Attached files

| file | filename |

|---|---|

| EX-99.2 - INVESTOR UPDATE 02.05.20 - Spirit Airlines, Inc. | investorupdate020520.htm |

| 8-K - 8-K - Spirit Airlines, Inc. | a8-k4qandfullyear2019e.htm |

EXHIBIT 99.1

Spirit Airlines Reports Fourth Quarter and Full Year 2019 Results

MIRAMAR, Fla., February 5, 2020 - Spirit Airlines, Inc. (NYSE: SAVE) today reported fourth quarter and full year 2019 financial results.

Fourth Quarter 2019 | Fourth Quarter 2018 | ||||||

As Reported | Adjusted | As Reported | Adjusted | ||||

(GAAP) | (non-GAAP)1 | (GAAP) | (non-GAAP)1 | ||||

Revenue | $969.8 million | $969.8 million | $862.8 million | $862.8 million | |||

Operating Income | $124.6 million | $129.6 million | $136.1 million | $139.3 million | |||

Operating Margin | 12.9% | 13.4% | 15.8% | 16.2% | |||

Net Income | $81.2 million | $85.0 million | $91.9 million | $94.7 million | |||

Diluted EPS | $1.18 | $1.24 | $1.34 | $1.38 | |||

"2019 was a year of many accomplishments for Spirit. Our improving operational reliability, and the investments we're making to provide our Guests the best value in the sky are being noticed by our Guests and earning us international acclaim. We once again achieved a fourth-place ranking for on-time performance among reporting U.S. carriers2. Spirit also recently received several global recognitions: Low-Cost Airline of the Year at the CAPA World Aviation Summit; Value Airline of the Year by Air Transport World; and, most on-time Low Cost Airline by Flight Global. Our team also delivered strong financial results for 2019. For the full year 2019, our GAAP pre-tax earnings increased 112.9 percent year over year. Excluding special items, our Adjusted pre-tax earnings increased 15.3 percent year over year1,” said Ted Christie, Spirit’s President and Chief Executive Officer. "I am very proud of the Spirit team for these accomplishments. Looking ahead to 2020, we are focused on running a safe and reliable airline, leveraging technology and automation to drive further efficiencies, and executing on our revenue initiatives to deliver strong returns for our shareholders.”

Revenue Performance

For the fourth quarter 2019, Spirit's total operating revenue was $969.8 million, an increase of 12.4 percent compared to the fourth quarter 2018, driven by an 18.6 percent increase in flight volume. Fourth quarter 2019 revenue includes approximately $7.2 million of out-of-period revenue related to the reclamation of over-remitted Federal Excise Tax.

Total operating revenue per available seat mile ("TRASM") for the fourth quarter 2019 decreased 3.6 percent compared to the same period last year. Without the out-of-period revenue, the Company estimates its fourth quarter 2019 TRASM would have been down about 4.3 percent year-over-year. The decrease in TRASM was driven by lower operating yields, as load factor for the period was up slightly.

On a per passenger flight segment ("PFS") basis, for the fourth quarter 2019 total revenue per PFS decreased 5.5 percent year over year, to $110.71, non-ticket revenue per PFS increased 2.3 percent to $58.033, and fare revenue per PFS decreased 12.9 percent to $52.68.

1

Cost Performance

For the fourth quarter 2019, total GAAP operating expenses increased 16.3 percent year over year to $845.2 million. Adjusted operating expenses for the fourth quarter 2019 increased 16.1 percent year over year to $840.2 million4. Primary drivers of the increase in adjusted operating expense compared to the fourth quarter last year include increased flight volume and higher ground handling rates.

Aircraft fuel expense increased in the fourth quarter 2019 by 6.7 percent year over year, due to a 14.8 percent increase in fuel gallons consumed, partially offset by a 7.1 percent decrease in fuel rates.

Spirit reported fourth quarter 2019 cost per available seat mile ("ASM"), excluding operating special items and fuel (“Adjusted CASM ex-fuel”), of 5.67 cents4, up 3.3 percent compared to the same period last year. Primary drivers of the increase on a per ASM basis compared to the same period last year included heavy maintenance amortization, maintenance, material and repairs and other operating expenses.

“Our team did a great job recovering from the operational issues we faced in the summer and finished the year 2019 with strong operational results. Strong operational performance is key to our continued good cost management and we believe we are well-positioned as we enter 2020. As we’ve noted previously, we have several inflationary pressures we are facing such that we expect our 2020 CASM ex-fuel to increase 1 to 2 percent year over year. From a timing perspective, we face the toughest hurdle in the first quarter, but we anticipate the headwinds will ease as we progress through the year. And, while we already have one of the most fuel-efficient fleets in the U.S., with our growing fleet of A320neo aircraft we should see even greater fuel efficiency this year, helping us offset some Adjusted CASM ex-fuel pressure,” said Scott Haralson, Spirit’s Chief Financial Officer.

Liquidity

Spirit ended the year with unrestricted cash, cash equivalents, and short-term investments of $1.1 billion. For the twelve months ended December 31, 2019, Spirit generated $409.2 million of operating cash flow. After investing $294.5 million for aircraft purchases and pre-delivery deposits, and receiving $225.9 million of proceeds from issuance of long-term debt, Adjusted free cash flow for the twelve months ended December 31, 2019 was $340.6 million5. For the twelve months ended December 31, 2019, net cash used in financing activities was $120.2 million.

Fleet

Spirit took delivery of nine new aircraft (seven A320neo and two A320ceo) during the fourth quarter 2019, ending the year with 145 aircraft in its fleet.

Full Year 2019 Highlights

• | Launched service to the following new destinations: Austin, Burbank, Charlotte-Douglas, Indianapolis, Nashville, Raleigh-Durham and Sacramento. |

• | Received global recognition as the Low-Cost Airline of the Year at the CAPA (Centre for Aviation) World Aviation Summit. CAPA, part of the Aviation Week Network, is one of the world’s most trusted sources of market intelligence for the aviation and travel industry. |

• | Continued its commitment to invest in the Guest experience with an industry-leading technology to connect with its Guests via the messaging application WhatsApp. |

• | Unveiled new, ergonomic and more comfortable seats that provide additional usable legroom as well as added comfort to its Big Front Seats, making the best value in the sky even better. |

• | Announced a new $250 million global headquarters investment at a new campus in Dania Beach, Florida. |

• | Announced an order for 100 Airbus A320neo Family Aircraft, with an option to purchase up to 50 more, to support the airline's growth and sustain one of the youngest, most fuel-efficient fleets in the U.S. These aircraft are planned for delivery through 2027. |

2

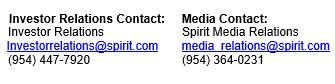

Conference Call/Webcast Detail

Spirit will conduct a conference call to discuss these results tomorrow, February 6, 2020, at 9:30 a.m. ET. A live audio webcast of the conference call will be available to the public on a listen-only basis at http://ir.spirit.com. An archive of the webcast will be available under "Webcasts & Presentations" for 60 days.

About Spirit Airlines:

Spirit Airlines (NYSE: SAVE) is committed to delivering the best value in the sky. We are the leader in providing customizable travel options starting with an unbundled fare. This allows our Guests to pay only for the options they choose - like bags, seat assignments and refreshments - something we call À La Smarte. We make it possible for our Guests to venture further and discover more than ever before. Our Fit Fleet® is one of the youngest and most fuel-efficient in the U.S. We operate more than 600 daily flights to 77 destinations in the U.S., Latin America and the Caribbean, and are dedicated to giving back and improving the communities we serve. Come save with us at spirit.com. At Spirit Airlines, we go. We go for you.

Investors are encouraged to read the Company's periodic and current reports filed with or furnished to the Securities and Exchange Commission, including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, for additional information regarding the Company.

End Notes

(1) See "Reconciliation of Adjusted Net Income, Adjusted Pre-tax Income, and Adjusted Operating Income to GAAP Net Income" table below for more details.

(2) Preliminary data using DOT A:14 methodology.

(3) See "Calculation of Total Non-Ticket Revenue per Passenger Flight Segment" table below for more details.

(4) See "Reconciliation of Adjusted Operating Expense to GAAP Operating Expense" table below for more details.

(5) See "Reconciliation of Adjusted Free Cash Flow to GAAP Net Operating Cash Flow" table below for more details.

Forward-Looking Statements

Statements in this release and certain oral statements made from time to time by representatives of the Company contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,” and similar expressions intended to identify forward-looking statements. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Furthermore, such forward-looking statements speak only as of the date of this release. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. Risks or uncertainties (i) that are not currently known to us, (ii) that we currently deem to be immaterial, or (iii) that could apply to any company, could also materially adversely affect our business, financial condition, or future results. References in this report to “Spirit,” “we,” “us,” “our,” or the “Company” shall mean Spirit Airlines, Inc., unless the context indicates otherwise. Additional information concerning certain factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

3

SPIRIT AIRLINES, INC.

Statements of Operations

(unaudited, in thousands, except per-share amounts)

Three Months Ended | Year Ended | ||||||||||||||||||||

December 31, | Percent | December 31, | Percent | ||||||||||||||||||

2019 | 2018 | Change | 2019 | 2018 | Change | ||||||||||||||||

Operating revenues: | |||||||||||||||||||||

Passenger | $ | 951,757 | $ | 846,568 | 12.4 | $ | 3,757,605 | $ | 3,260,015 | 15.3 | |||||||||||

Other | 18,059 | 16,227 | 11.3 | 72,931 | 63,019 | 15.7 | |||||||||||||||

Total operating revenues | 969,816 | 862,795 | 12.4 | 3,830,536 | 3,323,034 | 15.3 | |||||||||||||||

Operating expenses: | |||||||||||||||||||||

Aircraft fuel | 244,989 | 229,680 | 6.7 | 993,478 | 939,324 | 5.8 | |||||||||||||||

Salaries, wages and benefits | 220,674 | 191,740 | 15.1 | 865,019 | 719,635 | 20.2 | |||||||||||||||

Landing fees and other rents | 62,773 | 51,903 | 20.9 | 256,275 | 214,677 | 19.4 | |||||||||||||||

Depreciation and amortization | 61,913 | 47,963 | 29.1 | 225,264 | 176,727 | 27.5 | |||||||||||||||

Aircraft rent | 50,279 | 43,023 | 16.9 | 182,609 | 177,641 | 2.8 | |||||||||||||||

Distribution | 38,289 | 33,505 | 14.3 | 153,770 | 137,001 | 12.2 | |||||||||||||||

Maintenance, materials and repairs | 41,131 | 29,937 | 37.4 | 143,575 | 129,078 | 11.2 | |||||||||||||||

Loss on disposal of assets | 477 | 3,019 | nm | 17,350 | 9,580 | nm | |||||||||||||||

Special charges | 717 | 265 | nm | 717 | 88,921 | nm | |||||||||||||||

Other operating | 123,950 | 95,695 | 29.5 | 491,432 | 379,536 | 29.5 | |||||||||||||||

Total operating expenses | 845,192 | 726,730 | 16.3 | 3,329,489 | 2,972,120 | 12.0 | |||||||||||||||

Operating income | 124,624 | 136,065 | (8.4 | ) | 501,047 | 350,914 | 42.8 | ||||||||||||||

Other (income) expense: | |||||||||||||||||||||

Interest expense | 25,975 | 23,505 | 10.5 | 101,350 | 83,777 | 21.0 | |||||||||||||||

Capitalized interest | (3,539 | ) | (2,636 | ) | 34.3 | (12,471 | ) | (9,841 | ) | 26.7 | |||||||||||

Interest income | (4,851 | ) | (5,835 | ) | (16.9 | ) | (25,133 | ) | (19,107 | ) | 31.5 | ||||||||||

Other expense | 276 | 129 | nm | 875 | 752 | nm | |||||||||||||||

Special charges, non-operating | — | — | nm | — | 90,357 | nm | |||||||||||||||

Total other (income) expense | 17,861 | 15,163 | 17.8 | 64,621 | 145,938 | (55.7 | ) | ||||||||||||||

Income before income taxes | 106,763 | 120,902 | (11.7 | ) | 436,426 | 204,976 | 112.9 | ||||||||||||||

Provision for income taxes | 25,549 | 28,965 | (11.8 | ) | 101,171 | 49,227 | 105.5 | ||||||||||||||

Net income | $ | 81,214 | $ | 91,937 | (11.7 | ) | $ | 335,255 | $ | 155,749 | 115.3 | ||||||||||

Basic earnings per share | $ | 1.19 | $ | 1.35 | (11.9 | ) | $ | 4.90 | $ | 2.28 | 114.9 | ||||||||||

Diluted earnings per share | $ | 1.18 | $ | 1.34 | (11.9 | ) | $ | 4.89 | $ | 2.28 | 114.5 | ||||||||||

Weighted average shares, basic | 68,452 | 68,267 | 0.3 | 68,429 | 68,249 | 0.3 | |||||||||||||||

Weighted average shares, diluted | 68,553 | 68,687 | (0.2 | ) | 68,559 | 68,431 | 0.2 | ||||||||||||||

4

SPIRIT AIRLINES, INC.

Statements of Comprehensive Income

(unaudited, in thousands)

Three Months Ended | Year Ended | ||||||||||||||

December 31, | December 31, | ||||||||||||||

2019 | 2018 | 2019 | 2018 | ||||||||||||

Net income | $ | 81,214 | $ | 91,937 | $ | 335,255 | $ | 155,749 | |||||||

Unrealized gain (loss) on short-term investment securities and cash and cash equivalents, net of deferred taxes of ($9), $22, $38 and $44 | 6 | (40 | ) | 167 | 30 | ||||||||||

Interest rate derivative loss reclassified into earnings, net of taxes of $13, $9, $76 and $75 | 82 | 68 | 239 | 241 | |||||||||||

Other comprehensive income | $ | 88 | $ | 28 | $ | 406 | $ | 271 | |||||||

Comprehensive income | $ | 81,302 | $ | 91,965 | $ | 335,661 | $ | 156,020 | |||||||

5

SPIRIT AIRLINES, INC.

Selected Operating Statistics

(unaudited)

Three Months Ended December 31, | ||||||||

Operating Statistics | 2019 | 2018 | Change | |||||

Available seat miles (ASMs) (thousands) | 10,491,833 | 8,998,928 | 16.6 | % | ||||

Revenue passenger miles (RPMs) (thousands) | 8,897,193 | 7,606,962 | 17.0 | % | ||||

Load factor (%) | 84.8 | 84.5 | 0.3 | pts | ||||

Passenger flight segments (thousands) | 8,760 | 7,365 | 18.9 | % | ||||

Block hours | 151,277 | 130,309 | 16.1 | % | ||||

Departures | 57,035 | 48,073 | 18.6 | % | ||||

Total operating revenue per ASM (TRASM) (cents) | 9.24 | 9.59 | (3.6 | )% | ||||

Average yield (cents) | 10.90 | 11.34 | (3.9 | )% | ||||

Fare revenue per passenger flight segment ($) | 52.68 | 60.45 | (12.9 | )% | ||||

Non-ticket revenue per passenger flight segment ($) | 58.03 | 56.70 | 2.3 | % | ||||

Total revenue per passenger flight segment ($) | 110.71 | 117.15 | (5.5 | )% | ||||

CASM (cents) | 8.06 | 8.08 | (0.2 | )% | ||||

Adjusted CASM (cents) (1) | 8.01 | 8.04 | (0.4 | )% | ||||

Adjusted CASM ex-fuel (cents) (2) | 5.67 | 5.49 | 3.3 | % | ||||

Fuel gallons consumed (thousands) | 116,591 | 101,595 | 14.8 | % | ||||

Average fuel cost per gallon ($) | 2.10 | 2.26 | (7.1 | )% | ||||

Aircraft at end of period | 145 | 128 | 13.3 | % | ||||

Average daily aircraft utilization (hours) | 11.7 | 11.5 | 1.7 | % | ||||

Average stage length (miles) | 998 | 1,019 | (2.1 | )% | ||||

Year Ended December 31, | ||||||||

Operating Statistics | 2019 | 2018 | Change | |||||

Available seat miles (ASMs) (thousands) | 41,783,001 | 36,502,982 | 14.5 | % | ||||

Revenue passenger miles (RPMs) (thousands) | 35,245,285 | 30,623,379 | 15.1 | % | ||||

Load factor (%) | 84.4 | 83.9 | 0.5 | pts | ||||

Passenger flight segments (thousands) | 34,537 | 29,312 | 17.8 | % | ||||

Block hours | 607,055 | 526,343 | 15.3 | % | ||||

Departures | 227,041 | 192,845 | 17.7 | % | ||||

Total operating revenue per ASM (TRASM) (cents) | 9.17 | 9.10 | 0.8 | % | ||||

Average yield (cents) | 10.87 | 10.85 | 0.2 | % | ||||

Fare revenue per passenger flight segment ($) | 54.63 | 58.14 | (6.0 | )% | ||||

Non-ticket revenue per passenger flight segment ($) | 56.28 | 55.23 | 1.9 | % | ||||

Total revenue per passenger flight segment ($) | 110.91 | 113.37 | (2.2 | )% | ||||

CASM (cents) | 7.97 | 8.14 | (2.1 | )% | ||||

Adjusted CASM (cents) (1) | 7.93 | 7.87 | 0.8 | % | ||||

Adjusted CASM ex-fuel (cents) (2) | 5.55 | 5.30 | 4.7 | % | ||||

Fuel gallons consumed (thousands) | 470,939 | 412,256 | 14.2 | % | ||||

Average fuel cost per gallon ($) | 2.11 | 2.28 | (7.5 | )% | ||||

Average daily aircraft utilization (hours) | 12.3 | 12.1 | 1.7 | % | ||||

Average stage length (miles) | 1,002 | 1,032 | (2.9 | )% | ||||

(1) | Excludes operating special items. |

(2) | Excludes fuel expense and operating special items. |

6

The Company is providing a reconciliation of GAAP financial information to non-GAAP financial information as it believes that non-GAAP financial measures provide management and investors the ability to measure the performance of the Company on a consistent basis. These non-GAAP financial measures have limitations as analytical tools. Because of these limitations, determinations of the Company's operating performance excluding unrealized gains and losses or special items should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. These non-GAAP financial measures may be presented on a different basis than other companies using similarly titled non-GAAP financial measures.

Calculation of Total Non-Ticket Revenue per Passenger Flight Segment

(unaudited)

Three Months Ended | Year Ended | ||||||||||||||

December 31, | December 31, | ||||||||||||||

(in thousands, except per segment data) | 2019 | 2018 | 2019 | 2018 | |||||||||||

Operating revenues | |||||||||||||||

Fare | $ | 461,438 | $ | 445,203 | $ | 1,886,855 | $ | 1,704,107 | |||||||

Non-fare | 490,319 | 401,365 | 1,870,750 | 1,555,908 | |||||||||||

Total passenger revenues | 951,757 | 846,568 | 3,757,605 | 3,260,015 | |||||||||||

Other revenues | 18,059 | 16,227 | 72,931 | 63,019 | |||||||||||

Total operating revenues | $ | 969,816 | $ | 862,795 | $ | 3,830,536 | $ | 3,323,034 | |||||||

Non-ticket revenues (1) | $ | 508,378 | $ | 417,592 | $ | 1,943,681 | $ | 1,618,927 | |||||||

Passenger segments | 8,760 | 7,365 | 34,537 | 29,312 | |||||||||||

Non-ticket revenue per passenger flight segment ($) | $ | 58.03 | $ | 56.70 | $ | 56.28 | $ | 55.23 | |||||||

(1) | Non-ticket revenues equals the sum of non-fare passenger revenues and other revenues. |

Special Items

(unaudited)

Three Months Ended | Year Ended | ||||||||||||||

December 31, | December 31, | ||||||||||||||

(in thousands) | 2019 | 2018 | 2019 | 2018 | |||||||||||

Operating special items include the following: | |||||||||||||||

Supplemental rent (credit) (1) | 3,774 | — | (530 | ) | — | ||||||||||

Loss on disposal of assets (2) | 477 | 3,019 | 17,350 | 9,580 | |||||||||||

Operating special charges (3) | 717 | 265 | 717 | 88,921 | |||||||||||

Total operating special items | $ | 4,968 | $ | 3,284 | $ | 17,537 | $ | 98,501 | |||||||

Non-operating special items include the following: | |||||||||||||||

Non-operating special charges (4) | — | — | — | $ | 90,357 | ||||||||||

Total non-operating special items | $ | — | $ | — | $ | — | $ | 90,357 | |||||||

Total special items | $ | 4,968 | $ | 3,284 | $ | 17,537 | $ | 188,858 | |||||||

(1) | Accrual adjustments related to lease modifications. |

(2) | 2019 includes amounts primarily related to the disposal of excess and obsolete inventory, partially offset by gains on aircraft sale-leaseback transactions. 2018 includes amounts primarily related to losses on sale of engines and the disposal of excess and obsolete inventory. |

(3) | Operating special charges for 2019 are related to the write-off of aircraft related credits resulting from the exchange of credits negotiated under the new purchase agreement with Airbus S.A.S ("Airbus") executed during the fourth quarter of 2019. 2018 includes amounts primarily related to a one-time ratification incentive recognized in connection with a pilot agreement approved in February 2018. |

(4) | Non-operating special charges in 2018 are related to the purchase of 14 A319-100 aircraft. The contract was deemed a lease modification which resulted in a change of classification from operating leases to finance leases for the 14 aircraft. |

7

Reconciliation of Adjusted Operating Expense to GAAP Operating Expense

(unaudited)

Three Months Ended | Year Ended | ||||||||||||||

December 31, | December 31, | ||||||||||||||

(in thousands, except CASM data in cents) | 2019 | 2018 | 2019 | 2018 | |||||||||||

Total operating expenses, as reported | $ | 845,192 | $ | 726,730 | $ | 3,329,489 | $ | 2,972,120 | |||||||

Less operating special items expense | 4,968 | 3,284 | 17,537 | 98,501 | |||||||||||

Adjusted operating expenses, non-GAAP (1) | 840,224 | 723,446 | 3,311,952 | 2,873,619 | |||||||||||

Less: Fuel expense | 244,989 | 229,680 | 993,478 | 939,324 | |||||||||||

Adjusted operating expenses excluding fuel, non-GAAP (2) | $ | 595,235 | $ | 493,766 | $ | 2,318,474 | $ | 1,934,295 | |||||||

Available seat miles | 10,491,833 | 8,998,928 | 41,783,001 | 36,502,982 | |||||||||||

CASM (cents) | 8.06 | 8.08 | 7.97 | 8.14 | |||||||||||

Adjusted CASM (cents) (1) | 8.01 | 8.04 | 7.93 | 7.87 | |||||||||||

Adjusted CASM ex-fuel (cents) (2) | 5.67 | 5.49 | 5.55 | 5.30 | |||||||||||

(1) | Excludes operating special items. |

(2) | Excludes operating special items and fuel expense. |

Reconciliation of Adjusted Net Income, Adjusted Pre-Tax Income, and Adjusted Operating Income to GAAP Net Income

(unaudited)

Three Months Ended | Year Ended | ||||||||||||||

December 31, | December 31, | ||||||||||||||

(in thousands, except per share data) | 2019 | 2018 | 2019 | 2018 | |||||||||||

Net income, as reported | $ | 81,214 | $ | 91,937 | $ | 335,255 | $ | 155,749 | |||||||

Add: Provision for income taxes | 25,549 | 28,965 | 101,171 | 49,227 | |||||||||||

Income before income taxes, as reported | 106,763 | 120,902 | 436,426 | 204,976 | |||||||||||

Pre-tax margin | 11.0 | % | 14.0 | % | 11.4 | % | 6.2 | % | |||||||

Add special items expense (1) (2) | $ | 4,968 | $ | 3,284 | $ | 17,537 | $ | 188,858 | |||||||

Adjusted income before income taxes, non-GAAP (2) | 111,731 | 124,186 | 453,963 | 393,834 | |||||||||||

Adjusted pre-tax margin, non-GAAP (2) | 11.5 | % | 14.4 | % | 11.9 | % | 11.9 | % | |||||||

Add: Total other (income) expense (3) | 17,861 | 15,163 | 64,621 | 55,581 | |||||||||||

Adjusted operating income, non-GAAP (4) | 129,592 | 139,349 | 518,584 | 449,415 | |||||||||||

Adjusted operating margin, non-GAAP (4) | 13.4 | % | 16.2 | % | 13.5 | % | 13.5 | % | |||||||

Provision for income taxes | 26,704 | 29,494 | 105,219 | 92,920 | |||||||||||

Adjusted net income, non-GAAP (2) | $ | 85,027 | $ | 94,692 | $ | 348,744 | $ | 300,914 | |||||||

Weighted average shares, diluted | 68,553 | 68,687 | 68,559 | 68,431 | |||||||||||

Adjusted net income per share, diluted (2) | $1.24 | $1.38 | $5.09 | $4.40 | |||||||||||

Total operating revenues | $ | 969,816 | $ | 862,795 | $ | 3,830,536 | $ | 3,323,034 | |||||||

(1) | See "Special Items" for more details. |

(2) | Excludes operating and non-operating special items. |

(3) | Excludes non-operating special items. |

(4) | Excludes operating special items. |

8

As most of the Company’s capital expenditures are related to acquiring assets to grow the business, the Company believes it is beneficial for investors to use Adjusted Free Cash Flow to assess whether the Company has sufficient liquidity. Adjusted Free Cash Flow adjusts for Purchase of property and equipment, Pre-delivery deposits on flight equipment, net of refunds, and Proceeds from issuance of long-term debt to provide a consistent view of the Company’s liquidity regardless of how the Company chooses to finance aircraft required for growth. Management believes investors should have a metric to assess the Company’s liquidity on a consistent basis regardless of how the Company chooses to finance assets used for growth.

Reconciliation of Adjusted Free Cash Flow to GAAP Net Operating Cash Flow

(unaudited)

Year Ended | |||||||

December 31, | |||||||

(in thousands) | 2019 | 2018 | |||||

Net cash provided by operating activities | $ | 409,221 | $ | 506,463 | |||

Less: | |||||||

Purchase of property and equipment (1) | 192,437 | 606,971 | |||||

Pre-delivery deposits on flight equipment, net of refunds (1) | 102,102 | 177,424 | |||||

Add: Proceeds from issuance of long-term debt (2) | 225,891 | 832,099 | |||||

Adjusted free cash flow | $ | 340,573 | $ | 554,167 | |||

Net cash used in investing activities | (314,829 | ) | (783,708 | ) | |||

Net cash (used in) provided by financing activities | (120,168 | ) | 481,129 | ||||

Net increase (decrease) in cash and cash equivalents | (25,776 | ) | 203,884 | ||||

(1) | Included within net cash used in investing activities in the Company's Statements of Cash Flows. |

(2) | Included within net cash (used in) provided by financing activities in the Company's Statements of Cash Flows. |

9