Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Arcosa, Inc. | exh991agreementtoacqui.htm |

| 8-K - 8-K - Arcosa, Inc. | a20191212form8-kcherry.htm |

Exhibit 99.2 Overview of Cherry Acquisition December 12, 2019

How to Find Us OUR WEBSITE NYSE TICKER www.arcosa.com ACA HEADQUARTERS INVESTOR CONTACT Arcosa, Inc. InvestorResources@arcosa.com 500 North Akard Street, Suite 400 Dallas, Tx 75201 2 / Moving Infrastructure Forward

Forward-Looking Statements Some statements in this presentation, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about Arcosa, Inc.’s (“Arcosa” or the “Company”) estimates, expectations, beliefs, intentions or strategies for the future. Arcosa uses the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance,” “outlook,” “vision,” and similar expressions to identify these forward-looking statements. Forward-looking statements speak only as of the date of this presentation, and Arcosa expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein, except as required by federal securities laws. Forward-looking statements are based on management’s current views and assumptions and involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations, including but not limited to assumptions, risks and uncertainties regarding achievement of the expected benefits of Arcosa’s separation from Trinity Industries, Inc. (“Trinity”; NYSE:TRN); tax treatment of the separation; failure to successfully close or integrate the Cherry acquisition, or failure to achieve the expected benefits of the acquisition; market conditions and customer demand for Arcosa’s business products and services; the cyclical nature of, and seasonal or weather impact on, the industries in which Arcosa competes; competition and other competitive factors; governmental and regulatory factors; changing technologies; availability of growth opportunities; market recovery; improving margins; and Arcosa’s ability to execute its long-term strategy, and such forward-looking statements are not guarantees of future performance. For further discussion of such risks and uncertainties, see “Risk Factors” and the “Forward-Looking Statements” section of “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Arcosa’s Form 10-K for the year ended December 31, 2018, as may be revised and updated by Arcosa’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Non-GAAP Financial Measures This presentation contains financial measures that have not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Reconciliations of non-GAAP financial measures to the closest GAAP measure are provided in the Appendix. Presentation of Financials The spin-off of the Company by Trinity was completed on November 1, 2018. The Company’s financial statements for periods prior to November 1, 2018 were presented on a “carve-out” basis. The carve-out financials of the Company are not necessarily representative of the amounts that would have been reflected in the financial statements had the Company been an independent company during the applicable periods. 3 / Moving Infrastructure Forward

Executive Summary . On December 12th, we announced an agreement to acquire the Cherry Companies (“Cherry”) for $298M . Cherry is a leading provider of natural and recycled aggregates in greater Houston, with 12 locations in the area. Cherry had trailing 12 month revenues of $176M and EBITDA of ~$37M as of 09/30/2019, implying an ~8x EBITDA multiple . The acquisition is a strong strategic fit for several reasons: - Expands Arcosa’s aggregates business into the greater Houston market, a key gap in our current Texas network - Builds leadership position in recycled aggregates, a growing product category due to resource scarcity and ESG benefits - Provides platform to replicate Cherry’s natural and recycled aggregates offering in additional geographies - Accelerates Arcosa’s overall portfolio shift into Construction Products, a key Stage 1 Initiative . We expect to fund the transaction with a combination of cash on-hand and advances under our credit facility, and expect to close the acquisition in Q1 2020 4 / Moving Infrastructure Forward

Cherry Companies Highlights $176M Natural Aggregates Recycled Aggregates Revenue $37M . Mining and processing of sand, including . Crushing and recycling concrete to re-use EBITDA processing into stabilized materials by as aggregates mixing with cement 6M+ Strategic Rationale Tons Produced . Expands aggregates business into the greater Houston market, a key gap in our current Texas network Annually . Builds leadership position in recycled aggregates, a growing product category due to resource scarcity and ESG benefits . Provides platform to replicate Cherry’s natural and recycled aggregates offering in new geographies 12 . Accelerates Arcosa’s overall portfolio shift into Construction Products Houston Locations Note: Revenue and EBITDA are TTM as of 09/30/19 5 / Moving Infrastructure Forward

Broad Construction Materials Product Offering Cherry produces and sells a range of construction materials used in infrastructure Materials1: ~95% of EBITDA Natural Aggregates/Stabilized Sand Recycled Aggregate Products Demolition Services: ~5% of EBITDA . Road/bridge, commercial/ industrial, and other demolition, . . Mining of sand from owned and leased reserves, Variety of material types derived from crushed primarily to provide raw material including processing into stabilized sand, a concrete, ranging from screened rock to stabilized for recycled aggregates products mixture of sand, cement, and water crushed concrete . Demolition has declined in strategic importance over time, . Stabilized sand is primarily used for backfill, . Used in diverse applications, including road base, and Cherry now buys ~40% of bedding, and site preparation (e.g., underground backfill, ballast, and erosion control raw material for recycled aggregates from 3rd parties utilities, pipeline support, retaining walls) Provides raw material for recycled aggregates products 1 Freight is included in materials EBITDA. TTM as of 09/30/19 6 / Moving Infrastructure Forward

Unique Platform with Sustainable Competitive Advantages Cherry’s competitive advantages have helped it build a market-leading platform that generates attractive financial returns Cherry’s Competitive Advantages Attractive Financial Returns Network of Access to critical raw . Demonstrated history of revenue and EBITDA strategically located products, both facilities and reserve internally and growth positions externally . EBITDA margins of ~21% Comprehensive Long-term customer solution offering to and supplier . Broad base of construction-related customers, serve range of relationships with Top 10 customers accounting for only 24% customers of 2018 revenues Top-tier management team with deep Technical expertise in . Stable platform expected to produce high returns Houston expertise; concrete recycling and on capital through a cycle strong cultural fit with repurposing Arcosa 7 / Moving Infrastructure Forward

Attractive Houston Market Transaction expands Arcosa’s aggregates business into greater Houston market, a key gap in our current Texas network Houston’s end market fundamentals suggest …and Cherry’s continued growth… platform fills in a key gap in our current . Population Annual 2.6% population growth from 2008- Texas/Gulf Coast growth 2018 was >3x the US average Aggregate mines network Specialty locations . Houston metro area had second highest Cherry locations total growth in the US from 2010-2018, behind only Dallas-Fort Worth Houston-area Cherry locations Montgomery Washington . Liberty Major ~$11B long term TxDOT plan to enhance Cherry Headquarters Austin infrastructure Houston’s highway system; major projects Waller Recycling Facility Harris investments include I-45, I-10, and US 59 Chambers Stabilized Facility . Fort Bend Traffic named as the “biggest problem facing Galveston people in Houston today” Recycling + Stabilized Facility Brazoria Sources: Rice University / Kinder Institute of Urban Research, US Census Bureau, TxDOT Unified Transportation Program (2020) 8 / Moving Infrastructure Forward

Recycled Aggregates: A Platform for Growth Acquisition builds leadership position in recycled aggregates, a growing product category due to resource scarcity and ESG benefits Demand drivers Description . Virgin natural aggregates are becoming more scarce near established metropolitan Resource areas, as decades of growth and development have depleted reserves. Scarcity is scarcity most pronounced in areas that lack coarse aggregates (e.g., TX coastal areas) . Permitting challenges are likely to push quarries further from dense, urban centers Cherry was listed as Environmental . Recycling of demolished aggregates reduces landfill use the largest recycled benefits . Shortening length of freight hauls reduces GHG emissions and road congestion aggregates producer in the US, ahead of several large . As part of “Road to Recycling” initiative, TxDOT has prioritized using recycled Increased aggregates players aggregates where possible: “Natural resources are conserved, waste disposal is product and a number of acceptance reduced, and air quality is improved due to reduced haul distances and reduced independent players energy consumption” Increased focus . Particularly in Houston and other areas with adverse weather events, recycled on erosion / aggregates are a cost-competitive material to meet increased demand for erosion flood control and flood control projects Source: Construction & Demolition Recycling (March 2019); TxDOT 9 / Moving Infrastructure Forward

Accelerates Arcosa’s portfolio shift into Construction Products The acquisition is consistent with our strategy to grow Construction Products and reduce the cyclicality of our overall portfolio Arcosa Construction Materials Platform Infrastructure-related End Markets Aggregates Specialty Materials Public Infrastructure Private Infrastructure Lightweight aggregates Highways Residential Natural aggregates Building products Buildings Commercial Recycled aggregates Non-Highway Industrial Agricultural and other infrastructure specialty materials Other Markets (Industrial, Agricultural, Oil & Gas) 10 / Moving Infrastructure Forward

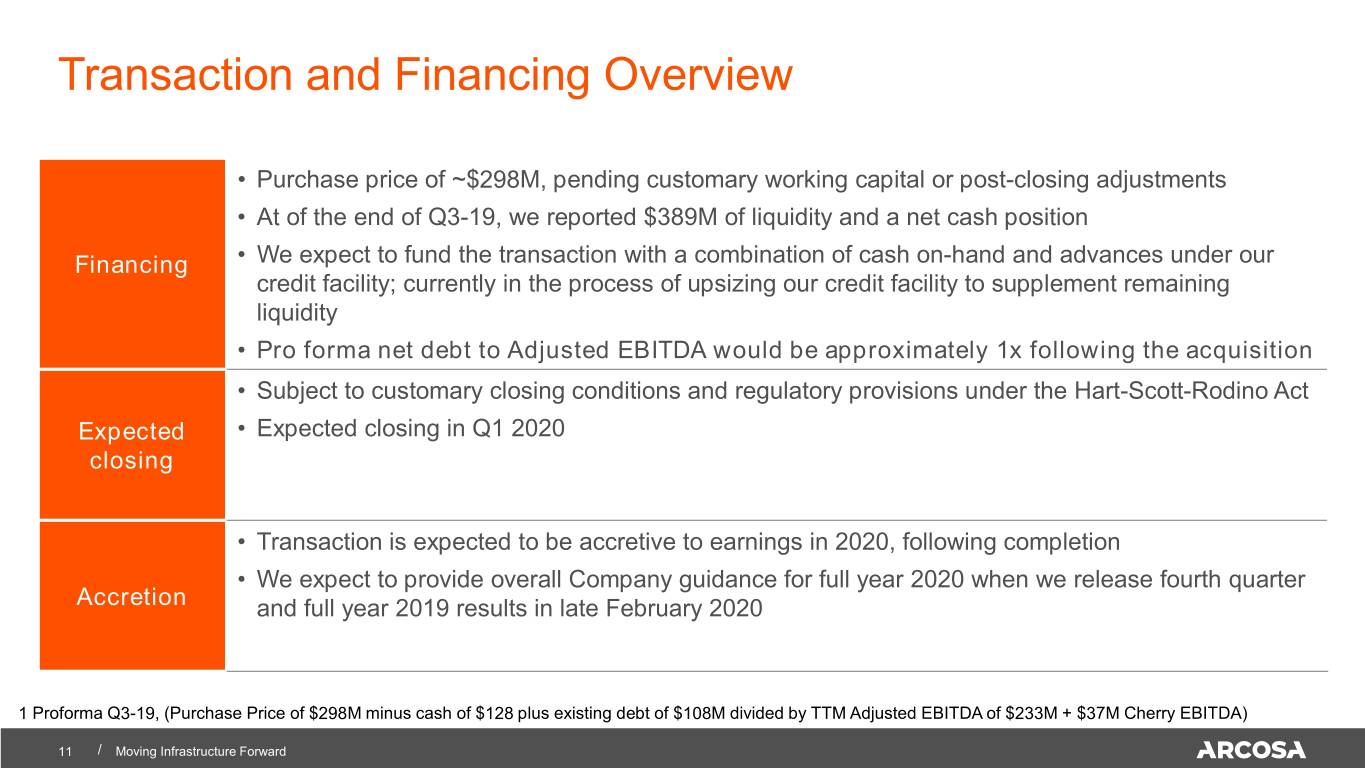

Transaction and Financing Overview • Purchase price of ~$298M, pending customary working capital or post-closing adjustments • At of the end of Q3-19, we reported $389M of liquidity and a net cash position Financing • We expect to fund the transaction with a combination of cash on-hand and advances under our credit facility; currently in the process of upsizing our credit facility to supplement remaining liquidity • Pro forma net debt to Adjusted EBITDA would be approximately 1x following the acquisition • Subject to customary closing conditions and regulatory provisions under the Hart-Scott-Rodino Act Expected • Expected closing in Q1 2020 closing • Transaction is expected to be accretive to earnings in 2020, following completion • We expect to provide overall Company guidance for full year 2020 when we release fourth quarter Accretion and full year 2019 results in late February 2020 1 Proforma Q3-19, (Purchase Price of $298M minus cash of $128 plus existing debt of $108M divided by TTM Adjusted EBITDA of $233M + $37M Cherry EBITDA) 11 / Moving Infrastructure Forward

Investment Highlights Cherry’s unique platform of Grows Arcosa’s Recycled Aggregates stabilized sand, recycled construction materials positioned to grow as a aggregates, and services presence in attractive category due to resource creates sustainable Houston market scarcity and ESG benefits competitive advantage Provides platform to replicate Cherry’s natural Accelerates Arcosa’s and recycled aggregates overall portfolio shift into offering in new Construction Products geographies 12 / Moving Infrastructure Forward

Appendix 13 / Moving Infrastructure Forward

EBITDA Reconciliation $ Millions (For the Trailing Twelve Months Ended September 30, 2019) Net income $28.5 Add: Interest expense 0.1 Provision for income taxes 1.2 Depreciation & amortization expense 7.1 EBITDA $36.9 “EBITDA” is defined as Cherry’s net income plus interest expense, income taxes, depreciation and amortization. EBITDA is not a calculation based on generally accepted accounting principles. The amounts included in the EBITDA calculation, however, are derived from amounts included in the historical statements of operations data. In addition, EBITDA should not be considered as an alternative to net income or operating income as an indicator of Cherry’s operating performance, or as an alternative to operating cash flows as a measure of liquidity. We believe EBITDA assists investors in comparing a company’s performance on a consistent basis without regard to depreciation and amortization and other expenses, which can vary significantly depending upon many factors. 14 / Moving Infrastructure Forward