Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CAMBRIDGE BANCORP | catc-8k_20200203.htm |

Investor Presentation February 3, 2020 NASDAQ: CATC Parent of Cambridge Trust Company EX: 99-1

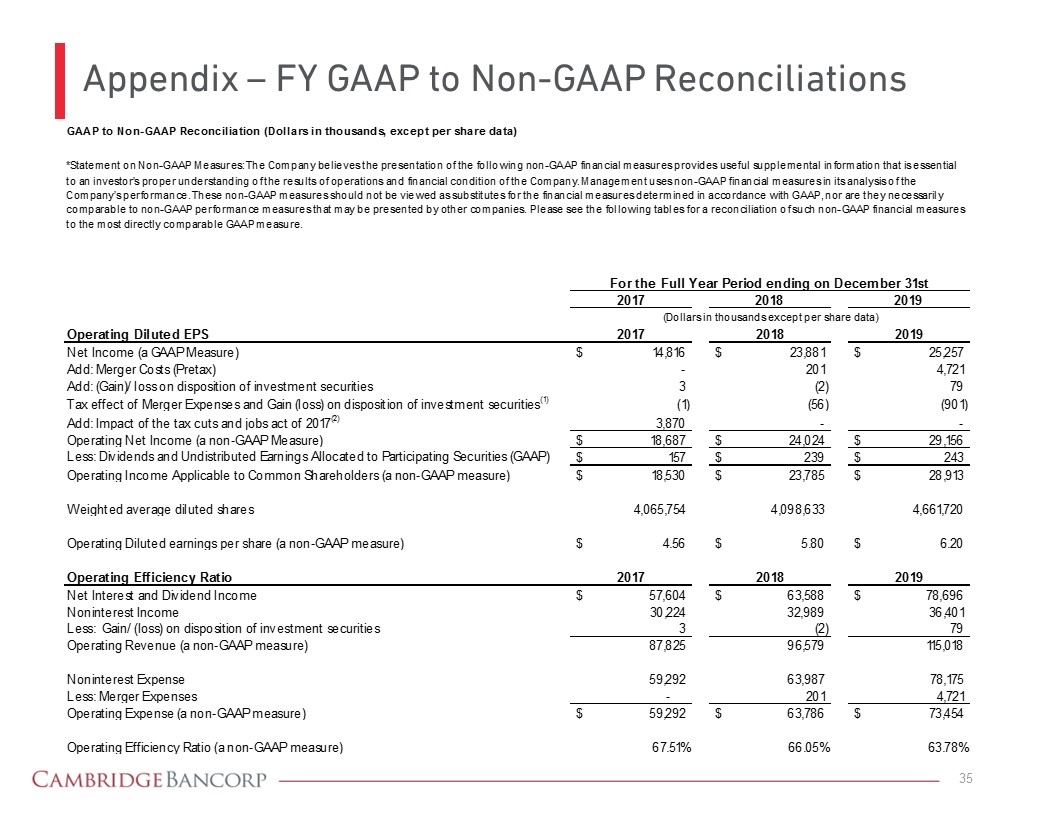

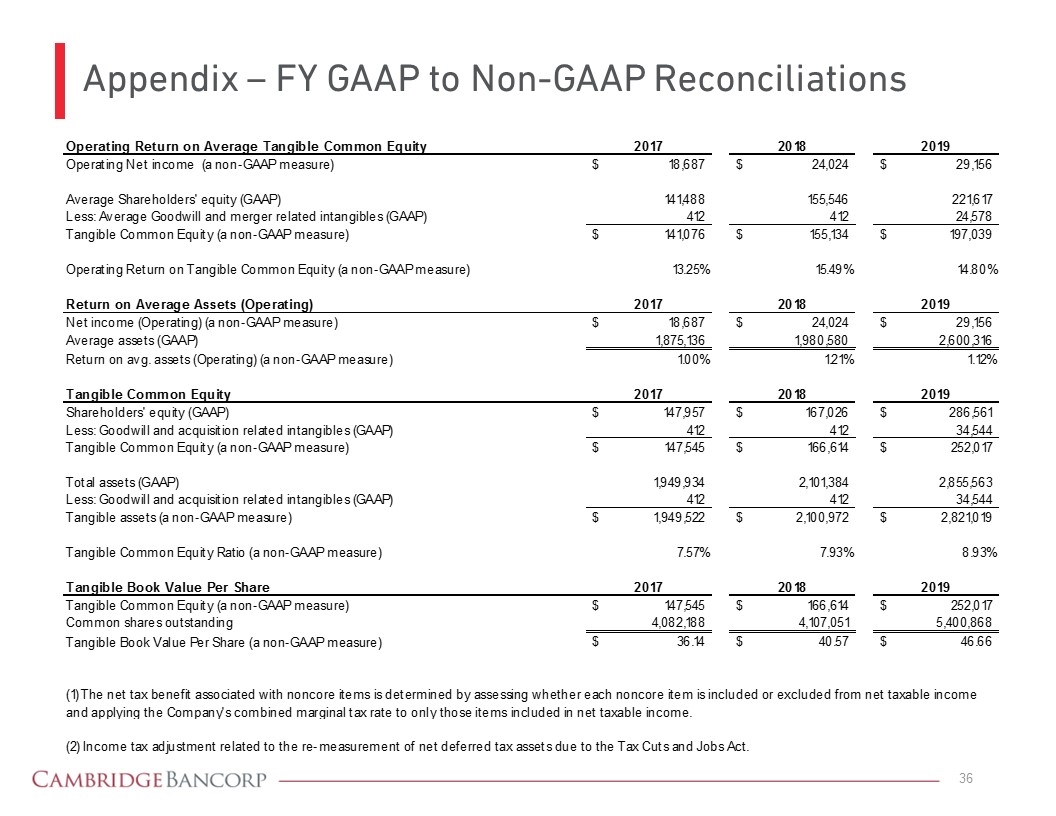

Forward Looking Statements and Non-GAAP Measures This presentation contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements about Cambridge Bancorp (together with its bank subsidiary unless the context otherwise requires, the “Company”) and its industry involve substantial risks and uncertainties. Statements other than statements of current or historical fact, including statements regarding the Company’s future financial condition, results of operations, business plans, liquidity, cash flows, projected costs, and the impact of any laws or regulations applicable to the Company, are forward-looking statements. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “may,” “will,” “should,” and other similar expressions are intended to identify these forward-looking statements. Such statements are subject to factors that could cause actual results to differ materially from anticipated results. Such factors are described within the Company’s filings with the Securities & Exchange Commission, including the Company’s Annual Report on Form 10-K for the year end December 31, 2018, which the Company filed on March 18, 2019. Except required by the law, the Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. You are cautioned not to place undue reliance on these forward-looking statements. This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). This information includes Operating Diluted EPS, Operating Efficiency Ratio, Operating Return on Average Tangible Common Equity, Return on Average Assets (Operating), Tangible Common Equity and Tangible Book Value Per Share. These non-GAAP measures should not be viewed as a substitute for operating results and other financial measures determined in accordance with GAAP. An item which management deems to be non-core and excludes when computing these non-GAAP measures can be of substantial importance to the Company’s results for any particular quarter or year. The Company’s non-GAAP performance measures, including Operating Diluted EPS, Operating Efficiency Ratio, Operating Return on Average Tangible Common Equity, Return on Average Assets (Operating), Tangible Common Equity and Tangible Book Value Per Share are not necessarily comparable to non-GAAP performance measures which may be presented by other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are presented in the Appendix under “GAAP to Non-GAAP Reconciliations.”

Company Profile (as of December 31, 2019) Banking subsidiary: Cambridge Trust Company (1890) Headquarters: Harvard Square, Cambridge, MA Wealth Assets: $3.5 billion Banking Assets: $2.9 billion Gross Loans: $2.2 billion Total Deposits: $2.4 billion Non interest income: 32% of revenue in 2019 NASDAQ: CATC Market Cap: $433 million

Cambridge Bancorp Investment Highlights High-performing, commercially-oriented private bank operating throughout attractive and affluent markets in Greater Boston and southern New Hampshire Greater Boston and southern New Hampshire offer significant growth prospects Low-cost core deposit base with 27% of balances in non-interest accounts Financially compelling acquisition of Wellesley Bancorp, Inc. will strategically enhance scale and support future growth opportunities The combined company would have 10th largest deposit market share in Boston MSA as of 6/30/2019, among Massachusetts-based institutions Pro forma assets of $3.8 billion Diversified revenue and growth opportunities driven by wealth management focus $3.5 billion assets under management and administration ($3.8 billion pro forma) Fee income contributes ~32% of revenue Strong asset quality metrics reflecting proactive risk management, experienced lending teams and a strong underwriting culture History of demonstrated value creation for shareholders reflecting strong price performance and consistent dividend growth Deep and experienced management team

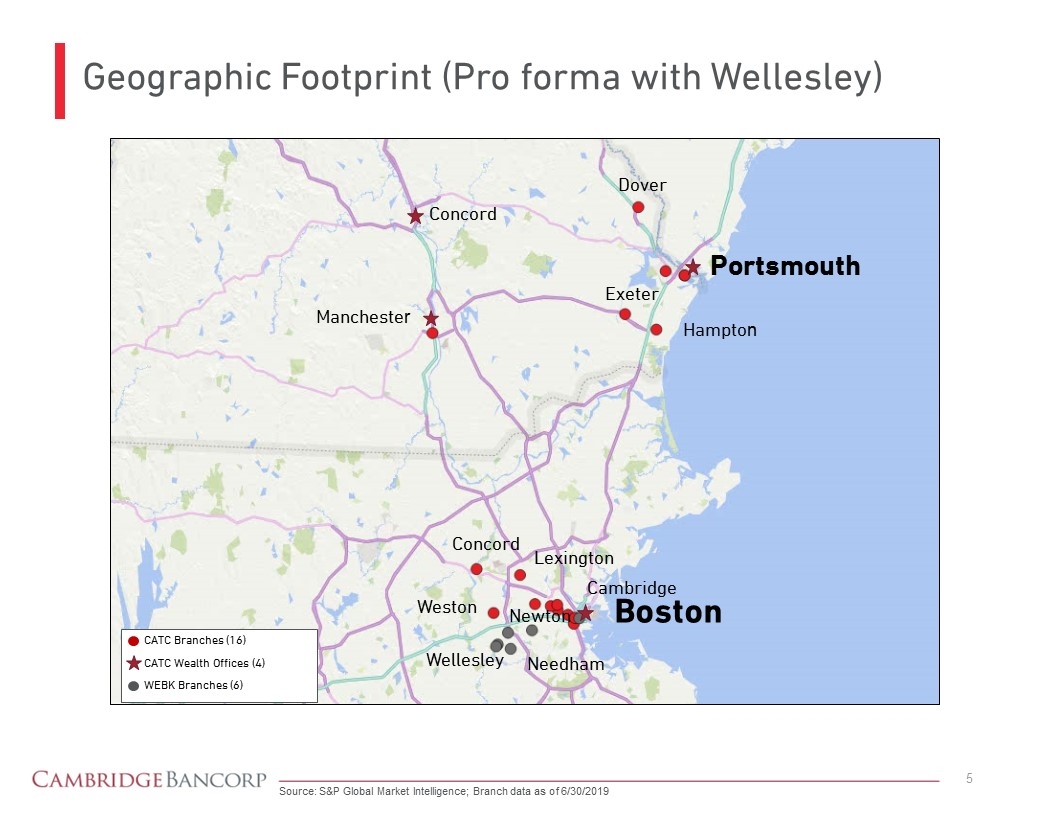

Geographic Footprint (Pro forma with Wellesley) Source: S&P Global Market Intelligence; Branch data as of 6/30/2019 Boston Cambridge Lexington Concord Weston Wellesley Needham Newton CATC Branches (16) CATC Wealth Offices (4) WEBK Branches (6) Portsmouth Dover Concord Manchester Hampton Exeter

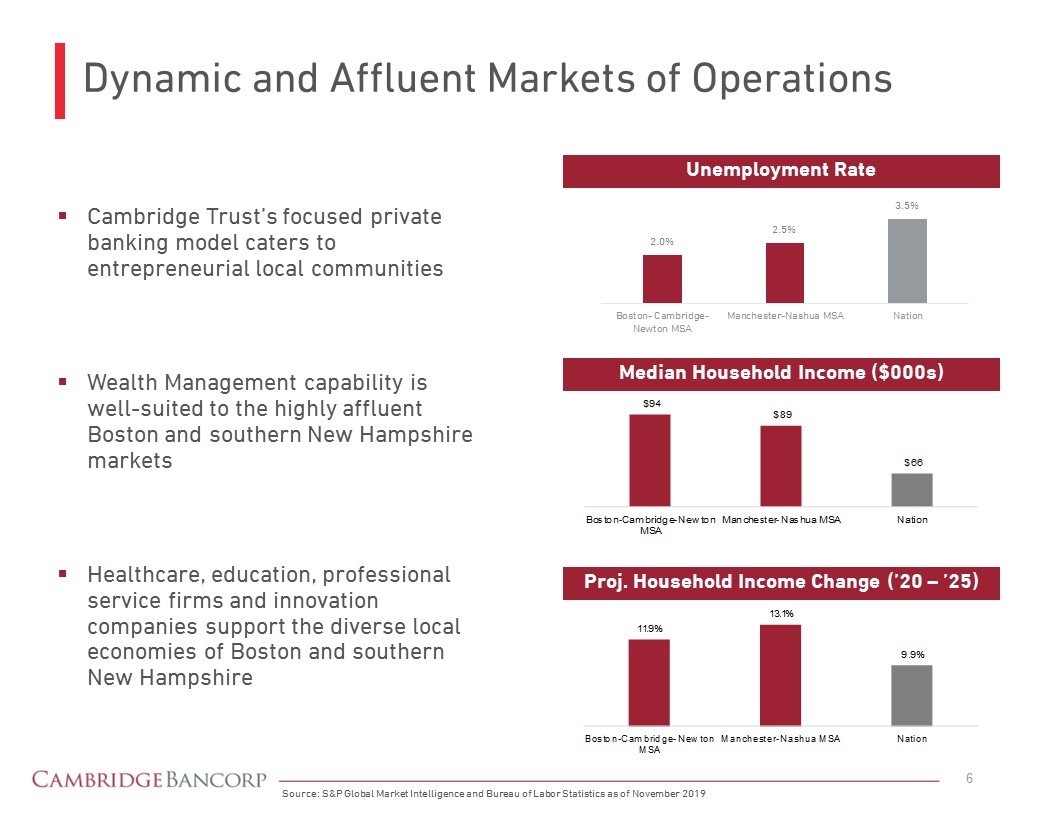

Dynamic and Affluent Markets of Operations Source: S&P Global Market Intelligence and Bureau of Labor Statistics as of November 2019 Unemployment Rate Median Household Income ($000s) Proj. Household Income Change (’20 – ’25) Cambridge Trust’s focused private banking model caters to entrepreneurial local communities Wealth Management capability is well-suited to the highly affluent Boston and southern New Hampshire markets Healthcare, education, professional service firms and innovation companies support the diverse local economies of Boston and southern New Hampshire

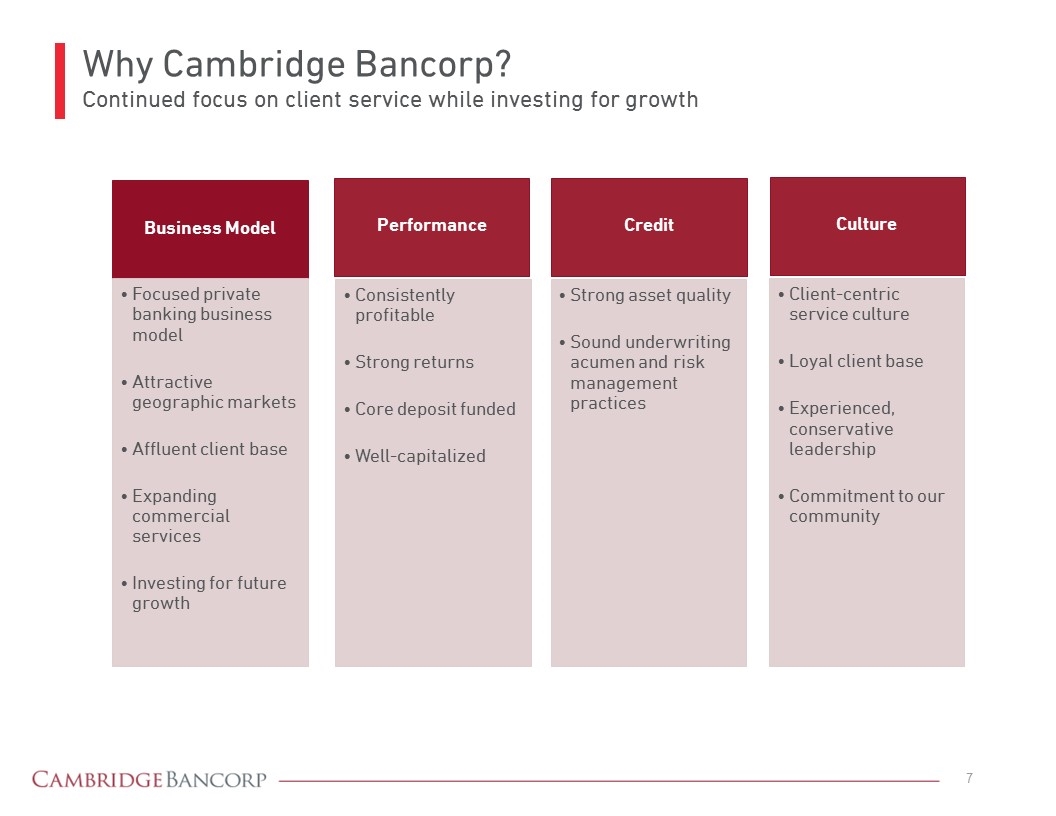

Why Cambridge Bancorp? Continued focus on client service while investing for growth Business Model Focused private banking business model Attractive geographic markets Affluent client base Expanding commercial services Investing for future growth Culture Client-centric service culture Loyal client base Experienced, conservative leadership Commitment to our community Performance Consistently profitable Strong returns Core deposit funded Well-capitalized Credit Strong asset quality Sound underwriting acumen and risk management practices

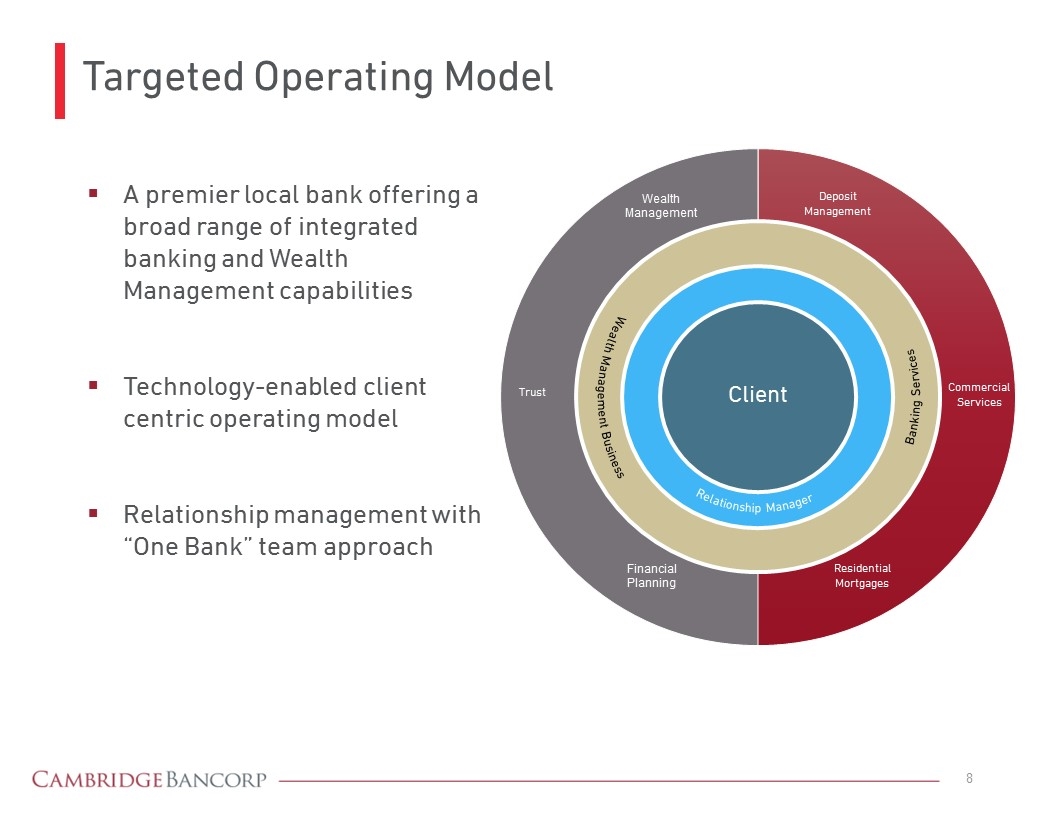

Targeted Operating Model A premier local bank offering a broad range of integrated banking and Wealth Management capabilities Technology-enabled client centric operating model Relationship management with “One Bank” team approach Client Relationship Manager Wealth Management Business Banking Services Wealth Management Financial Planning Trust Deposit Management Residential Mortgages Commercial Services

Strategic Focus Be recognized as the premier private bank in Greater Boston & Southern New Hampshire Leverage private banking model in highly attractive markets Increase brand awareness Expand Wealth Management assets under management Grow and diversify Commercial Banking opportunities & relationships Expand client base & deepen existing relationships to grow deposit base

Recent Strategic Progress Generated record operating earnings in 2019 Announced merger with Wellesley Bancorp in Q4 2019 Strategic merger which expands the company’s presence in Greater Boston with the addition of 6 banking office locations in Norfolk, Middlesex and Suffolk Counties Anticipated to close during the second quarter of 2020 Systems conversion anticipated during fourth quarter of 2020 Completed a common equity raise in fourth quarter of 2019 of $38.2 million, net of underwriter discount Completed merger with Optima Bank & Trust effective April 17, 2019, with successful systems conversion in July Addition of 6 banking office locations in New Hampshire to complement over $1 billion of Wealth Management assets in this important market Launched new brand identity, bank website and brand awareness campaign Named in the Top 25 Independent Investment Advisors in Massachusetts for second consecutive year (according to Boston Business Journal) Increased resources to support expansion of business development initiatives

Strong Financial Performance

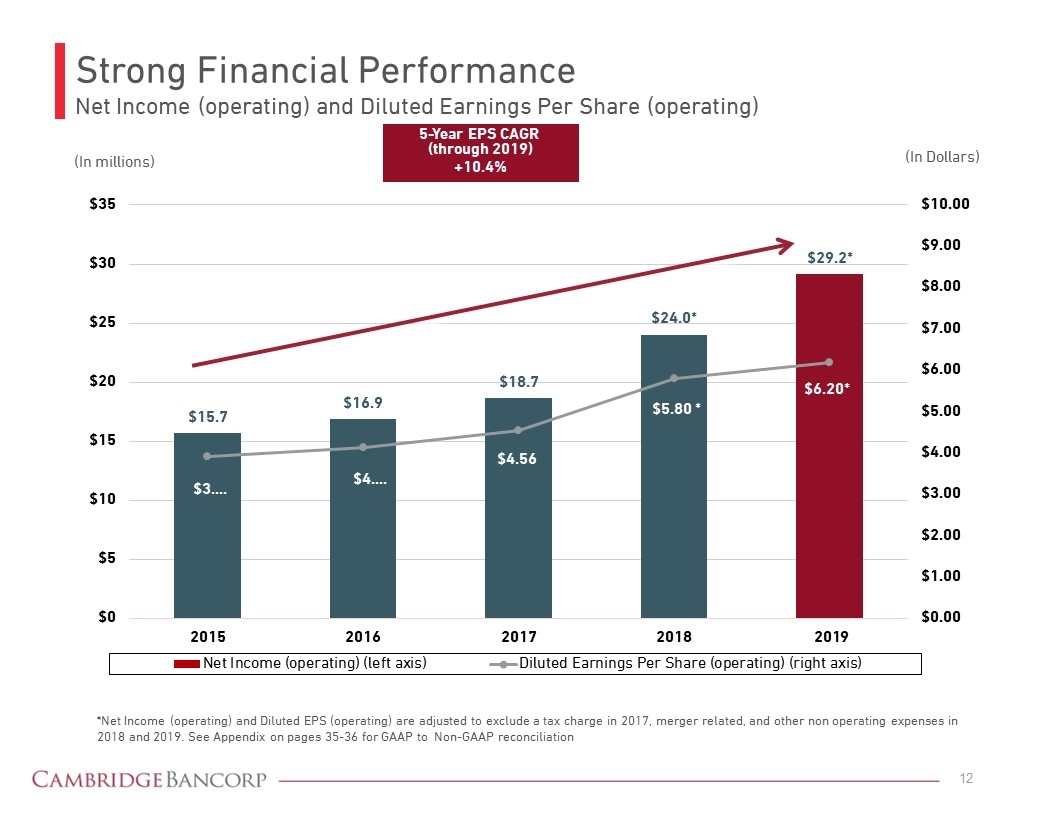

Strong Financial Performance Net Income (operating) and Diluted Earnings Per Share (operating) 5-Year EPS CAGR (through 2019) +10.4% (In Dollars) *Net Income (operating) and Diluted EPS (operating) are adjusted to exclude a tax charge in 2017, merger related, and other non operating expenses in 2018 and 2019. See Appendix on pages 35-36 for GAAP to Non-GAAP reconciliation (In millions)

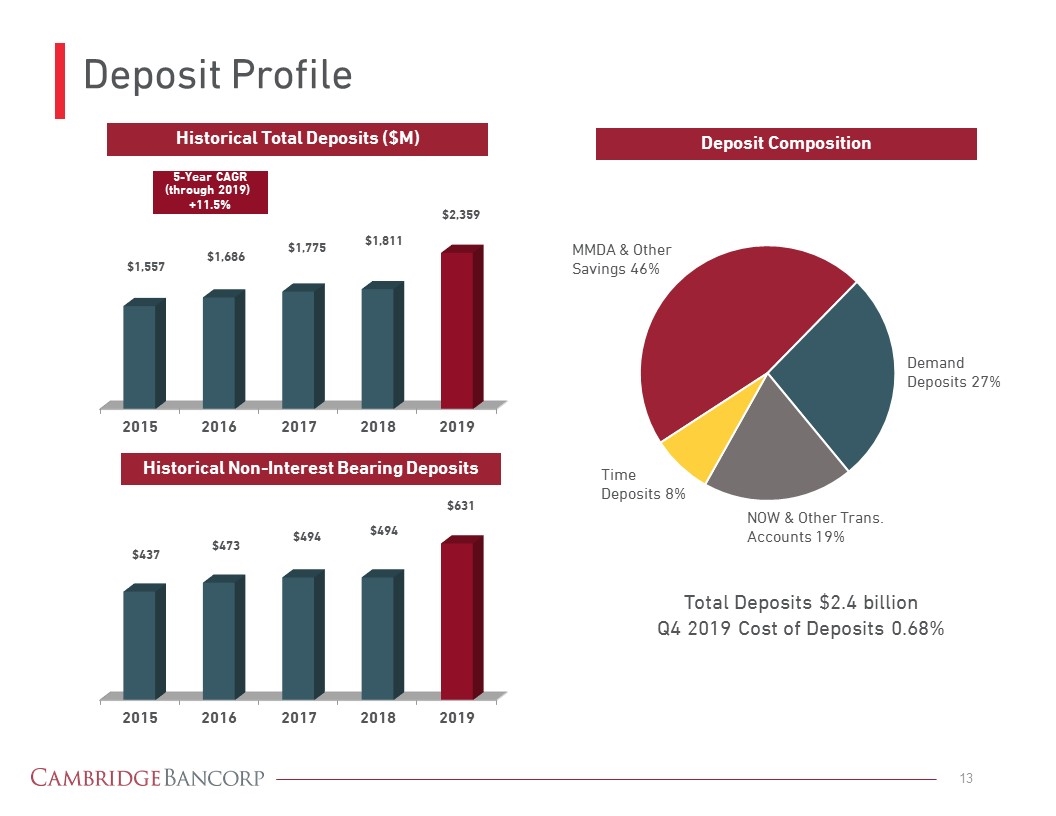

Deposit Profile Historical Total Deposits ($M) Historical Non-Interest Bearing Deposits MMDA & Other Savings 46% Time Deposits 8% Deposit Composition Demand Deposits 27% NOW & Other Trans. Accounts 19% Total Deposits $2.4 billion Q4 2019 Cost of Deposits 0.68% 5-Year CAGR (through 2019) +11.5%

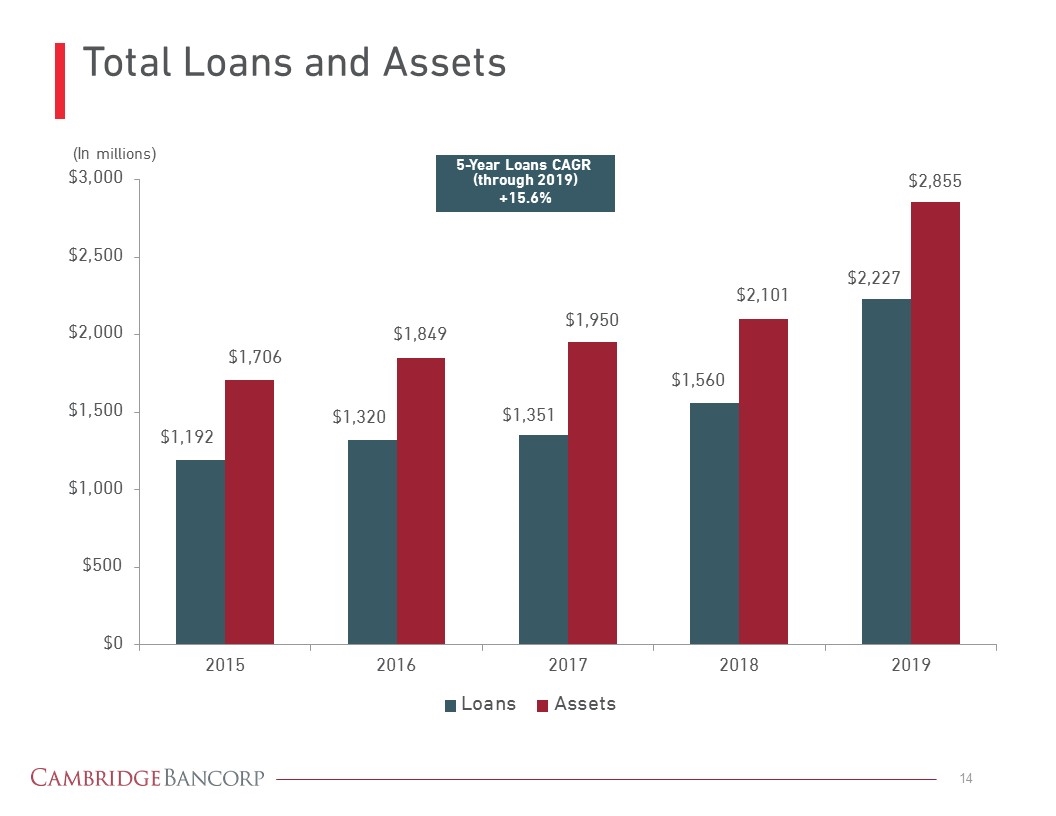

Total Loans and Assets (In millions) 5-Year Loans CAGR (through 2019) +15.6%

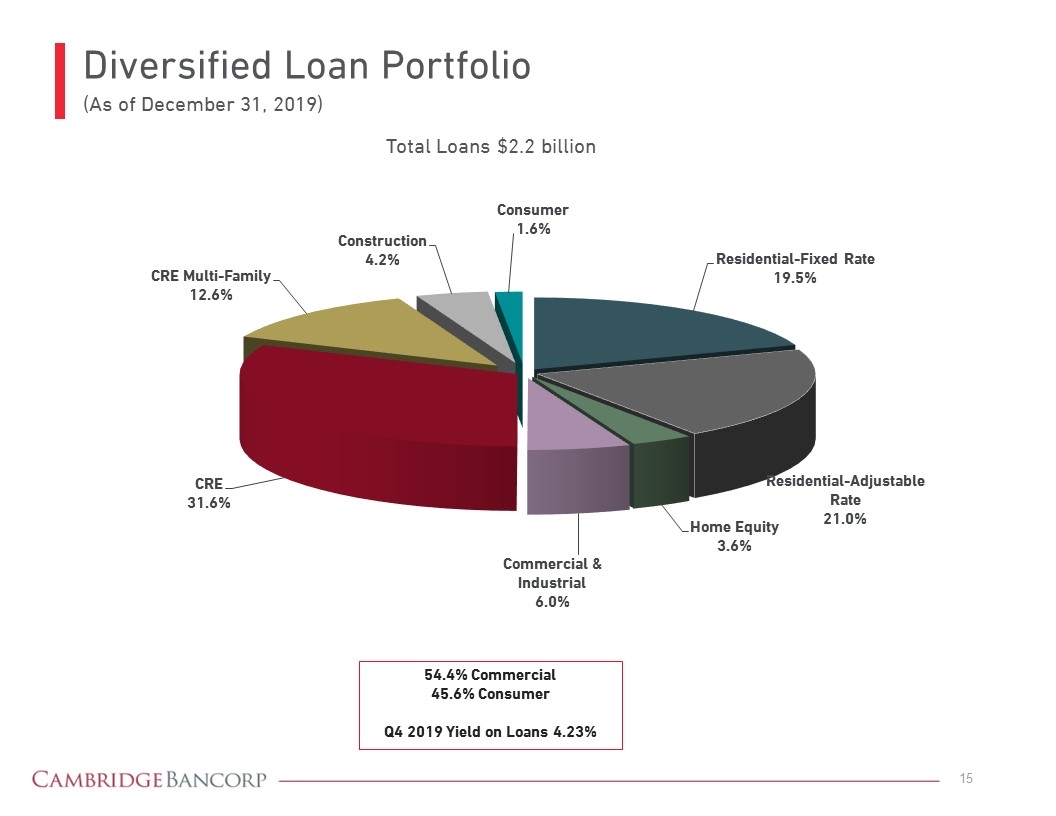

Diversified Loan Portfolio (As of December 31, 2019) Total Loans $2.2 billion 54.4% Commercial 45.6% Consumer Q4 2019 Yield on Loans 4.23%

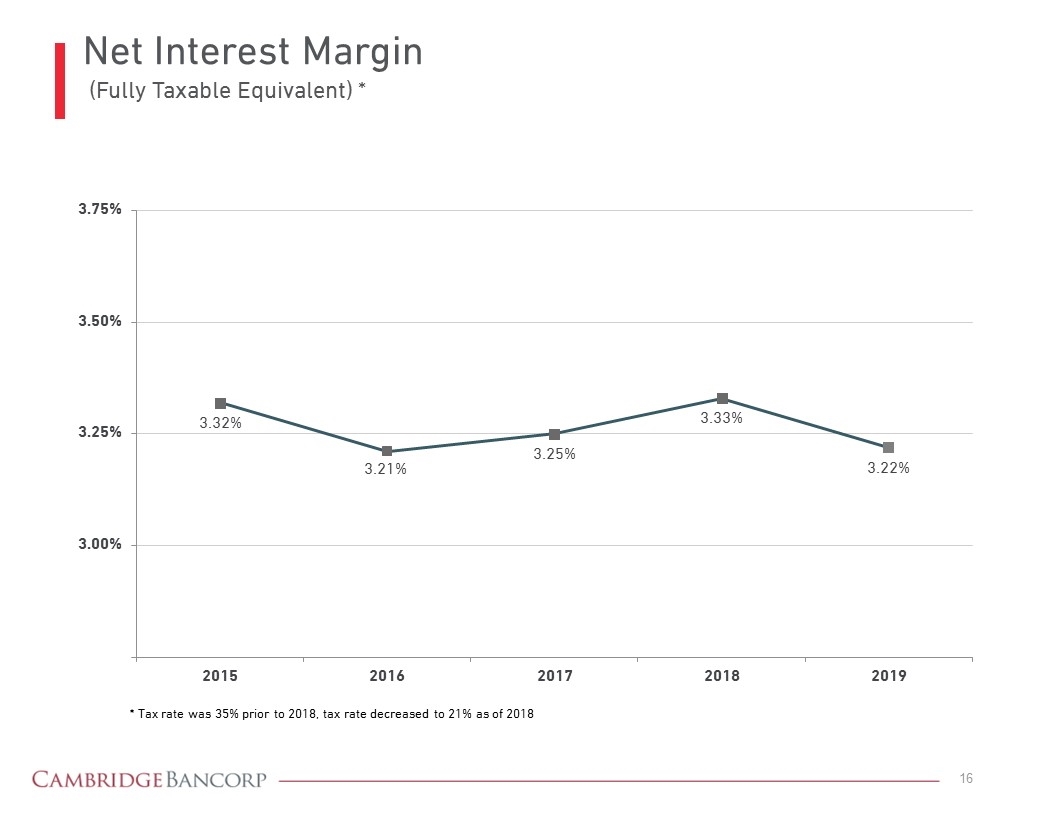

Net Interest Margin (Fully Taxable Equivalent) *

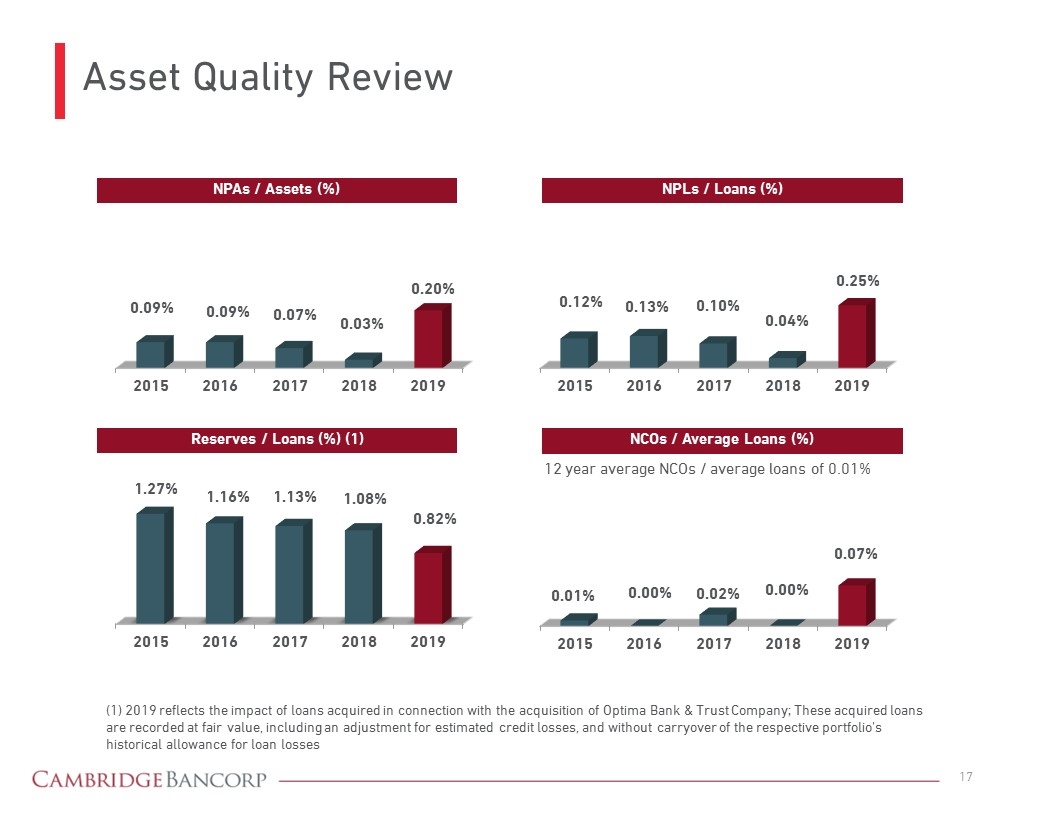

Asset Quality Review NPLs / Loans (%) Reserves / Loans (%) (1) NCOs / Average Loans (%) NPAs / Assets (%) 12 year average NCOs / average loans of 0.01% (1) 2019 reflects the impact of loans acquired in connection with the acquisition of Optima Bank & Trust Company; These acquired loans are recorded at fair value, including an adjustment for estimated credit losses, and without carryover of the respective portfolio’s historical allowance for loan losses

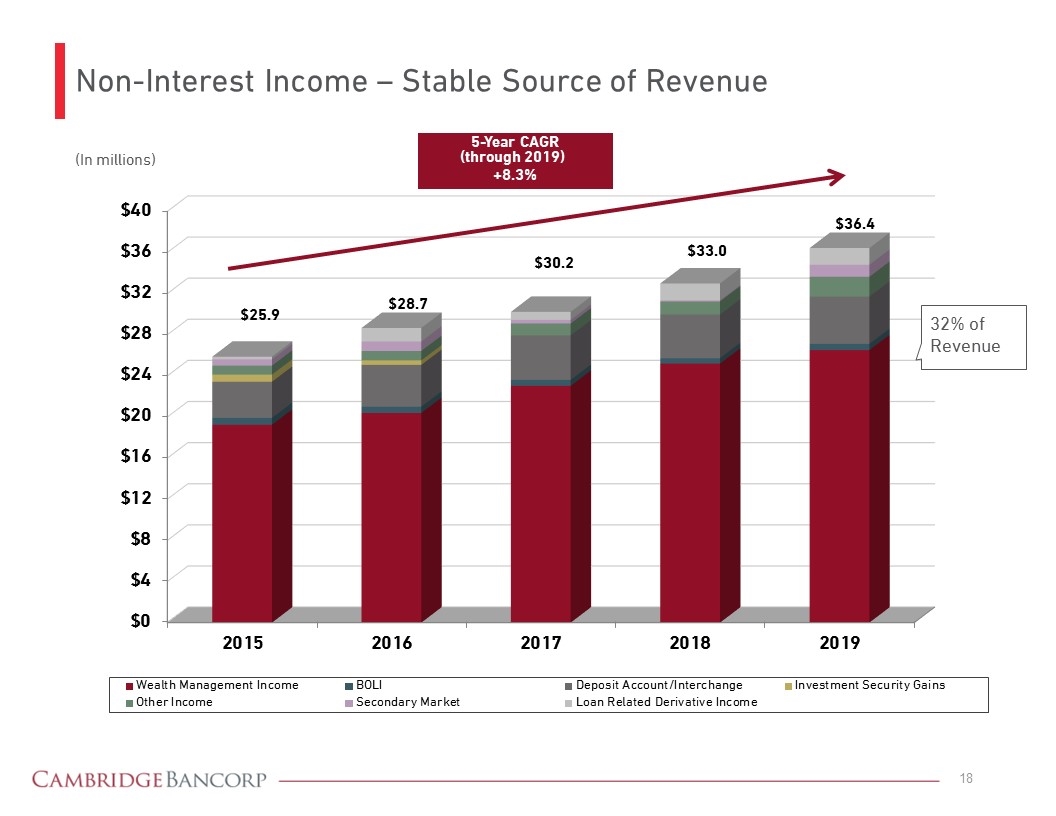

Non-Interest Income – Stable Source of Revenue (In millions) 32% of Revenue 5-Year CAGR (through 2019) +8.3%

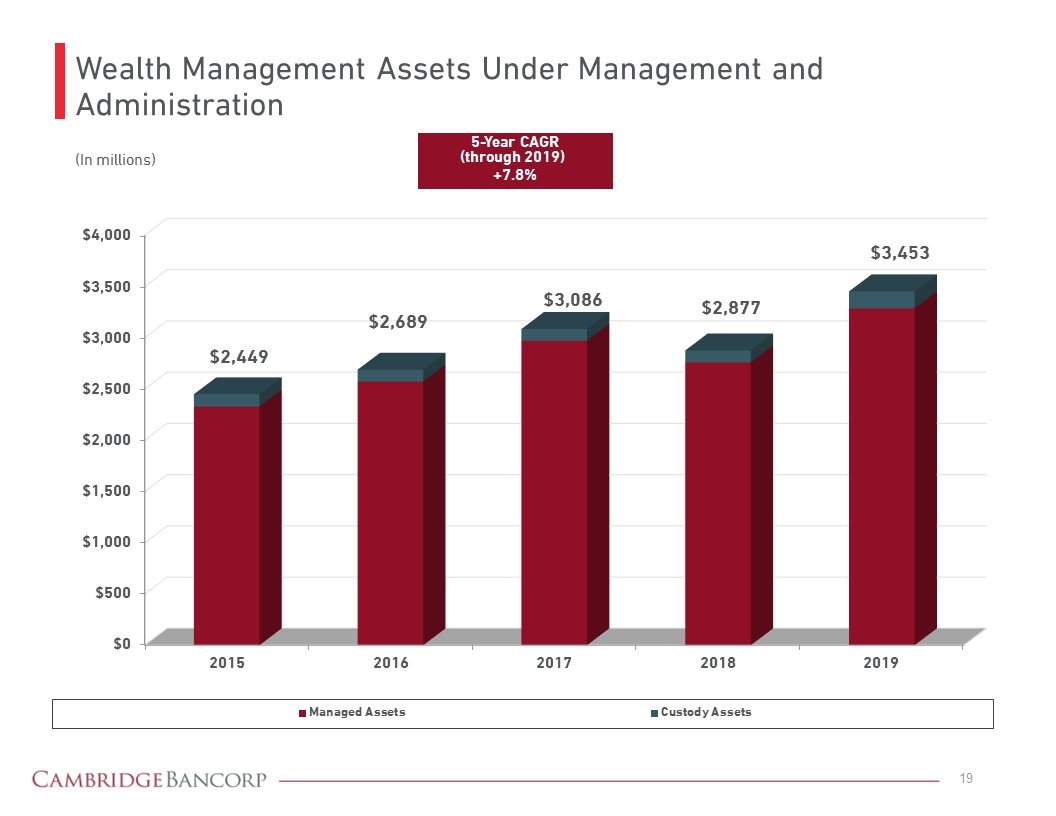

Wealth Management Assets Under Management and Administration 5-Year CAGR (through 2019) +7.8% (In millions)

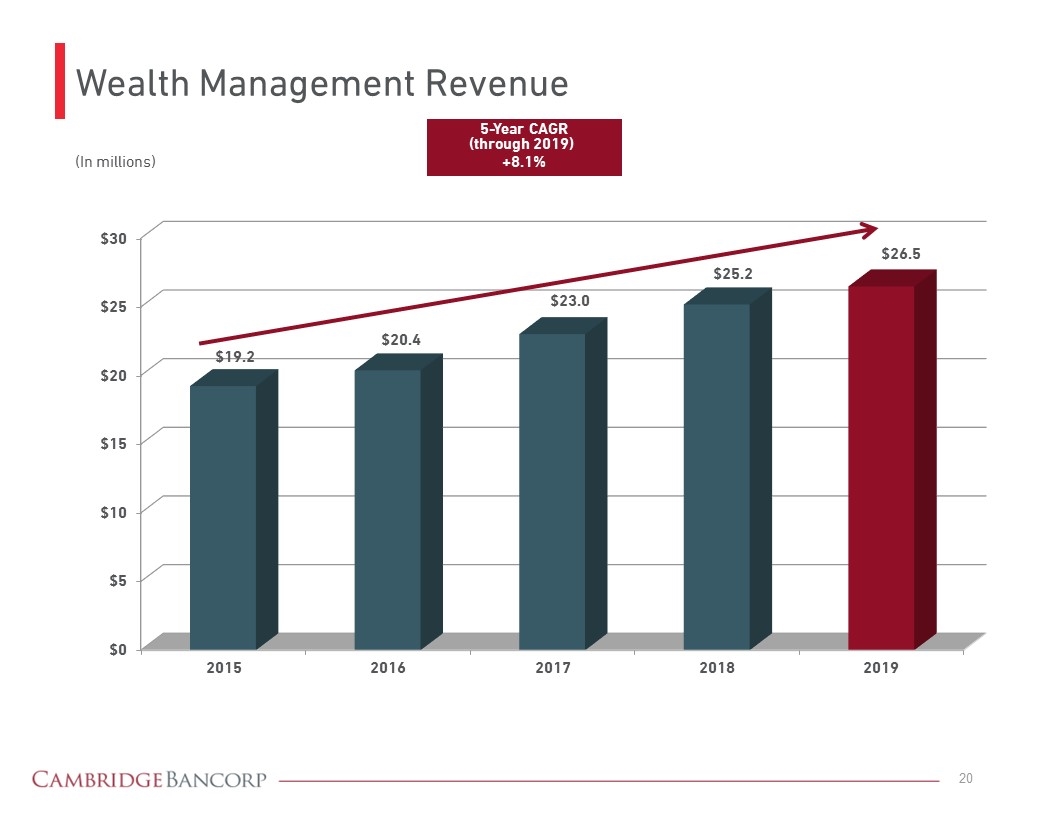

Wealth Management Revenue 5-Year CAGR (through 2019) +8.1% (In millions)

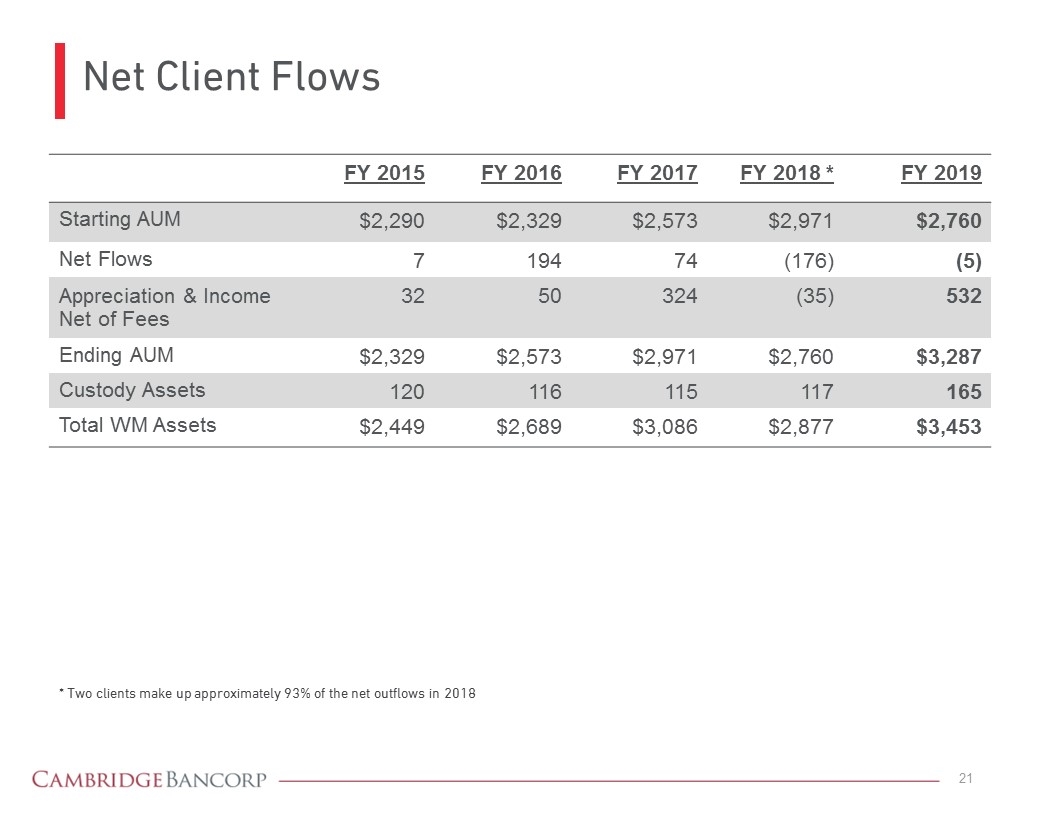

Net Client Flows * Two clients make up approximately 93% of the net outflows in 2018 FY 2015 FY 2016 FY 2017 FY 2018 * FY 2019 Starting AUM $2,290 $2,329 $2,573 $2,971 $2,760 Net Flows 7 194 74 (176) (5) Appreciation & Income Net of Fees 32 50 324 (35) 532 Ending AUM $2,329 $2,573 $2,971 $2,760 $3,287 Custody Assets 120 116 115 117 165 Total WM Assets $2,449 $2,689 $3,086 $2,877 $3,453

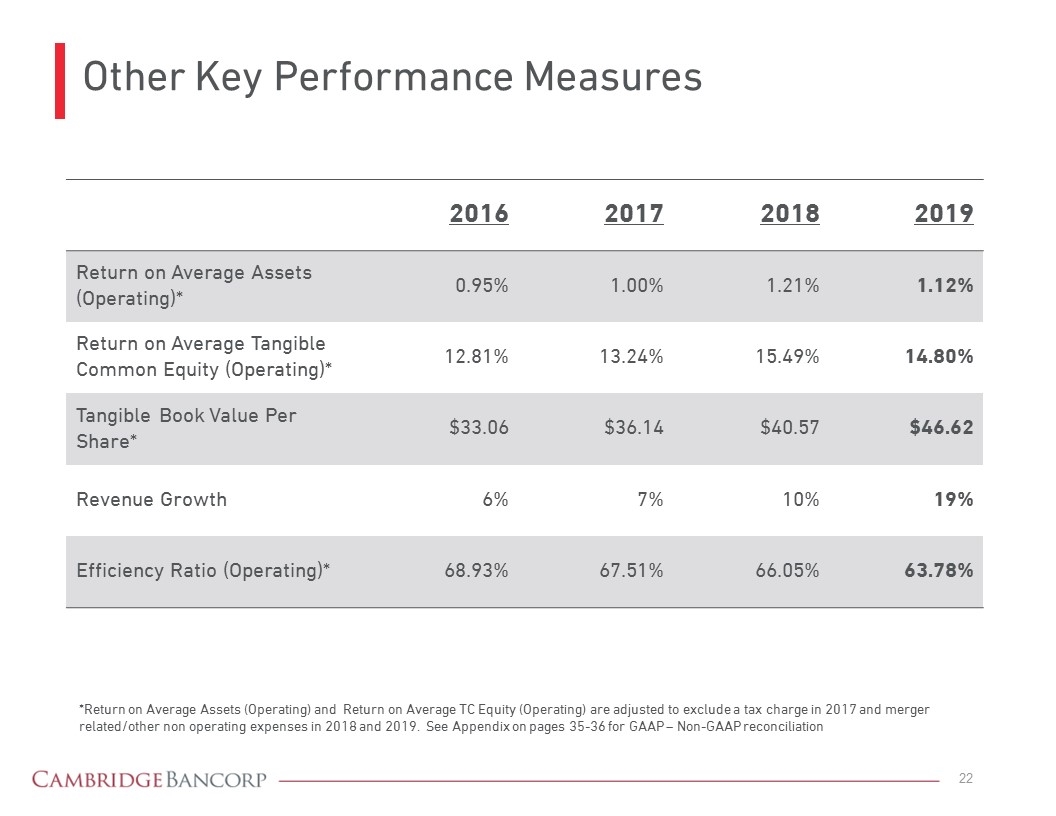

Other Key Performance Measures 2016 2017 2018 2019 Return on Average Assets (Operating)* 0.95% 1.00% 1.21% 1.12% Return on Average Tangible Common Equity (Operating)* 12.81% 13.24% 15.49% 14.80% Tangible Book Value Per Share* $33.06 $36.14 $40.57 $46.62 Revenue Growth 6% 7% 10% 19% Efficiency Ratio (Operating)* 68.93% 67.51% 66.05% 63.78% *Return on Average Assets (Operating) and Return on Average TC Equity (Operating) are adjusted to exclude a tax charge in 2017 and merger related/other non operating expenses in 2018 and 2019. See Appendix on pages 35-36 for GAAP – Non-GAAP reconciliation

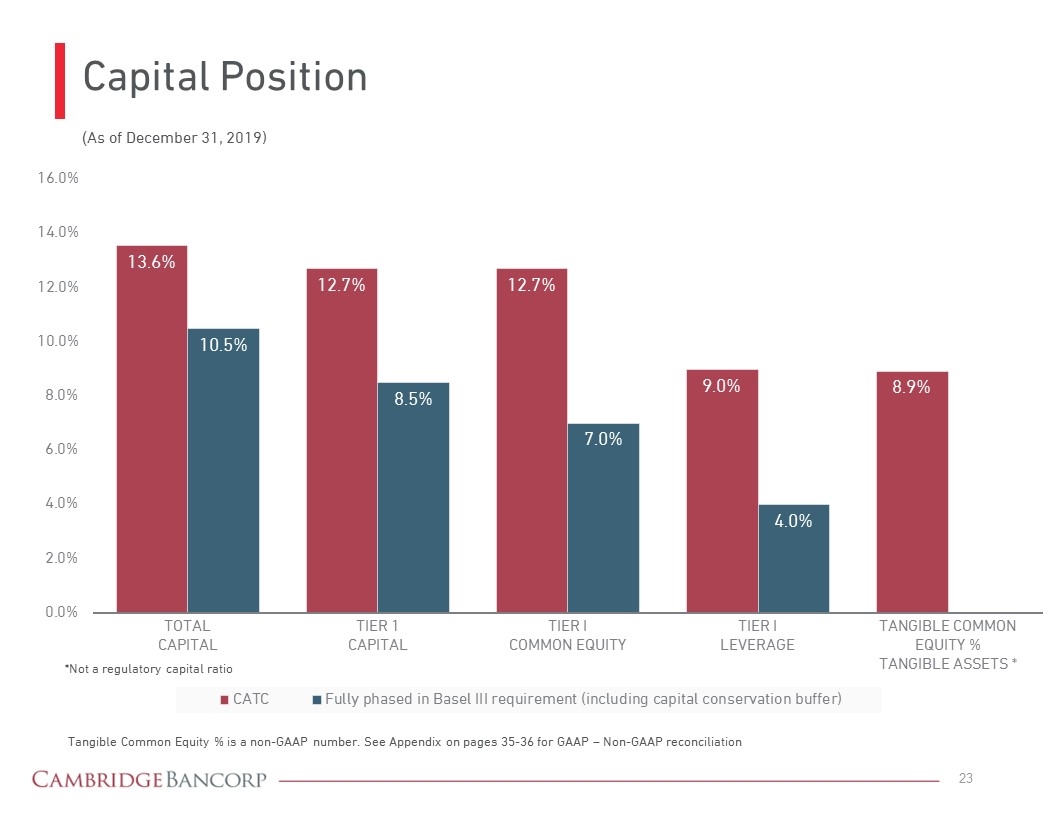

Capital Position (As of December 31, 2019) Tangible Common Equity % is a non-GAAP number. See Appendix on pages 35-36 for GAAP – Non-GAAP reconciliation

Stock Performance & Dividend

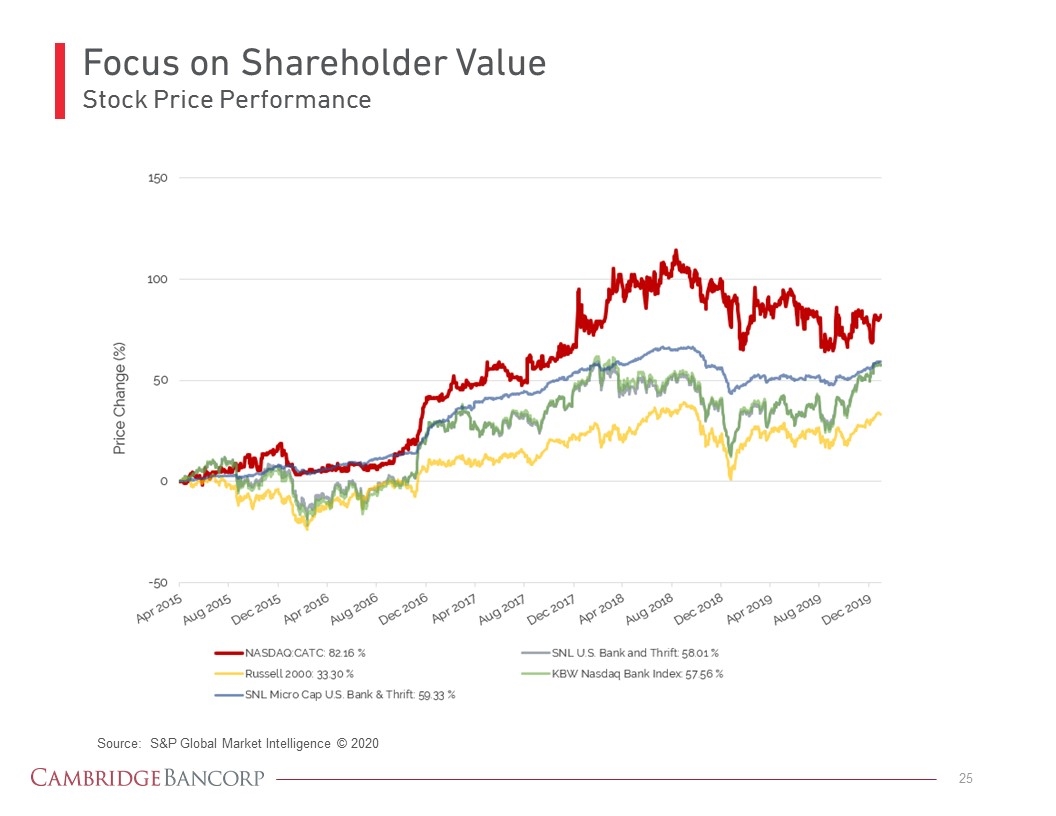

Focus on Shareholder Value Stock Price Performance Source: S&P Global Market Intelligence © 2020

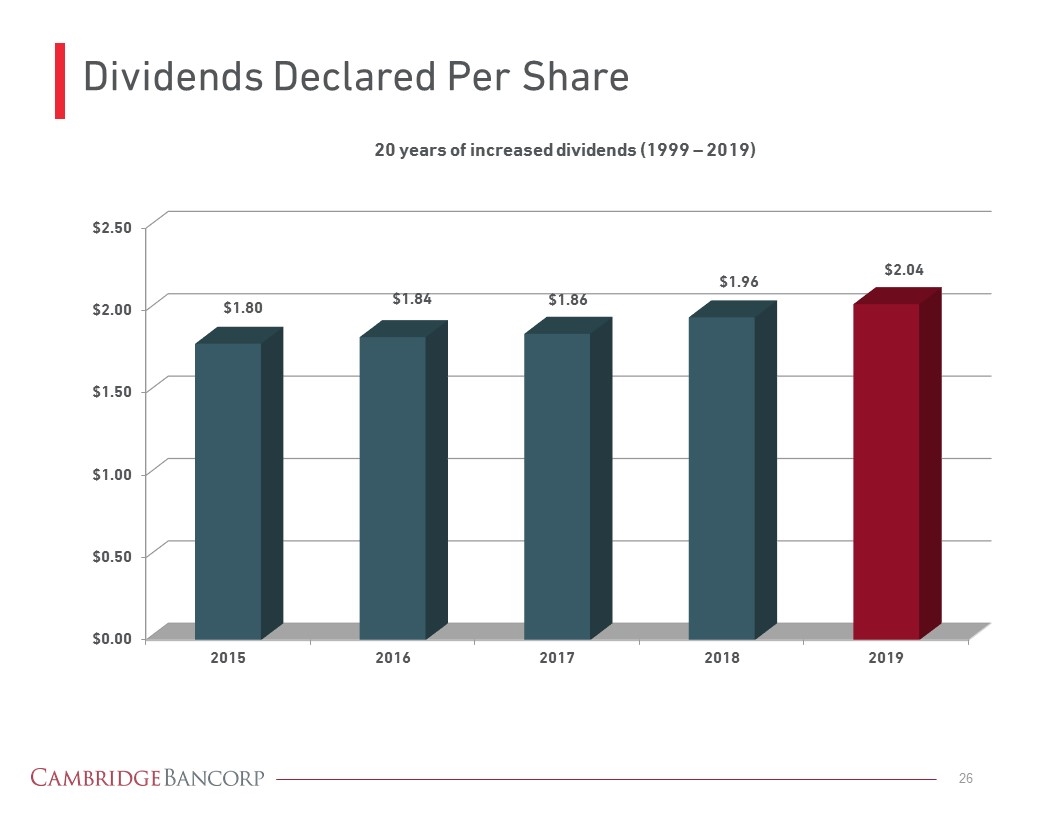

Dividends Declared Per Share 20 years of increased dividends (1999 – 2019)

Merger with Wellesley Bank

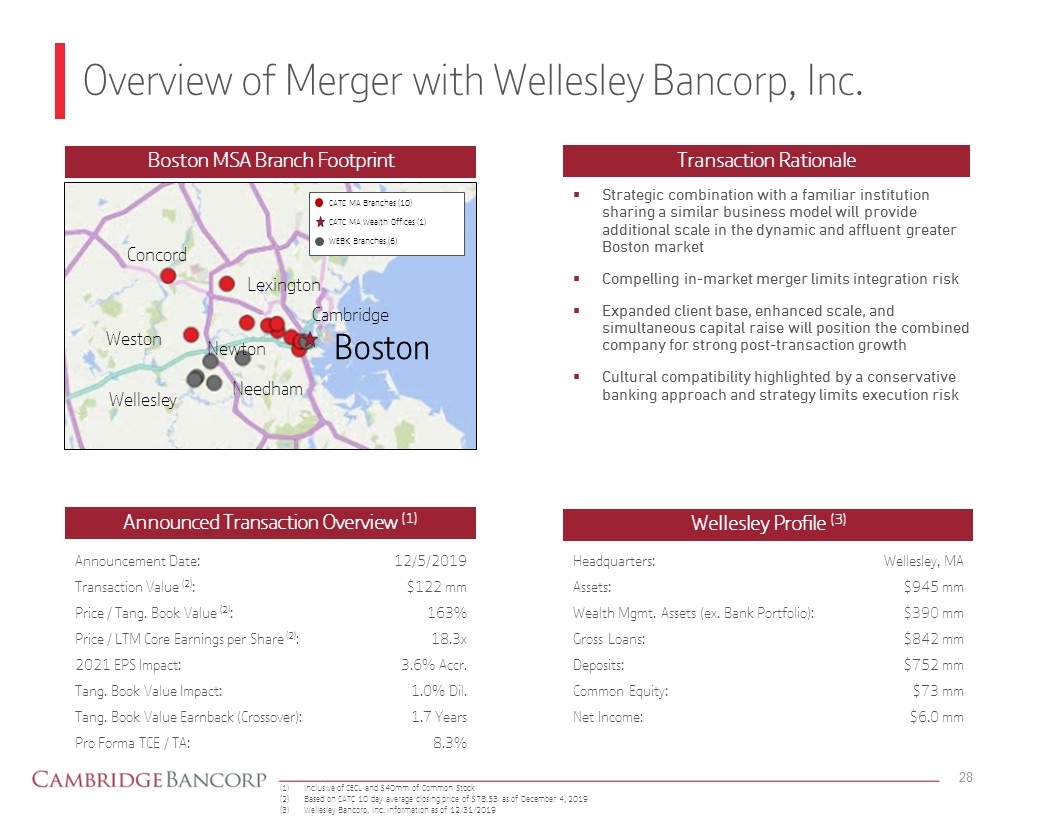

Overview of Merger with Wellesley Bancorp, Inc. Announced Transaction Overview (1) Announcement Date: Transaction Value (2): Price / Tang. Book Value (2): Price / LTM Core Earnings per Share (2): 2021 EPS Impact: Tang. Book Value Impact: Tang. Book Value Earnback (Crossover): Pro Forma TCE / TA: 12/5/2019 $122 mm 163% 18.3x 3.6% Accr. 1.0% Dil. 1.7 Years 8.3% Transaction Rationale Strategic combination with a familiar institution sharing a similar business model will provide additional scale in the dynamic and affluent greater Boston market Compelling in-market merger limits integration risk Expanded client base, enhanced scale, and simultaneous capital raise will position the combined company for strong post-transaction growth Cultural compatibility highlighted by a conservative banking approach and strategy limits execution risk Boston MSA Branch Footprint (1) Inclusive of CECL and $40mm of Common Stock (2) Based on CATC 10 day average closing price of $78.53 as of December 4, 2019 (3) Wellesley Bancorp, Inc. information as of 12/31/2019 Wellesley Profile (3) Headquarters: Assets: Wealth Mgmt. Assets (ex. Bank Portfolio): Gross Loans: Deposits: Common Equity: Net Income: Wellesley, MA $945 mm $390 mm $842 mm $752 mm $73 mm $6.0 mm CATC MA Branches (10) CATC MA Wealth Offices (1) WEBK Branches (6) Boston Cambridge Lexington Concord Weston Wellesley Needham Newton

Cambridge Trust – Investment Merits Private Banking Business Model Diverse revenue stream (Non interest income, 32% of Revenue) Proven wealth management competency Attractive Geographic Market Boston-Cambridge-Nashua, MA-NH unemployment rate of 2.1%* Diverse innovative economy Affluent Markets Solid financial performance Record operating earnings in 2018 and 2019 Core Deposit funded Demand deposits represent 27% of total deposits Sound risk manager with excellent asset quality track record * Bureau of Labor Statistics November 2019 (Preliminary)

Appendix

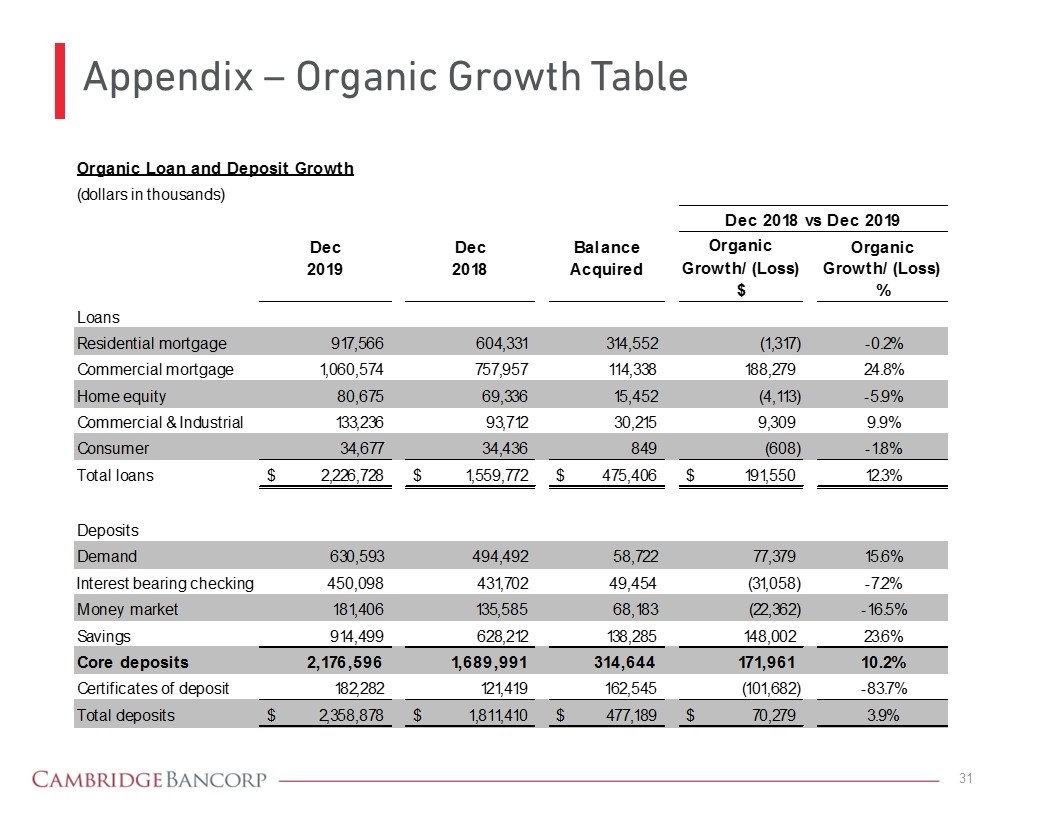

Appendix – Organic Growth Table

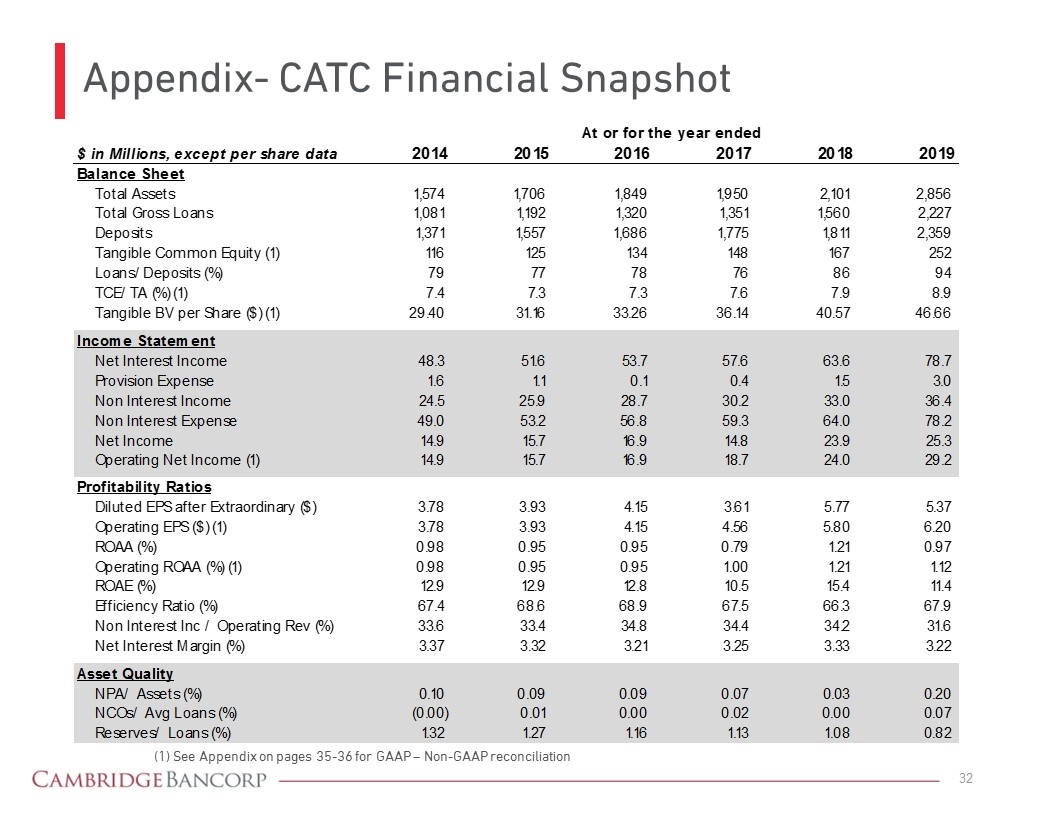

Appendix- CATC Financial Snapshot (1) See Appendix on pages 35-36 for GAAP – Non-GAAP reconciliation

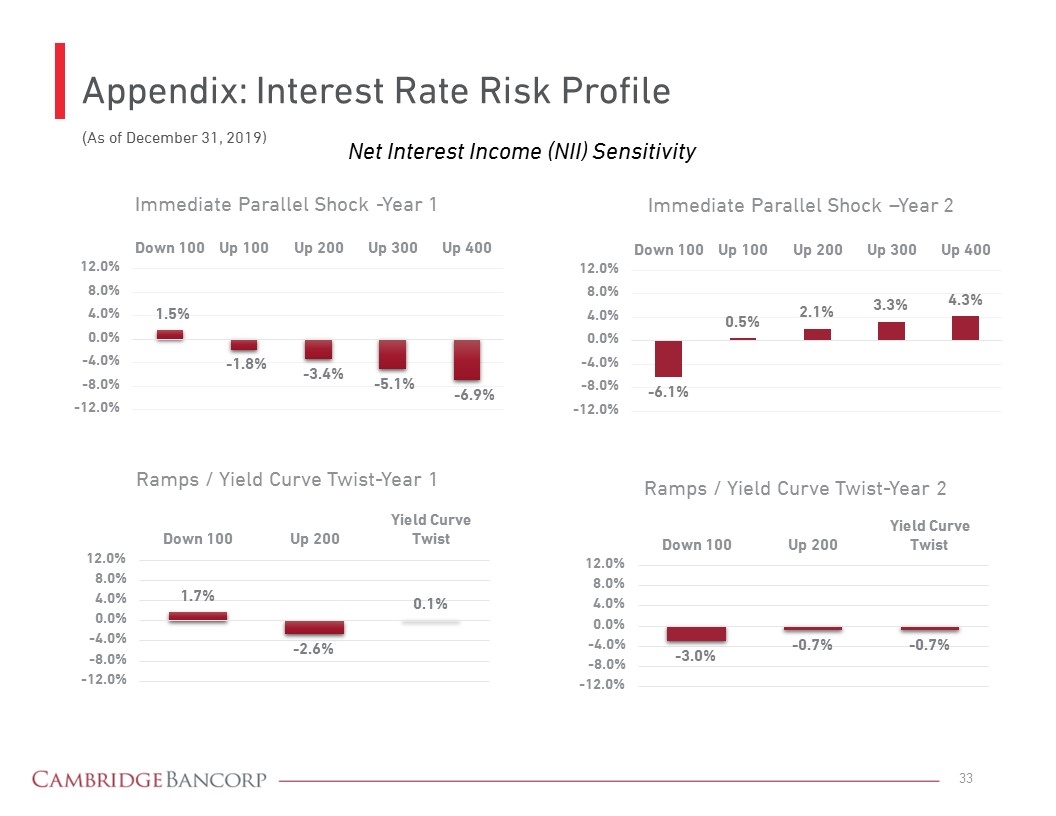

Appendix: Interest Rate Risk Profile Net Interest Income (NII) Sensitivity (As of December 31, 2019)

Appendix: GAAP to Non-GAAP Reconciliations

Appendix – FY GAAP to Non-GAAP Reconciliations

Appendix – FY GAAP to Non-GAAP Reconciliations

Cambridge Bancorp Parent of Cambridge Trust Company Denis K. Sheahan Chairman and Chief Executive Officer 617-441-1533 Michael F. Carotenuto Senior Vice President and Chief Financial Officer 617-520-5520