Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OWENS & MINOR INC/VA/ | a8k1_16x20.htm |

38th Annual J.P. Morgan Healthcare Conference January 16, 2020 | San Francisco, CA

This presentation is intended to be disclosure through methods reasonably designed to provide broad, non-exclusionary distribution to the public in compliance with the SEC's Fair Disclosure Regulation. This presentation may contain certain ''forward-looking'' statements made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, the statements in this presentation regarding our expectations with respect to our financial performance, closing of the sale of our Movianto business, and other statements related to the company’s expectations regarding the performance of its business, growth, and improvement of operational performance. Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from those projected or contemplated in the Safe Harbor forward-looking statements. Investors should refer to Owens & Minor’s Annual Report on Form 10-K for the year ended December 31, 2018, filed with the SEC including the sections captioned “Cautionary Note Regarding Forward-Looking Statements” and “Item 1A. Risk Factors,” and subsequent quarterly reports on Form 10-Q and current reports on Form 8-K filed with or furnished to the SEC, for a discussion of certain known risk factors that could cause the company’s actual results to differ materially from its current estimates. These filings are available at www.owens- minor.com. Given these risks and uncertainties, Owens & Minor can give no assurance that any forward-looking statements will, in fact, transpire and, therefore, cautions investors not to place undue reliance on them. Owens & Minor specifically disclaims any obligation to update or revise any forward- looking statements, whether as a result of new information, future developments or otherwise. This presentation contains non-GAAP financial measures related to the Company’s performance. You can find a reconciliation of these non-GAAP financial measures to their most comparable GAAP financial measure at the end of this presentation. 2 38th Annual J.P. Morgan Healthcare Conference

Owens & Minor Overview A global healthcare solutions company with integrated distribution, products, and services aligned to deliver value to the healthcare industry. 125+ 17,000 Healthcare 1,400+ 4,000+ Customers in Branded Healthcare Facilities Teammates Worldwide Worldwide 90 Manufacturers Providers Countries Served 3 38th Annual J.P. Morgan Healthcare Conference

Reporting Segments Global Solutions Global Products Pillars Leading Brands DISTRIBUTION my 4 38th Annual J.P. Morgan Healthcare Conference

Approach to Market We Will Provide The Highest Level of Customer Focus Along With Industry-leading Integrity. Maintaining Intense Operational Leveraging Actionable Technology and Solutions Customer Focus Excellence Data to Improve Experience Culture Shift Build A Streamlined Use The Vast Amount Of Improve Transparency And Listen To Customer Organization Focused On Data We Process To Provide A Combination Of Feedback, Deliver On Our Efficiencies While More Drive Efficiencies And Services To Serve The Promises, And Never Take Closely Integrating With Operational Improvements Changing Model Of Our Customers For Granted The Needs Of Our Healthcare Customers 5 38th Annual J.P. Morgan Healthcare Conference

2019 Achievements Established Foundation: . Assembled world-class leadership . Renewed focus on Customers . Restored service levels . Improved financial profile Fostering: . Results-oriented culture . Customer and supplier confidence . Ongoing debt reduction . Strong platform for share gains 6 38th Annual J.P. Morgan Healthcare Conference

Mark Beck - Director Director, IDEX Corporation Past Director, Dow-Corning Corporation Past President & CEO, JELD-WEN Holding Past EVP, Danaher Corporation Proven Past EVP, Corning Robert Henkel - Director Leadership Pres., Healthcare Transformation – THEO Group Recruited New Past Pres. & CEO, Ascension Health Past COO, Ascension Health Directors & Past C-Suite Executive - Mount Sinai Medical Center, Assembled World- DePaul Health Center and Montefiore Medical Center Class Executive Team Michael Riordan - Director in 2019 Past Co-CEO & Director, Prisma Health Past CEO, Greenville Health System Past Pres & CEO, U of Chicago Health Systems Past COO, Emory University Hospitals 7 38th Annual J.P. Morgan Healthcare Conference

Perry Bernocchi - CEO, Byram Healthcare David Myers - SVP, Chief Procurement Officer Past EVP & COO, Byram Healthcare Past Pres. & COO, Concordance Healthcare Past SVP & COO, Hemophilia Resources of Solutions (formerly Seneca Medical) America Director & Past Chair, Health Industry Past SVP, Operations, Coram Healthcare Distributors Association (HIDA) Shana Neal - SVP, Human Resources Jeff Jochims - EVP, COO Proven Past SVP, HR, Becton Dickinson Life Sciences Past Director, Sarnova Past Integration Leader, BD acquisitions of Past Director, Reliable Biopharmaceutical Bard & CareFusion Leadership Past Director, Cenduit Past Global President, Fisher Scientific Nick Pace - EVP, General Counsel Recruited New (Thermo Fisher Scientific) Past EVP, General Counsel, Landmark Health Past President, Fisher Safety (Thermo Fisher Directors & Scientific) Past EVP, Corporate Development & General Counsel, Avalon Health Services Assembled World- Past EVP, Operations & Compliance, Health Andy Long - EVP, CFO Diagnostic Laboratory Past CEO, Insys Therapeutics Class Executive Team Past EVP, General Counsel, Amerigroup Corp Past CFO, Insys Therapeutics Past SVP of Global Finance, Patheon in 2019 Mark Zacur - EVP, CCO Past VP of Global Finance, Thermo Fisher Director, St. Clair Hospital Scientific Director & Past Chair, Health Industry Distributors Association (HIDA) Chris Lowery - EVP & Pres, Global Products Past VP & General Manager, Fisher Healthcare Past SVP & COO, Halyard Health (Thermo Fisher Scientific) Past Global VP, Sales & Marketing, Kimberly- 8 38th Annual J.P. Morgan Healthcare Conference Clark Health Care

Aligned Focus Operating with Integrity Empowering Our Customers to Advance Healthcare Focused on the Development of opportunities and solutions for customers, suppliers and teammates Performing to the highest standards of Excellence Ensuring Accountability internally and externally Listening to our stakeholders 9 38th Annual J.P. Morgan Healthcare Conference

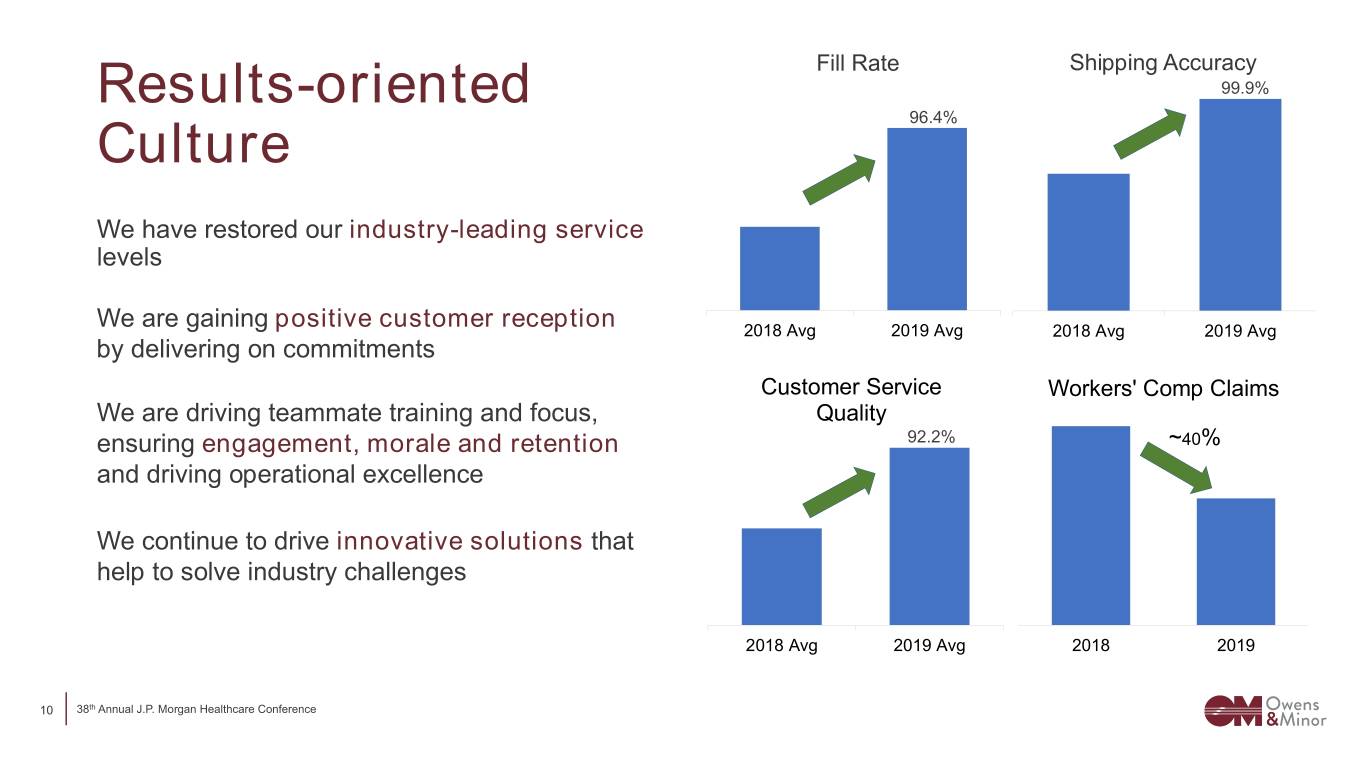

Fill Rate Shipping Accuracy Results-oriented 99.9% 96.4% Culture We have restored our industry-leading service levels We are gaining positive customer reception 2018 Avg 2019 Avg 2018 Avg 2019 Avg by delivering on commitments Customer Service Workers' Comp Claims We are driving teammate training and focus, Quality ensuring engagement, morale and retention 92.2% ~40% and driving operational excellence We continue to drive innovative solutions that help to solve industry challenges 2018 Avg 2019 Avg 2018 2019 10 38th Annual J.P. Morgan Healthcare Conference

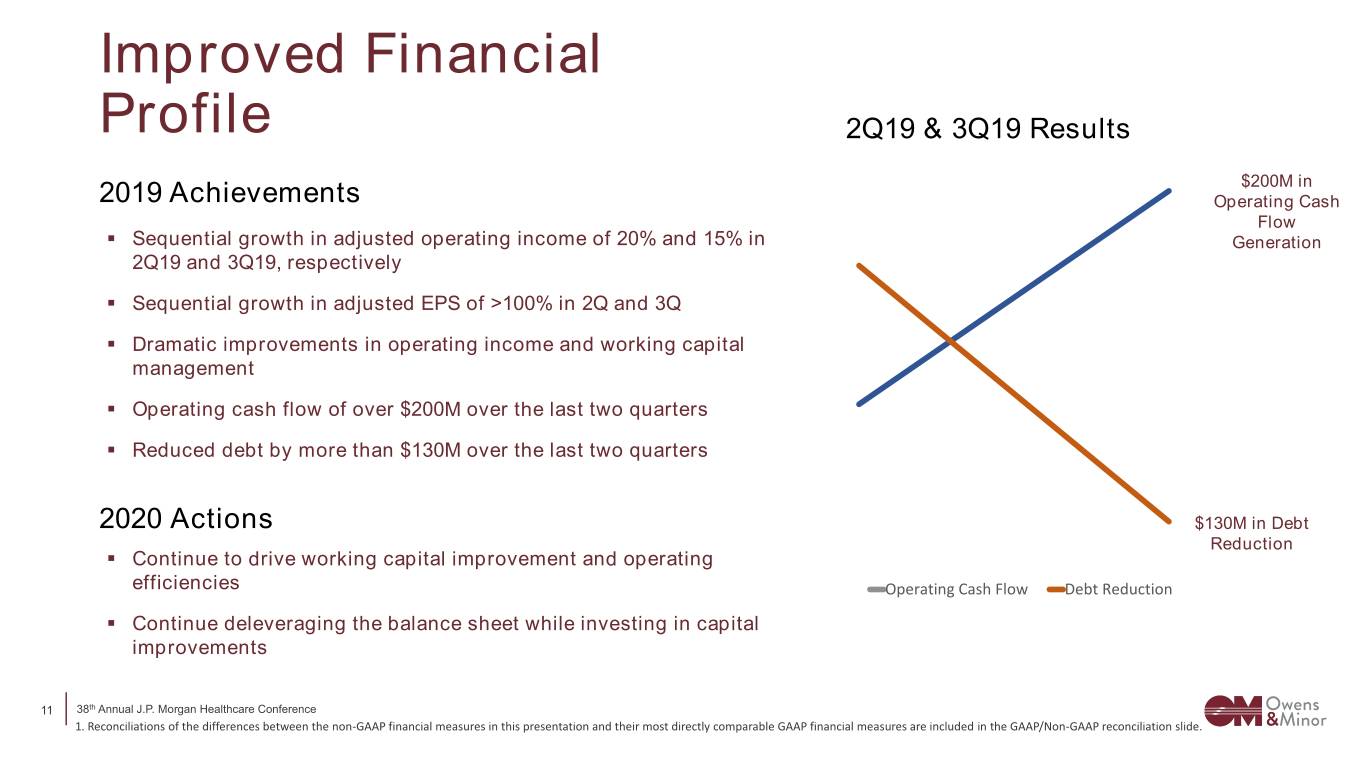

Improved Financial Profile 2Q19 & 3Q19 Results $200M in 2019 Achievements Operating Cash Flow . Sequential growth in adjusted operating income of 20% and 15% in Generation 2Q19 and 3Q19, respectively . Sequential growth in adjusted EPS of >100% in 2Q and 3Q . Dramatic improvements in operating income and working capital management . Operating cash flow of over $200M over the last two quarters . Reduced debt by more than $130M over the last two quarters 2020 Actions $130M in Debt Reduction . Continue to drive working capital improvement and operating efficiencies Operating Cash Flow Debt Reduction . Continue deleveraging the balance sheet while investing in capital improvements 11 38th Annual J.P. Morgan Healthcare Conference 1. Reconciliations of the differences between the non-GAAP financial measures in this presentation and their most directly comparable GAAP financial measures are included in the GAAP/Non-GAAP reconciliation slide.

Investing In Our Reinvesting In Our Future Business • Technology • QSight® • myOM Leveraging our • Inventory Management differentiated growth • Operations drivers • Home Healthcare • Services • Warehouse Infrastructure 12 38th Annual J.P. Morgan Healthcare Conference my

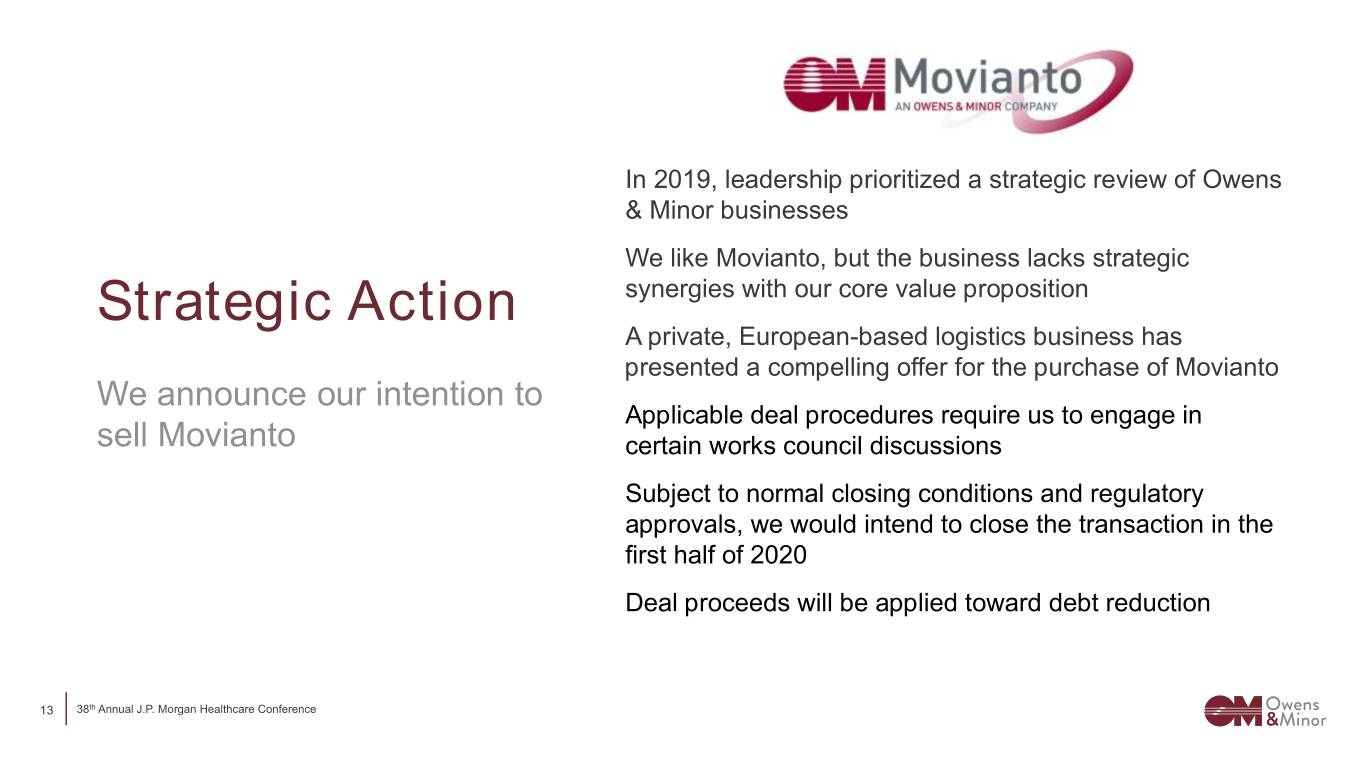

In 2019, leadership prioritized a strategic review of Owens & Minor businesses We like Movianto, but the business lacks strategic Strategic Action synergies with our core value proposition A private, European-based logistics business has presented a compelling offer for the purchase of Movianto We announce our intention to Applicable deal procedures require us to engage in sell Movianto certain works council discussions Subject to normal closing conditions and regulatory approvals, we would intend to close the transaction in the first half of 2020 Deal proceeds will be applied toward debt reduction 13 38th Annual J.P. Morgan Healthcare Conference

Investment Merits . World-class leadership . Industry leading service levels and stabilized operations . Deleveraging balance sheet . Strong operating cash flow . Differentiated solutions in technology and businesses like QSight® & Byram . Managing for the long term: investing in teammates, training and technology 14 38th Annual J.P. Morgan Healthcare Conference

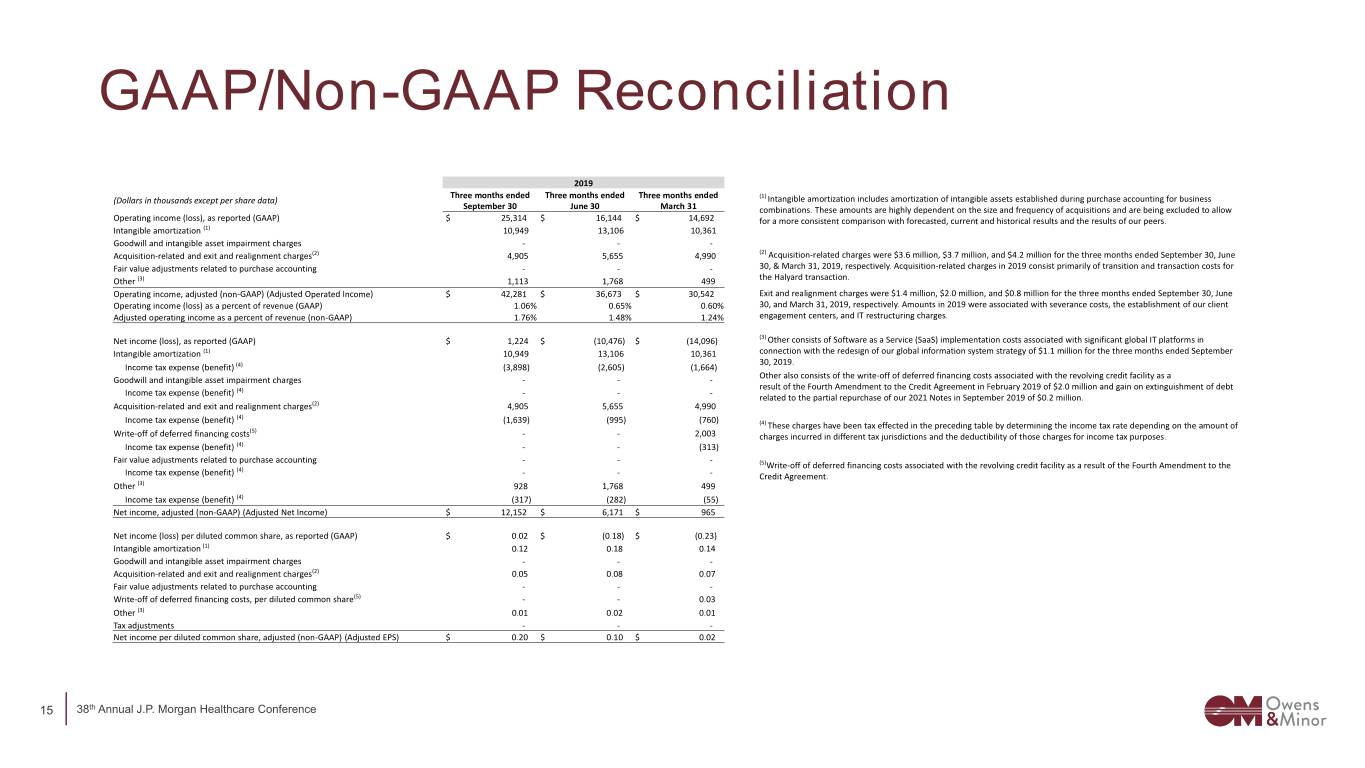

GAAP/Non-GAAP Reconciliation 2019 Three months ended Three months ended Three months ended (1) (Dollars in thousands except per share data) Intangible amortization includes amortization of intangible assets established during purchase accounting for business September 30 June 30 March 31 combinations. These amounts are highly dependent on the size and frequency of acquisitions and are being excluded to allow Operating income (loss), as reported (GAAP) $ 25,314 $ 16,144 $ 14,692 for a more consistent comparison with forecasted, current and historical results and the results of our peers. Intangible amortization (1) 10,949 13,106 10,361 Goodwill and intangible asset impairment charges - - - Acquisition-related and exit and realignment charges(2) 4,905 5,655 4,990 (2) Acquisition-related charges were $3.6 million, $3.7 million, and $4.2 million for the three months ended September 30, June Fair value adjustments related to purchase accounting - - - 30, & March 31, 2019, respectively. Acquisition-related charges in 2019 consist primarily of transition and transaction costs for Other (3) 1,113 1,768 499 the Halyard transaction. Operating income, adjusted (non-GAAP) (Adjusted Operated Income) $ 42,281 $ 36,673 $ 30,542 Exit and realignment charges were $1.4 million, $2.0 million, and $0.8 million for the three months ended September 30, June Operating income (loss) as a percent of revenue (GAAP) 1.06% 0.65% 0.60% 30, and March 31, 2019, respectively. Amounts in 2019 were associated with severance costs, the establishment of our client Adjusted operating income as a percent of revenue (non-GAAP) 1.76% 1.48% 1.24% engagement centers, and IT restructuring charges. Net income (loss), as reported (GAAP) $ 1,224 $ (10,476) $ (14,096) (3) Other consists of Software as a Service (SaaS) implementation costs associated with significant global IT platforms in Intangible amortization (1) 10,949 13,106 10,361 connection with the redesign of our global information system strategy of $1.1 million for the three months ended September 30, 2019. Income tax expense (benefit) (4) (3,898) (2,605) (1,664) Other also consists of the write-off of deferred financing costs associated with the revolving credit facility as a Goodwill and intangible asset impairment charges - - - result of the Fourth Amendment to the Credit Agreement in February 2019 of $2.0 million and gain on extinguishment of debt Income tax expense (benefit) (4) - - - related to the partial repurchase of our 2021 Notes in September 2019 of $0.2 million. Acquisition-related and exit and realignment charges(2) 4,905 5,655 4,990 Income tax expense (benefit) (4) (1,639) (995) (760) (4) These charges have been tax effected in the preceding table by determining the income tax rate depending on the amount of (5) Write-off of deferred financing costs - - 2,003 charges incurred in different tax jurisdictions and the deductibility of those charges for income tax purposes. Income tax expense (benefit) (4) - - (313) Fair value adjustments related to purchase accounting - - - (5) (4) Write-off of deferred financing costs associated with the revolving credit facility as a result of the Fourth Amendment to the Income tax expense (benefit) - - - Credit Agreement. Other (3) 928 1,768 499 Income tax expense (benefit) (4) (317) (282) (55) Net income, adjusted (non-GAAP) (Adjusted Net Income) $ 12,152 $ 6,171 $ 965 Net income (loss) per diluted common share, as reported (GAAP) $ 0.02 $ (0.18) $ (0.23) Intangible amortization (1) 0.12 0.18 0.14 Goodwill and intangible asset impairment charges - - - Acquisition-related and exit and realignment charges(2) 0.05 0.08 0.07 Fair value adjustments related to purchase accounting - - - Write-off of deferred financing costs, per diluted common share(5) - - 0.03 Other (3) 0.01 0.02 0.01 Tax adjustments - - - Net income per diluted common share, adjusted (non-GAAP) (Adjusted EPS) $ 0.20 $ 0.10 $ 0.02 15 38th Annual J.P. Morgan Healthcare Conference

Thank You 16 38th Annual J.P. Morgan Healthcare Conference

Supplemental Information January 16, 2020 17 38th Annual J.P. Morgan Healthcare Conference

Our Mission Statement Empowering Our Customers to Advance Healthcare Customers are at the heart of what we do. We are a critical part of the healthcare process across its full continuum, Empowering our customers to do the critical work that they do. We have the ambition to be part of the improvement and progress of healthcare into the future, to Advance Healthcare. 18 38th Annual J.P. Morgan Healthcare Conference

Values Explained: Bringing Our Mission to Life I IntegrityE : Act with the highestL standards of ethics. Honor commitments. D Development: Aspire for improvement and growth. Excellence: Perform to the highest standards. Embrace our mission to empower our E customers to advance healthcare into the future. A Accountability: Own our actions and results. Be responsible for what we do. L Listening: Listen to our customers and to one another. Understand needs and deliver solutions. 19 38th Annual J.P. Morgan Healthcare Conference

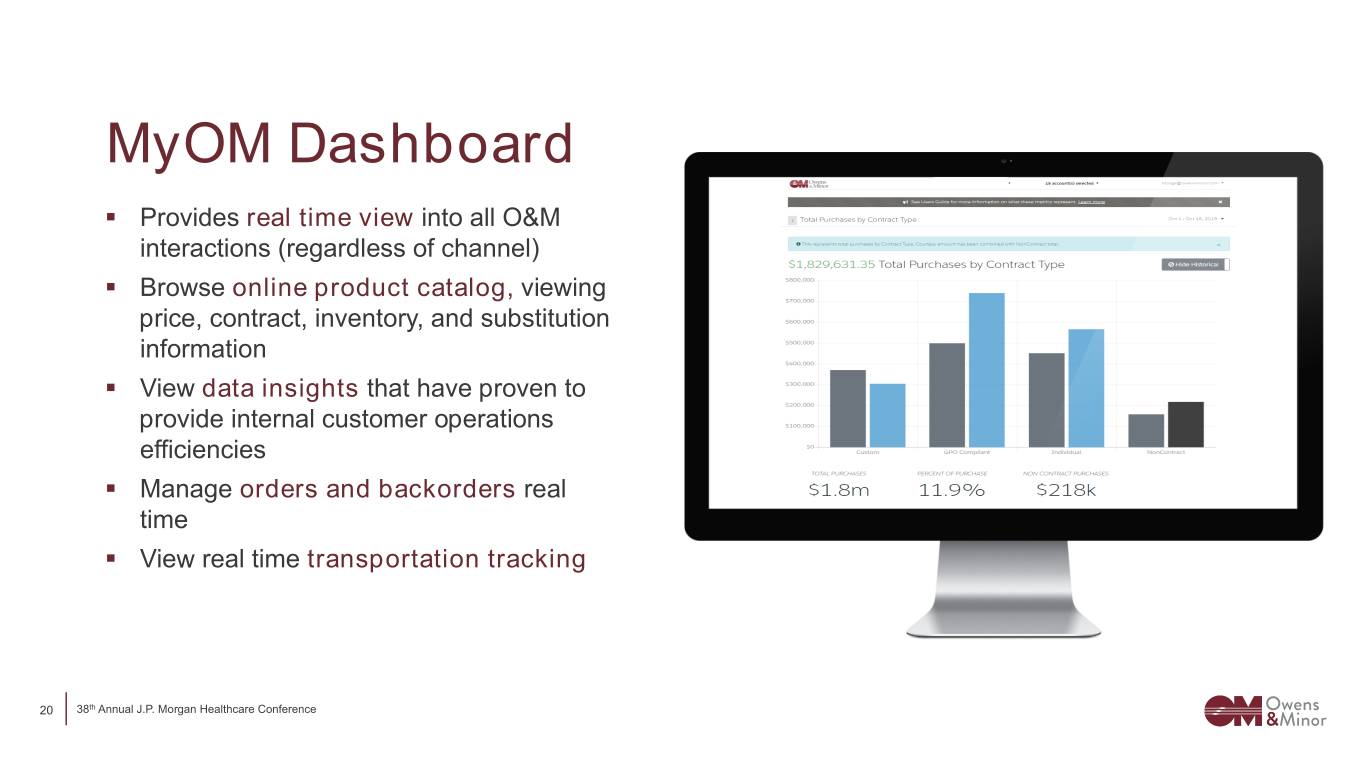

MyOM Dashboard . Provides real time view into all O&M interactions (regardless of channel) . Browse online product catalog, viewing price, contract, inventory, and substitution information . View data insights that have proven to provide internal customer operations efficiencies . Manage orders and backorders real time . View real time transportation tracking 20 38th Annual J.P. Morgan Healthcare Conference

Owens & Minor Suite of Services A more efficient & clinically integrated supply chain to provide high quality, cost-effective care Single software solution for Industry leading unitized On-site inventory clinical inventory surgical delivery system management for hospitals management and surgery centers 21 38th Annual J.P. Morgan Healthcare Conference

Owens & Minor End-to-End Inventory Management 22 38th Annual J.P. Morgan Healthcare Conference

. Capture near-real-time demand signals . Seamlessly push data to EMR and ERP systems . Drive Standardization: Capture Demand . Physician preference products . Preference cards at Point of Use . Schedules With QSight®, the industry-leading . Track cost per case and physician cloud-based clinical inventory management system from Owens & . Standardize processes and data across Minor departments and health network/IDN . Optimize and share inventory – eliminate waste by moving inventory to where it will be used . Single global item master of over 500K unique SKUs 23 38th Annual J.P. Morgan Healthcare Conference

SurgiTrack® is: An industry leading delivery system grouped by procedure and surgeon Combining: Lean methodologies, technology, and products into one streamlined process Ensures: Quality supplies, high clinical satisfaction, while keeping procedure cost as low as possible 24 38th Annual J.P. Morgan Healthcare Conference

Byram Healthcare Leading home healthcare offering focused on reducing total costs & supporting quality of care FOR IDN’S, WE REDUCE TOTAL COSTS BY: . Support smooth patient transitions home . Patient education and compliance programs . Extend GPO pricing to affiliated HHA . Reduce supply leakage at hospital discharge . Reduce billing errors INDUSTRY LEADER: . More in-network coverage and ability to serve 80% of insured patients . Servicing over 500 home health agencies . National leader with local presence 25 38th Annual J.P. Morgan Healthcare Conference