Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019 | |

or | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____ | |

Commission file number 001-37363 | |

Enviva Partners, LP | ||

(Exact name of registrant as specified in its charter) | ||

Delaware | 46-4097730 | |

(State or other jurisdiction | (I.R.S. Employer | |

of incorporation or organization) | Identification No.) | |

7200 Wisconsin Ave, Suite 1000 | ||

Bethesda, MD | 20814 | |

(Address of principal executive offices) | (Zip code) | |

(301) 657-5560 | ||

(Registrant’s telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Units Representing Limited Partner Interests | EVA | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☒ | |

Non-accelerated filer ☐ | Smaller reporting company ☐ | |

Emerging growth company ☒ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common units held by non-affiliates of the registrant as of June 30, 2019 was approximately $624.3 million, based upon a closing price of $31.42 per common unit as reported on the New York Stock Exchange on such date.

As of February 14, 2020, 33,605,138 common units were outstanding.

Documents Incorporated by Reference: | ||||

None | ||||

ENVIVA PARTNERS, LP

ANNUAL REPORT ON FORM 10‑K

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD‑LOOKING STATEMENTS

Certain statements and information in this Annual Report on Form 10‑K (this “Annual Report”) may constitute “forward-looking statements.” The words “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could” or other similar expressions are intended to identify forward‑looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. Although management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. All comments concerning our expectations for future revenues and operating results are based on our forecasts for our existing operations and do not include the potential impact of any future acquisitions. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, those summarized below:

• | the volume and quality of products that we are able to produce or source and sell, which could be adversely affected by, among other things, operating or technical difficulties at our wood pellet production plants or deep-water marine terminals; |

• | the prices at which we are able to sell our products; |

• | our ability to successfully negotiate, complete and integrate drop-down or third-party acquisitions, including the associated contracts, or to realize the anticipated benefits of such acquisitions; |

• | failure of our customers, vendors and shipping partners to pay or perform their contractual obligations to us; |

• | our inability to successfully execute our project development and construction activities, including the expansion of our Northampton and Southampton plants, on time and within budget; |

• | the creditworthiness of our contract counterparties; |

• | the amount of low-cost wood fiber that we are able to procure and process, which could be adversely affected by, among other things, disruptions in supply or operating or financial difficulties suffered by our suppliers; |

• | changes in the price and availability of natural gas, coal or other sources of energy; |

• | changes in prevailing economic conditions; |

• | unanticipated ground, grade or water conditions; |

• | inclement or hazardous environmental conditions, including extreme precipitation, temperatures and flooding; |

• | fires, explosions or other accidents; |

• | changes in domestic and foreign laws and regulations (or the interpretation thereof) related to renewable or low-carbon energy, the forestry products industry, the international shipping industry or power, heat or combined heat and power generators; |

• | changes in the regulatory treatment of biomass in core and emerging markets; |

• | our inability to acquire or maintain necessary permits or rights for our production, transportation or terminaling operations; |

• | changes in the price and availability of transportation; |

• | changes in foreign currency exchange or interest rates, and the failure of our hedging arrangements to effectively reduce our exposure to the risks related thereto; |

• | risks related to our indebtedness; |

1

• | our failure to maintain effective quality control systems at our production plants and deep-water marine terminals, which could lead to the rejection of our products by our customers; |

• | changes in the quality specifications for our products that are required by our customers; |

• | labor disputes; |

• | our inability to hire, train or retain qualified personnel to manage and operate our business and newly acquired assets; |

• | the effects of the exit of the United Kingdom from the European Union on our and our customers’ businesses; and |

• | our inability to borrow funds and access capital markets. |

All forward-looking statements in this Annual Report are expressly qualified in their entirety by the foregoing cautionary statements.

Please read Part I, Item 1A. “Risk Factors.” Readers are cautioned not to place undue reliance on forward-looking statements and we undertake no obligation to update or revise any such statements after the date they are made, whether as a result of new information, future events or otherwise.

2

GLOSSARY OF TERMS

biomass: any organic biological material derived from living organisms that stores energy from the sun.

co-fire: the combustion of two different types of materials at the same time. For example, biomass is sometimes fired in combination with coal in existing coal plants.

cost pass-through mechanism: a provision in commercial contracts that passes costs through to the purchaser.

dry-bulk: describes dry-bulk commodities that are shipped in large, unpackaged amounts.

metric ton: one metric ton, which is equivalent to 1,000 kilograms and 1.1023 short tons.

net calorific value: the amount of usable heat energy released when a fuel is burned completely and the heat contained in the water vapor generated by the combustion process is not recovered. The European power industry typically uses net calorific value as the means of expressing fuel energy.

off-take contract: an agreement concerning the purchase and sale of a certain volume of future production of a given resource such as wood pellets.

ramp: increasing production for a period of time following the startup of a plant or completion of a project.

Riverstone: Riverstone Holdings LLC.

Riverstone Funds: Riverstone/Carlyle Renewable and Alternative Energy Fund II, L.P. and certain affiliated entities, collectively.

stumpage: the price paid to the underlying timber resource owner for the raw material.

utility-grade wood pellets: wood pellets meeting minimum requirements generally specified by industrial consumers and produced and sold in sufficient quantities to satisfy industrial‑scale consumption.

wood fiber: cellulosic elements that are extracted from trees and used to make various materials, including paper. In North America, wood fiber is primarily extracted from hardwood (deciduous) trees and softwood (coniferous) trees.

wood pellets: energy-dense, low-moisture and uniformly sized units of wood fuel produced from processing various wood resources or byproducts.

3

PART I

ITEM 1. | BUSINESS |

References in this Annual Report to “we,” “us,” “our,” the “Partnership”, or similar expressions refer to Enviva Partners, LP, including its subsidiaries. References to “our sponsor” refer to Enviva Holdings, LP, and, where applicable, its wholly owned subsidiaries Enviva MLP Holdco, LLC and Enviva Development Holdings, LLC. References to “our General Partner” refer to Enviva Partners GP, LLC, a wholly owned subsidiary of Enviva Holdings, LP. References to “Enviva Management” refer to Enviva Management Company, LLC, a wholly owned subsidiary of Enviva Holdings, LP, and references to “our employees” refer to the employees of Enviva Management and its affiliates who provide services to the Partnership. References to the “Sponsor JV” refer to Enviva JV Development Company, LLC, which is a joint venture between our sponsor and John Hancock Life Insurance Company (U.S.A.) and certain of its affiliates. Please read Cautionary Statement Regarding Forward-Looking Statements on page 1 and Item 1A. “Risk Factors” for information regarding certain risks inherent in our business.

Overview

We are a growth-oriented master limited partnership formed in 2013 that is focused on owning, operating and acquiring assets from our sponsor or third parties. We aggregate a natural resource, wood fiber, and process it into a transportable form, wood pellets. We sell a significant majority of our wood pellets through long-term, take-or-pay off-take contracts with creditworthy customers in the United Kingdom (the “U.K.”), Europe and increasingly in Japan. We own and operate seven plants (collectively, “our plants”) with a combined production capacity of approximately 3.5 million metric tons of wood pellets per year (“MTPY”) in Virginia, North Carolina, Mississippi, and Florida, the production of which is fully contracted through 2025. We export wood pellets through our wholly owned dry-bulk, deep-water marine terminal at the Port of Chesapeake, Virginia (the “Chesapeake terminal”) and terminal assets at the Port of Wilmington, North Carolina (the “Wilmington terminal”) and from third-party deep-water marine terminals in Mobile, Alabama (the “Mobile terminal”) and Panama City, Florida (the “Panama City terminal”). All of our facilities are located in geographic regions with low input costs and favorable transportation logistics. Owning these cost-advantaged assets, the output from which is fully contracted, in a rapidly expanding industry provides us with a platform to generate stable and growing cash flows. Our plants are sited in robust fiber baskets providing stable pricing for the low-grade fiber used to produce wood pellets. Our raw materials are byproducts of traditional timber harvesting, principally low-value wood materials, such as trees generally not suited for sawmilling or other manufactured forest products, and tree tops and limbs, understory, brush and slash that are generated in a harvest.

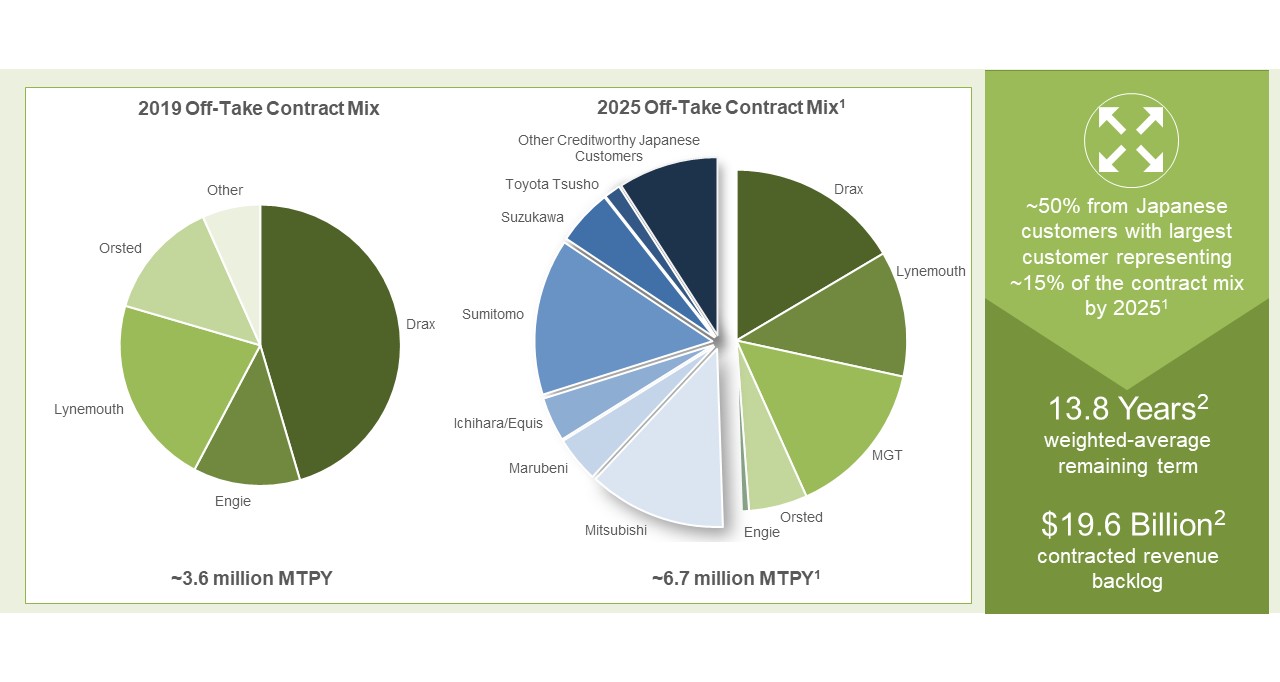

Our strategy is to fully contract the wood pellet production from our plants under long-term, take-or-pay off-take contracts with a diversified and creditworthy customer base. Our long-term off-take contracts typically provide for fixed-price deliveries that may include provisions that escalate the price over time and provide for other margin protection. During 2019, production capacity from our wood pellet production plants and wood pellets sourced from our affiliates and third parties were approximately equal to the contracted volumes under our existing long-term, take-or-pay off-take contracts. Our long-term, take-or-pay off-take contracts provide for a product sales backlog of $10.6 billion and have a total weighted-average remaining term of 11.4 years from February 1, 2020. Under our current product sales backlog, our plants are fully contracted through 2025. Assuming all volumes under the firm and contingent long-term off-take contracts held by our sponsor and the Sponsor JV were included with our product sales backlog for firm and contingent contracted product sales, our product sales backlog would increase to $19.6 billion and the total weighted-average remaining term from February 1, 2020 would increase to 13.8 years.

Our customers use our wood pellets as a substitute fuel for coal in dedicated biomass or co-fired coal power plants. Wood pellets serve as a suitable “drop-in” alternative to coal because of their comparable heat content, density and form. Due to the uninterruptible nature of our customers’ fuel consumption, our customers require a reliable supply of wood pellets that meet stringent product specifications. We have built our operations and assets to deliver and certify the highest levels of product quality and our proven track record of reliable deliveries enables us to charge premium prices for this certainty. In addition to our customers’ focus on the reliability of supply, they are concerned about the combustion efficiency of the wood pellets and their safe handling. Because combustion efficiency is a function of energy density, particle size distribution, ash/inert content and moisture, our customers require that we supply wood pellets meeting minimum criteria for a variety of specifications and, in some cases, provide incentives for exceeding our contract specifications.

Our Production Plants, Logistics and Storage Capabilities

We procure low-grade wood fiber and process it into utility-grade wood pellets and load the finished wood pellets into railcars, trucks and barges for transportation to deep-water marine terminals, where they are received, stored and ultimately loaded onto oceangoing vessels for delivery to our customers.

We own and operate seven industrial-scale wood pellet production plants strategically located in the Mid-Atlantic and Gulf Coast regions of the United States, geographic areas in which wood fiber resources are plentiful and readily available. Our plants are

4

constructed according to a “build and copy” approach, which allows for operating efficiencies. Furthermore, our multi-plant profile and scale provide us with flexibility under our portfolio of off-take contracts that enhances the reliability of our deliveries and provides opportunities for optimization.

Our facilities are designed to operate 24 hours per day, 365 days per year, although we schedule up to 15 days of planned maintenance for our wood pellet production plants during each calendar year. There are no regularly required major turnarounds or overhauls.

Mid-Atlantic Region Plants

The following table describes our wood pellet production plants in the Mid-Atlantic region:

Plant Location | Operations Commenced | Production (MTPY) | ||||

Ahoskie, North Carolina | 2011 | 415,000 | ||||

Northampton, North Carolina (1) | 2013 | 550,000 | ||||

Southampton, Virginia (1) | 2013 | 545,000 | ||||

Sampson, North Carolina (2) | 2016 | 555,000 | ||||

Hamlet, North Carolina (3) | 2019 | 500,000 | ||||

Total | 2,565,000 | |||||

(1) | Production capacities for the Northampton and Southampton plants do not include increased production capacity pursuant to ongoing expansion projects. We expect to commence the production ramp for the Northampton and Southampton plant expansions in the second and third quarters of 2020, respectively. |

(2) | We expect the Sampson plant to increase production capacity to 600,000 MTPY during 2020. |

(3) | The Hamlet plant currently has a production capacity of approximately 500,000 MTPY. We expect the Hamlet plant to reach its nameplate production capacity of approximately 600,000 MTPY by the end of 2020. |

Ahoskie

We acquired the site of our wood pellet production plant in Ahoskie, North Carolina (the “Ahoskie plant”) in December 2010 and constructed the Ahoskie plant there in less than one year, commencing operations in November 2011. Through an expansion completed in June 2012, we increased the plant’s production from 260,000 MTPY to 350,000 MTPY and have made further improvements to increase production to 415,000 MTPY of wood pellets.

Production from the Ahoskie plant is transported by truck to our Chesapeake terminal.

Hamlet

In April 2019, we acquired from our sponsor all of the Class B units of Enviva Wilmington Holdings, LLC (the “Hamlet JV,” and such acquisition, the “Hamlet Drop-Down”). The Hamlet JV owns a wood pellet production plant in Hamlet, North Carolina (the “Hamlet plant”). We are the managing member of the Hamlet JV, which is partially owned by John Hancock Life Insurance Company (U.S.A.) and certain of its affiliates (collectively, where applicable, “John Hancock”). We accounted for the Hamlet JV as a consolidated subsidiary, not as a joint venture, following the Hamlet Drop-Down. For more information regarding our rights and obligations with respect to the Hamlet JV, see Note 17, Partners’ Capital-Noncontrolling Interests—Hamlet JV.

The Hamlet plant currently has a production capacity of approximately 500,000 MTPY. We expect the Hamlet plant to reach its nameplate production capacity of approximately 600,000 MTPY by the end of 2020.

Production from the Hamlet plant is transported by rail to our Wilmington terminal.

Northampton

Our wood pellet production plant in Northampton, North Carolina (the “Northampton plant”) was constructed based on the Ahoskie plant design, utilizing the same major equipment suppliers. The Northampton plant currently produces 550,000 MTPY of wood pellets. We are currently engaged in an expansion project to increase the wood pellet production of the Northampton plant to 750,000 MTPY. We expect to commence the production ramp for the Northampton plant expansion in the second quarter of 2020.

Production from the Northampton plant is transported by truck to our Chesapeake terminal.

5

Sampson

Our wood pellet production plant in Sampson, North Carolina (the “Sampson plant”), which was built based on our templated design and which we acquired from our sponsor’s first development joint venture in December 2016, commenced operations during the fourth quarter of 2016 and currently produces 555,000 MTPY of wood pellets. We expect the production capacity of the Sampson plant to increase to 600,000 MTPY during 2020.

Production from the Sampson plant is transported by truck to our Wilmington terminal.

Southampton

We acquired a wood pellet production plant in Southampton County, Virginia (the “Southampton plant”) from our sponsor’s first development joint venture in December 2015. The Southampton plant is a build-and-copy replica of our Northampton plant and currently produces 545,000 MTPY of wood pellets. We are currently engaged in an expansion project to increase the production capacity of the Southampton plant to 745,000 MTPY of wood pellets. We expect to commence the production ramp for the Southampton plant expansion in the third quarter of 2020.

Production from the Southampton plant is transported by truck to our Chesapeake terminal.

Gulf Coast Region Plants

The following table describes our wood pellet production plants in the Gulf Coast region:

Plant Location | Acquisition Year | Production (MTPY) | |||

Cottondale, Florida | 2015 | 760,000 | |||

Amory, Mississippi | 2010 | 120,000 | |||

Total | 880,000 | ||||

Cottondale

Our sponsor acquired a wood pellet production plant in Cottondale, Florida (the “Cottondale plant”) in January 2015 and contributed it to us in April 2015. Following the acquisition of the Cottondale plant from our sponsor, the Cottondale plant has undergone several expansions and process improvements. Expansion projects since 2016 increased its production capacity from 720,000 MTPY to 760,000 MTPY of wood pellets.

Wood pellets produced by the Cottondale plant are transported approximately 50 miles by short-line rail to a warehouse that currently can store up to 32,000 metric tons (“MT”) of wood pellet inventory at the Panama City terminal.

Amory

We purchased a wood pellet production plant in Amory, Mississippi (the “Amory plant”) in August 2010. The Amory plant initially consisted of three pellet mills producing wood pellets at a rate of 41,500 MTPY. Through operational improvements and installation of a fourth pellet mill, the Amory plant currently produces 120,000 MTPY of wood pellets.

Production from the Amory plant is transported by barge to the Mobile terminal.

Wood Fiber Procurement and Sustainability

Our fleet of production plants is sited in robust fiber baskets in the Southeast United States that sustainably support our growth operations with low-grade fiber. Our sites minimize wood fiber procurement and logistics costs, which provides a structural cost of goods advantage over many other fiber baskets around the world. Although “stumpage,” the industry term for the amount of consideration paid for fiber, constitutes a small portion of our total cost of delivered products, wood fiber procurement is a vital function of our business and cost-effective access to wood fiber is an important factor in our pricing stability.

Wood fiber is a unique energy commodity in that, in resource basins like the Southern United States where we operate, more wood fiber grows each year than is harvested, meaning that the commodity is a negative depletion resource. Over the period from 1953 to 2015, the amount of timberland acreage in the U.S. South remained stable; however, during this same period wood fiber inventory stored in Southern forests increased by 108%. From 2000 to 2016, total wood fiber volume grew by approximately 39.1 billion cubic feet and total wood fiber drain was approximately 29.2 billion cubic feet in the four primary areas from which we source our wood fiber. As a result, net fiber volume grew by approximately 9.9 billion cubic feet, an increase of 24%. Between 2011,

6

the year in which we opened our first wood pellet production plant, and 2018, forest inventory in our overall supply base increased by more than 270 million metric tons, or 14%.

Because wood fiber is approximately 50% water at the time of harvest, it has a limited economically efficient distribution radius of roughly 75 miles. The combination of consistent excess supply over demand for a commodity that is not cost-effective to transport to new demand regions means that this stranded natural resource experiences structurally stable long-term pricing: during the period from 2000 to 2018, the delivered cost of fiber in North Carolina, one of our primary sourcing areas, increased at a modest 1.6% compound annual growth rate with limited annual volatility.

We and our customers are subject to stringent requirements regarding the sustainability of the fuels they procure. In addition to our internal sustainability policies and initiatives like our Responsible Sourcing Policy, our wood fiber procurement is conducted in accordance with leading forest certification standards. Our fiber supply chains are routinely audited by independent third parties. We maintain multiple forest certifications including: Forest Stewardship Council (FSC®) Chain of Custody, FSC® Controlled Wood, Programme for the Endorsement of Forest Certification (PEFC™) Chain of Custody, Sustainable Forestry Initiative (SFI®) Fiber Sourcing and SFI® Chain of Custody. We have obtained independent third-party certification for all of our plants to the applicable Sustainable Biomass Program (SBP) Standards.

Our wood fiber demand is complementary to, rather than in competition with, demand for high-grade wood for use by most other forest-related industries, such as lumber and furniture making. For example, improvements in the U.S. housing construction industry typically increase the demand for construction-quality lumber, which in turn increases the available supply of the low-cost pulpwood and mill residues that we use in wood pellet production. By using commercial thinnings and byproducts as raw materials, wood pellet production also indirectly supports other forest-related industries as well as the sustainable management of commercial forests.

We make wood pellets only with low-grade or leftover wood. On average, we receive approximately 31% of the volume of wood from an individual harvest and we estimate that we contribute approximately 10-15% of the economic value of an individual harvest. Our sponsor has created a first-of-its kind, proprietary Track and Trace® program to track the origin and characteristics of fiber that we use, and we publish this information, providing unprecedented transparency into our fiber sourcing activities.

The wood fiber used for wood pellet production predominantly is comprised of:

• | low-grade wood fiber: trees or wood that are unsuitable for or rejected by the sawmilling and lumber industries because of small size, defects (e.g. crooked or knotty), disease, or pest infestation; |

• | tops and limbs: the parts of trees that cannot be processed into lumber; |

• | commercial thinnings: harvests that promote the growth of higher value timber by removing weaker or deformed trees to reduce competition for water, nutrients, and sunlight; and |

• | mill residues: chips, sawdust and other wood industry byproducts. |

Demand for the non-merchantable fiber, waste products or byproducts that we use is generally low because they have few competing uses, in part because they cannot be transported cost-effectively. The tops, limbs and other low-grade wood fiber we purchase would otherwise generally be left on the forest floor, impeding reforestation, or burned. Wood pellet production provides a profitable use for the residues from sawmill and furniture industries and also for the trees that are thinned to support the growth of higher-value lumber-grade trees. U.S. demand for such low-grade wood fiber historically emerged from the pulp and paper industry. However, due to the decline in demand from paper and pulp, many landowners lack commercial markets for this wood fiber. Wood pellet producers help fill the gap.

As a result of the fragmented nature of tract ownership, we procure raw materials from hundreds of landowners, loggers, and timber industry participants, with no individual landowner representing a material fraction of any of our plants’ needs. Our wood fiber is procured under a variety of arrangements, including (1) logging contracts for the thinnings, pulpwood and other unmerchandised low-grade fiber, (2) in-woods chipping contracts where we may also provide the harvesting equipment and (3) contracts with timber dealers. Via our sponsor’s proprietary Track & Trace® system, we maintain traceability of the primary wood that is delivered to us directly from forests. Any supplier delivering wood to one of our plants must first share the details about the forest characteristics of the tract from which the wood is sourced with our forestry staff so we can verify that it meets our strict sustainability criteria. Our supplier contracts require a certification that the relevant tract information has been entered into our database before wood may be delivered directly from a particular tract. We summarize all such tract information periodically and publish tract-level details on our website. During 2019, we sourced wood fiber from approximately 310 suppliers, including brokers who source from landowners growing both hardwoods and softwoods and other suppliers. The diversity of our supply base and our facilities’ advantaged siting enables us to benefit from more reliable deliveries, at a lower cost, than others in our region or industry.

7

Plant Operations

Our plants receive wood fiber in both stem-length and chip form. When this raw material is delivered by truck from our suppliers, it is scaled for weight, checked for quality, and recorded consistent with our Track & Trace® system and Responsible Sourcing Policy requirements at the scale house at each of our plants. Each truck is then unloaded in a particular location in each respective plant’s woodyard based on the form and species (generally hardwood or softwood) of the raw material. Stem-length wood is stacked by radial or portal cranes and chips are piled, typically through automated conveyors to be reclaimed later for use. Stem-length wood is debarked prior to processing, providing fuel for each plant’s drying systems.

Following debarking, stem-length wood is size-reduced through a disc chipper, the chip product from which is co-mingled with delivered chips. The production process begins by mixing a specific formula of species and form factors of chips and metering them into a set of green hammer mills, which perform primary sizing. At this point, most of the wood fiber is between 45% and 55% moisture. The now-smaller chips are fed into a green chip bin and metered into a rotary kiln drier, where drying heat is provided by a biomass and bark-fueled furnace. The drying operation reduces moisture content to between 15% and 20%. Dried chips are fed from the drier to the secondary sizing process island, which comprises a combination of screening and dry-hammermilling to further size reduce the chips. The secondary sizing operation further reduces wood fiber moisture content to between 6% and 13%. This dry, further size-reduced flour or meal is stored in a dry storage silo and conveyed to ripening bins which further homogenize moisture prior to pelletizing. To the extent sawdust or other residuals are available, it is also size-reduced and combined with the processed wood fiber at this point in the process. The meal is metered into a series of pellet mills where hydraulic pressure extrudes the fiber into wood pellets. The pressure and temperature of the pelleting process activate natural lignin present in the wood which acts as a natural binder and finishes the pellet with a shiny exterior. The pellets are gravity fed into large coolers which utilize counter-current air flow to reduce pellet temperature and moisture. Once cool, the pellets, now approximately 5-7% moisture, are screened to reduce entrained dust and then conveyed to finished goods silos prior to being loaded onto trucks, railcars or barges depending upon the facility.

Our larger plants are staffed by approximately 85-90 employees including operators, maintenance technicians, quality leads and area, shift and operations supervisors. Plants operate two shifts per day, and the employees are spread across four teams alternating three days on, two days off, two days on and three days off with a rotation between day shift and night shift periodically. Plant management consists of a plant manager, operations manager, maintenance manager, quality manager, human capital manager and a safety manager, complemented by wood procurement, sustainability, accounting and engineering personnel.

Maintenance activities at the plant include planned and preventive maintenance as well as refurbishment of tools, dies, screens and hammers for key process equipment. The plants receive power from local utilities, have minimal process water requirements and limited exposure to fossil fuel volatility. The furnace burns wood in the form of bark and fuel chips as the source of heat for the dryer to evaporate moisture. Natural gas or propane is used as the energy source for emissions control equipment onsite like regenerative thermal oxidizers and a small amount of diesel is used in mobile equipment on each site. Very little waste besides office refuse leaves the plant as the by-product ash from the furnace operations is usually desirable as a fertilizer and is land-applied by local farmers.

To-Port Logistics and Port Infrastructure

Each of our plants is located near multiple truck, rail, river and ocean transportation access points. We also have inland waterway access and rail access at the Chesapeake, Wilmington and Panama City terminals. Our multi-year fixed-cost contracts with third-party logistics providers allow for long-term visibility into our to-port logistics cost structure.

The wood pellets produced at our plants are stored, terminaled, and shipped to our customers, principally in the U.K., Europe and increasingly in Japan. Limited deep-water, dry-bulk terminaling assets exist in the Southeastern United States, and very few of them have the appropriate handling and storage infrastructure necessary for receiving, storing and loading wood pellets. In response to such scarcity, we have vertically integrated our Mid-Atlantic operations downstream to encompass finished product logistics and storage. As a largely fixed cost and capital intensive piece of the value chain, we believe our port infrastructure allows us to ship incremental product from our regional plants at a fraction of the cost of our competitors. Management of port terminal infrastructure is also a key element in reducing distribution-related costs as it allows us to manage the arrival and loading of vessels. Additionally, we are able to improve our cost position by maintaining a dedicated berth where pellets from our Mid-Atlantic region plants have priority and equipment with sufficient load-rate capabilities to turn around vessels within the allotted time windows.

In addition to terminaling wood pellets from our production plants, we will, on occasion, provide terminaling services for third- and related-party wood pellet producers as well as for owners of other dry-bulk commodities.

8

Port Operation in the Mid-Atlantic Region

We acquired the Chesapeake terminal in January 2011 and converted it into a dry-bulk terminal. The Chesapeake terminal receives, stores and loads wood pellets for export and serves as the shipment point for products produced at our Ahoskie, Northampton and Southampton plants. The Chesapeake terminal accommodates Handysize, Supramax and Panamax-sized vessels, and has a 200-car rail yard adjacent to a Norfolk Southern track, a loading/unloading system that accommodates deliveries by truck, rail and barge and a highly automated conveying system. In May 2011, we erected a 157-foot tall, 175-foot wide storage dome that receives, stores and loads up to 45,000 MT of wood pellets. In April 2013, we placed into operation a second storage dome at the site to add an additional 45,000 MT of storage.

The Chesapeake terminal’s storage and loading capacity is more than adequate to store and facilitate the loading of the wood pellets produced at our Ahoskie, Northampton and Southampton plants, and its location decreases our customers’ transportation time and costs. Efficiently positioned near our Ahoskie, Northampton and Southampton plants, the Chesapeake terminal delivers up to a three- to four-day European shipping advantage compared to other Southern or Gulf Coast ports. In addition, because we own the Chesapeake terminal, we enjoy preferential berth access and loading, which minimizes costs of shipping and logistics without the need for excess storage. Our ownership and operation of this terminal enable us to control shipment of the production of our Mid-Atlantic region plants that it serves.

Wood pellets produced at our Sampson and Hamlet plants, and the Greenwood plant, are terminaled at our Wilmington terminal. The Wilmington terminal accommodates Handysize, Supramax and Panamax-sized vessels, and has a receiving system that accommodates deliveries by truck and rail, a highly automated conveying system and two wood pellet storage domes with capacities of 45,000 MT each. The Wilmington terminal’s storage and loading capacity is more than adequate to store and facilitate the loading of wood pellets produced at our Sampson and Hamlet plants and the Greenwood plant and its location decreases transportation time and costs through the entire supply chain. We benefit from preferential berth access and loading at our Wilmington terminal, which minimizes costs of shipping and logistics without need for excess storage.

Port Operation in the Gulf Coast Region

Wood pellets from our Cottondale plant are transported via short‑line rail to the Panama City terminal, where we store up to 32,000 MT of wood pellet inventory in a warehouse at Port Panama City. Production from the Cottondale plant is received, stored and loaded under a long‑term terminal services agreement with the Panama City Port Authority and a stevedoring contract, each of which runs through September 2023 and may be extended by us for an additional five-year period.

Wood pellets produced at our Amory plant are transported by barge to the Mobile terminal, where, pursuant to a services agreement with Cooper Marine & Timberlands (“Cooper”), we export from Cooper’s ChipCo terminal. This privately owned and maintained deep-water, multi-berth terminal operates 24 hours per day, seven days per week and is the fleeting and loading point for production from our Amory plant. The Amory plant is sited along a major inland waterway that makes transportation to the Mobile terminal easy and efficient, thereby reducing emissions and costs. Our ability to store our wood pellets in barges provides a capital-light, flexible solution that accommodates the storage needs of the Amory plant.

Please read Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recent Developments” for more information regarding our plants, terminals and other long‑lived assets.

Our Contracts

We refer to the structure of our long-term sales contracts as “take-or-pay” because they include a firm obligation of the customer to take a fixed quantity of product at a stated price and provisions for us to be compensated in the event of a customer’s failure to accept all or a part of the contracted volumes or for termination of a contract by a customer. Our long-term sales contracts typically provide for annual inflation-based adjustments or price escalators. Certain of our long-term sales contracts also contain provisions that allow us to increase or decrease the volume of product that we deliver by a percentage of the base annual volume, as well as cost pass-through mechanisms related to stumpage, fuel, or transportation costs (including pricing fluctuations in bunker fuel) and price adjustments based on actual product specifications. In addition, many of our long-term sales contracts provide for cost recovery and sharing arrangements in connection with certain changes in law or sustainability requirements as well as payments to us in the case of their termination as a result of such changes. In order to mitigate volatility in our shipping costs, we have entered into fixed-price shipping contracts with reputable shippers to form a shipping portfolio matching the terms and volumes of our sales contracts for which we are responsible for arranging shipping.

We also have entered into several other contracts that have smaller off-take quantities than the contracts described above. We diversified our customer base during 2019; however, our four largest customers accounted for 94% of our product sales in 2019.

9

In some cases, we may purchase shipments of product from third-party suppliers and resell them in back-to-back transactions. We determined that we are the principal in such transactions because we control the pellets prior to transferring them to the customer and therefore we recognize the related revenue on a gross basis in product sales.

In some instances, a customer may request to cancel, defer or accelerate a shipment, in which case we seek to optimize our position by selling or purchasing the subject shipment to or from another party, including in some cases a related party, either within our contracted off‑take portfolio or as an independent transaction on the spot market. In most instances, the original customer pays us a fee, including reimbursement of any incremental costs, which is included in other revenue. Other revenue also includes certain sales and marketing, scheduling, sustainability, consultation, shipping and risk management services (collectively, the “Commercial Services”) that are outside of the scope of an existing take-or-pay off-take contract.

We also provide terminaling services for third- and related-party wood pellet producers as well as for owners of other dry-bulk commodities.

The following chart presents information relating to our, our sponsor’s and the Sponsor JV’s long-term, take-or-pay off-take contracts:

____________________________________________

(1) | Includes base annual delivery quantity and excludes the impact of the Partnership, our sponsor and the Sponsor JV’s option to increase or decrease the annual delivery quantity under the associated off-take contracts. |

(2) | As of February 1, 2020, includes all volumes under the firm and contingent off-take contracts held by the Partnership, our sponsor and the Sponsor JV. Although we expect to have the opportunity to acquire these contracts from our sponsor and the Sponsor JV, there can be no guarantee that we will acquire these, or any, contracts from our sponsor or the Sponsor JV. |

With our existing long-term, take-or-pay off-take contracts, all of the current production capacity of our production plants is fully contracted. As our current off-take contracts expire, we will seek to re-contract our capacity with a combination of renewals with existing customers, the assumption of additional contracts from our sponsor and the entry into contracts with new customers.

Contracted backlog

As of February 1, 2020, we had approximately $10.6 billion of product sales backlog for firm and contingent contracted product sales to our long-term off-take customers with a total weighted-average remaining term of 11.4 years. Contracted backlog represents the revenue to be recognized under existing contracts assuming deliveries occur as specified in the contracts. Contracted future product sales denominated in foreign currencies, excluding revenue hedged with foreign currency forward contracts, are included in

10

U.S. Dollars at February 1, 2020 forward rates. The contracted backlog includes forward prices including inflation, foreign currency and commodity prices. The amount also includes the effects of related foreign currency derivative contracts.

Our expected future product sales revenue under our contracted backlog as of February 1, 2020 is as follows (in millions):

Period from February 1, 2020 to December 31, 2020 | $ | 782 | |

Year ending December 31, 2021 | 1,043 | ||

Year ending December 31, 2022 and thereafter | 8,751 | ||

Total product sales contracted backlog | $ | 10,576 | |

Assuming all volumes under the firm and contingent off-take contracts held by our sponsor and its joint ventures were included with our product sales backlog for firm and contingent contracted product sales, the total weighted-average remaining term as of February 1, 2020 would increase to 13.8 years and product sales contracted backlog would increase to $19.6 billion as follows (in millions):

Period from February 1, 2020 to December 31, 2020 | $ | 782 | |

Year ending December 31, 2021 | 1,086 | ||

Year ending December 31, 2022 and thereafter | 17,699 | ||

Total product sales contracted backlog | $ | 19,567 | |

Included in the product sales contracted backlog above are $1.3 billion and $3.9 billion of contingent contracts held by the Partnership, our sponsor and the Sponsor JV, respectively.

Industry Overview

Our product, utility-grade wood pellets, is used as a substitute for coal in both dedicated and co-fired power generation and combined heat and power plants. It enables major power, heat or combined heat and power generators (“generators”) to profitably generate electricity and heat in a manner that reduces the overall cost of compliance with certain mandatory greenhouse gas (“GHG”) emissions limits and renewable energy targets while also allowing countries to diversify their sources of electricity supply.

Unlike intermittent sources of renewable generation like wind and solar power, wood pellet-fired plants are capable of meeting baseload electricity demand and are dispatchable (that is, power output can be switched on or off or adjusted based on demand). As a result, utilities and major generators in Europe, Asia and other areas have made and continue to make long-term, profitable investments in power plant conversions and new builds of generating assets that either co-fire wood pellets with coal or are fully dedicated wood pellet-fired plants. Such developments help generators maintain and increase baseload generating capacity and comply with binding climate change regulations and other emissions reduction targets.

The capital costs required to convert a coal plant to co-fire biomass, or to burn biomass exclusively, are a fraction of the capital costs associated with implementing offshore wind and most other renewable technologies. Furthermore, the relatively quick process of converting coal-fired plants to biomass-fired generation can be an attractive benefit for generators whose generation assets are no longer viable as coal plants due to the expiration of operating permits, regulatory phase-out of coal-fired power generation, the introduction of taxes or other restrictions on fossil fuel usage or emissions of GHGs and other pollutants.

There also continues to be significant growth in the European and Asian demand for wood pellets as a preferred fuel source and renewable alternative to fossil fuels for district heating loops, for heating homes and commercial buildings and for the production of process heat for industrial sites. Increasingly, wood pellets are also being sought as a raw material input for bio-based substitutes for traditional fossil fuel-based fuels and chemicals. As these markets further develop, we believe we will continue to have opportunities to serve this growing material demand beyond our current product sales backlog.

Competition

We compete with other utility-grade wood pellet producers for long-term, take-or-pay off-take contracts with major power generation customers and trading houses. Competition in our industry is based on the price, quality and consistency of the wood pellets produced, the reliability of wood pellet deliveries and the producer’s ability to verify and document, through customer and third-party audits, that its wood pellets meet the regulatory sustainability obligations of a particular customer.

11

Most of the world’s current wood pellet production plants are owned by small, private companies, with few companies owning or operating multiple plants. Few companies have the scale, technical expertise or commercial infrastructure necessary to supply utility-grade wood pellets under large, long-term off-take contracts with generators.

We are the largest producer by production capacity, and consider other companies with comparable scale, technical expertise or commercial infrastructure to be our competitors, including AS Graanul Invest, Pinnacle Renewable Energy Inc., Drax Biomass Inc., Georgia Biomass, LLC, Fram Renewable Fuels, LLC, Highland Pellets LLC and Pacific BioEnergy Corporation.

Our Relationship with Our Sponsor

The Riverstone Funds became the majority owners of our sponsor in March 2010.

We entered into a purchase rights agreement with our sponsor pursuant to which our sponsor agreed to provide us with a right of first offer to purchase any wood pellet production plant or deep‑water marine terminal that it, its subsidiaries or any other entity that it controls (including its joint venture with John Hancock (the “Sponsor JV”)) owns and proposes to sell (each, a “ROFO Asset”) for a five-year period. Pursuant to an amendment, the term of the purchase rights agreement was extended to May 2021 and will automatically renew on an annual basis unless either party provides notice of termination within 60 days prior to the end of the then-current term.

We will have 30 days following receipt of notice of our sponsor entity’s intention to sell a ROFO Asset to propose an offer for the ROFO Asset. If we submit an offer, our sponsor will negotiate with us exclusively and in good faith to enter into a letter of intent or definitive documentation for the purchase of the ROFO Asset on mutually acceptable terms. If we are unable to agree to terms within 45 days, our sponsor entity will have 150 days to enter into definitive documentation with a third party purchaser on terms that are, in the good faith judgment of our sponsor entity selling such ROFO Assets, superior to the most recent offer proposed by us.

We expect to continue to pursue the acquisition of such assets from our sponsor and the Sponsor JV to the extent they are supported by long-term off-take contracts with creditworthy counterparties and have long useful lives, stable cost positions and advantaged locations.

Our sponsor owns approximately 40% of our common units and 100% of our General Partner. Our General Partner owns all of our incentive distribution rights, which entitle our General Partner to increasing percentages of our cash distributions above certain targets. As a result, our sponsor is incentivized to facilitate our access to accretive acquisition and organic growth opportunities, including those pursuant to the purchase rights agreement.

The Sponsor JV is developing and constructing certain wood pellet production and terminaling assets in the Southeastern United States. Our sponsor is the managing member of the Sponsor JV and Enviva Management is the operator of the Sponsor JV and is responsible for managing its activities, including the development and construction of its development projects.

Although we expect to continue to have the opportunity to acquire assets, including from our sponsor and the Sponsor JV, our sponsor and the Sponsor JV may not complete their development projects, and our sponsor may not decide to sell, or compel the Sponsor JV to sell, assets or completed development projects to us.

Our Sponsor’s Assets and Development Projects

Greenwood Plant

The Sponsor JV acquired the wood pellet production plant located in Greenwood, South Carolina (the “Greenwood plant”) as its first investment. Our sponsor intends to invest incremental capital in the Greenwood plant to significantly expand production capacity to 600,000 MTPY of wood pellets, subject to receiving the necessary permits.

In February 2018, we entered into a contract with Enviva Pellets Greenwood, LLC (“Greenwood”) to purchase wood pellets produced by the Greenwood plant through March 2022 and have a take-or-pay obligation beginning in 2021 with respect to 550,000 MTPY of wood pellets (prorated for partial contract years), subject to Greenwood’s option to increase or decrease the volume by 10% each contract year. Wood pellets produced at the Greenwood plant are exported from our Wilmington terminal.

Other Sponsor Development Projects

The Sponsor JV is also constructing a wood pellet production plant in Lucedale, Mississippi (the “Lucedale plant”) as well as a deep-water marine terminal in Pascagoula, Mississippi (the “Pascagoula terminal”). In addition, our sponsor is developing a wood pellet production plant in Epes, Alabama (the “Epes plant”) along with other sites in Mississippi and Alabama. Our sponsor employs a “build and copy” approach to constructing production plants and terminals, allowing synergies of common processes and

12

operational knowledge. We expect to have the opportunity to acquire assets and off-take contracts from our sponsor and the Sponsor JV.

Environmental Matters

Our operations are subject to stringent and comprehensive federal, state and local laws and regulations governing matters including protection of the environment and natural resources, occupational health and safety and the release or discharge of materials into the environment, including air emissions and wastewater discharges. These laws and regulations may (1) require acquisition, compliance with and maintenance of certain permits or other approvals to conduct regulated activities, (2) impose technology requirements or standards on our operations, (3) restrict the amounts and types of substances that may be discharged or emitted into the environment, (4) limit or prohibit construction or timbering activities in sensitive areas such as wetlands or areas inhabited by endangered or threatened species, (5) govern worker health and safety aspects of operations, (6) require measures to investigate, mitigate or remediate releases of hazardous or other substances from our operations and (7) impose substantial liabilities, including possible fines and penalties, for unpermitted emissions or discharges from our operations. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of investigatory and remedial obligations and the issuance of orders enjoining some or all of our operations in affected areas.

Moreover, the global trend in environmental regulation is towards increasingly broad and stringent requirements for activities that may affect the environment. Any changes in environmental laws and regulations or re‑interpretation of enforcement policies that result in more stringent and costly requirements could have a material adverse effect on our operations and financial position. Although we monitor environmental requirements closely and budget for the expected costs, actual future expenditures may be different from the amounts we currently anticipate spending. Moreover, certain environmental laws impose strict joint and several liability for costs to clean up and restore sites where pollutants have been disposed or otherwise spilled or released. We cannot assure that we will not incur significant costs and liabilities for remediation or damage to property, natural resources or persons as a result of spills or releases from our operations or those of a third party. Although we believe that our competitors face similar environmental requirements, market factors may prevent us from passing on any increased costs to our customers. Additionally, although we believe that continued compliance with existing requirements will not materially adversely affect us, there is no assurance that the current levels of regulation will continue in the future.

The following summarizes some of the more significant existing environmental, health and safety laws and regulations applicable to our operations, the failure to comply with which could have a material adverse impact on our capital expenditures, results of operations and financial position.

Air Emissions

The federal Clean Air Act, as amended (the “CAA”), and state and local laws and regulations that implement and add to CAA requirements, regulate the emission of air pollutants from our facilities. The CAA and state and local laws and regulations impose significant monitoring, testing, recordkeeping and reporting requirements for these emissions. These laws and regulations require us to obtain pre-approval for the construction or modification of certain projects or facilities expected to produce or significantly increase air emissions, obtain and strictly comply with stringent air permit emission limits, and in certain cases utilize specific equipment or technologies to control and measure emissions. Obtaining these permits can be both costly and time intensive and has potential to delay opening of new plants or significant expansion of existing plants; moreover, complying with these permits, including satisfying testing requirements, can also be costly and time-intensive. Failure to comply with these laws, regulations and permit requirements may cause us to face fines, penalties or injunctive orders in connection with air pollutant emissions from our operations.

The CAA requires that we obtain various construction and operating permits, including, in some cases, Title V air permits. In certain cases, the CAA requires us to incur capital expenditures to install air pollution control devices at our facilities. We are also required to control fugitive emissions from our operations and may face fines, penalties or injunctive orders in connection with fugitive emissions from our operations. We have incurred, and expect to continue to incur, substantial administrative, operating and capital expenditures to maintain compliance with CAA requirements that have been promulgated or may be promulgated or revised in the future.

Climate Change and Greenhouse Gases

Our operations are subject to limited direct regulation with respect to emissions of GHGs. For example, at this time, the U.S. Environmental Protection Agency (the “EPA”) requires certain large facilities to undergo CAA pre-construction review and obtain operating permits for their GHG emissions. Our operations are also indirectly affected by regulations regarding the carbon treatment of biomass. While several jurisdictions to which we ship our products treat biomass as a carbon-neutral fuel, certain environmental groups have criticized this determination and are attempting to have it changed. For example, lawsuits have been filed in the European Union (the “EU”) challenging the sufficiency of the Renewable Energy Directive II (“RED II”) in addressing climate

13

concerns, including challenging the treatment of biomass. Similar lawsuits have been brought against the European Investment Bank (the “EIB”) for financing the construction of biomass-fired power plants. A change in the characterization of biomass could negatively impact demand for our products. Finally, scientists have concluded that increasing concentrations of GHGs in the earth’s atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, floods and other climatic events, including forest fires. If any such effects were to occur, they could have an adverse effect on our operations.

Water Discharges

The Federal Water Pollution Control Act, as amended (the “Clean Water Act”), as well as state laws and regulations that implement, and may be more stringent than, the Clean Water Act, restrict the discharge of pollutants into waters of the United States. Any such discharge of pollutants must be performed in accordance with the terms of a permit issued by the EPA or the implementing state agency. In addition, the Clean Water Act and implementing state laws and regulations require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. Federal and state regulatory agencies can impose administrative, civil and criminal penalties for non‑compliance with discharge permits or other requirements of the Clean Water Act and analogous state laws and regulations. These permits generally have a term of five years. Certain of our facilities hold such discharge permits. Changes to the terms and conditions of our permits in future renewals or new or modified regulations could require us to incur additional capital or operating expenditures, which may be material.

Pursuant to the Clean Water Act, the EPA has adopted the Discharge of Oil regulation, which requires any person in charge of an onshore facility to report any discharge of a harmful quantity of oil into U.S. navigable waters, adjoining shorelines or the contiguous zone. A harmful quantity is any quantity of discharged oil that violates state water quality standards, causes a film or sheen on the water’s surface or leaves sludge or emulsion beneath the surface. Spills from our production plants that are located along waterways or from our deep-water marine terminal facilities may result in fines, penalties and obligations to respond to and remediate any such spills. We could also be liable for removal and remediation costs, as well as damages to natural resources, in the event of an unauthorized discharge of oil from one of our facilities.

Spill Response and Release Reporting

Certain of our facilities are subject to federal requirements to prepare for and respond to spills or releases from tanks and other equipment located at these facilities and provide training to employees on operation, maintenance and discharge prevention procedures and the applicable pollution control laws. At such facilities, we have developed or will develop Spill Prevention, Control and Countermeasure plans to memorialize our preparation and response plans and will update them on a regular basis. From time to time, these requirements may be made more stringent and may require us to modify our operations or expand our plans accordingly. The costs of implementing any such modifications or expansion may be significant. In addition, in the event of a spill or release, we may incur fines or penalties or incur responsibility for damage to natural resources, private property or personal injury in addition to obligations to respond to and remediate any such spill or release.

Endangered Species Act

The federal Endangered Species Act, as amended (the “ESA”), restricts activities that may affect endangered and threatened species or their habitats. Although some of our facilities may be located in areas that are designated as habitats for endangered or threatened species, this has not so far had a material adverse impact on our business. Some of our suppliers may source materials from locations that provide habitats for species that are protected under the ESA, which may extend the time required to access those areas, or may impose conditions or restrictions on accessing those areas in a way that restricts our ability to obtain raw materials for our wood pellet production plants. Moreover, as a result of a settlement approved by the U.S. District Court for the District of Columbia on September 9, 2011, the U.S. Fish and Wildlife Service is required to make a determination regarding the listing of more than 250 species by the end of the agency’s 2017 fiscal year. While the agency did not complete its review by the deadline, that process reportedly remains underway. The designation of previously unidentified endangered or threatened species could cause us to incur additional costs or become subject to operating restrictions or bans in the affected areas, which could have an adverse impact on the availability or price of raw materials.

Coastal Area Protection and Wetlands and Navigable Waters Activity Regulations

Our terminals are located in areas that are subject to the various federal and state programs that regulate the conservation and development of coastal resources. At the federal level, the Coastal Zone Management Act (the “CZMA”) was enacted to preserve, protect, develop and, where possible, restore or enhance valuable natural coastal resources of the U.S. coastal zone. The CZMA authorizes and provides grants for state management programs to regulate land and water use and coastal development. Requirements under the CZMA may affect the siting of any new terminals and could impact the expansion of modification of existing terminal facilities. The CZMA process may result either in delays in obtaining the required authorizations to construct a new terminal or expand an existing terminal or conditions that may restrict the construction or operation of our terminals.

14

In addition to the CZMA, requirements under the Clean Water Act and related federal laws may result in federal or state regulators imposing conditions or restrictions on our operations or construction activities. For instance, the dredge and fill provisions of the Clean Water Act require a permit to conduct construction activities in protected waters and wetlands and prohibit unpermitted discharges of fill materials. Likewise, the Rivers and Harbors Act requires permits for the construction of certain port structures. Although compliance has not previously had a material adverse impact on our business, any delays in obtaining future permits or renewals, or the inclusion of restrictive conditions in such permits, could adversely affect the cost of, or result in delays to, our operations and the construction of new, or expansion of existing, terminals.

Safety and Maintenance

We are subject to a number of federal and state laws and regulations, including the federal Occupational Safety and Health Act, as amended (“OSHA”), and comparable state statutes, whose purpose is to protect the health and safety of workers. We have a corporate health and safety program that governs the way we conduct our operations at our facilities. Our employees receive OSHA training that is appropriate and tailored to the tasks performed at our facilities and general training on our health and safety plans. Compliance with OSHA and general training is mandatory. We perform preventive and routine maintenance on all of our manufacturing and deep-water marine terminaling systems and make repairs and replacements when necessary or appropriate. We also conduct routine and required inspections of those assets in accordance with applicable regulations. In addition, the OSHA hazard communication standards in the Emergency Planning and Community Right-to-Know Act and comparable state statutes require that information be maintained concerning hazardous materials used or produced in our operations and that this information be provided to employees, state and local governmental authorities and citizens. Our facilities adhere to National Fire Protection Association (NFPA) standards for combustible dust and incorporate pollution control equipment such as cyclones, baghouses and electrostatic precipitators to minimize regulated emissions. Our deep-water marine terminals adhere to Homeland Security/U.S. Coast Guard regulations regarding physical security and emergency response plans. We continually strive to maintain compliance with applicable air, solid waste and wastewater regulations; nevertheless, we cannot guarantee that serious accidents will not occur in the future.

Seasonality

Our business is affected by seasonal fluctuations. The cost of producing wood pellets tends to be higher in the winter months because of increases in the cost of delivered raw materials, primarily due to a reduction in accessibility during cold and wet weather conditions. Our raw materials typically have higher moisture content during this period, resulting in a lower product yield; moreover, the cost of drying wood fiber increases during periods of lower ambient temperatures.

The increase in demand for power and heat during the winter months drives greater customer demand for wood pellets. As some of our wood pellet supply to our customers is sourced from third-party purchases, we may experience higher wood pellet costs and a reduction in our gross margin during the winter months.

Employees

We are party to management services agreements (the “MSAs”) with Enviva Management, pursuant to which Enviva Management provides us with the employees, management and services necessary for the operation of our business. As of December 31, 2019, Enviva Management had 1,039 employees. Please read Part II, Item 13. “Certain Relationships and Related Transactions, and Director Independence—Other Transactions with Related Persons--Management Services Agreement” for more information regarding our MSA with Enviva Management.

Principal Executive Offices

We lease office space for our principal executive offices at 7200 Wisconsin Avenue, Suite 1000, Bethesda, Maryland 20814. The lease expires in June 2024.

Available Information

We file annual, quarterly and current reports and other documents with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The SEC maintains a website at www.sec.gov that contains reports and other information regarding issuers that file electronically with the SEC.

We also make available free of charge our Annual Reports on Form 10‑K, Quarterly Reports on Form 10-Q, Current Reports on Form 8‑K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, simultaneously with or as soon as reasonably practicable after filing such materials with, or furnishing such materials to, the SEC and on or through our website, www.envivabiomass.com. The information on our website, or information about us on any other website, is not incorporated by reference into this Annual Report.

15

ITEM 1A. | RISK FACTORS |

There are many factors that could have a material adverse effect on our business, financial condition, results of operations and cash available for distribution. New risks may emerge at any time and we cannot predict those risks or estimate the extent to which they may affect financial performance. Each of the risks described below could adversely impact the value of our common units.

Risks Inherent in Our Business

We may not have sufficient cash from operations following the establishment of cash reserves and payment of costs and expenses, including cost reimbursements to our General Partner and its affiliates, to enable us to pay quarterly distributions to our unitholders at our current distribution rate.

We may not have sufficient cash each quarter to enable us to pay quarterly distributions at our current distribution rate. The amount of cash we can distribute on our common units principally depends upon the amount of cash we generate from our operations, which fluctuates from quarter to quarter based on the following factors, some of which are beyond our control:

• | the volume and quality of products that we are able to produce or source and sell, which could be adversely affected by, among other things, operating or technical difficulties at our wood pellet production plants or deep-water marine terminals; |

• | the prices at which we are able to sell our products; |

• | our ability to successfully negotiate, complete and integrate drop-down or third-party acquisitions, including the associated contracts, or to realize the anticipated benefits of such acquisitions; |

• | failure of our customers, vendors and shipping partners to pay or perform their contractual obligations to us; |

• | our inability to successfully execute our project development and construction activities, including the expansion of our Northampton and Southampton plants, on time and within budget; |

• | the creditworthiness of our contract counterparties; |

• | the amount of low‑cost wood fiber that we are able to procure and process, which could be adversely affected by, among other things, disruptions in supply or operating or financial difficulties suffered by our suppliers; |

• | changes in the price and availability of natural gas, coal or other sources of energy; |

• | changes in prevailing economic conditions; |

• | unanticipated ground, grade or water conditions; |

• | inclement or hazardous environmental conditions, including extreme precipitation, temperatures and flooding; |

• | fires, explosions or other accidents; |

• | changes in domestic and foreign laws and regulations (or the interpretation thereof) related to renewable or low‑carbon energy, the forestry products industry, the international shipping industry or power, heat or combined heat and power generators; |

• | changes in the regulatory treatment of biomass in core and emerging markets; |

• | our inability to acquire or maintain necessary permits or rights for our production, transportation or terminaling operations; |

• | changes in the price and availability of transportation; |

• | changes in foreign currency exchange or interest rates, and the failure of our hedging arrangements to effectively reduce our exposure to the risks related thereto; |

• | risks related to our indebtedness; |

16

• | our failure to maintain effective quality control systems at our production plants and deep‑water marine terminals, which could lead to the rejection of our products by our customers; |

• | changes in the quality specifications for our products that are required by our customers; |

• | labor disputes; |

• | our inability to hire, train or retain qualified personnel to manage and operate our business and newly acquired assets; |

• | the effects of the exit of the U.K. from the European Union on our and our customers’ businesses; and |

• | our inability to borrow funds and access capital markets. |

In addition, the actual amount of cash we have available for distribution depends on other factors, some of which are beyond our control, including:

• | the level of capital expenditures we make; |

• | fluctuations in our working capital needs; |

• | our treatment as a pass‑through entity for U.S. federal income tax purposes; |

• | our debt service requirements and other liabilities; |

• | restrictions contained in our existing or future debt agreements; and |

• | the amount of cash reserves established by our General Partner. |

The amount of cash we have available for distribution to holders of our units depends primarily on our cash flow and not solely on profitability, which may prevent us from making cash distributions during periods when we record net income.

The amount of cash we have available for distribution depends primarily upon our cash flow, including cash flow from reserves and working capital or other borrowings, and not solely on profitability, which will be affected by non‑cash items. As a result, we may pay cash distributions during periods when we record net losses for financial accounting purposes and may be unable to pay cash distributions during periods when we record net income.

Substantially all of our revenues currently are generated under contracts with five customers, and the loss of any of them could adversely affect our business, financial condition, results of operations, cash flows and ability to pay distributions to our unitholders. We may not be able to renew or obtain new and favorable contracts with these customers when our existing contracts expire, and we may not be able to obtain contracts with new customers, which could adversely affect our revenues and profitability.

Our contracts with Drax, Lynemouth Power, ENGIE, MGT and Ørsted will represent substantially all of our product sales volumes in 2020; as a result, we face counterparty concentration risk. The ability of each of our customers to perform its obligations under a contract with us will depend on a number of factors that are beyond our control and may include the overall financial condition of the counterparty, the counterparty’s access to capital, the condition of the regional and global power, heat and combined heat and power generation industry, continuing regulatory and economic support for wood pellets as a fuel source, spot market pricing trends and general economic conditions. In addition, in depressed market conditions, our customers may no longer need the amount of our products they have contracted for or may be able to obtain comparable products at a lower price. If our customers experience a significant downturn in their business or financial condition, they may attempt to renegotiate, reject or declare force majeure under our contracts. Should any counterparty fail to honor its obligations under a contract with us, we could sustain losses, which could have a material adverse effect on our business, financial condition, results of operations and cash available for distribution. We may also decide to renegotiate our existing contracts on less favorable terms and/or at reduced volumes in order to preserve our relationships with our customers.

Upon the expiration of our off-take contracts, our customers may decide not to recontract on terms as favorable to us as our current contracts, or at all. For example, our current customers may acquire wood pellets from other providers that offer more competitive pricing or logistics or develop their own sources of wood pellets. Some of our customers could also exit their current business or be acquired by other companies that purchase wood pellets from other providers. The demand for wood

17

pellets or their prevailing prices at the times at which our current off‑take contracts expire may also render entry into new long-term-off-take contracts difficult or impossible.