Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - NET 1 UEPS TECHNOLOGIES INC | exhibit32.htm |

| EX-31.2 - EXHIBIT 31.2 - NET 1 UEPS TECHNOLOGIES INC | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - NET 1 UEPS TECHNOLOGIES INC | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 31, 2019

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

For the transition period from ___________________ To_____________________

Commission file number: 000-31203

NET 1 UEPS TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

Florida |

98-0171860 |

|

(State or other jurisdiction |

(IRS Employer |

|

of incorporation or organization) |

Identification No.) |

|

President Place, 4th Floor, Cnr. Jan Smuts Avenue and Bolton Road |

|

Rosebank, Johannesburg 2196, South Africa |

|

(Address of principal executive offices, including zip code) |

Registrant's telephone number, including area code: 27-11-343-2000

|

Not Applicable |

|

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

|

on which registered

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES [X] NO [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act (check one):

|

[ ] Large accelerated filer |

[X] Accelerated filer |

|

|

|

|

[ ] Non-accelerated filer |

[X] Smaller reporting company |

|

|

|

|

|

[ ] Emerging growth company |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES [ ] NO [X]

As of February 3, 2020 (the latest practicable date), 56,568,425 shares of the registrant's common stock, par value $0.001 per share, net of treasury shares, were outstanding.

Form 10-Q

NET 1 UEPS TECHNOLOGIES, INC

Table of Contents

Part I. Financial information

Item 1. Financial Statements

NET 1 UEPS TECHNOLOGIES, INC

Unaudited Condensed Consolidated Balance Sheets

| December 31, | June 30, | |||||||||||||

| 2019 | 2019(A) | |||||||||||||

| (In thousands, except share data) | ||||||||||||||

| ASSETS | ||||||||||||||

| CURRENT ASSETS | ||||||||||||||

| Cash and cash equivalents | $ | 50,719 | $ | 46,065 | ||||||||||

| Restricted cash (Note 10) | 84,360 | 75,446 | ||||||||||||

| Accounts receivable, net and other receivables (Note 3) | 68,565 | 72,494 | ||||||||||||

| Finance loans receivable, net (Note 3) | 29,117 | 30,631 | ||||||||||||

| Inventory (Note 4) | 21,196 | 7,535 | ||||||||||||

| Total current assets before settlement assets | 253,957 | 232,171 | ||||||||||||

| Settlement assets (Note 5) | 55,401 | 63,479 | ||||||||||||

| Total current assets | 309,358 | 295,650 | ||||||||||||

| PROPERTY, PLANT AND EQUIPMENT, net of accumulated depreciation of - December: $121,584 June: $129,185 | 16,450 | 18,554 | ||||||||||||

| OPERATING LEASE RIGHT-OF-USE (Note 18) | 7,838 | - | ||||||||||||

| EQUITY-ACCOUNTED INVESTMENTS (Note 7) | 155,627 | 151,116 | ||||||||||||

| GOODWILL (Note 8) | 148,938 | 149,387 | ||||||||||||

| INTANGIBLE ASSETS, NET (Note 8) | 8,043 | 11,889 | ||||||||||||

| DEFERRED INCOME TAXES | 2,112 | 2,151 | ||||||||||||

| OTHER LONG-TERM ASSETS, including reinsurance assets (Note 7 and 9) | 41,144 | 44,189 | ||||||||||||

| TOTAL ASSETS | 689,510 | 672,936 | ||||||||||||

| LIABILITIES | ||||||||||||||

| CURRENT LIABILITIES | ||||||||||||||

| Short-term credit facilities for ATM funding (Note 10) | 84,360 | 75,446 | ||||||||||||

| Short-term credit facilities (Note 10) | 13,906 | 9,544 | ||||||||||||

| Accounts payable | 14,211 | 17,005 | ||||||||||||

| Other payables (Note 11) | 69,134 | 66,449 | ||||||||||||

| Operating lease right of use lease liability - current (Note 18) | 3,534 | - | ||||||||||||

| Current portion of long-term borrowings (Note 10) | 4,063 | - | ||||||||||||

| Income taxes payable | 5,043 | 6,223 | ||||||||||||

| Total current liabilities before settlement obligations | 194,251 | 174,667 | ||||||||||||

| Settlement obligations (Note 5) | 55,402 | 63,479 | ||||||||||||

| Total current liabilities | 249,653 | 238,146 | ||||||||||||

| DEFERRED INCOME TAXES | 4,503 | 4,682 | ||||||||||||

| RIGHT-OF-USE OPERATING LEASE LIABILITY - LONG TERM (Note 18) | 4,499 | - | ||||||||||||

| OTHER LONG-TERM LIABILITIES, including insurance policy liabilities (Note 7) | 2,623 | 3,007 | ||||||||||||

| TOTAL LIABILITIES | 261,278 | 245,835 | ||||||||||||

| REDEEMABLE COMMON STOCK | 107,672 | 107,672 | ||||||||||||

| EQUITY | ||||||||||||||

| COMMON STOCK (Note 12) | ||||||||||||||

| Authorized: 200,000,000 with $0.001 par value; | ||||||||||||||

| Issued and outstanding shares, net of treasury - December: 56,568,425 June: 56,568,425 | 80 | 80 | ||||||||||||

| PREFERRED STOCK | ||||||||||||||

| Authorized shares: 50,000,000 with $0.001 par value; | ||||||||||||||

| Issued and outstanding shares, net of treasury: December: - June: - | - | - | ||||||||||||

| ADDITIONAL PAID-IN-CAPITAL | 277,891 | 276,997 | ||||||||||||

| TREASURY SHARES, AT COST: December: 24,891,292 June: 24,891,292 | (286,951 | ) | (286,951 | ) | ||||||||||

| ACCUMULATED OTHER COMPREHENSIVE LOSS (Note 13) | (194,439 | ) | (199,273 | ) | ||||||||||

| RETAINED EARNINGS | 523,979 | 528,576 | ||||||||||||

| TOTAL NET1 EQUITY | 320,560 | 319,429 | ||||||||||||

| NON-CONTROLLING INTEREST | - | - | ||||||||||||

| TOTAL EQUITY | 320,560 | 319,429 | ||||||||||||

| TOTAL LIABILITIES, REDEEMABLE COMMON STOCK AND SHAREHOLDERS' EQUITY | $ | 689,510 | $ | 672,936 | ||||||||||

(A) - Derived from audited financial statements

See Notes to Unaudited Condensed Consolidated Financial Statements

NET 1 UEPS TECHNOLOGIES, INC

Unaudited Condensed Consolidated Statements of Operations

| Three months ended | Six months ended | ||||||||||||||

| December 31, | December 31, | ||||||||||||||

| 2019 | 2018 | 2019 | 2018 | ||||||||||||

| (In thousands, except per share data) | (In thousands, except per share data) | ||||||||||||||

| REVENUE (Note 17) | $ | 74,080 | $ | 77,442 | $ | 154,836 | $ | 184,539 | |||||||

| EXPENSE | |||||||||||||||

| Cost of goods sold, IT processing, servicing and support | 43,160 | 41,231 | 89,954 | 103,335 | |||||||||||

| Selling, general and administration | 33,393 | 69,730 | 65,324 | 111,152 | |||||||||||

| Depreciation and amortization | 4,381 | 7,191 | 9,146 | 15,048 | |||||||||||

| Impairment loss (Note 8) | - | 8,191 | - | 8,191 | |||||||||||

| OPERATING LOSS | (6,854 | ) | (48,901 | ) | (9,588 | ) | (53,187 | ) | |||||||

| CHANGE IN FAIR VALUE OF EQUITY SECURITIES (Note 6 and 7) | - | (15,836 | ) | - | (15,836 | ) | |||||||||

| GAIN ON DISPOSAL OF FIHRST (Note 2) | 9,743 | - | 9,743 | - | |||||||||||

| INTEREST INCOME | 1,343 | 2,177 | 1,994 | 3,778 | |||||||||||

| INTEREST EXPENSE | 3,221 | 2,563 | 4,576 | 5,121 | |||||||||||

| IMPAIRMENT OF CEDAR CELLULAR NOTE (Note 7) | - | 2,732 | - | 2,732 | |||||||||||

| INCOME (LOSS) BEFORE INCOME TAX EXPENSE (BENEFIT) | 1,011 | (67,855 | ) | (2,427 | ) | (73,098 | ) | ||||||||

| INCOME TAX EXPENSE (BENEFIT) (Note 20) | 1,722 | (4,398 | ) | 3,739 | 577 | ||||||||||

| NET LOSS BEFORE EARNINGS (LOSS) FROM EQUITY-ACCOUNTED INVESTMENTS | (711 | ) | (63,457 | ) | (6,166 | ) | (73,675 | ) | |||||||

| EARNINGS (LOSS) FROM EQUITY-ACCOUNTED INVESTMENTS (Note 7) | 506 | (1,291 | ) | 1,569 | 184 | ||||||||||

| NET LOSS FROM CONTINUING OPERATIONS | (205 | ) | (64,748 | ) | (4,597 | ) | (73,491 | ) | |||||||

| NET INCOME FROM DISCONTINUED OPERATIONS (Note 22) | - | 3,779 | - | 7,418 | |||||||||||

| NET (LOSS) INCOME | (205 | ) | (60,969 | ) | (4,597 | ) | (66,073 | ) | |||||||

| LESS (ADD) NET INCOME (LOSS) ATTRIBUTABLE TO NON-CONTROLLING INTEREST | - | 2,972 | - | 3,067 | |||||||||||

| Continuing | - | 721 | - | (877 | ) | ||||||||||

| Discontinued | - | 2,251 | - | 3,944 | |||||||||||

| NET (LOSS) INCOME ATTRIBUTABLE TO NET1 | (205 | ) | (63,941 | ) | (4,597 | ) | (69,140 | ) | |||||||

| Continuing | (205 | ) | (65,469 | ) | (4,597 | ) | (72,614 | ) | |||||||

| Discontinued | $ | - | $ | 1,528 | $ | - | $ | 3,474 | |||||||

| Net (loss) earnings per share, in United States dollars (Note 15): | |||||||||||||||

| Basic (loss) earnings attributable to Net1 shareholders | $ | (0.00 | ) | $ | (1.13 | ) | $ | (0.08 | ) | $ | (1.22 | ) | |||

| Continuing | $ | (0.00 | ) | $ | (1.16 | ) | $ | (0.08 | ) | $ | (1.28 | ) | |||

| Discontinued | $ | - | $ | 0.03 | $ | - | $ | 0.06 | |||||||

| Diluted (loss) earnings attributable to Net1 shareholders | $ | (0.00 | ) | $ | (1.12 | ) | $ | (0.08 | ) | $ | (1.22 | ) | |||

| Continuing | $ | (0.00 | ) | $ | (1.15 | ) | $ | (0.08 | ) | $ | (1.28 | ) | |||

| Discontinued | $ | - | $ | 0.03 | $ | - | $ | 0.06 | |||||||

| See Notes to Unaudited Condensed Consolidated Financial Statements | |||||||||||||||

NET 1 UEPS TECHNOLOGIES, INC

Unaudited Condensed Consolidated Statements of Comprehensive Income

| Three months ended | Six months ended | |||||||||||||||||||

| December 31, | December 31, | |||||||||||||||||||

| 2019 | 2018 | 2019 | 2018 | |||||||||||||||||

| (In thousands) | (In thousands) | |||||||||||||||||||

| Net loss | $ | (205 | ) | $ | (60,969 | ) | $ | (4,597 | ) | $ | (66,073 | ) | ||||||||

| Other comprehensive income (loss), net of taxes | ||||||||||||||||||||

| Movement in foreign currency translation reserve | 19,114 | (10,353 | ) | 1,029 | (23,675 | ) | ||||||||||||||

| Release of foreign currency translation reserve related to disposal of FIHRST | 1,578 | - | 1,578 | - | ||||||||||||||||

| Movement in foreign currency translation reserve related to equity-accounted investments | (491 | ) | - | 2,227 | 5,430 | |||||||||||||||

| Total other comprehensive income (loss), net of taxes | 20,201 | (10,353 | ) | 4,834 | (18,245 | ) | ||||||||||||||

| Comprehensive income (loss) | 19,996 | (71,322 | ) | 237 | (84,318 | ) | ||||||||||||||

| (Less) Add comprehensive (gain) loss attributable to non-controlling interest | - | (1,363 | ) | - | 1,342 | |||||||||||||||

| Comprehensive income (loss) attributable to Net1 | $ | 19,996 | $ | (72,685 | ) | $ | 237 | $ | (82,976 | ) | ||||||||||

See Notes to Unaudited Condensed Consolidated Financial Statements

NET 1 UEPS TECHNOLOGIES, INC

Unaudited Condensed Consolidated Statements of Changes in Equity

| Net 1 UEPS Technologies, Inc. Shareholders | ||||||||||||||||||||||||||||||||||||

| Number of Shares | Amount | Number of Treasury Shares | Treasury Shares | Number of shares, net of treasury | Additional Paid-In Capital | Retained Earnings | Accumulated other comprehensive (loss) | Total Net1 Equity | Non-controlling Interest | Total | Redeemable common stock | |||||||||||||||||||||||||

| For the three months ended December 31, 2018 (dollar amounts in thousands) |

||||||||||||||||||||||||||||||||||||

| Balance - October 1, 2018 | 81,725,217 | $ | 80 | (24,891,292 | ) | $ | (286,951 | ) | 56,833,925 | $ | 276,865 | $ | 830,995 | $ | (189,630 | ) | $ | 631,359 | $ | 91,477 | $ | 722,836 | $ | 107,672 | ||||||||||||

| Stock-based compensation charge (Note 14) | 598 | 598 | 598 | |||||||||||||||||||||||||||||||||

| Dividends paid to non-controlling interest | - | (1,208 | ) | (1,208 | ) | |||||||||||||||||||||||||||||||

| Net (loss) income | (63,941 | ) | (63,941 | ) | 2,972 | (60,969 | ) | |||||||||||||||||||||||||||||

| Other comprehensive loss (Note 13) | (8,744 | ) | (8,744 | ) | (1,609 | ) | (10,353 | ) | ||||||||||||||||||||||||||||

| Balance - December 31, 2018 | 81,725,217 | $ | 80 | (24,891,292 | ) | $ | (286,951 | ) | 56,833,925 | $ | 277,463 | $ | 767,054 | $ | (198,374 | ) | $ | 559,272 | $ | 91,632 | $ | 650,904 | $ | 107,672 | ||||||||||||

| For the six months ended December 31, 2018 (dollar amounts in thousands) | ||||||||||||||||||||||||||||||||||||

| Balance - July 1, 2018 | 81,577,217 | $ | 80 | (24,891,292 | ) | $ | (286,951 | ) | 56,685,925 | $ | 276,201 | $ | 836,194 | $ | (184,538 | ) | $ | 640,986 | $ | 95,911 | $ | 736,897 | $ | 107,672 | ||||||||||||

| Restricted stock granted | 148,000 | 148,000 | - | - | ||||||||||||||||||||||||||||||||

| Stock-based compensation charge (Note 14) | 1,185 | 1,185 | 1,185 | |||||||||||||||||||||||||||||||||

| Stock-based compensation charge related to equity accounted investment | 77 | 77 | 77 | |||||||||||||||||||||||||||||||||

| Dividends paid to non-controlling interest | - | (2,937 | ) | (2,937 | ) | |||||||||||||||||||||||||||||||

| Net (loss) income | (69,140 | ) | (69,140 | ) | 3,067 | (66,073 | ) | |||||||||||||||||||||||||||||

| Other comprehensive loss (Note 13) | (13,836 | ) | (13,836 | ) | (4,409 | ) | (18,245 | ) | ||||||||||||||||||||||||||||

| Balance - December 31, 2018 | 81,725,217 | $ | 80 | (24,891,292 | ) | $ | (286,951 | ) | 56,833,925 | $ | 277,463 | $ | 767,054 | $ | (198,374 | ) | $ | 559,272 | $ | 91,632 | $ | 650,904 | $ | 107,672 | ||||||||||||

NET 1 UEPS TECHNOLOGIES, INC

Unaudited Condensed Consolidated Statements of Changes in Equity

| Net 1 UEPS Technologies, Inc. Shareholders | ||||||||||||||||||||||||||||||||||||

| Number of Shares | Amount | Number of Treasury Shares | Treasury Shares | Number of shares, net of treasury | Additional Paid-In Capital | Retained Earnings | Accumulated other comprehensive (loss) income | Total Net1 Equity | Non-controlling Interest | Total | Redeemable common stock | |||||||||||||||||||||||||

| For the three months ended December 31, 2019 (dollar amounts in thousands) | ||||||||||||||||||||||||||||||||||||

| Balance - October 1, 2019 | 81,459,717 | $ | 80 | (24,891,292 | ) | $ | (286,951 | ) | 56,568,425 | $ | 277,455 | $ | 524,184 | $ | (214,640 | ) | $ | 300,128 | $ | - | $ | 300,128 | $ | 107,672 | ||||||||||||

| Stock-based compensation charge (Note 14) | 436 | 436 | 436 | |||||||||||||||||||||||||||||||||

| Net loss | (205 | ) | (205 | ) | - | (205 | ) | |||||||||||||||||||||||||||||

| Other comprehensive income (Note 13) | 20,201 | 20,201 | - | 20,201 | ||||||||||||||||||||||||||||||||

| Balance - December 31, 2019 | 81,459,717 | $ | 80 | (24,891,292 | ) | $ | (286,951 | ) | 56,568,425 | $ | 277,891 | $ | 523,979 | $ | (194,439 | ) | $ | 320,560 | $ | - | $ | 320,560 | $ | 107,672 | ||||||||||||

| For the six months ended December 31, 2019 (dollar amounts in thousands) | ||||||||||||||||||||||||||||||||||||

| Balance - July 1, 2019 | 81,459,717 | $ | 80 | (24,891,292 | ) | $ | (286,951 | ) | 56,568,425 | $ | 276,997 | $ | 528,576 | $ | (199,273 | ) | $ | 319,429 | $ | - | $ | 319,429 | $ | 107,672 | ||||||||||||

| Stock-based compensation charge (Note 14) | 823 | 823 | 823 | |||||||||||||||||||||||||||||||||

| Stock-based compensation charge related to equity accounted investment (Note 7) | 71 | 71 | 71 | |||||||||||||||||||||||||||||||||

| Net loss | (4,597 | ) | (4,597 | ) | - | (4,597 | ) | |||||||||||||||||||||||||||||

| Other comprehensive income (Note 13) | 4,834 | 4,834 | - | 4,834 | ||||||||||||||||||||||||||||||||

| Balance - December 31, 2019 | 81,459,717 | $ | 80 | (24,891,292 | ) | $ | (286,951 | ) | 56,568,425 | $ | 277,891 | $ | 523,979 | $ | (194,439 | ) | $ | 320,560 | $ | - | $ | 320,560 | $ | 107,672 | ||||||||||||

| See Notes to Unaudited Condensed Consolidated Financial Statements | ||||||||||||||||||||||||||||||||||||

NET 1 UEPS TECHNOLOGIES, INC

Unaudited Condensed Consolidated Statements of Cash Flows

| Three months ended | Six months ended | ||||||||||||||||

| December 31, | December 31, | ||||||||||||||||

| 2019 | 2018 | 2019 | 2018 | ||||||||||||||

| (In thousands) | (In thousands) | ||||||||||||||||

| Cash flows from operating activities | |||||||||||||||||

| Net loss | $ | (205 | ) | $ | (60,969 | ) | $ | (4,597 | ) | $ | (66,073 | ) | |||||

| Depreciation and amortization | 4,381 | 9,853 | 9,146 | 20,647 | |||||||||||||

| Impairment loss (Note 8) | - | 8,191 | - | 8,191 | |||||||||||||

| Movement in allowance for doubtful accounts receivable | (429 | ) | 21,368 | 83 | 23,958 | ||||||||||||

| (Earnings) loss from equity-accounted investments (Note 7) | (506 | ) | 1,247 | (1,569 | ) | (126 | ) | ||||||||||

| Movement in allowance for doubtful loans | 620 | - | 620 | - | |||||||||||||

| Interest on Cedar Cellular note (Note 7) | - | (1,216 | ) | - | (1,372 | ) | |||||||||||

| Impairment of Cedar Cellular note (Note 7) | - | 2,732 | - | 2,732 | |||||||||||||

| Change in fair value of equity securities (Note 6 and 7) | - | 15,836 | - | 15,836 | |||||||||||||

| Fair value adjustment related to financial liabilities | 147 | 83 | 234 | 1 | |||||||||||||

| Interest payable | 526 | 131 | 1,158 | 241 | |||||||||||||

| Facility fee amortized | - | 68 | - | 155 | |||||||||||||

| Gain on disposal of FIHRST (Note 2) | (9,743 | ) | - | (9,743 | ) | - | |||||||||||

| Profit on disposal of property, plant and equipment | (49 | ) | (139 | ) | (203 | ) | (266 | ) | |||||||||

| Stock-based compensation charge (Note 14) | 436 | 598 | 823 | 1,185 | |||||||||||||

| Dividends received from equity accounted investments | 380 | 454 | 1,448 | 454 | |||||||||||||

| Decrease in accounts receivable, pre-funded social welfare grants receivable and finance loans receivable | 8,767 | 18,753 | 3,101 | 28,755 | |||||||||||||

| (Increase) Decrease in inventory | (682 | ) | (24 | ) | (12,995 | ) | 2,161 | ||||||||||

| Increase (Decrease) in accounts payable and other payables | 3,132 | (11,759 | ) | (264 | ) | (19,535 | ) | ||||||||||

| (Decrease) increase in taxes payable | (2,244 | ) | (7,007 | ) | (956 | ) | 1,347 | ||||||||||

| Decrease in deferred taxes | (117 | ) | (3,436 | ) | (205 | ) | (7,070 | ) | |||||||||

| Net cash provided by (used in) operating activities | 4,414 | (5,236 | ) | (13,919 | ) | 11,221 | |||||||||||

| Cash flows from investing activities | |||||||||||||||||

| Capital expenditures | (827 | ) | (2,547 | ) | (3,451 | ) | (5,665 | ) | |||||||||

| Proceeds from disposal of property, plant and equipment | 90 | 212 | 303 | 486 | |||||||||||||

| Proceeds from disposal of FIHRST (Note 2) | 10,895 | - | 10,895 | - | |||||||||||||

| Investment in equity-accounted investments (Note 7) | - | (2,500 | ) | (1,250 | ) | (2,500 | ) | ||||||||||

| Loan to equity-accounted investment (Note 7) | (612 | ) | - | (612 | ) | - | |||||||||||

| Repayment of loans by equity-accounted investments | - | - | 4,268 | - | |||||||||||||

| Acquisition of intangible assets | - | (1,384 | ) | - | (1,384 | ) | |||||||||||

| Investment in MobiKwik | - | (1,056 | ) | - | (1,056 | ) | |||||||||||

| Return on investment | - | - | - | 284 | |||||||||||||

| Net change in settlement assets | 3,371 | 2,031 | (10,138 | ) | 77,962 | ||||||||||||

| Net cash provided by (used in) investing activities | 12,917 | (5,244 | ) | 15 | 68,127 | ||||||||||||

| Cash flows from financing activities | |||||||||||||||||

| Proceeds from bank overdraft (Note 10) | 207,876 | 221,582 | 391,550 | 306,237 | |||||||||||||

| Repayment of bank overdraft (Note 10) | (193,725 | ) | (245,726 | ) | (378,554 | ) | (245,726 | ) | |||||||||

| Long-term borrowings utilized (Note 10) | - | 3,203 | 14,798 | 11,004 | |||||||||||||

| Repayment of long-term borrowings (Note 10) | (11,313 | ) | (13,551 | ) | (11,313 | ) | (23,811 | ) | |||||||||

| Guarantee fee | - | (258 | ) | (148 | ) | (394 | ) | ||||||||||

| Finance lease capital repayments | (26 | ) | - | (52 | ) | - | |||||||||||

| Dividends paid to non-controlling interest | - | (1,208 | ) | - | (2,937 | ) | |||||||||||

| Net change in settlement obligations | (3,371 | ) | (2,031 | ) | 10,138 | (77,962 | ) | ||||||||||

| Net cash (used in) provided by financing activities | (559 | ) | (37,989 | ) | 26,419 | (33,589 | ) | ||||||||||

| Effect of exchange rate changes on cash | 7,508 | (1,823 | ) | 1,053 | (2,772 | ) | |||||||||||

| Net increase (decrease) in cash and cash equivalents | 24,280 | (50,292 | ) | 13,568 | 42,987 | ||||||||||||

| Cash and cash equivalents - beginning of period | 110,799 | 183,333 | 121,511 | 90,054 | |||||||||||||

| Cash and cash equivalents - end of period(1) | $ | 135,079 | $ | 133,041 | $ | 135,079 | $ | 133,041 | |||||||||

| See Notes to Unaudited Condensed Consolidated Financial Statements | |||||||||||||||||

| (1) Cash, cash equivalents and restricted cash as of December 31, 2019, includes restricted cash of approximately $84.4 million related to cash withdrawn from the Company's various debt facilities to fund ATMs. This cash may only be used to fund ATMs and is considered restricted as to use and therefore is classified as restricted cash. Refer to Note 10 for additional information regarding the Company's facilities. | |||||||||||||||||

NET 1 UEPS TECHNOLOGIES, INC

Notes to the Unaudited Condensed Consolidated Financial Statements

For the three and six months ended December 31, 2019 and 2018

(All amounts in tables stated in thousands or thousands of U.S. dollars, unless otherwise stated)

1. Basis of Presentation and Summary of Significant Accounting Policies

In November 2019, the Company through its wholly owned subsidiary, Net1 Applied Technologies South Africa Proprietary Limited ("Net1 SA"), entered into an agreement with Transaction Capital Payment Solutions Proprietary Limited, or its nominee, a limited liability private company duly incorporated in the Republic of South Africa, pursuant to which Net1 SA agreed to sell its entire shareholding in Net1 FIHRST Holdings Proprietary Limited ("FIHRST") for $11.7 million (ZAR 172.2 million). The transaction closed in December 2019. FIHRST was deconsolidated following the closing of the transaction. Net1 SA was obliged to utilize the full purchase price received from the sale of FIHRST to partially settle its obligations under its lending arrangements and applied the proceeds received against its outstanding borrowings - refer to Note 10.

Unaudited Interim Financial Information

The accompanying unaudited condensed consolidated financial statements include all majority-owned subsidiaries over which the Company exercises control and have been prepared in accordance with U.S. generally accepted accounting principles ("GAAP") and the rules and regulations of the United States Securities and Exchange Commission for Quarterly Reports on Form 10-Q and include all of the information and disclosures required for interim financial reporting. The results of operations for the three and six months ended December 31, 2019 and 2018, are not necessarily indicative of the results for the full year. The Company believes that the disclosures are adequate to make the information presented not misleading.

These financial statements should be read in conjunction with the financial statements, accounting policies and financial notes thereto included in the Company's Annual Report on Form 10-K for the fiscal year ended June 30, 2019. In the opinion of management, the accompanying unaudited condensed consolidated financial statements reflect all adjustments (consisting only of normal recurring adjustments), which are necessary for a fair representation of financial results for the interim periods presented.

References to the "Company" refer to Net1 and its consolidated subsidiaries, collectively, unless the context otherwise requires. References to "Net1" are references solely to Net 1 UEPS Technologies, Inc.

Consideration of going concern

Accounting guidance requires the Company's management to assess whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company's ability to continue as a going concern within one year after its unaudited condensed consolidated financial statements are issued. The Company's management has identified certain conditions or events, which, considered in the aggregate, could raise substantial doubt about the Company's ability to continue as a going concern including the risk that the Company will be unable to:

- deliver all or a substantial part of the financial results forecast in its fiscal 2020 budget;

- retain its existing borrowings and facilities, as described in Note 10, or obtain additional borrowings and facilities on commercially reasonable terms;

- arrive at a commercial settlement with SASSA, given the September 30, 2019, Supreme Court of Appeal ruling regarding the repayment of the additional implementation costs received to SASSA (refer Note 11) and the ongoing dispute the Company has with SASSA over fees due for the six-month contract extension period in accordance with National Treasury's recommendation;

- dispose of all or a portion of its remaining 30% interest in DNI-4PL Contracts Proprietary Limited ("DNI"). DNI's operations are also significantly dependent on Cell C because it is the largest distributor of Cell C starter packs in South Africa. Therefore, the inability of Cell C to continue to operate through the next 12 months could also have an adverse impact on DNI's operations; or

- dispose of additional investments in order to realize sufficient cash flows.

The Company's management has implemented a number of plans to alleviate the substantial doubt about the Company's ability to continue as a going concern. These plans include disposing of its Korean business unit, KSNET, as announced in its press release of January 27, 2020, certain non-core assets (refer to Note 3 to the Company's audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended June 30, 2019, for additional information regarding a call option granted to DNI), and extending its existing borrowings used to fund its ATMs through September 2020. Provided the KSNET disposal closes, as expected, in March 2020, this is expected to remove the substantial doubt about the Company's ability to continue as a going concern.

In addition, the Company's management believes it has a number of mitigating actions it can pursue, including (i) limiting the expansion of its microlending finance loans receivable book in South Africa; (ii) implementing further cost cutting measures; (iii) commencing additional asset realizations; (iv) managing its capital expenditures; and (v) accessing alternative sources of capital (including through the issuance of additional shares of its common stock), in order to generate additional liquidity.

1. Basis of Presentation and Summary of Significant Accounting Policies (continued)

Consideration of going concern (continued)

The Company's management believes that these plans and mitigating actions alleviate the substantial doubt referred to above and therefore have concluded that the Company remains a going concern.

Recent accounting pronouncements adopted

In February 2016, the Financial Accounting Standards Board ("FASB") issued guidance regarding Leases. The guidance increases transparency and comparability among organizations by requiring the recognition of lease assets and lease liabilities on the balance sheet. The amendments to current lease guidance include the recognition of assets and liabilities by lessees for those leases currently classified as operating leases. The guidance also requires disclosures to meet the objective of enabling users of financial statements to assess the amount, timing, and uncertainty of cash flows arising from leases. This guidance was effective for the Company beginning July 1, 2019. Refer to Note 18 for the impact of the adoption of this guidance on our condensed consolidated financial statements.

Recent accounting pronouncements not yet adopted as of December 31, 2019

In June 2016, the FASB issued guidance regarding Measurement of Credit Losses on Financial Instruments. The guidance replaces the incurred loss impairment methodology in current GAAP with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. For trade and other receivables, loans, and other financial instruments, an entity is required to use a forward-looking expected loss model rather than the incurred loss model for recognizing credit losses, which reflects losses that are probable. Credit losses relating to available-for-sale debt securities will also be recorded through an allowance for credit losses rather than as a reduction in the amortized cost basis of the securities. This guidance is effective for the Company beginning July 1, 2020. Early adoption is permitted beginning July 1, 2019. The Company is currently assessing the impact of this guidance on its financial statements and related disclosures.

In August 2018, the FASB issued guidance regarding Disclosure Framework: Changes to the Disclosure Requirements for Fair Value Measurement. The guidance modifies the disclosure requirements related to fair value measurement. This guidance is effective for the Company beginning July 1, 2020. Early adoption is permitted. The Company is currently assessing the impact of this guidance on its financial statements disclosure.

2. Disposal of controlling interest in FIHRST and KSNET

December 2019 disposal of FIHRST

In November 2019, the Company through its wholly owned subsidiary, Net1 Applied Technologies South Africa Proprietary Limited ("Net1 SA"), entered into an agreement with Transaction Capital Payment Solutions Proprietary Limited, or its nominee, a limited liability private company duly incorporated in the Republic of South Africa, pursuant to which Net1 SA agreed to sell its entire shareholding in Net1 FIHRST Holdings Proprietary Limited ("FIHRST") for $11.7 million (ZAR 172.2 million). The transaction closed in December 2019. FIHRST was deconsolidated following the closing of the transaction. Net1 SA was obliged to utilize the full purchase price received from the sale of FIHRST to partially settle its obligations under its lending arrangements and applied the proceeds received against its outstanding borrowings - refer to Note 10.

2. Disposal of controlling interest in FIHRST and KSNET (continued)

December 2019 disposal of FIHRST (continued)

The table below presents the impact of the deconsolidation of FIHRST and the calculation of the net gain recognized on deconsolidation:

| Total | |||

| Fair value of consideration received | $ | 11,749 | |

| Less: carrying value of FIHRST, comprising | 1,870 | ||

| Cash and cash equivalents | 854 | ||

| Accounts receivable, net | 367 | ||

| Property, plant and equipment, net | 64 | ||

| Goodwill (Note 8) | 599 | ||

| Intangible assets, net | 30 | ||

| Deferred income taxes assets | 42 | ||

| Accounts payable | (7 | ) | |

| Other payables | (1,437 | ) | |

| Income taxes payable | (220 | ) | |

| Released from accumulated other comprehensive income - foreign currency translation reserve (Note 13) | 1,578 | ||

| Settlement assets | 17,406 | ||

| Settlement liabilities | (17,406 | ) | |

| Gain recognized on disposal, before tax | 9,879 | ||

| Taxes related to gain recognized on disposal, comprising: | - | ||

| Capital gains tax | 2,418 | ||

| Release of valuation allowance related to capital gains tax previously unutilized(1) | (2,418 | ) | |

| Transaction costs | 136 | ||

| Gain recognized on disposal, after tax | $ | 9,743 |

(1) Net1 SA recorded a valuation allowance related to capital losses previously generated but not utilized. A portion of these unutilized capital losses was utilized as a result of the disposal of FIHRST and, therefore, the equivalent portion of the valuation allowance created was released.

Pro forma results of operations related to the FIHRST disposal have not been presented because the effect of the disposal was not material to the Company.

Disposal of KSNET

On January 23, 2020, the Company, through its wholly owned subsidiary Net1 Applied Technologies Netherlands B.V. ("Net1 BV"), a limited liability private company duly incorporated in The Netherlands, entered into an agreement with PayletterHoldings LLC, a limited liability private company duly incorporated in the Republic of Korea, in terms of which Net1 BV agreed to sell its entire shareholding in Net1 Applied Technologies Korea Limited, a limited liability private company incorporated in the Republic of Korea and the sole shareholder of KSNET, Inc. for $237.2 million. The transaction is subject to customary closing conditions and is expected to close in March 2020. The transaction is not subject to a financing condition.

3. Accounts receivable, net and other receivables and finance loans receivable, net

Accounts receivable, net and other receivables

The Company's accounts receivable, net, and other receivables as of December 31, 2019, and June 30, 2019, is presented in the table below:

| December 31, | June 30, | ||||||||||

| 2019 | 2019 | ||||||||||

| Accounts receivable, trade, net | $ | 26,568 | $ | 25,136 | |||||||

| Accounts receivable, trade, gross | 27,312 | 26,377 | |||||||||

| Allowance for doubtful accounts receivable, end of period | 744 | 1,241 | |||||||||

| Beginning of period | 1,241 | 1,101 | |||||||||

| Reversed to statement of operations | (535 | ) | (24 | ) | |||||||

| Charged to statement of operations | 108 | 3,296 | |||||||||

| Utilized | (58 | ) | (3,059 | ) | |||||||

| Deconsolidated | - | (38 | ) | ||||||||

| Foreign currency adjustment | (12 | ) | (35 | ) | |||||||

| Current portion of cash payments to agents in South Korea that are amortized over the contract period | 11,927 | 15,543 | |||||||||

| Cash payments to agents in South Korea that are amortized over the contract period | 18,457 | 25,107 | |||||||||

| Less: cash payments to agents in South Korea that are amortized over the contract period included in other long-term assets (Note 7) | 6,530 | 9,564 | |||||||||

| Loans provided to Carbon | 3,000 | 3,000 | |||||||||

| Loan provided to DNI | - | 4,260 | |||||||||

| Other receivables | 27,070 | 24,555 | |||||||||

| Total accounts receivable, net | $ | 68,565 | $ | 72,494 | |||||||

The loan provided to DNI was repaid in full in July 2019. Other receivables include prepayments, deposits and other receivables.

Finance loans receivable, net

The Company's finance loans receivable, net, as of December 31, 2019, and June 30, 2019, is presented in the table below:

| December 31, | June 30, | ||||||||||

| 2019 | 2019 | ||||||||||

| Microlending finance loans receivable, net | $ | 14,504 | $ | 20,981 | |||||||

| Microlending finance loans receivable, gross | 17,091 | 24,180 | |||||||||

| Allowance for doubtful finance loans receivable, end of period | 2,587 | 3,199 | |||||||||

| Beginning of period | 3,199 | 4,239 | |||||||||

| Reversed to statement of operations | (601 | ) | - | ||||||||

| Charged to statement of operations | 1,081 | 28,802 | |||||||||

| Utilized | (1,085 | ) | (29,721 | ) | |||||||

| Foreign currency adjustment | (7 | ) | (121 | ) | |||||||

| Working capital finance loans receivable, gross | 14,613 | 9,650 | |||||||||

| Working capital finance loans receivable, gross | 20,736 | 15,742 | |||||||||

| Allowance for doubtful finance loans receivable, end of period | 6,123 | 6,092 | |||||||||

| Beginning of period | 6,092 | 12,164 | |||||||||

| Charged to statement of operations | 30 | 712 | |||||||||

| Utilized | - | (6,777 | ) | ||||||||

| Foreign currency adjustment | 1 | (7 | ) | ||||||||

| Total accounts receivable, net | $ | 29,117 | $ | 30,631 | |||||||

4. Inventory

The Company's inventory comprised the following categories as of December 31, 2019, and June 30, 2019.

| December 31, | June 30, | ||||||

| 2019 | 2019 | ||||||

| Finished goods | $ | 7,538 | $ | 7,535 | |||

| Finished goods subject to sale restrictions | 13,658 | - | |||||

| $ | 21,196 | $ | 7,535 | ||||

Finished goods subject to sale restrictions represent airtime inventory purchased and held for sale to customers that may only be sold by the Company after March 31, 2020, and only with the express permission of certain South African banks. As discussed in Note 10, the Company obtained additional borrowings from its existing bankers to purchase Cell C airtime from an independent distributor of Cell C airtime. The Company did not pay the vendor for the airtime inventory directly because the parties (the vendor, Cell C, the Company and certain South African banks) agreed that the Company would pay the amount to Cell C to settle amounts payable to Cell C by the vendor in order to inject additional liquidity into Cell C. The Company may not return any unsold airtime inventory to either the vendor or Cell C. The Company agreed to mandatory prepayment terms, which require the Company to use the proceeds from the sale of the airtime inventory to settle certain borrowings. For more information about the amended finance documents, refer to Note 10.

5. Settlement assets and settlement obligations

Settlement assets comprise (1) cash received from the South African government that the Company holds pending disbursement to recipient cardholders of social welfare grants (2) cash received from credit card companies (as well as other types of payment services) which have business relationships with merchants selling goods and services via the internet that are the Company's customers and on whose behalf it processes the transactions between various parties, and (3) cash received from customers on whose behalf the Company processes payroll payments that the Company will disburse to customer employees, payroll-related payees and other payees designated by the customer.

Settlement obligations comprise (1) amounts that the Company is obligated to disburse to recipient cardholders of social welfare grants, (2) amounts that the Company is obligated to disburse to merchants selling goods and services via the internet that are the Company's customers and on whose behalf it processes the transactions between various parties and settles the funds from the credit card companies to the Company's merchant customers, and (3) amounts that the Company is obligated to pay to customer employees, payroll-related payees and other payees designated by the customer.

The balances at each reporting date may vary widely depending on the timing of the receipts and payments of these assets and obligations.

6. Fair value of financial instruments

Initial recognition and measurement

Financial instruments are recognized when the Company becomes a party to the transaction. Initial measurements are at cost, which includes transaction costs.

Risk management

The Company manages its exposure to currency exchange, translation, interest rate, customer concentration, credit and equity price and liquidity risks as discussed below.

Currency exchange risk

The Company is subject to currency exchange risk because it purchases inventories that it is required to settle in other currencies, primarily the euro and U.S. dollar. The Company has used forward contracts in order to limit its exposure in these transactions to fluctuations in exchange rates between the South African rand ("ZAR"), on the one hand, and the U.S. dollar and the euro, on the other hand.

6. Fair value of financial instruments (continued)

Risk management (continued)

Translation risk

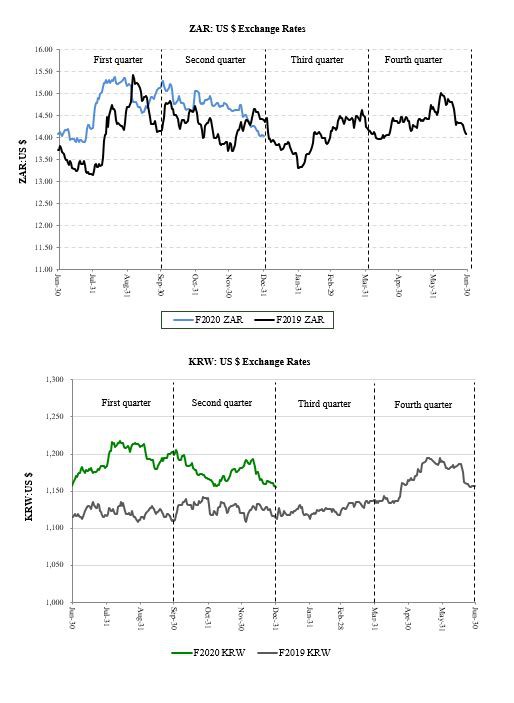

Translation risk relates to the risk that the Company's results of operations will vary significantly as the U.S. dollar is its reporting currency, but it earns a significant amount of its revenues and incurs a significant amount of its expenses in ZAR and Korean won ("KRW"). The U.S. dollar to both the ZAR and KRW exchange rates has fluctuated significantly over the past three years. As exchange rates are outside the Company's control, there can be no assurance that future fluctuations will not adversely affect the Company's results of operations and financial condition.

Interest rate risk

As a result of its normal borrowing and lending activities, the Company's operating results are exposed to fluctuations in interest rates, which it manages primarily through regular financing activities. The Company generally maintains limited investments in cash equivalents and held to maturity investments and has occasionally invested in marketable securities.

Credit risk

Credit risk relates to the risk of loss that the Company would incur as a result of non-performance by counterparties. The Company maintains credit risk policies with regard to its counterparties to minimize overall credit risk. These policies include an evaluation of a potential counterparty's financial condition, credit rating, and other credit criteria and risk mitigation tools as the Company's management deems appropriate. With respect to credit risk on financial instruments, the Company maintains a policy of entering into such transactions only with South African, South Korean and European financial institutions that have a credit rating of "B" (or its equivalent) or better, as determined by credit rating agencies such as Standard & Poor's, Moody's and Fitch Ratings.

Microlending credit risk

The Company is exposed to credit risk in its microlending activities, which provide unsecured short-term loans to qualifying customers. The Company manages this risk by performing an affordability test for each prospective customer and assigning a "creditworthiness score", which takes into account a variety of factors such as other debts and total expenditures on normal household and lifestyle expenses.

Equity price and liquidity risk

Equity price risk relates to the risk of loss that the Company would incur as a result of the volatility in the exchange-traded price of equity securities that it holds and the risk that it may not be able to liquidate these securities. The market price of these securities may fluctuate for a variety of reasons and, consequently, the amount that the Company may obtain in a subsequent sale of these securities may significantly differ from the reported market value.

Liquidity risk relates to the risk of loss that the Company would incur as a result of the lack of liquidity on the exchange on which these securities are listed. The Company may not be able to sell some or all of these securities at one time, or over an extended period of time without influencing the exchange traded price, or at all.

Financial instruments

The following section describes the valuation methodologies the Company uses to measure its significant financial assets and liabilities at fair value.

In general, and where applicable, the Company uses quoted prices in active markets for identical assets or liabilities to determine fair value. This pricing methodology would apply to Level 1 investments. If quoted prices in active markets for identical assets or liabilities are not available to determine fair value, then the Company uses quoted prices for similar assets and liabilities or inputs other than the quoted prices that are observable either directly or indirectly. These investments would be included in Level 2 investments. In circumstances in which inputs are generally unobservable, values typically reflect management's estimates of assumptions that market participants would use in pricing the asset or liability. The fair values are therefore determined using model-based techniques that include option pricing models, discounted cash flow models, and similar techniques. Investments valued using such techniques are included in Level 3 investments.

6. Fair value of financial instruments (continued)

Financial instruments (continued)

Asset measured at fair value using significant unobservable inputs - investment in Cell C

The Company's Level 3 asset represents an investment of 75,000,000 class "A" shares in Cell C, a significant mobile telecoms provider in South Africa. The Company used a discounted cash flow model developed by the Company to determine the fair value of its investment in Cell C as of June 30, 2019, and valued Cell C at $0.0 (zero) at December 31, 2019, and June 30, 2019. As of June 30, 2019, the Company changed its valuation methodology from a Company-developed adjusted EV/ EBITDA model to a discounted cash flow approach due to anticipated changes in Cell C's business model and the current challenges faced by Cell C, which would not have been captured by the previous valuation approach. The Company believes the Cell C business plan utilized in the Company's valuation is reasonable based on the current performance and the expected changes in Cell C's business model.

The Company utilized the latest business plan provided by Cell C management for the period ending December 31, 2024, and the following key valuation inputs were used as of December 31, 2019 and June 30, 2019:

|

Weighted Average Cost of Capital: |

Between 15% and 20% over the period of the forecast |

|

Long term growth rate: |

3 % (4,5% as of June 30, 2019) |

|

Marketability discount: |

10% |

|

Minority discount: |

15% |

|

Net adjusted external debt - December 31, 2019:(1) |

ZAR 16,4 billion ($1,2 billion), includes R6 billion of lease liabilities |

|

Net adjusted external debt - June 30, 2019:(2) |

ZAR 13,9 billion ($1 billion), includes R6,4 billion of lease liabilities |

|

Deferred tax (incl, assessed tax losses) - December 31, 2019:(1) |

ZAR 2,9 billion ($206,4 million) |

|

Deferred tax (incl, assessed tax losses) - June 30, 2019:(2) |

ZAR 2,9 billion ($205,9 million) |

|

(1) translated from ZAR to U.S. dollars at exchange rates applicable as of December 31, 2019. |

|

|

(2) translated from ZAR to U.S. dollars at exchange rates applicable as of June 30, 2019. |

|

The Company utilized the aforementioned adjusted EV/EBITDA multiple valuation model in order to determine the fair value of the Cell C shares as of December 31, 2018. The primary inputs to the valuation model as of December 31, 2018, were unchanged from June 30, 2018, except for the EBITDA multiple. The primary inputs to the valuation model were Cell C's annualized adjusted EBITDA for the 11 months ended June 30, 2018, of ZAR 3.9 billion ($270.9 million, translated at exchange rates applicable as of December 31, 2018), an EBITDA multiple of 6.32; Cell C's net external debt of ZAR 8.8 billion ($611.4 million, translated at exchange rates applicable as of December 31, 2018); and a marketability discount of 10% as Cell C is not listed. The EBITDA multiple was determined based on an analysis of Cell C's peer group, which comprises eight African and emerging market mobile telecommunications operators. The fair value of Cell C utilizing the adjusted EV/EBITDA valuation model developed by the Company is sensitive to the following inputs: (i) the Company's determination of adjusted EBITDA; (ii) the EBITDA multiple used; and (iii) the marketability discount used. Utilization of different inputs, or changes to these inputs, may result in significantly higher or lower fair value measurement.

The following table presents the impact on the carrying value of the Company's Cell C investment of a 2.0% increase and 2.0% decrease in the WACC rate and the EBITDA margins used in the Cell C valuation on December 31, 2019, all amounts translated at exchange rates applicable as of December 31, 2019:

| Sensitivity for fair value of Cell C investment | 2.0% increase(A) | 2.0% decrease(A) | ||||

| WACC rate | $ | - | $ | 8,238 | ||

| EBITDA margin | $ | 1,687 | $ | - |

(A) the carrying value of the Cell C investment is not impacted by a 1.0% increase or a 1.0% decrease and therefore the impact of a 2.0% increase and a 2.0% decrease is presented.

The fair value of the Cell C shares as of December 31, 2019, represented approximately 0% of the Company's total assets, including these shares. The Company expects to hold these shares for an extended period of time and that there will be short-term equity price volatility with respect to these shares particularly given the current situation of Cell C's business.

Liability measured at fair value using significant unobservable inputs - DNI contingent consideration

The salient terms of the Company's investment in DNI are described in Note 3 to the Company's audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended June 30, 2019. Under the terms of its subscription agreements with DNI, the Company agreed to pay to DNI an additional amount of up to ZAR 400.0 million ($27.8 million, translated at exchange rates applicable as of December 31, 2018), in cash, subject to the achievement of certain performance targets by DNI.

6. Fair value of financial instruments (continued)

Financial instruments (continued)

Liability measured at fair value using significant unobservable inputs - DNI contingent consideration

The Company expected to pay the additional amount during the first quarter of the year ended June 30, 2020, and recorded an amount of ZAR 385.7 million ($26.8 million) and ZAR 373.6 million ($27.2 million), in other payables in its unaudited condensed consolidated balance sheet as of December 31, 2018, and in long-term liabilities as of June 30, 2018, respectively, which amount represents the present value of the ZAR 400.0 million to be paid (amounts translated at exchange rates applicable as of December 31, 2018, and June 30, 2018, respectively). The amount was settled on March 31, 2019, as described in Note 3 to the Company's audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended June 30, 2019.

Derivative transactions - Foreign exchange contracts

As part of the Company's risk management strategy, the Company enters into derivative transactions to mitigate exposures to foreign currencies using foreign exchange contracts. These foreign exchange contracts are over-the-counter derivative transactions. Substantially all of the Company's derivative exposures are with counterparties that have long-term credit ratings of "B" (or equivalent) or better. The Company uses quoted prices in active markets for similar assets and liabilities to determine fair value (Level 2). The Company has no derivatives that require fair value measurement under Level 1 or 3 of the fair value hierarchy. The Company had no outstanding foreign exchange contracts as of December 31, 2019, or June 30, 2019.

The following table presents the Company's assets and liabilities measured at fair value on a recurring basis as of December 31, 2019, according to the fair value hierarchy:

| Quoted Price in Active Markets for Identical Assets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | ||||||||||||

| Assets | |||||||||||||||

| Investment in Cell C | $ | - | $ | - | $ | - | $ | - | |||||||

| Related to insurance business: | |||||||||||||||

| Cash, cash equivalents and restricted cash (included in other long term assets) | 587 | - | - | 587 | |||||||||||

| Fixed maturity investments (included in cash and cash equivalents) | 2,845 | - | - | 2,845 | |||||||||||

| Other | - | 414 | - | 414 | |||||||||||

| Total assets at fair value | $ | 3,432 | $ | 414 | $ | - | $ | 3,846 |

The following table presents the Company's assets and liabilities measured at fair value on a recurring basis as of June 30, 2019, according to the fair value hierarchy:

| Quoted Price in Active Markets for Identical Assets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | ||||||||||||

| Assets | |||||||||||||||

| Investment in Cell C | $ | - | $ | - | $ | - | $ | - | |||||||

| Related to insurance business | |||||||||||||||

| Cash and cash equivalents (included in other long-term assets) | 619 | - | - | 619 | |||||||||||

| Fixed maturity investments (included in cash and cash equivalents) | 5,201 | - | - | 5,201 | |||||||||||

| Other | - | 413 | - | 413 | |||||||||||

| Total assets at fair value | $ | 5,820 | $ | 413 | $ | - | $ | 6,233 |

6. Fair value of financial instruments (continued)

There have been no transfers in or out of Level 3 during the three and six months ended December 31, 2019 and 2018, respectively.

There was no movement in the carrying value of assets measured at fair value on a recurring basis, and categorized within Level 3, during the three and six months ended December 31, 2019. Summarized below is the movement in the carrying value of assets and liabilities measured at fair value on a recurring basis, and categorized within Level 3, during the six months ended December 31, 2019:

| Carrying value | |||||

| Assets | |||||

| Balance as of June 30, 2019 | - | ||||

| Foreign currency adjustment(1) | - | ||||

| Balance as of December 31, 2019 | $ | - | |||

(1) The foreign currency adjustment represents the effects of the fluctuations of the South African rand and the U.S. dollar on the carrying value.

Summarized below is the movement in the carrying value of assets and liabilities measured at fair value on a recurring basis, and categorized within Level 3, during the six months ended December 31, 2018:

| Carrying value | |||||

| Assets | |||||

| Balance as at June 30, 2018 | 172,948 | ||||

| Realized losses | (15,836 | ) | |||

| Foreign currency adjustment(1) | (8,054 | ) | |||

| Balance as of December 31, 2018 | 149,058 | ||||

| Liabilities | |||||

| Balance as at June 30, 2018 | 27,222 | ||||

| Accretion of interest | 835 | ||||

| Foreign currency adjustment(1) | (1,267 | ) | |||

| Balance as of December 31, 2018 | 26,790 | ||||

(1) The foreign currency adjustment represents the effects of the fluctuations of the South African rand and the U.S. dollar on the carrying value.

Assets measured at fair value on a nonrecurring basis

We measure equity investments without readily determinable fair values on a nonrecurring basis. The fair values of these investments are determined based on valuation techniques using the best information available, and may include quoted market prices, market comparables, and discounted cash flow projections.

7. Equity-accounted investments and other long term assets

Refer to Note 9 to the Company's audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended June 30, 2019, for additional information regarding its equity-accounted investments and other long-term assets.

Equity-accounted investments

The Company's ownership percentage in its equity-accounted investments as of December 31, 2019 and June 30, 2019, was as follows:

|

|

December 31, |

June 30, |

|

||

|

|

|

2019 |

|

2019 |

|

|

Bank Frick & Co AG ("Bank Frick") |

|

35% |

|

35% |

|

|

DNI |

|

30% |

|

30% |

|

|

Finbond Group Limited ("Finbond") |

|

29% |

|

29% |

|

|

Carbon Tech Limited ("Carbon"), formerly OneFi Limited |

|

25% |

|

25% |

|

|

Revix ("Revix") |

|

25% |

|

- |

|

|

SmartSwitch Namibia (Pty) Ltd ("SmartSwitch Namibia") |

|

50% |

|

50% |

|

|

V2 Limited ("V2") |

|

50% |

|

50% |

|

|

Walletdoc Proprietary Limited ("Walletdoc") |

|

20% |

|

20% |

|

7. Equity-accounted investments and other long term assets (continued)

Equity-accounted investments (continued)

DNI

During the three and six months ended December 31, 2019, the Company recorded earnings from DNI that resulted in the carrying value of DNI exceeding the amount that the Company could receive pursuant to the call option granted to DNI in May 2019. During the three and six months ended December 31, 2019, the Company has recorded an impairment loss of $0.8 million and $1.1 million, respectively, which represents the difference between the amount that the Company could receive pursuant to the call option and DNI's carrying value.

Bank Frick

On October 2, 2019, the Company exercised its option to acquire an additional 35% interest in Bank Frick from the Frick Family Foundation. The Company will pay an amount, the "Option Price Consideration", for the additional 35% interest in Bank Frick, which represents the higher of CHF 46.4 million ($46.5 million at exchange rates on October 2, 2019) or 35% of 15 times the average annual normalized net income of the Bank over the two years ended December 31, 2018. The shares will only transfer on payment of the Option Price Consideration, which shall occur on the later of (i) 180 days after the date of exercise of the option; (ii) in the event of any regulatory approvals being required, 10 days after receipt of approval (either unconditionally or on terms acceptable to both parties); and (iii) 10 days after the date on which the Option Price Consideration is agreed or finally determined.

Finbond

As of December 31, 2019, the Company owned 268,820,933 shares in Finbond representing approximately 29.1% of its issued and outstanding ordinary shares. Finbond is listed on the Johannesburg Stock Exchange and its closing price on December 31, 2019, the last trading day of the month, was ZAR 3.50 per share. The market value of the Company's holding in Finbond on December 31, 2019, was ZAR 0.9 billion ($67.0 million translated at exchange rates applicable as of December 31, 2019). On August 2, 2019, the Company, pursuant to its election, received an additional 1,148,901 shares in Finbond as a capitalization share issue in lieu of a dividend.

V2 Limited

In August 2019, the Company made a further equity contribution of $1.3 million to V2 Limited ("V2") and in January 2020 it made its final committed equity contribution of $1.3 million bringing the total equity contribution to $5.0 million. The Company has also committed to provide V2 with a working capital facility of $5.0 million, which is subject to the achievement of certain pre-defined objectives.

7. Equity-accounted investments and other long term assets (continued)

Equity-accounted investments (continued)

| DNI | Bank Frick | Finbond | Other(1) | Total | ||||||||||||||||||

| Investment in equity | ||||||||||||||||||||||

| Balance as of June 30, 2019 | $ | 61,030 | $ | 47,240 | $ | 35,300 | $ | 7,398 | $ | 150,968 | ||||||||||||

| Acquisition of shares | - | - | 274 | 1,250 | 1,524 | |||||||||||||||||

| Stock-based compensation | - | - | 71 | - | 71 | |||||||||||||||||

| Comprehensive income (loss): | 1,108 | 469 | 2,718 | (499 | ) | 3,796 | ||||||||||||||||

| Other comprehensive loss | - | - | 2,227 | - | 2,227 | |||||||||||||||||

| Equity accounted earnings (loss) | 1,108 | 469 | 491 | (499 | ) | 1,569 | ||||||||||||||||

| Share of net income | 3,113 | 755 | 491 | (499 | ) | 3,860 | ||||||||||||||||

| Amortization of acquired intangible assets | (1,292 | ) | (376 | ) | - | - | (1,668 | ) | ||||||||||||||

| Deferred taxes on acquired intangible assets | 361 | 90 | - | - | 451 | |||||||||||||||||

| Impairment | (1,074 | ) | - | - | - | (1,074 | ) | |||||||||||||||

| Dividends received | (1,110 | ) | - | (274 | ) | (338 | ) | (1,722 | ) | |||||||||||||

| Foreign currency adjustment(2) | 137 | 453 | 300 | (48 | ) | 842 | ||||||||||||||||

| Balance as of December 31, 2019 | $ | 61,165 | $ | 48,162 | $ | 38,389 | $ | 7,763 | $ | 155,479 | ||||||||||||

| Investment in loans: | ||||||||||||||||||||||

| Balance as of June 30, 2019 | $ | - | $ | - | $ | - | $ | 148 | $ | 148 | ||||||||||||

| Loans granted | - | - | - | 612 | 612 | |||||||||||||||||

| Allowance for doubtful loans | - | - | - | (620 | ) | (620 | ) | |||||||||||||||

| Foreign currency adjustment(2) | - | - | - | 8 | 8 | |||||||||||||||||

| Balance as of December 31, 2019 | $ | - | $ | - | $ | - | $ | 148 | $ | 148 | ||||||||||||

| Equity | Loans | Total | ||||||||||||||||||||

| Carrying amount as of : | ||||||||||||||||||||||

| June 30, 2019 | $ | 150,968 | $ | 148 | $ | 151,116 | ||||||||||||||||

| December 31, 2019 | $ | 155,479 | $ | 148 | 155,627 | |||||||||||||||||

| (1) Includes primarily Carbon, SmartSwitch Namibia, V2 and Walletdoc; | ||||||||||||||||||||||

| (2) The foreign currency adjustment represents the effects of the fluctuations of the South African rand, Swiss franc, Nigerian naira and Namibian dollar, and the U.S. dollar on the carrying value. | ||||||||||||||||||||||

Other long-term assets

Summarized below is the breakdown of other long-term assets as of December 31, 2019, and June 30, 2019:

| December 31, | June 30, | ||||||||

| 2019 | 2019 | ||||||||

| Total equity investments | $ | 26,993 | $ | 26,993 | |||||

| Investment in 15% of Cell C, at fair value (Note 6) | - | - | |||||||

| Investment in 13% of MobiKwik | 26,993 | 26,993 | |||||||

| Total held to maturity investments | - | - | |||||||

| Investment in 7.625% of Cedar Cellular Investment 1 (RF) (Pty) Ltd 8.625% notes | - | - | |||||||

| Long-term portion of payments to agents in South Korea amortized over the contract period (Note 3) | 6,530 | 9,564 | |||||||

| Policy holder assets under investment contracts (Note 9) | 587 | 619 | |||||||

| Reinsurance assets under insurance contracts (Note 9) | 1,159 | 1,163 | |||||||

| Other long-term assets | 5,875 | 5,850 | |||||||

| Total other long-term assets | $ | 41,144 | $ | 44,189 | |||||

7. Equity-accounted investments and other long term assets (continued)

Other long-term assets (continued)

Summarized below are the components of the Company's equity securities without readily determinable fair value and held to maturity investments as of December 31, 2019:

| Cost basis | Unrealized holding | Unrealized holding | Carrying | |||||||||||||||

| gains | losses | value | ||||||||||||||||

| Equity securities: | ||||||||||||||||||

| Investment in Mobikwik | $ | 26,993 | $ | - | $ | - | $ | 26,993 | ||||||||||

| Held to maturity: | ||||||||||||||||||

| Investment in Cedar Cellular notes | - | - | - | - | ||||||||||||||

| Total | $ | 26,993 | $ | - | $ | - | $ | 26,993 | ||||||||||

Summarized below are the components of the Company's equity securities without readily determinable fair value and held to maturity investments as of June 30, 2019:

| Cost basis | Unrealized holding | Unrealized holding | Carrying | |||||||||||||||

| gains | losses | value | ||||||||||||||||

| Equity securities: | ||||||||||||||||||

| Investment in MobiKwik | $ | 26,993 | $ | - | $ | - | $ | - | ||||||||||

| Held to maturity: | ||||||||||||||||||

| Investment in Cedar Cellular notes | - | - | - | - | ||||||||||||||

| Total | $ | 26,993 | $ | - | $ | - | $ | - | ||||||||||

No interest income from the Cedar Cellular note was recorded during the three and six months ended December 31, 2019. The Company recognized interest income of $1.2 million and $1.4 million, related to the Cedar Cellular notes during the three and six months ended December 31, 2018, respectively. Interest on this investment will only be paid, at Cedar Cellular's election, on maturity in August 2022. The Company's effective interest rate on the Cedar Cellular note was 24.82% as of December 31, 2018.

As of December 31, 2018, the Company did not expect to recover the entire amortized cost basis of the Cedar Cellular notes due to a reduction in the amount of future cash flows expected to be collected from the debt security. The Company did not expect to generate any cash flows from the debt security prior to the maturity date in August 2022, and expected to recover approximately $22.0 million at maturity. As of December 31, 2018, the Company calculated the present value of the expected cash flows to be collected from the debt security by discounting the cash flows at the interest rate implicit in the security upon acquisition (at a rate of 24.82%). The present value of the expected cash flows of $9.0 million was less than the amortized cost basis recorded of $11.8 million (before the impairment) as of December 31, 2018. Accordingly, the Company recorded an other-than-temporary impairment related to a credit loss of $2.7 million during the three and six months ended December 31, 2018.

Contractual maturities of held to maturity investments

Summarized below is the contractual maturity of the Company's held to maturity investment as of December 31, 2019:

| Cost basis | Estimated fair value(1) | ||||||

| Due in one year or less | $ | - | $ | - | |||

| Due in one year through five years (2) | - | - | |||||

| Due in five years through ten years | - | - | |||||

| Due after ten years | - | - |

(1) The estimated fair value of the Cedar Cellular note has been calculated utilizing the Company's portion of the security provided to the Company by Cedar Cellular, namely, Cedar Cellular's investment in Cell C.

(2) The cost basis is zero ($0.0 million).

8. Goodwill and intangible assets, net

Goodwill

Impairment loss

The Company assesses the carrying value of goodwill for impairment annually, or more frequently, whenever events occur and circumstances change indicating potential impairment. The Company performs its annual impairment test as of June 30 of each year. During the three and six months ended December 31, 2018, the Company recognized an impairment loss of approximately $8.2 million, of which approximately $7.0 million related to goodwill allocated to its International Payment Group ("IPG") business within its international transaction processing operating segment and $1.2 million related to goodwill within its South African transaction processing operating segment.

Given the consolidation and restructuring of IPG during the period up to December 31, 2018, several business lines were terminated or meaningfully reduced, resulting in lower than expected revenues, profits and cash flows. IPG's new business initiatives are still in their infancy, and it is expected to generate lower cash flows than initially forecast. In order to determine the amount of goodwill impairment, the estimated fair value of the Company's IPG business assets and liabilities were compared to the carrying value of IPG's assets and liabilities. The Company used a discounted cash flow model in order to determine the fair value of IPG. The allocation of the fair value of IPG required the Company to make a number of assumptions and estimates about the fair value of assets and liabilities where the fair values were not readily available or observable. Based on this analysis, the Company determined that the carrying value of IPG's assets and liabilities exceeded their fair value at the reporting date.

In the event that there is a deterioration in the South African transaction processing and the international transaction processing operating segments, or in any other of the Company's businesses, this may lead to additional impairments in future periods.

Summarized below is the movement in the carrying value of goodwill for the six months ended December 31, 2019:

| Gross value | Accumulated impairment | Carrying value | ||||||||||||

| Balance as of June 30, 2019 | $ | 184,544 | $ | (35,157 | ) | $ | 149,387 | |||||||

| Disposal of FIHRST (Note 2) | (599 | ) | - | (599 | ) | |||||||||

| Foreign currency adjustment (1) | 122 | 28 | 150 | |||||||||||

| Balance as of December 31, 2019 | $ | 184,067 | $ | (35,129 | ) | $ | 148,938 | |||||||

| (1) - The foreign currency adjustment represents the effects of the fluctuations between the South African rand, the Euro and the Korean won, and the U.S. dollar on the carrying value. | ||||||||||||||

Goodwill has been allocated to the Company's reportable segments as follows:

| South African transaction processing | International transaction processing | Financial inclusion and applied technologies | Carrying value | |||||||||||||||

| Balance as of June 30, 2019 | $ | 19,208 | $ | 112,728 | $ | 17,451 | $ | 149,387 | ||||||||||

| Disposal of FIHRST (Note 2) | (599 | ) | - | - | (599 | ) | ||||||||||||

| Foreign currency adjustment (1) | 23 | 83 | 44 | 150 | ||||||||||||||

| Balance as of December 31, 2019 | $ | 18,632 | $ | 112,811 | $ | 17,495 | $ | 148,938 | ||||||||||

| (1) - The foreign currency adjustment represents the effects of the fluctuations between the South African rand, the Euro and the Korean won, and the U.S. dollar on the carrying value. | ||||||||||||||||||

8. Goodwill and intangible assets, net (continued)

Intangible assets

Carrying value and amortization of intangible assets

Summarized below is the carrying value and accumulated amortization of the intangible assets as of December 31, 2019 and June 30, 2019:

| As of December 31, 2019 | As of June 30, 2019 | ||||||||||||||||||||||||

| Gross carrying value | Accumulated amortization | Net carrying value | Gross carrying value | Accumulated amortization | Net carrying value | ||||||||||||||||||||

| Finite-lived intangible assets: | |||||||||||||||||||||||||

| Customer relationships | $ | 95,792 | $ | (89,273 | ) | $ | 6,519 | $ | 96,653 | $ | (86,285 | ) | $ | 10,368 | |||||||||||

| Software and unpatented | |||||||||||||||||||||||||

| technology | 28,883 | (28,598 | ) | 285 | 32,071 | (31,829 | ) | 242 | |||||||||||||||||

| FTS patent | 2,727 | (2,727 | ) | - | 2,721 | (2,721 | ) | - | |||||||||||||||||

| Trademarks | 6,784 | (6,307 | ) | 477 | 6,772 | (6,265 | ) | 507 | |||||||||||||||||

| Total finite-lived intangible assets | 134,186 | (126,905 | ) | 7,281 | 138,217 | (127,100 | ) | 11,117 | |||||||||||||||||

| Infinite-lived intangible assets: | |||||||||||||||||||||||||

| Financial institution licenses | 762 | - | 762 | 772 | - | 772 | |||||||||||||||||||

| Total infinite-lived intangible assets | 762 | - | 762 | 772 | - | 772 | |||||||||||||||||||

| Total intangible assets | $ | 134,948 | $ | (126,905 | ) | $ | 8,043 | $ | 138,989 | $ | (127,100 | ) | $ | 11,889 | |||||||||||

Aggregate amortization expense on the finite-lived intangible assets for the three months ended December 31, 2019 and 2018, was approximately $1.9 million and $6.1 million, respectively. Aggregate amortization expense on the finite-lived intangible assets for the six months ended December 31, 2019 and 2018, was approximately $3.8 million and $12.2 million, respectively.

Carrying value and amortization of intangible assets (continued)

Future estimated annual amortization expense for the next five fiscal years and thereafter, assuming exchange rates that prevailed on December 31, 2019, is presented in the table below. Actual amortization expense in future periods could differ from this estimate as a result of acquisitions, changes in useful lives, exchange rate fluctuations and other relevant factors.

| Fiscal 2020 | $ | 7,919 | |||||||||||||||||||

| Fiscal 2021 | 2,807 | ||||||||||||||||||||

| Fiscal 2022 | 73 | ||||||||||||||||||||

| Fiscal 2023 | 73 | ||||||||||||||||||||

| Fiscal 2024 | 72 | ||||||||||||||||||||

| Thereafter | 145 | ||||||||||||||||||||

| Total future estimated annual amortization expense | $ | 11,089 | |||||||||||||||||||

9. Assets and policyholder liabilities under insurance and investment contracts

Reinsurance assets and policyholder liabilities under insurance contracts

Summarized below is the movement in reinsurance assets and policyholder liabilities under insurance contracts during the six months ended December 31, 2019:

| Reinsurance Assets (1) | Insurance contracts (2) | ||||||||

| Balance as of June 30, 2019 | $ | 1,163 | $ | (1,880 | ) | ||||

| Increase in policy holder benefits under insurance contracts | 220 | (3,232 | ) | ||||||

| Claims and policyholders' benefits under insurance contracts | (227 | ) | 3,201 | ||||||

| Foreign currency adjustment (3) | 3 | (5 | ) | ||||||

| Balance as of December 31, 2019 | $ | 1,159 | $ | (1,916 | ) | ||||

|

|

|

(1) Included in other long-term assets. |

|

|||||||

|

|

|

(2) Included in other long-term liabilities. |

|

|||||||

|

|

|

(3) Represents the effects of the fluctuations between the ZAR and the U.S. dollar. |

|

|||||||

The Company has agreements with reinsurance companies in order to limit its losses from large insurance contracts, however, if the reinsurer is unable to meet its obligations, the Company retains the liability. The value of insurance contract liabilities is based on the best estimate assumptions of future experience plus prescribed margins, as required in the markets in which these products are offered, namely South Africa. The process of deriving the best estimates assumptions plus prescribed margins includes assumptions related to claim reporting delays (based on average industry experience).

Assets and policyholder liabilities under investment contracts

Summarized below is the movement in assets and policyholder liabilities under investment contracts during the six months ended December 31, 2019:

| Assets (1) | Investment contracts (2) | ||||||||

| Balance as of June 30, 2019 | $ | 619 | $ | (619 | ) | ||||

| Increase in policy holder benefits under investment contracts | 2 | (2 | ) | ||||||

| Claims and policyholders' benefits under investment contracts | (36 | ) | 36 | ||||||

| Foreign currency adjustment (3) | 2 | (2 | ) | ||||||

| Balance as of December 31, 2019 | $ | 587 | $ | (587 | ) | ||||

|

|

|

(1) Included in other long-term assets. |

|

|||||||

|

|

|

(2) Included in other long-term liabilities. |

|

|||||||

|

|

|

(3) Represents the effects of the fluctuations between the ZAR and the U.S. dollar. |

|

|||||||

The Company does not offer any investment products with guarantees related to capital or returns.

10. Borrowings

Refer to Note 12 to the Company's audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended June 30, 2019, for additional information regarding its borrowings.

South Africa

The amounts below have been translated at exchange rates applicable as of the dates specified.

July 2017 Facilities, as amended, comprising a short-term facility and long-term borrowings

Short-term facility - Facility E

On September 26, 2018, Net1 SA further revised its amended July 2017 Facilities agreement with RMB to include an overdraft facility ("Facility E") of up to ZAR 1.5 billion ($106.8 million, translated at exchange rates applicable as of December 31, 2019) to fund the Company's ATMs. The available Facility E overdraft facility was subsequently reduced to ZAR 1.2 billion ($85.4 million, translated at exchange rates applicable as of December 31, 2019) in September 2019. Interest on the overdraft facility is payable on the last day of each month and on the final maturity date based on the South African prime rate. The overdraft facility will be reviewed in September 2020. The overdraft facility amount utilized must be repaid in full within one month of utilization and at least 90% of the amount utilized must be repaid with 25 days.

10. Borrowings (continued)

South Africa (continued)

July 2017 Facilities, as amended, comprising a short-term facility and long-term borrowings (continued)