Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Northfield Bancorp, Inc. | a991pressrelease-final.htm |

| EX-2.1 - EXHIBIT 2.1 - Northfield Bancorp, Inc. | a21mergeragreement-tri.htm |

| 8-K - 8-K - Northfield Bancorp, Inc. | nfbk8-kprojecttriumph1.htm |

To Acquire VSB Bancorp, Inc. and its wholly-owned subsidiary, Victory State Bank December 23, 2019

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about (i) the benefits of the merger between Northfield Bancorp, Inc. (“Northfield”) and VSB Bancorp, Inc. (“VSB”), including future financial and operating results, cost savings and accretion to reported earnings that may be realized from the merger; (ii) Northfield’s and VSB’s plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts; and (iii) other statements identified by words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates," or words of similar meaning. These forward-looking statements are based upon the current beliefs and expectations of Northfield’s and VSB’s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the businesses of Northfield and VSB may not be combined successfully, or such combination may take longer to accomplish than expected; (2) the cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer loss, and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; (5) the stockholders of VSB may fail to approve the merger; (6) adverse governmental or regulatory policies may be enacted; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) the risks associated with continued diversification of assets and adverse changes to credit quality; (9) difficulties associated with achieving expected future financial results; (10) competition from other financial services companies in Northfield’s and Victory’s markets; (11) the risk of an economic slowdown that would adversely affect credit quality and loan originations. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Northfield’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K) filed with the Securities and Exchange Commission and available at the SEC's Internet site (http://www.sec.gov). All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to Northfield or Victory or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, Northfield and Victory do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made. Additional Information about the Merger and Where to Find It This communication is being made with respect to the proposed transaction involving Northfield and VSB. This material is not a solicitation of any vote or approval of the VSB stockholders and is not a substitute for the proxy statement/prospectus or any other documents that VSB may send to its stockholders in connection with the proposed merger. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities. In connection with the proposed merger, Northfield will file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 that will include a proxy statement of VSB and a prospectus of Northfield, as well as other relevant documents concerning the proposed merger. Before making any voting or investment decisions, investors and stockholders are urged to read the Registration Statement and the proxy statement/prospectus regarding the proposed merger, as well as any other relevant documents filed with the SEC and any amendments or supplements to those documents, because they will contain important information. VSB will mail the proxy statement/prospectus to its stockholders. Stockholders are also encouraged to carefully review and consider each of Northfield’s public filings with the SEC, including, but not limited to, its Annual Reports on Form 10-K, its proxy statements, its Quarterly Reports on Form 10-Q, and its Current Reports on Form 8-K. Copies of the Registration Statement and proxy statement/prospectus and other filings incorporated by reference therein, as well as other filings containing information about Northfield, may be obtained as they become available at the SEC’ s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Northfield at www.eNorthfield.com. Northfield and VSB and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies of VSB’s stockholders in connection with the proposed transaction. Information about the directors and executive officers of Northfield and their ownership of Northfield common stock is set forth in the proxy statement for Northfield’s 2019 Annual Meeting of Stockholders, as filed with the SEC on Schedule 14A on April 9, 2019. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. 2

Well-Run, In-Market, Strong Core Deposit Franchise Target Snapshot Pro Forma Branch Footprint Name: VSB Bancorp, Inc. Current NFBK● ● Locations (40) Ticker (Exchange): VSBN (OTCBX) Current VSBN Locations (6) Headquarters: Staten Island, NY Established: 1997 Branches: 6 total in Staten Island Total Assets: $375.7 Million Total Loans: $157.2 Million Total Deposits: $325.3 Million Loan-to-Deposit Ratio: 48.3% YTD Yield on Loans: 5.77% YTD Cost of Deposits: 0.46% VSB Bancorp, Inc. is the one-bank holding company for Victory State YTD ROAA: 0.91% Bank, a Staten Island based commercial bank, which operates six full YTD ROAE: 9.82% service locations in Staten Island. YTD Net Interest Margin: 3.34% $325 million total deposits, of which $145 million (~45%) are non- interest bearing demand accounts. YTD Efficiency Ratio: 71.0% Source: S&P Global Market Intelligence. Financial data as of or for the period ended September 30, 2019. 3

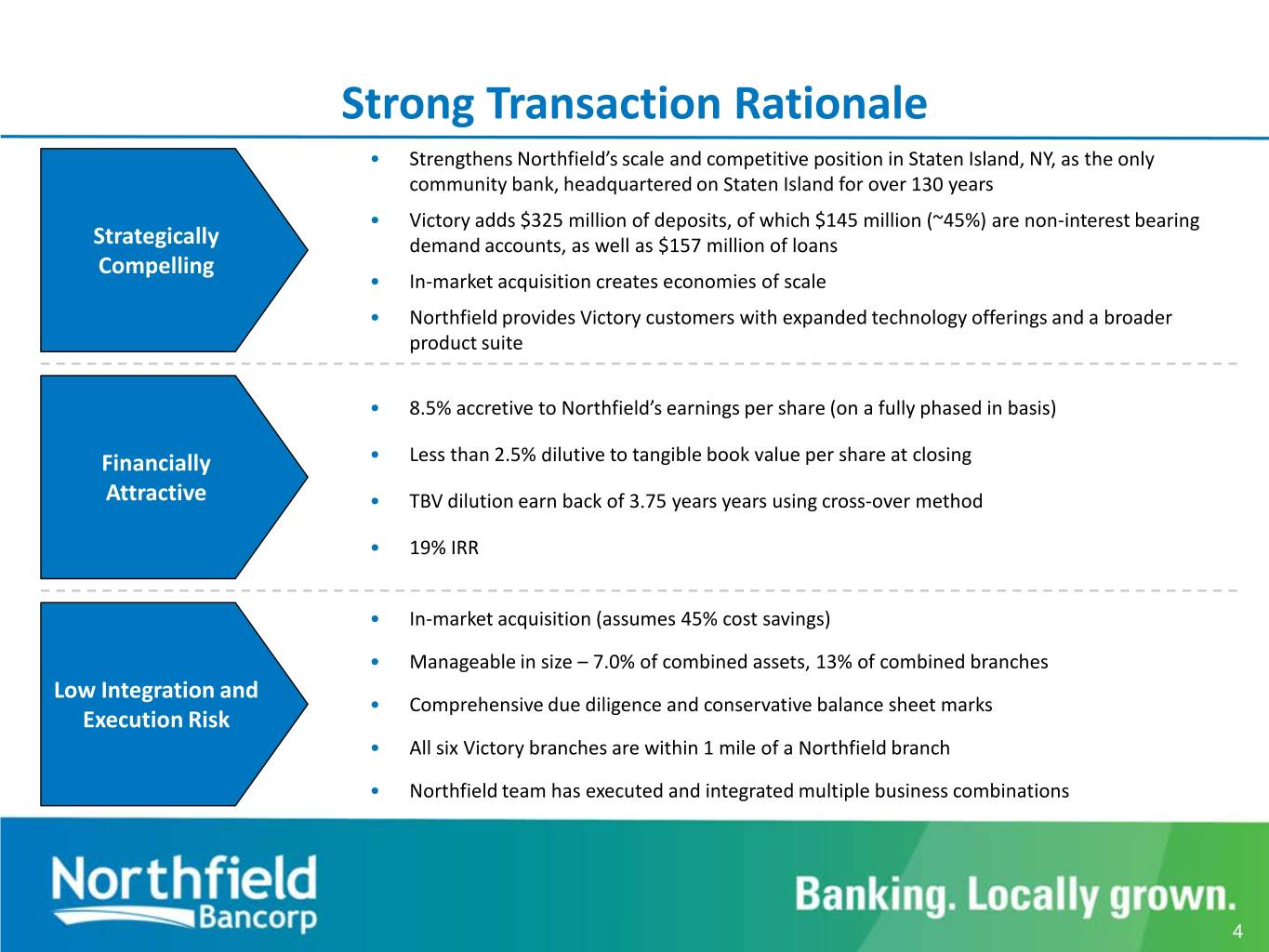

Strong Transaction Rationale • Strengthens Northfield’s scale and competitive position in Staten Island, NY, as the only community bank, headquartered on Staten Island for over 130 years • Victory adds $325 million of● ● deposits, of which $145 million (~45%) are non-interest bearing Strategically demand accounts, as well as $157 million of loans Compelling • In-market acquisition creates economies of scale • Northfield provides Victory customers with expanded technology offerings and a broader product suite • 8.5% accretive to Northfield’s earnings per share (on a fully phased in basis) Financially • Less than 2.5% dilutive to tangible book value per share at closing Attractive • TBV dilution earn back of 3.75 years years using cross-over method • 19% IRR • In-market acquisition (assumes 45% cost savings) • Manageable in size – 7.0% of combined assets, 13% of combined branches Low Integration and • Comprehensive due diligence and conservative balance sheet marks Execution Risk • All six Victory branches are within 1 mile of a Northfield branch • Northfield team has executed and integrated multiple business combinations 4

Transaction Summary Buyer • Northfield Bancorp, Inc. (NASDAQ: NFBK) ● ● Seller • VSB Bancorp, Inc. (OTCQX: VSBN) • $33.30 fixed price per share transaction value; subject to a 5% collar Transaction Value¹ • $62.9 million in aggregate transaction value • 100% Stock Consideration¹ • 1.9440 shares of NFBK common stock for each share of VSBN common stock Pro Forma Ownership • ~93% NFBK / ~7% VSBN • Advisory board established, Victory CEO retained, and Victory Chairman entering into Board/Management consulting agreement to maintain business continuity • VSBN shareholder approval and customary regulatory approvals Approvals & Closing • Expected closing second quarter 2020 (1) Based on NFBK 10-day average closing price stock price of $17.13 as of December 20, 2019. Aggregate deal value inclusive of options outstanding and RSUs. 5

Complementary Loan Portfolio & Low-Cost Deposits Loan Portfolio Composition¹ High Quality, Low-Cost Deposit Base 5 0. 0% $157 Million in Gross Loans as of September 30, 2019 47.5% 1.60% 46.0% 45.7% Other ● ● 44.8% Consumer 1.40% 4 5. 0% 0.5% 43.0% 43.5% 0.3% Multifamily 41.6% 0.6% 1.20% 4 0. 0% C&I 1-4 Family 1.00% 0.84% 0.87% 0.88% 13.2% 11.1% 0.80% 0.70% 0.70% 0.63% 3 5. 0% 0.60% 0.51% C&D 0.40% 3 0. 0% 12.8% 0.44% 0.46% 0.49% 0.20% 0.36% 0.39% 0.38% 0.29% 0.00% 2 5. 0% 2018Q1 2018Q2 2018Q3 2018Q4 2019Q1 2019Q2 2019Q3 Noninterest-Bearing Deposits/Deposits Cost of Interest Bearing Deposits CRE Cost of Deposits 61.4% • VSBN’s strong deposit base has maintained low cost of deposits despite the rate environment • Solid credit quality and strong credit metrics: • VSBN’s deposit base has been consistently composed of – NPA’s / Assets: 0.58% | NPL’s / Loans: 1.37% ~45% noninterest-bearing deposits, standing at 44.8% of total deposits as of September 30, 2019 • VSBN’s YTD yield on loans for the nine months ended September 30, 2019 is equal to 5.77% • VSBN provides liquidity with a 48.3% loan-to-deposit ratio as of September 30, 2019 (1) Loan composition data reflects Call Report loan data as of September 30, 2019. Source: S&P Global Market Intelligence. 6