Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - 10x Genomics, Inc. | d849320dex322.htm |

| EX-32.1 - EX-32.1 - 10x Genomics, Inc. | d849320dex321.htm |

| EX-31.2 - EX-31.2 - 10x Genomics, Inc. | d849320dex312.htm |

| EX-31.1 - EX-31.1 - 10x Genomics, Inc. | d849320dex311.htm |

| EX-23.1 - EX-23.1 - 10x Genomics, Inc. | d849320dex231.htm |

| EX-4.3 - EX-4.3 - 10x Genomics, Inc. | d849320dex43.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-39035

10x Genomics, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 45-5614458 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 6230 Stoneridge Mall Road Pleasanton, California |

94588 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (925) 401-7300

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered | ||

| Class A common stock, par value $0.00001 per share | TXG | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

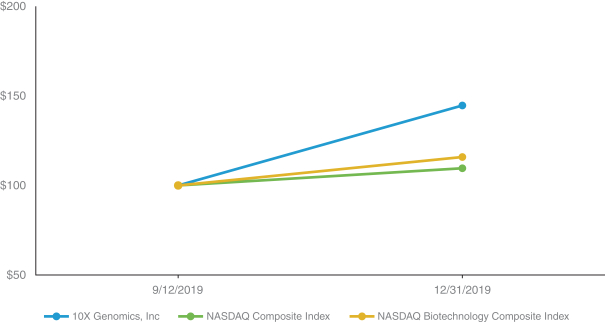

The registrant was not a public company as of June 28, 2019, the last business day of its most recently completed second fiscal quarter and therefore, cannot calculate the aggregate market value of its voting and non-voting common equity held by non-affiliates as of such date. The registrant’s Class A common stock began trading on The Nasdaq Stock Market LLC on September 12, 2019.

As of January 31, 2020, the registrant had 21,282,464 shares of Class A common stock, $0.00001 par value per share, outstanding and 75,269,430 shares of Class B common stock, $0.00001 par value per share, outstanding.

Portions of the registrant’s Definitive Proxy Statement relating to the registrant’s 2020 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. Such Definitive Proxy Statement will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year ended December 31, 2019.

Table of Contents

Table of Contents

10x Genomics, Inc.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by those sections. All statements, other than statements of historical facts included in this Annual Report, including statements concerning our plans, objectives, goals, beliefs, business strategies, future events, business conditions, results of operations, financial position, business outlook, business trends and other information, may be forward-looking statements. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negatives of these terms or variations of them or similar terminology. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot provide any assurance that these expectations will prove to be correct and actual results may vary materially from what is expressed in or indicated by the forward-looking statement. Such statements reflect the current views of our management with respect to our business, results of operations and future financial performance.

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors, including those described in the section titled “Risk Factors” and elsewhere in this Annual Report. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements. For a more detailed discussion of the risks, uncertainties and other factors that could cause actual results to differ, please refer to the “Risk Factors” in this Annual Report, as such risk factors may be updated from time to time in our periodic filings with the SEC. Our periodic filings are accessible on the SEC’s website at www.sec.gov.

The forward-looking statements made in this Annual Report relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report to reflect events or circumstances after the date of this Annual Report or to reflect new information or the occurrence of unanticipated events, except as required by law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or occur and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

Unless otherwise stated or the context otherwise indicates, references to “we,” “us,” “our,” “the Company,” “10x” and similar references refer to 10x Genomics, Inc.

Channels for Disclosure of Information

Investors and others should note that we may announce material information to the public through filings with the SEC, our website (https://www.10xGenomics.com), press releases, public conference calls, public webcasts and our social media accounts (https://twitter.com/10xGenomics, https://www.facebook.com/10xGenomics/ and https://www.linkedin.com/company/10xgenomics/). We use these channels to communicate with our customers and the public about the Company, our products, our services and other matters. We encourage our investors, the media and others to review the information disclosed through such channels as such information could be deemed to be material information. The information on such channels, including on our website and our social media accounts, is not incorporated by reference in this Annual Report and shall not be deemed to be incorporated by reference into any other filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing. Please note that this list of disclosure channels may be updated from time to time.

1

Table of Contents

PART I

Mission

Our mission is to accelerate the mastery of biology to advance human health.

Overview

We are a life science technology company building products to interrogate, understand and master biology. Our integrated solutions include instruments, consumables and software for analyzing biological systems at a resolution and scale that matches the complexity of biology. We have built deep expertise across diverse disciplines including chemistry, biology, hardware and software. Innovations in all of these areas have enabled our rapidly expanding suite of products, which allow our customers to interrogate biological systems at previously inaccessible resolution and scale. Our products have enabled researchers to make fundamental discoveries across multiple areas of biology, including oncology, immunology and neuroscience, and have helped empower the single cell revolution hailed by Science magazine as the 2018 “Breakthrough of the Year” and the technological advancements in single cell multimodal omics hailed by Nature Methods journal as the 2019 “Method of the Year.” Our Single Cell ATAC solution was named one of the top 10 life sciences innovations of 2019 by The Scientist magazine. Since launching our first product in mid-2015 through December 31, 2019, we have sold 1,666 instruments to researchers around the world, including 97 of the top 100 global research institutions as ranked by Nature in 2018 based on publications and 19 of the top 20 global biopharmaceutical companies by 2018 revenue. We believe that this represents the very beginning of our penetration into multiple large markets. We expect that 10x will power a “Century of Biology” in which many of humanity’s most pressing health challenges will be solved by precision diagnostics, targeted therapies and cures to currently intractable diseases.

The “10x” in our name refers to our focus on opportunities with the greatest potential for exponential advances and impact. We believe that the scientific and medical community currently understands only a tiny fraction of the full complexity of biology. The key to advancing human health lies in accelerating this understanding. The human body consists of over 40 trillion cells, each with a genome of 3 billion DNA base pairs and a unique epigenetic program regulating the transcription of tens of thousands of different RNAs, which are then translated into tens of thousands of different proteins. Progress in the life sciences will require the ability to measure biological systems in a much more comprehensive fashion and to experiment on biological systems at fundamental resolutions and massive scales, which are inaccessible with existing technologies. We believe that our technologies overcome these limitations, unlocking fundamental biological insights essential for advancing human health.

Resolution and scale are the imperatives underlying our technologies and products. Our Chromium and Visium product lines provide this resolution and scale along distinct but complementary dimensions of biology. Our Chromium products enable high throughput analysis of individual biological components, such as up to millions of single cells. They use our precisely engineered reagent delivery system to divide a sample into individual components in up to a million or more partitions, enabling large numbers of parallel micro-reactions. In this manner, a large population of cells can be segregated into partitions and analyzed on a cell by cell basis. Our Visium products enable analysis of biological molecules within their spatial context, providing the locations of analytes that give insight into higher order biological structure and function. Our Visium platform uses high density DNA arrays with DNA sequences that encode the physical locations of biological analytes within a sample, such as a tissue section. Our products utilize our sensitive and robust molecular assays to convert biological analytes into detectable signals, enabling researchers to obtain vast amounts of information about diverse biological analytes together with their single cell and spatial context. Finally, we provide highly sophisticated and scalable software for analyzing the raw data researchers generate and presenting it in a form that is readily understood by biologists.

2

Table of Contents

Our product portfolio consists of multiple integrated solutions that include instruments, consumables and software. These solutions guide customers through the workflow from sample preparation to sequencing on third-party sequencers that are commonly available in research settings to subsequent analysis and visualization.

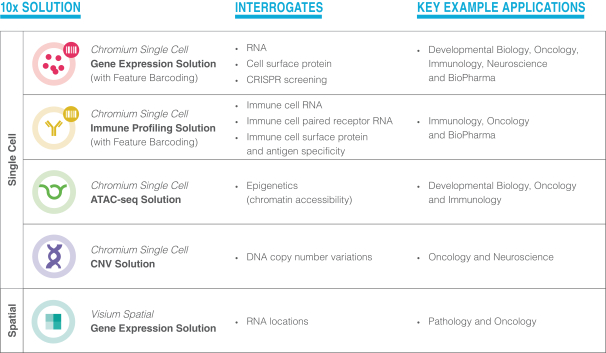

Each of our solutions is designed to interrogate a major class of biological information that is impactful to researchers:

| • | Our single cell solutions, all of which run on our Chromium instruments, include: |

| • | Single Cell Gene Expression for measuring gene activity on a cell-by-cell basis; |

| • | Single Cell Immune Profiling for measuring the activity of immune cells and their targets; |

| • | Single Cell ATAC for measuring epigenetics, including the physical organization of DNA; and |

| • | Single Cell CNV for measuring cellular heterogeneity through DNA changes such as copy number variation. |

| • | Our Visium Spatial Gene Expression solution measures the spatial gene expression patterns across a tissue sample. |

Our Feature Barcoding technology, which is currently compatible with our Single Cell Gene Expression and Immune Profiling solutions, allows researchers to simultaneously measure multiple analytes, such as protein and RNA, within the same set of cells or tissues.

Collectively, our solutions enable researchers to interrogate, understand and master biology at the appropriate resolution and scale.

We believe our solutions, which enable a comprehensive view of biology, target numerous market opportunities across the more than $50 billion global life sciences research tools market. We view much of this total market opportunity as ultimately accessible to us due to our ability to answer a broad diversity of biological questions. Based on the capabilities of our current solutions, and focusing solely on cases where our current solutions offer alternative or complementary approaches to existing tools, we believe, based on our internal estimates, we could access approximately $13 billion of the global life sciences research tools market. We believe we can further drive growth across our current and adjacent markets by improving or enabling new uses and applications of existing tools and technologies, as our solutions allow researchers to answer questions that may be impractical or impossible to address using existing tools.

As of December 31, 2019, we employed a commercial team of over 200 employees, many of whom hold Ph.D. degrees, who help drive adoption of our products and support our vision. We prioritize creating a superior user

3

Table of Contents

experience from pre-sales to onboarding through the generation of novel publishable discoveries, which drive awareness and adoption of our products. We have a scalable, multi-channel commercial infrastructure including a direct sales force in North America and certain regions of Europe and distribution partners in Asia, certain regions of Europe, Oceania, South America, the Middle East and Africa that drives our customer growth. This is supplemented with an extensive and highly specialized customer service infrastructure with Ph.D.-level specialists. We currently have customers in more than 40 countries.

Our revenue was $146.3 million and $245.9 million for the years ended 2018 and 2019, respectively, representing an annual growth rate of 68%. We generated net losses of $112.5 million and $31.3 million for the years ended 2018 and 2019, respectively.

The complexity of biology

Biology is staggeringly complex. The cell is the basic, fundamental organizational unit of all biological organisms. A human being starts from a single cell, which divides into over 40 trillion cells–such as blood cells, skin cells, muscle cells, bone cells, stem cells and neurons–to create the tissues that enable all necessary functions in the human body. These cells utilize the basic building blocks of DNA, RNA and protein, configured in cell-specific ways.

DNA, the hereditary material of living organisms, is the foundation for a series of biological processes that form the basis for biology and how cells function. DNA is transcribed into messenger RNA (“mRNA”) in a process referred to as transcription or, alternatively, gene expression. Information from the mRNA molecules is then translated into protein in a process called translation. Each gene has the ability to create multiple different mRNAs, resulting in the production of over 100,000 different mRNAs from about 30,000 genes. The complete collection of all of the DNA, mRNA and proteins are called the genome, transcriptome or gene expression profile, and the proteome, respectively. The epigenome includes molecular configurations and chemical DNA modifications that affect how genes are regulated. The genome, epigenome, transcriptome and proteome can be distinct for each of the trillions of cells in the human body and collectively constitute a rich architecture of biology.

Industry direction

The 20th century discovery of DNA, RNA, protein and the basic molecular and cellular mechanisms of their function paved early foundations for humanity to understand our own biology. In the early 2000s, the study of biology shifted from focusing on individual genes and their products to a more global level of characterizing the full collection of DNA, RNA and proteins and how they interact, giving rise to the field of genomics. Genomics is a broad, highly interdisciplinary field that approaches the study of biology at a system-wide level. We believe that genomics-based approaches will encompass much of biology and medical applications in the coming decades.

The Human Genome Project, which was completed in 2003, determined a reference sequence of the three billion nucleotides of the human genome as a composite over several individuals. This reference sequence provided an initial “parts list” of genes, enabling researchers to begin understanding human biology at a global molecular level.

The subsequent two decades of genomic research in many ways have been defined by genome-wide association studies (“GWAS”) and large-scale sequencing of individuals and populations. The goal was to compile all of the genetic variants in human populations and to link those variants to different conditions, traits and diseases. These associations would serve to generate clues and hypotheses that can be tested by subsequent experimentation to understand the detailed biology of each gene and variant.

Both of these efforts have provided substantial value and have been foundational in enabling multiple new research and clinical applications. However, much of the initial promise of the Human Genome Project and

4

Table of Contents

subsequent GWAS projects remains unfulfilled. We believe this is ultimately due to the tremendous underlying complexity of biology. The human genome project provided a list of parts and subsequent GWAS projects looked for statistical links between these parts and various diseases and traits. Going forward we need to understand the biological function of each gene and all the molecular and cellular networks they encode. Genomics needs to expand from its focus on the genome and statistical associations to the study of biology more broadly.

This presents an enormous challenge because of the limited capabilities of existing tools for accessing biology at the molecular and cellular level. Some of these limitations are:

| • | Average, or “bulk,” measurements obscure underlying differences between different biological units, such as individual cells; |

| • | Low throughput prevents requisite sampling of the underlying complexity—for example, when only a few hundred cells can be evaluated at a time; |

| • | Limited number of biological analytes are interrogated, giving a myopic view of only a few biological processes; |

| • | Limited ability for multi-omic interrogation; |

| • | Inefficient use of sample to generate a signal of sufficient strength to analyze the biological molecules of interest; and |

| • | Inadequate bioinformatics and software tools. |

We believe technologies that address these limitations will serve large and unmet market needs by providing a better understanding of molecular and cellular function, the origin of disease and how to improve treatment.

Measure the full complexity of biology. A major need is for an in-depth cataloguing of biological complexity. This will involve going from a basic biological parts list to a detailed map of exactly how all of these parts are used and interact in both healthy and disease states. Researchers and clinicians need to characterize every cell in the human body, to understand how cell-to-cell variations in genomes, epigenomes, transcriptomes and proteomes give rise to function or dysfunction. They also need to characterize every tissue at a full molecular and cellular level, including how cells are arranged together into spatial patterns that affect function, give rise to disease or impact treatment. For example, in the context of cancer biology, many tumors consist of a heterogeneous population of healthy and cancerous cells, the latter of which may consist of genetically distinct subpopulations that are susceptible to different therapeutics. Furthermore, different spatial patterns of cancer antigens may require different treatment approaches. Without being able to see cells and molecules in their spatial context it is difficult to fully understand tumor resistance and how cells interact with one another within the tumor microenvironment and enable targeted therapies.

Massively parallelize experimentation. Mastering biology will require moving beyond the cataloguing of biological complexity and into performing experiments to understand the impact of active changes to biological systems. We believe technologies that enable measurement of massively parallel perturbation and the impact of these perturbations will be important for accelerating biological and medical discovery. For example, an unmet goal of researchers has been to compile all of the genetic variations in human populations and link those variations to different conditions, traits and diseases. Linking these variations to disease requires the analysis of the impact of these variations within different systems, alone and in various combinations. Technologies that enable these variations to be created in arbitrary combinations within various biological contexts and the impact of these combinations measured in a massively parallel fashion will highly accelerate this work. In another example, a longstanding need of researchers has been to predict the interactions between immune cells and the target molecules they can recognize. The human body can make over a trillion different immune cells that are collectively capable of recognizing and mounting a response to nearly any conceivable antigen. We believe that understanding, and ultimately harnessing, this targeting will require technologies that can enable the massively

5

Table of Contents

parallel screening of interactions between a set of recognizing immune cells and a set of synthetic antigen target molecules.

We believe technologies that address these needs will redefine biological discovery and power a “Century of Biology” in which many of humanity’s most pressing health challenges will be solved by precision diagnostics, targeted therapies and cures to currently intractable diseases.

Our solutions

We have built and commercialized multiple product lines that allow researchers to interrogate, understand and master biological systems at a resolution and scale commensurate with the complexity of biology. We believe that our products overcome the limitations of existing tools. Our vision, discipline and multidisciplinary approach have allowed us to continuously innovate to develop the platforms, molecular assays and software that underlie our solutions.

Our technological imperatives: resolution and scale

Resolution and Scale are the imperatives that underlie our products and technology. First, our solutions enable understanding biology at the right level of biological resolution, such as at the level of the single cell or at high spatial resolution of tissues and organs. Second, we believe that high resolution tools only become truly powerful when they are built into technologies with tremendous scale. Measuring individual cells, spatial portions of tissues or molecular interactions in small numbers is insufficient. Our products enable measuring and manipulating up to millions of single cells or thousands of tissue sample positions. Thus, our products provide the appropriate levels of both resolution and scale in a manner that allows researchers to easily sift through the complexity to access the underlying biology.

Our platforms, molecular assays and software

Our Chromium platform, Visium platform, molecular assays and software constitute the building blocks of our integrated solutions. These shared building blocks allow us to rapidly build and improve our solutions for studying biology at the appropriate resolution and scale:

Our Chromium platform enables high-throughput analysis of individual biological components. It is a precisely engineered reagent delivery system that divides a sample into individual components in up to a million or more partitions, enabling large numbers of parallel micro-reactions. In this manner, for example, the individual single cells of a large population of cells can be segregated so that each cell resides in its own partition. Each partition then behaves as a micro-scale reaction vessel in which its contents are barcoded with a DNA sequence that specifically identifies those contents as being distinct from the contents of other partitions. Once biological material in each partition is barcoded, they can then be pooled and sequenced together. Finally, the barcode sequences can be used to easily tease apart information originating from different partitions. Our paradigm of partitioning and barcoding gives researchers the ability to measure many discrete biological materials and/or perform many different experiments in parallel, providing tremendous resolution and scale.

We have leveraged our Chromium platform to create a suite of solutions that measure biological analytes at the resolution of the single cell, the most fundamental organizational unit of biology. We believe that, in this sense, all of biology is single cell biology and that our single cell solutions can enhance and sharpen a wide array of scientific work in genetics, developmental biology, molecular biology and cell biology.

Our Visium platform empowers researchers to identify where biological components are located and how they are arranged with respect to each other, otherwise referred to as “spatial analysis.” Our Visium platform uses high density DNA arrays which have DNA barcode sequences that encode the physical location of biological analytes within a sample, such as a tissue section. This solution allows the spatial location of the analytes to be

6

Table of Contents

“read out” using sequencing to constitute a visual map of the analytes across the sample. Similar to partitioning, spatial barcoding with large numbers of probes on an array can unlock tremendous insights, providing high resolution genomic information to visualize analytes across biological tissues.

Our molecular assays are used with our Chromium and Visium platforms to provide sensitive and robust biochemistries that convert minute amounts of biological analytes into detectable signals. We have created a wide variety of proprietary assays compatible with our platforms for measuring the genome, epigenome, transcriptome and proteome. For example:

| • | Our GEM-RT assay is a highly sensitive technique for detecting mRNA molecules that are in low abundance in single cells. Less sensitive methods easily miss low abundance mRNA molecules, resulting in loss of information about the activities of many important genes that are detectable using our assay. |

| • | Our ATAC-seq assay can be used to determine whether particular genes are active or dormant on a system-wide basis and is tremendously useful in studying gene regulation. |

| • | Our Feature Barcoding assay allows simultaneous multi-omic interrogation of different classes of biological analytes in a sample. Feature Barcoding is highly versatile and can be customized to analyze many different classes of analytes for a wide variety of applications. |

| • | Our Visium Spatial Gene Expression assay can be used to assess gene expression across biological samples. |

Our software is essential to our mission of accelerating the mastery of biology. Since our platforms and molecular assays enable new levels of resolution and scale, they produce entirely new types of data and at much larger scales than previously achievable. To that end, we have developed sophisticated and scalable software that completes our solutions which we provide to researchers generally free of charge. Our analysis software transforms large amounts of raw data into usable results, giving researchers user friendly tools to dynamically explore these results. As larger and larger amounts of biological data are generated with greater ease, we believe that software tools will become increasingly critical for progress in biology.

Since our founding, we have committed to making software engineering and computational biology world-class, core internal competencies. We believe this deep investment distinguishes us from our competition and is worthwhile because it:

| • | Removes barriers to adoption. With our software, our customers can immediately begin making sense of their experimental data. Without it, they would be forced to develop their own software or wait for the community to do so, slowing down adoption of our products by months or even years; |

| • | Accelerates pull-through. Easy-to-use, efficient software helps our customers analyze their data and complete their experiments and studies faster, enabling them to move on to their next experimental questions sooner; |

| • | Increases scale. Reliable, scalable software helps to remove analysis as a bottleneck as our customers plan larger and more ambitious experimental designs; |

| • | Expands the user base. While early adopters are more likely to have access to bioinformatics expertise, our software enables a broader range of customers to take advantage of our solutions; |

| • | Enables better understanding of our customers’ needs. By supplying analysis software for our customers, we gain much greater insight into their use cases, helping us to design future products that best meet their needs; and |

| • | Enhances and accelerates product development. The software we ship to customers is the same software we use to develop and optimize our platforms and chemistry. This aligns us closely with the needs of our customers and reduces our time-to-market. |

7

Table of Contents

Our product development approach

The success of our products is founded on how we approach product development. Our employees are deeply scientifically oriented, having the relevant scientific expertise embedded not only within research and development, but also within the management team and throughout the company. We are ambitious and focus on fundamentals. We strive to solve big challenges to enable new fundamental biology and to build technological capabilities with potential for exponential impact. We work closely with our customers, many of whom are thought leaders in genomics and medicine, to identify future frontiers and unmet needs. Once we identify the correct opportunities, we have the discipline to focus on execution and have a track record of bringing successful products to market.

Multidisciplinary collaboration and technological innovation are central to our product development process. We have built teams with deep expertise across diverse disciplines including chemistry, molecular biology, microfluidics, hardware, computational biology and software engineering. This multidisciplinary expertise forms the basis of our innovation engine, which allows us to introduce new products at a rapid pace as well as continuously launch improved versions of our existing products.

Our solutions enable our customers to focus on biology by providing them with intuitive user interfaces and software. Our products guide customers through the workflow, from preparing samples, to reading sample information on a third-party sequencer, through analyzing and visualizing this information, to make obtaining biological answers as easy as possible. Our workflows operate with existing sequencers that are widely available in research settings.

Our market opportunity

According to industry sources, the worldwide life sciences research tools market totaled more than $50 billion in 2017. Our diverse products and solutions allow biologists to interrogate and understand biological systems at exceptional resolution and scale. Our focus on enabling a comprehensive view of biology, and not narrowly focusing on a particular analyte such as DNA alone, has produced products which we believe have broad applications and target numerous market opportunities across different areas of life sciences research. Because we provide solutions to answer a broad diversity of biological questions, we view much of this total market as ultimately accessible to us.

Markets in which our current solutions offer alternative or complementary approaches to existing tools represented a total market opportunity of approximately $13 billion of the more than $50 billion global life sciences research tools market in 2017. This $13 billion market includes flow cytometry, next generation sequencing, laboratory automation, microscopy and sample preparation, among other tools. In many cases, our current solutions offer alternative approaches to existing tools, where the advantages of our solutions can provide more precise answers to existing biological questions than existing tools and technologies. Our tools may also complement, enhance and enable new applications of these technologies. Within this market, and more broadly within the entire life science research tools market, we believe we will compete for research spending and capture an increasing share of research budgets as our solutions deliver new capabilities, enable new applications and lead to new discoveries. We also expect to enter additional markets in the future that will further expand our market opportunity.

We believe a strong benchmark of the potential adoption of our solutions is the installed base of real-time polymerase chain reaction (“RT-PCR”) units, which is approximately 50,000 units globally. We also believe, based on industry sources, that there are over 15,000 next generation sequencers installed globally. While owners of next-generation sequencing instruments are one of several potential constituencies for buying our solutions, many of our customers do not own a sequencer and, as our installed base has grown, many of our customers have purchased multiple Chromium instruments. We believe that our market opportunity for placements of our instruments is meaningfully larger than the installed base of next generation sequencers.

8

Table of Contents

Growth of our market opportunity is also driven by a broad and increasing range of applications for our solutions. Our solutions can be used in many different applications, including basic biology, oncology and immuno-oncology, genetic disease, neurological disease, autoimmunity, infectious disease, the human microbiome and many others. As we enter the “Century of Biology,” we believe that the mastery of biology will create advances and benefits for a broad and growing range of industries including broader segments of the healthcare industry and beyond.

Our competitive strengths

We believe our continued growth will be driven by the following competitive strengths:

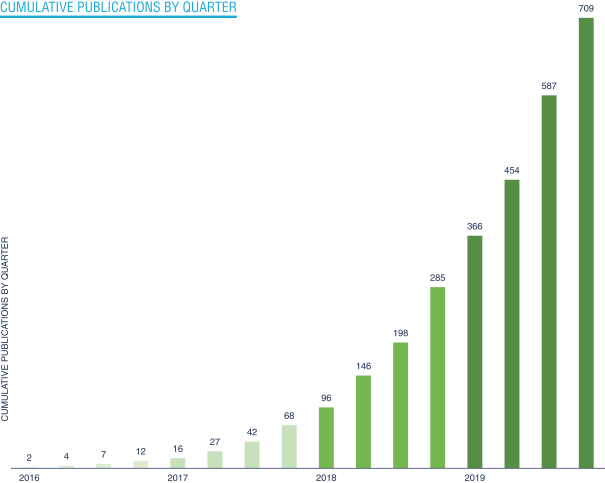

Our position as a leader in a large and growing market. Since launching our first product in mid-2015 through December 31, 2019, we have sold 1,666 instruments and we serve thousands of researchers globally. We have fostered deep relationships with many key opinion leaders and as of December 31, 2019, our customers included 97 of the top 100 global research institutions as ranked by Nature in 2018 based on publications and 19 of the top 20 global biopharmaceutical companies by 2018 revenue. Our products are entrenched within our customers’ workflow and a significant portion of them utilize more than one of our solutions. Our technologies have become a vital tool for biological research. To date, more than 700 peer-reviewed articles have been published based on data generated using our products, with more than 200 of these published in 2018 and more than 300 published in 2019. Our position as a leader in this market allows us to form deep partnerships with our customers who help us stay on the frontiers of biology, giving us insight on industry needs that inform our product strategy and providing us with a strong competitive advantage.

Our proprietary technologies. Through multiple years of development, acquisition and licensing, we have amassed a core set of technologies that form the foundation of our growing suite of products and solutions. These technologies, including instruments, assays and software, combine a diverse set of disciplines, including chemistry, molecular biology, microfluidics, hardware, computational biology and software engineering. Our technologies underlie features and performance that differentiate our products from the competition. Further, many of these technological elements can be utilized across multiple products, enabling us to leverage our existing infrastructure and investment when building future products, increasing the speed of product development and product performance. As of December 31, 2019, worldwide we owned or exclusively licensed over 200 issued or allowed patents and over 480 pending patent applications. In addition to these exclusively licensed patents and pending patent applications, we also license patents on a non-exclusive and/or territory restricted basis. Our intellectual property portfolio includes foundational patents in single cell analysis, epigenomics, spatial analysis and multi-omics.

Our rigorous product development processes and scalable infrastructure. We have implemented a rigorous and systematic product development process by which our vision can be efficiently translated into commercial products. We develop our products over a set of defined phases delineated by validating multifunctional reviews, which ensure our teams remain focused on quality, efficiency and profitability. This process allows many highly focused teams to execute on separate product development efforts in parallel while drawing effectively on the resources and capabilities of the company. We have also built extensive technological and operational infrastructure to support the efficient execution of these teams. This infrastructure includes multiple technological investments across a range of areas, including custom barcoded gel bead production, microfluidic chip manufacturing, scalable high-performance computation and automated software productization and testing tools. This infrastructure can be drawn on to develop new products and improved versions of our existing products with high quality at a rapid pace.

Our customer experience and broad commercial reach. We believe in providing our customers with a high-quality experience from start to finish: starting with a collection of validated methods for preparation of samples to be run on our systems and ending with extensive software to aid in analysis and visualization of the data generated. We have also built comprehensive product testing and quality control into our culture and processes to help guarantee the performance of our products in customer hands. As of December 31, 2019, we employed a

9

Table of Contents

commercial team of over 200 full time employees. This includes an extensive and highly specialized customer service infrastructure with technical specialists covering multiple areas of expertise, including both experimental biology and software. Many members of our sales and customer service teams have a Ph.D. degree in the relevant scientific field. Both our sales and customer service teams help ensure our customers have a positive experience with our products.

Our experienced multidisciplinary team. At 10x, our success begins with our people. We have built a multidisciplinary team with expertise across a diverse set of areas such as chemistry, molecular biology, microfluidics, hardware, computational biology and software engineering who are committed to identifying and addressing problems at the forefront of biology. We have supplemented our diverse technical experience by assembling an operational team with expertise in manufacturing, legal, sales, marketing, customer service and finance. We believe this confluence of talent from multiple disciplines at 10x allows us to stay ahead of our competitors by identifying highly impactful opportunities and building products and solutions that address these opportunities.

Our growth strategy

Our growth strategy includes the following key elements:

Develop critical enabling technologies. Just as our past success is attributable to our innovative technologies, we believe that our future growth will be driven in large part by our significant continued investment in research and development. We aim to build new platforms, consumables and software that further our goals of interrogating, understanding and mastering biological systems at the needed resolution and scale. We prioritize innovations that meet large unmet market needs, such as measuring novel biological analytes with key functional impact at the single cell or spatial level. We expect that these investments in research and development will allow us to increase our penetration of our accessible market.

Expand the installed base of our Chromium instruments. Since our commercial launch in mid-2015 through December 31, 2019, we have placed 1,666 instruments and serve thousands of researchers globally. Utilizing our multi-channel sales and distribution infrastructure, we will continue to engage with researchers to increase our installed base of Chromium instruments. We will target new customers in addition to expanding the number of instruments within institutions that have already recognized the significant value of our technology. A portion of our current laboratory customers do not yet own a Chromium instrument, but rather gain access to one of our instruments through an adjacent lab or core facility within the institution. These customers are substantial and easily accessible and therefore represent an opportunity for future instrument sales. We also intend to expand our existing geographic reach, both directly and through distributors.

Strengthen use and adoption of our consumables. Our instruments are designed to be used exclusively with our consumables. This closed system generates recurring revenue from consumables tied to each instrument we sell. We plan to drive wider adoption of our products within the workflows of our existing customers. For example, although most of the biopharmaceutical companies using our products use them at multiple sites, we believe that as our applications are increasingly incorporated into the validation steps in the drug development process, the amount of our consumables used will grow. We have built a dedicated global strategic sales, marketing and business development team to support the adoption cycle by biopharmaceutical companies. The recent introduction of our Chromium Connect instrument is also aimed at driving higher consumable revenue growth, as the fully automated workflow will reduce bottlenecks caused by manual processes. We also plan to demonstrate new applications using our current solutions, including applications making synergistic use of multiple solutions.

Identify the most relevant technologies, create or acquire such technologies and develop them into new products. Over the years, we have developed, acquired and licensed a core set of technologies and associated intellectual property across a broad range of emerging areas within biology and life sciences. The ability to identify these core technologies and capabilities has complemented our internal product development process and

10

Table of Contents

enhanced the foundation of our growing suite of products and solutions. We will continue to identify and acquire or license foundational technologies and intellectual property that accelerate the development of new products or complement our existing products and technologies. For instance, we acquired Epinomics, Inc. (“Epinomics”) and Spatial Transcriptomics Holdings AB (“Spatial Transcriptomics”) in 2018, obtaining technology and intellectual property that formed the foundation of our ATAC-seq assay and Visium platform, respectively.

Promote our platforms as the standard for single and spatial cell analysis. We believe many key opinion leaders have recognized our Chromium platform as the standard for single cell analysis. One of our strategies is to broaden this recognition and promote the breadth of scientific achievements enabled by our products. To date, more than 700 peer-reviewed articles have been published using data generated by our portfolio of Chromium solutions. We also highlight successful instances where our Visium platform is used to analyze biological samples within their spatial context. Further research and discoveries will unfold as our solutions are utilized as the global standard.

Our products and technology

Our products are integrated solutions comprised of instruments, consumables and software. They are built with our expertise in chemistry, molecular biology, microfluidics, hardware, computational biology and software engineering. Our products begin with a researcher’s sample (such as a collection of thousands to millions of cells) and perform high-throughput barcoding to construct libraries that are compatible with standard sequencers. Our proprietary software then provides turn-key analysis pipelines and intuitive visualization tools that allow researchers to easily interpret the biological data from the samples. A summary of our solutions is as follows:

Our Chromium Platform

Our Chromium platform, which includes our Chromium Controllers, microfluidic chips and related consumables, enables high-throughput analysis of individual biological components. It is a precisely engineered reagent delivery system that divides a sample into individual components in up to a million or more partitions, enabling large numbers of parallel micro-reactions. The Chromium platform can be used to partition not only single cells,

11

Table of Contents

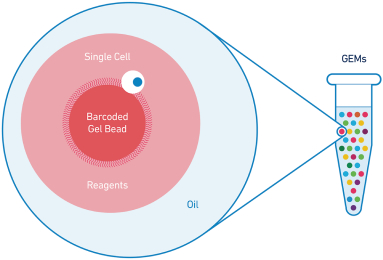

but also other biological materials such as cell nuclei and DNA molecules. The large numbers of partitions generated using our Chromium products can be used for analyzing samples at high resolutions and at large scales. We pair a partitioned sample with our proprietary gel beads bearing barcodes that allow researchers to uniquely identify the contents of each partition and distinguish them from contents of other partitions. We refer to the partitions that are generated on our Chromium platform as “GEMs,” which stands for Gel beads in EMulsion. We collectively refer to our partitioning and barcoding technologies as our GemCode technology.

Our Chromium Controller and microfluidic chips. All of our Chromium consumables run on our Chromium Controller instrument. We have designed our instrument to be widely accessible to researchers with a list price of $75,000 and a form factor that easily fits on a standard laboratory bench. Our Chromium Controller operates exclusively with our microfluidic chips, which are highly engineered single-use devices that process sample and reagents. During our Chromium workflows, the researcher loads sample onto the microfluidic chip along with our proprietary gel beads and oils. The loaded chip is inserted into the Chromium Controller, which facilitates the generation of GEMs that contain sample and gel beads. Our recently introduced Chromium Connect product is a high-throughput version of our Chromium instrument that incorporates liquid handling robotics to automate our workflow and can be utilized with our Single Cell Gene Expression solution.

12

Table of Contents

Our Gel Beads. Within each GEM, the sample is co-encapsulated with one of our proprietary gel beads which are designed to contain a unique, identifying DNA barcode for subsequent sequencing and analysis. Our gel beads, which we manufacture in-house using proprietary methods, incorporate barcoded DNA molecules that are designed to react with the sample inside each GEM. The GEMs act as individual reaction vessels to generate barcoded molecules. We have developed various molecular assays that can be used to perform barcoding reactions with different types of biological analytes—for example, our proprietary GEM-RT assay incorporates sequences of mRNA into barcoded molecules. Once those barcoded molecules are generated inside individual GEMs, the GEMs can be broken and their contents pooled to generate libraries that can be analyzed by widely available third-party sequencers. Critically, because different GEMs have different DNA barcodes, each sequencing read can be traced back to its GEM of origin, allowing identification of the biological source or context of the contents of the GEM. This barcoding paradigm enables multiplexing across very large numbers of cells or other biological material.

Key GemCode advantages. Our GemCode technology has a number of technological advantages over alternative tools. For example, our gel beads are composed of proprietary materials that permit their incorporation into GEMs at high efficiency. This efficiency increases the number of partitions that include one and only one barcoded gel bead and avoids loss of information from samples that are not paired with barcodes. Furthermore, the chemical structure of our gel beads allows them to not only encapsulate hundreds of millions of copies of DNA barcode oligonucleotides, but also permit their controlled release at precise times during our workflow. Similarly, our microfluidic chips are engineered to highly precise dimensions and consist of materials that optimize the partitioning of biological materials into GEMs. Such features enable our Chromium platform to provide a combination of superior performance characteristics for single cell analyses:

| • | High cell throughput: How many cells can be measured at once? Measuring more cells with resolution allows researchers to look for rare cells in a population. If a disease-causing cell occurs in only 1 in 10,000 cells in a sample, then measuring just 1,000 cells will be unlikely to find a single copy of the disease-causing cell. Our Single Cell Gene Expression and Immune Profiling solutions, on the other hand, have cell throughputs of up to 80,000 cells per run using one microfluidic chip which increases the likelihood of finding a copy of the disease-causing cell. |

| • | High cell capture rate: What fraction of the researcher’s sample cells are measured rather than lost? A high cell capture rate is important in many cases where researchers start with only a limited number of rare cells, such as a tumor biopsy from a patient. Our Single Cell Gene Expression and Immune Profiling solutions, for example, have typical cell capture rates of about 65%, which is significantly higher than those achieved by many competing solutions. |

| • | Low doublet rate: How often do researchers avoid doublets—artifacts where two or more cells are read as one? Doublets result in loss of cell information, inaccurate information, and wasted sequencing. Researchers seek products with low doublet rates. Our Single Cell Gene Expression, ATAC and Immune Profiling solutions, for example, have doublet rates of less than 1% per 1,000 cells. |

Our Chromium platform currently provides researchers with solutions in four major application areas:

Single Cell Gene Expression

Our Chromium Single Cell Gene Expression solution provides customers with the ability to measure the transcriptome of single cells, revealing gene activity and networks on a cell-by-cell basis. This approach enables customers to identify and characterize rare cell types in a population of cells, characterize cell populations without prior knowledge of cell subtypes or cell markers, define novel cell types and cell states, discover new biomarkers for specific cell populations and analyze and understand cellular heterogeneity and its effects on biological systems.

For this solution, customers run their samples of interest on the Chromium Controller or Chromium Connect to generate GEMs containing single cells and prepare single cell libraries using our reagents. Researchers can

13

Table of Contents

sequence these single cell libraries on compatible third-party sequencers, analyze their data using our Cell Ranger analysis pipeline software and visualize their data using our Loupe Cell Browser software. The browser displays a visual representation of the data in which cells having similar gene expression profiles are colored and clustered together. Researchers can explore their data by cluster or gene(s) of interest to derive biological meaning from the visualizations. The following visualization is an example showing single cell profiling of approximately 10,000 mouse brain cells that reveals multiple types of neurons.

t-SNE projection of approximately 10,000 mouse brain cells derived from the combined cortex, hippocampus and ventricular zones of embryonic day 18 brain tissue. Major subpopulations were identified based on gene markers that are enriched in each class.

Our Single Cell Gene Expression solution uses our proprietary biochemistry, GEM-RT, to capture mRNA molecules with high sensitivity. Sensitivity is the number of different mRNA transcripts that can be detected. Higher sensitivities are required to detect mRNA molecules that are present in low abundance in a cell. Our latest version of this solution uses a new GEM-RT biochemistry that now has an increased sensitivity of up to 8,500 unique transcripts per cell.

Furthermore, our Single Cell Gene Expression solution can be used with our Feature Barcoding technology to simultaneously measure multiple analytes in the same cells. Our Feature Barcoding is highly customizable, allowing our customers to add a barcode to any biological feature they want to analyze in conjunction with gene expression and other biological data. Feature Barcoding can currently be used to:

| • | Measure cell surface proteins simultaneously with gene expression, giving a far fuller picture of the states of single cells that includes the transcriptional profile inside the cells as well as the proteins on the outside of the cells; and |

| • | Measure a set of CRISPR genetic perturbations that have been applied to a cell simultaneously with the resulting changes to gene expression and/or surface protein characterization, allowing users to interrogate the impact of actively perturbing many different aspects of a biological system in a massively parallel fashion. |

14

Table of Contents

Our Single Cell Gene Expression solution, along with our other single cell solutions, are currently used by the Human Cell Atlas (“HCA”). The HCA is an international consortium of prominent genomics researchers that has emerged as the first and largest project aiming to develop reference maps for all cell types in all tissues of the human body. In 2017, we announced a collaboration with the HCA to enable pilot research projects. Under the terms of this collaboration, we provide members of the HCA consortium with discounts on our instruments and consumables. Sales to members of the HCA consortium accounted for less than 10% of our revenue for the years ended December 31, 2018 and December 31, 2019. In much the same way that the standardized reference human genome generated by the Human Genome Project in 2003 paved the way for significant leaps in genomics, we believe that creation of a standardized reference of human cell types is critical for future advances. We believe that our partnership with the HCA is a recognition of the quality of our products and may accelerate their adoption by the wider research community.

To date, more than 540 peer-reviewed scientific publications have been published using data generated by our Single Cell Gene Expression solution with the top research areas being developmental biology, immunology and oncology. This body of work is already yielding insights into diseases. For example, in 2018 researchers used our solution to identify all of the cell types present in the mouse trachea. They found the seven previously known lung cell types, but also found evidence for an eighth rare cell type that was previously unknown. This rare cellular population, comprising less than 1% of all lung cells in both mouse and human, was found to express more than 50% of the lung Cftr protein. Loss of Cftr protein in humans is known to cause cystic fibrosis, a relatively common inherited disorder for which carrier screening is routinely performed. Although the gene underlying cystic fibrosis has been known for nearly 30 years, the cells that may be most critical to understanding the progression of the disease were unknown until single cell expression analysis became available.

Single Cell Immune Profiling

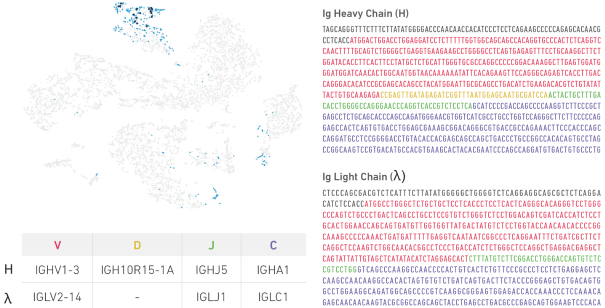

Our Chromium Single Cell Immune Profiling solution is used to study the immune system, which is the body’s natural diagnostic and therapeutic system. The immune system has a vast network of T-cells and B-cells that recognize pathogens using receptor molecules that bind to foreign molecules, or antigens. T-cells and B-cells can generate an immense diversity of receptors that are each specific to a different potential antigen, making it possible for the human body to recognize nearly any conceivable antigen. Our Single Cell Immune Profiling solution enables researchers to study these receptor molecules at the single cell level in conjunction with the transcriptome of the immune cell. Through the use of our solutions, researchers can measure both the T-cell or B-cell receptors while also determining whether the cell has been activated to attack its target or is quiescent and waiting for a threat to emerge. Importantly, because our analysis is performed at the single cell level, we obtain information regarding the pairing of the sequences of the alpha and beta chains of T-cell receptors or the heavy and light chains of B-cell receptors. This paired receptor information is unavailable from traditional bulk approaches for analyzing immune cells and is critical as it is the pair of receptors that defines the targets of each immune cell. By enabling paired immune receptor and transcriptome analysis in massive numbers of immune cells, our Single Cell Immune Profiling solution sheds insight on the clonality, diversity and cellular context of the immune repertoire.

The workflow of this solution, which is similar to that of the Single Cell Gene Expression solution, utilizes our Chromium Controller to generate GEMs, followed by single cell library preparation and sequencing. In contrast to Gene Expression, our Single Cell Immune Profiling solution uses a different biochemistry that obtains sequence information from the 5’ end of mRNA molecules, rather than their 3’ end. This biochemistry allows researchers to capture the more information-rich regions of immune receptor transcripts. Our Single Cell Immune Profiling solution also includes a step of enriching for immune receptor transcripts using specific primers to create an immune-specific library that can be sequenced separately from gene expression. We have also developed specialized pipelines within our Cell Ranger software and a specialized visualization software, Loupe V(D)J Browser, for visualizing the paired immune receptor information derived from this product. This software allows researchers to identify cell type clusters based on gene expression and then layer T-cell and/or B-cell

15

Table of Contents

receptor sequence diversity directly onto that visualization, enabling users to easily derive biological meaning from these two different data types. The following visualization is an example showing the simultaneous assessment of paired immune cell receptor information and gene expression in colorectal cancer cells.

Overlay of gene expression and lg clonotypes for colorectal cancer cells visualized using Loupe Cell Browser. Light blue dots indicate an lg clonotype cell. Dark blue dots show the location of the most prevalent lg clonotype in the plasma cell cluster, with the table outlining the gene calls for the heavy (H) and lambda l light chain. The paired H and l chain V(D)J sequences are shown to the right and corresponding V(D)J nucleotides are color-coded (5’UTR: gray, V: red, D: yellow, J: green, C: purple).

Feature Barcoding can be used in combination with our Single Cell Immune Profiling solution, adding significant multi-omic functionality. Importantly, this functionality allows users to determine the antigen that is bound by immune cells simultaneously with their gene expression. This capability allows researchers to determine both the receptor sequences of individual immune cells as well as an antigen that the receptor targets and makes this analysis practical to perform for millions of immune cells. We believe that the capability to understand immune receptor-antigen interactions at a high-throughput single cell level is tremendously valuable for elucidating the rules of immune cell targeting and can be used to understand disease and identify leads for immunotherapies.

We believe our technology can assist researchers in constructing an immune map of receptor-antigen targeting rules. Such a map would allow for the prediction of the antigens recognized by a given receptor, or conversely, the prediction of receptors that bind to a given antigen. Due to the large number of potential receptor sequences and the large number of possible antigens, researchers previously assumed that computational prediction of the cognate antigen from receptor sequence alone would be impractical. However, recent work demonstrated that T-cell receptor sequences that recognize the same antigen shared enough sequence features that a computational prediction framework for mapping T-cell receptors to antigens is feasible. We believe that our Single Cell Immune Profiling Solution combined with Feature Barcoding will enable extending this work at far higher scales.

As a proof of concept for the immune map, we presented at the Advances of Genomes, Biology and Technology (“AGBT”) meeting in February 2019 results from a single experiment utilizing our Single Cell Immune Profiling Solution on approximately 200,000 T-cells from four individuals and 44 feature-barcoded antigens to identify T-cell receptor-antigen pairs. This experiment, which took place over approximately one week, generated a paired receptor-antigen dataset six times larger than the collection of all previously published receptor-antigen

16

Table of Contents

pairings. This leap was made possible by the tremendous resolution and scale with which the immune system can be analyzed using our solutions.

Single Cell ATAC

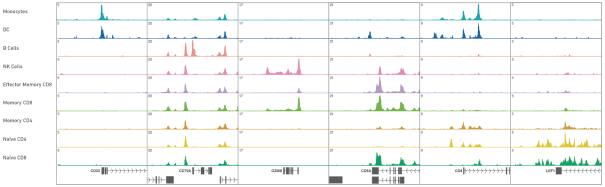

Our Chromium Single Cell ATAC solution enables customers to understand the epigenetic state—including how the genome and its surroundings are modified to “open” and “closed” states, affecting how genes are regulated—in up to millions of cells. While our Single Cell Gene Expression solution answers the “what” of what makes two cells different from each other, our Single Cell ATAC solution answers the “how.” These two products are highly complementary and can be used as a powerful combination to understand both the cause and effect of gene regulation.

ATAC-seq stands for “Assay for Transposase Accessible Chromatin using sequencing.” This technique uses an engineered transposase enzyme to insert nucleic acids tags into the genome while also excising the tagged sequences from its surroundings. ATAC-seq is based on the fact that the transposase enzyme will preferentially tag and excise regions of the genome that have an “open” chromatin state that is unimpeded by proteins bound to genomic DNA. The tagged sequences can be sequenced to infer genomic regions of increased chromatin accessibility as well as map regions that are bound by transcription factor proteins responsible for regulating gene expression. ATAC–seq was pioneered by researchers at Stanford University and is exclusively licensed to us. ATAC-seq has now become an important tool in epigenetics and genome-regulation research.

Our Single Cell ATAC solution uses the ATAC-seq assay in conjunction with our Chromium platform to create a product for high-throughput epigenetic interrogation at single cell resolution. In the workflow, users treat cell nuclei with transposase enzyme and then use our Chromium Controller to encapsulate these nuclei in GEMs. The tagged sequences from the nuclei are barcoded inside GEMs and then processed to generate sequencing libraries. Sequencing reads are analyzed using our Cell Ranger ATAC software, and visualized using our Loupe Cell Browser, which has been especially configured to display epigenetic data. The following visualization is an example of plots showing open chromatin around genes that are specifically associated with certain cell types.

Open chromatin signals around marker genes are specifically associated with the cell type of expression. Plots show aggregate chromatin accessibility profiles for each cluster at several marker gene loci.

Though we only launched this product in the fourth quarter of 2018, our Single Cell ATAC solution has already been adopted by a number of key opinion leaders. In one example, researchers used a combination of single cell transcriptome profiling and single cell ATAC-seq to identify enhancer elements that mark specific sub-classes of cells in the mouse brain. Once these elements are identified they can be targeted in order to generate mice with specific cell types labeled or perturbed at a level of specificity not usually achievable using gene expression alone. The ability to specifically target new cell types of interest allows in-depth investigations of the functions of those targeted cells.

17

Table of Contents

Single Cell Copy Number Variation (CNV)

Our Chromium Single Cell CNV solution enables the measurement of DNA changes—specifically changes in the number of copies of DNA segments—on a genome-wide basis at single cell resolution. This product is particularly useful for cancer research. Tumor cells frequently mutate and change such that a single “tumor” is actually comprised of many different types of tumor cells having different DNA mutations. This tumor heterogeneity allows different tumor cell types to evolve separately and respond differently to treatments. Our Single Cell CNV solution product enables researchers to systematically measure genomic differences between cells, providing information that is crucial in understanding how cancers evolve and can provide valuable insights into cancer treatment.

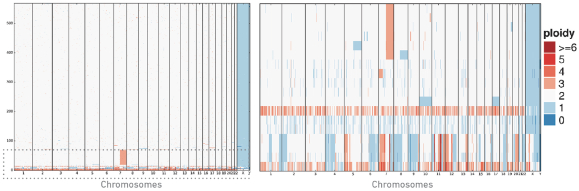

Our Single Cell CNV solution leverages a two-step process in which we first encapsulate cellular contents into cell beads, which are composed of a synthetic material that renders the genomic contents of individual cells accessible to our assays’ biochemistries. Once cell beads are formed, they are encapsulated into GEMs along with barcoded gel beads and undergo a reaction to generate barcoded sequencing libraries. Our Single Cell CNV solution has a cell throughput of up to 20,000 cells per run, cell capture rates of approximately 15% and doublet rates of less than 1% per 1,000 cells. Sequencing data is analyzed using our Cell Ranger DNA pipelines software, and visualized using our Loupe scDNA Browser, which offers intuitive visualization of DNA copy number changes along each human chromosome in the genome. The following visualization is an example of the detection of rare clones of a cell population having a particular DNA copy number variation.

Left: Heatmap showing the CNV profiles of 569 cells after 1% spike-in of MKN-45 cells (cancer cell line) into a BJ diploid cell line sample. The CNV profiles primarily correspond to the diploid cell line, while the bottom region of the heatmap corresponds to the MKN-45 cells.

Right: Enlargement of the bottom region of the heatmap highlighting the heterogeneous, non-diploid CNV profiles of the MKN-45 cells and an amplification in chromosome 7 of the diploid cell line, demonstrating that cell lines may not always be homogeneous.

This product, which became widely available in the third quarter of 2018, is yielding insights into disease states. For example, in a study undertaken by a major research university utilizing our products, gastric cancer samples were subjected to both single cell gene expression profiling and single cell CNV profiling. This combined approach allowed the direct comparison of sub-clonal structure revealed by DNA and RNA profiling. This study revealed that the use of both assays provided a more complete picture of the structure of the different cancerous and non-cancerous cells in their sample. This solution provides more resolution to researchers, enabling them to better understand the variations between the DNA in cloned cells.

For information relating to limitations on our ability to sell our Single Cell CNV solution, see the section titled “Risk Factors—Risks related to litigation and our intellectual property—We are involved in significant litigation which has consumed significant resources and management time and adverse resolution of these lawsuits could require us to pay significant damages, and prevent us from selling our products, which would severely adversely impact our business, financial condition or results of operations.”

18

Table of Contents

Our Visium platform

Our Visium platform enables researchers to understand the spatial positions of biological analytes within tissues at high resolution. Such spatial analysis can be critically important in understanding tissue function in both healthy and disease states. For example, in the context of neurobiology, neuronal degeneration in the substantia nigra, an area of the brain associated with movement, results in Parkinson’s disease, while degeneration of upper and lower motor neurons results in amyotrophic lateral sclerosis, or Lou Gehrig’s disease. In the context of cancer treatment, the knowledge of whether T-cells have infiltrated inside of a tumor, rather than merely surrounding the tumor, is an important prognostic indicator. Understanding the spatial relationship of the biological analytes in tissues may hold the key to unlocking the underlying causes and identifying cures for such diseases.

Our Visium products are based on technology that we acquired from Spatial Transcriptomics in 2018. Spatial Transcriptomics utilized arrays having specialized probes on their surfaces that are encoded with the spatial position of the probe. In the Visium product workflow, a tissue sample is placed onto the array and reagents are added by the user to create barcoded molecules from the array probes and the biological material in the tissues. This barcoded material encodes the spatial information that was contained in the probes. Users then pool the material from the array and follow a protocol to create libraries of molecules that can be sequenced using a standard sequencer. After sequencing, analysis software assigns each sequencing read to its spatial position of origin. Collectively, the spatially defined reads provide a visual depiction of the locations and patterns of large numbers of biological analytes simultaneously in the tissue sample.

The Spatial Transcriptomics product performed spatial analysis of mRNAs using arrays that had 1,000 probes with distances of approximately 200 microns between probes. This product was used to identify heterogeneity in metastatic melanoma and to demonstrate that there was significantly more heterogeneity than could be predicted by manual pathology annotation. In an independent study of mouse and human amyotrophic lateral sclerosis samples, researchers were able to observe changes in RNA expression over the disease course, while preserving the understanding of those changes in the spatial context. This allowed them to visualize the key changes that occur in brain regions before and during neuronal degeneration.

Our Visium solution for spatial gene expression analysis was launched in late 2019. Our Visium Spatial Gene Expression product has significant improvements over the Spatial Transcriptomics product, including increased spatial resolution, increased gene sensitivity, a simpler workflow and fully developed analysis and visualization software. We intend to continuously innovate to provide enhanced resolution, performance, throughput and efficiency for our existing Visium Spatial Gene Expression product and we also intend to develop additional Visium spatial products using our other assays which, analogously to the Chromium platform, allow spatial interrogation of a broader range of biological analytes including DNA, immune molecules, epigenetics and protein.

Our analysis and visualization software

Our software is a fundamental part of our integrated solutions and is comprised of two parts, analysis and visualization. Our analysis pipeline software tools, including Cell Ranger, Space Ranger, Long Ranger and Supernova, take raw sequencing data as input and transform them into biologically meaningful results. Customers can further analyze these results in their own or third-party tools, or take them into our Loupe family of visualization software tools, which allow users to draw insights using an intuitive user interface without writing code. Our analysis and visualization software is generally available to researchers free of charge, so as to accelerate the adoption of our products and software as a standard for genome, single cell and spatial analysis.

Since our launch, we have shipped more than 50 major releases of our software. We believe that the main factors that differentiate our software include:

| • | Ease of installation and use. Much of the software typically used in bioinformatics analysis requires substantial programming expertise to use and even just to install. We invest substantial effort in making our |

19

Table of Contents

| software both easy to install and use, so researchers can focus on their experiments rather than installation requirements. |

| • | Advanced algorithms and methods. Our software makes the latest analytical methods easily accessible to researchers and we are constantly working to improve our software’s ability to realize the maximum value and benefit of the data produced by our chemistries and platforms. |

| • | Scalable from workstation to cluster to cloud. A robust, common architecture underlying our software tools gives researchers maximum flexibility to run our software on-premises on individual workstations or servers, on large high-performance compute clusters and in private and public clouds. |

Peer-reviewed scientific publications using our products