Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 AVNW TRANSCRIPT - AVIAT NETWORKS, INC. | a992avnwtranscriptneedhamg.htm |

| 8-K - 8-K AVIAT NEEDHAM GROWTH PRESENTATION - AVIAT NETWORKS, INC. | form8-kneedhamgrowthpresen.htm |

21st Annual Needham Growth Conference Investor Presentation (NASDAQ: AVNW) January 16, 2019

FORWARD-LOOKING STATEMENTS The information contained in this presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 21E of the Securities Exchange Act and Section 27A of the Securities Act, including expectations regarding the results for the fiscal first quarter 2019 and cash flow in fiscal 2019, and our anticipated results for fiscal 2019. All statements, trend analyses and other information contained herein about the markets for the services and products of Aviat Networks, Inc. and trends in revenue, as well as other statements identified by the use of forward-looking terminology, including "anticipate," "believe," "plan," "estimate," "expect," "goal," "will," "see," "continue," "delivering," "view," and "intend," or the negative of these terms or other similar expressions, constitute forward-looking statements. These forward-looking statements are based on estimates reflecting the current beliefs of the senior management of Aviat Networks, Inc. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-lookingstatements. For more information regarding the risks and uncertainties for our business, see "Risk Factors" in our Form 10-K filed with the U.S. Securities and Exchange Commission ("SEC") on August 28, 2018, as well as other reports filed by Aviat Networks, Inc. with the SEC from time to time. Aviat Networks, Inc. undertakes no obligation to update publicly any forward-looking statement for any reason, except as required by law, even as new information becomes available or other events occur in the future. SLIDE 2 AVIAT NETWORKS

WHAT MAKES US AN ATTRACTIVE LONG-TERM INVESTMENT? Market Position: Leading provider and specialist in wireless backhaul and networking utilizing cutting-edge microwave transmission with growing professional services Competitive Trend: Capturing an increasing share of market within North America Private Networks while maintaining a strong position in the global Service Provider vertical Large Installed Base: Marquee customers including several of the premier mobile operators in the world; servicing over 50% of the largest utility companies and over 50% of US statewide networks, while partnering with the leading public safety integrator Technology: Leading products in several key categories addressing networking, automation, capacity and output power…the most important attributes for our industry Market Opportunity: We operate in an industry that is geared to grow in support of 5G, IoT, smart cities, and the explosion of video and data applications across all markets served; increasing investments in first responder networking – our sweet spot; continued growth in LTE while 5G momentum builds Proven Performance and Positive Outlook: We have successfully realigned our business, resulting in modest growth, significant margin expansion and close to a $22M Adjusted EBITDA improvement over the past 2 years; FY19 anticipated to show top- and bottom-line momentum Enterprise Value ~6.5X Trailing EBITDA and ~ .25X Revenue – Substantial Upside as we Deliver! SLIDE 3 AVIAT NETWORKS

Technology & Services Leadership Uniquely Positioned Specialist

TECHNOLOGY FOCUS 1 2 INCREASED 5G+ IP/MPLS TO CAPACITY THE EDGE 3 5G AUTOMATION 4G AND SDN EVOLVING INTELLIGENT WIRELESS CONNECTIVITY SLIDE 5 AVIAT NETWORKS

INDUSTRY LEADING PRODUCTS MOST SECURE, HYBRID SPLIT-MOUNT INDUSTRY’S NETWORK OUTDOOR RADIO UNIT MANAGEMENT MISSION-CRITICAL PLATFORM HIGHEST CAPACITY MICROWAVE UPGRADED (Capacity) UPGRADED (Capacity) ECLIPSE ODU 600 PROVISION MICROWAVE ROUTERS HIGHEST POWER MICROWAVE RADIO ALL NEW PLATFORM WTM 4000 Solutions for 5G Transport: High Capacity, Lifecycle AVIATCLOUD UPGRADED (IP/MPLS) UPGRADED (Capacity) Automation CTR 8000 IRU 600 SLIDE 6 AVIAT NETWORKS

UNIQUE ABILITY TO ADDRESS MULTIPLE VERTICAL MARKETS Multi-Gigabit SDN-Based Management Microwave for 5G Solutions for Network- Ready Mobile Wide Operations Backhaul Simplification Zero Footprint, Integrated Microwave Routing Solutions for Enterprise Access SDN-Based, Microwave Routing Solutions for Lowest TCO Transport Networks High Capacity, All-Outdoor Trunking for Long Haul Backbone Links Substation 10Gbps Millimeter Wave Solutions for Fixed Wireless Generation Grid Powerful, High Capacity & and 5G Access Secure Solutions for Utility Reliable, High Capacity Solutions Transport Networks for Public Safety Systems SLIDE 7 AVIAT NETWORKS

INCREASING AUTOMATION TO ENHANCE SERVICES CAPABILITIES Aviat Cloud Automation AVIATDEPLOY Design, Purchasing & licensing AVIATDESIGN TURNKEY SERVICE Installation, Operation, Optimization & Support AVIATCARE Increasing Recurring Revenue & Addressable Market Opportunity SLIDE 8 AVIAT NETWORKS

DIVERSE, STABLE BUSINESS WITH GROWTH POTENTIAL VERTICALS DIVERSITY GEOGRAPHICAL DIVERSITY Mobile Private 44% 56% Americas EMEA Asia Pacific 57% 32% 11% Positive Momentum in mobile and private networks Presence in all geographies, strongest in high margin regions SOLUTIONS DIVERSITY CUSTOMER DIVERSITY AviatCloud Differentiated total solution offering – hardware, software, services, on-line B2B capability. Brand name accounts; ~ 90% Direct Sales SLIDE 9 AVIAT NETWORKS

GAINING MOMENTUM AND MARKET SHARE ACROSS PRIVATE NETWORK VERTICALS Aviat Awarded Microwave Aviat Awarded Nearly $40M Aviat Networks Wins ~$20 Aviat Networks Selected by and IP/MPLS Business by in Business with the State Million in U.S. Utility Motorola Solutions for the the State of Nevada of Colorado Business State of Florida's Statewide • Awarded a $10M network upgrade • The state to support all mission- • Represents orders received in Network project, which includes hardware, critical communications for public FY19 YTD from U.S-based gas, • Aviat selected to provide wireless software and services safety, first responders and various water and electric utilities transport products and services state agencies • Aviat to provide its IRU 600 EHP • $5 million with sustainable energy • Supported Motorola Solutions radio, CTR microwave routers and • 3-year contract for ~$28M to company with operations in 24 throughout selection and award AviatCloud automation platform implement a network using Aviat’s states; $3.5 million with a leading process including systems • Includes multi-year outsourced microwave, IP/MPLS routers, west-coast water utility engineering and design and managed services, including management software and full • The remainder from over 25 utility contract phase of the project engineering, installation and turnkey services accounts indicating scope of support to design and build network • Additional $9.5M received since market penetration and reach in initial order (January 2018) this vertical • New customer for Aviat – highly competitive deal SLIDE 10

Financial Review Company Outlook

FISCAL 2019 Q1 NON-GAAP FINANCIAL HIGHLIGHTS Income Statement Summary (Non-GAAP) Key Take-Aways Q1 FY19 Q1 FY18 (In Millions $) Variance ➢ Fourth consecutive quarter of $60 million-plus in revenue Actual Actual Revenue $60.5 $56.2 Up 7.7% ➢ Revenue increased YOY driven by a 30% improvement in international business sales primarily from mobile operators in Gross Margin $17.9 $17.3 $0.6 APAC and several smaller customers in Africa Gross Margin % 29.6% 30.8% (120) bps ➢ Year-to-date, ~$20 million of new orders from the Utility market vertical Operating Expenses $18.3 $17.6 $0.7 ➢ Operating Income (Loss) $(0.4) $(0.3) $(0.1) Margin declined YOY due to a lower proportion of North America revenue; upside anticipated throughout FY19 Net Income (Loss) From Continuing Operations $(0.6) $(0.6) -- ➢ YOY increase in operating expenses driven by investments in Attributable to Aviat Networks growth-related activities in sales, marketing and R&D functions Adjusted EBITDA $0.9 $0.9 -- Direction Remains on Track With Eighth Consecutive Quarter of Adjusted EBITDA Profitability SLIDE 12 AVIAT NETWORKS

FISCAL 2019 Q1 BALANCE SHEET KEY INDICATORS ($’s in millions) Q1 FY19 Q4 FY18 Q1 FY18 Key Take-Aways Cash/Cash Equivalents (and $28.4 $37.4 $39.6 ➢ Cash down in Q1 FY19 due to timing of collections in Africa/ME and restricted cash) higher working capital requirements for larger projects Accounts Receivable $50.9 $43.1 $43.6 ➢ Accounts receivable increased directly due to timing of payments DSO’s 77 Days 63 Days 71 Days Inventory $10.0 $22.8 $24.7 ➢ Inventory down by $14.7 million on a YOY basis and reflects Turns 17.0 6.9 6.3 reduction of deferred inventories under ASC 606 DPO’s 71 Days 72 Days 81 Days Third-Party Debt $9.0 $9.0 $9.0 Accounts Payable $33.3 $30.9 $34.4 Strong Balance Sheet Capable of Supporting Continued Growth SLIDE 13 AVIAT NETWORKS

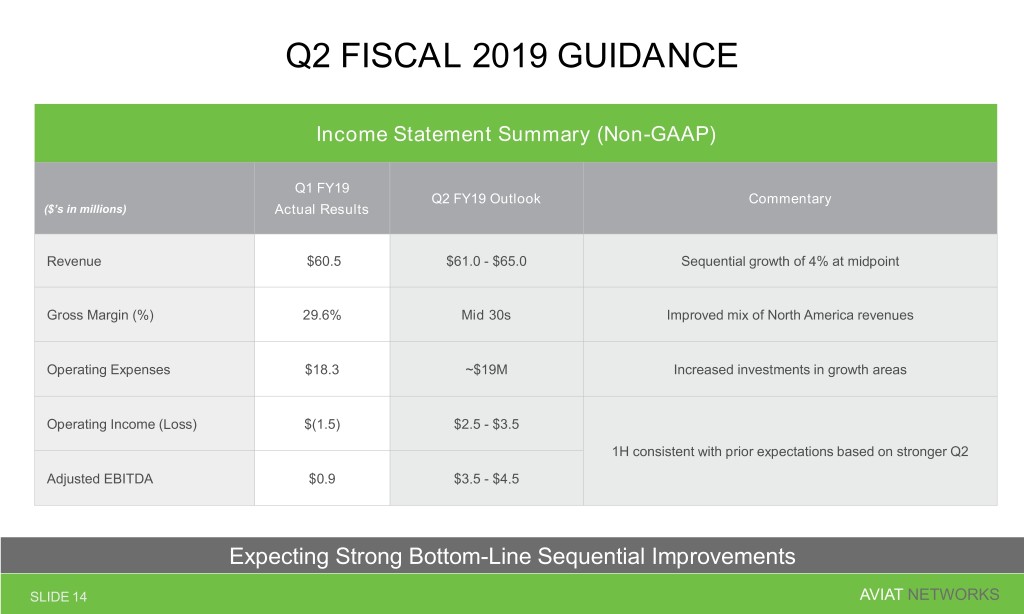

Q2 FISCAL 2019 GUIDANCE Income Statement Summary (Non-GAAP) Q1 FY19 Q2 FY19 Outlook Commentary ($’s in millions) Actual Results Revenue $60.5 $61.0 - $65.0 Sequential growth of 4% at midpoint Gross Margin (%) 29.6% Mid 30s Improved mix of North America revenues Operating Expenses $18.3 ~$19M Increased investments in growth areas Operating Income (Loss) $(1.5) $2.5 - $3.5 1H consistent with prior expectations based on stronger Q2 Adjusted EBITDA $0.9 $3.5 - $4.5 Expecting Strong Bottom-Line Sequential Improvements SLIDE 14 AVIAT NETWORKS

FISCAL YEAR 2019 GUIDANCE AND KEY DRIVERS Income Statement Summary (Non-GAAP) KEY DRIVERS FOR FY 2019: FY19 Outlook Commentary ($’s in millions) ➢ Opportunities across all private network verticals Revenue $250.0 - $260.0 Anticipate YOY growth of ~4.0% - 7.0% globally ➢ Increasing share with service provider customers Gross Margin (%) 32.0% - 33.0% In line with prior FY19 expectations preparing for 5G; supporting existing customer base in their 4G and LTE networks Operating Expenses $75.0 - $77.0 Increased investments in growth-related areas ➢ Addressable market expansion enabled by WTM product platform, Aviat store, new service Operating Income ~$7.0 ~30% increase YOY offerings and enhanced partnerships Adjusted EBITDA ~$12.5 ~24% increase YOY Maintaining Positive Expectations for FY19 Performance SLIDE 15 AVIAT NETWORKS

KEY TAKE-AWAYS • Competitive position continues to strengthen; multiple opportunities for long-term growth • Increasing investment in growth related activities; continue to optimize other areas • Expecting stronger second quarter with significant bottom-line improvements; maintaining positive full year outlook • Cash performance expected to improve over the course of the year • Potential for significant value appreciation as we deliver improved profitability and top-line growth Aviat Networks is Positioned for Long-Term Financial Success and Market Expansion SLIDE 16 AVIAT NETWORKS

FOR MORE USEFUL ANALYSIS AND INSIGHT, FOLLOW AVIAT NETWORKS ON AVIAT NETWORKS