 | 6 | |||||||||||||||||||

General and administrative expenses | (1 | ) | (14 | ) | (14 | ) | — | (7 | ) | (7 | ) | ||||||||||||||

Provision for income taxes | — | (2 | ) | (2 | ) | — | — | — | |||||||||||||||||

Core earnings | $ | 7 | $ | 17 | $ | 24 | $ | 2 | $ | — | $ | 2 | |||||||||||||

Key performance indicators | |||||||||||||||||||||||||

Average equity | $ | 172 | $ | 255 | $ | 427 | $ | 32 | $ | 55 | $ | 87 | |||||||||||||

Core return on equity | 16.1 | % | 27.4 | % | 22.9 | % | 23.6 | % | (1.0 | )% | 8.1 | % | |||||||||||||

Core pre-tax margin (1) | 59 | % | 4 | % | |||||||||||||||||||||

Loan originations | $ | 750 | $ | 162 | |||||||||||||||||||||

BPL Investments

Ñ | Core investment results improved, as we deployed $289 million of capital into investments, including $227 million into investments from the CoreVest acquisition, $41 million into additional bridge loan investments, and $21 million into SFR securities retained from our fourth quarter securitization. |

Ñ | Additionally, during the fourth quarter, we restructured our BPL warehouse facilities (including those assumed from CoreVest), improving borrowing terms. |

Ñ | During the fourth quarter, we funded $275 million of business purpose bridge loans and received repayments of $108 million. In addition, we transferred $219 million of single-family rental loans into our BPL investments portfolio to be financed with the FHLB. |

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

16 |

Q U A R T E R L Y R E S U L T S |

BPL Mortgage Banking

Ñ | Core mortgage banking results for our business purpose lending segment improved, as origination volume from 5 Arches increased and we added significant volume from CoreVest. In addition, improved execution drove incremental profitability on the inventory of SFR loans acquired from CoreVest that we sold through our first CoreVest sponsored securitization completed in November. |

Ñ | BPL loan originations in the fourth quarter included $435 million of single-family rental loans and $315 million of bridge loans. |

Ñ | During the fourth quarter, we securitized $395 million of single-family rental loans, transferred $219 million of single-family rental loans to our FHLB borrowing facility, and sold $20 million of single-family rental loans to third parties. |

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

17 |

Q U A R T E R L Y R E S U L T S |

Multifamily Investments

The following table presents non-GAAP core results from our multifamily investments segment for the fourth and third quarters of 2019.

Multifamily Investments: Non-GAAP Core Earnings | ||||||||

($ in millions) | ||||||||

Three Months Ended | ||||||||

12/31/2019 | 9/30/2019 | |||||||

Net interest income | $ | 4 | $ | 5 | ||||

Non-interest income | ||||||||

Other income, net | 1 | 1 | ||||||

Realized gains, net | 3 | 10 | ||||||

Total non-interest income, net | 4 | 11 | ||||||

General and administrative expenses | (1 | ) | — | |||||

Provision for income taxes | — | — | ||||||

Core earnings | $ | 7 | $ | 16 | ||||

Average equity | 146 | 159 | ||||||

Core return on equity | 20.4 | % | 39.4 | % | ||||

Ñ | Core net interest income decreased slightly in the fourth quarter as higher yields on deployed equity were partially offset by lower average equity, as fourth quarter sales outpaced deployment. |

Ñ | During the fourth quarter, we deployed $21 million of capital towards multifamily investments, including $11 million of capital towards multifamily b-pieces and $10 million of capital towards multifamily mezzanine securities. |

Ñ | During the fourth quarter, we sold $88 million of lower-yielding multifamily mezzanine securities, freeing up $46 million of capital after the repayment of associated short-term debt. |

Ñ | Core realized gains declined in the fourth quarter, as we realized fewer gains from the sale of multifamily mezzanine securities relative to the third quarter. |

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

18 |

Q U A R T E R L Y R E S U L T S |

Third-Party Residential Investments

The following table presents non-GAAP core results from our third-party residential investments segment for the fourth and third quarters of 2019.

Third-Party Residential Investments: Non-GAAP Core Earnings | ||||||||

($ in millions) | ||||||||

Three Months Ended | ||||||||

12/31/2019 | 9/30/2019 | |||||||

Net interest income | $ | 10 | $ | 10 | ||||

Non-interest income | ||||||||

Other income, net | — | — | ||||||

Realized gains, net | 17 | 14 | ||||||

Total non-interest income, net | 17 | 13 | ||||||

General and administrative expenses | (1 | ) | (1 | ) | ||||

Provision for income taxes | (2 | ) | — | |||||

Core earnings | $ | 24 | $ | 23 | ||||

Average equity | $ | 294 | $ | 308 | ||||

Core return on equity | 32.8 | % | 29.7 | % | ||||

Ñ | Core net interest income was consistent quarter-over-quarter, as higher yields on invested equity was offset by slightly lower average equity invested in this portfolio, as fourth quarter sales outpaced deployment. |

Ñ | During the fourth quarter, we deployed $54 million of capital towards third-party investments, including $37 million of capital towards shared home appreciation options, and $17 million of capital towards other third-party residential credit securities. |

Ñ | Core realized gains increased from the third quarter as we sold $108 million of lower-yielding third-party securities, freeing up $97 million of capital after the repayment of associated short-term debt. |

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

19 |

Q U A R T E R L Y P O S I T I O N S |

Capital Allocations

We capitalize our business with a combination of equity and long-term unsecured corporate debt (which we collectively refer to as corporate "capital"). Our total capital of $2.6 billion at December 31, 2019 was comprised of $1.8 billion of equity capital and $0.8 billion of convertible notes and other long-term unsecured corporate debt. We also utilize various forms of collateralized debt to finance certain investments and to warehouse our inventory of certain loans held-for-sale, but do not consider the collateralized debt as "capital".

In order to assess the performance of our business in terms of returns on equity, we allocate our corporate unsecured debt capital among our various investments within each of our segments to determine the amount of equity capital utilized by each business. In addition to the equity allocated to each segment, our remaining capital is held at a corporate level and includes $260 million of undeployed capital available for investment at December 31, 2019, as well as other miscellaneous net assets.

The following table presents a summary view of how our equity is allocated among our four business segments, along with our capital available for investment.

Allocations of Equity

(as of December 31, 2019)

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

20 |

Q U A R T E R L Y P O S I T I O N S |

The following table presents our allocations of capital by segment and by investment type as of December 31, 2019.

Capital Allocation Detail | ||||||||||||||||||||||

By Investment Type | ||||||||||||||||||||||

December 31, 2019 | ||||||||||||||||||||||

($ in millions) | ||||||||||||||||||||||

Fair Value of Assets | Collateralized Short-Term Debt | Collateralized Long-Term Debt | Unsecured Corporate Debt | Allocated Equity(1) | % of Total Equity | |||||||||||||||||

Residential Lending | ||||||||||||||||||||||

Residential loans | $ | 2,210 | $ | — | $ | (1,776 | ) | $ | (176 | ) | $ | 257 | 14% | |||||||||

Sequoia securities | 483 | (135 | ) | (185 | ) | (70 | ) | 102 | 6% | |||||||||||||

MSRs/Other | 63 | — | — | (30 | ) | 43 | 2% | |||||||||||||||

Mortgage banking working capital | — | — | — | — | 130 | 7% | ||||||||||||||||

Total Residential Lending | 2,756 | (135 | ) | (1,961 | ) | (276 | ) | 533 | 29% | |||||||||||||

Business Purpose Lending | ||||||||||||||||||||||

SFR securities | 195 | (80 | ) | — | (47 | ) | 68 | 4% | ||||||||||||||

SFR loan investments | 242 | — | (185 | ) | (23 | ) | 34 | 2% | ||||||||||||||

Bridge investments | 764 | (567 | ) | — | (92 | ) | 133 | 7% | ||||||||||||||

Mortgage banking working capital | — | — | — | — | 100 | 5% | ||||||||||||||||

Platform premium | — | — | — | — | 161 | 9% | ||||||||||||||||

Total Business Purpose Lending | 1,201 | (647 | ) | (185 | ) | (162 | ) | 497 | 27% | |||||||||||||

Multifamily Investments | ||||||||||||||||||||||

Multifamily mezzanine | 423 | (334 | ) | — | (52 | ) | 76 | 4% | ||||||||||||||

Multifamily B-pieces | 234 | (171 | ) | — | (38 | ) | 56 | 3% | ||||||||||||||

Other investments | 61 | — | — | (25 | ) | 36 | 2% | |||||||||||||||

Total Multifamily Investments | 717 | (505 | ) | — | (115 | ) | 168 | 9% | ||||||||||||||

Third-Party Residential Investments | ||||||||||||||||||||||

RPL investments | 611 | (315 | ) | (39 | ) | (106 | ) | 154 | 8% | |||||||||||||

CRT & third-party securities | 306 | (142 | ) | — | (70 | ) | 102 | 6% | ||||||||||||||

Other investments | 102 | — | — | (41 | ) | 60 | 3% | |||||||||||||||

Total Third-Party Residential Investments | 1,019 | (457 | ) | (39 | ) | (217 | ) | 316 | 17% | |||||||||||||

Other assets, net | — | — | — | — | 314 | 17% | ||||||||||||||||

Totals | $ | 5,693 | $ | (1,744 | ) | $ | (2,185 | ) | $ | (770 | ) | $ | 1,827 | 100% | ||||||||

Ñ | The equity allocated to each of our segments is determined by the fair value of its investment assets less the short-term and long-term collateralized debt used to finance its investments, less an allocation of our $770 million of long-term unsecured corporate debt. In addition, for investments financed with short-term repurchase debt, we allocate additional equity capital (our liquidity capital cushion) to manage liquidity in the event of an adverse change in market conditions. |

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

21 |

Q U A R T E R L Y P O S I T I O N S |

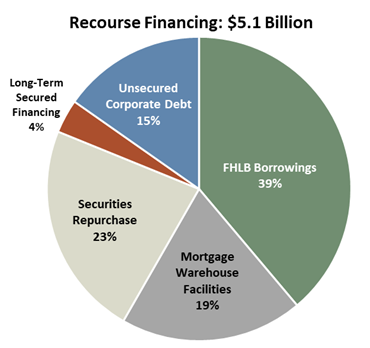

Recourse Leverage

We finance our business with a diversified mix of long-term and short-term recourse debt. The

following charts present the composition of our recourse debt and its characteristics at the end

of the fourth quarter of 2019:

| |||

Borrowing Type | Average Cost of Funds | Average Remaining Term (yrs.) | |

FHLB Borrowings | 2.1% | 6 | |

Unsecured Corporate Debt | 6.1% | 7 | |

Long-Term Secured Financing | 4.2% | 3 | |

Mortgage Warehouse | 4.3% | <1 | |

Securities Repo | 2.9% | <1 | |

Weighted Average Cost of Funds | 3.4% | 3 | |

Our unsecured corporate debt is comprised of $245 million of 4.75% convertible notes due in 2023, $200 million of 5.625% convertible notes due in 2024, $201 million of 5.75% exchangeable notes due in 2025, and $140 million of trust-preferred securities due in 2037 (that we hedge to yield approximately 6.9%). We allocate our corporate debt to the long-term investments in each of our operating segments, along with the associated interest expense.

Our FHLB borrowings, long-term secured financing, and securities repo are used to fund residential loans, single-family rental loans, and securities across our portfolio. This mix of debt changes as we invest our excess capital or optimize our existing investments. We utilize mortgage warehouse facilities to fund loans in inventory at each of our mortgage banking operations.

Our recourse leverage ratio(1) increased to 3.1x at the end of the fourth quarter from 2.7x at the end of the third quarter, primarily as a result of the CoreVest acquisition. As we continue to deploy our capital available for investment, we expect this leverage ratio to increase toward the mid-range of our 3.0x - 4.0x target range.

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

22 |

Q U A R T E R L Y P O S I T I O N S |

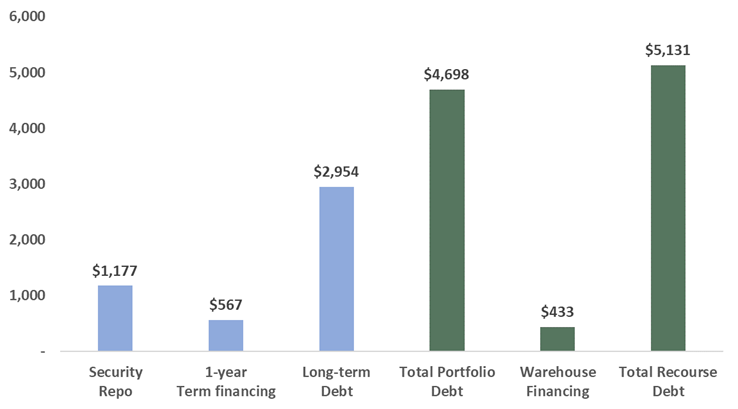

Below is a summary as of December 31, 2019 of our $5.1 billion of recourse financing by business activity and tenor of debt:

Average remaining term | 3.9 years | <1 year | 3.5 years | |

Average borrowing cost | 3.42% | 4.3% | 3.41% | |

Recourse leverage ratio (1) | 4.2x | 2.0x | 3.1x | |

At December 31, 2019, we had $4.7 billion of recourse debt financing our portfolios of long-term investments. Over 60% of this debt is long-term, with a weighted average remaining term of approximately 4 years. In addition, we had $0.6 billion of term borrowings financing our business purpose residential bridge loans, which are short-term in nature.

At December 31, 2019, we had $0.4 billion of mortgage warehouse debt funding our residential and business purpose residential loans held in inventory for sale. The balance of this debt will vary depending on our loan inventory balance, and we generally finance and accumulate loans in inventory for one to three months prior to sale or securitization.

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

23 |

Q U A R T E R L Y P O S I T I O N S |

Credit

This section presents select credit characteristics for our major investment types, with current information as of December 31, 2019.

Residential Investments Credit Characteristics | ||||||||||||||||

($ in millions) | ||||||||||||||||

Sequoia Select Securities | Sequoia Choice Securities | Residential Whole Loans | Re-Performing Loan Securities | |||||||||||||

Market value | $ | 180 | $ | 241 | $ | 2,112 | $ | 610 | ||||||||

Avg. FICO (at origination) | 771 | 744 | 768 | 622 | ||||||||||||

HPI updated LTV(1) | 48 | 66 | 48 | 70 | ||||||||||||

Avg. loan size (in thousands) | $ | 653 | $ | 710 | $ | 698 | $ | 188 | ||||||||

Gross weighted average coupon | 4.1 | % | 5.0 | % | 4.2 | % | 4.5 | % | ||||||||

Current 3-month prepayment rate | 23 | % | 38 | % | 24 | % | 6 | % | ||||||||

Current 90+ days delinquency | 0.1 | % | 0.3 | % | 0.1 | % | 4.5 | % | ||||||||

Current investment thickness | 4 | % | 13 | % | N/A | 20 | % | |||||||||

Sequoia Select Securities — As of December 31, 2019, we had securitized $19.8 billion of Sequoia Select loans since 2010. Our securitized Select portfolio includes fully documented loans to prime borrowers with an average FICO score (at loan origination) of 771, maximum loan-to-value (at origination) of 80%, and a maximum debt-to-income ratio (at origination) of 43%. We retain all first-loss securities from our Sequoia select securitizations, and on average we have exposure up to 4% of credit losses resulting from loans underlying the securities (represented by the thickness of the securities we currently own as investments).

Sequoia Choice Securities — As of December 31, 2019, we had securitized $3.4 billion of Sequoia Choice loans, since 2017. Our securitized Choice portfolio includes fully documented loans to prime borrowers with an average FICO score (at loan origination) of 744, maximum loan-to-value (at origination) of 90%, and a maximum debt-to-income ratio (at origination) of 49.9%. We retain all of the first-loss securities issued as part of our Sequoia Choice program, and on average we have exposure up to the first 13% of credit losses resulting from loans underlying the securities, (represented by the thickness of the securities we currently own as investments).

Residential Whole Loans — As of December 31, 2019, we had $2.1 billion of residential jumbo loans held for investment and financed with FHLB borrowings. These loans were sourced through our residential lending mortgage banking operations. Credit performance for these loans has been consistent with what we have experienced on our Sequoia securitizations.

Re-performing Loan Securities — As of December 31, 2019, we held $610 million of securities collateralized by re-performing loans, and on average we have exposure to up to 20% of the credit losses resulting from loans underlying the securities (represented by the thickness of the securities we currently own as investments). The collateral underlying these securities are seasoned re-

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

24 |

Q U A R T E R L Y P O S I T I O N S |

performing, and to a lesser extent non-performing, loans. In most cases, these loans experienced a credit event leading up to the securitization and were modified in order to keep the borrower in their home and current in their payments under recast loan terms. Central to the investment thesis in these securities is the view that a significant percentage of the underlying borrowers will improve upon their delinquency history and continue paying steadily under the modified or recast terms of the loan. To date, the performance of these investments has met or exceeded our original underwriting assumptions. The performance of the first consolidated RPL transaction we invested in late 2018 continues to trend favorably as delinquencies have declined from 50% to 35% in just over one year.

Business Purpose and Multifamily Investments Credit Characteristics | ||||||||||||||||

($ in millions) | ||||||||||||||||

Multifamily B-Pieces | SFR Securities | SFR Loans | BPL Bridge Loans | |||||||||||||

Market value | $ | 234 | $ | 193 | $ | 238 | $ | 745 | ||||||||

Avg. current DSCR(1) | 1.7x | 1.3x | 1.4x | N/A | ||||||||||||

LTV (at origination)(2) | 69 | 68 | 68 | 70 | ||||||||||||

Avg. loan size (in thousands) | $ | 15,035 | $ | 2,650 | $ | 2,161 | $ | 280 | ||||||||

Gross weighted average coupon | 4.1 | % | 5.7 | % | 4.9 | % | 8.1 | % | ||||||||

Current 90+ days delinquency | 0.0 | % | 1.8 | % | 0.0 | % | 1.9 | % | ||||||||

Current investment thickness | 8 | % | 10 | % | N/A | N/A | ||||||||||

Multifamily B-Pieces — As of December 31, 2019, we had $234 million of multifamily b-pieces, which represent first-loss risk on $4.2 billion of underlying multifamily loan collateral across five separate Freddie Mac sponsored securitizations. On average, we have exposure to the first 8% of credit losses resulting from loans underlying the securities (represented by the thickness of the securities we currently own as investments). Credit performance on this collateral to date has been strong, and cumulative losses to date have been zero.

SFR Securities — As of December 31, 2019, we had $193 million of SFR securities, comprised of subordinate and interest only securities retained from the ten CAFL securitizations completed by CoreVest to date. We own and retain the first-loss securities from the CAFL securitizations, and on average have exposure to the first 10% of credit losses (represented by the current thickness of the securities we currently own as investments).

SFR Loans — As of December 31, 2019, we had $238 million of single-family rental loans held for investment, and financed with FHLB borrowings. These loans were sourced through our business purpose mortgage banking operations. The majority of these loans were originated in the past twelve months, and none were delinquent as of December 30, 2019.

BPL Bridge Loans — As of December 31, 2019, we had $745 million of bridge loans held for investment. These loans are collateralized by residential and multifamily properties, many of which are being rehabilitated for either re-sale or rental purposes. The average loan term at origination is approximately 12 months.

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

25 |

L E V E R A G E |

See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 |

26 |

| Table 1: GAAP Earnings (in thousands, except per share data) | |||||||||||||||||||||||||

2019 Q4 | 2019 Q3 | 2019 Q2 | 2019 Q1 | 2018 Q4 | Twelve Months 2019 | |||||||||||||||||||||

Net interest income | ||||||||||||||||||||||||||

From investments | $ | 37,639 | $ | 27,679 | $ | 27,565 | $ | 26,952 | $ | 29,749 | $ | 119,835 | ||||||||||||||

From mortgage banking activities | 7,234 | 5,834 | 4,757 | 4,813 | 5,015 | 22,638 | ||||||||||||||||||||

Net interest income | 44,873 | 33,513 | 32,322 | 31,765 | 34,764 | 142,473 | ||||||||||||||||||||

Non-interest income | ||||||||||||||||||||||||||

Residential mortgage banking activities, net | 16,540 | 5,016 | 15,361 | 10,826 | 11,266 | 47,743 | ||||||||||||||||||||

Business purpose mortgage banking activities, net | 29,742 | 4,499 | 3,799 | 1,483 | (96 | ) | 39,523 | |||||||||||||||||||

Investment fair value changes, net | 759 | 11,444 | 3,138 | 20,159 | (38,519 | ) | 35,500 | |||||||||||||||||||

Realized gains, net | 5,594 | 4,714 | 2,827 | 10,686 | 5,689 | 23,821 | ||||||||||||||||||||

Other income | 5,417 | 4,356 | 4,859 | 4,625 | 4,106 | 19,257 | ||||||||||||||||||||

Total non-interest income (loss), net | 58,052 | 30,029 | 29,984 | 47,779 | (17,554 | ) | 165,844 | |||||||||||||||||||

Fixed compensation expense | (12,899 | ) | (9,391 | ) | (9,252 | ) | (8,205 | ) | (6,309 | ) | (39,747 | ) | ||||||||||||||

Variable compensation expense (excluding commissions) | (10,372 | ) | (3,489 | ) | (3,573 | ) | (4,402 | ) | (934 | ) | (21,836 | ) | ||||||||||||||

Equity compensation expense | (3,270 | ) | (3,155 | ) | (4,024 | ) | (2,953 | ) | (2,823 | ) | (13,402 | ) | ||||||||||||||

Acquisition-related equity compensation expense (1) | (1,010 | ) | — | — | — | — | (1,010 | ) | ||||||||||||||||||

Loan acquisition costs (including commissions) | (4,830 | ) | (1,993 | ) | (1,964 | ) | (1,477 | ) | (1,837 | ) | (10,264 | ) | ||||||||||||||

Other general and administrative expense | (10,062 | ) | (8,787 | ) | (7,442 | ) | (6,122 | ) | (7,350 | ) | (32,413 | ) | ||||||||||||||

Total general and administrative expenses | (42,443 | ) | (26,815 | ) | (26,255 | ) | (23,159 | ) | (19,253 | ) | (118,672 | ) | ||||||||||||||

Other expenses | (7,001 | ) | (2,531 | ) | (2,452 | ) | (1,038 | ) | (125 | ) | (13,022 | ) | ||||||||||||||

(Provision for) benefit from income taxes | (4,338 | ) | 114 | (2,333 | ) | (883 | ) | 1,255 | (7,440 | ) | ||||||||||||||||

Net income (loss) | $ | 49,143 | $ | 34,310 | $ | 31,266 | $ | 54,464 | $ | (913 | ) | $ | 169,183 | |||||||||||||

Diluted average shares (2) | 152,983 | 136,523 | 130,697 | 126,278 | 83,217 | 136,781 | ||||||||||||||||||||

Diluted earnings (loss) per common share | $ | 0.38 | $ | 0.31 | $ | 0.30 | $ | 0.49 | $ | (0.02 | ) | $ | 1.46 | |||||||||||||

(1) | Acquisition-related equity compensation expense relates to shares of restricted stock that were issued to members of CoreVest management as a component of the consideration paid to them for our purchase of their interests in CoreVest. |

(2) | Diluted average shares includes shares from the assumed conversion of our convertible and/or exchangeable debt in certain periods, in accordance with GAAP diluted EPS provisions. See Table 2 that follows for details of this calculation for the current and prior quarter and our respective Quarterly Reports on Form 10-Q and Annual Report on Form 10-K. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 | See Appendix for details on non-GAAP measures. | Table 1: GAAP Earnings 27 |

| Table 2: GAAP and Non-GAAP Core Basic and Diluted Earnings (1) per Common Share (in thousands, except per share data) | |||||||||||||

2019 Q4 | 2019 Q3 | Twelve Months 2019 | ||||||||||||

GAAP Earnings per Common Share ("EPS"): | ||||||||||||||

Net income attributable to Redwood | $ | 49,143 | $ | 34,310 | $ | 169,183 | ||||||||

Less: Dividends and undistributed earnings allocated to participating securities | (1,546 | ) | (856 | ) | (4,797 | ) | ||||||||

Net income allocated to common shareholders for GAAP basic EPS | 47,597 | 33,454 | 164,386 | |||||||||||

Incremental adjustment to dividends and undistributed earnings allocated to participating securities | (113 | ) | (180 | ) | (476 | ) | ||||||||

Add back: Interest expense on convertible notes for the period, net of tax (2) | 9,941 | 8,887 | 36,212 | |||||||||||

Net income allocated to common shareholders for GAAP diluted EPS | $ | 57,425 | $ | 42,161 | $ | 200,122 | ||||||||

Basic weighted average common shares outstanding | 112,818 | 101,872 | 101,147 | |||||||||||

Net effect of dilutive equity awards | 221 | 363 | 251 | |||||||||||

Net effect of assumed convertible notes conversion to common shares (2) | 39,943 | 34,288 | 35,382 | |||||||||||

Diluted weighted average common shares outstanding | 152,982 | 136,522 | 136,780 | |||||||||||

GAAP Basic Earnings per Common Share | $ | 0.42 | $ | 0.33 | $ | 1.63 | ||||||||

GAAP Diluted Earnings per Common Share | $ | 0.38 | $ | 0.31 | $ | 1.46 | ||||||||

Non-GAAP Core Earnings per Common Share: | ||||||||||||||

Non-GAAP core earnings | $ | 61,233 | $ | 43,326 | $ | 185,867 | ||||||||

Less: Dividends and undistributed earnings allocated to participating securities | (1,908 | ) | (1,099 | ) | (5,270 | ) | ||||||||

Non-GAAP core earnings allocated to common shareholders for core basic EPS | 59,325 | 42,227 | 180,597 | |||||||||||

Incremental adjustment to dividends and undistributed earnings allocated to participating securities | (19 | ) | (121 | ) | (356 | ) | ||||||||

Add back: Interest expense on convertible notes for the period, net of tax (2) | 9,941 | 8,887 | 36,212 | |||||||||||

Non-GAAP core earnings allocated to common shareholders for core diluted EPS | $ | 69,247 | $ | 50,993 | $ | 216,453 | ||||||||

Basic weighted average common shares outstanding | 112,818 | 101,872 | 101,147 | |||||||||||

Net effect of dilutive equity awards | 221 | 363 | 251 | |||||||||||

Net effect of assumed convertible notes conversion to common shares (2) | 39,943 | 34,288 | 35,382 | |||||||||||

Diluted weighted average common shares outstanding | 152,982 | 136,523 | 136,780 | |||||||||||

Non-GAAP Core Basic Earnings per Common Share | $ | 0.53 | $ | 0.41 | $ | 1.79 | ||||||||

Non-GAAP Core Diluted Earnings per Common Share | $ | 0.45 | $ | 0.37 | $ | 1.58 | ||||||||

(1) | A reconciliation of GAAP net income to non-GAAP core earnings and a definition of core earnings (which we updated during the third quarter of 2019) is included in the Non-GAAP Measurements section of the Appendix. |

(2) | Certain convertible notes were determined to be dilutive in the periods presented and were included in the calculations of diluted EPS under the "if-converted" method. Under this method, the periodic interest expense (net of applicable taxes) for dilutive notes is added back to the numerator and the number of shares that the notes are entitled to (if converted, regardless of whether they are in or out of the money) are included in the denominator. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 | See Appendix for details on non-GAAP measures. | Table 2: GAAP and Non-GAAP Core Earnings per Basic and Diluted Common Share 28 |

| Table 3: Taxable and GAAP Income (1) Differences and Dividends (In thousands, except for per share data) | ||||||||||||||||||||||||||||||||||||

Estimated Twelve Months 2019 (2) | Actual Twelve Months 2018 (2) | Actual Twelve Months 2017 (2) | |||||||||||||||||||||||||||||||||||

Taxable Income | GAAP Income | Differences | Taxable Income | GAAP Income | Differences | Taxable Income | GAAP Income | Differences | |||||||||||||||||||||||||||||

Taxable and GAAP Income Differences | |||||||||||||||||||||||||||||||||||||

Interest income | $ | 320,480 | $ | 622,281 | $ | (301,801 | ) | $ | 265,400 | $ | 378,717 | $ | (113,317 | ) | $ | 225,079 | $ | 248,057 | $ | (22,978 | ) | ||||||||||||||||

Interest expense | (183,550 | ) | (479,808 | ) | 296,258 | (139,147 | ) | (239,039 | ) | 99,892 | (89,662 | ) | (108,816 | ) | 19,154 | ||||||||||||||||||||||

Net interest income | 136,930 | 142,473 | (5,543 | ) | 126,253 | 139,678 | (13,425 | ) | 135,417 | 139,241 | (3,824 | ) | |||||||||||||||||||||||||

Realized credit losses | (534 | ) | — | (534 | ) | (1,738 | ) | — | (1,738 | ) | (3,442 | ) | — | (3,442 | ) | ||||||||||||||||||||||

Mortgage banking activities, net | 80,146 | 87,266 | (7,120 | ) | 57,212 | 59,566 | (2,354 | ) | 44,143 | 53,908 | (9,765 | ) | |||||||||||||||||||||||||

Investment fair value changes, net | 4,307 | 35,500 | (31,193 | ) | 4,927 | (25,689 | ) | 30,616 | (11,191 | ) | 10,374 | (21,565 | ) | ||||||||||||||||||||||||

General and administrative expenses | (109,737 | ) | (118,672 | ) | 8,935 | (78,022 | ) | (82,782 | ) | 4,760 | (73,203 | ) | (77,156 | ) | 3,953 | ||||||||||||||||||||||

Other income | 23,397 | 19,257 | 4,140 | 17,584 | 13,070 | 4,514 | 31,325 | 12,436 | 18,889 | ||||||||||||||||||||||||||||

Realized gains, net | 62,613 | 23,821 | 38,792 | 43,099 | 27,041 | 16,058 | (736 | ) | 13,355 | (14,091 | ) | ||||||||||||||||||||||||||

Other expenses | (3,351 | ) | (13,022 | ) | 9,671 | (65 | ) | (196 | ) | 131 | — | — | — | ||||||||||||||||||||||||

(Provision for) benefit from income taxes | (866 | ) | (7,440 | ) | 6,574 | (538 | ) | (11,088 | ) | 10,550 | (516 | ) | (11,752 | ) | 11,236 | ||||||||||||||||||||||

Income | $ | 192,905 | $ | 169,183 | $ | 23,722 | $ | 168,712 | $ | 119,600 | $ | 49,112 | $ | 121,797 | $ | 140,406 | $ | (18,609 | ) | ||||||||||||||||||

REIT taxable income | $ | 136,255 | $ | 110,161 | $ | 90,122 | |||||||||||||||||||||||||||||||

Taxable income at taxable subsidiaries | 56,650 | 58,551 | 31,675 | ||||||||||||||||||||||||||||||||||

Taxable income | $ | 192,905 | $ | 168,712 | $ | 121,797 | |||||||||||||||||||||||||||||||

Shares used for taxable EPS calculation | 114,353 | 84,884 | 76,600 | ||||||||||||||||||||||||||||||||||

REIT taxable income per share | $ | 1.28 | $ | 1.38 | $ | 1.17 | |||||||||||||||||||||||||||||||

Taxable income per share at taxable subsidiaries | $ | 0.54 | $ | 0.75 | $ | 0.42 | |||||||||||||||||||||||||||||||

Taxable income per share (3) | $ | 1.82 | $ | 2.13 | $ | 1.59 | |||||||||||||||||||||||||||||||

Dividends | |||||||||||||||||||||||||||||||||||||

Dividends declared | $ | 126,139 | $ | 94,134 | $ | 86,271 | |||||||||||||||||||||||||||||||

Dividends per share (4) | $ | 1.20 | $ | 1.18 | $ | 1.12 | |||||||||||||||||||||||||||||||

(1) | Taxable income for 2019 is an estimate until we file our tax returns for 2019. To the extent we expect to pay tax at the corporate level (generally as a result of activity at our taxable REIT subsidiaries), we are required to record a tax provision for GAAP reporting purposes. Any tax provision (or benefit) is not necessarily the actual amount of tax currently due (or receivable as a refund) as a portion of our provision (or benefit) is deferred in nature. It is our intention to retain any excess inclusion income generated in 2019 at our TRS and not pass it through to our shareholders. |

(2) | Reconciliation of GAAP income to taxable income (loss) for prior quarters is provided in the respective Redwood Reviews for those quarters. |

(3) | Taxable income (loss) per share is based on the number of shares outstanding at the end of each quarter. The annual taxable income (loss) per share is the sum of the quarterly per share estimates. |

(4) | Dividends in 2019 are expected to be characterized as 73% ordinary dividend income (or $92 million) and 27% long-term capital gain dividend income (or $34 million). Dividends in 2018 were characterized as 69% ordinary dividend income (or $65 million) and 31% long-term capital gain dividend income (or $29 million). Dividends in 2017 were characterized as 71% ordinary dividend income (or $61 million) and 29% qualified dividend income (or $25 million). |

THE REDWOOD REVIEW I 4TH QUARTER 2019 | See Appendix for details on non-GAAP measures. | Table 3: Taxable and GAAP Income Differences and Dividends 29 |

| Table 4: Financial Ratios and Book Value ($ in thousands, except per share data) | ||||||||||||||||||||||||

2019 Q4 | 2019 Q3 | 2019 Q2 | 2019 Q1 | 2018 Q4 | Twelve Months 2019 | ||||||||||||||||||||

Financial performance ratios | |||||||||||||||||||||||||

Net interest income | $ | 44,873 | $ | 33,513 | $ | 32,322 | $ | 31,765 | $ | 34,764 | $ | 142,473 | |||||||||||||

Corporate general and administrative expenses | $ | (15,436 | ) | $ | (12,727 | ) | $ | (12,448 | ) | $ | (12,394 | ) | $ | (8,188 | ) | $ | (53,005 | ) | |||||||

Total general and administrative expenses | $ | (42,443 | ) | $ | (26,815 | ) | $ | (26,255 | ) | $ | (23,159 | ) | $ | (19,253 | ) | $ | (118,672 | ) | |||||||

GAAP net income (loss) | $ | 49,143 | $ | 34,310 | $ | 31,266 | $ | 54,464 | $ | (913 | ) | $ | 169,183 | ||||||||||||

Average total assets | $ | 17,551,586 | $ | 14,017,627 | $ | 13,596,337 | $ | 11,795,343 | $ | 10,163,283 | $ | 14,255,384 | |||||||||||||

Average total equity | $ | 1,800,390 | $ | 1,591,792 | $ | 1,556,850 | $ | 1,452,282 | $ | 1,342,967 | $ | 1,601,259 | |||||||||||||

Corporate general and administrative expenses / average total equity | 3.43 | % | 3.20 | % | 3.20 | % | 3.41 | % | 2.44 | % | 3.31 | % | |||||||||||||

Total general and administrative expenses / average total equity | 9.43 | % | 6.74 | % | 6.75 | % | 6.38 | % | 5.73 | % | 7.41 | % | |||||||||||||

GAAP net income / average equity (GAAP ROE) | 10.92 | % | 8.62 | % | 8.03 | % | 15.00 | % | (0.27 | )% | 10.57 | % | |||||||||||||

Leverage ratios and book value per share | |||||||||||||||||||||||||

Short-term debt | $ | 2,176,591 | $ | 1,789,827 | $ | 2,227,183 | $ | 1,914,514 | $ | 2,138,686 | |||||||||||||||

Long-term debt | 2,970,415 | 2,971,552 | 2,584,499 | 2,584,499 | 2,584,499 | ||||||||||||||||||||

Total debt at Redwood | $ | 5,147,006 | $ | 4,761,379 | $ | 4,811,682 | $ | 4,499,013 | $ | 4,723,185 | |||||||||||||||

At consolidated securitization entities | |||||||||||||||||||||||||

ABS issued | 10,515,475 | 8,346,051 | 6,913,129 | 5,637,644 | 5,410,073 | ||||||||||||||||||||

Non-recourse short-term debt | 153,696 | 191,556 | 237,363 | 251,875 | 265,637 | ||||||||||||||||||||

Total ABS and non-recourse short-term debt | $ | 10,669,171 | $ | 8,537,607 | $ | 7,150,492 | $ | 5,889,519 | $ | 5,675,710 | |||||||||||||||

Consolidated debt (1) | $ | 15,816,177 | $ | 13,298,986 | $ | 11,962,174 | $ | 10,388,532 | $ | 10,398,895 | |||||||||||||||

Tangible stockholders' equity (2) | $ | 1,665,767 | $ | 1,735,938 | $ | 1,513,033 | $ | 1,497,032 | $ | 1,348,794 | |||||||||||||||

Total stockholders' equity | $ | 1,827,231 | $ | 1,785,059 | $ | 1,564,032 | $ | 1,549,927 | $ | 1,348,794 | |||||||||||||||

Total capital (3) | $ | 2,596,984 | $ | 2,554,118 | $ | 2,337,442 | $ | 2,322,515 | $ | 2,120,572 | |||||||||||||||

Recourse leverage ratio (recourse debt at Redwood to tangible stockholders' equity)(4) | 3.1x | 2.7x | 3.2x | 3.0x | 3.5x | ||||||||||||||||||||

Consolidated debt to tangible stockholders' equity | 9.5x | 7.7x | 7.9x | 6.9x | 7.7x | ||||||||||||||||||||

Shares outstanding at period end (in thousands) | 114,353 | 112,102 | 97,715 | 96,866 | 84,884 | ||||||||||||||||||||

Book value per share | $ | 15.98 | $ | 15.92 | $ | 16.01 | $ | 16.00 | $ | 15.89 | |||||||||||||||

(1) | Amounts presented in Consolidated debt above do not include deferred issuance costs or debt discounts. |

(2) | At December 31, 2019, September 30, 2019, June 30, 2019, March 31, 2019, and December 31, 2018, tangible stockholders' equity excluded $161 million, $49 million, $51 million, $53 million and $0, respectively, of goodwill and intangible assets. |

(3) | Our total capital of $2.6 billion at December 31, 2019 included $1.8 billion of equity capital and $0.8 billion of unsecured corporate debt. |

(4) | Excludes ABS issued and non-recourse debt at consolidated entities. See Table 5 for additional detail on our ABS issued and short-term debt at consolidated entities. |

THE REDWOOD REVIEW I 4TH QUARTER 2019 | See Appendix for details on non-GAAP measures. | Table 4: Financial Ratios and Book Value 30 |

| Table 5: Consolidating Balance Sheet ($ in thousands) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

December 31, 2019 | September 30, 2019 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Consolidated VIEs (1) | Consolidated VIEs (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

At Redwood (1) | Sequoia Choice | Freddie Mac SLST | Freddie Mac K-Series | CAFL | Other (2) | Redwood Consolidated | At Redwood (1) | Sequoia Choice | Freddie Mac SLST | Freddie Mac K-Series | CAFL | Other (2) | Redwood Consolidated | ||||||||||||||||||||||||||||||||||||||||||||