Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMEDISYS INC | d675092d8k.htm |

Amedisys J.P. Morgan Healthcare Conference 2019 Exhibit 99.1

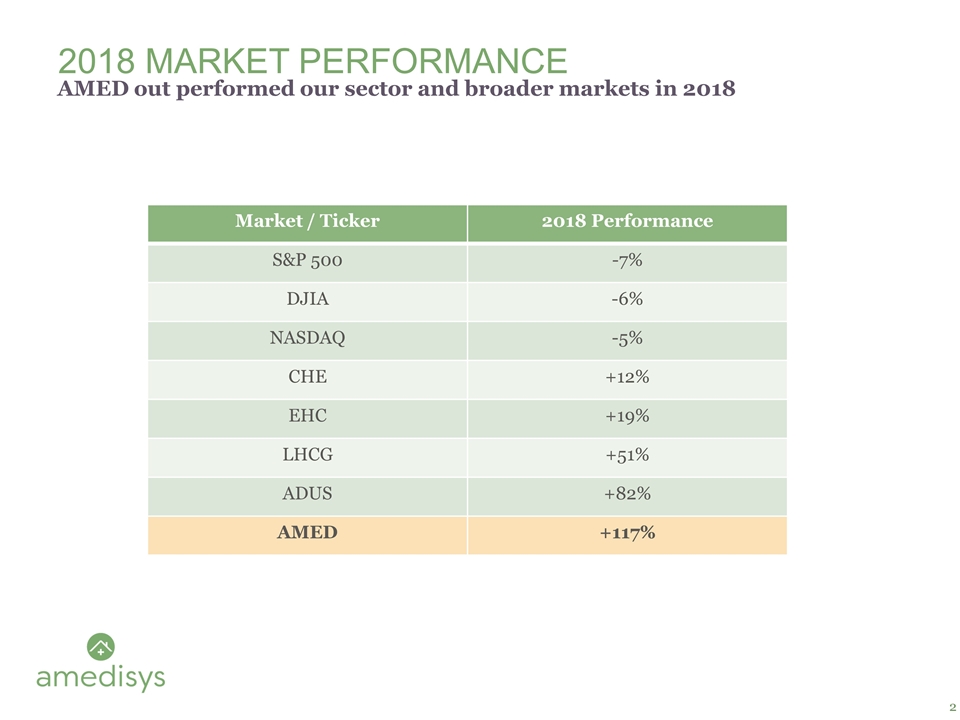

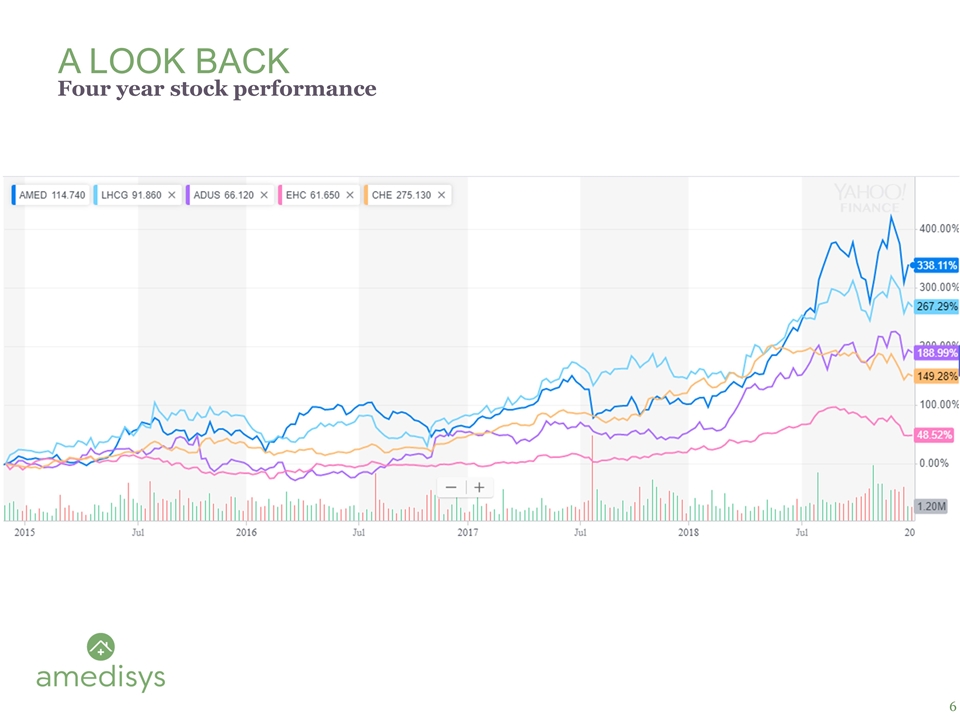

2018 market performance AMED out performed our sector and broader markets in 2018 Market / Ticker 2018 Performance S&P 500 -7% DJIA -6% NASDAQ -5% CHE +12% EHC +19% LHCG +51% ADUS +82% AMED +117%

The turnaround: intense and sole focus on our patients, our employees and our Processes

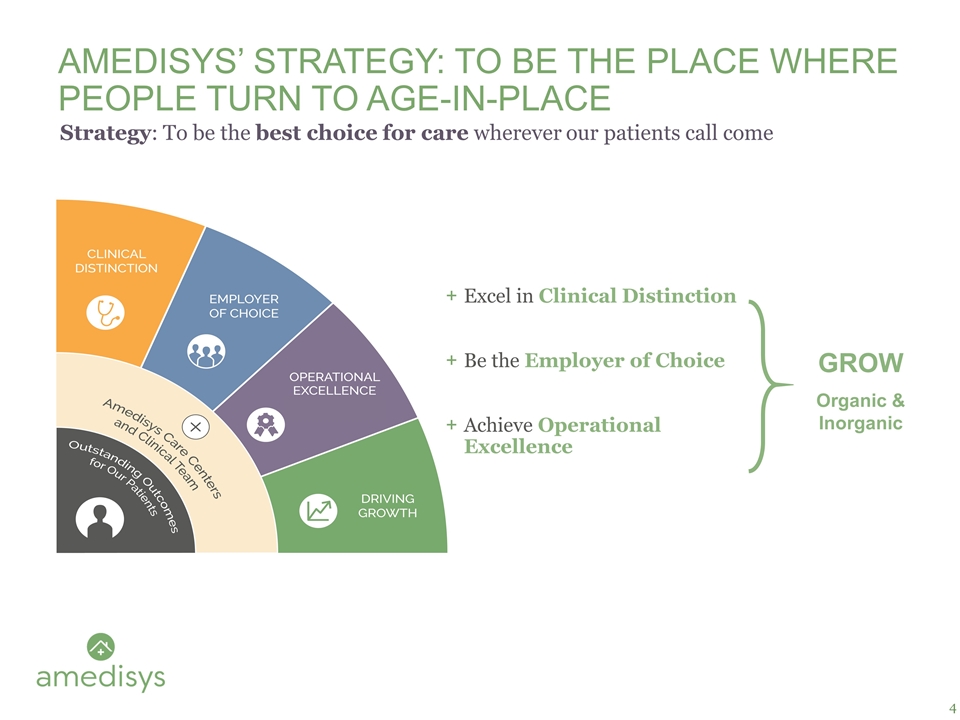

Amedisys’ Strategy: to be the place where people turn to age-in-place Excel in Clinical Distinction Be the Employer of Choice Achieve Operational Excellence GROW Organic & Inorganic Strategy: To be the best choice for care wherever our patients call come & Efficiency

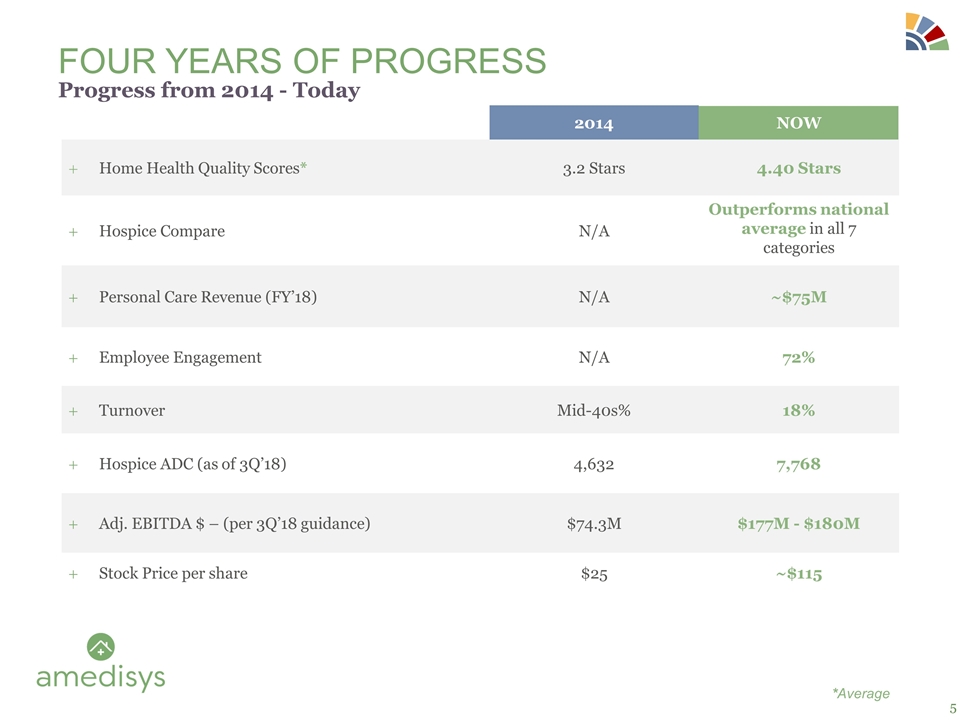

four years of progress 2014 NOW Home Health Quality Scores* 3.2 Stars 4.40 Stars Hospice Compare N/A Outperforms national average in all 7 categories Personal Care Revenue (FY’18) N/A ~$75M Employee Engagement N/A 72% Turnover Mid-40s% 18% Hospice ADC (as of 3Q’18) 4,632 7,768 Adj. EBITDA $ – (per 3Q’18 guidance) $74.3M $177M - $180M Stock Price per share $25 ~$115 *Average Progress from 2014 - Today

A look back Four year stock performance

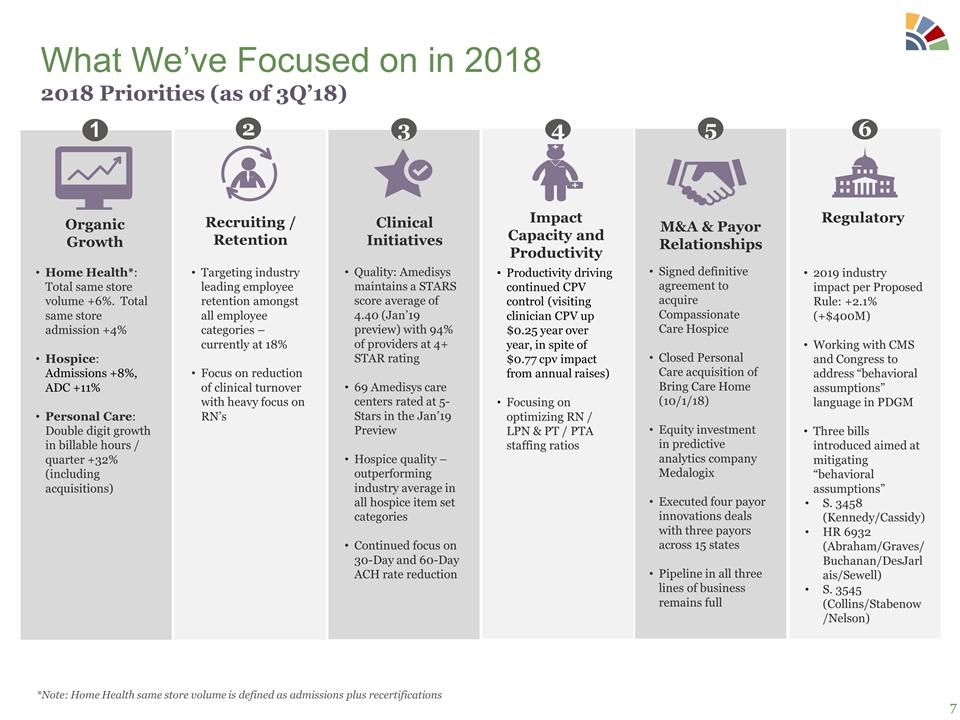

What We’ve Focused on in 2018 2018 Priorities (as of 3Q’18) Home Health*: Total same store volume +6%. Total same store admission +4% Hospice: Admissions +8%, ADC +11% Personal Care: Double digit growth in billable hours / quarter +32% (including acquisitions) 1 Organic Growth Quality: Amedisys maintains a STARS score average of 4.40 (Jan’19 preview) with 94% of providers at 4+ STAR rating 69 Amedisys care centers rated at 5-Stars in the Jan’19 Preview Hospice quality – outperforming industry average in all hospice item set categories Continued focus on 30-Day and 60-Day ACH rate reduction 3 Clinical Initiatives Productivity driving continued CPV control (visiting clinician CPV up $0.25 year over year, in spite of $0.77 cpv impact from annual raises) Focusing on optimizing RN / LPN & PT / PTA staffing ratios 4 Impact Capacity and Productivity Signed definitive agreement to acquire Compassionate Care Hospice Closed Personal Care acquisition of Bring Care Home (10/1/18) Equity investment in predictive analytics company Medalogix Executed four payor innovations deals with three payors across 15 states Pipeline in all three lines of business remains full 5 M&A & Payor Relationships 2 Recruiting / Retention Targeting industry leading employee retention amongst all employee categories – currently at 18% Focus on reduction of clinical turnover with heavy focus on RN’s *Note: Home Health same store volume is defined as admissions plus recertifications 2019 industry impact per Proposed Rule: +2.1% (+$400M) Working with CMS and Congress to address “behavioral assumptions” language in PDGM Three bills introduced aimed at mitigating “behavioral assumptions” S. 3458 (Kennedy/Cassidy) HR 6932 (Abraham/Graves/Buchanan/DesJarlais/Sewell) S. 3545 (Collins/Stabenow/Nelson) 6 Regulatory

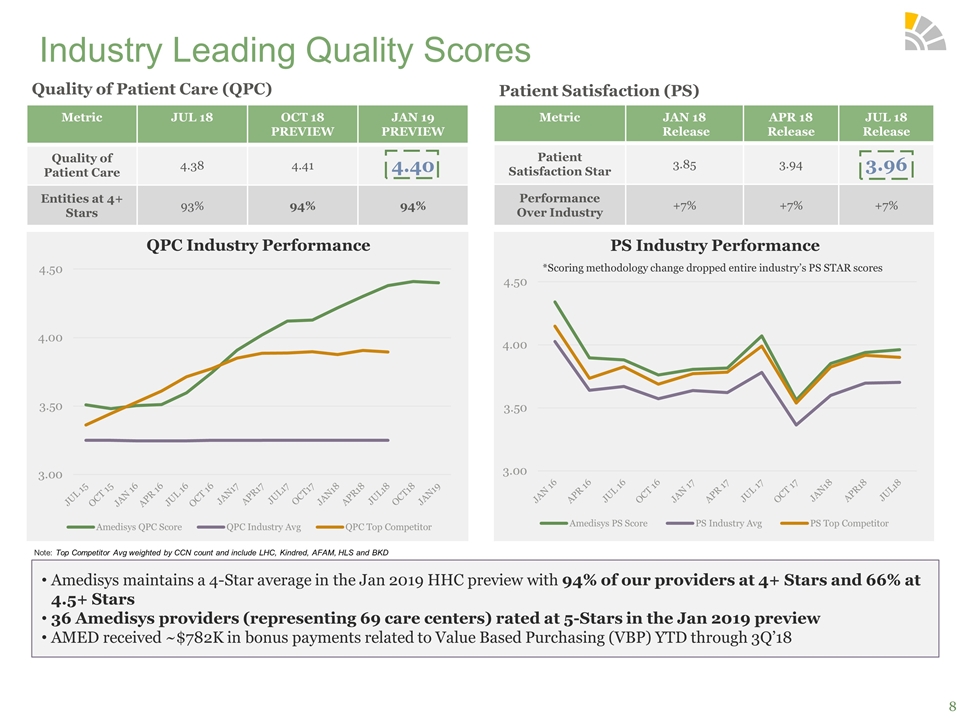

Industry Leading Quality Scores Note: Top Competitor Avg weighted by CCN count and include LHC, Kindred, AFAM, HLS and BKD Metric JUL 18 OCT 18 PREVIEW JAN 19 PREVIEW Quality of Patient Care 4.38 4.41 4.40 Entities at 4+ Stars 93% 94% 94% Metric JAN 18 Release APR 18 Release JUL 18 Release Patient Satisfaction Star 3.85 3.94 3.96 Performance Over Industry +7% +7% +7% Quality of Patient Care (QPC) Patient Satisfaction (PS) QPC Industry Performance PS Industry Performance *Scoring methodology change dropped entire industry’s PS STAR scores Amedisys maintains a 4-Star average in the Jan 2019 HHC preview with 94% of our providers at 4+ Stars and 66% at 4.5+ Stars 36 Amedisys providers (representing 69 care centers) rated at 5-Stars in the Jan 2019 preview AMED received ~$782K in bonus payments related to Value Based Purchasing (VBP) YTD through 3Q’18

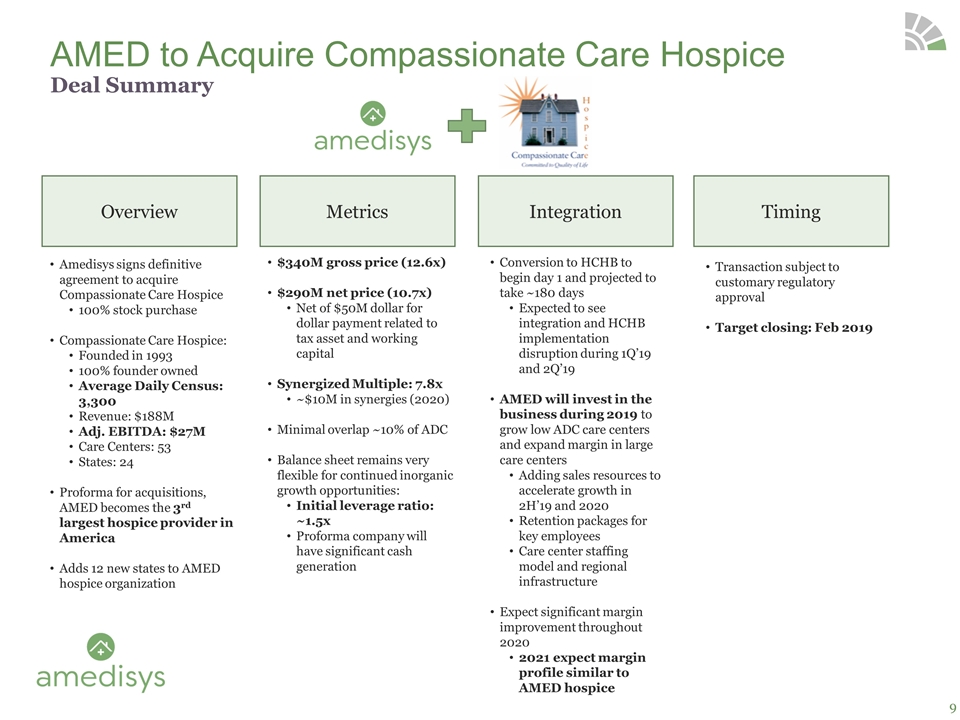

Overview Metrics Integration Timing Amedisys signs definitive agreement to acquire Compassionate Care Hospice 100% stock purchase Compassionate Care Hospice: Founded in 1993 100% founder owned Average Daily Census: 3,300 Revenue: $188M Adj. EBITDA: $27M Care Centers: 53 States: 24 Proforma for acquisitions, AMED becomes the 3rd largest hospice provider in America Adds 12 new states to AMED hospice organization $340M gross price (12.6x) $290M net price (10.7x) Net of $50M dollar for dollar payment related to tax asset and working capital Synergized Multiple: 7.8x ~$10M in synergies (2020) Minimal overlap ~10% of ADC Balance sheet remains very flexible for continued inorganic growth opportunities: Initial leverage ratio: ~1.5x Proforma company will have significant cash generation Conversion to HCHB to begin day 1 and projected to take ~180 days Expected to see integration and HCHB implementation disruption during 1Q’19 and 2Q’19 AMED will invest in the business during 2019 to grow low ADC care centers and expand margin in large care centers Adding sales resources to accelerate growth in 2H’19 and 2020 Retention packages for key employees Care center staffing model and regional infrastructure Expect significant margin improvement throughout 2020 2021 expect margin profile similar to AMED hospice Transaction subject to customary regulatory approval Target closing: Feb 2019 AMED to Acquire Compassionate Care Hospice Deal Summary

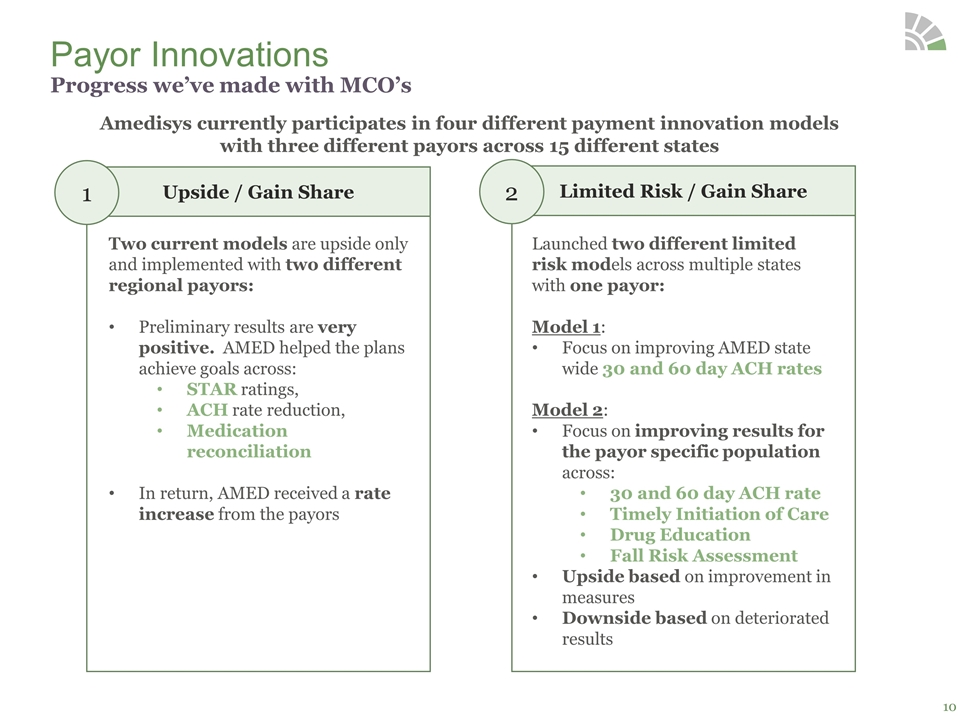

Payor Innovations Progress we’ve made with MCO’s Amedisys currently participates in four different payment innovation models with three different payors across 15 different states Upside / Gain Share 1 Limited Risk / Gain Share 2 Two current models are upside only and implemented with two different regional payors: Preliminary results are very positive. AMED helped the plans achieve goals across: STAR ratings, ACH rate reduction, Medication reconciliation In return, AMED received a rate increase from the payors Launched two different limited risk models across multiple states with one payor: Model 1: Focus on improving AMED state wide 30 and 60 day ACH rates Model 2: Focus on improving results for the payor specific population across: 30 and 60 day ACH rate Timely Initiation of Care Drug Education Fall Risk Assessment Upside based on improvement in measures Downside based on deteriorated results

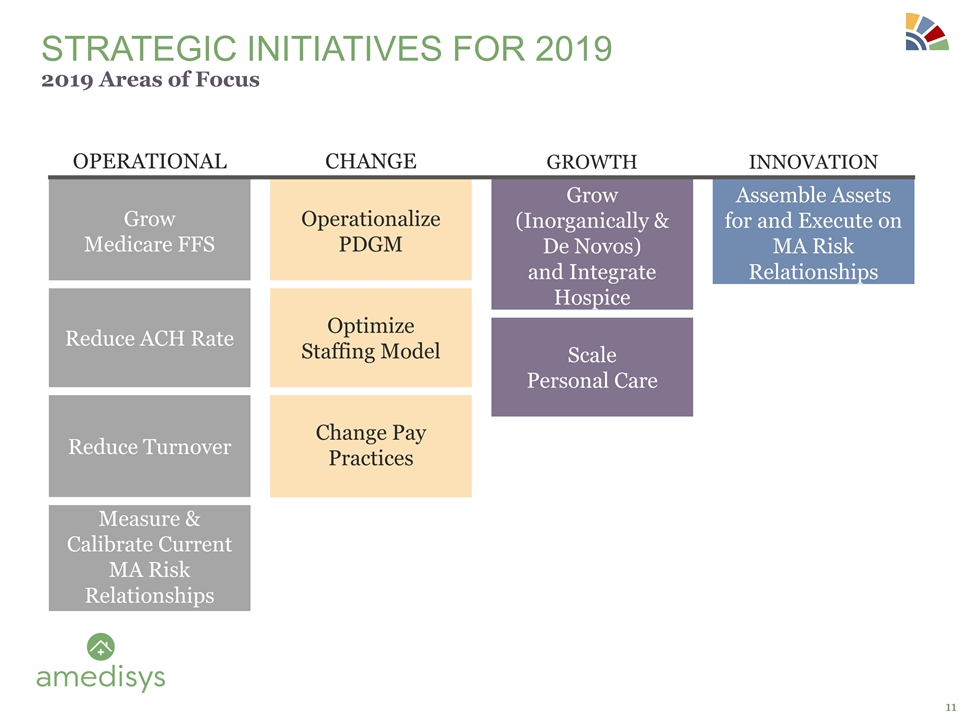

OPERATIONAL Grow Medicare FFS Reduce ACH Rate Reduce Turnover Measure & Calibrate Current MA Risk Relationships CHANGE Operationalize PDGM Optimize Staffing Model Change Pay Practices GROWTH Grow (Inorganically & De Novos) and Integrate Hospice Scale Personal Care INNOVATION Assemble Assets for and Execute on MA Risk Relationships Strategic initiatives for 2019 2019 Areas of Focus

Appendix

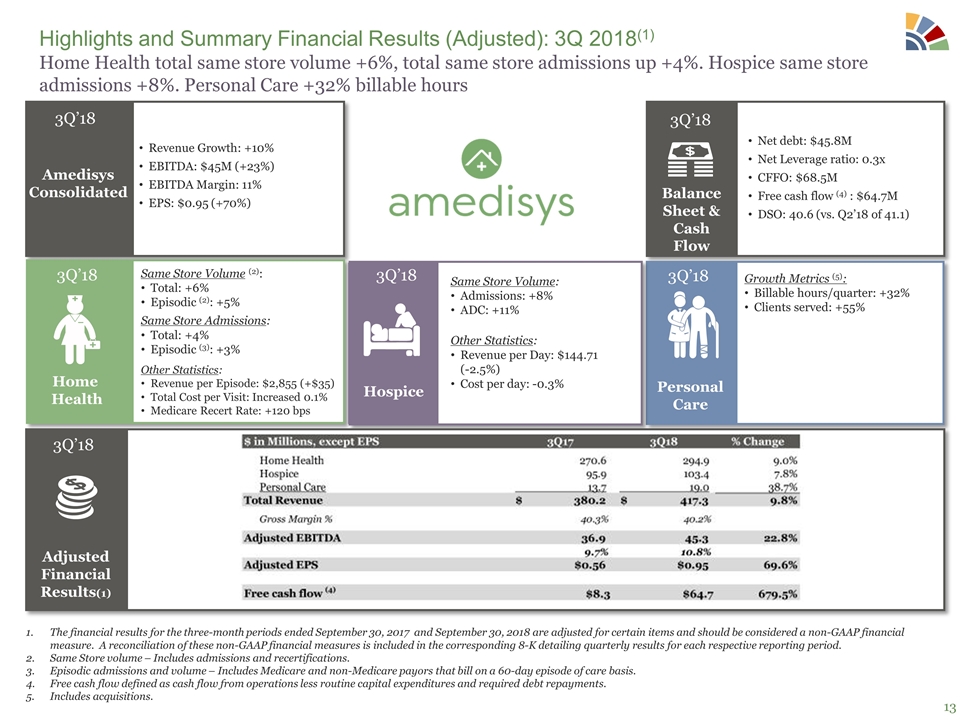

Highlights and Summary Financial Results (Adjusted): 3Q 2018(1) Home Health total same store volume +6%, total same store admissions up +4%. Hospice same store admissions +8%. Personal Care +32% billable hours Amedisys Consolidated Revenue Growth: +10% EBITDA: $45M (+23%) EBITDA Margin: 11% EPS: $0.95 (+70%) 3Q’18 Net debt: $45.8M Net Leverage ratio: 0.3x CFFO: $68.5M Free cash flow (4) : $64.7M DSO: 40.6 (vs. Q2’18 of 41.1) Balance Sheet & Cash Flow 3Q’18 Same Store Volume (2): Total: +6% Episodic (2): +5% Same Store Admissions: Total: +4% Episodic (3): +3% Other Statistics: Revenue per Episode: $2,855 (+$35) Total Cost per Visit: Increased 0.1% Medicare Recert Rate: +120 bps Home Health Growth Metrics (5): Billable hours/quarter: +32% Clients served: +55% Personal Care Same Store Volume: Admissions: +8% ADC: +11% Other Statistics: Revenue per Day: $144.71 (-2.5%) Cost per day: -0.3% Hospice 3Q’18 3Q’18 3Q’18 Adjusted Financial Results(1) 3Q’18 The financial results for the three-month periods ended September 30, 2017 and September 30, 2018 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. Same Store volume – Includes admissions and recertifications. Episodic admissions and volume – Includes Medicare and non-Medicare payors that bill on a 60-day episode of care basis. Free cash flow defined as cash flow from operations less routine capital expenditures and required debt repayments. Includes acquisitions.

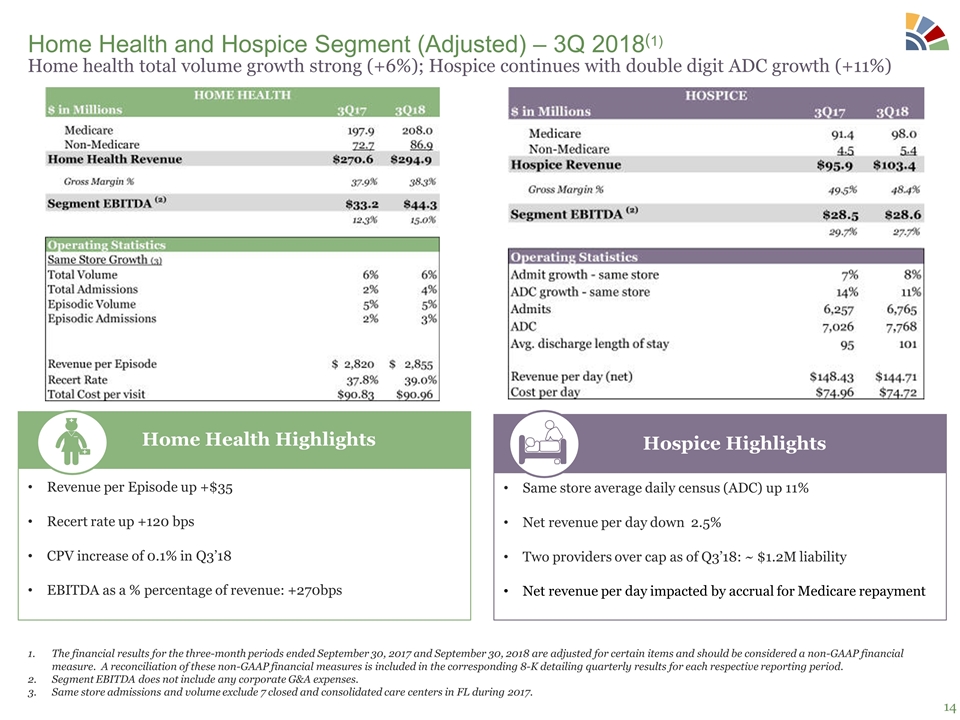

Home Health and Hospice Segment (Adjusted) – 3Q 2018(1) Revenue per Episode up +$35 Recert rate up +120 bps CPV increase of 0.1% in Q3’18 EBITDA as a % percentage of revenue: +270bps Home Health Highlights Same store average daily census (ADC) up 11% Net revenue per day down 2.5% Two providers over cap as of Q3’18: ~ $1.2M liability Net revenue per day impacted by accrual for Medicare repayment Hospice Highlights The financial results for the three-month periods ended September 30, 2017 and September 30, 2018 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. Segment EBITDA does not include any corporate G&A expenses. Same store admissions and volume exclude 7 closed and consolidated care centers in FL during 2017. Home health total volume growth strong (+6%); Hospice continues with double digit ADC growth (+11%)

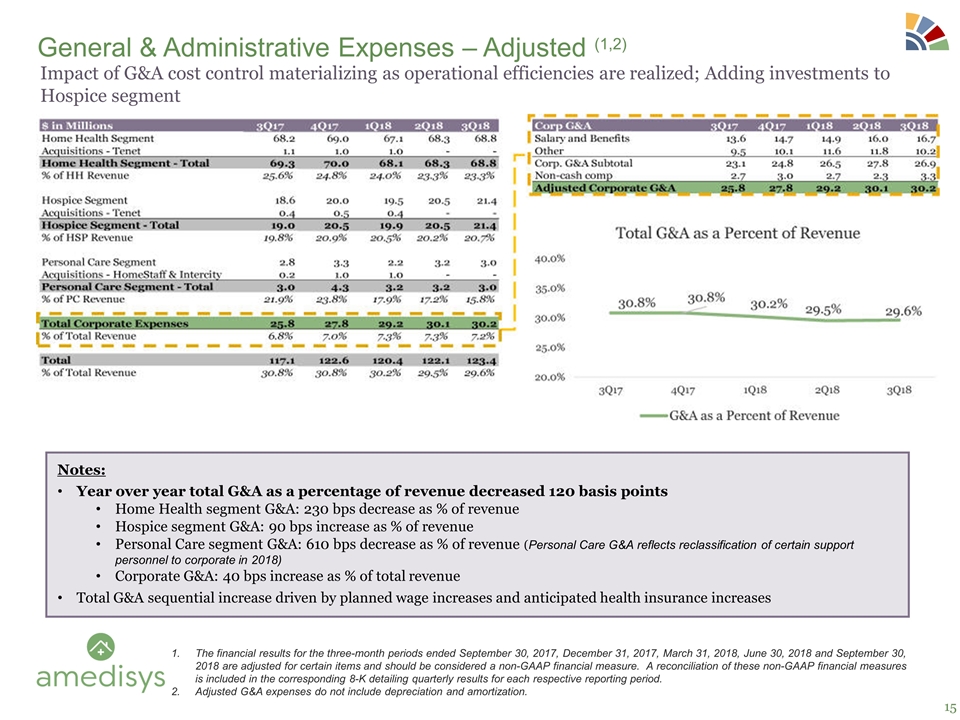

General & Administrative Expenses – Adjusted (1,2) Notes: Year over year total G&A as a percentage of revenue decreased 120 basis points Home Health segment G&A: 230 bps decrease as % of revenue Hospice segment G&A: 90 bps increase as % of revenue Personal Care segment G&A: 610 bps decrease as % of revenue (Personal Care G&A reflects reclassification of certain support personnel to corporate in 2018) Corporate G&A: 40 bps increase as % of total revenue Total G&A sequential increase driven by planned wage increases and anticipated health insurance increases The financial results for the three-month periods ended September 30, 2017, December 31, 2017, March 31, 2018, June 30, 2018 and September 30, 2018 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. Adjusted G&A expenses do not include depreciation and amortization. Impact of G&A cost control materializing as operational efficiencies are realized; Adding investments to Hospice segment

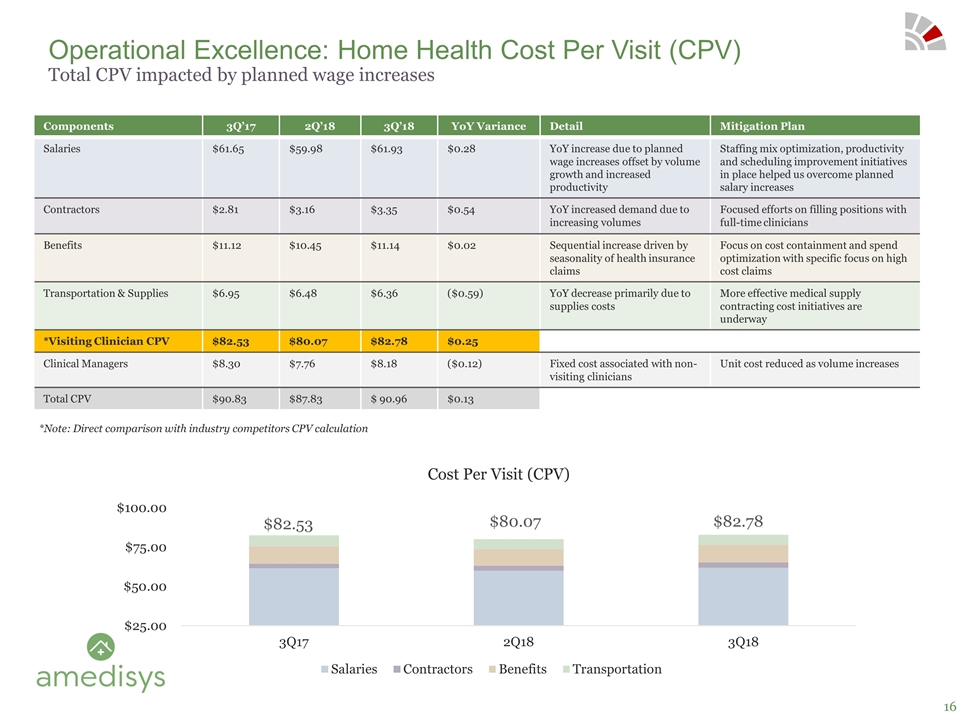

Components 3Q’17 2Q’18 3Q’18 YoY Variance Detail Mitigation Plan Salaries $61.65 $59.98 $61.93 $0.28 YoY increase due to planned wage increases offset by volume growth and increased productivity Staffing mix optimization, productivity and scheduling improvement initiatives in place helped us overcome planned salary increases Contractors $2.81 $3.16 $3.35 $0.54 YoY increased demand due to increasing volumes Focused efforts on filling positions with full-time clinicians Benefits $11.12 $10.45 $11.14 $0.02 Sequential increase driven by seasonality of health insurance claims Focus on cost containment and spend optimization with specific focus on high cost claims Transportation & Supplies $6.95 $6.48 $6.36 ($0.59) YoY decrease primarily due to supplies costs More effective medical supply contracting cost initiatives are underway *Visiting Clinician CPV $82.53 $80.07 $82.78 $0.25 Clinical Managers $8.30 $7.76 $8.18 ($0.12) Fixed cost associated with non-visiting clinicians Unit cost reduced as volume increases Total CPV $90.83 $87.83 $ 90.96 $0.13 Operational Excellence: Home Health Cost Per Visit (CPV) Total CPV impacted by planned wage increases *Note: Direct comparison with industry competitors CPV calculation $82.53 $80.07 $82.78

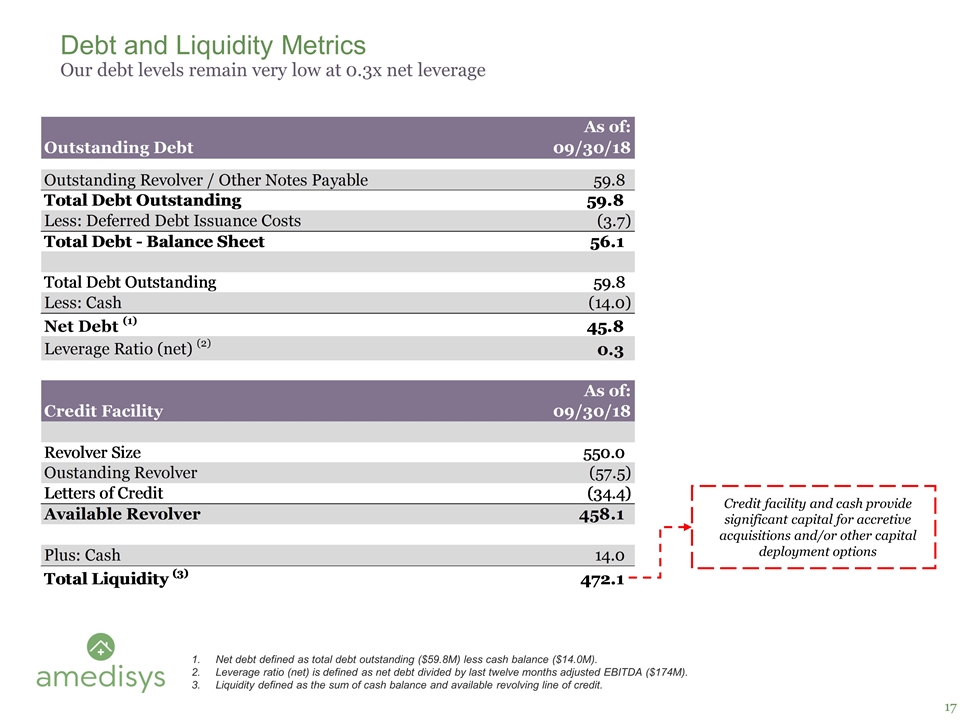

Debt and Liquidity Metrics Our debt levels remain very low at 0.3x net leverage Net debt defined as total debt outstanding ($59.8M) less cash balance ($14.0M). Leverage ratio (net) is defined as net debt divided by last twelve months adjusted EBITDA ($174M). Liquidity defined as the sum of cash balance and available revolving line of credit. Credit facility and cash provide significant capital for accretive acquisitions and/or other capital deployment options

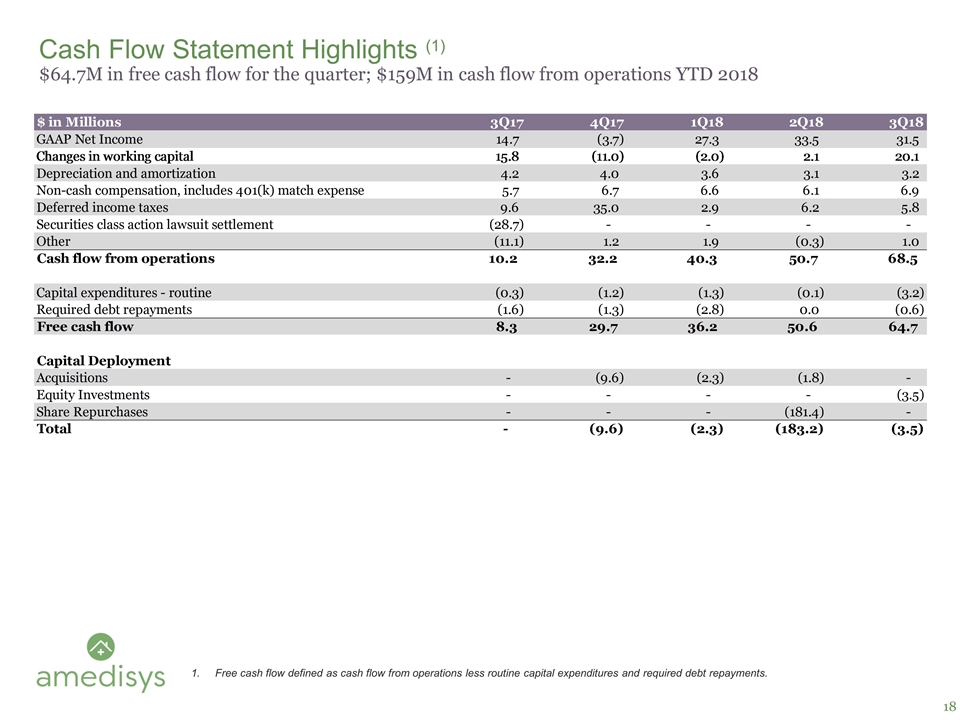

Cash Flow Statement Highlights (1) $64.7M in free cash flow for the quarter; $159M in cash flow from operations YTD 2018 Free cash flow defined as cash flow from operations less routine capital expenditures and required debt repayments.

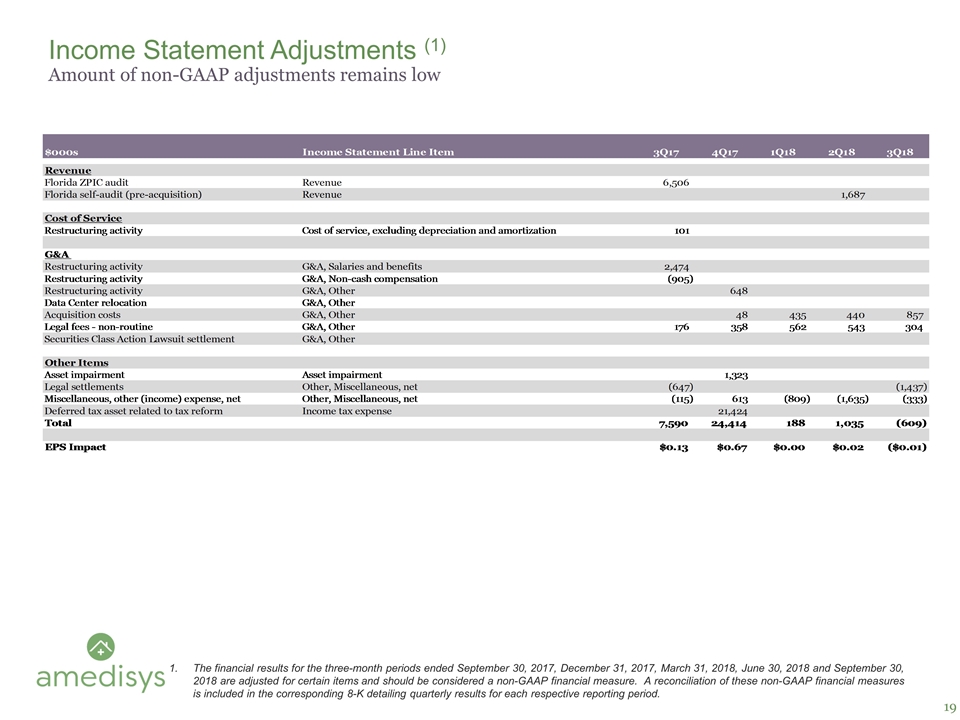

Income Statement Adjustments (1) Amount of non-GAAP adjustments remains low The financial results for the three-month periods ended September 30, 2017, December 31, 2017, March 31, 2018, June 30, 2018 and September 30, 2018 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period.

2018 Guidance

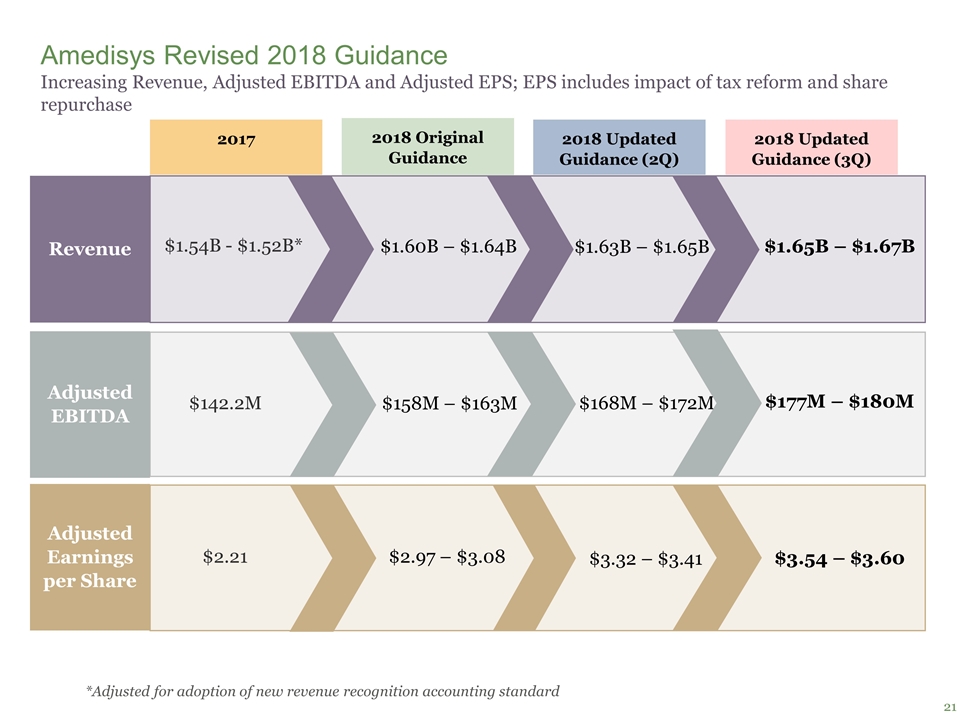

2018 Updated Guidance (2Q) Amedisys Revised 2018 Guidance Increasing Revenue, Adjusted EBITDA and Adjusted EPS; EPS includes impact of tax reform and share repurchase 2017 Revenue Adjusted EBITDA $142.2M $1.54B - $1.52B* Adjusted Earnings per Share $2.21 $158M – $163M $1.60B – $1.64B $2.97 – $3.08 *Adjusted for adoption of new revenue recognition accounting standard 2018 Original Guidance $168M – $172M $1.63B – $1.65B $3.32 – $3.41 2018 Updated Guidance (3Q) $177M – $180M $1.65B – $1.67B $3.54 – $3.60

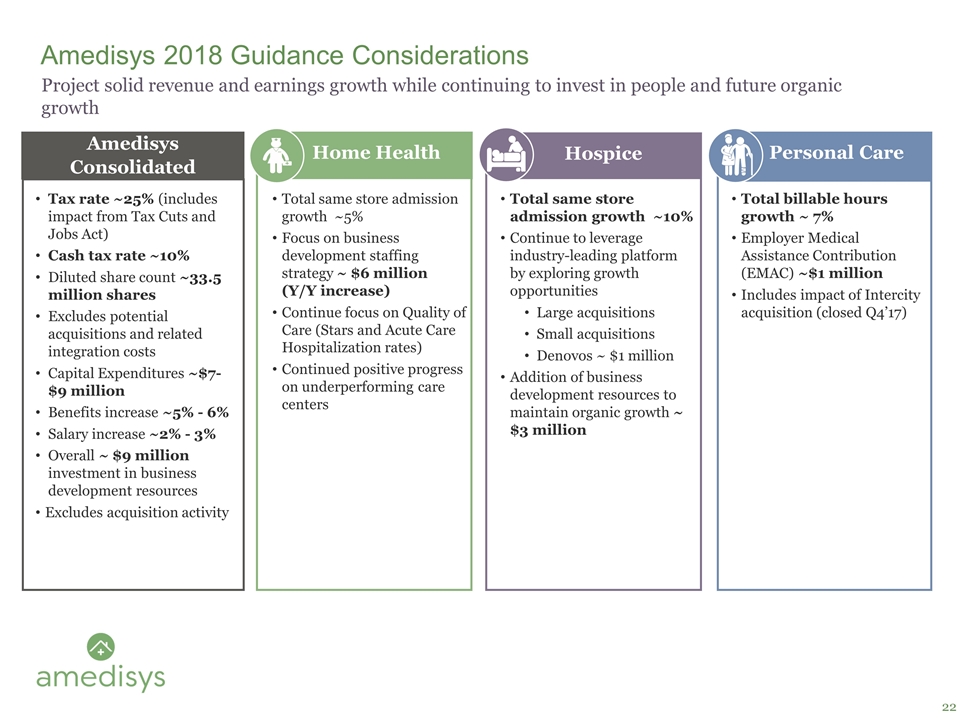

Amedisys 2018 Guidance Considerations Amedisys Consolidated Tax rate ~25% (includes impact from Tax Cuts and Jobs Act) Cash tax rate ~10% Diluted share count ~33.5 million shares Excludes potential acquisitions and related integration costs Capital Expenditures ~$7-$9 million Benefits increase ~5% - 6% Salary increase ~2% - 3% Overall ~ $9 million investment in business development resources Excludes acquisition activity Home Health Personal Care Hospice Total same store admission growth ~5% Focus on business development staffing strategy ~ $6 million (Y/Y increase) Continue focus on Quality of Care (Stars and Acute Care Hospitalization rates) Continued positive progress on underperforming care centers Total same store admission growth ~10% Continue to leverage industry-leading platform by exploring growth opportunities Large acquisitions Small acquisitions Denovos ~ $1 million Addition of business development resources to maintain organic growth ~ $3 million Total billable hours growth ~ 7% Employer Medical Assistance Contribution (EMAC) ~$1 million Includes impact of Intercity acquisition (closed Q4’17) Project solid revenue and earnings growth while continuing to invest in people and future organic growth

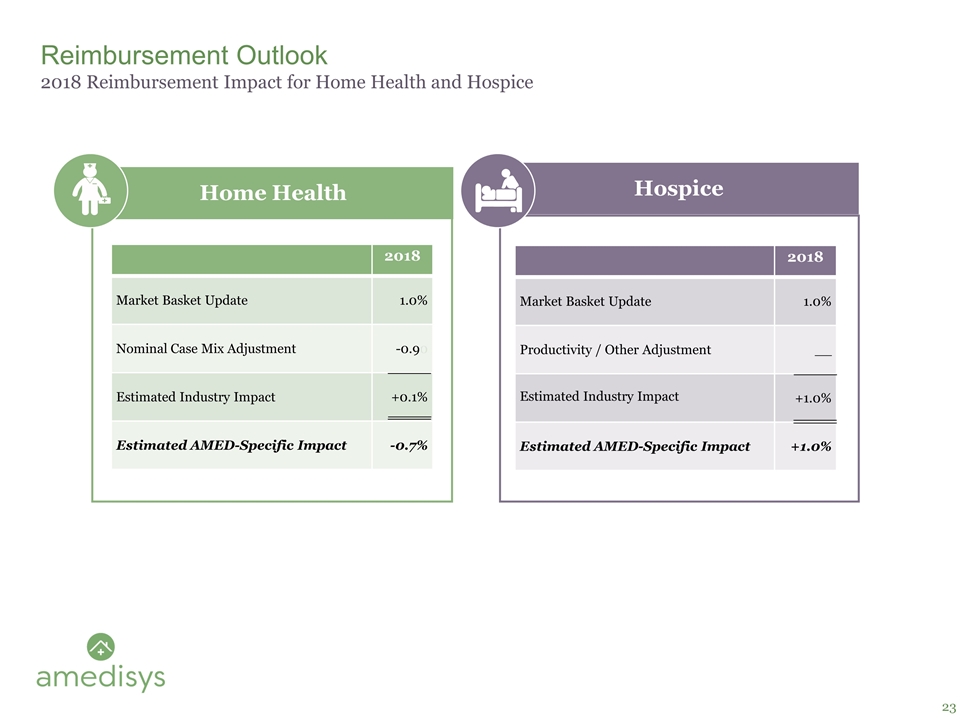

Reimbursement Outlook 2018 Reimbursement Impact for Home Health and Hospice Home Health Hospice 2018 Market Basket Update 1.0% Nominal Case Mix Adjustment -0.90 Estimated Industry Impact +0.1% Estimated AMED-Specific Impact -0.7% 2018 Market Basket Update 1.0% Productivity / Other Adjustment __ Estimated Industry Impact +1.0% Estimated AMED-Specific Impact +1.0%

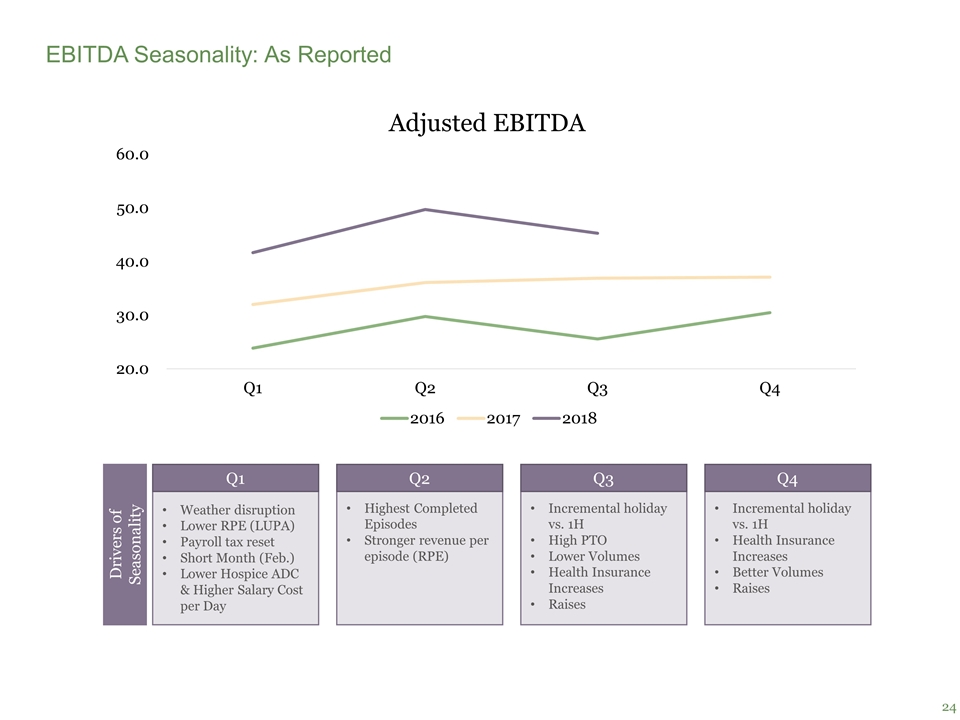

EBITDA Seasonality: As Reported Q1 Q2 Q3 Q4 Drivers of Seasonality Weather disruption Lower RPE (LUPA) Payroll tax reset Short Month (Feb.) Lower Hospice ADC & Higher Salary Cost per Day Highest Completed Episodes Stronger revenue per episode (RPE) Incremental holiday vs. 1H High PTO Lower Volumes Health Insurance Increases Raises Incremental holiday vs. 1H Health Insurance Increases Better Volumes Raises

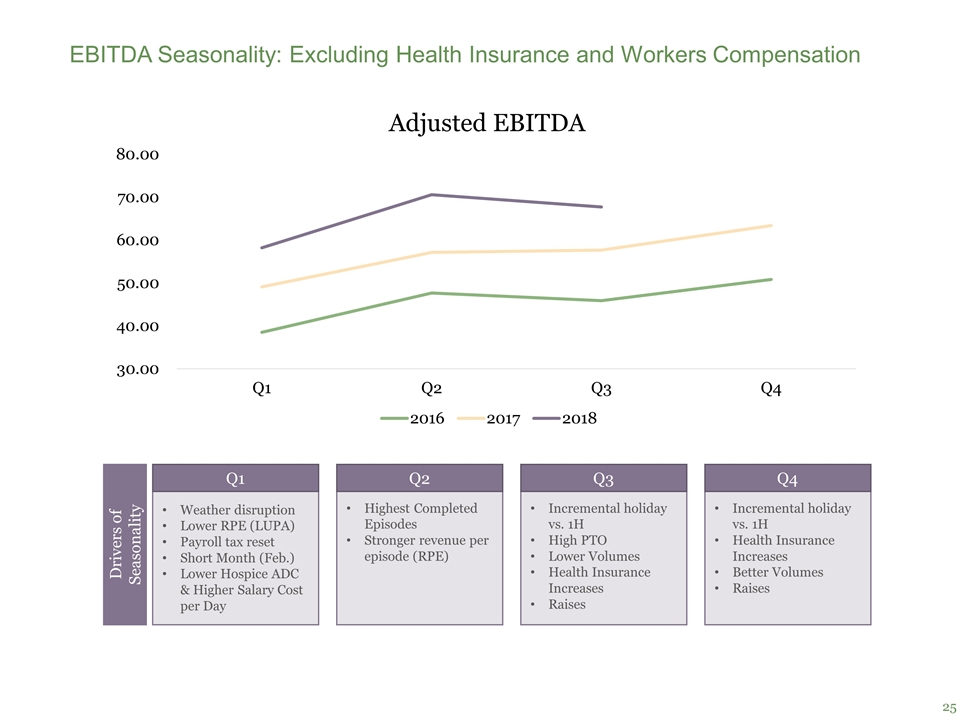

EBITDA Seasonality: Excluding Health Insurance and Workers Compensation Q1 Q2 Q3 Q4 Drivers of Seasonality Weather disruption Lower RPE (LUPA) Payroll tax reset Short Month (Feb.) Lower Hospice ADC & Higher Salary Cost per Day Highest Completed Episodes Stronger revenue per episode (RPE) Incremental holiday vs. 1H High PTO Lower Volumes Health Insurance Increases Raises Incremental holiday vs. 1H Health Insurance Increases Better Volumes Raises