Attached files

| file | filename |

|---|---|

| 8-K - Netcapital Inc. | f2svstr8k121719.htm |

valuesetters.com Investor Update December 18, 2019

valuesetters.com Forward - Looking Statements 2 This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of ValueSetters’ management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward - looking statements. Factors that could cause ValueSetters’ actual results to differ materially from those described in the forward - looking statements can be found in ValueSetters’ Quarterly Report on Form 10 - Q for the quarter ended October 31, 2019, which has been filed with the Securities and Exchange Commission and is available on ValueSetters’ website (https://valuesetters.com/sec - filings) and on the Securities and Exchange Commission’s website (www.sec.gov). ValueSetters does not undertake to update the forward - looking statements to reflect the impact of circumstances or events that may arise after the date of the forward - looking statements.

valuesetters.com Alignment of Interests with Shareholders Management is Paid in Stock • CEO controls 37% of shares out through direct and beneficial interest • CFO owns 5% of shares out • Together, management owns/controls 42% of shares out through direct and beneficial ownership • Management interests completely aligned with shareholders 3

valuesetters.com Success Management Delivers Results for Shareholders • Fourth consecutive quarter of profitability • Revenue increase of 943%, higher than preannouncement • Gross margin of 99.7% • Positive book value • Self - funded growth 4

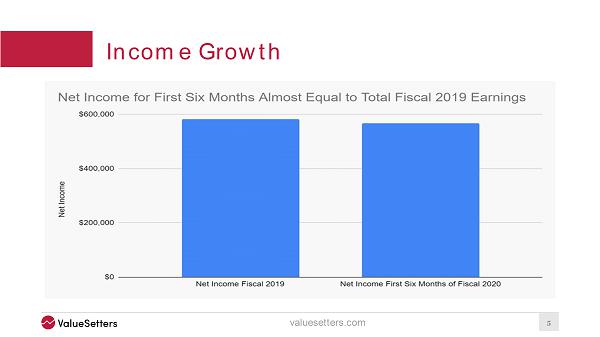

valuesetters.com Income Growth 5

valuesetters.com Growth in Shareholders Equity 6

valuesetters.com Team Experienced Team of Female Executives 7 Cecilia Lenk, Ph.D. CEO Ph.D., Harvard Angel Investor, Launchpad Venture Group Coreen Kraysler, CFA CFO S.M., MIT Sloan Former Morningstar 5 - star Rated Portfolio Manager Kathy Kraysler, CMO M.B.A., Yale Former Director of Audience Analytics at MIT

valuesetters.com Who We Are ValueSetters is a Boutique Advisory Firm • We work with companies at all stages to provide assistance with: 1) Raising capital through private market portals 2) Strategic advice 3) Technology consulting 8

valuesetters.com Business Model Fee - Based Revenue Model Plus Equity Stakes • Charge fixed fees for services provided • Take equity stakes in select technology start - ups, including: 9

valuesetters.com Portfolio Company Success KingsCrowd Showing Strength in Business Development • #1 ratings/analytics provider for online private capital markets • Announced acquisition of newchip aggregator platform • Increased investor community by tenfold, to 100,000+ 10

valuesetters.com Client Drivers Experience and Results Attract Clients • Professional investor experience provides unique capabilities ▪ Effective message crafting to all types of investors ▪ Deep network of potential shareholders • Experience in starting/selling/growing successful businesses • Political and economic development expertise • Marketing capabilities, including expert targeting and analytics 11

valuesetters.com Track Record Management Delivers Results for Clients • Established strong track record in marketing private, online capital offerings • Proven unique capabilities in targeted digital marketing to potential investors • Successfully completed multiple multi - million $ equity raises 12

valuesetters.com Income Statement Review 2Q Income Statement Showed Continued Improvement • 943% increase in revenues • 99.7% gross margin, a 12 point improvement • Net income of $542,451 • Positive operating leverage of 829 points 13

valuesetters.com Balance Sheet and Liquidity Review Balance Sheet Continued to Improve vs. F2019 • Increased cash balances by 63% • Grew investment balances by 101% • Reported positive shareholders equity for the first time • Achieved positive operating cash flow • No converts 14

valuesetters.com ValueSetters Pipeline Drivers • Established track record driving referrals • Potential clients taking notice of VSTR’s digital marketing and investor outreach success • Reciprocal referral agreements with Netcapital in place • Existing clients providing referrals to new customers • New verticals diversifying client mix 15

valuesetters.com Summary • Generated significant improvement in financial results • Assets now exceed liabilities, generating positive book value • Portfolio companies performing well • Expansion of consulting practice opens new markets • Expect further announcement regarding Logistics Tech in 3Q 16

valuesetters.com Coreen Kraysler, CFA ckraysler@valuesetters.com 781 - 925 - 1700