Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Bankwell Financial Group, Inc. | a11520208k.htm |

Bankwell Financial Group Analyst Meeting January 15th, 2020 All 2019 numbers, metrics and related references are unaudited

Safe Harbor This presentation may contain certain forward-looking statements about Bankwell Financial Group, Inc. (the “Company”). Forward-looking statements include statements regarding anticipated future events and can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believe,” “expect,” “would,” “should,” “could,” or “may.” Forward-looking statements, by their nature, are subject to risks and uncertainties. Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures, changes in the interest rate environment, general economic conditions or conditions within the securities markets, and legislative and regulatory changes that could adversely affect the business in which the Company and its subsidiaries are engaged. 2 All 2019 numbers, metrics and related references are unaudited

Agenda 1) Loan portfolio trends 2) Deposit mix & pricing trends 3) Net Interest Margin trends 4) Loan sale trends 5) Credit update 3 All 2019 numbers, metrics and related references are unaudited

1) Loan portfolio trends Dollars in millions Loan Volume $409 Originations • Fueled by strong originations in Fundings 4Q19, loan balances grew $40 $311 $308 $312 million, or +10% annualized growth $211 $216 • The incremental impact of the $40 million loan growth on 2020 core earnings is ~$0.12 EPS • 4Q19’s loan growth contributed '15 - '17 Avg 2018 2019 to a slightly larger provision for loan loss expense, impacting the quarter by ~($0.01) EPS $93 2019 by Quarter $92 $75 $69 $62 $60 $52 • 2020 net loan growth budgeted $26 to be approximately 5% 1Q 2Q 3Q 4Q 4 All 2019 numbers, metrics and related references are unaudited

1) Loan portfolio trends Dollars in millions Loan Portfolio Yields • Bankwell committed to disciplined loan $1,800 5.00% pricing to defend portfolio yield 4.48% 4.64% 4.58% $1,700 4.38% 4.50% $1,605 $1,604 • 2019 originations at a ~4.90% yield, $1,600 $1,543 4.00% with 4Q19 originations yields of $1,500 ~4.70% 3.50% $1,400 $1,366 3.00%• Minimal impact expected on 2020 $1,300 portfolio yields: 2.50% $1,200 $1,100 2.00% ̶ < 10% variable rate loans $1,000 1.50% ̶ Only ~$50 million of fixed rate 2016 2017 2018 2019 loans have rate reset dates in 1 2 Gross Loan Balance Portfolio Yield 2020 1 Weighted average yield based on active loans as of 12-31 for each of the respective years 2 Some fixed rate loans have a contractual interest rate reset after 3 or 5 years (as examples), prior to maturity 5 All 2019 numbers, metrics and related references are unaudited

1) Loan portfolio trends Dollars in millions Loan Prepayments $184 • 2019 reflects largest prepayment amounts $33 and fees in Bankwell’s history $119 $27 • Prepayment fees vary from loan to loan 4Q $62 $71 and are subject to deal terms and age of loan 3Q $17 • 2020 assumes prepayments and related 2Q $33 $53 1Q $7 fees will revert to 2018 levels 2018 2019 Qtr Average $30 $46 • 4Q19 fees well below quarterly average Prepayment Fees collected ($MMs) for last 2 years, negatively impacting EPS 1Q $0.01 $1.10 ~($0.02) 2Q $0.26 $1.04 3Q $0.04 $0.51 4Q $0.99 $0.10 TY $1.30 $2.75 6 All 2019 numbers, metrics and related references are unaudited

2) Deposit mix & pricing trends Dollars in millions Deposit Mix Treasury Management Balances1 2018 2019 $108 11.5% 12.8% $83 $70 $71 $53 88.5% 87.2% Non Int Bearing Int Bearing Wholesale 23.4% ~20.5% Ratio1 2015 2016 2017 2018 2019 • 2019 core deposits reached $1.25 billion, a record high • Treasury Management balances1 grew to $108 million, or 31% YoY growth • Treasury Management growth enabling retirement of costly wholesale deposits • Ongoing improvement in mix enabling lower 2020 deposit costs Successful Treasury Management program drives favorable deposit mix 1 Non-interest bearing balances only 2 Wholesale ratio includes Brokered deposits, National Listing Service CDs (NLS) and FHLB Borrowings; calculated on Bank balances (not 7 consolidated) All 2019 numbers, metrics and related references are unaudited

2) Deposit mix & pricing trends Cost of Deposits • Liability-sensitive balance sheet well 1.66% positioned to capture benefits of 1 ≤ 1.50% lower short-term rates 1.30% 0.93% • Lowered rates on Money Market, Savings and Retail CDs in September 2019 & December 2019 • The carry-through impact of the 2019 pricing changes on 2020 core 2017 A 2018 A 2019 A 2020 E earnings is ~$0.12 EPS 1 Assumes a static-rate environment 8 All 2019 numbers, metrics and related references are unaudited

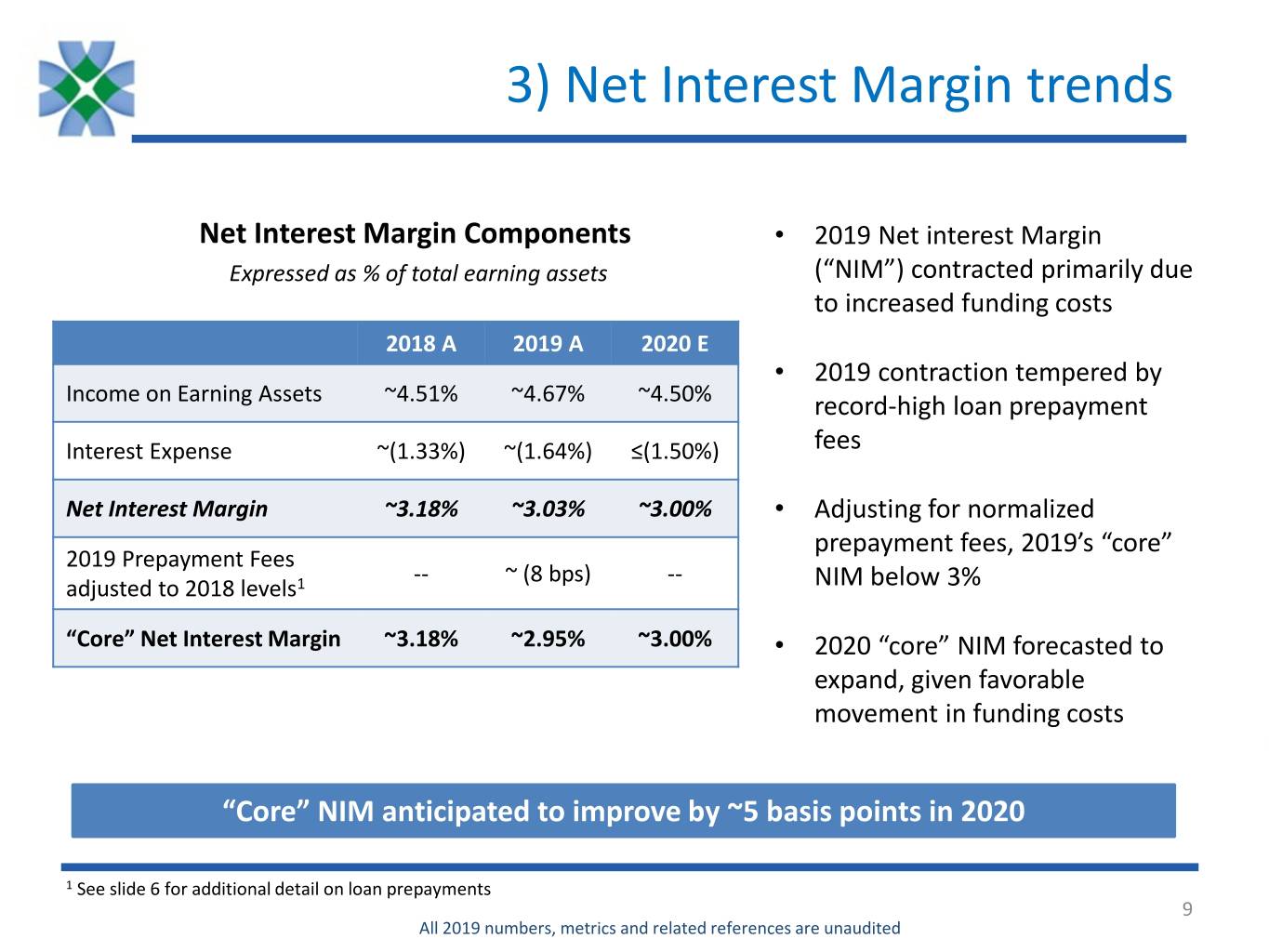

3) Net Interest Margin trends Net Interest Margin Components • 2019 Net interest Margin Expressed as % of total earning assets (“NIM”) contracted primarily due to increased funding costs 2018 A 2019 A 2020 E • 2019 contraction tempered by Income on Earning Assets ~4.51% ~4.67% ~4.50% record-high loan prepayment Interest Expense ~(1.33%) ~(1.64%) ≤(1.50%) fees Net Interest Margin ~3.18% ~3.03% ~3.00% • Adjusting for normalized prepayment fees, 2019’s “core” 2019 Prepayment Fees -- ~ (8 bps) -- adjusted to 2018 levels1 NIM below 3% “Core” Net Interest Margin ~3.18% ~2.95% ~3.00% • 2020 “core” NIM forecasted to expand, given favorable movement in funding costs “Core” NIM anticipated to improve by ~5 basis points in 2020 1 See slide 6 for additional detail on loan prepayments 9 All 2019 numbers, metrics and related references are unaudited

4) Loan sale trends Dollars in millions Gains on SBA Loan Sales • Continued focus on Bankwell’s SBA program driving income $1.7 from loan sales $0.4 • Lower than average gains in 4Q19 impacting the quarter $1.0 by ~($0.01) EPS $0.7 4Q $0.1 3Q $0.2 • Continued growth from SBA program anticipated in 2020 2Q $0.3 $0.6 1Q $0.3 $0.03 2018 A 2019 A 2020 E Successful SBA program drives gains on loan sales 10 All 2019 numbers, metrics and related references are unaudited

5) Credit update Dollars in thousands Non Performing Loans / Gross Loans 0.66% 0.88% SBA-guaranteed 0.29% portion of NPLs 0.66% 0.36% 0.37% Core NPL exposure 2017 2018 2019 $000s NPLs $5,481 $14,082 $10,588 Quarry Loans1 $0 $6,943 $1,863 2019 Detail • The Quarry Loans1 credit issue from 2018 is essentially resolved; remaining balance 100% guaranteed by the SBA • An additional $2.8 million of non-performing loan balances are also SBA-guaranteed Receipt of SBA guarantee will reduce NPLs by 29 basis points 1 See BWFG’s 4Q’18 Earnings Release and related Investor Presentation for Quarry Loans background 11 All 2019 numbers, metrics and related references are unaudited

5) Credit Update Dollars in millions • The allowance for loan loss (“ALLL”) methodology was updated in 2017 to 1 Impact of ALLL Methodology Change include peer group historical loss data, Annual impact on BWFG’s Loan Loss Provision due to increasing reliance on quantitative 2017 methodology change and subsequent application measures, as Bankwell had limited historical losses $4.4 • Broadly, the updated methodology has lowered the general reserve percentage for each of the past 3 years, $2.1 as the roll forward of the lookback period replaces higher post-financial $1.3 ~ $1.0 crisis historical loss periods with current periods containing lower losses • Methodology impact in 2020 expected 2017 A 2018 A 2019 A 2020 E to be approximately half of 2019 EPS Impact2 $0.11 $0.45 $0.21 ~$0.10 • 2020 impact does not account for loan growth, changes in mix, specific reserves or charge offs 1 Amounts represent pre-tax values 2 The corporate tax rate changed from 35% (applied in 2017) to 21% (applied in 2018 onwards) 12 All 2019 numbers, metrics and related references are unaudited

Thank You & Questions All 2019 numbers, metrics and related references are unaudited