Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - FUELCELL ENERGY INC | tm205526d1_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - FUELCELL ENERGY INC | tm205526d1_ex99-1.htm |

| 8-K - FORM 8-K - FUELCELL ENERGY INC | tm205526d1_8k.htm |

Exhibit 99.3

FUELCELL ENERGY INVESTOR PRESENTATION Fourth Quarter and Fiscal 2019 Financial Results & Strategy Update January 22, 2020

FUELCELL ENERGY INVESTOR PRESENTATION Safe Harbor Statement This presentation contains forward - looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 , including, without limitation, statements with respect to the Company’s anticipated financial results and statements regarding the Company's plans and expectations regarding the continuing development, commercialization and financing of its fuel cell technology and business plans . All forward - looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected . Factors that could cause such a difference include, without limitation, changes to projected deliveries and order flow, changes to production rate and product costs, general risks associated with product development, manufacturing, changes in the regulatory environment, customer strategies, unanticipated manufacturing issues that impact power plant performance, changes in critical accounting policies, potential volatility of energy prices, rapid technological change, competition, and the Company’s ability to achieve its sales plans and cost reduction targets, as well as other risks set forth in the Company’s filings with the Securities and Exchange Commission (SEC) . The forward - looking statements contained herein speak only as of the date of this presentation . The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statement to reflect any change in the Company's expectations or any change in events, conditions or circumstances on which any such statement is based . The Company may refer to non - GAAP financial measures in this presentation . The Company believes that this information is useful to understanding its operating results and assessing performance and highlighting trends on an overall basis . Please refer to the Company’s earnings release for further disclosure and reconciliation of non - GAAP financial measures . (As used herein, the term “GAAP” refers to generally accepted accounting principles in the U . S . ) The information set forth in this presentation is qualified by reference to, and should be read in conjunction with, our Annual Report on Form 10 - K for the fiscal year ended October 31 , 2019 , filed with the SEC on January 22 , 2020 and our earnings release for the fourth quarter ended October 31 , 2019 , filed as an exhibit to our Current Report on Form 8 - K filed with the SEC on January 22 , 2020 . 2

FUELCELL ENERGY INVESTOR PRESENTATION Purpose Statement 3 Enable the world to live a life empowered by clean energy

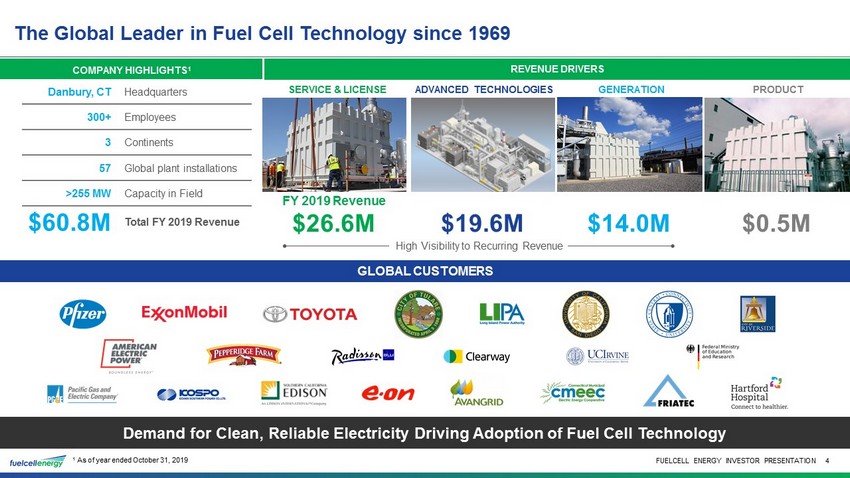

FUELCELL ENERGY INVESTOR PRESENTATION The Global Leader in Fuel Cell Technology since 1969 Demand for Clean, Reliable Electricity Driving Adoption of Fuel Cell Technology 4 GLOBAL CUSTOMERS 1 As of year ended October 31, 2019 GENERATION SERVICE & LICENSE FY 2019 Revenue $26.6M ADVANCED TECHNOLOGIES PRODUCT COMPANY HIGHLIGHTS 1 REVENUE DRIVERS Danbury, CT Headquarters 300+ Employees 3 Continents 57 Global plant installations >255 MW Capacity in Field $60.8M Total FY 2019 Revenue $14.0M $19.6M $0.5M High Visibility to Recurring Revenue

FUELCELL ENERGY INVESTOR PRESENTATION 4Q and Fiscal 2019 Financial Performance

FUELCELL ENERGY INVESTOR PRESENTATION 4Q and Fiscal 2019 Highlights x Many strategic actions taken throughout 2019 position FuelCell Energy for long - term success x Secured funding to provide immediate liquidity to execute inflight projects that will generate recurring cash flow upon completion x Concluded engagement with Huron to assist with restructuring based on progress made on many fronts, including right - sizing of the business, implementation of cost control measures, and reduction of substantial corporate debt x Expanded strategic relationships to enhance development of carbon capture technology and build FuelCell Energy’s growth opportunities in the European market x Made significant progress on execution of key projects 6

FUELCELL ENERGY INVESTOR PRESENTATION 4Q and Fiscal 2019 Financial Performance 7 Improved Financial Performance Resulting from Business Transformation Efforts ▪ 4Q revenue declined 38% to $11.0M, primarily reflecting decreased Product sales and Service and License revenues ▪ Adj. EBITDA loss for 4Q 2019 of $(11.0) M compared to $(8.8) M ▪ Fiscal 2019 revenue down 32% to $60.8M primarily due to decreased Product sales ▪ Adj. EBITDA loss for fiscal 2019 of $(31.4) M compared to $(32.7) M, reflecting decreased revenue and a higher cost of Generation and cost of Service and license revenue Highlights vs prior - year periods $17.9 $11.0 $89.4 $60.8 4Q18 4Q19 2018 2019 Total Revenues ($M) $(8.8) $(11.0) $(32.7) $(31.4) 4Q18 4Q19 2018 2019 Adjusted EBITDA 1 ($M) $(2.31) $(0.23) $(9.01) $(1.82) 4Q18 4Q19 2018 2019 Loss per Share 1 Refer to reconciliation in appendix

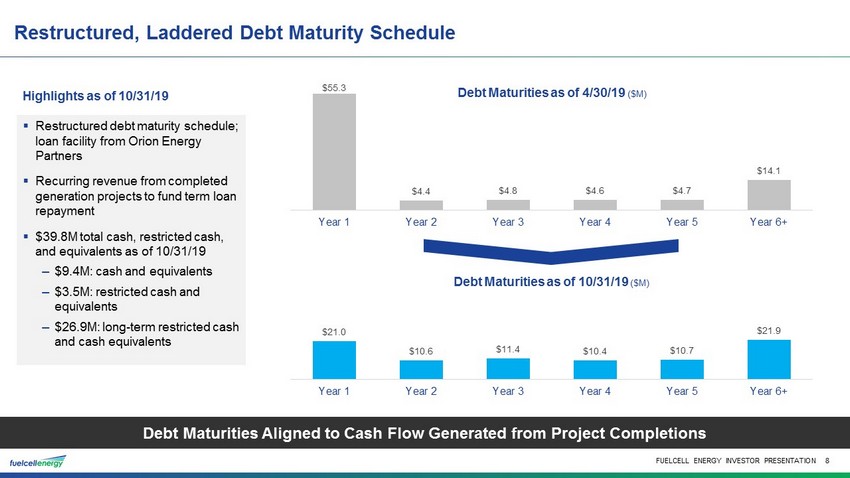

FUELCELL ENERGY INVESTOR PRESENTATION Restructured, Laddered Debt Maturity Schedule 8 Debt Maturities Aligned to Cash Flow Generated from Project Completions $55.3 $4.4 $4.8 $4.6 $4.7 $14.1 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6+ Debt Maturities as of 4/30/19 ($M) $21.0 $10.6 $11.4 $10.4 $10.7 $21.9 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6+ Debt Maturities as of 10/31/19 ($M) ▪ Restructured debt maturity schedule; loan facility from Orion Energy Partners ▪ Recurring revenue from completed generation projects to fund term loan repayment ▪ $39.8M total cash, restricted cash, and equivalents as of 10/31/19 – $9.4M: cash and equivalents – $3.5M: restricted cash and equivalents – $26.9M: long - term restricted cash and cash equivalents Highlights as of 10/31/19

FUELCELL ENERGY INVESTOR PRESENTATION Introducing the Transformational Strategy

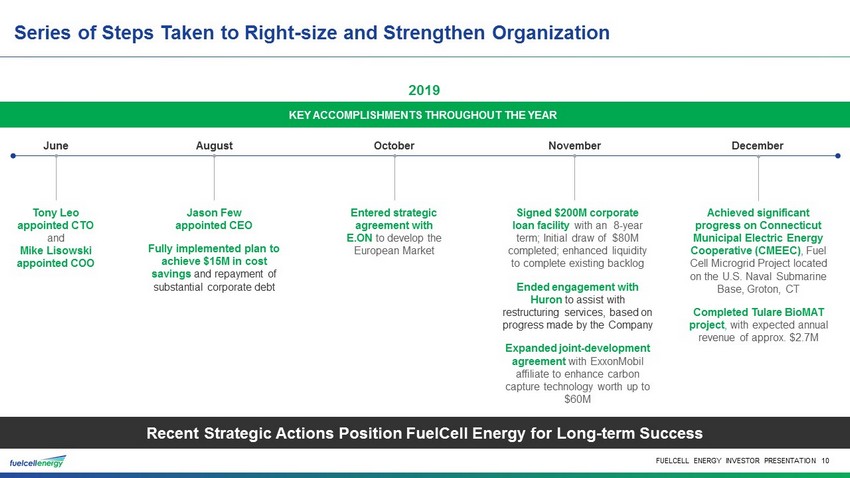

FUELCELL ENERGY INVESTOR PRESENTATION Series of Steps Taken to Right - size and Strengthen Organization Recent Strategic Actions Position FuelCell Energy for Long - term Success 10 KEY ACCOMPLISHMENTS THROUGHOUT THE YEAR 2019 Tony Leo appointed CTO and Mike Lisowski appointed COO June Jason Few appointed CEO Fully implemented plan to achieve $15M in cost savings and repayment of substantial corporate debt August Entered strategic agreement with E.ON to develop the European Market October Signed $200M corporate loan facility with an 8 - year term; Initial draw of $80M completed; enhanced liquidity to complete existing backlog Ended engagement with Huron to assist with restructuring services, based on progress made by the Company Expanded joint - development agreement with ExxonMobil affiliate to enhance carbon capture technology worth up to $60M November Achieved significant progress on Connecticut Municipal Electric Energy Cooperative ( CMEEC ) , Fuel Cell Microgrid Project located on the U.S. Naval Submarine Base, Groton, CT Completed Tulare BioMAT project , with expected annual revenue of approx. $2.7M December

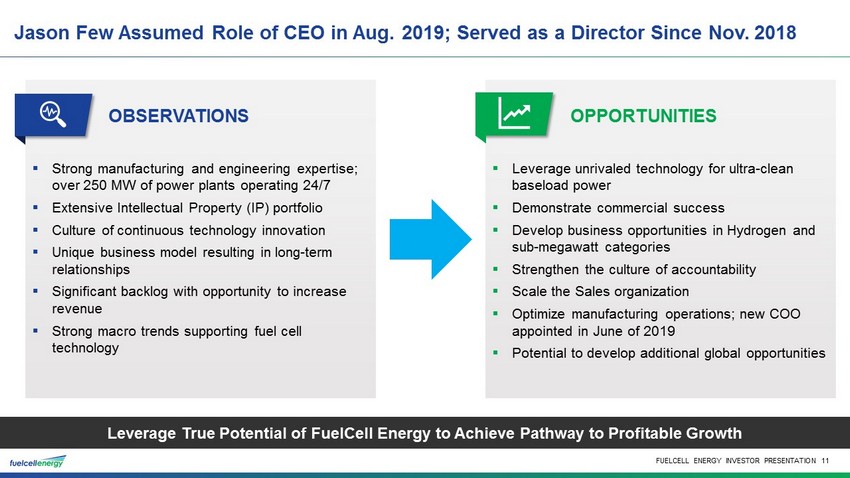

FUELCELL ENERGY INVESTOR PRESENTATION ▪ Strong manufacturing and engineering expertise; over 250 MW of power plants operating 24/7 ▪ Extensive Intellectual Property (IP) portfolio ▪ Culture of continuous technology innovation ▪ Unique business model resulting in long - term relationships ▪ Significant backlog with opportunity to increase revenue ▪ Strong macro trends supporting fuel cell technology Jason Few Assumed Role of CEO in Aug. 2019; Served as a Director Since Nov. 2018 11 Leverage True Potential of FuelCell Energy to Achieve Pathway to Profitable Growth OBSERVATIONS ▪ Leverage unrivaled technology for ultra - clean baseload power ▪ Demonstrate commercial success ▪ Develop business opportunities in Hydrogen and sub - megawatt categories ▪ Strengthen the culture of accountability ▪ Scale the Sales organization ▪ Optimize manufacturing operations; new COO appointed in June of 2019 ▪ Potential to develop additional global opportunities OPPORTUNITIES

FUELCELL ENERGY INVESTOR PRESENTATION Seasoned Leadership Team with Deep Industry Expertise 12 Committed to Flawless Project Execution and Achieving Pathway to Growth Jason Few President and Chief Executive Officer Joined: 2019 Jennifer Arasimowicz EVP, General Counsel and Corporate Secretary Joined: 2012 Michael Bishop EVP, Chief Financial Officer and Treasurer Joined: 2003 Michael Lisowski EVP, Chief Operating Officer Joined: 2001 Anthony Leo EVP, Chief Technology Officer Joined: 1978 New to FCEL within last 1 year New appointment within last 1 year

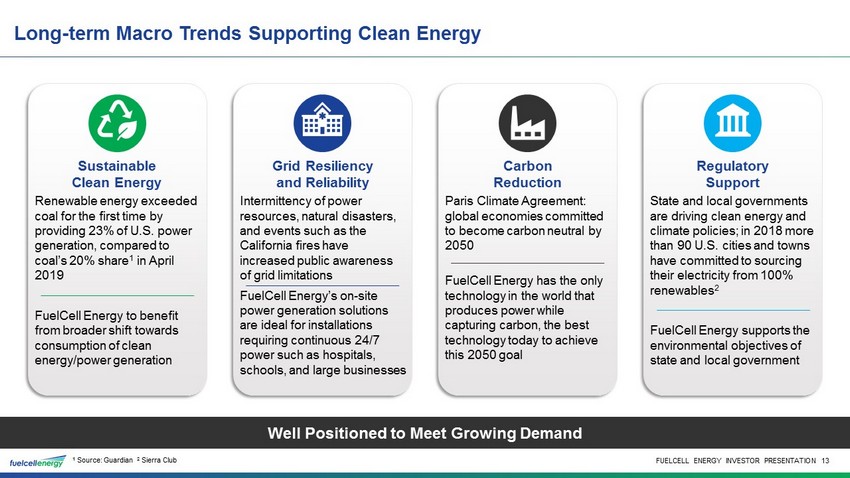

FUELCELL ENERGY INVESTOR PRESENTATION Long - term Macro Trends Supporting Clean Energy 13 Well Positioned to Meet Growing Demand 1 Source: Guardian 2 Sierra Club Sustainable Clean Energy Renewable energy exceeded coal for the first time by providing 23% of U.S. power generation, compared to coal’s 20% share 1 in April 2019 FuelCell Energy to benefit from broader shift towards consumption of clean energy/power generation Grid Resiliency and Reliability Intermittency of power resources, natural disasters, and events such as the California fires have increased public awareness of grid limitations FuelCell Energy’s on - site power generation solutions are ideal for installations requiring continuous 24/7 power such as hospitals, schools, and large businesses Carbon Reduction Paris Climate Agreement: global economies committed to become carbon neutral by 2050 FuelCell Energy has the only technology in the world that produces power while capturing carbon, the best technology today to achieve this 2050 goal Regulatory Support State and local governments are driving clean energy and climate policies; in 2018 more than 90 U.S. cities and towns have committed to sourcing their electricity from 100% renewables 2 FuelCell Energy supports the environmental objectives of state and local government

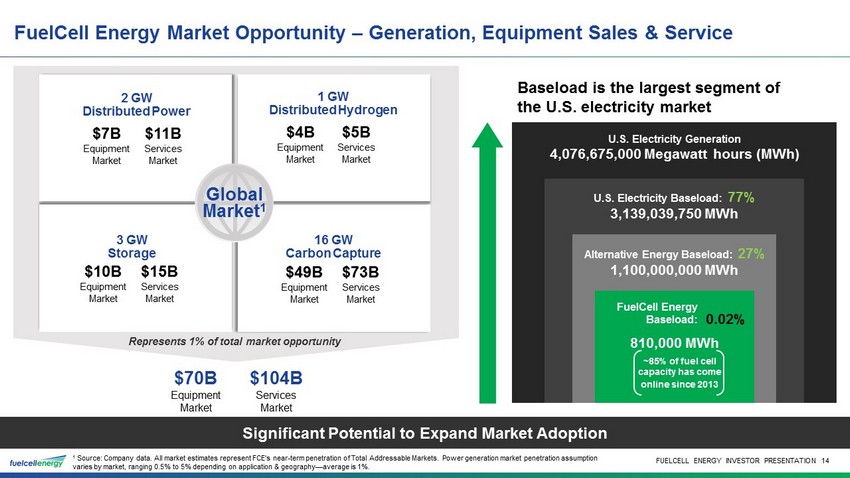

FUELCELL ENERGY INVESTOR PRESENTATION FuelCell Energy Market Opportunity – Generation, Equipment Sales & Service 14 Significant Potential to Expand Market Adoption Baseload is the largest segment of the U.S. electricity market U.S. Electricity Generation 4,076,675,000 Megawatt hours (MWh) U.S. Electricity Baseload: 77% 3,139,039,750 MWh Alternative Energy Baseload: 27% 1,100,000,000 MWh 810,000 MWh ~85% of fuel cell capacity has come online since 2013 $10B Equipment Market $15B Services Market 3 GW Storage $49B Equipment Market $73B Services Market 16 GW Carbon Capture Global Market 1 $70B Equipment Market $104B Services Market 1 Source: Company data. All market estimates represent FCE's near - term penetration of Total Addressable Markets. Power generation market penetration assumption varies by market, ranging 0.5% to 5% depending on application & geography — average is 1%. Represents 1% of total market opportunity FuelCell Energy Baseload: 0.02% $7B Equipment Market $11B Services Market 2 GW Distributed Power $4B Equipment Market $5B Services Market 1 GW Distributed Hydrogen

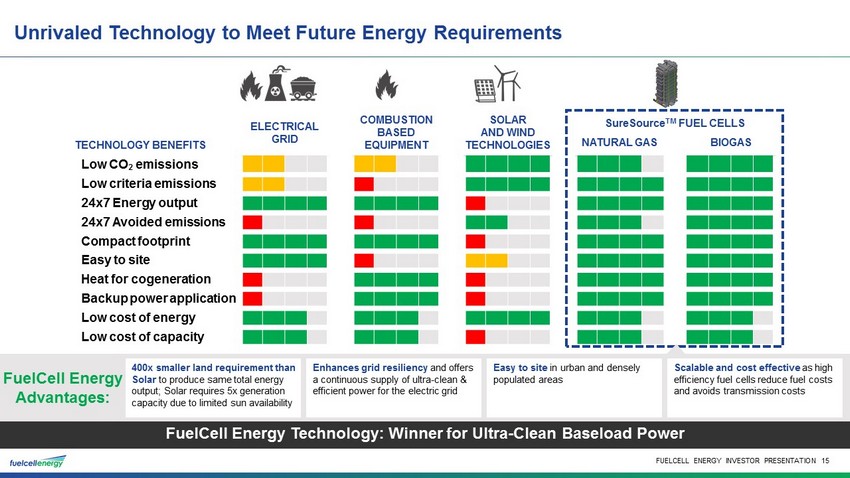

FUELCELL ENERGY INVESTOR PRESENTATION Unrivaled Technology to Meet Future Energy Requirements FuelCell Energy Technology: Winner for Ultra - Clean Baseload Power TECHNOLOGY BENEFITS ELECTRICAL GRID COMBUSTION BASED EQUIPMENT SOLAR AND WIND TECHNOLOGIES SureSource TM FUEL CELLS NATURAL GAS BIOGAS Low CO 2 emissions Low criteria emissions 24x7 Energy output 24x7 Avoided emissions Compact footprint Easy to site Heat for cogeneration Backup power application Low cost of energy Low cost of capacity 15 FuelCell Energy Advantages: Scalable and cost effective as high efficiency fuel cells reduce fuel costs and avoids transmission costs 400x smaller land requirement than Solar to produce same total energy output; Solar requires 5x generation capacity due to limited sun availability Enhances grid resiliency and offers a continuous supply of ultra - clean & efficient power for the electric grid Easy to site in urban and densely populated areas

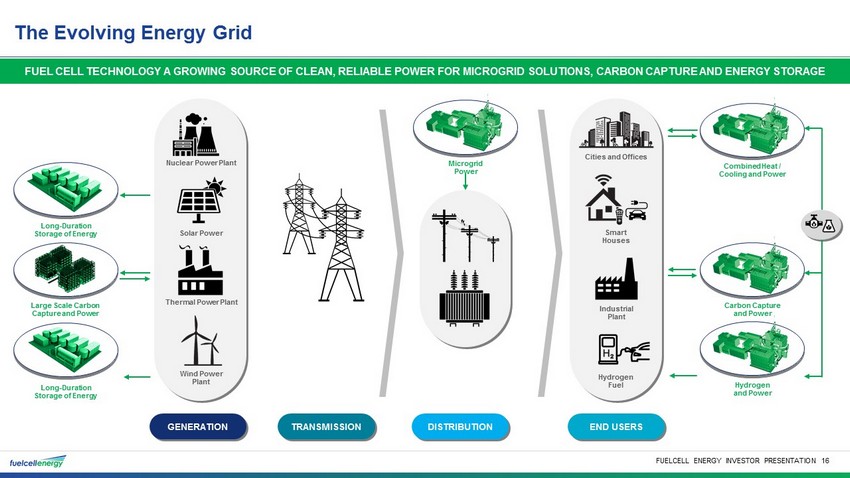

FUELCELL ENERGY INVESTOR PRESENTATION The Evolving Energy Grid 16 FUEL CELL TECHNOLOGY A GROWING SOURCE OF CLEAN, RELIABLE POWER F OR MICROGRID SOLUTIONS, CARBON CAPTURE AND ENERGY STORAGE GENERATION Solar Power Nuclear Power Plant Thermal Power Plant Wind Power Plant TRANSMISSION Hydrogen Fuel Cities and Offices Smart Houses Industrial Plant Large Scale Carbon Capture and Power Long - Duration Storage of Energy Long - Duration Storage of Energy Combined Heat / Cooling and Power Carbon Capture and Power Hydrogen and Power Microgrid Power DISTRIBUTION END USERS

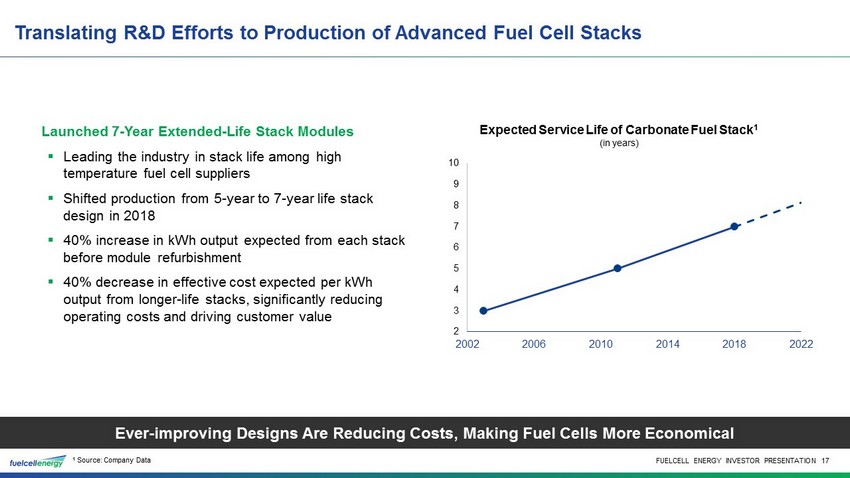

FUELCELL ENERGY INVESTOR PRESENTATION Translating R&D Efforts to Production of Advanced Fuel Cell Stacks 17 Ever - improving Designs Are Reducing Costs, Making Fuel Cells More Economical 1 Source: Company Data 2 3 4 5 6 7 8 9 10 2002 2006 2010 2014 2018 2022 Expected Service Life of Carbonate Fuel Stack 1 (in years) ▪ Leading the industry in stack life among high temperature fuel cell suppliers ▪ Shifted production from 5 - year to 7 - year life stack design in 2018 ▪ 40% increase in kWh output expected from each stack before module refurbishment ▪ 40% decrease in effective cost expected per kWh output from longer - life stacks, significantly reducing operating costs and driving customer value Launched 7 - Year Extended - Life Stack Modules

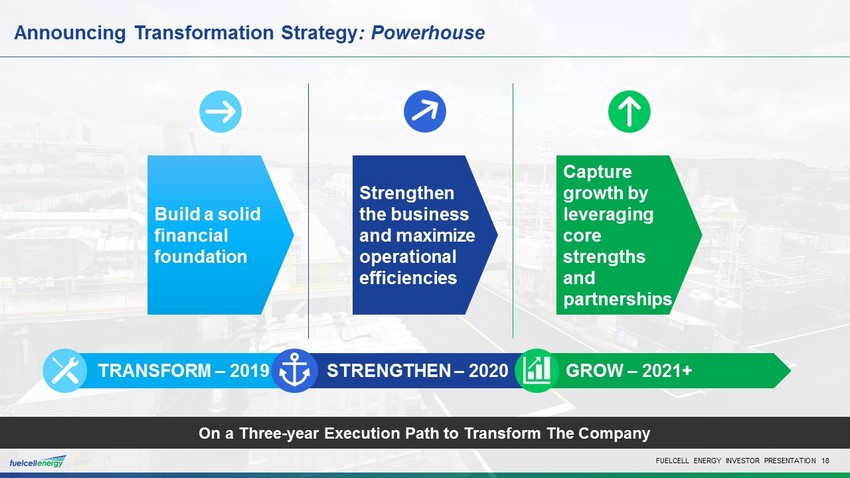

FUELCELL ENERGY INVESTOR PRESENTATION Announcing Transformation Strategy : Powerhouse 18 On a Three - year Execution Path to Transform The Company TRANSFORM – 2019 STRENGTHEN – 2020 GROW – 2021+ Build a solid financial foundation Strengthen the business and maximize operational efficiencies Capture growth by leveraging core strengths and partnerships

FUELCELL ENERGY INVESTOR PRESENTATION Powerhouse Phase I: Transform 19 Financial Flexibility to Support Long - term Strategy x Restructured our management: Appointed Jason Few as CEO, Michael Lisowski to COO and Anthony Leo to CTO x Secured funding: $200M senior secured credit facility with Orion Energy Partners to support execution of current projects and provide balance sheet strength and liquidity x Restructured organization: Ended engagement with Huron Consulting x Delivered cost savings: Realized annualized operating savings of approximately $15 million through the restructuring of our business x Refinanced debt: Repaid substantial portion of short - term debt with funds from combination of sales of common stock and long - term credit facility with Orion Energy Partners Phase I: Transform

FUELCELL ENERGY INVESTOR PRESENTATION Powerhouse Phase II: Strengthen 20 Strengthen the Business and Maximize Operational Efficiencies ▪ Capital deployment: Continue to focus on disciplined capital deployment and obtaining lower - cost, long - term financing for completed generation projects ▪ Commercial excellence: Strengthen customer relationships and build a customer - centric reputation ▪ Operational excellence: Implement a rigorous approach to backlog execution and delivery on time and on budget ▪ Cost reductions: Focus on continued lean resource management and cost reduction opportunities Phase II: Strengthen

FUELCELL ENERGY INVESTOR PRESENTATION Powerhouse Phase III: Grow 21 Capture Growth Opportunities by Leveraging Core Strengths and Partnerships ▪ Sales growth: Increase product sales with key strategic customers; grow service revenue through pricing strategy, improving cost of ownership for customers, and enhancing service solutions ▪ Innovation: Further increase product life and reliability; and expand commercialization of new technologies such as carbon capture, hydrogen, biofuels, and solid oxide systems ▪ Segment leadership: Capitalize on expertise and competitive advantages in key markets — biofuels, microgrid development, and hydrogen economy expansion ▪ Education: Ensure Legislators, Regulators and Environmental Organizations understand benefits of FuelCell SureSource TM platforms ▪ Geographic and Market expansion: Continue to develop clean and renewable energy partnerships; pursue growth in Asia and Europe Phase III: Grow

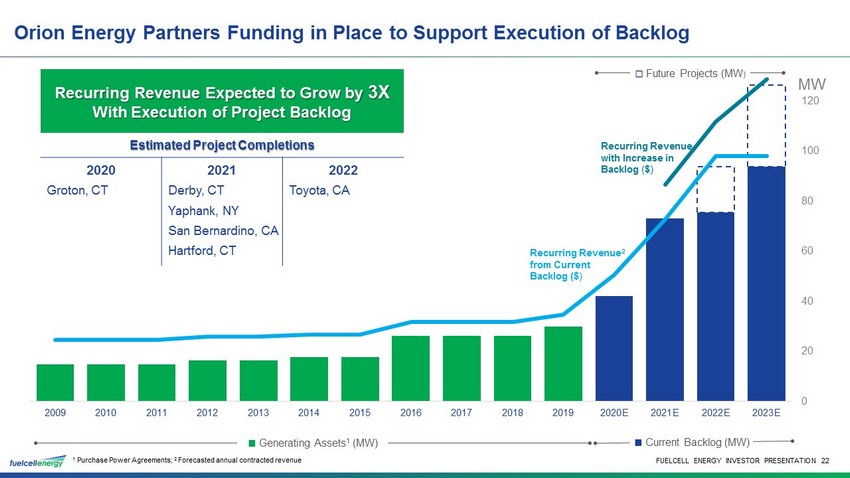

FUELCELL ENERGY INVESTOR PRESENTATION 0 20 40 60 80 100 120 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020E 2021E 2022E 2023E ■ Generating Assets 1 (MW) ■ Current Backlog (MW) Orion Energy Partners Funding in Place to Support Execution of Backlog 22 1 Purchase Power Agreements; 2 Forecasted annual contracted revenue Recurring Revenue with Increase in Backlog ( $ ) Recurring Revenue 2 from Current Backlog ($ ) Ƒ Future Projects (MW ) Recurring Revenue Expected to Grow by 3X With Execution of Project Backlog Estimated Project Completions 2020 2021 2022 Groton, CT Derby, CT Yaphank, NY San Bernardino, CA Hartford, CT Toyota, CA MW

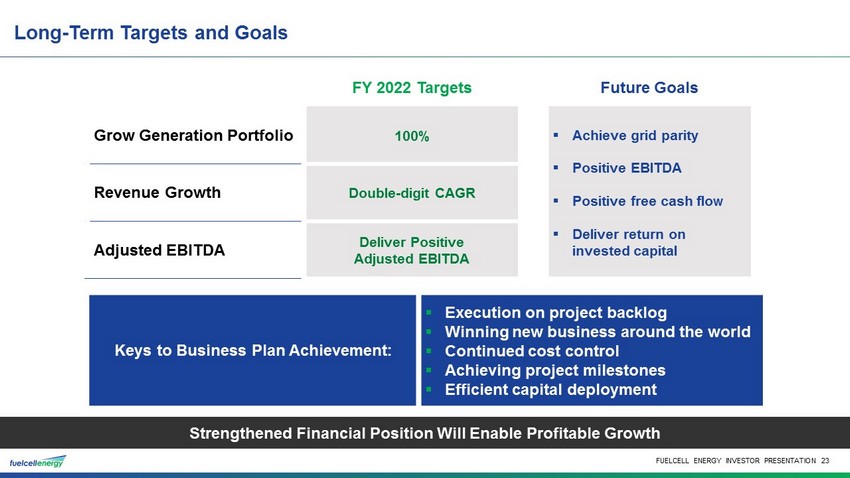

FUELCELL ENERGY INVESTOR PRESENTATION Long - Term Targets and Goals Strengthened Financial Position Will Enable Profitable Growth 23 FY 2022 Targets Grow Generation Portfolio 100% Revenue Growth Double - digit CAGR Adjusted EBITDA Deliver Positive Adjusted EBITDA Keys to Business Plan Achievement: ▪ Execution on project backlog ▪ Winning new business around the world ▪ Continued cost control ▪ Achieving project milestones ▪ Efficient capital deployment Future Goals ▪ Achieve grid parity ▪ Positive EBITDA ▪ Positive free cash flow ▪ Deliver return on invested capital

FUELCELL ENERGY INVESTOR PRESENTATION Key Investment Highlights Strengthened balance sheet with funding secured to deliver long - term projects to generate recurring revenue 1 New leadership committed to project execution , achieving financial milestones and operational efficiencies 2 On a three - year path of execution to Transform, Strengthen and Grow the organization for long - term success 4 Unrivaled technology for ultra - clean, reliable and scalable baseload power 3 24

FUELCELL ENERGY INVESTOR PRESENTATION Q&A

FUELCELL ENERGY INVESTOR PRESENTATION Appendix

FUELCELL ENERGY INVESTOR PRESENTATION GAAP to Non - GAAP Reconciliation 27 Three Months Ended October 31, Year Ended October 31, (Amounts in thousands) 2019 2018 2019 2018 Net loss $ (35,179) $ (14,096) $ (77,568) $ (47,334) Depreciation 4,034 2,123 12,353 8,648 Provision/(Benefit) for income taxes 20 5 109 (3,015) Other income, net (1) (649) (200) (93) (3,338) Interest expense 2,816 2,421 10,623 9,055 EBITDA $ (28,958) $ (9,747) $ (54,576) $ (35,984) Impairment expense 17,520 - 20,360 - Stock - based compensation expense 479 929 2,804 3,238 Adjusted EBITDA $ (10,959) $ (8,818) $ (31,412) $ (32,746) (1) Other income, net includes gains and losses from transactions denominated in foreign currencies, changes in fair value of embedded derivatives, and other items incurred periodically, which are not the result of the Company’s normal business operations.

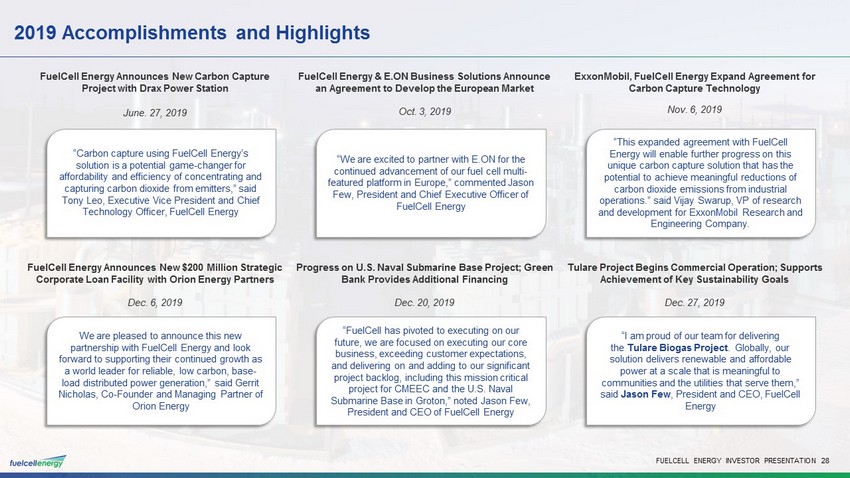

FUELCELL ENERGY INVESTOR PRESENTATION 2019 Accomplishments and Highlights 28 FuelCell Energy Announces New Carbon Capture Project with Drax Power Station June. 27, 2019 FuelCell Energy & E.ON Business Solutions Announce an Agreement to Develop the European Market Oct. 3, 2019 ExxonMobil, FuelCell Energy Expand Agreement for Carbon Capture Technology Nov. 6, 2019 FuelCell Energy Announces New $200 Million Strategic Corporate Loan Facility with Orion Energy Partners Dec. 6, 2019 Progress on U.S. Naval Submarine Base Project; Green Bank Provides Additional Financing Dec. 20, 2019 Tulare Project Begins Commercial Operation; Supports Achievement of Key Sustainability Goals Dec. 27, 2019 “Carbon capture using FuelCell Energy’s solution is a potential game - changer for affordability and efficiency of concentrating and capturing carbon dioxide from emitters,” said Tony Leo, Executive Vice President and Chief Technology Officer, FuelCell Energy “We are excited to partner with E.ON for the continued advancement of our fuel cell multi - featured platform in Europe,” commented Jason Few, President and Chief Executive Officer of FuelCell Energy “This expanded agreement with FuelCell Energy will enable further progress on this unique carbon capture solution that has the potential to achieve meaningful reductions of carbon dioxide emissions from industrial operations.” said Vijay Swarup, VP of research and development for ExxonMobil Research and Engineering Company. We are pleased to announce this new partnership with FuelCell Energy and look forward to supporting their continued growth as a world leader for reliable, low carbon, base - load distributed power generation,” said Gerrit Nicholas, Co - Founder and Managing Partner of Orion Energy “FuelCell has pivoted to executing on our future, we are focused on executing our core business, exceeding customer expectations, and delivering on and adding to our significant project backlog, including this mission critical project for CMEEC and the U.S. Naval Submarine Base in Groton,” noted Jason Few, President and CEO of FuelCell Energy “I am proud of our team for delivering the Tulare Biogas Project . Globally, our solution delivers renewable and affordable power at a scale that is meaningful to communities and the utilities that serve them,” said Jason Few , President and CEO, FuelCell Energy