Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Four Corners Property Trust, Inc. | fcpt2019q4earningspr1292.htm |

| 8-K - 8-K - Four Corners Property Trust, Inc. | fcpt4q2019earnings8-k.htm |

FOUR CORNERS PROPERTY TRUST NYSE: FCPT SUPPLEMENTAL FINANCIAL & OPERATING INFORMATION | Q4 2019 www.fcpt.com 1 | FCPT | Q4 2019

CAUTIONARY NOTE REGARDING FORWARD- LOOKING STATEMENTS This press release contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding the Company’s intent, belief or expectations, including, but not limited to, statements regarding: operating and financial performance; announced transactions; and expectations regarding the making of distributions and the payment of dividends. Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. Forward-looking statements speak only as of the date on which such statements are made and, except in the normal course of the Company’s public disclosure obligations, the Company expressly disclaims any obligation to publicly release any updates or revisions to any forward-looking statements to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which any statement is based. Forward-looking statements are based on management’s current expectations and beliefs and the Company can give no assurance that its expectations or the events described will occur as described. Forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by such forward-looking statements. For a further discussion of these and other factors that could cause the Company’s future results to differ materially from any forward-looking statements, see the section entitled “Risk Factors” in the Company’s most recent annual report on Form 10-K, and other risks described in documents subsequently filed by the Company from time to time with the Securities and Exchange Commission. 2 | FCPT | Q4 2019

TABLE OF CONTENTS Financial Summary Page Consolidating Balance Sheet 4 Consolidated Income Statement 5 FFO and AFFO Reconciliation 6 Net Asset Value Components 7 Capitalization and Key Credit Metrics 8 Debt Summary 9 Debt Maturity Schedule 10 Debt Covenants 11 Real Estate Portfolio Summary Property Locations by Brand 12 Brand Diversification 13 Geographic Diversification 14 Lease Maturity Schedule 15 Exhibits Glossary and Non-GAAP Definitions 16 Reconciliation of Net Income to Adjusted EBITDAre 17 3 | FCPT | Q4 2019

CONSOLIDATING BALANCE SHEET As of 12/31/2019 As of 12/31/2018 ($000s, except shares and per share data) Real Estate Restaurant Consolidated Consolidated Unaudited Operations Operations Elimination FCPT FCPT ASSETS Real estate investments: Land $ 687,514 $ 3,061 $ - $ 690,575 $ 569,057 Buildings, equipment and improvements 1,265,341 11,818 - 1,277,159 1,236,224 Total real estate investments 1,952,855 14,879 - 1,967,734 1,805,281 Less: accumulated depreciation (630,250) (5,380) - (635,630) (614,584) Real estate investments, net 1,322,605 9,499 - 1,332,104 1,190,697 Intangible real estate assets, net 57,917 - - 57,917 18,998 Total real estate investments and intangible real estate assets, net 1,380,522 9,499 - 1,390,021 1,209,695 Cash and cash equivalents 4,032 1,051 - 5,083 92,041 Straight-line rent adjustment 39,350 - - 39,350 30,141 Other assets 5,648 4,517 - 10,165 5,239 Derivative assets 1,451 - - 1,451 5,982 Investment in subsidiary 10,028 - (10,028) - - Intercompany receivable 297 - (297) - - Total Assets $ 1,441,328 $ 15,067 $ (10,325) $ 1,446,070 $ 1,343,098 LIABILITIES AND EQUITY Liabilities: Term loan ($400,000, net of deferred financing costs) $ 395,012 $ - $ - $ 395,012 $ 393,279 Revolving facility ($250,000 capacity) 52,000 - - 52,000 - Unsecured notes ($225,000, net of deferred financing costs) 222,928 - - 222,928 222,613 Rent received in advance 10,463 - - 10,463 1,609 Derivative liabilities 5,005 - - 5,005 - Dividends payable 21,325 - - 21,325 19,580 Other liabilities 6,826 5,770 - 12,596 7,053 Intercompany payable - 297 (297) - - Total liabilities $ 713,559 $ 6,067 $ (297) $ 719,329 $ 644,134 Equity: Preferred stock $ - $ - $ - $ - $ - Common stock 7 - - 7 7 Additional paid-in capital 686,181 10,028 (10,028) 686,181 639,116 Accumulated other comprehensive (loss) income (3,539) - - (3,539) 5,956 Noncontrolling interest 5,691 - - 5,691 7,867 Retained earnings 39,429 (1,028) - 38,401 46,018 Total equity $ 727,769 $ 9,000 $ (10,028) $ 726,741 $ 698,964 Total Liabilities and Equity $ 1,441,328 $ 15,067 $ (10,325) $ 1,446,070 $ 1,343,098 4 | FCPT | Q4 2019

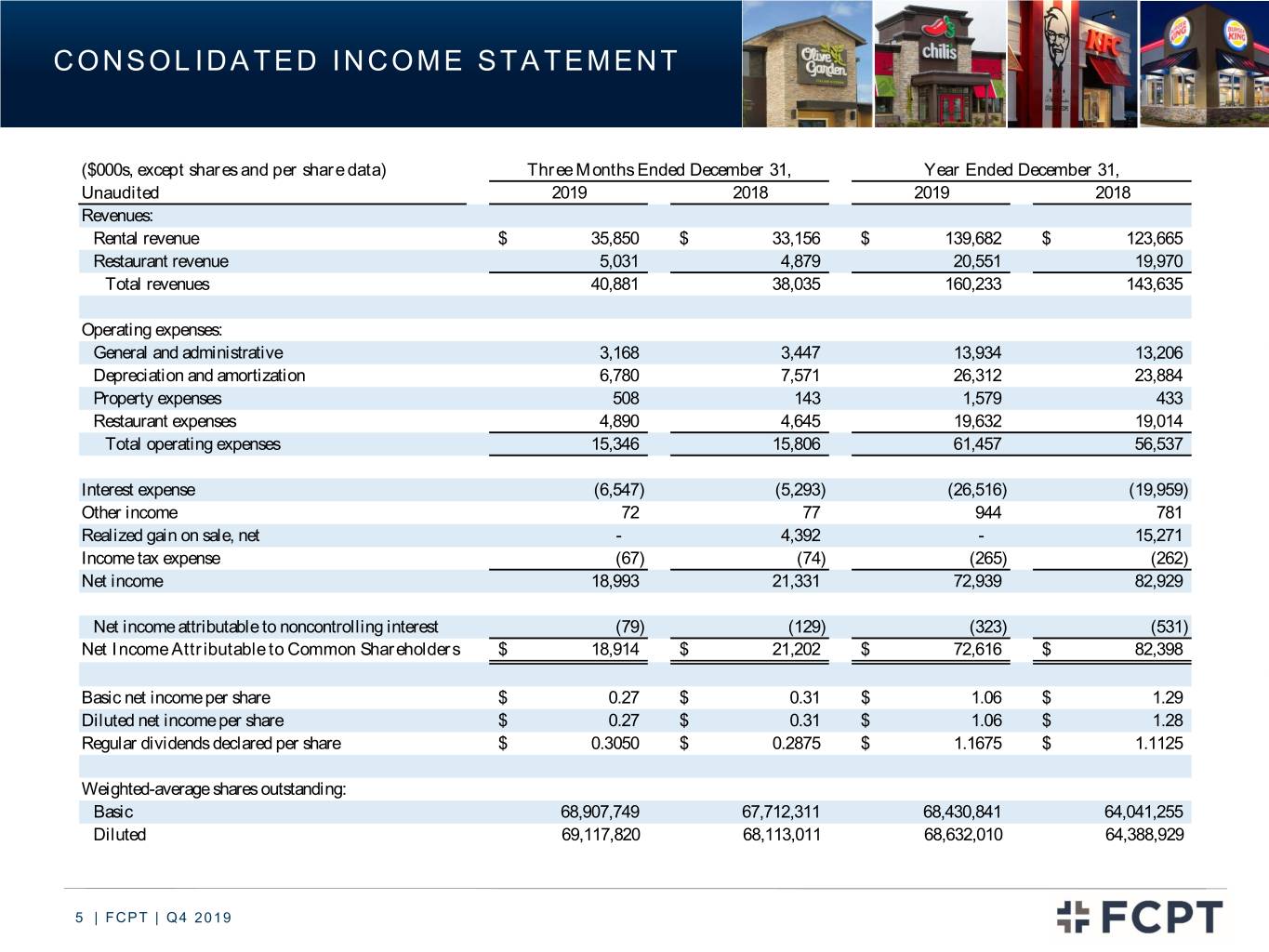

CONSOLIDATED INCOME STATEMENT ($000s, except shares and per share data) Three Months Ended December 31, Year Ended December 31, Unaudited 2019 2018 2019 2018 Revenues: Rental revenue $ 35,850 $ 33,156 $ 139,682 $ 123,665 Restaurant revenue 5,031 4,879 20,551 19,970 Total revenues 40,881 38,035 160,233 143,635 Operating expenses: General and administrative 3,168 3,447 13,934 13,206 Depreciation and amortization 6,780 7,571 26,312 23,884 Property expenses 508 143 1,579 433 Restaurant expenses 4,890 4,645 19,632 19,014 Total operating expenses 15,346 15,806 61,457 56,537 Interest expense (6,547) (5,293) (26,516) (19,959) Other income 72 77 944 781 Realized gain on sale, net - 4,392 - 15,271 Income tax expense (67) (74) (265) (262) Net income 18,993 21,331 72,939 82,929 Net income attributable to noncontrolling interest (79) (129) (323) (531) Net Income Attributable to Common Shareholders $ 18,914 $ 21,202 $ 72,616 $ 82,398 Basic net income per share $ 0.27 $ 0.31 $ 1.06 $ 1.29 Diluted net income per share $ 0.27 $ 0.31 $ 1.06 $ 1.28 Regular dividends declared per share $ 0.3050 $ 0.2875 $ 1.1675 $ 1.1125 Weighted-average shares outstanding: Basic 68,907,749 67,712,311 68,430,841 64,041,255 Diluted 69,117,820 68,113,011 68,632,010 64,388,929 5 | FCPT | Q4 2019

FFO & AFFO RECONCILIATION ($000s, except shares and per share data) Three Months Ended December 31, Year Ended December 31, Unaudited 2019 2018 2019 2018 Net income $ 18,993 $ 21,331 $ 72,939 $ 82,929 Depreciation and amortization 6,677 6,022 26,158 22,287 Realized gain on sales of real estate - (4,392) - (15,271) Provision for impairment - 1,530 - 1,530 Realized gain on exchange of real estate (1) - - - (228) FFO (as defined by NAREIT) $ 25,670 $ 24,491 $ 99,097 $ 91,247 Straight-line rent (2,199) (2,431) (9,207) (9,288) Stock-based compensation 810 930 3,602 3,967 Non-cash amortization of deferred financing costs 512 466 2,050 1,834 Other non-cash interest income 1 2 (4) 29 Non-real estate investment depreciation 103 19 154 67 Amortization of above and below market leases, net 109 18 158 64 Adjusted Funds From Operations (AFFO) $ 25,006 $ 23,495 $ 95,850 $ 87,920 Fully diluted shares outstanding(2) 69,407,212 68,522,331 68,937,263 64,798,250 FFO per diluted share $ 0.37 $ 0.36 $ 1.44 $ 1.41 AFFO per diluted share $ 0.36 $ 0.34 $ 1.39 $ 1.36 ___________________________ (1) Non-cash gain recognized for GAAP purposes on the transfer of nonfinancial assets related to an excess land parcel exchange. (2) Assumes the issuance of common shares for OP units held by non-controlling interests. 6 | FCPT | Q4 2019

NET ASSET VALUE COMPONENTS Purchase Total Square Avg. Rent Per Tenant Lease Term Annual Cash Base % Total Price # of Feet Square Foot EBITDAR Remaining Rent Cash Base Real Estate Portfolio as of 12/31/2019 ($000s) Properties (000s) ($) Coverage(1) (Yrs)(2) ($000s)(3) Rent(3) Olive Garden - 304 2,593 29 5.4x 10.7 74,171 53.2% LongHorn Steakhouse - 109 608 34 4.6x 9.6 20,471 14.7% Other Brands - Non-Darden - 273 1,313 31 3.1x 12.9 40,606 29.1% Other Brands - Darden - 13 120 35 3.9x 8.9 4,167 3.0% Total Owned Portfolio - 699 4,633 30 4.7x 11.1 139,415 100.0% Q4'19 Transaction Activity(4) Properties acquired 118,464 49 278 27 N/A 9.6 7,455 5.3% Land acquisition of Kerrow operated restaurant (5) 2,107 1 - - - - - - No sales in Q4 2019 Tangible Assets Book Value ($000s) Cash, cash equivalents, and restricted cash $ 5,083 Other tangible assets 6,185 Total Tangible Assets $ 11,268 Debt Face Value ($000s) Term loan $ 400,000 June 2024 note 50,000 December 2026 note 50,000 June 2027 note 75,000 December 2028 note 50,000 Revolving credit facility 52,000 Total Debt $ 677,000 Tangible Liabilities Book Value ($000s) Dividends payable $ 21,325 Rent received in advance, accrued interest, and other accrued expenses 16,791 Total Tangible Liabilities $ 38,116 Shares Outstanding Common stock (shares outstanding as of 12/31/2019) 70,020,660 Operating partnership units (OP units outstanding as of 12/31/2019) 289,392 Total Common Stock and OP Units Outstanding 70,310,052 ___________________________ (1) See glossary on page 16 for tenant EBITDAR and EBITDAR coverage definitions; 90% of portfolio ABR included in calculations based on portfolio reporting obligations. (2) Lease term weighted by annual cash base rent (ABR) as defined in glossary. (3) Current scheduled minimum contractual rent as of 12/31/2019. (4) FCPT acquired 49 properties and leasehold interests in Q4 2019; FCPT had no dispositions in the quarter. (5) FCPT purchased the land of a Kerrow operated Longhorn Steakhouse that previously had a third-party lease. 7 | FCPT | Q4 2019

CAPITALIZATION & KEY CREDIT METRICS % of Market Q4 2019 Capitalization ($000s, except shares and per share data) Capitalization Equity: Share price (12/31/2019) $ 28.19 Shares and OP units outstanding (12/31/2019) 70,310,052 Equity Value $ 1,982,040 74.5% Debt: Term loan $ 400,000 15.0% Revolving credit facility 52,000 2.0% Unsecured notes 225,000 8.5% Total Debt $ 677,000 25.5% Total Market Capitalization $ 2,659,040 100.0% Less: cash (5,083) Implied Enterprise Value $ 2,653,957 Dividend Data (fully diluted) Q4 2019 2019 Common dividend per share $0.3050 $1.1675 AFFO per share $0.36 $1.39 AFFO payout ratio 84.7% 84.0% (1) (2) Credit Metrics Net Debt Adjusted EBITDAre Ratio Net debt to Adjusted EBITDAre $ 671,917 $ 129,592 5.2x ___________________________ (1) Principal debt amount less cash and cash equivalents. (2) Current quarter annualized. See glossary on page 16 for definitions of EBITDAre and Adjusted EBITDAre and page 17 for reconciliation to net income. 8 | FCPT | Q4 2019

DEBT SUMMARY Balance as of Cash Interest Rate Weighted December 31, 2019 as of December 31, Average (4) Debt Type Maturity Date ($000s) % of Debt 2019 Maturity (Yrs.) Credit Facility(1) Revolving facility Nov-21 $ 52,000 7.7% 3.36% 1.9 Term loan Nov-22 150,000 22.2% 3.06% 2.9 Term loan Nov-23 150,000 22.2% 2.96% 3.9 Term loan Mar-24 100,000 14.8% 2.96% 4.2 Principal Amount $ 452,000 Unsecured Notes(2) June 2017 Jun-24 $ 50,000 7.4% 4.68% 4.4 June 2017 Jun-27 75,000 11.1% 4.93% 7.4 December 2018 Dec-26 50,000 7.4% 4.63% 7.0 December 2018 Dec-28 50,000 7.4% 4.76% 9.0 Principal Amount $ 225,000 Mortgages Payable(3) None - - - - Total/Weighted Average $ 677,000 100.0% 3.61% 4.6 Unamortized Deferred Financing Costs Credit facility $ (4,988) Unsecured notes (2,072) Debt Carrying Value (GAAP) $ 669,940 Fixed rate $ 525,000 77.5% Variable rate $ 152,000 22.5% Credit Rating (Fitch): BBB- ___________________________ (1) Borrowings under the term loan accrue interest at an average rate of LIBOR plus 1.29%. FCPT has entered into interest rate swaps that fix 75% of the term loan's rate exposure through November 2022, 63% through November 2023, and 38% through March 2024. The all-in cash interest rate on the 75% of the term loan that is fixed is approximately 3.0%, 3.4%, and 3.4% for 2020, 2021, and 2022, respectively. A LIBOR rate of 1.76% as of 12/31/2019 is used for the 25% of term loans that are not hedged. (2) These notes are senior unsecured fixed rate obligations of the Company. (3) As of 12/31/2019, FCPT had no mortgage debt and 100% of FCPT properties were unencumbered. (4) Excludes amortization of deferred financing costs on the credit facility and unsecured notes. 9 | FCPT | Q4 2019

FCPT DEBT MATURITY SCHEDULE Current Debt Maturity Schedule Staggered 4.6-year weighted (1) average term for notes/bonds Undrawn Revolver Capacity 78% fixed rate debt Drawn Revolver 3.6% weighted average cash interest rate Unsecured Term Loan $198 million available on revolver Unsecured Notes $250 $150 $150 $150 $100 $75 $50 $50 52 $50 $0 2020 2021 2022 2023 2024 2025 2026 2027 2028 % of Total Debt 0% 8% 22% 22% 22% 0% 7% 11% 7% Outstanding ___________________ Figures as of 12/31/2019. (1) The revolving credit facility expires on November 9, 2021 subject to FCPT’s availability to extend the term for two additional six-month periods to November 9, 2022. 10 | FCPT | Q4 2019

DEBT COVENANTS As of December 31, 2019 The following is a summary of the key financial covenants for our unsecured credit facility. These calculations are not based on U.S. GAAP measurements and are presented to demonstrate compliance with current credit covenants. Covenants Requirement Q4 2019 Limitation on incurrence of total debt ≤ 60% of consolidated capitalization value 32.8% Limitation on incurrence of secured debt ≤ 40% of consolidated capitalization value 0.0% Fixed charge coverage ratio ≥ 1.50x 5.4x Limitation on unencumbered leverage ≤ 60% 32.5% Unencumbered interest coverage ratio ≥ 1.75x 6.0x 11 | FCPT | Q4 2019

PROPERTY LOCATIONS BY BRAND Lease Count: (1) (51) 702 Leases (1) 58 Brands ___________________________ Figures as of 12/31/2019 (1) FCPT owns 699 properties as of 12/31/2019 with 702 leases. 12 | FCPT | Q4 2019

BRAND DIVERSIFICATION FCPT Portfolio Brands FCPT total ABR(1): Square Feet % of $139.4 million (1) Rank Brand Name Number (000s) ABR 1 Olive Garden 304 2,593 53.2% 2 Longhorn Steakhouse 109 608 14.7% 3 Chili's 61 336 9.0% 15% 4 Red Lobster 21 155 3.4% 109 units 5 Burger King 22 70 2.2% 6 Buffalo Wild Wings 18 111 2.2% 7 Bahama Breeze 9 84 2.1% 8 Bob Evans 17 93 1.9% 9% 9 KFC 20 57 1.2% 61 units 10 Arby's 13 41 1.0% 53% 11 BJ's Restaurant 6 49 0.9% 12 Taco Bell 11 28 0.7% 304 units 3% 13 units Other Darden2 13 Seasons 52 2 18 0.5% 14 Outback Steakhouse 5 33 0.5% 15 McDonald's 5 23 0.5% Other Restaurants 16 McAlister's Deli 4 15 0.4% 19% 17 Wendy's 6 21 0.4% 202 units 18 Texas Roadhouse 5 36 0.3% 39 brands 19 Starbucks 5 11 0.3% 20 Chick-Fil-A 4 19 0.3% 21 Pizza Hut 6 15 0.3% 22 Steak 'N Shake 4 15 0.3% 23 Popeyes 4 12 0.3% 24 Eddie V's 1 9 0.2% Non-Restaurant Retail 25 Panera 3 17 0.2% 1% / 13 units / 12 brands 26-58 Other 37 152 2.8% (3) Total Lease Portfolio 702 4,619 100% ___________________ 1. Represents current scheduled minimum Annual Cash Base Rent (ABR) as of 12/31/2019, as defined in glossary. 2. Other Darden represents Bahama Breeze, Cheddar’s, Seasons 52, and Eddie V’s branded restaurants. 13 | FCPT | Q4 2019

GEOGRAPHIC DIVERSIFICATION ND WA MT MN ME SD WI ID MI VT NH OR WY NY IA MA NE CT RI PA OH NV IL IN NJ UT CO MD DE KS MO WV KY VA CA TN OK NC (1) AR % ABR AZ NM SC ≥10.0% MS AL GA 5.0%–10.0% LA TX 3.0%–5.0% 2.0%–3.0% 1.0 %–2.0% FL <1.0% No Properties State % ABR Leases TX 12.5% 72 IL 3.4% 32 CO 2.2% 20 AZ 11 1.7% KS 1.0% 5 FL 10.8% 63 PA 3.0% 19 MD 2.2% 16 OK 10 1.7% Other 7.7% 51 OH 6.9% 50 CA 2.8% 14 SC 2.1% 14 MN 9 1.6% GA 6.3% 43 NC 2.6% 18 NY 2.0% 13 NV 8 1.6% MI 4.3% 38 VA 2.4% 19 WI 2.0% 18 LA 9 1.5% IN 4.0% 42 MS 2.4% 18 AL 1.7% 15 AR 8 1.2% TN 3.6% 28 IA 2.3% 22 KY 1.7% 11 WV 6 1.1% ___________________________ (1) Annual cash base rent (ABR) as defined in glossary. 14 | FCPT | Q4 2019

LEASE MATURITY SCHEDULE Lease Maturity Schedule (% Annualized Cash Base Rent1) 16.1% 99.7% occupied2 as of 12/31/2019 14.1% 13.1% 11.3% 11.4% Weighted average lease term of 10.6% 11.1 years 7.5% Less than 5.1% of rental income matures prior to 2027 3.0% 3.3% 2.5% 1.0% 0.9% 1.0% 0.9% 1.0% 0.5% 0.7% 0.7% 0.2% 0.2% 0.1% 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 ___________________ Note: Excludes renewal options. All data as of 12/31/2019. 1. Annual cash base rent (ABR) as defined in glossary. 2. Occupancy based on portfolio square footage. 15 | FCPT | Q4 2019

GLOSSARY AND NON-GAAP DEFINITIONS Non-GAAP Definitions and Cautionary Note Regarding Forward-Looking Statements: This document includes certain non-GAAP financial measures that employed by other REITs. condition and results from operations, the utility of FFO as a measure management believes are helpful in understanding our business, as of our performance is limited. FFO is a non-GAAP measure and further described below. Our definition and calculation of non-GAAP Tenant EBITDAR is calculated as EBITDA plus rental expense. should not be considered a measure of liquidity including our ability financial measures may differ from those of other REITs and therefore EBITDAR is derived from the most recent data provided by tenants to pay dividends or make distributions. In addition, our calculations of may not be comparable. The non-GAAP measures should not be that disclose this information, representing approximately 90% of our FFO are not necessarily comparable to FFO as calculated by other considered an alternative to net income as an indicator of our ABR. For Darden, EBITDAR is updated once annually by multiplying REITs that do not use the same definition or implementation performance and should be considered only a supplement to net the most recent individual property level sales information (reported guidelines or interpret the standards differently from us. Investors in income, and to cash flows from operating, investing or financing by Darden twice annually to FCPT) by the brand average EBITDA our securities should not rely on these measures as a substitute for any activities as a measure of profitability and/or liquidity, computed in margin reported by Darden in its most recent comparable period, and GAAP measure, including net income. accordance with GAAP. then adding back property level rent. FCPT does not independently verify financial information provided by its tenants. Adjusted Funds From Operations “AFFO” is a non-GAAP ABR refers to annual cash base rent as of 12/31/2019 and represents measure that is used as a supplemental operating measure specifically monthly contractual cash rent, excluding percentage rents, from Tenant EBITDAR coverage is calculated by dividing our reporting for comparing year over year ability to fund dividend distribution leases, recognized during the final month of the reporting period, tenants’ most recently reported EBITDAR by annual in-place cash from operating activities. AFFO is used by us as a basis to address our adjusted to exclude amounts received from properties sold during that base rent. ability to fund our dividend payments. We calculate adjusted funds period and adjusted to include a full month of contractual rent for from operations by adding to or subtracting from FFO: properties acquired during that period. Funds From Operations (“FFO”) is a supplemental measure of our 1. Transaction costs incurred in connection with the acquisition of performance which should be considered along with, but not as an real estate investments EBITDA represents earnings (GAAP net income) plus interest alternative to, net income and cash provided by operating activities as 2. Stock-based compensation expense expense, income tax expense, depreciation and amortization. a measure of operating performance and liquidity. We calculate FFO 3. Amortization of deferred financing costs in accordance with the standards established by NAREIT. FFO 4. Other non-cash interest expense EBITDAre is a non-GAAP measure computed in accordance with represents net income (loss) (computed in accordance with GAAP), 5. Non-real estate depreciation the definition adopted by the National Association of Real Estate excluding gains (or losses) from sales of property and undepreciated 6. Merger, restructuring and other related costs Investment Trusts (“NAREIT”) as EBITDA (as defined above) land and impairment write-downs of depreciable real estate, plus real 7. Impairment charges on non-real estate assets excluding gains (or losses) on the disposition of depreciable real estate estate related depreciation and amortization (excluding amortization 8. Amortization of capitalized leasing costs and real estate impairment losses. of deferred financing costs) and after adjustments for unconsolidated 9. Straight-line rent revenue adjustment partnerships and joint ventures. We also omit the tax impact of non- 10. Amortization of above and below market leases Adjusted EBITDAre is computed as EBITDAre (as defined above) FFO producing activities from FFO determined in accordance with the 11. Debt extinguishment gains and losses excluding transaction costs incurred in connection with the acquisition NAREIT definition. 12. Recurring capital expenditures and tenant improvements of real estate investments and gains or losses on the extinguishment of debt. Our management uses FFO as a supplemental performance measure AFFO is not intended to represent cash flow from operations for the because, in excluding real estate related depreciation and amortization period, and is only intended to provide an additional measure of We believe that presenting supplemental reporting measures, or non- and gains and losses from property dispositions, it provides a performance by adjusting the effect of certain items noted above GAAP measures, such as EBITDA, EBITDAre and Adjusted performance measure that, when compared year over year, captures included in FFO. AFFO is a widely-reported measure by other REITs; EBITDAre, is useful to investors and analysts because it provides trends in occupancy rates, rental rates and operating costs. We offer however, other REITs may use different methodologies for important information concerning our on-going operating this measure because we recognize that FFO will be used by investors calculating AFFO and, accordingly, our AFFO may not be performance exclusive of certain non-cash and other costs. These non- as a basis to compare our operating performance with that of other comparable to other REITs. GAAP measures have limitations as they do not include all items of REITs. However, because FFO excludes depreciation and income and expense that affect operations. Accordingly, they should amortization and captures neither the changes in the value of our Properties refers to properties available for lease. not be considered alternatives to GAAP net income as a performance properties that result from use or market conditions, nor the level of measure and should be considered in addition to, and not in lieu of, capital expenditures and capitalized leasing commissions necessary to GAAP financial measures. Our presentation of such non-GAAP maintain the operating performance of our properties, all of which measures may not be comparable to similarly titled measures have real economic effect and could materially impact our financial 16 | FCPT | Q4 2019

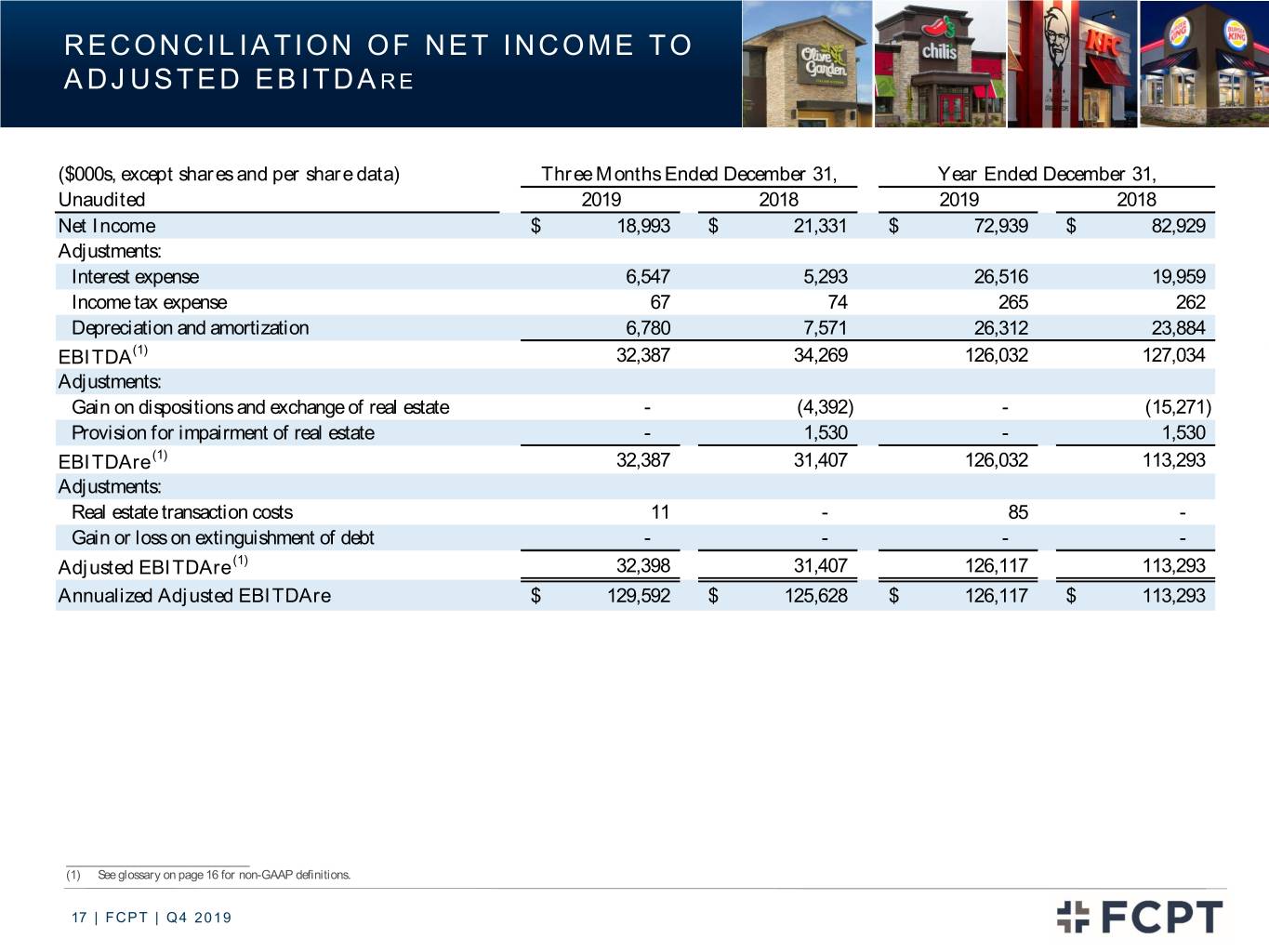

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDARE ($000s, except shares and per share data) Three Months Ended December 31, Year Ended December 31, Unaudited 2019 2018 2019 2018 Net Income $ 18,993 $ 21,331 $ 72,939 $ 82,929 Adjustments: Interest expense 6,547 5,293 26,516 19,959 Income tax expense 67 74 265 262 Depreciation and amortization 6,780 7,571 26,312 23,884 EBITDA(1) 32,387 34,269 126,032 127,034 Adjustments: Gain on dispositions and exchange of real estate - (4,392) - (15,271) Provision for impairment of real estate - 1,530 - 1,530 EBITDAre (1) 32,387 31,407 126,032 113,293 Adjustments: Real estate transaction costs 11 - 85 - Gain or loss on extinguishment of debt - - - - Adjusted EBITDAre (1) 32,398 31,407 126,117 113,293 Annualized Adjusted EBITDAre $ 129,592 $ 125,628 $ 126,117 $ 113,293 ___________________________ (1) See glossary on page 16 for non-GAAP definitions. 17 | FCPT | Q4 2019

FOUR CORNERS PROPERTY TRUST NYSE: FCPT SUPPLEMENTAL FINANCIAL & OPERATING INFORMATION | Q4 2019 www.fcpt.com 18 | FCPT | Q4 2019