Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CALIFORNIA WATER SERVICE GROUP | tm2011114d1_ex99-1.htm |

| 8-K - FORM 8-K - CALIFORNIA WATER SERVICE GROUP | tm2011114d1_8k.htm |

Exhibit 99.2

Year - End and Fourth Quarter 2019 Earnings Call Presentation February 27, 2020

Forward - Looking Statements This presentation contains forward - looking statements within the meaning established by the Private Securities Litigation Refor m Act of 1995 ("Act"). The forward - looking statements are intended to qualify under provisions of the federal securities laws for "safe harbor" treatme nt established by the Act. Forward - looking statements are based on currently available information, expectations, estimates, assumptions and projectio ns, and management's judgment about the Company, the water utility industry and general economic conditions. Such words as would, expects, intends, plans, believes, estimates, assumes, anticipates, projects, predicts, forecasts or var iat ions of such words or similar expressions are intended to identify forward - looking statements. The forward - looking statements are not guarantees of fu ture performance. They are subject to uncertainty and changes in circumstances. Actual results may vary materially from what is contained in a for ward - looking statement. Factors that may cause a result different than expected or anticipated include, but are not limited to: ability to invest or app ly the proceeds from the issuance of common stock in an accretive manner; governmental and regulatory commissions' decisions; consequences of eminent dom ain actions relating to our water systems; changes in regulatory commissions' policies and procedures; the timeliness of regulatory commi ssi ons' actions concerning rate relief and other actions; increased risk of inverse condemnation losses as a result of climate conditions; in abi lity to renew leases to operate water systems owned by others on beneficial terms; changes in California State Water Resources Control Board water qu ali ty requirements; changes in environmental compliance and water quality requirements; electric power interruptions, especially as a result of P ubl ic Safety Power Shutoff programs for the 2019 fire season as we further develop approaches to manage that risk; housing and customer growth index; the impact of opposition to rate increases; our ability to recover costs; availability of water supplies; issues with the implementation, m ain tenance or security of our information technology systems; civil disturbances or terrorist threats or acts; the adequacy of our efforts to mitigate phys ica l and cyber security risks and threats; the ability of our enterprise risk management framework to identify or address risks adequately; labor relations ma tters as we negotiate with unions; changes in customer water use patterns and the effects of conservation; the impact of weather , climate, natural disasters, and diseases on water quality, water availability, water sales and operating results, and the adequacy of our emergency preparedness; and, ot her risks and unforeseen events. When considering forward - looking statements, you should keep in mind the cautionary statements included in this paragraph, as we ll as the annual 10 - K, Quarterly 10 - Q, and other reports filed from time - to - time with the Securities and Exchange Commission (SEC). The Company a ssumes no obligation to provide public updates of forward - looking statements.

Today’s Participants Marty Kropelnicki President & CEO Tom Smegal Vice President, CFO & Treasurer Paul Townsley Vice President , Corporate Development and Chief Regulatory Officer Dave Healey Vice President, Controller

Presentation Overview • Our Operating Priorities • Financial Results, 2019 and Q4 • Financial Highlights, 2019 and Q4 • EPS Bridge, 2019 vs. 2018 • 2018 California General Rate Case (“GRC”) and 2020 Financial R eporting I mpacts • Capital Investment Update • Business Development Update • Wildfires and Public Safety Power Shutoffs (“PSPS”) • Update on Perfluorinated Compounds • Decoupling Balancing Account Update • Cap Ex 2008 Recorded to 2021 Projected • Rate Base 2014 Recorded to 2022 P rojected • Wrapping Up and Look Ahead

Our Operating Priorities

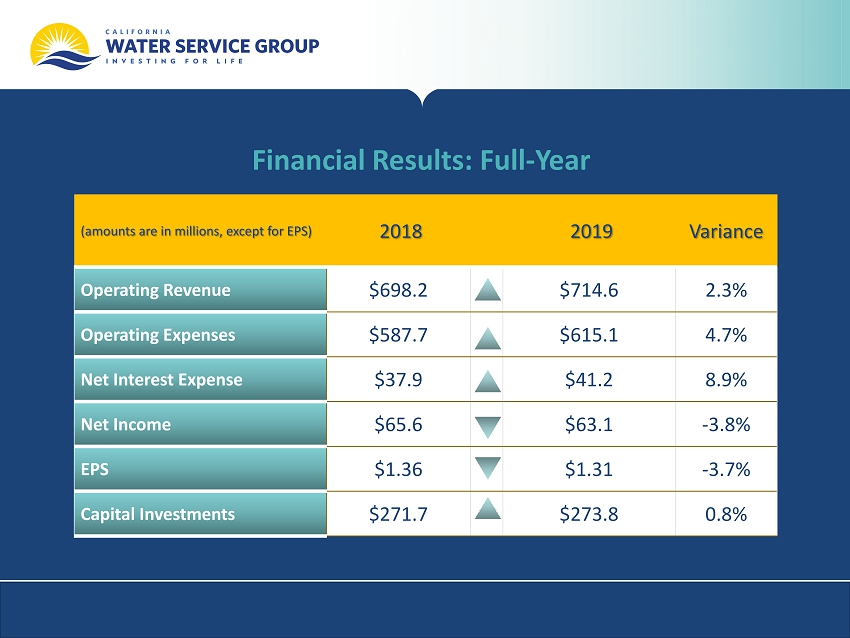

Financial Results: Full - Year (amounts are in millions, except for EPS) 2018 2019 Variance Operating Revenue $698.2 $714.6 2.3% Operating Expenses $587.7 $615.1 4.7% Net Interest Expense $37.9 $41.2 8.9% Net Income $65.6 $63.1 - 3.8% EPS $1.36 $1.31 - 3.7% Capital Investments $271.7 $273.8 0.8%

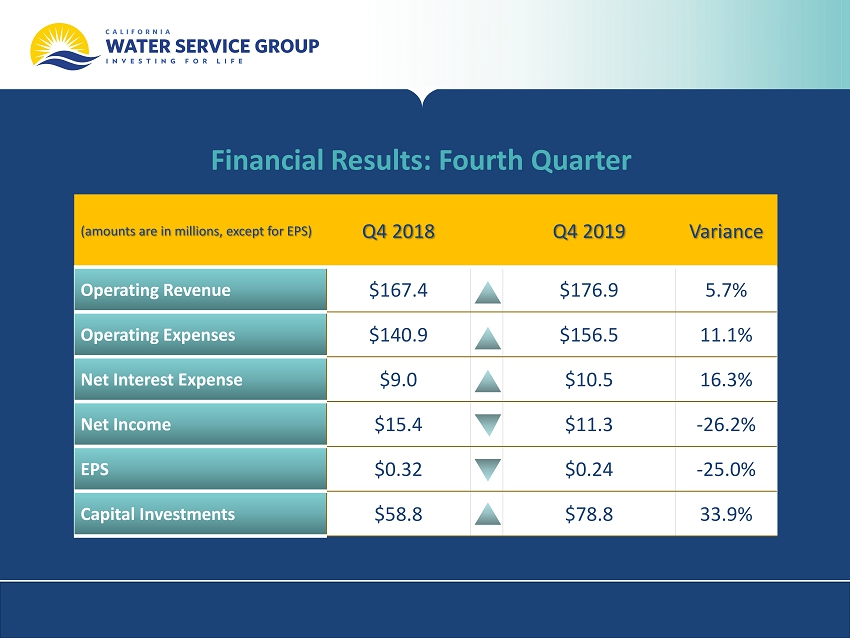

Financial Results: Fourth Quarter (amounts are in millions, except for EPS) Q4 2018 Q4 2019 Variance Operating Revenue $167.4 $176.9 5.7% Operating Expenses $140.9 $156.5 11.1% Net Interest Expense $9.0 $10.5 16.3% Net In come $15.4 $11.3 - 26.2% EPS $0.32 $0.24 - 25.0% Capital Investments $58.8 $78.8 33.9%

2019 Financial Highlights • Net income decreased by $2.5 million to $63.1 million; notable factors included: o Rate increases of $19.7 million were offset by asset - related costs of $7.6 million and increased expenses of $4.6 million for wages and $13.1 million for other operations o The company saw a reduction of $ 4.4 million in business development expenses, offset by $3.3 million less revenue from non - recurrence of drought cost recovery o $2.1 million costs to prepare for Public Safety Power Shutoffs (PSPS) and wildfire risk reduction activities in 2019 o Change in value of certain benefit plan investments added $7.4 million which was partially offset by a $2.2 million reduction to unbilled revenue accrual and $1.6 million reduction in benefit from Company - owned life insurance o Our final effective tax rate was 22%, higher than the 20% in 2018 due to a decrease in the benefit from repairs tax deductions o Capital Improvements accelerated in the fourth quarter, leading us to a record investment of $273.8 million in 2019

Q4 Financial Highlights • Net income decreased by $4.1 million to $11.3 million; notable factors included: o $4.4 million of general rate increases were offset by asset related expense increases of $ 2.8 million and cost increases of $3.9 million for wages, uninsured losses, outside services, and maintenance costs. o $3.3 million recovery of 2016 and 2017 incremental drought program costs in 2018 did not recur in 2019. o $1.0 million in PSPS program response costs in the quarter. o $3.9 million increase in unrealized income from certain benefit plan investments due to market conditions partially offset by a $1.5 million increase in non - operating expenses .

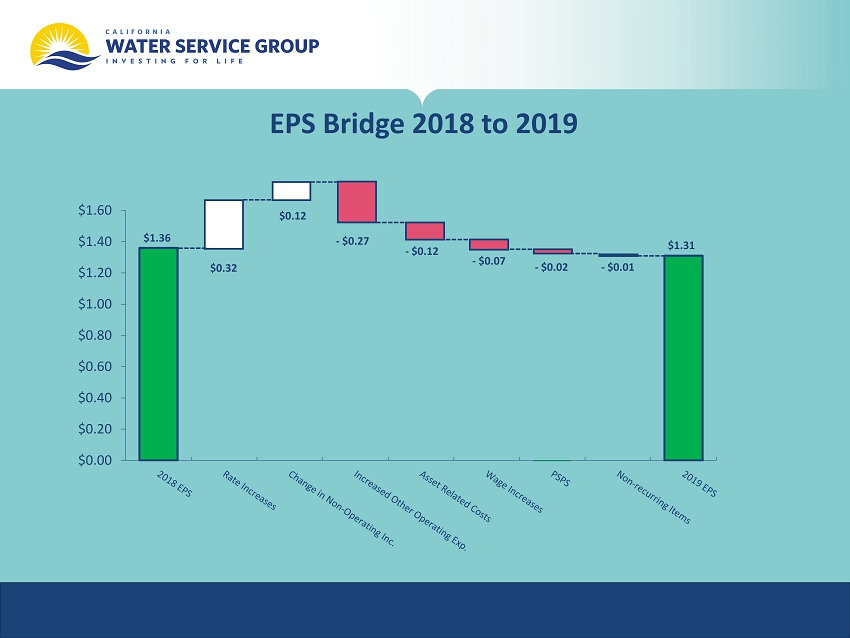

EPS Bridge 2018 to 2019 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 - $ 0.01 - $0.27 - $ 0.07 - $ 0.02 $1.36 $ 0.12 - $ 0.12 $0.32 $1.31

2018 California General Rate Case • On October 8, 2019 Cal Water and the California Public Utilities Commission (”CPUC”) Public Advocates Office filed a settlement covering the majority of issues in the case . The settlement must be approved by the CPUC. o Included in the settlement are $609 million of new capital authorizations along with approximately $200 million authorized improvements initiated in 2018 and prior years. o Disputed issues not included in the settlement include continuation of the Water Revenue Adjustment Mechanism (”WRAM”) and Sales Reconciliation Mechanism (”SRM”), balancing accounts for pension and medical costs, depreciation rates, working capital, allowance for equity funds used during construction, and advanced metering. o The assigned administrative law judge has allowed interim rates beginning January 1, 2020 but no decision on the disputed issues or the settlement has been issued. The CPUC extended its calendar and indicated it was planning to issue a decision in the first half of 2020.

Cal Water Rate Case Delay and 2020 Interim Period Financial Reporting • While Cal Water will be allowed to true - up a final decision back to January 1, 2020, a decision delayed beyond April could potentially affect our first quarter 2020 financial reporting. o Management is reasonably certain that the settlement will be approved. o Some unresolved issues relate to our 2020 balancing accounts (WRAM and benefits balancing accounts) and the Company may elect not to incorporate disputed balancing account regulatory assets and liabilities into its interim financial reporting until disposition is more certain. o Management is reasonably certain that the past balances in the WRAM/MCBA and other balancing accounts are recoverable. The Company plans to file its annual surcharge recovery advice letter in April to amortize the existing WRAM balances.

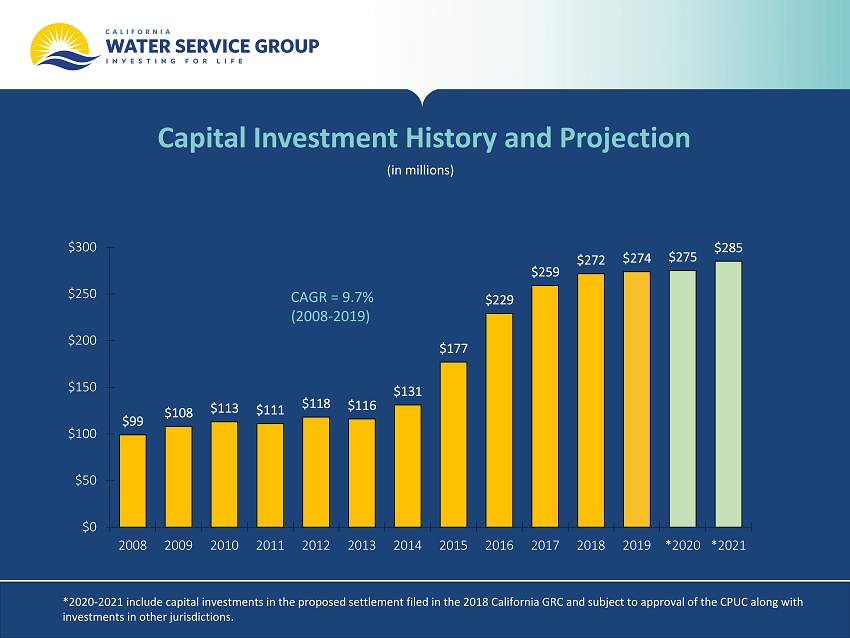

2019 Capital Investment Update • Full Year company and developer - funded capital investments were $273.8 million, an increase of 0.8% compared to 2018. • Increased investments in the fourth quarter are attributable in part to improved progress on our Palos Verdes Water Supply Reliability Project and a reduction in wildfire activity compared to 2018 . • The Company’s at - the - market equity program generated an additional net cash of $19.3 million in the fourth quarter to fund capital additions. o The program is intended to raise a total of $300 million through 2022.

Recent Business Development Activity • Agreements we signed in 2019, when completed, will increase our customer base by 4.5% • On November 6, 2019 we announced an agreement to acquire Rainier View Water (”RVW”) in Washington state o RVW has approximately 18,000 service connections in close proximity to our existing Washington water systems and will almost double the size of our Washington operations o Joint change of control application was filed with the Washington Utilities and Transportation Commission in February 2020 and we anticipate closing the purchase in the second half of 2020 • On December 23, 2019 we announced an agreement to acquire Kapalua Water Company and Kapalua Waste Treatment Company which serve a combined 1,000 connections on the island of Maui in Hawaii • In January 2020 we filed an application with the CPUC to serve the previously announced acquisition of the Preserve at Millerton in central California

• California experienced a relatively mild fire season with early rains and no major fires affecting our water systems • Our preparation and response to Public Safety Power Shutoffs (“PSPS”) and potential wildfires was effective in 2019 but we remain vigilant o Multiple PSPS affected our service areas including a large state - wide PSPS for up to five days in October o No water service interruptions due to PSPS o Cal Water spent $1.5 million on readiness for PSPS and an additional $0.6 million on wildfire prevention efforts in 2019 o We will seek regulatory recovery in a future filing for the PSPS expenses and operating expenses related to declared wildfire emergencies o We anticipate additional readiness costs during the 2020 fire season and future years until the state’s wildfire mitigation plans become effective Wildfires and Public Safety Power Shutoffs

Update on Perfluorinated Compounds • Media and regulatory attention on PFOS* and PFOA*, among other related compounds (collectively referred to as PFAS*), has accelerated in the last several months . PFAS are man - made substances found in industrial processes and consumer products such as fire - fighting foam, shampoo , clothing, and food wrappers. • There remain no regulatory maximum contaminant levels (“MCLs”) either from The US Environmental Protection Agency (EPA) or environmental regulators in the states we serve. New Jersey and New Hampshire have established MCLs and other states have proposed them. We anticipate MCL - setting processes will be accelerated by the EPA and regulators in the states we serve. Regulations will likely evolve rapidly. • In February 2020, California’s Division of Drinking Water (“DDW”) revised downward its “response levels” for PFOA to 10 parts per trillion (“ ppt ”) and PFOS to 40 ppt. A response level, while not a health standard, indicates the level over which the DDW recommends a source be removed from service or treated. • The Company has tested its wells which may have a higher risk of contamination from PFAS and will test all water sources by the end of 2020 to ensure we have comprehensive information. • Cal Water is working to minimize customer exposure to PFAS particularly in response to DDW’s latest recommendations. We anticipate that any costs related to compliance will be recoverable in customer rates through the state regulatory process. • The Company is participating in consolidated product liability litigation against manufacturers of firefighting foams which contain PFAS. * PFOS refers to Perfluorooctane Sulfonic Acid, PFOA refers to Perfluorooctanoic Acid, and PFAS refers to the class of Per - & Polyfluoroalkyl Substances

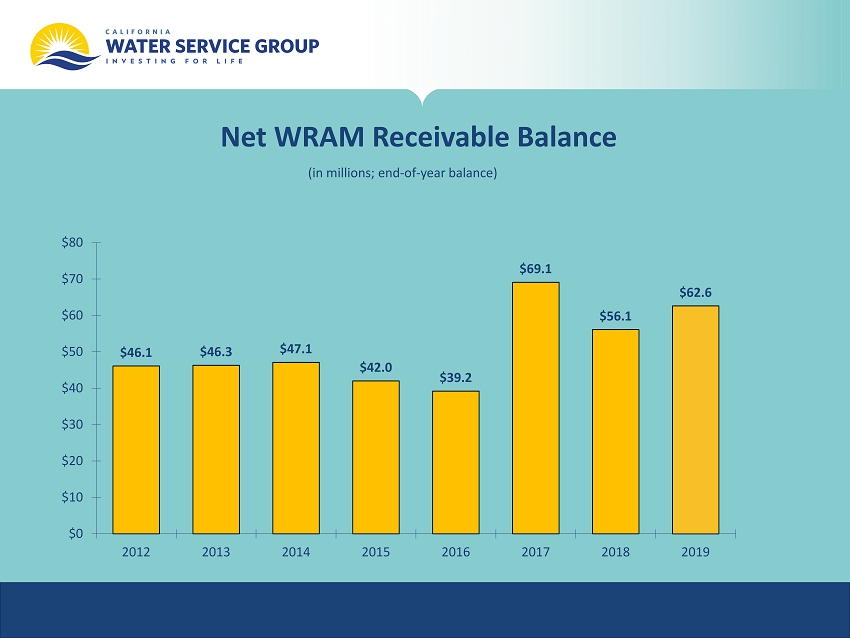

Decoupling Balancing Account Update • Cal Water 2019 sales were 86% of adopted estimates • The net WRAM receivable balance is $62.6 million, up from $56.1 million at year - end 2018 • Adopted sales had been adjusted lower due to triggering the SRM, which allows for a true - up when annual sales are above or below adopted sales by more than 5% • Had the SRM not been in place, lowering sales estimates in base rates, the WRAM/MCBA balance would have been $14.9 million higher for 2019

Net WRAM Receivable Balance (in millions; end - of - year balance) $46.1 $46.3 $47.1 $42.0 $39.2 $69.1 $56.1 $62.6 $0 $10 $20 $30 $40 $50 $60 $70 $80 2012 2013 2014 2015 2016 2017 2018 2019

Capital Investment History and Projection (in millions) *2020 - 2021 include capital investments in the proposed settlement filed in the 2018 California GRC and subject to approval of the CPUC along with investments in other jurisdictions. $99 $108 $113 $111 $118 $116 $131 $177 $229 $259 $272 $274 $275 $285 $0 $50 $100 $150 $200 $250 $300 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 *2020 *2021 CAGR = 9.7% ( 2008 - 2019)

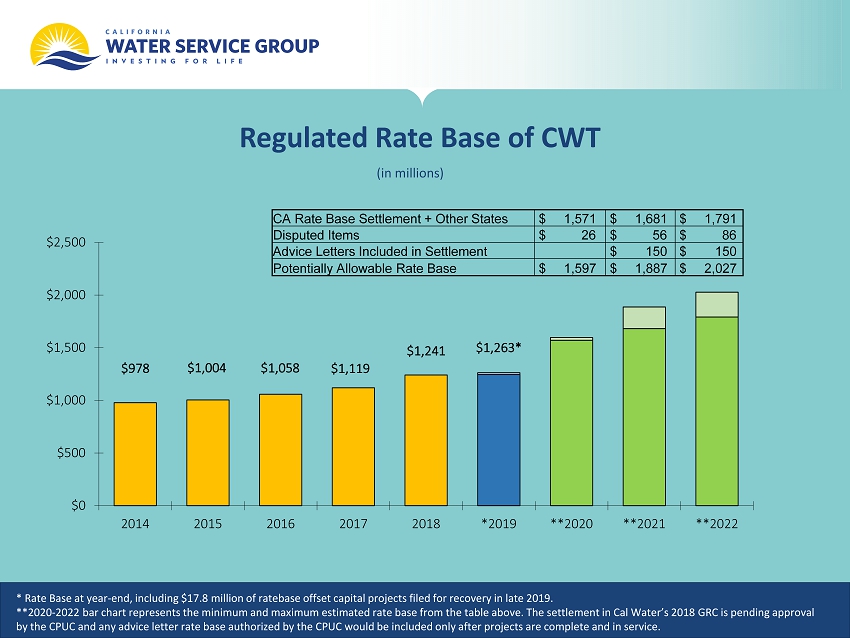

Regulated Rate Base of CWT (in millions) * Rate Base at year - end, including $17.8 million of ratebase offset capital projects filed for recovery in late 2019. ** 2020 - 2022 bar chart represents the minimum and maximum estimated rate base from the table above. The settlement in Cal Water’s 2018 GRC is pending approval by the CPUC and any advice letter rate base authorized by the CPUC would be included only after projects are complete and in ser vice. $978 $1,004 $1,058 $1,241 $1,119 $ 1,263* $0 $500 $1,000 $1,500 $2,000 $2,500 2014 2015 2016 2017 2018 *2019 **2020 **2021 **2022 CA Rate Base Settlement + Other States $ 1,571 $ 1,681 $ 1,791 Disputed Items $ 26 $ 56 $ 86 Advice Letters Included in Settlement $ 150 $ 150 Potentially Allowable Rate Base $ 1,597 $ 1,887 $ 2,027

Wrapping Up and Look Ahead • Company focus is on concluding the California GRC and ensuring the settlement is adopted by the CPUC • First quarter potential 10 - Q “noise” related to reporting on balancing accounts • We look forward to welcoming Rainier View’s employees and customers to our company later in the year • Company operations will continue its focus on needed cap ex, emergency preparedness, safety, and water quality

Discussion