Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - UNIVERSAL STAINLESS & ALLOY PRODUCTS INC | usap-ex321_6.htm |

| EX-31.2 - EX-31.2 - UNIVERSAL STAINLESS & ALLOY PRODUCTS INC | usap-ex312_7.htm |

| EX-31.1 - EX-31.1 - UNIVERSAL STAINLESS & ALLOY PRODUCTS INC | usap-ex311_9.htm |

| EX-23.1 - EX-23.1 - UNIVERSAL STAINLESS & ALLOY PRODUCTS INC | usap-ex231_11.htm |

| EX-21.1 - EX-21.1 - UNIVERSAL STAINLESS & ALLOY PRODUCTS INC | usap-ex211_10.htm |

| EX-10.24 - EX-10.24 - UNIVERSAL STAINLESS & ALLOY PRODUCTS INC | usap-ex1024_181.htm |

| EX-10.23 - EX-10.23 - UNIVERSAL STAINLESS & ALLOY PRODUCTS INC | usap-ex1023_180.htm |

| EX-10.22 - EX-10.22 - UNIVERSAL STAINLESS & ALLOY PRODUCTS INC | usap-ex1022_179.htm |

| EX-4.3 - EX-4.3 - UNIVERSAL STAINLESS & ALLOY PRODUCTS INC | usap-ex43_37.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2019

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 000-25032

UNIVERSAL STAINLESS & ALLOY PRODUCTS, INC.

(Exact name of Registrant as specified in its charter)

|

Delaware |

|

25-1724540 |

|

(State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

600 MAYER STREET, BRIDGEVILLE, PA 15017 |

|

(412) 257-7600 |

|

(Address of principal executive offices, including zip code) |

|

(Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

|

Common Stock, par value $0.001 per share |

USAP |

The NASDAQ Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act: [None]

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data file required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☒ |

|

|

|

|

|

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☒ |

|

|

|

|

|

|

Emerging growth company |

☐ |

|

|

If an emerging growth company DOCUMENTS INCORPORATED BY REFERENCE Part III of this Form 10-K incorporates by reference portions of the Company’s definitive Proxy Statement for the 2019 Annual Meeting of Stockholders.

, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant on June 30, 2019, based on the closing price of $16.00 per share on that date, was approximately $136,407,000. For the purposes of this disclosure only, the registrant has assumed that its directors and executive officers are the affiliates of the registrant. The registrant has made no determination that such persons are “affiliates” within the meaning of Rule 405 under the Securities Act of 1933.

As of February 10, 2020, there were 8,788,512 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE Part III of this Form 10-K incorporates by reference portions of the Company’s definitive Proxy Statement for the 2019 Annual Meeting of Stockholders.

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

|

1 |

|

|

|

|

|

|

|

Item 1A. |

|

5 |

|

|

|

|

|

|

|

Item 1B. |

|

10 |

|

|

|

|

|

|

|

Item 2. |

|

10 |

|

|

|

|

|

|

|

Item 3. |

|

10 |

|

|

|

|

|

|

|

Item 4. |

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

11 |

|

|

|

|

|

|

|

Item 6. |

|

13 |

|

|

|

|

|

|

|

Item 7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

14 |

|

|

|

|

|

|

Item 7A. |

|

23 |

|

|

|

|

|

|

|

Item 8. |

|

24 |

|

|

|

|

|

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

47 |

|

|

|

|

|

|

Item 9A. |

|

47 |

|

|

|

|

|

|

|

Item 9B. |

|

47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

48 |

|

|

|

|

|

|

|

Item 11. |

|

48 |

|

|

|

|

|

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

48 |

|

|

|

|

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

|

49 |

|

|

|

|

|

|

Item 14. |

|

49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

50 |

|

|

|

|

|

|

|

Item 16. |

|

53 |

i

CAUTIONARY STATEMENT FOR PURPOSES OF THE "SAFE HARBOR" PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

The statements contained in this Annual Report on Form 10-K (“Form 10-K”) of Universal Stainless & Alloy Products, Inc. and its wholly-owned subsidiaries (collectively, “we,” “us,” “our,” or the “Company”), including, but not limited to, the statements contained in Item 1, “Business,” and Item 7, “Management's Discussion and Analysis of the Financial Condition and Results of Operations,” along with statements contained in other reports that we have filed with the Securities and Exchange Commission (the “SEC”), external documents and oral presentations, which are not historical facts are considered to be "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Act of 1934, as amended. These statements which may be expressed in a variety of ways, including the use of forward looking terminology such as “believe,” “expect,” “seek,” “intend,” “may,” “will,” “should,” “could,” “potential,” “continue,” “estimate,” “plan,” or “anticipate,” or the negatives thereof, other variations thereon or compatible terminology, relate to, among other things, statements regarding future growth, cost savings, expanded production capacity, broader product lines, greater capacity to meet customer quality reliability, price and delivery needs, enhanced competitive posture, and the effect of new accounting pronouncements. We do not undertake any obligation to publicly update any forward-looking statements.

These forward-looking statements, and any forward looking statements contained in other public disclosures of the Company which make reference to the cautionary factors contained in this Form 10-K, are based on assumptions that involve risks and uncertainties and are subject to change based on the considerations described below. We discuss many of these risks and uncertainties in greater detail in Item 1A, “Risk Factors,” of this Form 10-K. These and other risks and uncertainties may cause our actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements.

Universal Stainless & Alloy Products, Inc., which was incorporated in 1994, and its wholly-owned subsidiaries, manufacture and market semi-finished and finished specialty steel products, including stainless steel, nickel alloys, tool steel and certain other premium alloyed steels. Our manufacturing process involves melting, remelting, heat treating, hot and cold rolling, forging, machining and cold drawing of semi-finished and finished specialty steels. Our products are sold to service centers, forgers, rerollers and original equipment manufacturers (“OEMs”). Our customers further process our products for use in a variety of industries, including the aerospace, power generation, oil and gas, heavy equipment and general industrial markets. We also perform conversion services on materials supplied by customers.

We operate in four locations: Bridgeville and Titusville, Pennsylvania; Dunkirk, New York; and North Jackson, Ohio. Our corporate headquarters is located at our Bridgeville location. We operate these four manufacturing locations as one business segment.

We produce a wide variety of specialty steel grades using several manufacturing processes including vacuum induction melting (“VIM”), vacuum-arc remelting (“VAR”), elecro-slag remelting (“ESR”) and argon oxygen decarburization (“AOD”). At our Bridgeville and North Jackson facilities, we produce specialty steel products in the form of semi-finished and finished long products (ingots, blooms, billets and bars). In addition, the Bridgeville facility produces flat rolled products (slabs and plates). Semi-finished long products are primarily used by our Dunkirk facility and certain customers to produce finished bar and rod. Finished bar products that we manufacture are primarily used by OEMs and by service center customers for distribution to a variety of end users. We also produce customized shapes primarily for OEMs that are cold rolled from purchased coiled strip, flat bar or extruded bar at our precision rolled products department, located at our Titusville facility.

INDUSTRY OVERVIEW

The specialty steel industry is a relatively small but distinct segment of the overall steel industry. Specialty steels include stainless steels, nickel alloys, tool steels, electrical steels, high-temperature alloys, magnetic alloys and electronic alloys. Specialty steels are made with a high alloy content, suitable for use in environments that demand exceptional hardness, toughness, strength and resistance to heat, corrosion or abrasion, or combinations thereof. Specialty steels generally must conform to more demanding customer specifications for consistency, straightness and surface finish than carbon steels. For the years ended December 31, 2019, 2018 and 2017, approximately 70% of our net sales were derived from stainless steel products.

1

We primarily manufacture our products within the following product lines and, generally, in response to customer orders:

Stainless Steel. Stainless steel, which represents the largest part of the specialty steel market, contains elements such as nickel, chrome and molybdenum that give it the unique qualities of high strength, good wear characteristics, natural attractiveness, ease of maintenance and resistance to corrosion and heat. Stainless steel is used, among other applications, in the aerospace, oil and gas, power generation and automotive industries, as well as in the manufacturing of equipment for food handling, health and medical, chemical processing and pollution control.

High-Strength Low Alloy Steel. High-strength low alloy steel is a relative term that refers to those steels that maintain alloying elements that range in versatility. The alloy elements of nickel, chrome and molybdenum in such steels typically exceeds the alloy element of carbon steels but not that of high-temperature alloy steel. High-strength low alloy steels are manufactured for use generally in the aerospace industry.

Tool Steel. Tool steels contain elements of nickel, chrome, vanadium and molybdenum to produce specific hardness characteristics that enable tool steels to form, cut, shape and shear other materials in the manufacturing process. Heating and cooling at precise rates in the heat-treating process bring out these hardness characteristics. Tool steels are utilized in the manufacturing of metals, plastics, paper and aluminum extrusions, pharmaceuticals, electronics and optics.

High-Temperature Alloy Steel. These steels are designed to meet critical requirements of heat resistance and structural integrity. They generally have very high nickel content relative to other types of specialty steels. High-temperature alloy steels are manufactured for use generally in the aerospace industry.

Our net sales by principal product line were as follows:

|

For the years ended December 31, |

|

2019 |

|

|

2018 |

|

|

2017 |

|

||||||

|

(dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stainless steel |

|

$ |

|

177,934 |

|

|

$ |

|

174,743 |

|

|

$ |

|

139,603 |

|

|

High-strength low alloy steel |

|

|

|

34,164 |

|

|

|

|

23,829 |

|

|

|

|

15,693 |

|

|

Tool steel |

|

|

|

22,303 |

|

|

|

|

40,308 |

|

|

|

|

32,279 |

|

|

High-temperature alloy steel |

|

|

|

4,337 |

|

|

|

|

11,467 |

|

|

|

|

12,435 |

|

|

Conversion services and other sales |

|

|

|

4,269 |

|

|

|

|

5,580 |

|

|

|

|

2,633 |

|

|

Total net sales |

|

$ |

|

243,007 |

|

|

$ |

|

255,927 |

|

|

$ |

|

202,643 |

|

RAW MATERIALS AND SUPPLIES

We depend on the delivery of key raw materials for our day-to-day melting operations. These key raw materials are carbon and stainless scrap metal and alloys, primarily consisting of nickel, chrome, molybdenum, vanadium and copper. Scrap metal is primarily generated by industrial sources and is purchased through a number of scrap brokers and processors. We also recycle scrap metal generated from our own production operations as a source of metal for our melt shops. Alloys are generally purchased from domestic agents and primarily originate in North America, Australia, China, Russia, South America and South Africa.

Our Bridgeville and North Jackson facilities currently supply semi-finished specialty steel products as starting materials to our other operating facilities. Semi-finished specialty steel starting materials, which we cannot produce at a competitive cost, are purchased from other suppliers. We generally purchase these starting materials from steel strip coil suppliers, extruders, flat rolled producers and service centers. We believe that adequate supplies of starting material will continue to be available.

The cost of raw materials represents approximately 40% of the cost of products sold in 2019 and 2018, and approximately 35% of the cost of products sold in 2017. Raw material costs can be impacted by significant price changes. Raw material prices vary based on numerous factors, including quality, and are subject to frequent market fluctuations. The average price of several of our major raw materials, including molybdenum, vanadium, and carbon scrap, decreased in 2019 compared to the prior year. The average price of nickel increased in 2019 compared to the prior year. Future raw material prices cannot be predicted with any degree of certainty. We do not maintain any fixed-price long-term agreements with any of our raw material suppliers.

We apply a raw material surcharge in our pricing mechanism to align our pricing with fluctuations in commodity costs. Short lead time orders embed the surcharge into the price at the time of order entry. Longer lead time orders apply the raw material surcharge in effect at the time of shipment to better align the selling price with commodity costs. Surcharges are published on our website, and can fluctuate by month in line with commodity cost changes. Over time, our surcharge will effectively offset changes in raw material costs; however, during a period of rising or falling prices the timing will cause variation between reporting periods.

2

Our operations at our Bridgeville and North Jackson facilities also require consumable operating supplies other than raw materials. Our Bridgeville facility uses graphite electrodes in the melting process, which are sourced from various suppliers both domestically and overseas. The price of these electrodes significantly increased during 2018 and through the third quarter of 2019, resulting in increased cost on the products sold during 2019.

CUSTOMERS

Our largest customer in 2019, Reliance Steel & Aluminum Co. (“Reliance”), accounted for approximately 27%, 18% and 17% of our net sales for the years ended December 31, 2019, 2018 and 2017, respectively. The increase in 2019 is primarily due to Reliance’s acquisition of another one of our customers at the end of 2019.

Our next largest customer in 2019 was Outokumpu Stainless Bar, LLC, which accounted for approximately 11% of our net sales. No other customer accounted for more than 10% of our net sales during 2019, 2018 or 2017.

International sales approximated 7% of annual net sales in 2019, 8% in 2018, and 9% in 2017.

BACKLOG

Our backlog of orders (excluding surcharges) on hand as of December 31, 2019 was approximately $119.1 million compared to approximately $126.2 million at December 31, 2018. We expect substantially all of the backlog orders as of December 31, 2019 to be filled during 2020. Our backlog may not be indicative of actual sales because certain surcharges are not determinable until the order is shipped to the customer and, therefore, should not be used as a direct measure of future revenue. However, we expect that our actual sales will be higher than the backlog once the actual surcharges are determined.

COMPETITION

Competition in our markets is based upon product quality, delivery capability, customer service, customer approval and price. Maintaining high standards of product quality, while responding quickly to customer needs and keeping production costs at competitive levels, is essential to our ability to compete in these markets.

We believe that there are several companies that manufacture one or more similar specialty steel products that are significant competitors. There are a few smaller producing companies and material converters that are also considered to be competitors.

High import penetration of specialty steel products, especially stainless and tool steels, also impacts the competitive nature within the United States. Unfair pricing practices by foreign producers have resulted in high import penetration into the U.S. markets in which we participate.

We consider the maintenance of good relations with our employees to be important to the successful conduct of our business. We have profit-sharing plans for certain salaried and hourly employees and for all of our employees represented by United Steelworkers (the “USW”) and have equity ownership programs for all of our eligible employees, in an effort to forge an alliance between our employees’ interests and those of our stockholders. At December 31, 2019, 2018 and 2017, we had 795, 781, and 703 employees, respectively, of which 611, 607, and 564, respectively, were USW members.

Collective Bargaining Agreements

Our Bridgeville, Titusville, Dunkirk and North Jackson facilities recognize the USW as the exclusive representative for their hourly employees with respect to the terms and conditions of their employment. The following collective bargaining agreements are currently in place:

|

Facility |

|

Commencement Date |

|

Expiration Date |

|

Bridgeville |

|

September 2018 |

|

August 2023 |

|

North Jackson |

|

July 2018 |

|

June 2024 |

|

Dunkirk |

|

November 2017 |

|

October 2022 |

|

Titusville |

|

October 2015 |

|

September 2020 |

We believe a critical component of our collective bargaining agreements is the inclusion of a profit sharing plan.

3

We maintain a 401(k) retirement plan for our hourly and salaried employees. Pursuant to the 401(k) plan, participants may elect to make pre-tax and after-tax contributions, subject to certain limitations imposed under the Internal Revenue Code of 1986, as amended. In addition, we make periodic contributions to the 401(k) plan for the hourly employees employed at the North Jackson, Dunkirk and Titusville facilities, based on service. Prior to the collective bargaining agreement reached with North Jackson hourly employees in 2018, contributions were based upon the employee’s age and wage rate for hourly employees at the North Jackson facility.

We make periodic contributions for the salaried employees at all locations based upon their service and their individual contribution to the 401(k) retirement plan. Prior to the North Jackson collective bargaining agreement, we made periodic contributions based upon the employee’s age, annual salary, and their individual contributions for salaried employees at the North Jackson facility.

We participate in the Steelworkers Pension Trust (the “Trust”), a multi-employer defined-benefit pension plan that is open to all hourly and salaried employees associated with the Bridgeville facility. We make periodic contributions to the Trust based on hours worked at a fixed rate for each hourly employee and a fixed monthly contribution on behalf of each salaried employee.

We also provide group life and health insurance plans for our hourly and salary employees.

Employee Stock Purchase Plan

Under the 1996 Employee Stock Purchase Plan, as amended (the “Plan”), the Company is authorized to issue up to 300,000 shares of common stock to its full-time employees, nearly all of whom are eligible to participate. Under the terms of the Plan, employees can choose as of January 1 and July 1 of each year to have up to 10% of their total earnings withheld to purchase up to 100 shares of our common stock each six-month period. The purchase price of the stock is 85% of the lower of its beginning-of-the-period or end-of-the-period market prices. At December 31, 2019, we have issued 251,367 shares of common stock since the Plan’s inception.

ENVIRONMENTAL

We are subject to federal, state and local environmental laws and regulations (collectively, “Environmental Laws”), including those governing discharges of pollutants into the air and water, and the generation, handling and disposal of hazardous and non-hazardous substances. We monitor our compliance with applicable Environmental Laws and, accordingly, believe that we are currently in compliance with all laws and regulations in all material respects. We are subject periodically to environmental compliance reviews by various regulatory offices. We may be liable for the remediation of contamination associated with generation, handling and disposal activities. Environmental costs could be incurred, which may be significant, related to environmental compliance, at any time or from time to time in the future.

EXECUTIVE OFFICERS

The following table sets forth, as of February 19, 2020, certain information with respect to the executive officers of the Company:

|

Name (Age) |

|

Executive Officer Since |

|

Position |

|

Dennis M. Oates (67) |

|

2008 |

|

Chairman, President and Chief Executive Officer |

|

Christopher M. Zimmer (46) |

|

2010 |

|

Executive Vice President and Chief Commercial Officer |

|

Graham McIntosh, Ph.D. (57) |

|

2015 |

|

Executive Vice President and Chief Technology Officer |

|

Paul A. McGrath (68) |

|

1996 |

|

Vice President of Administration, General Counsel and Secretary |

|

Christopher T. Scanlon (44) |

|

2018 |

|

Vice President of Finance, Chief Financial Officer and Treasurer |

|

Alyssa H. Snider (41) |

|

2018 |

|

Vice President and Chief Human Resources Officer |

Dennis M. Oates has been President and Chief Executive Officer of the Company since 2008. Mr. Oates was named to the Company’s Board of Directors in 2007. Mr. Oates previously served as Senior Vice President of the Specialty Alloys Operations of Carpenter Technology Corporation from 2003 to 2007. Mr. Oates also served as President and Chief Executive Officer of TW Metals, Inc. from 1998 to 2003. In May 2010, the Board of Directors elected Mr. Oates to the additional position of Chairman.

4

Christopher M. Zimmer has been Executive Vice President and Chief Commercial Officer since July 2014. Mr. Zimmer served as Vice President of Sales and Marketing from 2008 to July 2014. Mr. Zimmer previously served as Vice President of Sales and Marketing for Schmoltz+Bickenbach USA from 1995 to 2008. He held positions of increasing responsibility including inside sales, Commercial Manager—stainless bar, General Manager—nickel alloy products, and National Sales Manager.

Graham McIntosh, Ph.D. has been Executive Vice President and Chief Technology Officer since May 2018. Dr. McIntosh also served as the Company’s Vice President and Chief Technology Officer from November 2013 until May 2018. Dr. McIntosh previously served as Director of Global Technology Initiatives for Carpenter Technology Corporation where he joined in 2008. Dr. McIntosh also served as Vice President of Technology and Director of Quality for Firth Rixson Viking from 2001 to 2008, and also held several management and technical positions at Wyman-Gordon Livingston from 1987-2001, where he began his career.

Paul A. McGrath has been Vice President of Administration of the Company since 2007, General Counsel since 1995 and was appointed Secretary in 1996. Mr. McGrath served as Vice President of Operations from 2001 to 2006. Previously, he was employed by Westinghouse Electric Corporation for approximately 24 years in various management positions.

Christopher T. Scanlon has been Vice President of Finance, Chief Financial Officer and Treasurer since April 2018. Mr. Scanlon previously served as Controller and Chief Accounting Officer for L.B. Foster Company, a leading manufacturer and distributor of products and services for transportation and energy infrastructure, where he joined in 2012. Mr. Scanlon also served as Division Controller for Education Management Corporation from 2009 to 2012, and held positions of increasing responsibilities with Bayer Corporation, the U.S. operations of the German-based Bayer AG, and Respironics, Inc.

Alyssa H. Snider has been Vice President and Chief Human Resource Officer since November 2018. Ms. Snider previously served as Americas HR Talent Strategy Advisor, Manufacturing for Shell Oil Company, a global group of energy and petrochemical companies, which she joined in June 2002. She held positions of increasing responsibility including HR Analyst and Business Partner, HR Manager of Capital Projects in the U.S. and Organizational Effectiveness Consultant.

PATENTS AND TRADEMARKS

We do not consider our business to be materially dependent on patent or trademark protection, and believe we own or maintain effective licenses covering all the intellectual property used in our business. We benefit from our proprietary rights relating to designs, engineering and manufacturing processes and procedures. We seek to protect our proprietary information by use of confidentiality and non-competition agreements with certain employees.

AVAILABLE INFORMATION

Our common stock is listed on the NASDAQ Global Select Market under the “USAP” ticker symbol. Copies of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports, as well as proxy and information statements that we file with the SEC, are available free of charge on our website at www.univstainless.com as soon as reasonably practicable after such reports are filed with the SEC. The contents of our website are not part of this Form 10-K. Copies of these documents will be available to any shareholder upon request. Requests should be directed in writing to Investor Relations at 600 Mayer Street, Bridgeville, PA 15017. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers, like us, that file electronically with the SEC.

We wish to caution each reader of this Form 10-K to consider the following factors and other factors discussed herein and in other past reports, including but not limited to prior year Form 10-K and Form 10-Q reports filed with the SEC. Our business and results of operations could be materially affected by any of the following risks. The factors discussed herein are not exhaustive. Therefore, the factors contained herein should be read together with other reports that we file with the SEC from time to time, which may supplement, modify, supersede, or update the factors listed in this document.

A substantial amount of our sales is derived from a limited number of customers.

Our five largest customers in the aggregate accounted for approximately 54% of our net sales for the year ended December 31, 2019, 43% of our net sales for the year ended 2018 and 41% for the year ended 2017. The accounts receivable balance from these five customers comprised approximately 42% of total accounts receivable at December 31, 2019. An adverse change in, or termination of, the relationship with one or more of our customers or market segments could have a material adverse effect on our results of operations.

5

Our business is very competitive, and increased competition could reduce our sales.

We compete with domestic and foreign producers of specialty steel products. In addition, many of the finished products sold by our customers are in direct competition with finished products manufactured by foreign sources, which may affect the demand for those customers’ products. Any competitive factors that adversely affect the market for finished products manufactured by us or our customers could indirectly adversely affect the demand for our semi-finished products. Additionally, our products compete with products fashioned from alternative materials such as aluminum, composites and plastics, the production of which includes domestic and foreign enterprises. Competition in our field is intense and is expected to continue to be so in the foreseeable future. A majority of our business is not covered under long term supply contracts. There can be no assurance that we will be able to compete successfully in the future.

The demand for our products may be cyclical.

Demand for our products from our customers can be cyclical in nature and sensitive to various factors, including demand, production schedules and other conditions in each of our end markets, fluctuations in inventory levels throughout the supply chain, and general macroeconomic conditions. A significant adverse change in demand for any reason could have a material adverse effect on our results of operations.

A substantial amount of our sales is derived from the aerospace industry.

Approximately 70% of our sales and 55% of our tons shipped represented products sold to customers in the aerospace market in 2019. The aerospace market is historically cyclical due to both external and internal market factors. These factors include general economic conditions, supply chain fluctuations, diminished credit availability, airline profitability, demand for air travel, age of fleets, varying fuel and labor costs, price competition, new technology development and international and domestic political conditions such as military conflict and the threat of terrorism. The length and degree of cyclical fluctuation can be influenced by any one or a combination of these factors and therefore are difficult to predict with certainty.

The aerospace industry is currently projected to experience long-term growth; however a prolonged downturn in the industry would adversely affect the demand for our products and/or the prices at which we are able to sell our products, and our results of operations, business and financial condition could be materially adversely affected. The recent and continued market uncertainty regarding the production schedule and ultimate return to service of the Boeing 737 MAX aircraft could adversely impact our results.

Our business may be harmed by failure to develop, commercialize, market and sell new applications and new products.

We believe that our alloys and metallurgical manufacturing expertise provide us with a competitive advantage over other high-performance alloy producers. Our ability to maintain this competitive advantage depends on our ability to continue to offer products that have equal or better performance characteristics than competing products at competitive prices. Our future growth will depend, in part, on our ability to address the increasingly demanding needs of our customers by enhancing the properties of our existing alloys, by timely developing new applications for our existing products, and by timely developing, commercializing, marketing and selling new products. If we are not successful in these efforts, or if our new products and product enhancements do not adequately meet the requirements of the marketplace and achieve market acceptance, our business could be adversely affected.

Our business requires continuing efforts to obtain new customer approvals on existing products and applications, which is a stringent, difficult process subject to each customer’s varying approval methodology and preferences. If we are not successful in these efforts, our business could be adversely affected.

We are dependent on the availability and price of raw materials and operating supplies.

We purchase carbon and stainless scrap metal and alloy additives, principally nickel, chrome, vanadium, molybdenum, manganese and copper, for our melting operation. A substantial portion of the alloy additives is available only from foreign sources, some of which are located in countries that may be subject to unstable political and economic conditions. Those conditions might disrupt supplies or affect the prices of the raw materials. We maintain sales price surcharges on certain of our products to help offset the impact of raw material price fluctuations.

We do not maintain long-term fixed-price supply agreements with any of our raw material suppliers. If our supply of raw materials were interrupted, we might not be able to obtain sufficient quantities of raw materials, or obtain sufficient quantities of such materials at satisfactory prices, which, in either case, could adversely affect our results of operations. In addition, significant volatility in the price of our principal raw materials could adversely affect our financial results and there can be no assurance that the raw material surcharge mechanism employed by us will completely offset immediate changes in our raw material costs.

6

Our production processes require consumable operating supplies, such as electrodes, which have increased in price significantly compared to prior years. Significant volatility in the price of our consumable operating supplies could adversely affect our financial results.

Our business requires substantial amounts of energy.

The manufacturing of specialty steel is an energy-intensive process and requires the ready availability of substantial amounts of electricity and natural gas, for which we negotiate competitive supply agreements. While we believe that our energy agreements allow us to compete effectively within the specialty steel industry, the potential for increased costs exists during periods of high demand or supply disruptions. We have a sales price surcharge to help offset the cost fluctuations.

We are subject to risks associated with global economic and market factors.

Our results of operations are affected directly by the level of business activity of our customers and our suppliers, which in turn is affected by global economic and market factors, including health epidemics, impacting the industries and markets that we participate in. We are susceptible to macroeconomic downturns in the United States and abroad that may affect the general economic climate, our performance and the demand of our customers. We may face significant challenges if conditions in the financial markets deteriorate. There can be no assurance that global economic and market conditions will not adversely impact our results of operations, cash flow or financial position in the future.

Existing free trade laws and regulations, such as the North American Free Trade Agreement and its anticipated successor agreement, the United States-Mexico-Canada Agreement, which is still subject to legislative approval, provide certain beneficial duties and tariffs for qualifying imports and exports, subject to compliance with the applicable classification and other requirements. Changes in laws or policies governing the terms of foreign trade, and in particularly increased trade restrictions, tariffs or taxes on imports from countries where we sell products or purchase materials could have a material adverse effect on our business and financial results. Given the uncertainty regarding the scope and duration of current, proposed, or future imposed tariffs, we can provide no assurance that any strategies we implement to mitigate the impact of such tariffs on the Company will be successful.

Our business depends largely on our ability to attract and retain key personnel.

We depend on the continued service, availability and ability to attract skilled personnel, including members of our executive management team, other management positions, and metallurgists, along with maintenance and production positions. Our inability to attract and retain such people may adversely impact our ability to fill existing roles and support growth. Attraction and retention of qualified personnel remains challenging as the labor market remains tight.

Further, the loss of key personnel could adversely affect our ability to perform until suitable replacements can be found.

Our business may be harmed by strikes or work stoppages.

At December 31, 2019, we had 611 employees, out of a total of 795, who were covered under collective bargaining agreements with the USW expiring at various dates in 2020 to 2024. There can be no assurance that we will be successful in timely concluding collective bargaining agreements with the USW to succeed the agreements that expire, in which case, we may experience strikes or work stoppages that may have a material adverse impact on our results of operations.

Our business may be harmed by failures on critical manufacturing equipment.

Our manufacturing processes are dependent upon certain critical pieces of specialty steel making equipment, including our 50-ton electric-arc furnace and AOD vessel, our ESR, VIM and VAR furnaces, our radial hydraulic forge and our universal rolling mill. In the event a critical piece of equipment should become inoperative as a result of unexpected equipment failure, such as the fire at our North Jackson, OH forge during 2019, there can be no assurance that our operations would not be substantially curtailed, which may have a negative effect on our financial results.

7

Our business may be harmed if we are unable to meet our debt service requirements or the covenants in our credit agreement, or if interest rates increase.

We have debt upon which we are required to make scheduled interest and principal payments, and we may incur additional debt in the future. A significant portion of our debt bears interest at variable rates that may increase in the future. A significant increase in interest rates or disruption in the global financial markets may affect our ability to obtain financing or to refinance existing debt on acceptable terms, if at all, and could increase the cost of our borrowings.

Our credit agreement uses the London Interbank Offering Rate (“LIBOR”) as a benchmark for establishing the interest rate on a substantial portion of our debt. LIBOR is the subject of recent national, international and other regulatory guidance and proposals for reform. Reforms may cause LIBOR to perform differently than in the past or cause its discontinuance. Further developments and the resulting consequences cannot be entirely predicted, but could include an increase in our interest expense.

Our ability to satisfy our debt obligations will depend upon our future operating performance, which will be affected by prevailing economic conditions in the markets that we serve and financial, business and other factors, many of which are beyond our control. If we are unable to generate sufficient cash to service our debt or if interest rates increase, our results of operations and financial condition could be adversely affected. Our credit agreement, which provides for a $110.0 million senior secured revolving credit facility and a $10.0 million senior secured term loan facility, also requires us to comply with certain covenants. Failure to comply with the covenants contained in the credit agreement could result in a default, which, if not waived by our lenders, could substantially increase our borrowing costs and result in acceleration of our debt. As of December 31, 2019, we were in compliance with the covenants in our credit agreement.

We believe that our international sales and purchases are associated with various risks.

We conduct business with suppliers and customers in foreign countries which exposes us to risks associated with international business activities, including effects of the United Kingdom’s withdrawal from membership in the European Union (referred to as “Brexit”). We could be significantly impacted by these risks, which include the potential for volatile economic and labor conditions, political instability, collecting accounts receivable and exchange rate fluctuations (which may affect sales revenue to international customers and the margins on international sales when converted into U.S. dollars). International sales approximated 7% of annual net sales in 2019, 8% in 2018 and 9% in 2017, an immaterial portion of which is denominated in foreign currencies.

If we are unable to protect our information technology infrastructure against service interruptions, data corruption, cyber-based attacks or network security breaches, our operations could be disrupted.

We rely on information technology networks and systems to manage and support a variety of business activities, including procurement and supply chain, engineering support, and manufacturing. Our information technology systems, some of which are managed by third-parties, may be susceptible to the inability to continue to receive software updates and contractual vendor support, damage, disruptions or shutdown due to failures during the process of upgrading or replacing software, databases or components thereof, power outages, hardware failures, computer viruses, attacks by computer hackers, telecommunications failures, user errors or catastrophic events. In addition, security breaches could result in unauthorized disclosures of confidential information. If our information technology systems suffer severe damage, disruption or shutdown and our business continuity plans do not effectively resolve the issues in a timely manner, our manufacturing process could be disrupted resulting in late deliveries or even no deliveries if there is a total shutdown.

Changes in tax rules and regulations, or interpretations thereof, may adversely affect our effective tax rates.

We are a U.S. based company with customers and suppliers in foreign countries. We import various raw materials used in our production processes and we export goods to our foreign customers. The United States, the European Commission, countries in the European Union and other countries where we do business have implemented and may consider further changes in relevant tax, border tax, accounting and other laws, regulations and interpretations, that may unfavorably impact our effective tax rate or result in other costs to us.

8

Our business subjects us to risk of litigation claims, as a routine matter, and this risk increases the potential for a loss that might not be covered by insurance.

Litigation claims may relate to the conduct of our business, including claims relating to product liability, commercial disputes, employment actions, employee benefits, compliance with domestic and federal laws and personal injury. Due to the uncertainties of litigation, we might not prevail on claims made against us in the lawsuits that we currently face, and additional claims may be made against us in the future. The outcome of litigation cannot be predicted with certainty, and some of these lawsuits, claims or proceedings may be determined adversely to us. The resolution in any reporting period of one or more of these matters could have a material adverse effect on our business.

Costs related to our participation in a multi-employer pension plan could increase significantly.

We participate in the Steelworkers Pension Trust (the “Trust”), a multi-employer defined-benefit pension plan. We make contributions to the Trust with respect to all hourly and salaried employees associated with our Bridgeville facility. Our contributions to the Trust are based on hours worked at a fixed rate for each hourly employee, as determined by the collective bargaining agreement, which expires in August 2023, and a fixed monthly contribution on behalf of each covered salaried employee. The trustees of the Trust have provided us with the latest data available for the Trust year ended December 31, 2018. As of that date, the Trust is not fully funded. Our contribution rates could increase if the Trust is required to adopt a funding improvement plan or a rehabilitation plan as a result of funding deficiencies in excess of specified levels, which may be due to poor performance of Trust investments or other factors, or as a result of future wage and benefit agreements. In addition, if we choose to stop participating in the Trust, our contributions to the Trust decline or the Trust is terminated, we may be required to pay the Trust an amount based on the underfunded status of the Trust, referred to as a withdrawal liability. In the event that our contribution rates increase or if we must pay withdrawal liability because we stop participating in the Trust, our contributions decline or the Trust is terminated, our future results of operations and cash flows may be negatively impacted to a material extent.

Our business is subject to stringent environmental, health and safety regulations which may result in significant liabilities and/or costs to maintain compliance.

Our operations and properties are subject to extensive and varied federal, state, local and international laws and regulations relating to public health, the environment, pollution, and occupational safety and health. We have used, and currently use and manufacture, substances that are considered hazardous or toxic under worker safety and health laws and regulations. We take measures to control or eliminate the continuing risk associated with the environmental, health and safety issues, however we could incur substantial fines and civil or criminal sanctions, cleanup costs, compliance investments and third-party property or injury claims as a result of violations, or non-compliance related to these regulations affecting our facilities and operations.

9

None.

We own our Bridgeville, Pennsylvania facility, which consists of approximately 760,000 square feet of floor space and our executive offices on approximately 74 acres. The Bridgeville facility contains melting, remelting, conditioning, rolling, annealing and various other processing equipment. Substantially all products shipped from the Bridgeville facility are processed through its melt shop and universal rolling mill operations.

We own our North Jackson, Ohio facility, which consists of approximately 257,000 square feet of floor space on approximately 110 acres. The North Jackson facility contains melting, remelting, forging, annealing and various other processing operations. Our obligations under our credit agreement, which is more fully described under Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources,” are collateralized by a first lien on our real property in North Jackson, Ohio. Also, our obligations under our notes, also more fully described under Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources,” are collateralized by a second lien on our North Jackson, Ohio real property.

We own our Dunkirk, New York facility, which consists of approximately 680,000 square feet of floor space on approximately 81 acres. The Dunkirk facility processes semi-finished billet and bar stock through one or more of its five rolling mills, a high temperature annealing facility and/or a round or shape bar finishing facility.

We own our Titusville, Pennsylvania facility, which consists of seven buildings on approximately 10 acres, including two principal buildings of approximately 265,000 square feet in total area. The Titusville facility contains five VAR furnaces and various rolling and finishing equipment.

Specialty steel production is a capital-intensive industry. We believe that our facilities and equipment are suitable for our present manufacturing needs. We believe, however, that we will continue to require capital from time to time to add new equipment and to repair or replace our existing equipment to remain competitive and to enable us to manufacture quality products and provide delivery and other support service assurances to our customers.

Information regarding the Company’s legal proceedings and other commitments and contingencies is set forth in Part II, Item 8, Financial Statements and Supplementary Data, Note 14, which is incorporated by reference into this Item 3.

Not applicable.

10

|

ITEM 5. |

MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

At December 31, 2019, a total of 8,788,512 shares of common stock, par value $0.001 per share, were issued and held by 97 holders of record. There were 294,279 shares of the issued common stock held in treasury at December 31, 2019.

On May 25, 2018, the Company completed an underwritten, public offering involving the issuance and sale by the Company of 1,224,490 shares of common stock at a public offering price of $24.50 per share. In addition, the Company granted the underwriters a 30-day option to purchase up to an additional 183,673 shares of common stock. On June 1, 2018, the underwriters exercised the option in full, and an additional 183,673 shares of common stock were issued and sold on June 5, 2018. The public offering resulted in gross proceeds to the Company of approximately $34.5 million, or $32.2 million net of the underwriting discount and other offering fees and expenses. We used the net proceeds from the public offering to repay amounts outstanding under the Company’s revolving credit facility.

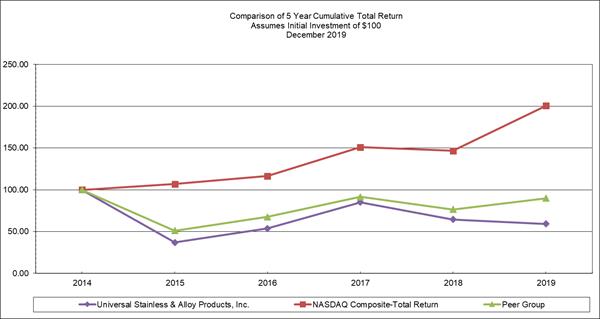

PERFORMANCE GRAPH

The performance graph below compares the cumulative total stockholder return on our common stock with the cumulative total return on the equity securities of the NASDAQ Composite Index and a peer group selected by us. The peer group consists of domestic specialty steel producers: Allegheny Technologies Incorporated; Materion Corporation; Carpenter Technology Corporation; and Haynes International, Inc. The graph assumes an investment of $100 on December 31, 2014 and reinvestment of dividends, if any, on the date of dividend payment, and the peer group is weighted by each company’s market capitalization. The performance graph represents past performance and should not be considered an indication of future performance.

11

Comparison of 5-Year Cumulative Total Shareholder Return among Universal Stainless & Alloy Products, Inc., the NASDAQ Composite Index and a Peer Group

|

|

|

For the years ended December 31, |

|

|||||||||||||||||||||||||||

|

Company/Peer/Market |

|

2014 |

|

|

2015 |

|

|

2016 |

|

|

2017 |

|

|

2018 |

|

|

2019 |

|

||||||||||||

|

Universal Stainless & Alloy Products, Inc. |

|

$ |

|

100.00 |

|

|

$ |

|

36.94 |

|

|

$ |

|

53.72 |

|

|

$ |

|

85.17 |

|

|

$ |

|

64.45 |

|

|

$ |

|

59.24 |

|

|

Peer Group |

|

$ |

|

100.00 |

|

|

$ |

|

51.05 |

|

|

$ |

|

67.49 |

|

|

$ |

|

91.50 |

|

|

$ |

|

76.39 |

|

|

$ |

|

89.91 |

|

|

NASDAQ Composite Index |

|

$ |

|

100.00 |

|

|

$ |

|

106.96 |

|

|

$ |

|

116.45 |

|

|

$ |

|

150.96 |

|

|

$ |

|

146.67 |

|

|

$ |

|

200.50 |

|

PREFERRED STOCK

Our Certificate of Incorporation provides that we may, by vote of our Board of Directors, issue up to 1,980,000 shares of preferred stock. The preferred stock may have rights, preferences, privileges and restrictions thereon, including dividend rights, dividend rates, conversion rights, voting rights, terms of redemption, redemption prices, liquidation preferences and the number of shares constituting any series or designation of such series, without further vote or action by the stockholders. The issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control of the Company without further action by the stockholders and may adversely affect the voting and other rights of the holders of common stock. The issuance of preferred stock with voting and conversion rights may adversely affect the voting power of the holders of common stock, including the loss of voting control to others. We have no outstanding preferred stock and have no current plans to issue any of the authorized preferred stock.

DIVIDENDS

We have never paid a cash dividend on our common stock. Our credit agreement does not permit the payment of cash dividends on our common stock.

12

|

For the years ended December 31, |

|

2019 |

|

|

2018 |

|

|

2017 |

|

|

2016 |

|

|

2015 |

|

||||||||||

|

(dollars in thousands, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summary of operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

|

243,007 |

|

|

$ |

|

255,927 |

|

|

$ |

|

202,643 |

|

|

$ |

|

154,434 |

|

|

$ |

|

180,660 |

|

|

Goodwill impairment |

|

$ |

|

- |

|

|

$ |

|

- |

|

|

$ |

|

- |

|

|

$ |

|

- |

|

|

$ |

|

20,268 |

|

|

Operating income (loss) |

|

$ |

|

7,291 |

|

|

$ |

|

16,070 |

|

|

$ |

|

4,237 |

|

|

$ |

|

(3,969 |

) |

|

$ |

|

(30,079 |

) |

|

Net income (loss) |

|

$ |

|

4,275 |

|

|

$ |

|

10,662 |

|

|

$ |

|

7,610 |

|

|

$ |

|

(5,347 |

) |

|

$ |

|

(20,672 |

) |

|

Financial position at year-end: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

|

170 |

|

|

$ |

|

3,696 |

|

|

$ |

|

207 |

|

|

$ |

|

75 |

|

|

$ |

|

112 |

|

|

Working capital |

|

$ |

|

141,342 |

|

|

$ |

|

115,654 |

|

|

$ |

|

101,316 |

|

|

$ |

|

84,397 |

|

|

$ |

|

85,006 |

|

|

Property, plant and equipment, net |

|

$ |

|

176,061 |

|

|

$ |

|

177,844 |

|

|

$ |

|

174,444 |

|

|

$ |

|

182,398 |

|

|

$ |

|

193,505 |

|

|

Total assets 1 |

|

$ |

|

368,399 |

|

|

$ |

|

353,320 |

|

|

$ |

|

321,231 |

|

|

$ |

|

296,045 |

|

|

$ |

|

297,302 |

|

|

Long-term debt 1 |

|

$ |

|

60,411 |

|

|

$ |

|

42,839 |

|

|

$ |

|

75,006 |

|

|

$ |

|

67,998 |

|

|

$ |

|

72,884 |

|

|

Stockholders’ equity |

|

$ |

|

243,136 |

|

|

$ |

|

237,011 |

|

|

$ |

|

191,668 |

|

|

$ |

|

181,220 |

|

|

$ |

|

184,977 |

|

|

Common share data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share - Basic 2 |

|

$ |

|

0.49 |

|

|

$ |

|

1.31 |

|

|

$ |

|

1.05 |

|

|

$ |

|

(0.74 |

) |

|

$ |

|

(2.92 |

) |

|

Net income (loss) per common share -Diluted 2 |

|

$ |

|

0.48 |

|

|

$ |

|

1.28 |

|

|

$ |

|

1.03 |

|

|

$ |

|

(0.74 |

) |

|

$ |

|

(2.92 |

) |

|

|

1 |

Total assets and Long-term debt have been adjusted for certain prior periods to reflect the reclassification of deferred financing costs from Other long-term assets to a reduction of debt, consistent with the current period presentation due to the adoption of ASC 2015-3, “Simplifying the Presentation of Debt Issuance Costs”. |

|

|

2 |

Includes approximately 1.2 million shares issued on May 25, 2018 and 0.2 million shares issued on June 1, 2018 in conjunction with the Company’s underwritten, public offering of common stock. The public offering’s impact on the weighted average number of shares for the year ended December 31, 2018 is approximately 0.8 million shares. |

13

The following Management Discussion and Analysis (“MD&A”) is intended to help the reader understand the consolidated results of operations and financial condition of Universal Stainless & Alloy Products, Inc. and its wholly-owned subsidiaries (collectively, “we,” “us,” “our,” or the “Company”). This MD&A should be read in conjunction with our consolidated financial statements and accompanying notes included in this Form 10-K. When reviewing the discussion, you should keep in mind the substantial risks and uncertainties that characterize our business. In particular, we encourage you to review the risk and uncertainties described under Item 1A “Risk Factors,” of this Form 10-K. These risks and uncertainties could cause actual results to differ materially from those forecasted in forward-looking statements or implied by past results and trends. Forward-looking statements are statements that attempt to project or anticipate future developments in our business; we encourage you to review the discussion of forward-looking statements under “Cautionary Statement for Purposes of the “Safe Harbor” Provisions of the Private Securities Litigation Reform Act of 1995,” at the beginning of this report. These statements, like all statements in this report, speak only as of the date of this report (unless another date is indicated), and we undertake no obligation to update or revise the statements in light of future developments. Unless otherwise specified, any reference to a “year” is to the year ended December 31.

Overview

We manufacture and market semi-finished and finished specialty steel products, including stainless steel, nickel alloys, tool steel and certain other alloyed steels. Our manufacturing process involves melting, remelting, heat treating, hot and cold rolling, forging, machining and cold drawing of semi-finished and finished specialty steels. Our products are sold to service centers, forgers, rerollers and original equipment manufacturers. Our customers further process our products for use in a variety of industries, including the aerospace, power generation, oil and gas, heavy equipment and general industrial markets. We also perform conversion services on materials supplied by customers.

Our aerospace end market continued to strengthen throughout 2019 and reached $170.4 million and more than 70% of our total net sales, both of which were new records for the company. Aerospace will continue to be a major driver of our future results, and our aerospace backlog remains healthy going into 2020. Sales into the power generation end market were also up in 2019 compared with 2018, while sales into our other end markets declined compared with 2018. The largest decline was in the heavy equipment end market, which primarily includes our tool steel sales. 2018 was a record year for tool steel sales, and order entry has been strong in the beginning of 2020. We expect tool steel sales to increase in 2020 compared to 2019 levels.

Total Company backlog at the end of 2019 was $119.1 million, a decrease of 6% compared to $126.2 million at the end of 2018.

Our 2019 gross margin was 11.4% of net sales, a decline from 14.8% of net sales in 2018. This was due to higher operations costs in the cost of products sold during 2019, lower surcharge revenue from falling raw material indices, and a less favorable product mix, primarily, lower premium alloy and tool steel sales. The increased operations cost was in part due to a fire at our North Jackson facility at the end of the second quarter.

We expect to see margin improvement in 2020 as misalignment between surcharges and material prices lessens, strong production at the North Jackson forge continues following the 2019 fire, and we continue to see incremental operating efficiency benefit from investments in our operations, including our new mid-size bar cell unit at our Dunkirk facility.

Selling, general and administrative (“SG&A”) expenses decreased by $1.4 million in 2019. The decrease in SG&A was driven by lower employee related costs, including incentive compensation.

Overall, our operating income in 2019 was $7.3 million, compared to $16.1 million in 2018, reflecting the decrease in sales and gross margin.

During 2019, we used $4.4 million of cash in our operations, primarily due to higher inventory levels. We used $17.4 million of cash on capital expenditures, a portion of which was related to payments for a mid-size bar cell unit at our Dunkirk facility.

Our financing activities provided net cash of $17.8 million, which primarily included net borrowings under our revolving credit facility, partially offset by principal payments on our term loan and scheduled payments of finance leases.

Our operating facilities are integrated, and therefore our chief operating decision maker (“CODM”) views the Company as one business unit. Our CODM sets performance goals, assesses performance and makes decisions about resource allocations on a consolidated basis. As a result of these factors, as well as the nature of the financial information available which is reviewed by our CODM, we maintain one reportable segment.

14

2019 Results Compared to 2018

|

For the years ended December 31, |

|

2019 |

|

2018 |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

(dollars in thousands, except per shipped ton information) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount |

|

|

Percentage of net sales |

|

Amount |

|

|

Percentage of net sales |

|

Dollar / ton variance |

|

|

Percentage variance |

|||||||||||||||

|

Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stainless steel |

|

$ |

|

177,934 |

|

|

|

73.2 |

|

% |

|

$ |

|

174,743 |

|

|

|

68.3 |

|

% |

|

$ |

|

3,191 |

|

|

|

1.8 |

|

% |

|

High-strength low alloy steel |

|

|

|

34,164 |

|

|

|

14.0 |

|

|

|

|

|

23,829 |

|

|

|

9.3 |

|

|

|

|

|

10,335 |

|

|

|

43.4 |

|

|

|

Tool steel |

|

|

|

22,303 |

|

|

|

9.2 |

|

|

|

|

|

40,308 |

|

|

|

15.7 |

|

|

|

|

|

(18,005 |

) |

|

|

(44.7 |

) |

|

|

High-temperature alloy steel |

|

|

|

4,337 |

|

|

|

1.8 |

|

|

|

|

|

11,467 |

|

|

|

4.5 |

|

|

|

|

|

(7,130 |

) |

|

|

(62.2 |

) |

|

|

Conversion services and other sales |

|

|

|

4,269 |

|

|

|

1.8 |

|

|

|

|

|

5,580 |

|

|

|

2.2 |

|

|

|

|

|

(1,311 |

) |

|

|

(23.5 |

) |

|

|

Total net sales |

|

|

|

243,007 |

|

|

|

100.0 |

|

|

|

|

|

255,927 |

|

|

|

100.0 |

|

|

|

|

|

(12,920 |

) |

|

|

(5.0 |

) |

|

|

Cost of products sold |

|

|

|

215,369 |

|

|

|

88.6 |

|

|

|

|

|

218,111 |

|

|

|

85.2 |

|

|

|

|

|

(2,742 |

) |

|

|

(1.3 |

) |

|

|

Gross margin |

|

|

|

27,638 |

|

|

|

11.4 |

|

|

|

|

|

37,816 |

|

|

|

14.8 |

|

|

|

|

|

(10,178 |

) |

|

|

(26.9 |

) |

|

|

Selling, general and administrative expenses |

|

|

|

20,347 |

|

|

|

8.4 |

|

|

|

|

|

21,746 |

|

|

|

8.5 |

|

|

|

|

|

(1,399 |

) |

|

|

(6.4 |

) |

|

|

Operating income |

|

|

|

7,291 |

|

|

|

3.0 |

|

|

|

|

|

16,070 |

|

|

|

6.3 |

|

|

|

|

|

(8,779 |

) |

|

|

(54.6 |

) |

|

|

Interest expense |

|

|

|

3,765 |

|

|

|

1.5 |

|

|

|

|

|

4,047 |

|

|

|

1.6 |

|

|

|

|

|

(282 |

) |

|

|

(7.0 |

) |

|

|

Deferred financing amortization |

|

|

|

227 |

|

|

|

0.1 |

|

|

|

|

|

255 |

|

|

|

0.1 |

|

|

|

|

|

(28 |

) |

|

|

(11.0 |

) |

|

|

Other (income), net |

|

|

|

(474 |

) |

|

|

(0.2 |

) |

|

|

|

|

(829 |

) |

|

|

(0.3 |

) |

|

|

|

|

355 |

|

|

|

42.8 |

|

|

|

Income before income taxes |

|

|

|

3,773 |

|

|

|

1.6 |

|

|

|

|

|

12,597 |

|

|

|

4.9 |

|

|

|

|

|

(8,824 |

) |

|

|

(70.0 |

) |

|

|

(Benefit) provision for income taxes |

|

|

|

(502 |

) |

|

|

(0.2 |

) |

|

|

|

|

1,935 |

|

|

|

0.8 |

|

|

|

|

|

(2,437 |

) |

|

|

(125.9 |

) |

|

|

Net income |

|

$ |

|

4,275 |

|

|

|

1.8 |

|

% |

|

$ |

|

10,662 |

|

|

|

4.2 |

|

% |

|

$ |

|

(6,387 |

) |

|

|

(59.9 |

) |

% |

|

Tons shipped |

|

|

|

41,462 |

|

|

|

|

|

|

|

|

|

44,554 |

|

|

|

|

|

|

|

|

|

(3,092 |

) |

|

|

(6.9 |

) |

% |

|

Sales dollars per shipped ton |

|

$ |

|

5,861 |

|

|

|

|

|

|

|

$ |

|

5,744 |

|

|

|

|

|

|

|

$ |

|

117 |

|

|

|

2.0 |

|

% |

Market Segment Information:

|

For the years ended December 31, |

|

2019 |

|

2018 |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

(dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount |

|

|

Percentage of net sales |

|

Amount |

|

|

Percentage of net sales |

|

Dollar variance |

|

|

Percentage variance |

|||||||||||||||

|

Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service centers |

|

$ |

|

166,327 |

|

|

|

68.4 |

|

% |

|

$ |

|

180,165 |

|

|

|

70.4 |

|

% |

|

$ |

|

(13,838 |

) |

|

|

(7.7 |

) |

% |

|

Original equipment manufacturers |

|

|

|

24,731 |

|

|

|

10.2 |

|

|

|

|

|

20,582 |

|

|

|

8.0 |

|

|

|

|

|

4,149 |

|

|

|

20.2 |

|

|

|

Rerollers |

|

|

|

27,236 |

|

|

|

11.2 |

|

|

|

|

|

29,337 |

|

|

|

11.5 |

|

|

|

|

|

(2,101 |

) |

|

|

(7.2 |

) |

|

|

Forgers |

|

|

|

20,444 |

|

|

|

8.4 |

|

|

|

|

|

20,263 |

|

|

|

7.9 |

|

|

|

|

|

181 |

|

|

|

0.9 |

|

|

|

Conversion services and other sales |

|

|

|

4,269 |

|

|

|

1.8 |

|

|

|

|

|

5,580 |

|

|

|

2.2 |

|

|

|

|

|

(1,311 |

) |

|

|

(23.5 |

) |

|

|

Total net sales |

|

$ |

|

243,007 |

|

|

|

100.0 |

|

% |

|

$ |

|

255,927 |

|

|

|

100.0 |

|

% |

|

$ |

|

(12,920 |

) |

|

|

(5.0 |

) |

% |

Melt Type Information:

|

For the years ended December 31, |

|

2019 |

|

2018 |

|