Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Conifer Holdings, Inc. | cnfr-8k_20200226.htm |

Exhibit 99.1

News Release

For Further Information:

Jessica Gulis, 248.559.0840

ir@cnfrh.com

Conifer Holdings Reports 2019 Fourth Quarter Financial Results

Company to Host Conference Call at 8:30 AM ET on Thursday, February 27, 2020

Birmingham, MI, February 26, 2020 - Conifer Holdings, Inc. (Nasdaq: CNFR) (“Conifer” or the “Company”) today announced results for the fourth quarter and year ended December 31, 2019.

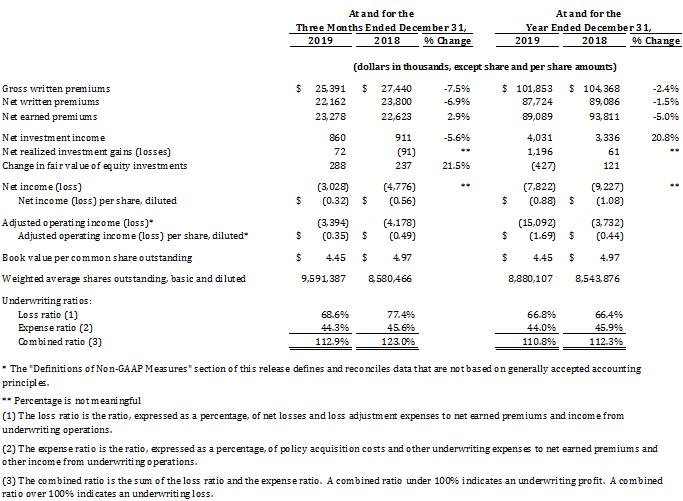

Fourth Quarter 2019 Financial Highlights (compared to the prior year period)

|

• |

Gross written premium decreased 7.5% to $25.4 million |

|

• |

Commercial Lines combined ratio was 111.3% (with accident year combined ratio of 98.0%) |

|

• |

Personal Lines combined ratio was 132.5% (with accident year combined ratio of 98.5%) |

|

• |

The Company’s overall combined ratio was 112.9% (accident year combined ratio was 98.1%) |

|

• |

Net loss of $3.0 million, or $0.32 per share based on 9.6 million average shares outstanding |

Year End 2019 Financial Highlights

|

• |

Gross written premium overall declined to $101.9 million from $104.4 million |

|

• |

Combined ratio was 110.8% (accident year combined ratio of 99.0%) |

|

• |

Net loss of $7.8 million, or $0.88 per share based on 8.9 million average shares outstanding |

|

• |

Book value per share of $4.45 at December 31, 2019 |

Management Comments

James Petcoff, Chairman and CEO, commented, “For the year, the Company continued its transition in our specialty markets where we have a competitive advantage and expect to grow to be a leader. While we experienced higher than anticipated losses in certain commercial lines in the fourth quarter, we feel strongly that we are well positioned to show substantial growth in 2020, leading to improved profitability.”

Conifer Holdings, Inc.Page 2

Febuary 26, 2020

Financial Results for the Three Months Ended and Year Ended December 31, 2019

Gross Written Premiums

Gross written premiums decreased 7.5% in the fourth quarter of 2019 to $25.4 million, compared to $27.4 million in the prior year period. The decrease was largely due to non-renewal of certain hospitality business. In addition, the Company reported higher gross written premiums in its personal lines, driven by stable growth in its low-value dwelling line.

Net Earned Premiums

Net earned premiums increased 2.9% to $23.3 million for the fourth quarter of 2019, compared to $22.6 million for the prior year period. The increase was in both commercial and personal lines and was partially due to lower reinsurance costs.

Conifer Holdings, Inc.Page 3

Febuary 26, 2020

Commercial Lines Financial and Operational Review

The Company’s commercial lines of business, representing 91.9% of total gross written premium in the fourth quarter of 2019, primarily consists of property and liability coverage offered to owner-operated small- to mid-sized businesses, such as hospitality risks including restaurants, bars, taverns and professional organizations.

Commercial lines gross written premium declined 10.6% in the fourth quarter of 2019 as the Company continues to shift its mix towards more profitable specialty lines.

For the full year 2019, the commercial lines loss ratio was 63.3%, with profitable current year operations being offset by prior-year development.

The commercial lines accident year combined ratio was 97.6% for the full year and 98.0% for the quarter.

Conifer Holdings, Inc.Page 4

Febuary 26, 2020

Personal Lines Financial and Operational Review

Personal lines, representing 8.1% of total gross written premium for the fourth quarter of 2019, consists largely of low-value dwelling homeowner’s insurance. Personal lines gross written premium increased 52.8% to $2.1 million in the fourth quarter of 2019 compared to the prior year period, largely due to renewed growth in the Company’s low-value dwelling line of business.

The loss ratio for the three months ended December 31, 2019 was 80.5%, compared to 93.3% in the prior year period, largely driven by losses from wind-exposed homeowners lines (specifically Florida homeowners). The Company’s wind-exposed lines of business continue to represent a smaller portion of the Company’s overall gross premiums written, with wind-exposed homeowners insurance declining over 30% during the period and 23% for the full year.

Conifer Holdings, Inc.Page 5

Febuary 26, 2020

Combined Ratio

The Company's combined ratio was 112.9% for the quarter ended December 31, 2019, compared to 123.0% for the same period in 2018. The Company’s accident year combined ratio for the quarter ended December 31, 2019 was 98.1%, compared to 104.7% in the prior year period.

Loss Ratio:

The Company’s losses and loss adjustment expenses were $16.0 million for the three months ended December 31, 2019, compared to $17.6 million in the prior year period. This resulted in a lower loss ratio of 68.6%, compared to 77.4% in the prior year period.

Expense Ratio:

The expense ratio improved slightly to 44.3% for the fourth quarter of 2019, compared to 45.6% in the prior year period.

Net Investment Income

Net investment income was $860,000 during the fourth quarter ended December 31, 2019, compared to $911,000 in the prior year period. Net realized gains during the fourth quarter ended December 31, 2019 were $72,000, compared to a net realized loss of $91,000 in the prior year period.

Net Income (Loss)

In the fourth quarter of 2019, the Company reported net loss of $3.0 million, or $0.32 per share, compared to a net loss of $4.8 million, or $0.56 per share in the prior year period.

Conifer Holdings, Inc.Page 6

Febuary 26, 2020

Adjusted Operating Income (Loss)

In the fourth quarter of 2019, the Company reported adjusted operating loss of $3.4 million, or $0.35 per share, compared to adjusted operating loss of $4.2 million, or $0.49 per share, for the same period in 2019. See Definitions of Non-GAAP Measures.

Earnings Conference Call with Accompanying Slide Presentation

The Company will hold a conference call/webcast on Thursday, February 27, 2020 at 8:30 a.m. ET to discuss results for the fourth quarter ended December 31, 2019.

Investors, analysts, employees and the general public are invited to listen to the conference call via:

Webcast:On the Event Calendar at IR.CNFRH.com

Conference Call:844-868-8843 (domestic) or 412-317-6589 (international)

The webcast will be archived on the Conifer Holdings website and available for replay for at least one year.

About the Company

Conifer Holdings, Inc. is a Michigan-based insurance holding company. Through its subsidiaries, Conifer offers customized insurance coverage solutions in both specialty commercial and specialty personal product lines marketing mainly through independent agents in all 50 states. The Company is traded on the Nasdaq Global Market (Nasdaq: CNFR). Additional information is available on the Company’s website at www.CNFRH.com.

Definitions of Non-GAAP Measures

Conifer prepares its public financial statements in conformity with accounting principles generally accepted in the United States of America (GAAP). Statutory data is prepared in accordance with statutory accounting rules as defined by the National Association of Insurance Commissioners' (NAIC) Accounting Practices and Procedures Manual, and therefore is not reconciled to GAAP data.

We believe that investors’ understanding of Conifer’s performance is enhanced by our disclosure of adjusted operating income. Our method for calculating this measure may differ from that used by other companies and therefore comparability may be limited. We define adjusted operating income (loss), a non-GAAP measure, as net income (loss) excluding net realized investment gains and losses, after-tax, excluding the tax impact of changes in unrealized gains and losses, and including the net change in deferred gain on losses ceded to the Adverse Development Cover (ADC). We use adjusted operating income as an internal performance measure in the management of our operations because we believe it gives our management and other users of our financial information useful insight into our results of operations and our underlying business performance.

Conifer Holdings, Inc.Page 7

Febuary 26, 2020

Reconciliations of adjusted operating income and adjusted operating income per share:

This press release contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give current expectations or forecasts of future events or our future financial or operating performance, and include Conifer’s expectations regarding premiums, earnings, its capital position, expansion, and growth strategies. The forward-looking statements contained in this press release are based on management’s good-faith belief and reasonable judgment based on current information. The forward-looking statements are qualified by important factors, risks and uncertainties, many of which are beyond our control, that could cause our actual results to differ materially from those in the forward-looking statements, including those described in our form 10-K (“Item 1A Risk Factors”) filed with the SEC on March 13, 2019 and subsequent reports filed with or furnished to the SEC. Any forward-looking statement made by us in this report speaks only as of the date hereof or as of the date specified herein. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable laws or regulations.