Attached files

| file | filename |

|---|---|

| 8-K/A - FORM 8-K/A - HomeStreet, Inc. | a8-kaq32019revisedinvestor.htm |

3rd Quarter 2019 as of December 12, 2019 Nasdaq: HMST

Important Disclosures Forward-Looking Statements This presentation includes forward-looking statements, as that term is defined for purposes of applicable securities laws, about our industry, our future financial performance, business plans and expectations. These statements are, in essence, attempts to anticipate or forecast future events, and thus subject to many risks and uncertainties. These forward-looking statements are based on our management's current expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts, as well as a number of assumptions concerning future events. Forward-looking statements in this presentation include, among other matters, statements regarding our business plans and strategies, general economic trends, strategic initiatives we have announced, including forecasted reductions in the Company’s cost structure and future run rates and growth scenarios and performance targets. Readers should note, however, that all statements in this presentation other than assertions of historical fact are forward-looking in nature. These statements are subject to risks, uncertainties, assumptions and other important factors set forth in our SEC filings, including but not limited to our Annual report on Form 10-K for the year ended December 31, 2018 and our most recent quarterly report on Form 10-Q. Many of these factors and events that affect the volatility in our stock price and shareholders’ response to those events and factors are beyond our control. Such factors could cause actual results to differ materially from the results discussed or implied in the forward-looking statements. These risks include, without limitation, changes in general political and economic conditions that impact our markets and our business, actions by the Federal Reserve Board and financial market conditions that affect monetary and fiscal policy, regulatory and legislative findings or actions that may increase capital requirements or otherwise constrain our ability to do business, including restrictions that could be imposed by our regulators on certain aspects of our operations or on our growth initiatives and acquisition activities, risks related to our ability to: retain adequate key personnel to operate our business, realize the expected cost savings from restructuring activities and cost containment measures that we have recently undertaken or that we have announced, continue to expand our commercial and consumer banking operations, grow our franchise and capitalize on market opportunities, cost-effectively manage our overall growth efforts to attain the desired operational and financial outcomes, manage the losses inherent in our loan portfolio, improve long-term shareholder value through effective use of our surplus capital, make accurate estimates of the value of our non-cash assets and liabilities, maintain electronic and physical security of customer data, respond to our restrictive and complex regulatory environment, and attract and retain key personnel. Actual results may fall materially short of our expectations and projections, and we may be unable to execute on our strategic initiatives, change our plans or take additional actions that differ in material ways from our current intentions. Accordingly, we can give no assurance of future performance, and you should not rely unduly on forward-looking statements. All forward-looking statements are based on information available to us as of the date hereof, and we do not undertake to update or revise any forward-looking statements, for any reason. Basis of Presentation of Financial Data Unless noted otherwise in this presentation, all reported financial data is being presented as of the period ending September 30, 2019, and is unaudited, although certain information related to the year ended December 31, 2018, has been derived from our audited financial statements. All financial data should be read in conjunction with the notes in our consolidated financial statements. Non-GAAP Financial Measures and Targets Information on any non-GAAP financial measures such as core measures or tangible measures referenced in this presentation, including a reconciliation of those measures to GAAP measures, may also be found in the appendix, our SEC filings, and in the earnings release available on our web site. This presentation refers to long-term targets. Because targets are forward-looking and not based on historical performance, it is not possible to provide a reconciliation without undertaking unreasonable efforts. A GAAP reconciliation would require estimates of such excluded items, and it is not possible to estimate such excluded items at this time. p. 1

Nasdaq: HMST Focus on efficiency and profitability while emerging as a Leading West • Seattle-based diversified commercial & consumer bank – company founded in Coast regional 1921 bank • Locations in all of the major coastal markets in the Western U.S. and Hawaii • 67 bank branches and primary offices • Total assets $6.8 billion p. 2

Where is HomeStreet? Retail deposit branches (62) Primary stand-alone lending centers (4) Primary stand-alone insurance office (1) Seattle Metro Washington Market Focus: • Seattle / Puget Sound & Spokane, WA • Portland, OR • San Francisco / Bay Area, CA Oregon • Southern California Idaho • Hawaiian Islands Hawaii Utah California Southern California The number of offices depicted does not include five satellite offices that have a limited number of staff which report to a manager located in a separate primary office. p. 3

Strategy Focus on Commercial & Consumer Banking • Grow and diversify loan portfolio with focus on expanding C&I and Fannie Mae DUS(1) multifamily lending • Grow core deposits to improve deposit mix • Improve operating efficiency • Introduce smart product offerings - fast- follower of technology • Grow market share in highly attractive metropolitan markets • Optimize capitalization (1) DUS® is registered trademark of Fannie Mae p. 4

Strategic Changes Underway What we said Steps we took Sell home loan center based mortgage Transactions completed as announced banking business and related servicing • Returned $81.1 million, year-to-date Return excess capital to shareholders • Announced additional $25 million share repurchase program expected to commence in the 4th quarter, 2019 • Completed consolidation of three retail deposit branches Improve operating efficiency and profitability • Retained banking efficiency consultant to identify additional opportunities to improve efficiency ratio to peer levels Increase return on equity to peer levels 2020 goal p. 5

Simplifying the organizational structure by reducing management Improving our levels and management redundancy operating efficiency to Consolidating similar functions reflect our currently residing in multiple simplified business units business model and Renegotiating where possible our lower growth contracts – primarily technology expectations by: Identifying and eliminating redundant or unnecessary systems and services Rationalizing staffing appropriate to the significant changes in work volumes and company direction p. 6

Results of Operations 3 Months Ended 9 Months Ended $ Thousands Sep. 30, 2019 Jun. 30, 2019 Sep. 30, 2018 Sep. 30, 2019 Sep. 30, 2018 Net Interest Income $47,134 $49,187 $47,860 $143,878 $141,053 Provision for Credit Losses - - 750 1,500 2,500 Noninterest Income 24,580 19,829 10,650 52,501 26,151 Noninterest Expense 55,721 58,832 47,914 162,399 147,349 Income from Continuing Operations Before Taxes 15,993 10,184 9,846 32,480 17,355 Income Tax 2,328 1,292 1,757 4,865 3,341 Net Income from Continuing Operations 13,665 8,892 8,089 27,615 14,014 Income from Discontinued Operations Before Taxes 190 (16,678) 4,561 (24,928) 13,651 Income Tax 28 (2,198) 815 (3,837) 2,865 Net Income from Discontinued Operations 162 (14,480) 3,746 (21,091) 10,786 Net Income 13,827 (5,588) 11,835 6,524 24,800 Diluted EPS $0.55 $(0.22) $0.44 $0.22 $0.91 Diluted EPS from Continuing Operations $0.54 $0.32 $0.30 $1.03 $0.52 Tangible BV/Share(1) $26.83 $26.34 $25.43 $26.83 $25.43 ROAA – Continuing Operations 0.78% 0.49% 0.45% 0.51% 0.27% ROAE – Continuing Operations 7.88% 4.80% 4.25% 5.06% 2.51% ROATE – Continuing Operations (1) 8.32% 5.05% 4.42% 5.30% 2.62% Net Interest Margin 2.96% 3.11% 3.20% 3.06% 3.22% Efficiency Ratio of Continuing Operations 77.70% 85.24% 81.89% 82.70% 88.13% Tier 1 Leverage Ratio (Bank) 10.17% 9.86% 9.70% 10.17% 9.70% Total Risk-Based Capital (Bank) 14.37% 14.15% 14.15% 14.37% 14.15% Tier 1 Leverage Ratio (Company) 10.04% 10.12% 9.17% 10.04% 9.17% Total Risk-Based Capital (Company) 13.69% 13.95% 12.82% 13.69% 12.82% (1) See appendix for reconciliation of non-GAAP financial measures. p. 7

Highlights and Developments Results of Operations • Third quarter 2019 net income of $13.8 million, or $0.55 diluted EPS • Income from continuing operations of $13.7 million, or $0.54 diluted EPS • Total deposits at September 30, 2019, of $5.8 billion, Approved a $25 growing 4% since June 30, 2019 million common • Noninterest expense decreased by $3.1 million or 5% during stock repurchase the third quarter program expected to • Nonperforming asset ratio of 0.21% commence during the fourth quarter Strategic Results • Reduced FTE count by 7% to 1,132 at September 30, 2019, from 1,221 at June 30, 2019 • Completed interim servicing related to our MSR sales and concluded the transition services related to our sale of our stand-alone home loan center-based mortgage business • Completed consolidation of Oswego, OR retail deposit branch into nearby Lake Grove, OR location p. 8 (1) See appendix for reconciliation o non-GAAP financial measures.

Net Interest Income & Margin Net Interest Income The flat or inverted yield $ Millions curve has pressured our Net Interest Income net interest margin Net Interest Margin 3.20% 3.19% 3.11% • 3Q19 Net Interest Margin declined to 2.96% 3.11% and net interest income decreased to $47.1 million compared to the prior quarter $47.9 $48.9 • Higher deposit costs and lower balances and 2.96% yields on loans due to flat or inverted yield $47.6 curve compared to second quarter $49.2 $47.1 • 3Q19 trailing 12 month loans held-for- investment beta 41% • 3Q19 trailing 12 month retail deposit beta of 3Q18 4Q18 1Q19 2Q19 3Q19 61% p. 9

Interest-Earning Assets Cash & Cash Equivalents Investment Securities Loans Held for Sale Average interest-earning asset yield Loans Held for Investment decreased 12 basis points since Average Yield 2Q19 due to lower market interest Average Balances rates Average Yield $ Billions Percent $8 4.60% $6.46 $6.46 $6.47 $6.70 $6.44 $7 4.50% $6 4.40% $5 4.50% 4.50% 4.38% $4 4.46% 4.30% $3 4.20% 4.31% $2 4.10% $1 $0 4.00% 3Q18 4Q18 1Q19 2Q19 3Q19 p. 10

Deposits Balances Interest-Bearing Transaction & Savings Deposits Noninterest-Bearing Transaction & Savings Deposits $ Millions Time Deposits Mortgage Svcg. Escrow Accts. & Other $7,000 $5,724 $5,804 $6,000 $5,397 $5,155 $5,051 $5,000 47% 47% $4,000 51% 51% 49% $3,000 12% 12% 13% $2,000 12% 12% 36% $1,000 30% 31% 31% 37% $- 7% 6% 7% 5% 4% 9/30/2018 12/31/2018 3/31/2019 6/30/2019 9/30/2019 Total Cost of Deposits 0.88% 1.03% 1.14% 1.26% 1.41% • De novo branches, those opened within the past five years, grew deposits by 11% during the third quarter; opened 19 branches, or 31% of our total network, during this time period • Total deposits include $0, $133m, $219m, $163m, and $212m in servicing deposits related to discontinued operations for the periods ended September, 30, 2019, June 30, 2019, March 31, 2019, December 31, 2018, and September 30, 2018, respectively p. 11

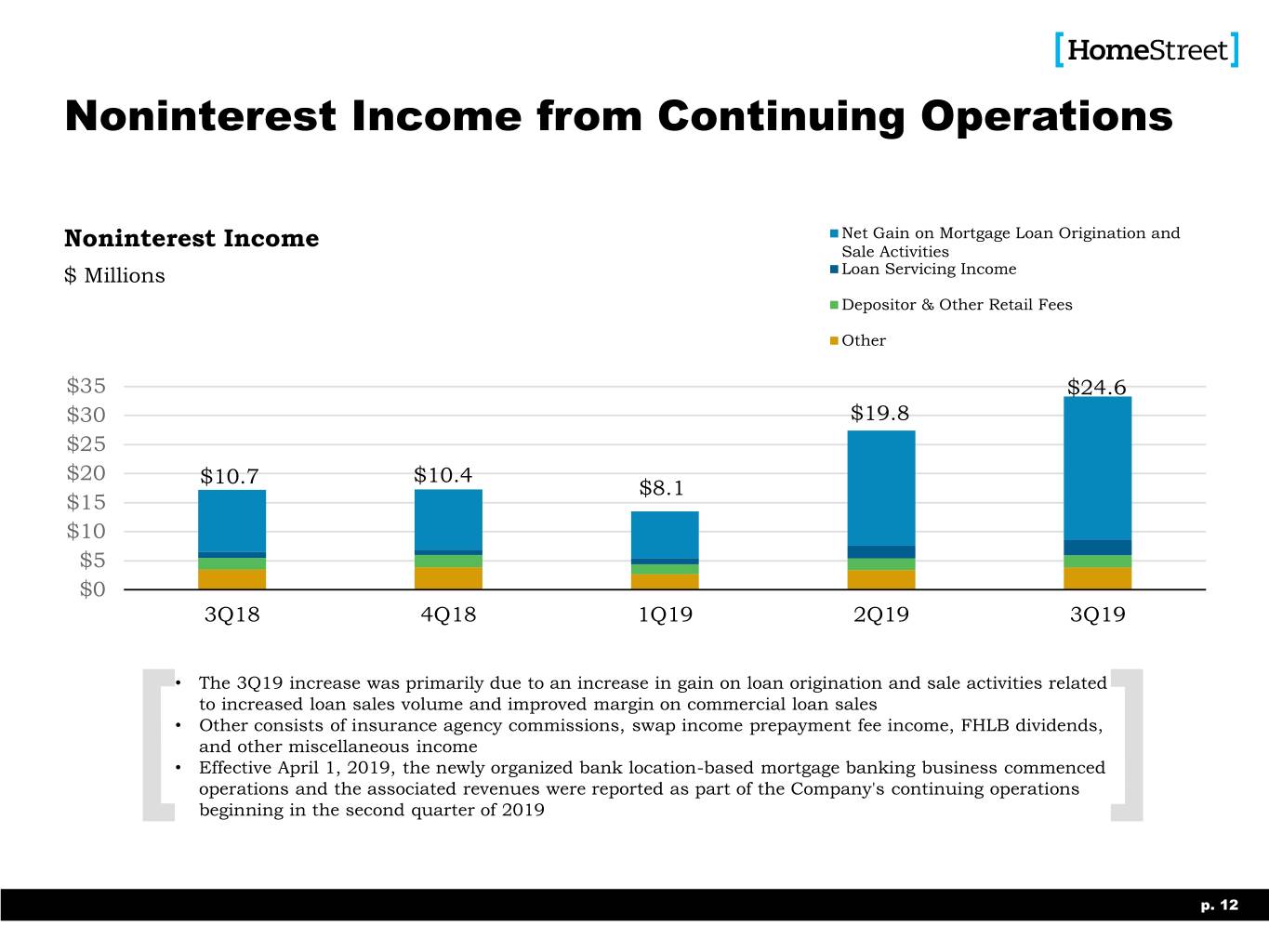

Noninterest Income from Continuing Operations Noninterest Income Net Gain on Mortgage Loan Origination and Sale Activities $ Millions Loan Servicing Income Depositor & Other Retail Fees Other $35 $24.6 $30 $19.8 $25 $20 $10.7 $10.4 $8.1 $15 $10 $5 $0 3Q18 4Q18 1Q19 2Q19 3Q19 • The 3Q19 increase was primarily due to an increase in gain on loan origination and sale activities related to increased loan sales volume and improved margin on commercial loan sales • Other consists of insurance agency commissions, swap income prepayment fee income, FHLB dividends, and other miscellaneous income • Effective April 1, 2019, the newly organized bank location-based mortgage banking business commenced operations and the associated revenues were reported as part of the Company's continuing operations beginning in the second quarter of 2019 p. 12

Noninterest Expense from Continuing Operations Salaries & related costs Noninterest Expense FTE General & administrative $ Millions Other noninterest expense 2,053 2,036 FTE $60 1,937 2,200 $50 1,900 $40 $30 1,221 1,132 1,600 $20 1,300 $10 $0 1,000 3Q18 4Q18 1Q19 2Q19 3Q19 Noninterest Expense $47.9 $47.9 $47.8 $58.8 $55.7 Salaries & Related Costs $25.1 $25.6 $25.3 $34.2 $32.8 General & Administrative $8.6 $7.3 $8.2 $7.8 $9.5 Other Noninterest Expense $14.2 $15.0 $14.3 $16.8 $13.4 FTE 2,053 2,036 1,937 1,221 1,132 • The 3Q19 decrease was due primarily to a $1.7 million FDIC assessment credit, lower proxy solicitation costs, and a decrease in salaries and occupancy costs related to our cost savings initiatives • Management and our bank efficiency consultants have identified substantial potential expense reduction opportunities involving technology, organizational, and personnel changes. The timing of the reductions will vary, though a meaningful amount is projected to be realized in early 2020 p. 13

Loan Portfolio Production Trend Commitments Sep. 30, 2019 Jun. 30, 2019 Mar. 31, 2019 Dec. 30, 2018 Sep. 30, 2018 $ Millions Single Family $22 4% $28 5% $36 7% $55 8% $107 14% SFR Custom Home Construction 58 12% 44 7% 51 10% 77 11% 71 10% Home Equity and Other 43 9% 84 14% 97 18% 124 18% 124 17% Total Consumer Loans $123 25% $156 26% $184 35% $256 37% $302 41% Non-owner Occupied CRE $36 7% $27 4% $45 8% $65 9% $49 7% Multifamily 162 33% 202 33% 142 26% 152 22% 137 19% Residential Construction 113 23% 154 25% 89 16% 152 22% 145 20% CRE / Multifamily Construction 0 0% 0 0% 7 1% 12 2% 20 3% Total CRE Loans $311 63% $383 62% $283 51% $381 55% $351 49% Owner Occupied CRE $27 5% $11 2% $6 1% $17 2% $9 1% Commercial Business 34 7% 61 10% 73 13% 38 6% 63 9% Total C&I loans $61 12% $72 12% $79 14% $55 8% $72 10% Total $495 100% $611 100% $546 100% $692 100% $725 100% p. 14

Loan Balance Trend Balances Sep. 30, 2019 Jun. 30, 2019 Mar. 31, 2019 Dec. 30, 2018 Sep. 30, 2018 $ Millions Single Family $1,188 23% $1,259 24% $1,349 25% $1,358 27% $1,418 28% SFR Custom Home Construction 186 4% 197 4% 190 4% 188 4% 185 4% Home Equity and Other 568 11% 588 11% 585 11% 571 11% 541 11% Total Consumer Loans $1,942 38% $2,044 39% $2,124 40% $2,117 42% $2,144 43% Non-owner Occupied CRE $795 15% $768 14% $781 15% $702 14% $667 13% Multifamily 920 18% 996 19% 940 17% 908 18% 893 18% Residential Construction 280 5% 303 6% 339 6% 333 7% 320 6% CRE / Multifamily Construction 296 6% 279 5% 308 6% 274 5% 286 6% Total CRE Loans $2,291 44% $2,346 44% $2,368 44% $2,217 44% $2,166 43% Owner Occupied CRE $477 9% $471 9% $450 8% $429 8% $421 8% Commercial Business 447 9% 444 8% 422 8% 331 6% 315 6% Total C&I Loans $924 18% $915 17% $872 16% $760 14% $736 14% Total Loans Held for Investment $5,157 100% $5,305 100% $5,364 100% $5,094 100% $5,046 100% p. 15

Loan Portfolio Loan Composition: $5.2 Billion CRE by Property Type: $2.2 Billion (1) Other C&I (1) 9% 18% CRE Perm Retail Multifamily 16% 43% Nonowner Single 15% Family 23% Office 21% Industrial 11% Multifamily 18% Construction by Property Type: $762 Million Land & Lots Home Equity & Other Construction 9% 11% All Types Custom Home 15% Construction 24% Residential Construction 28% A highly diversified loan portfolio by product and geography. Multifamily Construction 26% CRE 13% (1) Includes owner occupied CRE p. 16

Permanent Commercial Real Estate CA Los Angeles County Other Lending Overview CA Other WA King/Pierce/Snohomish Oregon WA Other Geographical Distribution (Balances) 8% 2% 21% 14% 17% 7% 21% 5% 4% 16% 15% 8% 43% 1% 12% 45% 38% 9% 15% 26% 40% 11% 9% 16% 3% 3% 6% 7% 12% 66% Multifamily Industrial / Warehouse Office Retail Other Loan Characteristics • Up To 30 Year Term • Up To 15 Year Term • Up To 15 Year Term • Up To 15 Year Term • Additional property types are • $30MM Loan Amt. Max • $30MM Loan Amt. Max • $30MM Loan Amt. Max • $30MM Loan Amt. Max reviewed on a case by case • ≥ 1.15 DSCR • ≥ 1.25 DSCR • ≥ 1.25 DSCR • ≥ 1.25 DSCR basis • Avg. LTV @ Orig. ~ 60% • Avg. LTV @ Orig. ~ 66% • Avg. LTV @ Orig. ~ 68% • Avg. LTV @ Orig. ~ 61% • Includes acquired loan types • Examples include: hotels, schools, churches, marinas 9/30/19 Balances Outstanding Totaling $2.19 Billion • Balance: $940M • Balance: $242M • Balance: $469M • Balance: $338M • Balance: $203M • % of Balances: 43% • % of Balances: 11% • % of Balances: 21% • % of Balances: 16% • % of Balances: 9% • Portfolio Avg. LTV ~ 55%(1) • % Owner Occupied: 49% • % Owner Occupied: 29% • % Owner Occupied: 25% • % of Owner Occupied: 29% • Portfolio Avg. DSCR ~ 1.49x • Portfolio LTV ~ 59%(1) • Portfolio LTV ~ 60%(1) • Portfolio LTV ~ 53%(1) • Portfolio LTV ~ 42%(1) • Avg. Loan Size: $2.5M • Portfolio Avg. DSCR ~ 1.61x • Portfolio Avg. DSCR ~ 1.71x • Portfolio Avg. DSCR ~ 1.63x • Portfolio Avg. DSCR ~ 1.76x • Largest Dollar Loan: $24.4M • Avg. Loan Size: $1.7M • Avg. Loan Size: $2.2M • Avg. Loan Size: $2.2M • Avg. Loan Size: $1.7M • Largest Dollar Loan: $13.0M • Largest Dollar Loan: $24.4M • Largest Dollar Loan: $18.7M • Largest Dollar Loan: $27.2M HomeStreet lends across the full spectrum of commercial real estate lending types, but is deliberate in its efforts to achieve diversification among property types and geographic areas to mitigate concentration risk. (1) Property values as of origination date. p. 17

Seattle Metro Hawaii Construction Lending Overview Puget Sound Other California WA Other Utah Portland Metro Idaho OR Other Other: AZ, CO Geographical Distribution (Balances) 3% 2% 24% 6% 2% 13% 15% 4% 5% 1% 8% 32% 10% 33% 36% 7% 24% 1% 1% 10% 1% 5% 45% 47% 11% 17% 18% 15% 1% 15% 32% 2% 3% 29% 14% 7% 2% 2% Custom Home Construction Multifamily Commercial Residential Construction Land and Lots Loan Characteristics • 18-36 Month Term • 18-36 Month Term • 12-18 Month Term • ≤ 80% LTC • 12-24 Month Term • 12 Month Term • ≤ 80% LTC • LTC: ≤ 95% Presale & Spec • Minimum 15% Cash Equity • ≤ 50% -80% LTC • Consumer Owner Occupied • Minimum 15% Cash Equity • Leverage, Liquid. & Net • ≥ 1.25 DSC • Strong, experienced, • Borrower Underwritten • ≥ 1.20 DSC Worth Covenants as • ≥ 50% pre-leased office/retail vertically integrated builders similar to Single Family • Portfolio LTV ~ 63% appropriate • Portfolio LTV ~63% • Portfolio LTV ~ 67% • Liquidity and DSC covenants • Portfolio LTV ~ 72% • Liquidity and DSC covenants 9/30/19 Balances Outstanding Totaling $762 Million • Balance: $187M • Balance: $206M • Balance: $95M • Balance: $204M • Balance: $70M • Unfunded Commitments: • Unfunded Commitments: • Unfunded Commitments: • Unfunded Commitments: • Unfunded Commitments: $121M $76M $6M $172M $25M • % of Balances: 25% • % of Balances: 27% • % of Balances: 12% • % of Balances: 27% • % of Balances: 9% • % of Unfunded • % of Unfunded • % of Unfunded • % of Unfunded • % of Unfunded Commitments: 30% Commitments: 19% Commitments: 2% Commitments: 43% Commitments: 6% • Avg. Loan Size: $529K • Avg. Loan Size: $7.1M • Avg. Loan Size: $10.6M • Avg. Loan Size: $317K • Avg. Loan Size: $845K • Largest Dollar Loan: $2.0M • Largest Dollar Loan: $22.7M • Largest Dollar Loan: $22.6M • Largest Dollar Loan: $12.6M • Largest Dollar Loan: $6.7M Construction lending is a broad category that includes many different loan types, which possess different risk profiles. HomeStreet lends across the full spectrum of construction lending types. Additionally, expansion has provided an opportunity to increase geographic diversification. p. 18

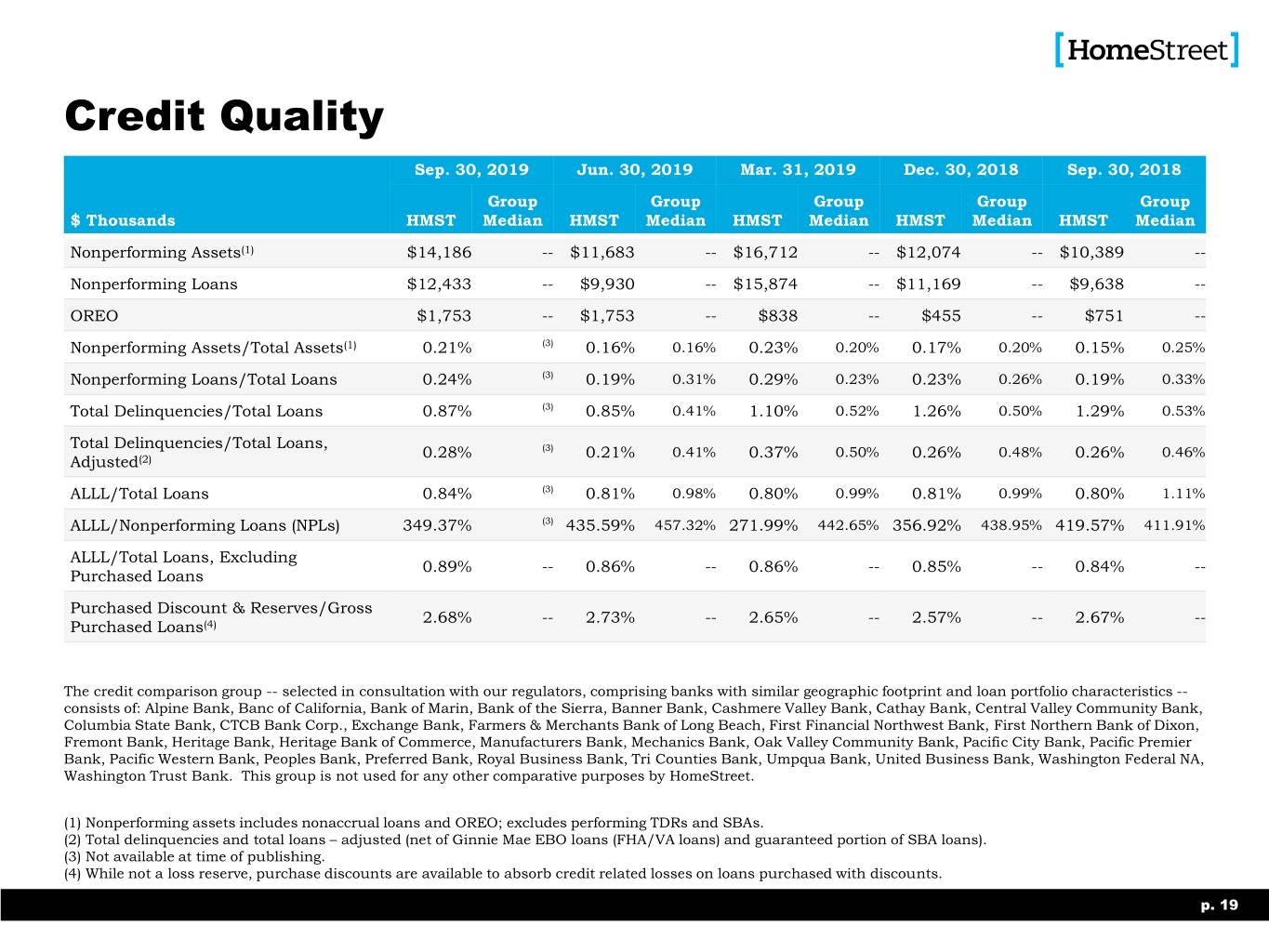

Credit Quality Sep. 30, 2019 Jun. 30, 2019 Mar. 31, 2019 Dec. 30, 2018 Sep. 30, 2018 Group Group Group Group Group $ Thousands HMST Median HMST Median HMST Median HMST Median HMST Median Nonperforming Assets(1) $14,186 -- $11,683 -- $16,712 -- $12,074 -- $10,389 -- Nonperforming Loans $12,433 -- $9,930 -- $15,874 -- $11,169 -- $9,638 -- OREO $1,753 -- $1,753 -- $838 -- $455 -- $751 -- Nonperforming Assets/Total Assets(1) 0.21% (3) 0.16% 0.16% 0.23% 0.20% 0.17% 0.20% 0.15% 0.25% Nonperforming Loans/Total Loans 0.24% (3) 0.19% 0.31% 0.29% 0.23% 0.23% 0.26% 0.19% 0.33% Total Delinquencies/Total Loans 0.87% (3) 0.85% 0.41% 1.10% 0.52% 1.26% 0.50% 1.29% 0.53% Total Delinquencies/Total Loans, 0.28% (3) 0.21% 0.41% 0.37% 0.50% 0.26% 0.48% 0.26% 0.46% Adjusted(2) ALLL/Total Loans 0.84% (3) 0.81% 0.98% 0.80% 0.99% 0.81% 0.99% 0.80% 1.11% ALLL/Nonperforming Loans (NPLs) 349.37% (3) 435.59% 457.32% 271.99% 442.65% 356.92% 438.95% 419.57% 411.91% ALLL/Total Loans, Excluding 0.89% -- 0.86% -- 0.86% -- 0.85% -- 0.84% -- Purchased Loans Purchased Discount & Reserves/Gross 2.68% -- 2.73% -- 2.65% -- 2.57% -- 2.67% -- Purchased Loans(4) The credit comparison group -- selected in consultation with our regulators, comprising banks with similar geographic footprint and loan portfolio characteristics -- consists of: Alpine Bank, Banc of California, Bank of Marin, Bank of the Sierra, Banner Bank, Cashmere Valley Bank, Cathay Bank, Central Valley Community Bank, Columbia State Bank, CTCB Bank Corp., Exchange Bank, Farmers & Merchants Bank of Long Beach, First Financial Northwest Bank, First Northern Bank of Dixon, Fremont Bank, Heritage Bank, Heritage Bank of Commerce, Manufacturers Bank, Mechanics Bank, Oak Valley Community Bank, Pacific City Bank, Pacific Premier Bank, Pacific Western Bank, Peoples Bank, Preferred Bank, Royal Business Bank, Tri Counties Bank, Umpqua Bank, United Business Bank, Washington Federal NA, Washington Trust Bank. This group is not used for any other comparative purposes by HomeStreet. (1) Nonperforming assets includes nonaccrual loans and OREO; excludes performing TDRs and SBAs. (2) Total delinquencies and total loans – adjusted (net of Ginnie Mae EBO loans (FHA/VA loans) and guaranteed portion of SBA loans). (3) Not available at time of publishing. (4) While not a loss reserve, purchase discounts are available to absorb credit related losses on loans purchased with discounts. p. 19

Outlook p. 20

Key Drivers Guidance Metric Outlook Comments • Seasonal run-off in single family portfolio due to higher prepayments Loans Held for Investment Slightly Increasing • Offset by continued growth in commercial and commercial real estate loans • Consumer deposit balances are expected to increase as de novo branches continue to mature • Business deposit balances are expected to increase in line with Deposits Increasing growth of C&I lending • Offset somewhat by shrinkage of servicing related deposits as portfolio declines • Adverse impact of flat yield curve and lower short-term rates Net Interest Margin Slightly Decreasing • Higher-rate promotional CD balances funding servicing related deposit transfers will remain through 1Q20 Assuming that we are able to realize the expense reductions currently planned by management and projected by our consultants and absent continuing negative impacts to our net interest margin beyond current expectations or as a result of changes in the interest rate environment, including any additional cuts to short-term rates by the Federal Reserve, or other changes in the business environment that would negatively impact our ability to accomplish our goals, we continue to expect to achieve an efficiency ratio in the low to mid 60% range, return on average assets exceeding 1.1%, and return average on tangible equity exceeding 11% by the end of the third quarter 2020. The timing of future expense reductions will vary depending on the nature of the expense, although a meaningful amount is expected to be realized in early 2020. The information in this presentation, particularly including but not limited to that presented on this slide, is forward-looking in nature, and you should review Item 1A, “Risk Factors,” in our most recent Quarterly Report on From 10-Q for a list of factors that may cause us to deviate from our plans or to fall short of our expectations. p. 21

Appendix p. 22

Statements of Financial Condition Quarter Ended $ Thousands Sep. 30, 2019 Jun. 30, 2019 Mar. 31, 2019 Dec. 30, 2018 Sep. 30, 2018 Cash and Cash Equivalents $74,708 $99,602 $67,690 $57,982 $59,006 Investment Securities 866,736 803,819 816,878 923,253 903,685 Loans Held For Sale 172,958 145,252 56,928 77,324 103,763 Loans Held For Investment, Net 5,139,108 5,287,859 5,345,969 5,075,371 5,026,301 Mortgage Servicing Rights 90,624 94,950 95,942 103,374 106,592 Other Real Estate Owned 1,753 1,753 838 455 751 Goodwill 30,170 30,170 29,857 22,564 22,564 Operating Lease Right-of-Use Assets 101,843 102,353 113,083 - - Other Assets 274,987 282,103 287,436 304,864 292,181 Assets of Discontinued Operations 82,911 352,929 356,784 477,034 514,239 Total Assets $6,835,878 $7,200,790 $7,171,405 $7,042,221 $7,029,082 Deposits $5,804,307 $5,590,893 $5,178,334 $4,888,558 $4,943,545 Federal Home Loan Bank Advances 5,590 387,590 599,590 932,590 816,591 Accounts Payable And Other Liabilities 84,905 102,943 126,546 169,970 156,283 Federal funds purchased & securities sold under agreements to repurchase - - 27,000 19,000 55,000 Long-term Debt 125,603 125,556 125,509 125,462 125,415 Operating Lease Liabilities 120,072 121,677 130,221 - - Liabilities of Discontinued Operations 5,075 148,221 237,174 167,121 217,466 Total Liabilities 6,144,742 6,476,880 6,424,374 6,302,701 6,314,300 Common Stock 511 511 511 511 511 Share Subject to Repurchase - 52,735 - - - Additional Paid-in Capital 309,649 308,705 342,049 342,439 341,606 Retained Earnings 372,981 359,252 411,826 412,009 396,782 Accumulated Other Comprehensive Income (Loss) 7,995 2,707 (7,355) (15,439) (24,117) Total Shareholders’ Equity 691,136 671,175 747,031 739,520 714,782 Total Liabilities and Shareholders’ Equity $6,835,878 $7,200,790 $7,171,405 $7,042,221 $7,029,082 p. 23

HomeStreet Available for Sale Securities Portfolio Investment Portfolio Composition as of 9/30/2019 Agency Debenture AFS Investment securities portfolio 3% market value is $862 million The investment portfolio has an average CMO credit rating of Aa1 35% Accumulated other comprehensive Municipal income increased by $5.3 million from 44% 2Q19 to 3Q19 Corporates 2019 YTD 2% Yield(2) Duration(2) Total Return(1) HomeStreet AFS Investment MBS 16% 6.87% 2.72% 3.69 Portfolio Composition Adjusted MBS 6.15 2.40 3.39 and municipal indices(3) HMST performance data: Bloomberg PORT+. (1) As of 9/30/2019 (2) Yield and duration Include FTE adjustment. Yields are at current market prices, not book. Duration adjusted using 21% effective tax rate. (3) Bloomberg Barclays US MBS index total return value unhedged USD (52% primary liquidity portfolio) and Bloomberg Barclays Municipal Bond index total return index value unhedged (48% contingent liquidity portfolio) adjusted to reflect HMST portfolio composition as of 9/30/2019 p. 24

Non-GAAP Financial Measures Consolidated Results 3 Months Ended 9 Months Ended $ Thousands Sep. 30, 2019 Jun. 30, 2019 Sep. 30, 2018 Sep. 30, 2019 Sep. 30, 2018 Net Income $13,827 $(5,588) $11,835 $6,524 $24,800 Impact of Income Tax Reform-related Benefit - - - - - Impact of Restructuring-related Items (Net of Tax) (858) 9,572 414 18,278 5,629 Impact of Acquisition-related Items (Net of Tax) 4 (33) 4 261 (32) Core Net Income 12,973 3,951 12,253 25,063 30,397 Noninterest Expense 57,644 101,585 94,595 256,929 305,929 Impact of Restructuring-related Expenses 1,086 (12,116) (524) (23,136) (7,125) Impact of Acquisition-related Expenses (5) 42 (5) (330) 41 Noninterest Expense, Excluding Restructuring and Acquisition- 58,725 89,511 94,066 233,463 298,845 related Expenses Diluted Earnings Per Common Share $0.55 $(0.22) $0.44 $0.22 $0.91 Impact of Income Tax Reform-related Benefit - - - - - Impact of Restructuring-related Items (Net of Tax) (0.03) 0.36 0.01 0.70 0.21 Impact Of Acquisition-related Items (Net of Tax) - - - 0.01 - Diluted Earnings Per Common Share, Excluding Income Tax Reform- related Benefit, Restructuring (Net of Tax) and Acquisition-related 0.52 0.14 0.45 0.93 1.12 Items (Net of Tax) p. 25

Non-GAAP Financial Measures Consolidated Results (cont.) 3 Months Ended 9 Months Ended $ Thousands Sep. 30, 2019 Jun. 30, 2019 Sep. 30, 2018 Sep.30, 2019 Sep. 30, 2018 Return On Average Shareholders' Equity 7.98% (3.02)% 6.23% 1.19% 4.45% Impact of Restructuring-related Items (Net of Tax) (0.49)% 5.16% 0.22% 3.35% 1.01% Impact of Acquisition-related Items (Net of Tax) 0.00% (0.02)% 0.00% 0.05% (0.01)% Return On Average Shareholders' Equity, Excluding Income Tax Reform-related Benefit, Restructuring (Net of Tax) And Acquisition- 7.49% 2.12% 6.45% 4.59% 5.45% related Items (Net of Tax) Return On Average Tangible Shareholders' Equity 8.42% (3.17)% 6.47% 1.25% 4.63% Impact of Restructuring-related Items (Net of Tax) (0.52)% 5.43% 0.23% 3.51% 1.05% Impact of Acquisition-related Items (Net of Tax) 0.00% (0.02)% 0.00% 0.05% (0.01)% Return On Average Tangible Shareholders' Equity, Excluding Income Tax Reform-related Benefit, Restructuring (Net of Tax) And 7.90% 2.24% 6.70% 4.81% 5.67% Acquisition-related Items (Net of Tax) Efficiency Ratio 78.08% 106.83% 86.19% 96.60% 90.13% Impact of Restructuring-related Items 1.47% (12.74)% (0.48)% (8.70)% (2.10)% Impact of Acquisition-related Items (0.01)% 0.04% 0.00% (0.12)% 0.01% Efficiency Ratio, Excluding Restructuring and Acquisition-related 79.54% 94.13% 85.71% 87.78% 88.04% Items Return On Average Assets 0.79% (0.31)% 0.66% 0.12% 0.47% Impact of Restructuring-related Items (Net Of Tax) (0.05)% 0.52% 0.02% 0.34% 0.11% Impact of Acquisition-related Items (Net of Tax) 0.00% 0.00% 0.01% 0.00% 0.00% Return On Average Assets, Excluding Income Tax Reform-related Benefit, Restructuring (Net of Tax) and Acquisition-related Items (Net 0.74% 0.21% 0.69% 0.46% 0.58% of Tax) p. 26

Non-GAAP Financial Measures Tangible Book Value $ Thousands, 3 Months Ended 9 Months Ended Except Share Data Sep. 30, 2019 Jun. 30, 2019 Sep. 30, 2018 Sep. 30, 2019 Sep. 30, 2018 Shareholders’ Equity $691,136 $723,910 $714,782 $691,136 $714,782 Less: Goodwill and Other Intangibles (36,341) (36,771) (28,442) (36,341) (28,442) Tangible Shareholders’ Equity $654,795 $687,139 $686,340 $654,795 $686,340 Common Shares Outstanding 24,408,513 26,085,164 26,989,742 24,408,513 26,989,742 Book Value Per Share $28.32 $27.75 $26.48 $28.32 $26.48 Impact of Goodwill and Other (1.49) (1.41) (1.05) (1.49) (1.05) Intangibles Tangible Book Value Per Share 26.83 26.34 25.43 26.83 25.43 Average Shareholders’ Equity 693,475 741,330 760,446 728,215 743,417 Less: Average Goodwill and Other (36,617) (36,604) (28,698) (33,973) (29,099) Intangibles Average Tangible Shareholders’ Equity $656,858 $704,726 $731,748 $694,242 $714,318 Return on Average Shareholders’ Equity 7.88% 4.80% 4.25% 5.06% 2.51% – Continuing Operations Impact of Goodwill and Other 0.44% 0.25% 0.17% 0.24% 0.11% Intangibles Return on Average Tangible Shareholders’ Equity – Continuing 8.32% 5.05% 4.42% 5.30% 2.62% Operations p. 27