Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PACIFIC PREMIER BANCORP INC | ex991-prfeb2020ppbiopu.htm |

| 8-K - 8-K - PACIFIC PREMIER BANCORP INC | a8-kfeb2020ppbiopusban.htm |

Exhibit 99.2 Creating a $20 Billion Premier Banking Franchise in the Western U.S. Acquisition of Opus Bank February 3, 2020

FORWARD LOOKING STATEMENTS AND WHERE TO FIND MORE INFORMATION Forward Looking Statements This investor presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and the future performance of Pacific Premier Bancorp, Inc. (“PPBI”), including its wholly-owned subsidiary Pacific Premier Bank (“Pacific Premier”), Opus Bank (“Opus”), including its wholly-owned subsidiary PENSCO Trust Company (“PENSCO”), and the proposed acquisition. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on PPBI’s and Opus’s current expectations and assumptions regarding PPBI’s and Opus’s businesses, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Many possible events or factors could affect PPBI’s or Opus’s future financial results and performance and could cause actual results or performance to differ materially from anticipated results or performance. Such risks and uncertainties include, among others: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive agreement and plan of reorganization by and among PPBI, Pacific Premier and Opus, the outcome of any legal proceedings that may be instituted against PPBI or Opus, delays in completing the transaction, the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction) and shareholder approvals or to satisfy any of the other conditions to the transaction on a timely basis or at all, the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where PPBI and Opus do business, the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, diversion of management’s attention from ongoing business operations and opportunities, potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction, the ability to complete the transaction and integration of Pacific Premier and Opus successfully, and the dilution caused by PPBI’s issuance of additional shares of its capital stock in connection with the transaction. Except to the extent required by applicable law or regulation, each of PPBI and Opus disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Further information regarding PPBI, Opus and factors which could affect the forward-looking statements contained herein can be found in PPBI’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018, its Quarterly Reports on Form 10-Q for the periods ended March 31, 2019, June 30, 2019 and September 30, 2019, and its other filings with the SEC, and in Opus’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018, its Quarterly Reports on Form 10-Q for the periods ended March 31, 2019, June 30, 2019 and September 30, 2019, and its other filings with the Federal Deposit Insurance Corporation (“FDIC”). Additional Information About the Merger and Where to Find It In connection with the proposed acquisition transaction, a registration statement on Form S-4 will be filed with the SEC that will include a joint proxy statement/prospectus filed with the SEC and the FDIC to be distributed to the shareholders of Opus and PPBI in connection with their votes on the acquisition. INVESTORS AND SECURITY HOLDERS ARE ENCOURAGED TO READ THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS WHEN THEY BECOME AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SEC OR THE FDIC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE JOINT PROXY STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER AND RELATED MATTERS. The final joint proxy statement/prospectus will be mailed to shareholders of Opus and PPBI. Investors and security holders will be able to obtain the documents, and any other documents PPBI has filed with the SEC, free of charge at the SEC’s website, www.sec.gov or by accessing PPBI’s website at www.ppbi.com under the “Investor Relations” link and then under the heading “SEC Filings”. Investors and security holders will be able to obtain the documents, and any other documents Opus has filed with the FDIC, free of charge at Opus’s website at www.opusbank.com under the tab “Investor Relations” and then under the heading “Presentations & Filings”. In addition, documents filedwiththeSECbyPPBIorwiththeFDICbyOpuswillbeavailablefreeofcharge by (1) writing PPBI at 17901 Von Karman Avenue, Suite 1200, Irvine, CA 92614, Attention: Investor Relations, or (2) writing Opus at 19900 MacArthur Boulevard, 12th Floor, Irvine, CA 92612, Attention: Investor Relations. Before making any voting or investment decision, shareholders of PPBI and Opus are urged to read carefully the entire registration statement and joint proxy statement/prospectus when they become available, including any amendments thereto, because they will contain important information about the proposed transaction, PPBI and Opus. Free copies of these documents may be obtained as described above. The directors, executive officers and certain other members of management and employees of PPBI may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction from the shareholders of PPBI. Information about PPBI’s directors and executive officers is included in the proxy statement for its 2019 annual meeting of PPBI’s shareholders, which was filed with the SEC on April 9, 2019. The directors, executive officers and certain other members of management and employees of Opus may also be deemed to be participants in the solicitation of proxies in connection with the proposed transaction from the shareholders of Opus. Information about the directors and executive officers of Opus is included in the proxy statement for its 2019 annual meeting of Opus shareholders, which was filed with the FDIC on March 14, 2019. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed acquisition when it becomes available. Free copies of this document may be obtained as described above. 2

PRESENTERS Steve Gardner Paul Taylor Ronald J. Nicolas, Jr. Chairman, President President & Sr. EVP & Chief Financial Officer & Chief Executive Officer Chief Executive Officer Pacific Premier Pacific Premier Opus Bank 3

CREATING THE PREMIER BANK IN THE WESTERN U.S. Transformative • ~$20 billion in pro forma assets – will become the 6th largest bank in Western U.S.1 Merger • Ideal timing – both banks have significant momentum, clean credit quality and record earnings • Greater operational scale and increased efficiencies Geographic • Geographic footprint in some of the most attractive metropolitan markets in the Western U.S. Fit and Scale • Increases Pacific Premier’s presence in California by 60% to $13.0 billion in deposits • PPBI to enter Seattle MSA with $1.2 billion in deposits – creates platform for growth in the attractive Pacific Northwest markets Complementary • Diversification of business lines, products and services as well as deposit base and clients Combination • Specialty lines of business from Opus, including multifamily, trust (PENSCO) and escrow (Commerce Escrow) • Trust and escrow provide $2.0 billion in deposits with a blended deposit cost of 0.10% • Both business lines generate attractive fee income with potential for growth and expansion of services • Accelerates PPBI’s ability to invest in technology and further strengthens risk management framework Financially • Double-digit EPS accretion of 14% in 2021 Attractive • Tangible book value payback period of 1.8 years • Accretive to ROAA and ROATCE • IRR greater than 15% • Cost savings estimated at 25% • Pro forma efficiency ratio in the high 40% range • Merger consideration is 138.4% Price / Tangible Book Value per share for Opus Note: Financial information as of 12/31/2019 and market data as of 1/31/2020 4 1. Rank based on company headquarters and total assets, excluding CCAR and ethnic focused institutions. Western U.S. includes CA, OR, WA, NV and AZ

OVERVIEW OF OPUS BANK Overview Branch Network • Opus is a commercial bank headquartered in Irvine, California with $8.0 billion in assets, $5.9 billion in loans and $6.5 billion in deposits 16 Washington • Paul Taylor joined as CEO in May 2019, most recently serving as CEO of Primarily in Seattle MSA (15) Guaranty Bancorp in Colorado before its sale to Independent Bank Group, Inc. 1 • Located in attractive, major metropolitan markets in the Western U.S. with 46 Oregon Portland branch locations Business Lines • Opus is one of the leading multifamily lenders in the Western U.S. • Multifamily loans are 64% of total portfolio 3 Northern California San Francisco (3) • Full suite of commercial banking products focused on small to middle market businesses, including C&I, owner-occupied CRE, and SBA loans 25 Southern California • PENSCO is a wholly-owned subsidiary of Opus and IRA custodian for alternative Los Angeles-Orange (20) assets offering attractive, low-cost deposit funding and fee income San Diego (3) Riverside-San Bernardino (2) • Commerce Escrow division is a Los Angeles-based escrow company and 1031 exchange accommodator - increasing specialty deposit capability and fee income 1 Arizona Scottsdale Mitigated Risk Financial Information Balance Sheet (as of 12/31/2019) Income Statement (Q4 2019) • Simplified business model over the last few years – de-risked balance sheet Total Assets$ 7,992 Net Income$ 20.3 • Management exited Enterprise Value Loans, Healthcare Practice Loans, and Tg. Common Equity$ 704 ROAA 1.02% Technology Banking Gross Loans$ 5,901 ROATCE 11.54% Total Deposits$ 6,474 Net Interest Margin 2.76% • Zero multifamily loan charge-offs since inception in 2010 Loans / Deposits 91.2% Efficiency Ratio 61.3% Non-CDs (% of Deposits) 87.2% Non-Int. Income / Op. Rev. 21.0% NPAs / Total Assets 0.07% Note: All dollars in millions, financial information as of or for the quarter-ended 12/31/2019 5

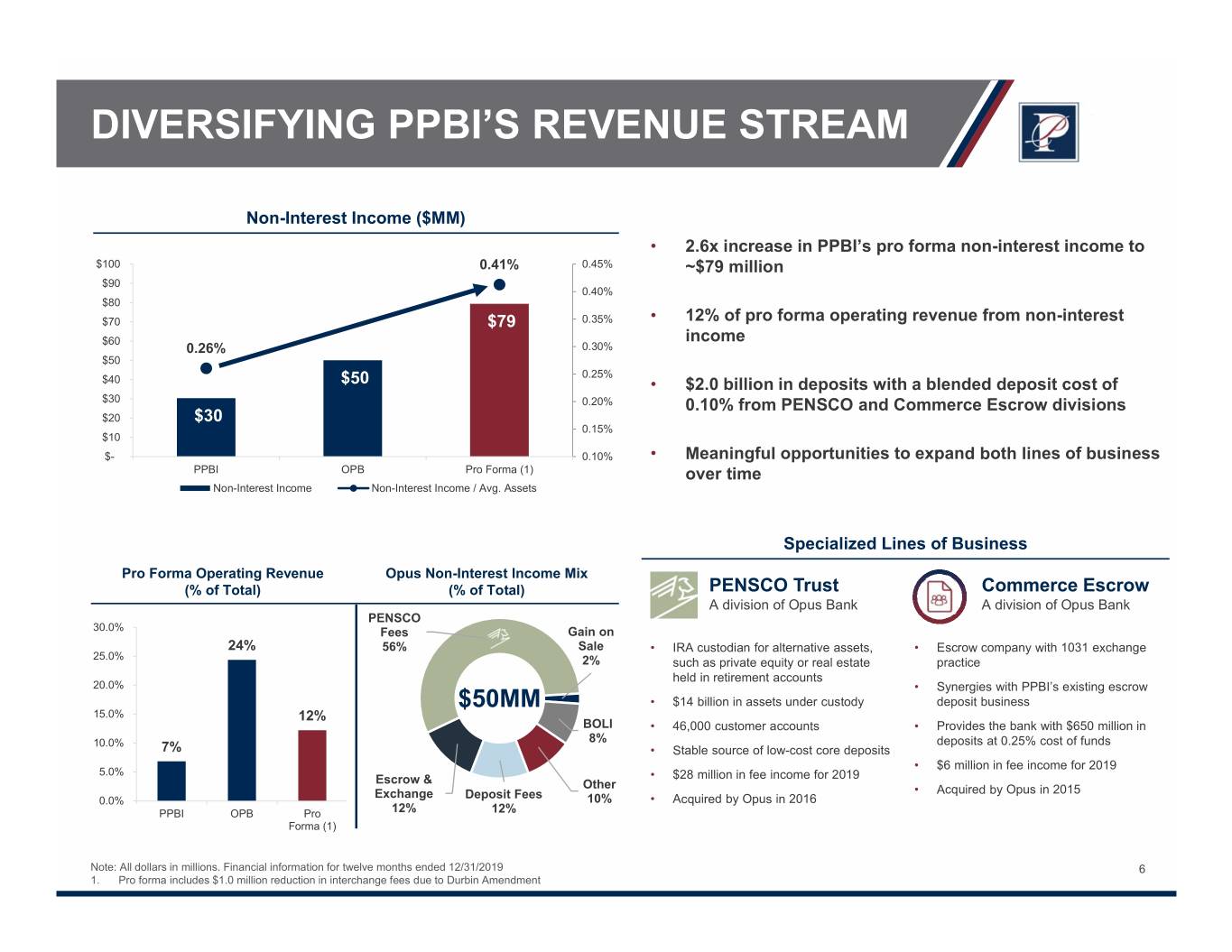

DIVERSIFYING PPBI’S REVENUE STREAM Non-Interest Income ($MM) • 2.6x increase in PPBI’s pro forma non-interest income to $100 0.41% 0.45% ~$79 million $90 0.40% $80 $70 $79 0.35% • 12% of pro forma operating revenue from non-interest $60 income 0.26% 0.30% $50 0.25% $40 $50 • $2.0 billion in deposits with a blended deposit cost of $30 0.20% 0.10% from PENSCO and Commerce Escrow divisions $20 $30 0.15% $10 $- 0.10% • Meaningful opportunities to expand both lines of business PPBI OPB Pro Forma (1) over time Non-Interest Income Non-Interest Income / Avg. Assets Specialized Lines of Business Pro Forma Operating Revenue Opus Non-Interest Income Mix (% of Total) (% of Total) PENSCO Trust Commerce Escrow A division of Opus Bank A division of Opus Bank PENSCO 30.0% Fees Gain on 24% 56% Sale • IRA custodian for alternative assets, • Escrow company with 1031 exchange 25.0% 2% such as private equity or real estate practice held in retirement accounts 20.0% • Synergies with PPBI’s existing escrow $50MM • $14 billion in assets under custody deposit business 15.0% 12% BOLI • 46,000 customer accounts • Provides the bank with $650 million in 10.0% 8% deposits at 0.25% cost of funds 7% • Stable source of low-cost core deposits • $6 million in fee income for 2019 5.0% • $28 million in fee income for 2019 Escrow & Other Exchange Deposit Fees • Acquired by Opus in 2015 0.0% 10% • Acquired by Opus in 2016 PPBI OPB Pro 12% 12% Forma (1) Note: All dollars in millions. Financial information for twelve months ended 12/31/2019 6 1. Pro forma includes $1.0 million reduction in interchange fees due to Durbin Amendment

CREATES A LEADING WESTERN U.S. FRANCHISE Pro Forma Branch Footprint • Efficient pro forma branch network with $172 million deposits per branch1 • Significant branch overlap creates opportunities for branch consolidations • PPBI has a history of branch rationalization and effectively managing deposit costs • 7 of 9 geographic regions will rank in top-10 for deposit market share2 Pro Forma Deposits by Region Top-10 Deposits % of Region Branches Rank2 ($B) Total Los Angeles-Orange MSA 32 $9.1 60% Central Coast California3 11 $1.8 12% Riverside-San Bernardino MSA 11 $1.3 8% Seattle MSA3 16 $1.2 8% San Diego MSA 8 $0.8 5% Arizona 4 $0.6 4% Portland MSA 2 $0.2 1% Las Vegas MSA 1 $0.1 1% PPBI (42) San Francisco MSA 3 $0.1 1% OPB (46) Total 88 $15.2 100% Source: S&P Global Market Intelligence. Deposit data as of 6/30/2019. All dollars in billions. 1. Excludes branch consolidations from pro forma cost savings. Deposit data as of 6/30/2019 2. Rank excludes CCAR designated banks and foreign owned subsidiaries 7 3. Central Coast includes Santa Barbara and San Luis Obispo MSAs. Seattle MSA includes Mount Vernon branch

DIVERSIFIED LOAN PORTFOLIO Pro Forma NOO-CRE OO-CRE 20% NOO-CRE 19% 24% OO-CRE Multifamily NOO-CRE 13% 64% 13% C&I + Multifamily 37% Franchise C&I + Multifamily 25% Franchise 18% OO-CRE C&I 21% 5% 15% 1-4 Family Farm & Ag. 1-4 Family 3% 3% 1-4 Family 2% Farm & Ag. 2% Construction & Land Consumer & 1% Consumer & Construction & Land 5% Other SBA Consumer & Other SBA Construction & Land Other 3% 1% 1% 0% 2% 1% SBA 0% 1% Gross Loans: $8.7 Billion Gross Loans: $5.9 Billion Gross Loans: $14.6 Billion Loan Yield: 5.44% Loan Yield: 4.13% Loan Yield: 4.92% NPAs/Assets: 0.08% NPAs/Assets: 0.07% NPAs/Assets: 0.08% • Attractive credit quality and risk adjusted returns on • Continuing momentum to grow middle-market banking loan portfolio practice – will benefit from larger pro forma balance sheet • Differentiated specialty lending verticals and expertise • Multifamily loans are geographically diversified in West Coast metropolitan areas Note: S&P Global Market Intelligence, financial information as of or for the quarter-ended 12/31/2019 8

ATTRACTIVE FUNDING PROFILE Pro Forma IB Demand 7% IB IB Demand 21% Demand MMDA & MMDA & 41% Savings NIB Savings 34% MMDA & Demand 38% Savings 43% NIB 36% Demand 30% NIB Time Deposits Time Deposits Time Deposits Demand 13% 12% 12% 12% Total Deposits: $8.9 Billion Total Deposits: $6.5 Billion Total Deposits: $15.4 Billion Cost of Deposits: 0.58% Cost of Deposits: 1.01% Cost of Deposits: 0.76% • $2.0 billion in deposits with a blended deposit cost of • Greater deposit diversification 0.10% from PENSCO and Commerce Escrow divisions • Ability to run-off and replace Opus’ higher-cost funding • Strong pro forma core deposit franchise with core deposits at PPBI Note: S&P Global Market Intelligence, financial information as of or for the quarter-ended 12/31/2019 9

TRANSACTION OVERVIEW Buyer • Pacific Premier Bancorp, Inc. (NASDAQ: PPBI) Seller • Opus Bank (NASDAQ: OPB) Consideration • 100% stock • 0.90x shares of PPBI common stock for each share of Opus stock – fixed exchange ratio, no caps or collars • 34.7 million shares issued to holders of Opus common stock, as-converted preferred stock, and restricted stock awards Transaction • $1.0 billion in aggregate consideration 1 Value • $26.82 per share consideration Transaction • 138.4% price / tangible book value per share Multiples1,2 • 5.2% core deposit premium (excluding CDs > $100k) • 16.6x price / EPS (2019A) • 16.3x price / EPS (2020E) • 14.7x price / EPS (2021E), or 8.7x including fully-phased in cost savings Pro Forma • 14% EPS accretion in 2021, or $0.36 per share Impact • Tangible book value dilution of 2.8%, or $0.53 per share, with an earnback period of 1.8 years Ownership / • Opus shareholders will have pro forma ownership of 36.8% in PPBI Board Seats • Two Board seats for Opus, pro forma PPBI Board of Directors will remain at 11 people Approvals • Estimated to close in Q2 2020. Conversion and system integration in 2H 2020 and Timing • Customary regulatory and shareholder approval 1. Market data as of 1/31/2020. Includes consideration for common shareholders, preferred stock holders, stock options, warrants and restricted stock awards 2. Financial information as of 12/31/2019. Opus EPS in 2020 and 2021 based on average Street consensus estimates 10

KEY MERGER ASSUMPTIONS Earnings Estimates • EPS projections based on average Street Consensus estimates for PPBI and Opus in 2020 and 2021 Cost • Cost savings: 25% of non-interest expense, or $41.0 million in 2021 Savings • Cost savings phased-in 37.5% in 2020 and 100% in 2021 Core Deposit • 1.24% of non-time deposits; amortized over 10 years based on sum-of-years digit methodology Intangible Gross • Fair market value adjustment of 1.34%, or $78.8 million, including credit mark and interest rate mark Loan Mark • Non-PCD Loans: Credit mark of 0.74% and interest rate mark of 0.61%, or $43.3 million and $35.5 million • PCD Loans: Interest rate mark of 0.12% on PCD loans, or $92k • Accretable yield equal to $78.8 million, accreted over 5 years based on sum-of-years digit methodology CECL • Non-PCD Loans: CECL reserve (Day-2) of 0.81%, or $47.0 million Impact • PCD Loans: CECL reserve of 4.04%, or $3.0 million • CECL is a “double hit” to equity, in addition to the fair market value adjustments described above • Both PPBI and Opus fully prepared for implementing CECL accounting on standalone basis Other • Estimated annual interchange revenue loss of $1.0 million attributable to Durbin Assumptions • Revenue enhancements identified but not modeled • Other balance sheet adjustments of $46.5 million including securities, fixed assets, leases, other assets, sub-debt and CD’s Merger • $67.4 million in pre-tax expenses Expenses • Fully recognized in pro forma tangible book value at closing Due • Comprehensive financial, legal, regulatory and operational due diligence conducted Diligence 11

ACQUISITION HISTORY Continuing PPBI’s Valuation Creation Strategy for Organic and Acquisitive Growth • Solid track record of delivering value for shareholders Total April 2017 and TBV/ January 2014 July 2018 February 2011 November 2017 Assets Acquired Infinity Acquired Grandpoint Share Acquired Canyon Acquired Heritage Franchise Holdings Capital, Inc. National Bank Oaks Bancorp $20 B $20 ($80MM assets), ($3.2B assets) $20.00 ($192MM assets) in ($2.0B assets) a specialty finance FDIC-assisted deal and Plaza Bancorp $18.84 company $18 ($1.3B assets) $18.00 April 2012 $16 January 2015 January 2016 $16.97 Acquired Palm Acquired Acquired Security Desert National Bank Independence Bank California Bancorp ($103MM assets) in $14 ($422MM assets) ($715MM assets) FDIC-assisted deal $15.26 $16.00 $12 $11 B $12 B March 2013 and June 2013 $10 Acquired First $14.00 Associations Bank ($424MM assets) and $12.51 $8 B $8 San Diego Trust Bank ($211MM assets) $11.17 $12.00 $6 $10.12 $4 B $4 $3 B $9.08 $2 B $10.00 $2 $- $8.00 2013 2014 2015 2016 2017 2018 2019 Pro Forma with Opus Non-Acquired Assets Acquired Assets TBV/Share Note: All dollars in billions, except per share data 12 Note: Pro forma with Opus as of 12/31/2019. Excludes impact of purchase accounting adjustments

SUMMARY Strategically Compelling ~$20 billion asset franchise with meaningful presence in desirable Western U.S. metropolitan markets Complementary combination which creates greater scale and diversification Expanded strategic flexibility for technology investment, organic growth and acquisition opportunities Track record of successful merger execution and integration Financially Attractive Double-digit EPS accretion in 2021 and modest tangible book value dilution Significant increase in PPBI’s non-interest income – strengthens revenue mix Prudent deployment of PPBI’s capital while maintaining strong pro forma capital ratios Accelerating capital generation and growing dividend – enhancing shareholder value 13

Appendix

NON-U.S. GAAP FINANCIAL MEASURES Tangible common equity to tangible assets (the "tangible common equity ratio") and tangible book value per share are a non-U.S. GAAP financial measures derived from U.S. GAAP-based amounts. We calculate the tangible common equity ratio by excluding the balance of intangible assets from common stockholders' equity and dividing by tangible assets. We calculate tangible book value per share by dividing tangible common equity by common shares outstanding, as compared to book value per common share, which we calculate by dividing common stockholders’ equity by common shares outstanding. We believe that this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of risk-based capital ratios. Accordingly, we believe that these non-U.S. GAAP financial measures provide information that is important to investors and that is useful in understanding our capital position and ratios. However, these non-U.S. GAAP financial measures are supplemental and are not a substitute for an analysis based on U.S. GAAP measures. As other companies may use different calculations for these measures, this presentation may not be comparable to other similarly titled measures reported by other companies. A reconciliation of the non-U.S. GAAP measure of tangible common equity ratio to the U.S. GAAP measure of common equity ratio and tangible book value per share to the U.S. GAAP measure of book value per share are set forth below. PPBI with Pro 1 PPBI CECL Forma Common Stockholders' Equity$ 2,012,594 $ 1,972,994 $ 2,933,547 Less: Intangible Assets$ 891,634 $ 891,634 $ 1,282,959 Tangible Common Equity$ 1,120,960 $ 1,081,360 $ 1,650,587 Common Shares Outstanding 59,506,057 59,506,057 94,181,127 Book Value Per Share$ 33.82 $ 33.16 $ 31.15 Less: Intangible Assets Per Share$ 14.98 $ 14.98 $ 13.62 Tangible Book Value Per Share$ 18.84 $ 18.17 $ 17.53 Total Assets$ 11,776,012 $ 11,743,412 $ 19,619,897 Less: Intangible Assets$ 891,634 $ 891,634 $ 1,282,959 Tangible Assets$ 10,884,378 $ 10,851,778 $ 18,336,938 Tangible Common Equity Ratio 10.3% 10.0% 9.0% Note: PPBI and Opus as of 12/31/2019 Note: All dollars in thousands, except per share data 15 1. Impact from CECL transition, on a standalone basis