Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - ASBURY AUTOMOTIVE GROUP INC | d855100dex994.htm |

| EX-99.3 - EX-99.3 - ASBURY AUTOMOTIVE GROUP INC | d855100dex993.htm |

| EX-99.2 - EX-99.2 - ASBURY AUTOMOTIVE GROUP INC | d855100dex992.htm |

| 8-K - FORM 8-K - ASBURY AUTOMOTIVE GROUP INC | d855100d8k.htm |

Exhibit 99.1

Certain Information Excerpted from the Company’s Preliminary Offering Memorandum and Disclosed Pursuant to Regulation FD

Disclosure Regarding Forward-Looking Statements

Certain of the discussions and information included in various places herein may constitute “forward-looking statements” within the meaning of the United States federal securities laws. Forward-looking statements are statements that are not historical in nature and may include statements relating to our goals, plans and projections regarding industry and general economic trends, our expected financial position, the expected terms or timeline of the currently contemplated Acquisition (as defined below), the anticipated cost savings, run-rate synergies, revenue enhancement strategies, operational improvements and other benefits from the Acquisition, results of operations or market position and our business strategy. Such statements can generally be identified by words such as “may,” “target,” “could,” “would,” “will,” “should,” “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee” and other similar words or phrases. Forward-looking statements may also relate to our expectations and assumptions with respect to, among other things:

| • | the expected financial and operational performance of Park Place; |

| • | our estimated future capital expenditures, including with respect to the operations of Park Place following the consummation of the Acquisition; |

| • | sales fluctuations to and changes in our relationships with key customers, including the customers of Park Place following the consummation of the Acquisition; |

| • | the seasonally adjusted annual rate of new vehicle sales in the United States; |

| • | our estimated future capital expenditures; |

| • | general economic conditions and its expected impact on our revenue and expenses; |

| • | our expected parts and service revenue due to, among other things, improvements in vehicle technology; |

| • | our ability to limit our exposure to regional economic downturns due to our geographic diversity and brand mix, which limits exposure to regional economic downturn; |

| • | our capital allocation strategy, including as it relates to acquisitions and divestitures, stock repurchases, dividends and capital expenditures; |

| • | the growth of the brands that comprise our portfolio over the long-term. |

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual future results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, but are not limited to:

| • | the occurrence of any event, change or other circumstance that could give rise to the termination of the Asset Purchase Agreement, including the risk that the necessary manufacturer approvals may not be obtained; |

| • | the ability to consummate the Acquisition and the other transactions |

| constituting the Transactions on the terms or timeline currently contemplated or at all, successfully integrate the operations of Park Place into our existing operations and the diversion of management’s attention from ongoing business and regular business responsibilities to effect such integration; |

| • | the effects of increased expenses or unanticipated liabilities incurred as a result of, or due to activities related to, the Acquisition; |

| • | disruption from the Acquisition, making it more difficult to maintain relationships with customers or suppliers of Park Place; |

| • | changes in general economic and business conditions, including changes in employment levels, consumer demand, preferences and confidence levels, the availability and cost of credit in a rising interest rate environment, fuel prices, levels of discretionary personal income and interest rates; |

| • | our ability to execute our balanced automotive retailing and service business strategy; |

| • | our ability to attract and retain skilled employees; |

| • | adverse conditions affecting the vehicle manufacturers whose brands we sell, and their ability to design, manufacture, deliver and market their vehicles successfully; |

| • | changes in the mix, and total number, of vehicles we are able to sell; |

| • | our outstanding indebtedness and our continued ability to comply with applicable covenants in our various financing and lease agreements, or to obtain waivers of these covenants as necessary; |

| • | high levels of competition in our industry, which may create pricing and margin pressures on our products and services; |

| • | our relationships with manufacturers of the vehicles we sell and our ability to renew, and enter into new framework and dealer agreements with vehicle manufacturers whose brands we sell, on terms acceptable to us; |

| • | the availability of manufacturer incentive programs and our ability to earn these incentives; |

| • | failure of our management information systems or any security breaches; |

| • | changes in laws and regulations governing the operation of automobile franchises, including trade restrictions, consumer protections, accounting standards, taxation requirements and environmental laws; |

| • | changes in, or the imposition of, new tariffs or trade restrictions on imported vehicles or parts; |

| • | adverse results from litigation or other similar proceedings involving us; |

| • | our ability to generate sufficient cash flows, maintain our liquidity and obtain any necessary additional funds for working capital, capital expenditures, acquisitions, stock repurchases, debt maturity payments and other corporate purposes, if necessary or desirable; |

| • | our ability to consummate planned mergers, acquisitions and dispositions; |

| • | any disruptions in the financial markets, which may impact our ability to access capital; |

| • | our relationships with, and the financial stability of, our lenders and lessors; |

| • | significant disruptions in the production and delivery of vehicles and parts for any reason, including natural disasters, product recalls, work stoppages or other occurrences that are outside of our control; |

| • | our ability to execute our initiatives and other strategies; |

| • | our ability to leverage gains from our dealership portfolio; and |

| • | in addition to the Acquisition, our ability to successfully integrate businesses we may acquire, or that any business we acquire may not perform as we expected at the time we acquired it. |

Many of these factors are beyond our ability to control or predict, and their ultimate impact could be material. Forward-looking statements also include, but are not limited to, those described in Risks related to the Business” and “Risks Related to the Acquisition” herein. Forward-looking statements contained herein are made only as of the date they are made, and we assume no obligation to update any forward-looking statements.

Certain Terms Used Herein

When used herein, unless the context requires otherwise, or as specifically described below:

| • | The term “2013 BofA Real Estate Credit Agreement” means the real estate term loan credit agreement (as amended, restated or supplemented from time to time), dated as of September 26, 2013, between the Company, certain of its subsidiaries, as borrowers, and Bank of America, as lender. |

| • | The term “2013 BofA Real Estate Facility” means the 2013 BofA Real Estate Credit Agreement providing for term loans in an aggregate amount not to exceed $75.0 million. |

| • | The term “2015 Wells Fargo Master Loan Agreement” means the amended and restated master loan agreement (as amended, restated or supplemented from time to time), dated as of February 13, 2015, between certain of the Company’s subsidiaries and Wells Fargo Bank, National Association, as lender. |

| • | The term “2015 Wells Fargo Master Loan Facility” means the 2015 Wells Fargo Master Loan Agreement providing term loans to certain of the Company’s subsidiaries that are borrowers in an aggregate amount not to exceed $100.0 million. |

| • | The term “2018 BofA Real Estate Credit Agreement” means the real estate term loan credit agreement (as amended, restated or supplemented from time to time), dated as of November 13, 2018, between the Company, certain of its subsidiaries, as borrowers, and Bank of America, as lender. |

| • | The term “2018 BofA Real Estate Facility” means the 2018 BofA Real Estate Credit Agreement providing for term loans in an aggregate amount not to exceed $128.1 million. |

| • | The term “2018 Wells Fargo Master Loan Agreement” means the master loan agreement (as amended, restated or supplemented from time to time), dated as of November 16, 2018, between certain of the Company’s subsidiaries and Wells Fargo Bank, National Association, as lender, which provides form term loans to certain of our subsidiaries that are in an aggregate amount not to exceed $100.0 million. |

| • | The term “2018 Wells Fargo Master Loan Facility” means the agreement which provides for term loans to certain of the Company’s subsidiaries that are borrowers under the Wells Fargo Master Loan Agreement in an aggregate not to exceed $100.0 million. |

| • | The term “2019 Senior Credit Agreement” means collectively the Third Amended and Restated Credit Agreement, dated as of September 25, 2019, by and among the Company, as borrower, certain of its subsidiaries, as vehicle borrowers, Bank of America, as administrative agent, revolving swing line lender, new vehicle floorplan swing line lender, used vehicle floorplan swingline lender and an L/C issuer, and the other lenders party thereto, JPMorgan Chase Bank, N.A. and Wells Fargo Bank, N.A., as co-syndication agents, Mercedes- Benz Financial Services USA LLC and Toyota Motor Credit Corporation, as co-documentation agents, and BofA Securities, Inc., as sole lead arranger and sole book manager, as further amended, modified, renewed, refunded, replaced or refinanced or otherwise restructured in whole or in part from time to time, whether by the same or any other agent, lender or group of lenders. |

| • | The term “2019 Senior Credit Facility” means the 2019 Senior Credit Agreement providing for the Revolving Credit Facility, the New Vehicle Used Floor Plan Facility and the Used Vehicle Floor Plan Facility. |

| • | The term “Asbury,” the “Company,” “we,” “us” or “our” means Asbury Automotive Group, Inc. and its subsidiaries, prior to the Acquisition |

| • | The term “Bank of America” means Bank of America, N.A. |

| • | The term “Borrowers” means the Company and the Company’s dealership subsidiaries that are borrowers under the 2019 Senior Credit Facility. |

| • | The term “Bridge Commitment Letter” means the bridge commitment letter with the Bank of America as amended, restated or supplemented from time to time. |

| • | The term “Bridge Credit Facility” means the $650.0 million senior unsecured bridge credit facility in connection with the bridge debt financing for the Acquisition. |

| • | The term “Bridge lenders” means the Bank of America and a syndicate of lenders. |

| • | The term the “Combined Company” means Asbury Automotive Group, Inc. and its subsidiaries, after giving effect to the Acquisition. |

| • | The term “Elway Dealership” means the John Elway Chrysler, Dodge, Jeep dealership operating in Denver, Colorado. |

| • | The term “Existing Notes” means the 6.0% Senior Subordinated Notes due 2024 issued under the indenture dated as of December 4, 2014, among Asbury, as issuer, each of the guarantors party thereto and U.S. Bank National Association, as trustee, as amended and supplemented from time to time. |

| • | The term “Existing Real Estate Credit Agreements” means the 2013 BofA Real Estate Credit Agreement, the 2015 Wells Fargo Master Loan Agreement, the 2018 Wells Fargo Master Loan Agreement and the 2018 BofA Real Estate Credit Agreement. |

| • | The term “Existing Real Estate Facilities” means the 2013 BofA Real Estate Facility, the 2015 Wells Fargo Master Loan Facility, the 2018 Wells Fargo Master Loan Facility and the 2018 BofA Real Estate Facility. |

| • | The term “F&I” means finance and insurance products. |

| • | The term “Gray Daniels Dealerships” means the Company’s five Gray Daniels dealerships operating in the Jackson, Mississippi area. |

| • | The term “LIBOR” means the London Interbank Offered Rate. |

| • | The term “LTM Period” means the twelve months ended September 30, 2019. |

| • | The term “Nalley Nissan Dealership” means the Company’s Nalley Nissan dealership operating in metropolitan Atlanta. |

| • | The term “New BofA Real Estate Credit Agreement” means a new real estate term loan credit agreement (as amended, restated or supplemented from time to time), to be entered into in connection with the Acquisition, the Company, certain of our subsidiaries that own or lease the real estate financed thereunder, as borrowers, the various financial institutions party thereto, as lenders, and Bank of America, as lender. |

| • | The term “New BofA Real Estate Facility” means the New BofA Real Estate Credit Agreement providing for term loans in an aggregate amount not to exceed approximately $300 million. |

| • | The term “New Vehicle Floor Plan Facility” means the new vehicle floor plan facility under the 2019 Senior Credit Agreement providing for $1.04 billion of aggregate commitments as of the date hereof and $1.35 billion of aggregate commitments upon the consummation of the Acquisition. |

| • | The term “P&S” means replacement parts and collision repair services. |

| • | The term “Real Estate Purchase Agreement” means the Real Estate Purchase Agreement, dated as of December 11, 2019, among the Company and the Sellers. |

| • | The term “Revolving Credit Facility” means the revolving credit facility under the 2019 Senior Credit Agreement providing for $250 million of aggregate comments as of the date hereof and $350 million of aggregate commitments upon the consummation of the Acquisition. |

| • | The term “Sellers” means Park Place and the other parties to the Asset Purchase Agreement and the Real Estate Purchase Agreement. |

| • | The “Shaw Dealership” means the Mike Shaw Subaru dealership operating in Thornton, Colorado. |

| • | The term “Special Mandatory Redemption” means the required redemption by the Company if (i) the consummation of the Acquisition does not occur on or before the End Date or (ii) the Company notifies the |

| Trustee of its abandonment or termination of the Asset Purchase Agreement or its determination that the consummation of the Acquisition will not occur on or before the End Date. |

| • | The term “Transaction Agreements” means the Asset Purchase Agreement and the Real Estate Purchase Agreement, together. |

| • | The term “Transactions” means the Acquisition and the financing transactions (including the redemption of the Existing Notes), collectively. |

| • | The term “Used Vehicle Floor Plan Facility” means the used vehicle floor plan facility under the 2019 Senior Credit Agreement providing for $160 million of aggregate commitments as of the date hereof and $200 million of aggregate commitments upon the consummation of the Acquisition. |

| • | The term “Wells Fargo” means Wells Fargo Bank, National Association. |

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION OF THE COMBINED COMPANY

The unaudited pro forma condensed combined financial statements (referred to as the “pro forma financial statements”) presented below are derived from the historical consolidated financial statements of the Company and Park Place, as adjusted to reflect the issuance of $525.0 million of the Notes hereby and the other financing transactions expected to fund the purchase price for the Acquisition (the “Financing”) and the Acquisition. For summaries of the Financing and Acquisition, see the section of this offering memorandum entitled “Summary–Acquisition of Park Place.”

The unaudited pro forma condensed combined balance sheet as of September 30, 2019, assumes that the Acquisition and Financing occurred on September 30, 2019.

The unaudited pro forma condensed combined statements of income for the twelve months ended September 30, 2019 and the nine months ended September 30, 2019, assume that the Acquisition and Financing occurred on October 1, 2018.

The following unaudited pro forma condensed combined financial information should be read in conjunction with the following financial statements, all of which are included in this offering memorandum:

| • | the audited consolidated financial statements of Asbury as of December 31, 2018 and for the three years ended December 31, 2018; |

| • | the unaudited consolidated financial statements of Asbury as of and for the nine months ended September 30, 2019; |

| • | the audited combined and consolidated financial statements of Park Place as of and for the two years ended December 31, 2018; |

| • | the audited combined and consolidated financial statements of Park Place as of and for the nine months ended September 30, 2019; and |

| • | the unaudited condensed combined and consolidated financial statements of Park Place as of and for the three months ended December 31, 2018. |

The unaudited pro forma condensed combined financial information of the Combined Company does not give effect to (1) the issuance of $600 million of Notes for which the proceeds will be used to fund the redemption of the Existing Notes, (2) the acquisitions of the Elway Dealership and Shaw Dealership (except with respect to the cash and cash equivalents from the Shaw Dealership which was consummated on September 30, 2019 and accordingly is reflected in the unaudited pro forma condensed combined balance sheet as of September 30, 2019), (3) the anticipated dispositions of the Gray Daniels dealerships and the Nalley Nissan dealership, (4) the repayment of $25.0 million of mortgage notes payable at maturity during the three months ended December 31, 2019 and (5) the repayment of $25.0 million under the Used Vehicle Floor Plan Facility during the three months ended December 31, 2019. The consummation of the Financing and Acquisition is subject to the satisfaction of customary closing conditions, including the absence of a material adverse change in Park Place and the receipt of competition clearances in certain jurisdictions. If the Acquisition is consummated, our post-closing recourse is limited. See “Risk Factors—Risks Related to the Acquisition—If the Acquisition is consummated, our post-closing recourse for liabilities related to Park Place is limited.”

The pro forma adjustments reported in these financial statements are based upon available information and certain assumptions that the Company’s management believes are reasonable. The unaudited pro forma condensed combined financial information of the Combined Company is presented for informational purposes only and is not intended to represent or be indicative of what the results of operations or financial condition would have been had the Financing and Acquisition actually occurred on the dates indicated, nor is it meant to be

6

indicative of future results of operations or financial condition for any future period or as of any future date. The unaudited pro forma condensed combined financial information of the Combined Company should be read in conjunction with “Summary—Acquisition of Park Place,” “Risk Factors,” “Use of Proceeds,” “Summary—Summary Historical Consolidated Financial Information of Asbury and Unaudited Pro Forma Condensed Combined Financial Information of the Combined Company,” “Summary—Summary Historical Combined Financial Information of Park Place,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations of the Company,” as well as the audited and unaudited historical financial statements and related notes of the Company and Park Place included in this offering memorandum.

Assumptions underlying the pro forma adjustments are described in the accompanying notes, which should be read in conjunction with the unaudited pro forma condensed combined financial information of the Combined Company.

7

COMBINED COMPANY

Pro Forma Condensed Combined Balance Sheet

As of September 30, 2019

(In millions)

(Unaudited)

| Asbury | Park Place |

Pro Forma Adjustments |

Pro Forma Combined |

|||||||||||||||

| ASSETS | ||||||||||||||||||

| Current assets: |

||||||||||||||||||

| Cash and cash equivalents |

$ | 1.8 | $ | 16.5 | $ | (16.5 | ) | a | $ | 1.8 | ||||||||

|

Contracts-in-transit, net |

148.6 | 20.0 | (20.0 | ) | a | 148.6 | ||||||||||||

| Accounts receivable, net |

112.5 | 35.6 | (35.6 | ) | a | 112.5 | ||||||||||||

| Inventories, net |

1,030.1 | 231.3 | (2.4 | ) | a, b | 1,259.0 | ||||||||||||

| Assets held for sale |

26.1 | — | — | 26.1 | ||||||||||||||

| Other current assets |

128.9 | 84.2 | (6.5 | ) | a | 206.6 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total current assets |

1,448.0 | 387.6 | (81.0 | ) | 1,754.6 | |||||||||||||

| Property and equipment, net |

943.4 | 186.3 | 50.9 | a, c | 1,180.6 | |||||||||||||

| Operating lease right-of-use-assets |

77.1 | 49.7 | 83.0 | d | 209.8 | |||||||||||||

| Goodwill |

272.1 | 0.5 | 784.5 | e | 1,057.1 | |||||||||||||

| Intangible franchise rights |

65.8 | 11.4 | (11.4 | ) | e | 65.8 | ||||||||||||

| Other long-term assets |

10.1 | 6.7 | (5.7 | ) | a | 11.1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 2,816.5 | $ | 642.2 | $ | 820.3 | $ | 4,279.0 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||||||||

| Current liabilities: |

||||||||||||||||||

| Floor plan notes payable—trade, net |

$ | 122.1 | $ | 74.3 | $ | (66.4 | ) | a, g | $ | 130.0 | ||||||||

| Floor plan notes payable—non-trade, net |

738.9 | 83.5 | 261.3 | a, g | 1,083.7 | |||||||||||||

| Current maturities of long-term debt |

38.1 | 12.7 | 4.1 | a, g | 54.9 | |||||||||||||

| Current maturities of operating leases |

21.0 | 10.9 | (0.3 | ) | d | 31.6 | ||||||||||||

| Accounts payable and accrued liabilities |

315.0 | 136.0 | (60.4 | ) | a | 390.6 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total current liabilities |

1,235.1 | 317.4 | 138.3 | 1,690.8 | ||||||||||||||

| Long-term debt |

867.8 | 90.4 | 792.6 | a, g | 1,750.8 | |||||||||||||

| Operating lease liability |

60.3 | 39.5 | 82.6 | d | 182.4 | |||||||||||||

| Deferred income taxes |

20.4 | — | — | 20.4 | ||||||||||||||

| Other long-term liabilities |

32.9 | 7.2 | (5.5 | ) | a | 34.6 | ||||||||||||

| Commitments and contingencies |

||||||||||||||||||

| Shareholders’ equity: |

||||||||||||||||||

| Total shareholders’ equity |

600.0 | 187.7 | (187.7 | ) | h | 600.0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities and shareholders’ equity |

$ | 2,816.5 | $ | 642.2 | $ | 820.3 | $ | 4,279.0 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

8

COMBINED COMPANY

Pro Forma Condensed Combined Statements of Income

For the Twelve Months Ended September 30, 2019

(In millions, except share and per share data)

(Unaudited)

| Asbury | Park Place | Pro Forma Adjustments |

Pro Forma Combined |

|||||||||||||||||||||||||

| For the Nine Months Ended September 30, 2019 |

For the Three Months Ended December 31, 2018 |

For the Nine Months Ended September 30, 2019 |

For the Three Months Ended December 31, 2018 |

|||||||||||||||||||||||||

| Revenue: |

||||||||||||||||||||||||||||

| New vehicle |

$ | 2,823.9 | $ | 1,022.4 | $ | 620.2 | $ | 271.8 | $ | — | $ | 4,738.3 | ||||||||||||||||

| Used vehicle |

1,590.4 | 473.4 | 474.1 | 149.1 | — | 2,687.0 | ||||||||||||||||||||||

| Parts and service |

669.7 | 211.1 | 206.4 | 66.4 | — | 1,153.6 | ||||||||||||||||||||||

| Finance and insurance, net |

232.3 | 77.3 | 21.9 | 8.3 | — | 339.8 | ||||||||||||||||||||||

| Other |

— | — | 7.2 | 2.4 | — | 9.6 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total revenue |

5,316.3 | 1,784.2 | 1,329.8 | 498.0 | — | 8,928.3 | ||||||||||||||||||||||

| Cost of sales: |

||||||||||||||||||||||||||||

| New vehicle |

2,709.1 | 978.5 | 574.9 | 252.4 | — | 4,514.9 | ||||||||||||||||||||||

| Used vehicle |

1,487.6 | 444.1 | 447.9 | 141.8 | — | 2,521.4 | ||||||||||||||||||||||

| Parts and service |

252.3 | 79.8 | 91.1 | 29.9 | — | 453.1 | ||||||||||||||||||||||

| Other |

— | — | 0.5 | 0.1 | — | 0.6 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total cost of sales |

4,449.0 | 1,502.4 | 1,114.4 | 424.2 | — | 7,490.0 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Gross profit |

867.3 | 281.8 | 215.4 | 73.8 | — | 1,438.3 | ||||||||||||||||||||||

| Operating expenses: |

||||||||||||||||||||||||||||

| Selling, general, and administrative |

593.7 | 192.2 | 151.8 | 50.0 | — | 987.7 | ||||||||||||||||||||||

| Depreciation and amortization |

26.7 | 8.5 | 11.5 | 3.7 | (4.7 | ) | c | 45.7 | ||||||||||||||||||||

| Franchise rights impairment |

— | 3.7 | — | — | — | 3.7 | ||||||||||||||||||||||

| Other operating (income) expense, net |

1.0 | 0.1 | (0.2 | ) | — | — | 0.9 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Income from operations |

245.9 | 77.3 | 52.3 | 20.1 | 4.7 | 400.3 | ||||||||||||||||||||||

| Other expenses (income): |

||||||||||||||||||||||||||||

| Floor plan interest expense |

29.7 | 9.5 | 5.6 | 1.9 | 2.6 | i | 49.3 | |||||||||||||||||||||

| Other interest expense, net |

41.2 | 13.7 | 5.6 | 1.9 | 39.0 | i | 101.4 | |||||||||||||||||||||

| Gain on divestiture |

(11.7 | ) | — | — | — | — | (11.7 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total other expenses, net |

59.2 | 23.2 | 11.2 | 3.8 | 41.6 | 139.0 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Income before income taxes |

186.7 | 54.1 | 41.1 | 16.3 | (36.9 | ) | 261.3 | |||||||||||||||||||||

| Income tax expense |

45.9 | 13.7 | 1.2 | 0.4 | (5.9 | ) | f | 55.3 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net income |

$ | 140.8 | $ | 40.4 | $ | 39.9 | $ | 15.9 | $ | (31.0 | ) | $ | 206.0 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Earnings per share: |

||||||||||||||||||||||||||||

| Basic— |

||||||||||||||||||||||||||||

| Net income |

$ | 7.37 | $ | 2.09 | $ | 10.79 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Diluted— |

||||||||||||||||||||||||||||

| Net income |

$ | 7.30 | $ | 2.06 | $ | 10.67 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Weighted average shares outstanding: |

||||||||||||||||||||||||||||

| Basic |

19.1 | 19.3 | 19.1 | |||||||||||||||||||||||||

| Restricted stock |

0.1 | 0.1 | 0.1 | |||||||||||||||||||||||||

| Performance share units |

0.1 | 0.2 | 0.1 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||

| Diluted |

$ | 19.3 | $ | 19.6 | $ | 19.3 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||

9

COMBINED COMPANY

Pro Forma Condensed Combined Statements of Income

For the Nine Months Ended September 30, 2019

(In millions, except share and per share data) (Unaudited)

| Asbury | Park Place | Pro Forma Adjustments |

Pro Forma Combined |

|||||||||||||||||

| For the Nine Months Ended September 30, 2019 |

For the Nine Months Ended September 30, 2019 |

|||||||||||||||||||

| Revenue: |

||||||||||||||||||||

| New vehicle |

$ | 2,823.9 | $ | 620.2 | $ | — | $ | 3,444.1 | ||||||||||||

| Used vehicle |

1,590.4 | 474.1 | — | 2,064.5 | ||||||||||||||||

| Parts and service |

669.7 | 206.4 | — | 876.1 | ||||||||||||||||

| Finance and insurance, net |

232.3 | 21.9 | — | 254.2 | ||||||||||||||||

| Other |

— | 7.2 | — | 7.2 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Revenue |

5,316.3 | 1,329.8 | — | 6,646.1 | ||||||||||||||||

| Cost of Sales: |

||||||||||||||||||||

| New vehicle |

2,709.1 | 574.9 | — | 3,284.0 | ||||||||||||||||

| Used vehicle |

1,487.6 | 447.9 | — | 1,935.5 | ||||||||||||||||

| Parts and service |

252.3 | 91.1 | — | 343.4 | ||||||||||||||||

| Other |

— | 0.5 | — | 0.5 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Cost of Sales |

4,449.0 | 1,114.4 | — | 5,563.4 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Gross Profit |

867.3 | 215.4 | — | 1,082.7 | ||||||||||||||||

| Operating Expenses: |

||||||||||||||||||||

| Selling, general, and administrative |

593.7 | 151.8 | — | 745.5 | ||||||||||||||||

| Depreciation and amortization |

26.7 | 11.5 | (3.6 | ) | c | 34.6 | ||||||||||||||

| Franchise rights impairment |

— | — | — | — | ||||||||||||||||

| Other operating (income) expense, net |

1.0 | (0.2 | ) | — | 0.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income from Operations |

245.9 | 52.3 | 3.6 | 301.8 | ||||||||||||||||

| Other Expenses (Income): |

||||||||||||||||||||

| Floor plan interest expense |

29.7 | 5.6 | 2.0 | i | 37.3 | |||||||||||||||

| Other interest expense, net |

41.2 | 5.6 | 29.2 | i | 76.0 | |||||||||||||||

| Gain on divestiture |

(11.7 | ) | — | — | (11.7 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total other expenses, net |

59.2 | 11.2 | 31.2 | 101.6 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income Before Income Taxes |

186.7 | 41.1 | (27.6 | ) | 200.2 | |||||||||||||||

| Income tax expense |

45.9 | 1.2 | (4.7 | ) | f | 42.4 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Income |

$ | 140.8 | $ | 39.9 | $ | (22.9 | ) | $ | 157.8 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Earnings Per Share: |

||||||||||||||||||||

| Basic— |

||||||||||||||||||||

| Net income |

$ | 7.37 | $ | 8.26 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Diluted— |

||||||||||||||||||||

| Net income |

$ | 7.30 | $ | 8.18 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Weighted Average Shares Outstanding: |

||||||||||||||||||||

| Basic |

19.1 | 19.1 | ||||||||||||||||||

| Restricted stock |

0.1 | 0.1 | ||||||||||||||||||

| Performance share units |

0.1 | 0.1 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Diluted |

$ | 19.3 | $ | 19.3 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||

10

1. Basis of Presentation

The unaudited pro forma condensed combined financial information includes pro forma adjustments that are (1) directly attributable to the Financing and Transactions, (2) factually supportable and (3) with respect to the unaudited pro forma condensed combined statements of income, expected to have a continuing impact on the operating results of the combined company.

The acquisition of the Park Place Business is accounted for as a business combination using the acquisition method of accounting under ASC Topic 805, Business Combinations. Under the acquisition method of accounting, the purchase price is allocated to the underlying tangible and intangible assets acquired and liabilities assumed based on their respective fair values at the date of acquisition, with any excess purchase price allocated to goodwill. To date, the Company has estimated a preliminary allocation of the purchase price to the assets acquired and liabilities assumed in the Acquisition, and upon consummation of the Acquisition will complete the allocation of such purchase price as further information becomes available. The final purchase price allocation may differ from that reflected in the following unaudited pro forma condensed combined financial statements, and these differences may be material.

The unaudited pro forma condensed combined consolidated balance sheet as of September 30, 2019, assumes that the Transactions occurred on September 30, 2019.

The unaudited pro forma condensed combined statements of income for the twelve months ended September 30, 2019 and the nine months ended September 30, 2019, assume that the Transactions occurred on October 1, 2018.

The pro forma adjustments reported in these financial statements are based upon available information and certain assumptions that the Company’s management believes are reasonable. The unaudited pro forma condensed combined financial information is presented for informational purposes only and is not intended to represent or be indicative of what the results of operations or financial condition would have been had the Financing and Transactions actually occurred on the dates indicated, nor is it meant to be indicative of future results of operations or financial condition for any future period or as of any future date. The unaudited pro forma condensed combined financial information of the Combined Company should be read in conjunction with “Summary—The Transactions,” “Summary—Recent Developments,” “Summary—Summary Historical Consolidated Financial Information of Asbury and Unaudited Pro Forma Condensed Combined Financial Information of the Combined Company,” “Summary—Summary Historical Combined and Consolidated Financial Information of Park Place,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations of the Company” as well as the audited and unaudited historical financial statements and related notes of the Company and the Park Place Business included in this offering memorandum.

Assumptions underlying the pro forma adjustments are described in the accompanying notes, which should be read in conjunction with the unaudited pro forma condensed combined financial information.

11

2. Sources of Purchase Price

The Company will acquire substantially all of the assets of, and certain real property related to, Park Place including goodwill and franchise rights intangible assets, real estate and leaseholds, and parts and fixed assets, in each case subject to certain adjustments described in the Acquisition Agreements. We anticipate that approximately $1.4 billion will be required to fund the purchase consideration (including vehicle inventory that we will acquire) and to pay approximately $20 million in estimated transaction fees and expenses related to the Acquisition. We intend to finance the Acquisition from the following sources:

| (In millions) |

||||

| Cash |

$ | 38.9 | ||

| Portion of the proceeds of Notes offered hereby |

525.0 | |||

| 2019 Senior Credit Facility |

386.9 | |||

| 2018 Wells Fargo Master Loan Facility |

69.0 | |||

| 2018 BofA Real Estate Facility |

97.2 | |||

| New BofA Real Estate Facility |

216.0 | |||

| Less: Capitalized deferred financing issuance costs |

(8.4 | ) | ||

|

|

|

|||

| $ | 1,324.6 | |||

|

|

|

|||

3. Purchase Price Allocation

Under the acquisition method of accounting, the purchase price is allocated to the tangible and intangible assets acquired and liabilities assumed based on information currently available. The following table summarizes the allocation of the estimated purchase price based on preliminary estimates of fair value:

| (In millions) |

||||

| Assets Acquired and Liabilities assumed |

||||

| Inventories |

$ | 228.9 | ||

| Other current assets |

77.7 | |||

| Property and equipment |

237.2 | |||

| Goodwill and intangible franchise rights |

785.0 | |||

| Operating lease right-of-use assets |

132.7 | |||

|

|

|

|||

| Total assets acquired |

1,461.5 | |||

|

|

|

|||

| Operating lease liabilities |

(132.7 | ) | ||

| Other liabilities |

(4.2 | ) | ||

|

|

|

|||

| Total liabilities assumed |

(136.9 | ) | ||

|

|

|

|||

| Net assets acquired |

$ | 1,324.6 | ||

|

|

|

|||

The fair value of property, plant and equipment acquired is summarized below:

| Fair

value |

Estimated useful life |

|||||||

| Land |

$ | 55.2 | N/A | |||||

| Buildings |

139.7 | 30-40 years | ||||||

| Leasehold improvements |

25.2 | |

Lesser of lease life or life of asset |

| ||||

| Furniture, fixtures and equipment |

17.1 | 3-10 years | ||||||

|

|

|

|||||||

| $ | 237.2 | |||||||

|

|

|

|||||||

The final purchase price allocation will be determined once the Company has completed the detailed valuations and necessary calculations, subject to consummation of the Acquisition. New and used vehicle

12

inventories at the Park Place dealerships vary significantly from time to time, and the actual value of vehicle inventories acquired will depend on the actual new and used vehicle inventories at the Park Place dealerships on the closing date of the Acquisition. If the acquired used vehicle inventory and/or new vehicle inventory, and accordingly, the purchase price for the Acquisition, increases significantly from the used vehicle inventory and/or new vehicle inventory as of September 30, 2019, the Company intends to use, with respect to new vehicle inventory, borrowings under the New Vehicle Floor Plan Facility to pay the additional purchase price of, if any, such new vehicle inventory and, with respect to used vehicle inventory, a combination of all or any of cash on hand, borrowings under the Used Vehicle Floor Plan Facility and borrowings under the Revolving Credit Facility to fund the additional purchase price of, if any, such used vehicle inventory.

The estimated fair values of assets acquired and liabilities assumed were based upon preliminary analysis performed for the preparation of the pro forma financial information and are subject to the final valuations that will be completed after consummation of the Acquisition. These estimates and assumptions are subject to change within the measurement period as additional information is obtained. A decrease in the fair value of the assets acquired or liabilities assumed in the Acquisition from the preliminary valuations presented would result in a dollar-for-dollar corresponding increase in the amount of goodwill resulting from the Acquisition. In addition, if the value of the property and equipment and other intangible assets is higher than the amount included in these unaudited pro forma condensed combined financial statements, it may result in higher depreciation and amortization expense than is presented herein. Any such increases could be material, and could result in the Company’s actual future financial condition or results of operations differing materially from that presented herein. As a result, the final purchase price allocation may differ materially from the preliminary purchase price allocation.

4. Reclassifications

Upon consummation of the Acquisition, the accounting policies applicable to Park Place will be conformed to those of the Company. The Company has identified preliminary adjustments to the presentation of the historical financial statements of Park Place to those of the Company based upon currently available information and assumptions management believes to be reasonable. The following reclassifications were made in order to conform with the corresponding treatment for the Company’s financial reporting:

| • | Courtesy vehicles, net of $64.0 million and subscription rental vehicles, net of $9.1 million, as of September 30, 2019, were reclassified to other current assets. |

| • | Floor plan notes payable-trade, and floor plan notes payable-non-trade, related to courtesy vehicles and subscription vehicles, of $44.3 million and $39.9 million, respectively, as of September 30, 2019, were reclassified to accounts payable and accrued liabilities. |

13

| • | The following amounts of sales and cost of sales are presented in the categories shown below to align with the Company’s presentation: |

| Nine Months Ended September 30, 2019 |

Three Months Ended December 31, 2018 |

LTM Period | ||||||||||

| (In millions) | ||||||||||||

| Revenue |

||||||||||||

| New vehicle |

$ | 620.2 | $ | 271.8 | $ | 892.0 | ||||||

| Used vehicle |

474.1 | 149.1 | 623.2 | |||||||||

| Parts and service |

206.4 | 66.4 | 272.8 | |||||||||

| Finance and insurance, net |

21.9 | 8.3 | 30.2 | |||||||||

| Other |

7.2 | 2.4 | 9.6 | |||||||||

| Cost of Sales |

||||||||||||

| New vehicle |

$ | 574.9 | $ | 252.4 | $ | 827.3 | ||||||

| Used vehicle |

447.9 | 141.8 | 589.7 | |||||||||

| Parts and service |

91.1 | 29.9 | 121.0 | |||||||||

| Other |

0.5 | 0.1 | 0.6 | |||||||||

| • | The following line items were reclassified to selling, general and administrative expenses for the nine months ended September 30, 2019, and the three months ended December 31, 2018: variable selling expense, advertising expense, personnel expense, management fee expense, deferred compensation expense, profits interest obligation expense, fixed expense (excluding the amounts reclassified to depreciation and amortization described below), and semi-fixed expense (excluding the amounts reclassified to other interest expense, net described below). |

| • | Interest income on the floor plan offset facility for the nine months ended September 30, 2019 and the three months ended December 31, 2018, respectively, was reclassified to floor plan interest expense. |

| • | Floor plan interest expense on subscription vehicles of $0.3 million and $0.1 million for the nine months ended September 30, 2019 and the three months ended December 31, 2018, respectively, was reclassified from floor plan interest expense to other interest expense, net. |

| • | Floor plan interest expense on courtesy vehicles of $2.1 million and $0.7 million for the nine months ended September 30, 2019 and the three months ended December 31, 2018, respectively, was reclassified from semi-fixed expense to other interest expense, net. |

| • | $11.5 million and $3.7 million was reclassified from fixed expenses to depreciation and amortization for the nine months ended September 30, 2019, and the three months ended December 31, 2018, respectively. |

Management of the Company is currently in the process of conducting a more detailed review of accounting policies used in the historical financial statements of Park Place to determine if differences in accounting policies require any further reclassification to conform to the Company’s accounting policies and classifications. As a result, we may identify additional differences between the accounting policies of the two companies that, when conformed, could have a material impact on these unaudited pro forma condensed combined financial statements.

5. Pro forma adjustments

The pro forma adjustments set forth in the unaudited pro forma condensed combined financial information reflect the following:

| a. | The elimination of assets and liabilities not assumed in connection with the Transaction. |

14

| b. | The elimination of inventory not assumed in the Transaction and recording the preliminary fair value estimate of inventory acquired. |

| c. | The preliminary estimated fair value of property and equipment acquired and related depreciation expense. |

| d. | The right-of-use asset and lease liabilities for operating leases entered into and assumed in the Acquisition. |

| e. | The preliminary estimate of fair value of intangible assets and goodwill arising from the Acquisition less the adjustment to remove Park Place’s historical goodwill and intangible assets. |

| f. | The income tax effect of the pro forma adjustments reflected in the Condensed Combined Statements of Income. |

| g. | Changes in indebtedness incurred in connection with the Financing, and resulting from the indebtedness of Park Place to be repaid at the consummation of the Acquisition, and not assumed by the Company in the Acquisition. |

| h. | The equity impact of the elimination of historical equity balances of Park Place. |

| i. | Changes in interest expense resulting from the Financing, including amortization of estimated debt issuance costs, and resulting interest expense that were not incurred on the indebtedness of Park Place, which were not assumed by the Company in the Transactions. |

| The $1,294.1 million of indebtedness the Company expects to incur in connection with the Financing includes $525.0 million borrowings with respect to the Notes offered hereby (which is less than the $1,125.0 million of Notes being offered hereby), as well as additional borrowings under the 2019 Credit Facility, the 2018 Wells Fargo Master Loan Facility, the 2018 BofA Real Estate Facility and the New BofA Real Estate Facility, and assumes a weighted average estimated interest rate of 4.3% per annum. A change of 0.125% per annum in the assumed interest rate for the variable interest rate Financings would increase or decrease interest expense on a pro forma basis by $0.9 million. In addition, if the Company does not obtain financing on the terms as anticipated in the unaudited pro forma condensed combined statements of income and borrows under the Bridge Loan Facility contemplated by the Commitment Letter, it would be subject to interest expense and costs at rates higher than those assumed. Any borrowings under the Bridge Credit Facility would be classified as short-term debt in current liabilities. See “Summary—The Transactions” and “Description of Other Indebtedness.” |

15

OFFERING MEMORANDUM SUMMARY

This summary highlights selected information included in this offering memorandum. The following summary does not contain all of the information that you should consider before deciding whether to invest in any series of Notes and is qualified in its entirety by the more detailed information appearing elsewhere in the offering memorandum. You should carefully read the entire offering memorandum, including the sections titled “Risk Factors,” “Management’s Discussion and Analysis of the Financial Condition and Results of Operations of the Company” and “Unaudited Pro Forma Condensed Combined Financial Information of the Combined Company” before investing in any series of Notes. All references to the “Acquisition” refer to the acquisition of substantially all of the assets of the businesses of the Park Place Dealership family of entities (collectively, “Park Place”) pursuant to that certain Asset Purchase Agreement, dated as of December 11, 2019 (the “Asset Purchase Agreement”), among the Company, Park Place, and the other parties thereto (collectively, the “Sellers”) and to related agreements and transactions. Additionally, except as otherwise indicated or as the context otherwise requires, all references in this offering memorandum to (i) “Asbury,” the “Company,” “we,” “us” or “our” refer to Asbury Automotive Group, Inc. and its subsidiaries, prior to the Acquisition and (ii) the “Combined Company” refer to Asbury Automotive Group, Inc. and its subsidiaries, after giving effect to the Acquisition.

Overview

Asbury Automotive Group, Inc., headquartered in Duluth, Georgia, is the 7th largest U.S.-based franchised automotive retailer, operating 107 franchises (88 dealership locations) representing 31 brands of automobiles and 25 collision repair centers in 17 metropolitan markets within 10 states as of September 30, 2019. We offer an extensive range of automotive products and services, including new and used vehicles; vehicle repair and maintenance services, replacement parts and collision repair services (collectively referred to as “parts and services” or “P&S”); and finance and insurance products (“F&I”).

Park Place, based in Dallas, Texas, is one of the country’s largest luxury dealer groups, with an attractive portfolio of high volume, award-winning, luxury dealerships and high-quality real estate. Park Place is estimated to be the #2 dealer group in the U.S. based on revenue per dealership in 2019. Park Place consists of a collection of:

| • | ten luxury dealerships, including one dealership scheduled to open in the first quarter of 2020; |

| • | an auto auction business for wholesaling used cars; and |

| • | a subscription service platform that offers customers access to a range of luxury vehicles for a monthly fee. |

The operating assets expected to be acquired include 20 new vehicle franchises, 18 of which are located in the Dallas/Fort Worth market: 3 Mercedes-Benz, 2 Lexus, 1 Jaguar, 1 Land Rover, 1 Porsche, 1 Volvo, 1 Bentley, 1 Rolls Royce, 1 McLaren, 1 Maserati, 1 Karma, 1 Koenigsegg and 3 Sprinter. In addition to these 18 new vehicle franchises, Park Place has rights to 1 Jaguar and 1 Land Rover open point in Austin, Texas that are both expected to open under a single dealership facility late in the first quarter of 2020.

As of September 30, 2019, three of Park Place’s franchises are ranked among the top 10 stores in volume in the country among their franchise: Mercedes-Benz Dallas, Porsche Dallas and Bentley Dallas. In addition, the Jaguar/Land Rover Dallas and both Lexus franchises are ranked among the top 15, and the Volvo franchise is ranked among the top 20 stores in volume.

16

We believe that the Acquisition will create a substantially larger and more diversified enterprise with enhanced profitable growth opportunities and a larger base of stable, recurring revenue from the high margin parts and service business. For the twelve months ended September 30, 2019 (the “LTM Period”), the Combined Company generated pro forma revenue of $8.9 billion, pro forma net income of $206.0 million and Pro Forma Adjusted EBITDA of $447.1 million, inclusive of an estimated $20 million of run-rate synergies and operational improvements.

Combination Rationale

We believe the Acquisition strengthens our dual strategy of driving operational excellence and deploying capital to its highest return. We believe Park Place is a highly efficient operator of luxury stores, with a strong base of loyal clients and approximately 2,100 team members throughout the growing Dallas/Fort Worth market. We expect that our demonstrated success acquiring and integrating well-run businesses will provide us the opportunity to leverage the best practices of both businesses going forward.

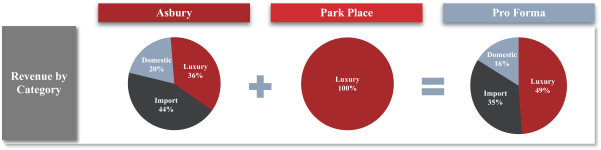

After giving effect to the Acquisition, the Combined Company’s pro forma revenue mix for the LTM Period will be enhanced, with approximately 30% exposure to the Texas market and 50% from luxury brands. The luxury segment has historically delivered strong and stable margins that are significantly above those achieved by mid-line import and domestic brands. Luxury stores have historically been more resilient in economic downturns, have fewer dealers nationwide and derive a higher portion of gross profit from parts and service. According to IHS Markit and MotorIntelligence, the Dallas/Fort Worth market had a 30% higher penetration of luxury new vehicle sales than the national average in 2019. Additionally, the Dallas/Fort Worth market is expected to experience population growth significantly higher than the national forecast through 2023 according to IHS Markit.

17

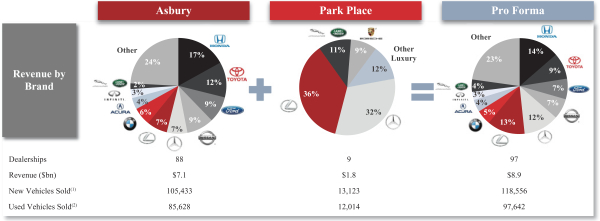

The below figure summarizes the highly complementary scale and brand diversity benefits of the Acquisition:

Brand and Category Mix

For the LTM Period ended September 30, 2019

| (1) | Including fleet. |

| (2) | Retail units only. |

We believe that we can achieve meaningful run-rate synergies and operational improvements of at least $20 million within three years following the closing of the Transactions, consisting of (1) a reduction in corporate costs, (2) lower servicing costs by maintaining key store-level accounting and administrative activities in our shared service centers, (3) the ability to leverage our scale to reduce costs related to purchasing certain equipment, supplies, and services through national vendor relationships and (4) expected operational improvements primarily with respect to F&I and to a lesser extent P&S. See “Risk Factors—Risks Related to the Acquisition—The Acquisition, if consummated, will create numerous risks and uncertainties which could adversely affect our business and results of operations.”

Asbury Automotive

We are one of the largest automotive retailers in the United States by revenue. As of September 30, 2019, we owned and operated 107 new vehicle franchises (88 dealership locations) representing 31 brands of automobiles and 25 collision repair centers in 17 metropolitan markets within 10 states. Our stores offer an extensive range of automotive products and services, including new and used vehicles, P&S and F&I. For the LTM Period, our total revenue brand mix consisted of 44% imports, 36% luxury and 20% domestic.

18

Our retail network is made up of dealerships operating primarily under the following locally-branded dealership groups.

Our operations provide a diverse revenue base that we believe mitigates the impact of fluctuations in new vehicle sales volumes and gross profit margins. In addition, our geographic footprint decreases our exposure to regional economic conditions and our brand diversification decreases our exposure to manufacturer-specific risks, such as brand perception or production disruptions. For the nine months ended September 30, 2019, 48% of our gross profit was derived from our parts and service business, which historically has been more stable throughout economic cycles.

| • | New Vehicle Sales. As of September 30, 2019, our dealerships represented a diverse portfolio of 31 brands. In the nine months ended September 30, 2019, we sold 77,636 new vehicles through our dealerships. Our new vehicle revenue represented 53% of our total revenue and 13% of our total gross profit for the nine months ended September 30, 2019. |

| • | Used Vehicle Sales. We sell used vehicles at all of our dealership locations. In the nine months ended September 30, 2019, we sold 66,330 used vehicles through our dealership network. Our used vehicle business, which generally has higher gross margins than our new vehicle business, accounted for approximately 30% of our total revenue and 12% of our total gross profit for the nine months ended September 30, 2019. |

| • | Parts and Service. We provide vehicle maintenance and repair services in the markets of all of our franchised dealerships, primarily for the vehicle brands sold at those dealerships, and sell replacement parts. In addition, we maintained 25 free-standing collision repair centers either on the |

19

| premises of, or in close proximity to, our dealerships as of September 30, 2019. Our parts and service business accounted for approximately 13% of our total revenue and 48% of our total gross profit for the nine months ended September 30, 2019. |

| • | Finance and Insurance. Through our F&I business, we arrange, and receive commissions for, third-party financing of the sale or lease of new and used vehicles to customers, as well as offer a number of aftermarket products. We also generate F&I revenue from the receipt of certain fees paid to us under agreements with preferred lenders. Our F&I business generated approximately 4% of our total revenue and 27% of our total gross profit for the nine months ended September 30, 2019. |

For the LTM Period, the Company generated revenue of $7.1 billion and Adjusted EBITDA of $337.7 million. For a reconciliation of the Company’s Adjusted EBITDA to net income, which is the most directly comparable GAAP financial measure, please see “Summary Historical Consolidated of Asbury and Unaudited Pro Forma Condensed Combined Financial Information of the Combined Company.”

Park Place

Founded in 1987, Park Place is a founder-owned business that has become one of the country’s largest and most prominent luxury dealer groups. Park Place engages in the retail and wholesale of new and used automobiles of multiple manufacturers, and also provides financing, auto parts, repair and maintenance services.

Park Place consists of 9 dealerships concentrated in the Dallas-Fort Worth-Arlington metroplex (“Dallas Metro”), and will expand into the Austin, Texas market with a new Jaguar-Land Rover dealership expected to open in the first quarter of 2020. Park Place includes a vehicle subscription service, known as the “Select Subscription Service,” and an auto auction business, known as the “Auto Auction.”

The Dallas Metro market has a population of 7.4 million, which is the 4th largest in the United States. According to Urban Science, the Dallas Metro market is expected to experience sustained continued market growth above the national average, including with respect to population growth, household annual income growth and household income distribution.

Additionally, we believe Park Place has a track record of having superior customer service and well-maintained dealerships which make the business well positioned to capture market share in a metro area that historically has a higher concentration of luxury new vehicle sales as compared to the national average.

For the LTM Period, Park Place generated revenue of $1.8 billion and Adjusted EBITDA of $75.0 million. For a reconciliation of Park Place’s Adjusted EBITDA to net income, which is the most directly comparable GAAP financial measure, please see “Summary Historical Consolidated Financial Information of Park Place.”

Industry Overview

In the United States, the franchised automotive dealer industry is the largest retail sector by revenue, where nearly all new cars and light trucks are purchased in the United States. According to Edmunds.com and NADA DATA 2019, the total addressable market for new and used vehicle sales in 2018 was $1.4 trillion on 57 million units, with new vehicles representing $0.6 trillion and 17 million units, and used vehicles representing $0.8 trillion and 40 million units. The U.S. franchised automotive retail market is highly fragmented, with no single dealership group accounting for more than 2% of industry revenue. Key trends that we expect to continue to impact our industry include:

| • | Moderately declining new vehicle unit sales—The seasonally adjusted annual rate (“SAAR”) of new vehicle sales in the United States hit a record peak of 17.5 million units in 2016 and reached |

20

| 17.0 million units in 2019. In contrast to other business models in the automotive supply chain, such as part suppliers and original equipment manufacturers (“OEMs”), new vehicle sales are not the primary driver of profits for franchised dealerships. However, the volume of new vehicle sales over time is a critical driver of dealership profitablity from higher margin revenue streams such as sales of certified pre-owned used vehicles, P&S, and F&I products. New vehicle sales are driven by a variety of economic factors such as availability and cost of financing, disposable income, unemployment rates and exchange rates. Additionally, improvements in product quality, safety and technology features drive demand. We believe that our exposure to brands with higher than average new product introductions expected over the next five years, such as Ford, Mercedes-Benz, BMW and Toyota, will postively impact our new vehicle sales compared to national averages. |

| • | Rapidly growing used car market—According to Factbook 2020, the number of vehicles in operation in the United States grew every year during the 2012 to 2018 time period from 249 million to 278 million, representing an increase of approximately 12% in the aggregate and a compound annual growth rate of 1.8%. A larger number of vehicles in operation increases the market for high margin P&S revenue. In addition, used vehicles represented approximately 70% of unit sales in 2018 with a total addressable market of $830 billion.1 Used vehicle unit sales have historically been less volatile and less sensitive to economic cycles than new vehicle unit sales (other than the sale of new luxury vehicles). Used vehicle sales generate higher gross margins than new vehicles and have consistently contributed a higher portion of gross profits than new vehicles to overall dealership profitability. |

| • | Investments in P&S operations enhance franchised dealership business model—Since the 2008-2009 recession, we believe franchised automotive retailers have made substantial investments in the high margin parts and service business to take market share from independent providers by focusing on increasing capacity, improving customer service and leveraging their scale and OEM relationships to invest in the capital equipment and training required to service vehicles with increasingly more technology. |

| • | Growth in F&I income per vehicle has more than offset the decline in gross profit per new vehicle over the last decade—Dealer groups have experienced growing F&I revenue per vehicle in the last decade. Improvement in employee training, inflation in vehicle pricing, as well as the renegotiation of contribution to insurance underwriters, has helped improve our F&I income per vehicle. |

| • | Luxury dealerships outperform import and domestic dealerships—Luxury dealerships tend to have higher and more stable vehicle gross margins, fewer dealerships per capita and a greater portion of revenue derived from P&S. Additionally, we believe luxury brands benefit from higher customer loyalty and a customer demographic that is less price-sensitive, which we believe was reflected in our operations during the 2008-2009 recession. In 2008, our pre-tax store level income for our luxury dealerships declined by 23%, compared to 46% and 47% for our import and domestic dealerships, respectively. In 2009, our pre-tax store level income for our luxury dealerships increased by 3%, compared to 1% growth in import dealerships and a 12% decline in our domestic dealerships. |

| 1 | Edmunds.com Inc. 2019 Used Vehicle Outlook report for number of used vehicles sold and NADA DATA 2019 report for average vehicle price. |

21

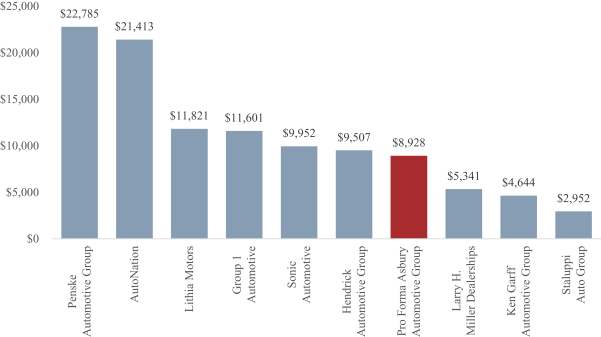

Our Competitive Strengths

Leading dealership group with growing scale in the fragmented auto retail sector. We are the 7th largest franchised dealership group in the United States based on revenue for the year ended December 31, 2018. Our size and scale enhances our relationships with OEMs and key finance partners, leverages our investments in new technologies/systems and corporate overhead across a larger revenue base and maximizes the benefits of implementing best practices within our dealership group. Additionally, the concentration of our dealerships in certain markets and geographies increases operational and personnel efficiencies.

Top 10 U.S. Based Franchised Dealership Groups by Revenue for the Year Ended December 31, 2018

($ in millions)

Source: Automotive News.

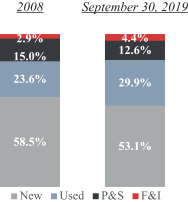

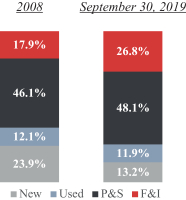

Our gross profit is increasingly driven by more stable, higher-margin revenue streams. Since the last recession in 2008-2009, we have made significant investments in our fixed operations and implemented strategic initiatives that have created a more resilient, higher-margin business model that is less reliant on vehicle sales. In our P&S business, we have added capacity, increased throughput and invested in technology to improve customer satisfaction, which has allowed us to expand our margins and take market share from independent service providers. In our F&I business, we have added headcount at the dealership level, increased the quality of our training programs and invested in consumer-friendly technologies, which have resulted in higher F&I income per vehicle. The figure below illustrates the transformation of our revenue and gross profit mix from 2008 as compared to the nine months ended September 30, 2019.

22

Asbury Revenue and Gross Profit Contribution (2008 vs Nine Months Ended September 30, 2019)

| Revenue Mix | Gross Profit Mix | |

|

| |

Strong margin profile. We strive to drive operational excellence across our dealership platform to consistently deliver above industry average profit margins, and we have expanded our Adjusted EBITDA margins from below 3% in 2007 to 4.8% for the LTM Period. The Acquisition is expected to further expand our Adjusted EBITDA margins as a Combined Company. We believe that our Adjusted EBITDA margins will continue to expand from the sharing of best practices between companies, the realization of identified run-rate synergies from duplicative corporate overhead functions and the implementation of Asbury’s products and processes within Park Place’s dealerships to increase the F&I income per vehicle sold. We have confidence in the success of these initiatives based on our track record of acquiring and integrating similar dealerships.

Highly variable cost structure and significant fixed cost absorption from stable P&S revenue. Our cost structure is highly variable at the dealership and corporate level, which minimizes the profit margin impact from any decline in vehicle sales. From 2008 to 2018, our selling, general and administrative expenses (“SG&A”) as a percentage of gross profit have declined from approximately 81% to approximately 69%, and the profits we generate from our P&S business cover an increasing portion of our fixed costs. We estimate that over 70% of our SG&A is variable. We have created a hybrid strategy to leverage fixed costs across our dealership portfolio that (1) allows our higher volume stores the flexibility to add headcount for improved local customer service and (2) offers our lower volume stores access to a high quality shared service center to maintain dealership-level profitability.

Strong free cash flow generation to reduce our leverage and support our strong credit profile. Our goal is to generate cash flow that will allow us to achieve a total net leverage target of less than 3.0x. Our financial policy and capital allocation strategy is focused on reducing funded debt. We expect our continued focus on operational excellence and on a well-defined integration plan for the Acquisition to further reduce our net leverage ratio. In addition, we will continue to monitor and manage working capital to maintain a strong liquidity profile.

23

Business Strategy

We seek to create long-term value in our business by striving to drive operational excellence and deploy capital to its highest risk adjusted returns. To achieve these objectives, we employ the strategies described below.

Invest in and attract top talent to improve backend operations and front-line service. We believe the core of our business success lies in our talent pool, so we are focused on obtaining and retaining the best people. Our executive management team has extensive experience in the auto retail sector, and is able to leverage experience from all positions throughout the Company. In addition, we believe that local management of dealership operations enables our retail network to provide market specific responses to sales, customer service and inventory requirements. The general manager of each of our dealerships is responsible for the operations, personnel and financial performance of that dealership as well as other day-to-day operations.

Implement best practices and improve productivity. We have discipline-specific executives who focus on increasing the penetration of current services and expanding the breadth of our offerings to customers through the implementation of best practices and continuous training on our technology solutions throughout our dealership network. In addition, we have marketing initiatives designed to attract customers to our online channels and mobile applications.

We tie management and employee compensation at various operational levels to performance through incentive-based pay systems based on various metrics, including dealership profitability, departmental profitability, customer satisfaction and individual performance, as appropriate. In addition, a portion of management’s compensation is variable-based in nature, including an annual cash bonus based on achieving certain EBITDA targets and a component of equity compensation tied to our financial performance in comparison to our peer group.

Provide an exceptional guest experience. We are focused on providing a high level of customer service and have designed our dealerships’ services to meet the needs of an increasingly sophisticated and demanding automotive consumer. We endeavor to establish relationships that we believe will result in both repeat business and additional business through customer referrals. Furthermore, we provide our dealership managers with appropriate incentives to employ efficient selling approaches, engage in extensive follow-up to develop long-term relationships with customers and extensively train our sales staff to meet customer needs.

Centralize, streamline and automate processes. Our Dealership Support Center (“DSC”) management is responsible for our capital expenditure and operating strategy, while the implementation of our operating strategy rests with our market-based management teams and each dealership management team based on the policies and procedures established by DSC management. DSC management and our market-based management teams continuously evaluate the financial and operating results of our dealerships, as well as each dealership’s geographical location, and from time to time, make decisions to evaluate new technologies and/or processes to further refine our operational processes.

Leverage our scale and cost structure to improve our operating efficiencies. We are positioned to leverage our significant scale so that we are able to achieve competitive operating margins by centralizing and streamlining various back-office functions. We are able to improve financial controls and lower servicing costs by maintaining key store-level accounting and administrative activities in our shared service centers, and we leverage our scale to reduce costs related to purchasing certain equipment, supplies and services through national vendor relationships. Similarly, we are able to leverage our scale to implement these best practices when integrating newly acquired dealerships allowing us to continue to improve our operating efficiencies.

24

Successfully integrate Park Place and maximize the benefits of this transformational Acquisition. We have a well-defined integration plan for Park Place. Park Place already performs at a high level and is operated by seasoned general managers, with an average tenure of approximately 20 years, who we expect to retain. Our integration strategy is focused on achieving cost savings at a corporate level from duplicative functions and implementing our training programs and F&I product offerings at Park Place to achieve higher F&I income per vehicle sold. Asbury and Park Place utilize the same operational, human resources and accounting information technology systems, which we expect to support as part of the integration process. Additionally, we have ample internal resources at Asbury to manage the integration process, as the 10 dealership locations (including Jaguar/Land Rover Austin) of Park Place represent an increase of approximately 10% of our existing store count.

Deploy Capital to Highest Returns. Our capital allocation decisions are made within the context of maintaining sufficient liquidity and a prudent capital structure. We target a 2.5x to 3.0x net leverage ratio, and our primary focus for capital allocation will be to decrease our debt levels; however, we believe our cash position and borrowing capacity, combined with our current and expected future cash generation capability, provides us with financial flexibility to enhance shareholder value through capital deployment by reinvesting in our business, acquiring dealerships as well as repurchasing shares, when prudent.

Continue to invest in our business. We continually evaluate our existing dealership network and seek to make strategic investments that will increase the capacity of our dealerships and improve the customer experience. In addition, we continue to execute on our strategy of selectively acquiring our leased properties where financing rates make it attractive to be an owner and provide us a further means to finance our business.

Evaluate opportunities to refine our dealership portfolio. We continually evaluate the financial and operating results of our dealerships, as well as each dealership’s geographical location and, based on various financial and strategic rationales, may make decisions to dispose of dealerships to refine our dealership and real estate portfolio. We also evaluate dealership acquisition opportunities based on market position and geography, brand representation and availability, key personnel and other factors.

25

Recent Developments

Unaudited Quarterly Results of Operations

Set forth below are unaudited financial results and other data for the Company and preliminary estimated financial results and other data for Park Place that have been prepared by management of the Company and Park Place based on currently available information.

The following table presents selected preliminary unaudited financial results as of, and for, the three months ended December 31, 2019. The unaudited financial results reflects the Company’s preliminary estimates based on currently available information. The Company’s financial closing procedures for the three months ended December 31, 2019, are not yet complete and, as a result, the Company’s final results upon completion of the Company’s closing procedures may vary from the preliminary estimates. The estimates were prepared by the Company’s management, based upon a number of assumptions, in connection with preparation of the Company’s

26

financial statements and completion of the Company’s preliminary review for the quarter ended December 31, 2019. Additional items that would require material adjustments to the preliminary financial information may be identified. Estimates of results are inherently uncertain and subject to change, and the Company undertakes no obligation to update this information. These estimates should not be viewed as a substitute for interim financial statements prepared in accordance with U.S. GAAP. In addition, the preliminary results are not necessarily indicative of the actual results that may be reported. The Company’s independent registered public accounting firm has not conducted a review of and does not express an opinion or any other form of assurance with respect to, these preliminary estimates.