Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - KEMPHARM, INC | d850941dex991.htm |

| EX-10.5 - EX-10.5 - KEMPHARM, INC | d850941dex105.htm |

| EX-10.4 - EX-10.4 - KEMPHARM, INC | d850941dex104.htm |

| EX-10.3 - EX-10.3 - KEMPHARM, INC | d850941dex103.htm |

| EX-10.2 - EX-10.2 - KEMPHARM, INC | d850941dex102.htm |

| EX-10.1 - EX-10.1 - KEMPHARM, INC | d850941dex101.htm |

| EX-3.1 - EX-3.1 - KEMPHARM, INC | d850941dex31.htm |

| 8-K - FORM 8-K - KEMPHARM, INC | d850941d8k.htm |

December 18, 2019 December 2019 Debt Restructuring Exhibit 99.2

Cautionary Note Regarding Presentation Information This presentation contains forward-looking statements, including statements regarding the timing of the KP415 NDA filing, the probability of being accepted for review by the FDA, the potential label for KP415, the potential approval timing for KP415, the duration of our cash runway following the transactions described in this presentation, and our drug discovery collaboration with Deerfield. These statements involve substantial known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. The forward-looking statements in this presentation represent our views as of the date of this presentation. These and other risks concerning our business are described in additional detail in our Quarterly Report on Form 10-Q filed with the SEC on November 14, 2019, and our other Periodic and Current Reports filed with the SEC. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this presentation. Further, the information contained in this presentation speaks only as the date hereof. While we may elect to update the information in this presentation in the future, we disclaim any obligation to do so except to the extent required by applicable law. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

Travis Mickle, Ph.D. – President & Chief Executive Officer R. LaDuane Clifton, CPA – Chief Financial Officer, Secretary & Treasurer Gordon K. “Rusty” Johnson – Chief Business Officer Call Participants

Today’s Updates December 2019 Debt Restructuring Deerfield/KemPharm Drug Discovery Collaboration KP415 NDA Timeline Next Steps

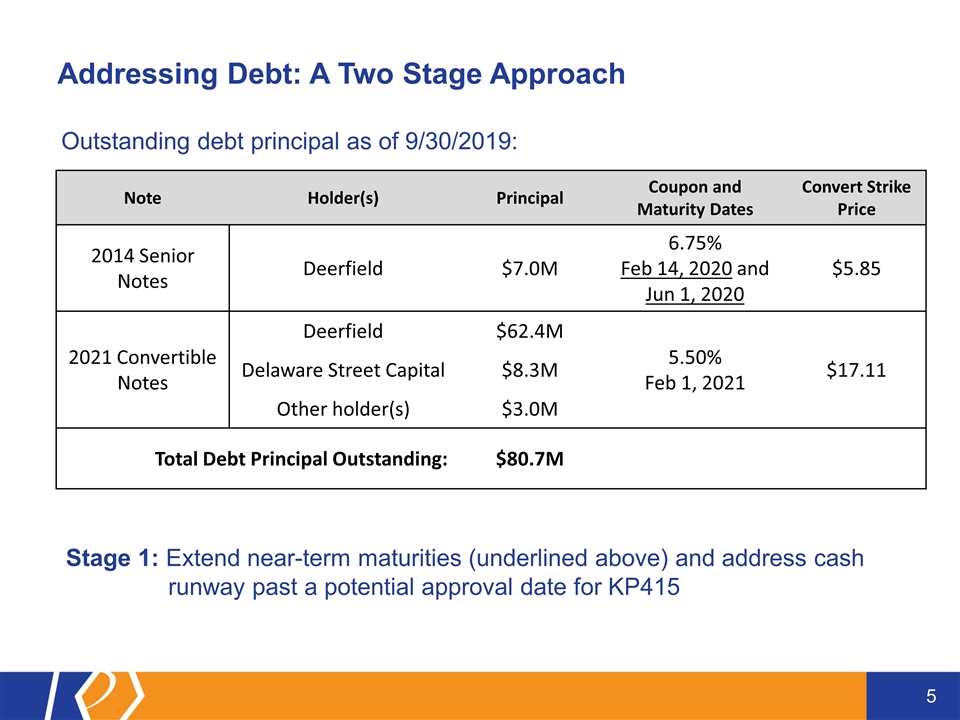

Addressing Debt: A Two Stage Approach Note Holder(s) Principal Coupon and Maturity Dates Convert Strike Price 2014 Senior Notes Deerfield $7.0M 6.75% Feb 14, 2020 and Jun 1, 2020 $5.85 2021 Convertible Notes Deerfield $62.4M 5.50% Feb 1, 2021 $17.11 Delaware Street Capital $8.3M Other holder(s) $3.0M Total Debt Principal Outstanding: $80.7M Stage 1: Extend near-term maturities (underlined above) and address cash runway past a potential approval date for KP415 Outstanding debt principal as of 9/30/2019:

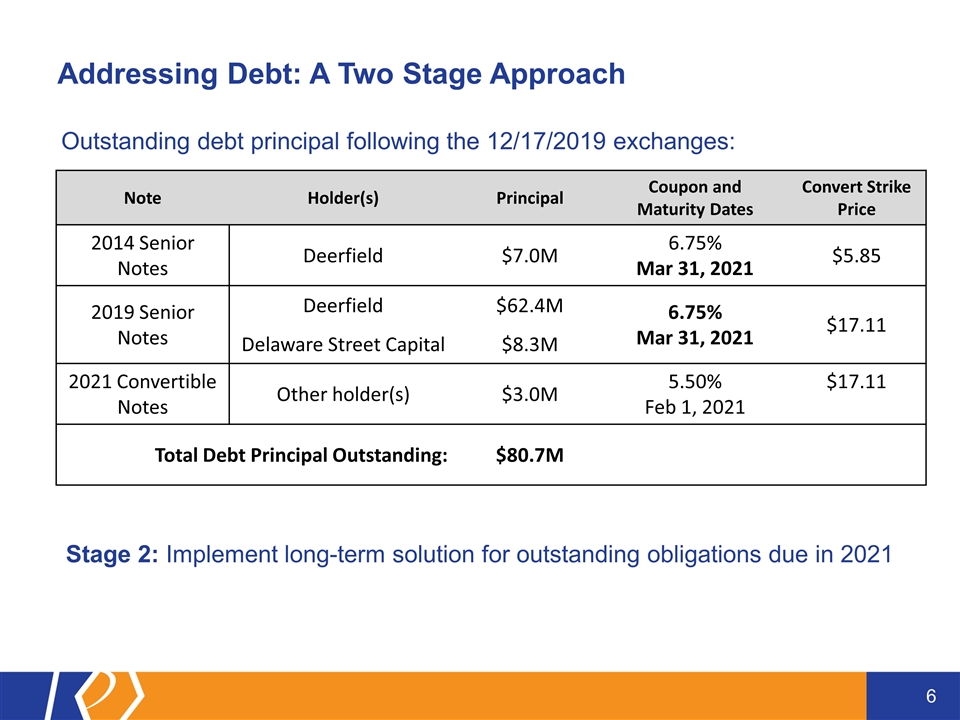

Addressing Debt: A Two Stage Approach Note Holder(s) Principal Coupon and Maturity Dates Convert Strike Price 2014 Senior Notes Deerfield $7.0M 6.75% Mar 31, 2021 $5.85 2019 Senior Notes Deerfield $62.4M 6.75% Mar 31, 2021 $17.11 Delaware Street Capital $8.3M 2021 Convertible Notes Other holder(s) $3.0M 5.50% Feb 1, 2021 $17.11 Total Debt Principal Outstanding: $80.7M Outstanding debt principal following the 12/17/2019 exchanges: Stage 2: Implement long-term solution for outstanding obligations due in 2021

Working with our two largest convertible note holders, we have pushed out the principal and interest payments due on $77.7M of our outstanding convertible notes until March 31, 2021 which is past the potential approval date of our first partnered ADHD product candidate, KP415 The maturity date of Deerfield’s 2014 Senior Note ($7.0M) originally due Feb 14, 2020 and Jun 1, 2020, has been extended to March 31, 2021 The 2021 Convertible Notes held by Deerfield ($62.4M) and Delaware Street Capital ($8.3M) have been exchanged into new 2019 Senior Notes (totaling $71.4M of principal and 50% of accrued interest as of Dec 18, 2019) with a coupon of 6.75%, maturity date extended to March 31, 2021, and interest added to principal through maturity Remainder of accrued interest on 2021 Convertible Notes paid at closing Following this exchange, only $3.0 million of the 2021 Convertible Notes remain outstanding As a result of this restructuring, $10.4 million is added back to our operating forecast and is expected to extend through March 31, 2021 Stage 1: December 2019 Debt Restructuring

The September 2019 Exchange Agreement has been amended as follows: Optional Exchange Price has been adjusted to the greater of (i) the 15-day VWAP as of date the option is used, or (ii) $0.60 (from $0.9494) Maximum common shares to be issued remains limited to 28.4M, but the limit on the amount of nominal debt that can be exchanged was removed For a maximum amount of potential dilution, increasing stock price reduces more debt To date, only $3M of debt has been exchanged; limited dilutive impact There are natural limitations which may limit the speed at which debt may be exchanged and converted into common shares: If principal is exchanged into preferred shares, then later converted to common shares, such conversion is subject to Deerfield’s limitation that common stock holdings cannot exceed 4.985% of KMPH common o/s KMPH’s ADTV further limits how much common stock can be sold Deerfield September 2019 Exchange Agreement

Deerfield, or its affiliates, may identify up to two compounds with applications for new disease indications, and KemPharm will utilize its proprietary technology to potentially discover acceptable new product candidates for development Potentially create new prodrugs designed to: Improve profile of drug candidate Generate long-lived composition-of-matter patents Address unmet patient needs If the discovery effort is successful, KemPharm and Deerfield, or its affiliate, may further collaborate to develop the product candidate subject to mutually agreeable terms and conditions Deerfield – KemPharm Drug Discovery Collaboration

KP415 NDA Timelines and Partnership Update Review of every NDA section is nearing completion Mutual goal for both KemPharm and GPC is to file the KP415 NDA ASAP We continue to believe that the two primary goals of the NDA submission should be (i) achieving the highest probability of NDA acceptance for review, and (ii) approval with the best possible label Current plan with GPC remains to file KP415 NDA around January 2020 Timing ultimately decided by GPC Commercial planning and preparations are well underway KemPharm managing commercial validation and manufacturing Expect to update our partner’s commercial activities when possible

Next Steps Maximize the value of our license agreements for both KP415/KP484 and APADAZ® GPC optional product candidates: KP879 and KP922 APADAZ now available File the KP415 NDA as soon as possible Continue supporting commercial launch preparation for KP415 If requested, initiate work with Deerfield on potential prodrug discovery programs Continue to work with the Company’s financial advisors to address the debt in its entirety Stage 1 complete Stage 2 underway