Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - MIDSOUTH BANCORP INC | a201810kerex991.htm |

| 8-K - 8-K - MIDSOUTH BANCORP INC | a201810ker8-k.htm |

4Q18 Update

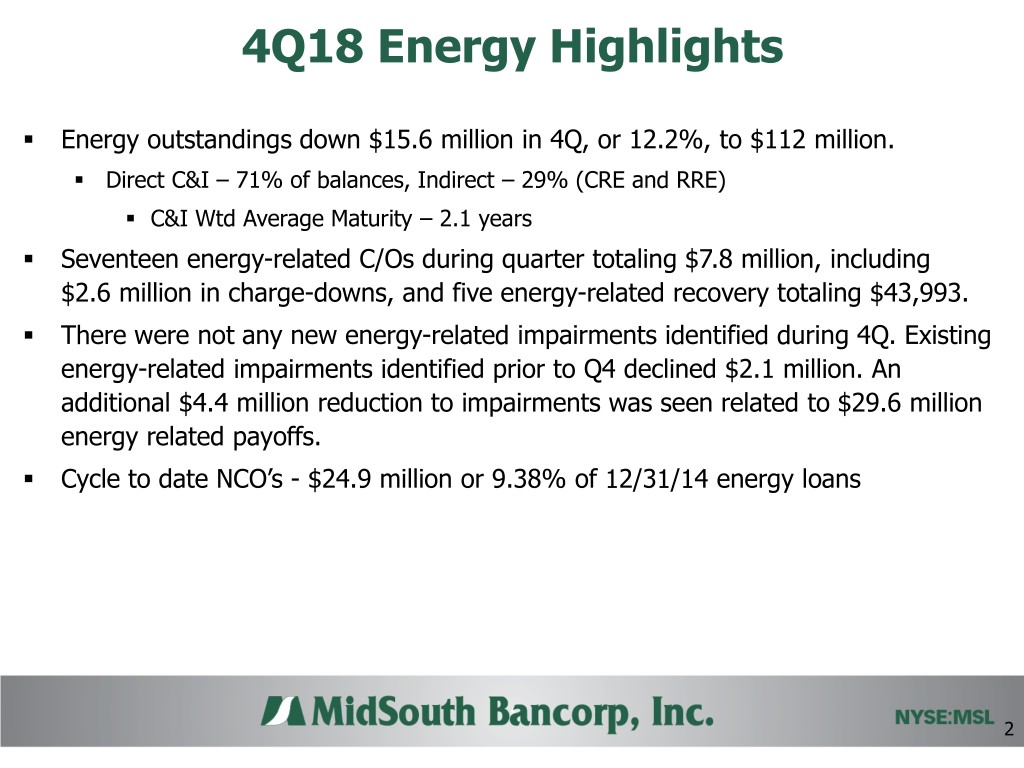

4Q18 Energy Highlights ▪ Energy outstandings down $15.6 million in 4Q, or 12.2%, to $112 million. ▪ Direct C&I – 71% of balances, Indirect – 29% (CRE and RRE) ▪ C&I Wtd Average Maturity – 2.1 years ▪ Seventeen energy-related C/Os during quarter totaling $7.8 million, including $2.6 million in charge-downs, and five energy-related recovery totaling $43,993. ▪ There were not any new energy-related impairments identified during 4Q. Existing energy-related impairments identified prior to Q4 declined $2.1 million. An additional $4.4 million reduction to impairments was seen related to $29.6 million energy related payoffs. ▪ Cycle to date NCO’s - $24.9 million or 9.38% of 12/31/14 energy loans 2

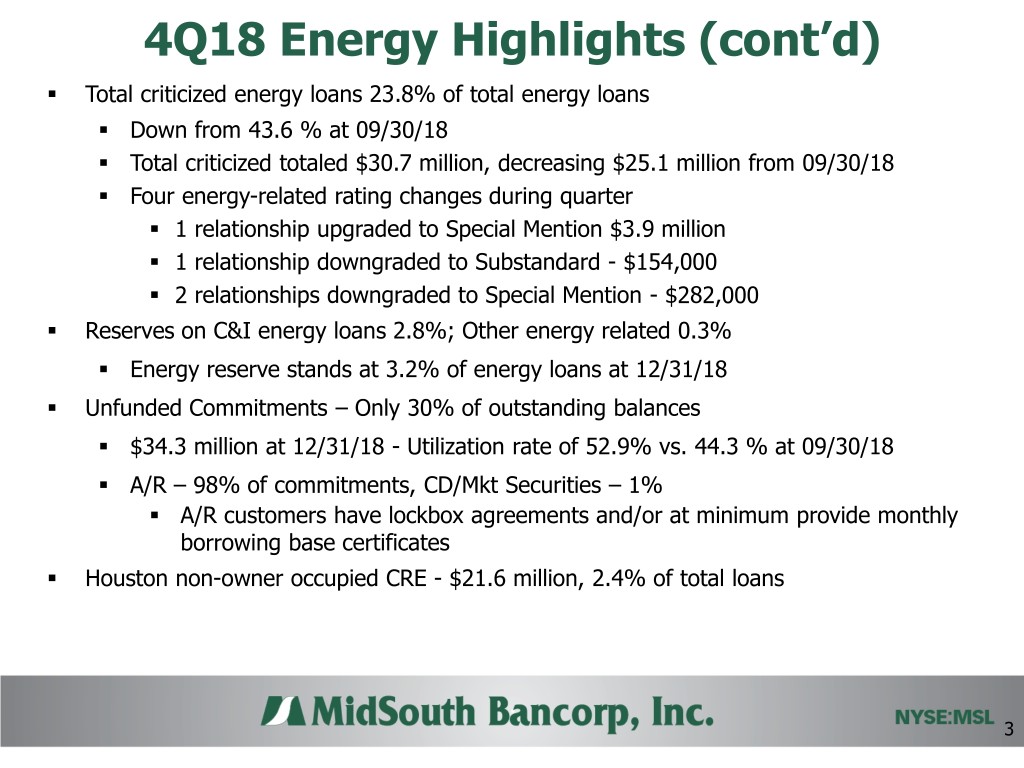

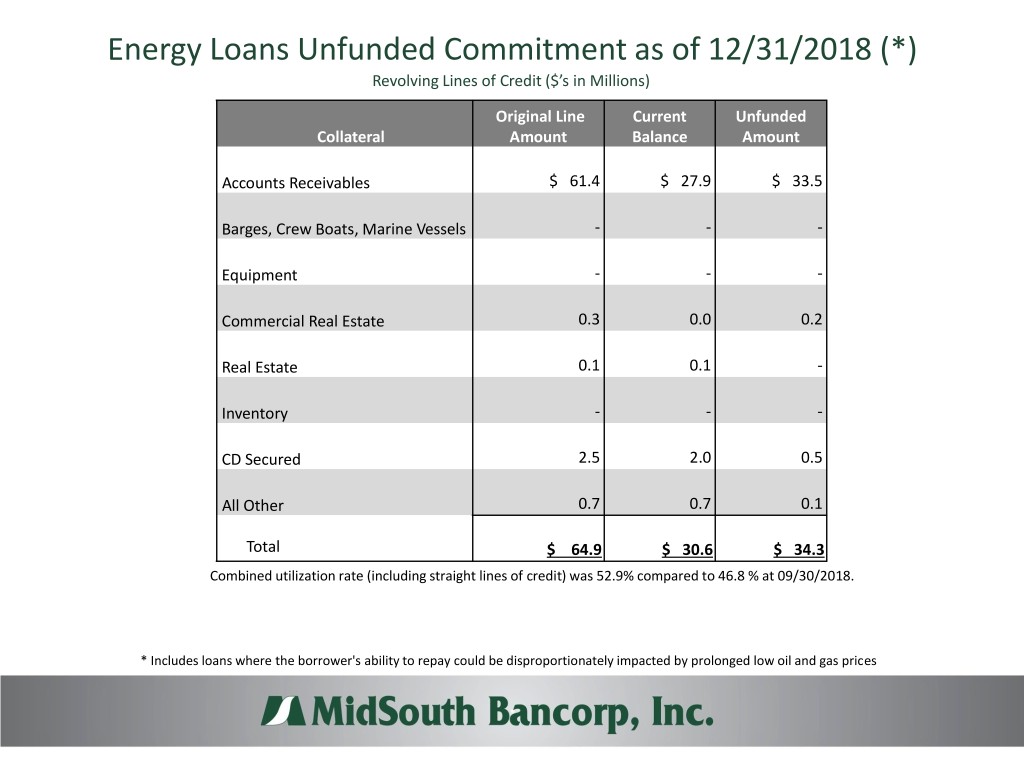

4Q18 Energy Highlights (cont’d) ▪ Total criticized energy loans 23.8% of total energy loans ▪ Down from 43.6 % at 09/30/18 ▪ Total criticized totaled $30.7 million, decreasing $25.1 million from 09/30/18 ▪ Four energy-related rating changes during quarter ▪ 1 relationship upgraded to Special Mention $3.9 million ▪ 1 relationship downgraded to Substandard - $154,000 ▪ 2 relationships downgraded to Special Mention - $282,000 ▪ Reserves on C&I energy loans 2.8%; Other energy related 0.3% ▪ Energy reserve stands at 3.2% of energy loans at 12/31/18 ▪ Unfunded Commitments – Only 30% of outstanding balances ▪ $34.3 million at 12/31/18 - Utilization rate of 52.9% vs. 44.3 % at 09/30/18 ▪ A/R – 98% of commitments, CD/Mkt Securities – 1% ▪ A/R customers have lockbox agreements and/or at minimum provide monthly borrowing base certificates ▪ Houston non-owner occupied CRE - $21.6 million, 2.4% of total loans 3

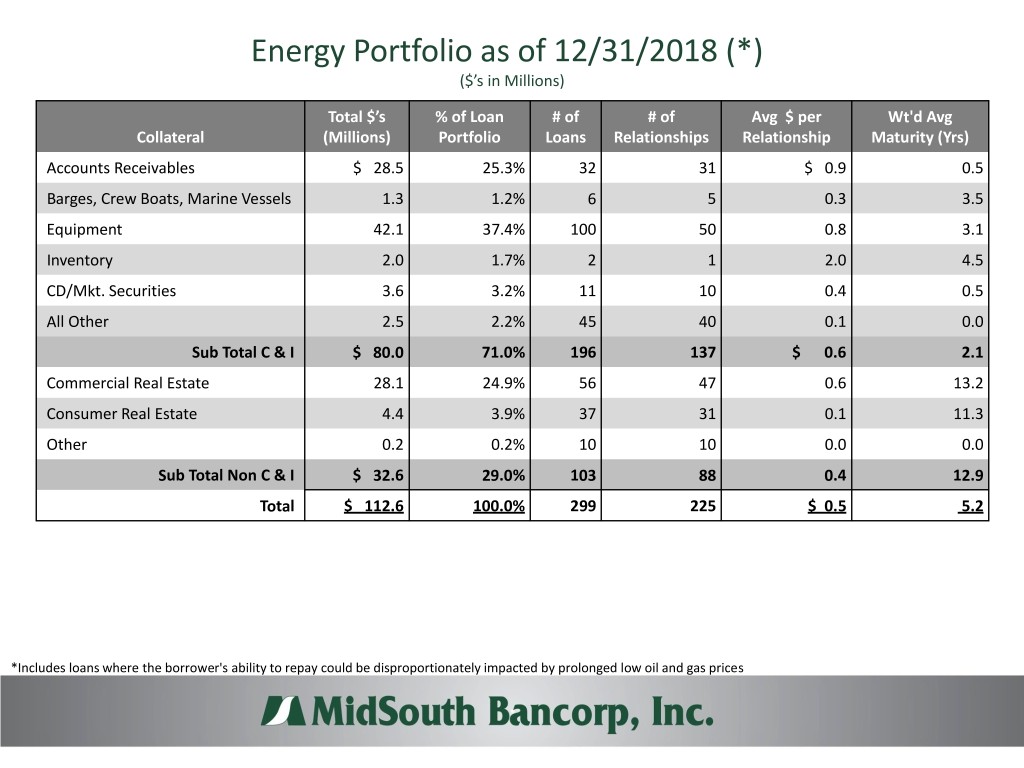

Energy Portfolio as of 12/31/2018 (*) ($’s in Millions) Total $’s % of Loan # of # of Avg $ per Wt'd Avg Collateral (Millions) Portfolio Loans Relationships Relationship Maturity (Yrs) Accounts Receivables $ 28.5 25.3% 32 31 $ 0.9 0.5 Barges, Crew Boats, Marine Vessels 1.3 1.2% 6 5 0.3 3.5 Equipment 42.1 37.4% 100 50 0.8 3.1 Inventory 2.0 1.7% 2 1 2.0 4.5 CD/Mkt. Securities 3.6 3.2% 11 10 0.4 0.5 All Other 2.5 2.2% 45 40 0.1 0.0 Sub Total C & I $ 80.0 71.0% 196 137 $ 0.6 2.1 Commercial Real Estate 28.1 24.9% 56 47 0.6 13.2 Consumer Real Estate 4.4 3.9% 37 31 0.1 11.3 Other 0.2 0.2% 10 10 0.0 0.0 Sub Total Non C & I $ 32.6 29.0% 103 88 0.4 12.9 Total $ 112.6 100.0% 299 225 $ 0.5 5.2 *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices

Past Due Energy Loans as of 12/31/2018 (*) ($’s in Millions) % of Total Past % of Accruing – Past Due ($ Millions) Total $’s Loan Due $’s Loan Non- Collateral (Millions) Portfolio (Millions) Portfolio 0-29 30-59 60-89 90+ Accruals Accounts Receivables $28.5 25.3% $ 2.57 2.3% $2.43 $0.00 $ - - $.14 Barges, Crew Boats, Marine Vessels 1.3 1.2% 0.94 0.8% - - - - 0.94 Equipment 42.1 37.4% 2.39 2.1% 0.04 - - - 2.34 Commercial Real Estate 28.1 24.9% 0.67 0.6% - 0.04 - - 0.63 Consumer Real Estate 4.4 3.9% 0.51 0.5% 0.35 - - - 0.14 Inventory 2.0 1.7% - 0.0% - - - - - CD/Mkt. Securities 3.6 3.2% 0.17 0.1% 0.17 - - - - All Other 2.7 2.4% 0.35 0.3% 0.12 .10 - - 0.14 Total $ 112.6 100.0% $ 7.60 6.7% $ 3.12 $ 0.14 $ 0.00 $ 0.00 $ 4.34 > 30 days + nonaccruals = 3.9% of energy loans *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices

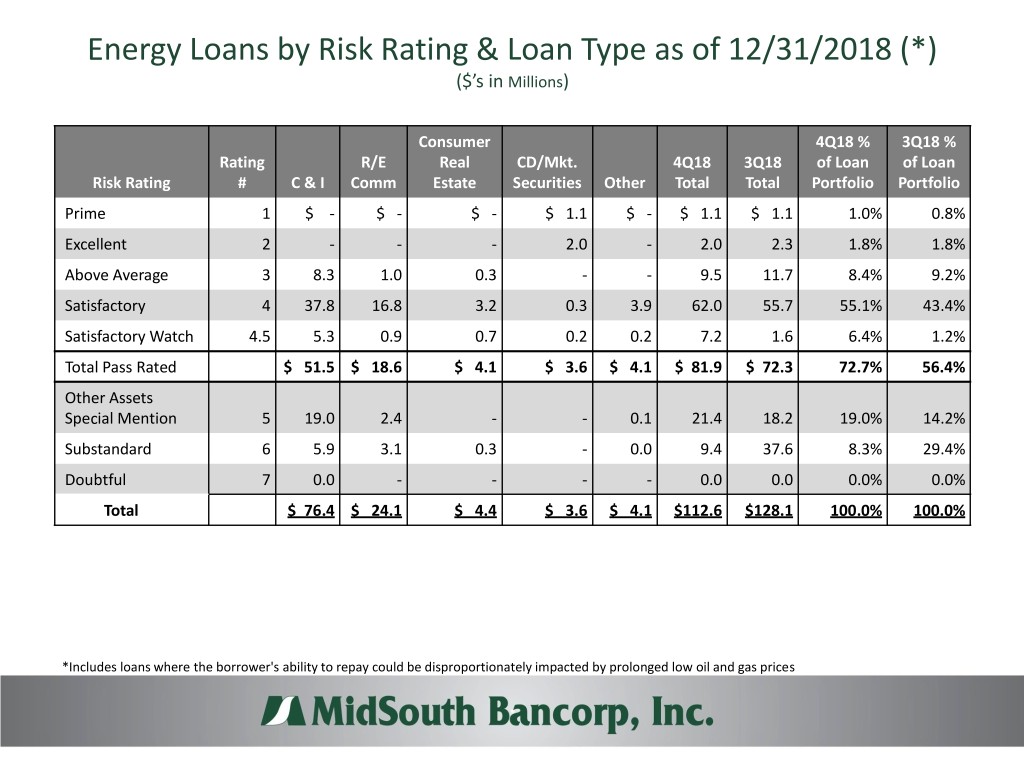

Energy Loans by Risk Rating & Loan Type as of 12/31/2018 (*) ($’s in Millions) Consumer 4Q18 % 3Q18 % Rating R/E Real CD/Mkt. 4Q18 3Q18 of Loan of Loan Risk Rating # C & I Comm Estate Securities Other Total Total Portfolio Portfolio Prime 1 $ - $ - $ - $ 1.1 $ - $ 1.1 $ 1.1 1.0% 0.8% Excellent 2 - - - 2.0 - 2.0 2.3 1.8% 1.8% Above Average 3 8.3 1.0 0.3 - - 9.5 11.7 8.4% 9.2% Satisfactory 4 37.8 16.8 3.2 0.3 3.9 62.0 55.7 55.1% 43.4% Satisfactory Watch 4.5 5.3 0.9 0.7 0.2 0.2 7.2 1.6 6.4% 1.2% Total Pass Rated $ 51.5 $ 18.6 $ 4.1 $ 3.6 $ 4.1 $ 81.9 $ 72.3 72.7% 56.4% Other Assets Special Mention 5 19.0 2.4 - - 0.1 21.4 18.2 19.0% 14.2% Substandard 6 5.9 3.1 0.3 - 0.0 9.4 37.6 8.3% 29.4% Doubtful 7 0.0 - - - - 0.0 0.0 0.0% 0.0% Total $ 76.4 $ 24.1 $ 4.4 $ 3.6 $ 4.1 $112.6 $128.1 100.0% 100.0% *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices

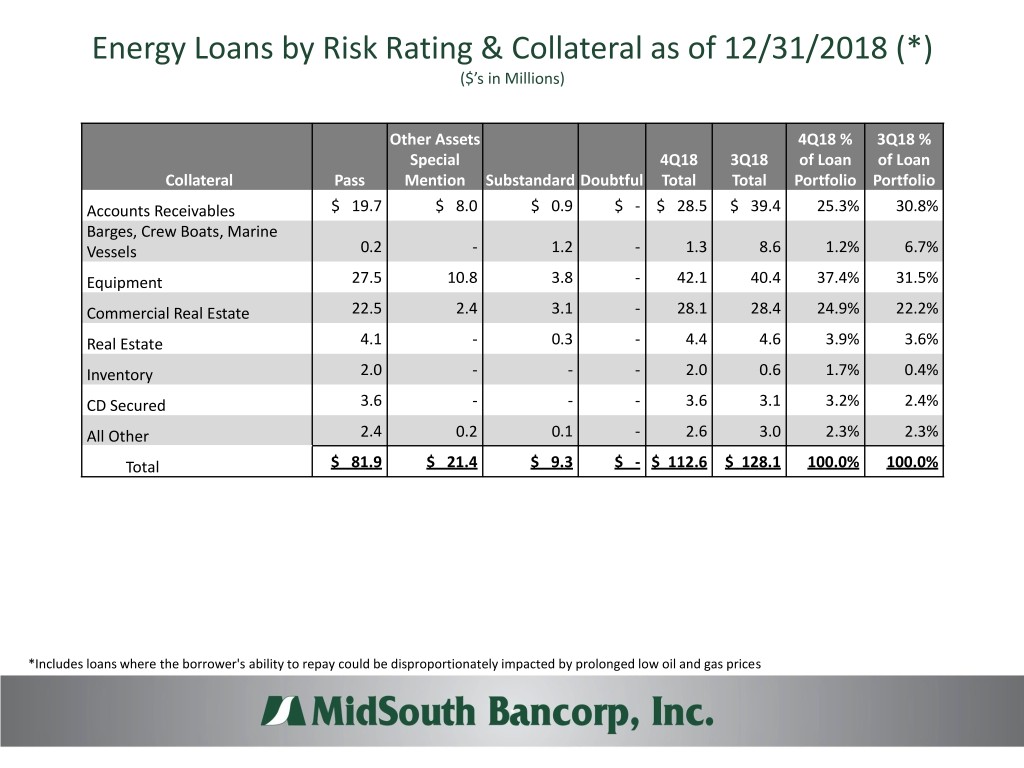

Energy Loans by Risk Rating & Collateral as of 12/31/2018 (*) ($’s in Millions) Other Assets 4Q18 % 3Q18 % Special 4Q18 3Q18 of Loan of Loan Collateral Pass Mention Substandard Doubtful Total Total Portfolio Portfolio Accounts Receivables $ 19.7 $ 8.0 $ 0.9 $ - $ 28.5 $ 39.4 25.3% 30.8% Barges, Crew Boats, Marine Vessels 0.2 - 1.2 - 1.3 8.6 1.2% 6.7% Equipment 27.5 10.8 3.8 - 42.1 40.4 37.4% 31.5% Commercial Real Estate 22.5 2.4 3.1 - 28.1 28.4 24.9% 22.2% Real Estate 4.1 - 0.3 - 4.4 4.6 3.9% 3.6% Inventory 2.0 - - - 2.0 0.6 1.7% 0.4% CD Secured 3.6 - - - 3.6 3.1 3.2% 2.4% All Other 2.4 0.2 0.1 - 2.6 3.0 2.3% 2.3% Total $ 81.9 $ 21.4 $ 9.3 $ - $ 112.6 $ 128.1 100.0% 100.0% *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices

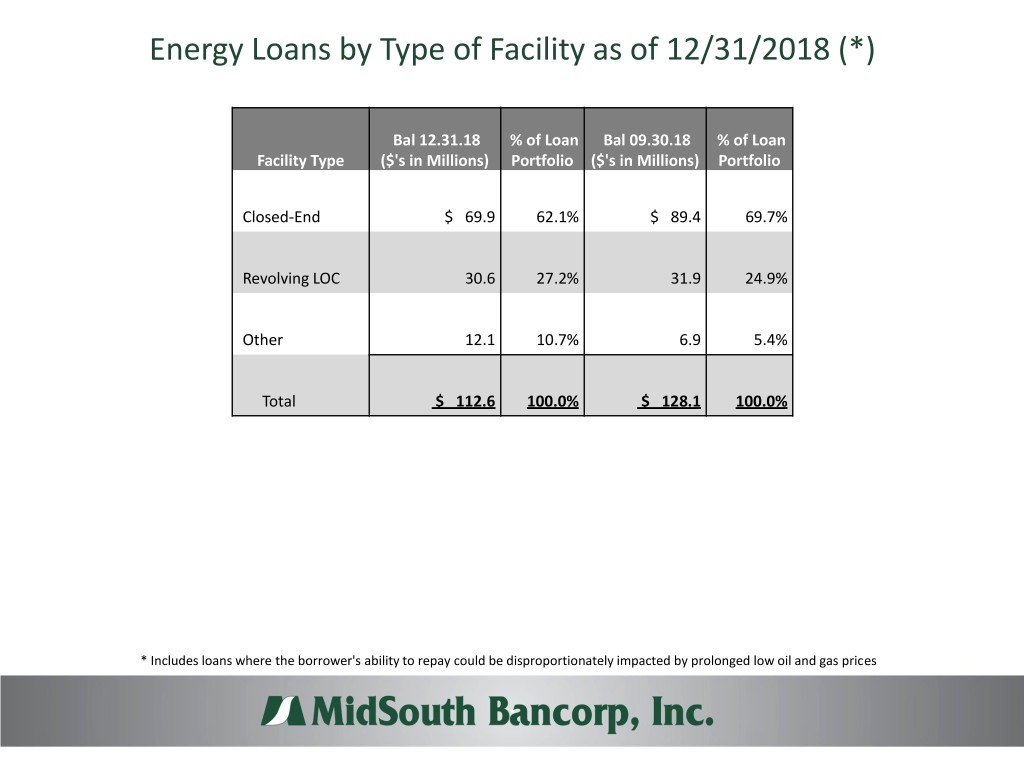

Energy Loans by Type of Facility as of 12/31/2018 (*) Bal 12.31.18 % of Loan Bal 09.30.18 % of Loan Facility Type ($'s in Millions) Portfolio ($'s in Millions) Portfolio Closed-End $ 69.9 62.1% $ 89.4 69.7% Revolving LOC 30.6 27.2% 31.9 24.9% Other 12.1 10.7% 6.9 5.4% Total $ 112.6 100.0% $ 128.1 100.0% * Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices

Energy Loans Unfunded Commitment as of 12/31/2018 (*) Revolving Lines of Credit ($’s in Millions) Original Line Current Unfunded Collateral Amount Balance Amount Accounts Receivables $ 61.4 $ 27.9 $ 33.5 Barges, Crew Boats, Marine Vessels - - - Equipment - - - Commercial Real Estate 0.3 0.0 0.2 Real Estate 0.1 0.1 - Inventory - - - CD Secured 2.5 2.0 0.5 All Other 0.7 0.7 0.1 Total $ 64.9 $ 30.6 $ 34.3 Combined utilization rate (including straight lines of credit) was 52.9% compared to 46.8 % at 09/30/2018. * Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices

Non-GAAP Financial Measures Non-GAAP Financial Measures This press release, including the accompanying financial statement tables, contains financial information determined by metho ds other than in accordance with generally accepted accounting principles, or GAAP. This financial information includes certain operating performance measures, which exclude charges that are not considered part of recurring operations. Non-GAAP measures in this press release include, but are not limited to, descriptions such as “operating net income,” “operating earnings (loss) per share,” “tangible book value per common share,” “operating return on average common equity,” “operating return on average assets,” and “operating efficiency ratio.” In addition, this press release, consistent with SEC Industry Guide 3, presents total reven ue, net interest income, net interest margin, and efficiency ratios on a fully taxable equivalent (“FTE”) basis, and ratios on an annualized basis. The FTE basis adjusts for the tax-favored status of net interest income from certain loans and investments using a federal tax rate of 21% for all periods beginning on or after January 1, 2018 and 35% for all periods prior to January 1, 2018, as well as state income taxes, where applicable, to increase tax-exempt interest income to a taxable-equivalent basis. MidSouth believes this measure to be the preferred industry measurement of net interest income and it enhances comparability of net interest income arising from taxable and tax -exempt sources. We use non-GAAP measures because we believe they are useful for evaluating our financial condition and performance over periods of time, as well as in managing and evaluating our business and in discussions about our performance. We also believe these non-GAAP financial measures provide users of our financial informati on with a meaningful measure for assessing our financial condition as well as comparison to financial results for prior periods. These measures should be viewed in addition to, and not as an alternative to or substitute for, measures determined in accordance with GAAP, and are not necessarily comparable to non-GAAP measures that may be presented by other companies. To the extent applicable, reconciliations of these non-GAAP measures to the most directly comparable measures as reported in accordance with GAAP are included with the accompanying financial statement tables.

Disclosure Forward-Looking Statements Certain statements contained herein are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, which involve risks and uncertainties. These statements include, among others, statements regarding expected future financial results, and remediation expenses, expected completion of regulatory remediation projects, our ability to return to profitability, expected loan sales and the strength of the Company's balance sheet and its positioning to address problem assets and achieve operating efficiencies and measured growth. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “will,” “would,” “could,” “should,” “guidance,” “potential,” “continue,” “project,” “forecast,” “confident,” and similar expressions are typically used to identify forward-looking statements. These statements are based on assumptions and assessments made by management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate. Any forward-looking statements are not guarantees of our future performance and are subject to risks and uncertainties and may be affected by various factors that may cause actual results, developments and business decisions to differ materially from those in the forward-looking statements. Factors that might cause such a difference include, among other matters, changes in interest rates and market prices that could affect the net interest margin, asset valuation, and expense levels; changes in local economic and business conditions in the markets we serve, including, without limitation, changes related to the oil and gas industries that could adversely affect customers and their ability to repay borrowings under agreed upon terms, adversely affect the value of the underlying collateral related to their borrowings, and reduce demand for loans; increases in competitive pressure in the banking and financial services industries; increased competition for deposits and loans which could affect compositions, rates and terms; changes in the levels of prepayments received on loans and investment securities that adversely affect the yield and value of the earning assets; our ability to successfully implement and manage our strategic initiatives and regulatory remediation efforts; costs and expenses associated with our strategic initiatives and possible changes in the size and components of the expected costs and charges associated with our strategic initiatives and regulatory remediation efforts; our ability to realize the anticipated benefits and cost savings from our strategic initiatives within the anticipated time frame, if at all; the ability of the Company to comply with the terms of the formal agreement and the consent order with the Office of the Comptroller of the Currency; risk of noncompliance with and further enforcement actions regarding the Bank Secrecy Act and other anti-money laundering statues and regulations; credit losses due to loan concentration, particularly our energy lending and commercial real estate portfolios; a deviation in actual experience from the underlying assumptions used to determine and establish our allowance for loan losses (“ALLL”), which could result in greater than expected loan losses; the adequacy of the level of our ALLL and the amount of loan loss provisions required in future periods including the impact of implementation of the new CECL (current expected credit loss) methodology; future examinations by our regulatory authorities, including the possibility that the regulatory authorities may, among other things, impose additional enforcement actions or conditions on our operations, required additional regulatory remediation efforts or require us to increase our allowance for loan losses or write-down assets; changes in the availability of funds resulting from reduced liquidity or increased costs; the timing and impact of future acquisitions or divestitures, the success or failure of integrating acquired operations, and the ability to capitalize on growth opportunities upon entering new markets; the ability to acquire, operate, and maintain effective and efficient operating systems; increased asset levels and changes in the composition of assets that would impact capital levels and regulatory capital ratios; loss of critical personnel and the challenge of hiring qualified personnel at reasonable compensation levels; legislative and regulatory changes, including the impact of regulations under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and other changes in banking, securities and tax laws and regulations and their application by our regulators, changes in the scope and cost of FDIC insurance and other coverage; regulations and restrictions resulting from our participation in government-sponsored programs such as the U.S. Treasury’s Small Business Lending Fund, including potential retroactive changes in such programs; changes in accounting principles, policies, and guidelines applicable to financial holding companies and banking; increases in cybersecurity risk, including potential business disruptions or financial losses; acts of war, terrorism, cyber intrusion, weather, or other catastrophic events beyond our control; and other factors discussed under the heading “Risk Factors” in MidSouth’s Annual Report on Form 10-K for the year ended December 31, 2017 filed with the SEC on March 16, 2018 and in its other filings with the SEC. MidSouth does not undertake any obligation to publicly update or revise any of these forward-looking statements, whether to reflect new information, future events or otherwise, except as required by law.