Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PERCEPTRON INC/MI | f8k_022420.htm |

Exhibit 99.1

1 Fiscal Second Quarter 2020 Investor Presentation February 2020

This presentation includes “forward - looking statements” within the meaning of the Securities Exchange Act of 1934 , which involve risks and uncertainties . Forward - looking statements include all statements that do not relate solely to historical or current facts, and you can identify forward - looking statements because they contain words such as “believes,” “expects,” “may,” “will,” “outlook,” “should,” “seeks,” “intends,” “trends,” “plans,” “estimates,” “projects,” “guidance,” “anticipates” or similar expressions that concern our strategy, plans, expectations or intentions . All statements made relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results are forward - looking statements . These forward - looking statements are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward looking statements . We derive many of our forward - looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions . We claim the protection of the safe harbor for forward - looking statements contained in the Private Securities Litigation Reform Act of 1995 for all of our forward - looking statements . While we believe that our assumptions are reasonable, it is very difficult to predict the effect of known factors and is impossible to anticipate all factors that could affect our actual results . Given the significant uncertainties inherent in the forward - looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be realized . Important factors could affect our results and could cause results to differ materially from those expressed in our forward - looking statements, including but not limited to the factors discussed in the section entitled “Risk Factors” in our filings with the Securities and Exchange Commission (the “SEC”) . All subsequent written and oral forward - looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements . Any forward - looking statement that we make herein speaks only as of the date of this presentation . We undertake no obligation to publicly update or revise any forward - looking statement as a result of new information, future events or otherwise, except as required by law . Included in this presentation are certain non - GAAP financial measures, such as Adjusted EBITDA, designed to complement the financial information presented in accordance with U . S . GAAP because management believes such measures are useful to investors and management . Management believes these non - GAAP financial measures, when taken together the corresponding GAAP measures, provide incremental insight into the underlying factors and trends affecting our performance . These non - GAAP financial measures should be considered only as supplemental to, and not superior to, financial measures provided in accordance with GAAP . Please refer to the appendix of this presentation for a reconciliation of the historical non - GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with GAAP . Reconciliations of the non - GAAP measures used in this presentation are included or described in the tables attached to the appendix . 2 Forward - Looking Statements and Non - GAAP Financial Measures DISCLAIMER

F2Q20 Results Summary 3

Executive Summary Fiscal Second Quarter 2020 4 F2Q20 Total Sales of $19.1 million, +7% q/q and (11.6%) y/y > Q/Q improvement in Americas and Europe; Y/Y decline across all geographic regions F2Q20 Total Bookings of $14.4 million, (16%) q/q and (30%) y/y > Significant Q/Q improvement in Asia, offset by declines in Americas and Europe; y/y decline across all geographic regions F2Q20 Total Backlog of $33.0 million, (12%) q/q and (13%) y/y > Q/Q and Y/Y improvement in Asia, offset by declines in Americas and Europe F2Q20 Gross Profit of $7.1 million, flat q/q and (10%) y/y > Gross margin of 37.2%, (250) bps q/q and +60 bps y/y F2Q20 Net Income of $0.8 million, +20% q/q and (53%) y/y > Diluted earnings per share of $0.08, compared with $0.17 in the prior quarter Adjusted EBITDA (1) of $1.8 million, (38%) q/q and 13% y/y > Adjusted EBITDA margin of 9.4%, compared with 7.1% in the prior quarter Debt Free, Ample Access to Liquidity > Company has more than $11 million of cash and liquidity and no debt as of Dec. 31, 2019 (1) See the attached appendix for a reconciliation of Adjusted EBITDA to GAAP net income.

Global Demand Conditions Fiscal Second Quarter 2020 5 Europe (46% of TTM Sales) > Market benefiting from a transition toward AV/EV models, with new programs replacing older IC models > Stable to growing market share – customer diversification underway > Challenging y/y comparison in F2Q20, given the award of a large floor plant contract w/ a major automotive OEM in F2Q19 Market Conditions By Key Geographic Market Executive Summary Americas (32% of TTM Sales) > Market remains in a holding pattern > Limited near - term visibility into timing of new EV/AV launches at domestic automotive OEMs > Seeing multiple new major domestic automotive programs on the horizon for FY21, with a y/y rebound expected in the Americas Consolidated Outlook > Timing of automotive industry program pivot away from internal combustion (IC) engines toward AV and EV vehicles > Europe and Asia are making the AV/EV transition more rapidly than the Americas > Product development guided by customer demand for accuracy and simplicity > Anticipate a rebound in FY21 performance vs. trade - war impacted FY20 Asia (22% of TTM Sales) > Market remains highly competitive, but we are viewed as a technology leader, which allows for competitive differentiation > Market poised to accelerate into the back half of fiscal 2020, recovering from the impact of the U.S. - China trade dispute earlier in the year > Targeted new business at more than 100 tier 1 suppliers throughout Asia; expect y/y improvement in China and Japan in FY21

Total Net Sales ($MM) Total Gross Profit ($MM) Current year sales softness primarily from Asia Adjusted EBITDA +12.5% y/y in F2Q20 Positive y/y growth in operating cash flow in F2Q20 2 3 1 $21.6 $19.1 $88.0 $70.8 F2Q19 F2Q20 TTM F2Q19 TTM F2Q20 Total Adj. EBITDA ($MM) $7.9 $7.1 $33.1 $ 2 5.2 F2Q19 F2Q20 TTM F2Q19 TTM F2Q20 Cash Flow From Operations ($MM) $1.6 $1.8 $7.2 $1.9 F2 Q 19 F2 Q 20 TTM F2Q19 TTM F2Q20 $1 . 7 $0.6 6 $2 . 3 ($0.6) F2 Q 19 F2 Q 20 TTM F2Q19 TTM F2Q20 Consolidated Financial Results Fiscal Second Quarter 2020 - Y/Y and TTM Comparisons Net Income for F2Q19 was $1.6 million, F2Q20 was $0.8 million, TTM F2Q19 was $4.5 million and TTM F2Q20 was ($8.0 million).

Consolidated Margin Analysis Focus on Higher - Margin Applications Results In Y/Y Gross Profit Margin Expansion Gross Profit Margin (%) Gross Margins improved through Fiscal 1H20 Cost reduction initiatives expected to improved GM in 2021 2 1 36 . 9 % 32 . 7 % 38 . 1 % 32 . 4 % 38 . 8 % 39 . 7 % 36 . 6 % 37 . 2 % F Y 3 Q 1 8 F Y 3 Q1 9 F Y 4 Q1 8 F Y 4 Q1 9 F Y 1 Q1 9 F Y 1 Q2 0 F Y 2 Q1 9 F Y 2 Q2 0 F 3 Q 1 8 F 3 Q 1 9 F 4 Q 1 8 F 4 Q 1 9 F 1 Q 1 9 F 2 Q 1 9 F 1 Q 2 0 F 2 Q 2 0 7

Sales Performance Bridge Fiscal 2Q19 vs. Fiscal 2Q20 Total Net Sales Bridge By Geography ($MM) Asia impacted by low F1Q20 bookings; expected to recover in Fiscal 2H20 Anticipate stabilization / recovery in sales in Fiscal 2H20 Measurement was down ($1.9) million y/y but +$1.3 million q/q 2 3 1 Total Net Sales Bridge By Product Line ($MM) $19.1 $19.1 8

Bookings and Backlog Fiscal 2Q19 vs. Fiscal 2Q20 Total Bookings By Geography (1) ($MM) (1) Bookings are defined as new orders received from customers that have been filled (2) Backlog is defined as bookings that have been received but not yet filled YoY bookings shortfall primarily due to European customer accounts Backlog declines due to soft F2Q20 bookings 2 1 Total Backlog (2) ($MM) $ 3.0 $5.5 $12.0 $20.5 $2.4 $4.7 $ 7.3 $14.4 Americas A si a Total Bookings F Y2 Q 1 9 FY2Q 2 0 $9.0 $7.5 $ 3 8.1 $7.9 $7.7 $21.6 $17.4 $33.0 Americas A sia E u r ope Total Backlog F Y2 Q 1 9 FY2Q 2 0 F2Q19 9 E u r ope F2Q20 F2Q19 F2Q20

Balance Sheet Update Sufficient Access to Capital, No Outstanding Debt on Balance Sheet Total Cash and Availability On Credit Facilities ($MM) Company continues to maintain adequate access to capital, as needed $10 .4 $12.5 $12.5 $10.9 $9.0 $8.9 $8.7 $11.2 F Y 3 Q 1 8 F Y 4 Q 1 8 F Y 1 Q 1 9 F Y 2 Q 1 9 F Y 3 Q 1 9 F Y 4 Q 1 9 F Y 1 Q 2 0 F Y 2 Q 2 0 F3Q 1 8 F4Q 1 8 F1Q 1 9 F2Q 1 9 F3Q 1 9 F1Q 2 0 F4Q 1 9 F2Q 2 0 10

Market Opportunity 11

Technology Leader In Industrial Metrology Our Unique Value Proposition Global Player In a Niche Technology Market Why We Win In The Markets We Serve Leading Player in Automotive Metrology > Sell 60% of the non - contact, in - line measurement products purchased by the auto industry Innovation / Technological Edge > Industry - leading gap and flush technology – continuing to invest in next - gen algorithms Successful Product Launches / Adoption > Hardware (Helix, TriCam, CMM); Software (Vector, Argus, TouchDMIS) > Core focus involves the development, manufacture, installation and sale of In - Line, Near - Line and Off - Line Measurement Solutions Key Product Lines Applications and Solutions By Product Line Measurement Solutions (91% of TTM Revenue) 3D Scanning Solutions (4% of TTM Revenue) > Core focus involves the development, manufacture and sale of laser - based sensors and software for three - dimensional measurement Value - Added Services (5% of TTM Revenue) 12 > Core focus involves training, field service and calibration, launch support, consulting and equipment/software maintenance Improve quality, reduce waste and outages > Instrumental in driving continuous improvement in manufacturing efficiency Valuable Intellectual Property > 12 U.S. patents, 5 foreign patents

The Evolution of Metrology Comparing Traditional Metrology vs. Perceptron’s In - Line Metrology Traditional Metrology Gauging/Measurement is outside the manufacturing process Limitation #2 > Errors determined by a sampling of production, not 100% inspection Limitation #3 > Requires substantial resources (e.g. time, labor, cost) Limitation #4 > Corrections implemented retroactively Perceptron’s In - Line Metrology Gauging/Measurement is included within the manufacturing process 13 Limitation #1 > Measurement occurs outside of the manufacturing process Limitation #5 > Errors are costly – no containment of non - conforming assemblies Advantage #2 > Advanced robotic assembly with 100% inspection fully integrated into the production line Advantage #3 > Reduced labor costs with higher quality Advantage #4 > Real - time measurement, analysis and feedback Advantage #1 > In - process measurement of every part Advantage #5 > Best - in - class plant - wide quality reporting package

Metrology Industry Positioning Our Solutions Are High On The Value Chain Solution Complexity Tower Perceptron Focuses On Innovating With the Most Complex Gauging and Measurement Solutions Gauging & Measurement > Measuring the dimensions of an object Most Co m plex Least Co m plex Gauging & M ea s u r ement Inspection M onitor i ng Location Monitoring Identification Inspection > Analyze object to determine flaws or defects Location > Determining 2D physical location and orientation of an object 14 Identification > Identifying objects by analyzing physical characteristics or reading codes and labels

Proven Track Record With Global Customers Experienced Metrology Leader Within Automotive Applications Engineered Solutions For Major Auto OEMs Executive Summary Large Installed Base > 12,000 sensors and 3,000+ Coord3 CMMs used daily Serve All Major Auto OEMs > Collaborative, long - standing relationships with an average tenure of 30+ years Preferred Solution Partner > Often a “sole sourced” supplier; provide custom innovations to complex issues Top Five Customers As % of Fiscal 2019 Revenue Depth Customer Experience > 900+ installations in 200+ manufacturing facilities End - Market Exposure As % of Fiscal 2019 Revenue 80% 20% Automotive Customer #1 13% Customer #2 11% Customer #3 7% Customer #4 4% Customer #5 4% Top 10 Customers 48% 15 Non - Automotive

Sizing The 3D Metrology Market Automotive Represents Nearly 30% of The Annual 3D Metrology Market Opportunity Global 3D Metrology Market (1) (Estimated Annual Market Opportunity - $ Billions) (1) Source: GIA, Jan - 20 Accuracy/precision standards are increasing due to miniaturization trend Focus on productivity and quality drives demand Migration toward “zero defect” measurement technologies 2 3 1 $8 . 4 $9 . 2 $10 . 1 $11 . 0 $12 . 0 $13 . 0 $14 . 0 $15 . 0 2018 2019 2020 2021 2022 2023 2024 2025 Largest Verticals Within The Global 3D Metrology Market (2020) (1) (Estimated Annual Market Opportunity - $ Billions) $1 . 4 $1 . 5 $1 . 7 $2 . 1 $2 . 9 Medical Construction Heavy Industry Aerospace/Defense Automotive 16

Sector - Specific Growth Within Global 3D Metrology Automotive, A/D, Heavy Industry Each Growing at a 5 - Year CAGR of More Than 8% 5 - Year Compounded Annual Growth Rate By Vertical Within The Global 3D Metrology Market (2020 - 2025) (1) (Growth Rate %) (1) Source: GIA (Jan - 20) Automotive – AV and EV platforms provide major opportunity A/D – focus on reduced inspection time / repairs during assembly process Heavy Industry – portable metrology solutions 2 3 1 A u t omo tive 8.7% A e ro s p a c e / D e f e n se 8.1% Heavy Industry 8.0% M e d i cal 7 . 4 % C o n st ru c t ion 7.0% 17

Automotive OEMs Investing In Vision Guided Robotics Automotive Industry Continues To Grow Adoption of VGR Solutions Global Automotive Annual Investment In Vision Guided Robotics (1) ($MM) (1) Source: Insight Partners (Jan - 20) Driving increased productivity and ensure product quality Increased use of automation in tight labor markets Supports shift toward “zero defect” manufacturing floor culture 2 3 1 $2 , 47 1 $2,228 18 $2 , 75 8 $3 , 09 4 $3 , 48 6 $5 , 06 2 $4,465 $3,941 $5 , 74 0 $6 , 50 7 C Y 1 8 C Y 1 9 C Y 2 0 C Y 2 1 C Y 2 2 C Y 2 3 C Y 2 4 C Y 2 5 C Y 2 6 C Y 2 7

Stable Automotive End - Market Demand Perceptron Benefits From New Platform Activity Number of Global Automotive Vehicle Launches By Year (1) We Sell Into the OEM 12 - 18 Months Before The Launch (1) Source: Source: IHS Markit Global Light Vehicle Production forecast, Jan. 2020. Program launch defined as any new platform, program, nameplate, plant combinations. Includes only traditional assembly plant (completely built up) production is represented, while completely knocked - down is not counted. (2) Source: IHS Markit Global Light Vehicle Production forecast, Jan. 2020. Anticipate stable base of more than 300 - 400 program launches per year China expected to represent nearly half of all global vehicle launches in 2020 LV production driven by demand in Asia and the Americas 2 3 1 Light Vehicle Production Forecast (2) (Millions of Units) 88 . 3 90 . 3 95 . 6 92.8 98 . 0 100 . 0 102 . 0 C Y 2 0 C Y 2 1 C Y 2 2 C Y 2 3 C Y 2 4 C Y 2 5 C Y 2 6 223 19 193 277 242 296 262 287 267 305 364 401 349 354 327 317 307 350 CY10 CY11 CY12 CY13 CY14 CY15 CY16 CY17 CY18 CY19 CY20 CY21 CY22 CY23 CY24 CY25 CY26

Near - Term Strategic Priorities Building a World - Class Metrology Brand Top Five Priorities for Perceptron Executive Summary Stabilize Financial Performance > Structure the company for maximum efficiency – focus on targeted sales growth, technological innovation, efficient cost management Enhance Core Technology Portfolio > Review all existing offerings and reallocate resources toward the highest - potential R&D initiatives Extend Market Leadership Position in the Automotive Vertical > Introduce a broader array of solutions for OEM partners, while energizing relationships with Tier I and II suppliers Diversify the Metrology Revenue Base into Alternative Growth Markets > Capture a greater share of the addressable market opportunity in A/D, Heavy Industry, Construction and Medical Select Visionary Long - Term Leadership > Engage long - term executive leadership (CEO and CFO) that will execute the vision aggressively and successfully 20

Management Outlook 21

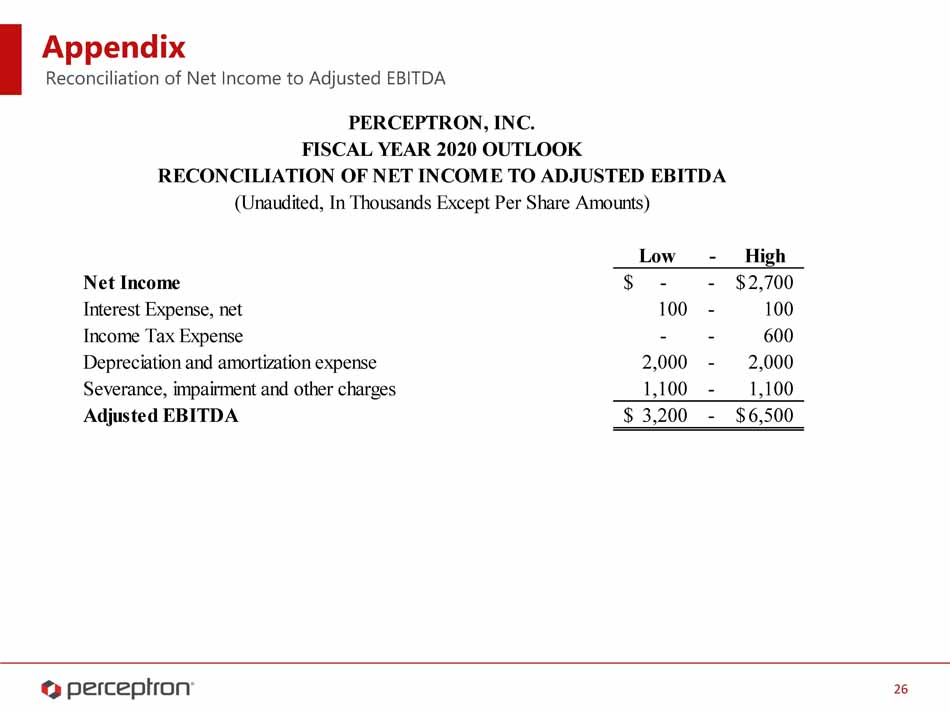

Financial Guidance Setting Expectations Under New Management 22 Guidance for the 12 months Ended June 30, 2020 (Fiscal 2020) Current as of February 11, 2020 Total Revenue Guidance > $70.0 million to $75.0 million GAAP Net Income Guidance > Net Income of break - even to $2.7 million, or between $0.00 to $0.28 per share Adjusted EBITDA Guidance > $3.2 million to $6.5 million

Investment Thesis Building a World - Class Metrology Brand 23 Technological Leader In Industrial Metrology > Next generation metrology IP positions Perceptron as an incumbent within In - Line, Near - Line, Off - Line metrology solutions Full - Service Solutions Represent Key Point of Differentiation > Solutions improve manufacturing quality, shorten product launch times and reduce cost, providing a competitive advantage to customers Long - Term Relationships With Large Global Customers > 30+ year history; 900+ installations in 200+ manufacturing plants; high level of customer collaboration in developing custom solutions Large, Untapped Metrology Opportunity > Automotive is 80% of revenues, but only 30% of the $10 billion annual metrology market opportunity – focused on revenue diversification Focused On Profitable Growth In Targeted Markets > Playing in markets where custom solutions, innovative technology and after market support warrant higher - margin sales Debt Free, Ample Access to Liquidity > Company has more than $11 million of cash and liquidity and no debt as of Dec. 31, 2019

Appendix 24

Appendix Reconciliation of Net Income to Adjusted EBITDA Three Months Ended September 30, 2019 2018 (As Revised) 2019 2019 (As Revised) 2018 (As Revised) Net Income $ 751 $ 1,609 $ 626 $ (7,977) $ 4,488 Interest Expense, net 43 29 24 263 153 Income Tax Expense (Benefit) 48 (45) 143 (252) 933 Depreciation and Amortization Expense 484 567 480 1,858 2,271 Severance, Impairment and Other Charges 471 (609) - 8,01 0 (612) Adjusted EBITDA $ 1,797 $ 1,551 $ 1,273 $ 1,902 $ 7,233 Net Sales $ 19,132 $ 21,553 $ 17,850 $ 70,869 $ 87,98 6 Adjusted EBITDA Margin 9.4% 7.2% 7.1% 2.7% 8.2% The tables below present a reconciliation of the non - GAAP measures to the most directly comparable financial measure calculated in accordance with GAAP. While Perceptron’s results under GAAP provide significant insight into our operations and financial position, Perceptron’s management supplements its analysis of the business using “Adjusted EBITDA”. Adjusted EBITDA, for the periods presented, represents net income before interest expense, net; income tax expense (benefit); and depreciation and amortization expense, severance costs, impairment charges and litigation settlements. Adjusted EBITDA does not represent net income, as that term is defined under GAAP, and should not be considered as an alternative to net income as an indicator of our operating performance. Adjusted EBITDA is not intended to be measures of free cash flow available for management or discretionary use as such measures do not consider certain cash requirements such as capital expenditures, tax payments and debt service requirements. Management believes this non - GAAP financial measure, when taken together with the corresponding GAAP measure, provides incremental insight into the underlying factors and trends affecting our performance because it excludes the effects of financing, investment, and other non - operating activities that management believes are not representative of our core business. PERCEPTRON, INC. RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA (Unaudited, In Thousands) Three Months Ended December 31, Trailing Twelve Months December 31, 25

Appendix Net Income $ - - $ 2,700 Interest Expense, net 100 - 100 Income Tax Expense - - 600 Depreciation and amortization expense 2,000 - 2,000 Severance, impairment and other charges Adjusted EBITDA 1,100 - 1,100 $ 3,200 - $ 6,500 Reconciliation of Net Income to Adjusted EBITDA PERCEPTRON, INC. FISCAL YEAR 2020 OUTLOOK RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA (Unaudited, In Thousands Except Per Share Amounts) Low - High 26