Attached files

| file | filename |

|---|---|

| 8-K - SWK Holdings Corp | e18470_swkh-8k.htm |

Exhibit 99.1

Collaborative Approach to Life Science Financing

Forward - looking and Cautionary Statements Statements in this presentation that are not strictly historical, and any statements regarding events or developments that we be lieve or anticipate will or may occur in the future are "forward - looking" statements within the meaning of the federal securities laws. There are a number of important fact ors that could cause actual results, developments and business decisions to differ materially from those suggested or indicated by such forward - looking statements an d you should not place undue reliance on any such forward - looking statements. Additional information regarding the factors that may cause actual results to differ mat erially from these forward - looking statements is available in our SEC filings, including our 2017 Annual Report on Form 10 - K and our Quarterly Reports on Form 10 - Q for subsequent periods. The Company does not assume any obligation to update or revise any forward - looking statement, whether as a result of new information , future events and developments or otherwise. Our specialty finance and asset management businesses are conducted through separate subsidiaries and the Company conducts it s o perations in a manner that is excluded from the definition of an investment company and exempt from registration and regulation under the Investment Compan y A ct of 1940. This presentation is neither an offer to sell nor a solicitation of any offer to buy any securities, investment product or in ves tment advisory services, including such services offered by SWK Advisors LLC. This presentation does not contain all of the information necessary to make an investm ent decision, including, but not limited to, the risks, fees and investment strategies of investing in life science investments. Any offering is made only pursuant t o t he relevant information memorandum, a relevant subscription agreement or investment management agreement, and SWK Advisors LLC’s Form ADV, all of which must be rea d i n their entirety. All investors must be “accredited investors” and/or “qualified purchasers” as defined in the securities laws before they can invest with SW K A dvisors LLC. Life science securities may rely on milestone payments and/or a royalty stream from an underlying drug, device, or product wh ich may or may not have received approval of the Food and Drug Administration (“FDA”). If the underlying drug, device, or product does not receive FDA approva l, it could negatively impact the securities, including the payments of principal and/or interest. In addition, the introduction of new drugs, devices, or prod uct s onto the market could negatively impact the securities, since that may decrease sales and/or prices of the underlying drug, device, or product. Changes to Medicare r eim bursement or third party payor pricing could negatively impact the securities, since they could negatively impact the prices and/or sales of the underlying drug, de vic e, or product. There is also risk that the licensing agreement that governs the payment of royalties may terminate, which could negatively impact the securities. There is also the risk that litigation involving the underlying drug, device, or product could negatively impact the securities, including payments of principal and/or interest o n a ny securities. 2

CORPORATE OVERVIEW

SWK Holdings Overview o SWK provides custom financing solutions for commercial - stage healthcare companies and royalty owners o Deploys balance sheet capital into secured financing portfolio ̶ Market capitalization on 12/20/18 was $ 124mm , 59% of 9/30/18 stockholders equity of $ 210mm ̶ $3.5mm stock buyback announced 12/16/18 o SWK targets $5mm to $20mm financings, a market niche it believes is largely ignored by larger market participants and generates attractive full - cycle returns o SWK targets unlevered, mid - teens return on capital ̶ 9/30/18 portfolio effective yield: 12.9%* o Life science business launched in 2012; since inception of business strategy SWK has completed financings with 31 different parties deploying $460mm of capital, including partner co - investments o Financings with 20 parties at 12/20/18 ; 14 exits from inception through 12/20/18 o Business focus is secured financings and royalty monetizations , but will selectively consider equity - like opportunities o Corporate goals: ̶ Increase book value per share at a 10%+ CAGR ̶ Be recognized as partner of choice for life science companies and inventors seeking $20mm or less ̶ Generate current income to utilize SWK’s substantial NOL asset, $377mm at 9/30/18 o Experienced and aligned management and Board 4 CORPORATE OVERVIEW *Effective yield is the rate at which income is expected to be recognized pursuant to the Company’s revenue recognition polic ies , if all payments are received pursuant to the terms of the finance receivable; excludes warrants

Why Life Science Finance? o Achieve high current yield from investment in non - correlated assets ̶ Invest in royalty, revenue, equity & debt interests from healthcare companies, research institutions and inventors ̶ Structured debt: high coupon drives current yield and warrants provide equity upside; backed by collateral value and lender r igh ts in downside scenario ̶ Royalties: strong underlying existing cash flow profile without material exposure to corporate costs o Access to capital is challenging for small/medium sized life science companies ̶ Unlike larger private - lending verticals, few participants exist for sub - $20mm life science financings ̶ Traditional alternatives to primary equity and convertible debt typically highly dilutive and difficult to execute o Life science products are highly portable among marketing organizations ̶ Approved & marketed products and/or royalty streams are valuable collateral regardless of corporate cash burn ̶ Small products often do not justify stand - alone sales force costs and can be highly accretive to larger companies ̶ Once ingrained into therapeutic practice, many products continue to ‘sell’ themselves o Revenues are predictable and have low correlation to economic growth and macro factors ̶ Product launch curves are relatively stable with much supporting data from comparables ̶ Given long approval times, competition is often identifiable up to a decade in advance o Mitigate FDA & clinical trial risk by focusing on commercial opportunities ̶ Diligence focuses on product necessity, intellectual property exclusivity, regulatory moat, competitive threats, reimbursemen t, and marketer ability and financial stability 5 CORPORATE OVERVIEW

Experienced Team o SWK’s investment professionals have extensive experience financing life science companies o CEO Winston Black has been active in life science structured finance asset class since 2007 when he helped manage a multi - billion dollar healthcare portfolio for a large investment firm and helped develop the royalty financing market o CEO Winston Black has financed life science companies for more than a decade and has experience in operations, public markets investing, and restructurings o Management has experience investing across the capital structure and understands various stakeholders’ incentives o The team has a broad network of clinical, financial, and legal experts o Experienced financial, accounting, and legal team combining in - house resources with veteran outsourced providers o SWK is 69% owned by Carlson Capital, a multi - billion dollar, Dallas - based asset manager ̶ Two Carlson representatives are on SWK’s Board of Directors o SWK’s Board of Directors provides wealth of investment, operational and corporate governance experience 6 CORPORATE OVERVIEW

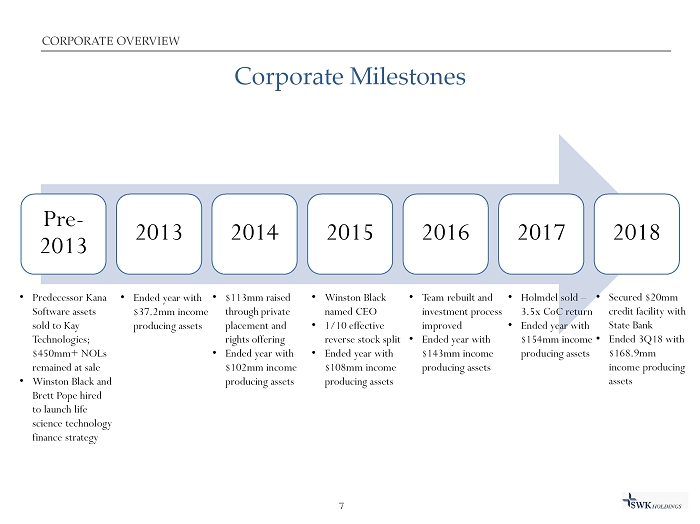

Corporate Milestones 7 Pre - 2013 2013 2014 2015 2016 2017 2018 • Predecessor Kana Software assets sold to Kay Technologies; $450mm+ NOLs remained at sale • Winston Black and Brett Pope hired to launch life science technology finance strategy • $113mm raised through private placement and rights offering • Ended year with $102mm income producing assets • Team rebuilt and investment process improved • Ended year with $143mm income producing assets • Winston Black named CEO • 1/10 effective reverse stock split • Ended year with $108mm income producing assets • Holmdel sold – 3.5x CoC return • Ended year with $154mm income producing assets CORPORATE OVERVIEW • Ended year with $37.2mm income producing assets • Secured $20mm credit facility with State Bank • Ended 3Q18 with $168.9mm income producing assets

Value Creation Strategy o Deploy balance sheet capital into secured financing portfolio ̶ $5mm to $20mm life science loan and royalty market sports attractive, low - to - mid teens yields ̶ SWK has established reputation as a go - to capital provider for this underserved market ̶ Majority of financings structured with warrants or other upside features to enhance return profile o Evaluate and pursue product acquisition opportunities ̶ Leverage SWK contacts, infrastructure, and lessons learned from Holmdel success ̶ Potential to use greater amount of NOLs o Utilize credit facility to boost ROE ̶ SWK targets a 10%+ ROE ̶ SWK carries minimal leverage while similarly sized BDCs often carry 50 % to 75% debt/equity leverage ̶ SWK will selectively consider other forms of outside capital including asset management arrangements o Selectively consider new capital deployment opportunities ̶ SWK’s core competency is life science finance but is willing to consider other capital deployment options that could utilize the company’s substantial NOLs o SWK believes this strategy can achieve a 10%+ book value per share CAGR 8 CORPORATE OVERVIEW

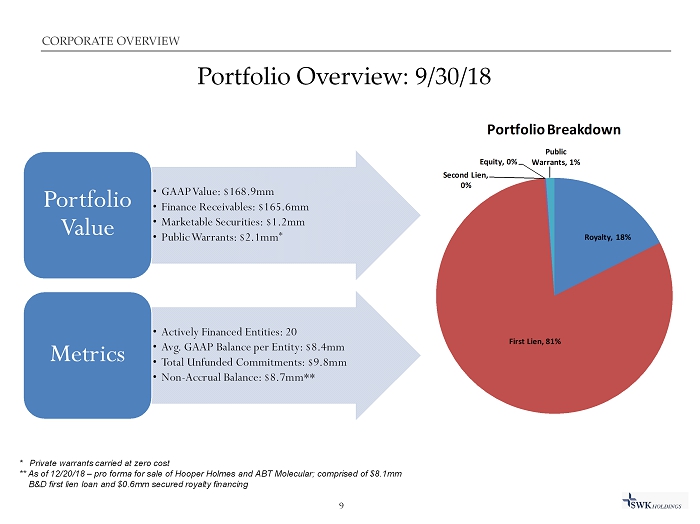

* Private warrants carried at zero cost ** As of 12/20/18 – pro forma for sale of Hooper Holmes and ABT Molecular; comprised of $ 8.1mm B&D first lien loan and $0.6mm secured r oyalty f inancing Portfolio Overview: 9/30/18 9 • GAAP Value: $168.9mm • Finance Receivables: $165.6mm • Marketable Securities: $1.2mm • Public Warrants: $2.1mm * Portfolio Value • Actively Financed Entities: 20 • Avg. GAAP Balance per Entity: $8.4mm • Total Unfunded Commitments: $9.8mm • Non - Accrual Balance: $ 8.7mm ** Metrics CORPORATE OVERVIEW Royalty , 18% First Lien , 81% Second Lien , 0% Equity , 0% Public Warrants , 1% Portfolio Breakdown

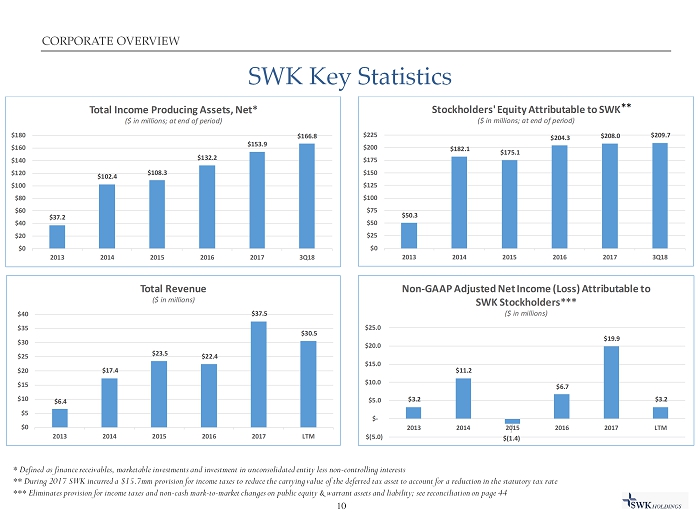

SWK Key Statistics 10 * Defined as finance receivables, marketable investments and investment in unconsolidated entity less non - controlling interests ** During 2017 SWK incurred a $15.7mm provision for income taxes to reduce the carrying value of the deferred tax asset to ac cou nt for a reduction in the statutory tax rate *** Eliminates provision for income taxes and non - cash mark - to - market changes on public equity & warrant assets and liability; s ee reconciliation on page 44 CORPORATE OVERVIEW $37.2 $102.4 $108.3 $132.2 $153.9 $166.8 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 2013 2014 2015 2016 2017 3Q18 Total Income Producing Assets, Net* ($ in millions; at end of period) $50.3 $182.1 $175.1 $204.3 $208.0 $209.7 $0 $25 $50 $75 $100 $125 $150 $175 $200 $225 2013 2014 2015 2016 2017 3Q18 Stockholders' Equity Attributable to SWK ($ in millions; at end of period) ** $6.4 $17.4 $23.5 $22.4 $37.5 $30.5 $0 $5 $10 $15 $20 $25 $30 $35 $40 2013 2014 2015 2016 2017 LTM Total Revenue ($ in millions) $3.2 $11.2 $(1.4) $6.7 $19.9 $3.2 $(5.0) $- $5.0 $10.0 $15.0 $20.0 $25.0 2013 2014 2015 2016 2017 LTM Non - GAAP Adjusted Net Income (Loss) Attributable to SWK Stockholders*** ($ in millions)

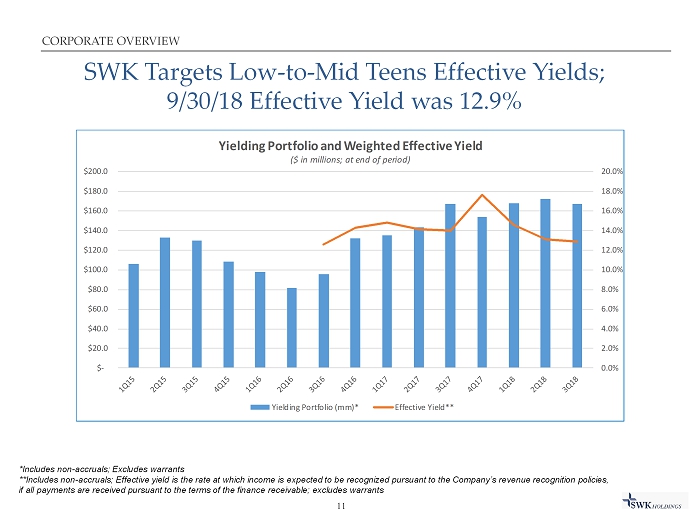

SWK Targets Low - to - Mid Teens Effective Yields; 9/30/18 Effective Yield was 12.9% 11 *Includes non - accruals; Excludes warrants **Includes non - accruals; Effective yield is the rate at which income is expected to be recognized pursuant to the Company’s reve nue recognition policies, if all payments are received pursuant to the terms of the finance receivable; excludes warrants CORPORATE OVERVIEW 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% $- $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 $200.0 Yielding Portfolio and Weighted Effective Yield ($ in millions; at end of period) Yielding Portfolio (mm)* Effective Yield**

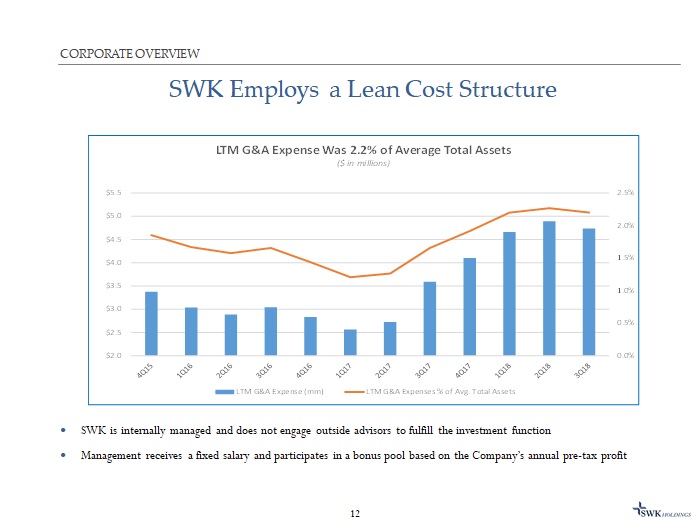

SWK Employs a Lean Cost Structure 12 o SWK is internally managed and does not engage outside advisors to fulfill the investment function o Management receives a fixed salary and participates in a bonus pool based on the Company’s annual pre - tax profit CORPORATE OVERVIEW 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 $5.0 $5.5 LTM G&A Expense Was 2.2% of Average Total Assets ($ in millions) LTM G&A Expense (mm) LTM G&A Expenses % of Avg. Total Assets

INVESTMENT PROCESS

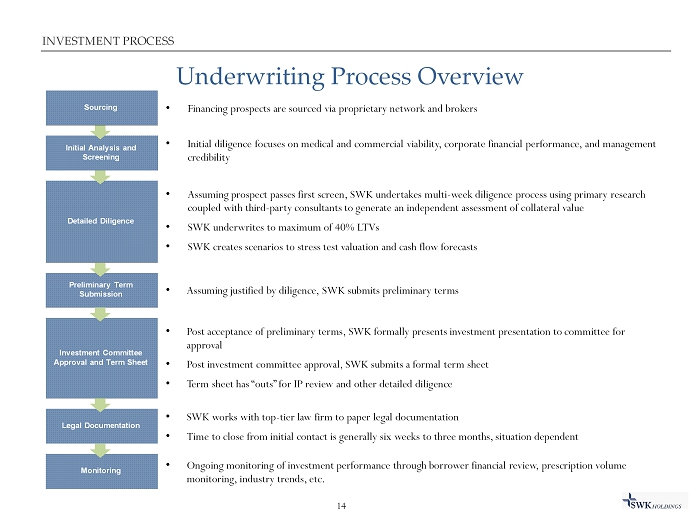

Underwriting Process Overview Sourcing Initial Analysis and Screening Detailed Diligence Preliminary Term Submission Investment Committee Approval and Term Sheet Monitoring Legal Documentation 14 • Financing prospects are sourced via proprietary network and brokers • Initial diligence focuses on medical and commercial viability, corporate financial performance, and management credibility • Assuming prospect passes first screen, SWK undertakes multi - week diligence process using primary research coupled with third - party consultants to generate an independent assessment of collateral value • SWK underwrites to maximum of 40% LTVs • SWK creates scenarios to stress test valuation and cash flow forecasts • Assuming justified by diligence, SWK submits preliminary terms • Post acceptance of preliminary terms, SWK formally presents investment presentation to committee for approval • Post investment committee approval, SWK submits a formal term sheet • Term sheet has “outs” for IP review and other detailed diligence • SWK works with top - tier law firm to paper legal documentation • Time to close from initial contact is generally six weeks to three months, situation dependent • Ongoing monitoring of investment performance through borrower financial review, prescription volume monitoring, industry trends, etc. INVESTMENT PROCESS

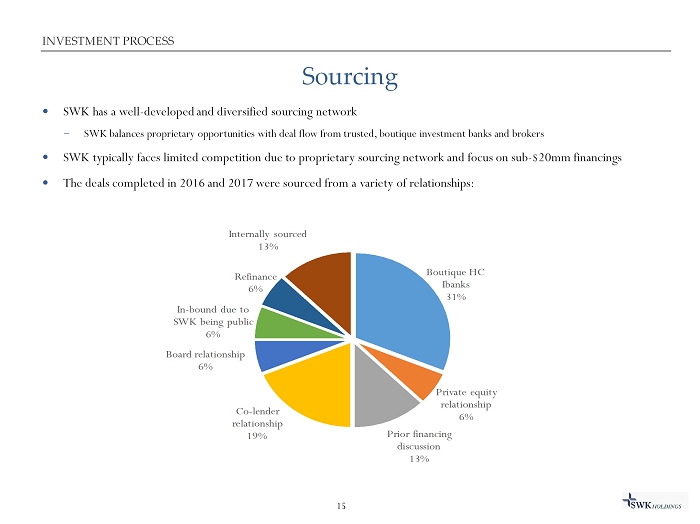

Sourcing o SWK has a well - developed and diversified sourcing network ̶ SWK balances proprietary opportunities with deal flow from trusted, boutique investment banks and brokers o SWK typically faces limited competition due to proprietary sourcing network and focus on sub - $20mm financings o The deals completed in 2016 and 2017 were sourced from a variety of relationships: 15 INVESTMENT PROCESS Boutique HC Ibanks 31% Private equity relationship 6% Prior financing discussion 13% Co - lender relationship 19% Board relationship 6% In - bound due to SWK being public 6% Refinance 6% Internally sourced 13%

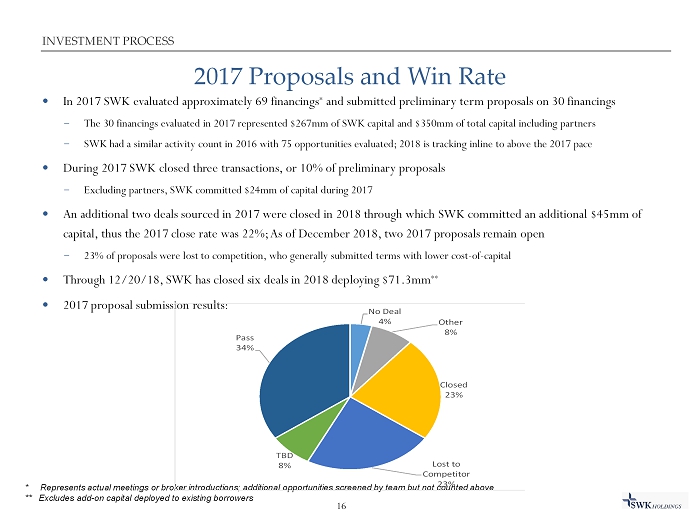

2017 Proposals and Win Rate o In 2017 SWK evaluated approximately 69 financings * and submitted preliminary term proposals on 30 financings ̶ The 30 financings evaluated in 2017 represented $267mm of SWK capital and $350mm of total capital including partners ̶ SWK had a similar activity count in 2016 with 75 opportunities evaluated; 2018 is tracking inline to above the 2017 pace o During 2017 SWK closed three transactions, or 10% of preliminary proposals ̶ Excluding partners, SWK committed $24mm of capital during 2017 o An additional two deals sourced in 2017 were closed in 2018 through which SWK committed an additional $45mm of capital, thus the 2017 close rate was 22 %; As of December 2018, two 2017 proposals remain open ̶ 23% of proposals were lost to competition, who generally submitted terms with lower cost - of - capital o Through 12/20/18 , SWK has closed six deals in 2018 deploying $71.3mm ** o 2017 proposal submission results: * Represents actual meetings or broker introductions; additional opportunities screened by team but not counted above ** Excludes add - on capital deployed to existing borrowers 16 INVESTMENT PROCESS No Deal 4% Other 8% Closed 23% Lost to Competitor 23% TBD 8% Pass 34%

Diligence Process o SWK’s diligence process is anchored by the “four Cs” of credit analysis: Collateral, Character, Capacity, and Capital o Collateral value is ascertained through analysis of medical and commercial need, market size, IP, and potential strategic buyers and historical transaction valuations o Character is validated through a review of management’s historical track record and current incentives, multiple meetings, and independent channel checks o Capacity to service debt is confirmed through scenario financial modeling of base, downside, and management cases o Capital analysis focuses on company’s ability to raise funds from existing shareholders, public market offerings, or strategi c partnerships 17 INVESTMENT PROCESS

CURRENT PORTFOLIO

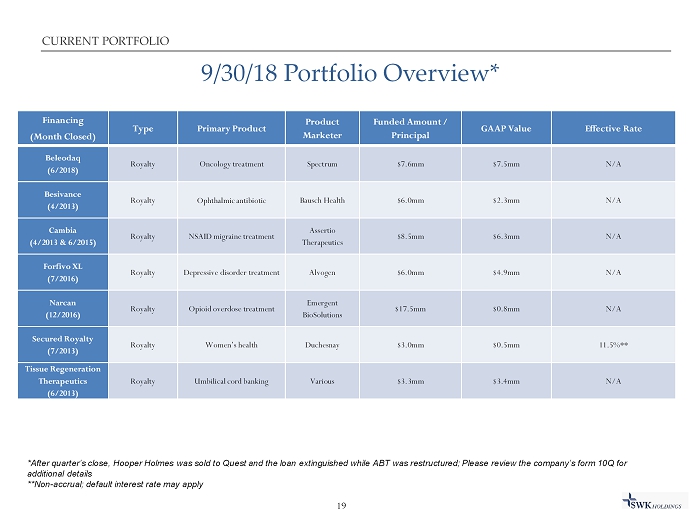

9/30/18 Portfolio Overview* 19 *After quarter’s close, Hooper Holmes was sold to Quest and the loan extinguished while ABT was restructured; Please review t he company’s form 10Q for additional details **Non - accrual; default interest rate may apply CURRENT PORTFOLIO Financing (Month Closed) Type Primary Product Product Marketer Funded Amount / Principal GAAP Value Effective Rate Beleodaq (6/2018) Royalty Oncology treatment Spectrum $7.6mm $7.5mm N/A Besivance (4/2013) Royalty Ophthalmic antibiotic Bausch Health $6.0mm $2.3mm N/A Cambia (4/2013 & 6/2015) Royalty NSAID migraine treatment Assertio Therapeutics $8.5mm $6.3mm N/A Forfivo XL (7/2016) Royalty Depressive disorder treatment Alvogen $6.0mm $4.9mm N/A Narcan (12/2016) Royalty Opioid overdose treatment Emergent BioSolutions $17.5mm $0.8mm N/A Secured Royalty (7/2013) Royalty Women’s health Duchesnay $3.0mm $0.5mm 11.5%** Tissue Regeneration Therapeutics (6/2013) Royalty Umbilical cord banking Various $3.3mm $3.4mm N/A

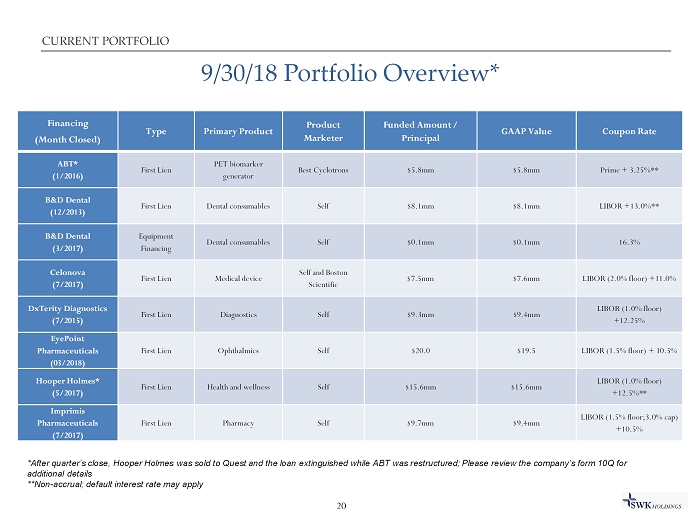

9/30/18 Portfolio Overview* 20 CURRENT PORTFOLIO Financing (Month Closed) Type Primary Product Product Marketer Funded Amount / Principal GAAP Value Coupon Rate ABT * ( 1/2016) First Lien PET biomarker generator Best Cyclotrons $5.8mm $5.8mm Prime + 3.25%** B&D Dental ( 12/2013) First Lien Dental consumables Self $8.1mm $8.1mm LIBOR +13.0%** B&D Dental ( 3/2017) Equipment Financing Dental consumables Self $0.1mm $0.1mm 16.3% Celonova (7/2017) First Lien Medical device Self and Boston Scientific $7.5mm $7.6mm LIBOR (2.0% floor) +11.0% DxTerity Diagnostics (7/2015) First Lien Diagnostics Self $9.3mm $9.4mm LIBOR (1.0% floor) +12.25% EyePoint Pharmaceuticals (03/2018) First Lien Ophthalmics Self $20.0 $19.5 LIBOR (1.5% floor) + 10.5% Hooper Holmes* (5/2017) First Lien Health and wellness Self $15.6mm $15.6mm LIBOR (1.0% floor) +12.5%** Imprimis Pharmaceuticals (7/2017) First Lien Pharmacy Self $9.7mm $9.4mm LIBOR (1.5% floor;3.0% cap) +10.5% *After quarter’s close, Hooper Holmes was sold to Quest and the loan extinguished while ABT was restructured; Please review t he company’s form 10Q for additional details **Non - accrual; default interest rate may apply

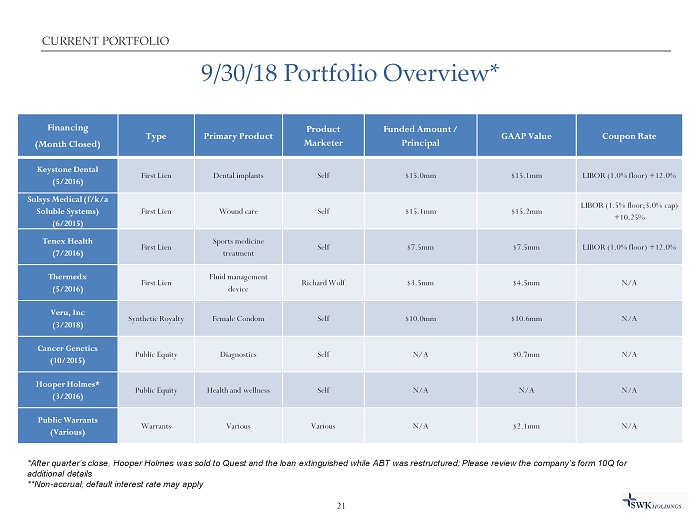

9/30/18 Portfolio Overview* 21 CURRENT PORTFOLIO Financing (Month Closed) Type Primary Product Product Marketer Funded Amount / Principal GAAP Value Coupon Rate Keystone Dental (5/2016) First Lien Dental implants Self $15.0mm $15.1mm LIBOR (1.0% floor) +12.0% Solsys Medical (f/k/a Soluble Systems) (6/2015) First Lien Wound care Self $15.1mm $15.2mm LIBOR (1.5% floor;3.0% cap) +10.25% Tenex Health (7/2016) First Lien Sports medicine treatment Self $7.5mm $7.5mm LIBOR (1.0% floor) +12.0% Thermedx (5/2016) First Lien Fluid management device Richard Wolf $3.5mm $4.5mm N/A Veru , Inc (3/2018 ) Synthetic Royalty Female Condom Self $10.0mm $10.6mm N/A Cancer Genetics (10/2015) Public Equity Diagnostics Self N/A $0.7mm N/A Hooper Holmes* (3/2016) Public Equity Health and wellness Self N/A N/A N/A Public Warrants (Various) Warrants Various Various N/A $2.1mm N/A *After quarter’s close, Hooper Holmes was sold to Quest and the loan extinguished while ABT was restructured; Please review t he company’s form 10Q for additional details **Non - accrual; default interest rate may apply

REALIZATIONS AND CASE STUDIES

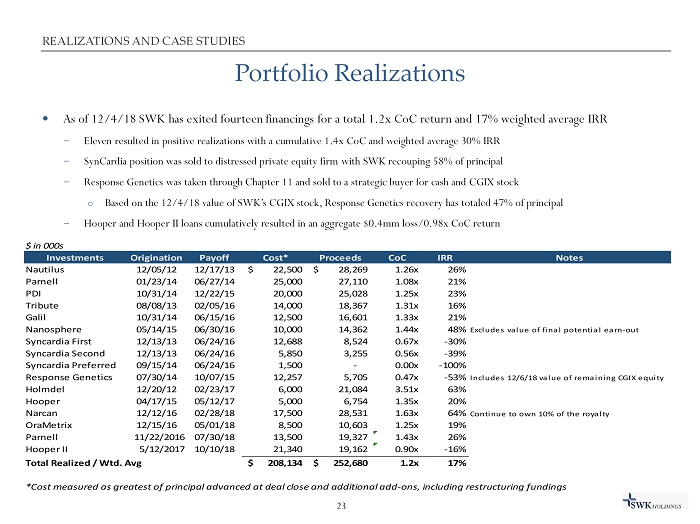

Portfolio Realizations o As of 12/4/18 SWK has exited fourteen financings for a total 1.2x CoC return and 17% weighted average IRR ̶ Eleven resulted in positive realizations with a cumulative 1.4x CoC and weighted average 30% IRR ̶ SynCardia position was sold to distressed private equity firm with SWK recouping 58% of principal ̶ Response Genetics was taken through Chapter 11 and sold to a strategic buyer for cash and CGIX stock o Based on the 12/4/18 value of SWK’s CGIX stock, Response Genetics recovery has totaled 47% of principal ̶ Hooper and Hooper II loans cumulatively resulted in an aggregate $0.4mm loss/0.98x CoC return 23 REALIZATIONS AND CASE STUDIES $ in 000s Investments Origination Payoff Cost* Proceeds CoC IRR Notes Nautilus 12/05/12 12/17/13 22,500$ 28,269$ 1.26x 26% Parnell 01/23/14 06/27/14 25,000 27,110 1.08x 21% PDI 10/31/14 12/22/15 20,000 25,028 1.25x 23% Tribute 08/08/13 02/05/16 14,000 18,367 1.31x 16% Galil 10/31/14 06/15/16 12,500 16,601 1.33x 21% Nanosphere 05/14/15 06/30/16 10,000 14,362 1.44x 48% Excludes value of final potential earn-out Syncardia First 12/13/13 06/24/16 12,688 8,524 0.67x -30% Syncardia Second 12/13/13 06/24/16 5,850 3,255 0.56x -39% Syncardia Preferred 09/15/14 06/24/16 1,500 - 0.00x -100% Response Genetics 07/30/14 10/07/15 12,257 5,705 0.47x -53% Includes 12/6/18 value of remaining CGIX equity Holmdel 12/20/12 02/23/17 6,000 21,084 3.51x 63% Hooper 04/17/15 05/12/17 5,000 6,754 1.35x 20% Narcan 12/12/16 02/28/18 17,500 28,531 1.63x 64% Continue to own 10% of the royalty OraMetrix 12/15/16 05/01/18 8,500 10,603 1.25x 19% Parnell 11/22/2016 07/30/18 13,500 19,327 1.43x 26% Hooper II 5/12/2017 10/10/18 21,340 19,162 0.90x -16% Total Realized / Wtd. Avg 208,134$ 252,680$ 1.2x 17% *Cost measured as greatest of principal advanced at deal close and additional add-ons, including restructuring fundings

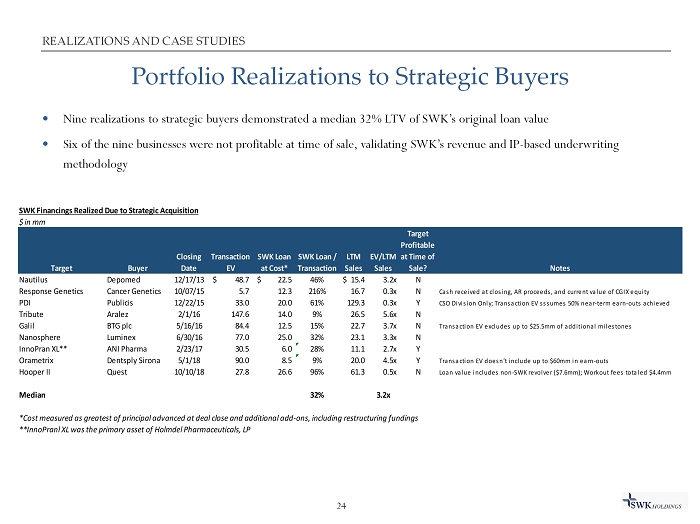

Portfolio Realizations to Strategic Buyers o Nine realizations to strategic buyers demonstrated a median 32% LTV of SWK’s original loan value o Six of the nine businesses were not profitable at time of sale, validating SWK’s revenue and IP - based underwriting methodology 24 REALIZATIONS AND CASE STUDIES SWK Financings Realized Due to Strategic Acquisition $ in mm Target Buyer Closing Date Transaction EV SWK Loan at Cost* SWK Loan / Transaction LTM Sales EV/LTM Sales Target Profitable at Time of Sale? Notes Nautilus Depomed 12/17/13 48.7$ 22.5$ 46% 15.4$ 3.2x N Response Genetics Cancer Genetics 10/07/15 5.7 12.3 216% 16.7 0.3x N Cash received at closing, AR proceeds, and current value of CGIX equity PDI Publicis 12/22/15 33.0 20.0 61% 129.3 0.3x Y CSO Division Only; Transaction EV sssumes 50% near-term earn-outs achieved Tribute Aralez 2/1/16 147.6 14.0 9% 26.5 5.6x N Galil BTG plc 5/16/16 84.4 12.5 15% 22.7 3.7x N Transaction EV excludes up to $25.5mm of additional milestones Nanosphere Luminex 6/30/16 77.0 25.0 32% 23.1 3.3x N InnoPran XL** ANI Pharma 2/23/17 30.5 6.0 28% 11.1 2.7x Y Orametrix Dentsply Sirona 5/1/18 90.0 8.5 9% 20.0 4.5x Y Transaction EV doesn't include up to $60mm in earn-outs Hooper II Quest 10/10/18 27.8 26.6 96% 61.3 0.5x N Loan value includes non-SWK revolver ($7.6mm); Workout fees totaled $4.4mm Median 32% 3.2x *Cost measured as greatest of principal advanced at deal close and additional add-ons, including restructuring fundings **InnoPranl XL was the primary asset of Holmdel Pharmaceuticals, LP

Historical Financing: Holmdel Pharmaceuticals, LP o In December 2012 SWK acquired a limited partnership interest in Holmdel Pharmaceuticals o Holmdel subsequently acquired U.S. marketing rights to InnoPran XL, a non - selective beta blocker with dosing technology to coincide with the body’s natural circadian rhythm o SWK partnered with an accomplished operator that handled marketing, distribution, and reimbursement functions o SWK and a financial partner contributed $13.0mm with the operating partner contributing $1.5mm in cash, an additional product’s cash flows, and operating expertise o SWK’s structure aligned incentives by allowing the operator to increase its share of the economics from 10% to 55% upon achieving return milestones o InnoPran XL sales grew from $5mm in 2012 to $13mm in 2015 o The first milestone was achieved in mid - 2016, more than doubling the operator’s economics o In February 2017, InnoPran XL sold for $30mm; SWK received an $8mm distribution o Investment generated a 3.5x CoC return and 63% IRR o SWK and the operating partner evaluated purchasing additional assets 25 REALIZATIONS AND CASE STUDIES

Historical Financing: Narcan Royalty o Narcan is the only FDA approved, intranasal Naloxone product for the treatment of opioid overdose o Narcan is appropriately priced with revenue growth from expanded distribution, not price hikes o Opiant is a publicly traded drug development company that receives a royalty on Narcan for developing the drug’s unique formulation ̶ Opiant’s novel formulation has a faster time to onset and more convenient and safer administration compared with injectable Naloxone o The product is marketed by Adapt Pharma, a private pharmaceutical company founded by former Azur Pharmaceutical executives with a history of strong sales execution o Opiant needed capital to pursue development programs o At time of monetization, Opiant was a thinly traded OTC stock and management believed the share price did not reflect underlying asset value, thus a share offering was not an attractive option o SWK structured a capped royalty that was smaller than competing proposals by larger royalty investors, and allowed Opiant to retain tail economics o In December 2016 SWK funded $13.8mm in exchange for a royalty that is capped at a 1.5x CoC return ̶ On August 8, 2017 upon achieving $25mm in cumulative sales during two consecutive quarters, SWK funded additional $3.8mm with a 1.5x CoC return cap o Narcan sales exceeded forecasts; CoC return cap achieved in February 2018 o SWK retains a residual royalty ranging from 5% to 10% 26 REALIZATIONS AND CASE STUDIES

Historical Financing: Galil Medical o Galil is a medical device company that delivers innovative cryotherapy solutions for tumor ablation o In 2014 the privately - held company was on the cusp of accelerating revenue growth, but was not yet cash - flow positive and could not tap traditional financing channels o Galil needed additional capital to run clinical trials and expand its sales force o In December 2014, SWK provided a $12.5mm senior secured term loan structured to delay principal repayment until growth initiatives matured ̶ Term loan was structured at a mid - teens cost of capital with a return cap if Galil was sold in first fifteen months o In late 2015, SWK committed to provide additional financing to support Galil’s proposed acquisition of a competitor ̶ The transaction was not consummated, but SWK’s support permitted opportunistic bid o By early 2016, the growth initiatives were bearing fruit and in June 2016 Galil was acquired by BTG plc for $84mm plus up to $26mm in earn - outs o The SWK facility gave Galil capital to grow the business and garner a higher acquisition price while allowing the equity owners to capture maximum upside o SWK facility represented 15% LTV of the take out price o SWK generated a 1.3x cash - on - cash return and 20% IRR 27 REALIZATIONS AND CASE STUDIES

Historical Financing: SynCardia o SynCardia manufactures and markets the only FDA - approved artificial heart o SWK’s original thesis: ̶ Device approved in US and EU; positive efficacy in over 1,500 implants ̶ Device reimbursed at $125,000 in US and $70,000 outside the US ̶ Large and untapped market with over 4,000 patients on US heart transplant waitlist ̶ Funding expected to facilitate marketing to achieve break - even level of implants ̶ Discussions with key heart transplant surgeons validated technology and verified need to exist (device implanted upon imminent risk of death) ̶ Unique positioning and existing sales thought to provide strategic value exceeding investment o December 2013 SWK invested $10mm in two tranches alongside existing first lien lender ̶ Over the next two years SWK invested additional $4mm in company with Syncardia raising ~$30mm in aggregate during that time span o In late 2015 Syncardia failed to complete an IPO, prompting a funding crisis ̶ SWK purchased co - lender’s first lien position for 58% of par and commenced operational restructuring ̶ Restructuring efforts led to cost cuts and implant pre - sales that preserved liquidity o In 4Q15 SWK wrote down the position from ~$20mm to $12.5mm due to failed IPO and challenges o In May 2016 SWK sold entire position to private equity buyer for $7.2mm cash and 5% share in profits once the PE firm received a 3x CoC return o Key lessons learned: ̶ Disparate equity ownership prohibited capital raise under stressed conditions ̶ SWK underappreciated product’s need for engineering improvements to drive sustainable gross margin and market opportunity ̶ SWK underappreciated controversial nature of product with strategics as well as a large portion of physicians 28 REALIZATIONS AND CASE STUDIES

MISCELLANEOUS

SWK Value Proposition to Partners o SWK’s asset base and nimble structure position it to serve the sub - $20mm financing market ̶ Smaller companies often don’t have financial profile to qualify for traditional financing sources ̶ Companies in this niche often have few options outside of a dilutive equity raise ̶ The IPO market is largely closed to companies of this size requiring expensive and difficult private equity sourcing ̶ Many alternative financing sources have grown too large to care about smaller companies ̶ Some historical financing sources have been acquired by regulated financial institutions that due to regulatory constraints cannot lend to unprofitable companies and prohibit SWK - style transactions ̶ Venture lenders often require principal payback over a shorter period than SWK’s structure o SWK structures financings to preserve liquidity and match a growing company’s revenue profile o SWK provides its borrowers with access to its network of capital markets resources and operators o While SWK focuses on the sub - $20mm market, through its RIA arm and industry relationships, it can access additional capital to finance larger opportunities 30 MISCELLANEOUS

Financing Structures o Structured debt ̶ Primarily first lien senior secured loans, though will selectively evaluate second lien opportunities ̶ Typically include covenants, prepayment penalties, origination and exit fees, and warrant coverage ̶ Provide working capital to support product commercialization and M&A o Royalties ̶ Companies: fund pipeline development & leverage a lower cost of capital for higher return on investment projects ̶ Institutions: capital planning for operating budgets, funding R&D initiatives, & financial asset diversification ̶ Inventors: financial asset diversification, fund start - up company o Synthetic Royalty ̶ Marketer creates a ‘royalty’ by selling an interest in a future revenue stream earned with a single product or basket of prod uct s in exchange for an upfront payment and potential future payments ̶ Ability to structure tiered revenues, reverse tiers, minimum payments, caps, step - downs and buy - out options, similar to a licens e agreement between innovator and marketer o Hybrid Financing ̶ Combination of royalty and revenue - based financings ̶ Can take on many forms, including structured debt and equity investments o Product acquisition ̶ Target legacy products with established revenue trends, minimal marketing and infrastructure requirements 31 MISCELLANEOUS

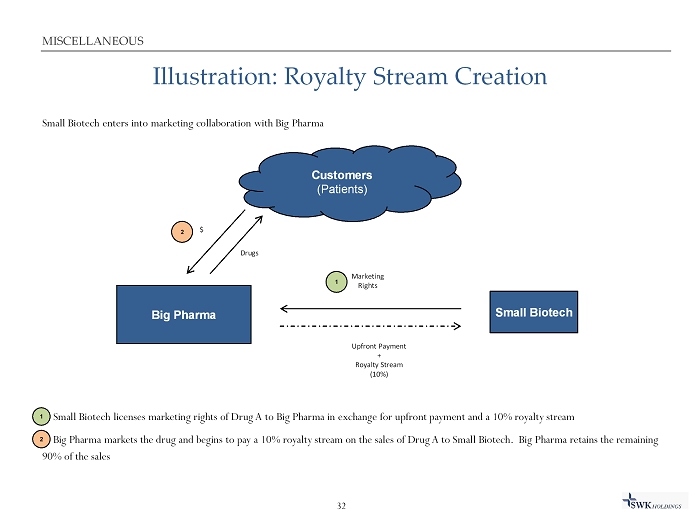

Illustration: Royalty Stream Creation Small Biotech enters into marketing collaboration with Big Pharma 1. Small Biotech licenses marketing rights of Drug A to Big Pharma in exchange for upfront payment and a 10% royalty stream 2. Big Pharma markets the drug and begins to pay a 10% royalty stream on the sales of Drug A to Small Biotech. Big Pharma re tai ns the remaining 90% of the sales $ Drugs Customers (Patients) Big Pharma Small Biotech Marketing Rights Upfront Payment + Royalty Stream (10%) 1 2 32 2 1 MISCELLANEOUS

BIOGRAPHIES AND CONTACT INFORMATION

Biographies Winston Black, CEO Mr. Black was appointed CEO in January 2016. He joined SWK as Managing Director in May 2012 from PBS Capital Management, LLC, an investment management business investing in pharmaceutical royalties and healthcare equities that Mr. Black co - founded in 2009. Prior to PB S Capital, Mr. Black was a Senior Portfolio Analyst at Highland Capital Management, L.P. from September 2007 to March 2009 where he managed a portfolio of approximately $2 billion in healthcare investments. Prior to joining Highland, Mr. Black served as COO/Analyst and Chief Compliance Officer at Mallett e C apital Management, Inc., a $200 million biotech focused hedge fund. Prior to Mallette Capital, Mr. Black was Vice President, Corporate Development for A TX Communications, Inc. (“ATX”). Mr. Black began his career as an Analyst in the Healthcare and Telecommunications groups at Salomon Smith Barney. Mr . B lack received MBAs with distinction from both Columbia Business School and London Business School and received a BA in Economics from Duke University , w here he graduated Cum Laude. Charles Jacobson, CFO Charles Jacobson was appointed CFO in September 2012. He serves as the CEO and Managing Director of Pine Hill Group, LLC (“Pi ne Hill”), a consulting firm which he co - founded in 2007. Pine Hill provides management level finance, accounting and transaction advisory services to middle market public and private companies. Mr. Jacobson serves as Director, Interim CEO and Interim CFO of The PMI Group, Inc., a position he has held since 201 7, 2016 and 2015, respectively. Since 2015, Mr. Jacobson serves as CFO and Director of Parkview Capital Credit, Inc., a Business Development Co rpo ration providing mezzanine debt and equity capital to lower middle market companies. From 2012 to 2013, Mr. Jacobson served as CEO and CFO of Pro Capita l, LLC (“Pro Cap”), an investment management business specializing in investments of municipal tax liens. Mr. Jacobson also served on Pro Cap’s boar d o f managers from 2012 to 2014. From 2008 to 2011, Mr. Jacobson served as CFO of FS Investment Corporation pursuant to an agreement between Pine Hill a nd FS Investment Corporation. From 2001 to 2007, Mr. Jacobson worked for ATX, becoming the organization’s senior vice president of finance whe re he was responsible for managing ATX’s finance organization. Prior to working for ATX, Mr. Jacobson held senior managerial audit positions with Ernst & Young LLP from 1999 to 2000 and with BDO Seidman, LLP from 1996 to 1999, where he was responsible for audit engagements of private, pre - IPO and publicl y traded companies in a variety of different industries. Mr. Jacobson began his professional career in 1993 at a regional public accounting firm wher e h e performed audits on governmental entities. Mr. Jacobson is a Certified Public Accountant and holds a B.S. in Accounting from Rutgers University. 34 BIOGRAPHIES AND CONTACT INFO

Biographies Jody Staggs, VP Mr. Staggs joined SWK Holdings as a Senior Analyst in August 2015. Prior to joining SWK, he was Vice President of Investments at Annandale Capital. Prior to joining Annandale, he was the first employee at Alistair Capital, a Dallas - based hedge fund. He previously co - founded PBS Capita l Management, LLC, an investment management business investing in pharmaceutical royalties and healthcare equities. Prior to co - founding PBS, he was a Senior Portfolio Analyst at Highland Capital Management, L.P. where he worked on the firm’s healthcare multi - strategy and public equity groups. While at Hig hland, Mr. Staggs was ranked first out of a class of eight analysts. Mr. Staggs began his career at Raymond James where he was a Senior Equity Rese arc h Associate covering healthcare companies and was ranked in the top quartile of all research associates. He was a Walton Scholar and on the Dean’s List at th e U niversity of Arkansas where he graduated with a B.A. in Finance. Mr. Staggs has earned the right to use the Chartered Financial Analyst designation. Brannon Morisoli, Senior Analyst Mr. Morisoli joined SWK Holdings as a Senior Analyst in March 2016. Prior to joining SWK, he was an Investment Analyst and Po rtf olio Manager at a family office. Prior, he was an Investment Analyst for Presidium Group, a real estate private equity firm, where he played an integr al role in closing over $100mm in transactions. Mr. Morisoli began his career at Neurografix , a medical technology startup in Santa Monica, CA exploring MRI imaging of peripheral nerves. While with Neurografix , he was published in two leading neurology journals. Mr. Morisoli graduated from UCLA with a B.S., was awarded a fellowship and graduated from the University of Notre Dame with an M.B.A, and was awarded a Samson Fellowship from the University of Wiscons in Law School, where he graduated with a J.D. Mr. Morisoli is an inactive member of the State Bar of Wisconsin. 35 BIOGRAPHIES AND CONTACT INFO

Biographies Wynn Lemmons, Analyst Mr. Lemmons joined SWK Holdings as an Analyst in January 2018. Prior to joining SWK, he was an Analyst at Oaklawn Investments , a Dallas - based investment company, working primarily on distressed credit and special situations. Prior to that, he performed equity research as an Ana lys t Intern at Greenwood Gearhart, Inc. while attending the University of Arkansas. Wynn graduated from the University of Arkansas Magna Cum Laude. Yvette Heinrichson, Controller Ms. Heinrichson joined SWK Holdings as Controller in January 2016. Prior to joining SWK, she provided technical GAAP accounti ng, SEC financial reporting, SOX implementation and process improvement for companies in a number of industries including healthcare/bioscience, technolog y, real estate, manufacturing, and retail. Prior to her industry experience, she was a financial statement auditor with Deloitte for several years. She hold s a B.S. in Business Administration from San Francisco State University and is a Certified Public Accountant with membership in professional associations AICPA, XBR L US, CalCPA , and CFE. She is also XBRL Certified by the AICPA and XBRL US. 36 BIOGRAPHIES AND CONTACT INFO

Biographies – Board of Directors Michael D. Weinberg, Chairman of the Board Mr. Weinberg is Chief Operating Officer of Carlson Capital, L.P. Mr. Weinberg has served in various capacities with Carlson s inc e November 1999. Since April 2007, Mr. Weinberg has served as the managing member of BirdDog Capital, LLC, a holding company involved in retail and restaurant franchises. From January 1996 to November 1999, Mr. Weinberg was Director of Investments at Richmont Capital Partners, L.P., the investment affiliate of privately - held Mary Kay. Mr. Weinberg holds a B.A. degree from the Plan II Liberal Arts Honors Program and a J.D. degree, both from the Universit y o f Texas at Austin. Christopher Haga Mr. Haga is a portfolio manager at Carlson. Mr. Haga, joined Carlson in 2003, has 22 years of experience in public and privat e i nvesting, investment banking and structured finance. His role at Carlson includes public and private investing in financial institutions, energy companies an d special situations. Prior to Carlson, Mr. Haga held investment banking and principal investing roles at RBC Capital Markets, Stephens, Inc., Lehman Brothe rs (London) and Alex. Brown & Sons. Mr. Haga holds a B.S. in Business Administration from the University of North Carolina at Chapel Hill and an M.B.A. f rom the University of Virginia. D. Blair Baker Mr. Baker is the president of Precept Capital Management, an investment management company based in Dallas, which he founded in 1998. Precept invests across multiple industries and asset types, focusing primarily on publicly - traded securities. His investments in the healthcare sector have included pharmaceutical, medical device, biotech, medical services and medical technology. He has extensive relationships throughout t he industry. Mr. Baker previously worked with the advance staff for Vice President George H.W. Bush. Mr. Baker also formed an oil and gas operating company wit h o ngoing operations in the Fort Worth Basin in North Texas. Other relevant prior experience includes Mr. Baker’s position as vice president and securiti es analyst covering telecommunications equipment companies at Rauscher Pierce Refsnes and as a member of the team at Friess Associates that managed $7 billion of client assets. 37 BIOGRAPHIES AND CONTACT INFO

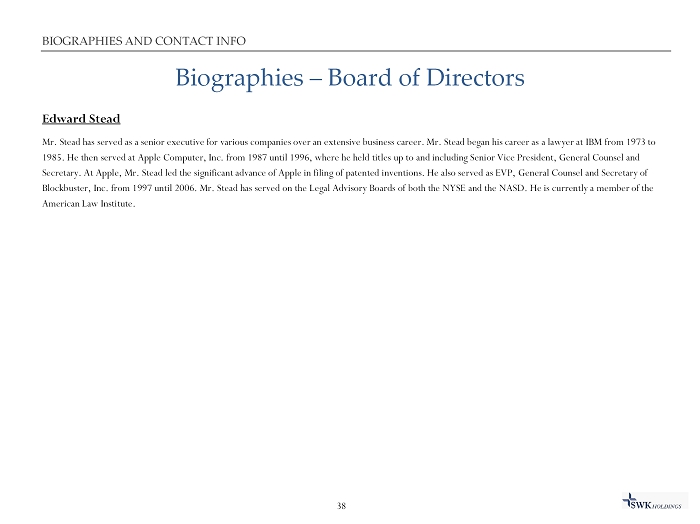

Biographies – Board of Directors Edward Stead Mr. Stead has served as a senior executive for various companies over an extensive business career. Mr. Stead began his caree r a s a lawyer at IBM from 1973 to 1985. He then served at Apple Computer, Inc. from 1987 until 1996, where he held titles up to and including Senior Vice Presi den t, General Counsel and Secretary. At Apple, Mr. Stead led the significant advance of Apple in filing of patented inventions. He also served as EVP, Gen eral Counsel and Secretary of Blockbuster, Inc. from 1997 until 2006. Mr. Stead has served on the Legal Advisory Boards of both the NYSE and the NASD. He i s c urrently a member of the American Law Institute. 38 BIOGRAPHIES AND CONTACT INFO

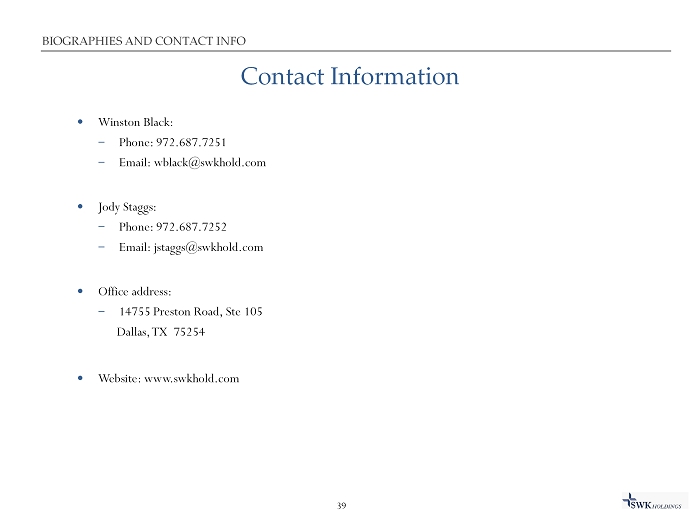

Contact Information o Winston Black: ̶ Phone: 972.687.7251 ̶ Email: wblack@swkhold.com o Jody Staggs: ̶ Phone: 972.687.7252 ̶ Email: jstaggs@swkhold.com o Office address: ̶ 14755 Preston Road, Ste 105 Dallas, TX 75254 o Website: www.swkhold.com 39 BIOGRAPHIES AND CONTACT INFO

FINANCIAL OVERVIEW

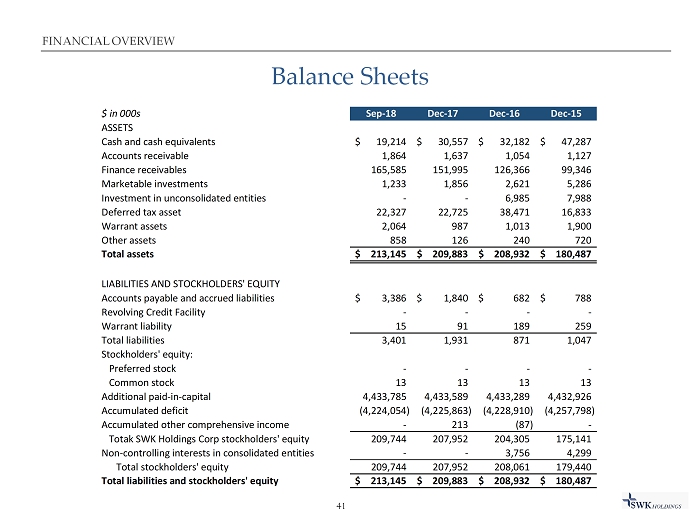

Balance Sheets 41 FINANCIAL OVERVIEW $ in 000s Sep-18 Dec-17 Dec-16 Dec-15 ASSETS Cash and cash equivalents 19,214$ 30,557$ 32,182$ 47,287$ Accounts receivable 1,864 1,637 1,054 1,127 Finance receivables 165,585 151,995 126,366 99,346 Marketable investments 1,233 1,856 2,621 5,286 Investment in unconsolidated entities - - 6,985 7,988 Deferred tax asset 22,327 22,725 38,471 16,833 Warrant assets 2,064 987 1,013 1,900 Other assets 858 126 240 720 Total assets 213,145$ 209,883$ 208,932$ 180,487$ LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable and accrued liabilities 3,386$ 1,840$ 682$ 788$ Revolving Credit Facility - - - - Warrant liability 15 91 189 259 Total liabilities 3,401 1,931 871 1,047 Stockholders' equity: Preferred stock - - - - Common stock 13 13 13 13 Additional paid-in-capital 4,433,785 4,433,589 4,433,289 4,432,926 Accumulated deficit (4,224,054) (4,225,863) (4,228,910) (4,257,798) Accumulated other comprehensive income - 213 (87) - Totak SWK Holdings Corp stockholders' equity 209,744 207,952 204,305 175,141 Non-controlling interests in consolidated entities - - 3,756 4,299 Total stockholders' equity 209,744 207,952 208,061 179,440 Total liabilities and stockholders' equity 213,145$ 209,883$ 208,932$ 180,487$

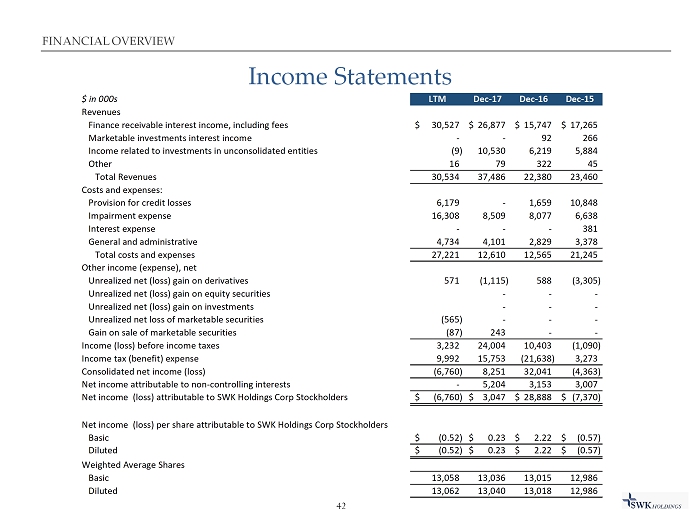

Income Statements 42 FINANCIAL OVERVIEW $ in 000s LTM Dec-17 Dec-16 Dec-15 Revenues Finance receivable interest income, including fees 30,527$ 26,877$ 15,747$ 17,265$ Marketable investments interest income - - 92 266 Income related to investments in unconsolidated entities (9) 10,530 6,219 5,884 Other 16 79 322 45 Total Revenues 30,534 37,486 22,380 23,460 Costs and expenses: Provision for credit losses 6,179 - 1,659 10,848 Impairment expense 16,308 8,509 8,077 6,638 Interest expense - - - 381 General and administrative 4,734 4,101 2,829 3,378 Total costs and expenses 27,221 12,610 12,565 21,245 Other income (expense), net Unrealized net (loss) gain on derivatives 571 (1,115) 588 (3,305) Unrealized net (loss) gain on equity securities - - - Unrealized net (loss) gain on investments - - - Unrealized net loss of marketable securities (565) - - - Gain on sale of marketable securities (87) 243 - - Income (loss) before income taxes 3,232 24,004 10,403 (1,090) Income tax (benefit) expense 9,992 15,753 (21,638) 3,273 Consolidated net income (loss) (6,760) 8,251 32,041 (4,363) Net income attributable to non-controlling interests - 5,204 3,153 3,007 Net income (loss) attributable to SWK Holdings Corp Stockholders (6,760)$ 3,047$ 28,888$ (7,370)$ Net income (loss) per share attributable to SWK Holdings Corp Stockholders Basic (0.52)$ 0.23$ 2.22$ (0.57)$ Diluted (0.52)$ 0.23$ 2.22$ (0.57)$ Weighted Average Shares Basic 13,058 13,036 13,015 12,986 Diluted 13,062 13,040 13,018 12,986

Cash Flow Statements 43 FINANCIAL OVERVIEW $ in 000s,* LTM Dec-17 Dec-16 Dec-15 Cash flows from operating activities: Consolidated net income ($6,760) $8,251 $32,041 ($4,363) Adjustments to reconcile net income to net cash provided by operating activities: Income from investments in unconsolidated entity 9 (10,530) (6,219) (5,884) Provision for loan credit losses 6,179 - 1,659 10,848 Impairment expense 16,308 8,509 8,077 6,638 Change in fair value of warrants (571) 1,115 (588) 3,305 Gain on sale of marketable securities 322 (243) - - Deferred income tax 9,984 15,745 (21,638) 3,273 Loan discount amortization and fee accretion 316 (1,926) (3,109) (1,778) Interest income in excess of cash collected (628) (534) - (1,063) Interest paid-in-kind (593) (1,779) (398) - Stock-based compensation 274 300 363 640 Gain (loss) on sale (write off) of investments 330 - - - Other 16 17 16 391 Changes in operating assets and liabilities: Accounts receivable (266) (583) (59) (74) Other assets (1) (42) (396) (648) Accounts payable and other liabilities (78) 1,158 (106) (76) Net cash provided by operating activities 24,841 19,458 9,643 11,209 Cash flows from investing activities: Cash distributions from investments in unconsolidated entity (9) 17,515 7,222 6,940 Cash received for settlement of warrants - - 1,405 - Proceeds from sale of available-for-sale marketable securities - 345 - - Net (increase) decrease in finance receivables (21,148) (30,064) (29,717) (25,849) Investment in marketable investments - - - - Marketable investment principal payment 72 93 41 80 Other (9) (12) (3) (50) Net cash provided by investing activities (21,094) (12,123) (21,052) (18,879) Cash flows from financing activities: Distribution to non-controlling interests - (8,960) (3,696) (3,575) Net paydown on revolver facility - - - - Equity offering, net - - - - Debt Issuance Costs (508) - - - Net cash used in financing activities (508) (8,960) (3,696) (3,771) Net increase in cash and cash equivalents 3,239 (1,625) (15,105) (11,441) Cash and cash equivalents at beginning of period 15,975 32,182 47,287 58,728 Cash and cash equivalents at end of period 19,214 30,557 $32,182 $47,287 *numbers may not add due to rounding

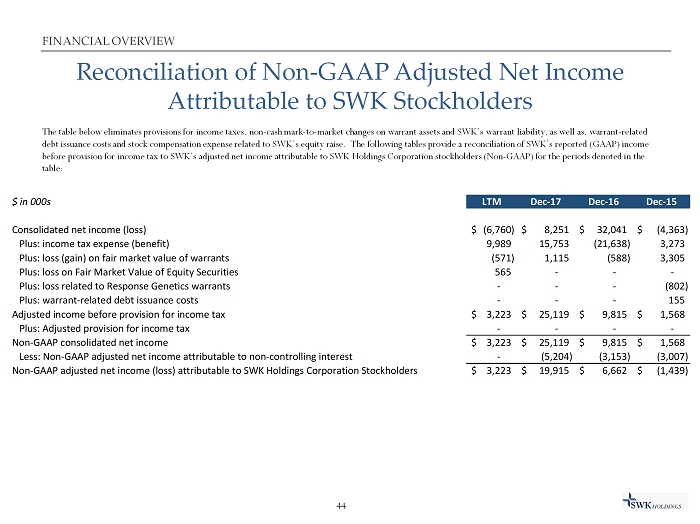

Reconciliation of Non - GAAP Adjusted Net Income Attributable to SWK Stockholders The table below eliminates provisions for income taxes, non - cash mark - to - market changes on warrant assets and SWK’s warrant liab ility, as well as, warrant - related debt issuance costs and stock compensation expense related to SWK’s equity raise. The following tables provide a reconciliat ion of SWK’s reported (GAAP) income before provision for income tax to SWK’s adjusted net income attributable to SWK Holdings Corporation stockholders (Non - GAAP) fo r the periods denoted in the table: 44 $ in 000s LTM Dec-17 Dec-16 Dec-15 Consolidated net income (loss) (6,760)$ 8,251$ 32,041$ (4,363)$ Plus: income tax expense (benefit) 9,989 15,753 (21,638) 3,273 Plus: loss (gain) on fair market value of warrants (571) 1,115 (588) 3,305 Plus: loss on Fair Market Value of Equity Securities 565 - - - Plus: loss related to Response Genetics warrants - - - (802) Plus: warrant-related debt issuance costs - - - 155 Adjusted income before provision for income tax 3,223$ 25,119$ 9,815$ 1,568$ Plus: Adjusted provision for income tax - - - - Non-GAAP consolidated net income 3,223$ 25,119$ 9,815$ 1,568$ Less: Non-GAAP adjusted net income attributable to non-controlling interest - (5,204) (3,153) (3,007) Non-GAAP adjusted net income (loss) attributable to SWK Holdings Corporation Stockholders 3,223$ 19,915$ 6,662$ (1,439)$ FINANCIAL OVERVIEW