Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BYLINE BANCORP, INC. | by-8k_20191213.htm |

Investor Presentation – December 2019 Exhibit 99.1

Forward-Looking Statements This communication contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated future performance of the Company. These statements are often, but not always, made through the use of words or phrases such as ‘‘may’’, ‘‘might’’, ‘‘should’’, ‘‘could’’, ‘‘predict’’, ‘‘potential’’, ‘‘believe’’, ‘‘expect’’, ‘‘continue’’, ‘‘will’’, ‘‘anticipate’’, ‘‘seek’’, ‘‘estimate’’, ‘‘intend’’, ‘‘plan’’, ‘‘projection’’, ‘‘would’’, ‘‘annualized’’, “target” and ‘‘outlook’’, or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. Forward-looking statements involve estimates and known and unknown risks, and reflect various assumptions and involve elements of subjective judgement and analysis, which may or may not prove to be correct, and which are subject to uncertainties and contingencies outside the control of Byline and its respective affiliates, directors, employees and other representatives, which could cause actual results to differ materially from those presented in this communication. No representations, warranties or guarantees are or will be made by Byline as to the reliability, accuracy or completeness of any forward-looking statements contained in this communication or that such forward-looking statements are or will remain based on reasonable assumptions. You should not place undue reliance on any forward-looking statements contained in this communication. Certain risks and important factors that could affect Byline’s future results are identified in its Annual Report on Form 10-K and other reports filed with the Securities and Exchange Commission, including among other things under the heading “Risk Factors” in such Annual Report on Form 10-K. Any forward-looking statement speaks only as of the date on which it is made, and Byline undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise unless required under the federal securities laws.

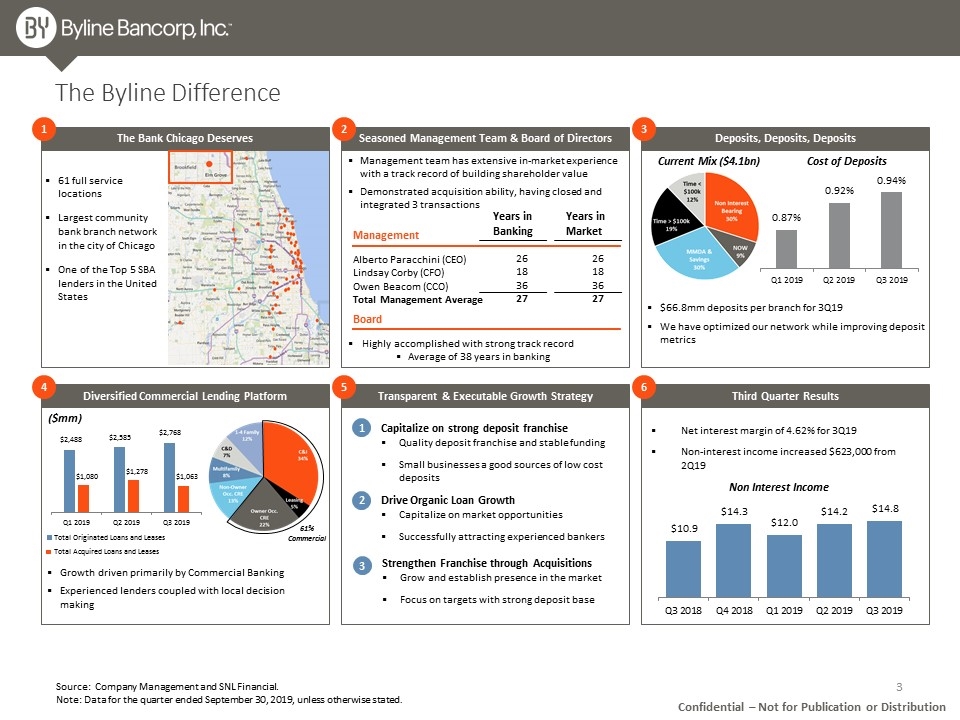

Strengthen Franchise through Acquisitions Grow and establish presence in the market Focus on targets with strong deposit base Total Acquired Loans and Leases Total Originated Loans and Leases The Byline Difference Source: Company Management and SNL Financial. Note: Data for the quarter ended September 30, 2019, unless otherwise stated. Confidential – Not for Publication or Distribution The Bank Chicago Deserves Deposits, Deposits, Deposits Diversified Commercial Lending Platform Transparent & Executable Growth Strategy Third Quarter Results 1 3 4 5 6 61 full service locations Largest community bank branch network in the city of Chicago One of the Top 5 SBA lenders in the United States $66.8mm deposits per branch for 3Q19 We have optimized our network while improving deposit metrics Growth driven primarily by Commercial Banking Experienced lenders coupled with local decision making ($mm) Current Mix ($4.1bn) Cost of Deposits Seasoned Management Team & Board of Directors Management Years in Banking Years in Market Alberto Paracchini (CEO) Lindsay Corby (CFO) Owen Beacom (CCO) Total Management Average 26 18 36 27 26 18 36 27 Highly accomplished with strong track record Average of 38 years in banking Board Management team has extensive in-market experience with a track record of building shareholder value Demonstrated acquisition ability, having closed and integrated 3 transactions 2 61% Commercial 1 2 Capitalize on strong deposit franchise Quality deposit franchise and stable funding Small businesses a good sources of low cost deposits Drive Organic Loan Growth Capitalize on market opportunities Successfully attracting experienced bankers Non Interest Income Net interest margin of 4.62% for 3Q19 Non-interest income increased $623,000 from 2Q19 3

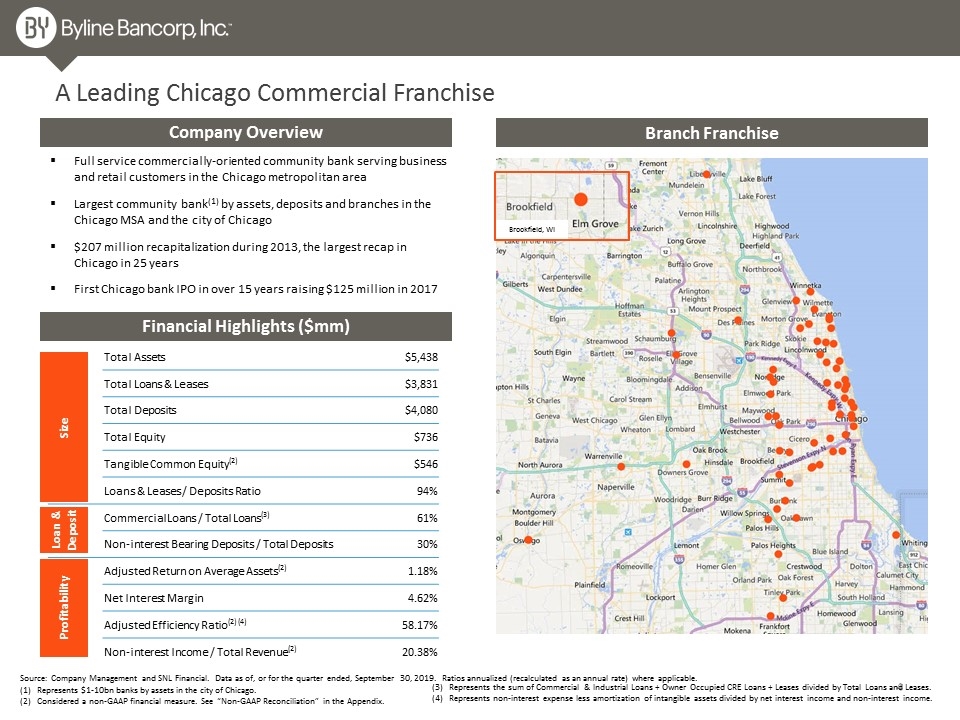

Total Assets $5,438 Total Loans & Leases $3,831 Total Deposits $4,080 Total Equity $736 Tangible Common Equity(2) $546 Loans & Leases / Deposits Ratio 94% Commercial Loans / Total Loans(3) 61% Non-interest Bearing Deposits / Total Deposits 30% Adjusted Return on Average Assets(2) 1.18% Net Interest Margin 4.62% Adjusted Efficiency Ratio(2) (4) 58.17% Non-interest Income / Total Revenue(2) 20.38% A Leading Chicago Commercial Franchise Company Overview Full service commercially-oriented community bank serving business and retail customers in the Chicago metropolitan area Largest community bank(1) by assets, deposits and branches in the Chicago MSA and the city of Chicago $207 million recapitalization during 2013, the largest recap in Chicago in 25 years First Chicago bank IPO in over 15 years raising $125 million in 2017 Source: Company Management and SNL Financial. Data as of, or for the quarter ended, September 30, 2019. Ratios annualized (recalculated as an annual rate) where applicable. Financial Highlights ($mm) Size Loan & Deposit Profitability Branch Franchise (3) Represents the sum of Commercial & Industrial Loans + Owner Occupied CRE Loans + Leases divided by Total Loans and Leases. (4) Represents non-interest expense less amortization of intangible assets divided by net interest income and non-interest income. (1) Represents $1-10bn banks by assets in the city of Chicago. (2) Considered a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the Appendix. Brookfield, WI

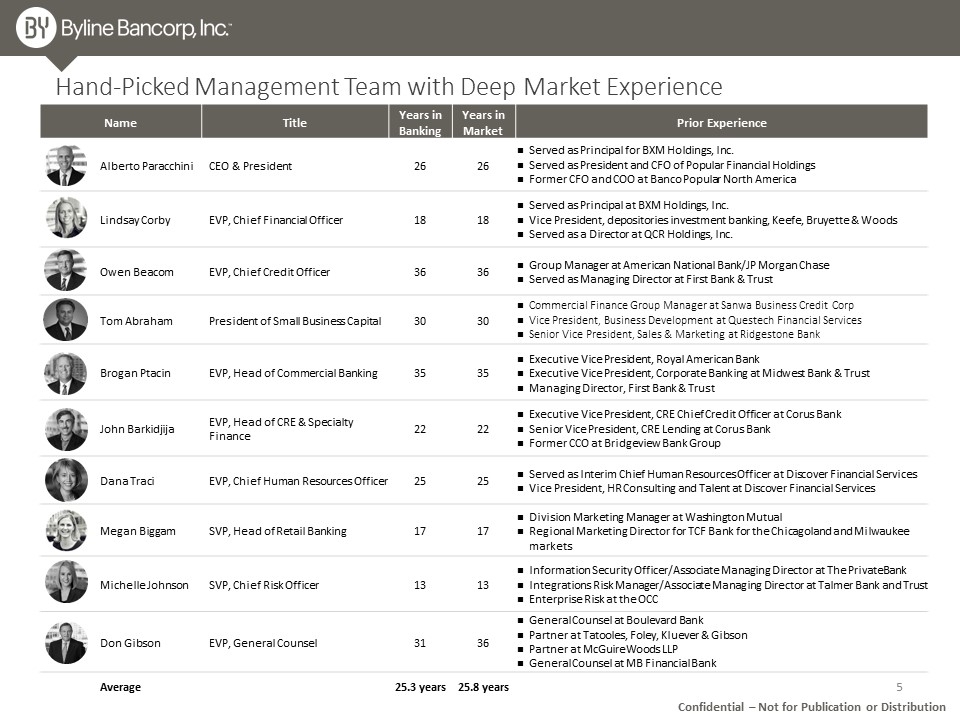

Hand-Picked Management Team with Deep Market Experience Confidential – Not for Publication or Distribution Name Title Years in Banking Years in Market Prior Experience Alberto Paracchini CEO & President 26 26 Served as Principal for BXM Holdings, Inc. Served as President and CFO of Popular Financial Holdings Former CFO and COO at Banco Popular North America Lindsay Corby EVP, Chief Financial Officer 18 18 Served as Principal at BXM Holdings, Inc. Vice President, depositories investment banking, Keefe, Bruyette & Woods Served as a Director at QCR Holdings, Inc. Owen Beacom EVP, Chief Credit Officer 36 36 Group Manager at American National Bank/JP Morgan Chase Served as Managing Director at First Bank & Trust Tom Abraham President of Small Business Capital 30 30 Commercial Finance Group Manager at Sanwa Business Credit Corp Vice President, Business Development at Questech Financial Services Senior Vice President, Sales & Marketing at Ridgestone Bank Brogan Ptacin EVP, Head of Commercial Banking 35 35 Executive Vice President, Royal American Bank Executive Vice President, Corporate Banking at Midwest Bank & Trust Managing Director, First Bank & Trust John Barkidjija EVP, Head of CRE & Specialty Finance 22 22 Executive Vice President, CRE Chief Credit Officer at Corus Bank Senior Vice President, CRE Lending at Corus Bank Former CCO at Bridgeview Bank Group Dana Traci EVP, Chief Human Resources Officer 25 25 Served as Interim Chief Human Resources Officer at Discover Financial Services Vice President, HR Consulting and Talent at Discover Financial Services Megan Biggam SVP, Head of Retail Banking 17 17 Division Marketing Manager at Washington Mutual Regional Marketing Director for TCF Bank for the Chicagoland and Milwaukee markets Michelle Johnson SVP, Chief Risk Officer 13 13 Information Security Officer/Associate Managing Director at The PrivateBank Integrations Risk Manager/Associate Managing Director at Talmer Bank and Trust Enterprise Risk at the OCC Don Gibson EVP, General Counsel 31 36 General Counsel at Boulevard Bank Partner at Tatooles, Foley, Kluever & Gibson Partner at McGuireWoods LLP General Counsel at MB Financial Bank Average 25.3 years 25.8 years

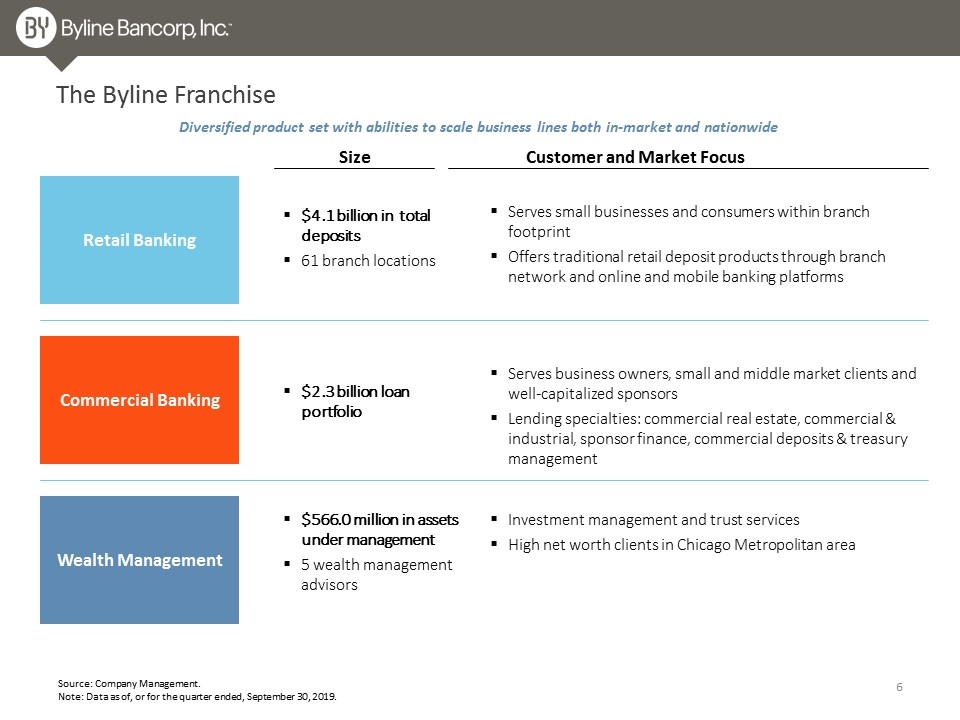

The Byline Franchise Commercial Banking Wealth Management Size Customer and Market Focus $4.1 billion in total deposits 61 branch locations Serves small businesses and consumers within branch footprint Offers traditional retail deposit products through branch network and online and mobile banking platforms $2.3 billion loan portfolio Serves business owners, small and middle market clients and well-capitalized sponsors Lending specialties: commercial real estate, commercial & industrial, sponsor finance, commercial deposits & treasury management $566.0 million in assets under management 5 wealth management advisors Investment management and trust services High net worth clients in Chicago Metropolitan area Source: Company Management. Note: Data as of, or for the quarter ended, September 30, 2019. Retail Banking Diversified product set with abilities to scale business lines both in-market and nationwide

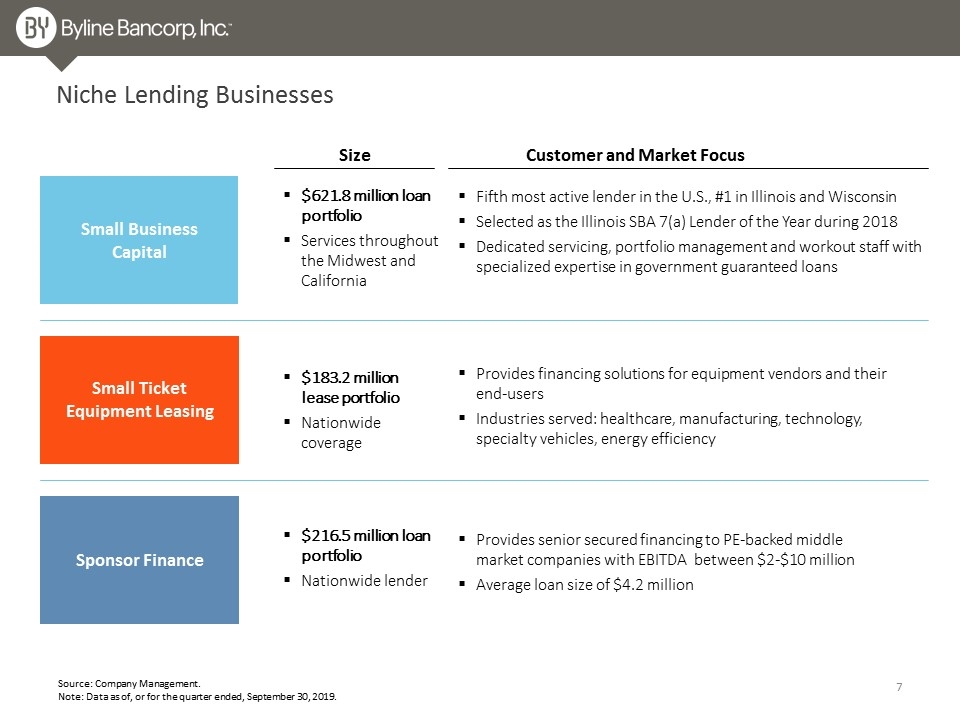

Niche Lending Businesses Small Ticket Equipment Leasing Sponsor Finance Size Customer and Market Focus $621.8 million loan portfolio Services throughout the Midwest and California Fifth most active lender in the U.S., #1 in Illinois and Wisconsin Selected as the Illinois SBA 7(a) Lender of the Year during 2018 Dedicated servicing, portfolio management and workout staff with specialized expertise in government guaranteed loans $183.2 million lease portfolio Nationwide coverage Provides financing solutions for equipment vendors and their end-users Industries served: healthcare, manufacturing, technology, specialty vehicles, energy efficiency $216.5 million loan portfolio Nationwide lender Provides senior secured financing to PE-backed middle market companies with EBITDA between $2-$10 million Average loan size of $4.2 million Source: Company Management. Note: Data as of, or for the quarter ended, September 30, 2019. Small Business Capital

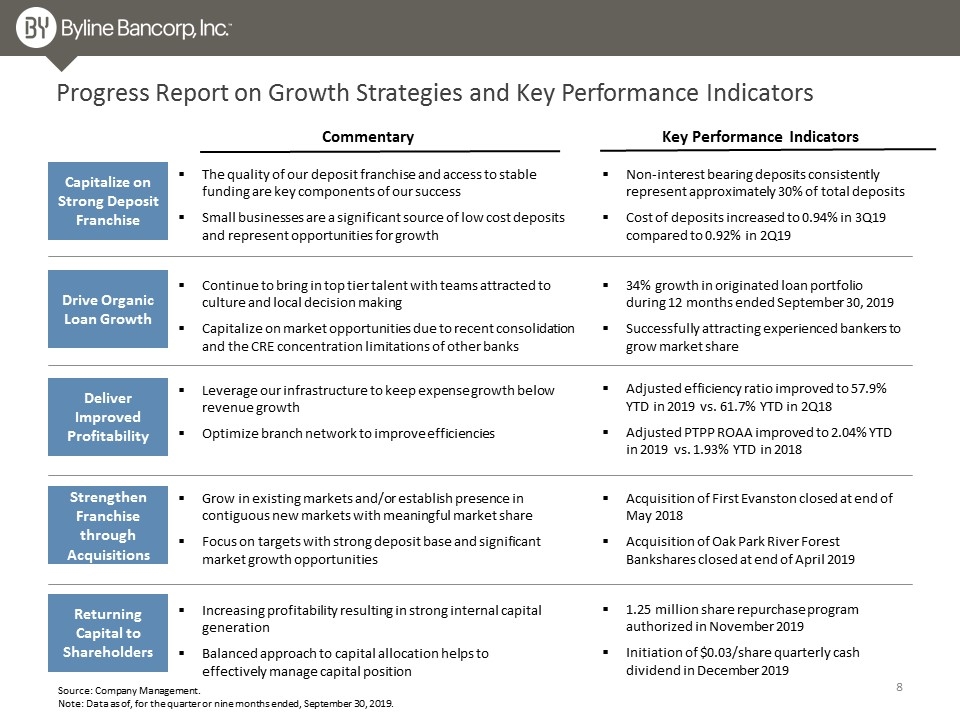

Drive Organic Loan Growth Deliver Improved Profitability Strengthen Franchise through Acquisitions Continue to bring in top tier talent with teams attracted to culture and local decision making Capitalize on market opportunities due to recent consolidation and the CRE concentration limitations of other banks Leverage our infrastructure to keep expense growth below revenue growth Optimize branch network to improve efficiencies Grow in existing markets and/or establish presence in contiguous new markets with meaningful market share Focus on targets with strong deposit base and significant market growth opportunities Capitalize on Strong Deposit Franchise The quality of our deposit franchise and access to stable funding are key components of our success Small businesses are a significant source of low cost deposits and represent opportunities for growth Progress Report on Growth Strategies and Key Performance Indicators Commentary Key Performance Indicators Non-interest bearing deposits consistently represent approximately 30% of total deposits Cost of deposits increased to 0.94% in 3Q19 compared to 0.92% in 2Q19 34% growth in originated loan portfolio during 12 months ended September 30, 2019 Successfully attracting experienced bankers to grow market share Adjusted efficiency ratio improved to 57.9% YTD in 2019 vs. 61.7% YTD in 2Q18 Adjusted PTPP ROAA improved to 2.04% YTD in 2019 vs. 1.93% YTD in 2018 Acquisition of First Evanston closed at end of May 2018 Acquisition of Oak Park River Forest Bankshares closed at end of April 2019 Source: Company Management. Note: Data as of, for the quarter or nine months ended, September 30, 2019. Returning Capital to Shareholders Increasing profitability resulting in strong internal capital generation Balanced approach to capital allocation helps to effectively manage capital position 1.25 million share repurchase program authorized in November 2019 Initiation of $0.03/share quarterly cash dividend in December 2019

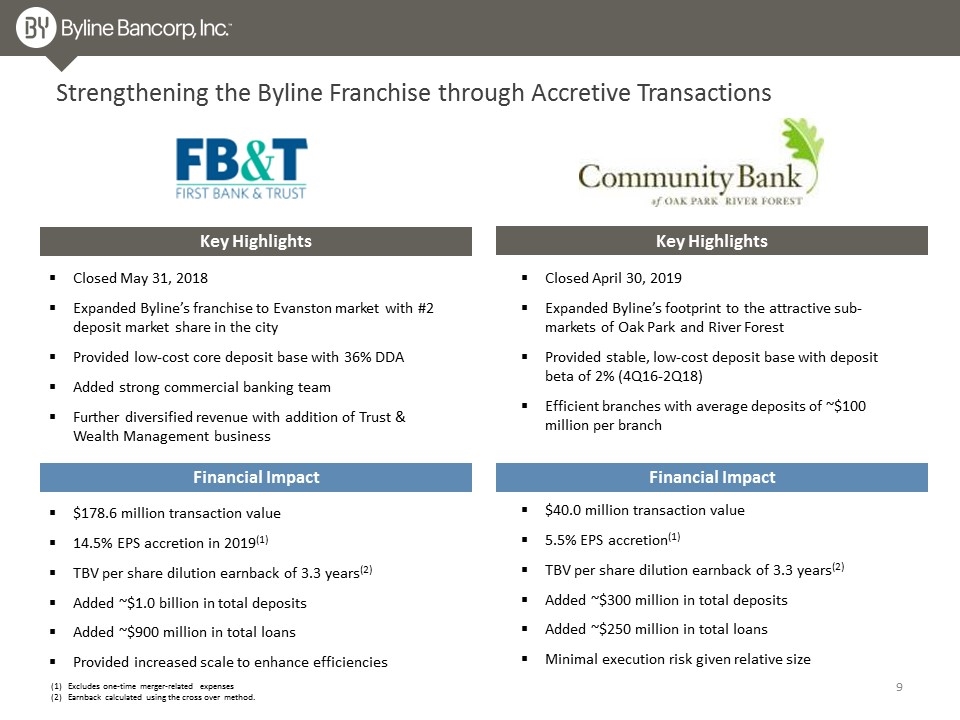

Strengthening the Byline Franchise through Accretive Transactions Key Highlights Closed May 31, 2018 Expanded Byline’s franchise to Evanston market with #2 deposit market share in the city Provided low-cost core deposit base with 36% DDA Added strong commercial banking team Further diversified revenue with addition of Trust & Wealth Management business Key Highlights (1) Excludes one-time merger-related expenses (2) Earnback calculated using the cross over method. Financial Impact $178.6 million transaction value 14.5% EPS accretion in 2019(1) TBV per share dilution earnback of 3.3 years(2) Added ~$1.0 billion in total deposits Added ~$900 million in total loans Provided increased scale to enhance efficiencies Closed April 30, 2019 Expanded Byline’s footprint to the attractive sub-markets of Oak Park and River Forest Provided stable, low-cost deposit base with deposit beta of 2% (4Q16-2Q18) Efficient branches with average deposits of ~$100 million per branch Financial Impact $40.0 million transaction value 5.5% EPS accretion(1) TBV per share dilution earnback of 3.3 years(2) Added ~$300 million in total deposits Added ~$250 million in total loans Minimal execution risk given relative size

Third Quarter 2019 Results

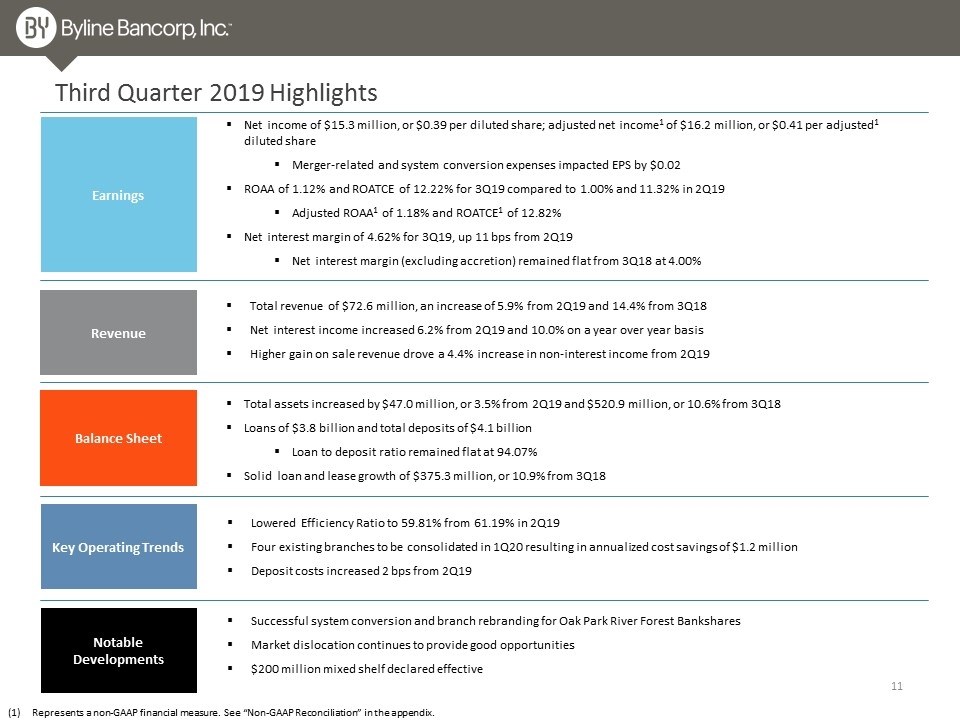

Third Quarter 2019 Highlights Balance Sheet Earnings Revenue Key Operating Trends Total revenue of $72.6 million, an increase of 5.9% from 2Q19 and 14.4% from 3Q18 Net interest income increased 6.2% from 2Q19 and 10.0% on a year over year basis Higher gain on sale revenue drove a 4.4% increase in non-interest income from 2Q19 Lowered Efficiency Ratio to 59.81% from 61.19% in 2Q19 Four existing branches to be consolidated in 1Q20 resulting in annualized cost savings of $1.2 million Deposit costs increased 2 bps from 2Q19 Notable Developments Successful system conversion and branch rebranding for Oak Park River Forest Bankshares Market dislocation continues to provide good opportunities $200 million mixed shelf declared effective Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. Net income of $15.3 million, or $0.39 per diluted share; adjusted net income1 of $16.2 million, or $0.41 per adjusted1 diluted share Merger-related and system conversion expenses impacted EPS by $0.02 ROAA of 1.12% and ROATCE of 12.22% for 3Q19 compared to 1.00% and 11.32% in 2Q19 Adjusted ROAA1 of 1.18% and ROATCE1 of 12.82% Net interest margin of 4.62% for 3Q19, up 11 bps from 2Q19 Net interest margin (excluding accretion) remained flat from 3Q18 at 4.00% Total assets increased by $47.0 million, or 3.5% from 2Q19 and $520.9 million, or 10.6% from 3Q18 Loans of $3.8 billion and total deposits of $4.1 billion Loan to deposit ratio remained flat at 94.07% Solid loan and lease growth of $375.3 million, or 10.9% from 3Q18

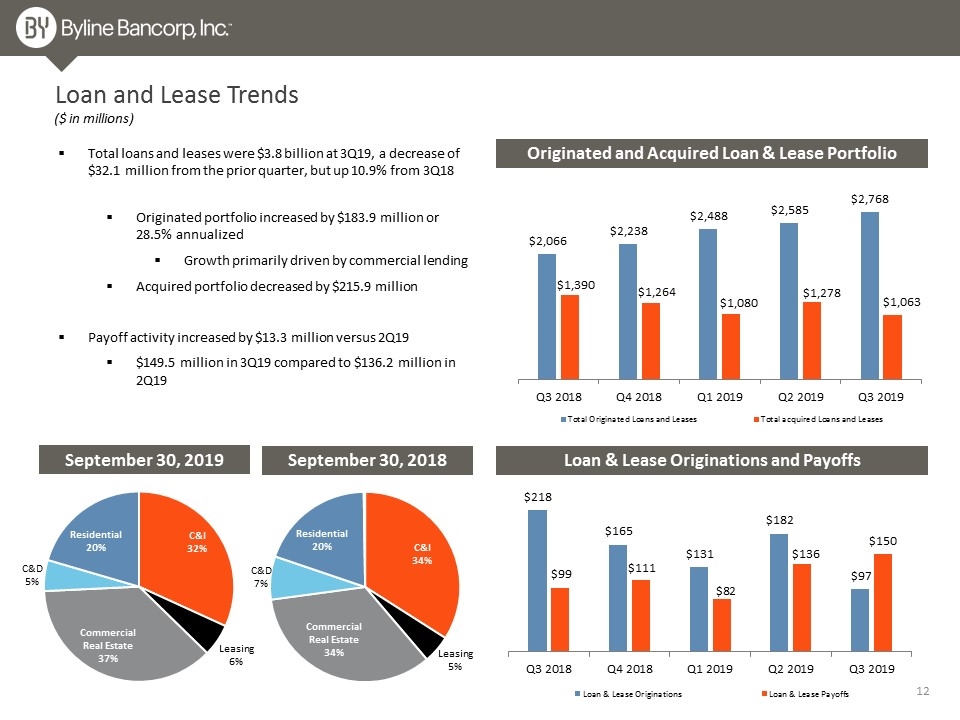

Loan and Lease Trends Loan & Lease Originations and Payoffs September 30, 2018 September 30, 2019 ($ in millions) Originated and Acquired Loan & Lease Portfolio Total loans and leases were $3.8 billion at 3Q19, a decrease of $32.1 million from the prior quarter, but up 10.9% from 3Q18 Originated portfolio increased by $183.9 million or 28.5% annualized Growth primarily driven by commercial lending Acquired portfolio decreased by $215.9 million Payoff activity increased by $13.3 million versus 2Q19 $149.5 million in 3Q19 compared to $136.2 million in 2Q19

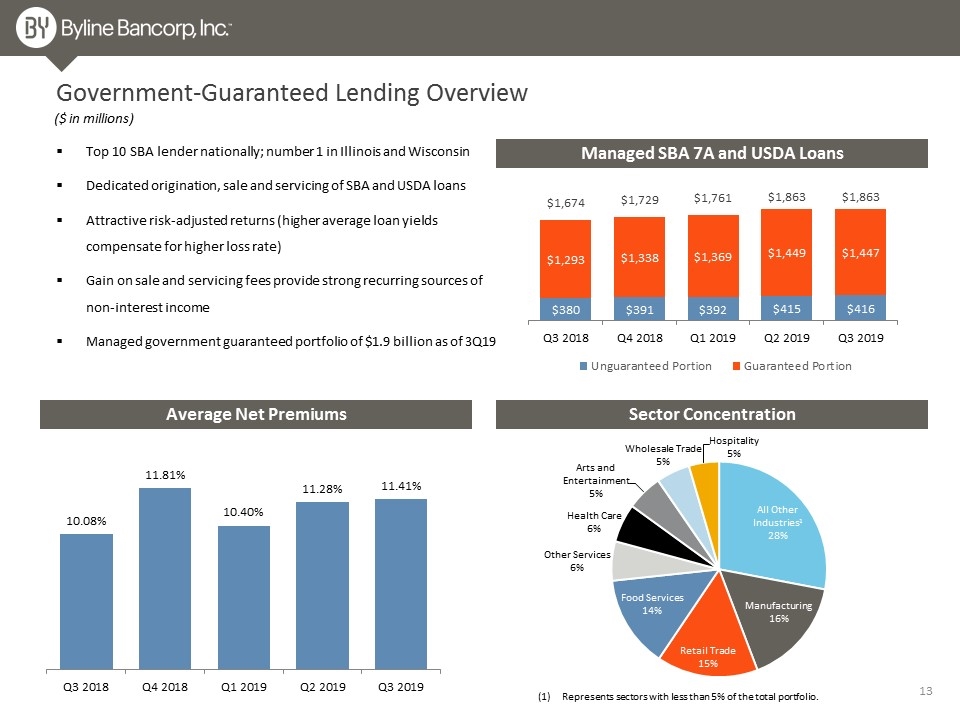

Government-Guaranteed Lending Overview Managed SBA 7A and USDA Loans Top 10 SBA lender nationally; number 1 in Illinois and Wisconsin Dedicated origination, sale and servicing of SBA and USDA loans Attractive risk-adjusted returns (higher average loan yields compensate for higher loss rate) Gain on sale and servicing fees provide strong recurring sources of non-interest income Managed government guaranteed portfolio of $1.9 billion as of 3Q19 Sector Concentration Average Net Premiums Represents sectors with less than 5% of the total portfolio. ($ in millions)

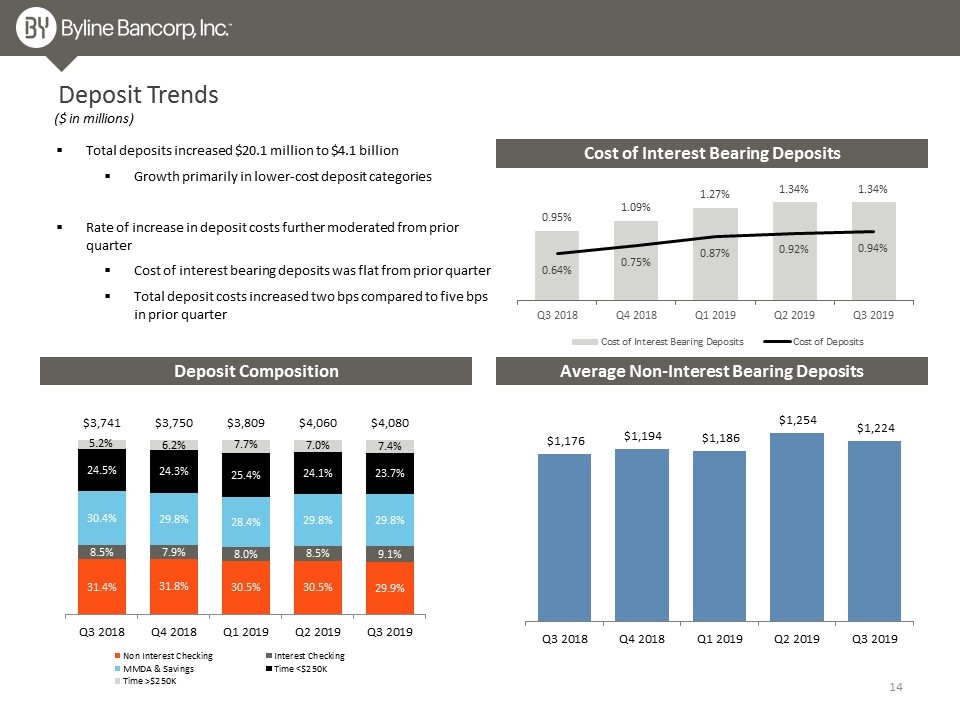

Total deposits increased $20.1 million to $4.1 billion Growth primarily in lower-cost deposit categories Rate of increase in deposit costs further moderated from prior quarter Cost of interest bearing deposits was flat from prior quarter Total deposit costs increased two bps compared to five bps in prior quarter Deposit Trends Average Non-Interest Bearing Deposits ($ in millions) Deposit Composition Cost of Interest Bearing Deposits

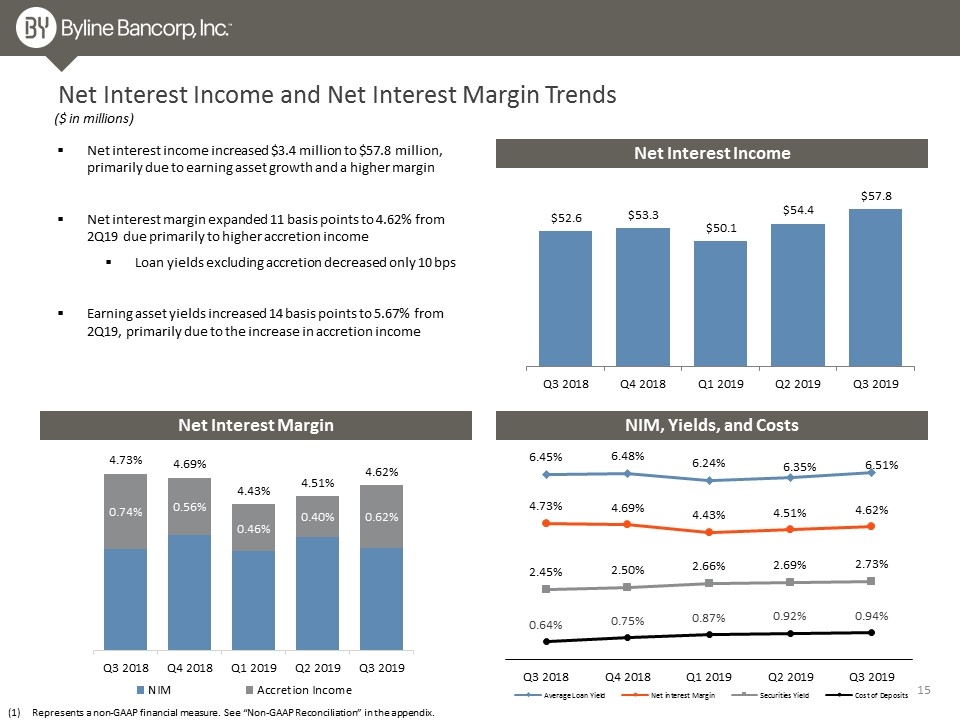

Net Interest Income and Net Interest Margin Trends Net interest income increased $3.4 million to $57.8 million, primarily due to earning asset growth and a higher margin Net interest margin expanded 11 basis points to 4.62% from 2Q19 due primarily to higher accretion income Loan yields excluding accretion decreased only 10 bps Earning asset yields increased 14 basis points to 5.67% from 2Q19, primarily due to the increase in accretion income Net Interest Margin Net Interest Income ($ in millions) NIM, Yields, and Costs Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix.

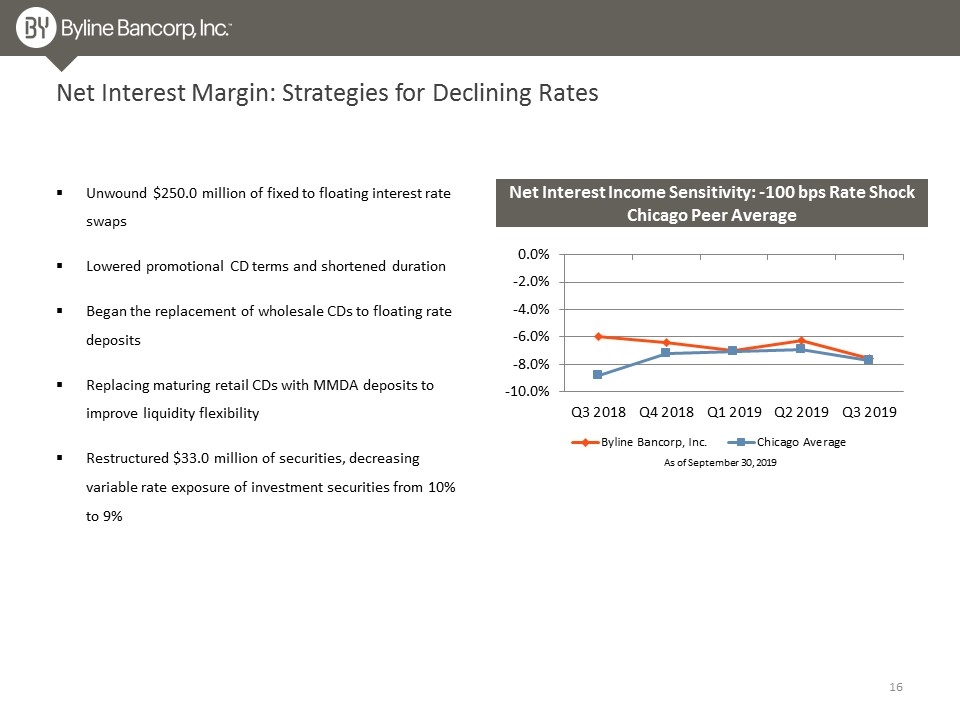

Net Interest Margin: Strategies for Declining Rates Net Interest Income Sensitivity: -100 bps Rate Shock Chicago Peer Average Unwound $250.0 million of fixed to floating interest rate swaps Lowered promotional CD terms and shortened duration Began the replacement of wholesale CDs to floating rate deposits Replacing maturing retail CDs with MMDA deposits to improve liquidity flexibility Restructured $33.0 million of securities, decreasing variable rate exposure of investment securities from 10% to 9% As of September 30, 2019

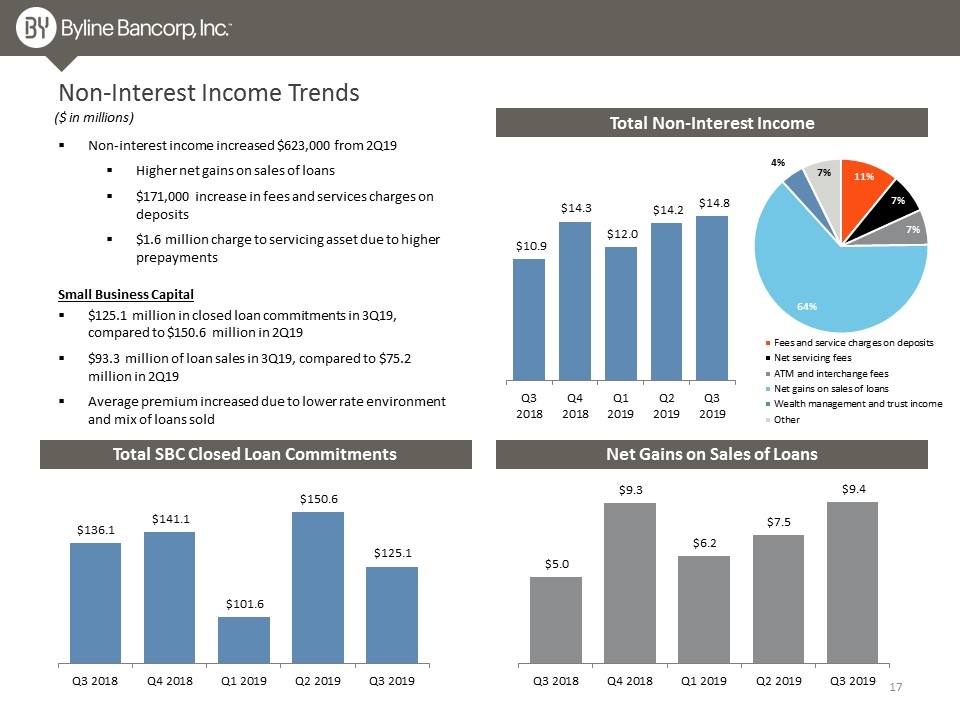

Total Non-Interest Income Non-Interest Income Trends Non-interest income increased $623,000 from 2Q19 Higher net gains on sales of loans $171,000 increase in fees and services charges on deposits $1.6 million charge to servicing asset due to higher prepayments ($ in millions) Total SBC Closed Loan Commitments Net Gains on Sales of Loans $125.1 million in closed loan commitments in 3Q19, compared to $150.6 million in 2Q19 $93.3 million of loan sales in 3Q19, compared to $75.2 million in 2Q19 Average premium increased due to lower rate environment and mix of loans sold Small Business Capital

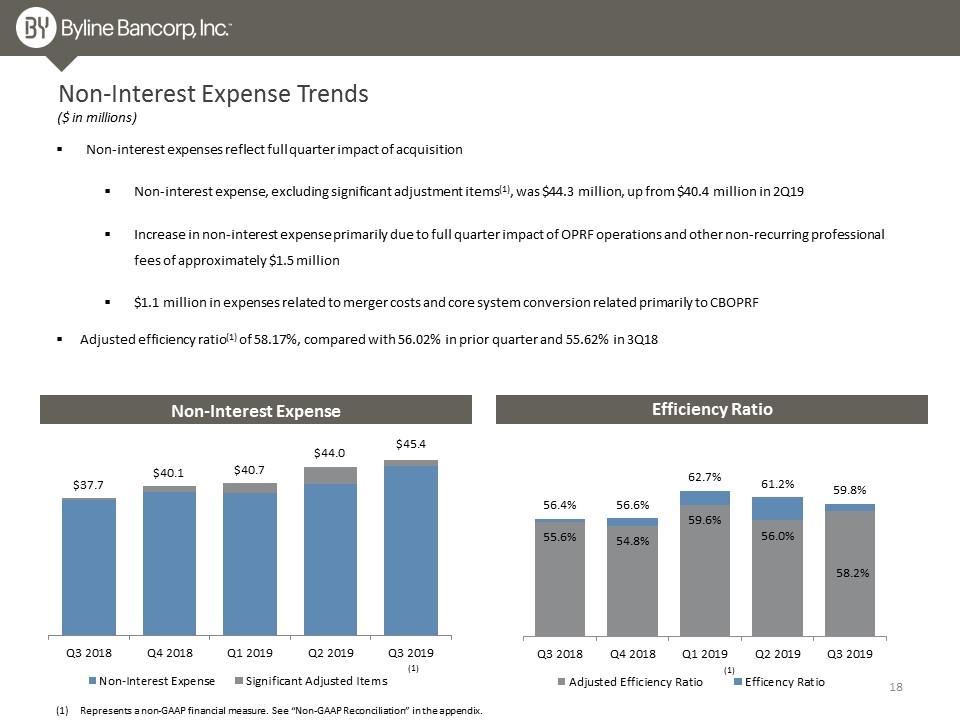

Non-Interest Expense Trends Non-interest expenses reflect full quarter impact of acquisition Non-interest expense, excluding significant adjustment items(1), was $44.3 million, up from $40.4 million in 2Q19 Increase in non-interest expense primarily due to full quarter impact of OPRF operations and other non-recurring professional fees of approximately $1.5 million $1.1 million in expenses related to merger costs and core system conversion related primarily to CBOPRF Adjusted efficiency ratio(1) of 58.17%, compared with 56.02% in prior quarter and 55.62% in 3Q18 ($ in millions) Efficiency Ratio Non-Interest Expense Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. (1) (1)

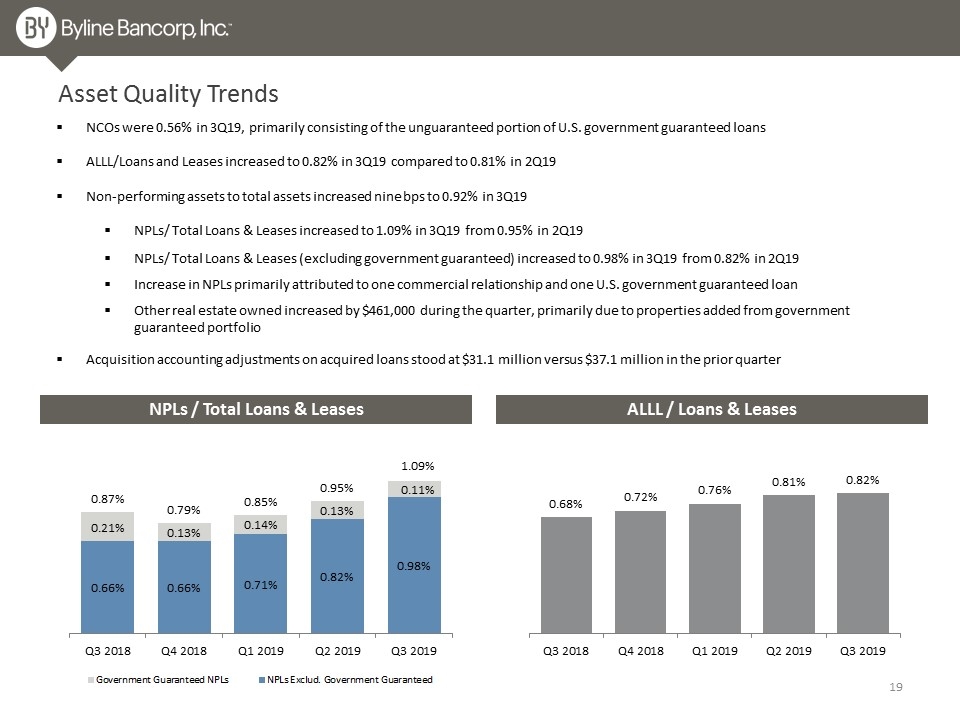

Asset Quality Trends NCOs were 0.56% in 3Q19, primarily consisting of the unguaranteed portion of U.S. government guaranteed loans ALLL/Loans and Leases increased to 0.82% in 3Q19 compared to 0.81% in 2Q19 Non-performing assets to total assets increased nine bps to 0.92% in 3Q19 NPLs/ Total Loans & Leases increased to 1.09% in 3Q19 from 0.95% in 2Q19 NPLs/ Total Loans & Leases (excluding government guaranteed) increased to 0.98% in 3Q19 from 0.82% in 2Q19 Increase in NPLs primarily attributed to one commercial relationship and one U.S. government guaranteed loan Other real estate owned increased by $461,000 during the quarter, primarily due to properties added from government guaranteed portfolio Acquisition accounting adjustments on acquired loans stood at $31.1 million versus $37.1 million in the prior quarter NPLs / Total Loans & Leases ALLL / Loans & Leases

Appendix

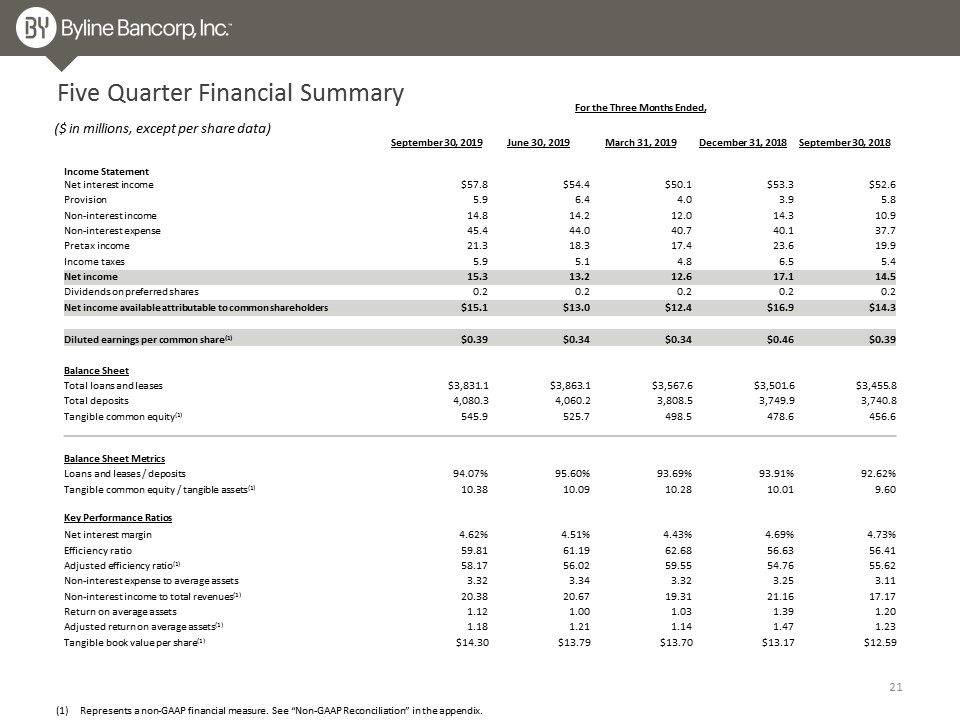

Five Quarter Financial Summary ($ in millions, except per share data) Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. For the Three Months Ended, September 30, 2019 June 30, 2019 March 31, 2019 December 31, 2018 September 30, 2018 Income Statement Net interest income $57.8 $54.4 $50.1 $53.3 $52.6 Provision 5.9 6.4 4.0 3.9 5.8 Non-interest income 14.8 14.2 12.0 14.3 10.9 Non-interest expense 45.4 44.0 40.7 40.1 37.7 Pretax income 21.3 18.3 17.4 23.6 19.9 Income taxes 5.9 5.1 4.8 6.5 5.4 Net income 15.3 13.2 12.6 17.1 14.5 Dividends on preferred shares 0.2 0.2 0.2 0.2 0.2 Net income available attributable to common shareholders $15.1 $13.0 $12.4 $16.9 $14.3 Diluted earnings per common share(1) $0.39 $0.34 $0.34 $0.46 $0.39 Balance Sheet Total loans and leases $3,831.1 $3,863.1 $3,567.6 $3,501.6 $3,455.8 Total deposits 4,080.3 4,060.2 3,808.5 3,749.9 3,740.8 Tangible common equity(1) 545.9 525.7 498.5 478.6 456.6 Balance Sheet Metrics Loans and leases / deposits 94.07% 95.60% 93.69% 93.91% 92.62% Tangible common equity / tangible assets(1) 10.38 10.09 10.28 10.01 9.60 Key Performance Ratios Net interest margin 4.62% 4.51% 4.43% 4.69% 4.73% Efficiency ratio 59.81 61.19 62.68 56.63 56.41 Adjusted efficiency ratio(1) 58.17 56.02 59.55 54.76 55.62 Non-interest expense to average assets 3.32 3.34 3.32 3.25 3.11 Non-interest income to total revenues(1) 20.38 20.67 19.31 21.16 17.17 Return on average assets 1.12 1.00 1.03 1.39 1.20 Adjusted return on average assets(1) 1.18 1.21 1.14 1.47 1.23 Tangible book value per share(1) $14.30 $13.79 $13.70 $13.17 $12.59

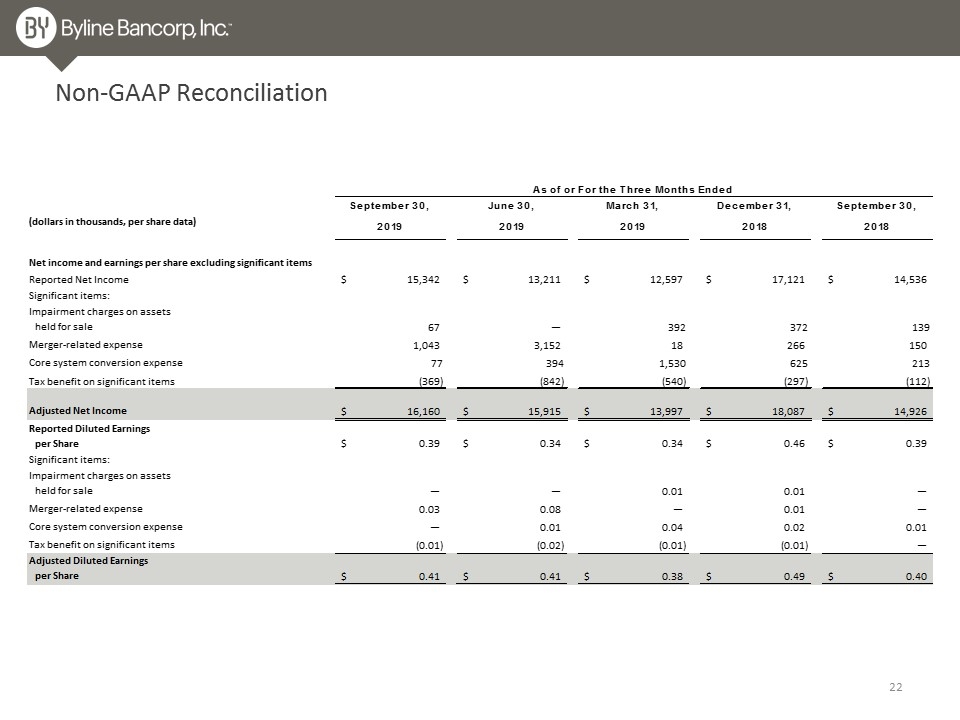

Non-GAAP Reconciliation

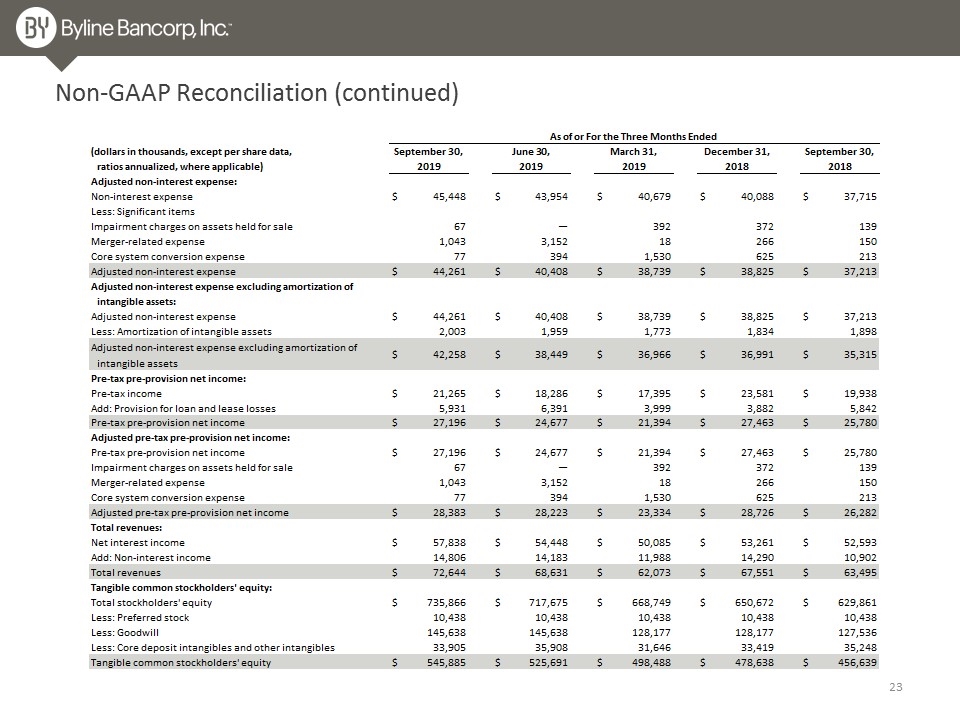

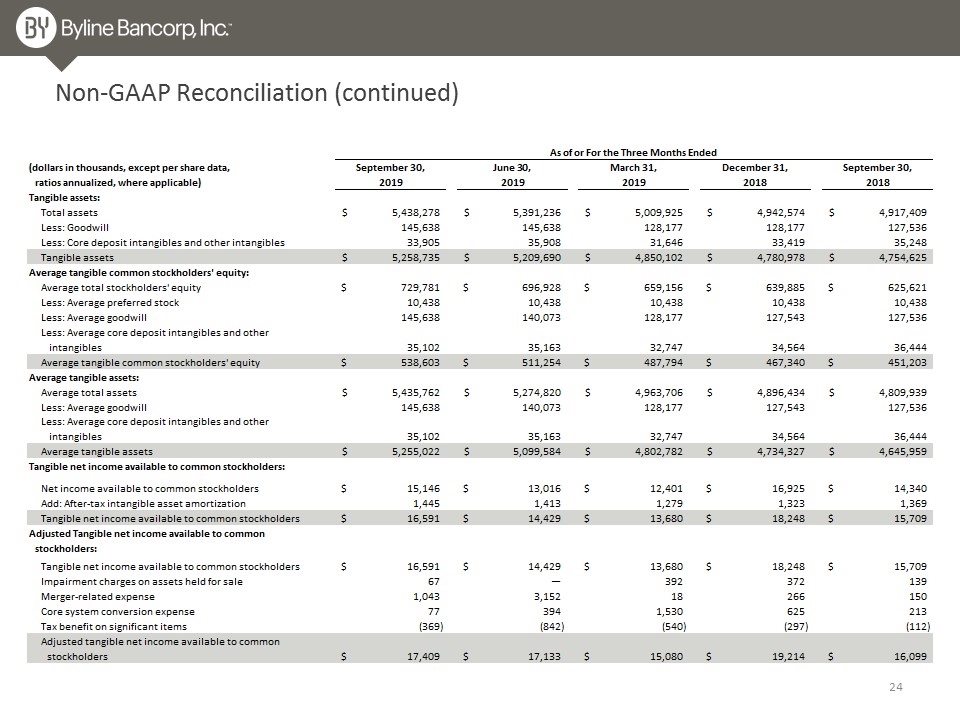

Non-GAAP Reconciliation (continued)

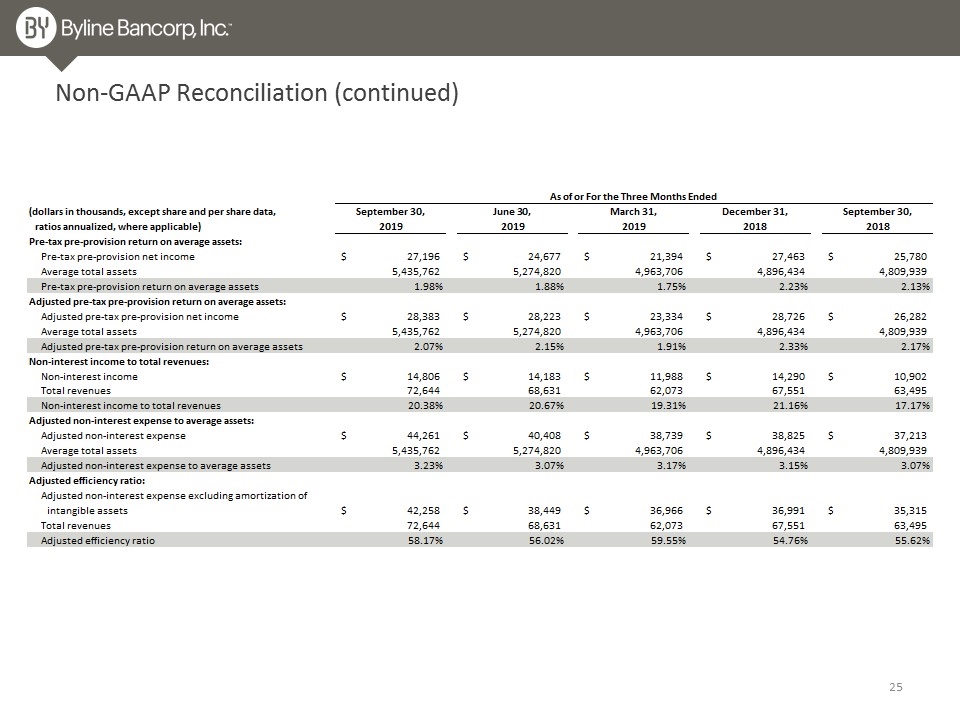

Non-GAAP Reconciliation (continued)

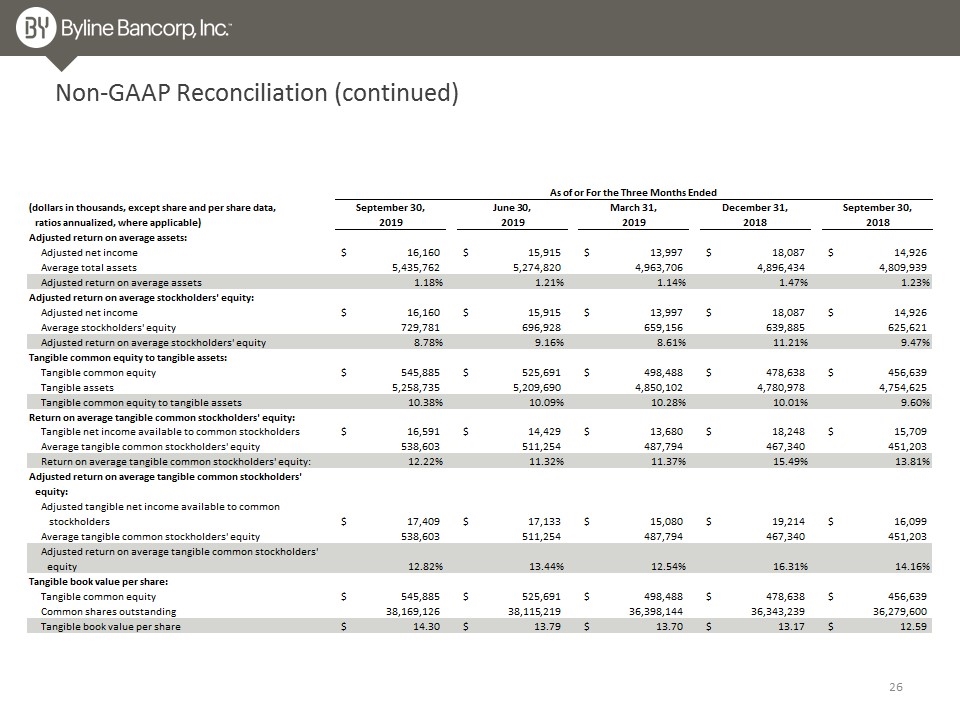

Non-GAAP Reconciliation (continued)

Non-GAAP Reconciliation (continued)