Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NEXTIER OILFIELD SOLUTIONS INC. | investorpresentation.htm |

Goldman Sachs 2020 Global Energy Conference January 7, 2020

Important Disclosure Forward-Looking Statements: This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1993, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Where a forward-looking statement expresses or implies an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. The words “believe” “continue,” “could,” “expect,” “goal”, “anticipate,” “intends,” “estimate,” “forecast,” “project,” “should,” “may,” “will,” “would” or the negative thereof and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond the Company's control. Statements in this presentation regarding the Company that are forward-looking, including statements as to the anticipated benefits of the merger with C&J Energy Services, Inc. (the “transaction”), the amount and timing of synergies from the transaction, and future financial and operating results, are based on management's estimates, assumptions and projections, and are subject to significant uncertainties and other factors, many of which are beyond the Company's control. These factors and risks include, but are not limited to, (i) the competitive nature of the industry in which the Company conducts its business, including pricing pressures; (ii) the ability to meet rapid demand shifts; (iii) the impact of pipeline capacity constraints and adverse weather conditions in oil or gas producing regions; (iv) the ability to obtain or renew customer contracts and changes in customer requirements in the markets the Company serves; (v) the ability to identify, effect and integrate acquisitions, joint ventures or other transactions; (vi) the ability to protect and enforce intellectual property rights; (vii) the effect of environmental and other governmental regulations on the Company's operations; (viii) the effect of a loss of, or interruption in operations of, one or more key suppliers, including resulting from product defects, recalls or suspensions; (ix) the variability of crude oil and natural gas commodity prices; (x) the market price and availability of materials or equipment; (xi) the ability to obtain permits, approvals and authorizations from governmental and third parties; (xii) the Company's ability to employ a sufficient number of skilled and qualified workers to combat the operating hazards inherent in the Company's industry; (xiii) fluctuations in the market price of the Company's stock; (xiv) the level of, and obligations associated with, the Company's indebtedness; and (xv) other risk factors and additional information. For a more detailed discussion of such risks and other factors, see the Company's filings with the Securities and Exchange Commission (the "SEC"), including under the heading "Risk Factors" in Item 1A of the Company's Annual Report on Form 10-K and Form 10-K/A for the fiscal year ended December 31, 2018, filed on February 27, 2019 and August 19, 2019, respectively, and in other periodic filings, available on the SEC website or www.NexTierOFS.com. The Company assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates, to reflect events or circumstances after the date of this presentation, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. Investors should not assume that any lack of update to a previously issued "forward-looking statement" constitutes a reaffirmation of that statement. Non-GAAP Measures: This presentation includes discussion of proforma Adjusted EBITDA, which is a measure not calculated in accordance with generally accepted accounting principles in the U.S. ("U.S. GAAP"). Adjusted EBITDA is defined as net income (loss) adjusted to eliminate the impact of interest, income taxes, depreciation and amortization, along with certain items management does not consider in assessing ongoing performance. Reconciliation of proforma Adjusted EBITDA has not been provided because such reconciliation could not be produced without unreasonable effort. 2

NexTier Overview

Company Overview An industry-leading U.S. land completions company Our foundation – Founded in 1973 as Keane Group Inc., renamed to NexTier Oilfield Solutions through the merger with C&J Energy Services, Inc. in October 2019 Ticker: NEX (NYSE) 1 Our position – Third largest provider of U.S. Market cap: $1.4 billion land completion services, including 2.2 million Headquarters: Houston, TX hydraulic horsepower and other services Employees: ~6,6002 Our mission – To consistently outperform in Annual Revenue: $3.7 billion3 service delivery and returns, enabling customers to win by safely unlocking affordable, reliable and plentiful sources of oil and natural gas Key Differentiators Diversified Proven Primarily U.S. services & integrated land focused footprint solutions model Focused on Experienced execution, Strong balance management safety & sheet & liquidity team partnerships 1 Based on NEX market capitalization as of 12/30/19. 2 As of 12/31/19. 3 Proforma consolidated LTM revenue ending 9/30/19. 4

NexTier at a Glance The evolving oilfield demands innovative service providers An industry-leading U.S. land completions company Equipment Segment Breakdown Geographic Overview 1 Overview Total Revenue Total Revenue1 45 Hydraulic frac fleets 11% 9% 118 Wireline units 42% Coiled tubing units 25 % of total revenue 80% 19% 13% 11% 101 Cementing units 8% 7% Completion Services 276 Workover rigs Well Construction & Intervention Services Well Support Services 1 Proforma consolidated LTM revenue ending 9/30/19. 5

Diversified Service Offering NexTier is a leading provider of a diversified base of oilfield solutions Well Construction & Completion Services Well Support Services Intervention Services Hydraulic fracturing Coiled tubing Rig services Wireline Special services Pumpdown Cementing Fluids management • 3rd largest provider of U.S. • Market-leader in high spec • Top 3 rig services position land completions coiled tubing; two newbuild in the U.S. large diameter delivered • Largest U.S. provider of • Strong service history with 1Q’20 wireline & pumpdown proven brand name • One of the largest providers • Proven strategy of • Nearly two-thirds of rig fleet of oilfield cementing services; bundling frac & wireline is high-spec (class 4+) 3rd largest in Permian Basin Market position #3 Hydraulic Fracturing Top 3 High-spec Coiled Tubing1 Top 3 Rig Services #1 Wireline & Pumpdown Top 5 Cementing Services Note: Market position data sourced from Spears & Associates, company estimates and public filings. 1 High-spec reflects large diameter units of 2-3/8” units or greater. Approximately 60% of our 25 coiled tubing units are considered high-spec. 6

Deep Bench of Executive Leadership High-caliber management team with significant experience Primary Past Primary Past Experience Experience Robert Drummond 30+ Ian Henkes 25+ President, Chief Years SVP, Operations Years Executive Officer Kenneth Pucheu Ed Kepler 20+ 25+ SVP, Chief SVP, Operations & Years Years Financial Officer Shared Services Greg Powell Ted Lafferty 20+ 25+ EVP, Chief SVP, Chief Years Years Integration Officer Technology Officer Kevin McDonald Jack Renshaw 25+ 30+ EVP, CAO & SVP, Well Years Years General Counsel Services Billy Driver Richard Vaclavik 30+ 35+ SVP, Product SVP, Chief Years Years Lines Commercial Officer Experienced management team with a demonstrated industry track record 7

Culture & Value System Deep commitment to customers, employees and business partners Safety Our Value System Unwavering commitment to the safety and well being of our people, Take customers and communities in Responsibility which we operate Do the Right Thing Innovate Employees We recognize that our greatest assets are our people, and we are focused on their growth and development Asset Quality Take Win We focus on maintaining high-quality Initiative equipment. Our well-maintained asset platform is capable of Work as a efficiently serving customers Team 8

Industry Leading Safety Record Performing safely is critical to winning and retaining quality customers (1) NexTier Rolling 12 Month TRIR1 ✓ Among the safest providers of oilfield services 1.40 ✓ Current rolling 12-month 1.2 average TRIR ~40% below 1.20 1.1 industry average ✓ Leading safety record 1.00 0.9 establishes license to 1.00 operate, attract and retain top-tier customers and 0.80 quality employees 0.80 0.83 ✓ Continuous focus on safety 0.60 and quality execution at the 0.60 0.56 wellsite 0.40 ✓ Results in less downtime NexTier and improved operational performance 0.20 Industry Average ✓ Reduced motor vehicle incident rate (the industry’s 0.00 most significant risk exposure) by ~45% year- over-year 1 Includes both legacy Keane and C&J rolling 12-month TRIR data. Excludes legacy C&J Well Support Services segment. YTD NexTier rolling 12-month TRIR including Well Support Services segment would be ~0.65 vs. 0.56 listed above. Historical industry average per Bureau of Labor Statistics (“BLS”), estimated for 2019. 9

Strong ESG Commitment Foster a culture focused on safety and sustainability Environmental Stewardship Goals • Focused on environmentally responsible practices • Deploy technologies reducing diesel consumption and carbon emissions • Minimize environmental footprint with focus on customers’ wellsites • Next generation fracturing technology initiatives in process Social & Sustainability Goals • Provide a safe work environment and support the well-being of our people • Empower employees to embrace Safety First culture • Tone at the top promotes culture of adhering to highest ethical standards • Engage and give back to the communities in which we live and work • Culture of diversity with more than 50% of employees ethnically diverse Robust Corporate Governance Practices • Diversity of Board comprised of members from legacy Keane and C&J • Declassified board comprised of 75% independent directors • Separation of Chief Executive Officer and Chairman roles • Annual Board, Committee and individual director evaluations • Robust Enterprise Risk Management process with board engagement 10

ESG Initiatives Implementing several impactful ESG initiatives Environmental Commitment: Dual-fuel Tier IV Engine Minimizing our environmental impact by reducing fuel consumption and emissions at the wellsite through innovation, technology and investment ✓ Dual-fuel Tier IV DGB Engines: Deploying refurbished fleets with new Tier IV DGB engine technology in 1Q’20 ✓ Tractor Reduction Solutions: Minimize idling tractors at wellsite upon commencement of fracturing operations ✓ EcoSeal Greaseless Cable: Eliminates need for certain lubricants; deploying on all perf and plug wireline trucks by YE’20 ✓ Next Generation Fracturing Equipment: Field testing next Greaseless Cable System generation pump technology and evaluating electric / natural gas driven pump designs Fuel Efficiency Initiatives: Reduce cost of operations with minimal capital investment while providing a favorable emissions footprint without compromising ability to provide leading service quality ✓ Hibernate™: Engine idle reduction technology deployed on all fleets by YE’20; targeting 6% reduction of fuel consumption ✓ Fuel Additives: Blending additives into diesel fuel supply that reduce emissions and fuel consumption; estimating 50% emissions reduction on deployed fleets Unlocking affordable and plentiful sources of energy safely while minimizing our environmental footprint Note: Dual-fuel Tier IV DGB engine graphic sourced from Caterpillar Oil & Gas and Marine Division presentation. 11

Integration Update

Transformative Merger Strategic combination of complementary oilfield service companies Combined Profile Merger Overview Increased Scale with High- • Merger between Keane and C&J created ✓ a leading U.S. focused completions and Quality Asset Base production services company Committed to Service • Combined revenue of $3.7 billion and ✓ Quality and Safety operating cash flow of $602 million1 • Combined company delivers attractive Improved Basin and diversification across geographies and ✓ Service Diversity services, with a continuing focus on safety, service quality, and innovation Enhanced Technology ✓ • Complementary platforms estimated to Platform drive ~$125 million of annualized run-rate cost synergies ✓ Strong Balance Sheet and Liquidity 1 Operating cash flow excludes $125 million of gross annualized run-rate synergies. Proforma consolidated LTM as of 9/30/19. 13

Transaction Rationale Combination results in enhanced scale, value and financial position Strong Financial Position: Strong balance sheet delivers stability, opportunities 1 for further innovation and financial flexibility. Immediately accretive to cash flow per share with enhanced potential for increased operating cash flow generation Significant Synergies and Value Creation: $125 million1 of expected annualized 2 run-rate cost synergies, runway for earnings growth from idle, market ready equipment, and the creation of a more investable equity security with greater liquidity Positioned for Continued Innovation and Investment: Combines shared legacies 3 of innovative R&D and a rich portfolio of proprietary technology to drive safety, value and operational efficiency. Improved ability to invest in next generation opportunities Complementary Cultures and Operating Philosophy: Combines businesses with 4 shared commitment to safety and integrity, employee development, partnerships with blue-chip customers, technological innovation, and community relationships Scale and Diversity Across Services and Geographies: Creates large, 5 diversified well completions and production services company, with strong presence in the most active U.S. basins 1 Gross annualized run-rate cost synergies expected to be achieved by end of 2Q’20. 14

Integration Update Vigilant in seamlessly integrating our two companies Primary focus on improving service quality and reducing cost of delivery Optimizing via economies of Launched new corporate scale and vertical integration and field-level branding Retired 5 hydraulic fracturing fleets and significant base of Supply non-frac equipment Chain Branding Identified best talent across organizations Team Integration Harmonizing critical system Increased synergy and technology estimate to $125 million1 infrastructure IT Synergy Systems Target and accelerated timing to achieve by end of 2Q’20 Back Facilities Office Leverage scale & Consolidating footprint automation to lower to increase scale and transaction costs lower cost to deliver 1 Gross annualized run-rate synergies. 15

Increase in Synergy Opportunities Upsized and accelerated base of synergies • Efficiency in support structure • Overhead consolidation $125+ • Economies of scale million1 Expected $100+ SG&A 1 1 synergies million End of Q2 2020 $125+ Operations Timing to Within 1 million1 achieve year (Q4 2020) Supply Chain • Equipment, consumables & indirects • Improved basin density & • Optimizing towards best- absorption in-class solutions • Facility At Current • Proprietary wireline perf Announcement Estimate consolidation gun systems manufactured internally • Adopting best practices • Economies of scale 1 Gross annualized run-rate synergies. Estimating approximately $60 million of one-time costs to achieve synergies. 16

Equipment Rationalization Strategy Contributing to responsible retirement of equipment High-quality base of marketed equipment capable of serving customer needs Frac Fleets Wireline • Underwent extensive diligence 10% retirement (5 fleets) 27% retirement (43 units) process to identify and retire 50 161 equipment unable to generate 45 acceptable returns 118 • Portion of retired fracturing equipment deployed within the last year Current Marketed Current Marketed Coiled Tubing Cementing Rig Services 17% retirement (5 units) 28% retirement (39 units) 24% retirement (88 rigs) 30 140 364 276 25 101 Current Marketed Current Marketed Current Marketed 17

High Quality Portfolio of Assets Assets kept fresh by perpetual maintenance cycle 420 375 • Operating philosophy focused on asset quality and reliability 360 300 • Distribution profile demonstrates 300 favorable condition of key frac 225 240 components • Significant investments made during # engines # 180 150 recent years in new capacity and # transmissions # 120 maintenance Engines 75 • Fracturing fleet with upside earnings 60 Transmissions potential from idle warm fleets 0 0 requiring no capex 100-80% 80-60% 60-40% 40-0% 20-0% Remaining Useful Life ✓ Safe and reliable ✓ Leading operational Continuous investment in operations execution ✓ fleet via surface innovation 18

Investment Opportunity

Unique Set of Attributes An oilfield services company with a compelling value proposition 70 Oilfield Service companies1 Public companies >$2 billion 18 $3.7 billion LTM revenue <1.0x 0.1x2 6 Net debt / LTM Adj. EBITDA >20% 4 1 FCF yield3 23% 1 Includes AKSO-NO, APY, AROC, ASPN, BAS, BHGE, BOOM, CEU-CA, CFX, CKH, CLB, CRR, CVIA, DNOW, DO, DRQ, ERA-US, ERII, ESI-CA, ESN-CA, EXTN, FET, FI, FTI, FTK, FTSI, GTLS, HAL, HCR, HLX, HP, ICD, KEG, KLXE, LBRT, MDR, MRC, NBR, NCSM, NE, NINE, NOV, NR, OII, OIS, PD-CA, PESX, PSI-CA, PTEN, PUMP, QES, RES, RIG, RNGR, SBO-AT, SLB, SLCA, SND, SOI, SPN, SUBC-NO, TCW-CA, TDW, TS, TTI, USWS, VAL, WEIR-GB, WHD, WTTR. 2 Net debt / LTM Adjusted EBITDA. Excludes $125mm of gross annualized run-rate synergies. 3 Free cash flow sourced from FactSet. LTM as of 9/30/19 vs. market capitalization as of 12/30/2019. 4 Includes $125mm of gross annualized run-rate synergies. 20

Our Four Points of Distinction Our strategy to drive success over the near and long-term Partnership: Unwavering commitment to partnerships, including on a dedicated basis with high-quality customers in all aspects of the relationship through open collaboration Innovation Safety: Focused daily on delivering safety performance – a key differentiator that enables our partnership approach and honors our commitment to the well-being of our employees and partners Efficiency Safety Efficiency: Strive every day to deliver leading efficiency, constantly challenging ourselves to do more on behalf of customers. Relentless in our pursuit of efficiency, which creates value for our stakeholders Partnership Innovation: Committed to leading the charge on innovation and being the clear choice for operators seeking a forward-thinking partner; innovation will drive the next leg of safety, efficiency and sustainability 21

Significant Scale in the U.S. Leading provider of multi-basin completions & production services Leading U.S. Frac Position1 Increased NAm Presence2 Total HHP (mm) NAm Rev. ($ billions) HAL 4.6 HAL SLB 2.6 SLB 2.2 BKR BJ Services 2.2 3.7 PUMP 1.4 PTEN FTSI 1.3 3rd largest HP company 4th largest PTEN 1.2 based on total WFT company HHP based on total LBRT 1.1 BJ Services North America ProFrac 0.9 NBR oilfield service revenues RES 0.7 CFW Ability to serve Improved efficiencies Ability to leverage Greater ✓ customers with broader ✓ via increased basin ✓ existing and ✓ relevancy to geographical footprint; density & leveraging emerging technology current and greater cross-sell field & corporate investments across a potential opportunities overhead larger platform supplier base 1 Source: Rystad Energy, company filings. Reflects U.S. land HHP per Rystad Energy as of 6/30/19 plus announced HHP attrition during 3Q’19 reporting cycle. 2 Source: Company filings, Spears & Associates. LTM as of 9/30/19. 22

Portfolio of Top-Tier Customers Partner with highly efficient customers under dedicated agreements Partnerships with high-quality customers Focused on delivering top-tier safety, efficiency and execution Combined scale enables growth via existing and new customers Note: Does not reflect an exhaustive list of customers. 23

NESR Partnership NexTier’s strategy in action; expands footprint overseas + Win-Win Partnership: Entry into MENA region to provide completion services with strong U.S. based partner under NEX recently commenced operations in favorable risk profile the Middle East North Africa ("MENA") Region with one dedicated fleet to Innovation: support NESR’s completion operations, NexTier provides equipment, operational expertise including the operation of hydraulic and skilled personnel while NESR provides access, fracturing and wireline equipment customers and relationships Efficiency: Demonstrates our unconventional expertise and ability to mobilize quickly Profitable: Accretive to our average deployed U.S. fracturing portfolio from a profitability perspective; no infrastructure investment given subcontractor status 24

Strong Balance Sheet Financial flexibility is an enabler to value creation for all stakeholders Benefits of Balance Sheet Strength ✓ Positions NexTier to execute in a range of market conditions Cash1 $270 million ✓ Serves as an enabler to continue to invest in innovation and evaluate alternatives for shareholder return ABL $377 2 Availability million $ million As of 9/30/19 Total $647 Cash1 $270 Liquidity1 million Senior Secured Term Loan $338 Net Debt1 $68 Strong liquidity and low leverage position provides differentiating flexibility and resiliency 1 Reflects the payment of $65.1 million related to the $1.00 / share dividend to C&J shareholders paid 10/31/19. Does not include one-time costs. 2 Represents total availability of new credit facility as of 10/31/19 upon closing of the merger with C&J Energy Services, Inc. 25

Market Observations Focused on leading efficiency, innovation and profitability Conditions & Market Response Additional NexTier Response Current Conditions: Efficiency & Innovation: Range-bound macro environment, Lead technology adoption across fracturing overcapacity, pursuing surface, subsurface and digital contract renewals, focused on need to further drive efficiencies Driving Cost-out: Striving to achieve low cost position Supply Attrition: across direct materials, maintenance Sizable base of horsepower and footprint attrition likely reflects early innings of larger cycle Capturing Synergies: Starting to capture cost synergies and leverage best practices to improve Manned Fleet Reduction: processes Significant reduction helps to balance effective supply & demand Right-sizing Operations: Aligning cost structure with market conditions Proactive response to market conditions by focusing on what we can control 26

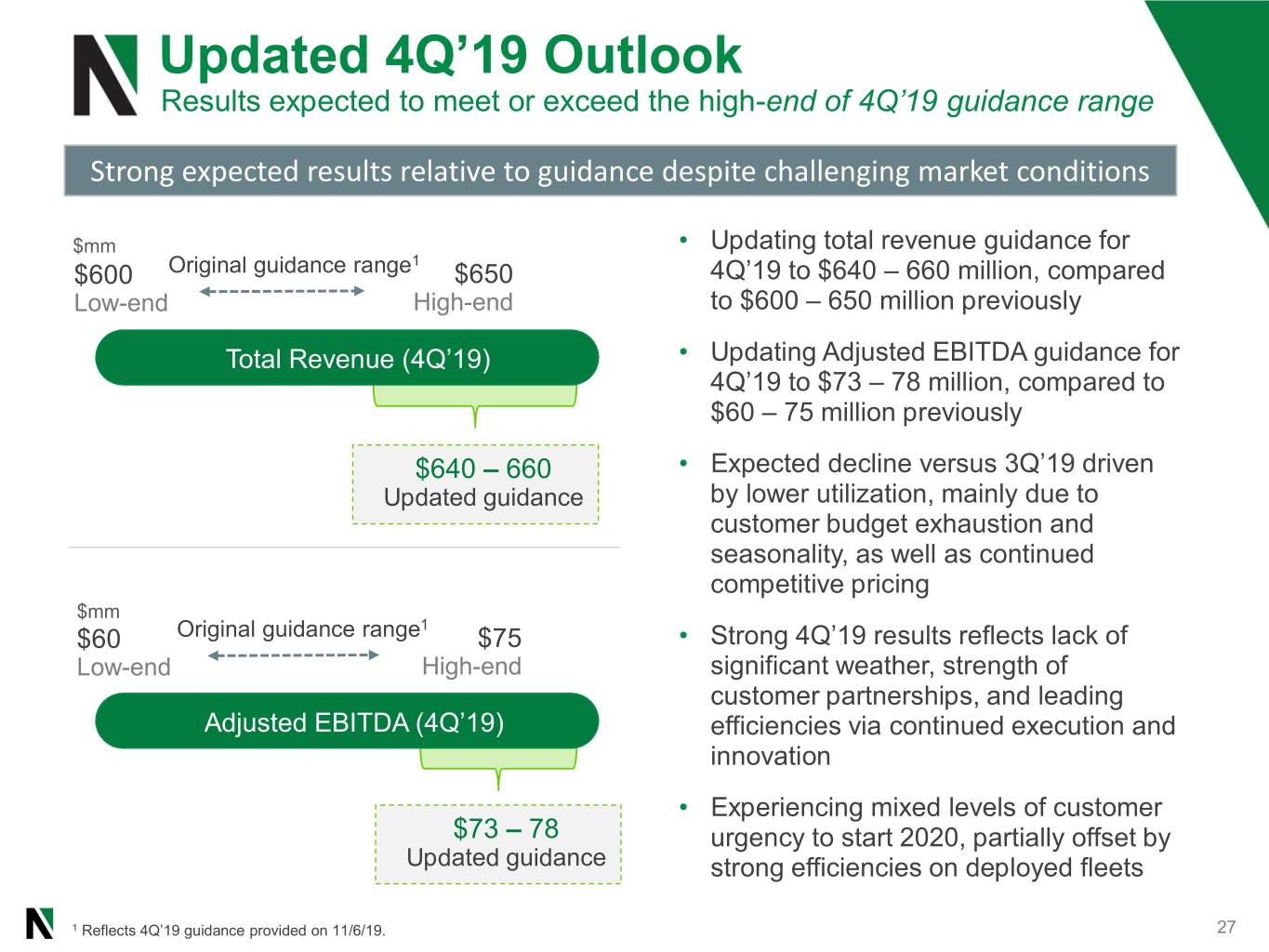

Updated 4Q’19 Outlook Results expected to meet or exceed the high-end of 4Q’19 guidance range Strong expected results relative to guidance despite challenging market conditions $mm • Updating total revenue guidance for 1 $600 Original guidance range $650 4Q’19 to $640 – 660 million, compared Low-end High-end to $600 – 650 million previously Total Revenue (4Q’19) • Updating Adjusted EBITDA guidance for 4Q’19 to $73 – 78 million, compared to $60 – 75 million previously $640 – 660 • Expected decline versus 3Q’19 driven Updated guidance by lower utilization, mainly due to customer budget exhaustion and seasonality, as well as continued competitive pricing $mm 1 $60 Original guidance range $75 • Strong 4Q’19 results reflects lack of Low-end High-end significant weather, strength of customer partnerships, and leading Adjusted EBITDA (4Q’19) efficiencies via continued execution and innovation • Experiencing mixed levels of customer $73 – 78 urgency to start 2020, partially offset by Updated guidance strong efficiencies on deployed fleets 1 Reflects 4Q’19 guidance provided on 11/6/19. 27

Leading 3Q’19 Frac Profitability Clear market bifurcation in profitability per fleet EBITDA per Fleet1 In $ millions Leading EBITDA per fleet – outcome of delivering differentiated efficiency, reduced NPT, innovation & partnership Efficiency Innovation Partnership Average Peer A Peer B Peer C Peer D Peer E 1 Source: Goldman Sachs report, ‘Global Oil Services 2020 Outlook – Themes and Stocks’ (12/17/19). Peers include FTSI, LBRT, PTEN, PUMP and RES. 28

Capital Return Objectives Expected to generate meaningful free cash flow ✓ Capital Return • In December 2019, Board authorized $100 Optionality million capital return program; reflects 7% of current market capitalization1 ✓ • May be implemented through stock repurchases, dividends, or other capital Balance Sheet return strategies Strengthening • Includes approval for up to $50 million of stock repurchases ✓ Asset • Program allows for flexible execution of Development capital return Our Commitment to Shareholders Create Maximize Prioritize shareholder shareholder returns uses of free cash value focusing on ROI flow generation 1 Based on NEX market capitalization as of 12/30/19. 29

Innovation

Partnering with our Customers to Create Value Maximize value to customers through technology and innovation Customer cash flow lifecycle Our focus is to: Invest Accelerate production Assess Acreage Lower customer $ per BOE Drill Accomplished by embracing innovation and Complete investing in technology to: • Optimize logistics Produce • Maximize efficiency • Reduce non-productive time Cash Flow • Reduce cost of operations • Optimize completions 31

Innovation: Core Part of NexTier’s DNA Developing a leading technology platform Surface Technology Digital Capabilities Subsurface Innovation • Next generation equipment • Digital operating center • Engineered completions • Proprietary control systems • Logistics control tower • Increased conductivity • Component life extension • Equipment health monitoring • Optimize frac placement • Modular perf guns • Utilization optimization • Improve field performance • Advanced flow control • Predictive maintenance ✓ Increase ✓ Reduce non- ✓ Decrease ✓ Generate ✓Beneficial ESG efficiency productive time labor costs revenue impacts 32

NexTier’s Digital Capabilities Working to implement several core technology initiatives by YE’20 Digital Operations Center (“DOC”) Equipment Health Monitoring & Logistics Control Tower (“LCT”) (“EHM”) Program • Expecting 24/7 operational • Expecting to be fully operational on support for all deployed fleets deployed fleets by YE’20 by YE’20 • Primary goals of extending major • DOC to enhance equipment component life, reducing overall monitoring and increase spend and lowering NPT operational reliability • Works in conjunction with our • Centralized reporting center to proprietary cloud-based data increase customer visibility and analytics insight platform satisfaction • Recent monitoring pilot activities • LCT designed to increase resulted in ~252 catches (estimated efficiencies and lower costs cost saving of ~$1.5mm1) 1 Data from an average of approximately 4.5 deployed fleets from April through October 2019. 33

NexTier’s Digital Transformation Our digital capabilities will drive operations of the future NexTier’s Strategic Technological Objectives: Equipment Real-time Business Management Health Monitoring • Enhanced visibility to operations, inventory and maintenance needs Digital Optimized Operational Cost Structure • Resource centralization and remote Transparency intervention Subsurface Cost Reduction Surface Lowest Cost to Own & Reduced Risk Technologies Technologies Efficiency • Data-driven predictive maintenance and Differentiation analytics-augmented decision making Improved Customer Relations Technologies • Customer portals, exchange of engineering data & integration with customer systems Digital Control Tower Differentiate and Win & Logistics Control • Greater collaboration of engineering data Tower to increase production and lower well costs Increased Real-time Asset Reduced Improved Efficiency & Decisions Optimization Costs Margins Safety Industry leading transformation through improved processes and proprietary technologies 34

Surface Technologies Investing in technologies that lower costs, increase efficiency and improve safety Equipment Reliability MDT Controls & Next Generation & Efficiency Hibernate™ Installation Equipment • Major component life extension • Installation of proprietary • Investing in next generation program to reduce early failures technologies on deployed fleets pump technologies: and extend useable life by YE’20 • Proprietary pump • Focused on extending engine • Iron Track & Trace program to • Tier IV DGB extend iron life, reduce NPT and life and reducing NPT • e-fleet technologies improve procurement process • Standardization and elimination • Dart Valve project to increase of third party control systems • Proprietary perforating gun reliability and performance and reduce overall cost of ownership design to improve reliability and efficiency reduce per stage operating cost • Reduced engine idle will result • Wireline perf gun and tool in less diesel consumption and • Advanced flow control technologies offer lowest lower overall emissions technologies to modernize frac perforating cost in the market fluid conveyance 35

Subsurface Innovation Technology partner of choice Subsurface Engineering Chemistry Technology Collaboration • Partnering with industry’s most • Leverage our world-class • Partnering with innovators to progressive customers to tackle laboratory facilities to bring the accelerate market introduction of reservoir challenges, including: best chemistry technologies to new technologies (i.e. Seismos) • Patented engineering tools our customers • Integration with NexTier for improved completions • Ideal partner for chemical technologies to deliver higher designs providers to achieve market value for customers • Optimized diversion penetration • Technology collaboration and strategies • Partner with customers and joint projects with our strategic • Low cost technologies for vendors to continuously improve customers evaluation of fracture environmental profile of our performance chemical portfolio 36

NexTier Takeaways Leading oilfield services company providing a compelling investment proposition 1 Scale & Diversity Across Services & Geographies 2 Attractive Synergies, Value Creation & Capital Return + 3 Strong Financial Position – Balance Sheet & Liquidity 4 Meaningful Free Cash Flow Generation 5 Well Positioned as Market Conditions Improve and for Continued Innovation & Investment Safety, efficiency and differentiation through quality service and innovation 37

Investor Contacts: Daniel Jenkins Vice President, Investor Relations investors@NexTierOFS.com Marc Silverberg Managing Director (ICR)