Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Kearny Financial Corp. | d597525dex992.htm |

| EX-2.1 - EX-2.1 - Kearny Financial Corp. | d597525dex21.htm |

| 8-K - 8-K - Kearny Financial Corp. | d597525d8k.htm |

Acquisition of MSB Financial Corp. (MSBF) December 19, 2019 Craig Montanaro Keith Suchodolski Eric Heyer Chief Executive Officer Chief Financial Officer Chief Operating Officer Exhibit 99.1

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about (i) the benefits of the merger between Kearny Financial Corp. (“Kearny”) and MSB Financial Corp. (“MSBF”), including anticipated future results, cost savings and accretion to reported earnings that may be realized from the merger; (ii) Kearny’s and MSBF’s plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts; and (iii) other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” or words of similar meaning. Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from those in such statements. The following factors, among others, could cause actual results to differ materially from the anticipated results expressed in the forward-looking statements: the businesses of Kearny and MSBF may not be combined successfully, or such combination may take longer than expected; the cost savings from the merger may not be fully realized or may take longer than expected; operating costs, customer loss and business disruption following the merger may be greater than expected; governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger or otherwise; the stockholders of MSBF may fail to approve the merger; the interest rate environment may further compress margins and adversely affect new interest income; the risks associated with continued diversification of assets and adverse changes to credit quality; and difficulties associated with achieving expected future financial results. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Kearny’s and MSBF’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the Securities and Exchange Commission (the “SEC”) and available at the SEC’s Internet website (www.sec.gov). All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to Kearny or MSBF or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Except as required by law, Kearny and MSBF do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statement is made. Forward Looking Statements

Investors and stockholders are urged to carefully review and consider each of Kearny’s and MSBF’s public filings with the SEC, including, but not limited to, their Annual Reports on Form 10-K, their proxy statements, their Current Reports on Form 8-K and their Quarterly Reports on Form 10-Q. The documents filed by Kearny with the Securities and Exchange Commission (the “SEC”) may be obtained at the SEC’s Internet site (www.sec.gov). You will also be able to obtain these documents, free of charge, from Kearny at www.kearnybank.com under the tab “About” under “Investor Relations” or by requesting them in writing to Kearny Financial Corp., 120 Passaic Avenue, Fairfield, New Jersey 07004, Attention: Gail Corrigan, or from MSBF at www.millingtonbank.com under the tab “About Us” under “Investor Relations” or by requesting them in writing to MSB Financial Corp., 1902 Long Hill Rd., Millington, New Jersey 07946, Attention: Nancy Schmitz. In connection with the proposed merger, Kearny will file with the SEC a registration statement on Form S-4 that will include a proxy statement of MSBF and a prospectus of Kearny, as well as other relevant documents concerning the proposed merger. Investors and stockholders are urged to carefully read the entire registration statement and the proxy statement/prospectus regarding the proposed merger when they become available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. Copies of the registration statement and proxy statement/prospectus and the filings that will be incorporated by reference therein, as well as other filings containing information about Kearny and MSBF, when they become available, may be obtained at the SEC’s Internet site (www.sec.gov). Free copies of these documents may be obtained as described in the preceding paragraph. MSBF and Kearny and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Kearny and MSBF in connection with the proposed merger. Information about the directors and executive officers of Kearny is set forth in the proxy statement for the Kearny 2019 annual meeting of stockholders, as filed with the SEC on Schedule 14A on September 13, 2019. Information about the directors and executive officers of MSBF is set forth in the proxy statement for the MSBF 2019 annual meeting of stockholders, as filed with the SEC on Schedule 14A on April 18, 2019. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction and a description of their direct and indirect interests, by security holdings or otherwise, may be obtained by reading the proxy statement/prospectus and other relevant documents regarding the proposed merger to be filed with the SEC when they become available. Free copies of these documents may be obtained as described above. Additional Information About the Proposed Merger and Where to Find It This presentation is being made with respect to the proposed merger between Kearny and MSBF. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

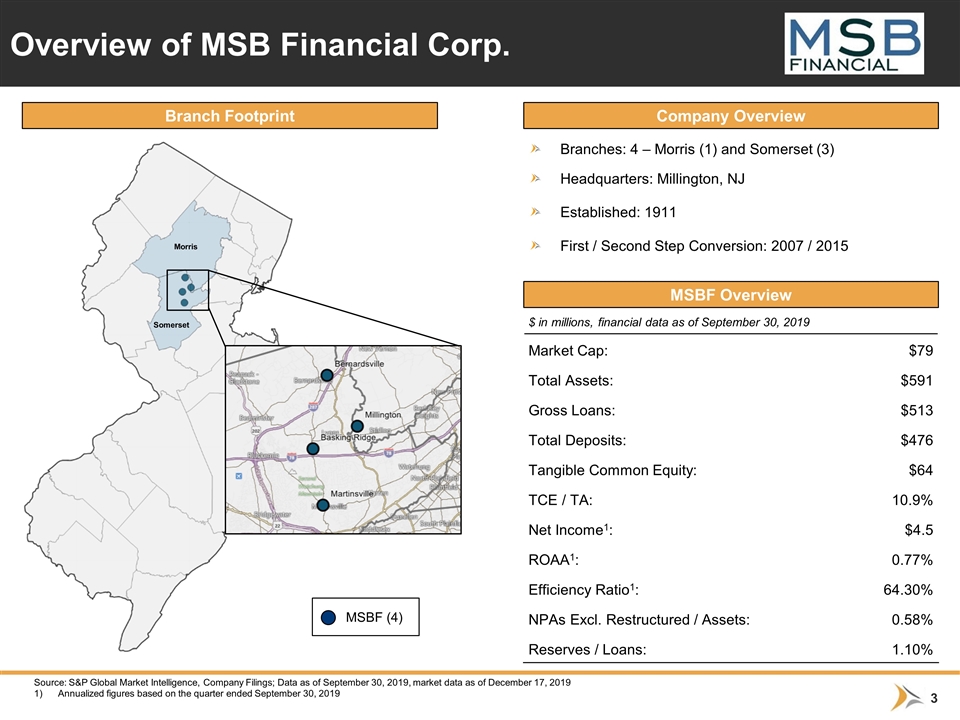

Branches: 4 – Morris (1) and Somerset (3) Headquarters: Millington, NJ Established: 1911 First / Second Step Conversion: 2007 / 2015 Overview of MSB Financial Corp. MSBF Overview $ in millions, financial data as of September 30, 2019 Market Cap: $79 Total Assets: $591 Gross Loans: $513 Total Deposits: $476 Tangible Common Equity: $64 TCE / TA: 10.9% Net Income1: $4.5 ROAA1: 0.77% Efficiency Ratio1: 64.30% NPAs Excl. Restructured / Assets: 0.58% Reserves / Loans: 1.10% Source: S&P Global Market Intelligence, Company Filings; Data as of September 30, 2019, market data as of December 17, 2019 Annualized figures based on the quarter ended September 30, 2019 Branch Footprint Company Overview MSBF (4) Morris Somerset

Low risk, natural westward expansion into economically attractive Morris and Somerset Counties Opportunities to grow existing MSBF relationships by leveraging Kearny’s platform of products and services Enhances Kearny’s loan and deposit mixes Improves Kearny’s standing as one of the largest New Jersey-based banks Transaction Highlights Transaction Rationale Low Risk Transaction Strong Transaction Economics Financially attractive transaction with significant cost savings, immediate earnings accretion, and minimal TBV dilution 11.3% accretive to EPS 1.6% dilutive to TBV TBV earnback of ~2.8 years (both crossover and earnings accretion methods) Leverages Kearny’s capital to improve returns Pro Forma ROAA: 0.74% Pro Forma TCE / TA: 13.4% Extension into familiar northern New Jersey markets where MSBF has been established for over 100 years Detailed due diligence completed, including extensive review of the loan portfolio

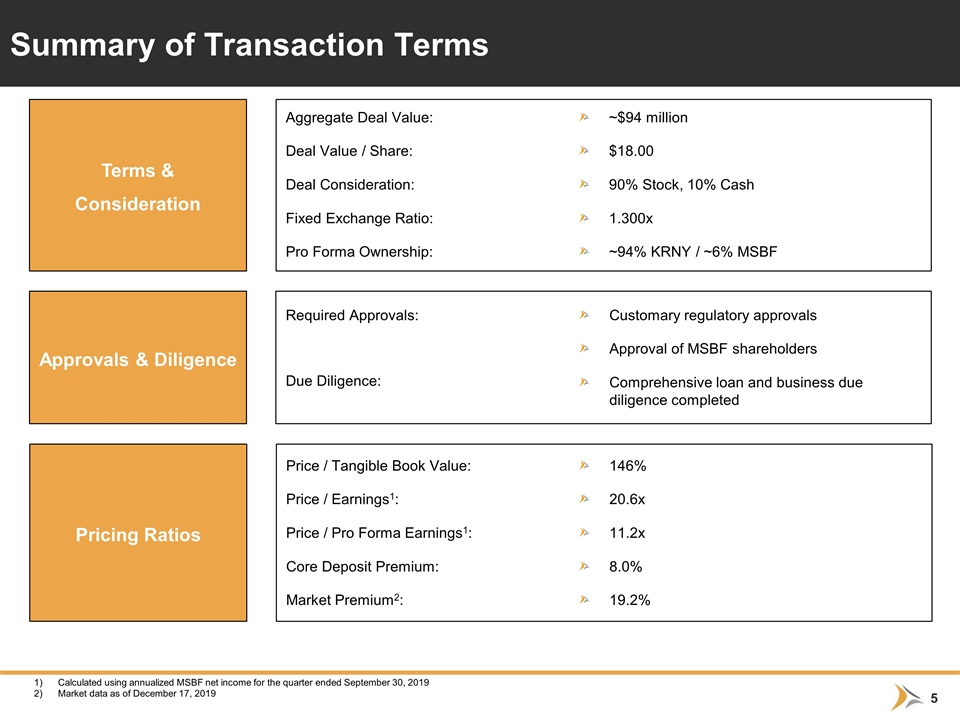

Summary of Transaction Terms Terms & Consideration Aggregate Deal Value: Deal Value / Share: Deal Consideration: Fixed Exchange Ratio: Pro Forma Ownership: ~$94 million $18.00 90% Stock, 10% Cash 1.300x ~94% KRNY / ~6% MSBF Pricing Ratios Price / Tangible Book Value: Price / Earnings1: Price / Pro Forma Earnings1: Core Deposit Premium: Market Premium2: 146% 20.6x 11.2x 8.0% 19.2% Approvals & Diligence Required Approvals: Due Diligence: Customary regulatory approvals Approval of MSBF shareholders Comprehensive loan and business due diligence completed Calculated using annualized MSBF net income for the quarter ended September 30, 2019 Market data as of December 17, 2019

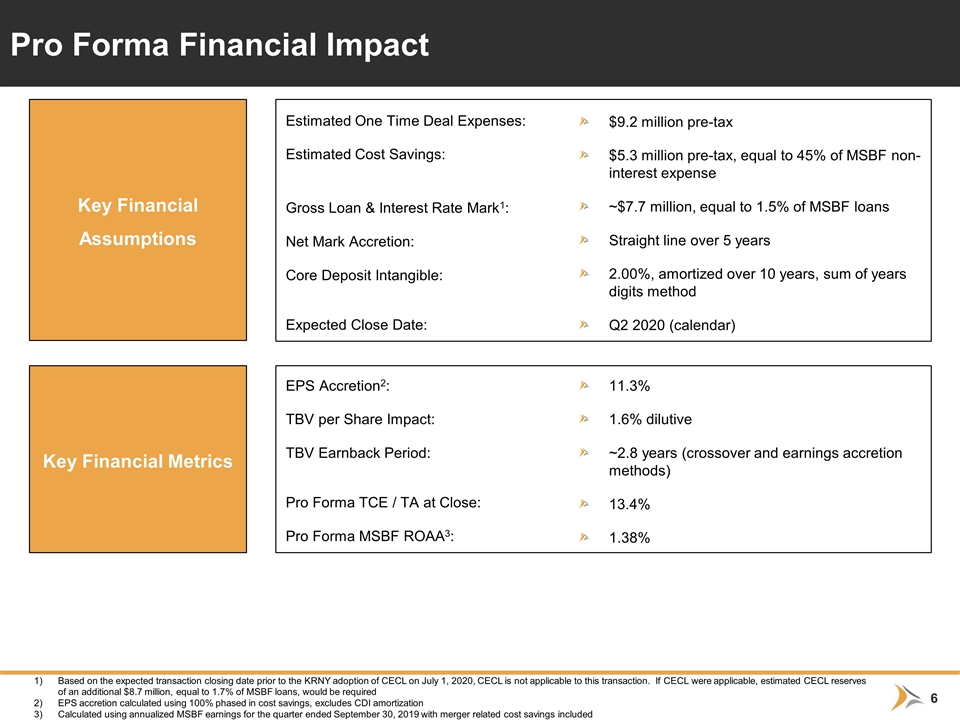

Pro Forma Financial Impact Key Financial Assumptions Estimated One Time Deal Expenses: Estimated Cost Savings: Gross Loan & Interest Rate Mark1: Net Mark Accretion: Core Deposit Intangible: Expected Close Date: Key Financial Metrics EPS Accretion2: TBV per Share Impact: TBV Earnback Period: Pro Forma TCE / TA at Close: Pro Forma MSBF ROAA3: $9.2 million pre-tax $5.3 million pre-tax, equal to 45% of MSBF non-interest expense ~$7.7 million, equal to 1.5% of MSBF loans Straight line over 5 years 2.00%, amortized over 10 years, sum of years digits method Q2 2020 (calendar) 11.3% 1.6% dilutive ~2.8 years (crossover and earnings accretion methods) 13.4% 1.38% Based on the expected transaction closing date prior to the KRNY adoption of CECL on July 1, 2020, CECL is not applicable to this transaction. If CECL were applicable, estimated CECL reserves of an additional $8.7 million, equal to 1.7% of MSBF loans, would be required EPS accretion calculated using 100% phased in cost savings, excludes CDI amortization Calculated using annualized MSBF earnings for the quarter ended September 30, 2019 with merger related cost savings included

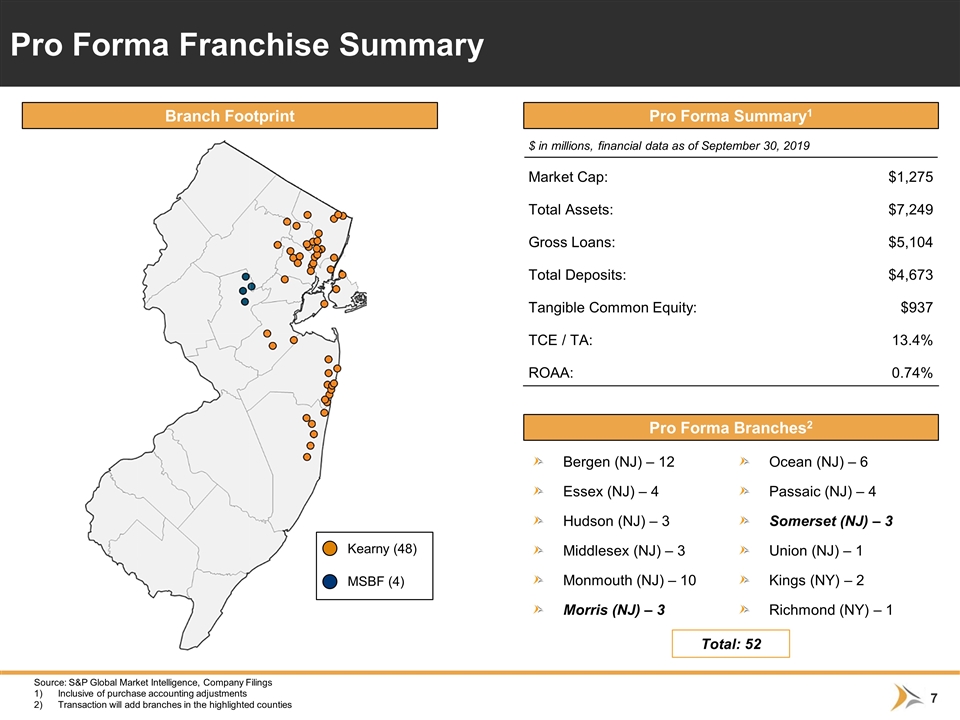

Pro Forma Franchise Summary Branch Footprint Pro Forma Summary1 $ in millions, financial data as of September 30, 2019 Market Cap: $1,275 Total Assets: $7,249 Gross Loans: $5,104 Total Deposits: $4,673 Tangible Common Equity: $937 TCE / TA: 13.4% ROAA: 0.74% Pro Forma Branches2 Bergen (NJ) – 12 Essex (NJ) – 4 Hudson (NJ) – 3 Middlesex (NJ) – 3 Monmouth (NJ) – 10 Morris (NJ) – 3 Ocean (NJ) – 6 Passaic (NJ) – 4 Somerset (NJ) – 3 Union (NJ) – 1 Kings (NY) – 2 Richmond (NY) – 1 Total: 52 Source: S&P Global Market Intelligence, Company Filings Inclusive of purchase accounting adjustments Transaction will add branches in the highlighted counties Kearny (48) MSBF (4)

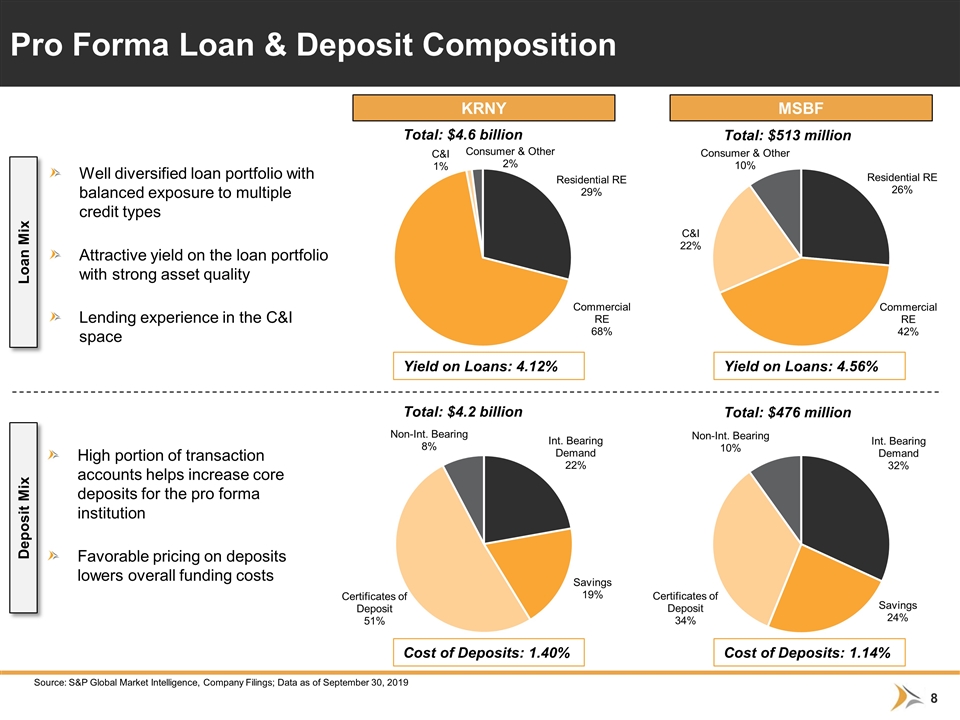

Pro Forma Loan & Deposit Composition KRNY MSBF Loan Mix Deposit Mix Total: $4.2 billion Total: $476 million Total: $4.6 billion Total: $513 million Well diversified loan portfolio with balanced exposure to multiple credit types Attractive yield on the loan portfolio with strong asset quality Lending experience in the C&I space High portion of transaction accounts helps increase core deposits for the pro forma institution Favorable pricing on deposits lowers overall funding costs Cost of Deposits: 1.40% Cost of Deposits: 1.14% Source: S&P Global Market Intelligence, Company Filings; Data as of September 30, 2019 Yield on Loans: 4.12% Yield on Loans: 4.56%

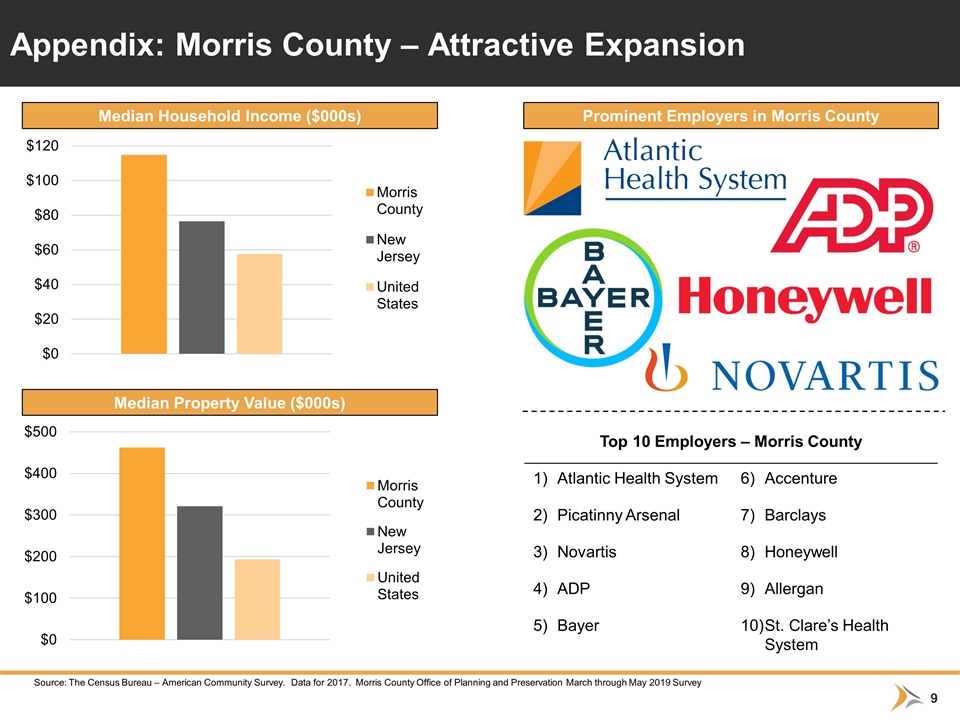

Appendix: Morris County – Attractive Expansion Source: The Census Bureau – American Community Survey. Data for 2017. Morris County Office of Planning and Preservation March through May 2019 Survey Median Household Income ($000s) Prominent Employers in Morris County Median Property Value ($000s) Top 10 Employers – Morris County Atlantic Health System Accenture Picatinny Arsenal Barclays Novartis Honeywell ADP Allergan Bayer St. Clare’s Health System

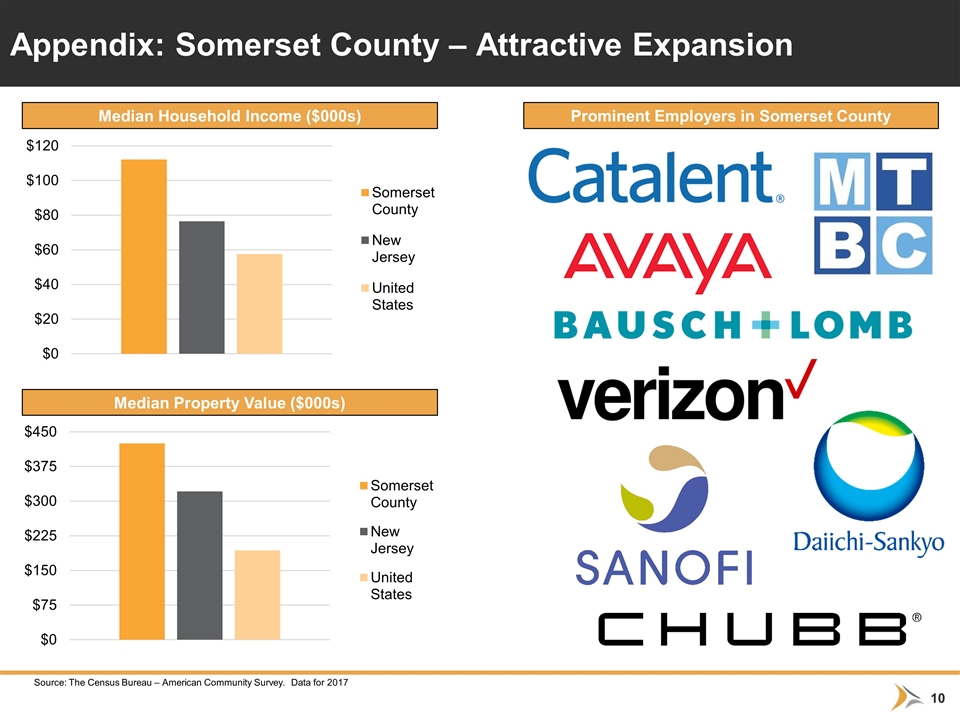

Appendix: Somerset County – Attractive Expansion Median Household Income ($000s) Prominent Employers in Somerset County Median Property Value ($000s) Source: The Census Bureau – American Community Survey. Data for 2017