Attached files

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended October 31, 2018

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 000-53848

RISE GOLD CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 30-0692325 | |

| (State or other jurisdiction of incorporation) | (IRS Employer Identification Number) |

650-669 Howe Street Vancouver, British Columbia, Canada V6E 3V7 |

| (Address of principal executive offices)(Zip Code) |

| (604) 260-4577 |

| (Registrant’s telephone number, including area code) |

| N/A |

| (Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer o | Smaller reporting company x |

| Emerging growth company x | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). q Yes x No

As of December 14, 2018, the registrant had 145,990,357 shares of common stock issued and outstanding.

PART I - FINANCIAL INFORMATION

| ITEM 1. | FINANCIAL STATEMENTS. |

The condensed consolidated interim financial statements of Rise Gold Corp. (“we”, “us”, “our”, the “Company”, or the “registrant”), a Nevada corporation, included herein were prepared, without audit, pursuant to rules and regulations of the Securities and Exchange Commission. Because certain information and notes normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America were condensed or omitted pursuant to such rules and regulations, the condensed consolidated interim financial statements should be read in conjunction with the financial statements and notes thereto included in the audited financial statements of the Company in the Company’s Form 10-K for the fiscal year ended July 31, 2018.

1

RISE

GOLD CORP.

(AN EXPLORATION STAGE COMPANY)

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

PERIOD ENDED OCTOBER 31, 2018

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS: | Page |

| Consolidated Interim Statement of Financial Position | F-1 |

| Consolidated Interim Statement of Loss and Comprehensive Loss | F-2 |

| Consolidated Interim Statement of Cash Flows | F-3 |

| Consolidated Interim Statement of Stockholders’ Equity | F-4 |

| Notes to Unaudited Consolidated Interim Financial Statements | F-5 |

2

| RISE GOLD CORP. |

| (An Exploration Stage Company) |

| CONDENSED CONSOLIDATED INTERIM STATEMENT OF FINANCIAL POSITION |

| (Expressed in Canadian Dollars) |

| (Unaudited) |

| AS AT | October 31, | July 31, | ||||||

| 2018 | 2018 | |||||||

| ASSETS | ||||||||

| Current | ||||||||

| Cash | $ | 992,438 | $ | 69,616 | ||||

| Receivables | 23,984 | 17,059 | ||||||

| Prepaid expenses (Note 3) | 346,751 | 532,389 | ||||||

| 1,363,173 | 619,064 | |||||||

| Mineral property interests (Note 4) | 5,447,674 | 5,447,674 | ||||||

| Equipment (Note 5) | 706,792 | 711,366 | ||||||

| $ | 7,517,639 | $ | 6,778,104 | |||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current | ||||||||

| Accounts payable and accrued liabilities | $ | 634,875 | $ | 521,058 | ||||

| Loan from related parties (Note 7) | 100,072 | 49,150 | ||||||

| Current portion of equipment loan (Note 5) | 328,751 | 305,710 | ||||||

| 1,063,698 | 875,918 | |||||||

| Equipment loan (Note 5) | 195,911 | 293,955 | ||||||

| 1,259,609 | 1,169,873 | |||||||

| Stockholders’ equity | ||||||||

| Capital stock, $0.001 par value, 400,000,000 shares authorized; | ||||||||

| 138,490,357 (July 31, 2018 – 116,105,982) shares issued and outstanding (Note 8) | 138,490 | 116,106 | ||||||

| Additional paid-in capital (Note 8) | 18,398,441 | 16,280,575 | ||||||

| Cumulative translation adjustment | (166,663 | ) | (166,663 | ) | ||||

| Deficit | (12,112,238 | ) | (10,621,787 | ) | ||||

| 6,258,030 | 5,608,231 | |||||||

| $ | 7,517,639 | $ | 6,778,104 | |||||

| Nature and continuance of operations (Note 1) |

| Contingency (Note 5) |

| Subsequent events (Note 11) |

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

F-1

| RISE GOLD CORP. |

| (An Exploration Stage Company) |

| CONDENSED CONSOLIDATED INTERIM STATEMENT OF LOSS AND COMPREHENSIVE LOSS |

| (Expressed in Canadian Dollars) |

| (Unaudited) |

| FOR THE THREE MONTHS ENDED OCTOBER 31, | 2018 | 2017 | ||||||

| EXPENSES | ||||||||

| Consulting | $ | 25,800 | $ | 18,000 | ||||

| Depreciation (Note 5) | 4,574 | - | ||||||

| Directors’ fees | 19,553 | 16,098 | ||||||

| Filing and regulatory | 13,949 | 14,612 | ||||||

| Foreign exchange | (41,442 | ) | (20,801 | ) | ||||

| Gain on settlement of debt | - | (1,608 | ) | |||||

| General and administrative | 59,487 | 55,302 | ||||||

| Geological, mineral, and prospect costs (Note 4) | 1,008,356 | 173,994 | ||||||

| Interest expense | 7,184 | - | ||||||

| Professional fees | 173,275 | 148,463 | ||||||

| Promotion and shareholder communication | 174,715 | 146,246 | ||||||

| Salaries | 45,000 | 45,000 | ||||||

| Net loss and comprehensive loss for the period | $ | 1,490,451 | $ | 595,306 | ||||

| Basic and diluted loss per common share | $ | (0.01 | ) | $ | (0.01 | ) | ||

| Weighted average number of common shares outstanding (basic and diluted) | 121,164,610 | 67,481,151 | ||||||

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

F-2

| RISE GOLD CORP. |

| (An Exploration Stage Company) |

| CONDENSED CONSOLIDATED INTERIM STATEMENT OF CASH FLOWS |

| (Expressed in Canadian Dollars) |

| (Unaudited) |

| FOR THE THREE MONTHS ENDED OCTOBER 31, | 2018 | 2017 | ||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Loss for the period | $ | (1,490,451 | ) | $ | (594,306 | ) | ||

| Items not involving cash | ||||||||

| Depreciation | 4,574 | - | ||||||

| Gain on settlement of debt | - | (1,608 | ) | |||||

| Unrealized loss on foreign exchange | 422 | 1,596 | ||||||

| Non-cash working capital item changes: | ||||||||

| Receivables | (6,925 | ) | 7,785 | |||||

| Prepaid expenses | 185,638 | (13,368 | ) | |||||

| Accounts payables and accrued liabilities | 113,817 | 9,817 | ||||||

| Net cash used in operating activities | (1,192,925 | ) | (590,084 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Mineral property | - | (372,078 | ) | |||||

| Net cash used in investing activities | - | (372,078 | ) | |||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Private placement | 2,140,750 | 1,061,571 | ||||||

| Repayment of equipment loan | (75,003 | ) | - | |||||

| Share issuance costs | - | (24,206 | ) | |||||

| Loan from related parties | 50,000 | - | ||||||

| Net cash provided by financing activities | 2,115,747 | 1,037,365 | ||||||

| Change in cash for the period | 922,822 | 75,203 | ||||||

| Cash, beginning of period | 69,616 | 337,099 | ||||||

| Cash, end of period | $ | 992,438 | $ | 412,302 | ||||

Supplemental cash flow information (Note 9)

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

F-3

| RISE GOLD CORP. |

| (An Exploration Stage Company) |

| CONDENSED CONSOLIDATED INTERIM STATEMENT OF STOCKHOLDERS’ EQUITY |

| (Expressed in Canadian Dollars) |

| (Unaudited) |

| Capital Stock | ||||||||||||||||||||||||

| Cumulative | ||||||||||||||||||||||||

| Additional Paid- | Translation | |||||||||||||||||||||||

| Number | Amount | in Capital | Adjustment | Equity | Total | |||||||||||||||||||

| Balance as at July 31, 2017 | 66,707,655 | $ | 66,708 | $ | 10,103,162 | $ | (166,663 | ) | $ | (6,027,924 | ) | $ | 3,975,283 | |||||||||||

| Shares issued for cash | 7,077,140 | 7,077 | 1,054,494 | - | - | 1,061,571 | ||||||||||||||||||

| Shares issued for debt | 417,184 | 417 | 95,535 | - | - | 95,952 | ||||||||||||||||||

| Share issuance costs | - | - | (18,249 | ) | - | - | (18,249 | ) | ||||||||||||||||

| Loss for the period | - | - | - | - | (594,306 | ) | (594,306 | ) | ||||||||||||||||

| Balance as at October 31, 2017 | 74,201,979 | $ | 74,202 | $ | 11,234,942 | $ | (166,663 | ) | $ | (6,622,230 | ) | $ | 4,520,251 | |||||||||||

| Balance as at July 31, 2018 | 116,105,982 | $ | 116,106 | $ | 16,280,575 | $ | (166,663 | ) | $ | (10,621,787 | ) | $ | 5,608,231 | |||||||||||

| Shares issued for cash | 22,384,375 | 22,384 | 2,117,866 | - | - | 2,140,250 | ||||||||||||||||||

| Loss for the period | - | - | - | - | (1,490,451 | ) | (1,490,451 | ) | ||||||||||||||||

| Balance as at October 31, 2018 | 138,490,357 | $ | 138,490 | $ | 18,398,441 | $ | (166,663 | ) | $ | (12,112,238 | ) | $ | 6,258,030 | |||||||||||

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

F-4

| RISE GOLD CORP. (FORMERLY RISE RESOURCES INC.) |

| (An Exploration Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEAR ENDED JULY 31, 2018 |

| (Expressed in Canadian Dollars) |

| 1. | NATURE AND CONTINUANCE OF OPERATIONS |

Rise Gold Corp. (the “Company”) was originally incorporated as Atlantic Resources Inc. in the State of Nevada on February 9, 2007 and is in the exploration stage. On April 11, 2012, the Company merged its wholly-owned subsidiary, Patriot Minefinders Inc., a Nevada corporation, in and to the Company to effect a name change to Patriot Minefinders Inc. On January 14, 2015, the Company completed a name change to Rise Resources Inc. in the same manner. On April 7, 2017, the Company changed its name to Rise Gold Corp. These mergers were carried out solely for the purpose of effecting these changes of names.

On February 16, 2015, the Company increased its authorized capital from 21,000,000 shares to 400,000,000 shares.

On January 29, 2016, the Company completed an initial public offering in Canada and began trading on the Canadian Securities Exchange (“CSE”) on February 1, 2016. On November 28, 2017, the Company ceased trading on the OTC Pink Market and began trading on the OTCQB Venture Market.

The Company is in the early stages of exploration and as is common with any exploration company, it raises financing for its acquisition activities. The accompanying condensed consolidated interim financial statements have been prepared on the going concern basis, which presumes that the Company will continue operations for the foreseeable future and will be able to realize assets and discharge liabilities in the normal course of business. The Company has incurred a loss of $1,490,451 for the period ended October 31, 2018 and has accumulated a deficit of $12,112,238. This raises substantial doubt about the Company’s ability to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company’s ability to maintain continued support from its shareholders and creditors and to raise additional capital and implement its business plan. The consolidated financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

At October 31, 2018, the Company had working capital of $299,475.

| 2. | BASIS OF PREPARATION |

Generally Accepted Accounting Principles

The accompanying unaudited condensed consolidated interim financial statements have been prepared in conformity with generally accepted accounting principles of the United States of America (“US GAAP”) and the rules and regulations of the Securities and Exchange Commission (“SEC”) for financial information with the instructions to Form 10-Q and Regulation S-K. Results are not necessarily indicative of results which may be achieved in the future. The unaudited condensed consolidated interim financial statements should be read in conjunction with the Company’s Annual Report on Form 10-K, which contains the audited financial statements and notes thereto, together with Management’s Discussion and Analysis, for the year ended July 31, 2018. Certain information and footnote disclosures normally included in the financial statements prepared in accordance with US GAAP have been condensed or omitted pursuant to such SEC rules and regulations. The operating results for the three months ended October 31, 2018 are not necessarily indicative of the results that may be expected for the year ended July 31, 2019.

Basis of Consolidation

These condensed consolidated interim financial statements include the accounts of the Company and its wholly-owned subsidiary Rise Grass Valley Inc. All significant intercompany accounts and transactions have been eliminated on consolidation.

F-5

| RISE GOLD CORP. (FORMERLY RISE RESOURCES INC.) |

| (An Exploration Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEAR ENDED JULY 31, 2018 |

| (Expressed in Canadian Dollars) |

| 2. | BASIS OF PREPARATION (continued) |

Basis of Consolidation (continued)

Subsidiaries

Subsidiaries are all entities over which the Company has exposure to variable returns from its involvement and has the ability to use power over the investee to affect its returns. The existence and effect of potential voting rights that are currently exercisable or convertible are considered when assessing whether the Company controls another entity. Subsidiaries are fully consolidated from the date on which control is transferred to the Company until the date on which control ceases.

The accounts of subsidiaries are prepared for the same reporting period as the parent company, using consistent accounting policies. Inter-company transactions, balances and unrealized gains or losses on transactions are eliminated upon consolidation.

Recently Adopted and Recently Issued Accounting Standards

In January 2016, the FASB issued ASU No. 2016-01, “Financial Instruments – Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Liabilities”. This ASU amendment addresses aspects of recognition, measurement, presentation and disclosure of financial instruments. It affects investments in equity securities and the presentation of certain fair value changes for financial liabilities measured at fair value, and simplifies the impairment assessment of equity investments without a readily determinable fair value by requiring a qualitative assessment. The ASU applies to all entities and is effective for annual periods beginning after December 15, 2017, and interim periods thereafter, with early adoption permitted. The Company is currently evaluating the impact of the adoption of this standard.

On February 25, 2016, the FASB issued ASU No. 2016-02, “Leases”. This ASU applies to public companies beginning January 1, 2019 and affects the requirement that lessees account for all leases – both operating and finance – on the balance sheet while recognizing both an asset for the right to use the leased asset and an obligation to make lease payments over the lease term. The Company is currently evaluating the impact of the adoption of this standard.

Other than the above, the Company has determined that other significant newly issued accounting pronouncements are either not applicable to the Company’s business or that no material effect is expected on the financial statements as a result of future adoption.

Use of Estimates

The preparation of these financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Significant areas requiring the use of estimates include the carrying value and recoverability of mineral properties and the recognition of deferred tax assets based on the change in unrecognized deductible temporary tax differences. Actual results could differ from those estimates, and would impact future results of operations and cash flows.

F-6

| RISE GOLD CORP. (FORMERLY RISE RESOURCES INC.) |

| (An Exploration Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEAR ENDED JULY 31, 2018 |

| (Expressed in Canadian Dollars) |

| 3. | PREPAID EXPENSES |

| October 31, 2018 | July 31, 2018 | |||||||

| Promotion and shareholder communication | $ | 272,621 | $ | 429,166 | ||||

| Insurance | 57,924 | 102,723 | ||||||

| Other | 16,206 | 500 | ||||||

| $ | 346,751 | $ | 532,389 | |||||

| 4. | MINERAL PROPERTY INTERESTS |

The Company’s mineral properties balance consists of:

| Idaho-Maryland, California | ||||

| Balance, July 31, 2017 | 3,789,854 | |||

| Additions | 1,657,820 | |||

| Balance, July 31, 2018 and October 31, 2018 | $ | 5,447,674 | ||

Title to mineral properties

Title to mineral properties involves certain inherent risks due to the difficulties of determining the validity of certain mineral titles as well as the potential for problems arising from the frequently ambiguous conveying history characteristic of many mineral properties. As at October 31, 2018, the Company holds title to the Idaho-Maryland Gold Mine Property.

As of October 31, 2018, based on management’s review of the carrying value of mineral rights, management determined that there is no evidence that the cost of these acquired mineral rights will not be fully recovered and accordingly, the Company determined that no adjustment to the carrying value of mineral rights was required. As of the date of these consolidated financial statements, the Company has not established any proven or probable reserves on its mineral properties and has incurred only acquisition and exploration costs.

Idaho-Maryland Gold Mine Property, California

On August 30, 2016, the Company entered into an option agreement with three parties to purchase a 100% interest in and to the Idaho-Maryland Gold Mine property located near Grass Valley, California, United States; pursuant to the option agreement, in order to exercise the option, the Company must pay US$2,000,000 by November 30, 2016. Upon execution of the option agreement, the Company paid the vendors a non-refundable cash deposit in the amount of $32,758 (US$25,000), which will be credited against the purchase price of US$2,000,000 upon exercise of the option. On November 30, 2016, the Company negotiated an extension of the closing date of the option agreement to December 26, 2016, in return for a cash payment of $32,758 (US$25,000), which will be credited against the purchase price of US$2,000,000 upon exercise of the option. On December 28, 2016, the Company negotiated a further no-cost extension of the closing date of the option agreement to April 30, 2017. On January 25, 2017, the Company exercised the option by paying $2,588,625 (US$1,950,000), and acquired a 100% interest in the Idaho-Maryland Gold Mine property.

F-7

| RISE GOLD CORP. (FORMERLY RISE RESOURCES INC.) |

| (An Exploration Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEAR ENDED JULY 31, 2018 |

| (Expressed in Canadian Dollars) |

| 4. | MINERAL PROPERTY INTERESTS (continued) |

Idaho-Maryland Gold Mine Property, California (continued)

In connection with the option agreement, the Company agreed to pay a cash commission of $184,000 (US$140,000) equal to 7 per cent of the purchase price of US$2,000,000; the commission was settled on January 25, 2017 through the issuance of 920,000 units valued at $0.20 per unit (Note 10). The Company also incurred additional transaction costs of $144,391, which have been included the carrying value of the Idaho-Maryland Gold Mine.

On January 6, 2017, the Company entered into an option agreement with Sierra Pacific Industries Inc. (“Sierra”) to purchase a 100% interest in and to certain surface rights totalling approximately 82 acres located near Grass Valley, California, United States, contiguous to the Idaho-Maryland Gold Mine property acquired by the Company on January 25, 2017. Pursuant to the option agreement, in order to exercise the option, the Company must pay US$1,900,000 by March 31, 2017. Upon execution of the option agreement, the Company paid the vendors a non-refundable cash deposit in the amount of $132,732 (US$100,000), which will be credited against the purchase price of US$1,900,000 upon exercise of the option. On April 3, 2017, the Company negotiated an extension of the closing date of the option agreement to June 30, 2017, in return for a cash payment of $268,000 (US$200,000), at which time a payment of US$1,600,000 is due in order to exercise the option. On June 7, 2017, the Company negotiated an extension of the closing date of the option agreement to September 30, 2017, in return for a cash payment of $406,590 (US$300,000), at which time a payment of US$1,300,000 is due in order to exercise the option.

On May 14, 2018, the Company completed the purchase of the surface rights totalling approximately 82 acres by making final payments totalling $1,657,820 (US$1,300,000).

As at October 31, 2018, the Company has incurred cumulative property investigation costs of $55,253 and cumulative exploration expenditures of $3,442,213 on the Idaho-Maryland Gold Mine property as follows:

| Three months ended October 31, 2018 | Year ended July 31, 2018 | |||||||

| Idaho-Maryland Gold Mine expenditures: | ||||||||

| Opening balance | $ | 2,433,857 | $ | 375,980 | ||||

| Consulting | 106,926 | 352,988 | ||||||

| Exploration | 627,593 | 1,030,710 | ||||||

| Rent | 39,535 | 32,380 | ||||||

| Supplies | 83,784 | 246,656 | ||||||

| Sampling | 72,714 | 278,344 | ||||||

| Logistics | 77,804 | 116,799 | ||||||

| Total expenditures for the year | $ | 1,008,356 | $ | 2,057,877 | ||||

| Closing balance | $ | 3,442,213 | $ | 2,433,857 | ||||

F-8

| RISE GOLD CORP. (FORMERLY RISE RESOURCES INC.) |

| (An Exploration Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEAR ENDED JULY 31, 2018 |

| (Expressed in Canadian Dollars) |

| 5. | EQUIPMENT AND EQUIPMENT LOAN |

On June 7, 2018, the Company purchased two diamond core drilling rigs for exploration at the Idaho-Maryland Gold Project for a total purchase price of $624,459. The purchase is financed and will be paid in equal monthly instalments of $27,396 per month over a 24-month period with an interest rate of 5% per annum. Cumulative interest expense incurred for the equipment purchase as at October 31, 2018 is $9,786.

During the year ended July 31, 2018, the Company also purchased additional drilling equipment for a total of $89,213.

| Purchases | 713,672 | |||

| At July 31, 2018 | $ | 713,672 | ||

| Purchases | - | |||

| At October 31, 2018 | $ | 713,672 | ||

| Accumulated depreciation | ||||

| At July 31, 2017 | $ | - | ||

| Depreciation | 2,306 | |||

| At July 31, 2018 | $ | 2,306 | ||

| Depreciation | 4,574 | |||

| At October 31, 2018 | $ | 6,880 | ||

| Total carrying value, July 31, 2018 | $ | 711,366 | ||

| Total carrying value, October 31, 2018 | $ | 706,792 |

During the year ended July 31, 2018, the Company recorded an equipment loan of $624,459 in connection with the two diamond core drilling rigs purchased. The Company paid $109,584 including $9,786 of interest towards this loan as at October 31, 2018. As at October 31, 2018, the outstanding balance on this loan was $524,662, out of which $328,751 has been classified as the current portion.

F-9

| RISE GOLD CORP. (FORMERLY RISE RESOURCES INC.) |

| (An Exploration Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEAR ENDED JULY 31, 2018 |

| (Expressed in Canadian Dollars) |

| 6. | CONTINGENCY |

During the year ended July 31, 2014, the Company entered into a binding letter of intent (“LOI”) with Wundr Software Inc. (“Wundr”). Under the terms of the LOI, the Company would acquire 100% of the issued and outstanding common shares of Wundr. Due to unforeseen circumstances, the Company did not complete the transactions contemplated in the LOI, which the Company announced had expired on January 10, 2014.

On September 17, 2014, the Company learned that it was the subject, along with a number of additional defendants, of a notice of civil claim (the “Claim”) filed in the Supreme Court of British Columbia by Wundr, under which Wundr is seeking general damages from the Company as well as damages for conspiracy to cause economic harm. None of the allegations contained in the Claim have been proven in court. Management has determined that the probability of the Claim resulting in an unfavourable outcome and financial loss to the Company is unlikely.

| 7. | RELATED PARTY TRANSACTIONS |

Key management personnel consist of the Chief Executive Officer, Chief Financial Officer, and the directors of the Company. The remuneration of the key management personnel is as follows:

| a) | Salaries of $45,000 (2017 - $45,000) to the CEO of the Company. |

| b) | Consulting fees of $20,000 (2017 - $12,000) to the former CFO of the Company, and consulting fees of $5,800 (2017 - $6,000) to the former CEO of the Company. |

| c) | Directors fees of $19,553 (2017 - $16,098) to directors of the Company. |

| d) | During the period ended October 31, 2018, the Company paid $15,000 (2017 - $Nil) in professional fees to a company controlled by a director of the Company. |

As at October 31, 2018, the Company has recorded loans from related parties of $60,646 and $39,426 (US$30,500) (July 31, 2018 -10,000 and $39,150 (US$30,500) respectively) representing advances made by a director and two former directors. The advances are due on demand without interest.

As at October 31, 2018, included in accounts payable and accrued liabilities is $121,414 (July 31, 2018 - $68,521) in accounts and advances payable and accrued liabilities to current and former directors, officers and companies controlled by directors and officers of the Company.

F-10

| RISE GOLD CORP. (FORMERLY RISE RESOURCES INC.) |

| (An Exploration Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEAR ENDED JULY 31, 2018 |

| (Expressed in Canadian Dollars) |

| 8. | CAPITAL STOCK AND ADDITIONAL PAID-IN-CAPITAL |

Issued Capital Stock

On August 9, 2017, the Company issued 417,184 units to a third party pursuant to a debt conversion by the third party in the amount of $95,952, representing finders’ fees payable on the private placement which closed May 5, 2017. Each unit consists of one share of common stock and one transferable share purchase warrant exercisable into one share of common stock at a price of $0.40 for a period of two years from the date of issuance. At the time of issuance, the units had a fair value of $60,491 ($0.145 per unit); accordingly, the Company recognized a gain on settlement of debt of $35,461 for the nine month period ended April 30, 2018.

On January 29, 2018, the Company issued a total of 192,670 shares of common stock upon the exercise of finders’ warrants at a price of $0.10 per share.

Private Placements

On September 26, 2017, the Company completed the first tranche of a non-brokered private placement, issuing an aggregate of 7,077,140 units at a price of $0.15 per unit for gross proceeds of $1,061,570. Each unit consisted of one share of common stock and one non-transferable share purchase warrant exercisable into one share of common stock at a price of $0.25 for a period of two years from the date of issuance. In connection with the private placement, the Company paid finders fees of $540 and issued a total of 3,600 finders’ warrants valued at $388 (discount rate – 1.59%, volatility – 150.97%, expected life – 2 years, dividend yield – 0%), exercisable into one share of common stock at a price of $0.25 for a period of two years from the date of issuance.

On December 27, 2017, the Company completed the second tranche of a non-brokered private placement, issuing an aggregate of 6,417,000 units at a price of $0.15 per unit for gross proceeds of $962,550. Each unit consisted of one share of common stock and one non-transferable share purchase warrant exercisable into one share of common stock at a price of $0.25 for a period of two years from the date of issuance. In connection with the private placement, the Company paid finders fees of $55,779 and issued a total of 371,860 finders’ warrants valued at $28,997 (discount rate – 1.64%, volatility – 139.85%, expected life – 2 years, dividend yield – 0%), exercisable into one share of common stock at a price of $0.25 for a period of two years from the date of issuance.

On January 3, 2018, the Company completed the third and final tranche of a non-brokered private placement, issuing an aggregate of 133,333 units at a price of $0.15 per unit for gross proceeds of $20,000. Each unit consisted of one share of common stock and one non-transferable share purchase warrant exercisable into one share of common stock at a price of $0.25 for a period of two years from the date of issuance.

On April 18, 2018, the Company completed a non-brokered private placement, issuing an aggregate of 35,161,000 units at a price of $0.10 per unit for gross proceeds of $3,516,100. Each unit consisted of one share of common stock and one non-transferable share purchase warrant exercisable into one share of common stock at a price of $0.15 for a period of three years from the date of issuance. In connection with the private placement, the Company paid finders fees of $2,100 and issued a total of 21,000 finders’ warrants valued at $1,467 (discount rate – 1.88%, volatility – 123.60%, expected life – 2 years, dividend yield – 0%), exercisable into one share of common stock at a price of $0.15 for a period of two years from the date of issuance.

On August 31, 2018, the Company completed a first tranche of a non-brokered private placement, issuing an aggregate of 2,881,250 units at a price of $0.08 per unit for gross proceeds of $230,500. Each unit consists of one share of common stock and one share purchase warrant exercisable into one share of common stock at a price of $0.12 for a period of three years from the date of issuance until August 31, 2021.

F-11

| RISE GOLD CORP. (FORMERLY RISE RESOURCES INC.) |

| (An Exploration Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEAR ENDED JULY 31, 2018 |

| (Expressed in Canadian Dollars) |

| 8. | CAPITAL STOCK AND ADDITIONAL PAID-IN-CAPITAL (continued) |

Private Placements (continued)

On September 17, 2018 completed a second tranche of a non-brokered private placement, issuing an aggregate of 2,003,125 units at a price of $0.08 per unit for gross proceeds of $160,250. Each unit consists of one share of common stock and one share purchase warrant exercisable into one share of common stock at a price of $0.12 for a period of three years from the date of issuance until September 17, 2021.

On October 16, 2018, the Company completed a strategic initial investment in a financing of $1.75 million by issuing 17,500,000 Units to Meridian Jerritt Canyon Corp., a wholly-owned subsidiary of Yamana Gold Inc. Each unit consists of one common stock at a price of $0.10 per Unit and one-half of one share purchase warrant at a price of $0.13 exercisable until October 16, 2020. As a result of the investment, the investor owns approximately 12.6% of the Company’s issued and outstanding shares on a non-diluted basis. In conjunction with the investment, the Company will issue 875,000 share purchase warrants as a finder’s fee (“Finder’s Warrants”) to Southern Arc Minerals Inc. Each finder’s Warrant entitles the holder to acquire one share at an exercise price of $0.13 until October 16, 2020.

Stock Options

During the year ended July 31, 2018, the Company granted a total of 6,381,000 stock options to employees, officers, directors, and consultants of the Company, exercisable at a weighted average price of $0.12 per share for a period of five years;

The following incentive stock options were outstanding at October 31, 2018:

| Number of Options | Exercise Price | Expiry Date | |||||||

| 1,100,000 | $ | 0.15 | March 22, 2021 | ||||||

| 586,600 | 0.20 | August 8, 2021 | |||||||

| 2,142,542 | 0.24 | December 27, 2021 | |||||||

| 500,000 | 0.27 | April 3, 2022 | |||||||

| 900,000 | 0.28 | April 20, 2020 | |||||||

| 6,381,000 | 0.12 | April 19, 2023 | |||||||

| 11,610,142 | $ | 0.17 | |||||||

F-12

| RISE GOLD CORP. (FORMERLY RISE RESOURCES INC.) |

| (An Exploration Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEAR ENDED JULY 31, 2018 |

| (Expressed in Canadian Dollars) |

| 8. | CAPITAL STOCK AND ADDITIONAL PAID-IN-CAPITAL (continued) |

Stock Options (continued)

Stock option transactions are summarized as follows:

| Number of Options | Weighted Average Exercise Price | Aggregate Intrinsic Value | ||||||||||

| Balance, July 31, 2017 | 5,729,142 | $ | 0.24 | Nil | ||||||||

| Options granted | 6,381,000 | 0.12 | Nil | |||||||||

| Options expired/forfeited | (500,000 | ) | (0.33 | ) | Nil | |||||||

| Balance outstanding and exercisable, July 31, 2018 and October 31, 2018 | 11,610,142 | $ | 0.17 | Nil | ||||||||

Warrants

The following warrants were outstanding at October 31, 2018:

| Number of Warrants | Exercise Price | Expiry Date | |||||||

| 22,148,800 | 0.40 | December 23, 2018 | |||||||

| 2,286,100 | 0.40 | January 24, 2019 | |||||||

| 465,500 | 0.40 | February 6, 2019 | |||||||

| 9,863,486 | 0.40 | May 5, 2019 | |||||||

| 7,080,740 | 0.25 | September 25, 2019 | |||||||

| 6,788,860 | 0.25 | December 27, 2019 | |||||||

| 133,333 | 0.25 | January 3, 2020 | |||||||

| 21,000 | 0.15 | April 18, 2020 | |||||||

| 35,161,000 | 0.15 | April 18, 2021 | |||||||

| 2,881,250 | 0.12 | August 31, 2021 | |||||||

| 2,003,125 | 0.12 | September 17, 2021 | |||||||

| 9,625,000 | 0.13 | October 15, 2020 | |||||||

| 98,458,194 | $ | 0.25 | |||||||

F-13

| RISE GOLD CORP. (FORMERLY RISE RESOURCES INC.) |

| (An Exploration Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEAR ENDED JULY 31, 2018 |

| (Expressed in Canadian Dollars) |

| 8. | CAPITAL STOCK AND ADDITIONAL PAID-IN-CAPITAL (continued) |

Warrants (continued)

Warrant transactions are summarized as follows:

| Number of Warrants | Weighted Average Exercise Price | |||||||

| Balance, July 31, 2017 | 36,039,372 | $ | 0.39 | |||||

| Warrants issued | 49,602,117 | 0.18 | ||||||

| Warrants Expired | (1,500,000 | ) | ||||||

| Warrants exercised | (192,670 | ) | (0.10 | ) | ||||

| Balance, July 31, 2018 | 83,948,819 | $ | 0.27 | |||||

| Warrants issued | 14,509,375 | 0.19 | ||||||

| Balance, October 31, 2018 | 98,458,194 | $ | 0.25 | |||||

The following weighted average assumptions were used for the Black-Scholes pricing model valuation of finders’ warrants issued during the period ended October 31, 2017:

| 2018 | 2017 | |||||||

| Risk-free interest rate | 1.65 | % | 0.76 | % | ||||

| Expected life of warrants | 2.0 years | 2.0 years | ||||||

| Expected annualized volatility | 139.09 | % | 179.45 | % | ||||

| Dividend | Nil | Nil | ||||||

| Forfeiture rate | 0 | % | 0 | % | ||||

Share-Based Payments

The Company has a stock option plan under which it is authorized to grant options to executive officers and directors, employees and consultants enabling them to acquire up to 10% of the issued and outstanding common stock of the Company. Under the plan the exercise price of each option equals the market price of the Company’s stock, less any applicable discount, as calculated on the date of grant. The options can be granted for a maximum term of 5 years with vesting determined by the board of directors.

The company issued no share purchase options during the period ended October 31, 2018 and 2017.

F-14

| RISE GOLD CORP. (FORMERLY RISE RESOURCES INC.) |

| (An Exploration Stage Company) |

| NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS |

| FOR THE YEAR ENDED JULY 31, 2018 |

| (Expressed in Canadian Dollars) |

| 9. | SUPPLEMENTAL DISCLOSURE WITH RESPECT TO CASH FLOWS |

During the three month period ended October 31, 2017, the Company:

| a) | Issued 3,600 finders’ warrants valued at $388 (Note 7); |

| b) | Issued 417,184 units, each unit comprised of one share of common stock and one share purchase warrant, valued at $95,952, pursuant to a debt conversion in relation to finders’ fees payable on the private placement which closed on May 5, 2017 (Note 7); and |

| c) | Accrued $1,600 in share issuance costs through accounts payable and accrued liabilities. |

| 10. | SEGMENTED INFORMATION |

A reporting segment is defined as a component of the Company that:

| - | Engages in business activities from which it may earn revenues and incur expenses; |

| - | Operating results are reviewed regularly by the entity’s chief operating decision maker; and |

| - | Discrete financial information is available |

The Company has determined that it operates its business in one geographical segment located in California, United States, where all of its equipment and mineral property interests are located.

| 11. | SUBSEQUENT EVENTS |

On November 5, 2018, the Company raised a total of $750,000 through the sale of 7,500,000 units (each a “Unit”) at $0.10 per Unit where each Unit consists of one share of common stock (a “Share”) and one half of one share purchase warrant (a “Warrant”). Each whole Warrant entitles the holder to acquire one Share at an exercise price of $0.13 until November 5, 2020. All 7,500,000 Units issued in the final tranche were acquired by Southern Arc Minerals Inc. (“Southern Arc”). All securities issued pursuant to the Private Placement will be subject to statutory hold periods in accordance with applicable United States and Canadian securities laws.

On November 30, 2018, the Company granted 2,900,000 stock options to employees and directors of the Company. The options are exercisable at $0.10 per share for a period of five years and expire on November 29, 2023.

F-15

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

SPECIAL NOTE OF CAUTION REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this report, including statements in the following discussion, are what are known as “forward looking statements”, which are basically statements about the future. For that reason, these statements involve risk and uncertainty since no one can accurately predict the future. Words such as “plans”, “intends”, “will”, “hopes”, “seeks”, “anticipates”, “expects” and the like often identify such forward looking statements, but are not the only indication that a statement is a forward looking statement. Such forward looking statements include statements concerning our plans and objectives with respect to present and future operations, and statements which express or imply that such present and future operations will or may produce revenues, income or profits. Numerous factors and future events could cause US to change such plans and objectives or fail to successfully implement such plans or achieve such objectives, or cause such present and future operations to fail to produce revenues, income or profits. Therefore, the following discussion should be considered in light of the discussion of risks and other factors contained in this QUARTERLY report on Form 10-Q and in OUR other filings with the Securities and Exchange Commission. No statements contained in the following discussion should be construed as a guarantee or assurance of future performance or future results.

Description of Business

The Company is a mineral exploration company and its primary asset is a major past producing high grade property near Grass Valley, California, United States, which it owns outright. The Company has held several other potential mineral properties in British Columbia, Canada, which were recently written off based on the strength of the Grass Valley asset. The Company’s common stock is currently traded on the OTC Markets under the symbol “RYES”, and is listed on the Canadian Securities Exchange (the “CSE”) under the symbol “RISE”. The Company ceased to be an OTC reporting issuer in Canada on February 2, 2016.

On May 18, 2015, the Company entered into an option agreement (the “Option Agreement”) with Eastfield Resources Ltd., a British Columbia company with its common shares listed for trading on the TSX Venture Exchange under the symbol “ETF” (“Eastfield”), pursuant to which Eastfield granted the Company the exclusive and irrevocable option to acquire up to a 75% undivided interest in and to certain mineral claims known as the Indata property located in the Omineca Mining Division in British Columbia, Canada (the “Indata Property”), by paying Eastfield an aggregate of $450,000 in cash, incurring a minimum of $2,500,000 in aggregate exploration expenditures on the Indata Property, and completing a feasibility study on the property. On May 5, 2017, the Company terminated the Option Agreement and wrote off $50,000 in acquisition costs relating to Indata during the year ended July 31, 2017.

Prior to entering into the Option Agreement, the Company was an exploration stage company engaged in exploring and evaluating potential strategic transactions in multiple industries, including but not limited to mineral properties and technology.

On May 31, 2016, the Company entered into a property purchase agreement (the “Purchase Agreement”) with Klondike Gold Corp., a British Columbia company with its common shares listed for trading on the TSX Venture Exchange under the symbol “KG” (“Klondike”), regarding the purchase of a portfolio of seven gold and base metal properties in southeast British Columbia consisting of 150 mining claims with a total area of 28,000 hectares (collectively, the “Klondike Properties”). Under the Purchase Agreement, on July 13, 2016 (the “First Closing”), the Company paid Klondike $50,000 in cash, issued 1,500,000 shares of the Company’s common stock, and issued 1,500,000 warrants exercisable at a price of $0.227 per share until July 13, 2018. On the one year anniversary of the First Closing, the Company was required to pay Klondike $150,000 in cash, issue 2,000,000 shares of the

3

Company’s common stock, and issue 1,000,000 warrants. Klondike would have retained a 2% net smelter return royalty (“NSR”) and the Company would have had the right to purchase 50% of the NSR for $1,000,000 at any time after the First Closing. Each of the warrants would have been exercisable for a period of two years into one share of the Company’s common stock at a price that is a 20% premium to the 10-day volume-weighted average price of the stock on the CSE immediately prior to the date of issuance. On July 17, 2017, the Company terminated the Purchase Agreement by making a one-time payment of $100,000 in cash to Klondike; accordingly, the Company wrote off $513,031 in acquisition costs relating to the Klondike Properties during the year ended July 31, 2017.

On August 30, 2016, the Company entered into an option agreement with three parties to purchase a 100% interest in and to the Idaho-Maryland Gold Mine property (the “I-M Mine Property”) located near Grass Valley, California, United States; pursuant to the option agreement, in order to exercise the option, the Company agreed to pay US$2,000,000 by November 30, 2016. Upon execution of the option agreement, the Company paid the vendors a non-refundable cash deposit in the amount of $32,758 (US$25,000), which was to be credited against the purchase price of US$2,000,000 upon exercise of the option. On November 30, 2016, the Company negotiated an extension of the closing date of the option agreement to December 26, 2016, in return for a cash payment of $32,758 (US$25,000), which also was to be credited against the purchase price of US$2,000,000 upon exercise of the option. On December 28, 2016, the Company negotiated a further no-cost extension of the closing date of the option agreement to January 31, 2017. On January 25, 2017, the Company exercised the option by paying $2,588,625 (US$1,950,000), and acquired a 100% interest in the Idaho-Maryland Gold Mine property. In connection with the option agreement, the Company agreed to pay a cash commission of $184,000 (US$140,000) equal to 7 per cent of the purchase price of US$2,000,000; the commission was settled on January 25, 2017 through the issuance of 920,000 units valued at $0.20 per unit, each unit consisting of one share of common stock and one transferable share purchase warrant exercisable into one share of common stock at a price of $0.40 for a period of two years from the date of issuance.

The Company has completed and announced the results of an exploration program on the I-M Mine Property, following a plan outlined in a National Instrument 43-101 report filed on June 1, 2017. This report was created through processing historic data on the I-M Mine Property obtained from the vendors.

On December 23, 2016, the Company completed a non-brokered private placement, issuing an aggregate of 21,044,500 units at a price of $0.20 per unit for gross proceeds of $4,208,900. Each unit consisted of one share of common stock and one transferable share purchase warrant exercisable into one share of common stock at a price of $0.40 for a period of two years from the date of issuance. In connection with the private placement, the Company paid finders fees of $218,410 and issued a total of 1,104,300 finders’ warrants exercisable into one share of common stock at a price of $0.40 for a period of two years from the date of issuance.

On January 6, 2017, the Company entered into an option agreement with Sierra Pacific Industries Inc. (“Sierra Pacific”) to purchase a 100% interest in and to certain surface rights totalling approximately 82 acres located near Grass Valley, California, United States, contiguous to the Idaho-Maryland Gold Mine property acquired by the Company on January 25, 2017. Pursuant to the option agreement, in order to exercise the option, the Company was to have paid US$1,900,000 by March 31, 2017. Upon execution of the option agreement, the Company paid the vendors a non-refundable cash deposit in the amount of $132,732 (US$100,000), which was credited against the purchase price of US$1,900,000 upon exercise of the option. On April 3, 2017, in return for a cash payment of $268,000 (US$200,000), the Company negotiated an extension of the closing date of the option agreement to June 30, 2017, at which time a payment of US$1,600,000 was to be due in order to exercise the option. On June 7, 2017, the Company negotiated a second extension of the closing date of the option agreement to September 30, 2017 in return for a cash payment of $406,590 (US$300,000), which was credited against the remaining purchase price of US$1,600,000 upon exercise of the option. On September 1, 2017, the Company negotiated a third extension of the closing date of the option agreement to June 30, 2018 in return for cash payments as follows: US$300,000 by September 30, 2017 (paid), US$300,000 by December 30, 2017 (paid), US$300,000 by March 30, 2018 (paid), and a final payment of US$400,000 by June 30, 2018. At the date of this MD&A, all payments have been made resulting in the Company fully exercising its option and purchase of the property from Sierra Pacific effective as of May 15, 2018.

On January 24, 2017, the Company completed a non-brokered private placement, issuing an aggregate of 1,340,000 units at a price of $0.20 per unit for gross proceeds of $268,000. Each unit consisted of one share of common stock

4

and one transferable share purchase warrant exercisable into one share of common stock at a price of $0.40 for a period of two years from the date of issuance. In connection with the private placement, the Company paid finders’ fees of $5,220 and issued a total of 26,100 finders’ warrants exercisable into one share of common stock at a price of $0.40 for a period of two years from the date of issuance.

On February 6, 2017, the Company completed a non-brokered private placement, issuing an aggregate of 455,000 units at a price of $0.25 per unit for gross proceeds of $113,750. Each unit consisted of one share of common stock and one transferable share purchase warrant exercisable into one share of common stock at a price of $0.40 for a period of two years from the date of issuance. In connection with the private placement, the Company paid finders’ fees of $2,625 and issued a total of 10,500 finders’ warrants exercisable into one share of common stock at a price of $0.40 for a period of two years from the date of issuance.

On May 5, 2017, the Company completed a non-brokered private placement, issuing an aggregate of 9,009,814 units at a price of $0.23 per unit for gross proceeds of $2,072,257. Each unit consists of one share of common stock and one transferable share purchase warrant exercisable into one share of common stock at a price of $0.40 for a period of two years from the date of issuance. In connection with the private placement, the Company paid finders’ fees of $100,392 and issued a total of 436,488 finders’ warrants exercisable into one share of common stock at a price of $0.40 for a period of two years from the date of issuance.

On September 26, 2017, the Company completed a non-brokered private placement, issuing an aggregate of 7,077,140 units at a price of $0.15 per unit for gross proceeds of $1,061,570. Each unit consisted of one share of common stock and one non-transferable share purchase warrant exercisable into one share of common stock at a price of $0.25 for a period of two years from the date of issuance. In connection with the private placement, the Company paid finders fees of $540 and issued a total of 3,600 finders’ warrants exercisable into one share of common stock at a price of $0.25 for a period of two years from the date of issuance.

On December 27, 2017, the Company completed the second tranche of a non-brokered private placement, issuing an aggregate of 6,417,000 units at a price of $0.15 per unit for gross proceeds of $962,550. Each unit consisted of one share of common stock and one non-transferable share purchase warrant exercisable into one share of common stock at a price of $0.25 for a period of two years from the date of issuance. In connection with the private placement, the Company paid finders fees of $55,779 and issued a total of 371,860 finders’ warrants exercisable into one share of common stock at a price of $0.25 for a period of two years from the date of issuance.

On January 3, 2018, the Company completed the third and final tranche of a non-brokered private placement, issuing an aggregate of 133,333 units at a price of $0.15 per unit for gross proceeds of $20,000. Each unit consisted of one share of common stock and one non-transferable share purchase warrant exercisable into one share of common stock at a price of $0.25 for a period of two years from the date of issuance.

On February 12, 2018, 500,000 stock options exercisable at a price of $0.33 were cancelled pursuant to a contract termination.

On April 18, 2018, the Company completed a non-brokered private placement, issuing an aggregate of 35,161,000 units at a price of $0.10 per unit for gross proceeds of $3,516,100. Each unit consisted of one share of common stock and one non-transferable share purchase warrant exercisable into one share of common stock at a price of $0.15 for a period of three years from the date of issuance. In connection with the private placement, the Company paid finders fees of $2,100 and issued a total of 21,000 finders’ warrants exercisable into one share of common stock at a price of $0.15 for a period of two years from the date of issuance.

On April 19, 2018, the Company granted an aggregate of 6,381,000 stock options to its employees, officers, directors, and consultants, each option exercisable at a price of $0.12 for a period of five years.

On August 31, 2018, the Company completed a first tranche of a non-brokered private placement, issuing an aggregate of 2,881,250 units at a price of $0.08 per unit for gross proceeds of $230,500. Each unit consists of one share of common stock and one share purchase warrant exercisable into one share of common stock at a price of $0.12 for a period of three years from the date of issuance until August 31, 2021.

5

On September 17, 2018 completed a second tranche of a non-brokered private placement, issuing an aggregate of 2,003,125 units at a price of $0.08 per unit for gross proceeds of $160,250. Each unit consists of one share of common stock and one share purchase warrant exercisable into one share of common stock at a price of $0.12 for a period of three years from the date of issuance until September 17, 2021.

On October 16, 2018, the Company completed a strategic initial investment in a financing of $1.75 million by issuing 17,500,000 Units to Meridian Jerritt Canyon Corp., a wholly-owned subsidiary of Yamana Gold Inc. Each unit consists of one common stock at a price of $0.10 per Unit and one-half of one share purchase warrant at a price of $0.13 exercisable until October 16, 2020. As a result of the investment, the investor owns approximately 12.6% of the Company’s issued and outstanding shares on a non-diluted basis. In conjunction with the investment, the Company will issue 875,000 share purchase warrants as a finder’s fee (“Finder’s Warrants”) to Southern Arc Minerals Inc. Each finder’s Warrant entitles the holder to acquire one share at an exercise price of $0.13 until October 16, 2020.

On November 5, 2018, the Company raised a total of $750,000 through the sale of 7,500,000 units (each a “Unit”) at $0.10 per Unit where each Unit consists of one share of common stock (a “Share”) and one half of one share purchase warrant (a “Warrant”). Each whole Warrant entitles the holder to acquire one Share at an exercise price of $0.13 until November 5, 2020. All 7,500,000 Units issued in the final tranche were acquired by Southern Arc Minerals Inc. (“Southern Arc”). All securities issued pursuant to the Private Placement will be subject to statutory hold periods in accordance with applicable United States and Canadian securities laws.

On November 30, 2018, the Company granted 2,900,000 stock options to employees and directors of the Company. The options are exercisable at $0.10 per share for a period of five years and expire on November 29, 2023.

Plan of Operations

As at October 31, 2018, the Company had a cash balance of $992,438, compared to a cash balance of $69,616 as of July 31, 2018.

Our plan of operations for the next 12 months is to continue our current diamond drilling exploration activities at the I-M Mine Property.

Rise has initiated but not yet completed an exploration drilling program on the I-M Mine Property to date.

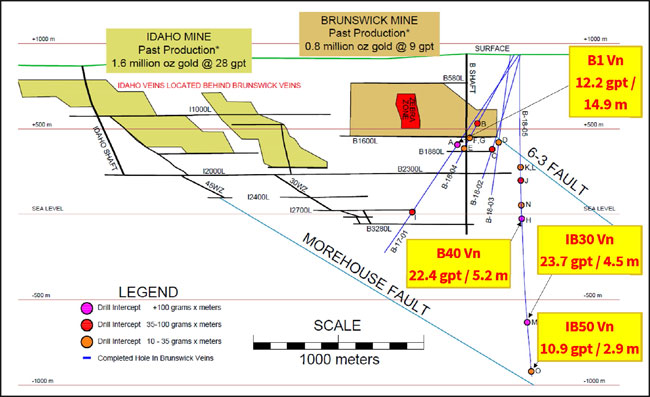

Up to October 31th 2018, Rise has completed ten drill holes, B-17-01, B-18-02 thru B-18-07, Z-18-08 & Z-18-09m and I-18-10 for total drilling of ~9,214 meters. Assay results for drill holes up to B-18-05 have been released as at October 31st, 2018.

Exploration drilling at the Brunswick portion of the Idaho-Maryland Gold project has been successful with numerous gold bearing veins intersected and previously released in 2018 on January 3rd, June 28th, July 23rd, and August 7th. A summary of drill highlights for the program released to date is presented in Table 4 and illustrated in Figure 8 below.

6

Previously Released Drill Intercept Highlights from B-17-01 to B-18-05*

| BRUNSWICK CONFIRMATION HOLES (B1600L-B2300L) | ||||||||||||||

| Hole | From (m) | To (m) | Gold (gpt) | Intercept Length (m) | Estimated True Width (m) | Vein | Map Ref | |||||||

| B-17-01 | 638.9 | 653.8 | 12.2 | 14.9 | 7.8 | B1 | A | |||||||

| Including | 643.7 | 646.5 | 62.7 | 2.7 | B1 Center | |||||||||

| Including | 645.0 | 645.6 | 266.0 | 0.6 | ||||||||||

| B-18-04 | 516.9 | 521.0 | 8.0 | 4.1 | 3.0 | B32 | C | |||||||

| Including | 516.9 | 518.0 | 23.0 | 1.1 | ||||||||||

| B-18-02 | 578.4 | 582.8 | 7.9 | 4.4 | 1.0 - 3.4 | B116 or B1 | C | |||||||

| B-18-03 | 516.6 | 518.6 | 6.0 | 2 | 1.7 | B1 East | D | |||||||

| B-18-04 | 711.9 | 715.2 | 5.1 | 2.3 | 1.8 | B18 | E | |||||||

| B-18-04 | 625.2 | 628.0 | 4.0 | 2.8 | 2.1 | B10 | F | |||||||

| B-18-04 | 637.0 | 640.0 | 4.4 | 3 | 2.3 | B10 | G | |||||||

| BRUNSWICK EXTENSION HOLES (B2300L-B3280L) | ||||||||||||||

| Hole | From (m) | To (m) | Gold (gpt) | Intercept Length (m) | Estimated True Width (m) | Vein | Map Ref | |||||||

| B-18-05 | 978.1 | 983.3 | 22.4 | 5.2 | 2.6 | B40 | H | |||||||

| Including | 978.1 | 979.3 | 93.2 | 1.2 | ||||||||||

| B-17-01 | 1111.6 | 1126.8 | 4.5 | 15.2 | ? | ? | I | |||||||

| Including | 1112.1 | 1113.6 | 40.6 | 1.5 | ||||||||||

| B-18-05 | 748.3 | 763.6 | 2.6 | 15.3 | 11.0 | B41 | J | |||||||

| B-18-05 | 667.9 | 671.4 | 5.9 | 3.5 | 2.0 | B6 | K | |||||||

| Including | 670.3 | 671.4 | 13.0 | 1.1 | ||||||||||

| B-18-05 | 682.9 | 690.4 | 2.4 | 7.5 | 4.1 | B6 | L | |||||||

| B-18-05 | 899.6 | 905.5 | 2.5 | 5.9 | 3.4 | B39 | N | |||||||

| IDAHO DEEP DRILLING (~1km BELOW MINE) | ||||||||||||||

| Hole | From (m) | To (m) | Gold (gpt) | Intercept Length (m) | Estimated True Width (m) | Vein | Map Ref | |||||||

| B-18-05 | 1590.1 | 1594.6 | 23.7 | 4.5 | 3.2 | IB30 | M | |||||||

| Including | 1593.6 | 1594.0 | 230.0 | 0.4 | ||||||||||

| B-18-05 | 1887.5 | 1890.4 | 10.9 | 2.9 | 2.0 | IB50 | O | |||||||

| Including | 1889.4 | 1889.9 | 61.0 | 0.5 | ||||||||||

| * | Details of drill intercepts in previous Rise Gold news releases previously released in 2018 on January 3rd, June 28th, July 23rd, and August 7th. |

7

Long section Showing Drill Results Previously Released

We have implemented a quality control program for our drill program to ensure best practices in the sampling and analysis of the drill core. This includes the insertion of blind blanks, duplicates and certified standards. HQ and NQ sized drill core is saw cut with half of the drill core sampled at intervals based on geological criteria including lithology, visual mineralization, and alteration. The remaining half of the core is stored on-site at our warehouse in Grass Valley, California. Drill core samples are transported in sealed bags to ALS Minerals analytical assay lab in Reno, Nevada.

All gold assays were obtained using a method of screen fire assaying. The Historic I-M Mine Project is known to contain ‘coarse’ gold, for which a screen fire assay is the best way to obtain a definitive result. This procedure involves screening a large pulverized sample of up to 1 kg at 100 microns. The entire oversize (including the disposable screen) is fire assayed as this contains the ‘coarse’ gold and a duplicate determination is made on the ‘minus’ 100 micron fraction. A calculation can then be made to determine the total weight of gold in the sample. Any +100 micron material remaining on the screen is retained and analyzed in its entirety by fire assay with gravimetric finish and reported as the Au (+) fraction result. The –100 micron fraction is homogenized and two sub-samples of 50 grams are analyzed by fire assay with AAS finish. If the grade of the material exceeds 10 gpt the sample is re-assayed using a gravimetric finish. The average of the two results is taken and reported as the Au (-) fraction result. All three values are used in calculating the combined gold content of the plus and minus fractions.

We have not attained profitable operations and are dependent upon obtaining financing to pursue our proposed exploration activities. For these reasons, our auditors believe that there is substantial doubt that we will be able to continue as a going concern.

8

Results of Operations

For the Periods Ended October 31, 2018 and 2017

The Company’s operating results for the periods ended October 31, 2018 and 2017 are summarized as follows:

| FOR THE THREE MONTHS ENDED OCTOBER 31, | 2018 | 2017 | ||||||

| EXPENSES | ||||||||

| Consulting | $ | 25,800 | $ | 18,000 | ||||

| Depreciation (Note 6) | 4,574 | - | ||||||

| Directors’ fees | 19,553 | 16,098 | ||||||

| Filing and regulatory | 13,949 | 14,612 | ||||||

| Foreign exchange | (41,442 | ) | (20,801 | ) | ||||

| Gain on settlement of debt (Note 10) | - | (1,608 | ) | |||||

| General and administrative | 59,487 | 55,302 | ||||||

| Geological, mineral, and prospect costs (Note 5) | 1,008,356 | 173,994 | ||||||

| Interest expense (Note 6) | 7,184 | - | ||||||

| Professional fees | 173,275 | 148,463 | ||||||

| Promotion and shareholder communication | 174,715 | 146,246 | ||||||

| Salaries | 45,000 | 45,000 | ||||||

| Net loss and comprehensive loss for the period | $ | 1,490,451 | $ | 595,306 | ||||

The Company’s operating expenses increased during the period ended October 31, 2018 compared to the prior period primarily as a result of increased exploration activities.

Liquidity and Capital Resources

Working Capital

| At October 31, 2018 | At July 31, 2018 | At July 31, 2017 | ||||||||||

| Current Assets | $ | 1,363,173 | $ | 619,064 | $ | 520,300 | ||||||

| Current Liabilities | $ | 1,063,698 | $ | 875,918 | $ | 334,871 | ||||||

| Working Capital | $ | 299,475 | $ | (256,854 | ) | $ | 185,429 | |||||

Cash Flows

| For the three month period ended October 31, 2018 | For the three month period ended October 31, 2017 | |||||||

| Net Cash used in Operating Activities | $ | (1,192,925 | ) | $ | (590,084 | ) | ||

| Net Cash used in Investing Activities | $ | - | $ | (372,078 | ) | |||

| Net Cash provided by Financing Activities | $ | 2,115,747 | $ | 1,037,365 | ||||

| Net Increase in Cash During Period | $ | 922,822 | $ | 75,203 | ||||

9

As of October 31, 2018, the Company had $992,438 in cash, $1,363,173 in current assets, $7,517,639 in total assets, $1,063,698 in current liabilities and $1,259,609 in total liabilities, working capital of $299,475 and an accumulated deficit of $12,11,2238.

During the three month period ended October 31, 2018, the Company used $1,192,925 (2017 - $590,084) in net cash on operating activities. The difference in net cash used in operating activities during the two periods was largely due to the increase in the Company’s net loss for the most recent period.

During the three month period ended October 31, 2018, the Company used net cash of $Nil (2017 - $372,078) in investing activities on its mineral property.

The Company received net cash of $2,140,750 (2017 - $1,037,365) from financing activities during the three month period ended October, 2018. During the period ended October 30, 2018, the Company also received $50,000 in loans from a related party.

The Company expects to operate at a loss for at least the next 12 months. It has no agreements for additional financing and cannot provide any assurance that additional funding will be available to finance its operations on acceptable terms in order to enable it to carry out its business plan. There are no assurances that the Company will be able to complete further sales of its common stock or any other form of additional financing. If the Company is unable to achieve the financing necessary to continue its plan of operations, then it will not be able to carry out any exploration work on the Idaho-Maryland Property or the other properties in which it owns an interest and its business may fail.

Off Balance Sheet Arrangements

The Company has no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on its financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK. |

Not applicable.

| ITEM 4. | CONTROLS AND PROCEDURES. |

10

Evaluation of Disclosure Controls and Procedures

The Securities and Exchange Commission (the “SEC”) defines the term “disclosure controls and procedures” to mean controls and other procedures of an issuer that are designed to ensure that information required to be disclosed in the reports that it files or submits under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer’s management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

As of the end of the period covered by this Report, management of the Company carried out an evaluation, with the participation of its Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of the Company’s disclosure controls and procedures. Based on this evaluation, management concluded that the Company’s disclosure controls and procedures were not effective as of October 31, 2018 because a material weakness in internal control over financial reporting existed as of that date as a result of a lack of segregation of incompatible duties due to insufficient personnel.

A material weakness is a deficiency or a combination of control deficiencies in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of annual or interim financial statements will not be prevented or detected on a timely basis.

Changes in Internal Control over Financial Reporting

There were no changes in the Company’s internal control over financial reporting during the period ended October 31, 2018 that have materially affected, or are reasonably likely to materially affect, its internal control over financial reporting.

PART II - OTHER INFORMATION

| ITEM 1. | LEGAL PROCEEDINGS. |

On September 17, 2014, the Company learned that it was the subject, along with a number of additional defendants, of a notice of civil claim (the “Claim”) filed in the Supreme Court of British Columbia by Wundr Software Inc. (“Wundr”), an eBook software developer. Wundr and the Company were formerly parties to a binding letter of intent that was announced on November 12, 2013 (the “Wundr LOI”), pursuant to which the Company proposed to acquire 100% of the outstanding shares of Wundr. On January 10, 2014, the Company reported that the Wundr LOI had expired.

Among other things, the Claim alleges that the Company committed the tort of intentional interference with economic or contractual relations by virtue of its role in an alleged scheme to establish a competing business to Wundr, and that the Company, through its agents, breached the terms of the Wundr LOI by appropriating certain confidential information and intellectual property of Wundr for the purpose of establishing a competing business. The Claim also alleges that the Company is vicariously liable for the actions of its agents.

Wundr is seeking general damages from the Company as well as damages for conspiracy to cause economic harm. None of the allegations contained in the Claim have been proven in court, the Company believes that they are without merit, and it therefore intends to vigorously defend its position against Wundr.

Other than as described above, the Company is not aware of any material pending legal proceedings to which it is a party or of which its property is the subject. The Company also knows of no proceedings to which any of its directors, officers or affiliates, or any registered or beneficial holders of more than 5% of any class of the Company’s securities, or any associate of any such director, officer, affiliate or security holder are an adverse party or have a material interest adverse to the Company.

11

| ITEM 1A. | RISK FACTORS. |

Not required.

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS. |

The Company has previously provided disclosure in Form 8-K reports regarding all of its unregistered sales of securities made during the quarter covered by this report except for those disclosed below.

On August 31, 2018, the Company completed a first tranche of a non-brokered private placement, issuing an aggregate of 2,881,250 units at a price of $0.08 per unit for gross proceeds of $230,500. Each unit consists of one share of common stock and one share purchase warrant exercisable into one share of common stock at a price of $0.12 for a period of three years from the date of issuance until August 31, 2021.

On September 17, 2018 completed a second tranche of a non-brokered private placement, issuing an aggregate of 2,003,125 units at a price of $0.08 per unit for gross proceeds of $160,250. Each unit consists of one share of common stock and one share purchase warrant exercisable into one share of common stock at a price of $0.12 for a period of three years from the date of issuance until September 17, 2021.

The Company issued the above-described units in reliance on the exclusion from registration provided by Rule 903 of Regulation S for offers and sales outside of the United States and Section 4(a)(2) of the Securities Act and Rule 506(b) of Regulation D thereunder for offers and sales in the United States and to U.S. persons. Our reliance on Rule 903 was based on the fact that the securities were sold in offshore transactions. We did not engage in any directed selling efforts in the United States in connection with the sale of the securities, and none of the purchasers of those securities was a U.S. person or acquired the securities for the account or benefit of any U.S. person. Our reliance on Rule 506(b) was based on the fact that the U.S. investors provided us with written representations regarding their investment intent and status as an accredited investor, and that neither we nor anyone acting on our behalf engaged in any general advertising or general solicitation.

| ITEM 3. | DEFAULTS UPON SENIOR SECURITIES. |

None.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

| ITEM 5. | OTHER INFORMATION. |

None.

| ITEM 6. | EXHIBITS. |

The following exhibits are filed herewith:

| 31.1 | Certification of the Chief Executive Officer pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 31.2 | Certification of the Chief Financial Officer pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 32.1 | Certification of the Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 32.2 | Certification of the Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 101.INS | XBRL Instance File |

| 101.SCH | XBRL Taxonomy Schema Linkbase Document |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document. |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document |

12

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| By: | /s/ Benjamin Mossman |

| Benjamin Mossman, Chief Executive Officer | |

| Date: | December 14, 2018 |

13