Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Kraton Corp | kra022720208-kearnings.htm |

Kraton Corporation Fourth Quarter 2019 Earnings Presentation February 27, 2020

Disclaimers Forward Looking Statements Some of the statements and information in this presentation contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. This presentation includes forward-looking statements that reflect our plans, beliefs, expectations and current views with respect to, among other things, our financial condition, financial performance and other future events or circumstances. Forward-looking statements are often identified by words such as “outlook,” “believes,” “target,” “estimates,” “expects,” “projects,” “may,” “intends,” “plans,” “on track,” “anticipate,” the negative of such words or similar terminology, and include, but are not limited to, our expectations regarding matters described on the slide titled “2020 Modeling Assumptions,” our expectations for targeted consolidated net debt reduction and 2020 Adjusted EBITDA and our expectations with respect to the timing for completion, and use of proceeds, of the sale of our Cariflex business. All forward-looking statements in this presentation are made based on management's current expectations and estimates, which are subject to known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from those expressed in forward-looking statements. These risks and uncertainties are more fully described in our latest Annual Report on Form 10-K, including but not limited to “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” therein, and in our other filings with the Securities and Exchange Commission (SEC), and include, but are not limited to, risks related to: not completing, or not completely realizing the anticipated benefits from, the sale of the Cariflex business; receipt and timing of necessary regulatory approvals; our reliance on third parties for the provision of significant operating and other services; conditions in, and risk associated with operating in, the global economy and capital markets; fluctuations in raw material costs; natural disasters and weather conditions; other extraordinary events such as heath epidemics and pandemics and terrorist attacks; limitations in the availability of raw materials; and other factors of which we are currently unaware, deems immaterial or are outside our control. In addition, to the extent any inconsistency or conflict exists between the information included in this presentation and the information included in our prior presentations, releases, reports or other filings with the SEC, the information contained in this presentation updates and supersede such information. We believe our expectations and assumptions are reasonable, but there can be no assurance that the expectations reflected herein will be achieved. Accordingly, readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made, and we assumes no obligation to update such information in light of new information or future events. Kraton Fourth Quarter 2019 Earnings Call 2

Disclaimers GAAP Disclaimer This presentation includes the use of non-GAAP financial measures, as defined below. Tables included in this presentation reconcile each of these non-GAAP financial measures with the most directly comparable GAAP financial measure. For additional information on the impact of the spread between the FIFO basis of accounting and estimated current replacement cost (ECRC), see our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, when filed. We consider these non-GAAP financial measures to be important supplemental measures in the evaluation of our absolute and relative performance. However, we caution that these non-GAAP financial measures have limitations as analytical tools and may vary substantially from other measures of our performance. You should not consider them in isolation, or as a substitute for analysis of our results under GAAP in the United States. EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin: For our consolidated results, EBITDA represents net income (loss) before interest, taxes, depreciation and amortization. For each reporting segment, EBITDA represents operating income before depreciation and amortization, other income (expense), loss on extinguishment of debt, and earnings of unconsolidated joint ventures. Among other limitations, EBITDA does not reflect the significant interest expense on our debt or reflect the significant depreciation and amortization expense associated with our long-lived assets and EBITDA included herein should not be used for purposes of assessing compliance or non-compliance with financial covenants under our debt agreements since it calculation differs in such agreements. Other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure. As an analytical tool, Adjusted EBITDA is subject to all the limitations applicable to EBITDA. We prepare Adjusted EBITDA by eliminating from EBITDA the impact of a number of items we do not consider indicative of our on-going performance but you should be aware that in the future we may incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. In addition, due to volatility in raw material prices, Adjusted EBITDA may, and often does, vary substantially from EBITDA and other performance measures, including net income (loss) calculated in accordance with U.S. GAAP. We define Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of revenue (for each reporting segment or on a consolidated bases, as applicable). Adjusted Gross Profit and Adjusted Gross Profit Per Ton: We define Adjusted Gross Profit Per Ton as Adjusted Gross Profit divided by total sales volume (for each reporting segment or on a consolidated basis, as applicable). We define Adjusted Gross Profit as gross profit excluding certain charges and expenses. Adjusted Gross Profit is limited because it often varies substantially from gross profit calculated in accordance with U.S. GAAP due to volatility in raw material prices. Certain amounts reported in the prior periods have been reclassified to conform to the current reporting presentation. Adjusted Diluted Earnings Per Share: Adjusted Diluted Earnings Per Share is Diluted Earnings (Loss) Per Share excluding the impact of a number of non-recurring items we do not consider indicative of our on-going performance. Consolidated Net Debt: We define consolidated net debt as total consolidated debt (including debt of KFPC) less consolidated cash and cash equivalents. Management uses consolidated net debt to determine our outstanding debt obligations that would not readily be satisfied by its cash and cash equivalents on hand. Management believes that using consolidated net debt is useful to investors in determining our leverage since we could choose to use cash and cash equivalents to retire debt. Consolidated Net Debt, as adjusted for foreign exchange impact accounts for the FX effect on the Euro Tranche of our Term Loan and the effect of our share buyback program. Kraton Fourth Quarter 2019 Earnings Call 3

Fourth Quarter and Full Year 2019 Highlights GAAP results ▪ Consolidated net income (loss): Q4 2019 – $(22.1) million; FY 2019 – $55.8 million ▪ Polymer segment operating income (loss): Q4 2019 – $(5.2) million; FY 2019 – $57.3 million ▪ Chemical segment operating income (loss): Q4 2019 – $(4.8) million; FY 2019 – $62.1 million Q4 2019 Adjusted EBITDA(1) of $49.0 million, down $36.1 million vs. Q4 2018 ▪ Polymer segment Adjusted EBITDA(1) of $29.5 million, down 33.4% compared to Q4 2018 ▪ Chemical segment Adjusted EBITDA(1) of $19.5 million, down 52.2% compared to Q4 2018 ▪ Q4 2019 impacted by higher fixed costs of $3.9 million, largely associated with planned maintenance activity ▪ Lower absorption of fixed costs related to turnarounds and lower plant operating rates resulted in less favorable absorption of fixed costs compared to Q4 2018, accounting for $14.9 million of the decline in Adjusted EBITDA(1) Full-year 2019 Adjusted EBITDA(1) of $320.6 million, down 15.2% vs. FY 2018 ▪ Polymer segment Adjusted EBITDA(1) of $188.2 million, down 12.4% vs. FY 2018 ▪ Chemical segment Adjusted EBITDA(1) of $132.4 million, down 18.9% vs. FY 2018 Full-year 2019 reduction in consolidated net debt of $125.6 million ($125.3 million excluding the effect of FX(1) and activity under the share buyback program) Cariflex sale currently projected to close by March 31, 2020 (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. Kraton Fourth Quarter 2019 Earnings Call 4

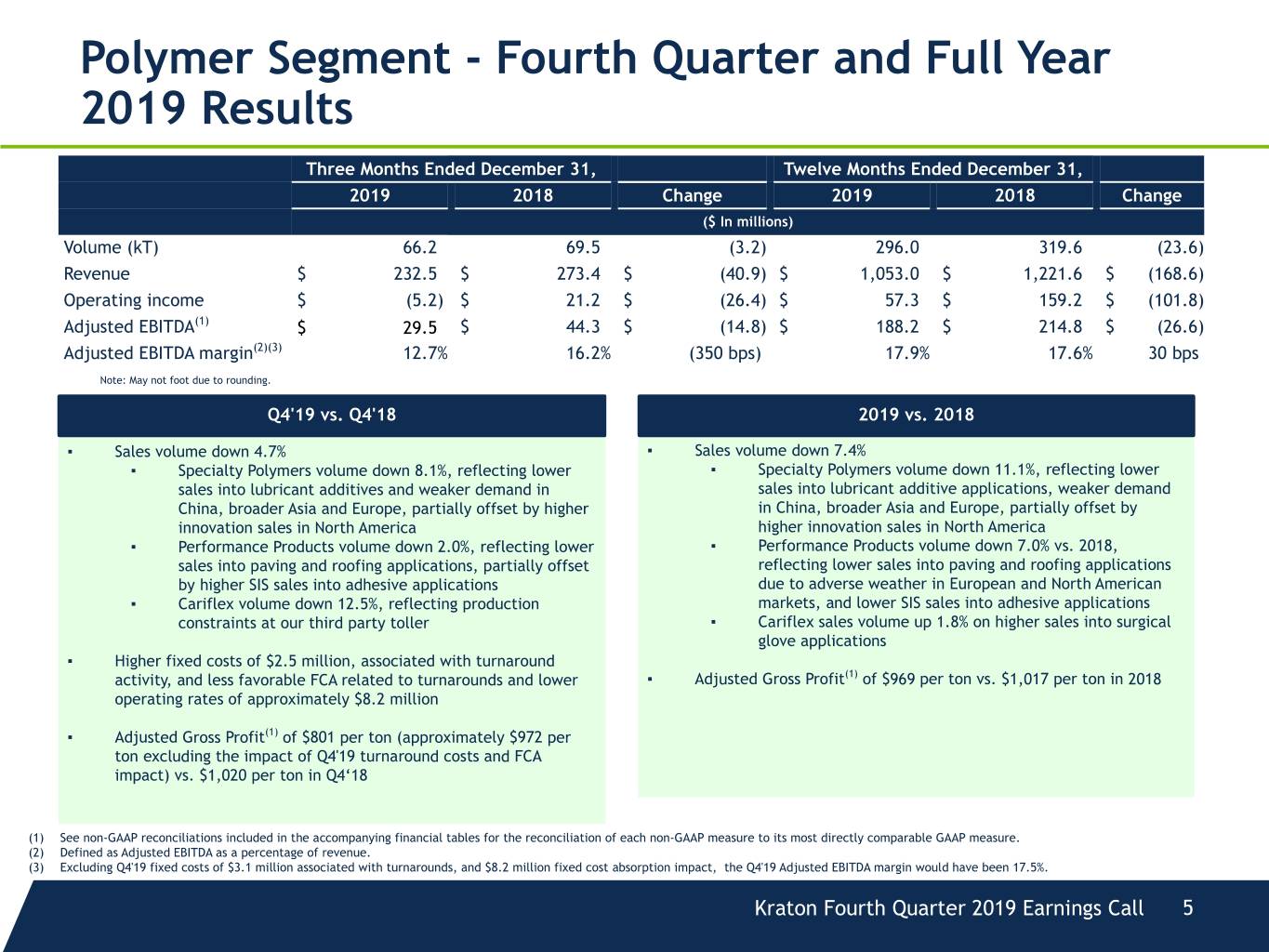

Polymer Segment - Fourth Quarter and Full Year 2019 Results Three Months Ended December 31, Twelve Months Ended December 31, 2019 2018 Change 2019 2018 Change ($ In millions) Volume (kT) 66.2 69.5 (3.2) 296.0 319.6 (23.6) Revenue $ 232.5 $ 273.4 $ (40.9) $ 1,053.0 $ 1,221.6 $ (168.6) Operating income $ (5.2) $ 21.2 $ (26.4) $ 57.3 $ 159.2 $ (101.8) Adjusted EBITDA(1) $ 29.5 $ 44.3 $ (14.8) $ 188.2 $ 214.8 $ (26.6) Adjusted EBITDA margin(2)(3) 12.7% 16.2% (350 bps) 17.9% 17.6% 30 bps Note: May not foot due to rounding. Q4'19 vs. Q4'18 2019 vs. 2018 ▪ Sales volume down 4.7% ▪ Sales volume down 7.4% ▪ Specialty Polymers volume down 8.1%, reflecting lower ▪ Specialty Polymers volume down 11.1%, reflecting lower sales into lubricant additives and weaker demand in sales into lubricant additive applications, weaker demand China, broader Asia and Europe, partially offset by higher in China, broader Asia and Europe, partially offset by innovation sales in North America higher innovation sales in North America ▪ Performance Products volume down 2.0%, reflecting lower ▪ Performance Products volume down 7.0% vs. 2018, sales into paving and roofing applications, partially offset reflecting lower sales into paving and roofing applications by higher SIS sales into adhesive applications due to adverse weather in European and North American ▪ Cariflex volume down 12.5%, reflecting production markets, and lower SIS sales into adhesive applications constraints at our third party toller ▪ Cariflex sales volume up 1.8% on higher sales into surgical glove applications ▪ Higher fixed costs of $2.5 million, associated with turnaround activity, and less favorable FCA related to turnarounds and lower ▪ Adjusted Gross Profit(1) of $969 per ton vs. $1,017 per ton in 2018 operating rates of approximately $8.2 million ▪ Adjusted Gross Profit(1) of $801 per ton (approximately $972 per ton excluding the impact of Q4'19 turnaround costs and FCA impact) vs. $1,020 per ton in Q4‘18 (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. (2) Defined as Adjusted EBITDA as a percentage of revenue. (3) Excluding Q4'19 fixed costs of $3.1 million associated with turnarounds, and $8.2 million fixed cost absorption impact, the Q4'19 Adjusted EBITDA margin would have been 17.5%. Kraton Fourth Quarter 2019 Earnings Call 5

Chemical Segment - Fourth Quarter and Full Year 2019 Results Three Months Ended December 31, Twelve Months Ended December 31, 2019 2018 Change 2019 2018 Change ($ In millions) Volume (kT) 98.0 95.8 2.2 398.6 428.5 (29.9) Revenue $ 176.1 $ 174.4 $ 1.7 $ 751.5 $ 790.1 $ (38.6) Operating income $ (4.8) $ 12.2 $ (17.0) $ 62.1 $ 91.6 $ (29.5) Adjusted EBITDA(1) $ 19.5 $ 40.8 $ (21.3) $ 132.4 $ 163.2 $ (30.8) Adjusted EBITDA margin(2)(3) 11.1% 23.4% (1,230 bps) 17.6% 20.7% (310 bps) Note: May not foot due to rounding. Q4'19 vs. Q4'18 2019 vs. 2018 ▪ Sales volume increased 2.3% ▪ Sales volume decreased 7.0% ▪ Performance Chemicals volume down 4.2% on lower sales of ▪ Performance Chemicals volume down 10.9%, on lower sales of raw materials, softer oilfield demand and lower sales of TOR raw materials, lower sales of TOR and TOFA, in part associated ▪ Adhesives volume up 15.7% on higher rosin upgrades relative with constrained CTO availability to Q4'18 (Hurricane Michael impact) ▪ Adhesives volume up 0.5% ▪ Tires volume up 22.1% relative to Q4'18 (Hurricane Michael ▪ Tires volume up 6.5% on higher sales leveraging expanded impact) and increased sales via expanded capacity at our capacity at our Niort, France, site and Q4'18 impact of Niort, France, site Hurricane Michael • Adjusted EBITDA margin(2) of 11.1% vs. 23.4% in Q4'18 reflecting $1.4 ▪ Adjusted EBITDA margin(2)(3) of 17.6% vs. 20.7% for 2018, reflecting million of higher fixed costs associated with turnaround activity, less lower pricing for TOR and higher average raw material costs favorable FCA related to turnarounds and lower operating rates of approximately $6.7 million, lower pricing in TOR and CST chains, lower sales of TOFA upgrades and higher raw material costs • Excluding fixed costs associated with turnaround activity and FCA impact, the Adjusted EBITDA margin(2) would have been 15.8% (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. (2) Defined as Adjusted EBITDA as a percentage of revenue. (3) Accounting for lost sales associated with Hurricane Michael, Adjusted EBITDA margin would have been 21.3% for the three months ended December 31, 2018. Adjusted EBITDA margin would have been 17.4% and 20.2% for the years ended December 31, 2019 and 2018, respectively. Kraton Fourth Quarter 2019 Earnings Call 6

Consolidated - Fourth Quarter and Full Year 2019 Results Three Months Ended December 31, Twelve Months Ended December 31, 2019 2018 Change 2019 2018 Change ($ In millions, except per share amounts) Revenue $ 408.5 $ 447.8 $ (39.3) $ 1,804.4 $ 2,011.7 $ (207.2) Net income (loss) attributable to Kraton $ (21.3) $ 17.5 $ (38.8) $ 51.3 $ 67.0 $ (15.7) Diluted earnings (loss) per share $ (0.67) $ 0.55 $ (1.22) $ 1.60 $ 2.08 $ (0.48) Operating income (loss) $ (9.9) $ 33.4 (43.3) $ 119.5 $ 250.7 $ (131.3) Adjusted EBITDA(1) $ 49.0 $ 85.1 (36.1) $ 320.6 $ 378.0 $ (57.5) Adjusted EBITDA margin(2)(3) 12.0% 19.0% (700 bps) 17.8% 18.8% (100 bps) Adjusted diluted earnings (loss) per share(1)(4) $ (0.06) $ 0.67 $ (0.73) $ 2.94 $ 3.16 $ (0.22) Note: May not foot due to rounding. (1) Operating Income Adjusted EBITDA $250.7 $378.0 $320.6 $163.2 $91.6 $132.4 $119.5 $62.1 $159.2 $85.1 $214.8 $33.4 $188.2 $49.0 $40.8 ($9.9) $12.2 $57.3 $19.5 ($5.2) $21.2 $29.5 $44.3 ($4.8) Q4'19 Q4'18 YTD'19 YTD'18 Q4'19 Q4'18 YTD'19 YTD'18 Polymer Chemical Polymer Chemical (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. (2) Defined as Adjusted EBITDA as a percentage of revenue. (3) Accounting for lost sales associated with Hurricane Michael, Adjusted EBITDA margin would have been 18.3% and 18.6% for the three months and year ended December 31, 2018, respectively, and 17.7% for the year ended December 31, 2019. (4) Q4'19 turnaround costs and FCA impact of $20.8 million impacted Adjusted diluted earnings per share by approximately $0.49 per diluted share Kraton Fourth Quarter 2019 Earnings Call 7

Consolidated Net Debt December 31, 2019 September 30, 2019 December 31, 2018 (In millions) Kraton debt $ 1,288.3 $ 1,401.0 $ 1,441.6 KFPC(1) loans 102.4 104.3 125.5 Consolidated debt 1,390.7 1,505.3 1,567.1 Kraton cash 24.6 77.0 79.3 KFPC(1) cash 10.4 6.2 6.6 Consolidated cash 35.0 83.2 85.9 Consolidated net debt $ 1,355.6 $ 1,422.1 $ 1,481.2 Effect of foreign currency on consolidated net debt 10.3 32.3 Consolidated net debt excluding effect of foreign currency $ 1,365.9 $ 1,454.4 Effect of share buyback program (10.0) (10.0) Consolidated net debt excluding effect of foreign currency and share buyback program $ 1,355.9 $ 1,444.4 Note: May not foot due to rounding. Consolidated Net Debt $1,595 $1,356 $1,799 $1,715 $1,595 $1,481 $1,356 01/06/16 12/31/16 12/31/17 12/31/18 12/31/19 (1) This amount includes all of the indebtedness of our Kraton Formosa Polymers Corporation (KFPC) joint venture, located in Mailiao, Taiwan, which we own a 50% stake in and consolidate within our financial statements. Kraton Fourth Quarter 2019 Earnings Call 8

Appendix

2020 Modeling Assumptions(1) ($ In millions) Adjusted EBITDA (1)(2) $200 - $220 Non-cash compensation expense $10 Depreciation & amortization $119 Interest expense $55 Cash taxes $20 Capex $90 Reduction in consolidated net debt excluding proceeds from Cariflex sale (2)(3) $40 - $60 Note: Non-cash compensation expense is excluded in determining Adjusted EBITDA and included in determining Adjusted EPS. (1) Management's estimates. These estimates are forward-looking statements and speak only as of February 27, 2020. Management assumes no obligation to update or confirm these estimates in light of new information or future events. (2) We have not reconciled Adjusted EBITDA guidance to net income (loss) because we do not provide guidance for net income (loss) or for items that we do not consider indicative of our on-going performance, including, but not limited to, transaction costs and production downtime, as certain of these items are out of our control and/or cannot be reasonably predicted. We have not reconciled consolidated net debt guidance to debt due to high variability and difficulty in making accurate forecasts and projections that are impacted by future decisions and actions. The actual amount of such reconciling items will have a significant impact if they were included in our net debt. Accordingly, a reconciliation of the non-GAAP financial measure guidance to the corresponding GAAP measures is not available without unreasonable effort. (3) Excludes impact of activity under share repurchase authorization and the effects of foreign currency. Kraton Fourth Quarter 2019 Earnings Call 10

Polymer Segment – Revenue by Geography and End Use (Full Year 2019) Segment Revenue by Geography Segment Revenue by End Use Other 14% Medical 19% Asia Pacific Roofing 31% 8% Americas Industrial 40% 7% Adhsv & Paving Coatings 20% 7% EMEA Consumer 29% Personal Care 4% 10% Polymod 5% Lubricant Additives 6% Kraton Fourth Quarter 2019 Earnings Call 11

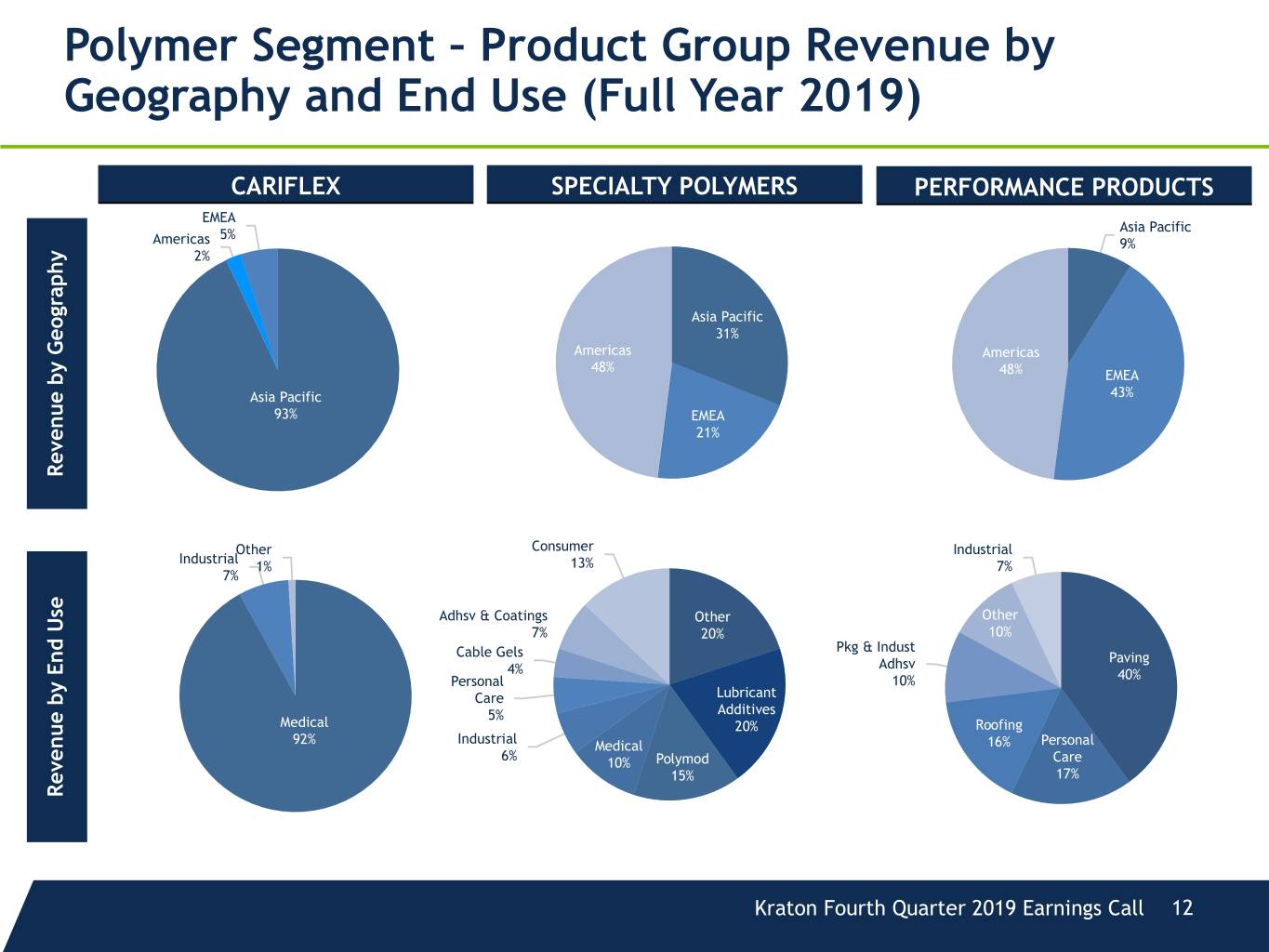

Polymer Segment – Product Group Revenue by Geography and End Use (Full Year 2019) CARIFLEX SPECIALTY POLYMERS PERFORMANCE PRODUCTS EMEA Asia Pacific 5% Americas 9% 2% Asia Pacific 31% Americas Americas 48% 48% EMEA Asia Pacific 43% 93% EMEA 21% Revenue by Geography Other Consumer Industrial Industrial 1% 13% 7% 7% Adhsv & Coatings Other Other 7% 20% 10% Pkg & Indust Cable Gels Paving 4% Adhsv Personal 10% 40% Care Lubricant 5% Additives Medical 20% Roofing Industrial 92% Medical 16% Personal 6% 10% Polymod Care 15% 17% Revenue by End Use Kraton Fourth Quarter 2019 Earnings Call 12

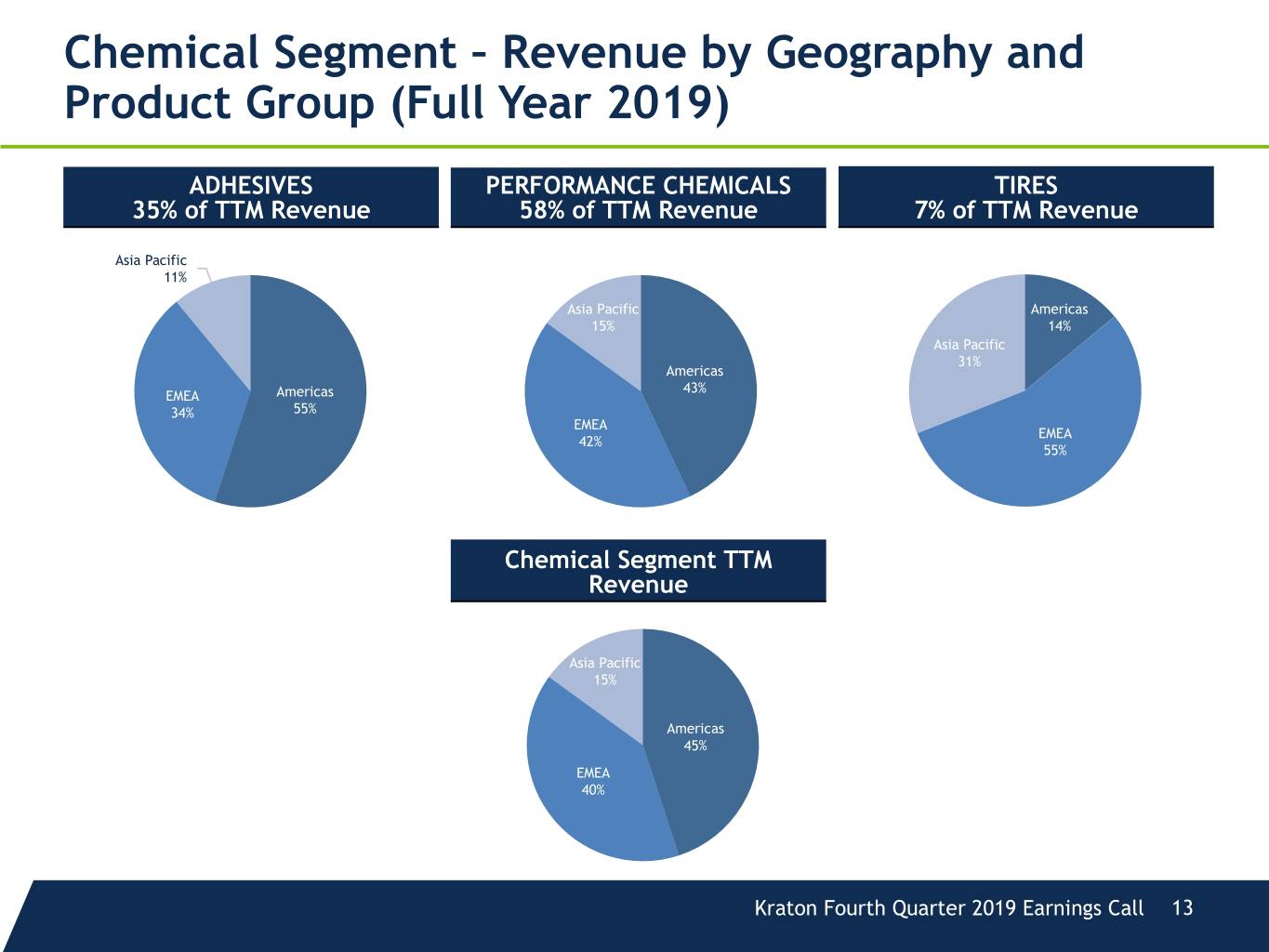

Chemical Segment – Revenue by Geography and Product Group (Full Year 2019) ADHESIVES PERFORMANCE CHEMICALS TIRES 35% of TTM Revenue 58% of TTM Revenue 7% of TTM Revenue Asia Pacific 11% Asia Pacific Americas 15% 14% Asia Pacific 31% Americas 43% EMEA Americas 34% 55% EMEA EMEA 42% 55% Chemical Segment TTM Revenue Asia Pacific 15% Americas 45% EMEA 40% Kraton Fourth Quarter 2019 Earnings Call 13

Polymer Reconciliation of Gross Profit to Adjusted Gross Profit Three Months Three Months Twelve Months Twelve Months Ended December Ended December Ended December Ended December 31, 2019 31, 2018 31, 2019 31, 2018 (In thousands) Gross profit $ 41,328 $ 67,598 $ 232,558 $ 349,080 Add (deduct): Restructuring and other charges (a) 115 1,581 1,030 1,581 KFPC startup costs (b) — — 3,019 — Non-cash compensation expense 81 29 570 486 Spread between FIFO and ECRC 11,498 1,669 49,565 (26,042) Adjusted gross profit (non-GAAP) $ 53,022 $ 70,877 $ 286,742 $ 325,105 Sales volume (kilotons) 66.2 69.5 296.0 319.6 Adjusted gross profit per ton (non-GAAP) $ 801 $ 1,020 $ 969 $ 1,017 (a) Severance expenses and other restructuring related charges. (b) Startup costs related to the joint venture company, KFPC, which are recorded in costs of goods sold. Kraton Fourth Quarter 2019 Earnings Call 14

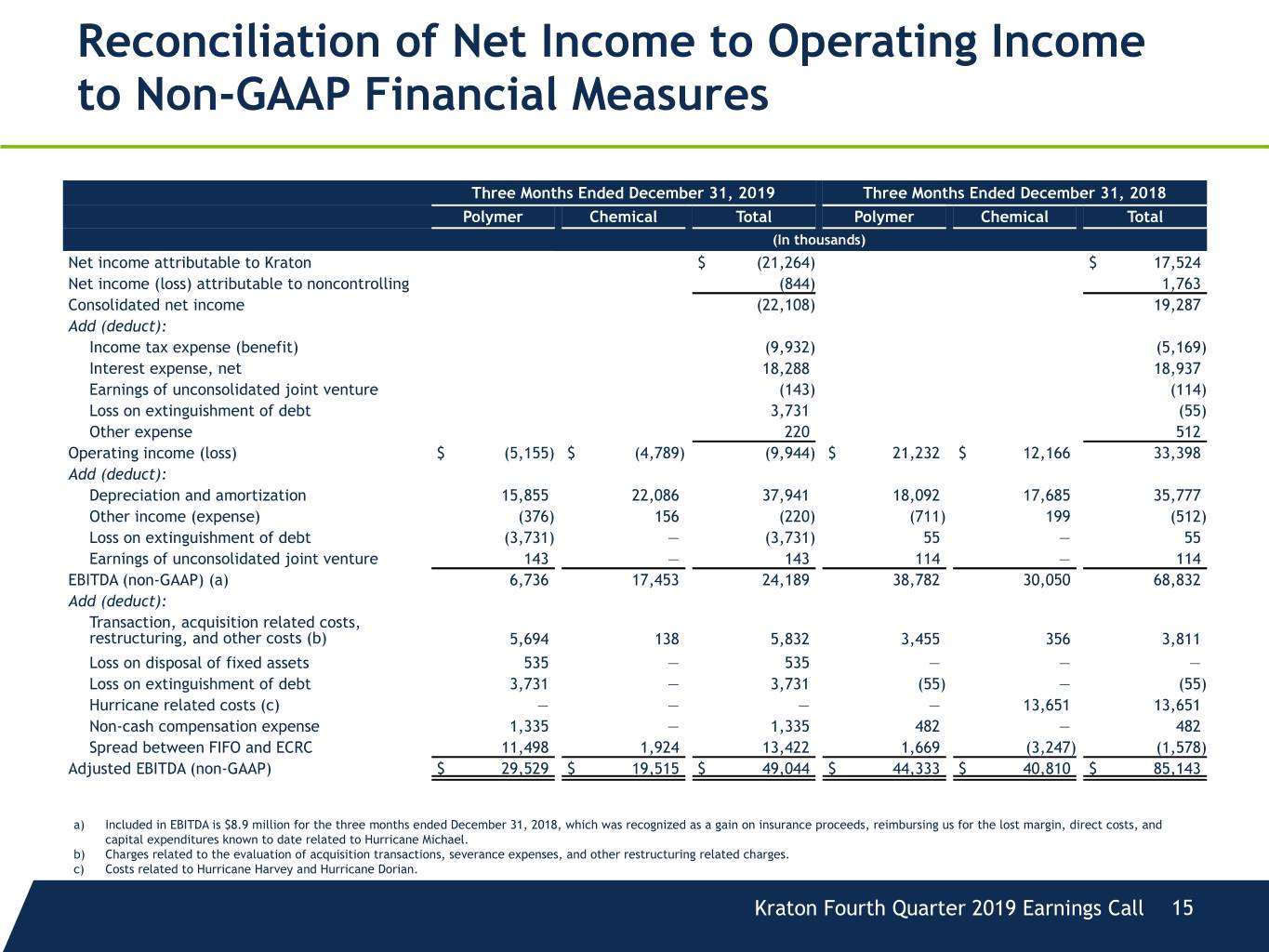

Reconciliation of Net Income to Operating Income to Non-GAAP Financial Measures Three Months Ended December 31, 2019 Three Months Ended December 31, 2018 Polymer Chemical Total Polymer Chemical Total (In thousands) Net income attributable to Kraton $ (21,264) $ 17,524 Net income (loss) attributable to noncontrolling (844) 1,763 Consolidated net income (22,108) 19,287 Add (deduct): Income tax expense (benefit) (9,932) (5,169) Interest expense, net 18,288 18,937 Earnings of unconsolidated joint venture (143) (114) Loss on extinguishment of debt 3,731 (55) Other expense 220 512 Operating income (loss) $ (5,155) $ (4,789) (9,944) $ 21,232 $ 12,166 33,398 Add (deduct): Depreciation and amortization 15,855 22,086 37,941 18,092 17,685 35,777 Other income (expense) (376) 156 (220) (711) 199 (512) Loss on extinguishment of debt (3,731) — (3,731) 55 — 55 Earnings of unconsolidated joint venture 143 — 143 114 — 114 EBITDA (non-GAAP) (a) 6,736 17,453 24,189 38,782 30,050 68,832 Add (deduct): Transaction, acquisition related costs, restructuring, and other costs (b) 5,694 138 5,832 3,455 356 3,811 Loss on disposal of fixed assets 535 — 535 — — — Loss on extinguishment of debt 3,731 — 3,731 (55) — (55) Hurricane related costs (c) — — — — 13,651 13,651 Non-cash compensation expense 1,335 — 1,335 482 — 482 Spread between FIFO and ECRC 11,498 1,924 13,422 1,669 (3,247) (1,578) Adjusted EBITDA (non-GAAP) $ 29,529 $ 19,515 $ 49,044 $ 44,333 $ 40,810 $ 85,143 a) Included in EBITDA is $8.9 million for the three months ended December 31, 2018, which was recognized as a gain on insurance proceeds, reimbursing us for the lost margin, direct costs, and capital expenditures known to date related to Hurricane Michael. b) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges. c) Costs related to Hurricane Harvey and Hurricane Dorian. Kraton Fourth Quarter 2019 Earnings Call 15

Reconciliation of Net Income to Operating Income to Non-GAAP Financial Measures Year Ended December 31, 2019 Year Ended December 31, 2018 Polymer Chemical Total Polymer Chemical Total (In thousands) Net income attributable to Kraton $ 51,305 $ 67,015 Net income (loss) attributable to noncontrolling 4,512 3,506 Consolidated net income 55,817 70,521 Add (deduct): Income tax expense (benefit) (11,813) 3,574 Interest expense, net 75,782 93,772 Earnings of unconsolidated joint venture (506) (471) Loss on extinguishment of debt 3,521 79,866 Other (income) expense (3,339) 3,472 Operating income $ 57,343 $ 62,119 119,462 $ 159,162 $ 91,572 250,734 Add (deduct): Depreciation and amortization 59,151 77,020 136,171 71,006 70,404 141,410 Other income (expense) (1,923) 5,262 3,339 (4,311) 839 (3,472) Loss on extinguishment of debt (3,521) — (3,521) (79,866) — (79,866) Earnings of unconsolidated joint venture 506 — 506 471 — 471 EBITDA (non-GAAP) (a) 111,556 144,401 255,957 146,462 162,815 309,277 Add (deduct): Transaction, acquisition related costs, restructuring, and other costs (b) 10,475 946 11,421 5,517 (607) 4,910 Loss on disposal of fixed assets 535 — 535 — — — Loss on extinguishment of debt 3,521 — 3,521 79,866 — 79,866 Hurricane related costs (c) — 15,025 15,025 — 13,651 13,651 Hurricane reimbursements (d) — (26,561) (26,561) — — — KFPC startup costs (e) 3,019 — 3,019 897 — 897 Sale of emissions credits (f) — (4,601) (4,601) — — — Non-cash compensation expense 9,493 — 9,493 8,102 — 8,102 Spread between FIFO and ECRC 49,565 3,218 52,783 (26,042) (12,618) (38,660) Adjusted EBITDA (non-GAAP) $ 188,164 $ 132,428 $ 320,592 $ 214,802 $ 163,241 $ 378,043 a) Included in EBITDA is $32.9 million and $8.9 million for the years ended December 31, 2019 and 2018, respectively, which was recognized as a gain on insurance proceeds, reimbursing us for the lost margin, direct costs, and capital expenditures known to date related to Hurricane Michael. b) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges. c) Costs related to Hurricane Harvey and Hurricane Dorian. d) Reimbursement of incremental costs related to Hurricane Michael, which is recorded in gain on insurance proceeds. e) Startup costs related to the joint venture company, KFPC, which are recorded in costs of goods sold. f) We recorded a gain of $4.6 million in other income (expense) related to the sale of emissions credits accumulated by our Swedish Chemical legal entity. Kraton Fourth Quarter 2019 Earnings Call 16

Reconciliation of Diluted EPS to Adjusted Diluted EPS Three Months Ended Twelve Months Ended December 31, December 31, 2019 2018 2019 2018 Diluted Earnings (Loss) Per Share $ (0.67) $ 0.55 $ 1.60 $ 2.08 Transaction, acquisition related costs, restructuring, and other costs (a) 0.14 0.10 0.27 0.13 Loss on disposal of fixed assets 0.01 — 0.01 — Loss on extinguishment of debt 0.09 0.02 0.08 1.91 Hurricane related costs (b) — 0.32 0.55 0.32 Hurricane reimbursements (c) — — (0.83) — KFPC startup costs (d) — — 0.04 0.01 Tax reform repatriation (e) — (0.28) — (0.28) Sale of emissions credits (f) 0.03 — (0.11) — Spread between FIFO and ECRC 0.34 (0.04) 1.33 (1.01) Adjusted Diluted Earnings (Loss) Per Share (non-GAAP) $ (0.06) $ 0.67 $ 2.94 $ 3.16 a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges. b) Costs related to Hurricane Harvey and Hurricane Dorian. c) Reimbursement of incremental costs related to Hurricane Michael, which is recorded in gain on insurance proceeds. d) Startup costs related to the joint venture company, KFPC, which are recorded in costs of goods sold. e) Tax repatriation and deferred tax rate change relating to the 2017 U.S. Tax Cuts and Jobs Act, see Note 11 Income Taxes to the consolidated financial statements in our Annual Report on Form 10-K. f) We recorded a gain of $4.6 million in other income (expense) related to the sale of emissions credits accumulated by our Swedish Chemical legal entity. Kraton Fourth Quarter 2019 Earnings Call 17