Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - FIRST BANCSHARES INC /MS/ | tm1926495d1_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - FIRST BANCSHARES INC /MS/ | tm1926495d1_ex2-1.htm |

| 8-K - FORM 8-K - FIRST BANCSHARES INC /MS/ | tm1926495d1_8k.htm |

Exhibit 99.2

December 18, 2019 Acquisition of

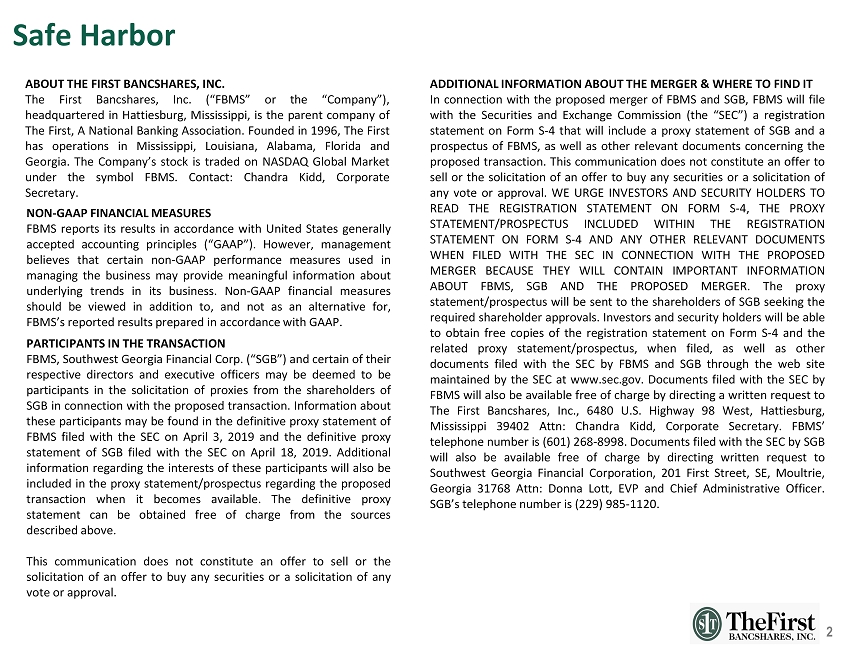

2 Safe Harbor ABOUT THE FIRST BANCSHARES, INC . The First Bancshares, Inc . (“FBMS” or the “Company”), headquartered in Hattiesburg, Mississippi, is the parent company of The First, A National Banking Association . Founded in 1996 , The First has operations in Mississippi, Louisiana, Alabama, Florida and Georgia . The Company’s stock is traded on NASDAQ Global Market under the symbol FBMS . Contact : Chandra Kidd, Corporate Secretary . NON - GAAP FINANCIAL MEASURES FBMS reports its results in accordance with United States generally accepted accounting principles (“GAAP”) . However, management believes that certain non - GAAP performance measures used in managing the business may provide meaningful information about underlying trends in its business . Non - GAAP financial measures should be viewed in addition to, and not as an alternative for, FBMS’s reported results prepared in accordance with GAAP . ADDITIONAL INFORMATION ABOUT THE MERGER & WHERE TO FIND IT In connection with the proposed merger of FBMS and SGB, FBMS will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S - 4 that will include a proxy statement of SGB and a prospectus of FBMS, as well as other relevant documents concerning the proposed transaction . This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval . WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S - 4 , THE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S - 4 AND ANY OTHER RELEVANT DOCUMENTS WHEN FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT FBMS, SGB AND THE PROPOSED MERGER . The proxy statement/prospectus will be sent to the shareholders of SGB seeking the required shareholder approvals . Investors and security holders will be able to obtain free copies of the registration statement on Form S - 4 and the related proxy statement/prospectus, when filed, as well as other documents filed with the SEC by FBMS and SGB through the web site maintained by the SEC at www . sec . gov . Documents filed with the SEC by FBMS will also be available free of charge by directing a written request to The First Bancshares, Inc . , 6480 U . S . Highway 98 West, Hattiesburg, Mississippi 39402 Attn : Chandra Kidd, Corporate Secretary . FBMS’ telephone number is ( 601 ) 268 - 8998 . D ocuments filed with the SEC by SGB will also be available free of charge by directing written request to Southwest Georgia Financial Corporation, 201 First Street, SE, Moultrie, Georgia 31768 Attn : Donna Lott, EVP and Chief Administrative Officer . SGB’s telephone number is ( 229 ) 985 - 1120 . PARTICIPANTS IN THE TRANSACTION FBMS , Southwest Georgia Financial Corp . (“SGB”) and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of SGB in connection with the proposed transaction . Information about these participants may be found in the definitive proxy statement of FBMS filed with the SEC on April 3 , 2019 and the definitive proxy statement of SGB filed with the SEC on April 18 , 2019 . Additional information regarding the interests of these participants will also be included in the proxy statement/prospectus regarding the proposed transaction when it becomes available . The definitive proxy statement can be obtained free of charge from the sources described above . This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval .

3 Caution Regarding Forward Looking Statements This presentation contains “forward - looking statements” as defined in the Private Securities Litigation Reform Act of 1995 , and is intended to be protected by the safe harbor provided by the same . These statements are subject to numerous risks and uncertainties . These risks and uncertainties include, but are not limited to, the following : competitive pressures among financial institutions increasing significantly ; economic conditions, either nationally or locally, in areas in which FBMS conducts operations being less favorable than expected ; legislation or regulatory changes which adversely affect the ability of the consolidated company to conduct business combinations or new operations ; and risks related to the proposed acquisition of SGB including the risk that the proposed transaction does not close when expected or at all because required regulatory or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all, the terms of the proposed transaction may need to be modified to satisfy such approvals or conditions, and the risk that anticipated benefits from the proposed transaction are not realized in the time frame anticipated or at all as a result of changes in general economic and market conditions or the inaccuracy of our transaction assumptions . For additional information concerning factors that could cause actual conditions, events or results to materially differ from those described in the forward - looking statements, please refer to the factors set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in FBMS’s Annual Report on Form 10 - K for the year ended December 31 , 2018 , which is available online at www . sec . gov . No assurances can be given that any of the events anticipated by the forward - looking statements will occur, or if any of them do so, what impact they will have on the results of operations or financial condition of FBMS or SGB . FBMS disclaims any obligation to update any factors or to announce publicly the result of revisions to any forward - looking statements included herein to reflect future events or developments, except to the extent required by law .

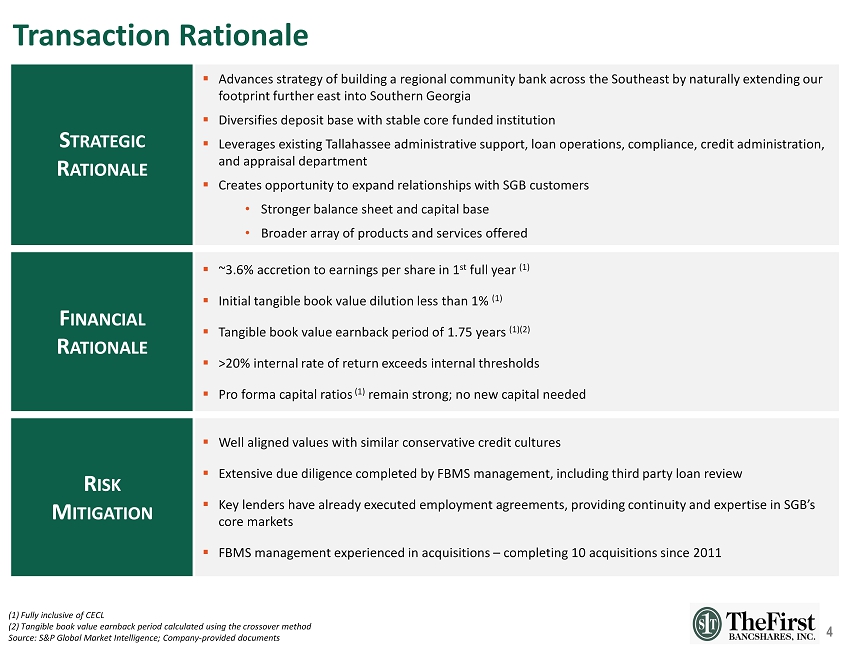

4 (1) F ully inclusive of CECL (2) Tangible book value earnback period calculated using the crossover method Source : S&P Global Market Intelligence; Company - provided documents Transaction Rationale S TRATEGIC R ATIONALE ▪ Advances strategy of building a regional community bank across the Southeast by naturally extending our footprint further east into Southern Georgia ▪ Diversifies deposit base with stable core funded institution ▪ Leverages existing Tallahassee administrative support, loan operations, compliance, credit administration, and appraisal department ▪ Creates opportunity to expand relationships with SGB customers • Stronger balance sheet and capital base • Broader array of products and services offered F INANCIAL R ATIONALE ▪ ~3.6% accretion to earnings per share in 1 st full year (1) ▪ Initial tangible book value dilution less than 1% (1) ▪ Tangible book value earnback period of 1.75 years (1)(2) ▪ >20% internal rate of return exceeds internal thresholds ▪ Pro forma capital ratios (1) remain strong; no new capital needed R ISK M ITIGATION ▪ Well aligned values with similar conservative credit cultures ▪ Extensive due diligence completed by FBMS management, including third party loan review ▪ Key lenders have already executed employment agreements, providing continuity and expertise in SGB’s core markets ▪ FBMS management experienced in acquisitions – completing 10 acquisitions since 2011

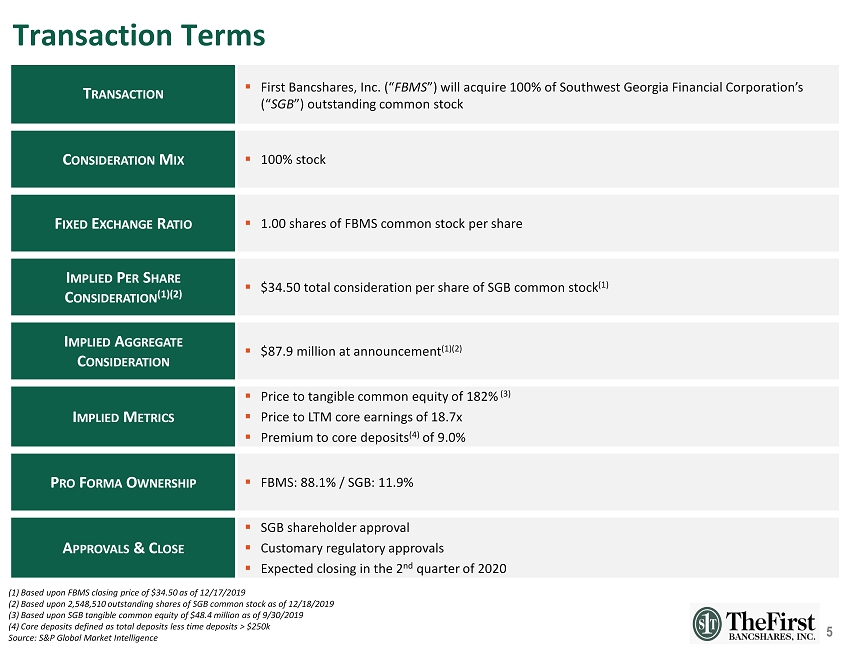

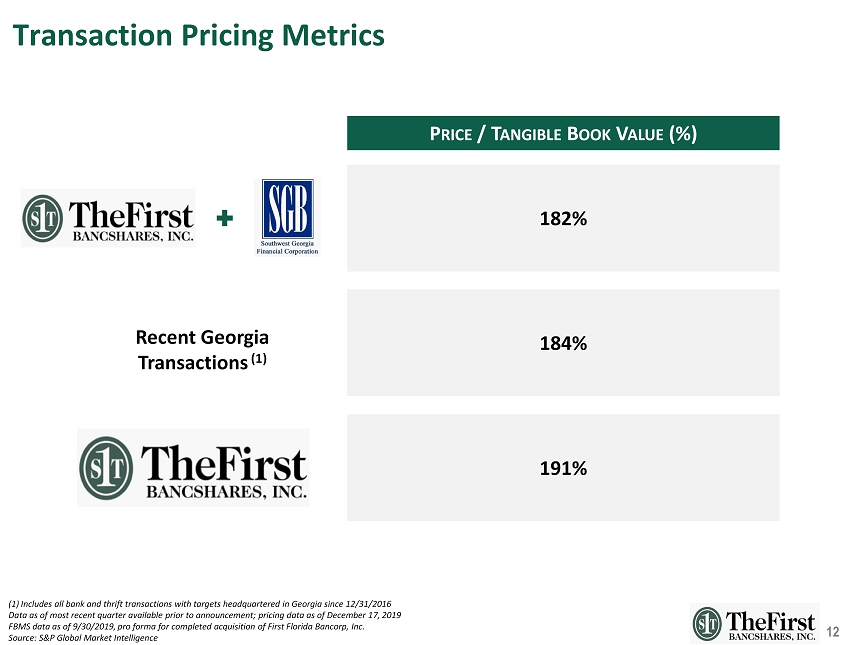

5 (1) Based upon FBMS closing price of $34.50 as of 12/17/2019 (2) Based upon 2,548,510 outstanding shares of SGB common stock as of 12/18/2019 (3) Based upon SGB tangible common equity of $48.4 million as of 9/30/2019 (4) Core deposits defined as total deposits less time deposits > $250k Source: S&P Global Market Intelligence Transaction Terms T RANSACTION ▪ First Bancshares, Inc. (“ FBMS ”) will acquire 100% of Southwest Georgia Financial Corporation’s (“ SGB ”) outstanding common stock C ONSIDERATION M IX ▪ 100% stock F IXED E XCHANGE R ATIO ▪ 1.00 shares of FBMS common stock per share I MPLIED P ER S HARE C ONSIDERATION (1)(2) ▪ $34.50 total consideration per share of SGB common stock (1) I MPLIED A GGREGATE C ONSIDERATION ▪ $87.9 million at announcement (1)(2) I MPLIED M ETRICS ▪ Price to tangible common equity of 182% (3) ▪ Price to LTM core earnings of 18.7x ▪ Premium to core deposits (4) of 9.0% P RO F ORMA O WNERSHIP ▪ FBMS: 88.1% / SGB: 11.9% A PPROVALS & C LOSE ▪ SGB shareholder approval ▪ Customary regulatory approvals ▪ Expected closing in the 2 nd quarter of 2020

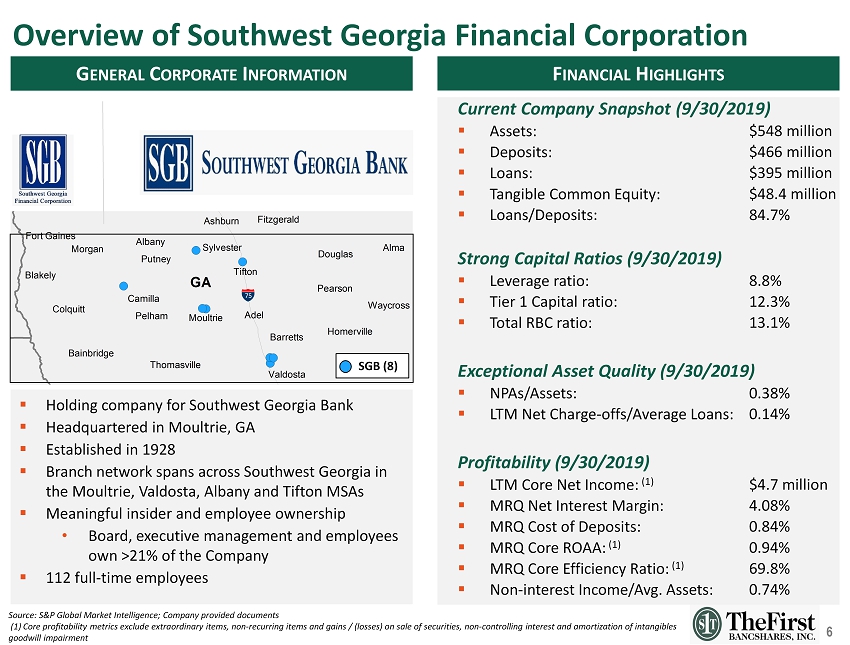

6 $548 million $466 million $395 million $48.4 million 84.7% 8.8% 12.3% 13.1% 0.38% 0.14% $ 4 .7 million 4.08% 0.84% 0 .94% 69.8% 0.74% Current Company Snapshot (9/30/2019) ▪ Assets : ▪ Deposits: ▪ Loans : ▪ Tangible Common Equity: ▪ Loans/Deposits: Strong Capital Ratios ( 9 /30/2019) ▪ Leverage ratio: ▪ Tier 1 Capital ratio : ▪ Total RBC ratio: Exceptional Asset Quality (9/30/2019) ▪ NPAs/Assets: ▪ LTM Net Charge - offs/Average Loans: Profitability (9/30/2019) ▪ LTM Core Net Income : (1) ▪ MRQ Net Interest Margin : ▪ MRQ Cost of Deposits: ▪ MRQ Core ROAA: (1) ▪ MRQ Core Efficiency Ratio: (1) ▪ Non - interest Income/Avg. Assets: ▪ Holding company for Southwest Georgia Bank ▪ Headquartered in Moultrie, GA ▪ Established in 1928 ▪ Branch network spans across Southwest Georgia in the Moultrie, Valdosta, Albany and Tifton MSAs ▪ Meaningful insider and employee ownership • Board, executive management and employees own >21% of the Company ▪ 112 full - time employees GA Valdosta Barretts Fort Gaines Tifton Waycross Alma Moultrie Sylvester Camilla Blakely Colquitt Morgan Bainbridge Thomasville Pelham Putney Albany Adel Pearson Douglas Homerville Ashburn Fitzgerald Source : S&P Global Market Intelligence; Company provided documents (1) Core profitability metrics exclude extraordinary items, non - recurring items and gains / (losses) on sale of securities, non - controlling interest and amortization of intangibles goodwill impairment Overview of Southwest Georgia Financial Corporation G ENERAL C ORPORATE I NFORMATION F INANCIAL H IGHLIGHTS SGB ( 8 ) 75

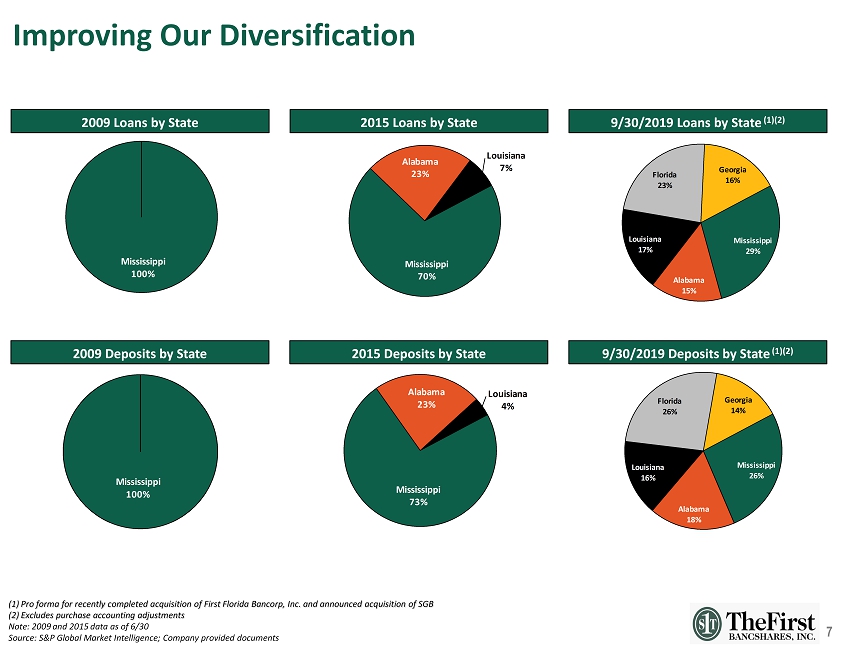

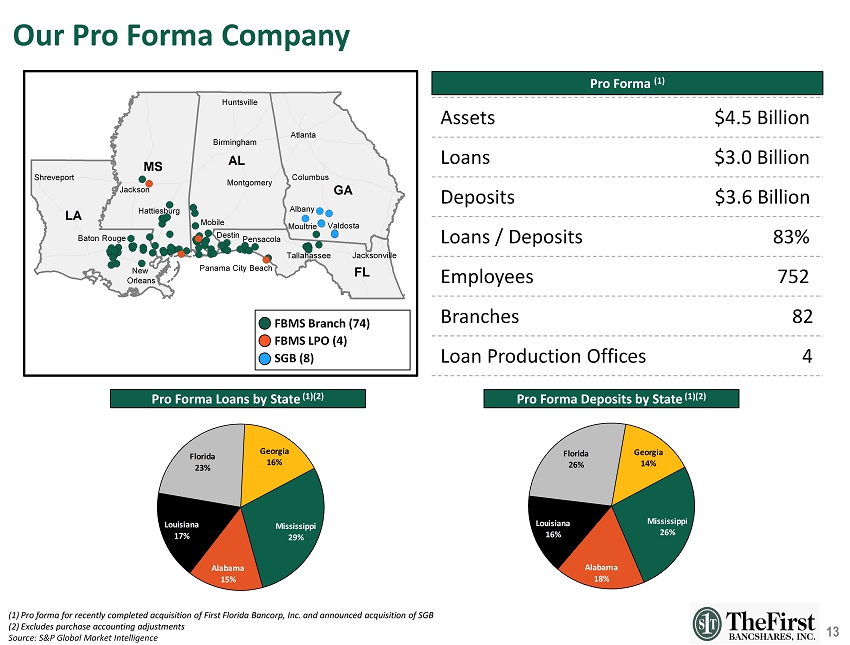

7 (1) Pro forma for recently completed acquisition of First Florida Bancorp, Inc. and announced acquisition of SGB (2) Excludes purchase accounting adjustments Note: 2009 and 2015 data as of 6/30 Source : S&P Global Market Intelligence; Company provided documents Improving Our Diversification Mississippi 70% Alabama 23% Louisiana 7% 2015 Deposits by State 9/30/2019 Deposits by State (1)(2) 2015 Loans by State 9 /30/2019 Loans by State (1)(2) 2009 Loans by State 2009 Deposits by State Mississippi 73% Alabama 23% Louisiana 4% Mississippi 29% Alabama 15% Louisiana 17% Florida 23% Georgia 16% Mississippi 26% Alabama 18% Louisiana 16% Florida 26% Georgia 14% Mississippi 100% Mississippi 100%

8 Summary of Our Due Diligence x Experienced in successfully executing and integrating M&A transactions ▪ FBMS management has successfully executed multiple M&A transactions in their recent history ▪ SGB and FBMS use the same core software platform Jack Henry Silverlake ▪ Increases the probability of a smooth integration process for employees and customers x Extensive credit review ▪ Reviewed loans in all product lines, with particular focus on commercial real estate ▪ Analyzed 100% of classified loans and 100% of loans with balances over $1.0 million ▪ In total, approximately 50% of loans by book balance of Southwest Georgia Bank were reviewed x Comprehensive operational due diligence performed ▪ Detailed review of business plans, budgets, credit processes, among other aspects of the businesses ▪ In depth evaluation of personnel at both companies to build the most efficient team for the combined company

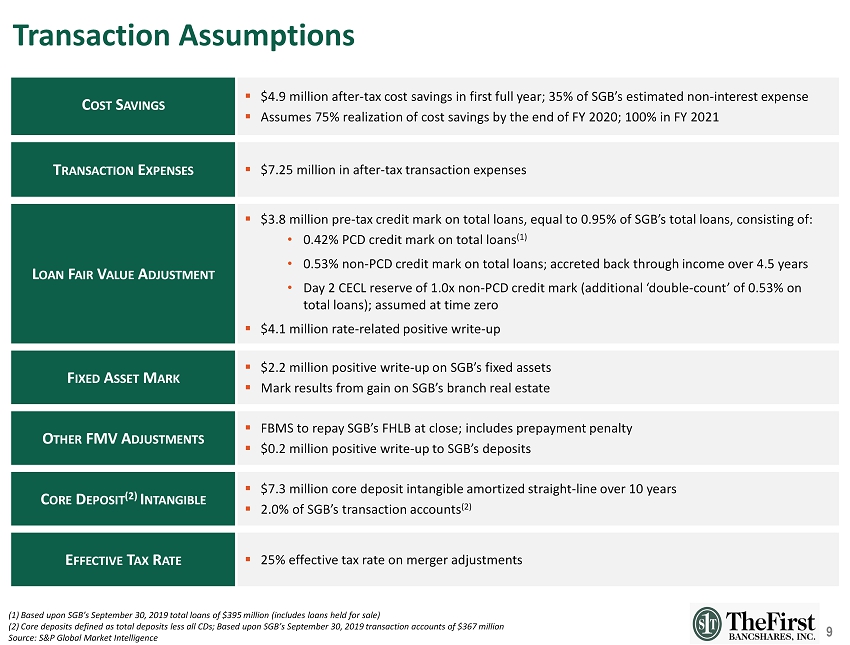

9 (1) Based upon SGB’s September 30, 2019 total loans of $395 million (includes loans held for sale) (2) Core deposits defined as total deposits less all CDs; Based upon SGB’s September 30, 2019 transaction accounts of $367 mi lli on Source: S&P Global Market Intelligence Transaction Assumptions C OST S AVINGS ▪ $4.9 million after - tax cost savings in first full year; 35% of SGB ’s estimated non - interest expense ▪ Assumes 75% realization of cost savings by the end of FY 2020; 100% in FY 2021 T RANSACTION E XPENSES ▪ $7.25 million in after - tax transaction expenses L OAN F AIR V ALUE A DJUSTMENT ▪ $3.8 million pre - tax credit mark on total loans, equal to 0.95% of SGB’s total loans, consisting of: • 0.42% PCD credit mark on total loans (1) • 0.53% non - PCD credit mark on total loans; accreted back through income over 4.5 years • Day 2 CECL reserve of 1.0x non - PCD credit mark (additional ‘double - count’ of 0.53% on total loans); assumed at time zero ▪ $4.1 million rate - related positive write - up F IXED A SSET M ARK ▪ $2.2 million positive write - up on SGB’s fixed assets ▪ Mark results from gain on SGB’s branch real estate O THER FMV A DJUSTMENTS ▪ FBMS to repay SGB’s FHLB at close; includes prepayment penalty ▪ $0.2 million positive write - up to SGB’s deposits C ORE D EPOSIT (2) I NTANGIBLE ▪ $7.3 million core deposit intangible amortized straight - line over 10 years ▪ 2.0% of SGB’s transaction accounts (2) E FFECTIVE T AX R ATE ▪ 25% effective tax rate on merger adjustments

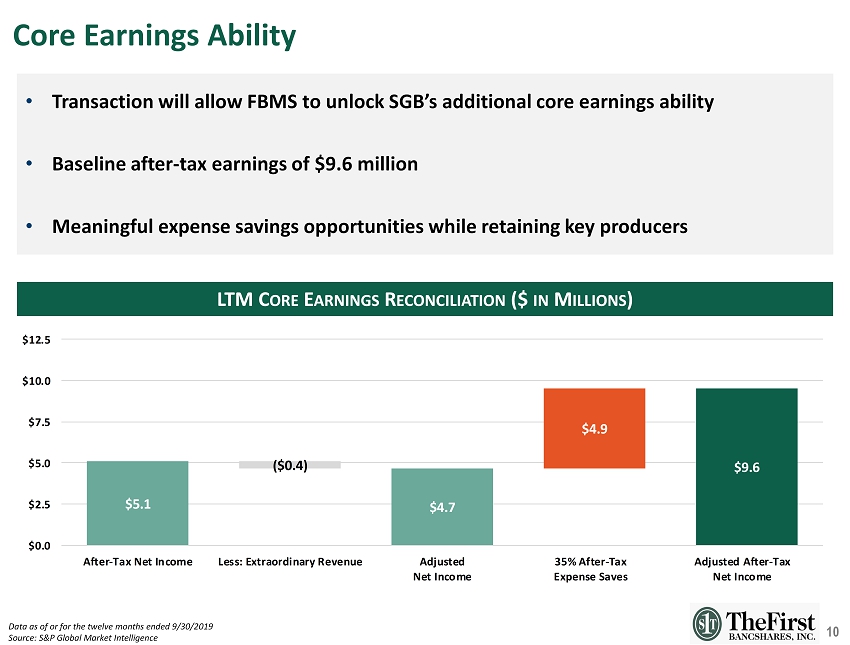

10 • Transaction will allow FBMS to unlock SGB’s additional core earnings ability • Baseline after - tax earnings of $9.6 million • Meaningful expense savings opportunities while retaining key producers Data as of or for the twelve months ended 9/30/2019 Source : S&P Global Market Intelligence Core Earnings Ability $5.1 $4.7 $9.6 ($0.4) $4.9 $0.0 $2.5 $5.0 $7.5 $10.0 $12.5 After-Tax Net Income Less: Extraordinary Revenue Adjusted Net Income 35% After-Tax Expense Saves Adjusted After-Tax Net Income LTM C ORE E ARNINGS R ECONCILIATION ($ IN M ILLIONS )

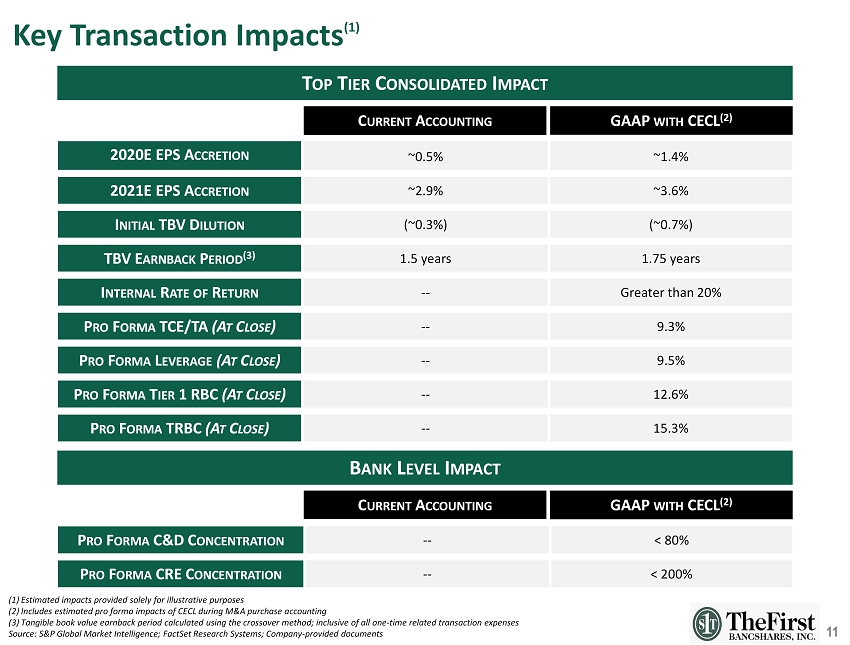

11 Key Transaction Impacts (1) (1) Estimated impacts provided solely for illustrative purposes (2) Includes estimated pro forma impacts of CECL during M&A purchase accounting (3) Tangible book value earn back period calculated using the crossover method; inclusive of all one - time related transaction expenses Source : S&P Global Market Intelligence; FactSet Research Systems; Company - provided documents 2020E EPS A CCRETION ~0.5% ~1.4% 2021E EPS A CCRETION ~2.9% ~3.6% I NITIAL TBV D ILUTION (~0.3%) (~0.7%) TBV E ARNBACK P ERIOD (3) 1.5 years 1.75 years I NTERNAL R ATE OF R ETURN -- Greater than 20% P RO F ORMA TCE/TA (A T C LOSE ) -- 9.3% P RO F ORMA L EVERAGE (A T C LOSE ) -- 9.5% P RO F ORMA T IER 1 RBC (A T C LOSE ) -- 12.6% P RO F ORMA TRBC (A T C LOSE ) -- 15.3% P RO F ORMA C&D C ONCENTRATION -- < 80% P RO F ORMA CRE C ONCENTRATION -- < 200% T OP T IER C ONSOLIDATED I MPACT B ANK L EVEL I MPACT C URRENT A CCOUNTING GAAP WITH CECL (2) GAAP WITH CECL (2) C URRENT A CCOUNTING

12 (1) Includes all bank and thrift transactions with targets headquartered in Georgia since 12/31/2016 Data as of most recent quarter available prior to announcement; pricing data as of December 17, 2019 FBMS data as of 9/30/2019, pro forma for completed acquisition of First Florida Bancorp, Inc. Source: S&P Global Market Intelligence Transaction Pricing Metrics 182% P RICE / T ANGIBLE B OOK V ALUE (%) 184% 191% Recent Georgia Transactions (1)

13 AL FL GA LA MS Employees 752 Loans / Deposits 83% Loan Production Offices 4 Assets $4.5 Billion Loans $3.0 Billion Deposits $3.6 Billion Branches 82 (1) Pro forma for recently completed acquisition of First Florida Bancorp, Inc. and announced acquisition of SGB (2) Excludes purchase accounting adjustments Source: S&P Global Market Intelligence Our Pro Forma Company Pro Forma (1) FBMS Branch (74) SGB ( 8 ) FBMS LPO (4) Albany Hattiesburg Valdosta Panama City Beach Moultrie Pro Forma Loans by State (1)(2) Pro Forma Deposits by State (1)(2) Mississippi 26% Alabama 18% Louisiana 16% Florida 26% Georgia 14% Mississippi 29% Alabama 15% Louisiana 17% Florida 23% Georgia 16% Tallahassee Destin Pensacola New Orleans Baton Rouge Shreveport Jackson Huntsville Birmingham Montgomery Mobile Atlanta Columbus Jacksonville

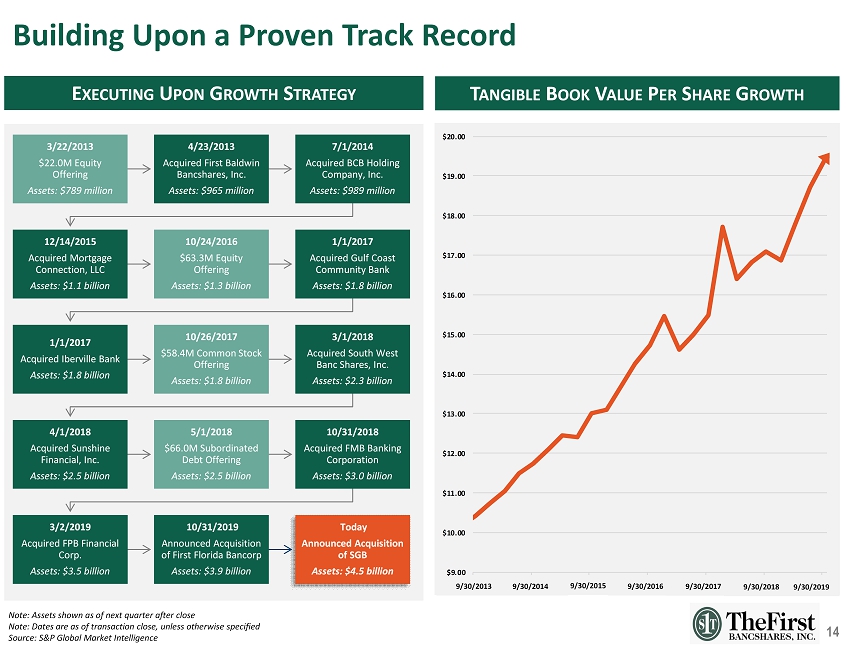

14 $9.00 $10.00 $11.00 $12.00 $13.00 $14.00 $15.00 $16.00 $17.00 $18.00 $19.00 $20.00 9/1/2013 9/1/2014 9/1/2015 9/1/2016 9/1/2017 9/1/2018 9/1/2019 Note: Assets shown as of next quarter after close Note: Dates are as of transaction close, unless otherwise specified Source: S&P Global Market Intelligence Building Upon a Proven Track Record 3/22/2013 $22.0M Equity Offering Assets: $789 million 4/23/2013 Acquired First Baldwin Bancshares, Inc. Assets: $965 million 7/1/2014 Acquired BCB Holding Company, Inc. Assets: $989 million 12/14/2015 Acquired Mortgage Connection, LLC Assets: $1.1 billion 10/24/2016 $63.3M Equity Offering Assets: $1.3 billion 1/1/2017 Acquired Gulf Coast Community Bank Assets: $1.8 billion 1/1/2017 Acquired Iberville Bank Assets: $1.8 billion 10/26/2017 $58.4M Common Stock Offering Assets: $1.8 billion 3/1/2018 Acquired South West Banc Shares, Inc. Assets: $2.3 billion 4/1/2018 Acquired Sunshine Financial, Inc. Assets: $2.5 billion 5/1/2018 $66.0M Subordinated Debt Offering Assets: $2.5 billion 10/31/2018 Acquired FMB Banking Corporation Assets: $3.0 billion 3/2/2019 Acquired FPB Financial Corp. Assets: $3.5 billion 10/31/2019 Announced Acquisition of First Florida Bancorp Assets: $3.9 billion Today Announced Acquisition of SGB Assets: $4.5 billion E XECUTING U PON G ROWTH S TRATEGY T ANGIBLE B OOK V ALUE P ER S HARE G ROWTH 9/30/2013 9/30/2014 9/30/2015 9/30/2016 9/30/2017 9/30/2018 9/30/2019

Appendix

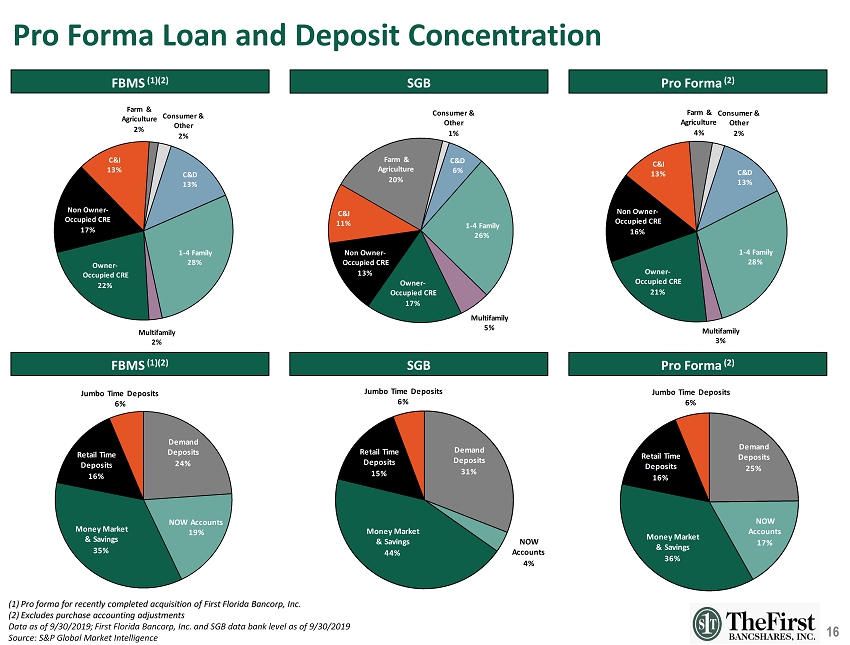

16 C&D 13% 1 - 4 Family 28% Multifamily 3% Owner - Occupied CRE 21% Non Owner - Occupied CRE 16% C&I 13% Farm & Agriculture 4% Consumer & Other 2% C&D 13% 1 - 4 Family 28% Multifamily 2% Owner - Occupied CRE 22% Non Owner - Occupied CRE 17% C&I 13% Farm & Agriculture 2% Consumer & Other 2% C&D 6% 1 - 4 Family 26% Multifamily 5% Owner - Occupied CRE 17% Non Owner - Occupied CRE 13% C&I 11% Farm & Agriculture 20% Consumer & Other 1% Demand Deposits 31% NOW Accounts 4% Money Market & Savings 44% Retail Time Deposits 15% Jumbo Time Deposits 6% Demand Deposits 25% NOW Accounts 17% Money Market & Savings 36% Retail Time Deposits 16% Jumbo Time Deposits 6% Demand Deposits 24% NOW Accounts 19% Money Market & Savings 35% Retail Time Deposits 16% Jumbo Time Deposits 6% (1) Pro forma for recently completed acquisition of First Florida Bancorp, Inc. (2) Excludes purchase accounting adjustments Data as of 9/30/2019; First Florida Bancorp, Inc. and SGB data bank level as of 9/30/2019 Source : S&P Global Market Intelligence Pro Forma Loan and Deposit Concentration SGB Pro Forma (2) SGB Pro Forma (2) FBMS (1)(2) FBMS (1)(2)

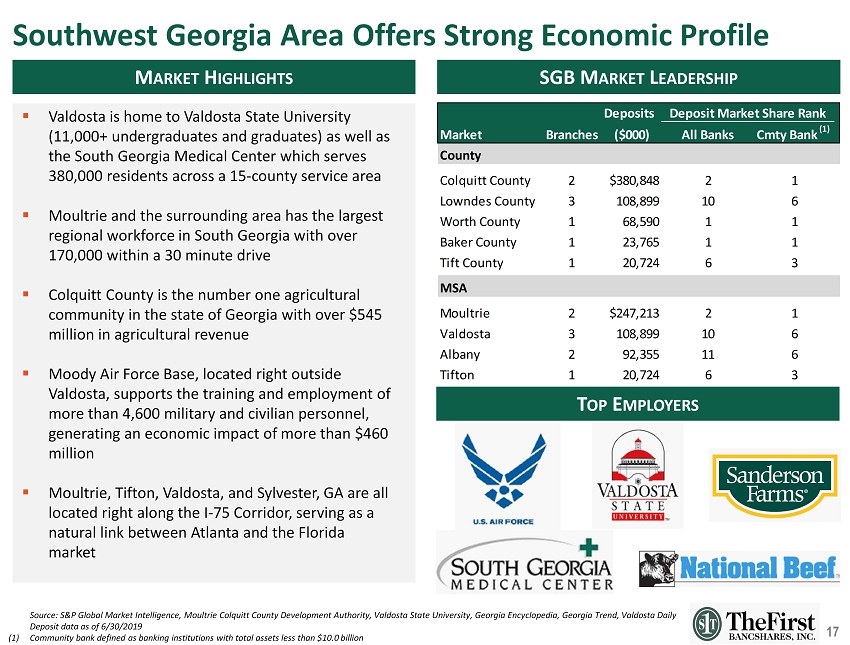

17 Southwest Georgia Area Offers Strong Economic Profile ▪ Valdosta is home to Valdosta State University (11,000+ undergraduates and graduates) as well as the South Georgia Medical Center which serves 380,000 residents across a 15 - county service area ▪ Moultrie and the surrounding area has the largest regional workforce in South Georgia with over 170,000 within a 30 minute drive ▪ Colquitt County is the number one agricultural community in the state of Georgia with over $545 million in agricultural revenue ▪ Moody Air Force Base, located right outside Valdosta, supports the training and employment of more than 4,600 military and civilian personnel, generating an economic impact of more than $460 million ▪ Moultrie, Tifton, Valdosta, and Sylvester, GA are all located right along the I - 75 Corridor, serving as a natural link between Atlanta and the Florida market M ARKET H IGHLIGHTS Deposits Deposit Market Share Rank Market Branches ($000) All Banks Cmty Bank (1) County Colquitt County 2 $380,848 2 1 Lowndes County 3 108,899 10 6 Worth County 1 68,590 1 1 Baker County 1 23,765 1 1 Tift County 1 20,724 6 3 MSA Moultrie 2 $247,213 2 1 Valdosta 3 108,899 10 6 Albany 2 92,355 11 6 Tifton 1 20,724 6 3 SGB M ARKET L EADERSHIP T OP E MPLOYERS Source : S&P Global Market Intelligence, Moultrie Colquitt County Development Authority, Valdosta State University, Georgia Encyclopedia, Georgia Trend, Valdosta Dail y Deposit data as of 6/30/2019 (1) Community bank defined as banking institutions with total assets less than $10.0 billion

18