Attached files

| file | filename |

|---|---|

| EX-4.3 - EX-4.3 - Solaris Oilfield Infrastructure, Inc. | soi-20191231ex43bc2f040.htm |

| EX-32.2 - EX-32.2 - Solaris Oilfield Infrastructure, Inc. | soi-20191231ex322766f0f.htm |

| EX-32.1 - EX-32.1 - Solaris Oilfield Infrastructure, Inc. | soi-20191231ex3218d412a.htm |

| EX-31.2 - EX-31.2 - Solaris Oilfield Infrastructure, Inc. | soi-20191231ex312ef727c.htm |

| EX-31.1 - EX-31.1 - Solaris Oilfield Infrastructure, Inc. | soi-20191231ex31179f519.htm |

| EX-23.1 - EX-23.1 - Solaris Oilfield Infrastructure, Inc. | soi-20191231ex2310bdce5.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

or

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001‑38090

SOLARIS OILFIELD INFRASTRUCTURE, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

81‑5223109 |

|

(State or other jurisdiction |

(I.R.S. Employer |

|

|

|

|

9811 Katy Freeway, Suite 700 Houston, Texas |

77024 |

|

(Address of principal executive offices) |

(Zip code) |

|

|

|

|

(281) 501‑3070 |

|

|

(Registrant’s telephone number, including area code) |

|

|

|

|

|

(Former name, former address and former fiscal year, if changed since last report) |

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Class A Common Stock, $0.01 par value |

“SOI" |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

|

Large accelerated filer ☐ |

|

Accelerated filer ☒ |

|

|

Non-accelerated filer ☐ |

|

Smaller reporting company ☐ |

|

|

|

Emerging growth company ☒ |

|

|

If an emerging growth company indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes ☐ No ☒

Aggregate market value of the voting and non‑voting common equity held by non‑affiliates of Registrant as of June 30, 2019: $467,029,613

As of February 14, 2020, the registrant had 30,218,896 shares of Class A common stock, $0.01 par value per share, and 15,939,169 shares of Class B common stock, $0.00 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement relating to the Registrant’s 2019 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

SOLARIS OILFIELD INFRASTRUCTURE, INC.

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include the words "believe," "expect," "anticipate," "intend," "estimate" and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. Our forward-looking statements include statements about our business strategy, our industry, our future profitability, our expected capital expenditures and the impact of such expenditures on our performance, the costs of being a publicly traded corporation and our capital programs.

A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We believe that we have chosen these assumptions or bases in good faith and that they are reasonable. You are cautioned not to place undue reliance on any forward-looking statements. You should also understand that it is not possible to predict or identify all such factors and should not consider the following list to be a complete statement of all potential risks and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include:

|

· |

the level of domestic capital spending by the oil and natural gas industry; |

|

· |

natural or man-made disasters and other external events that may disrupt our manufacturing operations; |

|

· |

volatility of oil and natural gas prices; |

|

· |

changes in general economic and geopolitical conditions; |

|

· |

large or multiple customer defaults, including defaults resulting from actual or potential insolvencies; |

|

· |

technological advancements in well completion technologies; |

|

· |

competitive conditions in our industry; |

|

· |

inability to fully protect our intellectual property rights; |

|

· |

changes in the long-term supply of and demand for oil and natural gas; |

|

· |

actions taken by our customers, competitors and third-party operators; |

|

· |

fluctuations in transportation costs or the availability or reliability of transportation to supply our systems and transloading services; |

|

· |

changes in the availability and cost of capital; |

|

· |

our ability to successfully implement our business plan; |

|

· |

our ability to complete growth projects on time and on budget; |

|

· |

the price and availability of debt and equity financing (including changes in interest rates); |

|

· |

changes in our tax status; |

|

· |

our ability to successfully develop our research and technology capabilities and implement technological developments and enhancements and expand our product and service offerings; |

3

|

· |

changes in market price and availability of materials; |

|

· |

the effects of existing and future laws and governmental regulations (or the interpretation thereof); |

|

· |

cyber-attacks targeting systems and infrastructure used by the oil and natural gas industry; |

|

· |

failure to secure or maintain contracts with our largest customers; |

|

· |

the effects of future litigation; |

|

· |

credit markets; |

|

· |

leasehold or business acquisitions; |

|

· |

weather and other natural phenomena; |

|

· |

uncertainty regarding our future operating results; |

|

· |

significant changes in the transportation industries that service our business, such as increased regulation and embargoes; and |

|

· |

plans, objectives, expectations and intentions contained in this Annual Report that are not historical. |

All forward-looking statements speak only as of the date of this Annual Report. You should not place undue reliance on our forward-looking statements. Although forward-looking statements reflect our good faith beliefs at the time they are made, forward-looking statements involve known and unknown risks, uncertainties and other factors, including the factors described under "Risk Factors," which may cause our actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, unless required by law.

4

You should read this entire report carefully, including the risks described under Part 1, Item 1A. Risk Factors and our consolidated financial statements and the notes to those consolidated financial statements included elsewhere in this Annual Report. Except as otherwise indicated or required by the context, all references in this Annual Report to the "Company," "Solaris," "we," "us" and "our" refer to (i) Solaris Oilfield Infrastructure, LLC ("Solaris LLC") and its consolidated subsidiaries prior to the completion of our initial public offering and (ii) Solaris Oilfield Infrastructure, Inc. ("Solaris Inc.") and its consolidated subsidiaries following the completion of our initial public offering, unless we state otherwise or the context otherwise requires.

Our Predecessor and Solaris

Solaris LLC was formed in July 2014. Solaris Inc. was incorporated as a Delaware corporation in February 2017 for the purpose of completing an initial public offering of equity in May 2017 (the "IPO" or the "Offering") and related transactions. On May 11, 2017, in connection with the IPO, Solaris Inc. became a holding company whose sole material asset consists of units in Solaris LLC ("Solaris LLC Units"). Solaris Inc. became the managing member of Solaris LLC and is responsible for all operational, management and administrative decisions relating to Solaris LLC's business and consolidates the financial results of Solaris LLC and its subsidiaries.

Overview

We design, manufacture and rent specialized equipment which combined with field technician support, logistics services and our software solutions, enables us to provide a service offering that helps oil and natural gas operators and their suppliers to drive efficiencies and reduce costs during the completion phase of well development. The majority of our revenue is currently derived from rental and services related to our patented mobile proppant and chemical management systems that unload, store and deliver proppant and chemicals used in the hydraulic fracturing of oil and natural gas wells, as well as coordinating the delivery of proppant and chemicals to the well site. Our systems are deployed in most of the active oil and natural gas basins in the United States, including the Permian Basin, Eagle Ford Shale, SCOOP/STACK formations, Haynesville Shale, Rockies, Marcellus and Utica Shales and Bakken formation.

In 2018 and 2019, we introduced new equipment and service enhancements, which we believe will help us maintain and expand our total revenue opportunity in the United States completions space. We introduced our mobile chemical management system to the market in late 2018 and we began commercializing the offering in 2019. Design enhancements to our mobile proppant system include our AutoHopper™ technology, which automates the delivery of proppant into the blender, and the latest version of our Solaris Lens® software, which is available on our systems and allows customers to view the entire last mile proppant supply chain in real time.

Organizational Structure

Solaris Inc. was incorporated in February 2017 for the purpose of completing an initial public offering and related transactions. Our IPO was completed on May 17, 2017.

In connection with the closing of the IPO, Solaris Inc. became the managing member of Solaris LLC and is responsible for all operational, management and administrative decisions relating to Solaris LLC's business. Solaris Inc. consolidates the financial results of Solaris LLC and its subsidiaries and reports non-controlling interest related to the portion of the Solaris LLC Units not owned by Solaris Inc., which reduces net income (loss) attributable to the holders of Solaris Inc.’s Class A common stock. As of December 31, 2019, Solaris Inc. owned 66% of Solaris LLC.

Each share of Class B common stock has no economic rights but entitles its holder to one vote on all matters to be voted on by stockholders generally. Holders of Class A common stock and Class B common stock vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by

5

applicable law or by our amended and restated certificate of incorporation. We do not intend to list our Class B common stock on any exchange.

In connection with the IPO, Solaris Inc. entered into a Tax Receivable Agreement (the “Tax Receivable Agreement”) with each member of Solaris LLC immediately prior to the IPO (collectively, the “Original Investors”) (each such person and any permitted transferee, a “TRA Holder,” and together, the “TRA Holders”) on May 17, 2017. The Tax Receivable Agreement generally provides for the payment by Solaris Inc. to each TRA Holder of 85% of the net cash savings, if any, in United States federal, state and local income tax and franchise tax that Solaris Inc. actually realizes (computed using simplifying assumptions to address the impact of state and local taxes) or is deemed to realize in certain circumstances in periods after the IPO as a result of (i) certain increases in tax basis that occur as a result of Solaris Inc.’s acquisition (or deemed acquisition for United States federal income tax purposes) of all or a portion of such TRA Holder’s Solaris LLC Units in connection with the IPO or pursuant to the exercise of the Redemption Right or the Call Right (each as defined in Solaris LLC’s Second Amended and Restated Limited Liability Company Agreement (the “Solaris LLC Agreement”)) and (ii) imputed interest deemed to be paid by Solaris Inc. as a result of, and additional tax basis arising from, any payments Solaris Inc. makes under the Tax Receivable Agreement. Solaris Inc. will retain the benefit of the remaining 15% of these cash savings. For additional information regarding the Tax Receivable Agreement, see Item 1A. “Risk Factors—Risks Related to Our Class A Common Stock.”

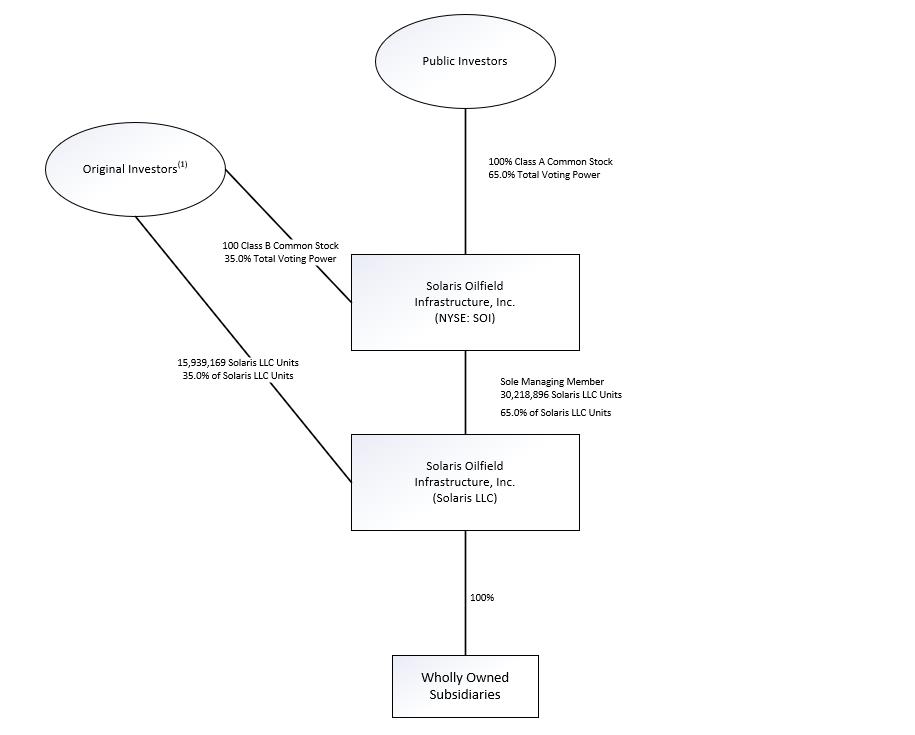

The following diagram indicates our simplified ownership structure as of February 18, 2020. This chart is provided for illustrative purposes only and does not represent all legal entities affiliated with us.

(1) Includes certain investment funds managed by Yorktown Partners LLC (“Yorktown”), certain of our officers and directors and the other members of Solaris LLC.

Our History

We were formed in 2014 in connection with the purchase of two proppant management systems from Loadcraft Industries, Ltd. (“Loadcraft Industries”), the original manufacturer of the systems, under an exclusive marketing

6

arrangement. In September 2014, we acquired Loadcraft Industries' proppant management system manufacturing business, including a manufacturing facility located in Early, Texas, and commenced our manufacturing operations.

Since our inception in 2014, we have grown our fleet of proppant management systems from two systems to 166 systems, improved the capabilities of our systems and developed and acquired additional product and service offerings.

Products and Services

We provide several products and services designed to increase efficiency, ensure reliable supply and reduce logistical costs to deliver and manage proppant and chemicals used during the completion phase of oil and gas well development. Our primary offerings include:

|

· |

System Rental – We manufacture and rent equipment to manage the delivery, handling and storage of proppant and chemicals at the well site. Our systems are highly mobile, can be easily deployed to any North American basin and do not require any specialized equipment to transport or deliver proppant or chemicals to the well site. |

|

o |

Mobile Proppant Management System – Our patented mobile proppant management systems typically contain six silos, two base units and one central conveyor. The six-silo configuration has the capacity to store approximately 2.5 million pounds of proppant and provides 24 unloading points for pneumatic trucks to deliver proppant into the silos. We also offer a non-pneumatic kit that allows our system to receive proppant from belly dump trucks. We believe our six-silo system provides increased inventory capacity compared to other systems, which reduces the amount of truck demurrage, or wait time, at the well site. Our systems are scalable in increments of three, including our 12-silo configuration, which provides a larger buffer to help manage increased proppant loadings, increased reliance on trucking for logistics as sand development shifts to in-basin sources and multi-well pad development activity. |

|

o |

Mobile Chemical Management System – Our patent-pending mobile chemical management systems typically contain three silos, one base unit, and a system of pumps meters and hoses to measure and deliver up to six different completion chemicals to the pressure pumping company’s blender. The three-silo configuration provides increased inventory capacity and control in a smaller footprint when compared to traditional storage and delivery methods which typically include a chem add unit, frac tanks, ISO tanks and dozens of manually operated totes on flatbed trailers. |

|

o |

Inventory Management Software – Each of our systems is equipped with sensors and our integrated Solaris Lens software system that enables our customers to track inventory and throughput volumes of each silo or silo compartment on a remote and real-time basis. With the integration of our Railtronix® software and third-party trucking applications, we can provide full visibility of the proppant and chemical from the vendor to the well site supply chain for certain customers. |

|

· |

Field and Logistics Services – We provide trained personnel to support our systems, train our customers to operate the systems and assist in the transportation of our systems. In addition, we provide last mile proppant logistics services, including managing trucking logistics from source to well site. |

|

· |

Transloading Services – At our Kingfisher Facility in Oklahoma, we provide manifest and unit-train transloading services, as well as provide forward staging storage of regional and local proppant. |

|

· |

Inventory Software Services – We provide real-time inventory management software, Solaris Lens, that enables our customers to monitor and measure proppant loaded into railcars or trucks at transload facilities or mines. |

Manufacturing

We manufacture our systems in our facility in Early, Texas (the “Early Facility”). Early is located in central Texas, which provides convenient access to several of our most active operating areas, including the Permian Basin, the Eagle

7

Ford Shale, the SCOOP/STACK formations and the Haynesville Shale. Our manufacturing process involves cutting, rolling and welding steel and assembly and testing of our systems. We have historically outsourced and may continue to outsource the manufacturing of certain components of our products in order to optimize our manufacturing capacity. When necessary, we also perform major repairs and overhauls of our systems in the Early Facility. We believe our Early Facility is a competitive advantage that provides us with a greater ability to control manufacturing costs, as well as additional supply chain and quality security and research and development capabilities.

Kingfisher Facility

The Kingfisher Facility is located central to the SCOOP/STACK plays and is capable of servicing multiple large volume customers. The Kingfisher Facility has over 45,000 feet of rail track and 30,000 tons of proppant storage in six silos with individual capacity of 5,000 tons per silo. The Kingfisher Facility services manifest and unit-trains and provides high efficiency silo and direct rail-to-truck transloading, in addition to forward staging storage. See our discussion of the Kingfisher Facility in Item 7. “—Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

Raw Materials and Key Suppliers

The primary raw materials used in the manufacturing of our equipment are steel in the form of plate, bar stock and square and round tubing. We purchase steel and most other raw materials and components on the open market and rely on third parties for providing certain materials, including axles, motors and generators. We believe that we will be able to obtain an adequate supply of raw materials and finished goods to meet our manufacturing requirements because these items are generally available from multiple sources. However, prices for such raw materials and finished goods can fluctuate widely and represent a significant portion of the cost of manufacturing. Accordingly, our cost of revenue and capital costs may be affected by changes in the market price or disruptions in the availability of raw materials, components and sourced finished goods.

We work with third-party suppliers to both transport equipment and materials and provide certain materials used in the manufacturing and maintenance of our systems. During the year ended December 31, 2019, one supplier, Automatize Logistics, LLC., accounted for approximately 19%, respectively, of our total spending. During the year ended December 31, 2018, two suppliers, BWJ Metalworks LLC and Heil Trailer International Co., accounted for approximately 13% and 11%, respectively, of our total spending. During the year ended December 31, 2017, no supplier accounted for more than 10% of our total spending.

Our Customers and Contracts

Our primary customers are major E&P and oilfield service companies. We generally execute master service agreements ("MSAs") with our customers. Generally, the MSAs govern the relationship with our customers with specific work performed under individual work orders. For the year ended December 31, 2019, Devon Energy Corporation and ProPetro Services, Inc., accounted for approximately 19% and 10%, respectively, of our total revenue. For the year ended December 31, 2018, EOG Resources, Inc., ProPetro Holding Corp. and BJ Services, LLC, accounted for approximately 15%, 10% and 10%, respectively, of our total revenue. For the year ended December 31, 2017, EOG Resources Inc., ProPetro Holding Corp., Schlumberger Technology Corporation and Devon Energy Corporation accounted for approximately 23%,15%, 13% and 11%, respectively, of our total revenue.

Competition

The oil and natural gas services industry is highly competitive. Please read Item 1A. "Risk Factors—Risks Related to Our Business—We face significant competition that may impede our ability to gain market share or cause us to lose market share or that could make adoption of new product offerings difficult." There are numerous large and small services companies in all regions of the United States with whom we compete. We face competition from proppant and chemical producers and proppant and chemical transporters who also offer solutions for unloading, storing and delivering proppant and chemicals at well sites and also from competitors who are focused on developing more efficient proppant and chemical logistic solutions. Our main competitors include U.S. Silica, Proppant Express Solutions, LLC, Hi-Crush Partners LP, National Oilwell Varco, Inc., CIG Logistics, OmniTRAX, Inc., Smart Sand Inc., Sand Revolution

8

LLC, Total Sand Solution and Hoover Ferguson Group, Inc. We also face competition from pressure pumping, logistics and sand companies that own their own proppant and chemical handling equipment. Many of these companies may be customers of ours on certain jobs while also utilizing their own equipment on other jobs.

We believe that we are well positioned competitively due to our existing market share, patent-protected technology, unique service offerings, low cost of operation, strong balance sheet and operational track record. The most important factors on which we compete are product and service quality, performance, reliability and price. Demand for our systems and services and the prices that we will be able to obtain for our systems and services, are closely linked to proppant and chemical consumption patterns for the completion of oil and natural gas wells in North America. These consumption patterns are influenced by numerous factors, including the price for hydrocarbons, the drilling rig count and hydraulic fracturing activity, including the number and rate of stages completed and the amount of proppant or chemical used per stage. Further, these consumption patterns are also influenced by the location, quality, price and availability of proppant and chemicals.

Seasonality

Our business is not significantly impacted by seasonality, although our fourth quarter activity has historically been impacted by holidays and our clients’ budget cycles, during which we may experience declines in our operating results.

In addition, we provide our proppant and chemical systems and services to E&P companies operating in oil and natural gas producing basins where severe weather conditions may curtail drilling activities and, as a result, impact our revenues generated from those regions. For a discussion of the impact of weather on our operations, please read “Risk Factors—Seasonal weather conditions and natural disasters could severely disrupt normal operations and harm our business.”

Environmental and Occupational Health and Safety Regulations

Our business operations are subject to stringent federal, tribal, regional, state and local laws and regulations governing occupational health and safety, the discharge of materials into the environment and environmental protection. Numerous governmental entities, including the U.S. Environmental Protection Agency (“EPA”), the U.S. Occupational Safety and Health Administration ("OSHA") and analogous state agencies, have the power to enforce compliance with these laws and regulations and the permits issued under them, often requiring difficult and costly actions, including the incurrence of potentially significant capital or operating expenditures to mitigate or prevent releases of materials from our equipment, facilities or from customer locations where we provide products and services. These laws and regulations may, among other things require the acquisition of permits to conduct regulated activities; restrict the types, quantities and concentration of various substances that can be released into the environment; require remedial measures to mitigate pollution from former and ongoing operations; impose specific safety and health criteria addressing worker protection; and impose substantial liabilities for pollution resulting from operations and support services.

The more significant of these existing environmental and occupational health and safety laws and regulations include the following U.S. legal standards, as amended from time to time:

|

· |

the Clean Air Act (“CAA”), which restricts the emission of air pollutants from many sources and imposes various pre-construction, operational, monitoring, and reporting requirements, and that the EPA has relied upon as authority for adopting climate change regulatory initiatives relating to greenhouse gas (“GHG”) emissions; |

|

· |

the Federal Water Pollution Control Act, also known as the Clean Water Act, which regulates discharges of pollutants to state and federal waters and establishes the extent to which waterways are subject to federal jurisdiction and rulemaking as protected waters of the United States; |

|

· |

the Oil Pollution Act of 1990, which, among other things, subjects owners and operators of onshore facilities to liability for removal costs and damages arising from an oil spill in waters of the United States; |

9

|

· |

the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (“CERCLA”), which imposes liability on generators, transporters, and arrangers of hazardous substances at sites where hazardous substance releases have occurred or are threatening to occur; |

|

· |

the Resource Conservation and Recovery Act (“RCRA”), which governs the generation, treatment, storage, transport, and disposal of solid wastes, including hazardous wastes; |

|

· |

the Safe Drinking Water Act (“SDWA”), which ensures the quality of the nation’s public drinking water through adoption of drinking water standards and controlling the injection of waste fluids into below-ground formations that may adversely affect drinking water sources; |

|

· |

the Occupational Safety and Health Act, which establishes workplace standards for the protection of the health and safety of employees, including the implementation of hazard communications programs designed to inform employees about hazardous substances in the workplace, potential harmful effects of these substances, and appropriate control measures; |

|

· |

the Endangered Species Act, which restricts activities that may affect federally identified endangered and threatened species or their habitats by the implementation of operating restrictions or a temporary, seasonal, or permanent ban in affected areas; and |

|

· |

the Department of Transportation regulations, which relate to advancing the safe transportation of energy and hazardous materials and emergency response preparedness. |

Additionally, there exist regional, state and local jurisdictions in the United States where we operate that also have, or are developing or considering developing, similar environmental and occupational health and safety laws and regulations governing many of these same types of activities. While the legal requirements imposed in state and local jurisdictions may be similar in form to federal laws and regulations, in some cases the actual implementation of these requirements may impose additional, or more stringent, conditions or controls that can significantly restrict, delay or cancel the permitting, development or expansion of a project or substantially increase the cost of doing business. Additionally, our operations may require state-law based permits in addition to federal permits, requiring state agencies to consider a range of issues, many the same as federal agencies, including, among other things, a project's impact on wildlife and their habitats, historic and archaeological sites, aesthetics, agricultural operations, and scenic areas. Our existing operations as well as the development of new sites also are subject to a variety of local environmental and regulatory requirements, including land use, zoning, building and transportation requirements. Moreover, whether at the federal, tribal, regional, state and local levels, environmental and occupational health and safety laws and regulations, including new or amended legal requirements that may arise in the future to address potential environmental concerns such as air and water impacts or to address perceived health or safety-related concerns such as oil and natural gas development in close proximity to specific occupied structures and/or certain environmentally-sensitive or recreational areas, are expected to continue to have a considerable impact on the demand for our systems and services.

These environmental and occupational health and safety laws and regulations generally restrict the level of pollutants emitted to ambient air, discharges to surface water, and disposals or other releases to surface and below-ground soils and ground-water. Failure to comply with these laws and regulations may result in the assessment of sanctions, including administrative, civil, and criminal penalties; the imposition of investigatory, remedial, and corrective action obligations or the incurrence of capital expenditures; the occurrence of restrictions, delays or cancellations in the permitting, development or expansion of projects; and the issuance of injunctions restricting or prohibiting some or all of our activities in a particular area. In particular, under certain circumstances, environmental agencies may delay or refuse to grant required approvals or cancel or amend existing permits or leases that may relate to our customers' operations, in which event such operations may be interrupted or suspended for varying lengths of time, causing a reduced demand for our products and services, an associated loss of revenue to us and adversely affecting our results of operations in support of those customers. Additionally, multiple environmental laws provide for citizen suits, which allow private parties, including environmental organizations, to act in place of the government and sue operators for alleged violations of environmental law. See Risk Factors under Part I, Item 1A of this Form 10-K for further discussion on environmental laws and regulations, including with respect to hydraulic fracturing; induced seismicity regulatory developments; ozone standards, site remediation; climate change, including methane or other GHG emissions; and other regulations relating to environmental protection and occupational health and safety. The ultimate financial

10

impact arising from environmental laws and regulations is neither clearly known nor determinable as existing standards are subject to change and new standards or more stringent enforcement programs continue to evolve.

We have incurred and will continue to incur operating and capital expenditures, some of which may be material, to comply with environmental and occupational health and safety laws and regulations. The trend in environmental regulation is to place more restrictions on activities that may affect the environment and, thus, any new laws and regulations, amendment of existing laws and regulations, reinterpretation of legal requirements or increased governmental enforcement that result in more stringent and costly pollution control equipment, the occurrence of restrictions, delays or cancellations in the permitting or performance of projects, or waste handling, storage, transport, disposal or remediation requirements could have a material adverse effect on our operations and financial position. Historically, our environmental compliance costs have not had a material adverse effect on our results of operations; however, there can be no assurance that such costs will not be material in the future or that such future compliance will not have a material adverse effect on our business and operational results. It is possible that other developments, such as stricter and more comprehensive environmental and occupational health and safety laws and regulations, claims for personal injuries to persons or damages to natural resources and property, or disruption of our customers' operations resulting from our actions or omissions, and imposition of penalties due to our operations could have a material adverse effect on us and our results of operations.

Intellectual Property

We continuously seek to innovate our product and service offerings to improve our operations and deliver increased value to our customers. Our engineering team is focused on continuing to enhance the capabilities of our systems, increasing our product and service offerings and improving our manufacturing operations. In addition, our software team is constantly designing and building increased software capabilities to enable efficient supply chain planning and management for our customers. We believe our investment in research and development will result in the development of complementary products and services, which will provide a competitive advantage as our customers focus on extracting oil and natural gas in the most economical and efficient ways possible.

We seek patent and trademark protections for our technology when we deem it prudent, and we aggressively pursue protection of these rights. We believe our patents, trademarks, and other protections for our proprietary technologies are adequate for the conduct of our business and that no single patent or trademark is critical to our business. In addition, we rely to a great extent on the technical expertise and know-how of our personnel to maintain our competitive position, and we take commercially reasonable measures to protect trade secrets and other confidential and/or proprietary information relating to the technologies we develop.

As of December 31, 2019, we had four issued patents in the United States, four corollary patents issued in Canada and two corollary patents issued in Mexico; three utility patent applications in the United States, two in Canada, and one in Mexico; and three provisional patent applications in the United States. Each patent and patent application relates to our systems and services and other technologies. Our issued patents expire, if all of the maintenance fees are paid, between 2032 and 2033. We cannot assure you that any of our patent applications will result in the issuance of a patent, or whether the examination process will require us to narrow our claims. In addition, any patents may be contested, circumvented, found unenforceable or invalid, and we may not be able to prevent third parties from infringing them.

Legal Proceedings

Due to the nature of our business, we may become, from time to time, involved in routine litigation or subject to disputes or claims related to our business activities. In the opinion of our management, there are no pending litigation, disputes or claims against us which, if decided adversely, would have a material adverse effect on our financial condition, cash flows or results of operations.

Employees

As of December 31, 2019, we employed 245 people pursuant to an Administrative Services Agreement. None of our employees are subject to collective bargaining agreements. We consider our employee relations to be good.

11

Available Information

We are required to file any annual, quarterly and current reports, proxy statements and certain other information with the Securities and Exchange Commission (the “SEC”).

The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC. Any documents filed by us with the SEC, including this Annual Report, can be downloaded from the SEC's website.

Our principal executive offices are located at 9811 Katy Freeway, Suite 700, Houston, Texas 77024, and our telephone number is (281) 501-3070. Our website is at www.solarisoilfield.com. Our periodic reports and other information filed with or furnished to the SEC, pursuant to Section 13(a) or 15(d) of the Exchange Act, including Annual Reports on Form 10-K and 10-K/A, quarterly reports on Form 10-Q and Form 10-Q/A, current reports on Form 8-K, and amendments to those reports are available, free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into this Annual Report and does not constitute a part of this Annual Report.

The following are certain risk factors that affect our business, financial condition, results of operations and cash flows. Many of these risks are beyond our control. These risk factors should be considered in connection with evaluating the forward-looking statements contained in this Annual Report. The risks and uncertainties described below are not the only ones that we face. If any of the events described below were to actually occur, our business, financial condition, results of operations and cash flows could be adversely affected and our results could differ materially from expected and historical results, any of which may also adversely affect the holders of our stock.

Risks Related to Our Business

Our business depends on domestic capital spending by the oil and natural gas industry, and reductions in capital spending could have a material adverse effect on our liquidity, results of operations and financial condition.

Our business is directly affected by capital spending to explore for, develop and produce oil and natural gas in the United States. The oil and natural gas industry is cyclical and historically has experienced periodic downturns in activity. The significant decline in oil and natural gas prices that began in late 2014 caused a reduction in the exploration, development and production activities of most of our customers. In response, we reduced the prices we charged for our systems. If oil and natural gas prices decline below current levels for an extended period of time, certain of our customers may be unable to pay their vendors and service providers, including us, as a result of the decline in commodity prices. Reduced activity in our areas of operation as a result of decreased capital spending may also have a negative long-term impact on our business, even in an environment of stronger oil and natural gas prices. Any of these conditions or events could adversely affect our operating results. If the recent recovery does not continue or our customers fail to further increase their capital spending, it could have a material adverse effect on our liquidity, results of operations and financial condition.

Industry conditions are influenced by numerous factors over which we have no control, including:

|

· |

expected economic returns to E&P companies of new well completions; |

|

· |

domestic and foreign economic conditions and supply of and demand for oil and natural gas; |

|

· |

the level of prices, and expectations about future prices, of oil and natural gas; |

|

· |

the level of global oil and natural gas exploration and production; |

12

|

· |

the level of domestic and global oil and natural gas inventories; |

|

· |

the supply of and demand for hydraulic fracturing and equipment in the United States; |

|

· |

federal, state and local regulation of hydraulic fracturing activities, as well as exploration and production activities, including public pressure on governmental bodies and regulatory agencies to regulate our industry or prohibit exploration and production activities on federal lands or in federal waters; |

|

· |

United States federal, tribal, state and local and non-United States governmental laws, regulations and taxes, including the policies of governments regarding the exploration for and production and development of their oil and natural gas reserves; |

|

· |

technical difficulties or failures; |

|

· |

changes in the price and availability of transportation; |

|

· |

shortages or late deliveries of qualified personnel, equipment or supplies; |

|

· |

political and economic conditions in oil and natural gas producing countries; |

|

· |

actions by the members of Organization of Petroleum Exporting Countries with respect to oil production levels and announcements of potential changes in such levels, including the failure of such countries to comply with production cuts; |

|

· |

global weather conditions and natural disasters; |

|

· |

worldwide political, military and economic conditions; |

|

· |

the cost of producing and delivering oil and natural gas; |

|

· |

lead times associated with acquiring equipment and products and availability of qualified personnel; |

|

· |

the discovery rates of new oil and natural gas reserves; |

|

· |

stockholder activism or activities by non-governmental organizations to limit certain sources of funding for the energy sector or restrict the exploration, development and production of oil and natural gas; |

|

· |

the availability of water resources, suitable proppant and chemical additives in sufficient quantities for use in hydraulic fracturing fluids; |

|

· |

advances in exploration, development and production technologies or in technologies affecting energy consumption; |

|

· |

the potential acceleration of development of alternative fuels; |

|

· |

significant changes in the rail industry or the rail lines that service our business, such as increased regulation, embargoes and disruption in service; and |

|

· |

uncertainty in capital and commodities markets and the ability of oil and natural gas companies to raise equity capital and debt financing. |

13

The volatility of oil and natural gas prices may adversely affect the demand for our systems, products and services, and negatively impact our results of operations.

The demand for our products and services is primarily determined by current and anticipated oil and natural gas prices and the related levels of capital spending and drilling activity in the areas in which we have operations. Volatility or weakness in oil prices or natural gas prices (or the perception that oil prices or natural gas prices will decrease or remain stagnant) affects the spending patterns of our customers and may result in the drilling of fewer new wells. As a result, demand for proppants or chemicals may decrease, which could, in turn, lead to lower demand for our products and services and may cause lower prices and lower utilization of our assets. We have, and may in the future, experienced significant fluctuations in operating results as a result of the reactions of our customers to changes in oil and natural gas prices. For example, prolonged low commodity prices experienced by the oil and natural gas industry beginning in late 2014 and uncertainty about future prices even when prices increased, combined with adverse changes in the capital and credit markets, caused many E&P companies to significantly reduce their capital budgets and drilling activity in recent years. This resulted in a significant decline in demand for oilfield services and adversely impacted the prices oilfield services companies could charge for their services.

Prices for oil and natural gas historically have been extremely volatile and are expected to continue to be volatile. During the past five years, the posted West Texas Intermediate ("WTI") price for oil has ranged from a low of $26.21 per barrel ("Bbl") in February 2016 to a high of $77.41 per Bbl in June 2018. During 2018 and 2019, WTI prices ranged from $44.48 to $77.41 per Bbl. If the prices of oil and natural gas continue to be volatile and reverse their recent increases or decline, our operations, financial condition, cash flows and level of expenditures may be materially and adversely affected.

We face significant competition that may impede our ability to gain market share or cause us to lose market share, or that could make adoption of new product offerings or services difficult.

The market for supply chain management and well site logistic services is becoming increasingly competitive. We face competition from proppant producers, pressure pumping companies, transloaders and proppant transporters who also offer solutions for unloading, storing and delivering proppant at well sites and also from competitors who, like us, are focused on developing more efficient last mile logistics management solutions. Some of these solutions utilize containers for on-site proppant storage and handling delivery, while others use silo-based storage as we do. Some of our competitors have greater financial and other resources than we do and may develop technology superior to ours or more cost-effective than ours. Competition in our industry and for our products is thus based on price, consistency and quality of products, distribution capability, customer service, reliability of supply, breadth of product offering and technical support. If our competitors are able to respond to industry conditions or trends more rapidly or effectively or resort to price competition, or if we are unable to gain market acceptance of new product offerings, we may be unable to gain or maintain our market share or may lose market share or operating profit, which could have an adverse effect on our business, results of operations and financial condition.

Technological advancements in well service products and technologies, including those that reduce the amount of proppant or chemicals required for hydraulic fracturing operations, could have a material adverse effect on our business, financial condition and results of operations.

Our industry is characterized by rapid and significant technological advancements and introductions of new products and services using new technologies. As competitors and others use or develop new technologies, or technologies comparable to ours, in the future, we may lose market share or be placed at a competitive disadvantage. Further, we may face competitive pressure to implement or acquire certain new technologies at a substantial cost. Some of our competitors may have greater financial, technical and personnel resources than we do, which may allow them to gain technological advantages or implement new technologies more rapidly than us. Additionally, we may be unable to implement new technologies or services at all, on a timely basis or at an acceptable cost. New technology or changes in our customers' well completion designs could also reduce the demand for proppant or chemicals or the amount of proppant or chemicals required for hydraulic fracturing activities, thereby reducing or eliminating the need for our systems and services. Limits on our ability to effectively use, implement or adapt to new technologies may have a material adverse effect on our business, financial condition and results of operations.

14

We may be adversely affected by uncertainty in the global financial markets and the deterioration of the financial condition of our customers.

Our future results may be impacted by the uncertainty caused by an economic downturn, volatility or deterioration in the debt and equity capital markets, inflation, deflation or other adverse economic conditions that may negatively affect us or parties with whom we do business resulting in a reduction in our customers' spending and their non-payment or inability to perform obligations owed to us, such as the failure of customers to honor their commitments or the failure of major suppliers to complete orders. Additionally, during times when the natural gas or crude oil markets weaken, our customers are more likely to experience financial difficulties, including being unable to access debt or equity financing, which could result in a reduction in our customers' spending for our systems and services. In addition, in the course of our business we hold accounts receivable from our customers. In the event of the financial distress or bankruptcy of a customer, we could lose all or a portion of such outstanding accounts receivable associated with that customer. Further, if a customer was to enter into bankruptcy, it could also result in the cancellation of all or a portion of our service contracts with such customer at significant expense or loss of expected revenues to us.

Reliance upon a few large customers may adversely affect our revenue and operating results.

During the years ended December 31, 2019 and 2018, our top three customers collectively represented approximately 39% and 35%, respectively, of our consolidated revenue. It is likely that we will continue to derive a significant portion of our revenue from a relatively small number of customers in the future. If a major customer fails to pay us, revenue would be impacted and our operating results and financial condition could be materially harmed. Additionally, we typically do not enter into long-term contractual agreements with our customers and if we were to lose any material customer, we may not be able to redeploy our equipment at similar utilization or pricing levels or within a short period of time and such loss could have a material adverse effect on our business until the equipment is redeployed at similar utilization or pricing levels.

The Kingfisher Facility currently operates under spot contracts without any commitments for future business. We may not be able to obtain long-term contracts with customers for contracted volumes on favorable terms, or at all, which could adversely affect our financial results.

The Kingfisher Facility currently operates with its customers on a spot, uncommitted basis. Our ability to enter into additional contracts with customers or add additional customer contracts on a long-term committed basis is subject to a number of factors, many of which are beyond our control. Any failure to obtain customers at the Kingfisher Facility or the loss of all or a portion of the revenues attributable to our existing customers as a result of competition, creditworthiness, inability to negotiate extensions or replacement of contracts or otherwise, could have a material adverse effect on our business, financial condition, prospects or results of operations.

We are exposed to the credit risk of our customers, and any material nonpayment or nonperformance by our customers could adversely affect our financial results.

We are subject to the risk of loss resulting from nonpayment or nonperformance by our customers, many of whose operations are concentrated solely in the domestic E&P industry which, as described above, is subject to volatility and, therefore, credit risk. Our credit procedures and policies may not be adequate to fully reduce customer credit risk. If we are unable to adequately assess the creditworthiness of existing or future customers or unanticipated deterioration in their creditworthiness, any resulting increase in nonpayment or nonperformance by them and our inability to re-market or otherwise use our equipment could have a material adverse effect on our business, financial condition, prospects or results of operations.

If we are unable to fully protect our intellectual property rights, we may suffer a loss in our competitive advantage or market share.

Our commercial success depends on our patented and proprietary information and technologies, know-how and other intellectual property. Because of the technical nature of our business, we rely on a combination of patent, copyright, trademark and trade secret laws, and restrictions on disclosure to protect our intellectual property. In particular, as of December 31, 2019, we had three patents issued with respect to our mobile proppant management

15

system design and one patent issued with respect to the lifting and lowering mechanism utilized by our systems to erect and lower their silos. We also have four pending utility patent applications and three provisional patent applications. We customarily enter into confidentiality or license agreements with our employees, consultants and corporate partners and control access to and distribution of our design information, documentation and other patented and proprietary information. In addition, in the future we may acquire additional patents or patent portfolios, which could require significant cash expenditures. However, third parties may knowingly or unknowingly infringe our patent or other proprietary rights, third parties may challenge patents or proprietary rights held by us, and pending and future trademark and patent applications may not be approved. Failure to protect, monitor and control the use of our existing intellectual property rights could cause us to lose our competitive advantage and incur significant expenses. It is possible that our competitors or others could independently develop the same or similar technologies or otherwise obtain access to our unpatented technologies. In such case, our trade secrets would not prevent third parties from competing with us. Consequently, our results of operations may be adversely affected. Furthermore, third parties or our employees may infringe or misappropriate our patented or proprietary technologies or other intellectual property rights, which could also harm our business and results of operations. Policing unauthorized use of intellectual property rights can be difficult and expensive, and adequate remedies may not be available.

We may be adversely affected by disputes regarding intellectual property rights of third parties.

Third parties from time to time may initiate litigation against us by asserting that the conduct of our business infringes, misappropriates or otherwise violates intellectual property rights. We may not prevail in any such legal proceedings related to such claims, and our systems may be found to infringe, impair, misappropriate, dilute or otherwise violate the intellectual property rights of others. If we are sued for infringement and lose, we could be required to pay substantial damages and/or be enjoined from using or selling the infringing products or technology. Any legal proceeding concerning intellectual property could be protracted and costly regardless of the merits of any claim and is inherently unpredictable and could have a material adverse effect on our financial condition, regardless of its outcome.

If we were to discover that our technologies or products infringe valid intellectual property rights of third parties, we may need to obtain licenses from these parties or substantially re-engineer our products in order to avoid infringement. We may not be able to obtain the necessary licenses on acceptable terms, or at all, or be able to re-engineer our products successfully. If our inability to obtain required licenses for our technologies or products prevents us from selling our products, that could adversely impact our financial condition and results of operations.

Additionally, we currently license certain third-party intellectual property in connection with our business, and the loss of any such license could adversely impact our financial condition and results of operations.

Our business is subject to inherent risks some of which are beyond our control. These risks may be self-insured or may not be fully covered under our insurance policies.

Our assets and operations may be affected by natural or man-made disasters and other external events such as extreme weather events that may disrupt our business, including manufacturing and field operations. These hazards can also cause personal injury and loss of life, severe damage to and destruction of property and equipment, pollution or environmental damage, and suspension or cancellation of operations. In addition, our operations are subject to, and exposed to, employee/employer liabilities and risks such as wrongful termination, discrimination, labor organizing, retaliation claims and general human resource related matters.

The occurrence of a significant event or adverse claim in excess of the insurance coverage that we maintain or that is not covered by insurance could have a material adverse effect on our liquidity, results of operations and financial condition. Claims for loss of oil and natural gas production and damage to formations can occur in our industry. Litigation arising from a catastrophic occurrence at a location where our systems are deployed or services are provided may result in our being named as a defendant in lawsuits asserting large claims.

We do not have insurance against all foreseeable risks, either because insurance is not available or because of the high premium costs. The occurrence of an event not fully insured against or the failure of an insurer to meet its insurance obligations could result in substantial losses. In addition, we may not be able to maintain adequate insurance in the future at rates we consider reasonable. Insurance may not be available to cover any or all of the risks to which we are subject,

16

or, even if available, it may be inadequate, or insurance premiums or other costs could rise significantly in the future so as to make such insurance prohibitively expensive.

Our assets require capital for maintenance, upgrades and refurbishment and may require significant capital expenditures for new equipment.

Our systems and facilities require capital investment in maintenance, upgrades and refurbishment to maintain their competitiveness. The costs of components and labor have increased in the past and may increase in the future with increases in demand, which will require us to incur additional costs to upgrade our facilities or any systems we may manufacture in the future. Any maintenance, upgrade or refurbishment project for our assets could increase our indebtedness or reduce cash available for other opportunities. Furthermore, such projects may require proportionally greater capital investments as a percentage of total asset value, which may make such projects difficult to finance on acceptable terms. To the extent we are unable to fund such projects, we may have less equipment available for service or our equipment may not be attractive to potential or current customers. Additionally, competition or advances in technology within our industry may require us to update or replace existing facilities or systems or build or acquire new ones. Such demands on our capital or reductions in demand for our products and services and the increase in cost of labor necessary for such maintenance and improvement, in each case, could have a material adverse effect on our business, liquidity position, financial condition, prospects and results of operations and may increase our costs.

We rely on a limited number of third-party manufacturers to supplement our internal production capacity during periods of peak demand, and delays in deliveries of any outsourced components or increases in the cost of such outsourced components could harm our business, results of operations and financial condition.

We have established relationships with a limited number of manufacturers that fabricate certain components of our systems during periods of peak demand to supplement our internal production capacity. Should any of these third-party manufacturers be unable to provide or otherwise fail to deliver such components in a timely manner and in the quantities and at the quality required, any resulting delays in the provision of such components could have a material adverse effect on our business, results of operations and financial condition. Additionally, increasing costs of manufacturing such outsourced components may negatively impact demand for our systems or the profitability of our business operations.

We currently rely on a limited number of suppliers for certain equipment and materials to build and maintain our systems, and our reliance on a limited number of suppliers for such equipment and materials exposes us to risks including price and timing of delivery.

We currently rely on a limited number of suppliers for equipment and materials to build and maintain our systems. If demand for our systems or the components necessary to build and maintain such systems increases or our suppliers for our equipment face financial distress or bankruptcy, our suppliers may not be able to provide such equipment on schedule at the current price or at all. In particular, steel is the principal raw material used in the manufacture of our systems, and the price of steel has historically fluctuated on a cyclical basis and has often depended on a variety of factors over which we have no control. Additionally, we depend on a limited number of suppliers for the motors that we use in our systems, which are a critical component. If our suppliers are unable to provide the raw materials and components needed to build and maintain our systems at the current price or at all, we could be required to seek other suppliers for the raw materials and components needed to build, maintain and operate our systems, which may adversely affect our revenues or increase our costs. Any inability to find alternative components at prices or with quality specifications similar to those deployed today could result in delays or a loss of customers.

Our business depends on our customers having access to an adequate supply of proppant to meet their needs.

There have been historical shortages of proppant during various periods. Because our business depends upon the availability of proppant to our customers, any future proppant shortages could decrease the demand for our products and services and have a material adverse effect on our operations, prospects and financial condition.

17

Changes in the transportation industry, including fluctuations in transportation costs, changes in the way in which proppant or chemicals are transported to the well site or the availability or reliability of transportation to supply our proppant or chemical management systems and transloading services, could impair the ability of our customers to take delivery of proppant or chemicals or make our products and services less attractive and thereby adversely impact our business.

Disruption of proppant or chemical transportation services due to shortages of rail cars or trucks, extreme weather-related events including rising sea levels, flooding and drought, accidents, mechanical difficulties, strikes, lockouts, bottlenecks, more stringent railcar or safety regulatory initiatives, or other events could temporarily impair the ability of our customers to take delivery of proppant or chemicals at the well site or our ability to provide transloading services. Accordingly, if there are disruptions of the services utilized by our customers (whether these services are provided by us or a third party), including but not limited to disruptions in the rail industry or a shortage of qualified motor carriers, and they are unable to find alternative transportation providers to transport proppant or chemicals to the well site, our business could be adversely affected. Additionally, alternative transportation methods for transporting and delivering proppant or chemicals to the well site could make our product offerings less attractive than those of our competitors and affect our results of operations.

Additionally, any disruptions in transportation services associated with delivery of our proppant or chemical management systems, or provision of last mile services, could result in reduced revenue associated with such systems or services, or the loss of customers.

A number of our customers operate in urban areas, which could increase the costs of deploying our systems and/or decrease the demand for our systems.

A number of our current and potential customers operate in urban areas, which could disproportionately expose them to operational and regulatory risk in that area. For example, operations within the city limits of various municipalities in Colorado may involve additional expenses as a result of changes in state law during 2019 that elevated the authority and regulatory oversight that local communities may exercise with respect to oil and gas developmental activities in the state, including expenses relating to limitations placed on operating hours or mitigation of noise, odor and light that may be emitted during operation. In addition, we and our customers may experience a higher rate of litigation or increased insurance and other costs related to operating in such highly populated areas.

We may have difficulty managing growth of our business, which could adversely affect our financial condition and results of operations.

Growth of our business could place a significant strain on our financial, technical, operational and management resources. As we expand the scope of our activities and our geographic coverage through organic growth, there will be additional demands on our financial, technical, operational and management resources. The failure to continue to upgrade our technical, administrative, operating and financial control systems or the occurrences of unexpected expansion difficulties, including the failure to recruit and retain experienced managers, engineers and other professionals in the oilfield services industry, could have a material adverse effect on our business, financial condition, results of operations and our ability to successfully or timely execute our business plan.

Federal, state and local legislative and regulatory initiatives relating to hydraulic fracturing as well as governmental reviews of such activities may serve to limit future oil and natural gas exploration and production activities and could have a material adverse effect on our results of operations and business.

Hydraulic fracturing is an important and commonly used process for the completion of oil and natural gas wells in targeted subsurface formations with low permeability, such as shale formations, and involves the pressurized injection of water, sand or other proppants and chemical additives into rock formations to stimulate oil and natural gas production. We do not conduct hydraulic fracturing but we manufacture specialized equipment that, combined with field products and well site storage and management of proppant and chemicals used by hydraulic fracturing operators in the oil and natural gas industry. In addition, we are able to provide transloading and other logistics services for our customers.

18

Hydraulic fracturing is an important and common practice that is typically regulated by state oil and natural gas commissions or similar agencies. However, the practice continues to be controversial in certain parts of the country, resulting in increased scrutiny and regulations of the fracturing process, including by federal agencies that has resulted in the assertion of regulatory authority or performance of investigations over certain aspects of the hydraulic fracturing process. For example, the EPA has asserted regulatory authority pursuant to the SDWA Underground Injection Control program over hydraulic fracturing activities involving the use of diesel and issued guidance covering such activities, as well as published an Advanced Notice of Proposed Rulemaking regarding Toxic Substances Control Act reporting of the chemical substances and mixtures used in hydraulic fracturing. The EPA also published final rules under the CAA in 2012 and in 2016 governing performance standards, including standards for the capture of air emissions released during oil and natural gas hydraulic fracturing. Additionally, in 2016, the EPA published an effluent limit guideline final rule prohibiting the discharge of wastewater from onshore unconventional oil and natural gas extraction facilities to publicly owned wastewater treatment plants. Also, in late 2016, the EPA released its final report on the potential impacts of hydraulic fracturing on drinking water resources, concluding that "water cycle" activities associated with hydraulic fracturing may impact drinking water resources under some circumstances.

Legislation has been introduced in United States Congress from time to time to provide for federal regulation of hydraulic fracturing and to require disclosure of the chemicals used in the hydraulic fracturing process but, to date, such legislation has not been adopted. Also, some states and local governments have adopted, and other governmental entities have, from time to time, considered adopting, regulations that could impose more stringent permitting, disclosure and well-construction requirements on hydraulic fracturing operations, including states where we or our customers operate. For example, in April 2019, the Governor of Colorado signed Senate Bill 19-181 into law, which legislation, among other things, revises the mission of the state oil and gas agency from fostering energy development in the state to instead focusing on regulating the oil and natural gas industry in a manner that is protective of public health and safety and the environment, as well as authorizing cities and counties to regulate oil and natural gas operations within their jurisdiction as they do other developments. Among other things, the Colorado oil and gas agency will consider enhanced safety and environmental protections during well development operations, including drilling and hydraulic fracturing activities. States could also elect to place prohibitions on hydraulic fracturing altogether, following the approach taken by the States of Maryland, New York and Vermont. Local governments may also seek to adopt ordinances within their jurisdictions regulating the time, place or manner of drilling activities in general or hydraulic fracturing activities in particular.

Moreover, our customers typically dispose of flowback and produced water or certain other oilfield fluids gathered from oil and natural gas producing operations in underground disposal wells. This disposal process has been linked to increased induced seismicity events in certain areas of the country, particularly in Oklahoma, Texas, Colorado, Kansas, New Mexico and Arkansas. These and other states have begun to consider or adopt laws and regulations that may restrict or otherwise prohibit oilfield fluid disposal in certain areas or underground disposal wells, and state agencies implementing these requirements may issue orders directing certain wells where seismic incidents have occurred to restrict or suspend disposal well operations or impose standards related to disposal well construction and monitoring. Any one or more of these developments may result in our customers having to limit disposal well volumes, disposal rates or locations, or require our customers or third party disposal well operators that are used by our customers to cease disposal well activities, which developments could adversely affect our customers' business and result in a corresponding decrease in the need for our systems and services, which could have a material adverse effect on our business, financial condition, and results of operations.

Additionally, non-governmental organizations may seek to restrict hydraulic fracturing, as has been the case in Colorado in recent years, when certain interest groups therein have, thus far, unsuccessfully pursued ballot initiatives in recent general election cycles that, had they been successful, would have revised the state constitution or state statutes in a manner that would have made exploration and production activities in the state more difficult or costly in the future including, for example, by increasing mandatory setback distances of oil and natural gas operations, including hydraulic fracturing, from specific occupied structures and/or certain environmentally sensitive or recreational areas. Notwithstanding the adoption of Colorado Senate Bill 19-181 in 2019, one or more interest groups in the state have already filed new ballot initiatives with the state in January 2020, in hopes of extending drilling setbacks from oil and natural gas development.

19

Increased regulation and attention given to the hydraulic fracturing process and associated processes could lead to greater opposition to, and litigation concerning, oil and natural gas production activities using hydraulic fracturing techniques. Additional legislation or regulation could also lead to operational delays for our customers or increased operating costs in the production of oil and natural gas, including from developing shale plays, or could make it more difficult for our customers to perform hydraulic fracturing. The adoption of any federal, state or local laws or ballot initiatives, or the implementation of any regulations, regarding hydraulic fracturing could potentially cause a decrease in the completion of new oil and natural gas wells and an associated decrease in demand for our products and services and increased compliance costs and time, which could have a material adverse effect on our liquidity, results of operations, and financial condition.

Finally, water is an essential component of shale oil and natural gas production during both the drilling and hydraulic fracturing processes. Our customers' access to water to be used in these processes may be adversely affected due to reasons such as periods of extended drought, private, third party competition for water in localized areas or the implementation of local or state governmental programs to monitor or restrict the beneficial use of water subject to their jurisdiction for hydraulic fracturing to assure adequate local water supplies. Our customers' inability to locate or contractually acquire and sustain the receipt of sufficient amounts of water could adversely impact their exploration and production operations and have a corresponding adverse effect on our business, results of operations and financial condition.

Changes in transportation regulations may increase our costs and negatively impact our results of operations.