Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE FROM THERAPEUTICSMD, INC., DATED FEBRUARY 20, 2020 - TherapeuticsMD, Inc. | ex99-1.htm |

| 8-K - CURRENT REPORT - TherapeuticsMD, Inc. | txmd-8k_021820.htm |

Exhibit 99.2

Building the Premier Women’s Health Company 4Q 2019 Earnings February 20, 2020

2 Forward - Looking Statements This presentation by TherapeuticsMD, Inc . (referred to as “we” and “our”) may contain forward - looking statements . Forward - looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, as well as statements, other than historical facts, that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future . These statements are often characterized by terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions and are based on assumptions and assessments made in light of our managerial experience and perception of historical trends, current conditions, expected future developments and other factors we believe to be appropriate . Forward - looking statements in this presentation are made as of the date of this presentation, and we undertake no duty to update or revise any such statements, whether as a result of new information, future events or otherwise . Forward - looking statements are not guarantees of future performance and are subject to risks and uncertainties, many of which may be outside of our control . Important factors that could cause actual results, developments and business decisions to differ materially from forward - looking statements are described in the sections titled “Risk Factors” in our filings with the Securities and Exchange Commission (SEC), including our most recent Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q, as well as our current reports on Form 8 - K, and include the following : our ability to maintain or increase sales of our products ; our ability to develop and commercialize IMVEXXY, ANNOVERA, BIJUVA and our hormone therapy drug candidates and obtain additional financing necessary therefor ; whether we will be able to comply with the covenants and conditions under our term loan facility, including the conditions to draw an additional tranche thereunder and whether our lender will make that tranche available ; the potential of adverse side effects or other safety risks that could adversely affect the commercialization of our current or future approved products or preclude the approval of our future drug candidates ; whether the FDA will approve the efficacy supplement for the lower dose of BIJUVA ; the length, cost and uncertain results of future clinical trials ; our reliance on third parties to conduct our clinical trials, research and development and manufacturing ; the ability of our licensees to commercialize and distribute our products ; the ability of the company’s marketing contractors to market ANNOVERA ; the effects of laws, regulations and enforcement ; the competitive nature of the industries in which we conduct our business ; the availability of reimbursement from government authorities and health insurance companies for our products ; the impact of product liability lawsuits ; the influence of extensive and costly government regulation ; the volatility of the trading price of our common stock, including the effect of any sales of common stock by our executive officers or directors, whether in connection with the expiration of stock options or otherwise ; and the concentration of power in our stock ownership . This non - promotional presentation is intended for investor audiences only .

3 Today’s Agenda 2019 Review 2020 Commercial Strategy and Marketing Plans 4Q 2019 Financial Results 2020 Financial Guidance Q&A

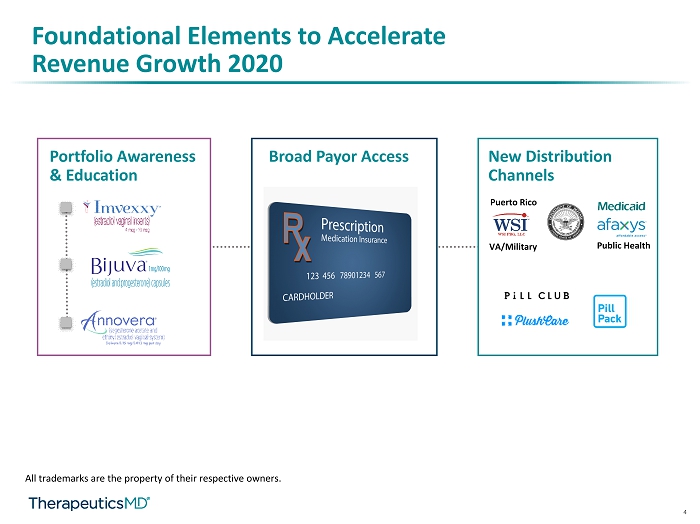

4 Foundational Elements to Accelerate Revenue Growth 2020 Portfolio Awareness & Education Broad Payor Access New Distribution Channels All trademarks are the property of their respective owners. VA/Military Public Health Puerto Rico

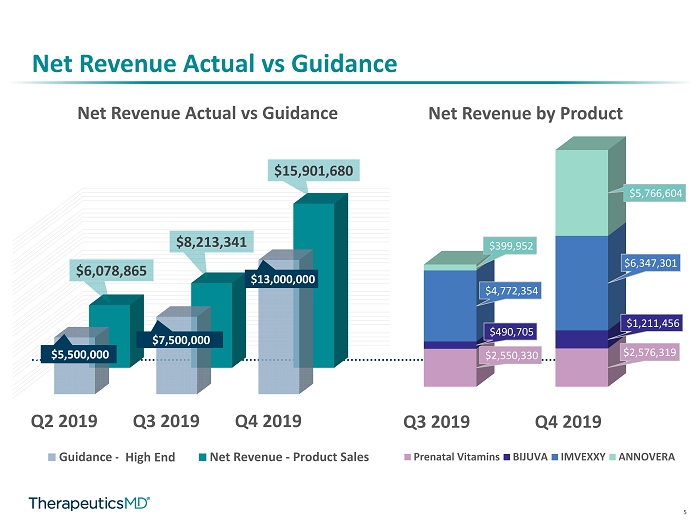

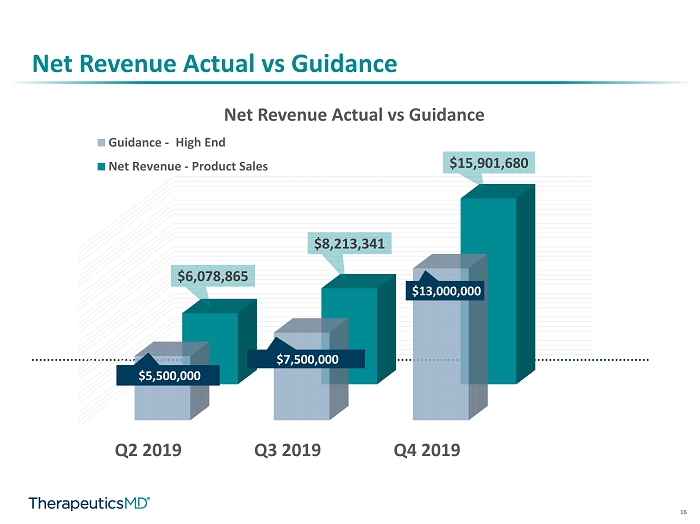

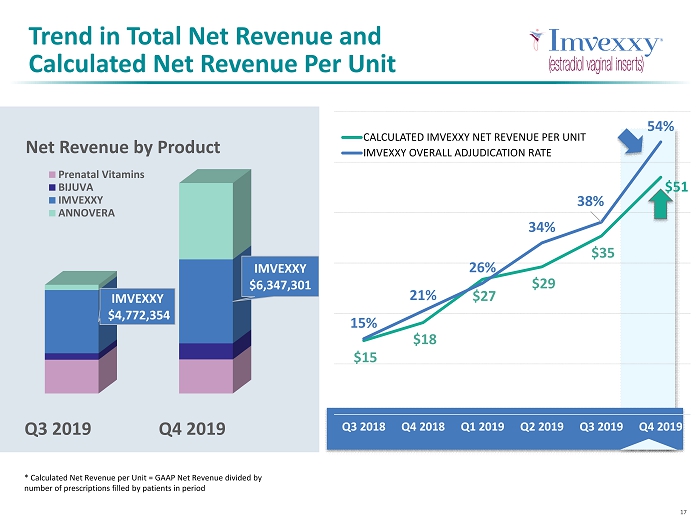

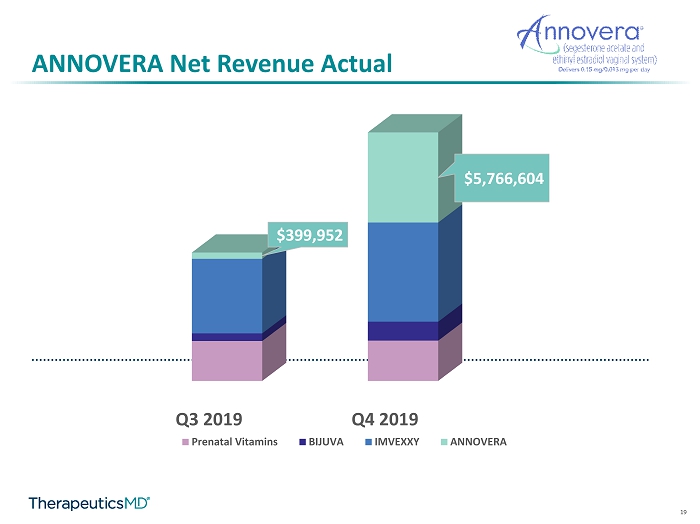

5 Net Revenue Actual vs Guidance Q2 2019 Q3 2019 Q4 2019 $5,500,000 $7,500,000 $13,000,000 $6,078,865 $8,213,341 $15,901,680 Net Revenue Actual vs Guidance Guidance - Midpointe Net Revenue - Product Sales High End Q3 2019 Q4 2019 $2,550,330 $2,576,319 $490,705 $1,211,456 $4,772,354 $6,347,301 $399,952 $5,766,604 Net Revenue by Product Prenatal Vitamins BIJUVA IMVEXXY ANNOVERA

6 Coverage Today February 20, 2020 Target Coverage Year - end 2020 ANNOVERA Commercial 75%* 80%* IMVEXXY Commercial 72% 75% Part D 29% 70% BIJUVA Commercial 56% 75% Significant Payor Coverage and Growing Source: MMIT February 20, 2020 Awaiting IMVEXXY Part D decisions from Humana, Wellcare and ESI; potential total unrestricted coverage of up to 40% by April 1 st *Annovera coverage includes unrestricted access and coverage with a step edit/prior authorization. Currently 65% unrestricted, 11% step/prior authorization.

PRODUCT OVERVIEW & COMMERCIAL UPDATES

8 Shifted from a clinically innovative company to a commercially successful company 3 Products in Launch Mode Q3 2018 Q2 2019 Q1 2020 COMMERCIAL LAUNCHES

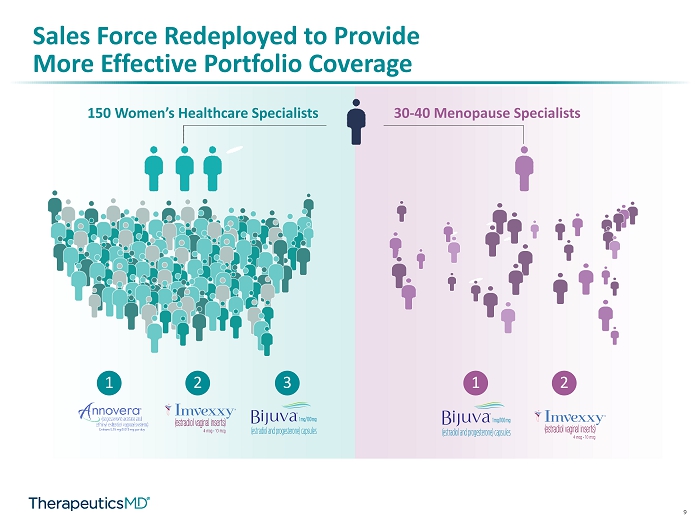

9 Sales Force Redeployed to Provide More Effective Portfolio Coverage 150 Women’s Healthcare Specialists 30 - 40 Menopause Specialists 1 2 3 1 2

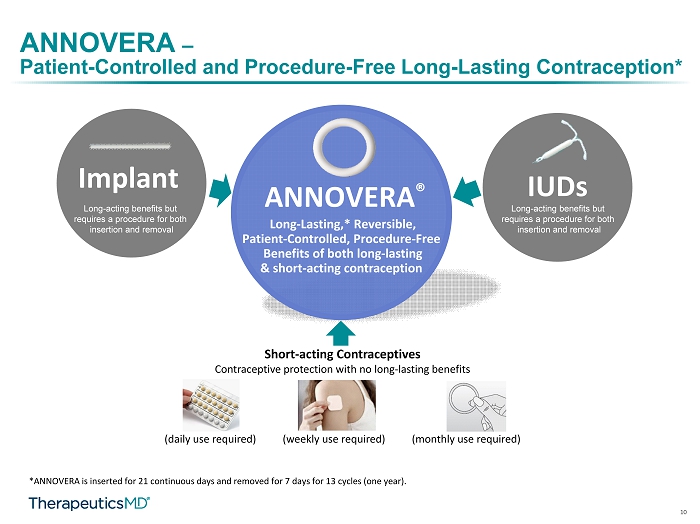

10 ANNOVERA – Patient - Controlled and Procedure - Free Long - Lasting Contraception* *ANNOVERA is inserted for 21 continuous days and removed for 7 days for 13 cycles (one year). IUDs Long - Lasting,* Reversible, Patient - Controlled, Procedure - Free Benefits of both long - lasting & short - acting contraception Long - acting benefits but requires a procedure for both insertion and removal ANNOVERA ® Implant Long - acting benefits but requires a procedure for both insertion and removal Short - acting Contraceptives Contraceptive protection with no long - lasting benefits (daily use required) (weekly use required) (monthly use required)

11 Sales Force Focus Consumer Advertising and Public Relations Effort ANNOVERA Growth Levers Lead Product for Spend and Focus 1 ANNOVERA is inserted for 21 continuous days and removed for 7 days for 13 cycles (one year) Expand into New Channels and Populations ▪ Focus on Empowerment and Control 1,2 ▪ Disruptive Consumer Campaign Launching in March ▪ Public Relations Initiatives ▪ Full scale launch planned for March 1 st ▪ Lead product designation for Women’s Healthcare Salesforce ▪ Online Platforms including Pillpack , PlushCare , and Pill Club ▪ WSI to market to the Department of Defense and Veteran’s Administration ▪ Puerto Rico Distribution ▪ Afaxys to meet the needs of public health clinics, college and university health clinics, and city, county, state and federal facilities

12 IMVEXXY Investment Across Multiple Levers *IQVIA data All trademarks are the property of their respective owners. 2020 Goal: surpass Premarin® Vaginal Cream on a monthly prescription basis by year end ▪ Current average monthly TRX of Premarin Vaginal Cream: 80K TRx * ▪ Promoted by all Sales Representatives ▪ 4,200 current heavy writers representing 20% of high volume VVA writers ▪ Goal to increase depth of writing among 20,000 prescribers who have prescribed IMVEXXY ▪ Increased overall funding ▪ Heavier investment in consumer marketing throughout the year Marketing Sales Force

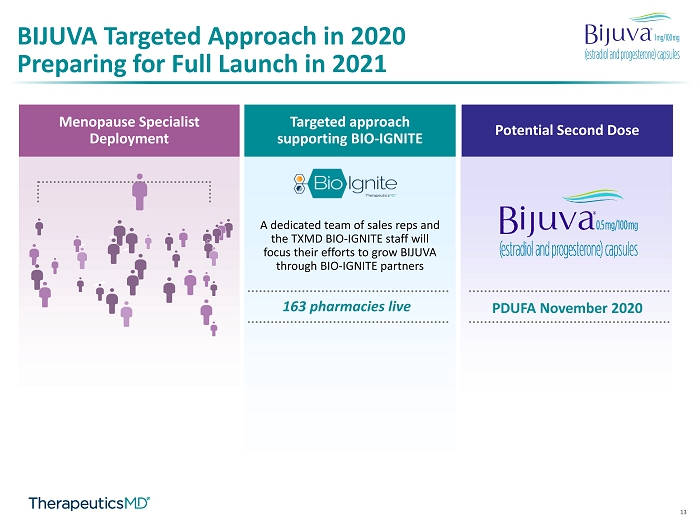

13 Targeted approach supporting BIO - IGNITE 163 pharmacies live A dedicated team of sales reps and the TXMD BIO - IGNITE staff will focus their efforts to grow BIJUVA through BIO - IGNITE partners Menopause Specialist Deployment Potential Second Dose PDUFA November 2020 BIJUVA Targeted Approach in 2020 Preparing for Full Launch in 2021

14 Chris Gish – Sales Lead ▪ Senior Sales Leader with 29 years of experience in pharmaceutical sales leadership ▪ Experience in large and small pharmaceutical companies including Pfizer, Sunovion, Alder - Bio ▪ Have launched 20+ brands over the course of his career ▪ Unique expertise in optimizing pharmaceutical sales organizations Build out of Commercial Expertise Commercial Leadership Team Mike Steelman – Market Access Lead ▪ Senior leader access positions at Pfizer and Sanofi with United States and International responsibility ▪ 22 years of pharma experience with 13 years in access ▪ Was responsible for 1/3 of Pfizer’s National Payor Accounts including government sector Dedra Lyden – Strategic Partnerships ▪ Launched and continues to lead the expansion of Bio - Ignite ▪ 16 years of Pharmaceutical experience across BD, Sales, Sales leadership Tyra Riehl – Training Lead ▪ Senior leader with expertise in sales training and leadership development ▪ 22 years in small and large biotech and pharmaceutical companies including Searle, Sunovion, Quest and Alkermes Kristen Landon – Marketing Lead ▪ Women’s Health commercial leader with prior tenures at Allergan, Radius Health, and Sprout ▪ 24 years’ experience in pharmaceutical marketing, sales, sales leadership, and business development ▪ Category experience in contraception, menopause, osteoporosis, sexual dysfunction, infertility, and infections ▪ Brands include Lo Loestrin , Estrace , Tymlos , Generess , Liletta , ella , Addyi , Crinone , and Solosec Erika Guay – Menopause Brand Lead ▪ Senior leader with over 15 years of marketing experience at Pfizer ▪ Brand experience across multiple categories including, Women’s Health, Depression, Cardiovascular & Dermatology Jerrold McRae - Reproductive Brand Lead ▪ Sales and marketing and strategy leader at Pfizer for 14 years ▪ Brand experience across multiple categories including Women’s Health ( Estring ), Pain (Lyrica), Urology (Detrol LA, Viagra) All trademarks are the property of their respective owners.

FINANCIAL UPDATE

16 Net Revenue Actual vs Guidance Q2 2019 Q3 2019 Q4 2019 $5,500,000 $7,500,000 $13,000,000 $6,078,865 $8,213,341 $15,901,680 Net Revenue Actual vs Guidance Guidance - Midpointe Net Revenue - Product Sales High End

17 * Calculated Net Revenue per Unit = GAAP Net Revenue divided by number of prescriptions filled by patients in period $15 $18 $27 $29 $35 15% 21% 26% 34% 38% 54% Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 CALCULATED IMVEXXY NET REVENUE PER UNIT IMVEXXY OVERALL ADJUDICATION RATE $51 Trend in Total Net Revenue and Calculated Net Revenue Per Unit Q3 2019 Q4 2019 IMVEXXY $4,772,354 IMVEXXY $6,347,301 Net Revenue by Product Prenatal Vitamins BIJUVA IMVEXXY ANNOVERA

18 * Calculated Net Revenue per Unit = GAAP Net Revenue divided by number of prescriptions filled by patients in period $29 $31 34% 45% 60% Q2 2019 Q3 2019 Q4 2019 CALCULATED BIJUVA NET REVENUE PER UNIT BIJUVA OVERALL ADJUDICATION RATE $56 Q3 2019 Q4 2019 BIJUVA $490,705 BIJUVA $1,211,456 Net Revenue by Product Prenatal Vitamins BIJUVA IMVEXXY ANNOVERA Trend in Total Net Revenue and Calculated Net Revenue Per Unit

19 ANNOVERA Net Revenue Actual Q3 2019 Q4 2019 $399,952 $5,766,604 Prenatal Vitamins BIJUVA IMVEXXY ANNOVERA

20 Financial Summary ▪ Operating expenses – SG&A expenses ▪ Net loss and basic & diluted per share

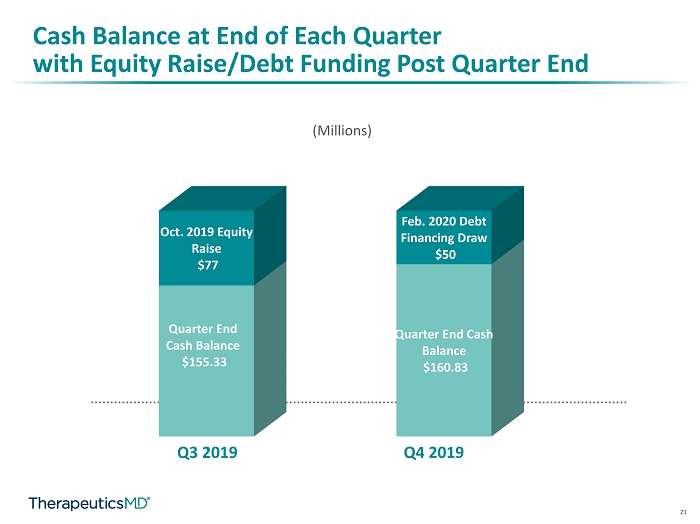

21 Cash Balance at End of Each Quarter with Equity Raise/Debt Funding Post Quarter End Quarter End Cash Balance $155.33 Quarter End Cash Balance $160.83 Oct. 2019 Equity Raise $77 Feb. 2020 Debt Financing Draw $50 (Millions) Q3 2019 Q4 2019

22 Drive Net Revenues: Control Operating Expenses: ▪ Invest appropriate financial resources to drive net revenue growth for our brands 2020 Cost Containment Measures Goal to reinvest the savings into marketing initiatives ▪ Scrutinized internal cost structure and reduced spend on the following: ▪ Non - revenue generating projects ▪ Headcount optimization / reduction ▪ Eliminated multiple clinical development roles ▪ Paused pipeline development projects

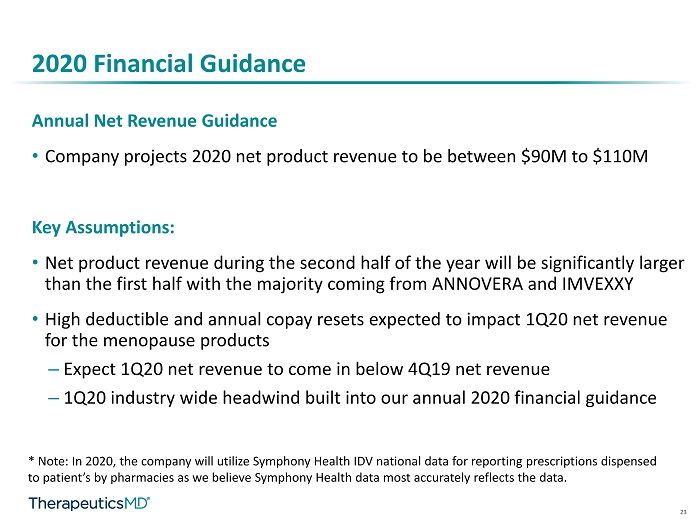

23 Annual Net Revenue Guidance • Company projects 2020 net product revenue to be between $90M to $110M Key Assumptions: • Net product revenue during the second half of the year will be significantly larger than the first half with the majority coming from ANNOVERA and IMVEXXY • High deductible and annual copay resets expected to impact 1Q20 net revenue for the menopause products ‒ Expect 1Q20 net revenue to come in below 4Q19 net revenue ‒ 1Q20 industry wide headwind built into our annual 2020 financial guidance 2020 Financial Guidance * Note: In 2020, the company will utilize Symphony Health IDV national data for reporting prescriptions dispensed to patient’s by pharmacies as we believe Symphony Health data most accurately reflects the data.

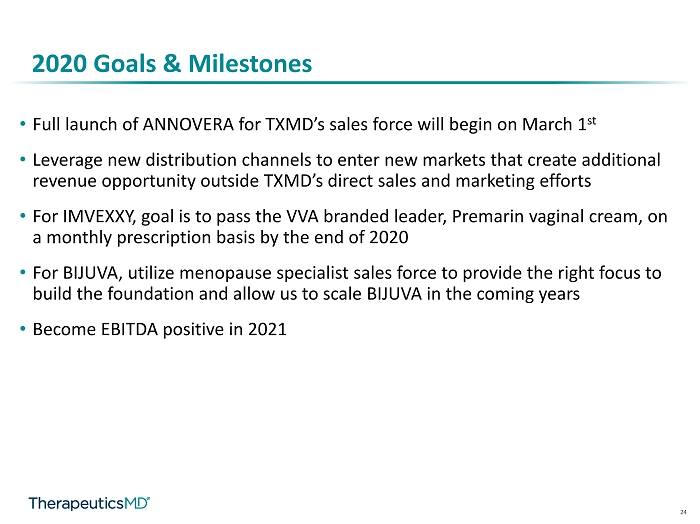

24 • Full launch of ANNOVERA for TXMD’s sales force will begin on March 1 st • Leverage new distribution channels to enter new markets that create additional revenue opportunity outside TXMD’s direct sales and marketing efforts • For IMVEXXY, goal is to pass the VVA branded leader, Premarin vaginal cream, on a monthly prescription basis by the end of 2020 • For BIJUVA, utilize menopause specialist sales force to provide the right focus to build the foundation and allow us to scale BIJUVA in the coming years • Become EBITDA positive in 2021 2020 Goals & Milestones

25 CONTRACEPTION PRENATAL CARE CONTRACEPTION/ FAMILY PLANNING - PERIMENOPAUSE VASOMOTOR SYMPTOMS DYSPAREUNIA (Vulvar & Vaginal Atrophy) REPRODUCTIVE HEALTH MENOPAUSE MANAGEMENT Prenatal Vitamins The Power of a Women’s Health Portfolio

26 CONTRACEPTION PRENATAL CARE CONTRACEPTION/ FAMILY PLANNING - PERIMENOPAUSE VASOMOTOR SYMPTOMS DYSPAREUNIA (Vulvar & Vaginal Atrophy) REPRODUCTIVE HEALTH MENOPAUSE MANAGEMENT Prenatal Vitamins Q&A