Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Spirit of Texas Bancshares, Inc. | d858321d8k.htm |

Spirit of Texas Bancshares, Inc. Stephens Inc. Regional Banks Investor Trip February 3, 2020 Exhibit 99.1

Important Information ABOUT SPIRIT OF TEXAS BANCSHARES, INC. Spirit of Texas Bancshares, Inc. (“Spirit,” “STXB” or the “Company”), through its wholly-owned subsidiary, Spirit of Texas Bank (the “Bank”), provides a wide range of relationship-driven commercial banking products and services tailored to meet the needs of businesses, professionals and individuals. Spirit of Texas Bank has 36 locations in the Houston, Dallas/Fort Worth, Bryan/College Station, San Antonio-New Braunfels and Corpus Christi metropolitan areas, as well as in North Central and North East Texas. Please visit www.sotb.com for more information. FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any statements about our expectations, beliefs, plans, predictions, protections, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. Forward-looking statements are typically, but not exclusively, identified by the use of forward-looking terminology such as “believes,” “expects,” “could,” “may,” “will, “should,” “seeks,” “likely,” “intends” “plans,” “pro forma,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: risks relating to the possibility that the expected benefits and synergies and our projections related to the acquisition of certain branches from Simmons Bank (the “Simmons branch acquisition”) may not materialize as expected; business and economic conditions generally and in the bank and non-bank financial services industries, nationally and within our local market areas; our ability to mitigate our risk exposures; our ability to maintain our historical earnings trends; risks related to the integration of acquired businesses (including our pending Simmons branch acquisition) and any future acquisitions; our ability to successfully identify and address the risks associated with our recent, pending and possible future acquisitions; changes in management personnel; interest rate risk; credit risk associated with our loan portfolio; deteriorating asset quality and higher loan charge-offs; time and effort necessary to resolve nonperforming assets; inaccuracy of the assumptions and estimates we make in establishing reserves for probable loan losses and other estimates and projections; lack of liquidity; fluctuations in the fair value and liquidity of the securities we hold for sale; impairment of investment securities, goodwill, other intangible assets or deferred tax assets; our risk management strategies; increased competition in the bank and non-bank financial services industries, nationally, regionally or locally, which may adversely affect pricing and terms; the accuracy of our financial statements and related disclosures and those of companies we acquire; material weaknesses in our internal control over financial reporting; system failures or failures to prevent breaches of our network security; the institution and outcome of litigation and other legal proceedings against us or to which we become subject; changes in federal tax law or policy; the impact of recent and future legislative and regulatory changes, including changes in banking, securities and tax laws and regulations, and their application by our regulators; governmental monetary and fiscal policies; increases in our capital requirements; and other risks identified in Spirit’s Annual Report on Form 10-K for the year ended December 31, 2018, filed with the Securities and Exchange Commission (“SEC”) on March 15, 2019, its Quarterly Report on Form 10-Q for the period ended September 30, 2019, filed with the SEC on November 8, 2019, and its other filings with the SEC. While forward-looking statements reflect our good-faith beliefs, they are not guarantees of future performance. All forward-looking statements are necessarily only estimates of future results. Accordingly, actual results may differ materially from those expressed in or contemplated by the particular forward-looking statement, and, therefore, you are cautioned not to place undue reliance on such statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law.

Experienced Executive Leadership Dean O. Bass Chairman and Chief Executive Officer David M. McGuire President, Director and Chief Lending Officer Founded the Company in 2008 Over 45 years of banking experience Founder, President and Chief Executive Officer of Royal Oaks Bank Former National Bank Examiner for the Office of the Comptroller of the Currency Former Director of the Texas Bankers Association Over 38 years of banking experience Co-Founder, President and Chief Lending Officer of Royal Oaks Bank Former Chief Executive Officer of Sterling Bank’s Fort Bend office Jerry D. Golemon Executive Vice President and Chief Operating Officer Over 39 years of banking experience Former Chief Financial Officer of Bank4Texas Holdings Former Chief Financial Officer, Director and Founder of Texas National Bank Certified Public Accountant Allison S. Johnson Interim Chief Financial Officer and Chief Accounting Officer Over 10 years of banking experience Former SEC Reporting Manager for Florida Community Bank Served as Chief Accounting Officer for Spirit of Texas Bank since 2016 Certified Public Accountant Source: SEC Filings and Management

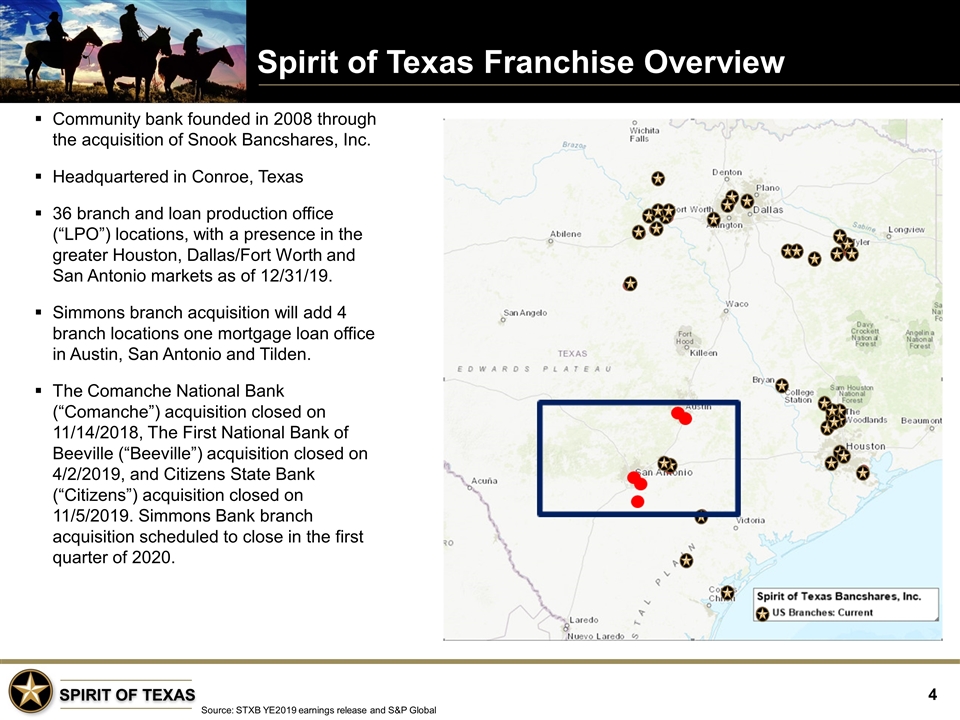

Spirit of Texas Franchise Overview Source: STXB YE2019 earnings release and S&P Global Community bank founded in 2008 through the acquisition of Snook Bancshares, Inc. Headquartered in Conroe, Texas 36 branch and loan production office (“LPO”) locations, with a presence in the greater Houston, Dallas/Fort Worth and San Antonio markets as of 12/31/19. Simmons branch acquisition will add 4 branch locations one mortgage loan office in Austin, San Antonio and Tilden. The Comanche National Bank (“Comanche”) acquisition closed on 11/14/2018, The First National Bank of Beeville (“Beeville”) acquisition closed on 4/2/2019, and Citizens State Bank (“Citizens”) acquisition closed on 11/5/2019. Simmons Bank branch acquisition scheduled to close in the first quarter of 2020.

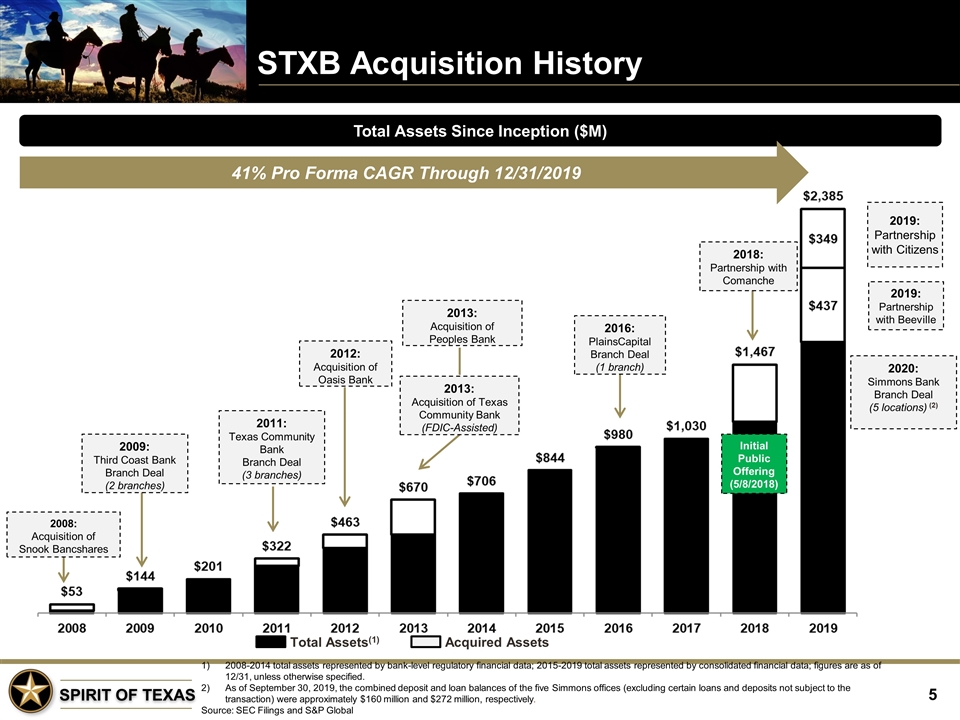

STXB Acquisition History 2008-2014 total assets represented by bank-level regulatory financial data; 2015-2019 total assets represented by consolidated financial data; figures are as of 12/31, unless otherwise specified. As of September 30, 2019, the combined deposit and loan balances of the five Simmons offices (excluding certain loans and deposits not subject to the transaction) were approximately $160 million and $272 million, respectively. Source: SEC Filings and S&P Global Total Assets Since Inception ($M) 2009: Third Coast Bank Branch Deal (2 branches) 2011: Texas Community Bank Branch Deal (3 branches) 2012: Acquisition of Oasis Bank 2013: Acquisition of Peoples Bank 2016: PlainsCapital Branch Deal (1 branch) 2013: Acquisition of Texas Community Bank (FDIC-Assisted) Total Assets(1) Acquired Assets 2018: Partnership with Comanche 41% Pro Forma CAGR Through 12/31/2019 2019: Partnership with Citizens 2019: Partnership with Beeville 2008: Acquisition of Snook Bancshares Initial Public Offering (5/8/2018) 2020: Simmons Bank Branch Deal (5 locations) (2)

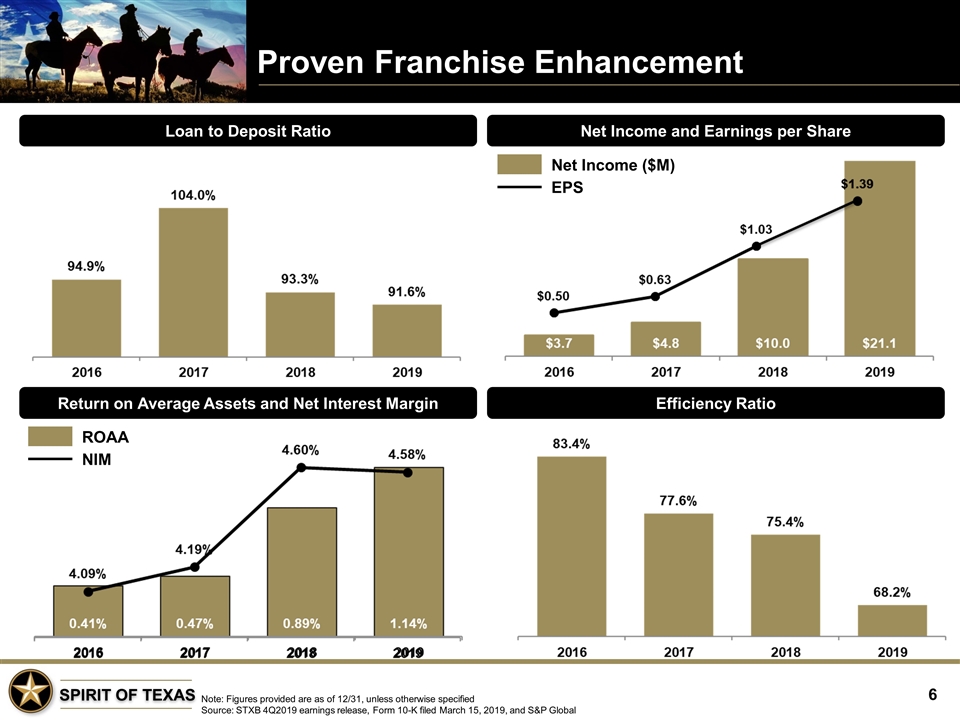

Proven Franchise Enhancement Loan to Deposit Ratio Net Income and Earnings per Share Return on Average Assets and Net Interest Margin Efficiency Ratio NIM ROAA EPS Net Income ($M) Note: Figures provided are as of 12/31, unless otherwise specified Source: STXB 4Q2019 earnings release, Form 10-K filed March 15, 2019, and S&P Global