Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WestRock Co | f8k_121418.htm |

Exhibit 99.1

Investor Presentation Paper and Packaging Solutions to Drive Business Growth and Value December 2018

2 Forward Looking Statements, Non - GAAP Financial Measures This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , including but not limited to the statements on the slides entitled “A Proven Model that Creates Value”, “We Operate in Growing Markets with Significant Opportunities for Expans ion ”, “Strong Cash Flow with High Value Options to Re - deploy Capital”, “Uniquely Positioned with Broad Packaging Portfolio to Solve Customer Challenges”, “Corrugated Packaging Seg ment Overview”, “Strategic Investments”, “Strategically Increasing Our Efficiency and Service Capabilities”, “Strategic Investments”, “Driving Significant Growth and Str ong Returns”, “FY19 Expected to Yield Even Better Performance”, “Multiple Sources of Value Creation”, “Track Record of Effective Capital Deployment”, and “FY19 Additional Guid anc e Assumptions” that give guidance or estimates for future periods as well as statements regarding, among other things, margin expansion and deployment of capital provide th e o pportunity to grow Adjusted Segment EBITDA to more than $4.0 billion in 2022; that the 2018 - 2022E CAGR’s are as presented on slide 6; that we expect (1) a rapid return to 2.2 5x – 2.50x leverage ratio, (2) to generate in fiscal 2019 approximately $2.55 billion in Adjusted Operating Cash Flow and (3) KapStone will provide $200 million of synergy and pe rfo rmance improvements opportunities; that we have further opportunity to expand business with our 15,000+ customers; that the project characteristics (including projected time lin es and investment amounts) will be as presented on slide 19; that we expect our Florence, SC mill to become a 1st quartile virgin fiber linerboard mill; that we expect Porto Feliz to become one of the Americas’ largest and most productive box plants and Tres Barras to become one of the worlds’ lowest cost containerboard mills; that the project charact eri stics (including projected timelines and investment amounts) will be as presented on slide 26; that we expect >$19 billion in combined company revenue in FY19; that FY19 earning s d rivers and estimates will be as presented on slide 30; that we expect (1) $200 million in synergies and performance improvements from KapStone by end of FY22, (2) our nea r - t erm focus to be on debt reduction to our target leverage ratio of 2.25x to 2.50x and (3) our capital allocation to be as presented on slide 31; that we expect our capital in ves tments and dividends to be as presented on slide 32; and that FY19 additional guidance assumptions and mill maintenance schedule will be as presented on slide 37. Forward - looking statements are based on our current expectations, beliefs, plans or forecasts and are typically identified by wo rds or phrases such as "may," "will," "could," "should," "would," "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "target," "prospects," "potent ial " and "forecast," and other words, terms and phrases of similar meaning. Forward - looking statements involve estimates, expectations, projections, goals, forecasts, assumptions, risks a nd uncertainties. WestRock cautions readers that a forward - looking statement is not a guarantee of future performance and that actual results could differ materially from those co ntained in the forward - looking statement. WestRock’s businesses are subject to a number of general risks that would affect any such forward - looking statements, including, among othe rs, decreases in demand for their products; increases in energy, raw materials, shipping and capital equipment costs; reduced supply of raw materials; fluctuations in se lli ng prices and volumes; intense competition; the potential loss of certain customers; the scope, costs, timing and impact of any restructuring of our operations and corporate an d tax structure; the occurrence of a natural disaster, such as hurricanes or other unanticipated problems, such as labor difficulties, equipment failure or unscheduled maintenance and repair, which could result in operational disruptions of varied duration; our desire or ability to continue to repurchase company stock; the impact of the Tax Cuts and Jo bs Act; risks associated with integrating KapStone’s operations into our operations and our ability to realize anticipated synergies and productivity improvements; and adverse ch ang es in general market and industry conditions. Such risks and other factors that may impact management's assumptions are more particularly described in our filings with the Secu rit ies and Exchange Commission, including in Item 1A under the caption "Risk Factors" in our Annual Report on Form 10 - K for the year ended September 30, 2018. The information contai ned herein speaks as of the date hereof and WestRock does not have or undertake any obligation to update or revise its forward - looking statements, whether as a result of ne w information, future events or otherwise. We may from time to time be in possession of certain information regarding WestRock that applicable law would not require us to disclose to the public in the ordinary course of business, but would require us to disclose if we were engaged in the purchase or sale of our securities. This presentation sh all not be considered to be part of any solicitation of an offer to buy or sell WestRock securities. This presentation also may not include all of the information regarding WestRock th at you may need to make an investment decision regarding WestRock securities. Any investment decision should be made on the basis of the total mix of information regarding Wes tRock that is publicly available as of the date of the investment decision. We report our financial results in accordance with accounting principles generally accepted in the United States ("GAAP"). Ho wev er, management believes certain non - GAAP financial measures provide users with additional meaningful financial information that should be considered when assessing ou r o ngoing performance. Management also uses these non - GAAP financial measures in making financial, operating and planning decisions and in evaluating our performance. Non - G AAP financial measures should be viewed in addition to, and not as an alternative for, our GAAP results. The non - GAAP financial measures we present may differ from similar ly captioned measures presented by other companies.

3 Our vision is to be the premier partner and unrivaled provider of winning solutions for our customers. WestRock Overview

4 A Proven Model that Creates Value Our Comprehensive Paper and Packaging Portfolio Disciplined and Balanced Capital Allocation A Solid Track Record of Execution Proven business model with track record of success and value creation 1) See Non - GAAP Financial Measures and Reconciliations in the Appendix. 2) As presented at our December 8, 2017 Investor Day. Paper and packaging are attractive businesses where scale, differentiation and sustainability matter. WestRock is building a paper and packaging leader with a differentiated strategy and capabilities to generate attractive returns over the long term. Margin expansion and deployment of capital provide the opportunity to grow Adjusted Segment EBITDA (1) to more than $4.0 billion in 2022 (2) .

5 Note: Based on WestRock FY18 and KapStone LTM 9/30/2018 sales. Pie slices are not to scale, except for Corrugated Packaging / Consumer Packaging split. Leveraging Our Capabilities Across the Organization 5 Corrugated Converting Corrugated Mills Consumer Mills Industry Leading Insights, Design and Package Innovation Full Range of Innovative Fiber - Based Substrates Comprehensive Printing & Converting Capabilities State - of - the - Art Packaging Systems Manufacturing and Supply Chain Consulting & Optimization WestRock’s 50,000+ Person Team Helps Our Customers Win in the Marketplace Consumer Converting

6 Global Packaging Consumption (1) Global Containerboard & Paperboard Market Share (2) 1) Based on Smithers Pira 2017 projections 2) RISI and WestRock estimates, including KapStone 3) Paper & Packaging Board 2017 Global Tons Produced (1) We Operate in Growing Markets with Significant Opportunities for Expansion “Consumers can rely on corrugated cardboard boxes to get their merchandise shipped/delivered safely.” “Paper - based product packaging tends to feel more premium.” “Consumers think more highly of companies that use paper - based packaging.” 82% agree (3) 68% agree (3) 63% agree (3) Containerboard & Paperboard 36% Flexible Packaging 23% Rigid Plastic 18% Metal 12% Glass 7% Other 4% WestRock 6% Other 94% Millions of Tons $851 billion 255 million tons 2000 – 2018 CAGR 2018 – 2022E CAGR 2.1% 2.0% 3.4% 2.0% 0 50 100 150 200 250 300 Containerboard Paperboard

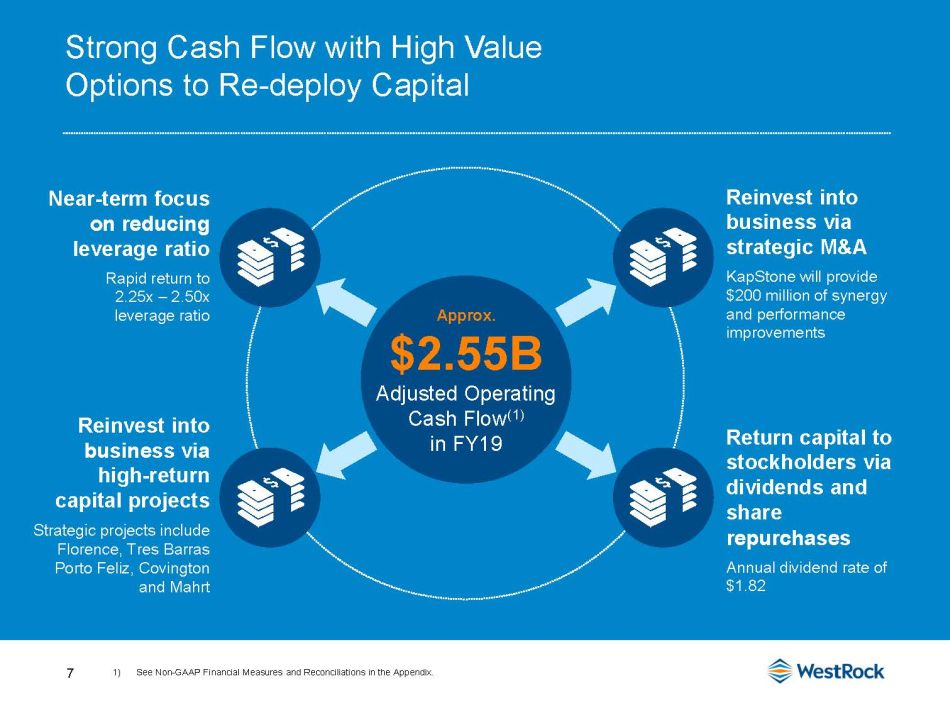

7 Strong Cash Flow with High Value Options to Re - deploy Capital Approx. $2.55B Adjusted Operating Cash Flow (1) in FY19 Near - term focus on reducing leverage ratio Rapid return to 2.25x – 2.50x leverage ratio Reinvest into business via high - return capital projects Strategic projects include Florence, Tres Barras Porto Feliz , Covington and Mahrt Reinvest into business via strategic M&A KapStone will provide $200 million of synergy and performance improvements Return capital to stockholders via dividends and share repurchases Annual dividend rate of $1.82 1) See Non - GAAP Financial Measures and Reconciliations in the Appendix.

8 We Have a Portfolio Focused on Paper - Based Packaging Solutions ACQUIRED 2018 2018 ACQUIRED 2018 ACQUIRED 2017 SOLD ACQUIRED 2017 2016 SPIN OFF ACQUIRED 2017 ACQUIRED 2017 ACQUIRED 2016 Packaging JOINT VENTURE 2016 ACQUIRED 2015 ACQUIRED 2017 FUTURE GROWTH JULY 2015 ACQUIRED 2017 Proven M&A Track Record to Become a Leading Paper - Based Packaging Provider

9 …with a strategic multinational footprint. We Are an Integrated Packaging Producer… Differentiated Paper and Packaging Solutions Broadest product portfolio Ability to meet customer needs across enterprise Differentiated packaging machinery solutions Supported by hundreds of structural and graphic designers >320 Operating and Business Locations Scale of North American container network serving attractive end - markets North American and European consumer converting assets Broad portfolio of label, insert and display solutions 31 Containerboard and Paperboard Mills ~16.5 million tons of containerboard and paperboard capacity Broadest substrate offering 67% / 33% Virgin / Recycled Fiber Mix Virgin / Recycled mix provides balance and flexibility A leading U.S. recycler with stable source of high - quality recycled fiber 9

10 Health & Beauty Cereal Beverage Pharmaceuticals Engineered to meet demanding end - use requirements Box On Demand/E - Commerce Retail Ready Packaging SBS CNK ® CRB URB Virgin Linerboard / Medium White Top Linerboard Recycled Linerboard / Medium Semi - Chemical Medium Kraft We’ve Created the Broadest Portfolio of Differentiated Paper Grades and Packaging Solutions

11 Our Approach to Delivering Value to Our Customers Lower Total Cost • Packaging line improvements / automation • Supply chain optimization • Raw material, structure and SKU optimization Grow Sales • Innovative package design and structure • Improved shelf appeal and in - store marketing solutions • Increased factory throughput and production Improve Sustainability • Supply chain reductions • Designs that improve performance with less fiber • Increased use of renewable and recycled resources Minimize Risk • Proven designs already in the marketplace • Comprehensive customer support • Material and machine performance matched solutions • Geographic footprint Delivering value to our customers

12 Examples of Delivering Value to Customers 12 Lower Total Costs Box on Demand ® Systems Improve Sustainability Plastic Replacement Solutions Minimize Risk Packaging Solutions Grow Sales Innovative Packaging Design Delivering value to our customers

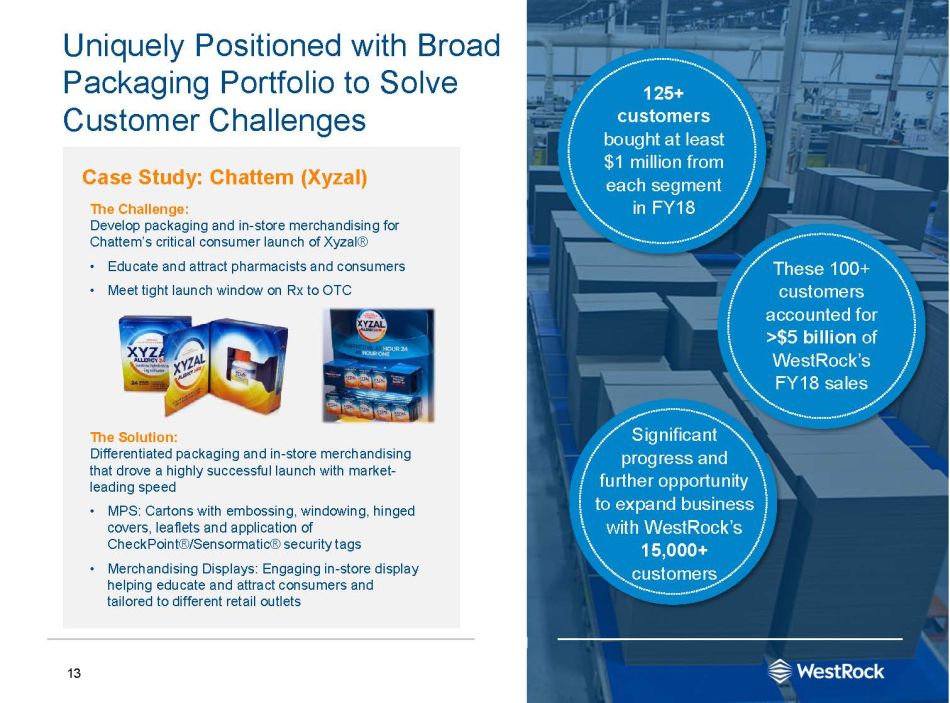

13 Uniquely Positioned with Broad Packaging Portfolio to Solve Customer Challenges 125+ customers bought at least $1 million from each segment in FY18 These 100+ customers accounted for >$5 billion of WestRock’s FY18 sales Significant progress and further opportunity to expand business with WestRock’s 15,000+ customers Case Study: Chattem (Xyzal) The Challenge: Develop packaging and in - store merchandising for Chattem’s critical consumer launch of Xyzal® • Educate and attract pharmacists and consumers • Meet tight launch window on Rx to OTC The Solution: Differentiated packaging and in - store merchandising that drove a highly successful launch with market - leading speed • MPS: Cartons with embossing, windowing, hinged covers, leaflets and application of CheckPoint®/Sensormatic® security tags • Merchandising Displays: Engaging in - store display helping educate and attract consumers and tailored to different retail outlets

Corrugated Packaging

15 Corrugated Packaging Investment Highlights Industry - Leading Margins a nd Financial Performance KapStone Improves our System, Broadens Our Portfolio and Provides Synergy Opportunities Well - positioned with Growing End Markets Full Suite of Differentiated Products and Solutions Large, Diversified Mill and Converting Network CORRUGATED PACKAGING Positioned for Future Growth 15

16 • Coated and uncoated white top linerboard • Solid bleached linerboard • Virgin and recycled linerboard • Corrugated medium • Kraft paper • Pulp (fluff pulp, bleached and unbleached market pulp) • Corrugated containers to protect, ship, store, and display products • Foodservice containers • Automated Packaging Systems • “Box on Demand” systems Key Differentiators Broad Portfolio of Differentiated Products and Solutions • Broad solutions range to serve diverse end - markets • Targeting emerging consumer trends • E - commerce • Shelf ready packaging • Fast and fresh • Brand revitalization • Broad suite of automated packaging systems • Well - positioned in attractive and growing packaging markets in Mexico and Brazil • Porto Feliz will be one of the world’s largest box plants • Tres Barras expected to one of the worlds’ lowest cost containerboard mills Corrugated Packaging Segment Overview FY18 Adj. Segment EBITDA Margin (1) 21.6% Key Metrics & Operational Statistics 19 Mills 145 Converting Facilities Approx. 60 Distribution Facilities 12.3M tons Mill Capacity FY18 Segment Sales $9.1 Billion ($ in billions) FY18 FY17 Segment Sales $9.1 $8.4 Adj. Segment Income $1.2 $0.8 Adj. Segment EBITDA (1) $1.9 $1.4 Adj. Segment EBITDA Margin (1) 21.6% 16.7% North American Adj. Segment EBITDA Margin (1) 22.6% 17.5% Financial Performance 1) See Non - GAAP Financial Measures and Reconciliations in the Appendix.

17 Corrugated Packaging Serves Diverse End - Markets Diverse end markets driving sustainable growth throughout the economic cycle 1) Represents WestRock FY18. 17 Processed Foods 17% Distribution 15% Retail / E - commerce 13% Industrial 13% Pizza 11% Agricultural / Produce 9% Protein 8% Bakery 6% Dairy 4% Beverage & Other 4% WestRock Shipments by End Market 1

18 12.7% 22.6% FY12 FY18 Demonstrated Significant Growth in North American Adjusted Segment EBITDA Margins (1) 1) Non - GAAP Financial Measure. See reconciliations in the Appendix. 18 +990 bps Improvement • Network Optimization • Footprint Consolidation • Investments to Improve Operational Efficiencies • Focus on Strategic M&A • Lean 6 - Sigma Programs • Improved Price Realization

19 Strategic Investments Florence, SC Mill Investment x New 330” state - of - the - art paper machine x Replaces 3 old machines with 1 new machine x 710k tons of capacity x Expected to become a 1 st quartile virgin fiber linerboard mill x Total estimated project cost of $410 million x Expected completion in 1H FY20 19 Porto Feliz Corrugated Plant Tres Barras Mill Upgrade x Expected to become one of the largest and most productive box plants in the Americas x Enhanced capability with high - graphic technology x Increased integration with Tres Barras virgin containerboard mill x Total estimated net investment of $125 million x Expected completion in Q3 FY19 x Expected to achieve full potential of the mill x Production increases to approx. 750k tons per year from approx. 520K tons per year x Increases energy self - sufficiency to approx. 85% from 55% x Fiber mix improves to 100% virgin fiber from approx. 80% virgin / 20% recycled x Expected capital investment of $345 million x Expected completion in 1H CY21

20 Strategically Increasing Our Efficiency and Service Capabilities $200 MILLION opportunity for synergies and performance improvements. of differentiated paper and packaging solutions, adding attractive paper grades and distribution capabilities. ENHANCED PORTFOLIO on the West Coast and enhanced ability to serve customers more efficiently. EXPANDED PRESENCE Immediately cash flow and adjusted EPS accretive 20

Consumer Packaging

22 Consumer Packaging Investment Highlights Award - winning Product Design and Innovation Capabilities Full Portfolio of Differentiated Solutions MPS Provided Expanded Solutions and Market Diversification Broadest Portfolio of High - Quality Paperboard Grades Diversified Mill and Global Converting Network CONSUMER PACKAGING Winning Through Differentiation 22

23 Consumer Packaging Segment Overview • Solid bleached sulfate (SBS) • Coated natural kraft (CNK®) • Coated recycled board (CRB) • Uncoated recycled board (URB) • Packaging machinery • Premium folding cartons • Beverage carriers • Express mail envelopes • Labels and inserts • Merchandising displays • Solid fiber and corrugated partitions • Die - cut paperboard Key Differentiators • Broadest grade mix in the industry (SBS, CNK®, CRB and URB) • Innovation in substrates, packaging design and machinery solutions • Extensive converting network with global scale Key Metrics & Operational Statistics 13 Mills 118 Converting Facilities 2 Machinery Solutions 4.2M tons Mill Capacity FY18 Segment Sales $7.3 Billion Financial Performance FY18 Adj. Segment EBITDA Margin (1) 14.0% FY18 FY17 Segment Sales $7.3B $6.5B Adj. Segment Income $455M $451M Adj. Segment EBITDA (1) $1,024M $959M % Margin (1) 14.0% 14.9% 1) See Non - GAAP Financial Measures and Reconciliations in the Appendix. Broad Portfolio of Differentiated Products and Solutions

24 Consumer Packaging Serves Diverse End - Markets Diverse end markets driving sustainable growth throughout the economic cycle 1) Represents WestRock FY18. Retail Food 22% Beverage 18% Healthcare 15% Beauty & Cosmetics 10% Food Service 8% Commercial Print 6% Tobacco 5% Liquid Packaging 3% Other 13% WestRock Shipments by End Market 1

25 Global Consumer Packaging Operations and Locations million annual tons of capacity 4.2 >43 billion square feet of converted products per year 86 NORTH AMERICA 13 MILLS 72 CONVERTING 1 MACHINERY SOLUTIONS 2 SOUTH AMERICA 2 CONVERTING 5 ASIA - PACIFIC 5 CONVERTING 40 EUROPE 39 CONVERTING 1 MACHINERY SOLUTIONS Approx.

26 Strategic Investments 26 Mahrt Curtain Coater x Replacing and upgrading coating section of #1 PM Expected results include: x Reduced costs from improved machine performance and lower coating costs x Improved quality and consistency of our CNK produced at the Mahrt mill x Approx. $60 million in total investment with unlevered after - tax returns of >20% x Completion in April 2019 Covington Upgrade x Upgrading headbox, press section, dryer, coater and other systems Expected results include: x Improved operating efficiency and lowered costs x Further enhances quality and reduces basis weight of leading SBS products for the tobacco and food packaging markets x Approx. $60 million total investment with unlevered after - tax returns of >20% x Completion in May 2019

Financial Overview

28 Driving Significant Growth and Strong Returns 1) Total stockholder return (includes impact of dividends and stock splits). Includes WestRock predecessor — RockTenn performance. 2) FY19 WestRock guidance as presented with Q4 FY18 Earnings Call, including KapStone. 3) KapStone acquisition completed in Q1 FY19. Note: S&P 500 performance relative to WestRock starting stock price. Source: FactSet and Wall Street research. $1.4 $2.1 $2.8 $9.2 $14.9 $16.3 >$19 (2) FY00 FY06 FY09 FY12 FY17 FY18 FY19E 2005 2008 2011 2015 Merger with CAGR: 15% Stock Performance (2000 to Present) Revenue Growth (CAGR of 15%) Driven organically and through M&A 2018 (3) $44.21 TSR 1 : +13.0% $6.48 TSR 1 : +5.2% $1 $10 $100 2000 2003 2007 2011 2014 2018 WestRock S&P 500

29 We reported record year - over - year performance improvement 1) See Non - GAAP Financial Measures and Reconciliations in the Appendix. 2) Non - GAAP Financial Measure. On a GAAP basis, earnings per diluted share were $7.34 in FY18 and $2.77 in FY17. See reconciliations in the Appendix. Net Sales $16.3 Billion 10% Adjusted Segment EBITDA (1) $2.89 Billion 26% Adjusted Segment EBITDA Margin (1) 17.8% 240 bps Adjusted Earnings Per Diluted Share (2) $4.09 56% Adjusted Operating Cash Flow (1) $2.46 Billion 23% x Advanced our strategy to provide differentiated solutions to our customers x Achieved our financial goals for FY18 x Executed on strategic capital investments and acquisitions that strengthen our business x Returned meaningful capital to stockholders FY18 Key Accomplishments 29

30 FY19 Expected to Yield Even Better Performance Net Sales > $19 billion vs FY18 of $16.3 billion >16% Adjusted Segment EBITDA (1) Approx. $3.6 billion vs. FY18 of $2.89 billion >24% Adjusted EPS (2) Approx. $4.60 vs. FY18 of $4.09 Approx. 12% Adjusted Operating Cash Flow (1) Approx. $2.55 billion vs. FY18 of $2.46 billion Approx. $100M • Full year impact of previously published price increases in both segments • 11 Months of KapStone contributions and beginning of realization of KapStone synergies and performance improvements • Value creation through differentiated product portfolio offering, catering to prevailing and emerging market trends (shelf - ready packaging, eco - conscious materials, etc.) • Benefits of Victory integration and full run - rate of MPS integration Drivers of FY19 Results 1) See Non - GAAP Financial Measures and Reconciliations in the Appendix. 2) Non - GAAP Financial Measure. On a GAAP basis, earnings per diluted share were $7.34 in FY18 and $2.77 in FY17. See reconciliations in the Appendix.

31 Multiple Sources of Value Creation Revenue Growth • Growing with North American corrugated market • Stable US Consumer packaging demand, growing global demand • Increasing exposure to attractive high - growth markets and applications • E.g. e - commerce, healthcare, food service, “War on Plastics” • Innovating to provide differentiated solutions to our customers • Leveraging broad product portfolio to increase our Enterprise sales opportunities Margin Improvement • Investing in high return strategic projects to reduce costs • Achieved $1 billion synergy and performance improvement goal met during first three years as WestRock • Implemented multiple published price increases across both segments • Improved North American Corrugated margins by 990 bps since purchase of Smurfit Stone • $200 million in expected synergies and performance improvements from KapStone by end of FY22 Capital Allocation • Long - term maintenance capital (50%) and normal, high - return capital investments (50%) of approximately $1 billion per year • $500 million of strategic capital investments in FY19 • Near - term focus on debt reduction to target leverage ratio of 2.25x to 2.50x • Stable and growing dividend; currently at an annual $1.82 rate • High - returning acquisitions and share buy - backs as markets allow 31

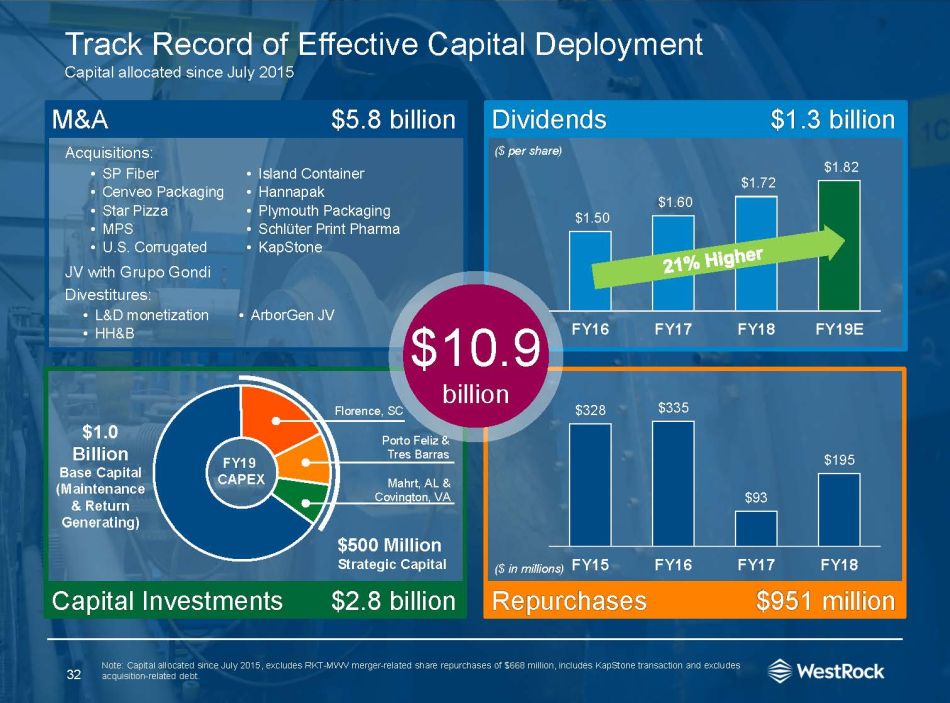

32 Dividends $1.3 billion Repurchases $951 million Track Record of Effective Capital Deployment Capital allocated since July 2015 32 Florence, SC Porto Feliz & Tres Barras Mahrt, AL & Covington, VA $1.0 Billion Base Capital (Maintenance & Return Generating) M&A $5.8 billion Capital Investments $2.8 billion $10.9 billion Acquisitions: JV with Grupo Gondi Divestitures: • SP Fiber • Cenveo Packaging • Star Pizza • MPS • U.S. Corrugated • Island Container • Hannapak • Plymouth Packaging • Schlüter Print Pharma • KapStone • L&D monetization • HH&B • ArborGen JV $1.50 $1.60 $1.72 $1.82 FY16 FY17 FY18 FY19E $500 Million Strategic Capital $328 $335 $93 $195 FY15 FY16 FY17 FY18 ($ per share) ($ in millions) Note: Capital allocated since July 2015, excludes RKT - MWV merger - related share repurchases of $668 million, includes KapStone tr ansaction and excludes acquisition - related debt. FY19 CAPEX

33 Customers WestRock 100% Recycled Mills Sustainable Forests WestRock Recycling WestRock Paperboard Mills WestRock Converting Plants WestRock Containerboard Mills Recovered 8 million tons of recycled fiber in 2018 that was turned into new paper products. One of North America’s largest recycling networks. One of the largest chain - of - custody certified fiber procurement organizations in the industry. Products are made with renewable and recyclable materials. Sustainability is the Fiber of our Company A long - term strategy

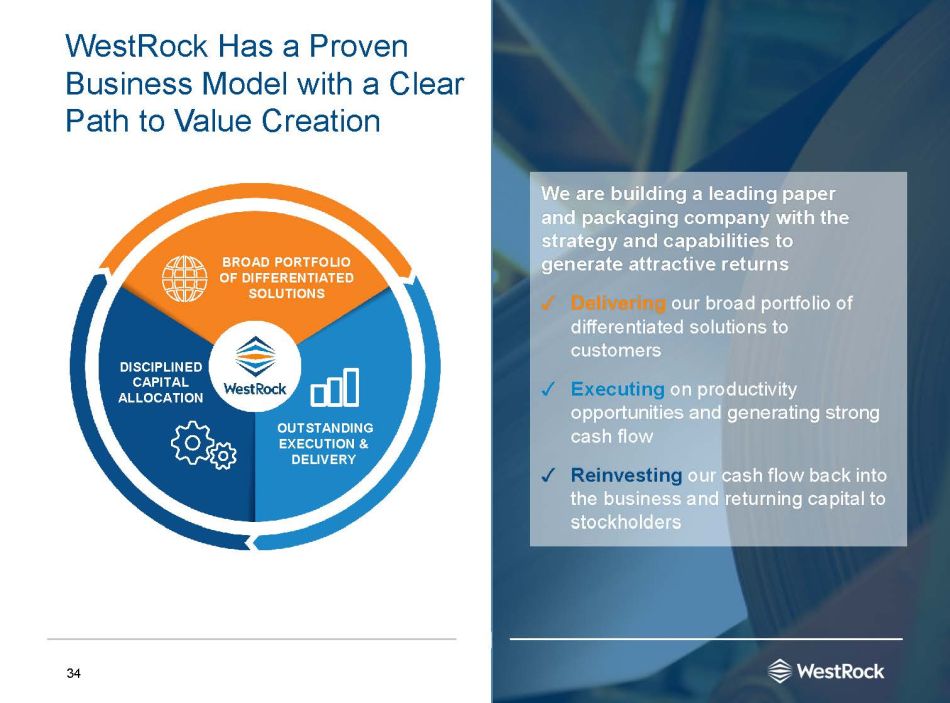

34 WestRock Has a Proven Business Model with a Clear Path to Value Creation We are building a leading paper and packaging company with the strategy and capabilities to generate attractive returns ✓ Delivering our broad portfolio of differentiated solutions to customers ✓ Executing on productivity opportunities and generating strong cash flow ✓ Reinvesting our cash flow back into the business and returning capital to stockholders OUTSTANDING EXECUTION & DELIVERY DISCIPLINED CAPITAL ALLOCATION BROAD PORTFOLIO OF DIFFERENTIATED SOLUTIONS

Appendix

36 Non - GAAP Financial Measures Adjusted Earnings Per Diluted Share We use the non - GAAP financial measure “adjusted earnings per diluted share,” also referred to as “adjusted earnings per share” o r “Adjusted EPS” because we believe this measure provides our board of directors, investors, potential investors, securities analysts and others with useful information to evaluate our performance si nce it excludes restructuring and other costs, net, and other specific items that we believe are not indicative of our ongoing operating results. Our management and board of directors use this information to ev aluate our performance relative to other periods. We believe the most directly comparable GAAP measure is Earnings per diluted share. Adjusted Operating Cash Flow We use the non - GAAP financial measure “adjusted operating cash flow” because we believe this measure provides our board of direc tors, investors, potential investors, securities analysts and others with useful information to evaluate our performance relative to other periods because it excludes restructuring and other costs, n et of tax, that we believe are not indicative of our ongoing operating results. While this measure is similar to adjusted free cash flow, we believe it provides greater comparability across periods when ca pit al expenditures are changing since it excludes an adjustment for capital expenditures. While this measure is similar to adjusted free cash flow, we believe it provides greater comparability across p eri ods when capital expenditures are changing since it excludes an adjustment for capital expenditures. We believe the most directly comparable GAAP measure is net cash provided by operating activities. Adjusted Segment EBITDA and Adjusted Segment EBITDA Margins We use the non - GAAP financial measures “adjusted segment EBITDA” and “adjusted segment EBITDA margins”, along with other factors , to evaluate our segment performance against our peers. We believe that investors also use these measures to evaluate our performance relative to our peers. We calculate adjusted segme nt EBITDA for each segment by adding that segment’s adjusted segment income to its depreciation, depletion and amortization. We calculate adjusted segment EBITDA margin for each segment by divid ing that segment’s adjusted segment EBITDA by its adjusted segment sales. Leverage Ratio We use the non - GAAP financial measures “leverage ratio” and “net leverage ratio” as measurements of our operating performance an d to compare to our publicly disclosed target leverage ratio. We believe investors use each measure to evaluate our available borrowing capacity – in the case of “net leverage ratio”, adjusted for cash and cash equivalents. We define leverage ratio as our Total Funded Debt divided by our Credit Agreement EBITDA, each of which term is defined in our credit agreement, dated July 1, 2015. Borro win g capacity under our credit agreement depends on, in addition to other measures, the Credit Agreement Debt/EBITDA ratio or the leverage ratio. While the leverage ratio under our credit agreement d ete rmines the credit spread on our debt, we are not subject to a leverage ratio cap. Our credit agreement is subject to a Debt to Capitalization and Consolidated Interest Coverage Ratio, as defined t her ein. Forward - looking Guidance We are not providing a reconciliation of forward - looking non - GAAP financial measures to the most directly comparable U.S. GAAP m easure because we are unable to predict with reasonable certainty the ultimate outcome of certain significant items without unreasonable effort. These items include, but are not limited to, merge r a nd acquisition - related expenses, restructuring expenses, asset impairments, litigation settlements, changes to contingent consideration and certain other gains or losses. These items are uncertain, dep end on various factors, and could have a material impact on U.S. GAAP reported results for the guidance period. Adjusted Tax Rate We use the non - GAAP financial measure “Adjusted Tax Rate”. We believe this non - GAAP financial measure is useful because it adjus ts our GAAP effective tax rate to exclude the impact of restructuring and other costs, net, and other specific items that management believes are not indicative of the ongoing operating results o f t he business. “Adjusted Tax Rate” is calculated as “Adjusted Tax Expense” divided by “Adjusted Pre - Tax Income”. We believe that the most directly comparable GAAP measures to Adjusted Tax Expense and Adj usted Pre - Tax Income are “Income tax (expense) benefit” and “Income before income taxes”, respectively.

37 FY19 Additional Guidance Assumptions Other Guidance Assumptions Depreciation & Amortization Approx. $1.50 - $1.55 billion FY19 Adjusted EPS (1) Profile Approx. 38% 1H / 62% 2H Interest Expense Approx. $505 - $515 million Interest Income Approx. $55 - $60 million Effective Adjusted Book Tax Rate 24% to 25% Adjusted Cash Tax Rate Approx. 23% Share Count Approx. 265 million 1) Non - GAAP Financial Measure. 2) FY19 amounts are forecasts. North American Corrugated Packaging Consumer Packaging Mill Maintenance Schedule (2) (tons in thousands) Q1 Q2 Q3 Q4 Full Year WestRock 41 84 101 0 226 FY19 KapStone 9 1 31 4 45 Combined 50 85 132 4 271 FY18 WestRock 73 35 125 0 233 Q1 Q2 Q3 Q4 Full Year FY19 19 41 56 3 119 FY18 28 11 8 0 47

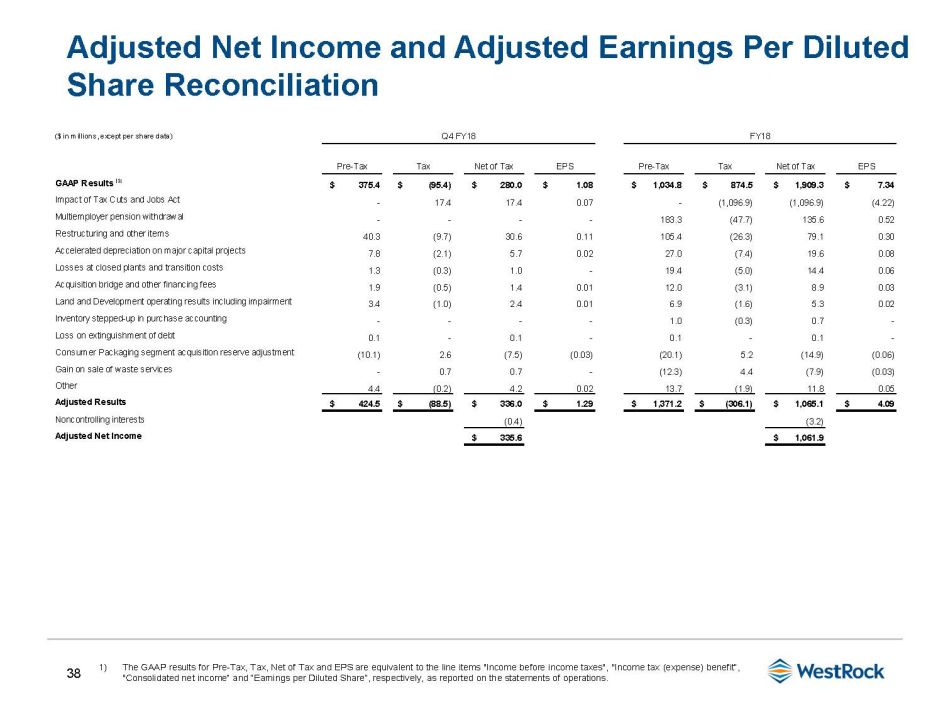

38 Adjusted Net Income and Adjusted Earnings Per Diluted Share Reconciliation 1) The GAAP results for Pre - Tax, Tax, Net of Tax and EPS are equivalent to the line items "Income before income taxes", "Income tax (expense) benefit“, "Consolidated net income“ and “Earnings per Diluted Share”, respectively, as reported on the statements of operations. ($ in millions, except per share data) Q4 FY18 FY18 Pre-Tax Tax Net of Tax EPS Pre-Tax Tax Net of Tax EPS GAAP Results (1) $ 375.4 $ (95.4) $ 280.0 $ 1.08 $ 1,034.8 $ 874.5 $ 1,909.3 $ 7.34 Impact of Tax Cuts and Jobs Act - 17.4 17.4 0.07 - (1,096.9) (1,096.9) (4.22) Multiemployer pension withdrawal - - - - 183.3 (47.7) 135.6 0.52 Restructuring and other items 40.3 (9.7) 30.6 0.11 105.4 (26.3) 79.1 0.30 Accelerated depreciation on major capital projects 7.8 (2.1) 5.7 0.02 27.0 (7.4) 19.6 0.08 Losses at closed plants and transition costs 1.3 (0.3) 1.0 - 19.4 (5.0) 14.4 0.06 Acquisition bridge and other financing fees 1.9 (0.5) 1.4 0.01 12.0 (3.1) 8.9 0.03 Land and Development operating results including impairment 3.4 (1.0) 2.4 0.01 6.9 (1.6) 5.3 0.02 Inventory stepped-up in purchase accounting - - - - 1.0 (0.3) 0.7 - Loss on extinguishment of debt 0.1 - 0.1 - 0.1 - 0.1 - Consumer Packaging segment acquisition reserve adjustment (10.1) 2.6 (7.5) (0.03) (20.1) 5.2 (14.9) (0.06) Gain on sale of waste services - 0.7 0.7 - (12.3) 4.4 (7.9) (0.03) Other 4.4 (0.2) 4.2 0.02 13.7 (1.9) 11.8 0.05 Adjusted Results $ 424.5 $ (88.5) $ 336.0 $ 1.29 $ 1,371.2 $ (306.1) $ 1,065.1 $ 4.09 Noncontrolling interests (0.4) (3.2) Adjusted Net Income $ 335.6 $ 1,061.9

39 Adjusted Net Income and Adjusted Earnings Per Diluted Share Reconciliation ($ in millions, except per share data) Q4 FY17 FY17 Pre-Tax Tax Net of Tax EPS Pre-Tax Tax Net of Tax EPS GAAP Results (1) $ 246.4 $ (51.1) $ 195.3 $ 0.76 $ 857.6 $ (159.0) $ 698.6 $ 2.77 Gain on sale of HH&B (2.2) - (2.2) (0.01) (192.8) - (192.8) (0.76) HH&B - impact of held for sale accounting - - - - (10.1) 2.3 (7.8) (0.03) Restructuring and other items 38.0 (12.0) 26.0 0.10 196.7 (62.8) 133.9 0.52 Pension lump sum settlement 3.9 (1.6) 2.3 0.01 32.6 (12.6) 20.0 0.08 Inventory stepped-up in purchase accounting 12.1 (3.1) 9.0 0.03 26.5 (7.0) 19.5 0.08 Land and Development operating results including impairment 8.3 (3.3) 5.0 0.02 26.7 (10.6) 16.1 0.06 Losses at closed plants and transition costs 9.3 (3.0) 6.3 0.03 18.2 (5.8) 12.4 0.05 Gain on sale or deconsolidation of subsidiaries (6.7) 3.0 (3.7) (0.01) (5.0) 2.4 (2.6) (0.01) Federal, state and foreign tax items - (16.7) (16.7) (0.06) - (40.5) (40.5) (0.16) Loss (gain) on extinguishment of debt 0.2 (0.1) 0.1 - (1.8) 0.6 (1.2) - Other 1.4 (0.5) 0.9 - 8.1 (2.7) 5.4 0.02 Adjusted Results $ 310.7 $ (88.4) $ 222.3 $ 0.87 $ 956.7 $ (295.7) $ 661.0 $ 2.62 Noncontrolling interests 0.8 9.6 Adjusted Net Income $ 223.1 $ 670.6 1) The GAAP results for Pre - Tax, Tax, Net of Tax and EPS are equivalent to the line items "Income before income taxes", "Income tax (expense) benefit“, "Consolidated net income“ and “Earnings per Diluted Share”, respectively, as reported on the statements of operations.

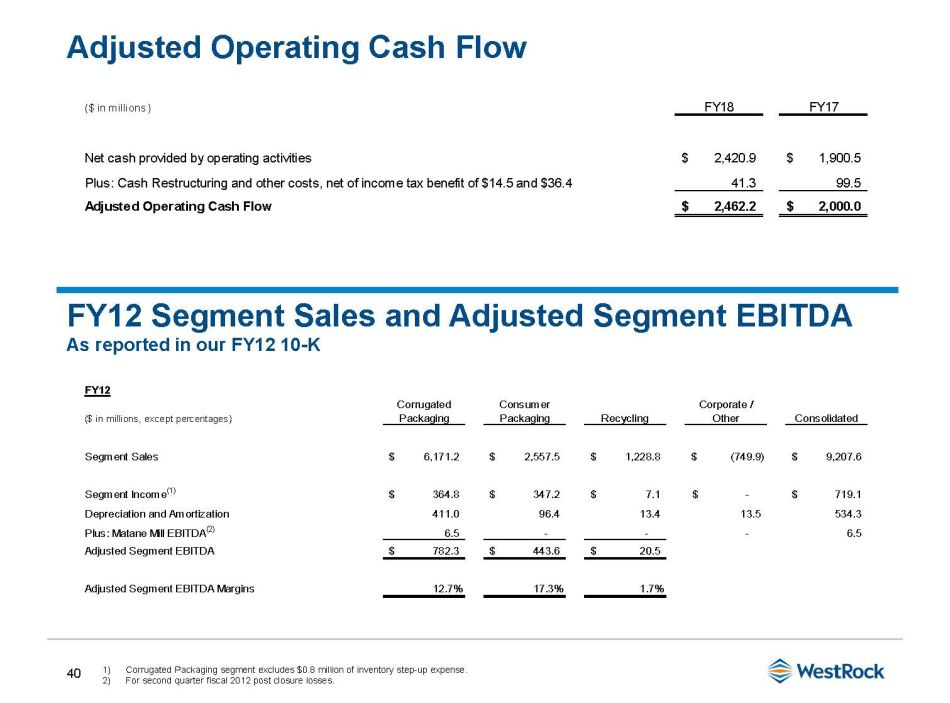

40 Adjusted Operating Cash Flow ($ in millions) FY18 FY17 Net cash provided by operating activities 2,420.9$ 1,900.5$ Plus: Cash Restructuring and other costs, net of income tax benefit of $14.5 and $36.4 41.3 99.5 Adjusted Operating Cash Flow 2,462.2$ 2,000.0$ FY12 Segment Sales and Adjusted Segment EBITDA As reported in our FY12 10 - K 1) Corrugated Packaging segment excludes $0.8 million of inventory step - up expense. 2) For second quarter fiscal 2012 post closure losses. FY12 ($ in millions, except percentages) Corrugated Packaging Consumer Packaging Recycling Corporate / Other Consolidated Segment Sales 6,171.2$ 2,557.5$ 1,228.8$ (749.9)$ 9,207.6$ Segment Income (1) 364.8$ 347.2$ 7.1$ -$ 719.1$ Depreciation and Amortization 411.0 96.4 13.4 13.5 534.3 Plus: Matane Mill EBITDA (2) 6.5 - - - 6.5 Adjusted Segment EBITDA 782.3$ 443.6$ 20.5$ Adjusted Segment EBITDA Margins 12.7% 17.3% 1.7%

41 Adjusted Segment Sales and Adjusted Segment EBITDA FY18 ($ in millions, except percentages) Corrugated Packaging Consumer Packaging Land and Development Corporate / Eliminations Consolidated Segment / Net Sales 9,103.4$ 7,291.4$ 142.4$ (252.1)$ 16,285.1$ Less: Trade Sales (385.8) - - - (385.8) Adjusted Segment Sales 8,717.6$ 7,291.4$ 142.4$ (252.1)$ 15,899.3$ Segment Income 1,207.9$ 454.6$ 22.5$ -$ 1,685.0$ Non-allocated Expenses - - - (47.5) (47.5) Depreciation and Amortization 676.8 569.3 0.7 5.4 1,252.2 Segment EBITDA 1,884.7$ 1,023.9$ 23.2$ (42.1)$ 2,889.7$ Plus: Inventory Step-up 1.0 - - - 1.0 Adjusted Segment EBITDA 1,885.7$ 1,023.9$ 23.2$ (42.1)$ 2,890.7$ Segment EBITDA Margins 20.7% 14.0% 17.7% Adjusted Segment EBITDA Margins 21.6% 14.0% 17.8% FY17 ($ in millions, except percentages) Corrugated Packaging Consumer Packaging Land and Development Corporate / Eliminations Consolidated Segment / Net Sales 8,408.3$ 6,452.5$ 243.8$ (244.9)$ 14,859.7$ Less: Trade Sales (318.2) - - - (318.2) Adjusted Segment Sales 8,090.1$ 6,452.5$ 243.8$ (244.9)$ 14,541.5$ Segment Income 753.9$ 425.8$ 13.8$ -$ 1,193.5$ Non-allocated Expenses - - - (43.5) (43.5) Depreciation and Amortization 597.9 508.2 0.7 5.3 1,112.1 Segment EBITDA 1,351.8$ 934.0$ 14.5$ (38.2)$ 2,262.1$ Plus: Inventory Step-up 1.4 25.1 - - 26.5 Adjusted Segment EBITDA 1,353.2$ 959.1$ 14.5$ (38.2)$ 2,288.6$ Segment EBITDA Margins 16.1% 14.5% 15.2% Adjusted Segment EBITDA Margins 16.7% 14.9% 15.4%

42 Corrugated Packaging Adjusted Segment EBITDA ($ in millions, except percentages) North American Corrugated Brazil Corrugated Other Corrugated Packaging Segment Sales 8,125.3$ 439.5$ 538.6$ 9,103.4$ Less: Trade Sales (385.8) - - (385.8) Adjusted Segment Sales 7,739.5$ 439.5$ 538.6$ 8,717.6$ Segment Income (Loss) 1,147.4$ 54.2$ 6.3$ 1,207.9$ Depreciation and Amortization 601.9 63.5 11.4 676.8 Segment EBITDA 1,749.3$ 117.7$ 17.7$ 1,884.7$ Plus: Inventory Step-up 1.0 - - 1.0 Adjusted Segment EBITDA 1,750.3$ 117.7$ 17.7$ 1,885.7$ Segment EBITDA Margins 21.5% 26.8% 20.7% Adjusted Segment EBITDA Margins 22.6% 26.8% 21.6% ($ in millions, except percentages) North American Corrugated Brazil Corrugated Other Corrugated Packaging Segment Sales 7,361.4$ 433.9$ 613.0$ 8,408.3$ Less: Trade Sales (318.2) - - (318.2) Adjusted Segment Sales 7,043.2$ 433.9$ 613.0$ 8,090.1$ Segment Income 704.0$ 34.3$ 15.6$ 753.9$ Depreciation and Amortization 527.2 60.1 10.6 597.9 Segment EBITDA 1,231.2$ 94.4$ 26.2$ 1,351.8$ Plus: Inventory Step-up 1.4 - - 1.4 Adjusted Segment EBITDA 1,232.6$ 94.4$ 26.2$ 1,353.2$ Segment EBITDA Margins 16.7% 21.8% 16.1% Adjusted Segment EBITDA Margins 17.5% 21.8% 16.7% FY18 FY17