Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 SECTION 906 CERTIFICATION - AMERICAN BATTERY METALS CORP | f10k093018_ex32z1.htm |

| EX-31.1 - EXHIBIT 31.1 SECTION 302 CERTIFICATION - AMERICAN BATTERY METALS CORP | f10k093018_ex31z1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2018

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE EXCHANGE ACT OF 1934

Commission File number: 000-55088

OROPLATA RESOURCES, INC. |

(Exact name of registrant as specified in its charter) |

Nevada |

| 33-1227980 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

930 Tahoe Blvd. Suite 802-16, Incline Village, NV 89451 |

(Address of principal executive offices) |

(775) 473-4744 |

(Registrant's telephone number) |

(Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically on its corporate Web site, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer", "accelerated filer" and "smaller reporting company" Rule 12b-2 of the Exchange Act.

[ ] | Accelerated filer | [ ] | |

Non-accelerated filer | [ ] (Do not check if a small reporting company) | Smaller reporting company | [X] |

Emerging growth company | [X] |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $4,679,307 as of March 31, 2018

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 102,114,239 as of December 18, 2018

1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (this “Report”) contains forward-looking statements. The forward-looking statements are contained principally in the “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this Report. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates”, “believes”, “seeks”, “could”, “estimates”, “expects”, “intends”, “may”, “plans”, “potential”, “predicts”, “projects”, “should”, “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Such statements may include, but are not limited to, information related to: anticipated operating results; relationships with our customers; consumer demand; financial resources and condition; changes in revenues; changes in profitability; changes in accounting treatment; cost of sales; selling, general and administrative expenses; interest expense; the ability to produce the liquidity or enter into agreements to acquire the capital necessary to continue our operations and take advantage of opportunities; legal proceedings and claims. Also, forward-looking statements represent our estimates and assumptions only as of the date of this Report. You should read this Report and the documents that we reference and file or furnish as exhibits to this Report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

PRESENTATION OF INFORMATION

Except as otherwise indicated by the context, references in this Report to “we”, “us”, “our” and the “Company” are to the combined business of Oroplata Resources, Inc. and its consolidated subsidiary.

This Report includes our audited consolidated financial statements as at and for the years ended September 30, 2018 and 2017. These financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“US GAAP”). All financial information in this Report is presented in US dollars, unless otherwise indicated, and should be read in conjunction with our audited consolidated financial statements and the notes thereto included in this Report.

2

TABLE OF CONTENTS

| ||

|

|

|

Item 1. | Business | 4 |

Item 1A. | Risk Factors | 6 |

Item 1B. | Unresolved Staff Comments | 6 |

Item 2. | Properties | 7 |

Item 3. | Legal Proceedings | 12 |

Item 4 | Mine Safety Disclosures | 12 |

|

|

|

PART II |

| |

|

|

|

Item 5. | Market for Registrant's Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities | 13 |

Item 6. | Selected Financial Data | 15 |

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 15 |

Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 17 |

Item 8. | Financial Statements and Supplementary Data | 17 |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 18 |

Item 9A | Control and Procedures | 18 |

Item 9B. | Other Information | 18 |

|

|

|

PART III |

| |

|

|

|

Item 10. | Directors, Executive Officers and Corporate Governance | 19 |

Item 11. | Executive Compensation | 22 |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 22 |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 23 |

Item 14. | Principal Accounting Fees and Services | 23 |

|

|

|

PART IV |

| |

|

|

|

Item 15. | Exhibits, Financial Statement Schedules | 23 |

Item 16. | Form 10-K Summary | 24 |

| Signatures | 24 |

3

PART I

Background

We are a start-up, lithium exploration mining company whose purpose is to explore mineral properties which, hopefully, will contain lithium and other economic minerals. We were incorporated under the laws of the State of Nevada on October 6, 2011 for the purpose of acquiring rights to mineral properties with the eventual objective of being a producing mineral company, if and when it ever occurs. We have limited operating history and have not yet generated or realized any revenues from our activities. Our principal executive offices are located at 930 Tahoe Blvd., Suite 802-16, Incline Village, NV 89451.

Currently, the Board of Directors (consisting of Mr. Douglas Cole, Mr. Douglas MacLellan and Mr. William Hunter) are involved in guiding the Company though a significant management reorganization and to reorient the company’s goals and objective to solely focus on the exploration and development of Lithium (Li) and other battery metal deposits in the State of Nevada, primarily through new capital commitments which Mr. Cole is actively seeking.

On August 8, 2016, the Company formed Lithortech Resources Inc. as a wholly owned subsidiary of the Company to serve as its operating subsidiary for lithium resource exploration and development. On June 29, 2018, the Company changed the name of Lithortech Resources to LithiumOre Corp. (“LithiumOre”). LithiumOre currently has mining claims on 26,000 acres in the area known as the Western Nevada Basin, situated in Railroad Valley in Nye County, Nevada (the “WNB Claim”). In the second half of 2017, we engaged experts to evaluate the region and the WNB Claim to target on-site exploration efforts and determined that 260 claims of the WNB Claim were appropriate for the Company’s planned exploration, which we expect to begin in the first half of 2019. With many features similar to Clayton Valley and with no exploration work targeting lithium to date, Railroad Valley represents a new and untested target for lithium brine. The Railroad Valley brine exploration can build on both the dense existing oil field data and the experiences at Clayton Valley and other Lithum brine basins to target potential brine aquifers. Please see the Company’s website for more information: www.lithiumore.net.

The growth in demand for lithium batteries is predicted by industry researchers to outpace lithium production in the coming decade. Lithium-ion batteries for the automotive industry are expected to advance demand beyond current supply. These industry trends support and validate the Company’s new business model.

The Company is currently a pre-revenue organization and we do not anticipate earning revenues until such time as we have undertaken sufficient exploration work to identify Lithium and or other battery metals reserves. Exploration work will take several years and there is no certainty we will ever reach a production stage. Our Company is considered to be in the exploration stage due to not having done exploration work which would result in a development decision.

We own no real estate, other than mineral rights in the Nye County properties located in Nevada, United States. On March 19, 2018, the Company entered into a purchase agreement to purchase an additional 120 acres in Railroad Valley, NV for possible future exploration. The purchase is expected to be completed in the first quarter of 2019. In the meantime, the Company has entered into a short-term lease agreement for this property to allow mineral testing prior to the completion of the property purchase.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we intend to take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

allowance to provide only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure;

reduced disclosure about our executive compensation arrangements;

no non-binding advisory votes on executive compensation or golden parachute arrangements; and

exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting.

4

We may take advantage of these provisions for up to five years (ending on September 30, 2019) or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company on the date that is the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the completion of our initial public offering (our “IPO”); (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you have beneficial ownership. In addition, we have elected to opt out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Exchange Act. As a result, our financial statements may not be comparable to those of companies that comply with public company effective dates.

Market and Industry

Lithium is extracted from primarily two sources: pegmatite crystals and lithium salt from brine pools. Currently, the world’s five top producers of Lithium are located in Australia, Chile, Argentina, China, and Zimbabwe.

In 2017, worldwide Lithium production totaled approximately 43,000 metric tons, with the top 3 countries contributing roughly 89% of the global production. Most of the world’s lithium supply is produced by three companies: FMC Corporation, Sociedad Quimicay Minera de Chile (SQM) and the Albemarle Corporation.

Much of the current production of Lithium in Australia is derived from conventional mining techniques of ancient Precambrian rocks containing Lithium ore which is crushed and fed into capital intensive processing plants which upgrade the lithium mineral using gravity, flotation, magnetic and roasting purification processes.

Alternatively, Lithium production from Chile and Argentina uses a much less capital intense extraction method. Lithium is located beneath various salt flats. The Lithium is leached from nearby source rocks and becomes concentrated in salty brines just under the surface. The Lithium enriched brines are then pumped up to settle on hundreds of shallow surface evaporation pools which produces a thicker Lithium rich liquid. That liquid is treated with sodium carbonate, which creates lithium carbonate.

Lithium is a soft silver-white metal. With an atomic number of 3, it is the lightest of the all metals, only the gases Hydrogen (atomic number 1) and Helium (atomic number 2) are lighter.

Light weight Lithium has many applications but the metal is a perfect replacement of the much heavier Nickel used in most large batteries. Lithium batteries also have a high charge density, a longer life and lithium-ion batteries are rechargeable.

The Lithium market has typically been dominated by the ceramic and medical sectors, however, 2015 presented a marked change in the market as the demand for Lithium for the battery market outstripped any other sector.

At the moment, the primary lithium-ion battery manufacturers are: CATL, BYD, and OptimumNano Energy Co. Ltd. of China, Panasonic of Japan, and LG Chem of South Korea.

Lithium is not currently traded on any commodity exchanges, but rather is usually distributed in a chemical form such as lithium carbonate (Li2CO3) and sold directly to end users for a negotiated price per ton of Lithium carbonate. Recently that price has spiked, exceeding expectations and is projected to continue to rise due to increased demand.

General Market Analysis

Lithium-ion batteries have become the rechargeable battery of choice in cell phones, computers, electric cars and now larger scale electric storage. The growth in demand for lithium batteries is predicted to far outpace lithium production in the coming decade; in particular, Lithium-ion batteries for the automotive industry is expected to continue to drive demand beyond supply.

Recently, Japan and South Korea have both recorded high levels of Lithium-ion battery exports in as auto companies’ ramp up battery consumption to power all-electric vehicle sales. Lithium ion battery shipments from Japan, the world’s leading electric vehicle producer topped 33,500 tons in 2016, an increase of 31% year to year.

Goldman Sachs predicted that the market consumption could very well triple from the current production by 2025. Just a 1% increase of Electric Vehicles hitting the market could increase lithium demand by roughly half of the current production of lithium today.

SQM’s CEO Patricio de Solminihac said in a 2018 interview with Reuters that the company would invest $525 million in order to expand its lithium production in Chile through 2021, due to the high demand for electric vehicle batteries.

5

FMC and Albemarle have decided not to wait either. FMC announced in May 2017 it would triple its production of lithium hydroxide by 2019, increasing to 30,000 tons from 10,000. Albemarle also announced it would be increasing production of lithium carbonate to 70,000 tons from 24,000 over a few years.

Tesla’s mile long Gigafactory started producing powerful Lithium-ion batteries in January 2017 with its partner Panasonic. The Gigafactory will supply batteries for the 500,000 cars Tesla hopes to produce by the end of the decade, as well as to power homes. Also, Chrysler, Dodge, Ford, GM, Mercedes-Benz, Mitsubishi, Nissan, Saturn, Tesla and Toyota have all announced plans to build lithium-ion battery powered cars.

After Tesla released the Model 3 in July 2017, there have been over 500,000 reservations for the vehicle and production is starting 2 years ahead of schedule. Elon Musk has stated that Tesla will have to acquire the entire lithium market to meet the current demands.

Thus, the global lithium market is approaching shortages, which has made it a useful commodity and mineral explorers have launched efforts to locate and bring new suppliers to the marketplace.

Lithium brine exploration and development has proven to be much more cost effective and faster to be put into production than the hard rock mine counterparts.

Lithium brine deposits are considered placer deposits and are easier to gain mining permits. Brine is also a liquid which means that drilling to find it is more akin to drilling for water or oil. It’s also typically located relatively close to surface, which limits the depth of required drilling. Once a Lithium Brine is found, the reserve data is more straightforward to understand and quantify.

As the brines are found in large flat areas, the construction of numerous flat evaporation pools or direct solvent extraction can be achieved at relatively low cost. Environmental impact is minimized as the excess residual brines can be pumped back into the salt flats.

Oroplata competes with other companies searching for minerals in Nevada and seeks financing for the development of their specific properties. Often, but not in all cases, these other mineral companies are better financed, have properties which have had sufficient exploration work done on them to warrant a future investor to consider investing in their company rather than ours. There are only a limited number of investors willing to invest in a company which had no proven reserves and has just started its exploration work. These other mineral exploration companies might induce investors to consider their properties and not ours. Hence, any additional funds they receive will be directed to the future exploration work on their properties whereas our company might be strapped for funds and unable to do any worthwhile exploration work on the Western Nevada Basin claim. We might never be able to compete against these other companies and hence never bring the Western Nevada Basin project into a stage where a production decision is to be made. In addition, we will have to compete with both large and small exploration companies for other resources we will need; professional geologists, transportation to and from the Western Nevada Basin Project, materials to set up a camp if required and supplies including drill rigs.

Item 1A. Risk Factors

Not required.

Item 1B. Unresolved Staff Comments

Not applicable.

6

Description of Properties

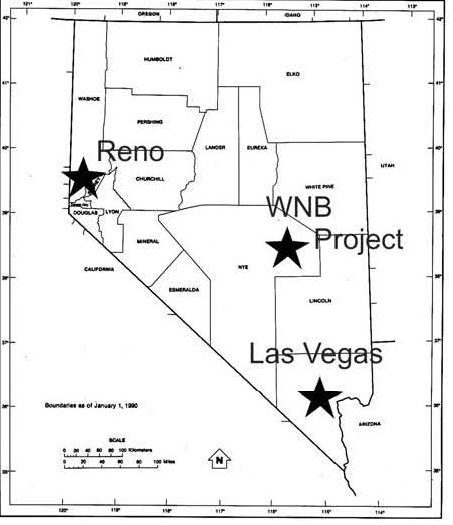

The Western Nevada Basin (WNB) Claim is located in east central Nye County, Nevada (Figure 1) approximately 93 miles northeast of the county seat of Tonopah, NV, the major commercial center for the region; 56 miles southwest of the town of Ely, NV and 120 miles northeast of the village of Silver Peak the only currently operating Lithium producer in the State.

Figure 1. Location Map. The Western Nevada Basin Claim is located within the central portion of the Railroad Valley, approximately 169 miles north-northwest of Las Vegas, NV and 234 miles east-southeast of Reno, NV.

7

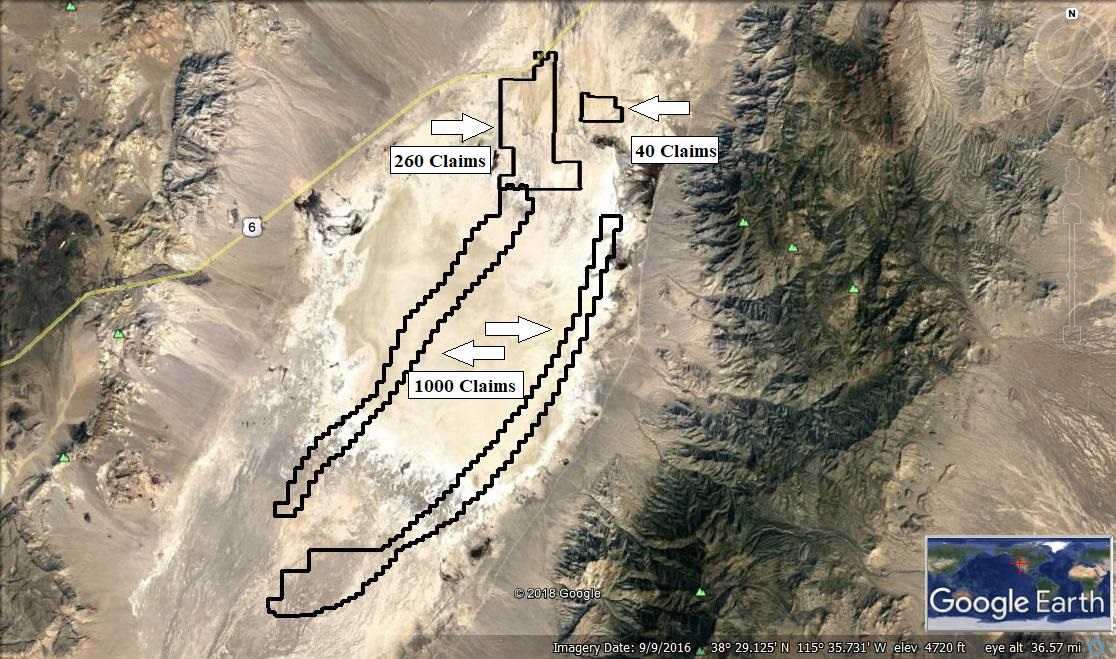

Figure 2. The Western Nevada Basin Claim covers just over 30,000 acres. It consists of a total of one thousand three hundred (1,300) placer claims. Each claim covers approximately 20 acres and was laid out by aliquot parts as required by the Bureau of Land Management.

Lithium is a locatable mineral according to the Code of Federal Regulations. Rights to Lithium are to be held by lode claims where it occurs in bedrock and by placer claims where it occurs in sediments. A body of legal precedence set during the original development of lithium brines in the area provides that lithium in valley sediments by nature of the unconsolidated host rock are staked by and produced from placer claims.

The WNB Claim is held by 1,300 twenty-acre placer claims, which are located on public Federal lands managed by the Bureau of Land Management (BLM). The placer claims are located on U.S. Surveyed lands and fit to aliquot parts.

In Nevada the claim staking procedure requires recording documents with both the county Recorder’s Office and then with the state BLM office. Claims must be held by posts at the claims four corners and Notice of Location which describe the claims legal description of location and owner. The claims are required to be recorded at the county courthouse within the proper jurisdiction within 90 days from the staking date.

Placer claims on Federal lands are held to a September 1 to August 31 assessment year when Intent to Hold or Proof of Labor documents need to be filed with the county for the annual assessment work. The pertinent documents are filed with the Nye County Recorder’s Office.

260 claims were staked by the third Party, Plateau Ventures LLC of Moab, Utah and 1,040 claims were staked by 3 Proton Lithium, Inc. of Carson City, Nevada. Official rights to the claims by Oroplata are subject to Quit Claim Deed Transfer Approval by BLM. Oroplata, through its 100% owned subsidiary, LithiumOre Corp., received full entitlement to its claims in the Western Nevada Basin by way of the Quit Claim Deeds on January 2, 2017 (260 claims), August 13, 2018, (40 claims) and August 28, 2018 (1,000 claims). The current annual maintenance fee is $155 per 20-acre (or a portion thereof) placer claim (http://www.blm.gov/ca/st/en/info/iac/miningfacts.html). Payment of those fees allows the claim to stay on the BLM active database. Non-payment results in the claims moving to ‘closed’ status.

8

Before August 31st of each year, a payment of $155 per claim is made to the BLM to hold the claims in good standing for the following assessment year. The total cost for the 1,300 WNB Claims was $203,260. In August 2017, the Company paid $42,060 to the BLM for 260 Claims. In August 2018, the Company paid $6,200 to the BLM for 40 Claims, and $155,000 to the BLM for 1,000 Claims. When fees are paid a claim is deemed ‘active’. Active and approved claims are listed and can be viewed on the BLM interactive website LR2000 (http://www.blm.gov/lr2000/).

Before October 31st of each year, it is necessary to make a payment to the county of $10 per claim to file an affidavit of assessment fees paid and notice of intent to hold the claims into the next assessment year. The total cost for the current 1,300 WNB claims is $13,000.

As public lands, there is right of free access and both surface and mineral rights are held by the Federal government. Public records (Management, Bureau of Land) show no military withdrawals or Areas of Critical Environmental Concern. The Railroad Valley Wildlife Management Area is located to the west of the WNB claim boundary and has no effect on any planned work on the WNB claim area.

There is free access to the Federal land in Railroad Valley and there are no restrictions on casual prospecting. New exploration drilling will trigger a permitting process. There are two major levels of permitting: Notice of Intent (NOI) and Plan of Operations (POO). Historically, if the proposed disturbance was less than 5 acres or 1,000 tons, then the work can proceed under a NOI if there are no complications such as ancient ruins or endangered species. Application for a NOI is relatively simple with requirements like bonding the access route and re-seeding afterwards. A NOI is valid for two years and may be renewed on a two year basis. Maintaining it requires maintaining bonds and seeding disturbed areas when the work is complete. A POO is more complicated with requirements like an archeological survey, environmental assessment, etc. The BLM may respond within 15 days to a NOI application whereas a POO may require several months to years for final acceptance.

Any drilling planned will require a NOI filed with the Tonopah office of the BLM. To the best of the Company’s knowledge, there are no known environmental liabilities to which the property is subject or other significant factors and risks that may affect access, title, or the right or ability to perform work on the property. The NOI permit for the drilling site was approved on July 13, 2018.

Accessibility

The main route of access to the WNB project is Nevada State U.S. Route 6 which provides all year access to Railroad Valley and the project area. U.S. Route 6 provides direct access to the two nearby commercial centers; Tonopah, located southwest of the project at the junction of Routes 6 and 95, approximately 90 minutes away, and Ely, a slightly larger commercial center with a population of over 4,200 approximately, located northeast of the project approximately 60 minutes away. US Highway 95 is the main highway linking Las Vegas and Reno, the two largest metropolitan areas in Nevada.

Climate

Railroad Valley is in the rain shadow of the Sierra Nevada Mountains. The region is arid to almost semiarid. Winters are cold while summers are hot. Average annual precipitation is approximately 5 inches; however, variations occur at differing altitudes.

Exploration can be conducted in the spring, summer, and fall seasons.

Local Resources

The Railroad Valley contains several small communities; which include Currant, Crows Nest, Green Springs, Lockes, and Nyala. Electrical power is available within the valley area.

The larger population centers of Ely and Tonopah are connected via U.S. Route 6 to the project area. Tonopah has a population of approximately 2,500 and is the governmental center for the region. Ely has a population of approximately 4,000 and is the closest commercial center. Groceries, hardware, a bank and a choice of motels and restaurants are available in both Ely and Tonopah.

The area has a long history of mining. Mining personnel can be sourced mostly from the larger towns of Tonopah or Ely.

Infrastructure

A reasonable network of 4x4, graded and paved roads connects the claim area to the rest of Nevada. Electrical power is available at several sites throughout the valley and could easily provide power to any operation at the project area. The nearest rail and large commercial airline service are in Las Vegas, NV approximately 169 miles to the south.

9

Railroad Valley is one of the longest topographically closed drainage basins in Nevada, extending more than 110 miles in a north-south direction and up to 20 miles wide. This valley is one of the Central Nevada Desert Basins in the Tonopah Basin. The southern end of the valley begins near Gray Top Mountain (7,036 feet) and stretches north all the way to Mount Hamilton (10,745 feet). The mountain masses are dominated by the White Pine, Grant and Quinn Canyon ranges east of the valley.

Railroad Valley comprises an area of approximately 2,750 square miles. Two large flat areas occur within the valley. The Property is located on the large Northern flat area of the valley floor at elevations generally of 4400 – 4700 feet. The valley floor is characterized by subdued topography with washes eroding into slightly older valley-fill sediments.

The claims are located on the flat areas where vegetation is scarce. There is sufficient surface area for recovery and processing facilities within the Claims. Water in the basin is unallocated, which is an advantage for processing in the future.

Geologic Setting

The Claims are located in the Basin and Range physiographic province which stretches from southern Oregon and Idaho to Mexico. It is characterized by extreme elevation changes between mountains and flat intermountain valleys or basins.

Plate tectonics powered by crustal spreading broadly generates two types of forces: compression as plates are moved together and extension as those forces relax. Compression was the dominant geologic force affecting the western United States beginning about 200 million years ago as the Pacific Ocean plate moved eastward under the North American continent. Those forces compressed the overlying pile of sedimentary rocks accumulated over hundreds of millions of years into a thick stack reaching up to elevations of 14,000 feet, similar to the altiplano of Mexico and South America which formed at the same time from similar forces. That highland plateau stretched west – east from the Sierra Nevada Mountains in California to the Wasatch Range in Utah.

Extension became the dominant force beginning in the Eocene - Oligocene epochs approximately 55 to 25 million years ago. Also, the relative movement of the tectonic plates changed about 30 million years ago with the movement becoming more oblique to the continent. That relaxed the compressional forces and also tended to ‘tear’ the crust apart, creating diagonal extensions.

The resulting compressional and extensional tectonics have created throughout Nevada a classical Basin and Range province consisting of narrow, N- to NE-trending, fault block mountain chains separated by flat linear valleys. This geological pattern is repeated across the State and has created a number of currently arid, ‘trapped’ or closed basins with respect to drainage that have the potential of containing Lithium Brine deposits.

Geology of Lithium Brines

Lithium brine deposits are accumulations of saline groundwater that are enriched in dissolved lithium. All producing lithium brine deposits share a number of first-order characteristics: (1) arid climate; (2) closed basin containing a salt flat (also known as a Playa or Salar); (3) tectonically driven subsidence; (4) associated igneous or geothermal activity; (5) suitable lithium source-rocks; (6) one or more adequate aquifers; and (7) sufficient time to concentrate a brine.

The single most important factor determining if a nonmarine basin can accumulate lithium brine is whether or not the basin is closed.

Lithium enriched brines are formed by complex processes that include: evaporation, re-mobilization, salt and lithium clay dissolution and precipitation. In essence, lithium is liberated through weathering or derived from hydrothermal fluids from a variety of rock sources within a closed basin where Lithium, a lightweight element, cannot escape.

Lithium is highly soluble and, unlike sodium (Na), potassium (K), or calcium (Ca), does not readily produce evaporite minerals when concentrated by evaporation. Instead it ends up in residual brines in the shallow subsurface. Economic brines have Li concentrations in the range of 200 to 4,000 milligrams per liter (mg/l). 1 mg/l = 1 ppm.

Clayton Valley contains the only currently producing Lithium Brine project in Nevada. Production has been on-going since 1967. The production at Clayton Valley is located approximately 120 miles west of the Railroad Valley. Evidence from Clayton Valley suggests that felsic vitric tuffs are a particularly favorable primary source of Lithium as well, uplifted Neogene lake beds from earlier in the basin’s history, which have been altered to hectorite, may provide a source of Lithium.

10

Railroad Valley has produced about 44 million barrels of oil (MMBO) from nine petroleum fields and has been extensively studied to determine relations between structure and oil production. Several interpretations of basin configuration have evolved, based on improved seismic acquisition and processing and better understanding of deformation styles and kinetics.

Oil was first discovered at Railroad Valley by Shell Oil in 1954. Their first discovery well reached a depth of 10,360 feet and it was determined that there was commercial oil reserves at intervals between 6,450 and 6,730 feet. The valley area is essentially wedge shaped with the wedge increasing in thickness from west to east. A low-angle attenuation fault has been reported to underlie Railroad Valley which has been interpreted to be a result of asymmetric arching rather than a series of down-to-the-west high-angle normal faults.

The stratigraphy of the valley is known to contain Paleozoic platform carbonate rocks, Tertiary volcanic rocks, and Tertiary lacustrine sediments. In comparison to Clayton Valley, the Railroad Valley has a large endowment of Neogene volcanic flows and tophaceous rocks.

Oil exploration has reported several laterally continuous thick Lithium brine horizons throughout Railroad Valley. Testing for Lithium from the brines was not conducted by the oil industry. Good reservoir rocks for oil may not represent good reservoir hosts for Lithium. The underlying brine-waters of the Railroad Valley were at one time examined as a potential reservoir for Las Vegas.

Volcanic rocks form a large part of the Neogene rock sequence: ash-flow tuffs and basalt flows from major calderas in eastern and central Nevada. Thickness of the volcanic section can vary greatly because of Neogene erosion and faulting. The thickness of ash flow tuffs in Railroad Valley can range from less than 1,000 ft to more than 3,000 ft. These rocks have shown good porosity and may represent an enormous source for Lithium.

Tertiary lacustrine formations consist of varying proportions of fresh-water carbonate, shale, sandstone, and volcanic debris. To date, oil production from Tertiary lacustrine reservoirs is limited, but there is production from the Sheep Pass Formation in the Eagle Springs field, and formerly there was production from Currant field; both in Railroad Valley.

The northern Playa area of Railroad Valley contained a large lake during the Pleistocene Epoch, more than 7,000 years ago. The lake has subsequently evaporated within the valley; however, at one point it reportedly covered an area of over 525 square miles and attained a maximum depth of 315 feet.

The large Railroad Valley north playa today is partly covered by young erosional alluvium.

Mineral Resources and Mineral Reserves

The Railroad Valley has demonstrated enrichment in Lithium in the nearby dry sediments as evidenced from the NURE sample database from the U.S. Geologic Survey. However, the project is at an exploration stage. There are no lithium brine mineral resources or reserves for the property.

Exploration and Development

Exploration and Development would consist of direct sampling and analysis of Lithium both laterally and vertically across the project area from both volcanic horizons and underground Brines contained within the Playa. Drilling and mobilization represent the largest costs of the program. Every effort would be made to minimize costs and maximize the sampling of brine from either re-entry and perforation of ‘shut-in’ oil wells or testing of current water wells in the project area.

Exploration Time Table

The work for the initial phase exploration program will be designed over the following 4 to 5 months. Surficial sampling will be performed from February to March 2019 and Drilling and sampling from April to June. Analytical analysis will follow each program.

Other Mineral Properties

We are not contemplating any other mineral properties at this time.

11

Item 3. Legal Proceedings

In January 2018, the Company filed a complaint in Nevada seeking the return or cancellation of 16 million common shares which the Company believes were fraudulently issued as well as claims against the former CEO of the Company, Craig Alford. The Company has entered into agreements to cancel eleven million shares. The remaining five million shares were cancelled and reissued after the Company determined that the recipients provided proper consideration for such shares. The litigation continues against Alford and certain other relief defendants. Alford has filed a counterclaim against the Company for amounts allegedly owed to him that the Company believes is entirely without merit. Other than the preceding, to the best of our knowledge, we are not currently a party to any legal proceedings that, individually or in the aggregate, are deemed to be material to our financial condition or results of operations.

We are required by Section 78.090 of the Nevada Revised Statutes (the "NRS") to maintain a registered agent in the State of Nevada. Our registered agent for this purpose is United Corporate Services, Inc., 2520 St Rose Pkwy Suite 319, Henderson, NV 89074. All legal process and any demand or notice authorized by law to be served upon us may be served upon our registered agent in the State of Nevada in the manner provided in NRS 14.020(2).

Item 4. Mine Safety Disclosures

Not applicable.

12

PART II

Item 5. Market for Common Equity and Related Stockholder Matters

Market Information

Our shares of common stock are eligible for quotation on the OTC Markets Group under the symbol “ORRP.” However, our shares do not trade other than on an extremely limited and sporadic basis. The following table sets forth for the periods indicated the range of high and low bid quotations per share as reported on the OTC Markets Group for the two most recent fiscal years. These quotations represent inter-dealer prices, without retail markups, markdowns or commissions and may not necessarily represent actual transactions.

|

| High |

| Low |

Year 2018 |

|

|

|

|

Fourth Quarter | $ | 0.18 | $ | 0.111 |

Third Quarter | $ | 0.42 | $ | 0.061 |

Second Quarter | $ | 0.115 | $ | 0.0575 |

First Quarter | $ | 0.135 | $ | 0.085 |

|

|

|

|

|

Year 2017 |

|

|

|

|

Fourth Quarter | $ | 0.18 | $ | 0.095 |

Third Quarter | $ | 0.335 | $ | 0.095 |

Second Quarter | $ | 0.35 | $ | 0.1586 |

First Quarter | $ | 0.545 | $ | 0.16 |

On December 18, 2018, the closing price of our Common Stock as reported by the OTC Markets Group was $0.202 per share.

Holders

As of December 18, 2018, we have approximately 51 shareholders including our directors and officers. One such holder is Cede & Co., a nominee for Depository Trust Company, or DTC. Shares of Common Stock that are held by financial institutions as nominees for beneficial owners are deposited into participant accounts at DTC, and are considered to be held of record by Cede & Co. as one stockholder.

Dividends

We have never declared or paid any cash dividends on our capital stock. We currently intend to retain all available funds and any future earnings to support our operations and finance the growth and development of our business. We do not intend to pay cash dividends on our common stock for the foreseeable future. Any future determination related to dividend policy will be made at the discretion of our Board of Directors. The Nevada Revised Statutes, however, prohibits us from declaring dividends where, after giving effect to the distribution of the dividend:

we would not be able to pay our debts as they become due in the usual course of business; or

our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of stockholders who have preferential rights superior to those receiving the distribution, unless otherwise permitted under our Articles of Incorporation.

Stock Options, Warrants and Rights

As at September 30, 2018, Oroplata has potentially issuable shares of common stock as follows:

8,925,334 potentially issuable shares of common stock from share purchase warrants issued with an exercise price that ranges from $0.001 to $0.50 per share;

3,838,452 potentially issuable shares of common stock from convertible debt instruments held by Tangiers Investment Group, LLC that were issued and are convertible into common shares at the Company at $0.115 per share, at any time at the option of the note holder; and

In addition, the Company had an undeterminable amount of shares issuable based on convertible notes in the aggregate principal amount of $939,400 (plus accrued interest) which have a conversion price based on the market price of the Company’s stock prior to conversion.

13

Penny Stock

Our common stock is subject to the provisions of Section 15(g) of the Exchange Act and Rule 15g-9 thereunder, commonly referred to as the “penny stock rule”. Section 15(g) sets forth certain requirements for transactions in penny stock, and Rule 15g-9(d) incorporates the definition of “penny stock” that is found in Rule 3a51-1 of the Exchange Act. The SEC generally defines a penny stock to be any equity security that has a market price less than US$5.00 per share, subject to certain exceptions. We are subject to the SEC’s penny stock rules. Since our common stock is deemed to be penny stock, trading in the shares of our common stock is subject to additional sales practice requirements on broker dealers who sell penny stock to persons other than established customers and accredited investors. “Accredited investors” are generally persons with assets in excess of US$1,000,000 or annual income exceeding US$200,000 or US$300,000 together with their spouse. For transactions covered by these rules, broker dealers must make a special suitability determination for the purchase of securities and must have the purchaser’s written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the rules require the delivery, prior to the first transaction, of a risk disclosure document prepared by the SEC relating to the penny stock market. A broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information for penny stocks held in an account and information to the limited market in penny stocks. Consequently, these rules may restrict the ability of broker-dealer to trade and/or maintain a market in our common stock and may affect the ability of our stockholders to sell their shares.

Securities Authorized for Issuance under Equity Compensation Plans

As of the date of this Report, we do not have any compensation plans under which our equity securities are authorized for issuance. We intend to adopt an equity compensation plan in which our directors, officers, employees and consultants will be eligible to participate. However, no formal steps have yet been taken to adopt such a plan.

Recent Sales of Unregistered Securities

(a)On July 9, 2018, the Company issued 1,850,000 restricted common shares with a fair value of $240,500 as compensation to various advisors.

(b)On July 10, 2018, the Company entered into a loan agreement with a non-related party for proceeds of $58,800. On July 12, 2018, the Company received proceeds of $50,000, net of an original issue discount of $5,800. The amount owing is unsecured, bears interest at 12% per annum, is due on April 30, 2019, and is convertible into common shares at the lesser of (i) $0.15 per common share, (ii) 75% of the lowest trading price for the fifteen trading days prior to the date of the note, or (iii) 75% of the lowest trading price for the fifteen trading days prior to conversion. Upon the due date on April 30, 2019, if the loan remains unpaid, the interest will increase to 22% per annum.

(c)On July 18, 2018, the Company issued 500,000 restricted common shares with a fair value of $75,000 to a non-related investor pursuant to an equity purchase agreement.

(d)On July 18, 2018, pursuant to the terms of a convertible note agreement, the Company issued 12,500 restricted common shares with a fair value of $1,875.

(e)On July 18, 2018, pursuant to the terms of a convertible note agreement, the Company issued 37,500 restricted common shares with a fair value of $5,625.

(f)On August 30, 2018, the Company issued 1,130,435 common shares as part of a conversion of $130,000 of convertible notes payable and accrued interest.

(g)On September 4, 2018, the Company issued 1,000,000 common shares with a fair value of $143,000 in exchange for the acquisition of 1,000 land claims.

(h)On September 10, 2018, the Company entered into a loan agreement with a non-related party for proceeds of $53,000. On July 12, 2018, the Company received proceeds of $47,200, net of an original issue discount of $5,800. The amount owing is unsecured, bears interest at 12% per annum, is due on June 30, 2019, and is convertible into common shares at the lesser of (i) $0.15 per common share, (ii) 61% of the lowest trading price for the fifteen trading days prior to the date of the note, or (iii) 61% of the lowest trading price for the fifteen trading days prior to conversion. Upon the due date on June 30, 2019, if the loan remains unpaid, the interest will increase to 22% per annum.

(i)On September 27, 2018, the Company entered into a loan agreement with a non-related party for proceeds of $130,000. The amount owing is unsecured, bears interest at 12% per annum, is due on September 27, 2019, and is convertible into common shares at the lesser of (i) $0.15 per common share, (ii) 60% of the lowest trading price for the fifteen trading days prior to the date of the note, or (iii) 60% of the lowest trading price for the fifteen trading days prior to conversion. Upon the due date on September 27, 2019, if the loan remains unpaid, the interest will increase to 22% per annum.

(j)In September 2018, the Company granted 2,000,000 share purchase warrants to a loan holder of the Company in exchange for an extension for the maturity of its promissory notes dated February 16, 2017 and July 25, 2018. The maturity date has been extended until June 30, 2019. The warrants are exercisable into common shares at $0.10 per share for a period of five years.

(k)In September 2018, the Company granted 3,850,000 share purchase warrants to a loan holder of the Company. The warrants are exercisable into common shares at between $0.01 and $0.15 per share for a period of five years.

14

The foregoing securities were issued under Section 4(a)(2) of the Securities Act of 1933, as amended, and/or Rule 506 of Regulation D under the Securities Act. In the case of the promissory notes, each investor represented that it was an accredited investor, as defined in Rule 501 of Regulation D, and that it was acquiring the securities for its own account, not as nominee or agent, and not with a view to the resale or distribution of any part thereof in violation of the Securities Act. Any proceeds issued from the above issuances were used for working capital purposes of the Company.

Purchases of Equity Securities by the Issuer and “Affiliated Purchasers”

We did not purchase any shares of our common stock or other securities during the year ended September 30, 2018.

Item 6. Selected Financial Data

Not required.

Item 7. Management's Discussion and Analysis of Financial Conditions and Results of Operations.

You should read the following discussion of our financial condition and results of operations in conjunction with the financial statements and the notes thereto included elsewhere in the Form 10-K. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below and elsewhere in this Form 10-K.

RESULTS OF OPERATIONS

Working Capital

| September 30, 2018 |

| September 30, 2017 |

| $ | $ | |

Current Assets | 308,769 |

| 61,641 |

Current Liabilities | 2,741,281 |

| 1,327,646 |

Working Capital (Deficit) | (2,432,512) |

| (1,266,005) |

Cash Flows

| September 30, 2018 |

| September 30, 2017 |

$ | $ | ||

Cash Flows used in Operating Activities | (993,422) |

| (484,899) |

Cash Flows used in Investing Activities | (10,200) |

| - |

Cash Flows from Financing Activities | 1, 117,250 |

| 404,000 |

Net increase (decrease) in Cash During Period | 113,628 |

| (80,899) |

Operating Revenues

During the years ended September 30, 2018 and 2017, the Company did not record any revenues from operations.

Operating Expenses and Net Loss

During the year ended September 30, 2018, the Company incurred operating expenses of $5,588,730 compared to $2,198,907 during the year ended September 30, 2017. The increase in operating expenses is due to stock-based compensation expense of $887,007 compared to $652,977 during fiscal 2017 relating to the issuance of share purchase warrants. Furthermore, the Company issued $3,199,950 of common shares for services of which $3,013,950 was expensed and $186,000 was recorded in prepaid expense. Comparatively, the Company issued $357,000 of common shares for services during fiscal 2017. Finally, during the year ended September 30, 2018, the Company recorded an impairment loss of $153,200 on the Company’s mineral property due to inability to obtain reasonable fair value estimates to support continued capitalization of the project.

15

The Company recorded accretion and interest expense of $293,401 during the year ended September 30, 2018 compared to $497,269 during the year ended September 30, 2017. The decrease is due to the fact that the Company modified the terms of various agreements in the prior year that resulted in the extinguishment of the debt and the recording of additional accretion expense. For the current year, the Company did not modify any existing convertible notes, but did issue more convertible notes during the year to support its ongoing development work on its mineral properties. The Company also recorded a loss on the change in fair value of the derivative liability of $165,961, which was due in part to the fluctuation valuation of the beneficial conversion feature for convertible notes that were issued that had a floating interest rate. Finally, the Company recorded a loss on settlement of debt of $0 in fiscal 2018 compared to a loss on settlement of debt of $36,000 during fiscal 2017.

The Company incurred a net loss of $6,048,092, or $0.07 loss per share, during the year ended September 30, 2018 compared to a net loss of $2,690,342, or $0.05 loss per share, during the year ended September 30, 2017.

Liquidity and Capital Resources

As of September 30, 2018, the Company had cash of $122,769 and total assets of $308,769 compared to cash of $9,141 and total assets of $61,641 as at September 30, 2017. The increase in cash and total assets was due to the fact that the Company issued more convertible debentures during the year to support the ongoing development and exploration of its mineral properties, as well as issuance of common shares for future services owed to the Company by various consultants and members of management.

As of September 30, 2018, the Company had total liabilities of $2,741,281 compared to total liabilities of $1,327,646 as at September 30, 2017. The increase in total liabilities is due to an increase in the carrying value of convertible notes payable of $150,715 due in part to the issuance of more convertible notes during the year which was a main support of financing used by the Company to support its ongoing growth and development. There was also an increase in amounts due to related parties of $364,631 relating to unpaid amounts owing to management and directors for unpaid management and director fees, as the Company is trying to maintain its cash flow for operating activities as opposed to paying the amounts due to management and directors. The remaining increase of $800,973 was due to the fair value of the derivative liability relating to the fair value of the beneficial conversion feature of floating rate convertible debentures, and $97,316 is for accounts payable and accrued liabilities and is mainly due to timing differences between receipt of invoices and payment of amounts owing.

As of September 30, 2018, the Company has a working capital deficit of $2,432,512 compared to a working capital deficit of $1,266,005 as at September 30, 2017. The increase in the working capital deficit is due to the use of convertible debentures to pay for operating expenditures which increases the overall working capital deficit.

During the year ended September 30, 2018, the Company issued 1,000,000 common shares with a fair value of $143,000 to acquire mineral properties located in Nye County, Nevada, issued 500,000 common shares as a donation with a fair value of $75,000, issued 716,666 common shares for the issuance of convertible notes and exercise of cashless warrants, issued 31,340,000 common shares for services with a fair value of $3,199,950, and issued 4,874,783 common shares pursuant to the conversion of notes payable with a fair value of $560,550. In addition, the Company also cancelled 3,600,000 common shares and replaced those shares with the issuance of 3,600,000 share purchase warrants. During the year ended September 30, 2017, the Company issued 400,000 common shares with a fair value of $96,000 to settle outstanding accounts payables, and 1,600,000 common shares with a fair value of $357,000 for consulting and professional services. Furthermore, the Company also received 636,943 common shares that were previously issued for the Nye County property and the shares were returned to treasury.

Cashflows from Operating Activities

During the year ended September 30, 2018, the Company used $993,422 of cash for operating activities compared to the use of $484,899 of cash for operating activities during the year ended September 30, 2017. The increase in the use of cash for operating activities was due to additional costs incurred during the year due to an overall increase in day-to-day transactions and costs.

Cashflows from Investing Activities

During the year ended September 30, 2018, the Company used cash of $10,200 for acquisition of mineral properties compared to no investing activities during the year ended September 30, 2017.

Cashflows from Financing Activities

During the year ended September 30, 2018, the Company received $1,117,250 of cash from financing activities compared to $404,000 received during the year ended September 30, 2017. The increase in the cash received from financing activities was attributed to $1,117,250 received from the issuance of convertible notes. During the year ended September 30, 2017, the Company received $404,000 from the issuance of convertible notes.

16

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive acquisitions and activities. For these reasons, our auditors stated in their report on our audited financial statements that they have substantial doubt that we will be able to continue as a going concern without further financing.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Future Financings

We will continue to rely on equity sales of our common shares in order to continue to fund our business operations. Issuances of additional shares will result in dilution to existing stockholders. There is no assurance that we will achieve any additional sales of the equity securities or arrange for debt or other financing to fund planned acquisitions and exploration activities.

Critical Accounting Policies

Our financial statements and accompanying notes have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods.

We regularly evaluate the accounting policies and estimates that we use to prepare our financial statements. A complete summary of these policies is included in the notes to our financial statements. In general, management's estimates are based on historical experience, on information from third party professionals, and on various other assumptions that are believed to be reasonable under the facts and circumstances. Actual results could differ from those estimates made by management.

Recently Issued Accounting Pronouncements

The Company has implemented all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on the financial statements unless otherwise disclosed, and the Company does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Item 7a. Quantitative and Qualitative Disclosures About Market Risk

Item 8. Financial Statements and Supplementary Data.

OROPLATA RESOURCES, INC.

Financial Statements

For the Years Ended September 30, 2018 and 2017

Report of Independent Registered Public Accounting Firm | F-1 |

Consolidated Balance Sheets | F-2 |

Consolidated Statements of Operations | F-3 |

Consolidated Statement of Stockholders’ Deficit | F-4 |

Consolidated Statements of Cash Flows | F-5 |

Notes to the Consolidated Financial Statements | F-6 |

17

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Board of Directors and Stockholders of

Oroplata Resources, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Oroplata Resources, Inc. (the “Company”) as of September 30, 2018 and 2017, and the related consolidated statements of operations, stockholders’ equity (deficit), and cash flows for each of the years in the two-year period ended September 30, 2018 (collectively referred to as the consolidated financial statements). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of September 30, 2018 and 2017, and the results of its operations and its cash flows for each of the years in the two-year period ended September 30, 2018 and 2017, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

Emphasis of Matter

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 1 to the consolidated financial statements, the Company has not generated sufficient cash flows from operations to fund its business operations. This factor, among others, raises substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to this matter are also described in Note 1. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/Pinnacle Accountancy Group of Utah

We have served as the Company’s auditor since 2016

Farmington, Utah

December 28, 2018

F-1

OROPLATA RESOURCES, INC.

Consolidated Balance Sheets

| September 30, 2018 $ |

| September 30, 2017 $ |

ASSETS |

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

Cash | 122,769 |

| 9,141 |

Prepaid expenses | 186,000 |

| 52,500 |

|

|

|

|

Total assets | 308,769 |

| 61,641 |

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

Accounts payable and accrued liabilities | 509,779 |

| 412,463 |

Due to related parties | 582,877 |

| 218,246 |

Derivative liability | 800,973 |

| – |

Notes payable, net of unamortized discount of $533,170 and $13,063, respectively | 847,652 |

| 696,937 |

|

|

|

|

Total current liabilities | 2,741,281 |

| 1,327,646 |

|

|

|

|

STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

Common Stock Authorized: 500,000,000 common shares with a par value of $0.001 per share |

|

|

|

Issued and outstanding: 93,331,449 and 58,500,000 common shares, respectively | 93,331 |

| 58,500 |

Additional paid-in capital | 34,739,491 |

| 29,892,737 |

Deficit | (37,265,334) |

| (31,217,242) |

Total stockholders’ deficit | (2,432,512) |

| (1,266,005) |

|

|

|

|

Total liabilities and stockholders’ equity (deficit) | 308,769 |

| 61,641 |

(The accompanying notes are an integral part of these consolidated financial statements)

F-2

OROPLATA RESOURCES, INC.

Consolidated Statements of Operations

| For the year ended September 30, 2018 $ |

| For the year ended September 30, 2017 $ |

|

|

|

|

Expenses |

|

|

|

|

|

|

|

Exploration costs | 227,653 |

| 640,300 |

General and administrative | 5,207,877 |

| 1,558,607 |

Impairment of mineral property | 153,200 |

| – |

|

|

|

|

Net loss before other expenses | (5,588,730) |

| (2,198,907) |

|

|

|

|

Other expenses |

|

|

|

|

|

|

|

Accretion and interest expense | (293,401) |

| (497,269) |

Gain on forgiveness of debt | – |

| 41,834 |

Loss on settlement of debt | – |

| (36,000) |

Change in fair value of derivative liability | (165,961) |

| – |

|

|

|

|

Total other expenses | (459,362) |

| (491,435) |

|

|

|

|

Net loss | (6,048,092) |

| (2,690,342) |

Net loss per share, basic and diluted | (0.07) |

| (0.05) |

Weighted average shares outstanding | 82,297,005 |

| 58,337,070 |

(The accompanying notes are an integral part of these consolidated financial statements)

F-3

OROPLATA RESOURCES, INC.

Consolidated Statement of Stockholders’ Deficit

| Common Shares | Additional Paid-In Capital $ | Deficit $ | Total $ | |

| Number # | Amount $ | |||

|

|

|

|

|

|

Balance, September 30, 2016 | 57,136,943 | 57,137 | 27,925,770 | (28,526,900) | (543,993) |

|

|

|

|

|

|

Shares issued for settlement agreement | 2,000,000 | 2,000 | 598,000 | – | 600,000 |

|

|

|

|

|

|

Shares issued for accounts payable | 400,000 | 400 | 95,600 | – | 96,000 |

|

|

|

|

|

|

Shares issued for services | 1,600,000 | 1,600 | 355,400 | – | 357,000 |

|

|

|

|

|

|

Share cancellation | (2,636,943) | (2,637) | 2,637 | – | – |

|

|

|

|

|

|

Fair value of share purchase warrants | – | – | 652,977 | – | 652,977 |

|

|

|

|

|

|

Fair value of beneficial conversion feature | – | – | 262,353 | – | 262,353 |

|

|

|

|

|

|

Net loss for the year | – | – | – | (2,690,342) | (2,690,342) |

|

|

|

|

|

|

Balance, September 30, 2017 | 58,500,000 | 58,500 | 29,892,737 | (31,217,242) | (1,266,005) |

|

|

|

|

|

|

Shares issued to acquire mineral property | 1,000,000 | 1,000 | 142,000 | – | 143,000 |

|

|

|

|

|

|

Shares issued for services | 31,340,000 | 31,340 | 3,168,610 | – | 3,199,950 |

|

|

|

|

|

|

Shares issued for conversion of notes payable and accrued interest | 4,874,783 | 4,874 | 555,676 | – | 560,550 |

|

|

|

|

|

|

Shares issued as donation | 500,000 | 500 | 74,500 | – | 75,000 |

|

|

|

|

|

|

Shares issued for interest expense | 50,000 | 50 | 7,450 | – | 7,500 |

|

|

|

|

|

|

Shares issued for warrant exercise | 666,666 | 667 | (667) | – | – |

|

|

|

|

|

|

Share cancellation | (3,600,000) | (3,600) | 3,600 | – | – |

|

|

|

|

|

|

Fair value of share purchase warrants | – | – | 887,007 | – | 887,007 |

|

|

|

|

|

|

Fair value of beneficial conversion feature | – | – | 8,578 | – | 8,578 |

|

|

|

|

|

|

Net loss for the year | – | – | – | (6,048,092) | (6,048,092) |

|

|

|

|

|

|

Balance, September 30, 2018 | 93,331,449 | 93,331 | 34,739,491 | (37,265,334) | (2,432,512) |

(The accompanying notes are an integral part of these consolidated financial statements)

F-4

OROPLATA RESOURCES, INC.

Consolidated Statements of Cash Flows

| For the year ended September 30, 2018 $ |

| For the year ended September 30, 2017 $ |

Operating Activities |

|

|

|

|

|

|

|

Net loss | (6,048,092) |

| (2,690,342) |

|

|

|

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

Accretion expense | 194,234 |

| 447,611 |

Fair value of share purchase warrants issued | 887,007 |

| 652,977 |

Convertible note issued for commitment fee | – |

| 75,000 |

Gain on forgiveness of debt | – |

| (41,834) |

Impairment of mineral property | 153,200 |

| – |

Loss on settlement of debt | – |

| 36,000 |

Shares issued for settlement agreement | – |

| 600,000 |

Shares issued for services | 3,199,950 |

| 357,000 |

Shares issued as donation | 75,000 |

| – |

Shares issued for interest expense | 7,500 |

| – |

Change in fair value of derivative liability | 165,961 |

| – |

|

|

|

|

Changes in operating assets and liabilities: |

|

|

|

Prepaid expenses | (133,500) |

| (52,500) |

Accounts payable and accrued liabilities | 140,687 |

| 91,089 |

Due to related parties | 364,631 |

| 40,100 |

Net Cash Used In Operating Activities | (993,422) |

| (484,899) |

Investing Activities |

|

|

|

Mineral property costs | (10,200) |

| – |

Net Cash Used In Investing Activities | (10,200) |

| – |

Financing Activities |

|

|

|

Proceeds from issuance of convertible debentures | 1,117,250 |

| 404,000 |

Net Cash Provided By Financing Activities | 1,117,250 |

| 404,000 |

|

|

|

|

Change in Cash | 113,628 |

| (80,899) |

Cash – Beginning of Period | 9,141 |

| 90,040 |

Cash – End of Period | 122,769 |

| 9,141 |

|

|

|

|

Non-cash investing and financing activities: |

|

|

|

Original issue discount on convertible debentures | 70,750 |

| 37,080 |

Shares issued on the exercise of cashless warrants | 667 |

| – |

Shares issued to settle accrued interest | 43,371 |

| 60,000 |

Shares issued for acquisition of mineral property | 143,000 |

| – |

Shares issued for conversion of debt | 517,179 |

| – |

Discount on convertible debenture | 74,033 |

| 13,063 |

|

|

|

|

Supplemental disclosures: |

|

|

|

Interest paid | – |

| – |

Income tax paid | – |

| – |

(The accompanying notes are an integral part of these consolidated financial statements)

F-5

OROPLATA RESOURCES, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2018

1.Organization and Nature of Operations

Oroplata Resources Inc. (the “Company”) was incorporated under the laws of the state of Nevada on October 6, 2011 for the purpose of acquiring and developing mineral properties. The Company has a wholly-owned subsdiary called Oroplata Exploraciones E Ingenieria SRL, which was incorporated in the Dominican Republic on January 10, 2012. On July 26, 2016, the Company incorporated Lithortech Resources Inc., a Nevada company, as a wholly-owned subsidiary. On June 29, 2018, the Company changed the name of Lithortech Resources to LithiumOre Corp. The Company currently holds mineral rights in the Dominican Republic and in the Western Nevada Basin of Nye County in the state of Nevada.

Going Concern

These consolidated financial statements have been prepared on a going concern basis, which implies that the Company will continue to realize its assets and discharge its liabilities in the normal course of business. As at September 30, 2018, the Company has not earned revenue, has a working capital deficit of $2,432,512, and an accumulated deficit of $37,265,334. The continuation of the Company as a going concern is dependent upon the continued financial support from its management, and its ability to identify future investment opportunities and obtain the necessary debt or equity financing, and generating profitable operations from the Company’s future operations. If the Company is able to obtain financing, there is no certainty that terms will be favorable to the Company. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These consolidated financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

2.Summary of Significant Accounting Policies

(a)Basis of Presentation and Principles of Consolidation

The financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“US GAAP”) and are expressed in U.S. dollars. The Company’s fiscal year end is September 30.

These consolidated financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States and are expressed in U.S. dollars. These consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Oroplata Exploraciones E Ingenieria SRL and LithiumOne Corp. (formerly Lithortech Resources Inc). All inter-company accounts and transactions have been eliminated on consolidation.

(b)Cash and Cash Equivalents

The Company considers all highly liquid instruments with a maturity of three months or less at the time of issuance to be cash equivalents. As of September 30, 2018, and 2017, there were no cash equivalents.

(c)Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to the fair value of stock-based compensation, recoverability of long-lived assets, valuation of derivative liability, and deferred income tax asset valuation allowances. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

F-6

OROPLATA RESOURCES, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2018

2.Summary of Significant Accounting Policies (continued)

(d)Long-Lived Assets

Long-lived assets, such as property and equipment, mineral properties, and purchased intangibles with finite lives (subject to amortization), are evaluated for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable in accordance with Accounting Standards Codification topic 360 “Property, Plant, and Equipment”. Circumstances which could trigger a review include, but are not limited to: significant decreases in the market price of the asset; significant adverse changes in the business climate or legal factors; accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the asset; current period cash flow or operating losses combined with a history of losses or a forecast of continuing losses associated with the use of the asset; and current expectation that the asset will more likely than not be sold or disposed significantly before the end of its estimated useful life.

Recoverability of assets is measured by a comparison of the carrying amount of an asset to estimated undiscounted future cash flows expected to be generated by an asset. If the carrying amount of an asset exceeds its estimated future cash flows, an impairment charge is recognized as the amount by which the carrying amount exceeds the estimated fair value of the asset. The estimated fair value is determined using a discounted cash flow analysis. Any impairment in value is recognized as an expense in the period when the impairment occurs.

(e)Asset Retirement Obligations