Attached files

| file | filename |

|---|---|

| EX-21.1 - EXHIBIT 21.1 - LEARNING TREE INTERNATIONAL, INC. | ex_132030.htm |

| EX-32.2 - EXHIBIT 32.2 - LEARNING TREE INTERNATIONAL, INC. | ex_131993.htm |

| EX-32.1 - EXHIBIT 32.1 - LEARNING TREE INTERNATIONAL, INC. | ex_131992.htm |

| EX-31.2 - EXHIBIT 31.2 - LEARNING TREE INTERNATIONAL, INC. | ex_131991.htm |

| EX-31.1 - EXHIBIT 31.1 - LEARNING TREE INTERNATIONAL, INC. | ex_131990.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the fiscal year ended September 28, 2018 |

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the transition period from to |

Commission file number 0-27248

LEARNING TREE INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

95-3133814 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

13650 Dulles Technology Drive Herndon, VA |

20171 |

|

(Address of principal executive offices) |

(Zip Code) |

(703) 709-9119

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered |

|

None |

None |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.0001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth Company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act (Check one):

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☒ |

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common stock, $.0001 par value, held by non-affiliates of the registrant, as of March 30, 2018 was $12,575,924. (Excludes 7,508,020 shares held by directors and officers of the registrant since such persons may be deemed to be affiliates.)

The number of shares of common stock, $.0001 par value, outstanding as of December 14, 2018, was 13,224,349.

DOCUMENTS INCORPORATED BY REFERENCE

None

LEARNING TREE INTERNATIONAL, INC. AND SUBSIDIARIES

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

|

|

|

Page |

|

Part I |

||

|

|

|

|

|

Item 1. |

Business |

5 |

|

Item 1A. |

Risk Factors |

11 |

|

Item 1B. |

Unresolved Staff Comments |

23 |

|

Item 2. |

Properties |

23 |

|

Item 3. |

Legal Proceedings |

24 |

|

Item 4. |

Mine Safety Disclosure |

24 |

|

|

|

|

|

Part II |

||

|

|

|

|

|

Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

24 |

|

Item 6. |

Selected Financial Data |

25 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

26 |

|

Item 7A. |

Quantitative and Qualitative Disclosures about Market Risk |

34 |

|

Item 8. |

Financial Statements and Supplementary Data |

35 |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

60 |

|

Item 9A. |

Controls and Procedures |

60 |

|

Item 9B. |

Other Information |

60 |

|

|

|

|

|

Part III |

||

|

|

|

|

|

Item 10. |

Directors, Executive Officers and Corporate Governance |

61 |

|

Item 11. |

Executive Compensation |

64 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

70 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

71 |

|

Item 14. |

Principal Accountant Fees and Services |

72 |

|

|

|

|

|

Part IV |

||

|

|

|

|

|

Item 15. |

Exhibits and Financial Statement Schedules |

73 |

|

|

|

|

|

Exhibit Index |

74 |

|

|

|

|

|

|

Signatures |

78 |

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Report” or “Form 10-K”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”). You can find many (but not all) of these statements by looking for words such as “approximates,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “would,” “may” or other similar expressions in this Report. Our forward-looking statements contained herein relate to future events or our future performance and include, but are not limited to, statements concerning our business strategy, future commercial revenues, market growth, capital requirements, new product introductions, expansion plans and the adequacy of our funding. Other statements contained in this Report that are not historical facts are also forward-looking statements.

We claim the protection of the safe harbor contained in the Private Securities Litigation Reform Act of 1995. We caution investors that any forward-looking statements presented in this Report, or that we may make orally or in writing from time to time, are based on our beliefs, assumptions made by us and information currently available to us and actual outcomes and results will be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control or ability to predict. Although we believe that our assumptions are reasonable, they are not guarantees of future performance, and some will inevitably prove to be incorrect. As a result, our actual future results can be expected to differ from our expectations, and those differences may be material. Accordingly, investors should use caution in relying on forward-looking statements, which are based on known results and trends at the time they are made, to anticipate future results or trends.

Some of the risks and uncertainties that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include those related to the following:

|

• |

ability to continue as a going concern; |

|

• |

ability to reverse our trend of declining year over year revenues and negative cash flows from operations and to maintain sufficient liquidity; |

|

• |

ability to obtain additional financing to support our operations, as needed, in amounts and on terms acceptable to the Company; |

|

• |

our plans to deregister the Company’s common stock and suspend the Company’s reporting obligations with the Securities and Exchange Commission; |

|

• |

ability to successfully implement our new strategies to achieve our cost reduction goals; |

|

• |

competition; |

|

• |

international operations, including currency fluctuations; |

|

• |

attracting and retaining qualified personnel; |

|

• |

intellectual property, including having to defend potential infringement claims; |

|

• |

implementation of partnerships with third party providers of courses and or course material; |

|

• |

efficient delivery and scheduling of our courses; |

|

• |

technology development, new technology introduction; |

|

• |

maintaining cybersecurity |

|

• |

the timely development, introduction, and customer acceptance of our courses and other products; |

|

• |

our majority stockholder having significant influence over the composition of our Board, as well as being the largest unsecured creditor of the Company; |

|

• |

potential conversion of the amounts borrowed by the Company under the credit agreement with our largest stockholder (the “Credit Agreement”), which would result in substantial dilution; |

|

• |

ability to comply with the terms and covenants of and repay amounts when due under the Credit Agreement; |

|

• |

changing economic and market conditions; and |

|

• |

adverse weather conditions, strikes, acts of war or terrorism and other external events. |

For further discussion of these and other factors see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors.” It should be noted that the risks included in this Report and our other filings are not exhaustive, and additional factors could adversely affect our business and financial performance. We operate in a very competitive and rapidly changing environment. New risks emerge from time to time, and it is not possible for management to predict all such risk factors, nor can it assess the impact of all such risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

This Report and all subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake and specifically disclaim any obligation to release publicly any revisions or updates to our forward-looking statements to reflect events, occurrences or circumstances, whether or not anticipated after the date of this Report except as otherwise required by law.

SPECIAL NOTE REGARDING CLASSIFICATION AS A SMALLER REPORTING COMPANY

Our Form 10-K for our fiscal year ended September 28, 2018 has been prepared following the Securities and Exchange Commission (“SEC”) guidelines for a smaller reporting company as defined by 229.10 (Item 10) of Regulation S-K. The rules and guidelines for a smaller reporting company allow a company to reduce the amount of historical disclosure required.

PART I

Item 1. BUSINESS.

As used in this Report (unless the context otherwise requires) “Learning Tree”, “we”, “our”, the “Company”, and “us” refer to Learning Tree International, Inc. and its subsidiaries.

Overview

Learning Tree International, Inc. is a leading worldwide provider to business and government organizations for the training and workforce development of their information technology (“IT”) professionals and managers. Since our founding in 1974, we have provided high-quality, predominantly vendor independent training to more than 2.6 million IT professionals and managers. In fiscal year 2018, while presenting courses in 39 countries, we trained 50,534 course participants from approximately 4,400 organizations, including large national and multinational companies, government organizations, and small and medium-size companies.

We offer a broad library of intensive, instructor-led courses from one to five days in length, which at September 28, 2018 comprised 299 different course titles representing 5,835 hours of training, including 181 multi-day IT course titles, 82 multi-day management course titles, and 36 one-day course titles. Learning Tree courses provide education and training across a wide range of technical and management disciplines, including operating systems, databases, computer networks, cyber and network security, web development, programming languages, software engineering, open source applications, project management, business skills, leadership and professional development. We use a well-defined systematic approach to develop and update the Learning Tree course library to provide training that is immediately applicable by course participants to their work in a broad range of applications and industries. After assessing market need, courses may be translated into Swedish, Japanese, and other languages as needed. Our proprietary course development process enables us to efficiently and effectively customize our course content to specific customer requirements for delivery at customer sites.

We partner with other organizations to broaden the breadth of training that we offer to our customers, with the objective of enabling us to meet an organization’s complete workforce needs. In terms of vendor partners, we reached agreement with Microsoft to become a Microsoft approved training partner, and we now offer Microsoft approved courses. This also allows us to accept Microsoft training vouchers and eliminates the need for us to maintain duplicate course content which has allowed us to retire the majority of our self-developed Microsoft courses. We also offer our customers the ability to take courses we do not have in our course library from approved “Partner” providers. Through these “Partner” providers, we are able to offer courses in a number of different vendor technologies and products, including Cisco, Adobe, IBM, Red Hat, VMware, Hewlett Packard, and Amazon Web Services.

We are also working more closely with several certification and accreditation organizations to offer training programs for IT professionals seeking to earn such certifications. We are a continuing professional education (CPE) provider of the International Information Systems Security Certification Consortium. In addition, we are on the National Association of State Boards of Accountancy National Registry of CPE sponsors; a Registered Education Provider of the Project Management Institute; an APMG International Accredited Training Organization; an International Institute of Business Analysis (IIBA) Endorsed Education Provider; an AXELOS Global Best Practice Strategic Partner; a GCHQ Certified Cyber Security Training Provider; a British Computing Society (BCS) Accredited Training Organization; and a Skills Framework for the Information Age (SFIA) Foundation Accredited Training Partner. We also maintain partnerships and offer courses with Computing Technology Industry Association (CompTIA), International Council of E-Commerce Consultants (EC-Council), International Consortium for Agile (ICAgile), Information Systems Control Association (ISACA), International Info System Security Certification Consortium (ISC2), International Software Testing Qualifications Board (ISTQB), Lean Kanban, Scrum Alliance, and The Open Group (TOGAF). In the United Kingdom, our courses can be used to gain a Master’s degree in Professional Computing at Staffordshire University under a program administered by the Faculty of Computing, Engineering and Technology.

We also offer courses through our proprietary, live on-line learning platform, Learning Tree AnyWare™, which enables individuals located anywhere in the world to use an Internet browser to connect with the classroom and participate online in instructor-led classes being conducted live in our Education Centers, at customer locations, or at other specially equipped facilities, without the need to travel or commute to the course site. Once logged in, AnyWare™ class participants see and hear their classroom-based instructor and classmates in real time. They can participate in discussions, ask questions, work in breakout sessions, and complete the hands-on exercises in the same way as their in-class counterparts under the guidance of an expert instructor. They gain the full benefit of our courseware and achieve the same level of knowledge and skill transfer as in-class participants. Through technology such as AnyWare™, we are effectively applying technology to leverage the strengths of our classroom offerings while also providing greater flexibility to our customers by offering more scheduled course dates from which to choose. We are continuing to investigate other technology-based training formats and how they may be effectively integrated into our training programs.

Based on existing studies, instructor-led training currently remains the best way to learn a subject area. Yet we recognize that self-directed e-Learning (meaning online courses without an instructor) continues to grow and gain market acceptance, given the convenience and lower costs of e-Learning in certain situations. Accordingly, Learning Tree believes that a blended learning approach, in which we harness the best of both instructor-led and e-learning is the most effective way to deliver our courses and for attendees to learn today. To that end, we have and will continue to work with our clients to develop customized e-Learning modules that are optimized to augment instructor-led classes. More recently, we have partnered with organizations to provide “bundled” training solutions that bring together a mix of instructor-led training, on-demand training, and other learning services, to include additional stand-alone exercises, mentoring and coaching, and certification-based practice exams as a means to support an individual in meeting his or her learning objectives.

The needs of organizations for training and professional development are evolving, and particularly so in the IT technical, analyst, and management disciplines. Organizations, whether commercial companies or government agencies, are looking to ensure the investment in their IT workforce directly supports improved outcomes, including more successful project delivery, improved delivery processes and product quality, and ultimately improved business or mission outcomes. Further, from an individual learner’s perspective, the rise of e-learning solutions has provided significant new options for self-directed learning. As such, Learning Tree’s primary focus is evolving from being an IT training company for its customers’ employees to becoming a company that partners with the IT organizations of its customers to meet the full range of an organization’s training needs for its workforce. As such, in addition to our goal of maintaining our position as the premier provider of instructor led IT training and professional development, our business strategy has evolved.

In addition to training, we offer a suite of Workforce Optimization Solutions to support an IT organization’s life-cycle of workforce development needs. Our solutions help ensure that an organization’s investment in training is relevant and leveraged to improving overall organization performance. These solutions range from helping organizations define their job roles, to assessing the current skills of the staff, providing coaching and mentoring of staff, offering blended learning in which we use different training modalities to offer an organization an optimized learning approach and even serving as an outsourced provider of an organization’s learning and training requirements.

We market and present our training courses and Workforce Optimization Solutions through locally staffed operations in the United States, the United Kingdom, Canada, Sweden and Japan. In fiscal year 2018, we generated approximately 40% of our revenues outside of the United States. We coordinate, plan and deliver our courses at our own Education Centers, hotels, conference centers, other specially equipped facilities, and customer sites worldwide.

Business Approach. We are experiencing growth in our business of supporting enterprise customers by providing them with Workforce Optimization Solutions and customized training products to meet their needs. However, we continue to experience a decline in course attendance at our public courses which are taught at our Education Centers. To address this decline, the Company has been working to: leverage resellers and other partner models to increase our sales reach; offer special price promotions to attract new course attendees; increase the size of our sales team; shorten the duration of some of our courses; and partner with certification organizations and other training providers to broaden and deepen the training products we offer. Our overall objective continues to be the reversal of year-over-year declines in revenue by stabilizing revenue from our public course training offered to clients at our Education Centers while continuing to grow revenue from enterprise clients through Workforce Optimization Solutions and other customized training products.

In addition, we continue to invest in and improve our sales capabilities. Beginning in fiscal year 2018, we combined our North American sales forces into a single team that now enables every sales representative to offer the best training solution to the customer. This change together with the Workforce Optimization Solutions we now offer has enabled us to better position ourselves to support large corporations and government agencies and has supported our financial objective of seeking to reverse declines in our revenue base.

Comprehensive Cost Reduction Program. We have continued to reduce our operating expenses through a comprehensive cost reduction program initiated in fiscal year 2016. After reducing operating expenses by $10.7 million in fiscal year 2017 compared to fiscal year 2016 as a result of our cost reduction program, we further reduced operating expenses in fiscal year 2018 by an additional $2.0 million compared to fiscal year 2017. This excludes restructuring charges of $1.9 million, $0.4 million and $0.4 million in fiscal years 2016, 2017 and 2018, respectively, all relating to terminating excess world-wide leased real estate capacity. In addition to reducing operating expenses, we reduced cost of revenues in fiscal year 2018 by $3.7 million or 9.1% as compared with fiscal year 2017 by continuing to right-size our operations and reduce travel and shipping costs. We continue taking appropriate steps to streamline our operations to reduce or eliminate excess costs.

Commitment to Quality Training. For the past 44 years, we have set the highest standards of excellence in educating and training IT professionals and managers throughout the world. Our course participants have consistently rated Learning Tree instructors and courses at the top end of the scale. These ratings reflect our ongoing commitment to quality and innovations in instructional delivery, including our AdaptaLearn™ Hands-On Learning System, After-Course Instructor Coaching, Computing Sandbox for Practice and Experiments, as well as the latest up-to-date hands-on course equipment, continued revision and updating of our course materials, and the ongoing training and coaching of our already superb instructors. Our AnyWare™ e-Learning platform extends the full range of Learning Tree features and standards to our online participants so that they enjoy the same results as our in-class participants.

High Quality Instructor Team. As of September 28, 2018, we had more than 558 course instructors located around the world. Learning Tree instructors are practicing professionals with expert subject knowledge. Our average instructor has over 20 years of hands-on, real world experience in the fields they teach. Learning Tree instructors teach an average of approximately eight course events per year on an as-needed basis. During the remainder of the year, they typically work for other organizations either as full-time employees or as independent technical or management consultants. This on-demand structure enables us to quickly schedule additional courses anywhere in the world and to respond efficiently to customers’ needs for IT and management skills training. Our course participants particularly benefit because Learning Tree instructors generally spend much of their time working in industry settings, and therefore provide our course participants with up-to-date, practical knowledge and skills in the latest technological and management developments. Our instructors constitute a large pool of subject matter experts which provides us with unique insights into IT and management trends that is especially valuable to us in the development of new course titles.

Our success depends on our ability to attract and retain highly skilled instructors. We use a systematic process in each of our local operating subsidiaries to identify, engage, train, coach, and evaluate our instructor team. Our instructors are highly loyal as evidenced by our annual instructor retention rate of over 90%.

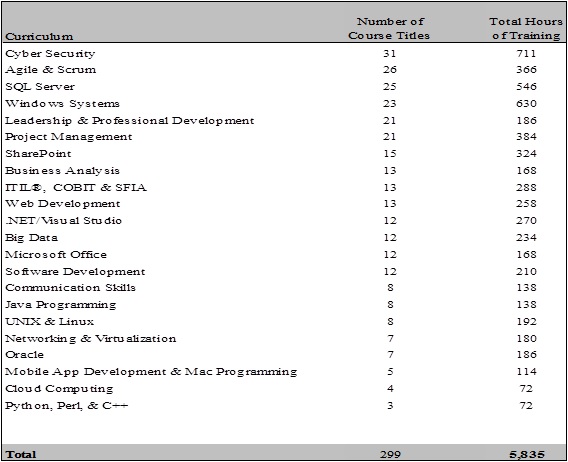

Broad Course Library. We offer a deep and broad library of courses which as of September 28, 2018, totaled 299 instructor-led one- to five-day course titles comprising a total of 5,835 hours of classroom instruction covering a wide range of IT and management topics.

The following table itemizes the number of Learning Tree course titles and number of hours of training by curriculum as of September 28, 2018:

As a leading provider of IT and management training, our objective is to provide our customers with job-focused, hands-on learning experiences that best meet the training needs of their professional IT staff and managers. We design our proprietary courses to provide participants an unbiased perspective of both the strengths and limitations of software and hardware products and an understanding of how to compare and integrate multiple platforms and technologies from various vendors. Drawing from the expertise of our international team of instructors, each course incorporates multiple points of view concerning IT applications used throughout the world. Our IT courses are designed to be highly interactive; most involve hands-on training using networked state-of-the-art workstations so that participants can practice and assimilate the skills being taught. Participants spend a significant portion of each hands-on course working on computer-based exercises and participating in group workshops and class interactions. As a result, they return to their jobs with the confidence to immediately apply the new skills and knowledge they have gained.

To ensure we can meet the full needs of our customers for IT training, we selectively augment our own proprietary courses by offering courses from vendors and other content providers. Prior to adding any such courses to our library, we use our subject matter experts to review the courses to ensure that such courses will meet the standards of quality our customers expect from Learning Tree.

Our management courses, while including core concepts and theory, focus heavily on providing practical skills, tools, and techniques that participants can apply immediately upon returning to their jobs. Participants work extensively in group exercises that provide them an opportunity to practice applying key concepts in real-world scenarios. These real-world scenarios are primarily delivered through our performance-based management training platform which brings the real world to life in the classroom through the use of computer-based and rich-media simulations, supplemented with substantial amounts of hands-on exercises and group activities, all facilitated by experts in their respective fields.

As of September 28, 2018, we offered 181 multi-day IT courses, compared to 168 multi-day IT courses at the end of fiscal year 2017. As of September 28, 2018, we offered 82 multi-day management courses, compared to 66 multi-day management courses at the end of fiscal year 2017. As of September 28, 2018, we offered 36 one-day courses compared to 83 one-day courses at the end of fiscal year 2017, bringing the total number of courses offered to 299. The number of one-day courses continued to decline in 2018 as we retired many these courses due to low demand.

We have developed and implemented a well-defined, systematic approach for rapidly developing, customizing and updating courses in the Learning Tree library and for translating our course content into multiple languages. We organize courses into curricula that reflect general topics or disciplines. We continuously update our course curriculum structure and course content and add new courses to keep pace with the introduction of new technologies and to reflect the evolving training needs of our customers. To identify potential new courses for development, we incorporate feedback from our worldwide instructor team, course participants and customers, and from the development groups of leading IT vendors. In fiscal year 2018, we introduced 55 new multi-day courses and one new one-day course, while retiring 26 multi-day and 48 one-day courses. We expect course development costs to vary in the future, primarily depending on the number of new courses we introduce in any period, as well as the overall size of the course library we must maintain. As described above, we also partner with other organizations to offer their courses.

International Infrastructure and Logistics Capability. We meet customer demand for scheduling flexibility by delivering course events frequently and at multiple locations throughout the world, and by making our advertised courses available online through Learning Tree AnyWare™. Our sophisticated infrastructure and logistics capability allow us to coordinate, plan and deliver Learning Tree courses at our education centers, hotels, and conference facilities worldwide. We also present standard or customized courses on demand at customer facilities whenever and wherever desired, with quality standards that are identical to those for courses presented in Learning Tree Education Centers. By using our team of 558 instructors, our course development and customization processes, our team of customer support specialists, our logistics team and our thousands of classroom computer workstations, we can rapidly and effectively deliver our Learning Tree courses both domestically and internationally.

In fiscal year 2018, we presented 4,473 course events at Learning Tree Education Centers and at third-party and customer sites in a total of 39 countries. We currently operate wholly-owned subsidiaries in the United States (since 1974), the United Kingdom (since 1978), Canada (since 1985), Sweden (since 1986) and Japan (since 1989). Each subsidiary is staffed by local personnel responsible for the sale and delivery of courses in its local country as well as in other designated countries. In fiscal year 2018, our foreign operations produced approximately 40% of our revenues. See Note 9 of notes to consolidated financial statements for financial data regarding operating segments and geographic regions. In August 2017, the Company terminated its License Agreement, dated March 3, 2015, with Educinvest SPRL, which became effective immediately. The License Agreement was entered into with Educinvest at the time of the sale of the Company’s subsidiary in France and provided for the license of courses by Educinvest in France. The French market is now being served by our UK operation as part of our Europe Middle East and Asia (EMEA) territories.

Long-Term Relationships with Global Customer Base. We have built long-standing relationships with our customer base of large national and multinational companies, medium-sized companies and government organizations throughout the world and seek to build continuing relationships both with these employers and with the individual employees who participate in our courses. Our customers operate in a wide range of sectors, including finance, IT, communications, electronics, systems integration, aerospace, government and military, manufacturing, and energy. Of our 100 largest clients in fiscal year 2013, 97 were still our clients five years later, in fiscal year 2018. In fiscal year 2018, 99 of our corporate and government customers purchased at least $100,000 of Learning Tree services. No one commercial customer or government agency accounted for 10% or more of our revenues in fiscal year 2018.

Backlog. Our sales backlog at September 28, 2018 was $11.9 million. This compares to a sales backlog of $13.5 million at September 29, 2017. We currently expect the entire backlog to be executed within fiscal year 2019.

Multi-Tiered Sales and Marketing Organization. We have a multi-tiered sales and marketing organization that integrates digital marketing, telemarketing and field sales to market and sell our course offerings to existing customers and to attract new customers. As of September 28, 2018, we employed a team of 105 sales representatives and related sales support staff.

We maintain a strong brand image for providing high-quality training for IT professionals and managers through the prominent use of our trademarks in our marketing and course materials. We market our courses primarily through digital marketing campaigns and electronic mail to our proprietary database of technology professionals and managers who have attended, inquired about, or sent a staff member to Learning Tree courses. We send targeted, personalized e-mails through our automated e-mail marketing system to advise prospective course participants of upcoming events. We also market our products and services on our website (www.learningtree.com). Information contained on our website is not part of this Form 10-K.

To encourage repeat purchases from existing customers, we have introduced My Learning Tree for attendees and managers of attendees. Learning Tree customers are provided with their own ‘My Learning Tree’ account, which attendees and their managers can use to access a growing list of unique benefits. We also offer multiple-course discount programs through Learning Tree Training Passports and Learning Tree Training Vouchers and provide Specialist and Expert Certification Programs. We believe that in addition to generating revenues directly, these programs foster long-term relationships with participants and encourage participants to recommend Learning Tree courses to their colleagues.

Learning Tree Training Passports permit an individual Passport holder to attend a specified number of courses, generally two, three or four, during a one- to two-year period. List prices for Passports are significantly discounted from the list price of the equivalent number of individual courses. The Learning Tree Training Voucher program allows corporate customers to buy Vouchers in quantities from three to hundreds at volume-discounted prices, for future courses to be taken by any person in the customer organization over a 12-month period.

Markets and Competition

Instructor-Led Training. We are a for-profit provider of IT training and management education. Our main competitors offer course titles and programs similar to ours and generally at prices that are equal to or lower than ours.

The IT and management training market is highly fragmented with low barriers to entry. We face intense competition from both established providers as well as new market entrants on a regular basis. Our primary competitors include:

|

• |

in-house training departments; |

|

• |

computer hardware and software vendors and their authorized training and education center partners; |

|

• |

independent education and training companies; |

|

• |

academic providers; and |

|

• |

systems integrators and value-added resellers. |

Many third-party training providers offer training as one of several services or product lines. We differentiate ourselves from these providers based on our primary focus on training, experience over four decades, the breadth and quality of our proprietary course library, our addition of workforce optimization solutions, our worldwide delivery capability, and the size, quality and experience of our instructor force.

In-house training departments generally deliver training at lower cost than third parties and provide companies with the most control over the method and content of training, enabling them to tailor programs to their specific needs. However, in-house trainers often find it difficult to keep pace with new technologies, lack the hands-on experience needed to teach the latest technological developments and lack the capacity to meet demand for training, and therefore many organizations supplement their in-house training resources with externally supplied training. This is particularly relevant when dealing with new and emerging technologies. Additionally, in-house training departments may not deliver consistent course content or use consistent instructional methods on a worldwide basis, while we offer consistent course content, instructional methods, and quality around the globe.

E-Learning and Blended Learning. IT and management training are primarily delivered by classroom instructors, video, and technology-based training, including Internet-based e-learning and printed means. Independent industry reports suggest that, consistent with the prior ten years, instructor-led classroom delivery continues to be the most widely used method for delivery of corporate training, with approximately 66% of all training being instructor-led. We believe this is because instructor-led training provides the greatest ability for participants to learn, practice and receive feedback on their mastery of new knowledge and skills. Course participants value the personalized interaction and problem-solving with their instructor and fellow participants, and the opportunity to obtain expert advice on the application of the course material to their own projects. Furthermore, instructor-led training insulates course participants from workplace interruptions and accelerates their learning of new technologies. The use of technology-based IT training formats, such as Internet-based e-learning, has gained acceptance in the IT and management training and education market, largely gaining market share at the expense of other self-study formats like video and printed materials.

We have continued to investigate technology-based training formats and how they might effectively be integrated into our training programs. We developed Learning Tree AnyWare™, our proprietary live online learning platform that integrates participants in remote locations into live class events. Remote participants use an ordinary Internet connection to connect to our AnyWare™ classroom interface. Once logged in, remote AnyWare™ class participants see and hear their classroom-based instructor and classmates in real time. They can participate in discussions, ask questions, work in breakout sessions, and complete the same hands-on exercises under the guidance of an expert instructor as their in-class counterparts. With the use of AnyWare™, our clients anywhere in the world can choose to participate in course events being taught at any of our Education Centers without the need to travel or commute to the actual course site.

We have utilized stand-alone AnyWare™ Learning Centers in strategic locations to promote the use of on-line attendance using our AnyWare™ product. These AnyWare™ Learning Centers provide our customers convenient access to our courses via our AnyWare™ platform in a setting optimized for equipment, communication, Internet connectivity speed, and learning environment, at a location near to where they live or work, minimizing added travel costs to attend courses at our Education Centers. As acceptance of the AnyWare™ product has grown and customers have become comfortable accessing AnyWare™ from their work places and homes, we have reduced the number of stand-alone AnyWare™ Learning Centers, which are typically located in short-term leased facilities. As of September 28, 2018, we had a total of 16 Learning Tree AnyWare™ Learning Centers, including seven stand-alone AnyWare™ Learning Centers in North America, four in Sweden, and another five located within our North American Education Centers. The AnyWare™ Learning Centers located within our existing Education Centers in North America have the capacity to handle on average six attendees each while the stand-alone centers have a capacity to handle from two to five attendees.

In recognition of the growing use of e-learning products in the IT and Management training market, we are selectively incorporating e-learning capabilities into our course library to improve our customers’ learning experience. We currently offer a number of e-learning products, including products from Microsoft, EC-Council, Red Hat, and ITProTV. During fiscal year 2018, we released our first blended learning bundled products which combine and augment instructor-led courses with e-learning capabilities. During fiscal year 2019, we anticipate releasing additional blended learning products.

Employees

Our executive officers have extensive experience in the training and education industries with an average tenure of 13 years at Learning Tree and over 24 years of relevant industry experience.

On September 28, 2018, we had a total of 248 full-time equivalent employees, 95 of whom were employed outside the United States. We also utilized the services of 558 instructors to teach our courses on an as-needed basis.

Intellectual Property Rights

Our course development process and many of our course titles are proprietary, and we rely on a combination of copyright, trademark and trade secret laws, customer licensing agreements, employee and third-party nondisclosure agreements and other methods to protect those proprietary rights.

“LEARNING TREE”, “LEARNING TREE INTERNATIONAL”, the Learning Tree “Tree Design” logo, “LEARNING TREE INTERNATIONAL” and Design, “LEARNING TREE ANYWARE”, “ANYWARE”, “ANYWARE” and Design, “ANYWARE LEARNING CENTER”, “LEARNING TREE ANYWARE ENTERPRISE”, “LEARNING TREE ANYWARE ENTERPRISE” and Design, “PRODUCTIVITY THROUGH EDUCATION”, “TRAINING PASSPORT”, “TRAINING ADVANTAGE”, “TRAINING YOU CAN TRUST”, “WWW.LEARNINGTREE.COM”, “MAGNALEARN”, “ADAPTALEARN”, “ADAPTALEARN” and Design, “MY LEARNING TREE”, “MY LEARNING TREE” and Design, “800-LRN-TREE”, and “800-THE-TREE” are among our trademarks and service marks. In addition to our trademarks and service marks, this Form 10-K also contains trademarks and trade names of other companies.

We develop proprietary course content and own the copyright to the majority of course materials we develop. We believe these copyrights help differentiate our services from those of our competitors.

We have obtained patent protection in the United States and a number of foreign countries related to our Learning Tree AnyWare™ live online learning platform.

Regulatory Environment

We are paid directly by the employers of course participants and do not receive funding from any government student-aid or loan programs. As a result, we do not depend on government Title IV funding and are generally exempt from the governmental regulation of public education providers. However, our results of operations could be affected by future changes to current licensing or regulatory requirements.

Available Information

We currently make available free of charge on our website (www.learningtree.com) via our “Investor Relations” link, our Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports filed or furnished with the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after such material is electronically filed or furnished to the SEC. In addition, for as long as we remain subject to Exchange Act reporting requirements, information concerning purchases and sales of our equity securities by our executive officers and directors is posted on our website. Information contained on our website is not part of this Form 10-K. Our 10-K may also be obtained free of charge by written request to the Chief Financial Officer, Learning Tree International, Inc., 13650 Dulles Technology Drive, Herndon, VA 20171. The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information that issuers, including Learning Tree, have filed electronically with the SEC.

Item 1A. RISK FACTORS.

You should carefully consider the following discussion of various risks and uncertainties, keeping in mind that they are not the only ones that affect us. Additional risks that we do not presently consider material, or of which we are not currently aware, may also have an adverse impact on us.

Going Concern; Limited Liquidity and Negative Cash Flows

We have had negative cash flows from operations, have not achieved a net profit on an annual basis for the past three years and there is substantial doubt about our ability to continue as a going concern. If we are not able to generate positive cash flow, our business operations may not be able to continue.

Over the past three years we have experienced net losses and declining revenues. In fiscal year 2018, our worldwide revenues from operations decreased 9.0% to $64.3 million from $70.7 million in fiscal year 2017. In fiscal year 2017, our worldwide revenues from operations decreased 13.4% to $70.7 million from $81.6 million in fiscal year 2016. For fiscal years 2017 and 2016, our registered independent public accounting firm issued a report on our audited financial statements that included an explanatory paragraph expressing substantial doubt about the Company’s ability to continue as a going concern. We have initiated several business strategies and initiatives to stabilize and increase revenue and implemented a comprehensive cost reduction program that reduced both cost of revenues and operating expenses and secured a $5.0 million Credit Agreement (“Credit Agreement”) with the Kevin Ross Gruneich Legacy Trust as lender (the “Trust”), which also is our largest stockholder. Despite these actions however, we may be unsuccessful in generating sufficient cash flow, and improving our profitability for fiscal year 2019 and beyond. For fiscal year 2018, the report the Company received from its independent registered public accounting firm on its consolidated financial statements as of September 28, 2018 again contains an explanatory paragraph stating that there is substantial doubt regarding the Company’s ability to continue as a going concern. If we become unable to continue as a going concern, we may have to liquidate our assets, and may realize significantly less than the values at which they are carried on our financial statements, and stockholders may lose all or part of their investment in our common stock.

Our consolidated financial statements were prepared based on the assumption that we will continue to operate as a going concern and do not reflect any adjustment that might result if we were not able to continue operations.

The consolidated financial statements for the fiscal year ended September 28, 2018 that accompany this Form 10-K were prepared under the assumption that we will continue to operate as a going concern. Although our consolidated financial statements raise substantial doubt about our ability to continue as a going concern, they do not reflect any adjustment or impact that might result if we were not unable to continue ongoing operations.

Our Credit Agreement contains covenants, representations and warranties that the Company is required to comply with in order to receive future advances or avoid triggering an event of default.

Our Credit Agreement includes covenants, representations and warranties that the Company must comply with during the term of the Credit Agreement, as well as at the time of an advance under the Credit Agreement. The terms of the Credit Agreement also contains an acceleration clause that can be triggered if the Trust, as the lender, determines an Event of Default has occurred that would reasonably be expected to have a Material Adverse Effect, as defined in the Credit Agreement, and continuance thereof for ten (10) calendar days, which in turn would permit the Trust to accelerate repayment of outstanding obligations. In addition, there are circumstances where an event of default under the Credit Agreement would occur if the Company is required to pay a final judgment or order against the Company above certain levels not covered by insurance, which final judgment or order would not be in the control of the Company.

The Credit Agreement allows the Company to make quarterly borrowings until the aggregate amount of the credit has been drawn, but if we are not able to make the representations and warranties under the Credit Agreement on such quarterly borrowing date, then the Company would not be able to borrow additional funds at that time. If the Company does not remain in compliance with certain covenants or obligations under the Credit Agreement, then it may result in an inability to borrow additional funds and/or constitute an event of default, in which case, could result in amounts borrowed under the Credit Agreement becoming immediately due and payable. If the Company is not able to receive advances or if an event of default were to occur resulting in payment acceleration, then such events could have a material adverse effect on the financial condition, results of operations, liquidity, capital resources and the business of the Company. Further, there is no assurance that the Company will have the ability to fully repay borrowings under the Credit Agreement, either upon maturity or if accelerated upon an event of default, or that the Company would be able to refinance or restructure payments on those borrowings.

The Company relies on the Credit Agreement as a significant source of capital and liquidity currently available to the Company. As of October 1, 2018, the outstanding principal balance under the Credit Agreement is $3.0 million, and the Company has the ability to borrow an additional $2.0 million. The Credit Agreement requires that the Company be in compliance with certain covenants as a condition to receiving additional advances under the Credit Agreement, including satisfying a financial covenant that requires the Company to maintain a required level of EBITDA, as well as representations, warranties and covenants. Current projections for fiscal year 2019 indicate that the Company will not meet the EBITDA requirement at the end of the first quarter of fiscal year 2019. If the Company is not able to satisfy the conditions to borrowing under the Credit Agreement, we will not be able to draw on the Credit Agreement at such time, and the Company’s options for capital and/or liquidity at such time may be limited to its cash and cash equivalents or its existing secured line of credit with Action Capital, which has higher borrowing costs and is subject to the prior approval of Action Capital and the availability of accounts receivable acceptable to Action Capital.

Our Financing Agreement requires there to be acceptable Company accounts receivable in order to receive advances from our lender, which amounts may not be available in the amounts or at the times that we may need them.

We entered into a Financing and Security Agreement dated January 12, 2017 (“Financing Agreement”) with Action Capital Corporation (“Action Capital”), which provides us with potential access to borrow up to $3.0 million. Amounts advanced to us under this Financing Agreement are subject to the prior approval of Action Capital and the availability of accounts receivable acceptable to Action Capital. Accordingly, there is no assurance that advances will be made to us in the amounts and at the times when they are requested by us, which could have an adverse impact on our liquidity and ability to operate the business. In addition, we may not have the requisite amount of acceptable accounts receivable in order to borrow up to the maximum principal amount under the Financing Agreement.

The loss of available credit under the Credit Agreement and the Financing Agreement or termination of either or both could adversely affect our liquidity and our ability to operate our business.

Although we were in compliance with all of the terms and conditions of the Credit Agreement and the Financing Agreement as of the end of fiscal year 2018, current projections for fiscal year 2019 indicate that the Company will not meet the minimum EBITDA requirement under the Credit Agreement at the end of the first quarter of fiscal year 2019. If this or other events were to occur which result in either a termination of the Credit Agreement and/or the Financing Agreement, or the loss of all or a substantial portion of our available credit under the Credit Agreement and/or the Financing Agreement, or if we are otherwise prevented from accessing such funds, and we did not have an alternative line of credit or other additional sources of capital available, then we would need to rely upon our cash and cash equivalents for our working capital needs, which may not be sufficient. In addition, because the Financing Agreement has no set term and may be terminated by either party at any time, we cannot be certain that access to capital sourced through this lending arrangement will be available when needed. If we were unable to replace these sources of liquidity, then our ability to fund our operations could be materially and adversely affected. We cannot be certain that any additional financing will be available to us or that it will be available on commercially reasonable terms.

We currently have limited sources of liquidity and may need to obtain another credit facility and/or raise new capital to provide additional liquidity. If we fail to obtain additional liquidity as needed, then we will continue to rely on our balance of cash and cash equivalents on hand, cash flows from operations to finance our operating cash needs to the extent that our operating cash flows will allow and amounts available under any existing lending arrangements.

Prior to entering into the Credit Agreement, we primarily relied upon our balance of cash and cash equivalents plus cash flows from operations to finance our operating cash needs. Our working capital needs have exceeded, and could continue to exceed for the near future, cash flows available from operations. If we do not generate positive cash flow from operations or have access to advances under the Credit and Financing Agreements in the amounts we need or obtain access to capital from additional sources that may or may not be available to us, or even if available, may not be on satisfactory terms or in adequate amounts, then our cash and cash equivalents will continue to decline. Consequently, any adverse impact on our operating results would impact our cash flows from operations and our ability to continue to meet our operating cash needs which would likely have a material adverse impact on our business, financial condition, results of operations and our stock price.

Deregistration: Limited Market for Our Common Stock

We intend to deregister our common stock under the Exchange Act, which may negatively affect the liquidity and trading prices of our common stock and will result in significantly less financial and other disclosures about the Company.

On December 20, 2018, we announced our intention to deregister our common stock under the Exchange Act on or about December 28, 2018. Upon the filing of our Form 15, our obligation to file reports with the SEC, such as Forms 10-K, 10-Q and 8-K, will immediately cease. Our announcement to suspend our periodic reporting obligations, as well as the ultimate cessation of our periodic reporting, may materially and adversely affect the market price and liquidity of the Company’s common stock on the OTC Markets, even though the availability of stock price quotations and limited trading may continue for a period time on the OTC Pink market after the Company suspends its SEC reporting. The market price of our stock and the availability of continued, limited trading on the OTC Markets also may be further negatively impacted if the market perceives our decision to go-dark to be the result of adverse changes in our prospects or seeking to serve insider interests. As a result, investors likely will find it more difficult to obtain quotations as to the market value of our common stock, if at all, and to dispose of their shares in desired amounts and within preferred timeframes, and the overall ability of our stockholders to sell our securities in the secondary market likely will be materially limited. Our anticipated deregistration also may make it more difficult for us to raise equity capital in the future if we desire to do so and may make our stock less attractive for use as consideration in any potential business combination transactions.

Our common stock is thinly traded, with currently only a minimal public market for our common stock.

The Company’s common stock currently is quoted on the OTCQX. Historically, our stock has had limited trading volume due to, among other things, our small size and minimal public float. There has been and may continue to be periods of several business days or more when trading activity in our common stock is non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on price. There has not been an active public trading market for our common stock in the past and, considering our plans to deregister our common stock under the Exchange Act and cease public reporting, one is not likely to develop in the future. Accordingly, investors may be unable to sell their shares in the public market at desired prices, in desired amounts, or at all.

Potential future Sales of Our Common Stock and Securities.

Sales of our common stock by our executive officers, directors and other affiliates, or the perception that sales by those persons may occur, could adversely and unpredictably affect the price of shares of our common stock. In addition to the 13,224,349 shares of common stock outstanding as of December 14, 2018, there were outstanding options to purchase an aggregate 775,000 shares of common stock, with an additional 475,000 shares reserved and available for future issuance under our equity incentive plan. We cannot predict the effect that any such future sales of our common stock, or the potential for those sales, will have on our share price.

Our common stock currently is a “penny stock” which may adversely impact the liquidity of our common stock.

The SEC has adopted regulations that generally define “penny stock” as an equity security that has a market price of less than $5.00 per share, subject to specific exemptions. Brokers and dealers effecting transactions in a “penny stock” must disclose certain information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. Those rules may restrict the ability of brokers or dealers to sell the Company’s common stock and may affect the ability of our stockholders to sell their shares of our common stock. As a result, our stockholders may find it difficult to obtain accurate quotations for our stock and may find few buyers to purchase our stock and few market makers to support its price.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority ("FINRA") has adopted rules that require that, in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA has indicated its belief that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. These FINRA requirements make it more difficult for broker-dealers to recommend that at least some of their customers buy our common stock, which may limit the ability of our stockholders to buy and sell our common.

Fluctuations in Operating Results

We may be unable to realize our business strategy of improving operating performance, growing our business and generating savings and improvements.

Over the past five years the Company has been experiencing a decline in course attendance and revenue generated from our operations. As a result, we have been implementing new strategic initiatives, including those described in this Form 10-K, which include offering and expanding the services provided through Workforce Optimization Solutions, adjusting the duration of some of our courses to be more competitive, the comprehensive cost reduction program, Guaranteed to Run (“GTR”) courses, and pricing promotions that are designed to improve our operating performance, stabilize and increase revenue and grow our business. The failure to achieve the goals of some or all of these initiatives could have a material adverse effect on our financial condition, results of operations and our business. There is no assurance that we will be able to pursue, successfully implement or realize the expected benefits of any initiative or that we will be able to sustain improvements made to date.

Our operating results have historically fluctuated, and we expect fluctuations to continue in the future.

Fluctuations in our historical operating results have resulted from many factors, some of which are beyond our control. In the future, these or other factors could have a material adverse impact on our operating results and cause our stock price to decrease. For example:

Timing of Course Development, and Sales and Marketing Expenditures.

We try to adjust our expenditures for course development and sales and marketing to maintain our long-term profitability, including our assessment of the potential to influence future customer demand, market conditions, and other factors. This may mean accepting reduced margins in poor economic periods, as we must commit too much of our spending before our attendees enroll in our courses. If revenues fall short of our expectations, we may not be able to adjust our expenditures quickly enough to compensate for lower than anticipated revenues. This could compound the impact of any revenue shortfall and further affect our operating results and the price of our common stock.

Many of the new titles now being offered are not developed or taught by Learning Tree, but rather were obtained from other providers.

Reselling other providers courses limits our ability to ensure a quality customer experience. While we do review and approve partner courses before offering them to our customers, our revenues could be negatively impacted if customers are not satisfied with these courses. In addition, the margins earned on these partner courses may be lower than those of our proprietary courses.

Course Scheduling and Marketing Activities.

The timing and content of our courses and our marketing activities can affect the number of participants who attend our courses. Some of the activities that can contribute to fluctuations in our operating results include:

|

• |

the frequency of our course events; |

|

• |

the number of weeks during which our courses can be conducted in a quarter; |

|

• |

the timing, timely delivery, frequency and size of, and the response to, our marketing and advertising campaigns; |

|

• |

the timing of introduction of new course titles; |

|

• |

the average length of courses, based on the current mix of course titles, which affects the average revenue per attendee; and |

|

• |

the mix between course events held at customer locations and course events held in our education centers and hotels due to differing gross profit margins. |

Seasonal Factors.

Our quarterly revenues and income fluctuate due to the seasonal spending patterns of our customers, which are affected by factors such as:

|

• |

cyclic or one-time budgetary considerations; |

|

• |

government spending and budget cycles; |

|

• |

factors specific to their business or industry; and |

|

• |

weather, holiday and vacation considerations. |

Use of Accounting Estimates.

The preparation of our financial statements in conformity with Generally Accepted Accounting Principles in the United States (“GAAP”) requires us to make estimates and assumptions in calculating our financial results. As one example, we currently offer our customers a multiple-course sales discount referred to as a Training Passport, which allows an individual Passport holder to attend up to a specified number of Learning Tree courses over a specified period for a fixed price. For a Training Passport, the amount of revenue we recognize for each attendance in one of our courses is based upon the selling price of the Training Passport, the list price of the course taken, the average list price of all courses taken, and our estimate of the average number of courses a Passport holder will attend. After expiration of a Training Passport, we record the difference, if any, between the revenue previously recognized and the Training Passport selling price. We base our estimate of the average number of course events that a Training Passport holder will attend based on historical trends. However, these historical trends may not accurately predict the actual number of course events that a Training Passport holder will attend in the future. If average Training Passport attendance rates were to increase, for example, we would have to make negative adjustments to our revenue, which could be significant. For a summary of some of our key accounting estimates, please see our “Critical Accounting Estimates and Policies” in Management’s Discussion and Analysis of Financial Condition and Results of Operations.

We may not be able to fully utilize our deferred tax assets and changes in our tax rates or exposure to additional tax liabilities could adversely affect our financial position.

In fiscal year 2012, we established a valuation allowance against our deferred tax assets in the United States due to current year and projected future pre-tax book losses. We continue to maintain this valuation allowance throughout the subsequent financial years. Management judgment is required in determining the provision for income taxes and in determining whether deferred tax assets will be realized in full or in part, primarily with respect to projecting taxable income. Future taxable income can never be projected with certainty as it is dependent on numerous factors, some of which are beyond our control. Substantial variances between our estimates of future taxable income and actual results, or changes in our estimate of future taxable income, could lead to changes in the amount of deferred tax assets that can be realized and could therefore require corresponding adjustments to the valuation allowance. Our income tax provision could be significantly impacted by estimates surrounding our uncertain tax positions, decisions on repatriation of foreign earnings, and changes to our valuation allowance in future periods. Furthermore, the new tax laws enacted in December 2017 under the Tax Cuts and Jobs Act, which brought about corporate income tax rate changes, the modification or elimination of certain tax incentives, changes to the U.S. tax regime for taxing overseas earnings (including modification to the regime for repatriating such earnings), and measures to prevent base erosion of profits in the U.S., may also impact our future effective tax rate and have a significant effect on our future operating results. As a result, we may never be able to use the full amount of our deferred tax assets which could adversely affect our financial position.

Changing Regulation of Corporate Governance and Public Disclosure.

Changing laws, regulations and standards relating to corporate governance and public disclosure can result in uncertainty regarding compliance matters and higher costs incurred with ongoing revisions to disclosure and governance practices. As a result, our efforts to comply with evolving laws, regulations and standards have resulted in, and are likely to continue to result in, increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new or changed laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, our reputation may be harmed. If the Company deregisters its common stock under the Exchange Act, the Company will be able to materially reduce its costs of public reporting compliance under U.S. securities laws.

Introductions and Adoption of New Technology.

Our customers tend to increase their training at times when new technology is being introduced. During periods when fewer new technologies are being introduced, demand for our training courses may decrease, which could have a material adverse effect on our operating results and stock price.

Other Factors.

Other factors that may affect our operating results include:

|

• |

competitive forces within our current and anticipated future markets; |

|

• |

our ability to attract customers and meet their expectations; |

|

• |

currency fluctuations and other risks inherent in international operations; |

|

• |

general economic conditions; |

|

• |

differences in the timing of our spending on the marketing of our courses, as well as the timing of our spending on the development of our courses and other areas; and |

|

• |

excess capacity and/or unused space in our education centers and/or administrative office facilities, and our ability to sublease or find other uses for it. |

All or any of these and similar factors could cause our operating results to differ substantially from the expectations of public market analysts and investors, which would likely have a material adverse impact on our stock price.

Risks Associated with Technology Changes

If we do not adequately anticipate or respond to changes in technology, it could have a material adverse effect on our operating results and stock price.

Changes in technology can affect our business in at least two principal ways. First, we must anticipate and keep pace with the introduction of new hardware, software and other information technologies and develop courses that effectively train customers in the technologies they use now and will use in the future. Second, we must adapt to changes in the technologies by which we can deliver training to our customers’ employees. Because of technology developments, we may have to make substantial and unanticipated expenditures to develop new course titles, buy new equipment, or invest in further course development software and processes to deliver our courses. Our liquidity and cash flow situation could negatively impact our ability to accomplish this. Further, we may not adequately anticipate or respond successfully to technology changes for many reasons, including misjudging the impact of technology changes, as well as financial, technological or other constraints. A lack of an adequate timely response on our part to changes in information technology platforms, customer preferences or software technology could have a material adverse impact on our operating results and stock price.

Competition

If our customers decide that they prefer training offered by new or existing competitors, it could have a material adverse effect on our operating results and stock price.

The IT and management training markets are highly fragmented, with low barriers to entry. No single competitor holds a dominant market share. We face intense competition from both established entities and new entries in the market. Our primary competitors include:

|

• |

in-house training departments within our current and potential customers; |

|

• |

computer hardware and software vendors and their Authorized Training and Education Center partners; |

|

• |

independent education and training companies; |

|

• |

academic providers; and |

|

• |

software systems integrators. |

Some of our competitors offer course titles and programs similar to ours at lower prices. In addition, some competitors have greater financial and other resources than we do. Additionally, hardware and software vendors, as well as software systems integrators, may bundle IT education and training with sales of their products or other services, which could allow them to offer training at lower prices than we do. Furthermore, future consolidation of IT vendors or training companies could have a material impact on our future operations.

The risk of outsourcing of corporate IT administration and software development overseas to countries or firms not currently served by us could have a material adverse impact on our future operations.

Although instructor-led classroom training continues to dominate the worldwide IT and management training markets, technology-based education and training formats, such as Internet-based distance learning, have gained acceptance. Accordingly, our future results may also depend on the extent to which the market will continue to value instructor-led IT and management training and on our ability to develop and market instructor-led courses that compete effectively against technology-based courses offered by our competitors.

Risks Associated with International Operations

Approximately 40% of our annual revenue is generated by courses conducted outside the United States. Therefore, if we do not adequately anticipate and respond to the risks inherent in international operations, it could have a material adverse effect on our operating results and stock price.

Foreign Currency Fluctuations.

Our consolidated financial statements are prepared in U.S. dollars, while the operations of our foreign subsidiaries are conducted in their respective local currencies. Consequently, changes in exchange rates can unpredictably and adversely affect our consolidated operating results and could result in exchange losses. We do not hedge against the risks associated with fluctuations in exchange rates. Even if we were to use hedging techniques in the future, we might not be able to eliminate or reduce the effects of currency fluctuations. Thus, exchange rate fluctuations could have a material adverse impact on our operating results and stock price.

Our operations in the United Kingdom pose additional risks to our profitability and operating results.