Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ROCKWELL MEDICAL, INC. | tm203460-2_8k.htm |

Exhibit 99.1

JANUARY 2020

Certain statements in this presentation may constitute "forward - looking statements" within the meaning of the federal securities laws, including, but not limited to, Rockwell Medical’s intention to bring to market Triferic®, and I.V. Triferic® . W ords such as "may," "might," "will," "should," "believe," "expect," "anticipate," "estimate," "continue," "could," "plan," "potent ial ," "predict," "forecast," "project," "plan", "intend" or similar expressions, or statements regarding intent, belief, or current expectations, are forward - looking statements. While Rockwell Medical believes these forward - looking statements are reasonable, undue reliance should not be placed on any such forward - looking statements, which are based on information available to us on the date of this release. These forward - looking statements are based upon current estimates and assumptions and are subject to various risks and uncertainties (including, without limitation, those set forth in Rockwell Medical’s SEC filings), many of which are beyond our control and subject to change. Actual results could be materially different. Risks and uncertainties include: statements about the issuance of a unique J code for Rockwell Medical’s Triferic Powder Packet; timing and regulatory approval process for Triferic internationally; timing and regulatory approval process of Rockwell Medical’s NDA filing for I.V. Triferic as filed with the FDA; timing for clinical trials for certain Rockwell Medica l products; receipt of certain milestone payments; the potential market opportunity and commercialization of Triferic internationally; potential market opportunity for I.V. Triferic, as well as other Rockwell Medical products; the pricing and reimbursement status for I.V. Triferic and other Rockwell Medical products, including the eligibility of I.V. Triferic for ad d - o n reimbursement under TDAPA, pursuant to CMS’ final rule relating to TDAPA as announced by CMS on October 31, 2019; liquidity and capital resources; the success of Rockwell Medical’s commercialization of Dialysate Triferic; timing and succes s o f Rockwell Medical’s efforts to maintain, grow and improve the profit margin of the Company’s concentrate business; and Rockwell Medical’s financial position and the future development of the Company’s business. Rockwell Medical expressly disclaims any obligation to update or alter any statements whether as a result of new information, future events or otherwise , except as required by law. NASDAQ: RMTI 2 Forward Looking Language

Rockwell Medical Overview POISED TO TRANSFORM THE TREATMENT OF ANEMIA

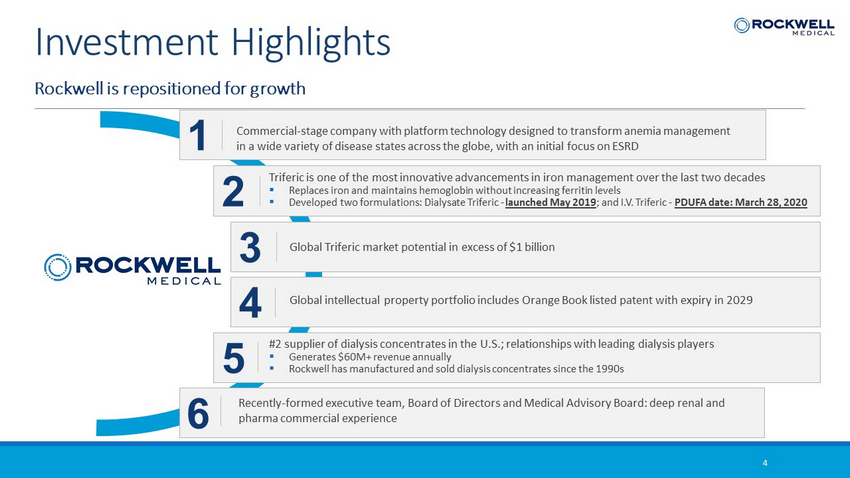

Rockwell is repositioned for growth Investment Highlights Recently - formed executive team, Board of Directors and Medical Advisory Board: deep renal and pharma commercial experience 6 #2 supplier of dialysis concentrates in the U.S.; relationships with leading dialysis players ▪ Generates $60M+ revenue annually ▪ Rockwell has manufactured and sold dialysis concentrates since the 1990s 5 Triferic is one of the most innovative advancements in iron management over the last two decades ▪ Replaces iron and maintains hemoglobin without increasing ferritin levels ▪ Developed two formulations: Dialysate Triferic - launched May 2019 ; and I.V. Triferic - PDUFA date: March 28, 2020 2 Commercial - stage company with platform technology designed to transform anemia management in a wide variety of disease states across the globe, with an initial focus on ESRD 1 Global intellectual property portfolio includes Orange Book listed patent with expiry in 2029 4 4 Global Triferic market potential in excess of $1 billion 3

Triferic: A New Way to Treat Anemia THE ONLY IRON REPLACEMENT THERAPY INDICATED TO MAINTAIN HEMOGLOB IN

Multiple opportunities to drive long - term value of Triferic Transforming Anemia Management 6 Dialysate Triferic I.V. Triferic Triferic Global ▪ U.S. Launch May 2019 ▪ Collecting real - world data from seven sites totaling 500+ patients; expect initial data readout in Q1 2020 ▪ Launched 3 - month Evaluation Program for new clinics ̶ 75% conversion rate since launch ▪ Signed contract with first medium - sized dialysis organization in November 2019 ̶ Clinics that adopt Triferic have option to provide data ▪ Submitted NDA May 2019 ▪ PDUFA date of March 28, 2020 ▪ Ability to leverage infrastructure and experience from Dialysate Triferic launch ▪ Partnerships in China, India, Canada, Peru and Chile ▪ Seeking partners in other key geographies, including Europe and Japan ▪ Completed clinical pharmacology studies in China (with partner Wanbang Biopharmaceutical) ▪ Agreed with EMA on design for Phase III study to support EU registration ▪ Building commercial / medical organization to support U.S. commercialization and medical education initiatives ▪ Triferic has the potential to transform anemia management in a wide variety of disease states – initially focused on ESRD ▪ Sales and distribution infrastructure provides a platform for future pharmaceutical and/or device development and acquisition s

Current treatment approaches overload the body with iron rather than providing true iron maintenance 7 Unmet Need in Iron Maintenance Therapy ▪ Blood loss and iron sequestration are leading causes of anemia in hemodialysis (HD) patients ▪ 5 - 7 mg iron loss during every HD treatment ▪ The current standard of care for anemia management in hemodialysis patients is costly and is associated with safety risks (1)(2)(3) • ESAs are costly and carry cardiovascular risks (black box warning) • I.V. Iron – not indicated for iron maintenance; increases ferritin and hepcidin levels • >75% of patients in the U.S. exceed KDIGO guidelines for ferritin levels as a result of increased I.V. iron dosing • Risk of hypersensitivity reactions, anaphylaxis, iron overload, increase in infections and functional iron deficiency (1)(2)(3) (1) Macdougall IC, Geisser P. Use of intravenous iron supplementation in chronic kidney disease: an update. Iran J Kidney Disease . 2 013;7(1):9 – 22. (2) Rostoker G, et al. Drugs. 2016;76(7):741 - 757; (3) Bailie GR, et al. Kidney Int. 2015;87(1):162 - 168. Late Stage CKD Patients Initiate Hemodialysis and are on Lifelong Treatment

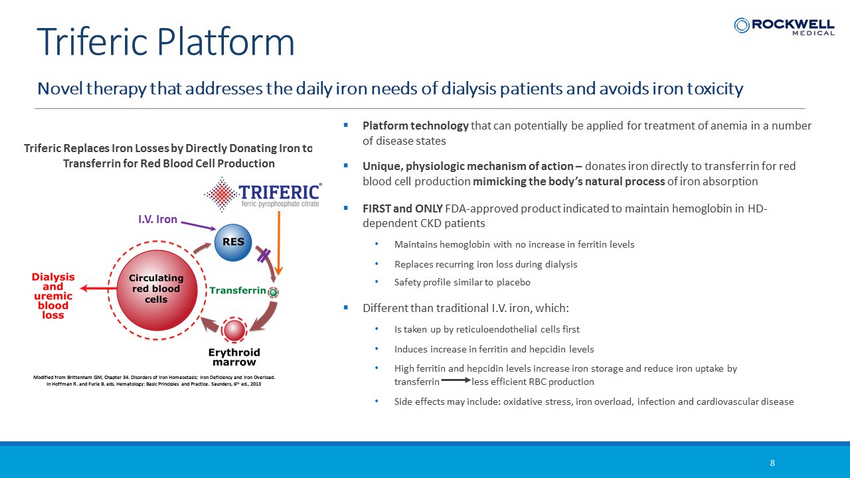

Triferic Replaces Iron Losses by Directly Donating Iron to Transferrin for Red Blood Cell Production I.V. Iron Modified from Brittenham GM, Chapter 34. Disorders of Iron Homeostasis: Iron Deficiency and Iron Overload. In Hoffman R. and Furie B. eds. Hematology: Basic Principles and Practice. Saunders, 6 th ed., 2013 Novel therapy that addresses the daily iron needs of dialysis patients and avoids iron toxicity 8 Triferic Platform ▪ Platform technology that can potentially be applied for treatment of anemia in a number of disease states ▪ Unique, physiologic mechanism of action – donates iron directly to transferrin for red blood cell production mimicking the body’s natural process of iron absorption ▪ FIRST and ONLY FDA - approved product indicated to maintain hemoglobin in HD - dependent CKD patients • Maintains hemoglobin with no increase in ferritin levels • Replaces recurring iron loss during dialysis • Safety profile similar to placebo ▪ Different than traditional I.V. iron, which: • Is taken up by reticuloendothelial cells first • Induces increase in ferritin and hepcidin levels • High ferritin and hepcidin levels increase iron storage and reduce iron uptake by transferrin less efficient RBC production • Side effects may include: oxidative stress, iron overload, infection and cardiovascular disease

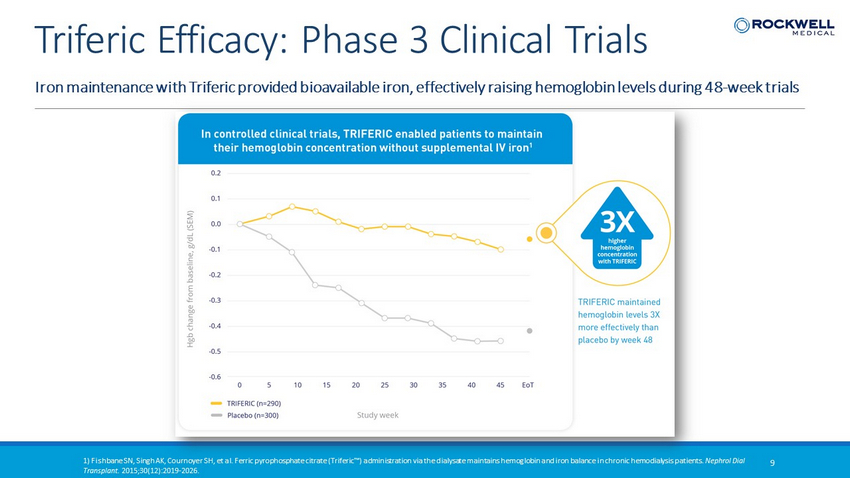

1) Fishbane SN, Singh AK, Cournoyer SH, et al. Ferric pyrophosphate citrate (Triferic™) administration via the dialysate main tai ns hemoglobin and iron balance in chronic hemodialysis patients. Nephrol Dial Transplant. 2015;30(12):2019 - 2026. 9 Iron maintenance with Triferic provided bioavailable iron, effectively raising hemoglobin levels during 48 - week trials Triferic Efficacy: Phase 3 Clinical Trials

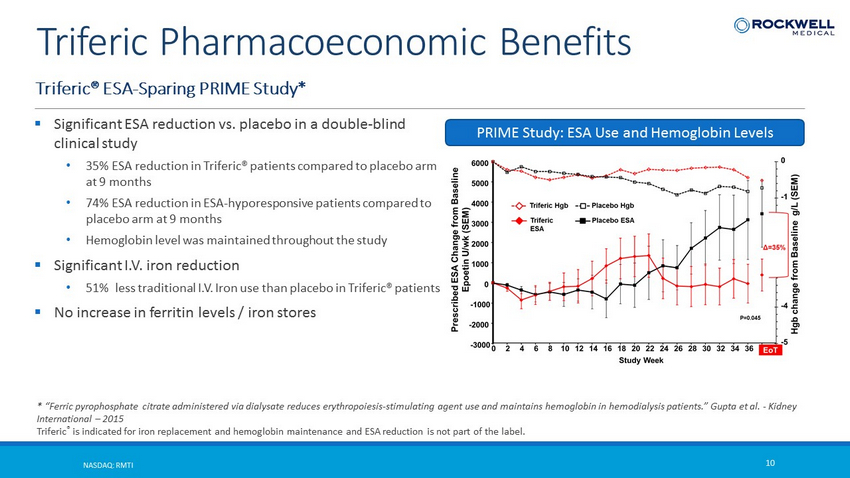

Triferic® ESA - Sparing PRIME Study* NASDAQ: RMTI 10 Triferic Pharmacoeconomic Benefits * “Ferric pyrophosphate citrate administered via dialysate reduces erythropoiesis - stimulating agent use and maintains hemoglobin in hemodialysis patients.” Gupta et al. - Kidney International – 2015 Triferic ® is indicated for iron replacement and hemoglobin maintenance and ESA reduction is not part of the label. ▪ Significant ESA reduction vs. placebo in a double - blind clinical study • 35% ESA reduction in Triferic® patients compared to placebo arm at 9 months • 74% ESA reduction in ESA - hyporesponsive patients compared to placebo arm at 9 months • Hemoglobin level was maintained throughout the study ▪ Significant I.V. iron reduction • 51% less traditional I.V. Iron use than placebo in Triferic® patients ▪ No increase in ferritin levels / iron stores PRIME Study: ESA Use and Hemoglobin Levels

Triferic Commercial Opportunity and Strategy BUILDING A LEADING COMMERCIAL AND MEDICAL ORGANIZATION TO TARGET A LARGE AND GROWING MARKET OPPORTUNITY

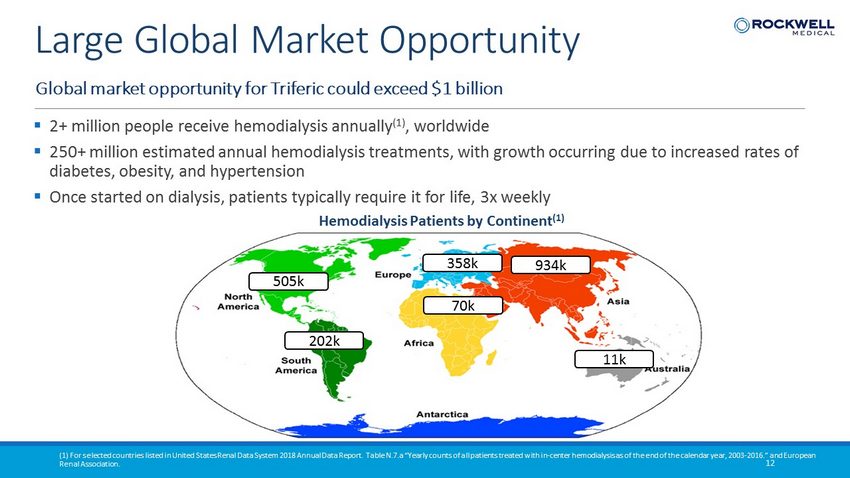

Hemodialysis Patients by Continent (1) 505k 934k 202k 70k 358k 11k ▪ 2+ million people receive hemodialysis annually (1) , worldwide ▪ 250+ million estimated annual hemodialysis treatments, with growth occurring due to increased rates of diabetes, obesity, and hypertension ▪ Once started on dialysis, patients typically require it for life, 3x weekly Global market opportunity for Triferic could exceed $1 billion 12 Large Global Market Opportunity (1) For selected countries listed in United States Renal Data System 2018 Annual Data Report. Table N.7.a “Yearly counts of all patients treated with in - center hemodialysis as of the end of the calendar year, 2003 - 2016.” and European Renal Association.

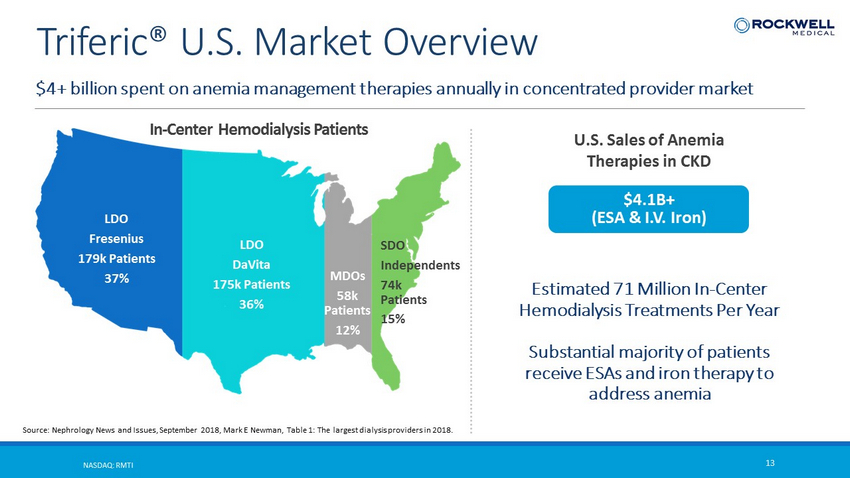

$4+ billion spent on anemia management therapies annually in concentrated provider market NASDAQ: RMTI 13 Triferic ® U.S. Market Overview LDO Fresenius 179k Patients 37% LDO DaVita 175k Patients 36% SDO Independents 74k Patients 15% MDOs 58k Patients 12% In - Center Hemodialysis Patients Source: Nephrology News and Issues, September 2018, Mark E Newman, Table 1: The largest dialysis providers in 2018. $4.1B+ (ESA & I.V. Iron) U.S. Sales of Anemia Therapies in CKD Estimated 71 Million In - Center Hemodialysis Treatments Per Year Substantial majority of patients receive ESAs and iron therapy to address anemia

Other Indications / Disease States ‘ Dialysate Triferic will allow our commercial & medical team to establish future foundation for I.V. Triferic 14 “Go to Market” Strategy: Building for Success ▪ Establish a strong commercial, medical and clinical support team • Building team of approximately 25 commercial and medical professionals • Include technical/biomed and clinical experts to support adoption of Triferic • Initially targeting Independents, SDOs, MDOs for Dialysate Triferic • First MDO contract for Dialysate Triferic signed in November 2019 ▪ Focus on generating retrospective and prospective real - world evidence • Support for clinical and financial benefits of Triferic to help drive future adoption for both Dialysate Triferic and I.V. Triferic ▪ Establish Triferic as standard of care • Dialysate launch: focus on medical education / KOL development • Publication strategy: build physiologic and pharmacoeconomic story • I.V Triferic: if approved, expected to drive growth and springboard launch using 2019 groundwork • International approvals: provide next leg of growth • Potential to expand into additional indications and disease states Large - Sized Dialysis Units ‘Established Growth’ Mid - Sized Dialysis Units ‘Expand & Solidify’ Small - sized and Independent Dialysis Units ‘Grow & Learn’

15 Building a Leading Medical Platform Efficacy Pharmaco - Economics Health Economic Outcomes Safety ▪ We believe Triferic’s unique mechanism of action will enable a wide range of benefits ▪ To successfully achieve our goal of becoming the standard of care, we are strengthening our medical capabilities to: • Establish Centers of Excellence and partnerships with key stakeholders • Generate real - world data • Enhance medical affairs capabilities and build strong key opinion leader (“KOL”) advisory relationships, including key additions to Medical Advisory Board • Provide medical education to the dialysis community • Guide future development and strategic collaborations

Expands U.S. access and more applicable to global markets heavily reliant on on - line bicarb generation NASDAQ: RMTI 16 I.V. Triferic Overview ▪ NDA submitted in May 2019 with PDUFA date of March 28, 2020 ▪ Hemodialysis market moving toward on - line bicarbonate generation in U.S.; already established in ROW ▪ Developed pursuant to Special Protocol Assessment: FDA agreed on bioequivalence approach ▪ Equivalence studies compared PK parameters of total iron and transferrin - bound iron of I.V. Triferic to Dialysate Triferic ▪ I.V. Triferic demonstrated equivalence with Dialysate Triferic in PK studies Pharmacokinetic Data (Absolute Fe and Absolute Transferrin - Bound Iron)

Estimated market potential >$1 billion in international markets NASDAQ: RMTI 17 Triferic International Updates China • Partnered to commercialize Triferic with Wanbang Biopharmaceutical • Clinical trial waiver denied by NMPA – assessing next steps with Wanbang • Low - to - mid 20% royalty due to Rockwell on Net Sales; $35 million potential milestone payments • Estimated peak market opportunity in excess of $400 million India • Signed licensing agreement with Sun Pharma in January 2020 • Sun Pharma will leverage its market leading nephrology franchise to promote Triferic to nephrologists in India LATAM • Received Peru regulatory approval January 2019; awaiting regulatory approval in Chile • Estimated peak market opportunity of $100 million across all countries Canada • Regulatory dossier nearly ready • Estimated peak market opportunity of $25 million Europe / Japan • Discussions ongoing with potential partners for I.V. Triferic • Estimated peak market opportunity of $600+ million

Financial Highlights and Upcoming Milestones STABLE REVENUE FROM BASE BUSINESS WITH MULTIPLE UPCOMING CATALYS TS

19 Selected Financials Metric ($ in millions) Q3 2019 (9 months / 09/30/19) FY 2018 (12 Months / 12/31/18) FY 2017 (12 Months / 12/31/17) Sales $45.8 $63.4 $57.3 Operating Loss $27.1 $32.4 $25.9 Cash Flow from Operations ($22.0) ($20.4) ($21.1) Cash & Investments: $29.0 $33.5 $33.1 Long - term Debt: $0 $0 $0 Shares Outstanding: 63,887,386 57,034,154 51,768,424 ▪ Historical sales ~99% from concentrates business • Primarily to two key customers in U.S.: Baxter and DaVita • #2 supplier of concentrates in U.S. • 14% of 2018 sales from international markets $49.8 $52.4 $54.2 $55.4 $53.3 $57.3 $63.4 $62.4 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 2012 2013 2014 2015 2016 2017 2018 LTM Q3 19 2012 – 2019 YTD Annual Sales ($ in millions)

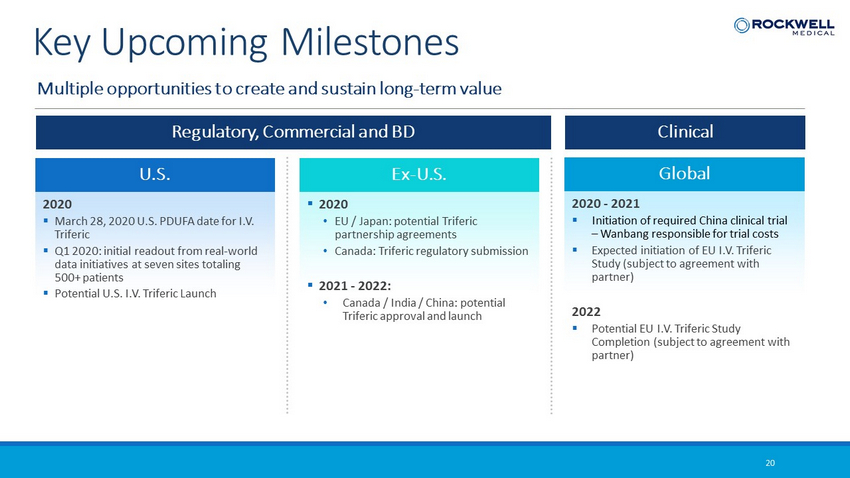

Multiple opportunities to create and sustain long - term value 20 Key Upcoming Milestones U.S. 2020 ▪ March 28, 2020 U.S. PDUFA date for I.V. Triferic ▪ Q1 2020: initial readout from real - world data initiatives at seven sites totaling 500+ patients ▪ Potential U.S. I.V. Triferic Launch Global 2020 - 2021 ▪ Initiation of required China clinical trial – Wanbang responsible for trial costs ▪ Expected initiation of EU I.V. Triferic Study (subject to agreement with partner) 2022 ▪ Potential EU I.V. Triferic Study Completion (subject to agreement with partner) Ex - U.S. ▪ 2020 • EU / Japan: potential Triferic partnership agreements • Canada: Triferic regulatory submission ▪ 2021 - 2022: • Canada / India / China: potential Triferic approval and launch Regulatory, Commercial and BD Clinical

• Triferic is the FIRST and ONLY FDA - approved therapy indicated to replace iron and maintain hemoglobin levels in adult hemodialysis patients • Launched Dialysate Triferic and submitted NDA for I.V. Triferic • Building on long - established existing relationships with other leaders in dialysis: Baxter, DaVita • Stepwise plan to establish Triferic as the new standard of care • Unique opportunity for investors to gain entry into Rockwell at a transformative inflection point NASDAQ: RMTI 21 Rockwell: Positioned for Growth