Attached files

| file | filename |

|---|---|

| 8-K - WEX INC. 8-K - WEX Inc. | a52163261.htm |

| EX-99.1 - EXHIBIT 99.1 - WEX Inc. | a52163261ex99_1.htm |

Exhibit 99.2

WEX to Acquire eNett & Optal January 24, 2020

Forward Looking Statement Disclaimer This material contains forward-looking statements, including

statements regarding: the proposed acquisition; the financial impact of the acquisition; the anticipated benefits and synergies of the acquisition; the timing of any potential completion; future opportunities for the combined operations and any

other statements about WEX’s, Optal’s or eNett’s future expectations, beliefs, goals, plans, or prospects. Any statements that are not statements of historical facts may be deemed to be forward-looking statements. When used in these materials,

the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain

such words. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially, including: the effects of general economic conditions on fueling patterns as well as payment

and transaction processing activity; the impact of foreign currency exchange rates on the Company’s operations, revenue and income; changes in interest rates; the impact of fluctuations in fuel prices; the effects of the Company’s business

expansion and acquisition efforts; potential adverse changes to business or employee relationships, including those resulting from the completion of an acquisition; competitive responses to any acquisitions; uncertainty of the expected

financial performance of the combined operations following completion of an acquisition; the failure to successfully integrate the Company's acquisitions; the ability to realize anticipated synergies and cost savings; unexpected costs, charges

or expenses resulting from an acquisition; the Company's ability to successfully acquire, integrate, operate and expand commercial fuel card programs; the failure of corporate investments to result in anticipated strategic value; the impact and

size of credit losses; the impact of changes to the Company's credit standards; breaches of the Company’s technology systems or those of the Company's third-party service providers and any resulting negative impact on the Company's reputation,

liabilities or relationships with customers or merchants; the Company’s failure to maintain or renew key commercial agreements; failure to expand the Company’s technological capabilities and service offerings as rapidly as the Company’s

competitors; failure to successfully implement the Company's information technology strategies and capabilities in connection with its technology outsourcing and insourcing arrangements and any resulting cost associated with that failure; the

actions of regulatory bodies, including banking and securities regulators, or possible changes in banking or financial regulations impacting the Company’s industrial bank, the Company as the corporate parent or other subsidiaries or affiliates;

the impact of the material weaknesses first disclosed in Item 9A of the Company's Annual Report for the year ended December 31, 2018 filed on Form 10-K with the Securities and Exchange Commission on March 18, 2019 and the effects of the

Company's investigation and remediation efforts in connection with certain immaterial errors in the financial statements of our Brazilian subsidiary; the impact of the Company’s outstanding notes on its operations; the impact of increased

leverage on the Company's operations, results or borrowing capacity generally, and as a result of acquisitions specifically; the incurrence of impairment charges if our assessment of the fair value of certain of our reporting units changes; the

uncertainties of litigation; as well as other risks and uncertainties identified in Item 1A of our Annual Report for the year ended December 31, 2018, filed on Form 10-K with the Securities and Exchange Commission on March 18, 2019. The

Company's forward-looking statements do not reflect the potential future impact of any alliance, merger, acquisition, disposition or stock repurchases. The forward-looking statements speak only as of the date of this material and undue reliance

should not be placed on these statements. The Company disclaims any obligation to update any forward-looking statements as a result of new information, future events or otherwise. 2

Transaction Summary OVERVIEW WEX to acquire eNett and Optal for total consideration of approximately

$1.7 billioneNett and Optal are already highly integrated companies and will be fully integrated under WEX’s ownershipeNett is a leading provider of B2B payments solutions to the travel industryOptal specializes in optimizing B2B transactions

and is the primary issuer of eNett payments Expect to realize run-rate synergies of approximately $25 million over a 24-month period post-closing, excluding one-time integration costsTransaction expected to enhance growth, generate cost

savings to improve EBITDA margins and increase cash flowTransaction expected to be accretive to adjusted net income EPS in the first 12 months, excluding one-time charges ESTIMATED SYNERGIES & FINANCIAL IMPACT Consideration consisting of

approximately $1.275 billion of cash and approximately 2 million shares of WEX common stock valued at approximately $425M based on the 30-day VWAP prior to signing to be issued to the sellers WEX has obtained commitments for approximately $1.4

billion of new debt to fund the acquisitionSignificant free cash flow generation expected to drive rapid debt reduction post-closing, with net leverage expected to be within long-term target range of 2.5X - 3.5X within 9-18 monthsExpect Moody’s

and S&P to affirm WEX’s existing ratings of Ba2 and BB-, respectively, post closing TRANSATION FINANCING 3 Expected to close in mid-year 2020, subject to regulatory approvals and other customary closing conditions TIMING

eNett and Optal Overview eNett and Optal provide B2B payment solutions globally, predominantly in the

travel spaceOfferings include:Issuing virtual account numbers (VANs)Prepay, chargeback and settlement solutions for hotel, airfare, car rental and rail optionsRisk, settlement and performance toolsCredit card processing, electronic fund

transfer/direct debit processing, merchant services and Card authorization and settlement eNett and Optal are highly integrated companies servicing the global travel market eNett and Optal Capabilities Capabilities in 58

Currencies Physical Card Electronic fund transfer Wholesale solutions Merchant services Virtual Account Numbers (VANs) Summary Financials(2019 Projections) ~$20bPurchaseVolume ~$150m to $160mRevenue* 4 $25 Million in Synergies two

years post-closing * Revenue estimates are subject to final review for potential adjustments to conform to US GAAP

Strategic Rationale Complementary businesses add product functionality and extend WEX’s geographic

coverage in the global travel market 5 ☑ ☑ ☑ Accelerates WEX’s global growth strategyExtends WEX’s leadership in the large and growing global travel market Provides complementary footprint in EMEA and APACIncreases exposure to high

growth travel sector while further diversifying WEX’s businessStrengthens WEX’s technology solutions and product offering Accelerates WEX’s revenue growth rate and adjusted EBITDA margin Accretive to WEX’s adjusted EPS in the first 12

months ☑ ☑ ☑ ☑

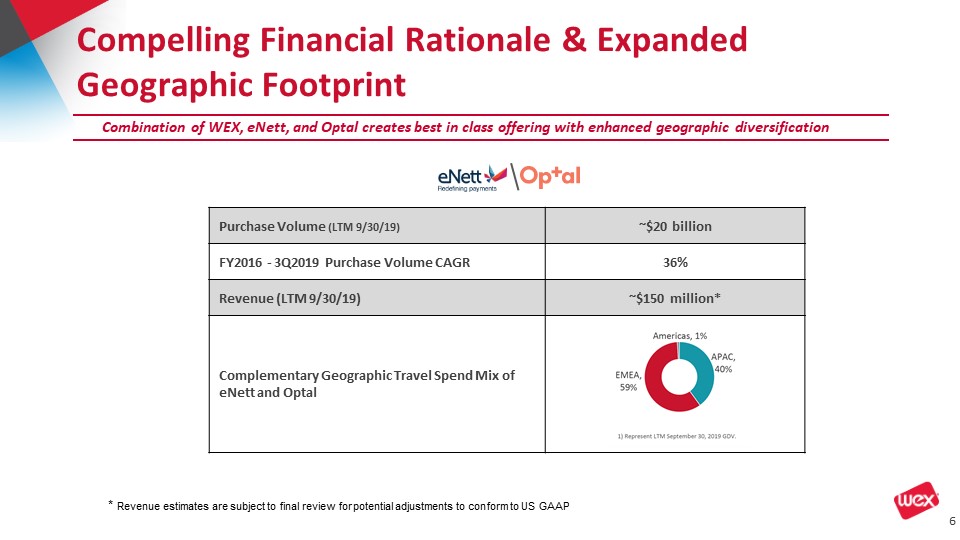

6 Compelling Financial Rationale & Expanded Geographic Footprint Purchase Volume (LTM

9/30/19) ~$20 billion FY2016 - 3Q2019 Purchase Volume CAGR 36% Revenue (LTM 9/30/19) ~$150 million* Complementary Geographic Travel Spend Mix of eNett and Optal Combination of WEX, eNett, and Optal creates best in class offering with

enhanced geographic diversification * Revenue estimates are subject to final review for potential adjustments to conform to US GAAP

Financial Considerations FINANCING STRUCTURE WEX has received committed financing to fund the cash

considerationNew debt financing expected to result in less than 4.50x net leverage at closingExpect to maintain current ratings profileStrong free cash flow generation drives enhanced deleveraging of approximately 1/2X to 1.0X of a turn per

yearStock consideration supports a strong capital structure post-transactionSufficient liquidity through cash on hand and revolver to fund operations and pursue additional ongoing opportunistic M&A, post closing FINANCIAL IMPACT WEX will

benefit from an improved growth profile, EBITDA margin expansion and cost synergiesAccretive to revenue growth and adjusted net income in the first twelve months post closingExpect to realize run-rate cost synergies of approximately $25 million

over a 24 month period post-closing, excluding costs to achieve the synergies 7

Key Takeaways Compelling strategic acquisition that adds capabilities and scale to Wex and strengthens

its position in the Travel Payments industry Combination of scale, distribution and technology creates a leading travel payments providerProvides additional product functionalityProvides geographic diversification, while reducing exposure to

macro-economic factorsProvides greater access to global travel market and further strengthens WEX’s customer pipelineAttractive financial profile with clear path to realizing synergies WEX, combined with eNett and Optal, will be better

positioned to deliver continuous innovation and sector expertise to better meet the evolving needs of our customers 8