Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BEACON ROOFING SUPPLY INC | becn-ex991_6.htm |

| 8-K - 8-K - BEACON ROOFING SUPPLY INC | becn-8k_20200203.htm |

February 3, 2020 2020 1st quarter earnings call Exhibit 99.2

Disclosure notice This presentation contains information about management's view of the Company's future expectations, plans and prospects that constitute forward-looking statements for purposes of the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including, but not limited to, those set forth in the "Risk Factors" section of the Company's latest Form 10-K. In addition, the forward-looking statements included in this presentation represent the Company's views as of the date of this presentation and these views could change. However, while the Company may elect to update these forward-looking statements at some point, the Company specifically disclaims any obligation to do so, other than as required by federal securities laws. These forward-looking statements should not be relied upon as representing the Company's views as of any date subsequent to the date of this presentation. This presentation contains references to certain financial measures that are not presented in accordance with United States Generally Accepted Accounting Principles (“GAAP"). The Company uses non-GAAP financial measures to evaluate financial performance, analyze underlying business trends and establish operational goals and forecasts that are used when allocating resources. The Company believes these non-GAAP financial measures permit investors to better understand changes in underlying operating performance over comparative periods by providing financial results that are unaffected by cyclical variances that can be driven by items such as investment activity or purchase accounting adjustments. While the Company believes these measures are useful to investors when evaluating performance, they are not prepared and presented in accordance with GAAP, and therefore should be considered supplemental in nature. The Company’s non-GAAP financial measures should not be considered in isolation or as a substitute for other financial performance measures presented in accordance with GAAP. These non-GAAP financial measures may have material limitations including, but not limited to, the exclusion of certain costs without a corresponding reduction of net income for the income generated by the assets to which the excluded costs are related. In addition, these non-GAAP financial measures may differ from similarly titled measures presented by other companies. A reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measure can be found in the Appendix as well as Company’s latest Form 8-K, filed with the SEC on February 3, 2020.

Opening Comments and Strategic Update Julian Francis, President & CEO Q1 Results and Outlook Joe Nowicki, Executive Vice President & CFO Q&A conference call agenda

Net sales of $1.68B GM% up sequentially 20 bps from Q419 to 24.5% Operating cash improved > $200M vs. PY Q1 Total debt lower by > $300M vs. PY Q1 Announcement of Beacon Building Products Q1 highlights

Pivot Focus to Organic Growth Enhance Branch Operating Performance Operationalize Our Market Model: Beacon OTC Network Expand on Industry Leading Digital Platform Strategic update Strategic Review underway…key priorities:

Beacon building products Benefits Unified brand reflecting our exterior & interior product offering Customers have a single brand to match their own footprint Bring together our salesforce and marketing efforts around one brand

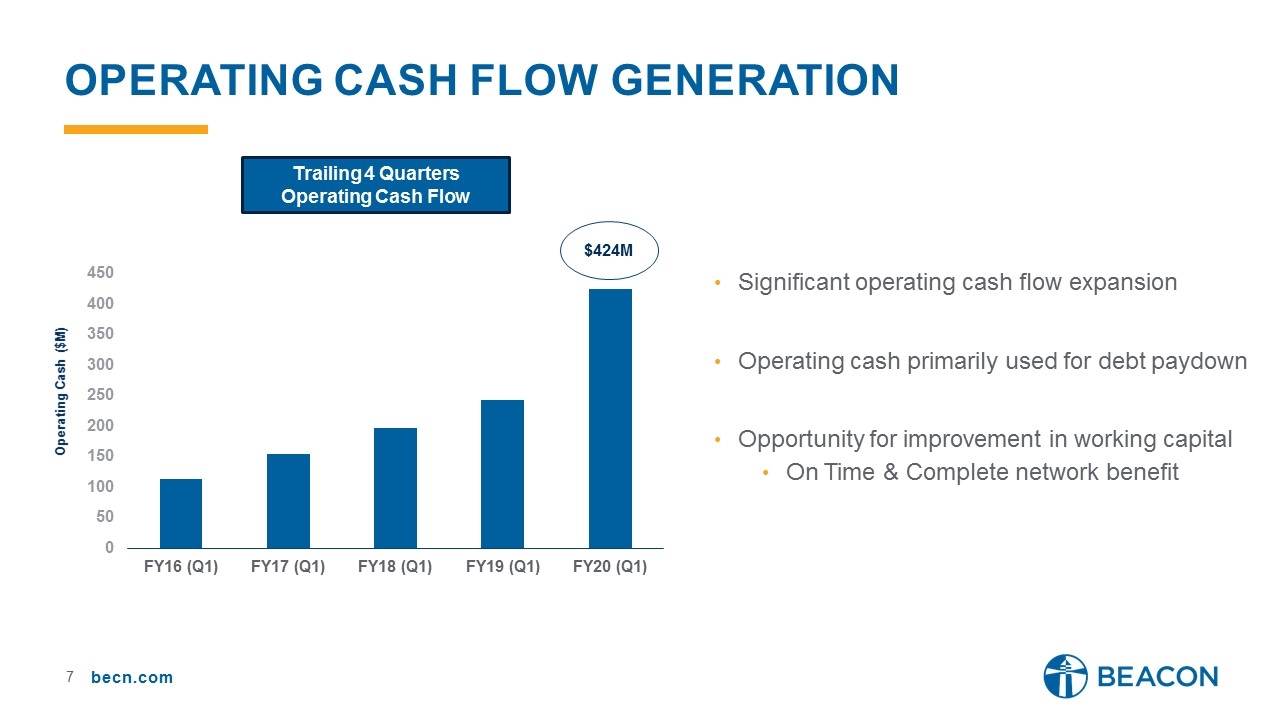

Operating Cash flow generation Operating Cash ($M) Trailing 4 Quarters Operating Cash Flow Significant operating cash flow expansion Operating cash primarily used for debt paydown Opportunity for improvement in working capital On Time & Complete network benefit $424M

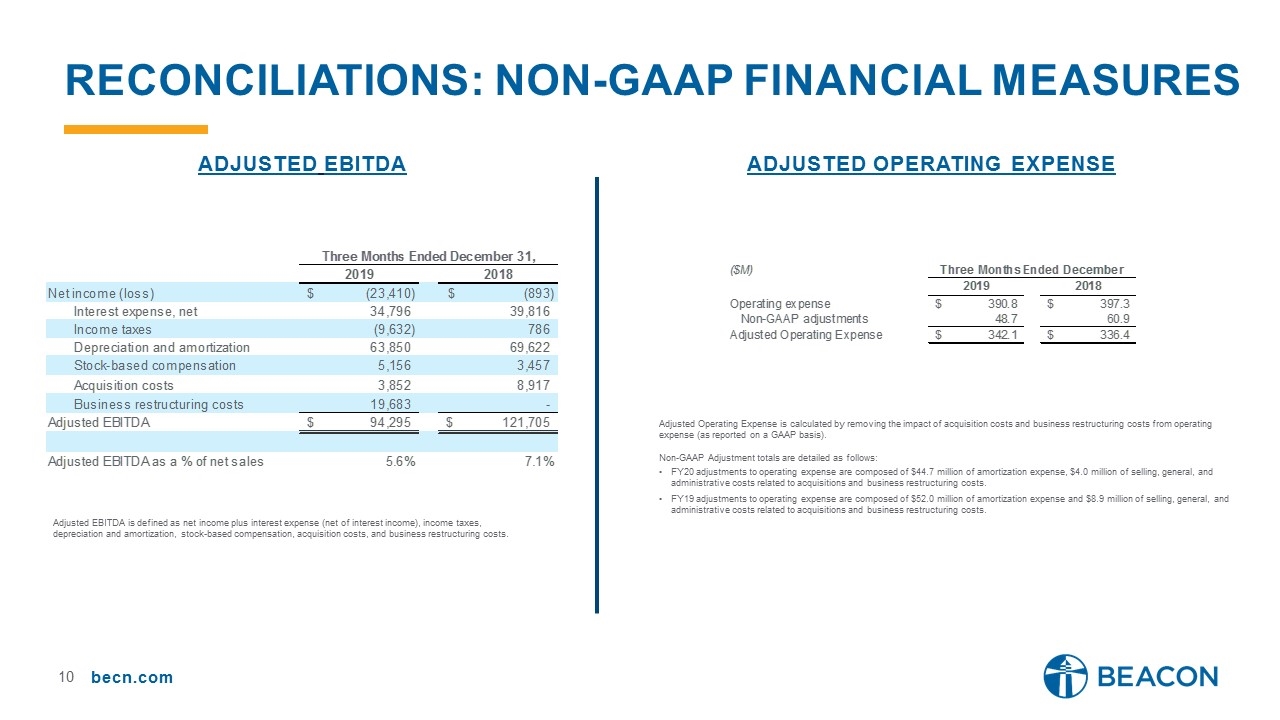

Reconciliations: non-gaap financial measures Adjusted EBITDA Adjusted Operating Expense Adjusted EBITDA is defined as net income plus interest expense (net of interest income), income taxes, depreciation and amortization, stock-based compensation, acquisition costs, and business restructuring costs. Adjusted Operating Expense is calculated by removing the impact of acquisition costs and business restructuring costs from operating expense (as reported on a GAAP basis). Non-GAAP Adjustment totals are detailed as follows: FY20 adjustments to operating expense are composed of $44.7 million of amortization expense, $4.0 million of selling, general, and administrative costs related to acquisitions and business restructuring costs. FY19 adjustments to operating expense are composed of $52.0 million of amortization expense and $8.9 million of selling, general, and administrative costs related to acquisitions and business restructuring costs.