Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ANNALY CAPITAL MANAGEMENT INC | a2019q4nlyex991.htm |

| 8-K - 8-K - ANNALY CAPITAL MANAGEMENT INC | a2019q4nly8-kearningsr.htm |

Fourth Quarter 2019 Financial Summary February 12, 2020

Important Notices This presentation is issued by Annaly Capital Management, Inc. ("Annaly"), a publicly traded company that has elected to be taxed as a real estate investment trust for federal income tax purposes and is being furnished in connection with Annaly’s Fourth Quarter 2019 quarterly report. This presentation is provided for investors in Annaly for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy, any security or instrument. Annaly is not a registered investment adviser. Annaly is managed by Annaly Management Company LLC ("AMCO"), a registered investment adviser. This presentation is not a communication by AMCO and is not designed to maintain any existing AMCO client or investor or solicit new AMCO clients or investors. Forward-Looking Statements This presentation, other written or oral communications, and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions (some of which are beyond our control) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “anticipate,” “continue,” or similar terms or variations on those terms or the negative of those terms. Such statements include those relating to our future performance, macro outlook, the interest rate and credit environments, tax reform and future opportunities. Actual results could differ materially from those set forth in forward-looking statements due to a variety of factors, including, but not limited to, changes in interest rates; changes in the yield curve; changes in prepayment rates; the availability of mortgage-backed securities (“MBS”) and other securities for purchase; the availability of financing and, if available, the terms of any financing; changes in the market value of our assets; changes in business conditions and the general economy; our ability to grow our commercial real estate business; our ability to grow our residential credit business; our ability to grow our middle market lending business; credit risks related to our investments in credit risk transfer securities, residential mortgage-backed securities and related residential mortgage credit assets, commercial real estate assets and corporate debt; risks related to investments in mortgage servicing rights ("MSR"); our ability to consummate any contemplated investment opportunities; changes in government regulations or policy affecting our business; our ability to maintain our qualification as a REIT for U.S. federal income tax purposes; and our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended; and risks and uncertainties associated with the Internalization, including but not limited to the occurrence of any event, change or other circumstances that could give rise to the termination of the Internalization Agreement; the outcome of any legal proceedings that may be instituted against the parties to the Internalization Agreement; the inability to complete the Internalization due to the failure to satisfy closing conditions or otherwise; risks that the Internalization disrupts our current plans and operations; the impact, if any, of the announcement or pendency of the Internalization on our relationships with third parties; and the amount of the costs, fees, expenses charges related to the Internalization; and the risk that the expected benefits, including long-term cost savings, of the Internalization are not achieved. For a discussion of the risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. We do not undertake, and specifically disclaim any obligation, to publicly release the result of any revisions which may be made to any forward- looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. We routinely post important information for investors on our website, www.annaly.com. We intend to use this webpage as a means of disclosing material information, for complying with our disclosure obligations under Regulation FD and to post and update investor presentations and similar materials on a regular basis. Annaly encourages investors, analysts, the media and others interested in Annaly to monitor the Investors section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations, webcasts and other information we post from time to time on our website. To sign-up for email- notifications, please visit the “Email Alerts” section of our website, www.annaly.com, under the “Investors” section and enter the required information to enable notifications. The information contained on, or that may be accessed through, our webpage is not incorporated by reference into, and is not a part of, this document. Past performance is no guarantee of future results. There is no guarantee that any investment strategy referenced herein will work under all market conditions. Prior to making any investment decision, you should evaluate your ability to invest for the long-term, especially during periods of downturns in the market. You alone assume the responsibility of evaluating the merits and risks associated with any potential investment or investment strategy referenced herein. To the extent that this material contains reference to any past specific investment recommendations or strategies which were or would have been profitable to any person, it should not be assumed that recommendations made in the future will be profitable or will equal the performance of such past investment recommendations or strategies. The information contained herein is not intended to provide, and should not be relied upon for accounting, legal or tax advice or investment recommendations for Annaly or any of its affiliates. Regardless of source, information is believed to be reliable for purposes used herein, but Annaly makes no representation or warranty as to the accuracy or completeness thereof and does not take any responsibility for information obtained from sources outside of Annaly. Certain information contained in the presentation discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures, including core earnings metrics, which are presented both inclusive and exclusive of the premium amortization adjustment (“PAA”). We believe the non-GAAP financial measures are useful for management, investors, analysts, and other interested parties in evaluating our performance but should not be viewed in isolation and are not a substitute for financial measures computed in accordance with U.S. generally accepted accounting principles (“GAAP”). In addition, we may calculate non-GAAP metrics, which include core earnings, and the PAA, differently than our peers making comparative analysis difficult. Please see the section entitled “Non-GAAP Reconciliations” in the attached Appendix for a reconciliation to the most directly comparable GAAP financial measures. 1

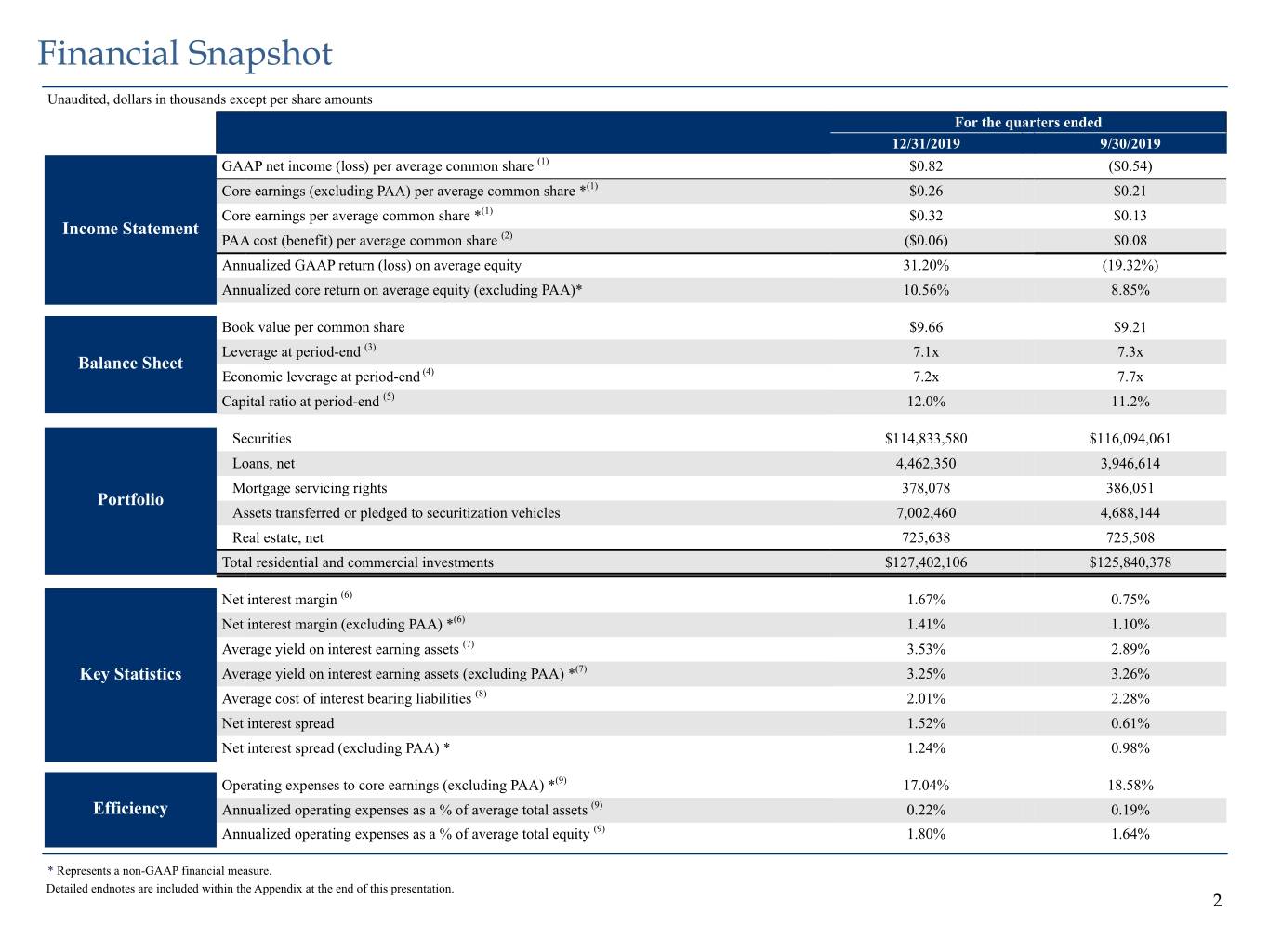

Financial Snapshot Unaudited, dollars in thousands except per share amounts For the quarters ended 12/31/2019 9/30/2019 GAAP net income (loss) per average common share (1) $0.82 ($0.54) Core earnings (excluding PAA) per average common share *(1) $0.26 $0.21 Core earnings per average common share *(1) $0.32 $0.13 Income Statement PAA cost (benefit) per average common share (2) ($0.06) $0.08 Annualized GAAP return (loss) on average equity 31.20% (19.32%) Annualized core return on average equity (excluding PAA)* 10.56% 8.85% Book value per common share $9.66 $9.21 Leverage at period-end (3) 7.1x 7.3x Balance Sheet Economic leverage at period-end (4) 7.2x 7.7x Capital ratio at period-end (5) 12.0% 11.2% Securities $114,833,580 $116,094,061 Loans, net 4,462,350 3,946,614 Mortgage servicing rights 378,078 386,051 Portfolio Assets transferred or pledged to securitization vehicles 7,002,460 4,688,144 Real estate, net 725,638 725,508 Total residential and commercial investments $127,402,106 $125,840,378 Net interest margin (6) 1.67% 0.75% Net interest margin (excluding PAA) *(6) 1.41% 1.10% Average yield on interest earning assets (7) 3.53% 2.89% Key Statistics Average yield on interest earning assets (excluding PAA) *(7) 3.25% 3.26% Average cost of interest bearing liabilities (8) 2.01% 2.28% Net interest spread 1.52% 0.61% Net interest spread (excluding PAA) * 1.24% 0.98% Operating expenses to core earnings (excluding PAA) *(9) 17.04% 18.58% Efficiency Annualized operating expenses as a % of average total assets (9) 0.22% 0.19% Annualized operating expenses as a % of average total equity (9) 1.80% 1.64% * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. 2

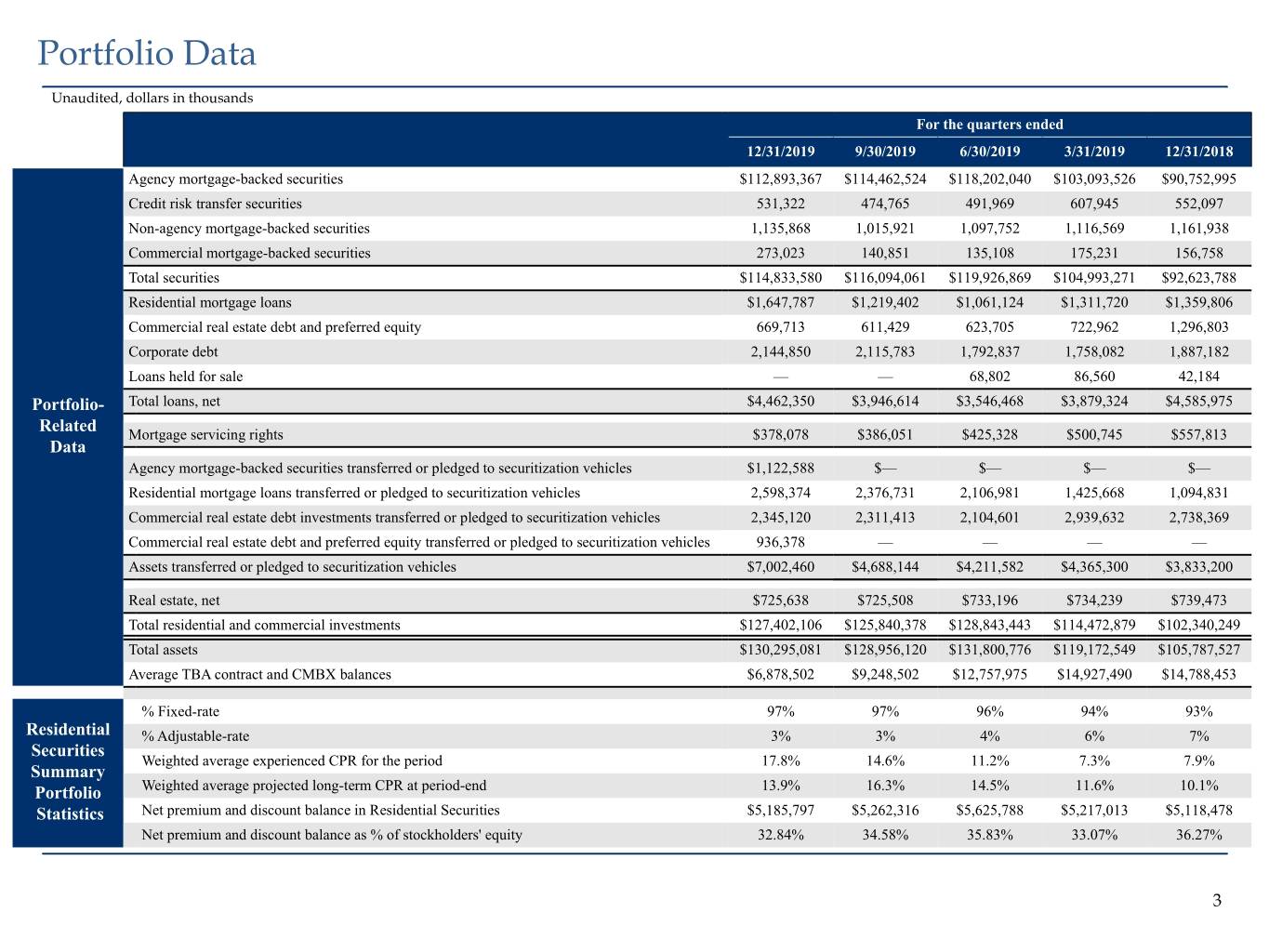

Portfolio Data Unaudited, dollars in thousands For the quarters ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Agency mortgage-backed securities $112,893,367 $114,462,524 $118,202,040 $103,093,526 $90,752,995 Credit risk transfer securities 531,322 474,765 491,969 607,945 552,097 Non-agency mortgage-backed securities 1,135,868 1,015,921 1,097,752 1,116,569 1,161,938 Commercial mortgage-backed securities 273,023 140,851 135,108 175,231 156,758 Total securities $114,833,580 $116,094,061 $119,926,869 $104,993,271 $92,623,788 Residential mortgage loans $1,647,787 $1,219,402 $1,061,124 $1,311,720 $1,359,806 Commercial real estate debt and preferred equity 669,713 611,429 623,705 722,962 1,296,803 Corporate debt 2,144,850 2,115,783 1,792,837 1,758,082 1,887,182 Loans held for sale — — 68,802 86,560 42,184 Portfolio- Total loans, net $4,462,350 $3,946,614 $3,546,468 $3,879,324 $4,585,975 Related Mortgage servicing rights $378,078 $386,051 $425,328 $500,745 $557,813 Data Agency mortgage-backed securities transferred or pledged to securitization vehicles $1,122,588 $— $— $— $— Residential mortgage loans transferred or pledged to securitization vehicles 2,598,374 2,376,731 2,106,981 1,425,668 1,094,831 Commercial real estate debt investments transferred or pledged to securitization vehicles 2,345,120 2,311,413 2,104,601 2,939,632 2,738,369 Commercial real estate debt and preferred equity transferred or pledged to securitization vehicles 936,378 — — — — Assets transferred or pledged to securitization vehicles $7,002,460 $4,688,144 $4,211,582 $4,365,300 $3,833,200 Real estate, net $725,638 $725,508 $733,196 $734,239 $739,473 Total residential and commercial investments $127,402,106 $125,840,378 $128,843,443 $114,472,879 $102,340,249 Total assets $130,295,081 $128,956,120 $131,800,776 $119,172,549 $105,787,527 Average TBA contract and CMBX balances $6,878,502 $9,248,502 $12,757,975 $14,927,490 $14,788,453 % Fixed-rate 97% 97% 96% 94% 93% Residential % Adjustable-rate 3% 3% 4% 6% 7% Securities Weighted average experienced CPR for the period 17.8% 14.6% 11.2% 7.3% 7.9% Summary Portfolio Weighted average projected long-term CPR at period-end 13.9% 16.3% 14.5% 11.6% 10.1% Statistics Net premium and discount balance in Residential Securities $5,185,797 $5,262,316 $5,625,788 $5,217,013 $5,118,478 Net premium and discount balance as % of stockholders' equity 32.84% 34.58% 35.83% 33.07% 36.27% 3

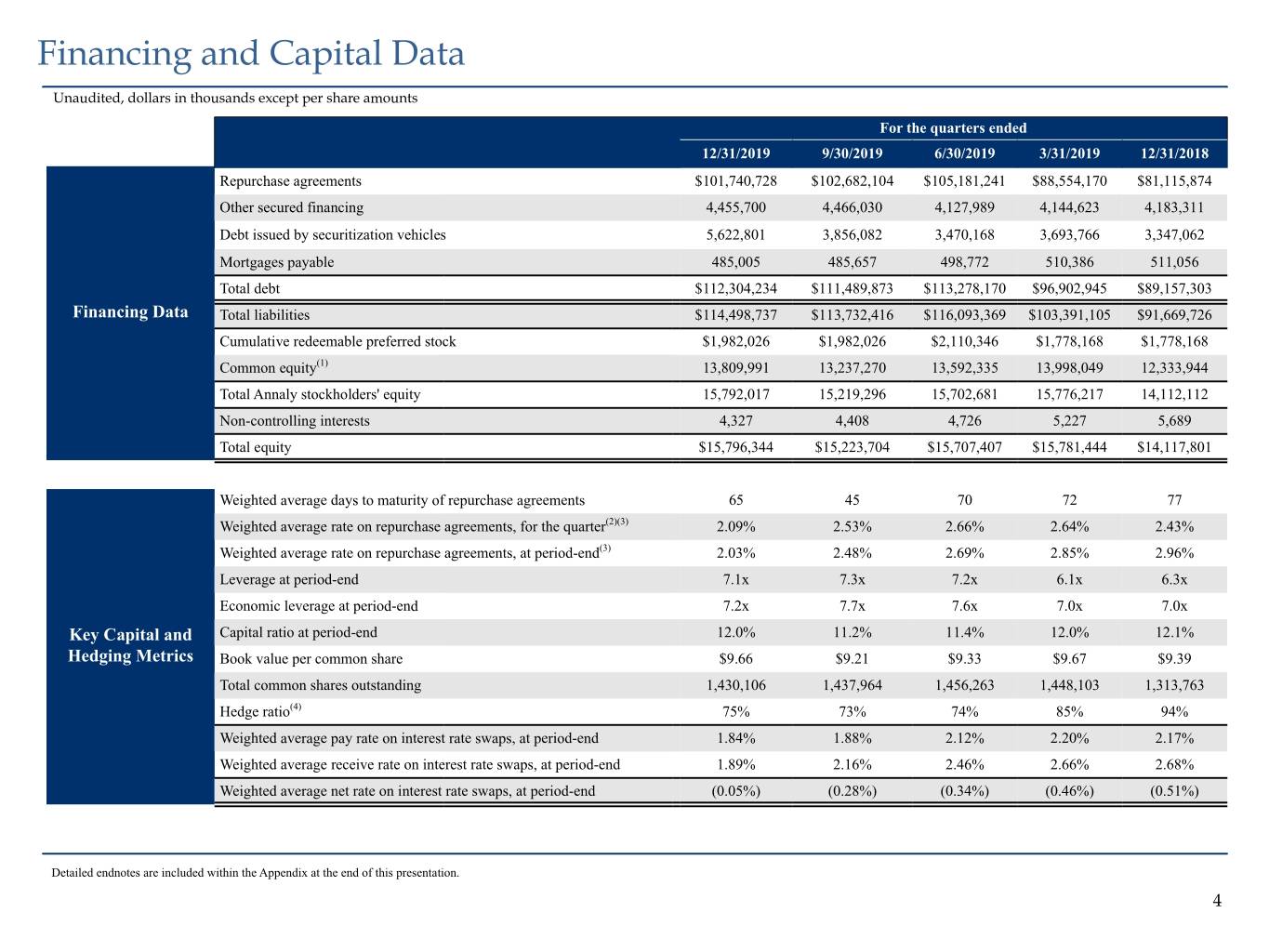

Financing and Capital Data Unaudited, dollars in thousands except per share amounts For the quarters ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Repurchase agreements $101,740,728 $102,682,104 $105,181,241 $88,554,170 $81,115,874 Other secured financing 4,455,700 4,466,030 4,127,989 4,144,623 4,183,311 Debt issued by securitization vehicles 5,622,801 3,856,082 3,470,168 3,693,766 3,347,062 Mortgages payable 485,005 485,657 498,772 510,386 511,056 Total debt $112,304,234 $111,489,873 $113,278,170 $96,902,945 $89,157,303 Financing Data Total liabilities $114,498,737 $113,732,416 $116,093,369 $103,391,105 $91,669,726 Cumulative redeemable preferred stock $1,982,026 $1,982,026 $2,110,346 $1,778,168 $1,778,168 Common equity(1) 13,809,991 13,237,270 13,592,335 13,998,049 12,333,944 Total Annaly stockholders' equity 15,792,017 15,219,296 15,702,681 15,776,217 14,112,112 Non-controlling interests 4,327 4,408 4,726 5,227 5,689 Total equity $15,796,344 $15,223,704 $15,707,407 $15,781,444 $14,117,801 Weighted average days to maturity of repurchase agreements 65 45 70 72 77 Weighted average rate on repurchase agreements, for the quarter(2)(3) 2.09% 2.53% 2.66% 2.64% 2.43% Weighted average rate on repurchase agreements, at period-end(3) 2.03% 2.48% 2.69% 2.85% 2.96% Leverage at period-end 7.1x 7.3x 7.2x 6.1x 6.3x Economic leverage at period-end 7.2x 7.7x 7.6x 7.0x 7.0x Key Capital and Capital ratio at period-end 12.0% 11.2% 11.4% 12.0% 12.1% Hedging Metrics Book value per common share $9.66 $9.21 $9.33 $9.67 $9.39 Total common shares outstanding 1,430,106 1,437,964 1,456,263 1,448,103 1,313,763 Hedge ratio(4) 75% 73% 74% 85% 94% Weighted average pay rate on interest rate swaps, at period-end 1.84% 1.88% 2.12% 2.20% 2.17% Weighted average receive rate on interest rate swaps, at period-end 1.89% 2.16% 2.46% 2.66% 2.68% Weighted average net rate on interest rate swaps, at period-end (0.05%) (0.28%) (0.34%) (0.46%) (0.51%) Detailed endnotes are included within the Appendix at the end of this presentation. 4

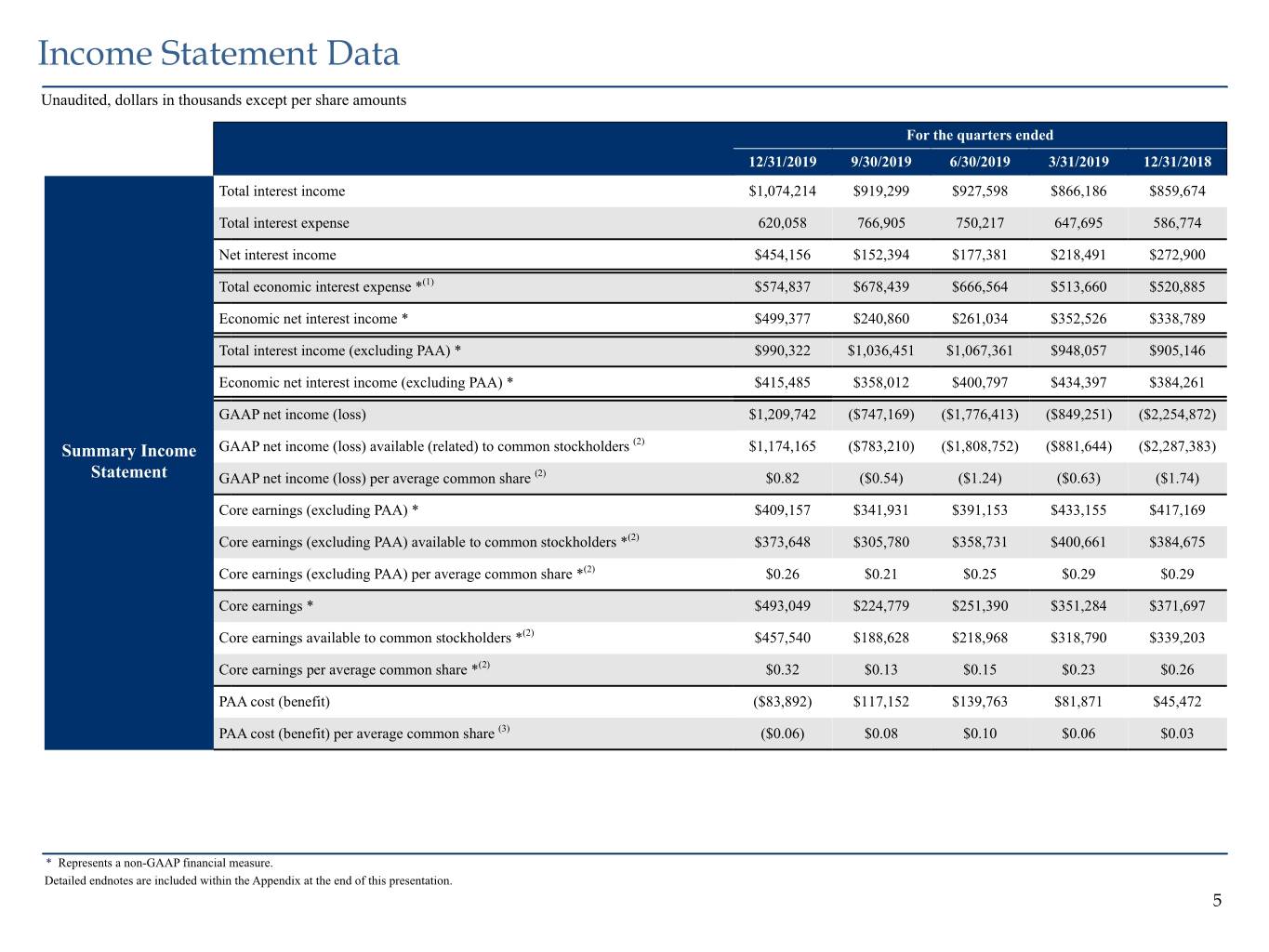

Income Statement Data Unaudited, dollars in thousands except per share amounts For the quarters ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Total interest income $1,074,214 $919,299 $927,598 $866,186 $859,674 Total interest expense 620,058 766,905 750,217 647,695 586,774 Net interest income $454,156 $152,394 $177,381 $218,491 $272,900 Total economic interest expense *(1) $574,837 $678,439 $666,564 $513,660 $520,885 Economic net interest income * $499,377 $240,860 $261,034 $352,526 $338,789 Total interest income (excluding PAA) * $990,322 $1,036,451 $1,067,361 $948,057 $905,146 Economic net interest income (excluding PAA) * $415,485 $358,012 $400,797 $434,397 $384,261 GAAP net income (loss) $1,209,742 ($747,169) ($1,776,413) ($849,251) ($2,254,872) (2) Summary Income GAAP net income (loss) available (related) to common stockholders $1,174,165 ($783,210) ($1,808,752) ($881,644) ($2,287,383) Statement GAAP net income (loss) per average common share (2) $0.82 ($0.54) ($1.24) ($0.63) ($1.74) Core earnings (excluding PAA) * $409,157 $341,931 $391,153 $433,155 $417,169 Core earnings (excluding PAA) available to common stockholders *(2) $373,648 $305,780 $358,731 $400,661 $384,675 Core earnings (excluding PAA) per average common share *(2) $0.26 $0.21 $0.25 $0.29 $0.29 Core earnings * $493,049 $224,779 $251,390 $351,284 $371,697 Core earnings available to common stockholders *(2) $457,540 $188,628 $218,968 $318,790 $339,203 Core earnings per average common share *(2) $0.32 $0.13 $0.15 $0.23 $0.26 PAA cost (benefit) ($83,892) $117,152 $139,763 $81,871 $45,472 PAA cost (benefit) per average common share (3) ($0.06) $0.08 $0.10 $0.06 $0.03 * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. 5

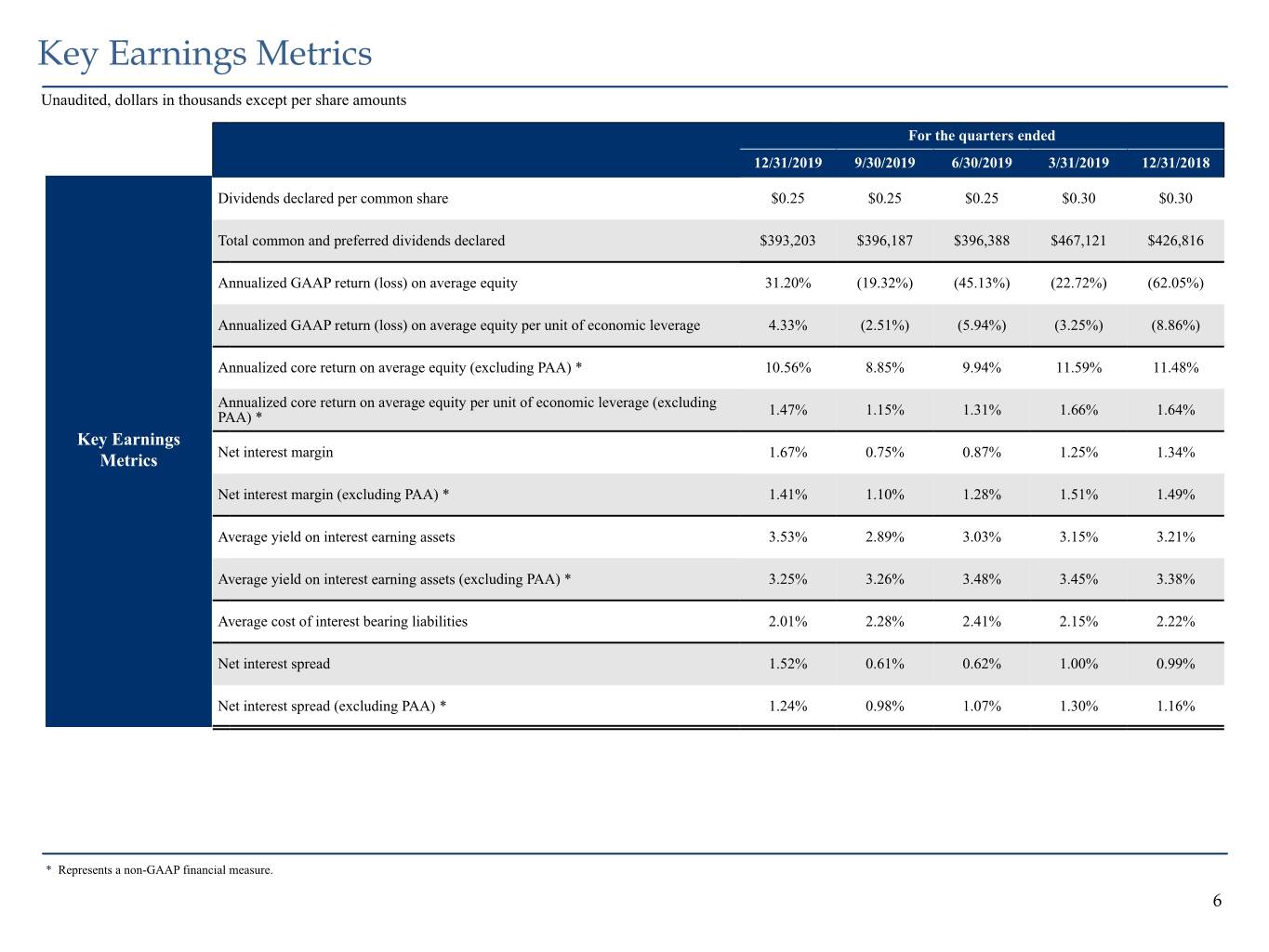

Key Earnings Metrics Unaudited, dollars in thousands except per share amounts For the quarters ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Dividends declared per common share $0.25 $0.25 $0.25 $0.30 $0.30 Total common and preferred dividends declared $393,203 $396,187 $396,388 $467,121 $426,816 Annualized GAAP return (loss) on average equity 31.20% (19.32%) (45.13%) (22.72%) (62.05%) Annualized GAAP return (loss) on average equity per unit of economic leverage 4.33% (2.51%) (5.94%) (3.25%) (8.86%) Annualized core return on average equity (excluding PAA) * 10.56% 8.85% 9.94% 11.59% 11.48% Annualized core return on average equity per unit of economic leverage (excluding PAA) * 1.47% 1.15% 1.31% 1.66% 1.64% Key Earnings Metrics Net interest margin 1.67% 0.75% 0.87% 1.25% 1.34% Net interest margin (excluding PAA) * 1.41% 1.10% 1.28% 1.51% 1.49% Average yield on interest earning assets 3.53% 2.89% 3.03% 3.15% 3.21% Average yield on interest earning assets (excluding PAA) * 3.25% 3.26% 3.48% 3.45% 3.38% Average cost of interest bearing liabilities 2.01% 2.28% 2.41% 2.15% 2.22% Net interest spread 1.52% 0.61% 0.62% 1.00% 0.99% Net interest spread (excluding PAA) * 1.24% 0.98% 1.07% 1.30% 1.16% * Represents a non-GAAP financial measure. 6

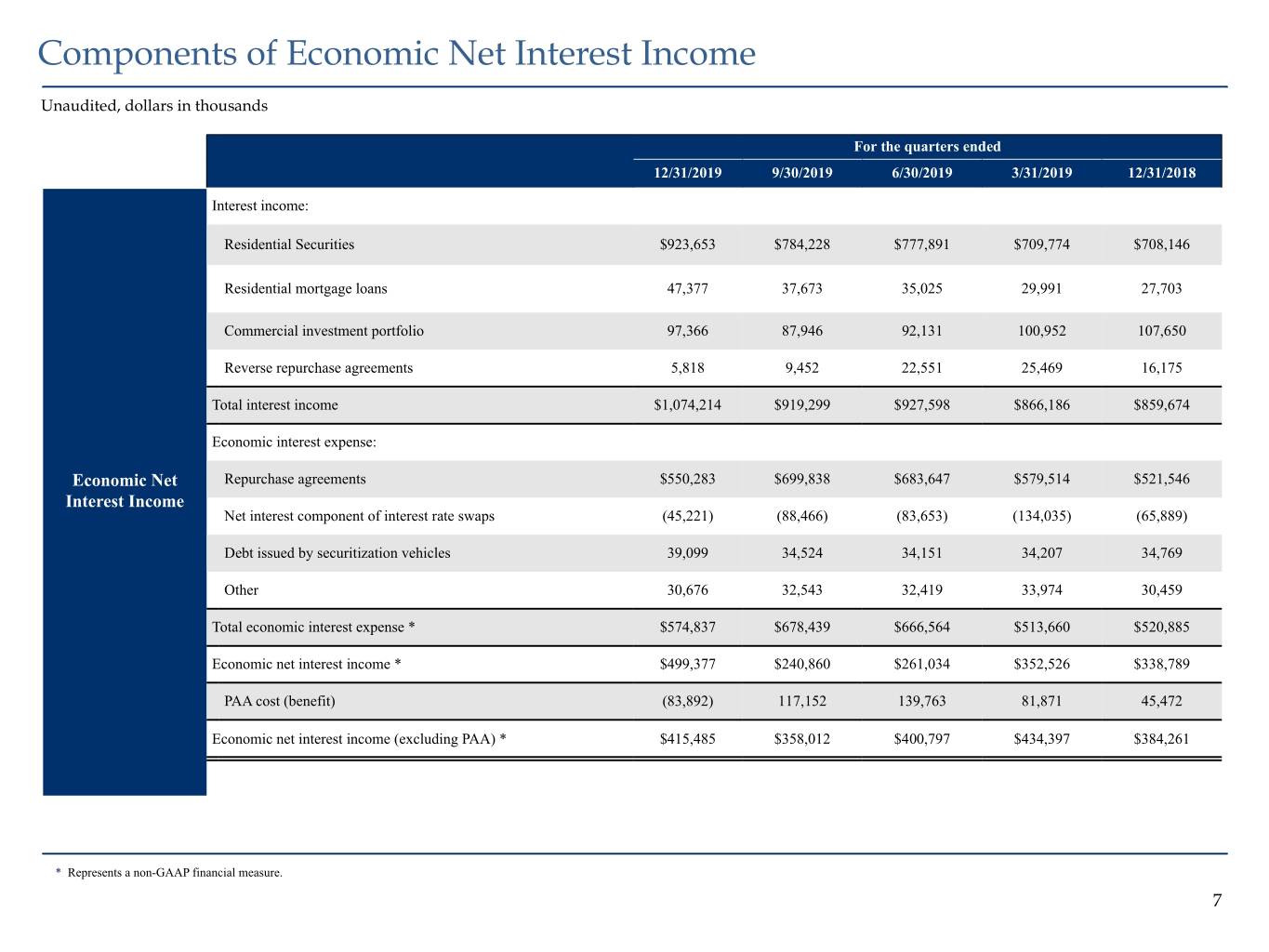

Components of Economic Net Interest Income Unaudited, dollars in thousands For the quarters ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Interest income: Residential Securities $923,653 $784,228 $777,891 $709,774 $708,146 Residential mortgage loans 47,377 37,673 35,025 29,991 27,703 Commercial investment portfolio 97,366 87,946 92,131 100,952 107,650 Reverse repurchase agreements 5,818 9,452 22,551 25,469 16,175 Total interest income $1,074,214 $919,299 $927,598 $866,186 $859,674 Economic interest expense: Economic Net Repurchase agreements $550,283 $699,838 $683,647 $579,514 $521,546 Interest Income Net interest component of interest rate swaps (45,221) (88,466) (83,653) (134,035) (65,889) Debt issued by securitization vehicles 39,099 34,524 34,151 34,207 34,769 Other 30,676 32,543 32,419 33,974 30,459 Total economic interest expense * $574,837 $678,439 $666,564 $513,660 $520,885 Economic net interest income * $499,377 $240,860 $261,034 $352,526 $338,789 PAA cost (benefit) (83,892) 117,152 139,763 81,871 45,472 Economic net interest income (excluding PAA) * $415,485 $358,012 $400,797 $434,397 $384,261 * Represents a non-GAAP financial measure. 7

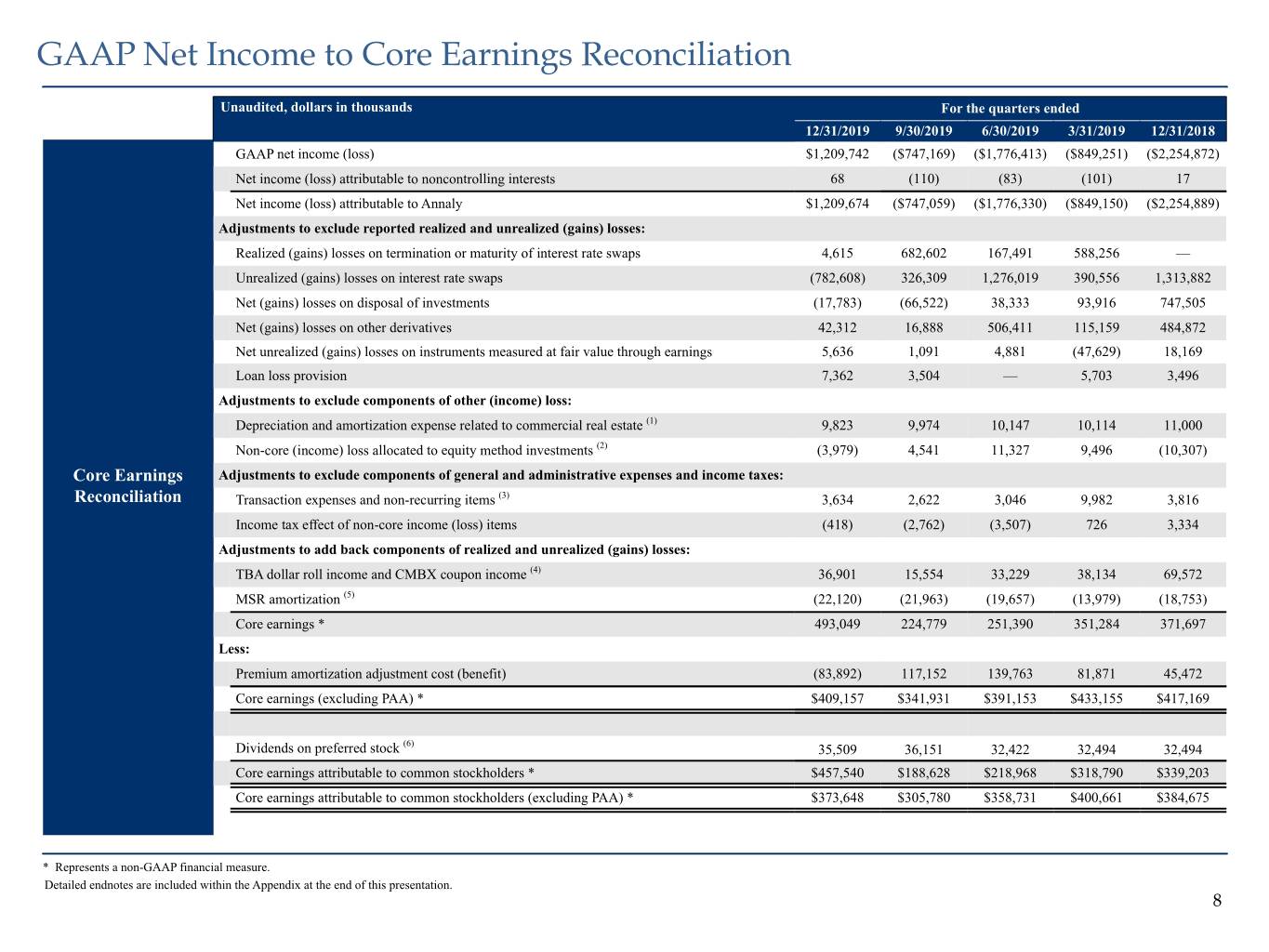

GAAP Net Income to Core Earnings Reconciliation Unaudited, dollars in thousands For the quarters ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 GAAP net income (loss) $1,209,742 ($747,169) ($1,776,413) ($849,251) ($2,254,872) Net income (loss) attributable to noncontrolling interests 68 (110) (83) (101) 17 Net income (loss) attributable to Annaly $1,209,674 ($747,059) ($1,776,330) ($849,150) ($2,254,889) Adjustments to exclude reported realized and unrealized (gains) losses: Realized (gains) losses on termination or maturity of interest rate swaps 4,615 682,602 167,491 588,256 — Unrealized (gains) losses on interest rate swaps (782,608) 326,309 1,276,019 390,556 1,313,882 Net (gains) losses on disposal of investments (17,783) (66,522) 38,333 93,916 747,505 Net (gains) losses on other derivatives 42,312 16,888 506,411 115,159 484,872 Net unrealized (gains) losses on instruments measured at fair value through earnings 5,636 1,091 4,881 (47,629) 18,169 Loan loss provision 7,362 3,504 — 5,703 3,496 Adjustments to exclude components of other (income) loss: Depreciation and amortization expense related to commercial real estate (1) 9,823 9,974 10,147 10,114 11,000 Non-core (income) loss allocated to equity method investments (2) (3,979) 4,541 11,327 9,496 (10,307) Core Earnings Adjustments to exclude components of general and administrative expenses and income taxes: Reconciliation Transaction expenses and non-recurring items (3) 3,634 2,622 3,046 9,982 3,816 Income tax effect of non-core income (loss) items (418) (2,762) (3,507) 726 3,334 Adjustments to add back components of realized and unrealized (gains) losses: TBA dollar roll income and CMBX coupon income (4) 36,901 15,554 33,229 38,134 69,572 MSR amortization (5) (22,120) (21,963) (19,657) (13,979) (18,753) Core earnings * 493,049 224,779 251,390 351,284 371,697 Less: Premium amortization adjustment cost (benefit) (83,892) 117,152 139,763 81,871 45,472 Core earnings (excluding PAA) * $409,157 $341,931 $391,153 $433,155 $417,169 Dividends on preferred stock (6) 35,509 36,151 32,422 32,494 32,494 Core earnings attributable to common stockholders * $457,540 $188,628 $218,968 $318,790 $339,203 Core earnings attributable to common stockholders (excluding PAA) * $373,648 $305,780 $358,731 $400,661 $384,675 * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. 8

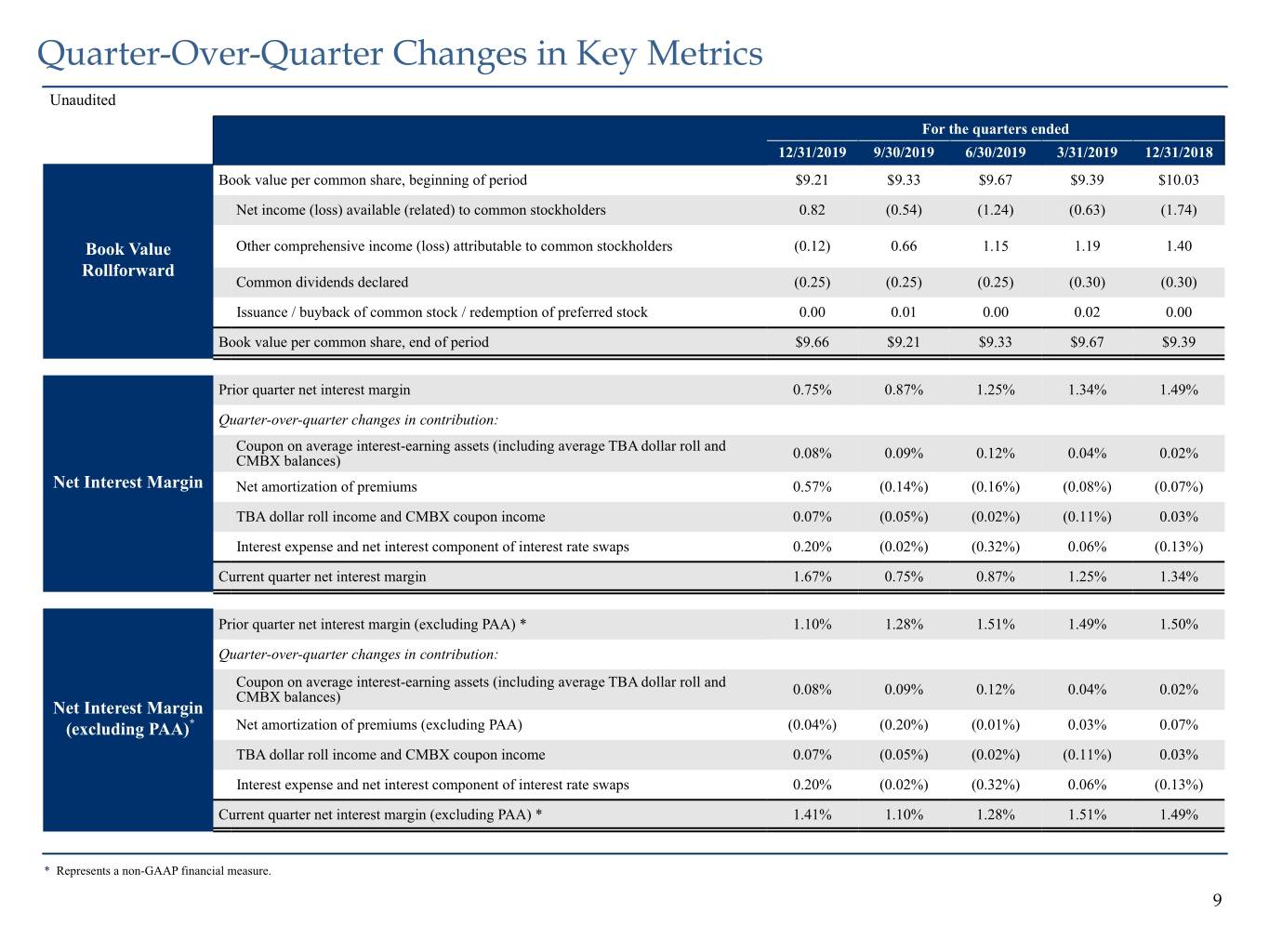

Quarter-Over-Quarter Changes in Key Metrics Unaudited For the quarters ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Book value per common share, beginning of period $9.21 $9.33 $9.67 $9.39 $10.03 Net income (loss) available (related) to common stockholders 0.82 (0.54) (1.24) (0.63) (1.74) Book Value Other comprehensive income (loss) attributable to common stockholders (0.12) 0.66 1.15 1.19 1.40 Rollforward Common dividends declared (0.25) (0.25) (0.25) (0.30) (0.30) Issuance / buyback of common stock / redemption of preferred stock 0.00 0.01 0.00 0.02 0.00 Book value per common share, end of period $9.66 $9.21 $9.33 $9.67 $9.39 Prior quarter net interest margin 0.75% 0.87% 1.25% 1.34% 1.49% Quarter-over-quarter changes in contribution: Coupon on average interest-earning assets (including average TBA dollar roll and 0.08% 0.09% 0.12% 0.04% 0.02% CMBX balances) Net Interest Margin Net amortization of premiums 0.57% (0.14%) (0.16%) (0.08%) (0.07%) TBA dollar roll income and CMBX coupon income 0.07% (0.05%) (0.02%) (0.11%) 0.03% Interest expense and net interest component of interest rate swaps 0.20% (0.02%) (0.32%) 0.06% (0.13%) Current quarter net interest margin 1.67% 0.75% 0.87% 1.25% 1.34% Prior quarter net interest margin (excluding PAA) * 1.10% 1.28% 1.51% 1.49% 1.50% Quarter-over-quarter changes in contribution: Coupon on average interest-earning assets (including average TBA dollar roll and CMBX balances) 0.08% 0.09% 0.12% 0.04% 0.02% Net Interest Margin (excluding PAA)* Net amortization of premiums (excluding PAA) (0.04%) (0.20%) (0.01%) 0.03% 0.07% TBA dollar roll income and CMBX coupon income 0.07% (0.05%) (0.02%) (0.11%) 0.03% Interest expense and net interest component of interest rate swaps 0.20% (0.02%) (0.32%) 0.06% (0.13%) Current quarter net interest margin (excluding PAA) * 1.41% 1.10% 1.28% 1.51% 1.49% * Represents a non-GAAP financial measure. 9

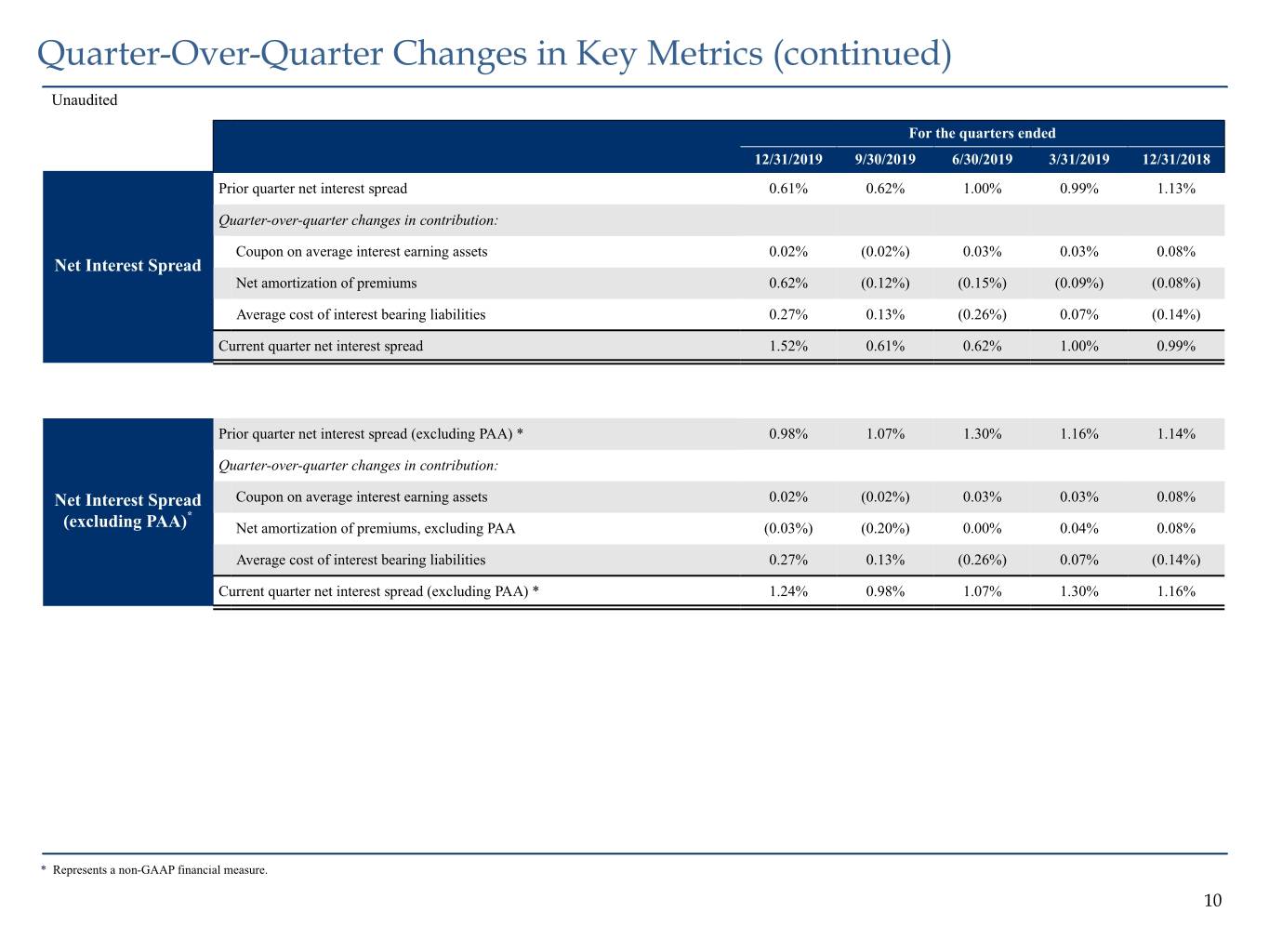

Quarter-Over-Quarter Changes in Key Metrics (continued) Unaudited For the quarters ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Prior quarter net interest spread 0.61% 0.62% 1.00% 0.99% 1.13% Quarter-over-quarter changes in contribution: Coupon on average interest earning assets 0.02% (0.02%) 0.03% 0.03% 0.08% Net Interest Spread Net amortization of premiums 0.62% (0.12%) (0.15%) (0.09%) (0.08%) Average cost of interest bearing liabilities 0.27% 0.13% (0.26%) 0.07% (0.14%) Current quarter net interest spread 1.52% 0.61% 0.62% 1.00% 0.99% Prior quarter net interest spread (excluding PAA) * 0.98% 1.07% 1.30% 1.16% 1.14% Quarter-over-quarter changes in contribution: Net Interest Spread Coupon on average interest earning assets 0.02% (0.02%) 0.03% 0.03% 0.08% * (excluding PAA) Net amortization of premiums, excluding PAA (0.03%) (0.20%) 0.00% 0.04% 0.08% Average cost of interest bearing liabilities 0.27% 0.13% (0.26%) 0.07% (0.14%) Current quarter net interest spread (excluding PAA) * 1.24% 0.98% 1.07% 1.30% 1.16% * Represents a non-GAAP financial measure. 10

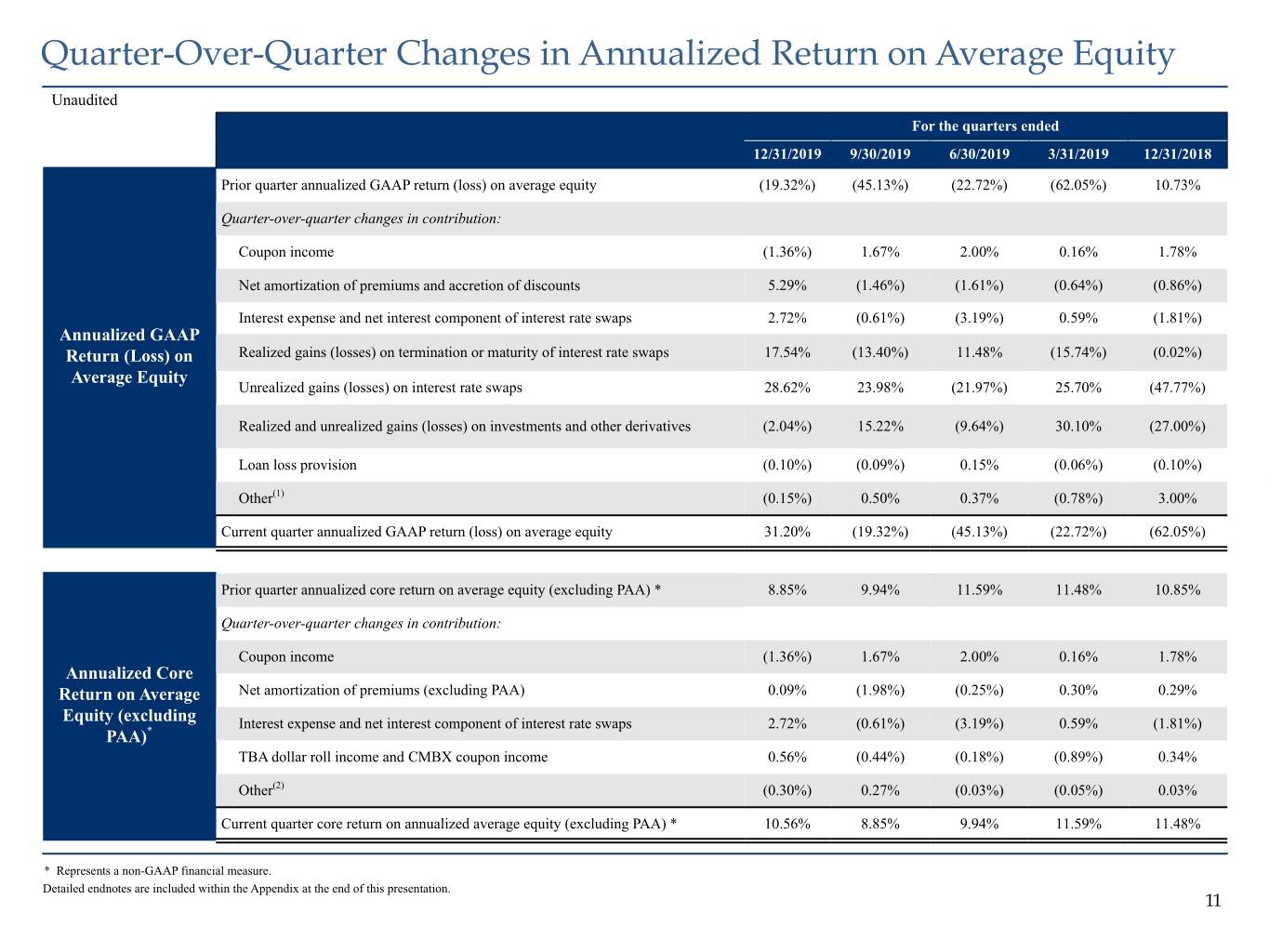

Quarter-Over-Quarter Changes in Annualized Return on Average Equity Unaudited For the quarters ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Prior quarter annualized GAAP return (loss) on average equity (19.32%) (45.13%) (22.72%) (62.05%) 10.73% Quarter-over-quarter changes in contribution: Coupon income (1.36%) 1.67% 2.00% 0.16% 1.78% Net amortization of premiums and accretion of discounts 5.29% (1.46%) (1.61%) (0.64%) (0.86%) Interest expense and net interest component of interest rate swaps 2.72% (0.61%) (3.19%) 0.59% (1.81%) Annualized GAAP Return (Loss) on Realized gains (losses) on termination or maturity of interest rate swaps 17.54% (13.40%) 11.48% (15.74%) (0.02%) Average Equity Unrealized gains (losses) on interest rate swaps 28.62% 23.98% (21.97%) 25.70% (47.77%) Realized and unrealized gains (losses) on investments and other derivatives (2.04%) 15.22% (9.64%) 30.10% (27.00%) Loan loss provision (0.10%) (0.09%) 0.15% (0.06%) (0.10%) Other(1) (0.15%) 0.50% 0.37% (0.78%) 3.00% Current quarter annualized GAAP return (loss) on average equity 31.20% (19.32%) (45.13%) (22.72%) (62.05%) Prior quarter annualized core return on average equity (excluding PAA) * 8.85% 9.94% 11.59% 11.48% 10.85% Quarter-over-quarter changes in contribution: Coupon income (1.36%) 1.67% 2.00% 0.16% 1.78% Annualized Core Return on Average Net amortization of premiums (excluding PAA) 0.09% (1.98%) (0.25%) 0.30% 0.29% Equity (excluding Interest expense and net interest component of interest rate swaps 2.72% (0.61%) (3.19%) 0.59% (1.81%) PAA)* TBA dollar roll income and CMBX coupon income 0.56% (0.44%) (0.18%) (0.89%) 0.34% Other(2) (0.30%) 0.27% (0.03%) (0.05%) 0.03% Current quarter core return on annualized average equity (excluding PAA) * 10.56% 8.85% 9.94% 11.59% 11.48% * Represents a non-GAAP financial measure. Detailed endnotes are included within the Appendix at the end of this presentation. 11

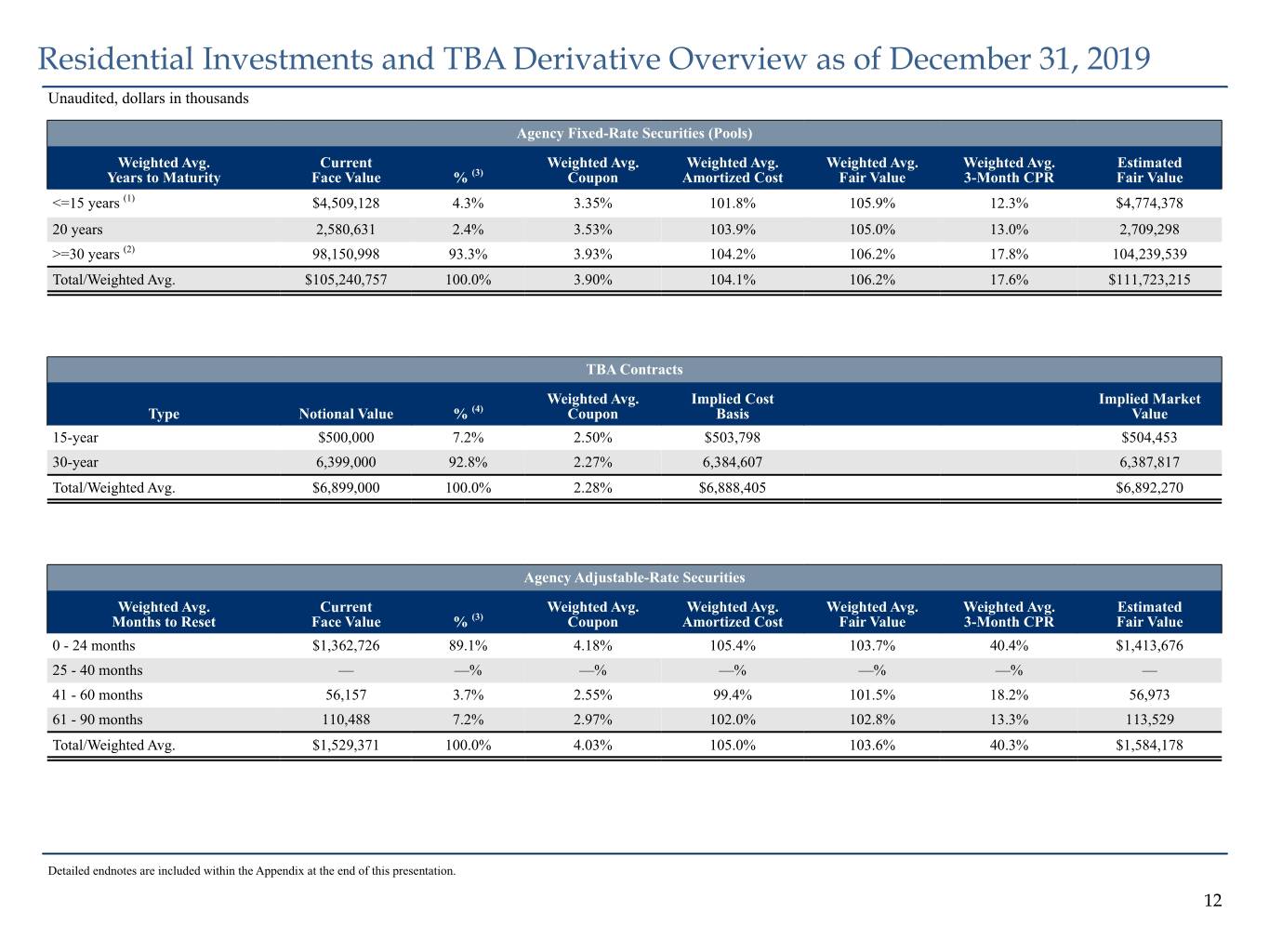

Residential Investments and TBA Derivative Overview as of December 31, 2019 Unaudited, dollars in thousands Agency Fixed-Rate Securities (Pools) Weighted Avg. Current Weighted Avg. Weighted Avg. Weighted Avg. Weighted Avg. Estimated Years to Maturity Face Value % (3) Coupon Amortized Cost Fair Value 3-Month CPR Fair Value <=15 years (1) $4,509,128 4.3% 3.35% 101.8% 105.9% 12.3% $4,774,378 20 years 2,580,631 2.4% 3.53% 103.9% 105.0% 13.0% 2,709,298 >=30 years (2) 98,150,998 93.3% 3.93% 104.2% 106.2% 17.8% 104,239,539 Total/Weighted Avg. $105,240,757 100.0% 3.90% 104.1% 106.2% 17.6% $111,723,215 TBA Contracts Weighted Avg. Implied Cost Implied Market Type Notional Value % (4) Coupon Basis Value 15-year $500,000 7.2% 2.50% $503,798 $504,453 30-year 6,399,000 92.8% 2.27% 6,384,607 6,387,817 Total/Weighted Avg. $6,899,000 100.0% 2.28% $6,888,405 $6,892,270 Agency Adjustable-Rate Securities Weighted Avg. Current Weighted Avg. Weighted Avg. Weighted Avg. Weighted Avg. Estimated Months to Reset Face Value % (3) Coupon Amortized Cost Fair Value 3-Month CPR Fair Value 0 - 24 months $1,362,726 89.1% 4.18% 105.4% 103.7% 40.4% $1,413,676 25 - 40 months — —% —% —% —% —% — 41 - 60 months 56,157 3.7% 2.55% 99.4% 101.5% 18.2% 56,973 61 - 90 months 110,488 7.2% 2.97% 102.0% 102.8% 13.3% 113,529 Total/Weighted Avg. $1,529,371 100.0% 4.03% 105.0% 103.6% 40.3% $1,584,178 Detailed endnotes are included within the Appendix at the end of this presentation. 12

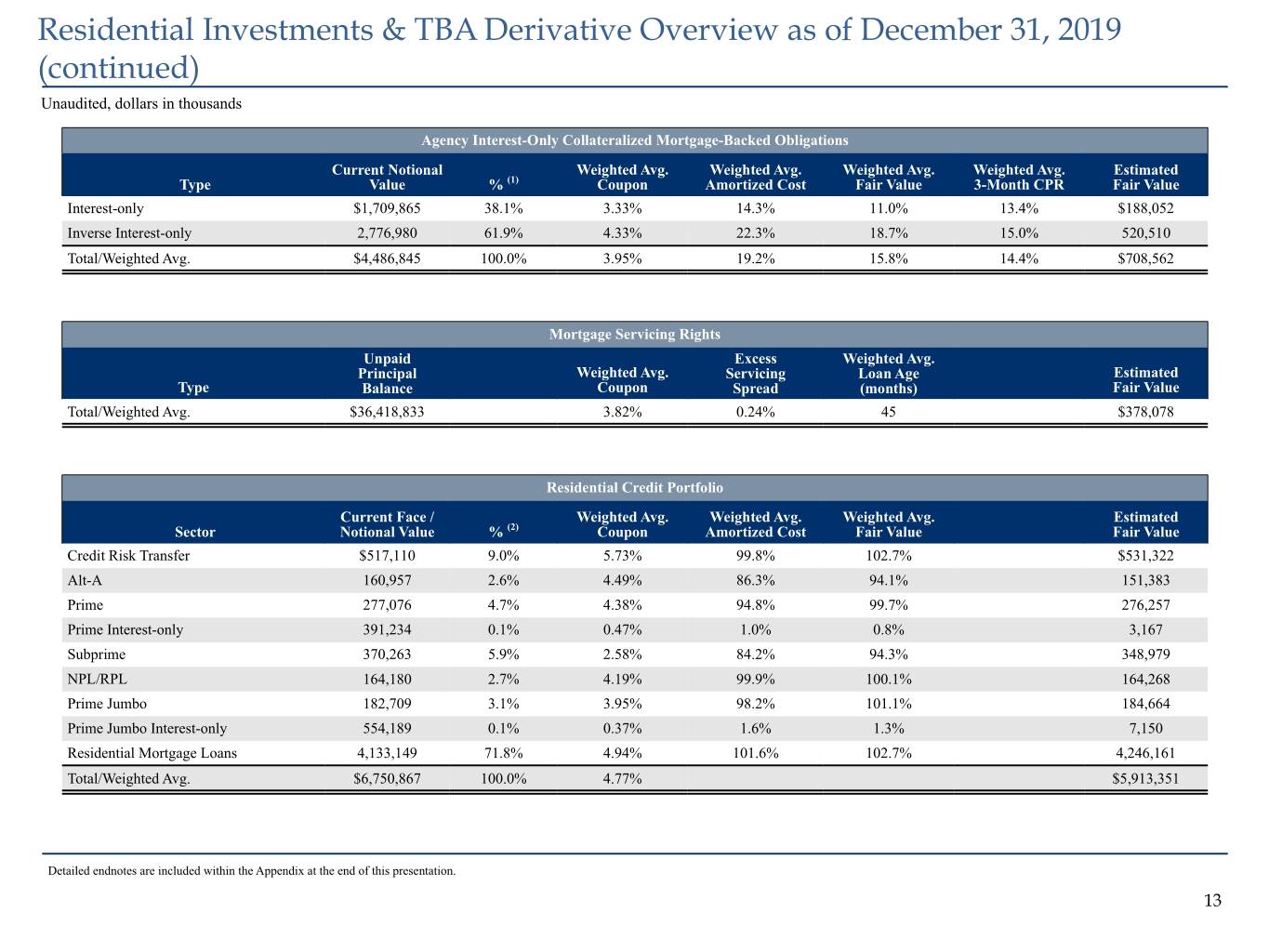

Residential Investments & TBA Derivative Overview as of December 31, 2019 (continued) Unaudited, dollars in thousands Agency Interest-Only Collateralized Mortgage-Backed Obligations Current Notional Weighted Avg. Weighted Avg. Weighted Avg. Weighted Avg. Estimated Type Value % (1) Coupon Amortized Cost Fair Value 3-Month CPR Fair Value Interest-only $1,709,865 38.1% 3.33% 14.3% 11.0% 13.4% $188,052 Inverse Interest-only 2,776,980 61.9% 4.33% 22.3% 18.7% 15.0% 520,510 Total/Weighted Avg. $4,486,845 100.0% 3.95% 19.2% 15.8% 14.4% $708,562 Mortgage Servicing Rights Unpaid Excess Weighted Avg. Principal Weighted Avg. Servicing Loan Age Estimated Type Balance Coupon Spread (months) Fair Value Total/Weighted Avg. $36,418,833 3.82% 0.24% 45 $378,078 Residential Credit Portfolio Current Face / Weighted Avg. Weighted Avg. Weighted Avg. Estimated Sector Notional Value % (2) Coupon Amortized Cost Fair Value Fair Value Credit Risk Transfer $517,110 9.0% 5.73% 99.8% 102.7% $531,322 Alt-A 160,957 2.6% 4.49% 86.3% 94.1% 151,383 Prime 277,076 4.7% 4.38% 94.8% 99.7% 276,257 Prime Interest-only 391,234 0.1% 0.47% 1.0% 0.8% 3,167 Subprime 370,263 5.9% 2.58% 84.2% 94.3% 348,979 NPL/RPL 164,180 2.7% 4.19% 99.9% 100.1% 164,268 Prime Jumbo 182,709 3.1% 3.95% 98.2% 101.1% 184,664 Prime Jumbo Interest-only 554,189 0.1% 0.37% 1.6% 1.3% 7,150 Residential Mortgage Loans 4,133,149 71.8% 4.94% 101.6% 102.7% 4,246,161 Total/Weighted Avg. $6,750,867 100.0% 4.77% $5,913,351 Detailed endnotes are included within the Appendix at the end of this presentation. 13

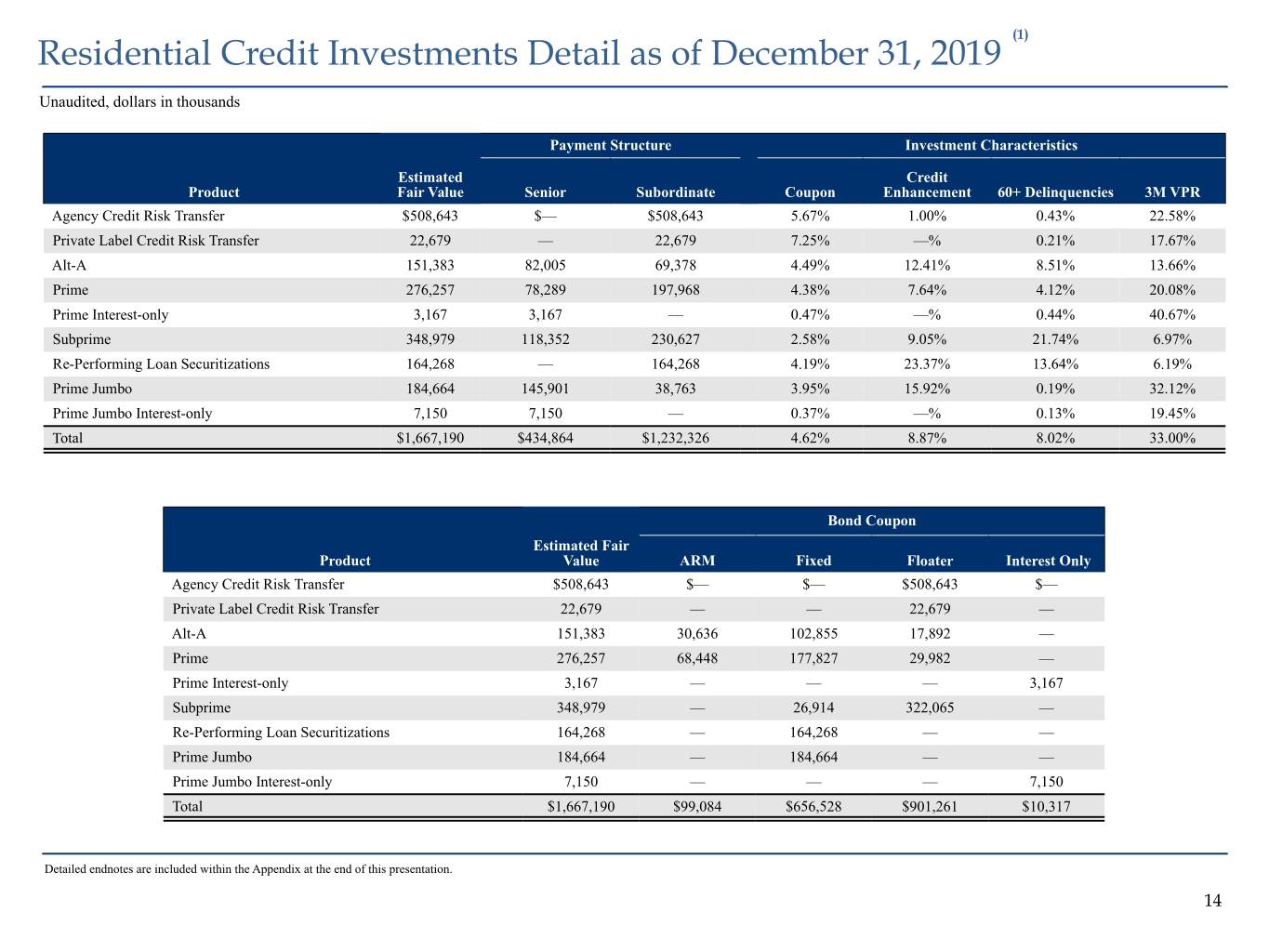

(1) Residential Credit Investments Detail as of December 31, 2019 Unaudited, dollars in thousands Payment Structure Investment Characteristics Estimated Credit Product Fair Value Senior Subordinate Coupon Enhancement 60+ Delinquencies 3M VPR Agency Credit Risk Transfer $508,643 $— $508,643 5.67% 1.00% 0.43% 22.58% Private Label Credit Risk Transfer 22,679 — 22,679 7.25% —% 0.21% 17.67% Alt-A 151,383 82,005 69,378 4.49% 12.41% 8.51% 13.66% Prime 276,257 78,289 197,968 4.38% 7.64% 4.12% 20.08% Prime Interest-only 3,167 3,167 — 0.47% —% 0.44% 40.67% Subprime 348,979 118,352 230,627 2.58% 9.05% 21.74% 6.97% Re-Performing Loan Securitizations 164,268 — 164,268 4.19% 23.37% 13.64% 6.19% Prime Jumbo 184,664 145,901 38,763 3.95% 15.92% 0.19% 32.12% Prime Jumbo Interest-only 7,150 7,150 — 0.37% —% 0.13% 19.45% Total $1,667,190 $434,864 $1,232,326 4.62% 8.87% 8.02% 33.00% Bond Coupon Estimated Fair Product Value ARM Fixed Floater Interest Only Agency Credit Risk Transfer $508,643 $— $— $508,643 $— Private Label Credit Risk Transfer 22,679 — — 22,679 — Alt-A 151,383 30,636 102,855 17,892 — Prime 276,257 68,448 177,827 29,982 — Prime Interest-only 3,167 — — — 3,167 Subprime 348,979 — 26,914 322,065 — Re-Performing Loan Securitizations 164,268 — 164,268 — — Prime Jumbo 184,664 — 184,664 — — Prime Jumbo Interest-only 7,150 — — — 7,150 Total $1,667,190 $99,084 $656,528 $901,261 $10,317 Detailed endnotes are included within the Appendix at the end of this presentation. 14

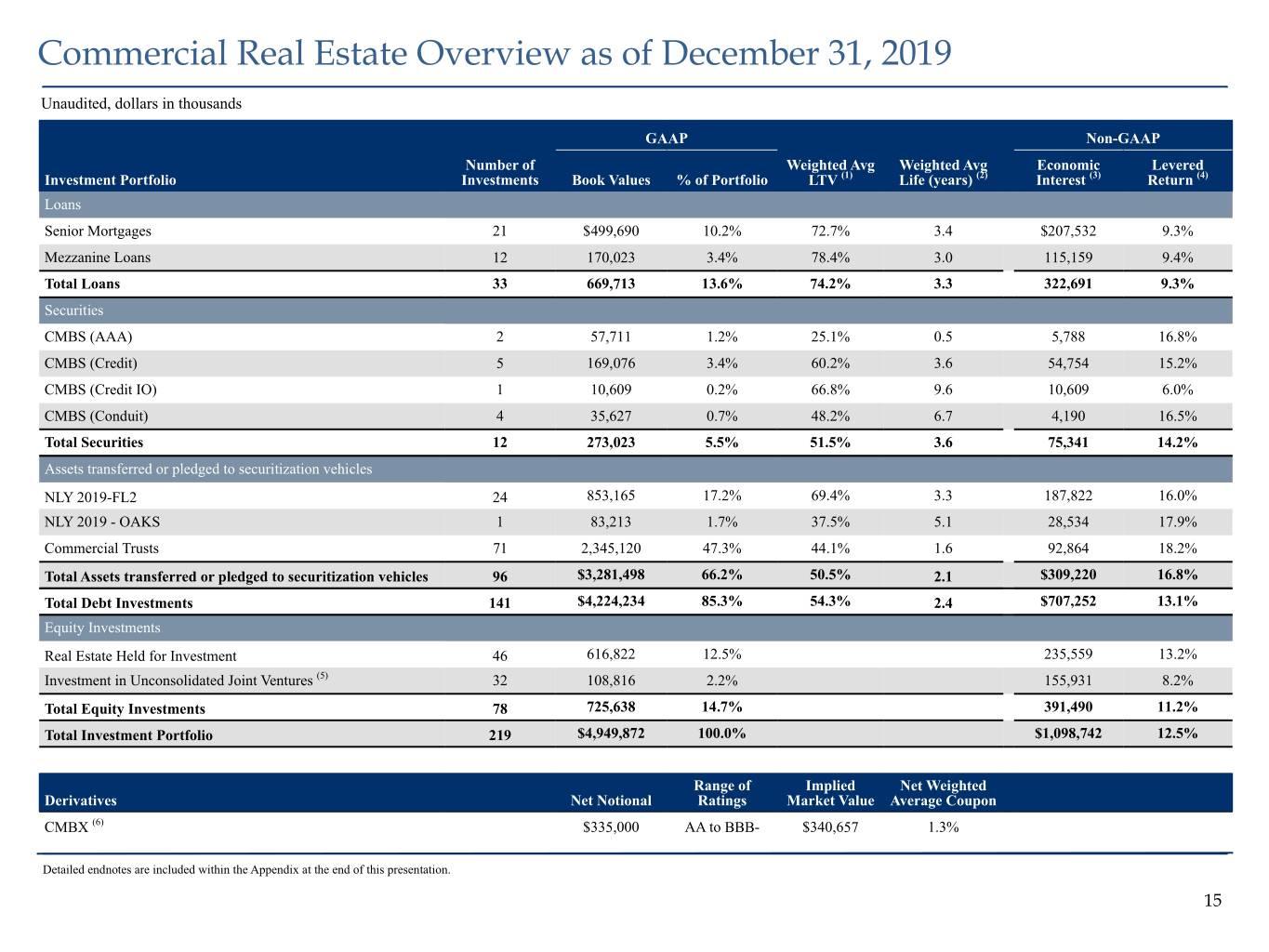

Commercial Real Estate Overview as of December 31, 2019 Unaudited, dollars in thousands GAAP Non-GAAP Number of Weighted Avg Weighted Avg Economic Levered Investment Portfolio Investments Book Values % of Portfolio LTV (1) Life (years) (2) Interest (3) Return (4) Loans Senior Mortgages 21 $499,690 10.2% 72.7% 3.4 $207,532 9.3% Mezzanine Loans 12 170,023 3.4% 78.4% 3.0 115,159 9.4% Total Loans 33 669,713 13.6% 74.2% 3.3 322,691 9.3% Securities CMBS (AAA) 2 57,711 1.2% 25.1% 0.5 5,788 16.8% CMBS (Credit) 5 169,076 3.4% 60.2% 3.6 54,754 15.2% CMBS (Credit IO) 1 10,609 0.2% 66.8% 9.6 10,609 6.0% CMBS (Conduit) 4 35,627 0.7% 48.2% 6.7 4,190 16.5% Total Securities 12 273,023 5.5% 51.5% 3.6 75,341 14.2% Assets transferred or pledged to securitization vehicles NLY 2019-FL2 24 853,165 17.2% 69.4% 3.3 187,822 16.0% NLY 2019 - OAKS 1 83,213 1.7% 37.5% 5.1 28,534 17.9% Commercial Trusts 71 2,345,120 47.3% 44.1% 1.6 92,864 18.2% Total Assets transferred or pledged to securitization vehicles 96 $3,281,498 66.2% 50.5% 2.1 $309,220 16.8% Total Debt Investments 141 $4,224,234 85.3% 54.3% 2.4 $707,252 13.1% Equity Investments Real Estate Held for Investment 46 616,822 12.5% 235,559 13.2% Investment in Unconsolidated Joint Ventures (5) 32 108,816 2.2% 155,931 8.2% Total Equity Investments 78 725,638 14.7% 391,490 11.2% Total Investment Portfolio 219 $4,949,872 100.0% $1,098,742 12.5% Range of Implied Net Weighted Derivatives Net Notional Ratings Market Value Average Coupon CMBX (6) $335,000 AA to BBB- $340,657 1.3% Detailed endnotes are included within the Appendix at the end of this presentation. 15

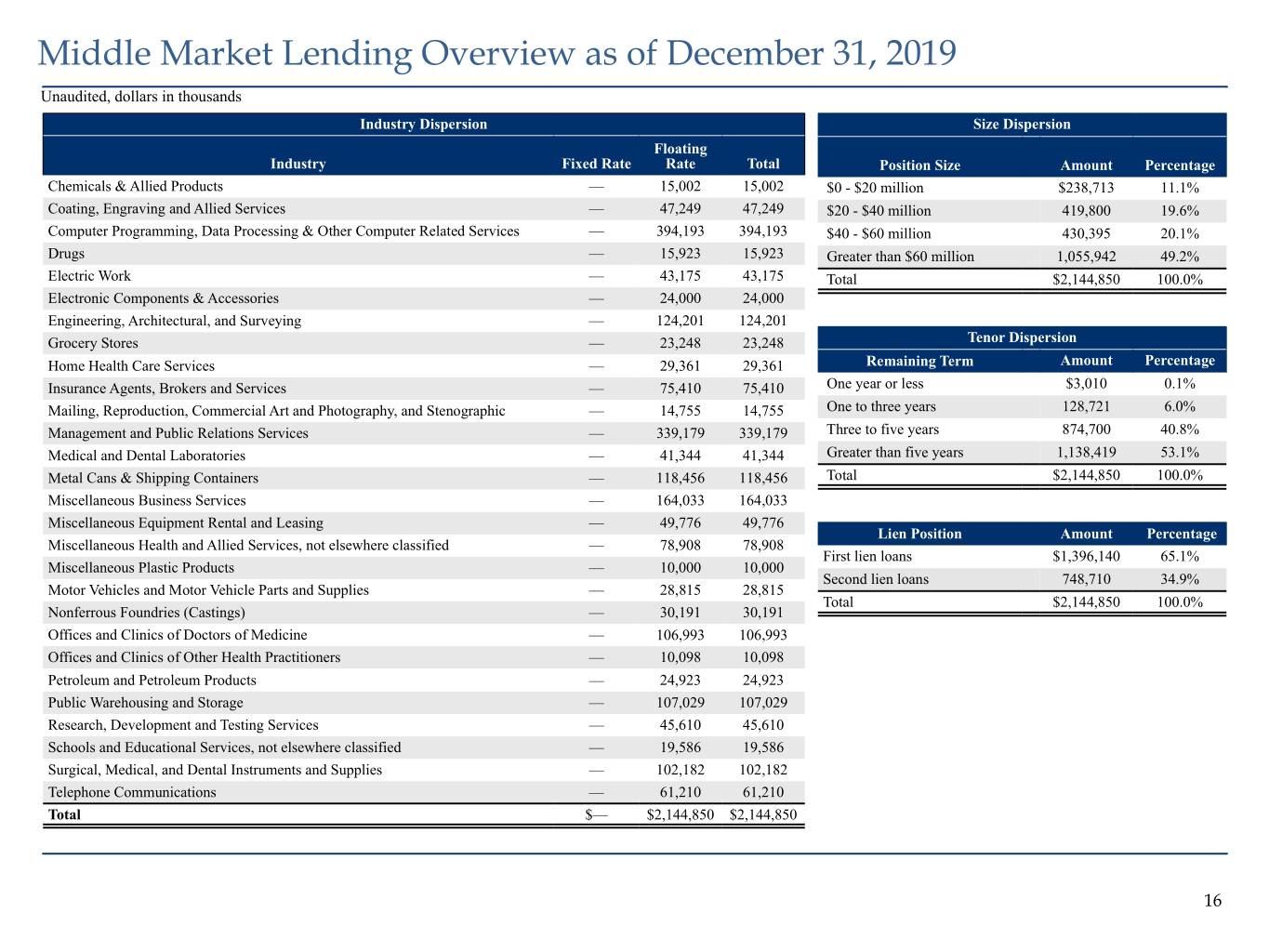

Middle Market Lending Overview as of December 31, 2019 Unaudited, dollars in thousands Industry Dispersion Size Dispersion Floating Industry Fixed Rate Rate Total Position Size Amount Percentage Chemicals & Allied Products — 15,002 15,002 $0 - $20 million $238,713 11.1% Coating, Engraving and Allied Services — 47,249 47,249 $20 - $40 million 419,800 19.6% Computer Programming, Data Processing & Other Computer Related Services — 394,193 394,193 $40 - $60 million 430,395 20.1% Drugs — 15,923 15,923 Greater than $60 million 1,055,942 49.2% Electric Work — 43,175 43,175 Total $2,144,850 100.0% Electronic Components & Accessories — 24,000 24,000 Engineering, Architectural, and Surveying — 124,201 124,201 Grocery Stores — 23,248 23,248 Tenor Dispersion Home Health Care Services — 29,361 29,361 Remaining Term Amount Percentage Insurance Agents, Brokers and Services — 75,410 75,410 One year or less $3,010 0.1% Mailing, Reproduction, Commercial Art and Photography, and Stenographic — 14,755 14,755 One to three years 128,721 6.0% Management and Public Relations Services — 339,179 339,179 Three to five years 874,700 40.8% Medical and Dental Laboratories — 41,344 41,344 Greater than five years 1,138,419 53.1% Metal Cans & Shipping Containers — 118,456 118,456 Total $2,144,850 100.0% Miscellaneous Business Services — 164,033 164,033 Miscellaneous Equipment Rental and Leasing — 49,776 49,776 Lien Position Amount Percentage Miscellaneous Health and Allied Services, not elsewhere classified — 78,908 78,908 First lien loans $1,396,140 65.1% Miscellaneous Plastic Products — 10,000 10,000 Second lien loans 748,710 34.9% Motor Vehicles and Motor Vehicle Parts and Supplies — 28,815 28,815 Total $2,144,850 100.0% Nonferrous Foundries (Castings) — 30,191 30,191 Offices and Clinics of Doctors of Medicine — 106,993 106,993 Offices and Clinics of Other Health Practitioners — 10,098 10,098 Petroleum and Petroleum Products — 24,923 24,923 Public Warehousing and Storage — 107,029 107,029 Research, Development and Testing Services — 45,610 45,610 Schools and Educational Services, not elsewhere classified — 19,586 19,586 Surgical, Medical, and Dental Instruments and Supplies — 102,182 102,182 Telephone Communications — 61,210 61,210 Total $— $2,144,850 $2,144,850 16

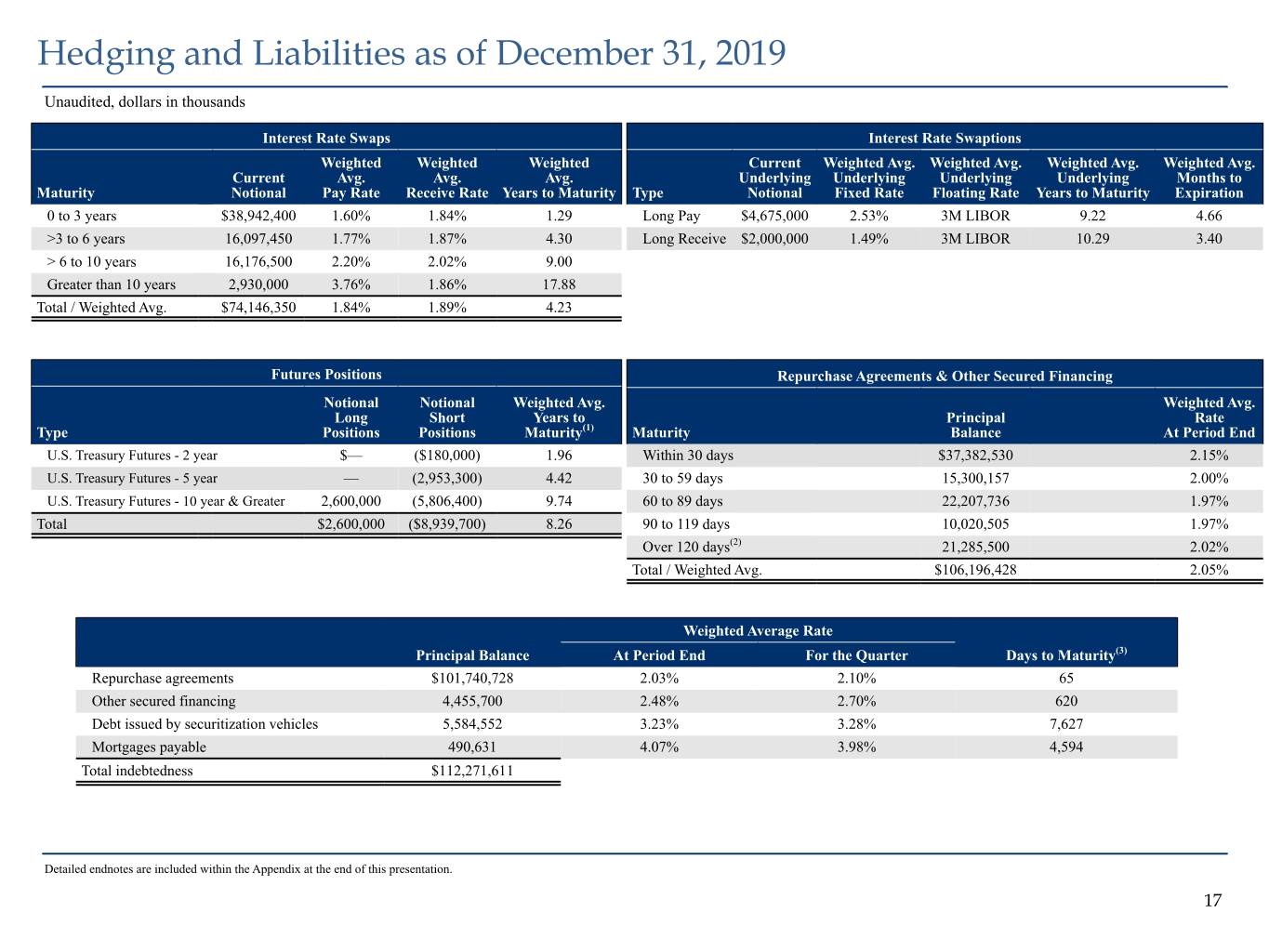

Hedging and Liabilities as of December 31, 2019 Unaudited, dollars in thousands Interest Rate Swaps Interest Rate Swaptions Weighted Weighted Weighted Current Weighted Avg. Weighted Avg. Weighted Avg. Weighted Avg. Current Avg. Avg. Avg. Underlying Underlying Underlying Underlying Months to Maturity Notional Pay Rate Receive Rate Years to Maturity Type Notional Fixed Rate Floating Rate Years to Maturity Expiration 0 to 3 years $38,942,400 1.60% 1.84% 1.29 Long Pay $4,675,000 2.53% 3M LIBOR 9.22 4.66 >3 to 6 years 16,097,450 1.77% 1.87% 4.30 Long Receive $2,000,000 1.49% 3M LIBOR 10.29 3.40 > 6 to 10 years 16,176,500 2.20% 2.02% 9.00 Greater than 10 years 2,930,000 3.76% 1.86% 17.88 Total / Weighted Avg. $74,146,350 1.84% 1.89% 4.23 Futures Positions Repurchase Agreements & Other Secured Financing Notional Notional Weighted Avg. Weighted Avg. Long Short Years to Principal Rate Type Positions Positions Maturity(1) Maturity Balance At Period End U.S. Treasury Futures - 2 year $— ($180,000) 1.96 Within 30 days $37,382,530 2.15% U.S. Treasury Futures - 5 year — (2,953,300) 4.42 30 to 59 days 15,300,157 2.00% U.S. Treasury Futures - 10 year & Greater 2,600,000 (5,806,400) 9.74 60 to 89 days 22,207,736 1.97% Total $2,600,000 ($8,939,700) 8.26 90 to 119 days 10,020,505 1.97% Over 120 days(2) 21,285,500 2.02% Total / Weighted Avg. $106,196,428 2.05% Weighted Average Rate Principal Balance At Period End For the Quarter Days to Maturity(3) Repurchase agreements $101,740,728 2.03% 2.10% 65 Other secured financing 4,455,700 2.48% 2.70% 620 Debt issued by securitization vehicles 5,584,552 3.23% 3.28% 7,627 Mortgages payable 490,631 4.07% 3.98% 4,594 Total indebtedness $112,271,611 Detailed endnotes are included within the Appendix at the end of this presentation. 17

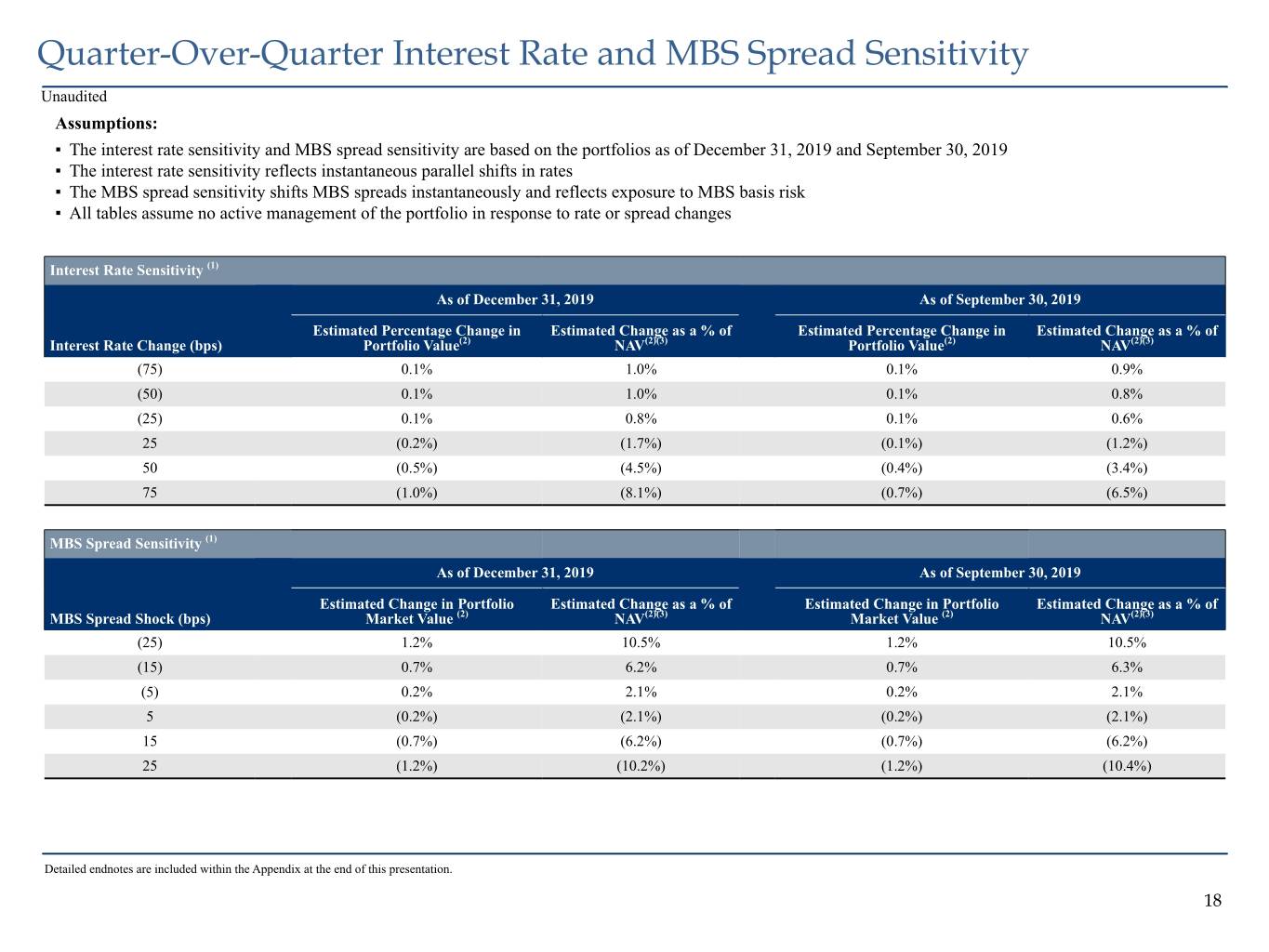

Quarter-Over-Quarter Interest Rate and MBS Spread Sensitivity Unaudited Assumptions: ▪ The interest rate sensitivity and MBS spread sensitivity are based on the portfolios as of December 31, 2019 and September 30, 2019 ▪ The interest rate sensitivity reflects instantaneous parallel shifts in rates ▪ The MBS spread sensitivity shifts MBS spreads instantaneously and reflects exposure to MBS basis risk ▪ All tables assume no active management of the portfolio in response to rate or spread changes Interest Rate Sensitivity (1) As of December 31, 2019 As of September 30, 2019 Estimated Percentage Change in Estimated Change as a % of Estimated Percentage Change in Estimated Change as a % of Interest Rate Change (bps) Portfolio Value(2) NAV(2)(3) Portfolio Value(2) NAV(2)(3) (75) 0.1% 1.0% 0.1% 0.9% (50) 0.1% 1.0% 0.1% 0.8% (25) 0.1% 0.8% 0.1% 0.6% 25 (0.2%) (1.7%) (0.1%) (1.2%) 50 (0.5%) (4.5%) (0.4%) (3.4%) 75 (1.0%) (8.1%) (0.7%) (6.5%) MBS Spread Sensitivity (1) As of December 31, 2019 As of September 30, 2019 Estimated Change in Portfolio Estimated Change as a % of Estimated Change in Portfolio Estimated Change as a % of MBS Spread Shock (bps) Market Value (2) NAV(2)(3) Market Value (2) NAV(2)(3) (25) 1.2% 10.5% 1.2% 10.5% (15) 0.7% 6.2% 0.7% 6.3% (5) 0.2% 2.1% 0.2% 2.1% 5 (0.2%) (2.1%) (0.2%) (2.1%) 15 (0.7%) (6.2%) (0.7%) (6.2%) 25 (1.2%) (10.2%) (1.2%) (10.4%) Detailed endnotes are included within the Appendix at the end of this presentation. 18

Appendix

Non-GAAP Reconciliations To supplement its consolidated financial statements, which are prepared and presented in accordance with GAAP, the Company provides non-GAAP financial measures. These measures should not be considered a substitute for, or superior to, financial measures computed in accordance with GAAP. While intended to offer a fuller understanding of the Company’s results and operations, non-GAAP financial measures also have limitations. For example, the Company may calculate its non-GAAP metrics, such as core earnings, or the PAA, differently than its peers making comparative analysis difficult. Additionally, in the case of non-GAAP measures that exclude the PAA, the amount of amortization expense excluding the PAA is not necessarily representative of the amount of future periodic amortization nor is it indicative of the term over which the Company will amortize the remaining unamortized premium. Changes to actual and estimated prepayments will impact the timing and amount of premium amortization and, as such, both GAAP and non-GAAP results. These non-GAAP measures provide additional detail to enhance investor understanding of the Company’s period-over-period operating performance and business trends, as well as for assessing the Company’s performance versus that of industry peers. Additional information pertaining to these non-GAAP financial measures and reconciliations to their most directly comparable GAAP results are provided on the following pages. A reconciliation of GAAP net income (loss) to non-GAAP core earnings for the quarters ended December 31, 2019, September 30, 2019, June 30, 2019, March 31, 2019 and December 31, 2018, is provided on page 8 of this financial summary. The Company calculates “core earnings”, a non-GAAP measure, as the sum of (a) economic net interest income, (b) TBA dollar roll income and CMBX coupon income, (c) realized amortization of MSRs, (d) other income (loss) (excluding depreciation and amortization expense on real estate and related intangibles, non-core income allocated to equity method investments and other non-core components of other income (loss)), (e) general and administrative expenses (excluding transaction expenses and non-recurring items) and (f) income taxes (excluding the income tax effect of non-core income (loss) items), and core earnings (excluding PAA), which is defined as core earnings excluding the premium amortization adjustment representing the cumulative impact on prior periods, but not the current period, of quarter-over-quarter changes in estimated long-term prepayment speeds related to the Company’s Agency mortgage- backed securities. 20

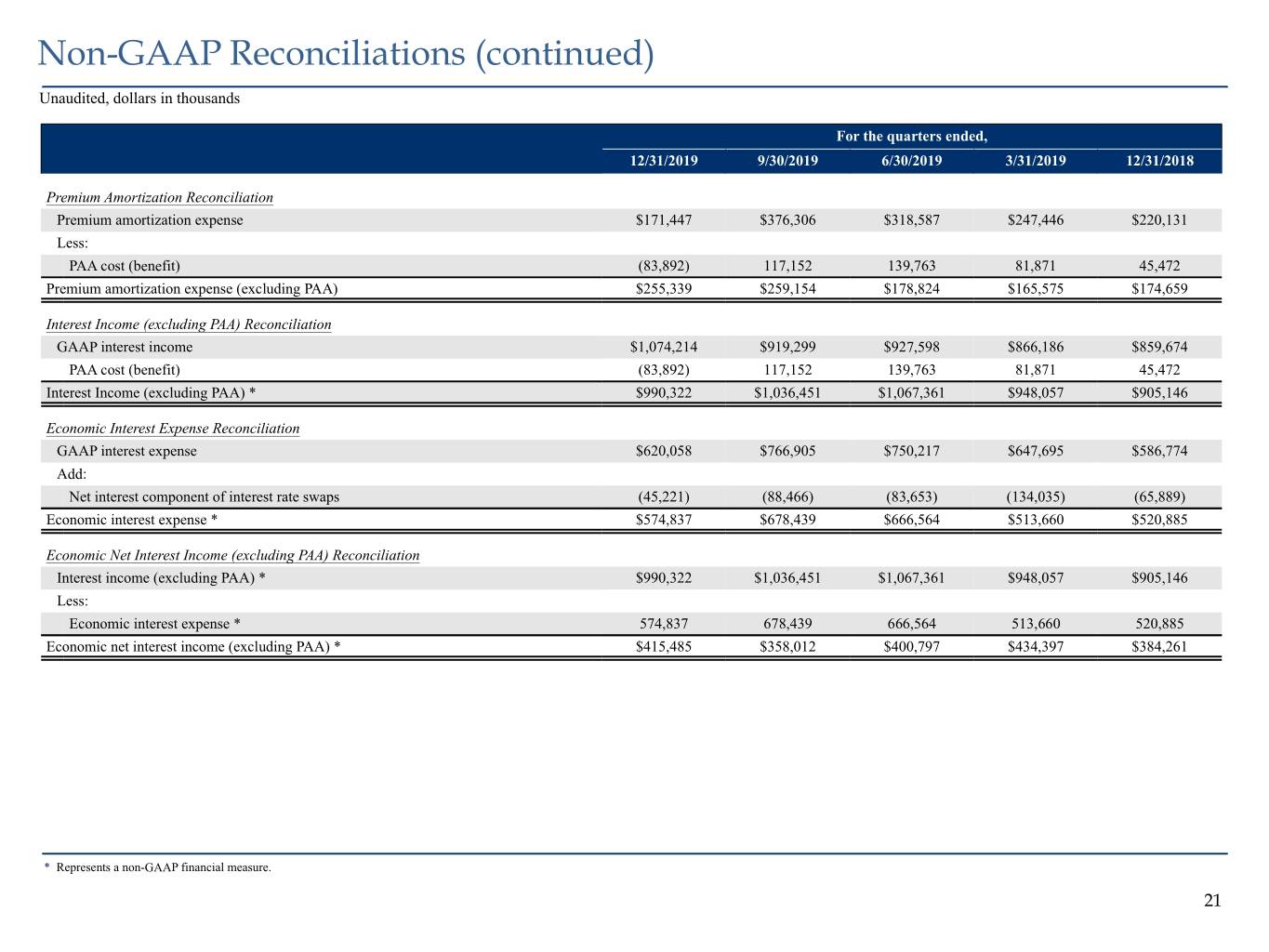

Non-GAAP Reconciliations (continued) Unaudited, dollars in thousands For the quarters ended, 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Premium Amortization Reconciliation Premium amortization expense $171,447 $376,306 $318,587 $247,446 $220,131 Less: PAA cost (benefit) (83,892) 117,152 139,763 81,871 45,472 Premium amortization expense (excluding PAA) $255,339 $259,154 $178,824 $165,575 $174,659 Interest Income (excluding PAA) Reconciliation GAAP interest income $1,074,214 $919,299 $927,598 $866,186 $859,674 PAA cost (benefit) (83,892) 117,152 139,763 81,871 45,472 Interest Income (excluding PAA) * $990,322 $1,036,451 $1,067,361 $948,057 $905,146 Economic Interest Expense Reconciliation GAAP interest expense $620,058 $766,905 $750,217 $647,695 $586,774 Add: Net interest component of interest rate swaps (45,221) (88,466) (83,653) (134,035) (65,889) Economic interest expense * $574,837 $678,439 $666,564 $513,660 $520,885 Economic Net Interest Income (excluding PAA) Reconciliation Interest income (excluding PAA) * $990,322 $1,036,451 $1,067,361 $948,057 $905,146 Less: Economic interest expense * 574,837 678,439 666,564 513,660 520,885 Economic net interest income (excluding PAA) * $415,485 $358,012 $400,797 $434,397 $384,261 * Represents a non-GAAP financial measure. 21

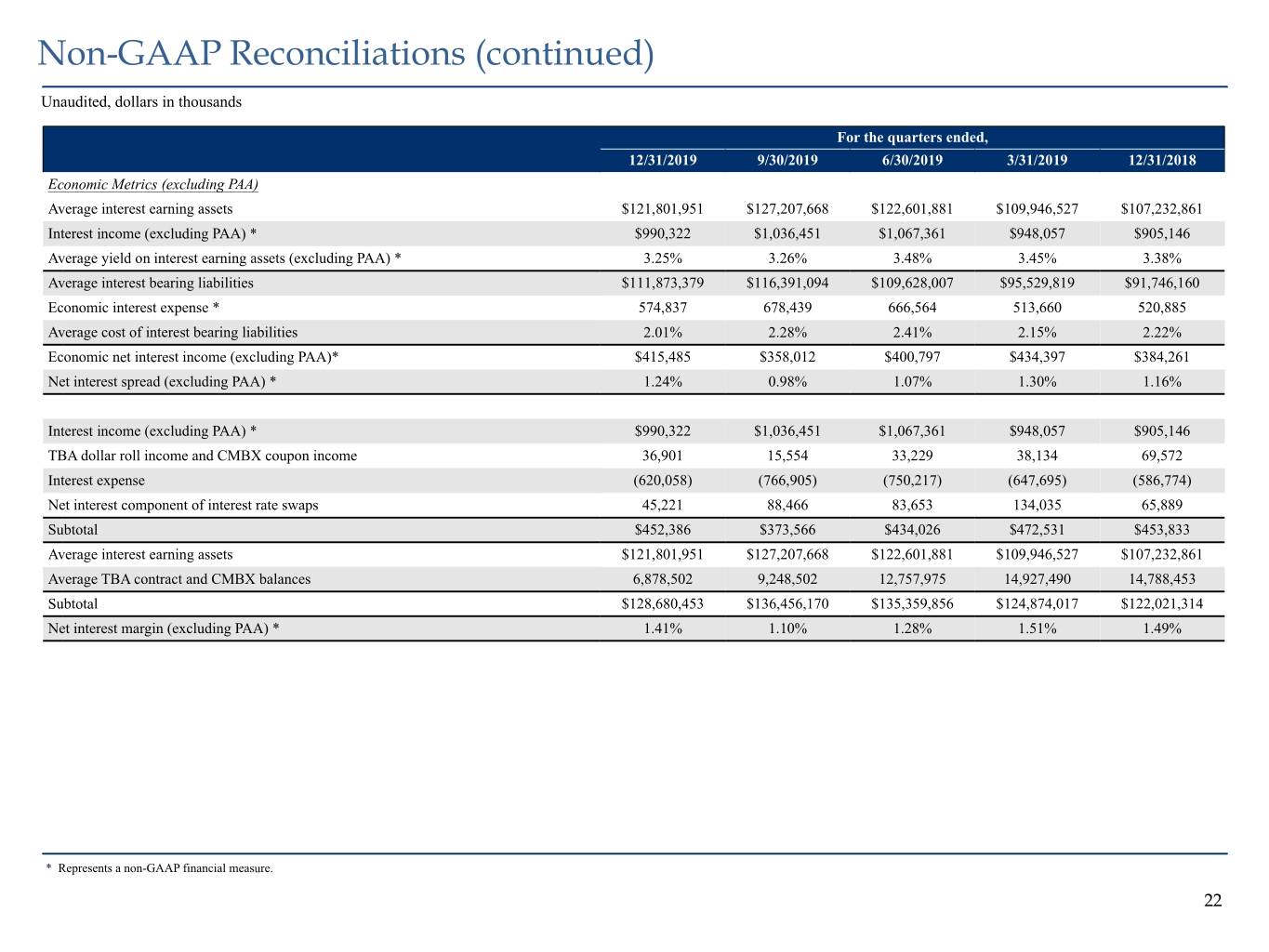

Non-GAAP Reconciliations (continued) Unaudited, dollars in thousands For the quarters ended, 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Economic Metrics (excluding PAA) Average interest earning assets $121,801,951 $127,207,668 $122,601,881 $109,946,527 $107,232,861 Interest income (excluding PAA) * $990,322 $1,036,451 $1,067,361 $948,057 $905,146 Average yield on interest earning assets (excluding PAA) * 3.25% 3.26% 3.48% 3.45% 3.38% Average interest bearing liabilities $111,873,379 $116,391,094 $109,628,007 $95,529,819 $91,746,160 Economic interest expense * 574,837 678,439 666,564 513,660 520,885 Average cost of interest bearing liabilities 2.01% 2.28% 2.41% 2.15% 2.22% Economic net interest income (excluding PAA)* $415,485 $358,012 $400,797 $434,397 $384,261 Net interest spread (excluding PAA) * 1.24% 0.98% 1.07% 1.30% 1.16% Interest income (excluding PAA) * $990,322 $1,036,451 $1,067,361 $948,057 $905,146 TBA dollar roll income and CMBX coupon income 36,901 15,554 33,229 38,134 69,572 Interest expense (620,058) (766,905) (750,217) (647,695) (586,774) Net interest component of interest rate swaps 45,221 88,466 83,653 134,035 65,889 Subtotal $452,386 $373,566 $434,026 $472,531 $453,833 Average interest earning assets $121,801,951 $127,207,668 $122,601,881 $109,946,527 $107,232,861 Average TBA contract and CMBX balances 6,878,502 9,248,502 12,757,975 14,927,490 14,788,453 Subtotal $128,680,453 $136,456,170 $135,359,856 $124,874,017 $122,021,314 Net interest margin (excluding PAA) * 1.41% 1.10% 1.28% 1.51% 1.49% * Represents a non-GAAP financial measure. 22

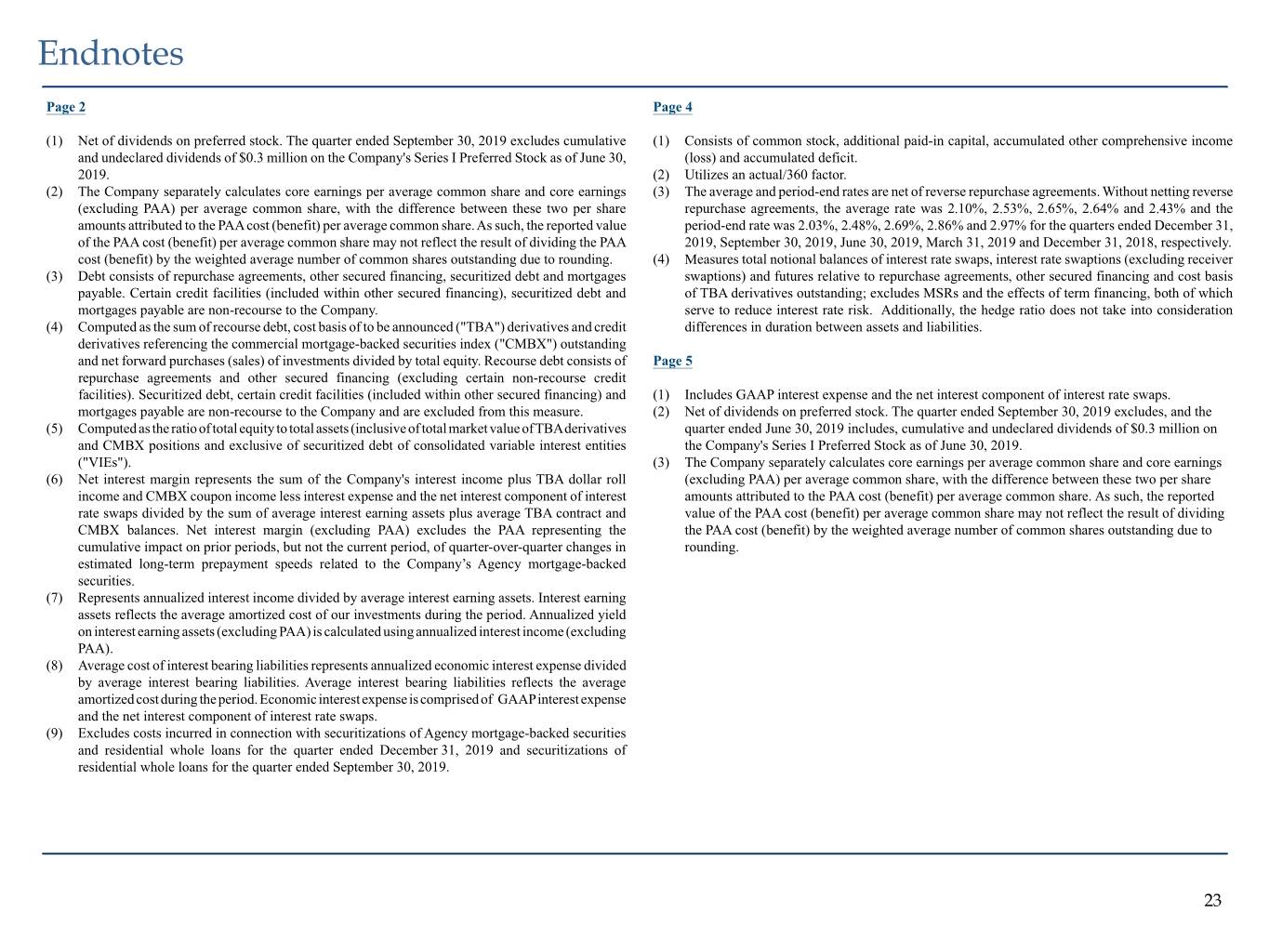

Endnotes Page 2 Page 4 (1) Net of dividends on preferred stock. The quarter ended September 30, 2019 excludes cumulative (1) Consists of common stock, additional paid-in capital, accumulated other comprehensive income and undeclared dividends of $0.3 million on the Company's Series I Preferred Stock as of June 30, (loss) and accumulated deficit. 2019. (2) Utilizes an actual/360 factor. (2) The Company separately calculates core earnings per average common share and core earnings (3) The average and period-end rates are net of reverse repurchase agreements. Without netting reverse (excluding PAA) per average common share, with the difference between these two per share repurchase agreements, the average rate was 2.10%, 2.53%, 2.65%, 2.64% and 2.43% and the amounts attributed to the PAA cost (benefit) per average common share. As such, the reported value period-end rate was 2.03%, 2.48%, 2.69%, 2.86% and 2.97% for the quarters ended December 31, of the PAA cost (benefit) per average common share may not reflect the result of dividing the PAA 2019, September 30, 2019, June 30, 2019, March 31, 2019 and December 31, 2018, respectively. cost (benefit) by the weighted average number of common shares outstanding due to rounding. (4) Measures total notional balances of interest rate swaps, interest rate swaptions (excluding receiver (3) Debt consists of repurchase agreements, other secured financing, securitized debt and mortgages swaptions) and futures relative to repurchase agreements, other secured financing and cost basis payable. Certain credit facilities (included within other secured financing), securitized debt and of TBA derivatives outstanding; excludes MSRs and the effects of term financing, both of which mortgages payable are non-recourse to the Company. serve to reduce interest rate risk. Additionally, the hedge ratio does not take into consideration (4) Computed as the sum of recourse debt, cost basis of to be announced ("TBA") derivatives and credit differences in duration between assets and liabilities. derivatives referencing the commercial mortgage-backed securities index ("CMBX") outstanding and net forward purchases (sales) of investments divided by total equity. Recourse debt consists of Page 5 repurchase agreements and other secured financing (excluding certain non-recourse credit facilities). Securitized debt, certain credit facilities (included within other secured financing) and (1) Includes GAAP interest expense and the net interest component of interest rate swaps. mortgages payable are non-recourse to the Company and are excluded from this measure. (2) Net of dividends on preferred stock. The quarter ended September 30, 2019 excludes, and the (5) Computed as the ratio of total equity to total assets (inclusive of total market value of TBA derivatives quarter ended June 30, 2019 includes, cumulative and undeclared dividends of $0.3 million on and CMBX positions and exclusive of securitized debt of consolidated variable interest entities the Company's Series I Preferred Stock as of June 30, 2019. ("VIEs"). (3) The Company separately calculates core earnings per average common share and core earnings (6) Net interest margin represents the sum of the Company's interest income plus TBA dollar roll (excluding PAA) per average common share, with the difference between these two per share income and CMBX coupon income less interest expense and the net interest component of interest amounts attributed to the PAA cost (benefit) per average common share. As such, the reported rate swaps divided by the sum of average interest earning assets plus average TBA contract and value of the PAA cost (benefit) per average common share may not reflect the result of dividing CMBX balances. Net interest margin (excluding PAA) excludes the PAA representing the the PAA cost (benefit) by the weighted average number of common shares outstanding due to cumulative impact on prior periods, but not the current period, of quarter-over-quarter changes in rounding. estimated long-term prepayment speeds related to the Company’s Agency mortgage-backed securities. (7) Represents annualized interest income divided by average interest earning assets. Interest earning assets reflects the average amortized cost of our investments during the period. Annualized yield on interest earning assets (excluding PAA) is calculated using annualized interest income (excluding PAA). (8) Average cost of interest bearing liabilities represents annualized economic interest expense divided by average interest bearing liabilities. Average interest bearing liabilities reflects the average amortized cost during the period. Economic interest expense is comprised of GAAP interest expense and the net interest component of interest rate swaps. (9) Excludes costs incurred in connection with securitizations of Agency mortgage-backed securities and residential whole loans for the quarter ended December 31, 2019 and securitizations of residential whole loans for the quarter ended September 30, 2019. 23

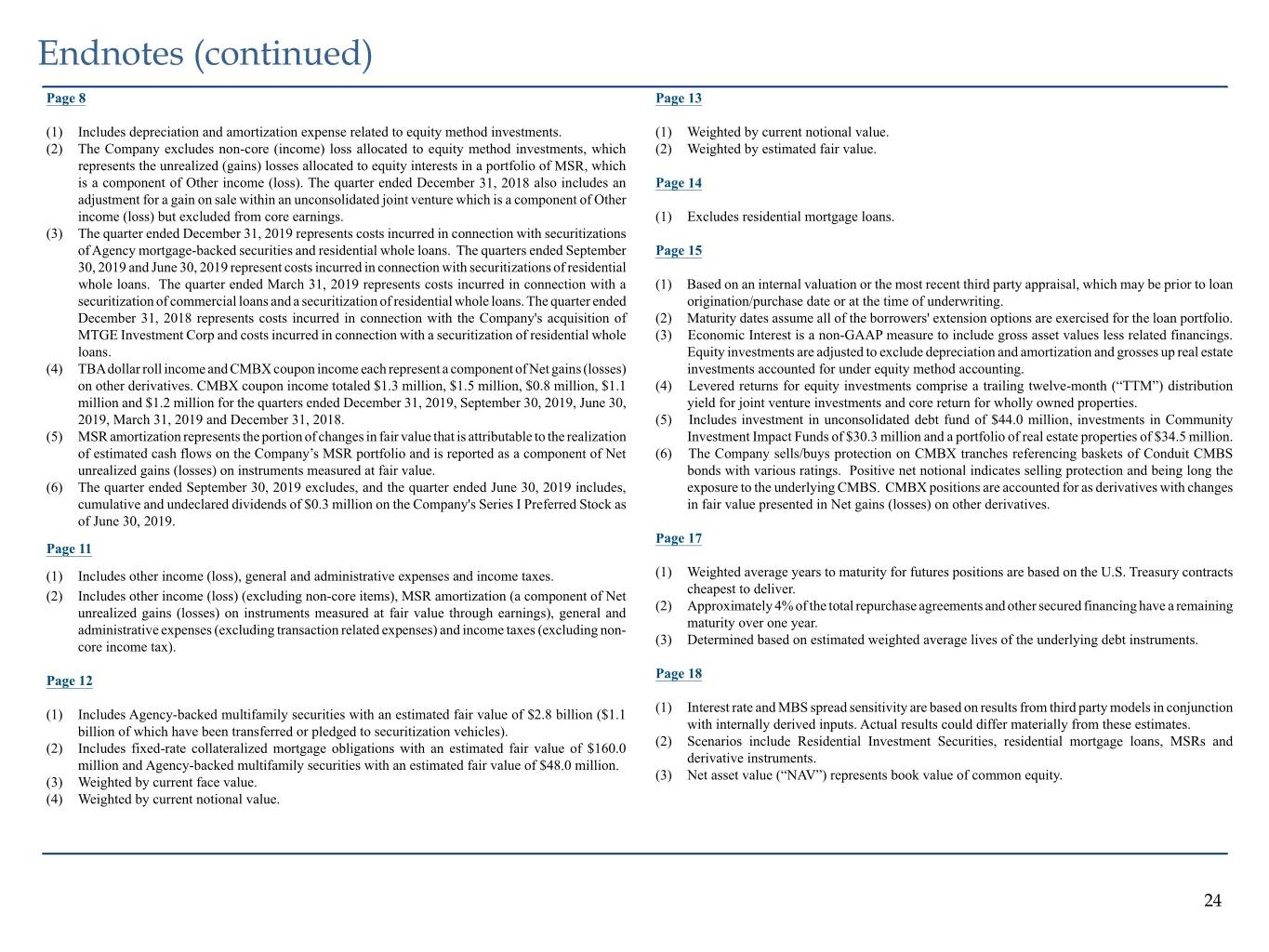

Endnotes (continued) Page 8 Page 13 (1) Includes depreciation and amortization expense related to equity method investments. (1) Weighted by current notional value. (2) The Company excludes non-core (income) loss allocated to equity method investments, which (2) Weighted by estimated fair value. represents the unrealized (gains) losses allocated to equity interests in a portfolio of MSR, which is a component of Other income (loss). The quarter ended December 31, 2018 also includes an Page 14 adjustment for a gain on sale within an unconsolidated joint venture which is a component of Other income (loss) but excluded from core earnings. (1) Excludes residential mortgage loans. (3) The quarter ended December 31, 2019 represents costs incurred in connection with securitizations of Agency mortgage-backed securities and residential whole loans. The quarters ended September Page 15 30, 2019 and June 30, 2019 represent costs incurred in connection with securitizations of residential whole loans. The quarter ended March 31, 2019 represents costs incurred in connection with a (1) Based on an internal valuation or the most recent third party appraisal, which may be prior to loan securitization of commercial loans and a securitization of residential whole loans. The quarter ended origination/purchase date or at the time of underwriting. December 31, 2018 represents costs incurred in connection with the Company's acquisition of (2) Maturity dates assume all of the borrowers' extension options are exercised for the loan portfolio. MTGE Investment Corp and costs incurred in connection with a securitization of residential whole (3) Economic Interest is a non-GAAP measure to include gross asset values less related financings. loans. Equity investments are adjusted to exclude depreciation and amortization and grosses up real estate (4) TBA dollar roll income and CMBX coupon income each represent a component of Net gains (losses) investments accounted for under equity method accounting. on other derivatives. CMBX coupon income totaled $1.3 million, $1.5 million, $0.8 million, $1.1 (4) Levered returns for equity investments comprise a trailing twelve-month (“TTM”) distribution million and $1.2 million for the quarters ended December 31, 2019, September 30, 2019, June 30, yield for joint venture investments and core return for wholly owned properties. 2019, March 31, 2019 and December 31, 2018. (5) Includes investment in unconsolidated debt fund of $44.0 million, investments in Community (5) MSR amortization represents the portion of changes in fair value that is attributable to the realization Investment Impact Funds of $30.3 million and a portfolio of real estate properties of $34.5 million. of estimated cash flows on the Company’s MSR portfolio and is reported as a component of Net (6) The Company sells/buys protection on CMBX tranches referencing baskets of Conduit CMBS unrealized gains (losses) on instruments measured at fair value. bonds with various ratings. Positive net notional indicates selling protection and being long the (6) The quarter ended September 30, 2019 excludes, and the quarter ended June 30, 2019 includes, exposure to the underlying CMBS. CMBX positions are accounted for as derivatives with changes cumulative and undeclared dividends of $0.3 million on the Company's Series I Preferred Stock as in fair value presented in Net gains (losses) on other derivatives. of June 30, 2019. Page 17 Page 11 (1) Includes other income (loss), general and administrative expenses and income taxes. (1) Weighted average years to maturity for futures positions are based on the U.S. Treasury contracts cheapest to deliver. (2) Includes other income (loss) (excluding non-core items), MSR amortization (a component of Net (2) Approximately 4% of the total repurchase agreements and other secured financing have a remaining unrealized gains (losses) on instruments measured at fair value through earnings), general and maturity over one year. administrative expenses (excluding transaction related expenses) and income taxes (excluding non- (3) Determined based on estimated weighted average lives of the underlying debt instruments. core income tax). Page 18 Page 12 (1) Interest rate and MBS spread sensitivity are based on results from third party models in conjunction (1) Includes Agency-backed multifamily securities with an estimated fair value of $2.8 billion ($1.1 with internally derived inputs. Actual results could differ materially from these estimates. billion of which have been transferred or pledged to securitization vehicles). (2) Scenarios include Residential Investment Securities, residential mortgage loans, MSRs and (2) Includes fixed-rate collateralized mortgage obligations with an estimated fair value of $160.0 derivative instruments. million and Agency-backed multifamily securities with an estimated fair value of $48.0 million. (3) Net asset value (“NAV”) represents book value of common equity. (3) Weighted by current face value. (4) Weighted by current notional value. 24