Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PATTERSON COMPANIES, INC. | d858512d8k.htm |

JP MORGAN HEALTHCARE CONFERENCE January 14, 2020 Mark Walchirk President and CEO Exhibit 99

Safe Harbor Statement The U.S. Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements to encourage companies to provide prospective information, so long as those statements are identified as forward-looking and are accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those disclosed in the statement. This presentation contains, and our officers and representatives may from time to time make, certain “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including statements regarding future financial performance, and the objectives and expectations of management. Forward-looking statements often include words such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “seeks” or words of similar meaning, or future or conditional verbs, such as “will,” “should,” “could” or “may.” Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not place undue reliance on any of these forward-looking statements. Any number of factors could affect our actual results and cause such results to differ materially from those contemplated by any forward-looking statements, including, but not limited to, the following: the effects of the highly competitive dental and animal health supply markets in which we compete; general economic conditions, including political and economic uncertainty; our dependence on relationships with sales representatives, service technicians and customers; potential disruption of distribution capabilities, including service issues with third-party shippers; our dependence on suppliers for the manufacture and supply of the products we sell; the risk that private label sales could adversely affect our sales of other products; our dependence on positive perceptions of Patterson’s reputation; litigation risks, including new or unanticipated litigation developments; changes in consumer preferences; fluctuations in quarterly financial results; risks from the expansion of customer purchasing power; increased competition from third-party online commerce sites; the risks inherent in international operations, including currency fluctuations; the effects of health care reform; failure to comply with regulatory requirements and data privacy laws; risks from disruption to our information systems; cyberattacks or other privacy or data security breaches; volatility in the financial markets; volatility in the price of our common stock; our dependence on our senior management; disruptions from our enterprise resource planning system initiatives; and risks associated with interest rate fluctuations. The order in which these factors appear should not be construed to indicate their relative importance or priority. We caution that these factors may not be exhaustive, accordingly, any forward-looking statements contained herein should not be relied upon as a prediction of actual results. You should carefully consider these and other relevant factors, including those risk factors in Part I, Item 1A, (“Risk Factors”) in our most recent Form 10-K, and information which may be contained in our other filings with the U.S. Securities and Exchange Commission, or SEC, when reviewing any forward-looking statement. Investors should understand it is impossible to predict or identify all such factors or risks. As such, you should not consider the foregoing list, or the risks identified in our SEC filings, to be a complete discussion of all potential risks or uncertainties. Any forward-looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made. We do not undertake any obligation to release publicly any revisions to any forward-looking statements whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Executive Summary New leadership team in place and successfully executing business plan Midway through our 3-year strategic plan, our business has growing momentum and is yielding improved financial results We believe we are positioned for continued success within attractive, growing markets with strong fundamentals Our value proposition is essential to helping customers profitably grow their businesses We expect to continue driving growth in sales and profitability and to increase shareholder value We view our dividend as an effective method of returning cash to shareholders

Highly Experienced Leadership Team MARK WALCHIRK President and Chief Executive Officer DON ZURBAY Chief Financial Officer ERIC SHIRLEY President, Dental ANDREA FROHNING Chief Human Resources Officer LES KORSH Vice President, General Counsel and Secretary KEVIN POHLMAN President, Animal Health TODD MARSHALL Chief Strategy and Digital Officer ADRIAN MEBANE Interim Chief Compliance Officer

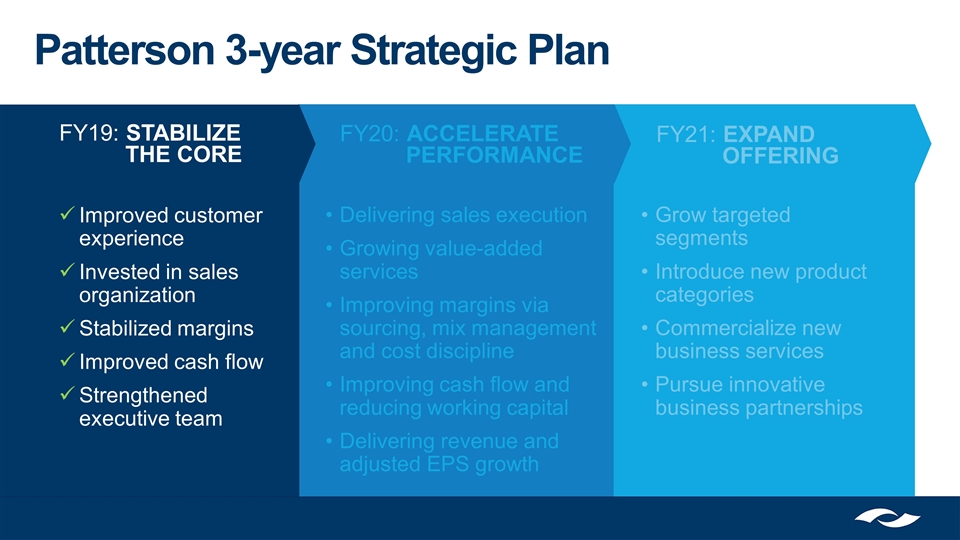

Grow targeted segments Introduce new product categories Commercialize new business services Pursue innovative business partnerships Delivering sales execution Growing value-added services Improving margins via sourcing, mix management and cost discipline Improving cash flow and reducing working capital Delivering revenue and adjusted EPS growth SERVING HEALTHY, GROWING MARKETS Improved customer experience Invested in sales organization Stabilized margins Improved cash flow Strengthened executive team Patterson 3-year Strategic Plan FY19: STABILIZE THE CORE FY20: ACCELERATE PERFORMANCE FY21: EXPAND OFFERING

Grow targeted segments Introduce new product categories Commercialize new business services Pursue innovative business partnerships SERVING HEALTHY, GROWING MARKETS Delivering sales execution Growing value-added services Improving margins via sourcing, mix management and cost discipline Improving cash flow and reducing working capital Delivering revenue and adjusted EPS growth Improved customer experience Invested in sales organization Stabilized margins Improved cash flow Strengthened executive team Patterson 3-year Strategic Plan FY20: ACCELERATE PERFORMANCE FY19: STABILIZE THE CORE FY21: EXPAND OFFERING

SERVING HEALTHY, GROWING MARKETS Delivering sales execution Growing value-added services Improving margins via sourcing, mix management and cost discipline Improving cash flow and reducing working capital Delivering revenue and adjusted EPS growth Improved customer experience Invested in sales organization Stabilized margins Improved cash flow Strengthened executive team Grow targeted segments Introduce new product categories Commercialize new business services Pursue innovative business partnerships Patterson 3-year Strategic Plan FY20: ACCELERATE PERFORMANCE FY19: STABILIZE THE CORE FY21: EXPAND OFFERING

FY20 Business Unit Highlights COMPANION ANIMAL Continued strong revenue growth Increasing higher margin equipment and software sales Accelerating private label penetration DENTAL Improving consumables trend and strong equipment and technology sales Growing value-added services accretive to margins Investments in sales and service yielding results PRODUCTION ANIMAL Strong performance in key segments Growing innovative services Highly developed private label portfolio

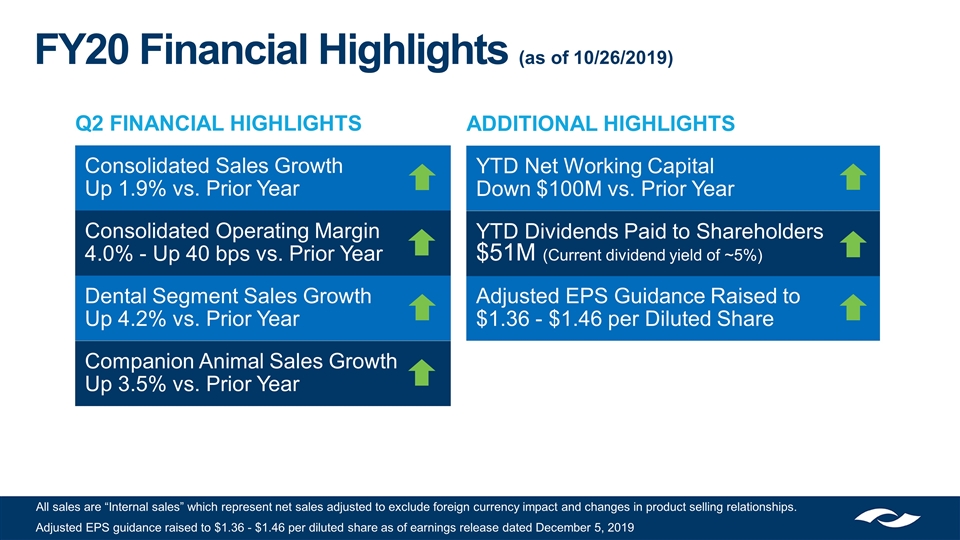

FY20 Financial Highlights (as of 10/26/2019) All sales are “Internal sales” which represent net sales adjusted to exclude foreign currency impact and changes in product selling relationships. Adjusted EPS guidance raised to $1.36 - $1.46 per diluted share as of earnings release dated December 5, 2019 Consolidated Sales Growth Up 1.9% vs. Prior Year Consolidated Operating Margin 4.0% - Up 40 bps vs. Prior Year Dental Segment Sales Growth Up 4.2% vs. Prior Year Companion Animal Sales Growth Up 3.5% vs. Prior Year YTD Net Working Capital Down $100M vs. Prior Year Adjusted EPS Guidance Raised to $1.36 - $1.46 per Diluted Share YTD Dividends Paid to Shareholders $51M (Current dividend yield of ~5%) Q2 FINANCIAL HIGHLIGHTS ADDITIONAL HIGHLIGHTS

Serving Healthy, Growing and Evolving Markets COMPANION ANIMAL Humanization of pets driving increased spending Strong pipeline of new products Essential role for the veterinarian DENTAL Stable growth Strong linkage between oral health and overall health Digital innovation driving practice investment PRODUCTION ANIMAL Strong global demand for protein Production operations enabled by technology Supply chain innovation supporting food animal operations

Our Value Proposition Is Essential to Our Customers

Driving Return of Practice Investment Dental Customer need: Investing in their practice to improve productivity, acquire new patients and enhance clinical care. Office design services Equipment sales Financing Installation services Maintenance services Training and support

Deepening Relationships with Pet Owners Companion Animal Customer need: Creating deeper relationships with pet owners through expertise, convenience and technology. Cloud-based practice management Practice branded mobile apps Online pet owner resources Home delivery platform Interactive dashboard Aggregated data across software platforms

Supporting Custom Supply Chain Requirements Production Animal Customer need: Ensuring herd health and wellness. Dedicated delivery fleet Single source supplier Drop point delivery Prescription management Lot tracking Manage multiple contract pricing structures

Patterson’s Investment Thesis New leadership team in place and successfully executing business plan Midway through our 3-year strategic plan, our business has growing momentum and is yielding improved financial results We believe we are positioned for continued success within attractive, growing markets with strong fundamentals Our value proposition is essential to helping customers profitably grow their businesses We expect to continue driving growth in sales and profitability and to increase shareholder value We view our dividend as an effective method of returning cash to shareholders

THANK YOU