Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FFBW, Inc. /MD/ | tm206084d1_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - FFBW, Inc. /MD/ | tm206084d1_ex99-1.htm |

Exhibit 99.2

“The Community Bank Difference”

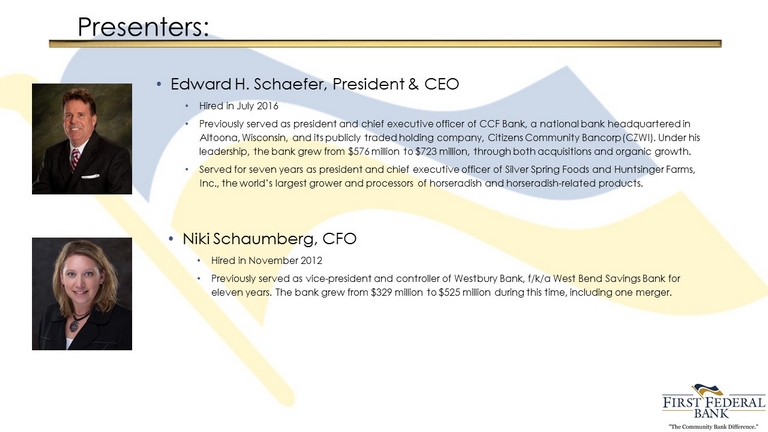

Presenters: • Edward H. Schaefer, President & CEO • Hired in July 2016 • Previously served as president and chief executive officer of CCF Bank, a national bank headquartered in Altoona, Wisconsin, and its publicly traded holding company, Citizens Community Bancorp(CZWI). Under his leadership, the bank grew from $576 million to $723 million, through both acquisitions and organic growth. • Served for seven years as president and chief executive officer of Silver Spring Foods and Huntsinger Farms, Inc., the world’s largest grower and processors of horseradish and horseradish - related products. • Niki Schaumberg, CFO • Hired in November 2012 • Previously served as vice - president and controller of Westbury Bank, f/k/a West Bend Savings Bank for eleven years. The bank grew from $329 million to $525 million during this time, including one merger.

Cautionary Statement Regarding Forward - Looking Statements This presentation may contain forward - looking statements, which can be identified by the use of words such as “estimate,” “project,” “believe,” “intend,” “anticipate,” “plan,” “seek,” “expect” and words of similar meaning. These forward - looking statements include, but are not limited to: statements of our goals, intentions and expectations; statements regarding our business plans, prospects, growth and operating strategies; statements regarding the quality of our loan and investment portfolios; and estimates of our risks and future costs and benefits. These forward - looking statements are based on current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward - looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual outcomes may differ materially from those expressed or implied as a result of factors described under “Forward - looking Statements” and “Risk Factors” in FFBW, Inc’s Prospectus dated November 12, 2019 and in other filings of FFBW, Inc. (“FFBW”) with the Securities and Exchange Commission (the “SEC”). FFBW has no duty to, and does not intend to, update or revise forward - looking statements after the date on which they are made. For further information about FFBW, please see the Company’s most recent annual and quarterly reports filed on Form 10 - K and Form 10 - Q.

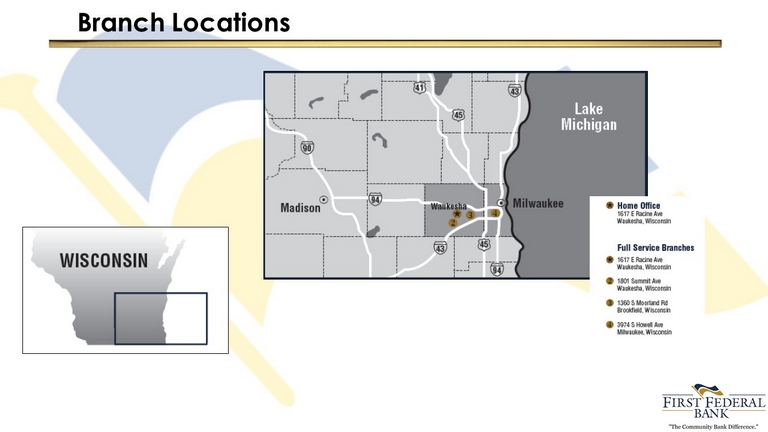

Branch Locations

History FFBW has served the City of Waukesha and surrounding communities since 1922 . For many years, FFBW functioned as a savings and loan institution with most of its customer base holding certificates of deposits and loans . Originally an association, the institution converted to a bank once it began to offer checking account products in the late 1970 ’s and early 1980 ’s . The once sleepy hometown community bank has grown substantially in the last 10 years including a merger with Bay View Federal Savings and Loan Association in 2014 , the construction of the Brookfield / New Berlin branch in 2015 , and the reorganization into the publicly - traded stock holding company, FFBW, Inc . , completed in 2020 . Today, FFBW is a markedly strong financial institution thanks to the efforts of our team members to solidify our policies, procedures, and internal controls to build a platform for future profitable growth .

2019 Highlights: • Strong Earnings Growth • Emphasis on Expense Control • Continued Strong Asset Quality • Completion of Second - Step Mutual - to - Stock Conversion

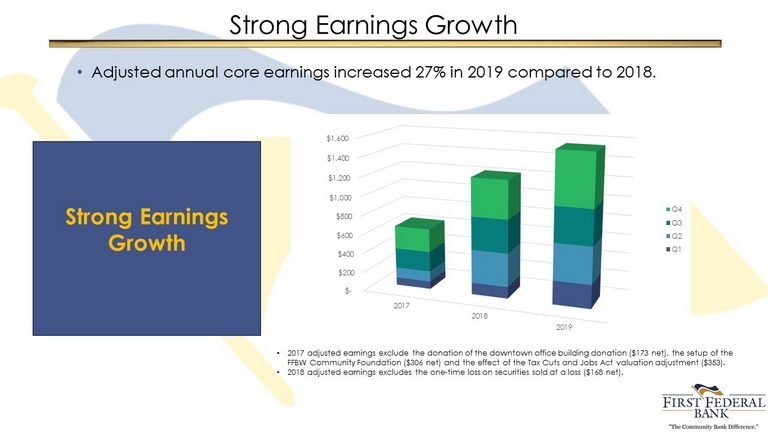

Strong Earnings Growth • Adjusted annual core earnings increased 27% in 2019 compared to 2018. Strong Earnings Growth $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 2017 2018 2019 Q4 Q3 Q2 Q1 • 2017 adjusted earnings exclude the donation of the downtown office building donation ($173 net), the setup of the FFBW Community Foundation ($306 net) and the effect of the Tax Cuts and Jobs Act valuation adjustment ($353). • 2018 adjusted earnings excludes the one - time loss on securities sold at a loss ($168 net).

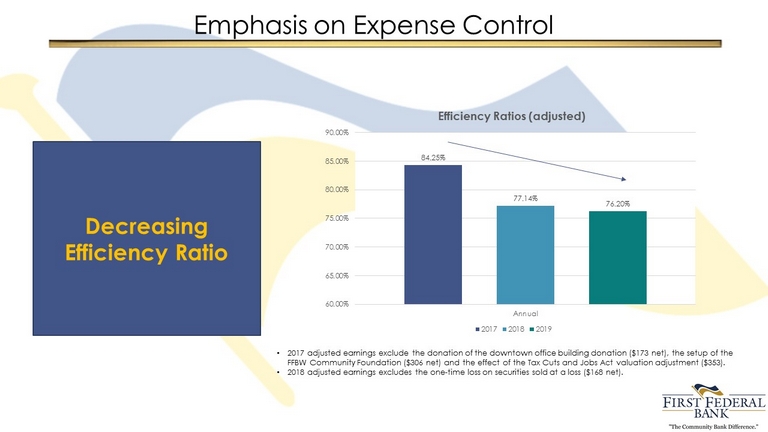

Emphasis on Expense Control Decreasing Efficiency Ratio • 2017 adjusted earnings exclude the donation of the downtown office building donation ($173 net), the setup of the FFBW Community Foundation ($306 net) and the effect of the Tax Cuts and Jobs Act valuation adjustment ($353). • 2018 adjusted earnings excludes the one - time loss on securities sold at a loss ($168 net). 84.25% 77.14% 76.20% 60.00% 65.00% 70.00% 75.00% 80.00% 85.00% 90.00% Annual Efficiency Ratios (adjusted) 2017 2018 2019

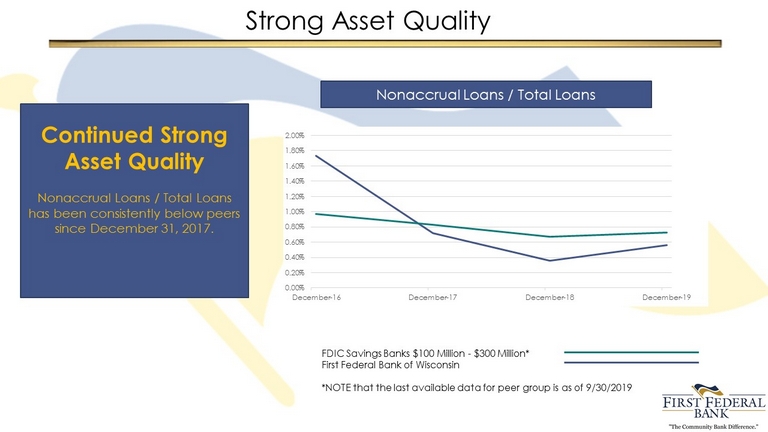

Strong Asset Quality Nonaccrual Loans / Total Loans FDIC Savings Banks $100 Million - $300 Million* First Federal Bank of Wisconsin *NOTE that the last available data for peer group is as of 9/30/2019 Continued Strong Asset Quality Nonaccrual Loans / Total Loans has been consistently below peers since December 31, 2017. 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% December-16 December-17 December-18 December-19

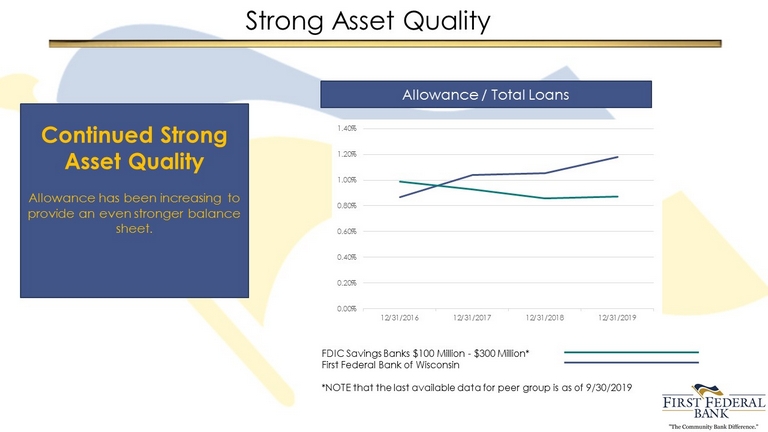

Strong Asset Quality Allowance / Total Loans FDIC Savings Banks $100 Million - $300 Million* First Federal Bank of Wisconsin *NOTE that the last available data for peer group is as of 9/30/2019 Continued Strong Asset Quality Allowance has been increasing to provide an even stronger balance sheet. 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 12/31/2016 12/31/2017 12/31/2018 12/31/2019

Completed Second Step Mutual to Stock Conversion • Effective January 16, 2020 • Additional $42.6 million raised • Total Shares Outstanding = 7,704,875

Utilization of Capital • Organic Commercial Banking Growth • Organic Residential Lending Growth • Potential Branch Expansion • Potential M&A Activities With the capital raised in the offering, FFBW is positioned for profitable growth. We will achieve this by focusing on the following:

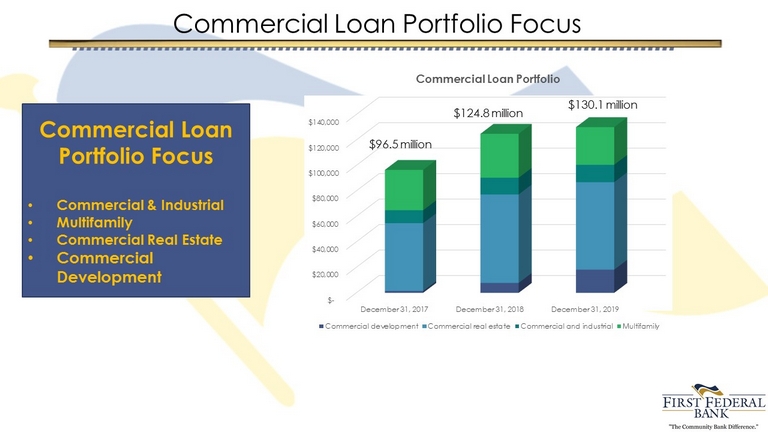

Commercial Loan Portfolio Focus Commercial Loan Portfolio Focus • Commercial & Industrial • Multifamily • Commercial Real Estate • Commercial Development $- $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 December 31, 2017 December 31, 2018 December 31, 2019 Commercial Loan Portfolio Commercial development Commercial real estate Commercial and industrial Multifamily $96.5 million $124.8 million $130.1 million

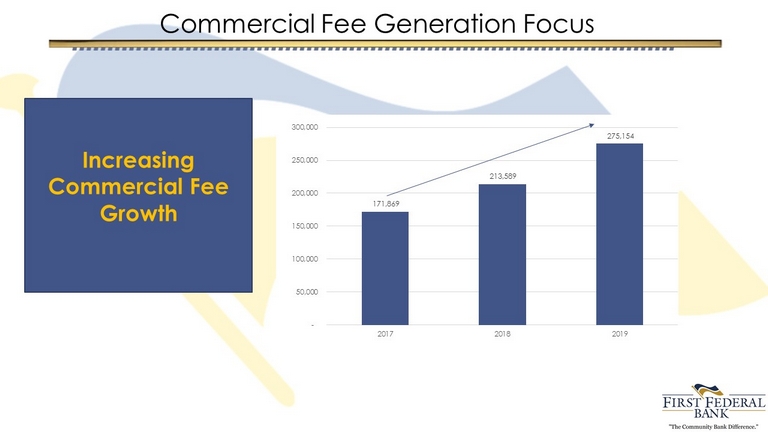

Commercial Fee Generation Focus Increasing Commercial Fee Growth 171,869 213,589 275,154 - 50,000 100,000 150,000 200,000 250,000 300,000 2017 2018 2019

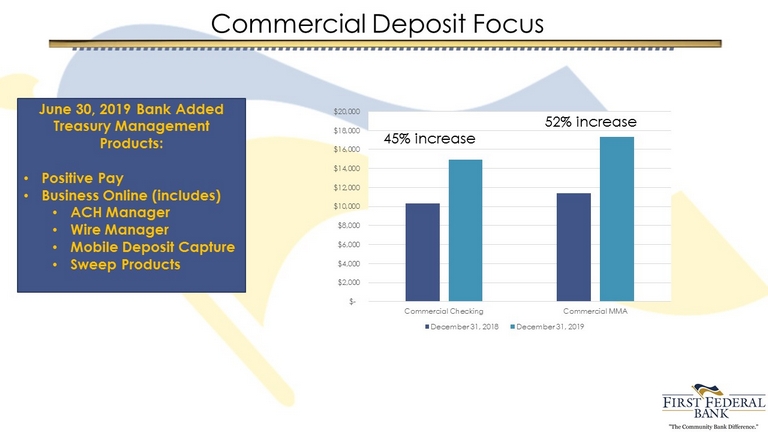

Commercial Deposit Focus June 30, 2019 Bank Added Treasury Management Products: • Positive Pay • Business Online (includes) • ACH Manager • Wire Manager • Mobile Deposit Capture • Sweep Products $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 Commercial Checking Commercial MMA December 31, 2018 December 31, 2019 52% increase 45% increase

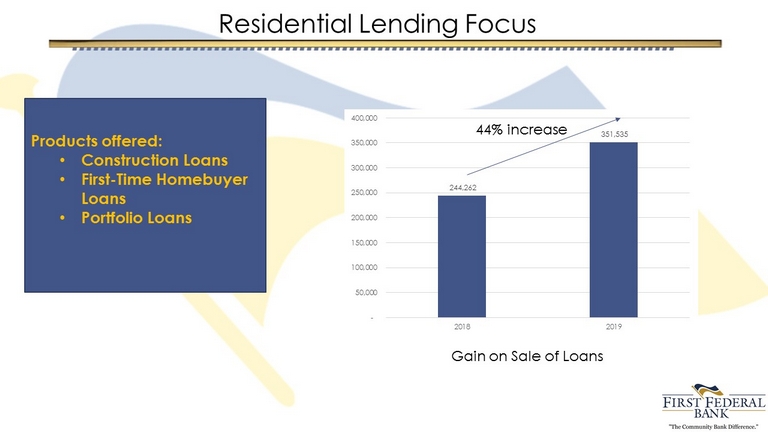

Residential Lending Focus Products offered: • Construction Loans • First - Time Homebuyer Loans • Portfolio Loans 244,262 351,535 - 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 2018 2019 44% increase Gain on Sale of Loans

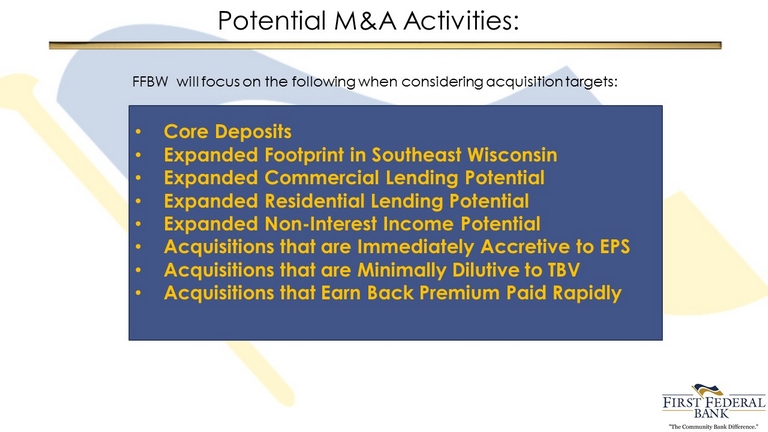

Potential Branch Expansion: • Core Deposits • Expanded Footprint in Southeast Wisconsin • Expanded Commercial Banking Potential • Expanded Residential Lending Potential • Expanded Non - Interest Income Potential FFBW will focus on the following when considering branch expansion

Potential M&A Activities: • Core Deposits • Expanded Footprint in Southeast Wisconsin • Expanded Commercial Lending Potential • Expanded Residential Lending Potential • Expanded Non - Interest Income Potential • Acquisitions that are Immediately Accretive to EPS • Acquisitions that are Minimally Dilutive to TBV • Acquisitions that Earn Back Premium Paid Rapidly FFBW will focus on the following when considering acquisition targets:

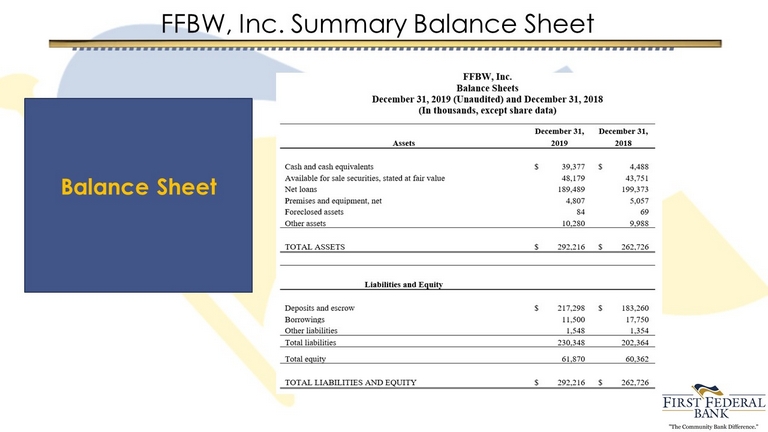

FFBW, Inc. Summary Balance Sheet Balance Sheet

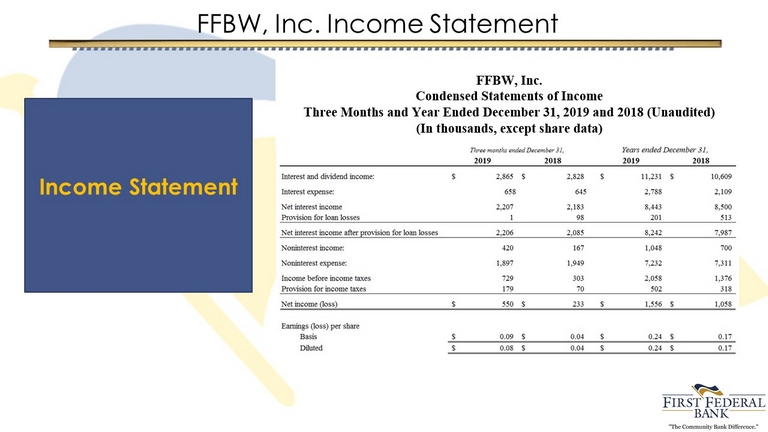

FFBW, Inc. Income Statement Income Statement

Questions?

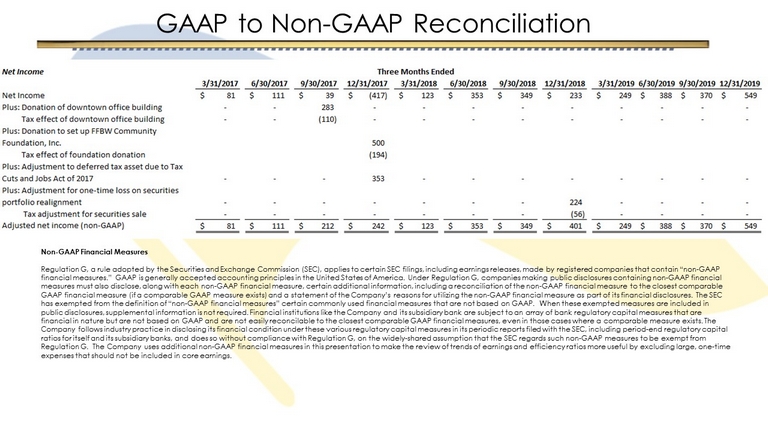

GAAP to Non - GAAP Reconciliation Non - GAAP Financial Measures Regulation G, a rule adopted by the Securities and Exchange Commission (SEC), applies to certain SEC filings, including earni ngs releases, made by registered companies that contain “non - GAAP financial measures.” GAAP is generally accepted accounting principles in the United States of America. Under Regulation G, com panies making public disclosures containing non - GAAP financial measures must also disclose, along with each non - GAAP financial measure, certain additional information, including a reconciliat ion of the non - GAAP financial measure to the closest comparable GAAP financial measure (if a comparable GAAP measure exists) and a statement of the Company’s reasons for utilizing the non - GAAP financial measure as part of its financial disclosures. The SEC has exempted from the definition of “non - GAAP financial measures” certain commonly used financial measures that are not based on GAAP. When these exempted measures are included in public disclosures, supplemental information is not required. Financial institutions like the Company and its subsidiary bank ar e subject to an array of bank regulatory capital measures that are financial in nature but are not based on GAAP and are not easily reconcilable to the closest comparable GAAP financial measur es, even in those cases where a comparable measure exists. The Company follows industry practice in disclosing its financial condition under these various regulatory capital measures in it s p eriodic reports filed with the SEC, including period - end regulatory capital ratios for itself and its subsidiary banks, and does so without compliance with Regulation G, on the widely - shared assumption th at the SEC regards such non - GAAP measures to be exempt from Regulation G. The Company uses additional non - GAAP financial measures in this presentation to make the review of trends of earn ings and efficiency ratios more useful by excluding large, one - time expenses that should not be included in core earnings.