Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AZZ INC | exhibit991fy20q3earnin.htm |

| 8-K - 8-K - AZZ INC | earningsreleaseform8-k.htm |

AZZ Inc. Third Quarter Fiscal Year 2020 Earnings Presentation January 9, 2020

Q3 FY2020 EARNINGS PRESENTATION Safe Harbor Statement Certain statements herein about our expectations of future events or results constitute forward-looking statements for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. You can identify forward- looking statements by terminology such as, “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology. Such forward-looking statements are based on currently available competitive, financial and economic data and management’s views and assumptions regarding future events. Such forward-looking statements are inherently uncertain, and investors must recognize that actual results may differ from those expressed or implied in the forward-looking statements. This presentation may contain forward-looking statements that involve risks and uncertainties including, but not limited to, changes in customer demand and response to products and services offered by AZZ, including demand by the power generation markets, electrical transmission and distribution markets, the industrial markets, and the metal coatings markets; prices and raw material cost, including zinc and natural gas which are used in the hot dip galvanizing process; changes in the political stability and economic conditions of the various markets that AZZ serves, foreign and domestic, customer requested delays of shipments, acquisition opportunities, currency exchange rates, adequacy of financing, and availability of experienced management and employees to implement AZZ’s growth strategies. AZZ has provided additional information regarding risks associated with the business in AZZ’s Annual Report on Form 10-K for the fiscal year ended February 28, 2019 and other filings with the SEC, available for viewing on AZZ’s website at www.azz.com and on the SEC’s website at www.sec.gov. You are urged to consider these factors carefully in evaluating the forward-looking statements herein and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement. These statements are based on information as of the date hereof and AZZ assumes no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise. 2

Q3 FY2020 EARNINGS PRESENTATION 3rd Quarter Segment Revenue and Market Drivers Total 3Q FY2020 Revenue: $291.1 million Metal Coatings Energy Segment Segment $129.2 $161.9 +20.2% vs. prior year +22.7% vs. prior year Market Drivers • Strong solar and petrochemical market activity • Strong North American turnaround season • Growing contribution from Surface Technologies • Shipped China HV Bus; Booked large domestic order • Maintaining price/value realization • Domestic nuclear market remains stable at a low level 3

Q3 FY2020 EARNINGS PRESENTATION 3rd Quarter Segment Results – Metal Coatings In millions $ except percentages Revenue Operating Income Operating Margin Key Statistics +20.2% +48.8% +410 bps $129.2 $107.5 FY2019 Revenue $107.5 $27.3 21.1% Organic $13.1 17.0% $18.3 Acquisitions $8.6 FY2020 Revenue $129.2 FY2019 FY2020 FY2019 FY2020 FY2019 FY2020 Segment Summary: • Record quarterly revenue driven by improved demand within solar and petrochemical markets. • Sales traction within our new business units – Surface Technologies and Galvabar • Lower zinc costs in Galvanizing offsetting higher wage expense • Improved labor productivity and operational efficiency driven by Digital Galvanizing System (DGS) • Operating Margins of 21.1%, compared to 17.0% for the same quarter last year • EBITDA of $34.9 million versus $25.5 million in same quarter last year 4

Q3 FY2020 EARNINGS PRESENTATION 3rd Quarter Segment Results – Energy In millions $ except percentages Revenue Operating Income Operating Margin Key Statistics +22.7% +51.1% +210 bps 10.8% $161.9 $17.4 FY19 Revenue $132.0 $132.0 8.7% FY19 Book to Ship 0.79 to 1 $11.5 FY20 Revenue $161.9 FY20 Book to Ship 0.83 to 1 FY2019 FY2020 FY2019 FY2020 FY2019 FY2020 Segment Summary: • Strong refinery turnaround business in 3Q FY2020 • Recognizing revenue and shipping Chinese orders; backlog down from prior year due to large China shipments • Improved Electrical operational execution and customer service • Operating Margin of 10.8% in Q3 FY2020, versus 8.7% same quarter last year • EBITDA of $22.5 million versus $15.9 million in same quarter last year 5

Q3 FY2020 EARNINGS PRESENTATION YTD Segment Results In $ millions except percentages Revenue Operating Income Operating Margin +11.0% +30.1% +340 bps $376.2 $85.3 $339.0 22.7% $65.6 19.3% Metal Coatings FY2019 FY2020 FY2019 FY2020 FY2019 FY2020 Revenue Operating Income Operating Margin +14.2% +32.9% +110 bps $440.3 $34.2 7.8% $385.5 6.7% $25.8 Energy FY2019 FY2020 FY2019 FY2020 FY2019 FY2020 6

Q3 FY2020 EARNINGS PRESENTATION YTD FY 2020 Financial Guidance and Key Assumptions Key Assumptions: In millions , except for EPS Current Metal Coatings: Continued operational execution Revenue $1,020-$1,060 No significant winter weather disruptions Energy Earnings Per Share $2.60-$2.90 Electrical Platform operational execution No China trade disruptions 7

Q3 FY2020 EARNINGS PRESENTATION 3rd Quarter Summary - Consolidated In $millions, except per share amounts Revenue Net Income Diluted EPS +21.6% +43.1% +42.4% $291.1 $0.84 $22.0 $239.5 $0.59 $15.4 FY2019 FY2020 FY2019 FY2020 2019 2020 • Organic growth • Lower zinc costs • Improved margins • Contribution from acquisitions • Improved operational efficiencies • Strong cash generation • Price realization • Emphasis on expense control 8

Q3 FY2020 EARNINGS PRESENTATION Q3 FY2020 Consolidated Results In millions, except for EPS and percentages Q3 FY 20 Q3 FY 19 % Change Revenue $291.1 $239.5 21.6% Gross Profit $67.3 $49.8 35.3% Gross Margin 23.1% 20.8% Operating Profit $33.4 $22.8 46.8% Operating Margin 11.5% 9.5% EBITDA $46.8 $34.8 34.4% Net Income (loss) $22.0 $15.4 43.1% Diluted EPS $0.84 $0.59 42.4% Diluted Shares Outstanding 26.263 26.151 0.4% 9

Q3 FY2020 EARNINGS PRESENTATION YTD FY 2020 Consolidated Results In millions, except for EPS and percentages YTD FY 20 YTD FY 19 % Change Revenue $816.5 $724.5 12.7% Gross Profit $186.1 $155.4 19.8% Gross Margin 22.8% 21.4% Operating Profit $86.6 $63.6 36.2% Operating Margin 10.6% 8.8% EBITDA $123.4 $102.5 20.5% Net Income (loss) $58.9 $42.4 39.0% Diluted EPS $2.24 $1.62 38.3% Diluted Shares Outstanding 26.246 26.092 0.6% 10

Q3 FY2020 EARNINGS PRESENTATION YTD FY 2020 Cash Flow Highlights In millions, except for percentages YTD FY 20 YTD FY 19 Cash flows provided by operating activities $72.1 $58.1 Less: Capital Expenditures $(22.5) ($13.7) Free Cash Flow $49.6 $44.4 Net Income $58.9 $42.4 Free Cash Flow/Net Income 84.2% 104.7% Acquisition of Subsidiaries, net of cash acquired $60.6 $8.0 Dividends $13.4 $13.3 Share Repurchases $0.0 $0.0 11

Q3 FY2020 EARNINGS PRESENTATION Capital Allocation Focused on Growth In millions FY 2020 YTD Capital Deployment • New business and product lines $60.6 Capital • Systems and technology Expenditures • Strategic fit Growth • Accretive within the first year Acquisitions • North American market focus $22.5 Share • No share repurchases to date Repurchases $13.4 Dividends • YTD payout ratio 22.8% Shareholder Shareholder Return Capital Expenditures Acquisitions Share Repurchases Dividends 12

Q3 FY2020 EARNINGS PRESENTATION Strategic Direction • Continue to grow Metal Coatings organically and with a robust acquisition program, while targeting 21-23% Operating Margins • Focus on operating excellence and providing outstanding customer service • Assumes continued inorganic growth in Surface Technologies • Energy will focus on operational excellence and profitable growth in its core businesses while divesting, exiting the non-core • Specialty welding will grow through international expansion, offering the best customized welding technology, and reducing dependence on the nuclear market space • Electrical businesses will focus on improving profitability and focus more on domestic market growth 13

Q&A

Reg G Tables

Q3 FY2020 EARNINGS PRESENTATION Non-GAAP Disclosure of EBITDA • In addition to reporting financial results in accordance with Generally Accepted Accounting Principles in the United States ("GAAP"), AZZ has provided EBITDA, which are non-GAAP measures. Management believes that the presentation of these measures provides investors with a greater transparency comparison of operating results across a broad spectrum of companies, which provides a more complete understanding of AZZ’s financial performance, competitive position and prospects for the future. Management also believes that investors regularly rely on non-GAAP financial measures, such as EBITDA, to assess operating performance and that such measures may highlight trends in the Company’s business that may not otherwise be apparent when relying on financial measures calculated in accordance with GAAP. 16

Q3 FY2020 EARNINGS PRESENTATION Non-GAAP Disclosure of Consolidated EBITDA In millions Consolidated Consolidated Consolidated Consolidated YTD FY 20 YTD FY 19 Q3 FY 20 Q3 FY 20 GAAP Net Income $58.9 $42.4 $22.0 $15.4 Adjustments to reconcile GAAP to non-GAAP Financial Measures Interest Expense $10.4 $11.5 $3.3 $3.7 Income Tax Expense $16.9 $10.5 $8.8 $3.3 Depreciation and Amortization $37.2 $38.1 $12.7 $12.4 Expense Total GAAP adjustments $64.5 $60.1 $24.8 $19.4 Non-GAAP EBITDA $123.4 $102.5 $46.8 $34.8 17

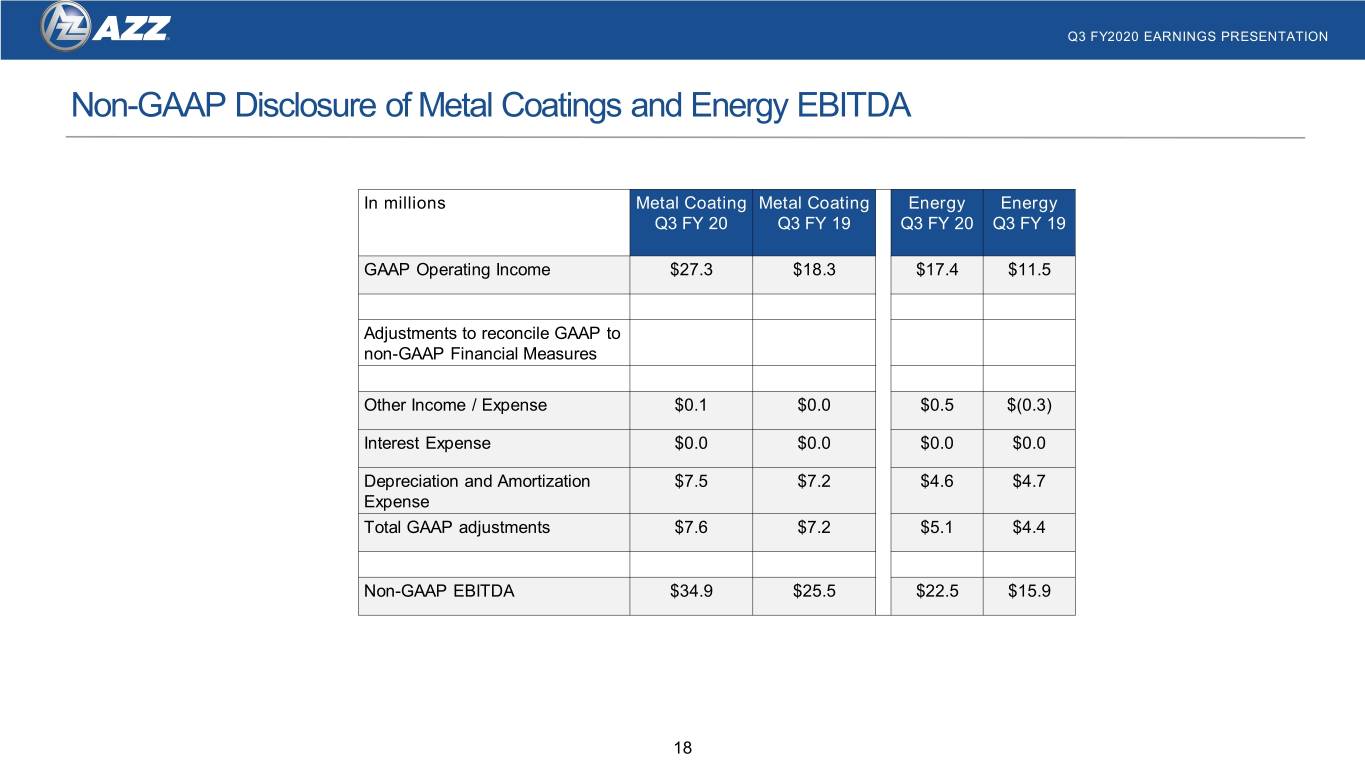

Q3 FY2020 EARNINGS PRESENTATION Non-GAAP Disclosure of Metal Coatings and Energy EBITDA In millions Metal Coating Metal Coating Energy Energy Q3 FY 20 Q3 FY 19 Q3 FY 20 Q3 FY 19 GAAP Operating Income $27.3 $18.3 $17.4 $11.5 Adjustments to reconcile GAAP to non-GAAP Financial Measures Other Income / Expense $0.1 $0.0 $0.5 $(0.3) Interest Expense $0.0 $0.0 $0.0 $0.0 Depreciation and Amortization $7.5 $7.2 $4.6 $4.7 Expense Total GAAP adjustments $7.6 $7.2 $5.1 $4.4 Non-GAAP EBITDA $34.9 $25.5 $22.5 $15.9 18