Attached files

| file | filename |

|---|---|

| 8-K - GTY 8-K 4Q19 INVESTOR PRESENTATION - GETTY REALTY CORP /MD/ | gty-8k_20200226.htm |

Investor Presentation Exhibit 99.1

Safe Harbor Statement 1 Certain statements in this Presentation constitute “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are statements that relate to management’s expectations or beliefs, future plans and strategies, future financial performance and similar expressions concerning matters that are not historical facts. In some cases, forward-looking statements can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential.” Such forward-looking statements reflect current views with respect to the matters referred to and are based on certain assumptions and involve known and unknown risks, uncertainties and other important factors, many of which are beyond the Company’s control, that could cause the actual results, performance, or achievements of the Company to differ materially from any future results, performance, or achievement implied by such forward-looking statements. While forward-looking statements reflect the Company’s good faith beliefs, assumptions and expectations, they are not guarantees of future performance. Except as required under the federal securities laws and the rules and regulations of the SEC, the Company does not undertake any obligation to release publicly any revisions to the forward-looking statements to reflect events or circumstances after the date of this Presentation or to reflect the occurrence of unanticipated events. Examples of forward-looking statements in this Presentation include, but are not limited to, statement(s) relating to (a) the Company’s Portfolio, Net Lease Portfolio, Long-Term Leases and Rent Escalators, Tenant Base, Growth Platform, Market Opportunity, and Redevelopment Projects, (b) Industry Fundamentals, (c) the Company’s Balance Sheet, Dividend Growth and Investment Highlights; and (d) the Company’s expected quarterly dividends and growth. Other unknown or unpredictable factors could also have material adverse effects on our business, financial condition, liquidity, results of operations and prospects. For a further discussion of these and other factors that could cause the Company’s future results to differ materially from any forward-looking statements, see the Company’s Annual Report on Form 10-K for the year ended December 31, 2019, and the Company’s other filings with the SEC, including, in particular, the section entitled “Risk Factors” contained therein. In light of these risks, uncertainties, assumptions and factors, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this Presentation will, in fact, transpire. Moreover, because the Company operates in a very competitive and rapidly changing environment, new risks are likely to emerge from time to time. Given these risks and uncertainties, potential investors are cautioned not to place undue reliance on these forward-looking statements as a prediction of future results. Unless otherwise noted in this Presentation, all reported financial data is presented as of the period ended December 31, 2019, and all portfolio data is as of December 31, 2019. This Presentation presents certain non-GAAP financial measures, including the Company’s Funds From Operations (“FFO”) and Adjusted Funds From Operations (“AFFO”). Please refer to the Appendix of this Presentation for complete reconciliations between each of these non-GAAP financial measures to the most directly comparable GAAP financial measure. The Company believes that FFO and AFFO are helpful to investors in measuring its performance because both FFO and AFFO exclude various items included in GAAP net earnings that do not relate to, or are not indicative of, the Company’s core operating performance. The Company pays particular attention to AFFO, a supplemental non-GAAP performance measure, as the Company believes it best represents its core operating performance and allows analysts and investors to better assess the Company’s core operating performance. Further, the Company believes that AFFO is useful in comparing the sustainability of the Company’s core operating performance with the sustainability of the core operating performance of other real estate companies. The information contained herein has been prepared from public and non-public sources believed to be reliable. However, the Company has not independently verified certain of the information contained herein, and does not make any representation or warranty as to the accuracy or completeness of the information contained in this Presentation.

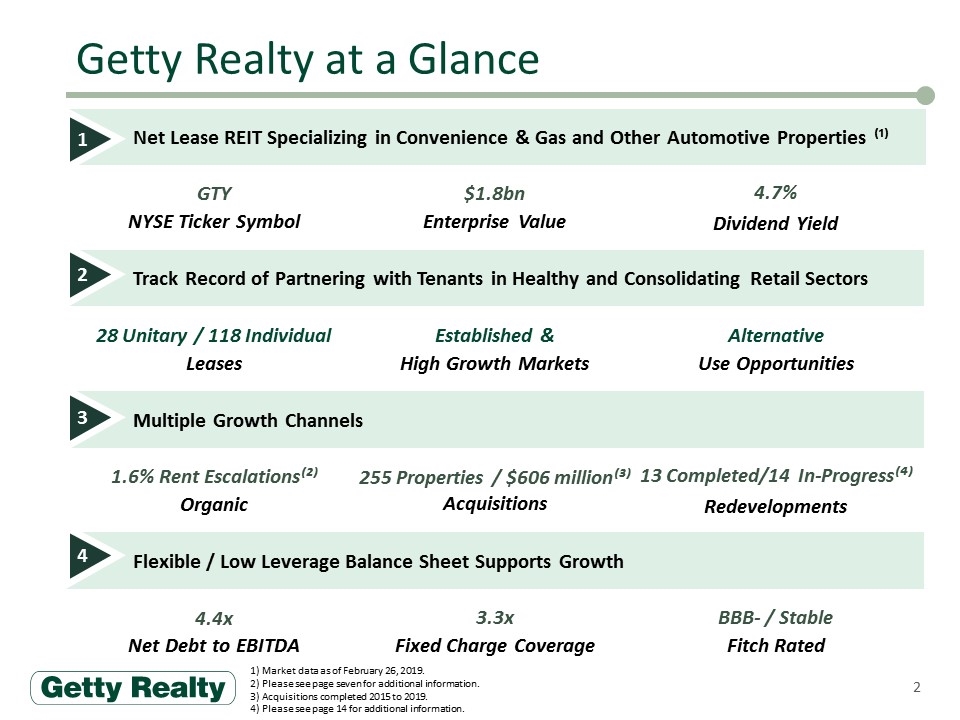

Getty Realty at a Glance Net Lease REIT Specializing in Convenience & Gas and Other Automotive Properties ⁽¹⁾ 1 Track Record of Partnering with Tenants in Healthy and Consolidating Retail Sectors Multiple Growth Channels Flexible / Low Leverage Balance Sheet Supports Growth $1.8bn Enterprise Value GTY NYSE Ticker Symbol 4.7% Dividend Yield 2 3 4 Established & High Growth Markets 28 Unitary / 118 Individual Leases Alternative Use Opportunities 1.6% Rent Escalations⁽²⁾ Organic 255 Properties / $606 million⁽³⁾ Acquisitions 13 Completed/14 In-Progress⁽⁴⁾ Redevelopments 4.4x Net Debt to EBITDA BBB- / Stable Fitch Rated 3.3x Fixed Charge Coverage Market data as of February 26, 2019. Please see page seven for additional information. Acquisitions completed 2015 to 2019. Please see page 14 for additional information.

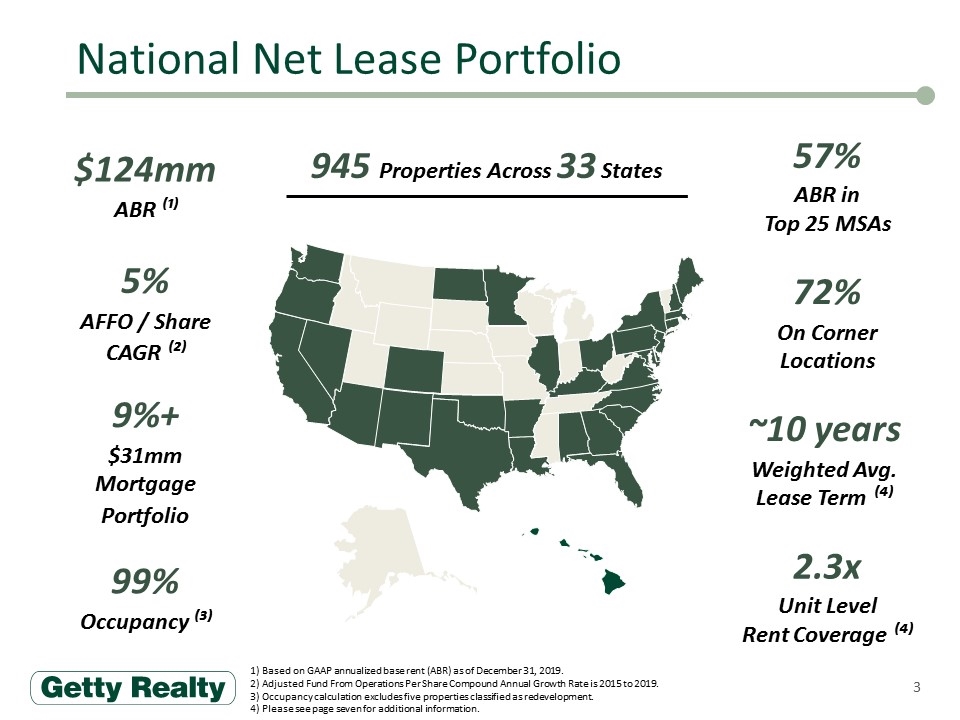

National Net Lease Portfolio 945 Properties Across 33 States 9%+ $31mm Mortgage Portfolio $124mm ABR ⁽¹⁾ 99% Occupancy ⁽³⁾ 5% AFFO / Share CAGR ⁽²⁾ 57% ABR in Top 25 MSAs ~10 years Weighted Avg. Lease Term ⁽⁴⁾ 2.3x Unit Level Rent Coverage ⁽⁴⁾ 72% On Corner Locations Based on GAAP annualized base rent (ABR) as of December 31, 2019. Adjusted Fund From Operations Per Share Compound Annual Growth Rate is 2015 to 2019. Occupancy calculation excludes five properties classified as redevelopment. Please see page seven for additional information.

Convenience Store, Gasoline Station and Other Automotive Properties Stable, yet growing sectors Institutional quality tenant base Urban Infill Markets Densely populated areas High barriers to entry Limited new development Prime locations and corners Mature transportation grid Convenient ingress and egress High Growth Markets Favorable population demographics 2017 to 2019 acquisition activity further accelerates entry into attractive markets High daily traffic counts Alternative Use Opportunities Retail, banking, service, restaurant Assemblage, redevelopment, repositioning Garland, TX Chula Vista, CA New Paltz, NY Well-Positioned Net Lease Portfolio Attractive Portfolio that is Difficult to Replicate

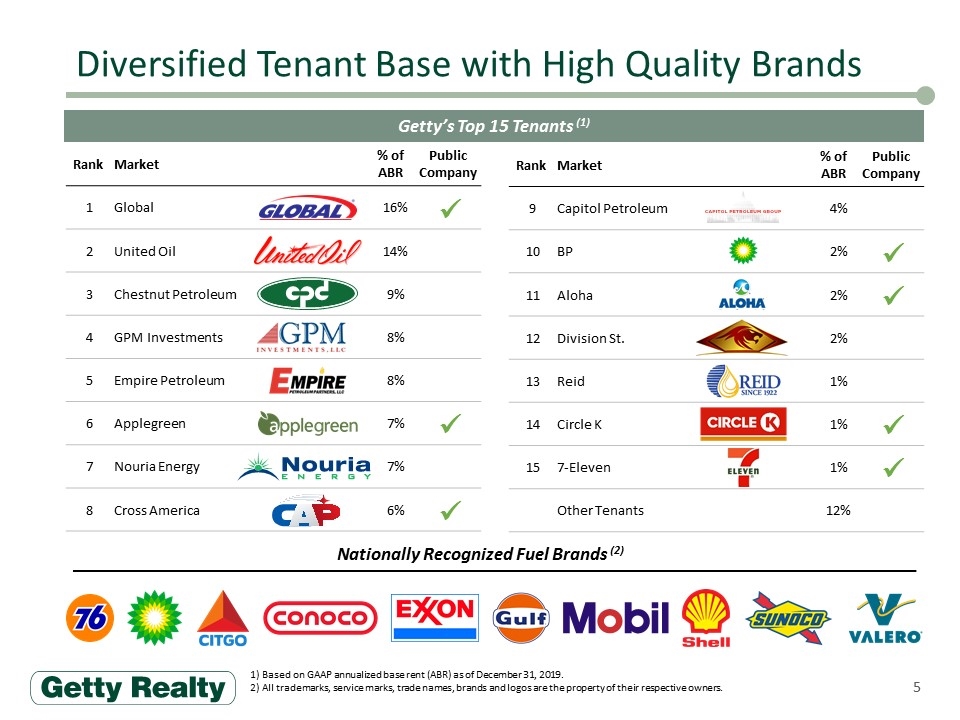

Rank Market % of ABR Public Company 1 Global 16% ü 2 United Oil 14% 3 Chestnut Petroleum 9% 4 GPM Investments 8% 5 Empire Petroleum 8% 6 Applegreen 7% ü 7 Nouria Energy 7% 8 Cross America 6% ü Diversified Tenant Base with High Quality Brands Getty’s Top 15 Tenants (1) Nationally Recognized Fuel Brands (2) Based on GAAP annualized base rent (ABR) as of December 31, 2019. All trademarks, service marks, trade names, brands and logos are the property of their respective owners. Rank Market % of ABR Public Company 9 Capitol Petroleum 4% 10 BP 2% ü 11 Aloha 2% ü 12 Division St. 2% 13 Reid 1% 14 Circle K 1% ü 15 7-Eleven 1% ü Other Tenants 12%

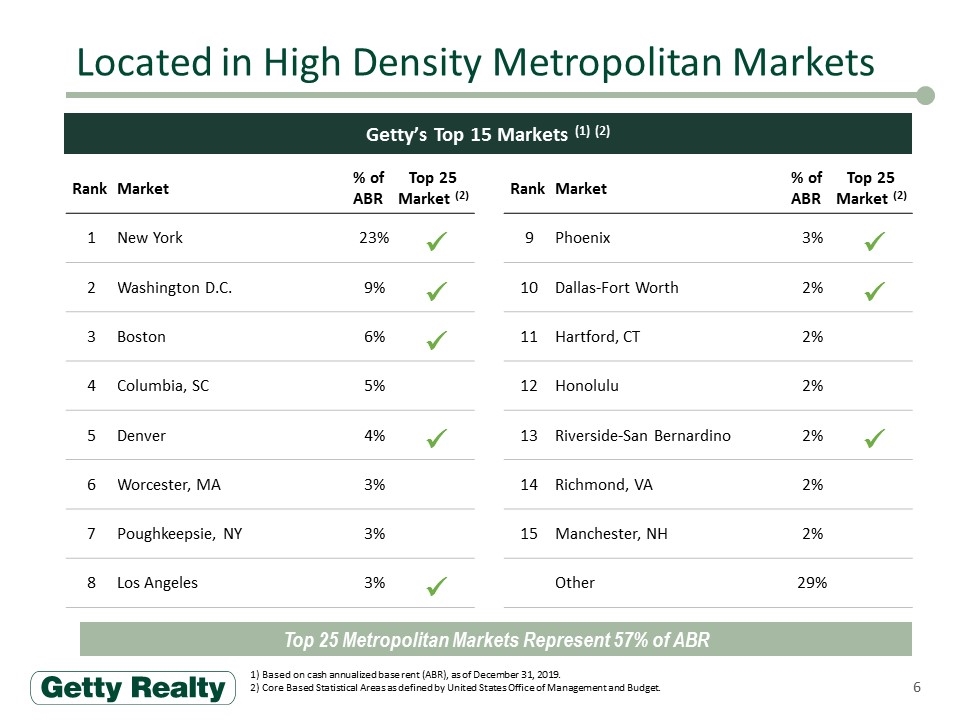

Rank Market % of ABR Top 25 Market (2) 9 Phoenix 3% ü 10 Dallas-Fort Worth 2% ü 11 Hartford, CT 2% 12 Honolulu 2% 13 Riverside-San Bernardino 2% ü 14 Richmond, VA 2% 15 Manchester, NH 2% Other 29% Located in High Density Metropolitan Markets Based on cash annualized base rent (ABR), as of December 31, 2019. Core Based Statistical Areas as defined by United States Office of Management and Budget. Getty’s Top 15 Markets (1) (2) Rank Market % of ABR Top 25 Market (2) 1 New York 23% ü 2 Washington D.C. 9% ü 3 Boston 6% ü 4 Columbia, SC 5% 5 Denver 4% ü 6 Worcester, MA 3% 7 Poughkeepsie, NY 3% 8 Los Angeles 3% ü Top 25 Metropolitan Markets Represent 57% of ABR

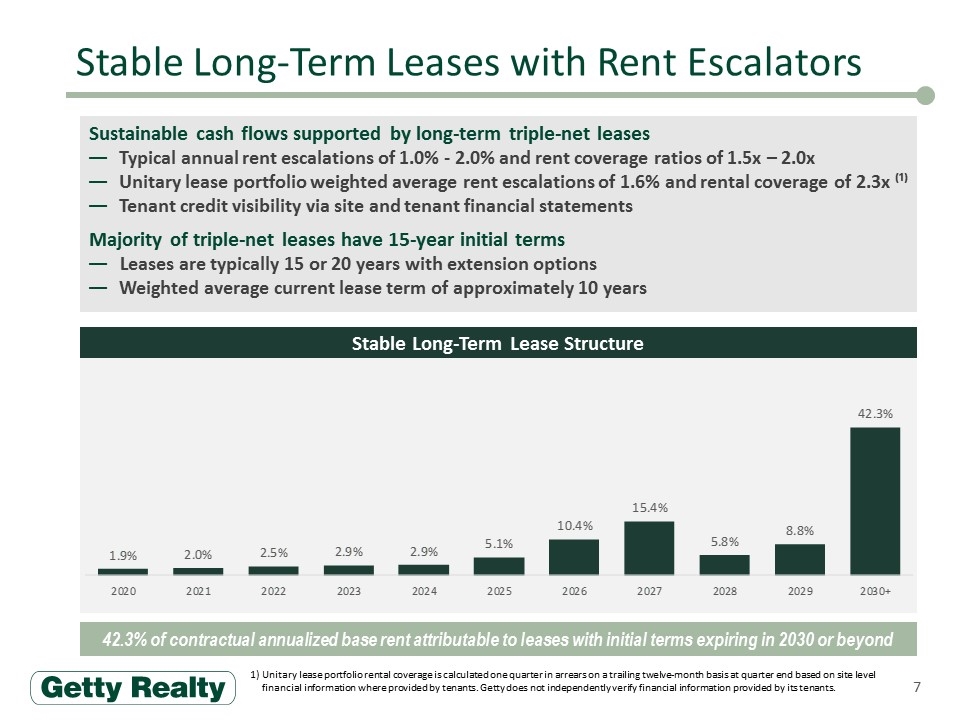

Stable Long-Term Lease Structure Sustainable cash flows supported by long-term triple-net leases Typical annual rent escalations of 1.0% - 2.0% and rent coverage ratios of 1.5x – 2.0x Unitary lease portfolio weighted average rent escalations of 1.6% and rental coverage of 2.3x ⁽¹⁾ Tenant credit visibility via site and tenant financial statements Majority of triple-net leases have 15-year initial terms Leases are typically 15 or 20 years with extension options Weighted average current lease term of approximately 10 years 42.3% of contractual annualized base rent attributable to leases with initial terms expiring in 2030 or beyond Stable Long-Term Leases with Rent Escalators Unitary lease portfolio rental coverage is calculated one quarter in arrears on a trailing twelve-month basis at quarter end based on site level financial information where provided by tenants. Getty does not independently verify financial information provided by its tenants.

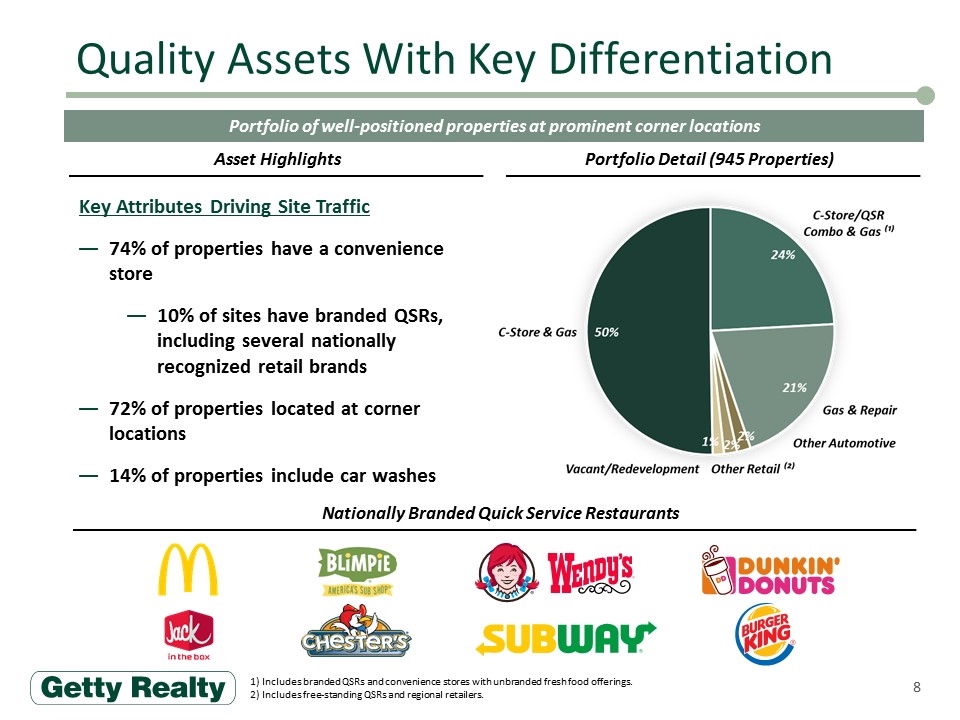

Quality Assets With Key Differentiation Includes branded QSRs and convenience stores with unbranded fresh food offerings. Includes free-standing QSRs and regional retailers. Portfolio of well-positioned properties at prominent corner locations Key Attributes Driving Site Traffic 74% of properties have a convenience store 10% of sites have branded QSRs, including several nationally recognized retail brands 72% of properties located at corner locations 14% of properties include car washes Asset Highlights Portfolio Detail (945 Properties) Nationally Branded Quick Service Restaurants

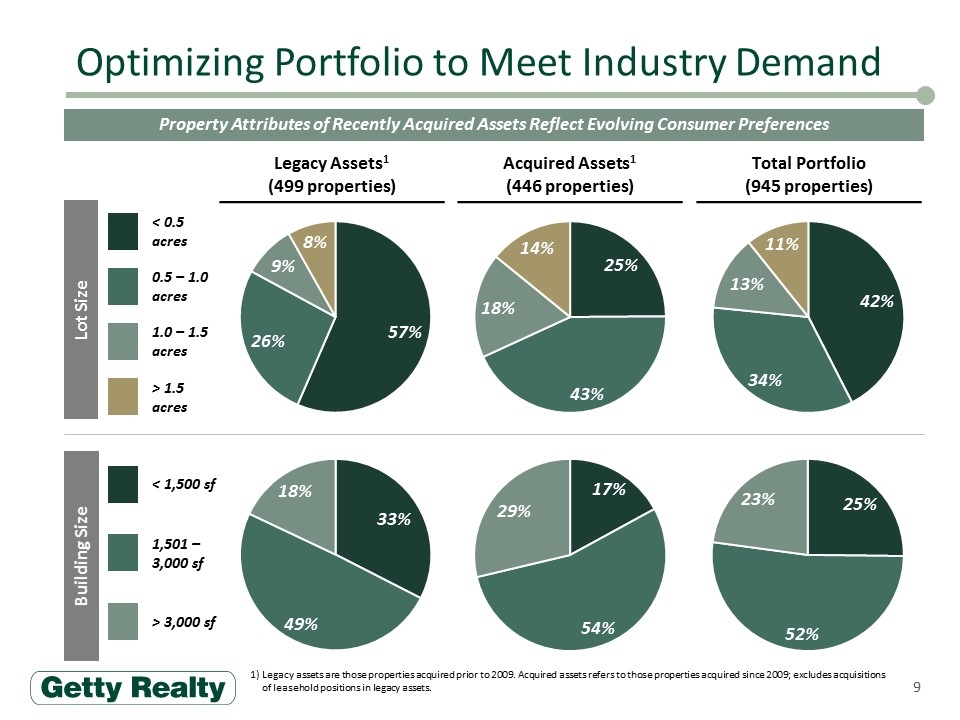

Optimizing Portfolio to Meet Industry Demand Property Attributes of Recently Acquired Assets Reflect Evolving Consumer Preferences Legacy Assets1 (499 properties) Lot Size Acquired Assets1 (446 properties) Total Portfolio (945 properties) Building Size 0.5 – 1.0 acres < 0.5 acres 1.0 – 1.5 acres > 1.5 acres 1,501 – 3,000 sf < 1,500 sf > 3,000 sf Legacy assets are those properties acquired prior to 2009. Acquired assets refers to those properties acquired since 2009; excludes acquisitions of leasehold positions in legacy assets.

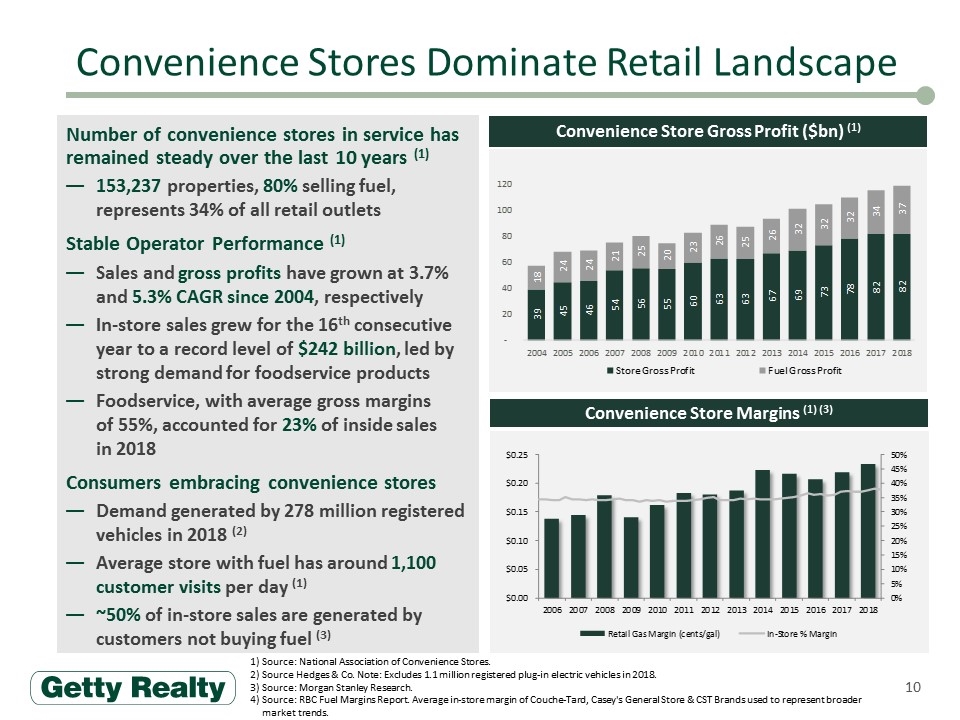

Number of convenience stores in service has remained steady over the last 10 years (1) 153,237 properties, 80% selling fuel, represents 34% of all retail outlets Stable Operator Performance (1) Sales and gross profits have grown at 3.7% and 5.3% CAGR since 2004, respectively In-store sales grew for the 16th consecutive year to a record level of $242 billion, led by strong demand for foodservice products Foodservice, with average gross margins of 55%, accounted for 23% of inside sales in 2018 Consumers embracing convenience stores Demand generated by 278 million registered vehicles in 2018 (2) Average store with fuel has around 1,100 customer visits per day (1) ~50% of in-store sales are generated by customers not buying fuel (3) Convenience Stores Dominate Retail Landscape Convenience Store Margins (1) (3) Convenience Store Gross Profit ($bn) (1) Source: National Association of Convenience Stores. Source Hedges & Co. Note: Excludes 1.1 million registered plug-in electric vehicles in 2018. Source: Morgan Stanley Research. Source: RBC Fuel Margins Report. Average in-store margin of Couche-Tard, Casey's General Store & CST Brands used to represent broader market trends.

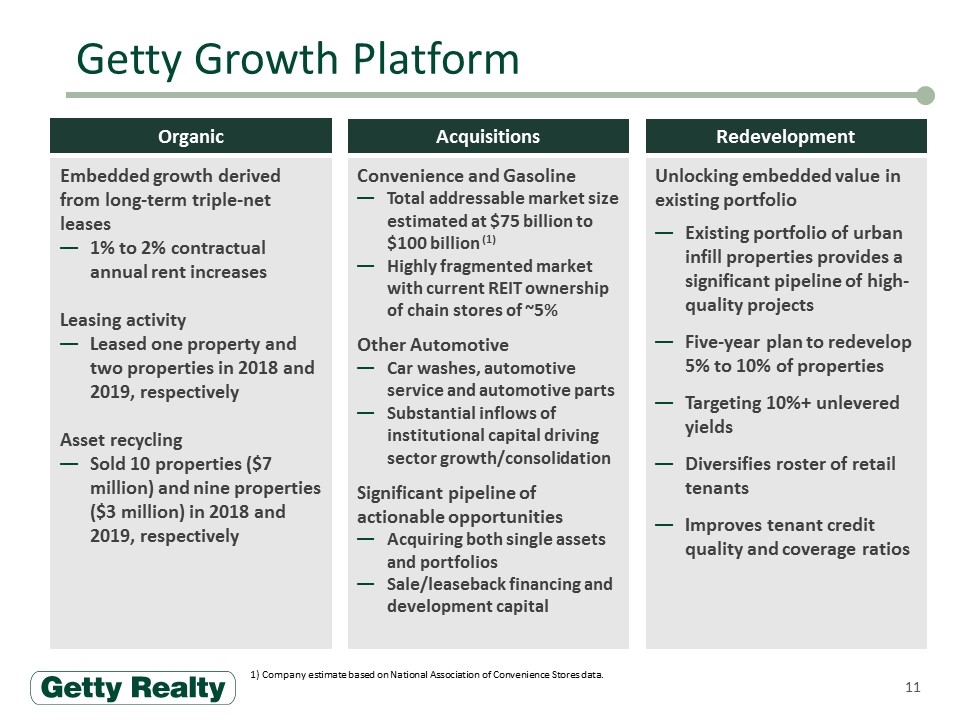

Getty Growth Platform Embedded growth derived from long-term triple-net leases 1% to 2% contractual annual rent increases Leasing activity Leased one property and two properties in 2018 and 2019, respectively Asset recycling Sold 10 properties ($7 million) and nine properties ($3 million) in 2018 and 2019, respectively Unlocking embedded value in existing portfolio Existing portfolio of urban infill properties provides a significant pipeline of high-quality projects Five-year plan to redevelop 5% to 10% of properties Targeting 10%+ unlevered yields Diversifies roster of retail tenants Improves tenant credit quality and coverage ratios Convenience and Gasoline Total addressable market size estimated at $75 billion to $100 billion (1) Highly fragmented market with current REIT ownership of chain stores of ~5% Other Automotive Car washes, automotive service and automotive parts Substantial inflows of institutional capital driving sector growth/consolidation Significant pipeline of actionable opportunities Acquiring both single assets and portfolios Sale/leaseback financing and development capital Organic Acquisitions Redevelopment Company estimate based on National Association of Convenience Stores data.

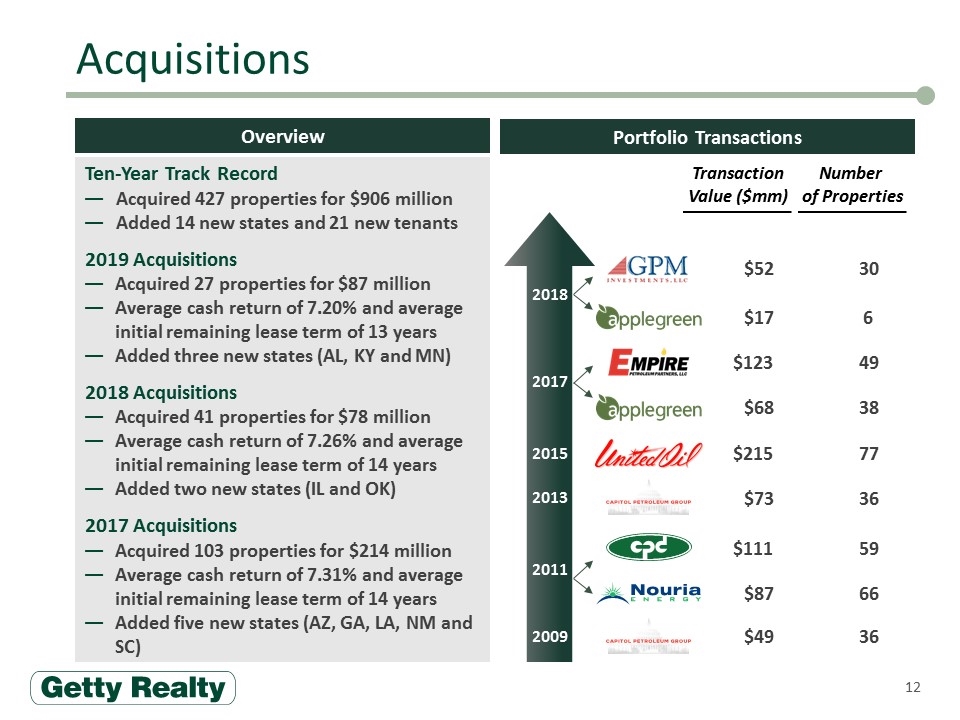

$68 38 $123 49 $17 6 $52 30 Acquisitions Ten-Year Track Record Acquired 427 properties for $906 million Added 14 new states and 21 new tenants 2019 Acquisitions Acquired 27 properties for $87 million Average cash return of 7.20% and average initial remaining lease term of 13 years Added three new states (AL, KY and MN) 2018 Acquisitions Acquired 41 properties for $78 million Average cash return of 7.26% and average initial remaining lease term of 14 years Added two new states (IL and OK) 2017 Acquisitions Acquired 103 properties for $214 million Average cash return of 7.31% and average initial remaining lease term of 14 years Added five new states (AZ, GA, LA, NM and SC) Overview Portfolio Transactions 2009 2018 2017 2013 2015 2011 Number of Properties Transaction Value ($mm) $111 59 $87 66 $73 36 $215 77 $49 36

2019 Acquisitions Purchase price – $49 million Properties – 16 Lot & building size – 0.9 acres and 2,519 sq. ft. Geography – AL, CA, FL, GA, IL, NC, NY, MA, OK and VA Purchase price – $38 million Properties – 11 Lot & building size – 1.1 acres and 5,614 sq. ft. Geography – AR, GA, KY, MN, NC and NV Convenience & Gas Other Automotive Irving Oil – Bellingham, MA Zips Car Wash – Rockingham, NC Sale/Leaseback Financing – NNN Acquisitions – Development Takeout Capital

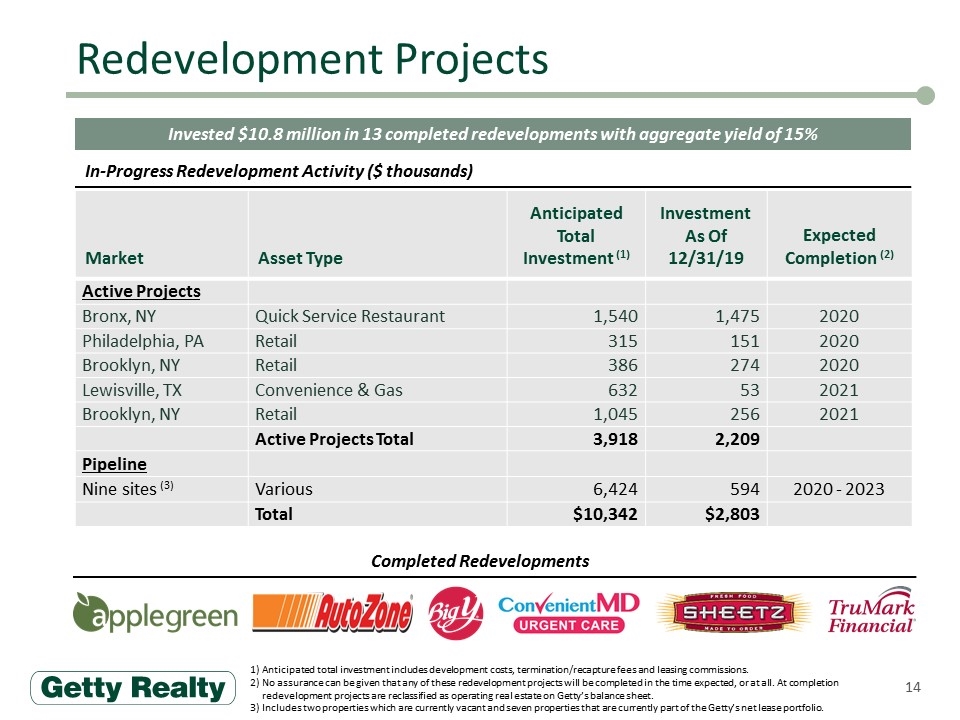

Market Asset Type Anticipated Total Investment (1) Investment As Of 12/31/19 Expected Completion (2) Active Projects Bronx, NY Quick Service Restaurant 1,540 1,475 2020 Philadelphia, PA Retail 315 151 2020 Brooklyn, NY Retail 386 274 2020 Lewisville, TX Convenience & Gas 632 53 2021 Brooklyn, NY Retail 1,045 256 2021 Active Projects Total 3,918 2,209 Pipeline Nine sites (3) Various 6,424 594 2020 - 2023 Total $10,342 $2,803 Redevelopment Projects Invested $10.8 million in 13 completed redevelopments with aggregate yield of 15% In-Progress Redevelopment Activity ($ thousands) Anticipated total investment includes development costs, termination/recapture fees and leasing commissions. No assurance can be given that any of these redevelopment projects will be completed in the time expected, or at all. At completion redevelopment projects are reclassified as operating real estate on Getty’s balance sheet. Includes two properties which are currently vacant and seven properties that are currently part of the Getty’s net lease portfolio. Completed Redevelopments

Redevelopment Case Studies Property type – Convenience and Gas Development type – Ground lease Lot & building size – 3.0 acres and 6,520 sq. ft. Total investment – $0.3 million Incremental yield – 67% Rent commencement – January 26, 2019 Tenant – Sheetz is one of America's fastest-growing convenience store chains with over 580 store locations Property type – Urgent Care Development type – Build to suit Lot & building size – 0.7 acres and 5,099 sq. ft. Total investment – $2.1 million Incremental yield – 10% Rent commencement – November 6, 2018 Tenant – ConvenientMD operates a network of 15 urgent care facilities across New England Sheetz, Inc. – 2019 ConvenientMD – 2018 Falmouth, MA Lancaster, PA

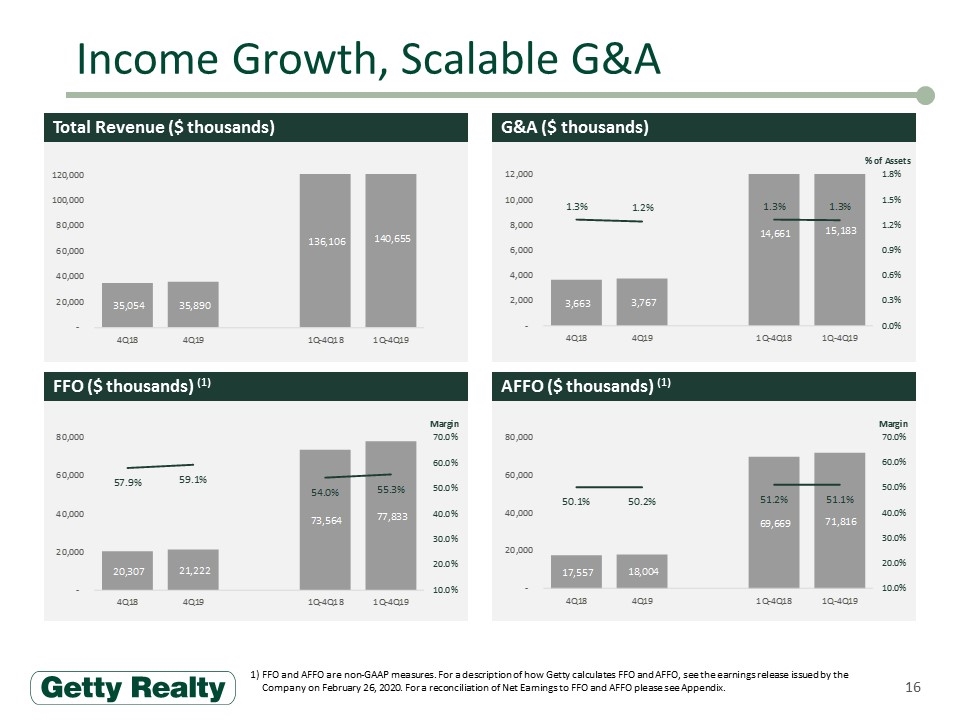

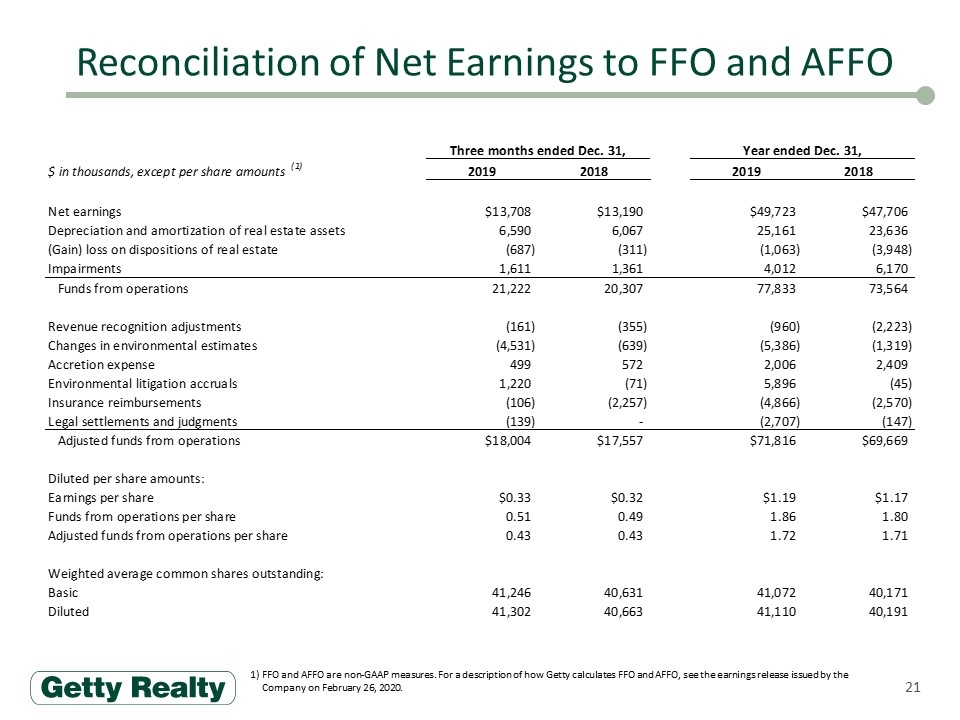

Income Growth, Scalable G&A G&A ($ thousands) AFFO ($ thousands) (1) Total Revenue ($ thousands) FFO ($ thousands) (1) FFO and AFFO are non-GAAP measures. For a description of how Getty calculates FFO and AFFO, see the earnings release issued by the Company on February 26, 2020. For a reconciliation of Net Earnings to FFO and AFFO please see Appendix.

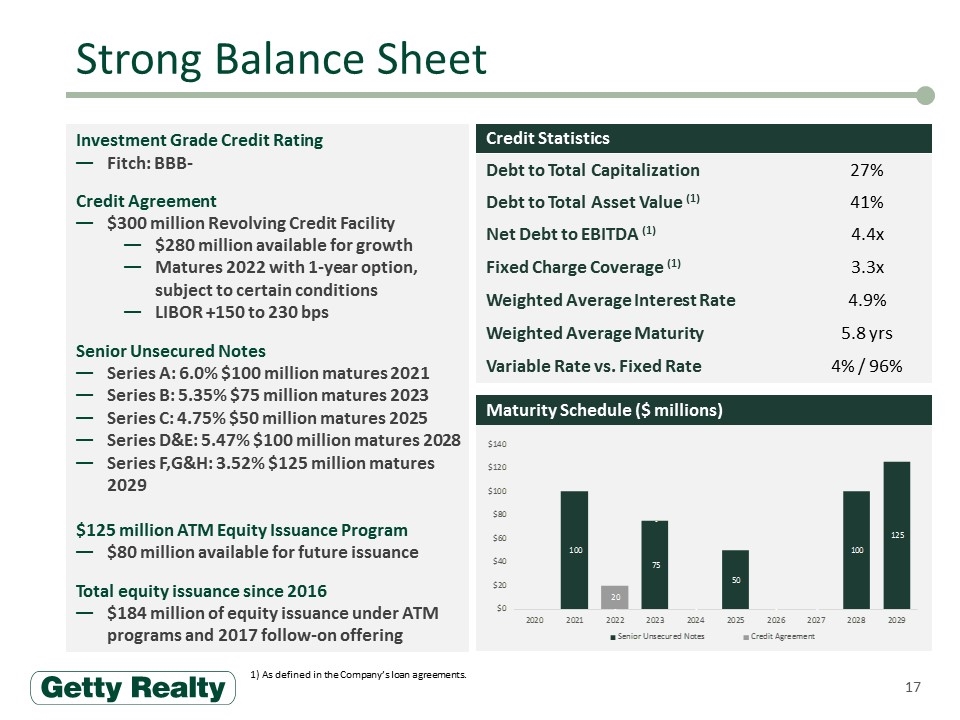

Strong Balance Sheet Investment Grade Credit Rating Fitch: BBB- Credit Agreement $300 million Revolving Credit Facility $280 million available for growth Matures 2022 with 1-year option, subject to certain conditions LIBOR +150 to 230 bps Senior Unsecured Notes Series A: 6.0% $100 million matures 2021 Series B: 5.35% $75 million matures 2023 Series C: 4.75% $50 million matures 2025 Series D&E: 5.47% $100 million matures 2028 Series F,G&H: 3.52% $125 million matures 2029 $125 million ATM Equity Issuance Program $80 million available for future issuance Total equity issuance since 2016 $184 million of equity issuance under ATM programs and 2017 follow-on offering Credit Statistics Maturity Schedule ($ millions) Debt to Total Capitalization 27% Debt to Total Asset Value (1) 41% Net Debt to EBITDA (1) 4.4x Fixed Charge Coverage (1) 3.3x Weighted Average Interest Rate 4.9% Weighted Average Maturity 5.8 yrs Variable Rate vs. Fixed Rate 4% / 96% As defined in the Company’s loan agreements.

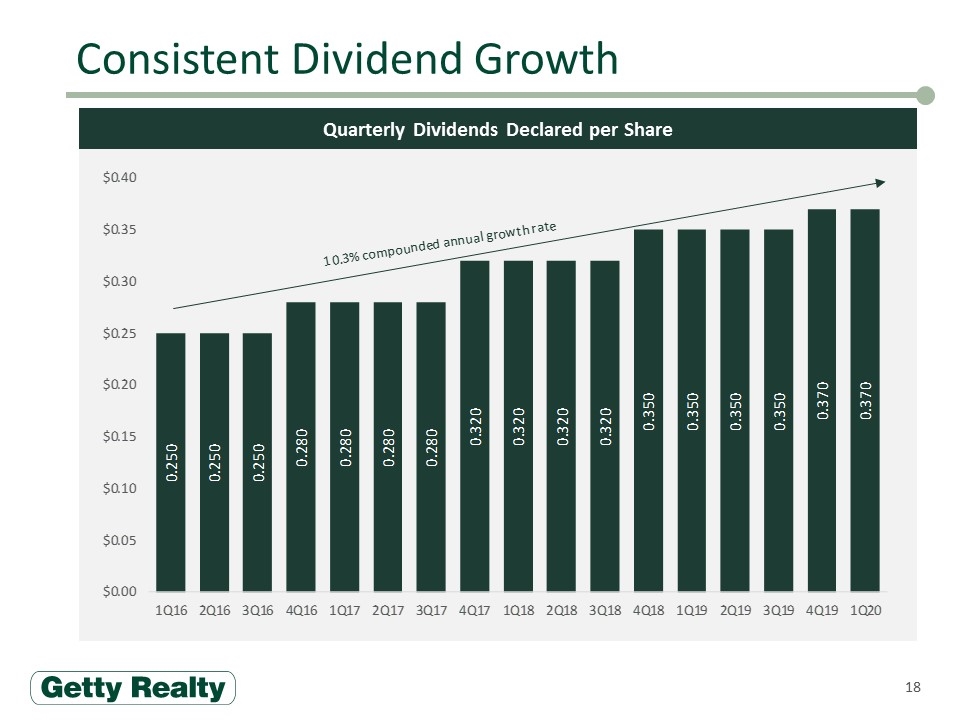

Quarterly Dividends Declared per Share Consistent Dividend Growth

Key Takeaways 1 National Net Lease Portfolio of Convenience Stores and Gasoline Stations 2 Well Located Retail Real Estate in both Established and High Growth Markets 3 Convenience and Gas Sector Continues to Grow and Remains One of the Healthiest Segments of the Retail Landscape 5 Cash Flow and Dividends Supported by Long-Term Triple-Net Leases 6 Proven Growth Track Record of Completing Acquisitions and Redevelopment Projects 7 Strong Balance Sheet to Support Future Growth 4 Entering Other Automotive Market – including Car Washes, Automotive Service and Automotive Parts

Appendix

Reconciliation of Net Earnings to FFO and AFFO FFO and AFFO are non-GAAP measures. For a description of how Getty calculates FFO and AFFO, see the earnings release issued by the Company on February 26, 2020.