Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CMC Materials, Inc. | ccmp-20200205xex991.htm |

| 8-K - 8-K - CMC Materials, Inc. | ccmp-20200205.htm |

First Quarter of Fiscal 2020 Earnings Call February 6, 2020 ©2020 Cabot Microelectronics Corporation

Safe Harbor Statement The information contained in and discussed during this presentation may include “forward- looking statements” within the meaning of federal securities regulations. These forward- looking statements involve a number of risks, uncertainties, and other factors, including those described in Cabot Microelectronics’ filings with the Securities and Exchange Commission (SEC), that could cause actual results to differ materially from those described by these forward-looking statements. Cabot Microelectronics Corporation assumes no obligation to update this forward-looking information. 2 ©2020 Cabot Microelectronics Corporation

First Quarter Highlights › Record revenue of $283M, up 28% versus prior year • Driven primarily by the acquisition of KMG Chemicals, Inc. (“KMG”) › Revenue was essentially flat compared with pro forma revenue last year * • Performance Materials revenue increased due to strong growth in pipeline performance products • Electronic Materials revenue declined due to softer semiconductor industry demand, particularly in memory › Revenue increased 2% sequentially • Driven by strong results in CMP slurries • Growth in foundry and logic, and stabilization of demand from memory customers • Continued strong growth in pipeline performance products, specifically drag reducing agents (DRAs) › Net Income was $38.5M or $1.30 per diluted share; adjusted diluted EPS * of $1.92 was 2% lower than adjusted pro forma EPS in the prior year * › Adjusted EBITDA* of $95M, up 7% year over year • Profitability improvement was driven by reduced SG&A expenses, primarily from synergies › Improving Semiconductor Industry Outlook • Optimistic near-term outlook from several large customers • Industry analysts expect growth to resume in 2020 • Memory chip inventories continue to normalize • Some uncertainty over novel coronavirus impact Data reflects rounded values *Refer to the Company's first quarter fiscal 2020 press release for information about these non-GAAP financial measures and reconciliations of these non-GAAP measures to their most comparable GAAP measure. 3 ©2020 Cabot Microelectronics Corporation

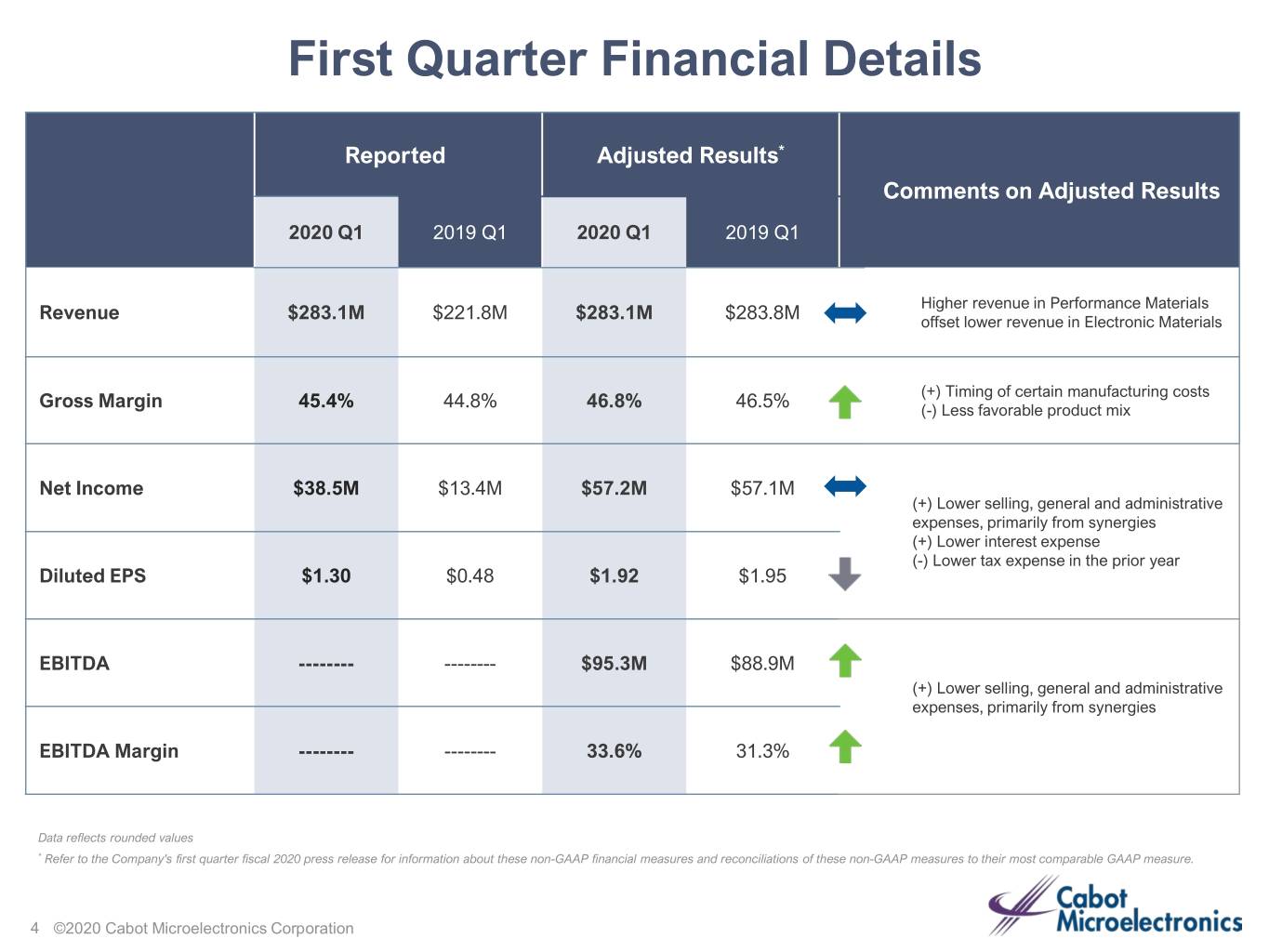

First Quarter Financial Details Reported Adjusted Results* Comments on Adjusted Results 2020 Q1 2019 Q1 2020 Q1 2019 Q1 Higher revenue in Performance Materials Revenue $283.1M $221.8M $283.1M $283.8M offset lower revenue in Electronic Materials (+) Timing of certain manufacturing costs Gross Margin 45.4% 44.8% 46.8% 46.5% (-) Less favorable product mix Net Income $38.5M $13.4M $57.2M $57.1M (+) Lower selling, general and administrative expenses, primarily from synergies (+) Lower interest expense (-) Lower tax expense in the prior year Diluted EPS $1.30 $0.48 $1.92 $1.95 EBITDA -------- -------- $95.3M $88.9M (+) Lower selling, general and administrative expenses, primarily from synergies EBITDA Margin -------- -------- 33.6% 31.3% Data reflects rounded values * Refer to the Company's first quarter fiscal 2020 press release for information about these non-GAAP financial measures and reconciliations of these non-GAAP measures to their most comparable GAAP measure. 4 ©2020 Cabot Microelectronics Corporation

First Quarter Segment and Business Revenue Reported Reported vs. Pro Forma* 2019 Q1 2020 Q1 2019 Q1 2020 Q1 Pro Forma Total Revenue $283M $222M $283M $284M Electronic Materials $221M $191M $221M $231M CMP Slurries $122M $126M $122M $126M CMP Pads $21M $24M $21M $24M Electronic Chemicals $78M $40M $78M $80M Performance Materials $62M $31M $62M $53M Quarter Highlights: › CMP slurries revenue faced difficult comparisons versus strong demand from memory customers in the prior year › CMP pads revenue was negatively impacted by industry softness and reduced customer demand › Electronic chemicals revenue was driven by advanced nodes, but offset by lower demand from legacy applications › Performance Materials revenue growth was driven by pipeline performance products, primarily DRAs Data reflects rounded values *Pro Forma data represents calculations as if KMG results were included in total company results for the full quarter of each period represented 5 ©2020 Cabot Microelectronics Corporation

Segment Financial Details 2020 Q1 2019 Q1 Electronic Materials Revenue $221M $191M Adjusted EBITDA* $81M $75M Adjusted EBITDA Margin 37% 39% Performance Materials Revenue $62M $31M Adjusted EBITDA* $27M $13M Adjusted EBITDA Margin 44% 42% Data reflects rounded values *Adjusted EBITDA for the Electronic Materials and Performance Materials segments is presented in conformity with Accounting Standards Codification Topic 280, Segment Reporting. This measure is reported to the chief operating decision maker for purposes of making decisions about allocating resources to the segments and assessing their performance. For these reasons, this measure is excluded from the definition of non-GAAP financial measures under the SEC’s Regulation G and Item 10(e) of Regulation S-K. 6 ©2020 Cabot Microelectronics Corporation

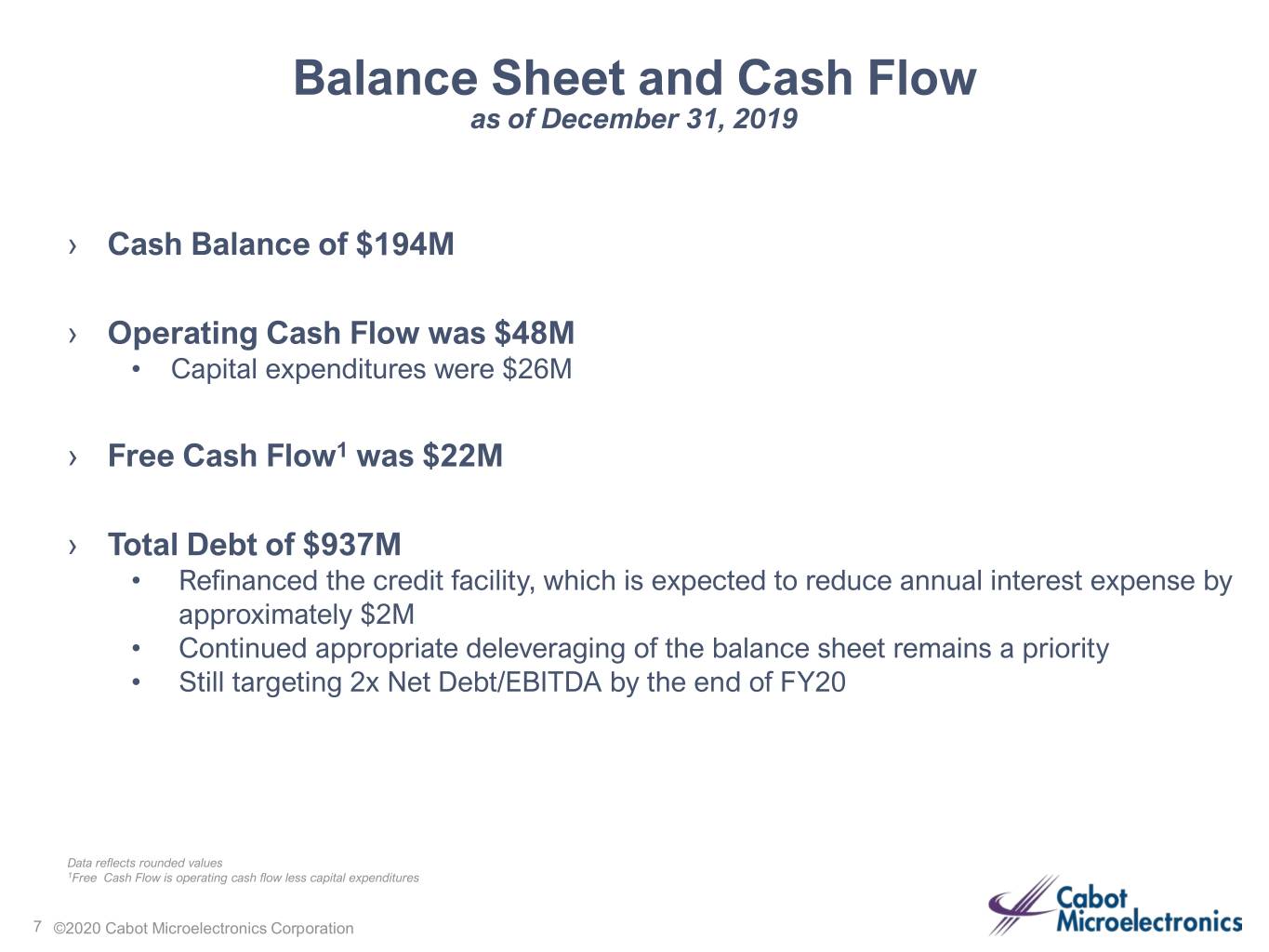

Balance Sheet and Cash Flow as of December 31, 2019 › Cash Balance of $194M › Operating Cash Flow was $48M • Capital expenditures were $26M › Free Cash Flow1 was $22M › Total Debt of $937M • Refinanced the credit facility, which is expected to reduce annual interest expense by approximately $2M • Continued appropriate deleveraging of the balance sheet remains a priority • Still targeting 2x Net Debt/EBITDA by the end of FY20 Data reflects rounded values 1Free Cash Flow is operating cash flow less capital expenditures 7 ©2020 Cabot Microelectronics Corporation

Current Financial Guidance 2020 Q2 FY2020 Approximately flat to up low Electronic Materials Revenue single digits* Segment Performance Materials Revenue Up low single digits* Approximately flat to up low Revenue single digits* Adjusted EBITDA $350M-$380M Depreciation and Amortization** $40M-$45M Total Company Interest Expense ~$12M $45M-$46M Tax Rate*** 22%-25% Capital Spending $100M-$130M Data reflects rounded values *Based on sequential changes compared to first quarter of fiscal 2020 **Excludes approximately $90 million in amortization of intangibles related to acquisitions ***Excludes tax impact from acquisition-related expenses 8 ©2020 Cabot Microelectronics Corporation

Appendix ©2020 Cabot Microelectronics Corporation

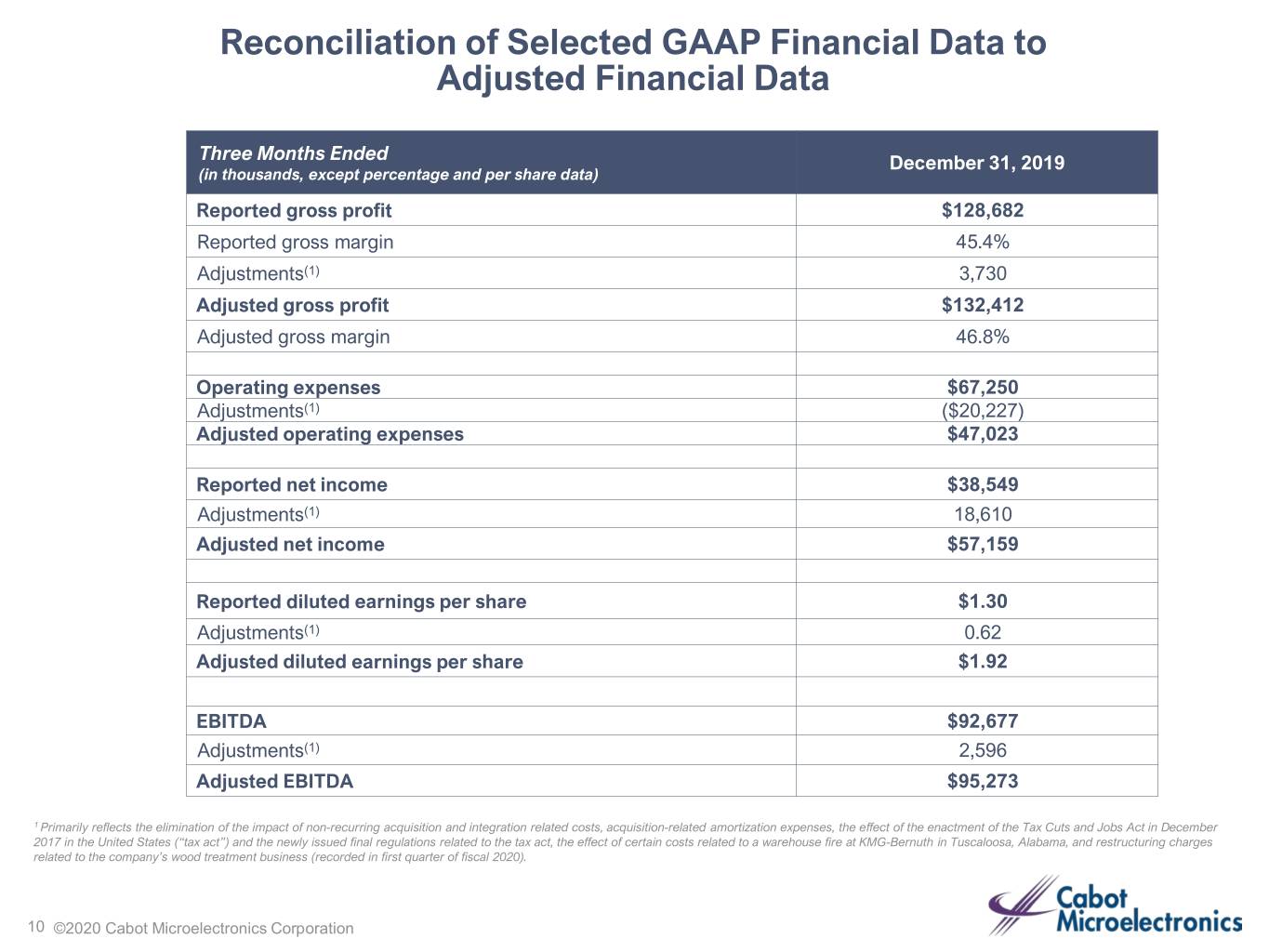

Reconciliation of Selected GAAP Financial Data to Adjusted Financial Data Three Months Ended December 31, 2019 (in thousands, except percentage and per share data) Reported gross profit $128,682 Reported gross margin 45.4% Adjustments(1) 3,730 Adjusted gross profit $132,412 Adjusted gross margin 46.8% Operating expenses $67,250 Adjustments(1) ($20,227) Adjusted operating expenses $47,023 Reported net income $38,549 Adjustments(1) 18,610 Adjusted net income $57,159 Reported diluted earnings per share $1.30 Adjustments(1) 0.62 Adjusted diluted earnings per share $1.92 EBITDA $92,677 Adjustments(1) 2,596 Adjusted EBITDA $95,273 1 Primarily reflects the elimination of the impact of non-recurring acquisition and integration related costs, acquisition-related amortization expenses, the effect of the enactment of the Tax Cuts and Jobs Act in December 2017 in the United States (“tax act”) and the newly issued final regulations related to the tax act, the effect of certain costs related to a warehouse fire at KMG-Bernuth in Tuscaloosa, Alabama, and restructuring charges related to the company’s wood treatment business (recorded in first quarter of fiscal 2020). 10 ©2020 Cabot Microelectronics Corporation

Reconciliation of Selected GAAP Financial Data to Adjusted Pro Forma1 Financial Data Three Months Ended December 31, 2018 (in thousands, except percentage and per share data) Pro forma gross profit $128,541 Pro forma gross margin 45.3% Adjustments(2) 3,470 Adjusted pro forma gross profit $132,011 Adjusted pro forma gross margin 46.5% Pro forma operating expenses $72,059 Adjustments(2) ($20,773) Adjusted pro forma operating expenses $51,286 Pro forma net income $38,356 Adjustments(2) 18,784 Adjusted pro forma net income $57,140 Pro forma diluted earnings per share $1.31 Adjustments(2) 0.64 Adjusted pro forma diluted earnings per share $1.95 Pro forma EBITDA $87,535 Adjustments(2) 1,331 Adjusted pro forma EBITDA $88,866 1 Pro forma adjustments are related to non-recurring items directly attributable to the transaction as well as recurring differences related to depreciation, amortization or financing costs that were included as if the companies were combined as of October 1, 2017. 2 Primarily reflects the elimination of the impact of non-recurring acquisition and integration related costs, acquisition-related amortization expenses, the effect of the enactment of the Tax Cuts and Jobs Act in December 2017 in the United States (“tax act”) and the newly issued final regulations related to the tax act, the effect of certain costs related to a warehouse fire at KMG-Bernuth in Tuscaloosa, Alabama, and restructuring charges related to the company’s wood treatment business (recorded in first quarter of fiscal 2020). 11 ©2020 Cabot Microelectronics Corporation

Thank you for your interest in Cabot Microelectronics Corporation For additional information, please contact: investor_relations@cabotcmp.com 630.499.2600 ©2020 Cabot Microelectronics Corporation