Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IES Holdings, Inc. | d788037d8k.htm |

IES Holdings, Inc. (NASDAQ: IESC) Investor Presentation January 7, 2020 Exhibit 99.1

Disclosures Forward-Looking Statements Certain statements in this document may be deemed "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, all of which are based upon various estimates and assumptions that the Company believes to be reasonable as of the date hereof. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "could," "should," "expect," "plan," "project," "intend," anticipate," "believe," "seek," "estimate," "predict," "potential," "pursue," "target," "continue," the negative of such terms or other comparable terminology. These statements involve risks and uncertainties that could cause the Company's actual future outcomes to differ materially from those set forth in such statements. Such risks and uncertainties include, but are not limited to, the ability of our controlling shareholder to take action not aligned with other shareholders; the possibility that certain tax benefits of our net operating losses may be restricted or reduced in an ownership change or a further change in the federal tax rate; the potential recognition of valuation allowances or further write-downs on net deferred tax assets; the inability to carry out plans and strategies as expected, including underperformance of our acquisitions or our inability to identify and complete acquisitions that meet our investment criteria in furtherance of our corporate strategy; competition in the industries in which we operate, both from third parties and former employees, which could result in the loss of one or more customers or lead to lower margins on new projects; fluctuations in operating activity due to downturns in levels of construction, seasonality and differing regional economic conditions; and our ability to successfully manage projects, as well as other risk factors discussed in this document, in the Company's annual report on Form 10-K for the year ended September 30, 2019 and in the Company’s other reports on file with the SEC. You should understand that such risk factors could cause future outcomes to differ materially from those experienced previously or those expressed in such forward-looking statements. The Company undertakes no obligation to publicly update or revise any information, including information concerning its controlling shareholder, not operating losses, borrowing availability, or cash position, or any forward-looking statements to reflect events or circumstances that may arise after the date of this document. Forward-looking statements are provided in this document pursuant to the safe harbor established under the Private Securities Litigation Reform Act of 1995 and should be evaluated in the context of the estimates, assumptions, uncertainties, and risks described herein. Non-GAAP Financial Measures and Other Adjustments This document includes adjusted net income per share and backlog, and, in the non-GAAP reconciliation tables included herein, adjusted net income attributable to IES, adjusted earnings per share attributable to IES, adjusted EBITDA and adjusted net income before taxes, each of which is a financial measure not calculated in accordance with generally accepted accounting principles in the U.S. (“GAAP”). Management believes that these measures provide useful information to our investors by, in the case of adjusted net income per share, adjusted net income attributable to IES, adjusted earnings per share attributable to IES, adjusted EBITDA and adjusted net income before taxes, distinguishing certain nonrecurring events such as litigation settlements or significant expenses associated with leadership changes, or noncash events, such as our valuation allowances release and write-down of our net deferred tax assets, or, in the case of backlog, providing a common measurement used in IES’s industry, as described further below, and that these measures, when reconciled to the most directly comparable GAAP measures, help our investors to better identify underlying trends in the operations of our business and facilitate easier comparisons of our financial performance with prior and future periods and to our peers. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information calculated in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measures, which has been provided in the financial tables included in this document. Remaining performance obligations represent the unrecognized revenue value of our contract commitments. While backlog is not a defined term under GAAP, it is a common measurement used in IES’s industry and IES believes this non-GAAP measure enables it to more effectively forecast its future results and better identify future operating trends that may not otherwise be apparent. IES’s remaining performance obligations are a component of IES’s backlog calculation, which also includes signed agreements and letters of intent which we do not have a legal right to enforce prior to work starting. These arrangements are excluded from remaining performance obligations until work begins. IES’s methodology for determining backlog may not be comparable to the methodologies used by other companies. For further details on the Company’s financial results, please refer to the Company’s annual report on Form 10-K for the fiscal year ended September 30, 2019, filed with the Securities and Exchange Commission (“SEC”) on December 6, 2019, and any amendments thereto. General information about IES Holdings, Inc. can be found at http://www.ies-co.com under "Investor Relations." The Company's annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, as well as any amendments to those reports, are available free of charge through the Company's website as soon as reasonably practicable after they are filed with, or furnished to, the SEC.

Company overview

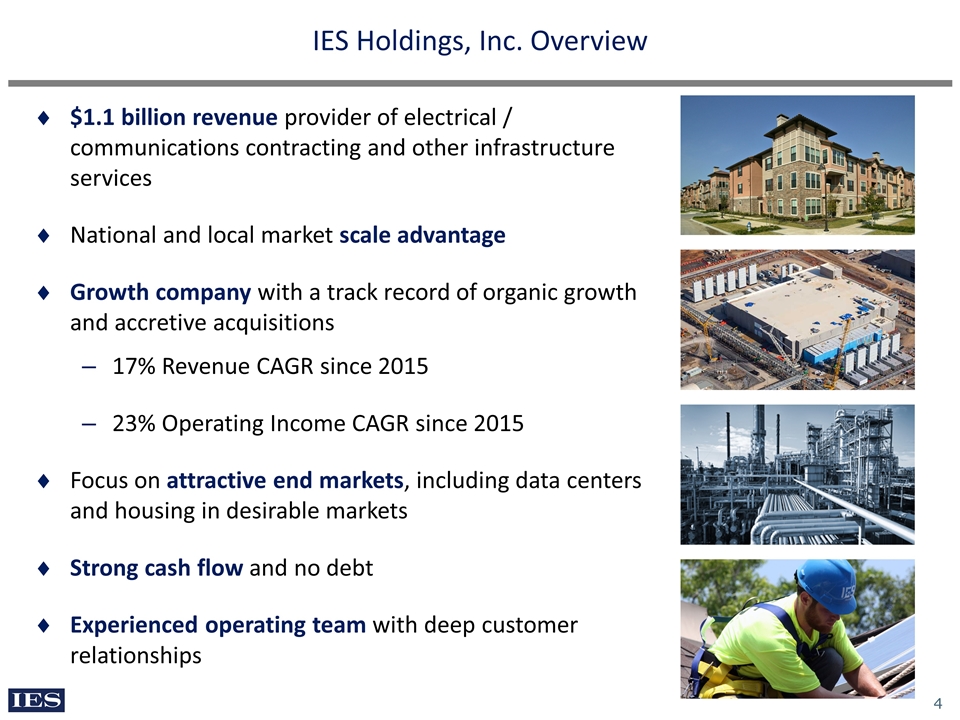

IES Holdings, Inc. Overview $1.1 billion revenue provider of electrical / communications contracting and other infrastructure services National and local market scale advantage Growth company with a track record of organic growth and accretive acquisitions 17% Revenue CAGR since 2015 23% Operating Income CAGR since 2015 Focus on attractive end markets, including data centers and housing in desirable markets Strong cash flow and no debt Experienced operating team with deep customer relationships

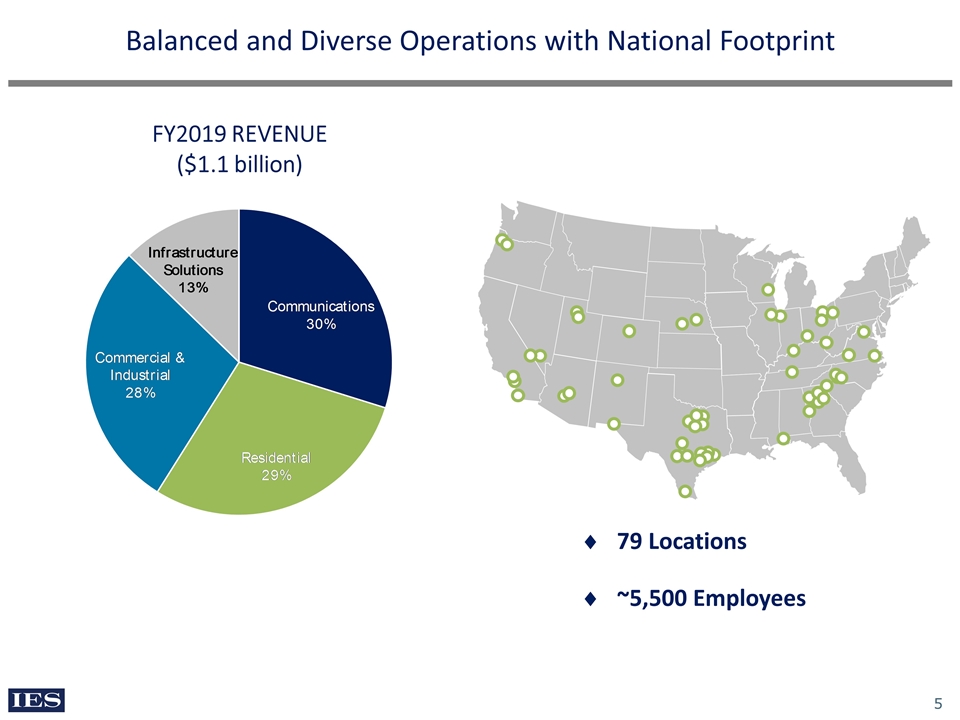

Balanced and Diverse Operations with National Footprint FY2019 REVENUE ($1.1 billion) 79 Locations ~5,500 Employees

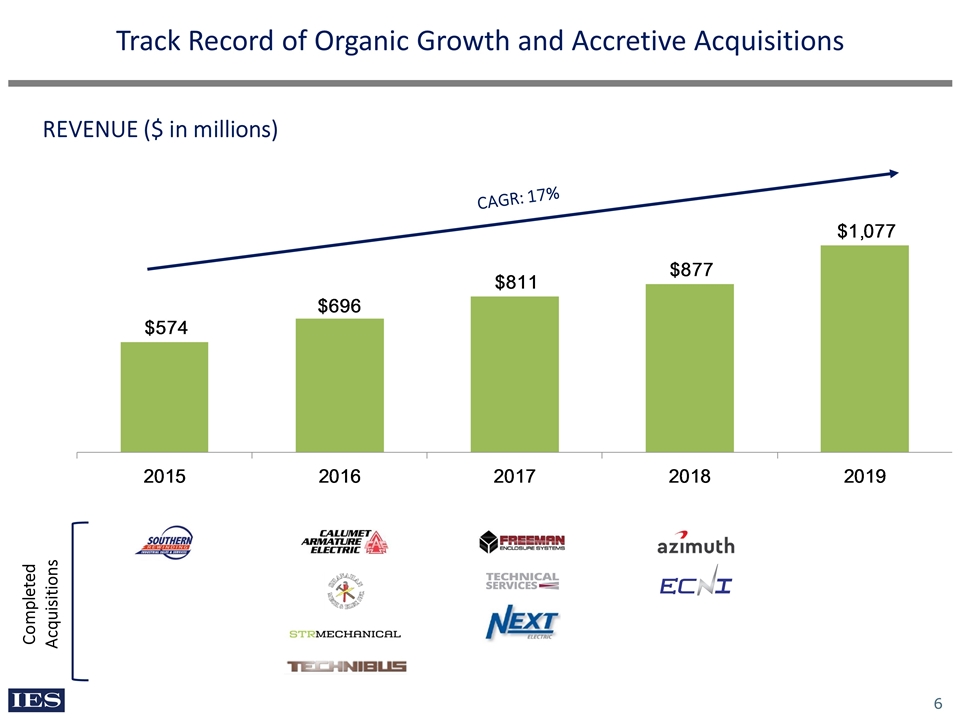

Track Record of Organic Growth and Accretive Acquisitions CAGR: 17% Completed Acquisitions REVENUE ($ in millions)

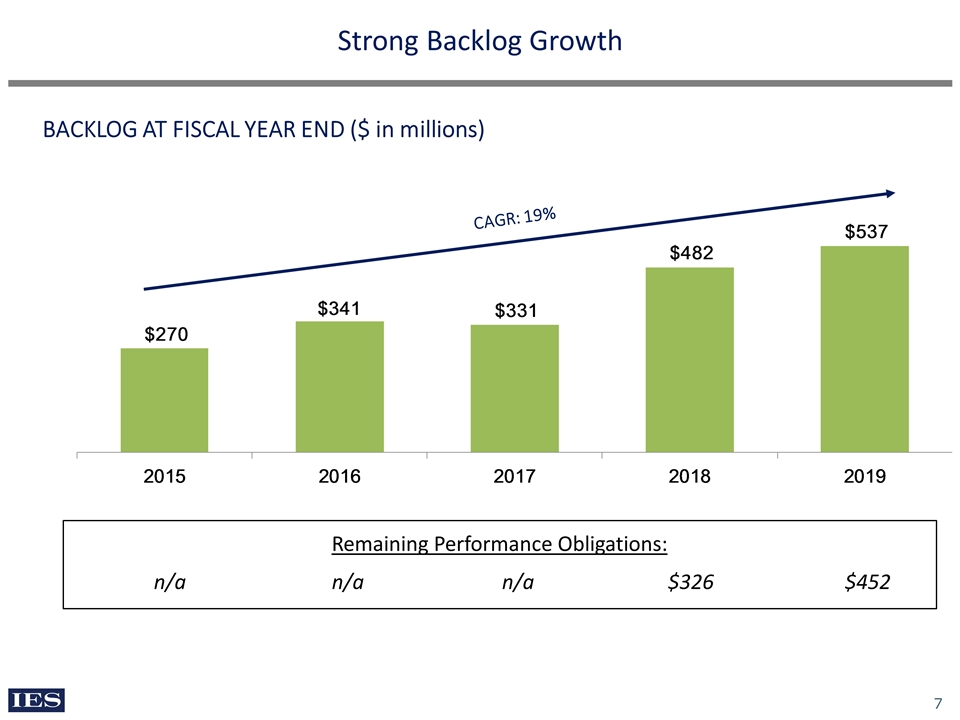

Strong Backlog Growth Remaining Performance Obligations: $452 n/a n/a $326 BACKLOG AT FISCAL YEAR END ($ in millions) CAGR: 19% n/a

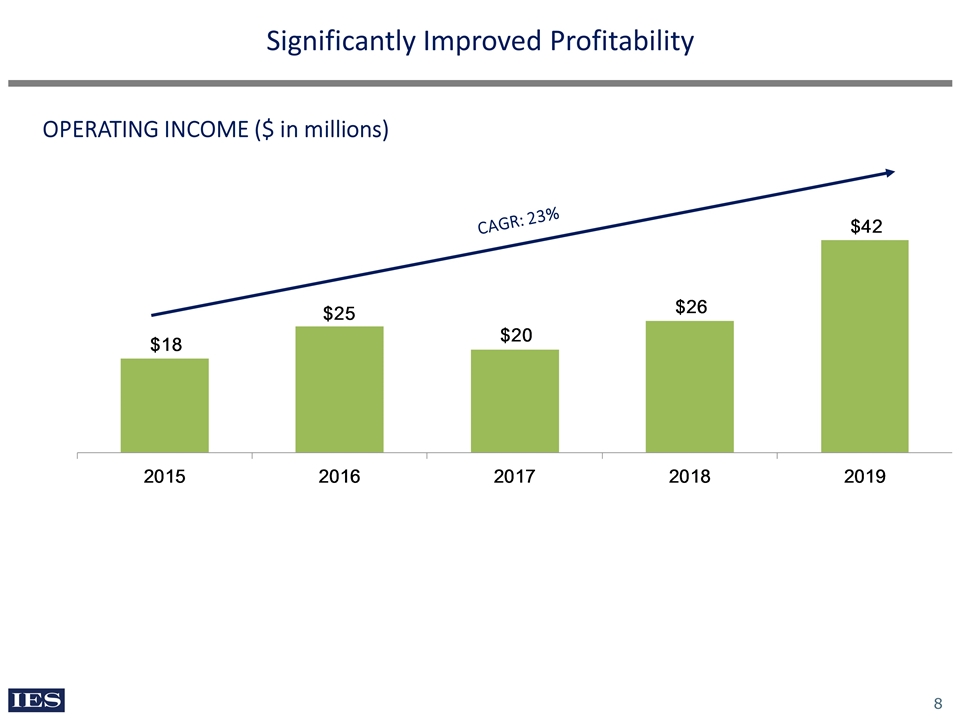

Significantly Improved Profitability OPERATING INCOME ($ in millions) CAGR: 23%

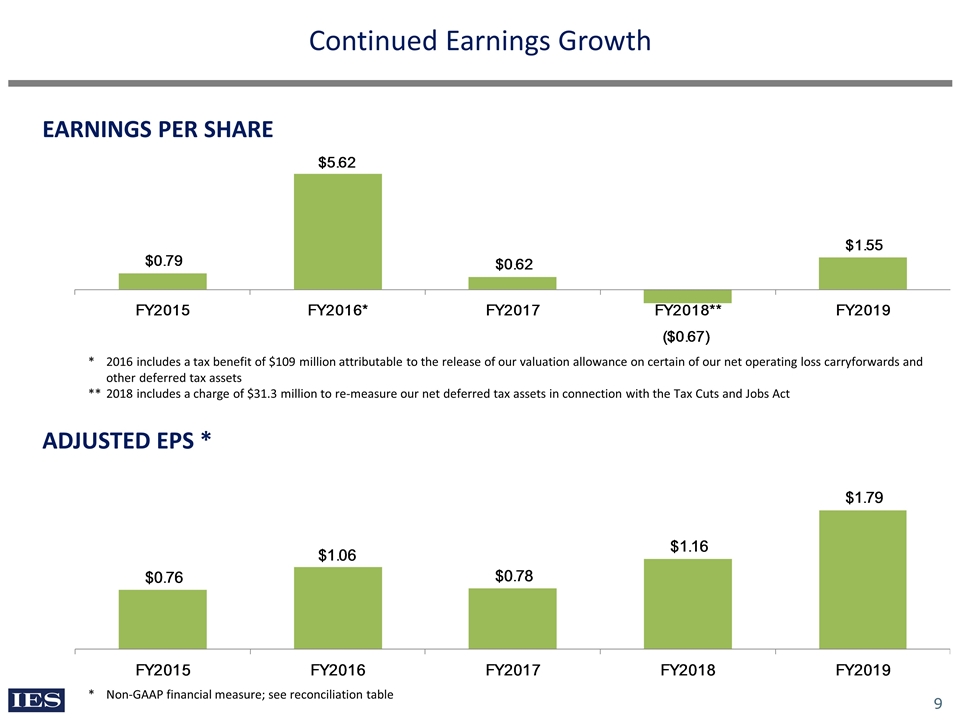

Continued Earnings Growth * Non-GAAP financial measure; see reconciliation table EARNINGS PER SHARE ADJUSTED EPS * *2016 includes a tax benefit of $109 million attributable to the release of our valuation allowance on certain of our net operating loss carryforwards and other deferred tax assets **2018 includes a charge of $31.3 million to re-measure our net deferred tax assets in connection with the Tax Cuts and Jobs Act

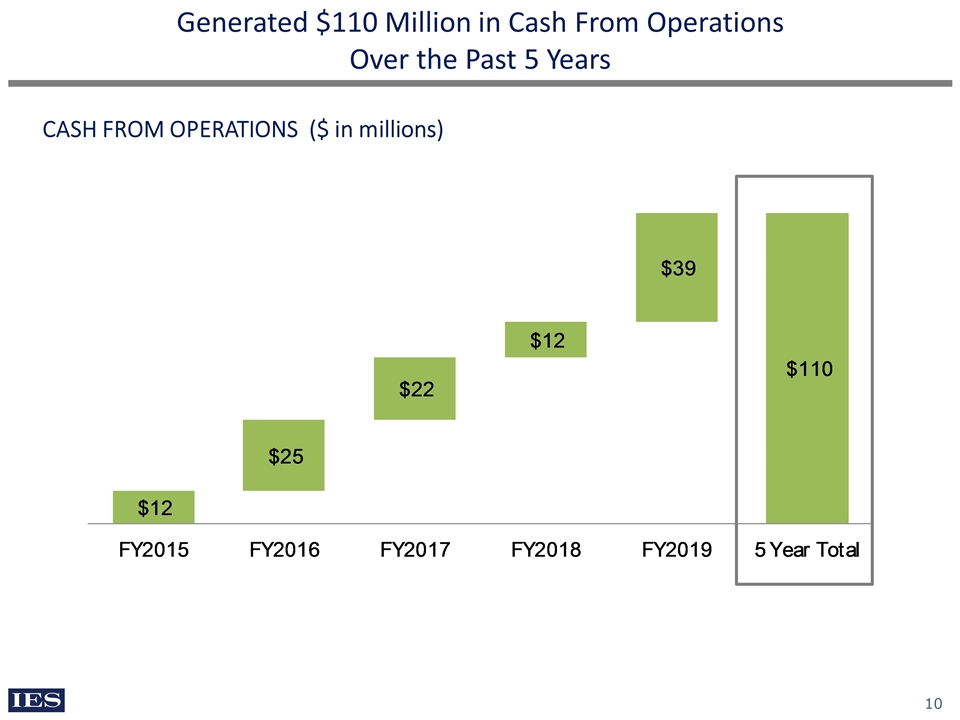

Generated $110 Million in Cash From Operations Over the Past 5 Years CASH FROM OPERATIONS ($ in millions)

Value Creation Strategy Return Capital to Shareholders Repurchased 1.2 million shares since 2015 for $15.9 million pursuant to our stock repurchase program 1.3 million shares remaining to be repurchased under current authorization Pursue Accretive Acquisitions Bolt-on acquisitions to expand geography and/or add products/services Acquisitions to leverage existing IES capabilities and end market expertise New platform acquisitions with attractive characteristics Grow In Core Markets Capitalize on our scale and expertise, especially in data centers, housing and industrial Strong repeat business via best-in-class service Invest In Our People Decentralized culture drives entrepreneurial mindset Focus on hiring, training and retaining top talent Dedication to safety Improve Margins Margin opportunity from sourcing, labor management and improving bid processes Leverage overhead costs with added scale

Business segments

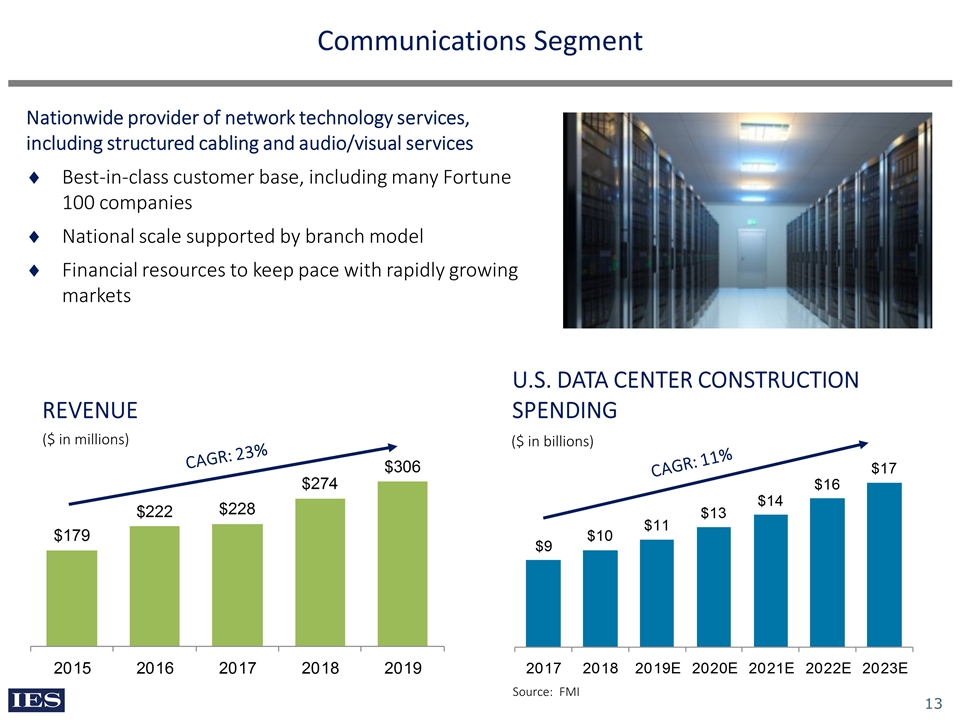

Nationwide provider of network technology services, including structured cabling and audio/visual services Best-in-class customer base, including many Fortune 100 companies National scale supported by branch model Financial resources to keep pace with rapidly growing markets Communications Segment U.S. DATA CENTER CONSTRUCTION SPENDING REVENUE ($ in millions) ($ in billions) Source: FMI CAGR: 23% CAGR: 11%

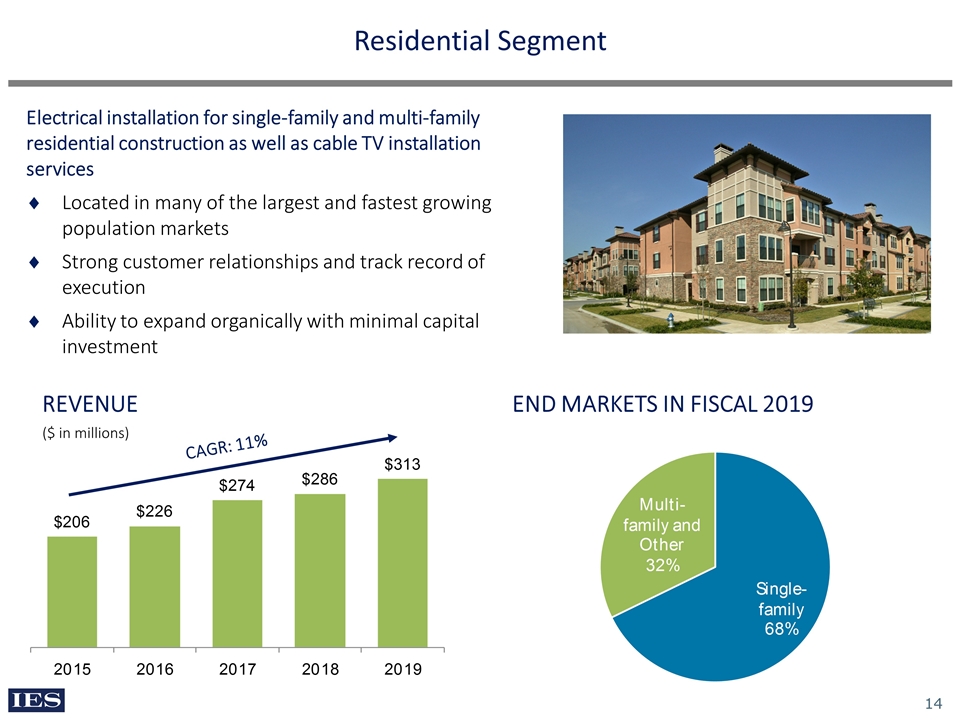

Residential Segment END MARKETS IN FISCAL 2019 REVENUE ($ in millions) Electrical installation for single-family and multi-family residential construction as well as cable TV installation services Located in many of the largest and fastest growing population markets Strong customer relationships and track record of execution Ability to expand organically with minimal capital investment CAGR: 11%

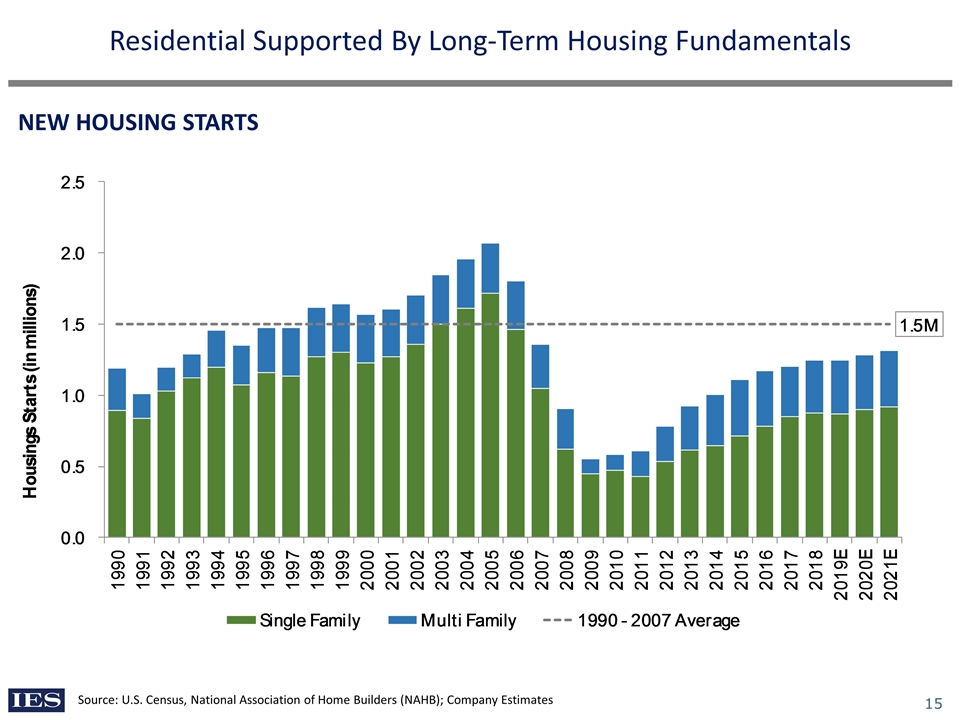

Residential Supported By Long-Term Housing Fundamentals Source: U.S. Census, National Association of Home Builders (NAHB); Company Estimates NEW HOUSING STARTS

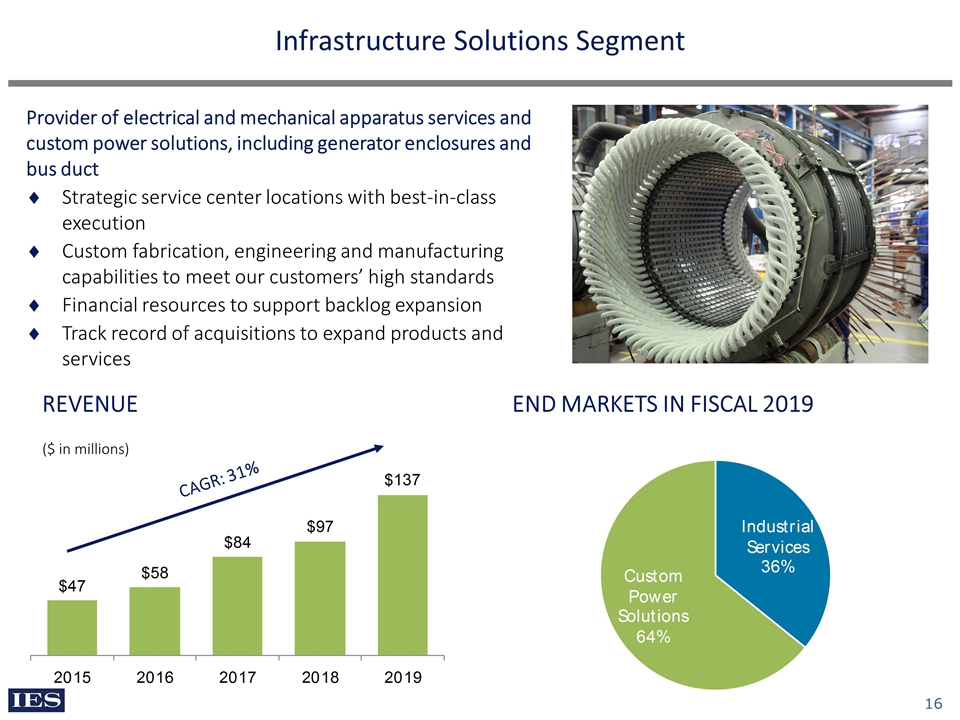

Infrastructure Solutions Segment END MARKETS IN FISCAL 2019 REVENUE ($ in millions) Provider of electrical and mechanical apparatus services and custom power solutions, including generator enclosures and bus duct Strategic service center locations with best-in-class execution Custom fabrication, engineering and manufacturing capabilities to meet our customers’ high standards Financial resources to support backlog expansion Track record of acquisitions to expand products and services CAGR: 31%

Infrastructure Solutions Products and Services Custom Power Solutions Industrial Services Motor repair & rewinding Manufacture and rebuild of traction motors & armatures Enclosures for custom diesel and gas generators Switchgear housings Custom sub-base and freestanding fuel supply tanks Metal enclosed bus systems (non-segregated, segregated phase systems and isolated phase bus duct) Magnet manufacturing & repair Power services for circuit breakers and switchgear

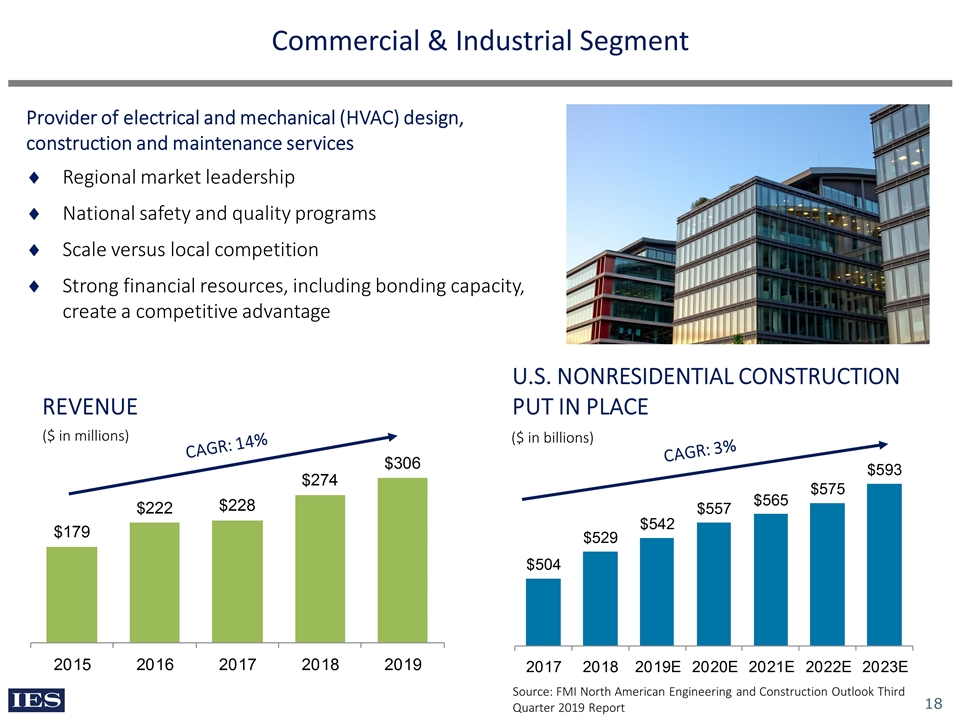

Commercial & Industrial Segment U.S. NONRESIDENTIAL CONSTRUCTION PUT IN PLACE REVENUE ($ in millions) ($ in billions) Source: FMI North American Engineering and Construction Outlook Third Quarter 2019 Report Provider of electrical and mechanical (HVAC) design, construction and maintenance services Regional market leadership National safety and quality programs Scale versus local competition Strong financial resources, including bonding capacity, create a competitive advantage CAGR: 14% CAGR: 3%

Capital allocation

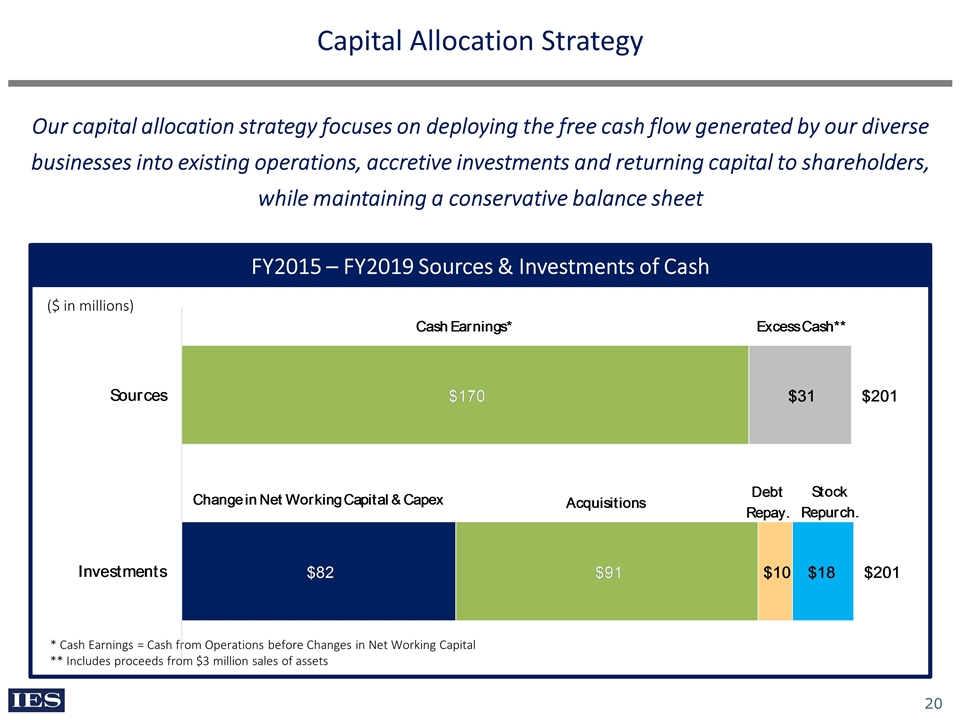

Capital Allocation Strategy Our capital allocation strategy focuses on deploying the free cash flow generated by our diverse businesses into existing operations, accretive investments and returning capital to shareholders, while maintaining a conservative balance sheet * Cash Earnings = Cash from Operations before Changes in Net Working Capital ** Includes proceeds from $3 million sales of assets FY2015 – FY2019 Sources & Investments of Cash ($ in millions)

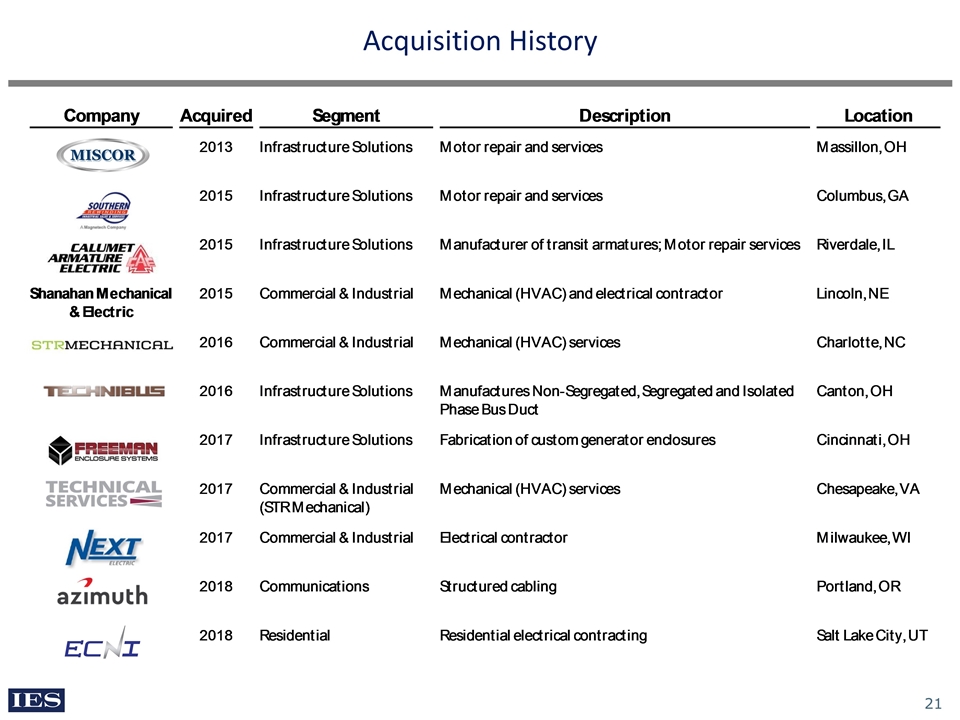

Acquisition History

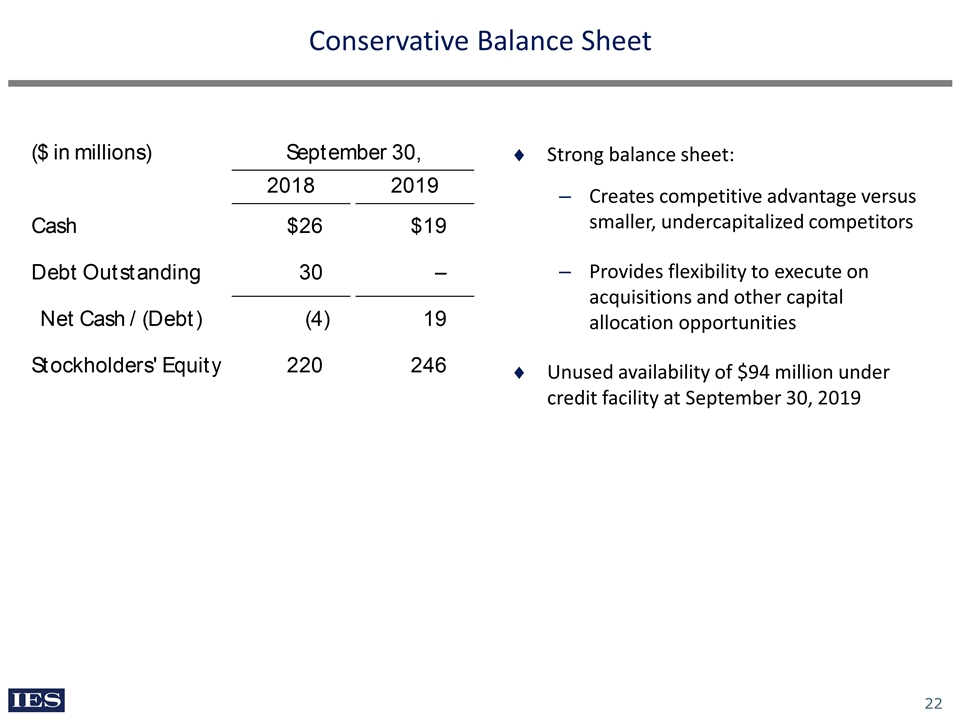

Conservative Balance Sheet Strong balance sheet: Creates competitive advantage versus smaller, undercapitalized competitors Provides flexibility to execute on acquisitions and other capital allocation opportunities Unused availability of $94 million under credit facility at September 30, 2019

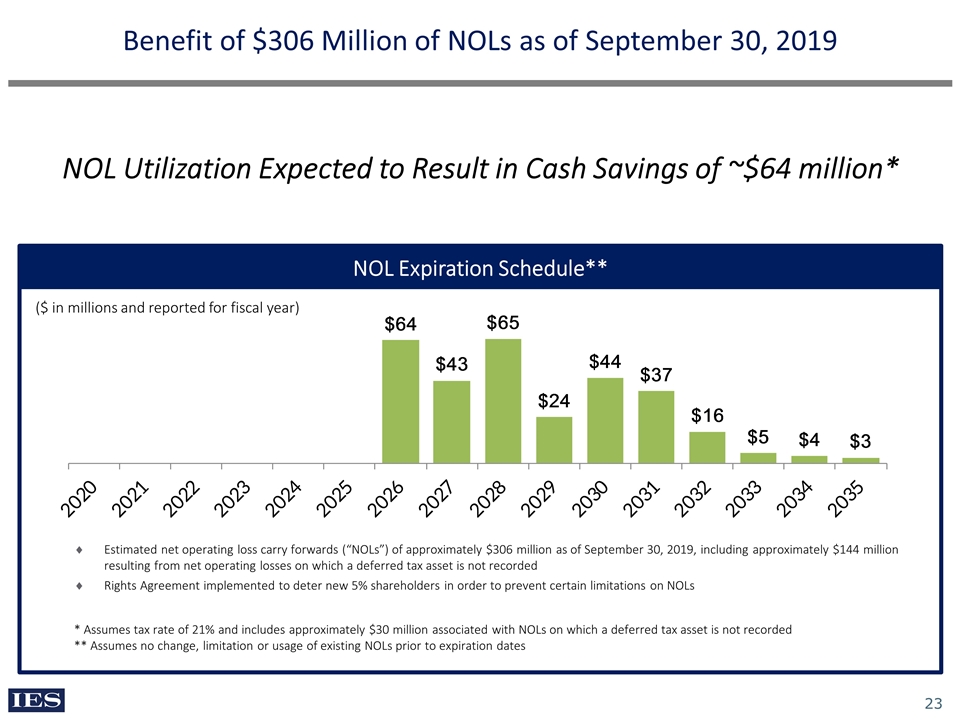

Benefit of $306 Million of NOLs as of September 30, 2019 NOL Expiration Schedule** * Assumes tax rate of 21% and includes approximately $30 million associated with NOLs on which a deferred tax asset is not recorded ** Assumes no change, limitation or usage of existing NOLs prior to expiration dates Estimated net operating loss carry forwards (“NOLs”) of approximately $306 million as of September 30, 2019, including approximately $144 million resulting from net operating losses on which a deferred tax asset is not recorded Rights Agreement implemented to deter new 5% shareholders in order to prevent certain limitations on NOLs NOL Utilization Expected to Result in Cash Savings of ~$64 million* ($ in millions and reported for fiscal year)

Key takeaways

IESC Key Takeaways Growth company in attractive end markets 1 Experienced operating team with deep customer relationships 2 Strong balance sheet and high free cash flow generation 3 Disciplined capital allocators Proven acquisition track record History of share buybacks 4 Focused value creation strategy 5

appendix

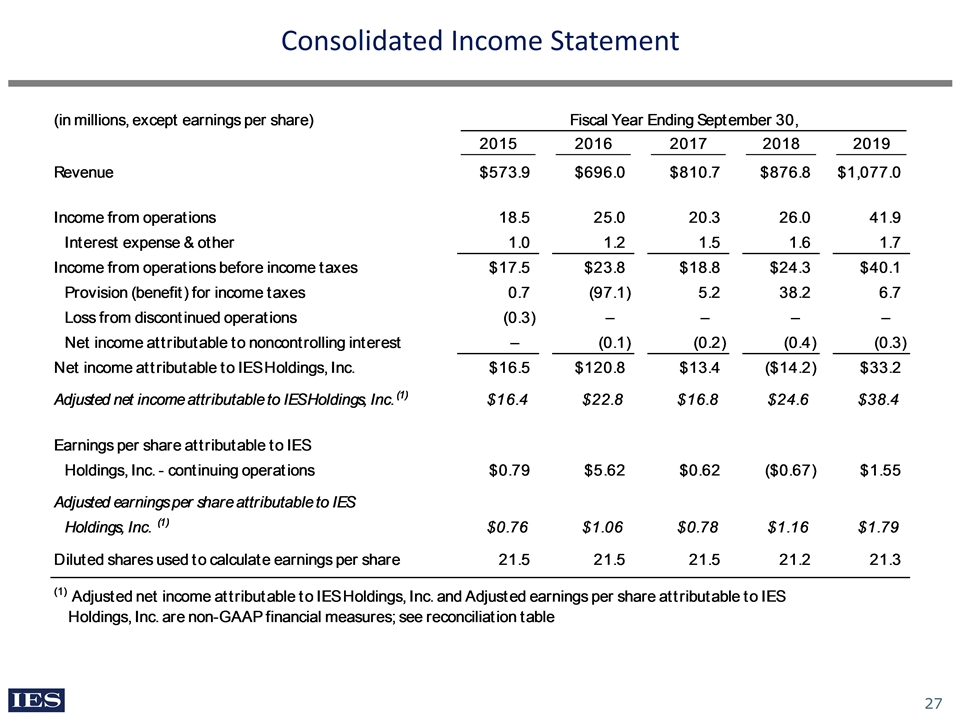

Consolidated Income Statement

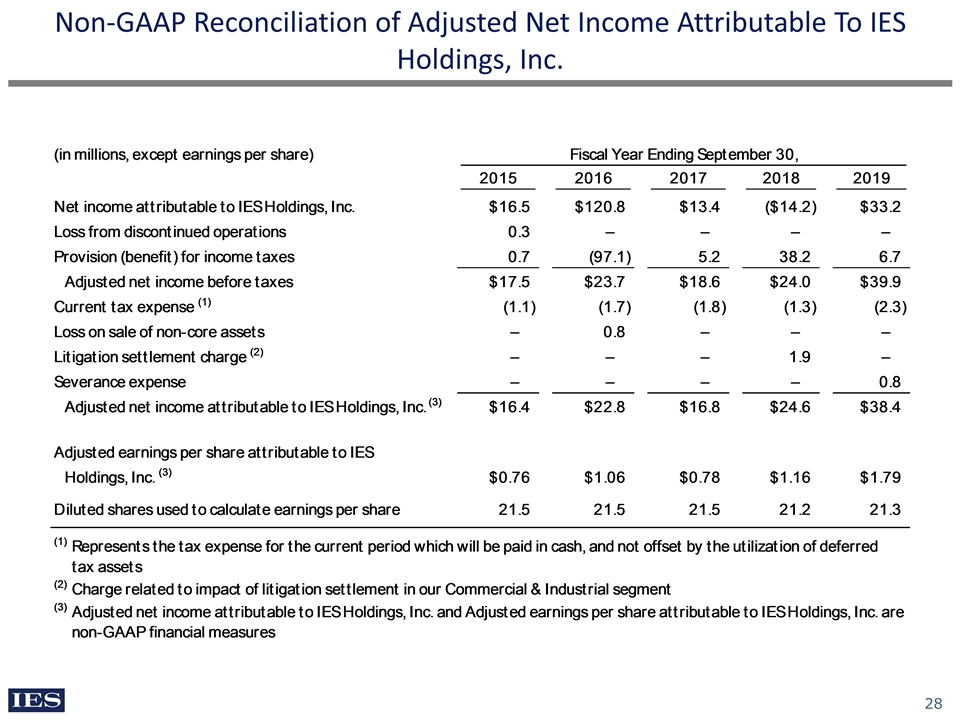

Non-GAAP Reconciliation of Adjusted Net Income Attributable To IES Holdings, Inc.

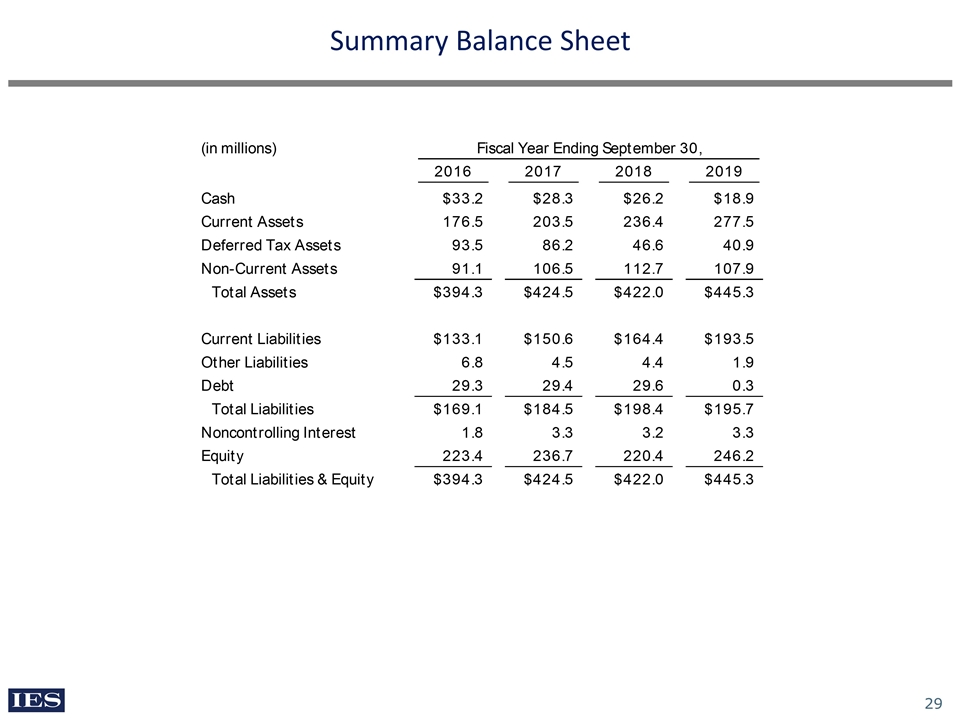

Summary Balance Sheet